Attached files

| file | filename |

|---|---|

| EX-95.1 - EX-95.1 - Foresight Energy LP | felp-ex951_8.htm |

| EX-32.2 - EX-32.2 - Foresight Energy LP | felp-ex322_11.htm |

| EX-32.1 - EX-32.1 - Foresight Energy LP | felp-ex321_14.htm |

| EX-31.2 - EX-31.2 - Foresight Energy LP | felp-ex312_9.htm |

| EX-31.1 - EX-31.1 - Foresight Energy LP | felp-ex311_6.htm |

| EX-24.1 - EX-24.1 - Foresight Energy LP | felp-ex241_7.htm |

| EX-23.1 - EX-23.1 - Foresight Energy LP | felp-ex231_13.htm |

| EX-21.1 - EX-21.1 - Foresight Energy LP | felp-ex211_12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36503

Foresight Energy LP

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

80-0778894 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

211 North Broadway, Suite 2600, Saint Louis, MO |

|

63102 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (314) 932-6160

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

Common Units representing limited partner interests |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_______________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of units held by non-affiliates as of June 30, 2016 was $41,702,566.

As of February 24, 2017, the registrant had 66,104,908 common units and 64,954,691 subordinated units outstanding.

TABLE OF CONTENTS

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10-K, and certain oral statements made from time to time by our representatives, may constitute “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “outlook,” “estimate,” “potential,” “continues,” “may,” “will,” “seek,” “approximately,” “predict,” “anticipate,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that the future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Known material factors that could cause our actual results to differ from those in the forward-looking statements are described in Part I. “Item 1A. Risk Factors.”

Readers are cautioned not to place undue reliance on forward-looking statements, which are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

REFERENCES WITHIN THIS ANNUAL REPORT

All references to “FELP,” the “Partnership,” “we,” “us,” and “our” refer to the combined results of Foresight Energy LP and Foresight Energy LLC and its subsidiaries, unless the context otherwise requires or where otherwise indicated.

PART I

We mine and market coal from reserves and operations located exclusively in the Illinois Basin. We control 2.1 billion tons of proven and probable coal in the state of Illinois, which, in addition to making us one of the largest reserve holders in the United States, provides organic growth opportunities. Our reserves consist principally of three large contiguous blocks of uniform, thick, high heat content (high Btu) thermal coal which is ideal for highly productive longwall operations. Thermal coal is used by power plants and industrial steam boilers to produce electricity or process steam.

We own four mining complexes where we can operate four longwall mines and one continuous miner operation. We invested substantially to construct state-of-the-art, low-cost and highly productive mining operations and related transportation infrastructure. Our four mining complexes can collectively support up to nine longwalls, with a portion of the existing surface infrastructure available to be shared among most of our potential future longwalls. Mining operations at our Hillsboro complex have been idled since March 2015 due to a combustion event and we are uncertain as to when production will resume.

Our operations are strategically located near multiple rail and river transportation access points giving us cost-competitive transportation options. We have developed infrastructure that provides each of our four mining complexes with multiple transportation outlets including direct and indirect access to five Class I railroads. Our access to competing rail carriers as well as access to truck and barge transport provides us with operating flexibility and minimizes transportation costs. We own a 25 million ton per year barge-loading river terminal on the Ohio River and also have contractual agreements for 6 million tons per year of export terminal capacity in the Gulf of Mexico. We have long-term, fixed price transportation contracts from our mines to these terminals. These logistical arrangements provide transportation cost certainty and the flexibility to direct shipments to markets that provide the highest margin for our coal sales.

We market and sell our coal primarily to electric utility and industrial companies in the eastern half of the United States and the international market. We sell the majority of our domestic tonnages to electric utilities with installed pollution control devices. These devices, also known as scrubbers, are designed to eliminate substantially all emissions of sulfur dioxide.

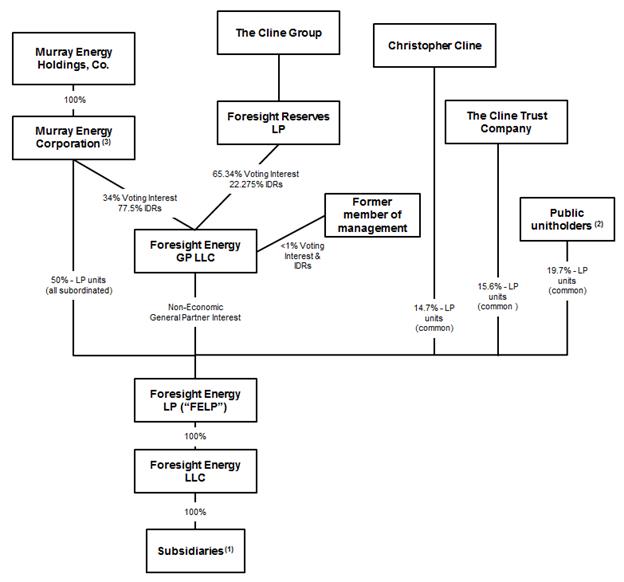

Foresight Energy LP, a Delaware limited partnership formed on January 26, 2012, completed its initial public offering on June 23, 2014 and is listed on the New York Stock Exchange (“NYSE”) under the ticker symbol “FELP.” We are managed and operated by the board of directors and executive officers of our general partner, Foresight Energy GP LLC (“FEGP”), which is owned by Foresight Reserves LP (“Foresight Reserves”), Murray Energy Corporation (“Murray Energy”), and a former member of management.

2

Below is a diagram of our organizational and ownership structure as of February 24, 2017:

|

|

(1) |

See Exhibit 21.1 for a list of subsidiaries. |

|

|

(2) |

Includes common units held by executive officers and directors (other than Christopher Cline). |

|

|

(3) |

Murray Energy, an affiliate of Murray Energy or a group of persons which includes Murray Energy or any of its affiliates (collectively, the “Murray Group”) has the right to purchase all (but not less than all) of the outstanding Exchangeable PIK Notes on or prior to October 2, 2017 for cash at a price equal to 100% of the principal amount of the Exchangeable PIK Notes plus accrued interest. Upon such a purchase, the Murray Group will receive FELP limited partner units at the exchange rate defined in the Exchangeable PIK Notes indenture agreement. Murray Energy also has an option to purchase an additional 46% of the voting interests in FEGP for $15 million, which is conditioned upon its redemption of the Exchangeable PIK Notes on or prior to October 2, 2017. Also, as part of the global restructuring of our debt, warrants were issued to certain holders of our indebtedness which are exercisable following a Note Redemption. Please read Part II. “Item 8. Financial Statements and Supplementary Data, Note 10–Long Term Debt and Capital Lease Obligations” and Part II. “Item 8. Financial Statements and Supplementary Data, Note 15–Related-Party Transactions” for additional discussion. |

3

On August 30, 2016, we completed a global restructuring of our indebtedness. The restructuring transactions alleviated existing defaults and events of default across the Partnership’s capital structure that resulted from the 2015 Delaware Chancery Court change-of-control litigation related to the purchase and sale agreement between Foresight Reserves and Murray Energy. See “Item 8. Financial Statements and Supplementary Data – Note 10. Long-Term Debt and Capital Lease Obligations” and “Item 8. Financial Statements and Supplementary Data – Note 15. Related-Party Transactions” for additional discussion of the restructuring transactions.

Mining Operations

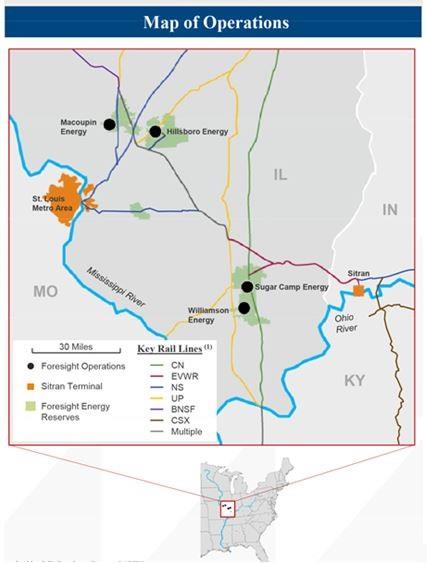

Each of our four mining complexes operates in the Illinois Basin; with two located in Southern Illinois and two located in Central Illinois. Williamson, Sugar Camp and Hillsboro are longwall operations, and Macoupin is currently a continuous miner operation. The geology, mine plan, equipment and infrastructure at each of our Williamson, Sugar Camp and Hillsboro mines are relatively similar. Each of our mining complexes has its own preparation plant and support facilities. The following map shows the location of our mining complexes and transportation network:

(1)“CN”: Canadian National line; “EVWR”: the Evansville Western line; “NS”: the Norfolk Southern line; “UP”: Union Pacific line; “BNSF”: BNSF Railway line; and “CSX”: CSX Corporation line.

4

The table below summarizes our operations, available mining methods, transportation access, reserves and production:

|

|

|

|

|

|

|

Proven and |

|

|

Production (3) |

|

||||||||||

|

|

|

Available Mining |

|

Transportation |

|

Probable |

|

|

Year Ended December 31, |

|

||||||||||

|

Complex |

|

Methods (1) |

|

Access (2) |

|

Reserves |

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

||||

|

|

|

|

|

|

|

(In Millions of Tons) |

|

|||||||||||||

|

Williamson |

|

LW, CM |

|

Rail (CN), Barge (OHR, MSR), Truck |

|

|

376.0 |

|

|

|

5.4 |

|

|

|

5.6 |

|

|

|

6.5 |

|

|

Sugar Camp |

|

LW, CM |

|

Rail (CN, NS, CSX, BNSF), Barge (OHR, MSR), Truck |

|

|

1,336.5 |

|

|

|

11.4 |

|

|

|

10.6 |

|

|

|

9.1 |

|

|

Hillsboro |

|

LW, CM |

|

Rail (UP, NS, CN), Barge (OHR, MSR), Truck |

|

|

322.1 |

|

|

|

- |

|

|

|

1.9 |

|

|

|

5.6 |

|

|

Macoupin |

|

CM, LW |

|

Rail (UP, NS, CN), Barge (OHR, MSR), Truck |

|

|

64.4 |

|

|

|

2.2 |

|

|

|

2.0 |

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

2,099.0 |

|

|

|

19.0 |

|

|

|

20.1 |

|

|

|

22.8 |

|

|

(1) |

LW: Longwall; CM: Continuous miner. Williamson, Sugar Camp and Hillsboro use CM for development sections only. Macoupin does not currently mine with a longwall. |

|

(2) |

CN: Canadian National Railway Company; UP: Union Pacific Railroad Corporation; NS: Norfolk Southern Corporation; CSX: CSX Corporation; BNSF: BNSF Railway Company; OHR: Ohio River; MSR: Mississippi River. |

|

(3) |

As reported by the Mine Safety and Health Administration (“MSHA”), inclusive of tons produced for certain mines in development. |

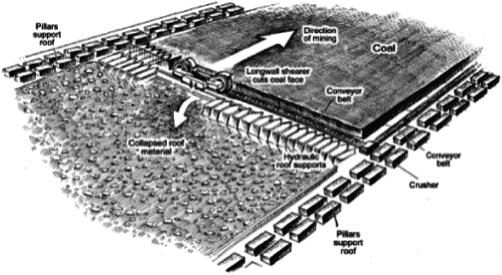

Longwall mining is a highly-automated, underground mining technique that generates high volumes of low-cost coal production and is typically supported by one or two continuous mining units. While the continuous mining units contribute to coal production, the primary function is to prepare an area of the mine for longwall operations. A longwall mining system uses a shearer to cut the coal, self-advancing roof supports to protect the miners working at the longwall face and an armored face conveyor to transport the coal. The longwall mining system is highly productive due to the continuous nature of coal production and the high volume of coal produced relative to the number of personnel required to operate the system.

Below is an illustrative diagram of the longwall mining process:

5

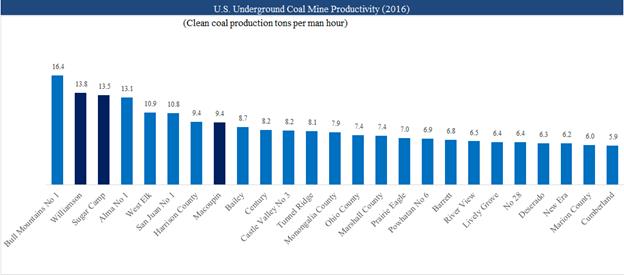

We have been able to sustain our high productivity and low operating costs since we started our first longwall in 2008 and the high productivity at the newer mines we have developed demonstrates the repeatability of our mine design. The high productivity translates into low costs and, in 2016, our operations had an average cash cost of $22.32 per ton sold. Our mines that operated during 2016 were among the ten most productive underground coal mines in the United States on a clean tons produced per man hour basis based on MSHA data, as illustrated below.

Source: MSHA data. Note: The chart above displays the top 25 most productive underground mines out of 210 mines with over 100,000 tons produced during 2016 on a clean tons produced per man hour basis. Darker shading denotes mines owned by Foresight Energy LP. Mining operations at our Hillsboro complex have been idled since March 2015 due to a combustion event.

Williamson Mining Complex

Our Williamson mine is wholly-owned by our subsidiary Williamson Energy, LLC (“Williamson”) and is located in southern Illinois near the town of Marion. Williamson is the first mine we developed, with longwall mining production commencing in 2008. The mine operates in the Herrin No. 6 Seam, using one longwall system and two continuous miner units to develop the mains and gate roads for its longwall panels. Coal is washed at Williamson’s 2,000 tons-per-hour (“tph”) preparation plant, stockpiled and then shipped by rail or truck to our customers or a terminal. Williamson’s coal is shipped via the CN railroad to the Ohio and Mississippi Rivers to serve the domestic thermal market or to a terminal near New Orleans to serve the international thermal market. Williamson has access to several barge facilities on the Ohio and Mississippi Rivers and two vessel loading facilities near New Orleans. Williamson was the second most productive underground coal mine in the United States in 2016 on a clean tons produced per man hour basis based on MSHA data.

Sugar Camp Mining Complex

Our Sugar Camp mine is wholly-owned by our subsidiary Sugar Camp Energy, LLC (“Sugar Camp”), and is located in southern Illinois approximately 12 miles north of Williamson. Sugar Camp’s first longwall system began production in the first quarter of 2012 and its second longwall system began production in the second quarter of 2014. Sugar Camp’s original infrastructure, including its bottom development, slope belt, material handling system and rail loadout, supports both longwalls. Sugar Camp operates in the Herrin No. 6 Seam and uses a similar mine design and equipment as Williamson. With additional equipment, infrastructure and mine development, Sugar Camp has the capacity to add two incremental longwall systems. Coal is washed at Sugar Camp’s two 2,000 tph preparation plants, stockpiled and then shipped by rail or truck to our customers or a terminal. Sugar Camp has direct access to the CN railroad which can deliver its coal to the Ohio and Mississippi Rivers to serve the domestic thermal market or to two vessel loading facilities near New Orleans to serve the international thermal market. Sugar Camp also has indirect access to the NS, BNSF and CSX railroads. Sugar Camp was the third most productive underground coal mine in the United States in 2016 on a clean tons produced per man hour basis based on MSHA data.

6

Our Hillsboro mine is wholly-owned by our subsidiary Hillsboro Energy LLC (“Hillsboro”), and is located in central Illinois near the town of Hillsboro. Hillsboro’s longwall mining system began production in the third quarter of 2012. The mine operates in the Herrin No. 6 Seam and uses similar mine design and similar equipment as Williamson and Sugar Camp. Coal is washed at Hillsboro’s 2,000 tph preparation plant, stockpiled and then shipped by rail or truck to our customers or a terminal. Hillsboro has direct access to the UP and NS railroads and indirect access to the CN railroad, which allows for the delivery of its coal directly to customers or to the Ohio and Mississippi Rivers in order to serve the domestic thermal market or the international thermal market through two terminals near New Orleans.

Our Hillsboro mine experienced an underground combustion event beginning in March 2015. Thus far, we have been unsuccessful at permanently extinguishing the fire. We continue to work closely with MSHA to gain re-entry to the mine. We are uncertain as to when production will resume at this operation but we are working closely with MSHA and the Illinois Office of Mines and Minerals Mine Safety and Training Division to ensure the safety of our employees throughout the process and to explore alternatives to safely resolve this issue.

Macoupin Mining Complex

Our Macoupin mine is wholly-owned by our subsidiary Macoupin Energy LLC (“Macoupin”), and is located in central Illinois near the town of Carlinville. We acquired the Macoupin mine in 2009 and sealed the majority of the previously mined area and implemented a new mine plan and design. In addition, the surface facilities were upgraded, including the rehabilitation of the preparation plant. Coal production began in 2009 with a single continuous miner super-section utilizing battery powered coal haulers. An additional continuous miner unit was added in 2011 using a flexible conveyor train system rather than coal haulers. Coal is washed at Macoupin’s 850 tph preparation plant, stockpiled and then shipped by rail or truck to our customers or a terminal. Macoupin has direct access to both the UP and NS railroads and indirect access to the CN railroad, which allows for the delivery of its coal directly to customers or to terminals at the Ohio and Mississippi Rivers to serve the domestic thermal market or the international thermal market through two terminals near New Orleans. Macoupin was the eighth most productive underground coal mine in the United States in 2016 on a clean tons produced per man hour basis based on MSHA data.

Transportation

Our coal is transported to our domestic customers and export terminal facilities by rail, barge and truck. Depending on the proximity of our customers to the mines and the transportation available to deliver coal to that customer, transportation costs can be a substantial part of the total delivered cost of coal. Because our reserves and mines are favorably located near multiple rail and river transportation options, we believe we can negotiate advantageous transportation rates, allowing us to keep our transportation costs relatively low while providing broad market access for our coal.

We have direct and indirect rail access to domestic customers via five Class I railroads, river access to domestic customers via various Ohio and Mississippi River terminals, and river and rail access to coal export terminals for shipping to international customers. We have agreements with rail carriers that vary in initial length from one to twenty years. We also have favorable access to the international market through the CN railroad and export terminals through long-term contractual arrangements. The international market provides us with an alternative to the domestic market and has historically been an important economic outlet for our coal. While transportation costs are higher for exports to the international market, we could, in certain market conditions, receive higher coal sale prices on export sales, which partially offset the higher transportation costs. Rates and practices of the transportation companies serving a particular mine or customer may affect our marketing efforts with respect to coal produced from the relevant mine.

For the year ended December 31, 2016, approximately 31% of our coal sales volume was shipped to our domestic customers by barge, 52% to our domestic customers by rail or truck and 17% was shipped to our international customers.

Our Sitran terminal is a high-capacity coal transloading facility on the Ohio River near Evansville, Indiana to which each of our mines has access. The facility currently has a single rail loop, a bottom discharge rail car unloader, stacking tubes to facilitate ground storage and blending, barge loading capabilities and throughput capacity of 25 million tons of coal per year. The terminal has the potential for a dual rail loop that would have capacity for two loaded and two empty unit trains.

7

During the years ended December 31, 2016, 2015 and 2014, we generated total revenues of $875.8 million, $984.9 million and $1,109.4 million, respectively. Our primary domestic customers are electric utility and industrial companies in the eastern half of the United States. Our three largest customers in 2016 were Southern Company, EDF Trading and Dayton Power and Light Company, representing approximately 30.1%, 12.6% and 10.2% of our total coal sales revenues, respectively. If these three customers or any of our largest customers were to significantly reduce their purchases of coal from us, or if we were unable to sell coal to our largest customers on terms as favorable to us as the terms under our current contracts, our results of operations may be materially adversely affected.

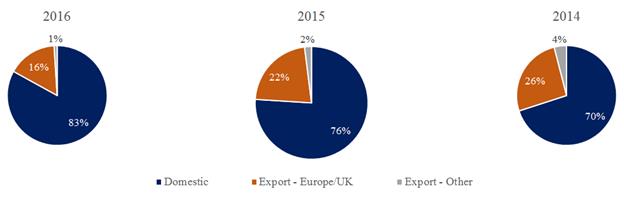

The international thermal coal market has also been a substantial part of our business with direct and indirect sales to end users in Europe, South America, Africa and Asia. During the years ended December 31, 2016, 2015 and 2014, export tons represented approximately 17%, 24% and 30% of tons sold, respectively. The charts below illustrate our sales mix, by destination, for the years ended December 31, 2016, 2015 and 2014.

Our management actively monitors trends in contract pricing and seeks to enter into coal sales contracts at favorable prices. Many of our contracts allow us to substitute coal from our other mining complexes. For 2017, as of February 17, 2017, we have 16.9 million tons of our projected production contractually committed.

The terms of our coal supply agreements result from competitive bidding and extensive negotiations with customers. Consequently, the terms of these contracts, including price adjustment features, price reopener terms, coal quality requirements, quantity adjustment mechanisms, permitted sources of supply, future regulatory changes, extension options, force majeure provisions, and termination and assignment provisions, vary significantly by customer.

Most of our coal supply agreements contain provisions requiring us to deliver coal within certain ranges for specific quality characteristics such as heat content, sulfur, and ash. Failure to meet these conditions could result in substantial price reductions or suspension or termination of the contract at the election of the customer. Although the minimum volume to be delivered under a long-term contract is stipulated, either party may vary the timing of delivery based on certain contractual provisions. Contracts also typically contain force majeure provisions allowing for the suspension of performance by either party for the duration of specified events beyond the control of the affected party, including labor disputes. Some contracts may terminate upon continuance of an event of force majeure for an extended period. Some of our long-term contracts provide for a predetermined adjustment to the stipulated base price at times specified in the agreement or at other periodic intervals to account for changes in prevailing market prices.

In addition, most of our contracts contain provisions permitting us to adjust the base price due to compliance with new statutes, ordinances or regulations that affect our costs related to performance of the agreement. Also, some of our contracts contain provisions that allow for the recovery of certain costs incurred due to modifications or changes in the interpretations or application of any applicable government statutes.

Price reopener provisions are present in several of our long-term contracts. These provisions may automatically set a new price based on prevailing market price or, in some instances, require the parties to agree on a new price. In a limited number of agreements, failure of the parties to agree on a price under a price reopener provision can lead to termination of the contract. Under some of our contracts, we have the right to match lower prices offered to our customers by other suppliers.

8

The United States coal industry is highly competitive, both regionally and nationally. In the Illinois Basin, we compete primarily with coal producers such as Peabody Energy Corporation; Alliance Resource Partners, L.P.; Murray Energy (an affiliate); Armstrong Energy Inc.; and Sunrise Coal LLC. Outside of the Illinois Basin, we compete broadly for coal sales with other United States-based producers of thermal coal, and we compete internationally with numerous global coal producers.

A number of factors beyond our control affect the markets in which we sell our coal. Continued demand for our coal and the prices obtained by us depend primarily on: the coal consumption patterns of the electricity industry in the United States and elsewhere around the world; the availability, location, cost of transportation and price of competing coal; and other electricity generation and fuel supply sources such as natural gas, oil, nuclear, hydroelectric and renewable energy. Coal consumption patterns are affected primarily by the demand for electricity, the amount of coal supply in the market, environmental and other governmental regulations and technological developments. The most important factors on which we compete are price, coal quality characteristics and reliability of supply.

Segments

We operate as a single reportable segment. See Part II. “Item 8. Financial Statements and Supplementary Data” for our consolidated revenues and total assets.

Employees and Labor Relations

As of December 31, 2016, we had 22 corporate employees and 777 employees working in mining and mining-related operations. None of our operations have employees represented by a union. In 2015, we entered into a management services agreement with a subsidiary of Murray Energy pursuant to which it provides certain management and administration services to us for a quarterly fee. Please read Part II. “Item 8. Financial Statements and Supplementary Data, Note 15–Related-Party Transactions” for additional discussion.

9

Environmental and Other Regulatory Matters

Our operations are subject to a variety of U.S. federal, state and local laws and regulations, such as those relating to employee health and safety; water discharges; air emissions; plant and wildlife protection; the restoration of mining properties; the storage, treatment and disposal of wastes; remediation of contaminants; surface subsidence from underground mining and the effects of mining on surface water and groundwater conditions.

We are not aware of any notice from a governmental agency of any material non-compliance with applicable laws, regulations, or permits that the Partnership has failed to address. However, there can be no assurance that violations will not occur in the future; that we will be able to always obtain, maintain or renew required permits; or that changes in these requirements or their enforcement or the discovery of new conditions will not cause us to incur significant costs and liabilities in the future. Due to the nature of the regulatory programs that apply to our mining operations, which can impose liability even in the absence of fault and often involve subjective criteria, it is not reasonable to expect any coal mining operation to be free of citations. Certain of our current and historical mining operations use or have used or store regulated materials which, if released into the environment, may require investigation and remediation. Under certain permits, we are required to monitor groundwater quality on and adjacent to our sites and to develop and implement plans to minimize and correct land subsidence, as well as impacts on waterways and wetlands, caused by our mining operations. Major regulatory requirements are briefly discussed below.

Mine Safety and Health

In the United States, the Coal Mine Health and Safety Act of 1969, the Federal Mine Safety and Health Act of 1977 (the “1977 Act”) and the Mine Improvement and New Emergency Response Act of 2006 (“MINER Act”) impose stringent mine safety and health standards on all aspects of mining operations. In 1978, MSHA was created to carry out the mandates of the 1977 Act and was granted enforcement authority. MSHA is authorized to inspect all underground mining operations at least four times a year and issue citations with civil penalties for the violation of a mandatory health and safety standard. MSHA review and approval is required for a number of miner safety and welfare plans including ventilation, roof control/bolting, safety training and ground control, refuse disposal and impoundments and respirable dust. Also, the State of Illinois has its own programs for mine safety and health regulation and enforcement.

Under the 1977 Act, MSHA has the authority to issue orders or citations to mine operators regardless of the degree of culpable conduct engaged in by the operator, and it must assess a penalty for each citation or order. Factors such as degree of negligence and gravity of the violation affect the amount of penalty assessed, and sometimes permit MSHA to issue orders directing withdrawal of miners from the mine or affected areas within the mine. The 1977 Act contains provisions that can impose criminal liability on the mine operator or individuals.

The MINER Act added more extensive health and safety compliance standards, and increased civil and criminal penalties. Some of the MINER Act requirements included stricter criteria for sealing off abandoned areas of mines, the addition of refuge alternatives, stricter requirements for conveyor belts, and upgrades to communication with and tracking of miners underground.

MSHA continues to promulgate rules that affect our mining operations. In March 2013, MSHA implemented a revised Pattern of Violations (“POV”) standard. Under the revised standard, mine operators are no longer entitled to a ninety day notice of potential POV. In addition, MSHA began screening for POV by using issued citations and orders, prior to their final adjudication. If a mine is designated as having a POV, MSHA will issue an order withdrawing miners from any areas affected by violations which pose a significant and substantial (“S&S”) hazard to the health and/or safety of miners. Once a mine is in POV status, it can be removed from that status only upon (i) a complete inspection of the entire mine with no S&S enforcement actions issued by MSHA or (ii) no POV-related withdrawal orders being issued by MSHA within ninety (90) days following the mine operator being placed on POV status. However, from time to time one or more of our operations may meet the POV screening criteria, and we cannot make assurances that one or more of our operations will not be placed into POV status, which could materially and adversely affect our results of operations.

In April 2014, MSHA issued, among other provisions, a final rule lowering certain standards for respirable dust. Specifically, the rule reduces the overall dust standard from 2.0 to 1.5 milligrams per cubic meter of air and cuts in half the standard from 1.0 to 0.5 for certain mine entries and miners with pneumoconiosis, as well as changes sampling protocols and increases governmental oversight. On August 1, 2016, Phase III of MSHA’s respirable dust rule, imposing these new limits, went into effect. These final rules could make compliance more costly and approval for ventilation plans in underground coal mines more difficult to obtain.

In July 2014, MSHA issued a proposed rule that would change its civil penalty criteria under 30 Code of Federal Regulation (“CFR”) Part 100. The proposed rule increases the civil penalties for those violations exhibiting more than ordinary negligence. While

10

this rule is not final, it could, if implemented, increase the amount of civil penalties our operations pay to MSHA. MSHA has yet to adopt a final rule regarding these proposed changes to Part 100; however, in August 2016 and then again in January 2017, MSHA adjusted its existing civil penalties for inflation, which prior to these dates were last set in 2007. While these rules resulted in different relative impacts on particular penalty amounts, the net effect of these adjustments increased the amount of penalties that MSHA may impose on operators.

In January 2015, MSHA issued a final rule on the use of proximity detection systems on certain pieces of underground mining equipment. The rule requires, among other provisions, continuous mining machines to be equipped with electronic sensing devices that can detect the presence of miners in proximity to the machines and then cause moving or repositioning continuous mining machines to stop before contacting a miner. The final rule has a phase in period, depending upon the age of the continuous mining machine, of 8 to 36 months.

These requirements have, and will continue to have, a significant effect on our operating costs.

In June 2016, MSHA issued a request for information on approaches to control and monitor miners’ exposures to diesel exhaust. While MSHA’s existing regulations address health hazards to coal miners from exposure to diesel particulate matter (“DPM”), MSHA is requesting information on approaches that would improve control of DPM and diesel exhaust. Although no rule has been proposed, if a rule that lowered DPM emission limits is proposed and adopted, it could have a significant impact on our operating costs.

Black Lung

Under the United States Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must secure payment of federal black lung benefits to claimants who have been diagnosed with pneumoconiosis and are current or former employees and must also pay into a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to July 1, 1973. The trust fund is funded by an excise tax on production sold domestically of up to $1.10 per ton for deep-mined coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price.

U.S. Environmental Laws

We are subject to various U.S. federal, state and local environmental laws. Some of these laws, as discussed below, impose stringent requirements on our coal mining operations. U.S. federal and state regulations require regular monitoring of our mines and other facilities to ensure compliance. U.S. federal and state inspectors are required to inspect our mining facilities on a frequent schedule. Future laws, regulations or orders, as well as future interpretations or more rigorous enforcement of existing laws, regulations or orders, may require increases in capital and operating costs, the extent of which we cannot predict.

The Surface Mining Control and Reclamation Act (“SMCRA”)

SMCRA, which is administered by the Office of Surface Mining Reclamation and Enforcement (“OSM”), establishes mining, environmental protection and reclamation standards for all aspects of surface mining as well as many aspects of deep mining. Mine operators must obtain SMCRA permits and permit renewals from the OSM or the applicable state agency. Where state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the regulatory authority. Illinois has achieved primary control of enforcement through federal authorization. SMCRA also stipulates compliance with many other major environmental statutes, including: the Clean Air Act; the Endangered Species Act; the Clean Water Act of 1972 (“CWA”); the Resource Conservation and Recovery Act (“RCRA”) and the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”).

SMCRA permit provisions include a complex set of requirements governing the following processes: coal prospecting; mine plan development; topsoil removal, storage and replacement; selective handling of overburden materials; mine pit backfilling and grading; protection of the hydrologic balance; subsidence control for underground mines; surface drainage control; mine drainage and mine discharge control and treatment; restoration to the approximate original contour; and re-vegetation. The disposal of coal refuse is also permitted under SMCRA. Both coarse refuse and slurry disposal areas, including the disposal of slurry underground, require permits from the Illinois Department of Natural Resources (“IDNR”).

The mining permit application process is initiated by collecting baseline data to adequately characterize the pre-mine environmental condition of the permit area. This work includes surveys of culturally and historically important natural resources, soils, vegetation, and wildlife, as well as the assessment of surface and ground water hydrology, climatology and wetlands. In conducting this work, we collect geologic data to define and model the soil and rock structures and coal that we will mine. We develop mining

11

and reclamation plans by utilizing this geologic data and incorporating elements of the environmental data. The mining and reclamation plan incorporates the provisions of SMCRA, state programs and other complementary environmental programs that regulate coal mining. Also included in the permit application are documents defining ownership and agreements pertaining to coal, minerals, oil and gas, water rights, rights of way and surface land, and documents required by the OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal owners of the entity.

Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness review and technical review. Public notice of the proposed permit is given that also provides for a comment period before a permit can be issued. Some SMCRA mine permits take over a year to prepare, depending on the size and complexity of the mine and may take months or years to be reviewed and issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public and other agencies have rights to comment on and otherwise engage in the permitting process, including through intervention in the courts. Before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of reclamation obligations.

In July 2015, the OSM issued a new proposed revision to its Stream Buffer Zone Rule (“Stream Protection Rule”). OSM issued the final Stream Protection Rule in December 2016. The final rule significantly expands the baseline data requirements for permit applications by requiring extensive baseline data on hydrology, geology and aquatic biology; provides a definition of “material damage” that a permittee must prevent outside of the permitted area; requires additional monitoring during mining and reclamation; imposes new requirements related to listed and proposed threatened and endangered species under the Endangered Species Act; increases bonding requirements for stream restoration and restricts the use of certain types of bonds; and expands other restoration and stream protection requirements for both surface and underground mines. The final rule made slight changes to the proposed rule, such as clarifying the definition of “material damage to the hydrologic balance outside the permit area.” The final rule defines this concept as an adverse impact on the quality or quantity of surface water or groundwater, or on the biological condition of a perennial or intermittent stream, and the final rule will measure compliance by determining whether the mining operation has caused or contributed to a violation of water quality standards promulgated under the Clean Water Act or to non-attainment of premining uses of surface water or groundwater. Additionally, the final rule prohibits mining operations that will result in a violation of the Endangered Species Act. The final rule also clarifies that longwall mining that uses planned subsidence is not prohibited, and that temporary impacts are allowed so long as they do not rise to the level of “material damage to the hydrologic balance outside the permit area.” Under the rule, the regulatory authority is required to determine whether a permittee’s proposed operation will cause “material damage,” and if it does, then a permit will not be issued.

North Dakota filed suit opposing the rule in the United States District Court for the District of Columbia. The rule will likely face opposition in Congress in the upcoming legislative session. In February 2017, both the House and the Senate passed measures to revoke the Stream Protection Rule under the Congressional Review Act, which gives Congress the ability to repeal regulations promulgated in the last 60 days of the congressional session. On February 16, 2017, President Donald J. Trump signed a bill revoking the Stream Protection Rule, and prohibiting federal agencies from issuing a new rule that is substantially similar without authorization from Congress. In the absence of federal regulation amending the Stream Buffer Rule, states, such as Illinois, with primacy over their mining programs, may adopt and implement requirements similar to, or more stringent than, the Stream Protection Rule at the state level. Such requirements would likely add costs and delays to the SMCRA permitting process, add costs to our operations and reclamation activities, subject our operations to new risks of suspension or revocation of permits to conduct mining activities, and possibly diminish our ability to fully mine our reserves with the longwall method.

In November 2016, eighteen states filed suit challenging a rule recently finalized by the Fish and Wildlife Service and the National Marine Fisheries Service that expands the definitions of “critical habitat” and “adverse modification” in regulations implementing the Endangered Species Act (“ESA”). Whether an area is designated as critical habitat has implications under Section 7 of the ESA, which requires Federal agencies to consult on any action that “may affect” a listed species. Section 7 consultation is potentially triggered in the permitting of coal mining operations, and the new rule could impact our ability to obtain necessary permits. The states’ lawsuit was filed soon after the election of President Trump, and it is possible that the Administration may decide not to defend the rule and, perhaps, ask for a judicial stay during a reconsideration of the rule.

The Abandoned Mine Land Fund, which is part of SMCRA, requires a fee on all coal produced. The proceeds are used to reclaim mine lands closed or abandoned prior to SMCRA’s adoption in 1977. The fee on surface-mined coal is currently $0.28 per ton and the fee on deep-mined coal, which is applicable to our operations, is $0.12 per ton.

Various federal and state laws, including SMCRA, require us to obtain surety bonds or other forms of financial security to secure payment of certain long-term obligations, including mine closure and reclamation costs. In August 2016, the OSM issued a Policy Advisory discouraging state regulatory authorities from approving self-bonding arrangements. The Policy Advisory indicated that the OSM would begin more closely reviewing instances in which states accept self-bonds for mining operations. In the same month, the OSM also announced that it was beginning the rulemaking process to strengthen regulations on self-bonding. Although we do not use

12

self-bonding, the elimination or restriction of this option may lead more parties to see third party bonding which could end up restricting supply and increasing our costs of maintaining our bonds.

As of December 31, 2016, we had outstanding surety bonds of $83.4 million primarily related to these matters. Changes in these laws or regulations could require us to obtain additional surety bonds or other forms of financial security.

Clean Air Act

The Clean Air Act and comparable state laws that regulate air emissions affect coal mining operations both directly and indirectly. Direct impacts on coal mining operations may occur through Clean Air Act permitting requirements or emission control requirements relating to particulate matter, such as fugitive dust, including future regulation of fine particulate matter measuring 2.5 micrometers in diameter or smaller. The Clean Air Act indirectly affects coal mining operations by extensively regulating the air emissions of sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal-fired electricity generating plants.

Clean Air Act requirements that may directly or indirectly affect our operations include the following:

Acid Rain. Title IV of the Clean Air Act requires a two-phase reduction of sulfur dioxide emissions by electric utilities and applies to all coal-fired power plants generating greater than 25 megawatts of power. The affected electricity generators have sought to meet these requirements by, among other compliance methods, switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing sulfur dioxide emission allowances. We cannot accurately predict the effect of these provisions of the Clean Air Act on our customers and in turn, on our business in future years. We believe that implementation of the Act has resulted in increasing installations of pollution control devices as a control measure and thus, has created a growing market for our higher sulfur coal.

Fine Particulate Matter. The Clean Air Act requires the Environmental Protection Agency (“EPA”) to set standards, referred to as National Ambient Air Quality Standards (“NAAQS”), for certain pollutants. Areas that are not in compliance (referred to as “non-attainment areas”) with these standards must take steps to reduce emissions levels. The EPA promulgated NAAQS for particulate matter with an aerodynamic diameter less than or equal to 10 microns, or PM10, and for fine particulate matter with an aerodynamic diameter less than or equal to 2.5 microns, or PM2.5. Meeting current or potentially more stringent new PM2.5 standards may require reductions of nitrogen oxide and sulfur dioxide emissions. Future regulation and enforcement of the new PM2.5 standard will affect many power plants and coke plants, especially coal-fired power plants and all plants in non-attainment areas. Continuing non-compliance could prevent issuance of permits to facilities within the non-attainment areas

Ozone. Significant additional emissions control expenditures will be required at coal-fired power plants and coke plants to meet the current NAAQS for ozone. Nitrogen oxides, which are a by-product of coal combustion, can lead to the creation of ozone. Accordingly, emissions control requirements for new and expanded coal-fired power plants and industrial boilers and coke plants will continue to become more stringent in the years ahead. In October 2015, the EPA updated the NAAQS for ozone to 70 parts per billion (ppb), down from 75 ppb. The EPA has the authority to further strengthen ozone standards to protect public health, and the Clean Air Act requires periodic review of the NAAQS. If the NAAQS for ozone becomes more stringent in the future, it could increase the costs of operating coal-fired power plants.

Cross-State Air Pollution Rule (“CSAPR”). The CSAPR, which was intended to replace the previously developed Clean Air Interstate Rule (“CAIR”), requires states to reduce power plant emissions that contribute to ozone or fine particle pollution in other states. Under the CSAPR, emissions reductions were to have started January 1, 2012, for SO2 and annual NOx reductions, and May 1, 2012, for ozone season NOx reductions. Several states and other parties filed suits in the United States Court of Appeals for the District of Columbia Circuit in 2011 challenging the CSAPR. On August 21, 2012, the D.C. Circuit vacated the CSAPR and ordered the EPA to continue administering CAIR, pending the promulgation of a replacement rule. On April 29, 2014, the United States Supreme Court found that the EPA was complying with statutory requirements when it issued CSAPR and reversed the D.C. Circuit’s vacation of CSAPR. On October 23, 2014, the D.C. Circuit granted the EPA’s request to lift the stay on CSAPR. In July 2015 and on remand from the Supreme Court of the United States, the D.C. Circuit upheld the provisions of CSAPR against broad challenges to the rule, but granted certain limited relief to states that brought “as applied” challenges to their respective emissions budgets set by EPA. In November 2015, the EPA issued a proposed CSAPR Rule Update in part to address the D.C. Circuit's ruling regarding emissions budgets. The Rule Update proposes implementation of CSAPR's emission budgets in the 2017 ozone season. In September 2016, the EPA finalized the CSAPR Rule Update for the 2008 ozone NAAQS. Starting in May 2017, the rule will reduce summertime NOx emissions from power plants in 22 states in the eastern U.S. It is unclear what effect, if any, CAIR will have on our operations or results. Because U.S. utilities have continued to take steps to comply with CAIR, which requires similar power plant emissions reductions, and because utilities are preparing to comply with the Mercury and Air Toxics Standards regulations which require overlapping power plant emissions reductions, the practical impact of the reinstatement of CSAPR is expected to be limited.

13

However, the cost of compliance with CAIR and now CSAPR could add to pressure to shut down units, which may further adversely affect the demand for our coal.

Mercury and Air Toxic Standards (“MATS”). On December 16, 2011, the EPA issued the MATS to reduce emissions of toxic air pollutants, including mercury, other metals and acid gases, from new and existing coal and oil fired power plants. Under the final rule, existing power plants will have up to four years to comply with the MATS by installing or upgrading pollution controls, fuel switching, or using existing emissions controls as necessary to meet the compliance deadline. On June 29, 2015, the Supreme Court of the United States ruled that the EPA acted unreasonably when it determined that cost was irrelevant to the threshold finding that regulating these emissions was appropriate and necessary. This ruling did not overturn the rules in their entirety or allow previously-installed pollution controls to be removed. The EPA has acted to address the Supreme Court ruling by issuing a proposed supplemental finding that a consideration of costs would not change its threshold finding that regulation of these pollutants is appropriate and necessary. MATS has remained in place and, in April 2016, EPA issued its final supplemental finding confirming its earlier appropriate and necessary finding supporting MATS. These requirements could continue to significantly increase our customers’ costs and to cause them to reduce their demand for coal, which may materially impact our results of operations. In August 2016, the EPA denied two petitions for reconsideration of startup and shutdown provisions in MATS, leaving in place the startup and shutdown provisions finalized in November 2014. The EPA also proposed changes to the electronic reporting requirements for MATS in an effort to streamline e-reporting requirements for power plants and make data about emissions more transparent and accessible to the public. EPA’s actions pertaining to startup and shutdown provisions and e-reporting requirements will have limited impact on coal-fired power plants relative to the overall impact of MATS.

Greenhouse Gases (“GHG”). Increasing concern about GHG, including carbon dioxide, emitted from burning coal at electricity generation plants has led to efforts at all levels of government to reduce their emissions, which could require utilities to burn less or eliminate coal in the production of electricity. Congress has considered federal legislation to reduce GHG emissions which, among other things, could establish a cap and trade system for GHG, including carbon dioxide emitted by coal burning power plants, and requirements for electric utilities to increase their use of renewable energy such as solar and wind power. Also, the EPA has taken several recent actions under the Clean Air Act to regulate GHG emissions. These include the EPA’s finding of “endangerment” to public health and welfare from GHG, its issuance in 2009 of the Final Mandatory Reporting of Greenhouse Gases Rule, which requires large sources, including coal-fired power plants, to monitor and report GHG emissions to the EPA annually starting in 2011, and issuance of its Prevention of Significant Deterioration (“PSD”) and Title V Greenhouse Gas Tailoring Rule, which requires large industrial facilities, including coal-fired power plants, to obtain permits to emit, and to use best available control technology to curb GHG emissions. In response to recent Supreme Court and D.C. Circuit decisions, in August 2016 the EPA issued a proposed rule to revise existing PSD and Title V regulations to ensure that a source is not required to obtain a permit under the regulations solely because of GHG emissions. On September 20, 2013, the EPA proposed new source performance standards (“NSPS”), and in January 2014 issued final rules establishing NSPS, for GHG for new coal and oil-fired power plants, which likely will require partial carbon capture and sequestration to comply. On June 2, 2014, the EPA further proposed new regulations limiting carbon dioxide emissions from existing power generation facilities. The EPA issued its final rules, called the Clean Power Plan (“CPP”), in August 2015. Under the CPP, nationwide carbon dioxide emissions from existing plants would be reduced by 32% by 2030, while offering states and utilities flexibility in achieving these reductions. On February 9, 2016, the U.S. Supreme Court issued a temporary stay of the CPP regulations. On September 27, 2016, an en banc panel of the D.C. Circuit Court of Appeals held oral argument in the case challenging the CPP, and a decision is expected in early 2017. The Supreme Court stay will remain in place until the D.C. Circuit Court of Appeals rules on the merits of legal challenges to those regulations, and, if following a ruling by the D.C. Circuit Court of Appeals, a writ of certiorari from the Supreme Court is sought and granted, the stay will remain in place until the Supreme Court issues its decision on the merits. While the EPA’s actions are subject to procedural delays and legal challenges, and efforts are underway in Congress to limit or remove the EPA’s authority to regulate GHG emissions, they will remain in effect unless altered by the courts or Congress. It is possible that the Administration may decide not to defend these and other rules concerning GHG emissions, or may seek to modify or revoke these rules.

In October 2016, a U.S. District Judge in West Virginia ruled that the EPA explicitly neglected its duties under Section 321(a) of the Clean Air Act to study the effects of its regulations on jobs and ordered the EPA to come up with a compliance plan. The EPA indicated that it planned to consult with its Science Advisory Board and appeal the order to the Fourth Circuit. Unsatisfied with EPA’s response, in January 2017, the federal judge ordered the agency to come up with an economic analysis of the effects of its regulations on the coal mining and power generating industries by July 1, 2017 and to put measures in place by the end of the year to continually monitor any losses or shifts in employment that result from its regulations. The EPA maintains that it has complied with the requirements of Section 321(a) and has appealed the judge’s decision to the Fourth Circuit.

In a parallel litigation, 25 states and other parties filed lawsuits challenging EPA’s final NSPS rules for carbon dioxide emissions from new, modified, and reconstructed power plants under the Clean Air Act. One of the primary issues in these lawsuits is EPA’s establishment of standards of performance based on technologies including carbon capture and sequestration (“CCS”). New coal plants cannot meet the new standards unless they implement CCS, which reportedly is not yet commercially available or technically

14

feasible. Oral arguments in this case are scheduled for April 2017. Should EPA’s regulations be upheld by the court, they could materially impact the ability of customers to build new, or modify or reconstruct existing, coal-fired power plants, and thus reduce the demand for coal.

In addition to the above developments, 195 nations (including the United States) signed the Paris Agreement, a long-term, international framework convention designed to address climate change over the next several decades. This agreement entered into force in November 2016 after more than 70 countries, including the United States, ratified or otherwise agreed to be bound by the agreement. The United States was among the countries that submitted its declaration of intended greenhouse gas reductions in early 2015, stating its intention to reduce U.S. greenhouse gas emissions by 26-28% by 2025 compared to 2005 levels. Whether and to what extent the United States meets its stated intention likely depends on several factors, including whether the presently-stayed Clean Power Plan (or a comparable alternative) is implemented and the Trump Administration’s reported reevaluation of the United States’ continued participation in the Paris Agreement. Over the long term, international participation in the Paris Agreement framework could reduce overall demand for coal which could have a material adverse impact on us. These effects could be more adverse to the extent the United States ultimately participates in these reductions (whether via the Paris Agreement or otherwise).

Regional Emissions Trading. Nine northeast and mid-Atlantic states have cooperatively developed a regional cap and trade program, the Regional Greenhouse Gas Initiative (“RGGI”), intended to reduce carbon dioxide emissions from power plants in the region. There can be no assurance at this time that this, or similar state or regional carbon dioxide cap and trade programs (including the Western Climate Initiative, the Midwestern Greenhouse Gas Reduction Accord and the California Global Warming Solutions Act), in the states where our customers operate, will not adversely affect the future market for coal in the region.

Regional Haze. The EPA has initiated a regional haze program designed to protect and to improve visibility at and around national parks, national wilderness areas and international parks. This program restricts the construction of new coal-fired power plants whose operation may impair visibility at and around federally protected areas. Moreover, this program may require certain existing coal-fired power plants to install additional control measures designed to limit haze-causing emissions, such as sulfur dioxide, nitrogen oxides, volatile organic chemicals and particulate matter. These limitations could adversely affect the future market for coal.

Resource Conservation and Recovery Act (“RCRA”)

The RCRA affects coal mining operations by establishing requirements for the treatment, storage, and disposal of hazardous wastes. Certain coal mine wastes, such as overburden and coal cleaning wastes, are exempted from hazardous waste management.

Coal Ash Rule. Subtitle C of the RCRA exempted fossil fuel combustion wastes from hazardous waste regulation until the EPA completed a report to Congress and made a determination on whether the wastes should be regulated as hazardous. In 2000, the EPA concluded that coal combustion wastes do not warrant regulation as hazardous under the RCRA. Following a large spill of coal ash waste at a coal burning power plant in Tennessee in 2008, the EPA, in 2010, proposed two alternative sets of regulations governing the management and storage of coal ash: one would regulate coal ash and related ash impoundments at coal-fired power plants under federal regulations governing hazardous solid waste under Subtitle C of the RCRA and the other would regulate coal ash as a non-hazardous solid waste under Subtitle D. In December 2014, the EPA announced that it would regulate coal combustion wastes as a nonhazardous substance under Subtitle D of the RCRA rather than as hazard waste pursuant to the provisions of Subtitle C. On April 17, 2015, the EPA finalized regulations under the solid waste provisions (“Subtitle D”) of RCRA and the finalized regulations became effective on October 19, 2015. While classifying coal combustion waste as a hazardous waste under Subtitle C would have led to more stringent requirements, the new rule could still increase customers’ operating costs and may make coal less attractive for electric utilities. Under the new rule, entities storing coal combustion wastes are susceptible to litigation from citizen groups or other stakeholders. The Coal Ash Rule is currently being challenged in the D.C. Circuit by both environmental and industry groups. The ongoing efforts by environmental groups to expand energy companies’ liability under RCRA could have potential adverse legal and business outcomes for coal-fired power plants.

Most state hazardous waste laws exempt coal combustion waste and instead treat it as either a solid waste or a special waste. These laws may also be revised, and the EPA and the U.S. Department of Interior (“DOI”) have indicated that they intend to address placement of coal combustion waste on mine sites in a separate rulemaking. Additionally, in December 2016, Congress passed the Water Infrastructure Improvements for the Nation Act, which provides for the establishment of state and EPA permit programs for the control of coal combustion residuals and authorizes states to incorporate EPA’s final rule for coal combustion residuals or develop other criteria that are at least as protective as the final rule. Any costs associated with handling or disposal of coal ash as hazardous waste would increase our customers’ operating costs and potentially reduce their ability to purchase coal. In addition, potential liability for contamination caused by the past or future use, storage or disposal of ash could substantially increase.

15

Clean Water Act of 1972 (“CWA”)

The CWA established in-stream water quality standards and treatment standards for wastewater discharge through the National Pollutant Discharge Elimination System (“NPDES”). Regular monitoring, reporting requirements and performance standards are requirements of NPDES permits that govern the discharge of pollutants into water.

Total Maximum Daily Load. Total Maximum Daily Load (“TMDL”) regulations establish a process by which states may designate stream segments as “impaired” (not meeting present water quality standards). Additionally, states periodically review water quality standards and related effluent limits and consider adopting more stringent limits. Industrial dischargers, including coal mines and plants, will be required to meet new TMDL effluent standards or more stringent water quality standards for these stream segments. The adoption of new TMDL regulations or more stringent water quality standards in receiving streams could hamper or delay the issuance of discharge and Section 404 permits, and if issued, could require new effluent limitations for our coal mines and could require more costly water treatment, which could adversely affect our coal production or results of operations. States are also adopting anti-degradation regulations in which a state designates certain water bodies or streams as “high quality.” These regulations would prohibit the degradation of water quality in these streams. Water discharged from coal mines to high quality streams will be required to meet or exceed new “high quality” standards. The designation of high quality streams at or in the vicinity of our coal mines could require more costly water treatment and could adversely affect our coal production or results of operations.

Waters of the United States. In June 2015, the EPA published its final "Waters of the United States" rule, specifying the waterways that are subject to the jurisdiction of the EPA and the U.S. Army Corps of Engineers. The rule expands the scope of a navigable body of water to include tributaries that contain flowing water for some portion of a year. Although the rule is final, the U.S. Court of Appeals for the Sixth Circuit issued a nationwide stay of the rule in October 2015. On January 13, 2017, the Supreme Court agreed to review the Sixth Circuit’s finding that it has jurisdiction to hear challenges to the rule. If upheld, the rule could pose additional permitting responsibilities for the coal industry, increasing costs, adding time to the permitting process, and potentially affecting coal supplies.

National Enforcement Initiative. In February 2016, the EPA announced its National Enforcement Initiatives for fiscal years 2017-2019, including an initiative called “Keeping Industrial Pollutants Out of the Nation’s Waters,” which focuses the EPA enforcement resources on certain industrial sectors including mining. Under the initiative, the EPA will use water pollution data to target potential violations of discharge permits and increase the scrutiny of compliance issues. The initiative raises the possibility of stricter permit standards and increased enforcement attention for companies and facilities that discharge wastewater to waters of the U.S.

Steam Electric Power Generating Effluent Guidelines. In addition, environmental groups filed a notice of intent to sue the EPA for failing to update effluent limitation guidelines (“ELG”) under the Clean Water Act for coal-fired power plants to limit discharges of toxic metals from handling of coal combustion waste. In April 2013, the EPA released its proposed revised ELG to address toxic pollutants discharged from power plants, including discharges from coal ash ponds. On November 3, 2015, the EPA issued final revised ELG for the Steam Electric Power Generating category, effective January 4, 2016. These regulations, for the first time, set federal limits on certain metals in wastewater discharges from power plants. Individually and collectively, these regulations could make coal burning more expensive or less attractive for electric utilities and, in turn, impact the market for our products. Several industry groups have filed lawsuits challenging the rule. If the revised Steam Electric Power Generating Effluent Guidelines and the Coal Ash Rule survive legal challenges, they could increase coal plant retirements and costs to the power industry, adversely affecting the future market for coal.

Cooling Water Intake Structures. On May 19, 2014, the EPA finalized standards under Section 316(b) of the CWA that require the use of Best Technology Available (“BTA”) for minimizing the injury and death of fish and other aquatic life from cooling-water intake structures at existing power plants. Because many coal-fired power plants utilize once-through cooling systems that are subject to this rule, implementation of the 316(b) regulations could, in addition to other regulatory burdens, result in further coal plant retirements and adversely affect the future market for coal.

CERCLA and Similar State Superfund Statutes

CERCLA and similar state laws affect coal mining by creating liability for the investigation and remediation of releases of regulated materials into the environment and for damages to natural resources. Under these laws, joint and several liability may be imposed on waste generators, current and former site owners or operators and others regardless of fault, for all related site investigation and remediation costs.

16

Mining companies must obtain numerous permits that impose strict regulations on various environmental and safety matters. These provisions include requirements for building dams; coal prospecting; mine plan development; topsoil removal, storage and replacement; protection of the hydrologic balance; subsidence control for underground mines; subsidence and surface drainage control; mine drainage and mine discharge control and treatment; and re-vegetation.

Required permits include mining and reclamation permits under the SMCRA (see “U.S. Environmental - The Surface Mining Control and Reclamation Act”), issued by the IDNR, and wastewater discharge, or NPDES, permits under the CWA, issued by the Illinois Environmental Protection Agency (“IEPA”). In addition to the required permits, for surface operations, the mining companies also need to obtain air quality permits from IEPA, fill and dredge permits from the United States Army Corps of Engineers and flood plain permits from the IDNR. For refuse disposal operations, the mining companies may need to obtain impounding permits or underground slurry disposal permits from the IDNR. In addition, MSHA approval for ventilation, roof control and numerous specific surface and underground operations must be obtained and maintained. The authorization and permitting requirements imposed by these and other governmental agencies are costly and may delay development or continuation of mining operations. In December 2014 the Council on Environmental Quality ("CEQ") released updated draft guidance discussing how federal agencies should consider the effects of GHG emissions and climate change in their National Environmental Policy Act (“NEPA”) evaluations. This type of analyses may increase the likelihood of future challenges to the NEPA documents prepared for actions requiring federal approval. The application review process may take years to complete, and agencies may ask for submission of additional studies, evaluations or other information. Regulatory authorities have considerable discretion in the timing of permit issuance. Additionally, many environmental laws and regulations provide the public with the opportunity to comment on draft permits, and otherwise engage in the permitting process. Permit applications are increasingly being challenged by environmental and other advocacy groups. Accordingly, we may experience difficulty or delays in obtaining mining permits or other necessary approvals, or even face denials of permits altogether.

Currently, we have the necessary permits for mining operations at each of the four complexes. Continued and expanded operations will require additional or renewed permits. These additional permits may include significant permit revisions to the SMCRA mining permit and fill and dredge permits; new NPDES, new SMCRA, new impounding, and possible CWA permits for additional refuse areas; and revisions to the SMCRA permit and a NPDES construction permit for additional bleeder shafts. Due to various and, sometimes, interrelated requirements from different agencies, it is not possible to predict an average or approximate time frame required to obtain all permits and approvals to operate new or expanded mines. In addition, expanded permitting activity in Illinois coupled with challenges from environmental groups will likely increase the various agencies’ permit and approval review time in the future.

Appeals of permits issued by the IEPA, including some CWA permits, are made to the Illinois Pollution Control Board (“IPCB”). The IPCB is an independent agency with five board members appointed by the Governor of the State of Illinois that both establishes environmental regulations under the Illinois Environmental Protection Act and decides contested environmental cases. Appeals before the IPCB are based on alleged violations of environmental laws as found in the permit and the accompanying permit record without additional testimony or evidence being taken. Appeals from the IPCB decisions are made to an Illinois appellate court.

Requests for an administrative review of permits issued by the IDNR, such as the SMCRA permits, are made to an IDNR hearing officer. Although the basis of the request for the administrative review is the alleged violations in the permit and the permit record, the administrative code rules allow for additional discovery and an evidentiary hearing. Appeals from the IDNR hearing officer’s decisions are made to an Illinois Circuit Court.

17

An investment in our common units involves risks. Limited partner interests are inherently different from the capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. You should carefully consider the risks described below, together with the other information in this Annual Report on Form 10-K, before investing in our common units. Our business, financial condition, results of operation and cash available for distribution could be materially and adversely affected by future events. In such case, we might not be able to make distributions on our common units, the trading price of our common units could decline, and you could lose all or part of your investment in, and expected return on, our common units.

Risks Related to Our Business

We may not have sufficient cash from operations to enable us to resume payment of distributions.

Even though we are currently restricted under our debt documents from paying certain distributions, the amount of cash we will be able to distribute on our common and subordinated units in the future primarily depends upon the amount of cash we generate from our operations, which fluctuates from quarter to quarter based on, among other things:

|

|

• |

the amount of coal we are able to produce from our properties, which could be adversely affected by, among other things, operating difficulties and unfavorable geologic conditions; |

|

|

• |

the market price of coal, which is affected by the supply of and demand for domestic and foreign coal; |

|

|

• |

the level of our operating costs, including expenses to Murray Energy Corporation pursuant to the Management Services Agreement; |

|

|

• |

the pricing terms contained in our long-term contracts; |

|

|

• |

the price and availability of other fuels; |

|

|

• |

cancellation or renegotiation of contracts; |

|

|

• |

prevailing economic and market conditions; |

|

|

• |

the impact of delays in the receipt of, failure to maintain, or revocation of, necessary governmental permits; |

|

|

• |

the impact of existing and future environmental and climate change regulations, including those impacting coal-fired power plants; |

|

|

• |

the loss of, or significant reduction in, purchases by our largest customers; |

|

|

• |

the cost of compliance with new environmental laws; |

|

|

• |