Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - SLM Corp | ex211_12312016.htm |

| EX-32.2 - EXHIBIT 32.2 - SLM Corp | ex322_12312016.htm |

| EX-32.1 - EXHIBIT 32.1 - SLM Corp | ex321_12312016.htm |

| EX-31.2 - EXHIBIT 31.2 - SLM Corp | ex312_12312016.htm |

| EX-31.1 - EXHIBIT 31.1 - SLM Corp | ex311_12312016.htm |

| EX-23.1 - EXHIBIT 23.1 - SLM Corp | ex231_12312016.htm |

| EX-12.1 - EXHIBIT 12.1 - SLM Corp | ex121_12312016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

ACT OF 1934

For the fiscal year ended December 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE |

ACT OF 1934

For the transition period from to

Commission file numbers 001-13251

SLM Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 52-2013874 |

(State of Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

300 Continental Drive, Newark, Delaware | 19713 |

(Address of Principal Executive Offices) | (Zip Code) |

(302) 451-0200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act

Common Stock, par value $.20 per share.

Name of Exchange on which Listed:

The NASDAQ Global Select Market

6.97% Cumulative Redeemable Preferred Stock, Series A, par value $.20 per share

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Floating Rate Non-Cumulative Preferred Stock, Series B, par value $.20 per share

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | ||

Non-accelerated filer ¨ | Smaller reporting company ¨ | ||

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of voting common stock held by non-affiliates of the registrant as of June 30, 2016 was $2.6 billion (based on closing sale price of $6.18 per share as reported for the NASDAQ Global Select Market).

As of January 31, 2017, there were 429,101,108 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement relating to the Registrant’s 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on

Form 10-K.

SLM CORPORATION

TABLE OF CONTENTS

Page Number | ||

Forward-Looking and Cautionary Statements | 1 | |

Available Information | 2 | |

PART I | ||

Item 1. | Business | 3 |

Item 1A. | Risk Factors | 19 |

Item 1B. | Unresolved Staff Comments | 33 |

Item 2. | Properties | 34 |

Item 3. | Legal Proceedings | 35 |

Item 4. | Mine Safety Disclosures | 36 |

PART II | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 37 |

Item 6. | Selected Financial Data | 40 |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 41 |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 82 |

Item 8. | Financial Statements and Supplementary Data | 86 |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 86 |

Item 9A. | Controls and Procedures | 86 |

Item 9B. | Other Information | 86 |

PART III. | ||

Item 10. | Directors, Executive Officers and Corporate Governance | 87 |

Item 11. | Executive Compensation | 87 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 87 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 87 |

Item 14. | Principal Accounting Fees and Services | 87 |

PART IV | ||

Item 15. | Exhibits, Financial Statement Schedules | 88 |

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

References in this Annual Report on Form 10-K to “we,” “us,” “our,” “Sallie Mae,” “SLM” and the “Company” refer to SLM Corporation and its subsidiaries, except as otherwise indicated or unless the context otherwise requires.

This Annual Report on Form 10-K contains “forward-looking” statements and information based on management’s current expectations as of the date of this report. Statements that are not historical facts, including statements about the Company’s beliefs, opinions or expectations and statements that assume or are dependent upon future events, are forward-looking statements. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A “Risk Factors” and elsewhere in this Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”); increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking and other laws; changes in accounting standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which the Company is a party; credit risk associated with the Company’s exposure to third-parties, including counterparties to the Company’s derivative transactions; and changes in the terms of education loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). The Company could also be affected by, among other things: changes in its funding costs and availability; reductions to its credit ratings; failures or breaches of its operating systems or infrastructure, including those of third-party vendors; damage to its reputation; risks associated with restructuring initiatives, including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on the Company’s business; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of the Company’s customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of the Company’s earning assets versus the Company’s funding arrangements; rates of prepayment on the loans that the Company makes; changes in general economic conditions and the Company’s ability to successfully effectuate any acquisitions; and other strategic initiatives. The preparation of the Company’s consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this Annual Report on Form 10-K are qualified by these cautionary statements and are made only as of the date of this report. The Company does not undertake any obligation to update or revise these forward-looking statements to conform such statements to actual results or changes in its expectations.

The financial information contained herein and in the accompanying consolidated balance sheets, statements of income, changes in equity, and cash flows for each of the years in the three-year period ended December 31, 2016, presents information on our business as configured after the Spin-Off, as hereafter defined. For more information regarding the basis of presentation of these statements, see Notes to Consolidated Financial Statements, Note 2, “Significant Accounting Policies — Basis of Presentation.”

1

AVAILABLE INFORMATION

Our website address is www.salliemae.com. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, and any significant investor presentations, are available free of charge through our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. In addition, copies of our Board Governance Guidelines, Code of Business Conduct (which includes the code of ethics applicable to our Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) and the governing charters for each committee of our Board of Directors are available free of charge on our website, as well as in print to any stockholder upon request. We intend to disclose any amendments to or waivers from our Code of Business Conduct (to the extent applicable to our Principal Executive Officer, Principal Financial Officer or Principal Accounting Officer) by posting such information on our website. Information contained or referenced on our website is not incorporated by reference into and does not form a part of this Annual Report on Form 10-K.

2

PART I.

Item 1. Business

Company History

SLM Corporation, more commonly known as Sallie Mae, is the nation’s leading saving, planning and paying for college company. For 44 years, we have made a difference in students’ and families’ lives, helping more than 34 million Americans pay for college. We recognize there is no single way to achieve this task, so we provide a range of products to help families, whether college is a long way off or right around the corner. We promote responsible financial habits that help our customers make college happen.

Our primary business is to originate and service Private Education Loans we make to students and their families. We use “Private Education Loans” to mean education loans to students or their families that are not made, insured or guaranteed by any state or federal government. Private Education Loans do not include loans insured or guaranteed under the previously existing Federal Family Education Loan program (“FFELP Loans”). We also offer a range of deposit products insured by the Federal Deposit Insurance Corporation (the “FDIC”) and operate a consumer savings network that provides financial rewards on everyday purchases to help families save for college.

We were formed in 1972 as the Student Loan Marketing Association, a federally chartered government-sponsored enterprise (“GSE”), with the goal of furthering access to higher education by providing a national secondary market and warehousing facilities for FFELP Loans. The GSE’s federal charter prohibited it from originating student loans in the primary market.

In 1996, the United States Congress passed the Student Loan Marketing Association Reorganization Act, which set the stage for the “privatization” of the GSE. As part of the privatization process, we incorporated SLM Corporation in 1997 as a Delaware corporation, the GSE became a subsidiary of SLM Corporation, and by mid-2004 the GSE stopped purchasing FFELP Loans in the secondary market and was dissolved by the end of 2004.

On November 3, 2005, SLM Corporation formed Sallie Mae Bank, a Utah industrial bank subsidiary (the “Bank”), to fund and originate Private Education Loans on behalf of SLM Corporation. While the Bank first originated Private Education Loans in February 2006, SLM Corporation continued to purchase a portion of its Private Education Loans from its third-party lending partners through mid-2009. With some minor exceptions, the Bank became the sole originator of Private Education Loans for SLM Corporation beginning with the 2009-2010 academic year, the first academic year following the launch of the Bank’s Smart Option Student Loan program in mid-2009.

On March 30, 2010, President Obama signed into law the Federal Direct Student Loan Program (the “DSLP”), effective July 1, 2010. At that time, the guaranteed student loan program (under which FFELP Loans were made) was eliminated, although the terms and conditions of existing guaranteed student loans were not altered or affected.

On April 30, 2014, we completed our plan to legally separate (the “Spin-Off”) into two distinct publicly traded entities: an education loan management, servicing and asset recovery business, named Navient Corporation (“Navient”), which retained all assets and liabilities generated prior to the Spin-Off other than those explicitly retained by SLM Corporation; and a consumer banking business, named SLM Corporation. We sometimes refer to the SLM Corporation that existed prior to the Spin-Off as “pre-Spin-Off SLM.”

Our principal executive offices are located at 300 Continental Drive, Newark, Delaware 19713, and our telephone number is (302) 451-0200.

3

Our Business

Our primary business is to originate and service high quality Private Education Loans. In 2016, we originated $4.7 billion of Private Education Loans, an increase of 8 percent from the year ended December 31, 2015. As of December 31, 2016, we had $14.1 billion of Private Education Loans outstanding.

Private Education Loans

The Private Education Loans we make to students and families serve primarily to bridge the gap between the cost of higher education and the amount funded through financial aid, federal loans and customers’ resources. We also extend Private Education Loans as an alternative to similar federal education loan products where we believe our rates are competitive. We earn interest income on our Private Education Loan portfolio, net of provisions for loan losses.

In 2009, we introduced the Smart Option Student Loan, our Private Education Loan product emphasizing in-school payment features that can produce shorter terms and minimize customers’ total finance charges. Customers elect one of three Smart Option repayment types at the time of loan origination. The first two, Interest Only and Fixed Payment options, require monthly payments while the student is in school and during the six-month grace period thereafter, and accounted for approximately 55 percent of the Private Education Loans Sallie Mae Bank originated during 2016. The third repayment option is the more traditional deferred Private Education Loan product where customers are not required to make payments while the student is in school and for a six-month grace period after separation. Lower interest rates on the Interest Only and Fixed Payment options encourage customers to elect those options. Making payments while in school helps customers reduce their total loan cost compared with the traditional deferred loan, and also helps them become accustomed to making on-time regular loan payments. We offer both variable rate and fixed rate loans.

We regularly review and update the terms of our Private Education Loan products. Our Private Education Loans include important protections for the family, including loan forgiveness in case of death or permanent disability of the student borrower and a free, quarterly FICO Score benefit to students and cosigners with a Smart Option Student Loan.

Private Education Loans bear the full credit risk of the customers. We manage this risk by underwriting and pricing based on customized credit scoring criteria and the addition of qualified cosigners. For the year ended December 31, 2016, our average FICO scores were 748 at the time of original approval and approximately 89 percent of our loans were cosigned. In addition, we voluntarily require school certification of both the need for, and the amount of, every Private Education Loan we originate, and we disburse the loan proceeds directly to the higher education institutions.

The core of our marketing strategy is to promote our products on campuses through financial aid offices as well as through online and direct marketing to students and their families. Our on-campus efforts with 2,400 higher education institutions are led by our sales force, the largest in the industry, which has become a trusted resource for financial aid offices.

Our loans are high credit quality and the overwhelming majority of our customers manage their payments with great success. At December 31, 2016, 2.1 percent of loans in repayment were greater than 30 days delinquent, and loans in forbearance were 3.5 percent of loans in repayment and forbearance. In 2016, net charge-offs as a percentage of average loans in repayment was 0.96 percent. Loans in repayment include loans on which customers are making interest only and fixed payments, as well as loans that have entered full principal and interest repayment status.

Sallie Mae Bank

Since 2006, the Bank, which is regulated by the Utah Department of Financial Institutions (the “UDFI”), the FDIC, and the Consumer Financial Protection Bureau (the “CFPB”), has originated Private Education Loans and accepted deposits. At December 31, 2016, the Bank had total assets of $18.3 billion, including $14.1 billion of Private Education Loans and $1.0 billion of FFELP Loans, and total deposits of $14.0 billion.

Our ability to obtain deposit funding and offer competitive interest rates on deposits will be necessary to sustain the growth of our Private Education Loan originations. Our ability to obtain such funding is dependent, in part, on the capital level of the Bank and its compliance with other applicable regulatory requirements. At the time of this filing, there are no restrictions on our ability to obtain deposit funding or the interest rates we charge other than those restrictions generally applicable to all FDIC-insured banks of similar charter and size. In 2016, we added $1.5 billion in deposits from Educational 529 and Health Savings Accounts as a way to diversify our funding sources. We further diversified our funding base by raising $1.8 billion in

4

term funding collateralized by pools of Private Education Loans in the long-term asset-backed securities (“ABS”) market. We plan to continue to do so, market conditions permitting. This helps us better match-fund our assets and reduce our reliance on deposits to fund our growth.

We expect the Bank or affiliates of the Bank to retain servicing of all Private Education Loans the Bank originates, regardless of whether the loans are held, sold or securitized. When Private Education Loans are sold and servicing is retained, the Bank receives ongoing servicing revenue for those loans in addition to the gain on sale recognized on the sale of those assets. The Bank did not sell loans in 2016 and does not expect to sell loans in 2017.

See the subsection titled “Regulation of Sallie Mae Bank” under “Supervision and Regulation” for additional details about the Bank.

Operational Infrastructure

In April 2014, we began to perform collection activity on our portfolio of Private Education Loans. In October 2014, we launched our stand-alone servicing platform and began servicing our portfolio of Private Education Loans. Since early 2015, all servicing and collections activities have been conducted in the United States.

Our servicing operation includes resources dedicated to assist customers with specialized needs and escalated inquiries. We also have a group of customer service representatives dedicated to assisting military personnel with available military benefits.

In 2015, we completed the build-out of our new loan originations platform to independently originate Private Education Loans.

In 2016, we transitioned all loan servicing call center functions from a third-party to our in-house servicing area in our Newark, Delaware and Indianapolis, Indiana offices. We also implemented several improvements in our ability to interact with our customers, including:

• | an integrated platform that allows customers and servicing agents to simultaneously access the same systems in real time interaction; |

• | an on-line chat function for customer service; and |

• | a mobile application accessible through smart phones and the Apple watch. |

These and other enhancements have contributed to streamlined originations and servicing processes, increased customer self-services rates, and improved customer satisfaction in all channels.

Upromise by Sallie Mae

Upromise by Sallie Mae is a save-for-college rewards program helping Americans save for higher education. The program is free to join, and in 2016, approximately 200,000 consumers enrolled. Members can earn money for college by receiving cash back rewards when shopping at participating on-line or brick-and-mortar retailers, booking travel, dining out at participating restaurants, and by using their Upromise MasterCard. Since inception, Upromise members have earned approximately $1 billion through the program, and more than 380,000 members are using their Upromise credit card to save.

5

Our Approach to Advising Students and Families How to Pay for College

Our annual research on How America Pays for College1 confirms students and their families cover the cost of college using multiple sources. According to this research, just 40 percent of families have a plan to pay for college. Sallie Mae offers free online financial literacy resources, including interactive tools and content, on SallieMae.com, to help families construct a comprehensive financial strategy to save and pay for college. Our College Planning Calculator helps families set college savings goals, project the full cost of a college degree, and estimate future student loan payments and the annual starting salary level needed to keep payments manageable. In addition, Sallie Mae offers a free mobile application, College Ahead, that engages high school juniors and seniors in a step-by-step journey to college.

To encourage responsible borrowing, Sallie Mae advises students and families to follow a three-step approach to paying for college:

Step 1: Use scholarships, grants, savings and income.

We provide access to an extensive, free, online scholarship database, which includes information about more than 5 million scholarships with an aggregate value in excess of $24 billion.

Through the Bank, we offer traditional savings products, such as high-yield savings accounts, money market accounts, and certificates of deposit (“CDs”).

In addition, our Upromise by Sallie Mae save-for-college rewards program helps families jumpstart their save-for-college plans by providing financial rewards on everyday purchases made at participating merchants.

Step 2: Explore federal government loan options.

We encourage students to explore federal government loan options, including Perkins loans, Direct loans, and PLUS loans. Students apply for federal student aid, including federal student loans, by completing the Free Application for Federal Student Aid.

Step 3: Consider affordable Private Education Loans to fill the gap.

We offer competitively priced Private Education Loan products to bridge the gap between family resources, federal loans, grants, student aid and scholarships, and the cost of a college education.

____________________

1 Sallie Mae’s How America Pays for College 2016, conducted by Ipsos, www.salliemae.com/howamericapays.

6

Our Approach to Assisting Students and Families Borrowing and Repaying Private Education Loans

To ensure applicants borrow only what they need to cover their school’s cost of attendance, we actively engage with schools and require school certification before we disburse a Private Education Loan. To help applicants understand their loan and its terms, we provide multiple, customized disclosures explaining the applicant’s starting interest rate, the interest rate during the life of the loan, and the loan’s total cost under the available repayment options. Our Smart Option Student Loan features no origination fees and no prepayment penalties, provides rewards for paying on time, and offers a choice of repayment options and a choice of either variable or fixed interest rates.

The majority of our Smart Option Student Loan customers elect an in-school repayment option. By making in-school payments, customers learn to establish good repayment patterns, reduce their total loan cost, and graduate with less debt. We send monthly communications to customers while they are in school, even if they have no monthly payments scheduled, to keep them informed and encourage them to reduce the amount they will owe when they leave school.

Some customers transitioning from school to the work force may require more time before they are financially capable of making full payments of principal and interest. Sallie Mae created a Graduated Repayment Program to assist new graduates with additional payment flexibility, allowing customers to elect to make interest-only payments instead of full principal and interest payments during the first year after their six-month grace period.

Our experience has taught us the successful transition from school to full principal and interest repayment status involves making and carrying out a financial plan. As customers approach the principal and interest repayment period on their loans, Sallie Mae engages with them and communicates what to expect during the transition. In addition, an informational section of SallieMae.com, Manage Your Student Loans, provides educational content for customers on how to organize loans, set up a monthly budget, and understand repayment obligations. Examples are provided that help explain how payments are applied and allocated, and help site visitors estimate payments and see how the accrued interest on alternative repayment programs could affect the cost of their loans. The site also provides important information on special benefits available to service men and women under the Servicemembers Civil Relief Act (the “SCRA”).

After graduation, a customer may apply for the cosigner to be released from the loan. This option is available once there have been 12 consecutive, on-time principal and interest payments and the student borrower adequately meets our credit requirements. In the event of a cosigner’s death, the student borrower automatically continues as the sole individual on the loan with the same terms.

During repayment, customers may struggle to meet their financial obligations. If a customer’s account becomes delinquent, we will work with the customer and/or the cosigner to understand their ability to make ongoing payments. If the customer is in financial hardship, we work with the customer and/or cosigner to understand their financial circumstances and identify any available alternative arrangements designed to reduce monthly payment obligations. These can include extended repayment schedules, temporary interest rate reductions and, if appropriate, short-term hardship forbearance, suited to their individual circumstances and ability to make payments. We grant forbearance in our servicing centers if a borrower who is current requests it for increments of three months at a time, for up to twelve months.

In some cases, loan modifications and other efforts may be insufficient for those experiencing extreme long-term hardship. Sallie Mae has long supported bankruptcy reform that (i) would permit the discharge of education loans, both private and federal, after a required period of good faith attempts to repay and (ii) is prospective in application, so as not to rewrite existing contracts. Any reform should recognize education loans have unique characteristics and benefits as compared to other consumer loan classes.

Key Drivers of Private Education Loan Market Growth

The size of the Private Education Loan market is based primarily on three factors: college enrollment levels, the costs of attending college, and the availability of funds from the federal government to pay for a college education. The amounts students and their families can contribute toward college costs and the availability of scholarships and institutional grants are also important. If the cost of education increases at a pace exceeding the sum of family income, savings, federal lending, and scholarships, more students and families can be expected to rely on Private Education Loans. If enrollment levels or college costs decline or the availability of federal education loans, grants or subsidies and scholarships significantly increases, Private Education Loan demand could decrease.

7

We focus primarily on students attending public and private not-for-profit four-year degree granting institutions. We lend to some students attending two-year and for-profit schools. Due to the low cost of two-year programs, federal grant and loan programs are typically sufficient for the funding needs of these students. The for-profit industry has been the subject of increased scrutiny and regulation over the last several years. Since 2007, we have reduced the number of for-profit institutions included in our lending program. Approximately 9 percent or $419 million of our 2016 Private Education Loan originations were for students attending for-profit schools. The for-profit schools where we continue to do business are focused on career training. We expect students who attend and complete programs at for-profit schools to support the same repayment performance as students who attend and graduate from public and private not-for-profit four-year degree granting institutions.

Our competitors1 in the Private Education Loan market include large banks such as Wells Fargo Bank, N.A., Discover Bank, Citizens Financial Group, Inc. and PNC Bank NA, as well as a number of smaller specialty finance companies. We compete based on our products, originations capability, and customer service.

Enrollment

We expect modest enrollment growth over the next several years.

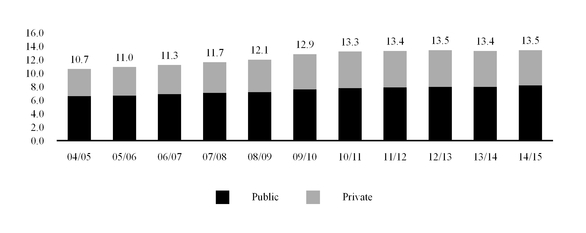

• | Enrollments at public and private not-for-profit four-year institutions increased by approximately 9 percent from academic years (“AYs”) 2004-2005 through 2007-2008. Enrollment increased especially during the recession of 2007-2009, which created high unemployment. Enrollment has been stable post-recession. |

Enrollment at Four-Year Degree Granting Institutions2

(in millions)

• | According to the U.S. Department of Education’s projections released in February 2014, the high school graduate population is projected to remain relatively flat from 2015 to 2022.2 |

_________________________

1Source: MeasureOne Q3 2015 Private Student Loan Report, December 2015. www.measureone.com.

2Source: U.S. Department of Education, National Center for Education Statistics, Projections of Education Statistics to 2022 (NCES, February 2014), Enrollment in Postsecondary Institutions (NCES, December 2013), Enrollment in Postsecondary Institutions (NCES, October 2014) and Enrollment and Employees in Postsecondary Institutions (NCES, November 2015). These are the most recent sources available to us for this information.

8

Tuition Rates

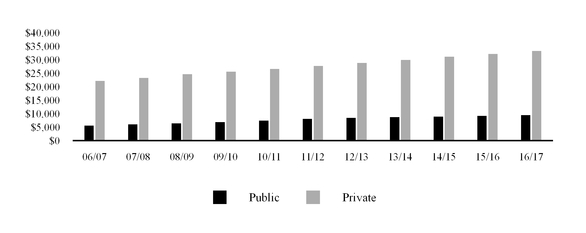

• | Average published tuition and fees (exclusive of room and board) at four-year public and private not-for-profit institutions increased at compound annual growth rates of 5.2 percent and 4.1 percent, respectively, from AYs 2006-2007 through 2016-2017. Growth rates have been more modest the last two AYs, with average published tuition and fees at public and private four-year not-for-profit institutions increasing 3.0 percent and 3.3 percent, respectively, between AYs 2014-2015 and 2015-2016 and 2.4 percent and 3.6 percent, respectively, between AYs 2015-2016 and 2016-2017.3 Tuition and fees are likely to continue to grow at the more modest rates of recent years. |

Published Tuition and Fees3

(Dollars in actuals)

______

3 Source: The College Board-Trends in College Pricing 2016. © 2016 The College Board. www.collegeboard.org. The College Board restates its data annually, which may cause previously reported results to vary.

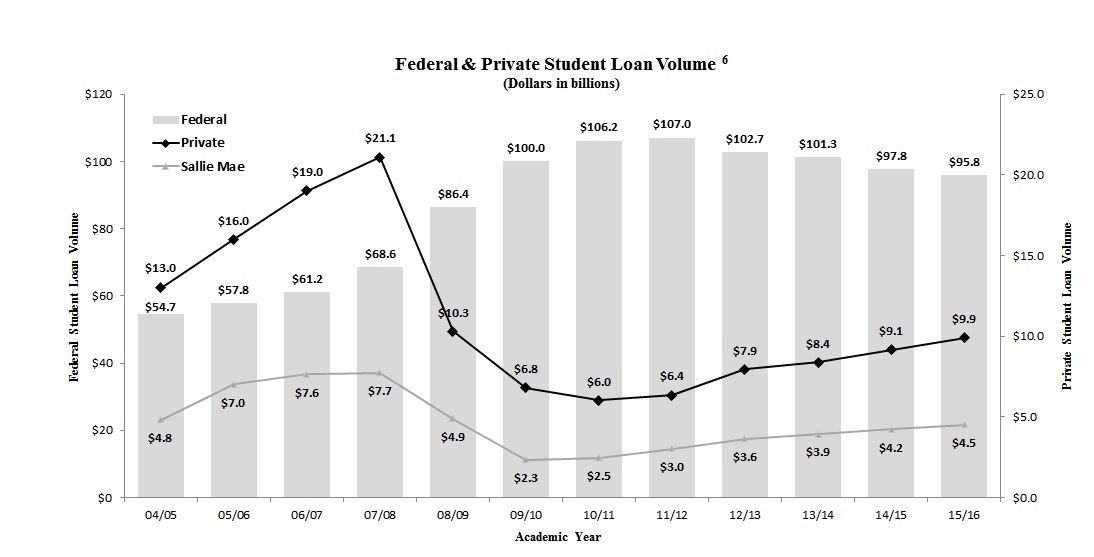

Sources of Funding

• | Borrowing through federal education loan programs increased at a compound annual growth rate of 10 percent between AYs 2004-2005 and 2011-2012.6 Federal borrowing increased considerably during the recession, with borrowing increasing 26 percent between AYs 2007-2008 and 2008-2009 alone. A major driver of this activity was the Higher Education Reconciliation Act of 2005, which in AY 2007-2008 raised annual Stafford loan limits for the first time since 1992 and expanded federal lending with the introduction of the Graduate PLUS loan. In response to the financial crisis in AY 2008-2009, The Ensuring Continued Access to Student Loans Act of 2008 raised unsubsidized Stafford loan limits for undergraduate students again by $2,000.4 Federal education loan program borrowing peaked in AY 2011-2012. Since then it declined by 4 percent in AY 2012-2013, 1 percent in AY 2013-2014, 4 percent in AY 2014-2015, and another 2 percent in AY 2015-2016. We believe these declines are principally driven by enrollment declines in the for-profit schools sector.4 Between AYs 2005-2006 and 2015-2016, federal grants for college students increased 151 percent to $43.3 billion.5 |

_________________________

4 Source: FinAid, History of Student Financial Aid and Historical Loan Limits. © 2014 by FinAid. www.FinAid.org.

5 Source: The College Board-Trends in Student Aid 2016. © 2016 The College Board. www.collegeboard.org.

9

• | These increases in federal lending for higher education had a significant impact on the market for Private Education Loans. Annual originations of Private Education Loans peaked at $21.1 billion in AY 2007-2008 and declined to $6.0 billion in AY 2010-2011. Contributing to the decline in Private Education Loan originations was a significant tightening of underwriting standards by Private Education Loan providers, including Sallie Mae. Private Education Loan originations increased to an estimated $9.9 billion in AY 2015-2016, up 8.0 percent over the previous year.6 |

_______

6 Source: The College Board-Trends in Student Aid 2016. © 2016 The College Board. www.collegeboard.org. Funding sources in current dollars and includes Federal Grants, Federal Loans, Education Tax Benefits, Work Study, State, Institutional and Private Grants and Non-Federal Loans. Other sources for the size of the Private Education Loan market exist and may cite the size of the market differently. We believe the College Board source includes Private Education Loans made by major financial institutions in the Private Education Loan market, with an unknown adjustment for Private Education Loans made by smaller lenders such as credit unions. The College Board restates its data annually, which may cause previously reported results to vary.

10

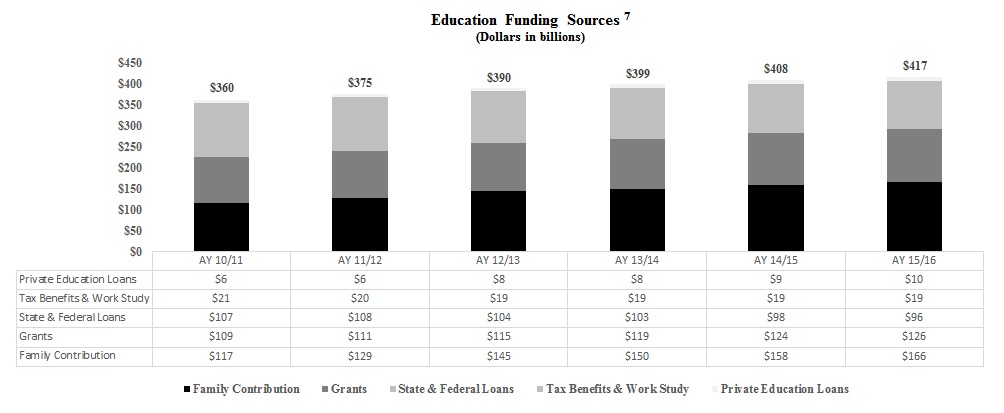

• | We estimate total spending on higher education was $417 billion in the AY 2015-2016, up from $360 billion in the AY 2010-2011. Private Education Loans represent just 2 percent of total spending on higher education. Modest growth in total spending can lead to meaningful increases in Private Education Loans in the absence of growth in other sources of funding.7 |

• | Over the AY 2009-2016 period, increases in total spending have been absorbed primarily through increased family contributions. If household finances continue to improve, we would expect this trend to continue. |

_________________________

7 Source: Total post-secondary education spending is estimated by Sallie Mae determining the full-time equivalents for both graduates and undergraduates and multiplying by the estimated total per person cost of attendance for each school type. In doing so, we utilize information from the U.S. Department of Education, National Center for Education Statistics, Projections of Education Statistics to 2022 (NCES 2014, February 2014), The Integrated Postsecondary Education Data System (IPEDS), College Board -Trends in Student Aid 2016. © 2016 The College Board. www.collegeboard.org, College Board -Trends in Student Pricing 2016. © 2016 The College Board. www.collegeboard.org, National Student Clearinghouse - Term Enrollment Estimates, and Company analysis. Other sources for these data points also exist publicly and may vary from our computed estimates. NCES, IPEDS, and College Board restate their data annually, which may cause previously reported results to vary. We have also recalculated figures in our Company analysis to standardize all costs of attendance to dollars not adjusted for inflation. This has a minimal impact on historically-stated numbers. |

11

Supervision and Regulation

Overview

We are subject to extensive regulation, examination and supervision by various federal, state and local authorities. The more significant aspects of the laws and regulations that apply to us and our subsidiaries are described below. These descriptions are qualified in their entirety by reference to the full text of the applicable statutes, legislation, regulations and policies, as they may be amended, and as interpreted and applied, by federal, state and local agencies.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) was adopted to reform and strengthen regulation and supervision of the U.S. financial services industry. It contains comprehensive provisions to govern the practices and oversight of financial institutions and other participants in the financial markets. It mandates significant regulations, additional requirements and oversight on almost every aspect of the U.S. financial services industry, including increased capital and liquidity requirements, limits on leverage and enhanced supervisory authority. It requires the issuance of many regulations, which will take effect over several years.

Consumer Protection Laws and Regulations

Our origination, servicing, first-party collection and deposit taking activities subject us to federal and state consumer protection, privacy and related laws and regulations. Some of the more significant laws and regulations that are applicable to our business include:

• | various state and federal laws governing unfair, deceptive or abusive acts or practices; |

• | the federal Truth-In-Lending Act and Regulation Z, which govern disclosures of credit terms to consumer borrowers; |

• | the Fair Credit Reporting Act and Regulation V, which govern the use and provision of information to consumer reporting agencies; |

• | the Equal Credit Opportunity Act and Regulation B, which prohibit creditor practices that discriminate on the basis of race, religion and other prohibited factors in extending credit; |

• | the SCRA, which applies to all debts incurred prior to commencement of active military service (including education loans) and limits the amount of interest, including fees, that may be charged; |

• | the Truth in Savings Act and Regulation DD, which mandate certain disclosures related to consumer deposit accounts; |

• | the Expedited Funds Availability Act, Check Clearing for the 21st Century Act and Regulation CC issued by the Federal Reserve Bank (“FRB”), which relate to the availability of deposit funds to consumers; |

• | the Right to Financial Privacy Act, which imposes a duty to maintain the confidentiality of consumer financial records and prescribes procedures for complying with federal government requests for and subpoenas of financial records; |

• | the Electronic Funds Transfer Act and Regulation E, which govern automated transfers of funds and consumers’ rights related thereto; |

• | the Telephone Consumer Protection Act, which governs communication methods that may be used to contact customers; and |

• | the Gramm-Leach-Bliley Act, which governs the ability of financial institutions to disclose nonpublic information about consumers to non-affiliated third-parties. |

12

Consumer Financial Protection Bureau

The Consumer Financial Protection Act, a part of the Dodd-Frank Act, established the CFPB, which has broad authority to promulgate regulations under federal consumer financial protection laws and to directly or indirectly enforce those laws, including regulatory oversight of the Private Education Loan industry, and to examine financial institutions for compliance. It is authorized to collect fines and order consumer restitution in the event of violations, engage in consumer financial education, track consumer complaints, request data and promote the availability of financial services to underserved consumers and communities. It has authority to prevent unfair, deceptive or abusive acts and practices by issuing regulations that define the same or by using its enforcement authority without first issuing regulations. The CFPB has been active in its supervision, examination and enforcement of financial services companies, notably bringing enforcement actions, imposing fines and mandating large refunds to customers of several large banking institutions. On January 1, 2015, the CFPB became the Bank’s primary consumer compliance supervisor with compliance examination authority and primary consumer protection enforcement authority. The CFPB began its formal examination of us in 2016. The UDFI and FDIC remain the prudential regulatory authorities with respect to the Bank’s financial strength.

The Dodd-Frank Act created the Private Education Loan Ombudsman within the CFPB to receive and attempt to informally resolve inquiries about Private Education Loans. The Private Education Loan Ombudsman reports to Congress annually on the trends and issues identified through this process. The CFPB continues to take an active interest in the student loan industry, undertaking a number of initiatives related to the Private Education Loan market and student loan servicing. On October 20, 2016, the Private Education Loan Ombudsman submitted its fifth report based on Private Education Loan inquiries, federal education loan inquiries, and debt collection inquiries related to both federal education loans and Private Education Loans. The report was based on inquiries received by the CFPB from September 1, 2015 through August 31, 2016. During that period of time, the Bank received 276 complaints related to its Private Education Loan portfolio through the CFPB complaint portal. As it did in the fall 2015 and spring 2016 agendas, the CFPB’s fall 2016 rulemaking agenda lists rules related to student loan servicing as a “long-term action” item with no estimated date for further action.

Regulation of Sallie Mae Bank

The Bank was chartered in 2005 and is a Utah industrial bank regulated by the FDIC, the UDFI and the CFPB. We are not a bank holding company and therefore are not subject to the federal regulations applicable to bank holding companies. However, we and our non-bank subsidiaries are subject to regulation and oversight as institution-affiliated parties. The following discussion sets forth some of the elements of the bank regulatory framework applicable to us, the Bank and our other non-bank subsidiaries.

General

The Bank is currently subject to prudential regulation and examination by the FDIC and the UDFI, and consumer compliance regulation and examination by the CFPB. Numerous other federal and state laws and regulations govern almost all aspects of the operations of the Bank and, to some degree, our operations and those of our non-bank subsidiaries as institution-affiliated parties.

Actions by Federal and State Regulators

Under federal and state laws and regulations pertaining to the safety and soundness of insured depository institutions, the UDFI and the FDIC have the authority to compel or restrict certain actions of the Bank if it is determined to lack sufficient capital or other resources, or is otherwise operating in a manner deemed to be inconsistent with safe and sound banking practices. Under this authority, the Bank’s regulators can require it to enter into informal or formal supervisory agreements, including board resolutions, memoranda of understanding, written agreements and consent or cease and desist orders, pursuant to which the Bank would be required to take identified corrective actions to address cited concerns and refrain from taking certain actions.

13

Enforcement Powers

As “institution-affiliated parties” of the Bank, we, our non-bank subsidiaries and our management, employees, agents, independent contractors and consultants are subject to potential civil and criminal penalties for violations of law, regulations or written orders of a government agency. Violations can include failure to timely file required reports, filing false or misleading information or submitting inaccurate reports. Civil penalties may be as high as $1,000,000 a day for such violations and criminal penalties for some financial institution crimes may include imprisonment for 20 years. Regulators have flexibility to commence enforcement actions against institutions and institution-affiliated parties, and the FDIC has the authority to terminate deposit insurance. When issued by a banking agency, cease and desist and similar orders may, among other things, require affirmative action to correct any harm resulting from a violation or practice, including by compelling restitution, reimbursement, indemnifications or guarantees against loss. A financial institution may also be ordered to restrict its growth, dispose of certain assets, rescind agreements or contracts, or take other actions determined to be appropriate by the ordering agency. The federal banking regulators also may remove a director or officer from an insured depository institution (or bar them from the industry) if a violation is willful or reckless.

At the time of this filing, the Bank remains subject to a Consent Order, Order to Pay Restitution and Order to Pay Civil Money Penalty dated May 13, 2014 issued by the FDIC (the “FDIC Consent Order”) and a Consent Order (the “DOJ Consent Order”) issued by the Department of Justice (the “DOJ”). On May 13, 2014, the Bank reached a settlement with the DOJ, and agreed to the DOJ Consent Order, regarding compliance issues with the SCRA. At the same time, the Bank reached a settlement with the FDIC regarding disclosures and assessments of certain late fees, as well as compliance with the SCRA. Under the FDIC Consent Order, the Bank agreed to pay $3.3 million in fines and oversee the refund of up to $30 million in late fees assessed on loans owned or originated by the Bank since its inception in November 2005. The DOJ Consent Order was approved by the U.S. District Court for the District of Delaware on September 29, 2014. Under the terms of the Separation and Distribution Agreement executed in connection with the Spin-Off (the “Separation and Distribution Agreement”), Navient is responsible for funding all liabilities under the regulatory orders and, as of the date hereof, has funded all liabilities other than fines directly levied against the Bank in connection with these matters which the Bank is required to pay.

We believe the Bank has complied with all the requirements of the FDIC Consent Order and the DOJ Consent Order. This includes implementing new SCRA policies, procedures and training, updated billing statement disclosures, steps to ensure its third-party service providers are also fully compliant in these regards, and overseeing Navient’s restitution responsibilities. Notwithstanding the assumption by the CFPB of the role of the Bank’s primary consumer compliance regulator in January 2015, the FDIC will continue to monitor the Bank’s improved compliance management system, policies and procedures until it is satisfied the Bank has demonstrated its ability to sustain the enhancements and additions implemented in response to the FDIC Consent Order. Pursuant to the terms of the DOJ Consent Order, the Bank will remain subject to certain DOJ reporting and record-keeping requirements until September 29, 2018.

In May 2014, the Bank received a Civil Investigative Demand (a “CID”) from the CFPB as part of the CFPB’s separate investigation relating to customer complaints, fees and charges assessed in connection with the servicing of student loans and related collection practices of pre-Spin-Off SLM by entities now subsidiaries of Navient during a time period prior to the Spin-Off. Two state attorneys general provided the Bank identical CIDs and other state attorneys general have become involved in the inquiry over time. To the extent requested, the Bank has been cooperating fully with the CFPB and the attorneys general but is not in a position at this time to predict the duration or outcome of these matters. Given the timeframe covered by the CIDs and the focus on practices and procedures previously conducted by Navient and its servicing subsidiaries prior to the Spin-Off, as contemplated by the Separation and Distribution Agreement relating to, and the structure of, the Spin-Off, Navient is leading the response to these investigations, is legally responsible for, and has accepted responsibility to indemnify the Company against all costs, expenses, losses and remediation that may arise from these matters. Additionally, on January 18, 2017, the Illinois Attorney General filed a separate lawsuit against Navient - its subsidiaries Navient Solutions, Inc., Pioneer Credit Recovery, Inc., and General Revenue Corporation - and the Bank arising out of the aforementioned multi-state investigation of various lending, servicing, and collection practices. As contemplated by the Separation and Distribution Agreement relating to, and the structure of, the Spin-Off, Navient is legally responsible for, and has accepted responsibility to indemnify the Company against, all costs, expenses, losses and remediation that may arise from these matters.

On January 18, 2017, the CFPB filed a complaint in federal court in Pennsylvania against Navient, along with its subsidiaries, Navient Solutions, Inc., and Pioneer Credit Recovery, Inc. The complaint alleges these Navient entities, among other things, engaged in deceptive practices with respect to its historic servicing and debt collection practices. Neither SLM, the

14

Bank, nor any of their current subsidiaries are named in, or otherwise a party to, the lawsuit and are not alleged to have engaged in any wrongdoing.

Standards for Safety and Soundness

The Federal Deposit Insurance Act requires the federal bank regulatory agencies such as the FDIC to prescribe, by regulation or guidance, operational and managerial standards for all insured depository institutions, such as the Bank, relating to internal controls, information systems and audit systems, loan documentation, credit underwriting, interest rate risk exposure, and asset quality. The agencies also must prescribe standards for asset quality, earnings, and stock valuation, as well as standards for compensation, fees and benefits. The federal banking regulators have implemented these required standards through regulations and interagency guidance designed to identify and address problems at insured depository institutions before capital becomes impaired. Under the regulations, if a regulator determines a bank fails to meet any prescribed standards, the regulator may require the bank to submit an acceptable plan to achieve compliance, consistent with deadlines for the submission and review of such safety and soundness compliance plans.

Dividends

The Bank is chartered under the laws of the State of Utah and its deposits are insured by the FDIC. The Bank’s ability to pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah’s industrial bank laws and regulations as well as FDIC regulations, the Bank may pay dividends to the Company from its net profits without regulatory approval if, following the payment of the dividend, the Bank’s capital and surplus would not be impaired. The Bank paid no dividends on its common stock for the years ended December 31, 2016, 2015 and 2014. For the foreseeable future, we expect the Bank to only pay dividends to the Company as may be necessary to provide for regularly scheduled dividends payable on the Company’s Series A and Series B Preferred Stock.

Regulatory Capital Requirements

The Bank is subject to various regulatory capital requirements administered by the FDIC and the UDFI. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a material adverse effect on our business, results of operations and financial position. Under the FDIC’s regulations implementing the Basel III capital framework (“U.S. Basel III”) and the regulatory framework for prompt corrective action, the Bank must meet specific capital standards that involve quantitative measures of its assets, liabilities and certain off-balance sheet items as calculated under regulatory accounting practices. The Bank’s capital amounts and its classification under the prompt corrective action framework are also subject to qualitative judgments by the regulators about components of capital, risk weightings and other factors.

U.S. Basel III, which is aimed at increasing both the quantity and quality of regulatory capital, established Common Equity Tier 1 as a new tier of capital and modified methods for calculating risk-weighted assets, among other things. Certain aspects of U.S. Basel III, including new deductions from and adjustments to regulatory capital and a new capital conservation buffer, are being phased in over several years.

The Bank is subject to the following minimum capital ratios under U.S. Basel III: a Common Equity Tier 1 risk-based capital ratio of 4.5 percent, a Tier 1 risk-based capital ratio of 6.0 percent, a Total risk-based capital ratio of 8.0 percent, and a Tier 1 leverage ratio of 4.0 percent. In addition, the Bank is subject to a Common Equity Tier 1 capital conservation buffer, which is being phased in over three years beginning January 1, 2016: 0.625 percent of risk-weighted assets for 2016, 1.25 percent for 2017, and 1.875 percent for 2018, with the fully phased-in level of greater than 2.5 percent effective as of January 1, 2019. Failure to maintain the buffer will result in restrictions on the Bank’s ability to make capital distributions, including the payment of dividends, and to pay discretionary bonuses to executive officers. Including the buffer, by January 1, 2019, the Bank will be required to maintain the following minimum capital ratios: a Common Equity Tier 1 risk-based capital ratio of greater than 7.0 percent, a Tier 1 risk-based capital ratio of greater than 8.5 percent and a Total risk-based capital ratio of greater than 10.5 percent.

U.S. Basel III also revised the capital thresholds for the prompt corrective action framework for insured depository institutions. To qualify as “well capitalized,” the Bank must maintain a Common Equity Tier 1 risk-based capital ratio of at least

15

6.5 percent, a Tier 1 risk-based capital ratio of at least 8.0 percent, a Total risk-based capital ratio of at least 10.0 percent, and a Tier 1 leverage ratio of at least 5.0 percent.

Stress Testing Requirements

The Dodd-Frank Act imposes stress testing requirements on banking organizations with total consolidated assets, averaged over the four most recent consecutive quarters, of more than $10 billion. As of September 30, 2014, the Bank met this asset threshold. Under the FDIC’s implementing regulations, the Bank is required to conduct annual company-run stress tests utilizing scenarios provided by the FDIC and publish a summary of those results. The Bank conducted its first annual stress test under the rules in the January 1, 2016 stress testing cycle, submitted the results of that stress test to the FDIC on July 16, 2016 and published the results on October 31, 2016. In all scenarios, including the severely adverse scenario, the Bank’s capital levels exceed regulatory expectations for “well capitalized”.

Deposit Insurance and Assessments

Deposits at the Bank are insured up to the applicable legal limits by the FDIC - administered Deposit Insurance Fund (the “DIF”), which is funded primarily by quarterly assessments on insured banks. An insured bank’s assessment is calculated by multiplying its assessment rate by its assessment base. A bank’s assessment base and assessment rate are determined each quarter.

The Bank’s insurance assessment base currently is its average consolidated total assets minus its average tangible equity during the assessment period. The Bank’s assessment rate is determined by the FDIC using a number of factors, including the results of supervisory evaluations, the Bank’s capital ratios and its financial condition, as well as the risk posed by the Bank to the DIF. Assessment rates for insured banks also are subject to adjustment depending on a number of factors, including significant holdings of brokered deposits in certain instances and the issuance or holding of certain types of debt.

Deposits

With respect to brokered deposits, an insured depository institution must be well capitalized to accept, renew or roll over such deposits without FDIC clearance. An adequately capitalized insured depository institution must obtain a waiver from the FDIC to accept, renew or roll over brokered deposits. Undercapitalized insured depository institutions generally may not accept, renew or roll over brokered deposits. For more information on the Bank’s deposits, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Key Financial Measures — Funding Sources.”

Regulatory Examinations

The Bank currently undergoes regular on-site examinations by the Bank’s regulators, who examine for adherence to a range of legal and regulatory compliance responsibilities. A regulator conducting an examination has complete access to the books and records of the examined institution. The results of the examination are confidential. The cost of examinations may be assessed against the examined institution as the agency deems necessary or appropriate. The CFPB conducted its first review of the Bank’s compliance management system in 2016 with no follow up actions required.

Source of Strength

Under the Dodd-Frank Act, we are required to serve as a source of financial strength to the Bank and to commit resources to support the Bank in circumstances when we might not do so absent the statutory requirement. Any loan by us to the Bank would be subordinate in right of payment to depositors and to certain other indebtedness of the Bank.

Community Reinvestment Act

The Community Reinvestment Act (the “CRA”) requires the FDIC to evaluate the record of the Bank in meeting the credit needs of its local community, including low- and moderate-income neighborhoods. These evaluations are considered in evaluating mergers, acquisitions and applications to open a branch or facility. Failure to adequately meet these criteria could result in additional requirements and limitations on the Bank. The Bank has received a CRA rating of Outstanding.

16

Privacy Laws

The federal banking regulators, as required by the Gramm-Leach-Bliley Act, have adopted regulations that limit the ability of banks and other financial institutions to disclose nonpublic information about consumers to nonaffiliated third-parties. Financial institutions are required to disclose to consumers their policies for collecting and protecting confidential customer information. Customers generally may prevent financial institutions from sharing nonpublic personal financial information with nonaffiliated third-parties, with some exceptions, such as the processing of transactions requested by the consumer. Financial institutions generally may not disclose certain consumer or account information to any nonaffiliated third-party for use in telemarketing, direct mail marketing or other marketing. The privacy regulations also restrict information sharing among affiliates for marketing purposes and govern the use and provision of information to consumer reporting agencies. Federal and state banking agencies have prescribed standards for maintaining the security and confidentiality of consumer information, and the Bank is subject to such standards, as well as certain federal and state laws or standards for notifying consumers in the event of a security breach.

Other Sources of Regulation

Many other aspects of our businesses are subject to federal and state regulation and administrative oversight. Some of the most significant of these are described below.

Oversight of Derivatives

Title VII of the Dodd-Frank Act requires all standardized derivatives, including most interest rate swaps, to be submitted for clearing to central intermediaries to reduce counterparty risk. As of December 31, 2016, $4.8 billion notional of our derivative contracts were cleared on the Chicago Mercantile Exchange and the London Clearing House. This represents 92.1 percent of our total notional derivative contracts of $5.2 billion. All derivative contracts cleared through an exchange require collateral to be exchanged based on the fair value of the derivative. Our exposure is limited to the value of the derivative contracts in a gain position less any collateral held by us and plus collateral posted with the counterparty.

Credit Risk Retention

In October 2014, the Department of the Treasury, the Federal Reserve, the Office of the Comptroller of the Currency, the FDIC, the SEC, the Federal Housing Finance Agency and the Department of Housing and Urban Development issued final rules to implement the credit risk retention requirements of Section 941 of the Dodd-Frank Act for ABS, including those backed by residential and commercial mortgages and automobile, commercial, credit card, and student loans, except for certain transactions with limited connections to the United States and U.S. investors. The regulations generally require securitizers of assets backing ABS, such as Sallie Mae, to retain an economic interest in an ABS transaction that represents at least five percent of the credit risk of the assets being securitized. The final rules provide reduced risk retention requirements for securitization transactions collateralized solely (excluding servicing assets) by FFELP Loans. The regulations took effect in December 2015 for securitization transactions backed by residential mortgages and took effect in December 2016 for other securitization transactions, including those collateralized by Private Education Loans. Prior to December 2016, the Bank’s on-balance sheet securitizations were subject to the credit risk retention requirements of the FDIC “safe harbor” rule, which generally reduced the risk to securitization investors in the event of an insolvency of the Bank.

Anti-Money Laundering, the USA PATRIOT Act, and U.S. Economic Sanctions

The USA PATRIOT Act of 2001 (the “USA Patriot Act”), which amended the Bank Secrecy Act, substantially broadened the scope of United States anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, creating new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department has issued and, in some cases proposed, a number of regulations that apply various requirements of the USA Patriot Act to financial institutions such as the Bank. These regulations impose obligations on financial institutions to maintain appropriate internal policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of their customers. In addition, U.S. law generally prohibits or substantially restricts U.S. persons from doing business with countries designated by the U.S. Department of State as state sponsors of terrorism, which currently are Iran, Sudan and Syria. Under U.S. law, there are similar prohibitions or restrictions with countries subject to other U.S. economic sanctions administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control or other

17

agencies. We maintain policies and procedures designed to ensure compliance with relevant U.S. laws and regulations applicable to U.S. persons.

Volcker Rule

In December 2013, the U.S. banking agencies, the SEC and U.S. Commodity Futures Trading Commission issued final rules to implement the “Volcker Rule” provisions of the Dodd-Frank Act. The rules prohibit insured depository institutions and their affiliates (collectively, “banking entities”) from engaging in proprietary trading and from investing in, sponsoring or having certain financial relationships with certain private funds. These prohibitions are subject to a number of important exclusions and exemptions that, for example, permit banking entities to trade for risk mitigating hedging and liquidity management, subject to certain conditions and restrictions. A conformance period ended on July 21, 2015. We do not expect the Volcker Rule to have a meaningful effect on our current operations or those of our subsidiaries, as we do not materially engage in the businesses prohibited by the Volcker Rule.

Employees

At December 31, 2016, we had approximately 1,300 employees, none of whom is covered by collective bargaining agreements.

18

Item 1A. Risk Factors

Economic Environment

Economic conditions could have a material adverse effect on our business, results of operations, financial condition and liquidity.

Our business is significantly influenced by economic conditions. Economic growth in the United States remains uneven. Employment levels in the United States are often sensitive not only to domestic economic growth but to the performance of major foreign economies and commodity prices. High unemployment rates and the failure of our in-school borrowers to graduate are two of the most significant macroeconomic factors that could increase loan delinquencies, defaults and forbearance, or otherwise negatively affect performance of our existing education loan portfolios. Since 2009, the unemployment rate of 20-24 year old college graduates has been higher than in the years immediately prior to 2009. It reached a high of 13.3 percent in 2011 and declined to 5.6 percent in December 2016. Likewise, high unemployment and decreased savings rates may impede Private Education Loan originations growth as loan applicants and their cosigners may experience trouble repaying credit obligations or may not meet our credit standards. Additionally, if interest rates rise, borrowers and cosigners of variable-rate loans in our portfolio could experience trouble repaying loans we have made to them. Consequently, for a number of reasons, our borrowers may experience more trouble in repaying loans we have made to them, which could increase our loan delinquencies, defaults and forbearance. In addition, some consumers may find that higher education is an unnecessary investment during uncertain economic times and defer enrollment in educational institutions until the economy grows at a stronger pace, or they may turn to less costly forms of secondary education, thus decreasing our education loan application and funding volumes. Higher credit-related losses and weaker credit quality negatively affect our business, financial condition and results of operations and limit funding options, which could also adversely impact our liquidity position.

Competition

We operate in a competitive environment. Our product offerings are primarily concentrated in loan products for higher education and deposit products for online depositors. Such concentrations and the competitive environment subject us to risks that could adversely affect our financial position.

The principal assets on our balance sheet are Private Education Loans. At December 31, 2016, approximately 76 percent of our assets were comprised of Private Education Loans, and this concentration will likely increase. We compete in the Private Education Loan market with banks and other consumer lending institutions, many with strong consumer brand name recognition and greater financial resources. We compete based on our products, origination capability and customer service. To the extent our competitors compete more aggressively or effectively, we could lose market share to them or subject our existing loans to refinancing risk.

Competition plays a significant role in our online deposit gathering activities. The market for online deposits is highly competitive, based primarily on a combination of reputation and rate. Increased competition for deposits could cause our cost of funds to increase, with negative impacts on our financial returns.

In addition to competition with banks and other consumer lending institutions, the federal government, through the DSLP, poses significant competition to our Private Education Loan products. The availability and terms of loans the government originates or guarantees affect the demand for Private Education Loans because students and their families often rely on Private Education Loans to bridge a gap between available funds, including family savings, scholarships, grants, and federal and state loans, and the costs of post-secondary education. The federal government currently places both annual and aggregate limitations on the amount of federal loans any student can receive and determines the criteria for student eligibility. Parents and graduate students may obtain additional federal education loans through other programs. These federal education lending programs are generally adjusted in connection with funding authorizations from the U.S. Congress for programs under the Higher Education Act of 1965 (the “HEA”). The HEA’s reauthorization is currently pending in the U.S. Congress and a vote may occur in 2017. Increased funding authorizations or federal education loan limits contained in any reauthorization could decrease demand for Private Education Loans.

19

Access to alternative means of financing the costs of education and other factors may reduce demand for Private Education Loans, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The demand for Private Education Loans could weaken if families and student borrowers use other vehicles to bridge the gap between available funds and costs of post-secondary education. These vehicles include, among others:

• | Home equity loans or other borrowings available to families to finance their education costs; |

• | Pre-paid tuition plans, which allow students to pay tuition at today’s rates to cover tuition costs in the future; |

• | Section 529 plans, which include both pre-paid tuition plans and college savings plans that allow a family to save funds on a tax-advantaged basis; |

• | Education IRAs, now known as Coverdell Education Savings Accounts, under which a holder can make annual contributions for education savings; |

• | Government education loan programs such as the DSLP; and |

• | Direct loans from colleges and universities. |

In addition, our ability to grow Private Education Loan originations could be negatively affected if

• | demographic trends in the United States result in a decrease in college-age individuals, |

• | demand for higher education decreases, |

• | the cost of attendance of higher education decreases, or |

• | public resistance to increasing higher education costs strengthens. |

Consolidation or refinancing of existing Private Education Loans could have a material adverse effect on our business, financial condition, results of operations and cash flows.

To date, we have experienced no significant increase in consolidation or refinancing of our existing Private Education Loans. We believe the design of our products, with emphasis on rigorous underwriting, credit-worthy cosigners and variable interest rates, creates sustainable, competitive loan products. However, a prolonged introduction of significant amounts of subsidized funding into the Private Education Loan market at below market interest rates - whether from federal or private sources (including financial technology (“FinTech”) companies) - could increase the prepayment rates of our existing Private Education Loans and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Since 2010, both the number of bills introduced in the United States Congress to promote federal financing for consolidation or refinancing of existing student loans, as well as the number of lenders offering similar products, have increased. Also, on December 2, 2016, the Comptroller of the Currency announced that the Office of the Comptroller of the Currency (the “OCC”) would move forward with considering applications from FinTech companies to become special purpose national banks. Concurrent with the announcement, the OCC published a white paper discussing the issues and conditions that agency will consider in granting special purpose national bank charters. We are still evaluating the potential competitive impact if the OCC begins to charter FinTech companies that offer bank products and services, including loans to consolidate or refinance existing student loans.

We are dependent on key personnel and the loss of one or more of those key personnel could harm our business.

Our future success depends significantly on the continued services and performance of our management team. We believe our management team’s depth and breadth of experience in our industry is integral to executing our business plan. We also will need to continue to attract, motivate and retain other key personnel. The loss of the services of members of our management team or other key personnel to our competitors or other companies or the inability to attract additional qualified personnel as needed could have a material adverse effect on our business, financial position, results of operations and cash flows.

20

Regulatory

Failure to comply with consumer protection laws could subject us to civil and criminal penalties or litigation, including class actions, and have a material adverse effect on our business.

We are subject to a broad range of federal and state consumer protection laws applicable to our Private Education Loan lending and retail banking activities, including laws governing fair lending, unfair, deceptive and abusive acts and practices, service member protections, interest rates and loan fees, disclosures of loan terms, marketing, servicing and collections.

Violations of, or changes in, federal or state consumer protection laws or related regulations, or in the prevailing interpretations thereof, may expose us to litigation, administrative fines, penalties and restitution, result in greater compliance costs, constrain the marketing of Private Education Loans, adversely affect the collection of balances due on the loan assets held by us or by securitization trusts or otherwise adversely affect our business. We could incur substantial additional expense complying with these requirements and may be required to create new processes and information systems. Moreover, changes in federal or state consumer protection laws and related regulations, or in the prevailing interpretations thereof, could invalidate or call into question the legality of certain of our services and business practices.

For example, the Bank is currently subject to the FDIC Consent Order and the DOJ Consent Order. Specifically, on May 13, 2014, the Bank reached settlements with the FDIC and the DOJ regarding disclosures and assessments of certain late fees, as well as compliance with the SCRA.

Effective January 1, 2015, the CFPB became the Bank’s primary consumer compliance supervisor, with consumer compliance examination authority and primary consumer compliance enforcement authority. CFPB jurisdiction could result in additional regulation and supervision, which could increase our costs and limit our ability to pursue business opportunities. Consent orders, decrees or settlements entered into with governmental agencies may also increase our compliance costs or restrict certain of our activities.