Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UCP, Inc. | a12312016ucppressrelease.htm |

| 8-K - 8-K - UCP, Inc. | ucpq420168-kcoverresults.htm |

© 2017 UCP | CONFIDENTIAL1

February 27, 2017

4Q16 Earnings Presentation

Forward-Looking Statements

© 2017 UPC | CONFIDENTIAL2

We make forward-looking statements in this presentation that are subject to risks,

uncertainties and assumptions. All statements other than statements of historical fact

included in this presentation are forward-looking statements. You can identify forward-

looking statements by the fact that they do not relate strictly to historical facts. These

statements may include words such as “may,” “might,” “will,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential” “project,” “goal,” “intend” or

“continue,” the negative of these terms and other comparable terminology. These forward-

looking statements may include projections of our future financial or operating performance,

our anticipated growth strategies, anticipated trends in our business and other future events

or circumstances. These statements are based on our current expectations and projections

about future events and may prove to be inaccurate.

Forward-looking statements involve numerous risks and uncertainties and you should not

rely on them as predictions of future events. Forward-looking statements depend on

assumptions, data or methods which may prove to be incorrect or imprecise and may prove

to be inaccurate. We do not guarantee that the transactions and events described in any

forward-looking statements will happen as described (or that they will happen at all). The

following factors, among others, could cause actual results and future events to differ

materially from those set forth or contemplated in the forward-looking statements: economic

changes, either nationally or in the markets in which we operate, including declines in

employment, volatility of mortgage interest rates, declines in consumer sentiment and an

increase in inflation; downturns in the homebuilding industry, either nationally or in the

markets in which we operate; continued volatility and uncertainty in the credit markets and

broader financial markets; the operating performance of our business; changes in our

business and investment strategy; availability of land to acquire and our ability to acquire

land on favorable terms or at all; availability, terms and deployment of capital; disruptions in

the availability of mortgage financing or increases in the number of foreclosures in our

markets; shortages of or increased prices for labor, land or raw materials used in housing

construction; delays or restrictions in land development or home construction, or reduced

consumer demand resulting from adverse weather and geological conditions or other events

outside our control; the cost and availability of insurance and surety bonds; changes in, or

the failure or inability to comply with, governmental laws and regulations; the timing of

receipt of regulatory approvals and the opening of communities; the degree and nature of

our competition; our leverage and debt service obligations; our future operating expenses,

which may increase disproportionately to our revenue; our ability to achieve operational

efficiencies with future revenue growth; our relationship, and actual and potential conflicts of

interest, with PICO, which owns a majority economic interest in UCP, LLC; and availability

of, and our ability to retain, qualified personnel. For a further discussion of these and other

factors, see the “Risk Factors” disclosed in our Annual Report on Form 10-K for the year

ended December 31, 2016, which is filed with the Securities and Exchange Commission. In

light of these risks and uncertainties, the forward-looking statements discussed in this

presentation might not occur.

You are cautioned not to place undue reliance on forward-looking statements, which speak

only as of the date of this presentation. While forward-looking statements reflect our good

faith beliefs, they are not guarantees of future performance, and our actual results could

differ materially from those expressed in any forward-looking statement. We disclaim any

obligation to publicly update or revise any forward-looking statement to reflect changes in

underlying assumptions or factors, new information, data or methods, future events or other

changes, except as required by law.

© 2017 UCP | CONFIDENTIAL3

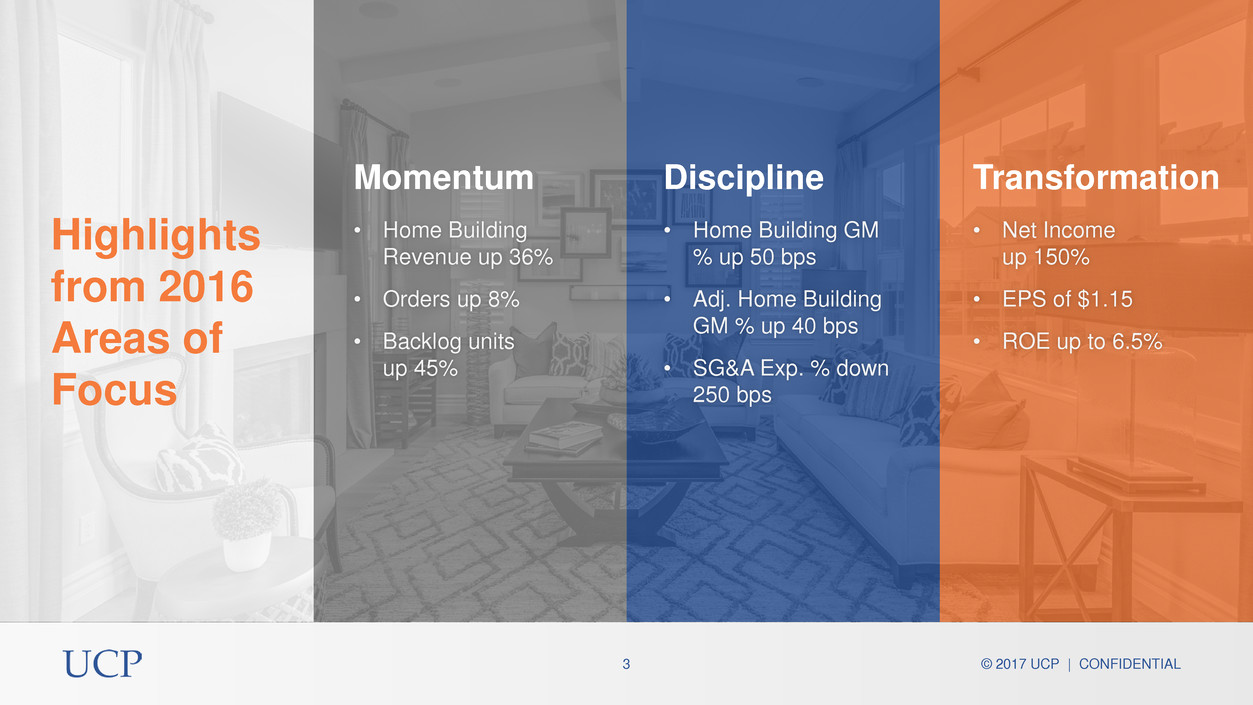

• Home Building

Revenue up 36%

• Orders up 8%

• Backlog units

up 45%

Highlights

from 2016

Areas of

Focus

Momentum

• Home Building GM

% up 50 bps

• Adj. Home Building

GM % up 40 bps

• SG&A Exp. % down

250 bps

Discipline

• Net Income

up 150%

• EPS of $1.15

• ROE up to 6.5%

Transformation

© 2017 UCP | CONFIDENTIAL4

Homebuilding

Revenue

($MM)

+36%

New Home

Orders

+8%

2016 Homebuilding Deliveries, Revenue & Orders

$252.6

$343.9

FY15 FY16

Deliveries by Region

27%

73%

Southeast FY16 West FY16

860 933

FY15 FY16

Homes

Delivered

+17%

701

820

FY15 FY16

Average Selling

Price

($000)

+16%

$360

$419

FY15 FY16

© 2017 UCP | CONFIDENTIAL5

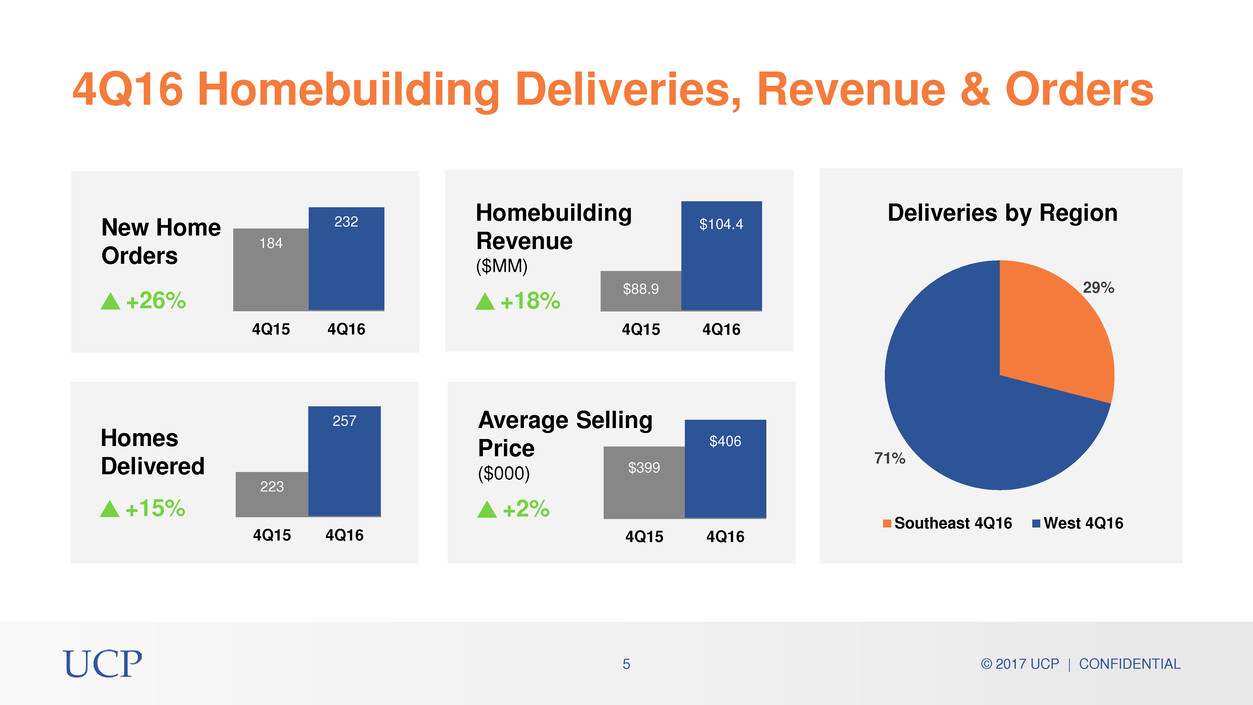

Homebuilding

Revenue

($MM)

+18%

$88.9

$104.4

4Q15 4Q16

29%

71%

Southeast 4Q16 West 4Q16

Deliveries by Region

New Home

Orders

+26%

184

232

4Q15 4Q16

Homes

Delivered

+15%

223

257

4Q15 4Q16

Average Selling

Price

($000)

+2%

$399

$406

4Q15 4Q16

4Q16 Homebuilding Deliveries, Revenue & Orders

© 2017 UCP | CONFIDENTIAL6

Backlog & Lots

249

362

4Q15 4Q16

Homes in Backlog

4,284 4,075

1,594

2,563

4Q15 4Q16

West Southeast

5,878

6,638

Lots by Region1

(1) ‘Lots by Region’ denotes owned & controlled lots as of December 31, 2016.

$108.8

$149.6

4Q15 4Q16

Backlog Value

($MM)

+38% +45%

© 2017 UCP | CONFIDENTIAL7

• 4Q16 and FY16 homebuilding gross margin

increased 60bps and 50bps, respectively,

from prior year

• Balancing pre-sales and spec sales

• Controlling price to help manage pace

• Focus on construction cost containment

• FY16 incentives decreased by 50bps to

2.1% of HB Revenue

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is

homebuilding gross margin. A discussion of adjusted homebuilding gross margin is included in the Appendix hereto, as well as a

reconciliation between homebuilding gross margin and adjusted homebuilding gross margin.

Strong Homebuilding

Gross Margin 18.0% 18.6%

4Q15 4Q16

17.8% 18.3%

FY15 FY16

21.1% 20.9%

4Q15 4Q16

20.3% 20.7%

FY15 FY16

Homebuilding

Gross Margin

Adj.

Homebuilding

Gross Margin1

© 2017 UCP | CONFIDENTIAL8

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is

homebuilding gross margin. A discussion of adjusted homebuilding gross margin is included in the Appendix hereto, as well as a

reconciliation between homebuilding gross margin and adjusted homebuilding gross margin.

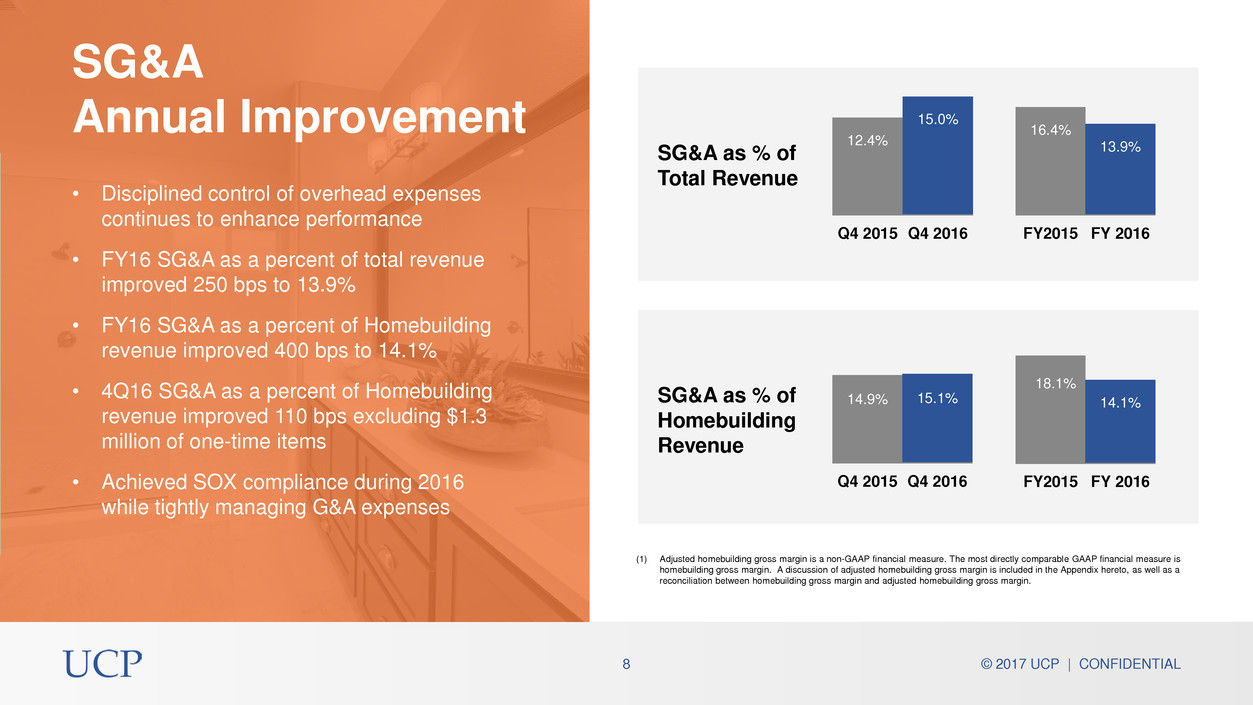

SG&A

Annual Improvement

SG&A as % of

Total Revenue

SG&A as % of

Homebuilding

Revenue

16.4%

13.9%

FY2015 FY 2016

18.1%

14.1%

FY2015 FY 2016

12.4%

15.0%

Q4 2015 Q4 2016

14.9% 15.1%

Q4 2015 Q4 2016

• Disciplined control of overhead expenses

continues to enhance performance

• FY16 SG&A as a percent of total revenue

improved 250 bps to 13.9%

• FY16 SG&A as a percent of Homebuilding

revenue improved 400 bps to 14.1%

• 4Q16 SG&A as a percent of Homebuilding

revenue improved 110 bps excluding $1.3

million of one-time items

• Achieved SOX compliance during 2016

while tightly managing G&A expenses

© 2017 UCP | CONFIDENTIAL9

Earnings & Returns Up

Earnings Per Share Return on Equity

$0.30

$1.15

FY15 FY16

2.7%

6.5%

FY15 FY16

$0.40

$0.89

4Q15 4Q16

© 2017 UCP | CONFIDENTIAL10

Core EPS (2)

(1) The valuation allowance applies only to net income (loss) attributable to UCP, Inc. Noncontrolling interest adjusted for non-recurring items excluding the impact from the valuation allowance removal.

(2) Core EPS is a non-GAAP financial measure. The most directly comparable GAAP financial measure is EPS. Core EPS is used by management in understanding the underlying earnings performance of the Company without the impact of

income and expenses that are not in the normal and ordinary course of the Company’s business.

Earnings Per Share Attributable to UCP, Inc.

4Q16 FY16 4Q16 FY16

Net income (loss) attributable to UCP,

Inc., as reported $7,151 $9,238 $0.89 $1.15

UCP, Inc. share of Non-Recurring

items, Net of Tax

$554 $3,006 $0.07 $0.37

Valuation Allowance Removal (1) $(5,482) $(5,482) $ (0.68) $ (0.68)

Core Net income (loss) attributable to

UCP, Inc.

$ 2,223 $6,762 $0.28 $0.84

Diluted Shares Outstanding 8,009,350 8,064,728 8,009,350 8,064,728

© 2017 UCP | CONFIDENTIAL11

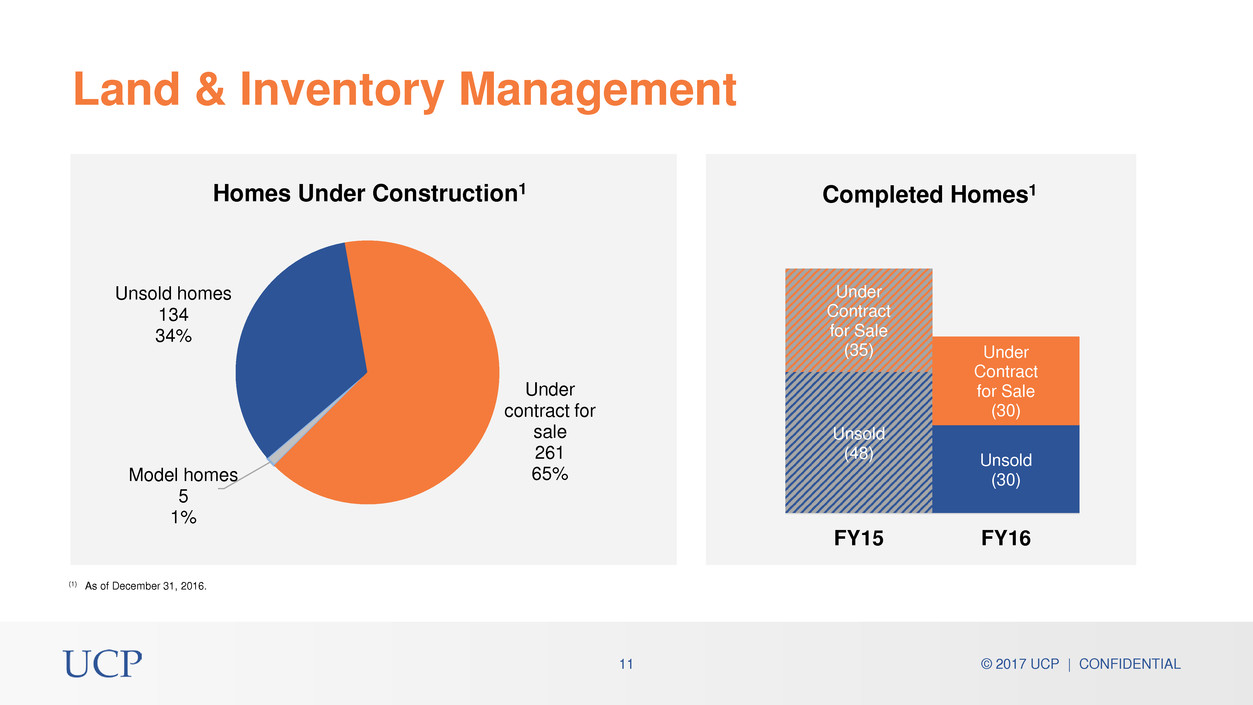

Land & Inventory Management

Model homes

5

1%

Unsold homes

134

34%

Under

contract for

sale

261

65%

Homes Under Construction1 Completed Homes1

(1) As of December 31, 2016.

Unsold

(48) Unsold

(30)

Under

Contract

for Sale

(35) Under

Contract

for Sale

(30)

FY15 FY16

© 2017 UCP | CONFIDENTIAL12

(1) The ratio of net debt-to-capital is a non-GAAP financial measure. The most directly comparable GAAP financial measure is the ratio of debt-to-capital. We believe that our leverage ratios provide useful information to the users of our financial statements regarding

our financial position and cash and debt management. A discussion of net debt-to-capital is included in the Appendix hereto, as well as a reconciliation between net-debt-to capital and debt-to-capital.

(2) Interest coverage is computed using EBIT, a non-GAAP financial measure. EBIT is computed by adding interest expense to pre-tax income calculated in accordance with GAAP. A reconciliation between EBIT and pre-tax income is included in the appendix hereto.

The interest coverage ratio is calculated by comparing EBIT to interest expensed.

(3) Interest coverage calculated on a last twelve months’ basis.

($ in millions, except where noted) Dec 31, 2016 Dec 31, 2015

Cash $40.9 $39.8

Real Estate Inventory $373.2 $361.0

Debt $161.0 $156.0

Equity $226.9 $217.4

Debt-to-Capital 41.5% 41.8%

Net Debt-to-Capital1 37.3% 37.6%

Cash to total Capital 10.6% 10.7%

Interest Coverage2,3 1.4 times 1.0 times

Balance Sheet Strength

Current Capitalization Dec 31, 2016

Cash

Cash & Cash Equivalents $40.9

Debt

Variable Interest Notes $81.3

Fixed Interest Notes $5.6

8.5% Senior Notes Due 2017 $74.9

Debt Issuance Cost ($0.7)

Total Debt $161.0

Total Equity $226.9

© 2017 UCP | CONFIDENTIAL13

$72.5

$155.4

$252.6

$343.9

FY13 FY14 FY15 FY16

Homebuilding

Revenue

• Continuous innovation in home design for

the way new home buyers want to live

• Strong commitment to best-in-class

construction standards

• Customer-driven experience that continues

long after purchase

• Consistent winner of Eliant Homebuyers’

Choice Awards for our exemplary

customer service

• Deliveries up more than 400% since 2013

Brand Promise Resonating

68%

CAGR

© 2017 UCP | CONFIDENTIAL14

3.6%

3.3%

2.5% 2.5%

1.9% 1.8%

1.6%

1.2%

Seattle San Jose Nashville Riverside Charlotte Fresno U.S.

Average

Myrtle

Beach

Employment Growth

(YoY % Change)

Source: John Burns Real Estate Consulting. Employment Data as of 11/2016. Months Supply Data as of 12/2016

Vibrant Markets Create Foundation for Growth

0.7

1.0

1.3

2.9

3.6

3.8 3.9

Seattle San Jose Fresno Charlotte U.S.

Average

Nashville Riverside

Resale Months of Supply

(2016)

© 2017 UCP | CONFIDENTIAL15

2017

Focus

Areas

Momentum

Discipline

Operational Excellence

Strengthening the Benchmark Brand

© 2017 UCP | CONFIDENTIAL16

2017 Outlook

Home

Deliveries

Homebuilding

Revenue ($MM)

During 2017 we will seek to:

• Continue growing home deliveries and revenue

• Maintain stable gross margin

• Expand backlog

• Strengthen position in existing markets

• Enhance customer experience

• Drive higher ROE

432

701

820

925-975

2014 2015 2016 2017E

(1) CAGR projection calculated to midpoint of 2017E range

30%

$155

$253

$344

$390-$410

2014 2015 2016 2017E

37%

CAGR1

CAGR1

© 2017 UCP | CONFIDENTIAL17

Appendix

© 2017 UCP | CONFIDENTIAL18

(1) Adjusted homebuilding gross margin is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. A discussion of adjusted homebuilding gross margin is included in the Appendix hereto, as well as a reconciliation

between homebuilding gross margin and adjusted homebuilding gross margin.

Three Months Ended December 31, Twelve Months Ended December 31,

($ in millions, except where noted) 2016 2015 2016 2015

Net Orders 232 184 933 860

Homebuilding Deliveries 257 223 820 701

ASP (000s) $406 $399 $419 $360

Revenue

Homebuilding $104.4 $88.9 $343.9 $252.6

Land development $0.1 $18.0 $5.4 $21.1

Other $— $— $— $5.1

Total revenue $104.6 $106.9 $349.4 $278.8

Homebuilding Gross Margin 18.6% 18.0% 18.3% 17.8%

Homebuilding Adjusted Gross Margin ¹ 20.9% 21.1% 20.7% 20.3%

Operating Expense

Sales and marketing $5.7 $5.7 $19.3 $18.9

General and administrative $10.1 $7.6 $29.2 $26.9

Goodwill impairment $— $— $4.2 $—

Total operating expense $15.7 $13.3 $52.6 $45.8

Other income, net $0.0 $0.0 $0.3 $0.2

Net income (loss) before income taxes $3.7 $7.7 $9.2 $5.9

Provision for income taxes $5.6 $(0.1) $5.3 $(0.1)

Net income (loss) $9.3 $7.6 $14.4 $5.8

Totals may not add due to roundingFinancial Summary

© 2017 UCP | CONFIDENTIAL19

(1) Adjusted homebuilding gross margin percentage is a non-GAAP financial measure. The most directly comparable GAAP financial measure is homebuilding gross margin. Adjusted gross margin is defined as gross margin plus capitalized interest, impairment and abandonment charges. We use adjusted gross margin

information as a supplemental measure when evaluating our operating performance. We believe this information is meaningful, because it isolates the impact that leverage and non-cash impairment and abandonment charges have on gross margin. However, because adjusted gross margin information excludes interest

expense and impairment and abandonment charges, all of which have real economic effects and could materially impact our results, the utility of adjusted gross margin information as a measure of our operating performance is limited. In addition, other companies may not calculate adjusted gross margin information in the

same manner that we do. Accordingly, adjusted gross margin information should be considered only as a supplement to gross margin information as a measure of our performance. The table above provides a reconciliation of adjusted gross margin numbers to the most comparable GAAP financial measure.

Three Months Ended December 31, Year Ended December 31,

($ in thousands) 2016 % 2015 % 2016 % 2015 %

Consolidated Gross Margin & Adjusted Gross

Margin

Revenue $104,565 100.0% $106,870 100.0% $349,368 100.0% $278,791 100.0%

Cost of Sales 85,171 81.5% 85,952 80.4% 287,840 82.4% 227,324 81.5%

Gross Margin 19,394 18.5% 20,918 19.6% 61,528 17.6% 51,467 18.5%

Add: interest in cost of sales 2,429 2.3% 2,176 2.0% 8,118 2.3% 5,592 2.0%

Add: impairment and abandonment charges 17 − 929 0.9% 3,112 0.9% 1,075 0.4%

Adjusted Gross Margin(1) $21,840 20.9% $24,023 22.5% $72,758 20.8% $58,134 20.9%

Consolidated Gross margin percentage 18.5% 19.6% 17.6% 18.5%

Consolidated Adjusted gross margin percentage(1) 20.9% 22.5% 20.8% 20.9%

Homebuilding Gross Margin & Adjusted Gross

Margin

Homebuilding revenue $104,438 100.0% $88,892 100.0% $343,919 100.0% $252,597 100.0%

Cost of home sales 85,053 81.4% 72,926 82.0% 281,072 81.7% 207,670 82.2%

Homebuilding gross margin 19,385 18.6% 15,966 18.0% 62,847 18.3% 44,927 17.8%

Add: interest in cost of home sales 2,418 2.3% 1,908 2.1% 7,737 2.2% 5,275 2.1%

Add: impairment and abandonment charges − − 923 1.0% 458 0.1% 1,042 0.4%

Adjusted homebuilding gross margin(1) $21,803 20.9% $18,797 21.1% $71,042 20.7% $51,244 20.3%

Homebuilding gross margin percentage 18.6% 18.0% 18.3% 17.8%

Adjusted homebuilding gross margin percentage(1) 20.9% 21.1% 20.7% 20.3%

Appendix – Gross Margin and Adj. Gross Margin Reconciliation

© 2017 UCP | CONFIDENTIAL20

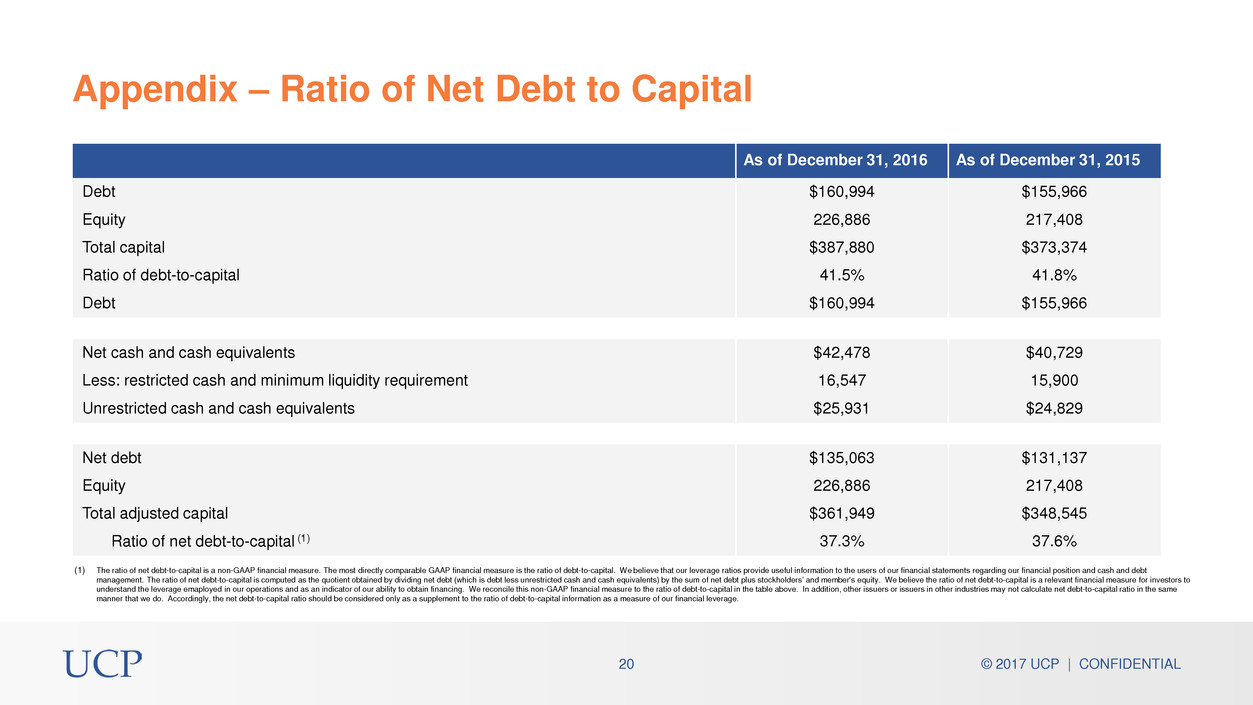

(1) The ratio of net debt-to-capital is a non-GAAP financial measure. The most directly comparable GAAP financial measure is the ratio of debt-to-capital. We believe that our leverage ratios provide useful information to the users of our financial statements regarding our financial position and cash and debt

management. The ratio of net debt-to-capital is computed as the quotient obtained by dividing net debt (which is debt less unrestricted cash and cash equivalents) by the sum of net debt plus stockholders’ and member's equity. We believe the ratio of net debt-to-capital is a relevant financial measure for investors to

understand the leverage emaployed in our operations and as an indicator of our ability to obtain financing. We reconcile this non-GAAP financial measure to the ratio of debt-to-capital in the table above. In addition, other issuers or issuers in other industries may not calculate net debt-to-capital ratio in the same

manner that we do. Accordingly, the net debt-to-capital ratio should be considered only as a supplement to the ratio of debt-to-capital information as a measure of our financial leverage.

As of December 31, 2016 As of December 31, 2015

Debt $160,994 $155,966

Equity 226,886 217,408

Total capital $387,880 $373,374

Ratio of debt-to-capital 41.5% 41.8%

Debt $160,994 $155,966

Net cash and cash equivalents $42,478 $40,729

Less: restricted cash and minimum liquidity requirement 16,547 15,900

Unrestricted cash and cash equivalents $25,931 $24,829

Net debt $135,063 $131,137

Equity 226,886 217,408

Total adjusted capital $361,949 $348,545

Ratio of net debt-to-capital (1) 37.3% 37.6%

Appendix – Ratio of Net Debt to Capital

© 2017 UCP | CONFIDENTIAL21

(1) EBIT (“earnings before interest & tax”) is a non-GAAP financial measure. The most directly comparable GAAP financial measure is net income before taxes. EBIT is computed from GAAP pre-taxable income by adding back interest expense. We believe that EBIT provides useful information to the users of our financial

statements regarding our operating profitability. We reconcile this non-GAAP financial measure to net income before taxes, based on the last twelve months, in the table above. In addition, other issuers or issuers in other industries may not calculate EBIT in the same manner that we do. Accordingly, EBIT should be

considered only as a supplement to the net income before taxes as a measure of our operating profitability.

(2) Interest coverage is computed using EBIT, a non-GAAP financial measure. The interest coverage ratio is calculated by comparing EBIT to interest expensed. We believe that interest coverage ratio is a relevant financial measure for investors to understand our debt and profitability of our operations and as an indicator of our

ability to pay interest on our debt.

UCP Interest Coverage

Twelve Months Ended Twelve Months Ended

12/31/2015 12/31/2016

Pre-Tax Income $5,852,371 $9,163,055

Interest Expense included in COS 5,592,089 8,117,453

EBIT 11,444,460 17,280,508

Depreciation 587,581 597,051

Amortization 34,000 34,000

EBITDA 12,066,041 17,911,559

Impairments (net of contingent consideration) 923,031 4,464,792

EBITDA (excluding Impairments) $12,989,072 $22,376,321

Interest Incurred $11,567,368 $12,502,682

Interest Coverage 1.0 1.4

Appendix – EBIT