Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ENCORE WIRE CORP | wire-2016x12x31xexx32x2.htm |

| EX-32.1 - EXHIBIT 32.1 - ENCORE WIRE CORP | wire-2016x12x31xexx32x1.htm |

| EX-31.2 - EXHIBIT 31.2 - ENCORE WIRE CORP | wire-2016x12x31xexx31x2.htm |

| EX-31.1 - EXHIBIT 31.1 - ENCORE WIRE CORP | wire-2016x12x31xexx31x1.htm |

| EX-23.1 - EXHIBIT 23.1 - ENCORE WIRE CORP | wire-2016x12x31xexx23x1.htm |

| EX-21.1 - EXHIBIT 21.1 - ENCORE WIRE CORP | wire-2016x12x31xexx21x1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-20278

ENCORE WIRE CORPORATION (Exact name of registrant as specified in its charter) |

Delaware | 75-2274963 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1329 Millwood Road McKinney, Texas | 75069 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (972) 562-9473

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $.01 per share | The NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes ý No

The aggregate market value of the Common Stock held by non-affiliates of the registrant computed by reference to the price at which the Common Stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $744,961,655 (Note: The aggregate market value of Common Stock held by the Company’s directors, executive officers, immediate family members of such directors and executive officers, 10% or greater stockholders and other stockholders deemed to be affiliates was excluded from the computation of the foregoing amount. The characterization of such persons as “affiliates” should not be construed as an admission that any such person is an affiliate of the Registrant for any other purpose).

Number of shares of Common Stock outstanding as of February 23, 2017: 20,736,248

DOCUMENTS INCORPORATED BY REFERENCE

Listed below are documents, parts of which are incorporated herein by reference, and the part of this report into which the document is incorporated:

(1) | Proxy statement for the 2017 annual meeting of stockholders – Part III |

ENCORE WIRE CORPORATION

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2016

Table of Contents

PAGE | |

Item 16. Form 10-K Summary | |

i

PART I

Item 1. Business.

General

Encore Wire Corporation is a Delaware corporation, incorporated in 1989, with its principal executive office and manufacturing plants located at 1329 Millwood Road, McKinney, Texas 75069. The Company’s telephone number is (972) 562-9473. As used in this annual report, unless otherwise required by the context, the terms “we,” “our,” “Company,” “Encore” and “Encore Wire” refer to Encore Wire Corporation and its consolidated entities.

Encore is a low-cost manufacturer of electrical building wire and cable. The Company is a significant supplier of building wire for interior electrical wiring in commercial and industrial buildings, homes, apartments, and manufactured housing.

The principal customers for Encore’s wire are wholesale electrical distributors, who sell building wire and a variety of other products to electrical contractors. The Company sells its products primarily through independent manufacturers’ representatives located throughout the United States and, to a lesser extent, through its own direct in-house marketing efforts.

Strategy

Encore’s strategy is to further expand its share of the building wire market primarily by emphasizing a high level of customer service and the addition of new products that complement its current product line, while maintaining and enhancing its low-cost production capabilities. Encore’s low-cost production capability features an efficient plant design incorporating highly automated manufacturing equipment, an integrated production process and a highly-motivated work force.

Customer Service: Encore is highly focused on responding to customer needs, with an emphasis on building and maintaining strong customer relationships. Encore seeks to establish customer loyalty by achieving a high order fill rate and rapidly handling customer orders, shipments, inquiries and returns. The Company maintains product inventories sufficient to meet anticipated customer demand and believes that the speed and completeness with which it fills orders are key competitive advantages critical to marketing its products.

Product Innovation: Encore has been a leader in bringing new ideas to a commodity product. Encore pioneered the widespread use of color feeder sizes of commercial wire and colors in the residential non-metallic cable. The colors have improved on-the-job safety and reduced installation times for contractors. Encore Wire’s patented SmartColor ID® system for metal-clad and armor-clad cables allows for quick and accurate identification of gauge, number of conductors, wire and jacket type. Additionally, Encore currently has nineteen patents and twenty-nine patent-pending innovations that range from process improvements to packaging solutions.

Low-Cost Production: Encore’s low-cost production capability features an efficient plant design and an incentivized work force.

Efficient Plant Design: Encore’s highly automated wire manufacturing equipment is integrated in an efficient design that reduces material handling, labor and in-process inventory.

Incentivized Work Force: The Company has a stock option plan and a stock appreciation rights plan that enhance the motivation of its salaried manufacturing supervisors. The Company also has a comprehensive safety program that emphasizes employee participation. The Company provides a 401(k) retirement savings plan to all employees.

Products

Encore offers an electrical building wire product line that consists primarily of NM-B cable, UF-B cable, THHN/THWN-2 and other types of wire products, including metal-clad and armored cable. All of these products are manufactured with copper or aluminum as the conductor. The principal bases for differentiation among stock-keeping units (“SKUs”) are product type, conductor type, diameter, insulation, color and packaging.

Bare Copper: Bare copper conductors are used in overhead electrical transmission and distribution systems for grounding and bonding of electrical systems, and where high conductivity and flexibility are required for equipment and circuit grounding.

NM-B Cable: Non-metallic sheathed cable is used primarily as interior wiring in homes, apartments and manufactured housing. NM-B cable is composed of either two or three insulated copper wire conductors, with an uninsulated ground wire, all sheathed in a polyvinyl chloride (“PVC”) jacket.

1

UF-B Cable: Underground feeder cable is used to conduct power underground to outside lighting and other applications remote from buildings or structures. UF-B cable is composed of two or three polyvinyl chloride (PVC) insulated copper wire conductors, with an uninsulated ground wire, all jacketed in PVC.

SE Style Cable (Style U): Service Entrance cable is primarily utilized as an aboveground external service entrance cable from the meter enclosure to the service distribution equipment. SE-U style cable is composed of copper or aluminum multiple conductors, insulated with polyvinyl chloride (PVC) or a single layer of cross-linked polyethylene (XLPE) insulation, all jacketed in polyvinyl chloride (PVC).

SE Style Cable (Style R): Service Entrance cable is primarily utilized as an aboveground service entrance cable from the service disconnecting means to other remotely located electrical distribution equipment. SE-R style cable is composed of copper or aluminum multiple conductors, insulated with polyvinyl chloride (PVC) or a single layer of cross-linked polyethylene (XLPE) insulation, all jacketed in polyvinyl chloride (PVC).

THHN/THWN-2 Cable: THHN/THWN-2 cable is used primarily as branch circuit, feeder and service entrance conductors within commercial and industrial buildings and structures. It is composed of a copper or aluminum single conductor, either stranded or solid, and insulated with PVC, which is further coated with nylon. Users typically pull THHN/THWN-2 cable through cable tray or protective conduit pipe.

XHHW-2: XHHW-2 cable is used primarily as branch circuit, feeder and service entrance conductors within commercial and industrial buildings and structures. It is composed of a copper or aluminum single conductor, either stranded or solid, and with a single layer of cross-linked polyethylene (XLPE) insulation.

USE-2 or RHH or RHW-2: USE-2, RHH or RHW-2 cable is intended for general purpose applications in direct burial, underground applications as USE-2 or as RHH or RHW-2 for either aboveground or underground applications in listed raceways for branch circuit, feeder and service entrance conductors. It is composed of a copper or aluminum single conductor, either stranded or solid, and with a single layer of cross-linked polyethylene (XLPE) insulation suitable for wet locations.

Tray Cable (Power and/or Control): Tray Cable is primarily used as branch circuit or feeders for power, lighting, control, and signal circuits for direct installations in raceways, outdoor locations where supported by a messenger wire, in cable trays and direct burial in underground installations where evaluated for the specific condition of use. It is composed of copper or aluminum multiple conductors, insulated with polyvinyl chloride (PVC) or cross-linked polyethylene (XLPE) with either insulated or bare equipment grounding conductor, all jacketed in rugged polyvinyl chloride (PVC).

Metal-Clad Cable: Metal-clad cable is used primarily as branch circuit, feeder, and service conductors, primarily in multi-family dwellings, commercial and industrial buildings. It is composed of multiple conductors, either stranded or solid, and insulated with polyvinyl chloride (PVC), which are further coated with nylon or with a single layer of cross-linked polyethylene (XLPE) insulation and then fully encased in a flexible aluminum or steel “armored” protective sheathing.

Armored Cable: Armored cable is used primarily as branch circuit and feeders, primarily in commercial and industrial buildings. It is composed of multiple conductors, either stranded or solid, and insulated with polyvinyl chloride (PVC), which are further coated with nylon and then fully encased in a flexible aluminum or steel “armored” protective sheathing.

Photovoltaic Single-Conductor Cable: Photovoltaic (PV) style conductors and/or cables are primarily intended for use as photovoltaic (PV) direct-current output circuit and source circuits between the PV arrays and combiner boxes. It is composed of a copper or aluminum single conductor, either stranded or solid, and with a single layer of cross-linked polyethylene (XLPE) insulation.

URD or UDC Cable: Underground Residential Distribution Cable (URD) or Underground Distribution Cable (UDC) is primarily for underground secondary distribution, as service entrance conductors underground, and as service laterals. It may be directly buried in earth or installed in an electrical duct system in both wet and dry locations. It is composed of a copper or aluminum single conductor, either stranded or solid, and with a single layer of cross-linked polyethylene (XLPE) insulation.

Mobile Home Feeder Cable: Mobile Home Feeder Cable is primarily for underground feeders to mobile homes as defined in Article 550 of the National Electrical Code®. It may be directly buried in earth or in a listed raceway system in both wet and dry locations. It is composed of a copper or aluminum single conductor, either stranded or solid, and with a single layer of cross-linked polyethylene (XLPE) insulation.

Overhead Service Drop: Overhead Service Drop conductors are primarily for overhead secondary distribution, as service entrance conductors overhead, and as service drop conductors from utility transformers to premise wiring systems. It is composed of electrical grade 1350 series aluminum alloy conductors, typically stranded, and with a single layer of cross-linked polyethylene (XLPE) insulation.

2

Manufacturing

The efficiency of Encore’s highly automated manufacturing facility is a key element of its low-cost production capability. Encore’s residential wire manufacturing lines have been integrated so that the handling of product is substantially reduced throughout the production process.

The manufacturing process for the Company’s various products involves multiple steps, including: casting, drawing, stranding, compounding, insulating, cabling, jacketing and armoring.

Casting: Rod is produced by melting sheets of copper cathode and copper scrap, casting the molten copper into a bar and rolling the hot copper bar into a 5/16 inch copper rod to be drawn into copper wire.

Drawing: Drawing is the process of reducing 5/16 inch copper rod through converging dies until the specified wire diameter is attained. The wire is then heated with electrical current to soften or “anneal” the wire to make it easier to handle.

Stranding: Stranding is the process of twisting together from seven to sixty-one individual bare wire strands to form a single cable. The purpose of stranding is to improve the flexibility of wire while maintaining its electrical current carrying capacity.

PVC Compounding: PVC compounding is the process of mixing the various raw materials that are required to produce the PVC necessary to meet specifications of Underwriters Laboratories, Inc. (“UL”) for the insulation and jacket requirements for the wire that is manufactured.

Insulating: Insulating is the process of extruding PVC over the solid or stranded wire.

Cabling: Cabling is the process of twisting together two or more insulated conductors to form a cable.

Jacketing: Jacketing is the process of extruding PVC over two or more insulated conductor wires, with or without an uninsulated ground wire, to form a finished product. The Company’s jacketing lines are integrated with packaging lines that cut the wire and coil it onto reels or package it in boxes or shrink-wrap. Jacketing also comprises extruding a nylon covering over some PVC-insulated products, such as THHN/THWN-2.

Metal-Cladding and Armoring: Metal-cladding and armoring is the process of covering two or more insulated conductor wires, with or without an uninsulated ground wire, with a spiral interlocking cover of aluminum or steel to form a finished product.

Encore manufactures and tests all of its products in accordance with the Underwriters Laboratories (UL) standards, a nationally recognized testing and standards agency. Encore’s machine operators and quality control inspectors conduct routine product inspections. The Company tests finished products for electrical continuity to ensure compliance with its own quality standards and those of UL. Encore’s manufacturing lines are equipped with laser micrometers to measure wire diameter and insulation thickness while the lines are in operation. During each shift, operators perform and record routine physical measurements of products, all of which are separately verified and approved by quality control inspectors. Although suppliers pre-test PVC and nylon compounds, the Company tests products for aging, cracking and brittleness of insulation and jacketing. Additionally, UL representatives routinely visit and test products from each area of manufacturing.

Customers

Encore sells its wire to wholesale electrical distributors throughout the United States. Most distributors supply products to electrical contractors. Encore’s customer base is numerous and diversified. Encore has two customers, each of whom slightly exceed 10% of the Company's total sales. Encore has no customer, the loss of which would have a material adverse effect on the Company.

Encore believes that the speed and completeness with which it fills customers’ orders is crucial to its ability to expand the market share for its products. The Company also believes that, for a variety of reasons, many customers strive to maintain lean inventories. Because of this trend, the Company seeks to maintain sufficient inventories to satisfy customers’ prompt delivery requirements.

Marketing and Distribution

Encore markets its products throughout the United States primarily through independent manufacturers’ representatives and, to a lesser extent, through its own direct marketing efforts.

Encore maintains the majority of its finished product inventory at its plant in McKinney, Texas. In order to provide flexibility in handling customer requests for immediate delivery, additional product inventories are maintained at warehouses owned and operated by independent manufacturers’ representatives located in Chattanooga, TN; Norcross, GA; Cincinnati, OH; Canton, MI; Fairless Hills, PA; Louisville, KY; Greensboro, NC; Pittsburgh, PA; Santa Fe Springs, CA; Hayward, CA; Portland, OR, and

3

Lakeland, FL. Some of these manufacturers’ representatives, as well as the Company’s other manufacturers’ representatives, maintain offices without warehouses in numerous locations throughout the United States.

Finished goods are typically delivered to warehouses and customers by trucks operated by common carriers. The decision regarding the carrier to be used is based primarily on availability and cost.

The Company invoices its customers directly for products purchased and, if an order has been obtained through a manufacturer’s representative, pays the representative a commission based on pre-established rates. The Company determines customer credit limits. The Company recorded no bad debt charges in 2016, 2015, and 2014. The manufacturers’ representatives have no discretion to determine prices charged for the Company’s products, and all sales are subject to Company approval. Encore sells all of its products with a one-year replacement warranty. Warranty expenses have historically been nominal.

Employees

Encore believes that its hourly employees are highly motivated and that their motivation contributes significantly to the plant’s efficient operation. The Company believes that competitive hourly compensation coupled with sound management practices focuses its employees on maintaining high production standards and product quality.

As of December 31, 2016, Encore had 1,253 employees, 1,060 of whom were paid hourly wages and were primarily engaged in the operation and maintenance of the Company’s manufacturing and warehouse facilities. The Company’s remaining employees were executive, supervisory, administrative, sales and clerical personnel. The Company considers its relations with its employees to be good. The Company has no collective bargaining agreements with any of its employees.

Raw Materials

The principal raw materials used by Encore in manufacturing its products are copper cathode, copper scrap, PVC thermoplastic compounds, XLPE compounds, aluminum, steel, paper and nylon, all of which are readily available from a number of suppliers. Copper is the principal raw material used by the Company in manufacturing its products, constituting 77.8% of the dollar value of all raw materials used by the Company during 2016. Copper requirements are purchased primarily from miners and commodity brokers at prices determined each month primarily based on the average daily COMEX closing prices for copper for that month, plus a negotiated premium. The Company also purchases raw materials necessary to manufacture various PVC thermoplastic compounds. These raw materials include PVC resin, clay and plasticizer.

The Company produces copper rod from purchased copper cathode and copper scrap in its own rod fabrication facility. The Company reprocesses copper scrap generated by its operations as well as copper scrap purchased from others. In 2016, the Company’s copper rod fabrication facility manufactured the majority of the Company’s copper rod requirements. The Company purchases aluminum rod from various suppliers for aluminum wire production.

The Company also compounds its own wire jacket and insulation compounds. The process involves the mixture of PVC raw material components to produce the PVC used to insulate the Company’s wire and cable products. The raw materials include PVC resin, clay and plasticizer. During the last year, the Company’s plastic compounding facility produced virtually all of the Company’s PVC requirements.

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several companies who manufacture and sell wire and cable products beyond the building wire segment in which the Company competes. The Company’s primary competitors include Southwire Company, Cerro Wire LLC, General Cable Corporation and AFC Cable Systems, Inc.

The principal elements of competition in the electrical wire and cable industry are, in the Company's opinion, order fill rate, quality, pricing, and, in some instances, breadth of product line. The Company believes that it is competitive with respect to all of these factors.

Competition in the electrical wire and cable industry, although intense, has been primarily from U.S. manufacturers, including foreign-owned facilities located in the United States. The Company has encountered little significant competition from imports of building wire. The Company believes this is primarily because direct labor costs generally account for a relatively small percentage of the cost of goods sold for these products and freight costs are relatively high to bring wire to the United States from overseas.

4

Compliance with Environmental Regulations

The Company is subject to federal, state and local environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. Management believes the Company is in compliance with all such rules including permitting and reporting requirements. Historically, compliance with such laws and regulations has not had a material impact on the capital expenditures, earnings and competitive position of the Company.

Research and Development Activities

The Company classifies research and development activities as a component of production overhead. Costs attributable to Company-sponsored research and development activities were approximately $2.0 million, $1.8 million and $1.7 million for the years ended December 31, 2016, 2015 and 2014, respectively.

Intellectual Property Matters

From time to time, the Company files patent applications with the United States Patent and Trademark Office. The Company currently owns several patents and pending patent applications. The Company also owns several registered trademarks and pending trademark applications with the U.S. Patent and Trademark Office. The current registrations for the marks will expire on various dates between 2017 and 2023, but each registration can be renewed indefinitely as long as the respective mark continues to be used in commerce and the requisite proof of continued use or renewal application, as applicable, is filed. These trademarks provide source identification for the goods manufactured and sold by the Company and allow the Company to achieve brand recognition within the industry.

Internet Address/SEC Filings

The Company’s Internet address is http://www.encorewire.com. Under the “Investors” section of our website, the Company provides a link to our electronic Securities and Exchange Commission (“SEC”) filings, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, director and officer beneficial ownership reports filed pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, and any amendments to these reports. All such reports are available free of charge and are available as soon as reasonably practicable after the Company files such material with, or furnishes it to, the SEC.

The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Item 1A. Risk Factors.

The following are risk factors that could affect the Company’s business, financial results and results of operations. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause the actual results and conditions to differ materially from those projected in forward-looking statements. Before purchasing the Company’s stock, an investor should know that making such an investment involves some risks, including the risks described below. If any of the risks mentioned below or other unknown risks actually occur, the Company’s business, financial condition or results of operations could be negatively affected. In that case, the trading price of its stock could fluctuate significantly.

Product Pricing and Volatility of Copper Market

Price competition for copper electrical wire and cable is intense, and the Company sells its products in accordance with prevailing market prices. Wire prices can, and frequently do, change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. Copper, a commodity product, is the principal raw material used in the Company’s manufacturing operations. Copper accounted for approximately 65.2%, 72.1% and 74.7% of the costs of goods sold by the Company during 2016, 2015 and 2014, respectively, and the Company expects that copper will continue to account for a significant portion of these costs in the future. The price of copper fluctuates depending on general economic conditions and in relation to supply and demand and other factors, and it causes monthly variations in the cost of copper purchased by the Company. The SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like it hold copper cathode as collateral against their shares. The acquisition of copper cathode by Copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased copper price volatility. The

5

Company cannot predict future copper prices or the effect of fluctuations in the costs of copper on the Company’s future operating results. Consequently, fluctuations in copper prices caused by market forces can significantly affect the Company’s financial results. With the volatility of both raw material prices and wire prices in the Company’s end market, hedging raw materials can be risky. Historically, the Company has not engaged in hedging strategies for raw material purchases.

Operating Results May Fluctuate

Encore’s results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for and shipments of the Company’s products. Therefore, comparisons of results of operations have been and will be impacted by the volume of such orders and shipments. In addition, the Company's operating results could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs and other significant costs, the loss of key manufacturer’s representatives who sell the Company’s product line, increases in utility costs (particularly electricity and natural gas) and various types of insurance coverage and interruptions in plant operations resulting from the interruption of raw material supplies and other factors.

Reliance on Senior Management

Encore’s future operating results depend, in part, upon the continued service of its senior management, Mr. Daniel L. Jones, the Chairman, President and Chief Executive Officer, and Mr. Frank J. Bilban, the Company’s Vice President and Chief Financial Officer (neither of whom are bound by an employment agreement). The Company’s future success will depend upon its continuing ability to attract and retain highly qualified managerial and technical personnel. Competition for such personnel is intense, and there can be no assurance that the Company will retain its key managerial and technical employees or that it will be successful in attracting, assimilating or retaining other highly qualified personnel in the future.

Industry Conditions and Cyclicality

The residential, commercial and industrial construction industry, which is the end user of the Company’s products, is cyclical and is affected by a number of factors, including the general condition of the economy, market demand and changes in interest rates. Industry sales of electrical wire and cable products tend to parallel general construction activity, which includes remodeling. Construction activity in the United States suffered through a severe recession in 2008 through 2012. Construction began to pick up in strongly in 2013 and continued doing well through 2016. While volumes were not at "boom" levels nationally, there were regional pockets of strength, such as Texas, while other regions of the country had lower levels of activity. According to various industry and national economic forecasts, the future is unclear for the next few years. Data on remodeling is not as readily available. However, remodeling activity historically trends up when new construction slows down.

Deterioration in the financial condition of the Company’s customers due to industry and economic conditions may result in reduced sales, an inability to collect receivables and payment delays or losses due to a customer’s bankruptcy or insolvency. Although the Company’s bad debt experience has been low in recent years, the Company’s inability to collect receivables may increase the amounts the Company must expense against its bad debt reserve, decreasing the Company’s profitability. A downturn in the residential, commercial or industrial construction industries and general economic conditions as a whole may have a material adverse effect on the Company.

Environmental Liabilities

The Company is subject to federal, state and local environmental protection laws and regulations governing the Company’s operations and the use, handling, disposal and remediation of hazardous substances currently or formerly used by the Company. A risk of environmental liability is inherent in the Company’s current manufacturing activities in the event of a release or discharge of a hazardous substance generated by the Company. Under certain environmental laws, the Company could be held jointly and severally responsible for the remediation of any hazardous substance contamination at the Company’s facilities and at third party waste disposal sites and could also be held liable for any consequences arising out of human exposure to such substances or other environmental damage. There can be no assurance that the costs of complying with environmental, health and safety laws and requirements in the Company’s current operations or the liabilities arising from past releases of, or exposure to, hazardous substances, will not result in future expenditures by the Company that could materially and adversely affect the Company’s financial results, cash flow or financial condition.

6

Competition

The electrical wire and cable industry is highly competitive. The Company competes with several manufacturers of wire and cable products that have substantially greater resources than the Company. Some of these competitors are owned and operated by large, diversified companies. The principal elements of competition in the wire and cable industry are, in the opinion of the Company, pricing, product availability and quality and, in some instances, breadth of product line. The Company believes that it is competitive with respect to all of these factors. While the number of firms producing wire and cable has declined in the past, there can be no assurance that new competitors will not emerge or that existing producers will not employ or improve upon the Company’s manufacturing and marketing strategy.

Patent and Intellectual Property Disputes

Disagreements about patents and intellectual property rights occur in the wire and cable industry. The unfavorable resolution of a patent or intellectual property dispute could preclude the Company from manufacturing and selling certain products or could require the Company to pay a royalty on the sale of certain products. Patent and intellectual property disputes could also result in substantial legal fees and other costs.

Common Stock Price May Fluctuate

Future announcements concerning Encore or its competitors or customers, quarterly variations in operating results, announcements of technological innovations, the introduction of new products or changes in product pricing policies by the Company or its competitors, developments regarding proprietary rights, changes in earnings estimates by analysts or reports regarding the Company or its industry in the financial press or investment advisory publications, among other factors, could cause the market price of the common stock to fluctuate substantially. These fluctuations, as well as general economic, political and market conditions, such as recessions, world events, military conflicts or market or market-sector declines, may materially and adversely affect the market price of the common stock.

Beneficial Ownership of the Company’s Common Stock by a Small Number of Stockholders

A small number of significant stockholders beneficially own greater than 44% of the Company’s outstanding common stock. Depending on stockholder turnout for a stockholder vote, these stockholders, acting together, could be able to control the election of directors and certain matters requiring majority approval by the Company’s stockholders. The interests of this group of stockholders may not always coincide with the Company’s interests or the interests of other stockholders.

In the future, these stockholders could sell large amounts of common stock over relatively short periods of time. The Company cannot predict if, when or in what amounts stockholders may sell any of their shares. Sales of substantial amounts of the Company’s common stock in the public market by existing stockholders or the perception that these sales could occur, may adversely affect the market price of our common stock by creating a public perception of difficulties or problems with the Company’s business.

Future Sales of Common Stock Could Affect the Price of the Common Stock

No prediction can be made as to the effect, if any, that future sales of shares or the availability of shares for sale will have on the market price of the common stock prevailing from time to time. Sales of substantial amounts of common stock, or the perception that such sales might occur, could adversely affect prevailing market prices of the common stock.

Cybersecurity Breaches and other Disruptions to our Information Technology Systems

The efficient operation of our business is dependent on our information technology systems to process, transmit and store sensitive electronic data, including employee, distributor and customer records, and to manage and support our business operations and manufacturing processes. The secure maintenance of this information is critical to our operations. Despite our security measures, our information technology system may be vulnerable to attacks by hackers or breaches due to errors or malfeasance by employees and others who have access to our system, or other disruptions during the process of upgrading or replacing computer software or hardware, power outages, computer viruses, telecommunication or utility failures or natural disasters. Any such event could compromise our information technology system, expose our customers, distributors and employees to risks of misuse of confidential information, impair our ability to effectively and timely operate our business and manufacturing processes, and cause other disruptions, which could result in legal claims or proceedings, disrupt our operations and the services we provide to customers, damage our reputation, and cause a loss of confidence in our products and services, any of which could adversely affect our results of operations and competitive position.

7

Regulations Related to Conflict-free Minerals May Force Us to Incur Additional Expenses.

In August 2012, the SEC adopted disclosure requirements related to certain minerals sourced from the Democratic Republic of Congo or adjoining countries, as required by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The SEC rules implementing Section 1502 of the Dodd-Frank Act require us to perform due diligence, and report whether “conflict minerals,” which are defined as tin, tantalum, tungsten and gold, necessary to the functionality of a product we purchase originated from the Democratic Republic of Congo or an adjoining country. Since 2014, we have been required to file with the SEC on an annual basis a specialized disclosure report on Form SD regarding such matters. As our supply chain is complex, we may incur significant costs to determine the source and custody of conflict minerals that are used in the manufacture of our products in order to comply with these regulatory requirements in the future. We may also face reputation challenges if we are unable to verify the origins for all conflict minerals used in our products, or if we are unable to conclude that our products are “conflict free.” Over time, conflict minerals reporting requirements may affect the sourcing, price and availability of our products, and may affect the availability and price of conflict minerals that are certified as conflict free. Accordingly, we may incur significant costs as a consequence of regulations related to conflict-free minerals, which may adversely affect our business, financial condition or results of operations.

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties.

Encore maintains its corporate office and manufacturing plants in McKinney, Texas, approximately 35 miles north of Dallas. The Company’s facilities are located on a combined site of approximately 430 acres and consist of buildings containing approximately 2.1 million square feet of floor space. The plant and equipment are owned by the Company and are not mortgaged to secure any of the Company’s existing indebtedness. Encore believes that its plant and equipment are suited to its present needs, comply with applicable federal, state and local laws and regulations, and are properly maintained and adequately insured.

Item 3. Legal Proceedings.

A description of the Company’s legal proceedings is contained in Note 9 to the Company’s consolidated financial statements included in Item 8 to this report and incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

8

EXECUTIVE OFFICERS OF THE COMPANY

Information regarding Encore’s executive officers including their respective ages as of February 24, 2017, is set forth below:

Name | Age | Position with Company | |

Daniel L. Jones | 53 | Chairman of the Board of Directors, President and Chief Executive Officer | |

Frank J. Bilban | 60 | Vice President – Finance, Treasurer, Secretary, and Chief Financial Officer | |

Mr. Jones has held the office of President and Chief Executive Officer of the Company since February 2006. He performed the duties of the Chief Executive Officer in an interim capacity from May 2005 to February 2006. From May 1998 until February 2005, Mr. Jones was President and Chief Operating Officer of the Company. He previously held the positions of Chief Operating Officer from October 1997 until May 1998, Executive Vice President from May 1997 to October 1997, Vice President-Sales and Marketing from 1992 to May 1997, after serving as Director of Sales since joining the Company in November 1989. He has also served as a member of the Board of Directors since May 1992, and was named Chairman of the Board in 2014.

Mr. Bilban has served as Vice President-Finance, Treasurer, Secretary and Chief Financial Officer of Encore since June 2000. From 1998 until joining the Company in June 2000, Mr. Bilban was Executive Vice President and Chief Financial Officer of Alpha Holdings, Inc., a plastics manufacturing conglomerate. From 1996 until 1998, Mr. Bilban was Vice President and Chief Financial Officer of Wedge Dia-Log Inc., an oil field services company.

All executive officers are elected annually by the Board of Directors to serve until the next annual meeting of the Board or until their respective successors are chosen and qualified.

9

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is traded and quoted on the NASDAQ Stock Market’s Global Select Market under the symbol “WIRE.” The following table sets forth the high and low intraday sales prices per share for the common stock as reported by NASDAQ for the periods indicated.

High | Low | ||||||

2016 | |||||||

First Quarter | $ | 40.13 | $ | 32.96 | |||

Second Quarter | 41.46 | 35.40 | |||||

Third Quarter | 43.78 | 34.03 | |||||

Fourth Quarter | 46.40 | 33.70 | |||||

2015 | |||||||

First Quarter | $ | 38.10 | $ | 29.36 | |||

Second Quarter | 48.50 | 37.05 | |||||

Third Quarter | 46.32 | 30.23 | |||||

Fourth Quarter | 44.95 | 31.89 | |||||

As of February 23, 2017, there were 33 holders of record of the Company’s common stock.

The Company paid its first cash dividend in January 2007 and has continued paying quarterly dividends of two cents per share through 2016. Aside from periodic dividends, management intends to retain the majority of future earnings for the operation and expansion of the Company’s business.

Issuer Purchases of Equity Securities

On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock on the open market or through privately negotiated transactions at prices determined by the President of the Company during the term of the program. The Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, and, as of December 31, 2016, 1,132,946 shares remained authorized for repurchase through March 31, 2018. The Company did not repurchase any shares of its stock in 2016 and 2014. The Company repurchased 92,804 shares of its stock in the third quarter of 2015, its only purchases in 2015. The Company also has a broker agreement to repurchase stock in the open market at certain trigger points pursuant to a Rule 10b5-1 plan announced on November 28, 2007.

Equity Compensation Plan Information

The following table provides information about the Company’s equity compensation plans as of December 31, 2016.

Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||

PLAN CATEGORY | (a) | (b) | (c) | ||||||

Equity compensation plans approved by security holders | 351,400 | $ | 31.28 | 172,300 | |||||

10

Performance Graph

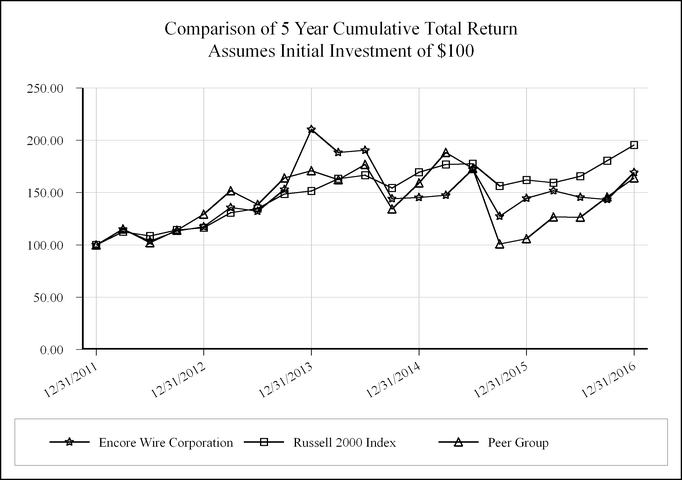

The following graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

The graph below sets forth the cumulative total stockholder return, which assumes reinvestment of dividends, of a $100 investment in the Company’s common stock, the Russell 2000 Index, and the Company’s self-determined peer group for the five years ended December 31, 2016

As of December 31, | ||||||||||||||

Symbol | Total Return For: | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||

« | Encore Wire Corporation | 100.00 | 117.36 | 210.42 | 145.20 | 144.50 | 169.25 | |||||||

n | Russell 2000 Index | 100.00 | 116.35 | 151.52 | 169.42 | 161.95 | 195.45 | |||||||

▲ | Peer Group | 100.00 | 129.34 | 170.78 | 159.20 | 105.77 | 164.04 | |||||||

11

Notes

(1) | Data presented in the performance graph is complete through December 31, 2016. |

(2) | The Peer Group is self-determined and consists of the following companies: General Cable Corporation and Belden, Inc. |

(3) | The peer group index uses only such peer group’s performance and excludes the performance of the Company. The peer group index uses beginning of period market capitalization weighting. |

(4) | Each data line represents quarterly index levels derived from compounded daily returns that include all dividends. |

(5) | The index level for all data lines was set to $100.00 on December 31, 2011. |

Item 6. Selected Consolidated Financial Data.

The following financial data should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data.” The table below presents, as of and for the dates indicated, selected historical financial information for the Company.

Year Ended December 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(in thousands, except per share data) | |||||||||||||||||||

Statement of Income Data: | |||||||||||||||||||

Net sales | $ | 940,790 | $ | 1,017,622 | $ | 1,166,979 | $ | 1,158,252 | $ | 1,072,348 | |||||||||

Cost of goods sold | 820,673 | 880,900 | 1,042,002 | 1,023,180 | 982,021 | ||||||||||||||

Gross profit | 120,117 | 136,722 | 124,977 | 135,072 | 90,327 | ||||||||||||||

Selling, general and administrative expenses | 69,351 | 64,493 | 68,876 | 64,453 | 60,981 | ||||||||||||||

Operating income | 50,766 | 72,229 | 56,101 | 70,619 | 29,346 | ||||||||||||||

Net interest and other income | (48 | ) | (155 | ) | (56 | ) | (64 | ) | (30 | ) | |||||||||

Income before income taxes | 50,814 | 72,384 | 56,157 | 70,683 | 29,376 | ||||||||||||||

Provision for income taxes | 16,975 | 24,779 | 19,034 | 23,773 | 9,565 | ||||||||||||||

Net income | $ | 33,839 | $ | 47,605 | $ | 37,123 | $ | 46,910 | $ | 19,811 | |||||||||

Earnings per common and common equivalent shares – basic | $ | 1.63 | $ | 2.30 | $ | 1.79 | $ | 2.27 | $ | 0.91 | |||||||||

Weighted average common and common equivalent shares – basic | 20,704 | 20,713 | 20,714 | 20,676 | 21,680 | ||||||||||||||

Earnings per common and common equivalent shares – diluted | $ | 1.63 | $ | 2.29 | $ | 1.78 | $ | 2.26 | $ | 0.91 | |||||||||

Weighted average common and common equivalent shares – diluted | 20,773 | 20,787 | 20,821 | 20,764 | 21,732 | ||||||||||||||

Annual dividends paid per common share | $ | 0.08 | $ | 0.08 | $ | 0.08 | $ | 0.08 | $ | 0.08 | |||||||||

As of December 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(in thousands) | |||||||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Working capital (1) | $ | 325,500 | $ | 315,913 | $ | 284,671 | $ | 277,392 | $ | 255,703 | |||||||||

Total assets | 657,964 | 628,116 | 572,751 | 525,826 | 472,467 | ||||||||||||||

Long-term debt, net of current portion | — | — | — | — | — | ||||||||||||||

Stockholders’ equity | 573,109 | 538,639 | 493,187 | 456,581 | 410,164 | ||||||||||||||

(1) Amounts are reflective of the retrospective adoption of accounting guidance for the presentation of deferred income taxes.

12

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

The following management’s discussion and analysis is intended to provide a better understanding of key factors, drivers and risks regarding the Company and the building wire industry.

Executive Overview

Encore Wire sells a commodity product in a highly competitive market. Management strongly believes that the historical strength of the Company’s growth and earnings is attributable to the following main factors:

• | industry leading order fill rates and responsive customer service |

• | product innovations and product line expansions based on listening to and understanding customer needs and market trends |

• | low cost manufacturing operations, resulting from a state-of-the-art manufacturing complex |

• | low distribution and freight costs due in large part to the “one campus” business model |

• | a focused management team leading an incentivized work force |

• | low general and administrative overhead costs, and |

• | a team of experienced independent manufacturers’ representatives with strong customer relationships across the United States. |

These factors, and others, have allowed Encore Wire to grow from a startup in 1989 to what management believes is one of the largest electric building wire companies in the United States of America. Encore has built a loyal following of customers throughout the United States. These customers have developed a brand preference for Encore Wire in a commodity product line due to the reasons noted above, among others. The Company prides itself on striving to grow sales by expanding its product offerings where profit margins are acceptable. Senior management monitors gross margins daily, frequently extending down to the individual order level. Management strongly believes that this “hands-on” focused approach to the building wire business has been an important factor in the Company's success, and will lead to continued success.

The construction and remodeling industries drive demand for building wire. Construction activity in the United States suffered through a severe recession in 2008 through 2012. Total unit sales, including pounds of aluminum wire sold, increased 14.9% in 2013 versus 2012. In 2013, copper unit sales increased 9.5% versus 2012, while aluminum unit sales increased 116.8% versus 2012. 2013 was the first full year of sales and production from the Company’s new aluminum wire plant. The Company believes that the expansion into building wire product offerings with aluminum conductors helped the increase in copper unit sales in 2013, as customers prefer to “one stop shop” and order from full line producers. In 2015, unit sales were down 1.5% in copper wire and 0.5% in aluminum wire versus 2014. It should be noted, however, that 2015 had a slow start, due in part to rough winter and spring weather. Unit sales volumes were down 9.4% for copper and 2.7% for aluminum through the first five months of 2015 versus the first five months of 2014. However, unit sales volumes were up 4.4% for copper and 1.0% for aluminum in the last seven months of 2015 versus the same period in 2014. In 2016, unit sales were up 2.4% in copper wire and 7.6% in aluminum wire versus 2015.

According to various industry and national economic forecasts, the future is unclear for the next few years. Data on remodeling is not as readily available; however, remodeling activity historically trends up when new construction slows down.

General

The Company’s operating results are driven by several key factors, including the volume of product produced and shipped, the cost of copper and other raw materials, the competitive pricing environment in the wire industry and the resulting influence on gross margins and the efficiency with which the Company’s plants operate during the period, among others. Price competition for electrical wire and cable is intense, and the Company sells its products in accordance with prevailing market prices. Copper, a commodity product, is the principal raw material used by the Company in manufacturing its products. Copper accounted for approximately 65.2%, 72.1%, and 74.7% of the Company’s cost of goods sold during 2016, 2015 and 2014, respectively. The price of copper fluctuates, depending on general economic conditions and in relation to supply and demand and other factors, which causes monthly variations in the cost of copper purchased by the Company. Additionally, the SEC allows shares of physically backed copper exchange traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like it hold copper cathode as collateral against their shares. The acquisition of copper cathode by Copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s

13

cost of copper. In addition to rising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased price volatility for copper. The Company cannot predict copper prices in the future or the effect of fluctuations in the cost of copper on the Company’s future operating results. Wire prices can, and frequently do change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. With the Company’s expansion into aluminum conductors in some of its building wire products, aluminum may slowly grow its percentage share of the raw materials cost for the Company. The Company built a plant to expand the production of aluminum building wire beginning in late 2011. The plant was fully operational by mid-year 2013. In 2012, aluminum wire sales constituted 3.6% of net sales, growing to 10.3% of net sales in 2016. The growth of aluminum sales to over $103.4 million in 2014 provided the impetus for the Company to construct a 250,000 square foot expansion to the aluminum plant to allow for the continued growth of this business. The construction of the building expansion was substantially completed in the fourth quarter of 2014. Machinery and equipment was installed during 2015. Historically, the cost of aluminum has been much lower and less volatile than copper. With the volatility of both raw material prices and wire prices in the Company’s end market, hedging raw materials can be risky. Historically, the Company has not engaged in hedging strategies for raw material purchases. The tables below highlight the range of closing prices of copper on the Comex exchange for the periods shown.

COMEX COPPER CLOSING PRICE 2016

October 2016 | November 2016 | December 2016 | Quarter Ended Dec. 31, 2016 | Year Ended Dec. 31, 2016 | |||||||||||||||

High | $ | 2.20 | $ | 2.67 | $ | 2.69 | $ | 2.69 | $ | 2.69 | |||||||||

Low | 2.08 | 2.22 | 2.47 | 2.08 | 1.94 | ||||||||||||||

Average | 2.14 | 2.47 | 2.57 | 2.39 | 2.20 | ||||||||||||||

COMEX COPPER CLOSING PRICE 2015

October 2015 | November 2015 | December 2015 | Quarter Ended Dec. 31, 2015 | Year Ended Dec. 31, 2015 | |||||||||||||||

High | $ | 2.43 | $ | 2.33 | $ | 2.14 | $ | 2.43 | $ | 2.95 | |||||||||

Low | 2.31 | 2.02 | 2.03 | 2.02 | 2.02 | ||||||||||||||

Average | 2.37 | 2.16 | 2.08 | 2.20 | 2.51 | ||||||||||||||

COMEX COPPER CLOSING PRICE 2014

October 2014 | November 2014 | December 2014 | Quarter Ended Dec. 31, 2014 | Year Ended Dec. 31, 2014 | |||||||||||||||

High | $ | 3.11 | $ | 3.08 | $ | 2.95 | $ | 3.11 | $ | 3.43 | |||||||||

Low | 2.98 | 2.86 | 2.84 | 2.84 | 2.84 | ||||||||||||||

Average | 3.04 | 3.02 | 2.90 | 2.98 | 3.12 | ||||||||||||||

14

Results of Operations

The following table presents certain items of income and expense as a percentage of net sales for the periods indicated.

Year Ended December 31, | ||||||||

2016 | 2015 | 2014 | ||||||

Net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||

Cost of goods sold: | ||||||||

Copper | 56.9 | % | 62.4 | % | 66.7 | % | ||

Other raw materials | 15.0 | % | 14.9 | % | 13.2 | % | ||

Depreciation | 1.5 | % | 1.4 | % | 1.2 | % | ||

Labor and overhead | 12.6 | % | 11.0 | % | 9.0 | % | ||

LIFO adjustment | 1.2 | % | (3.1 | )% | (0.8 | )% | ||

87.2 | % | 86.6 | % | 89.3 | % | |||

Gross profit | 12.8 | % | 13.4 | % | 10.7 | % | ||

Selling, general and administrative expenses | 7.4 | % | 6.3 | % | 5.9 | % | ||

Operating income | 5.4 | % | 7.1 | % | 4.8 | % | ||

Interest and other (income) expense | — | % | — | % | — | % | ||

Income before income taxes | 5.4 | % | 7.1 | % | 4.8 | % | ||

Provision for income taxes | 1.8 | % | 2.4 | % | 1.6 | % | ||

Net income | 3.6 | % | 4.7 | % | 3.2 | % | ||

The following discussion and analysis relates to factors that have affected the operating results of the Company for the years ended December 31, 2016, 2015 and 2014. Reference should also be made to the Consolidated Financial Statements and the related notes included under “Item 8. Financial Statements and Supplementary Data” of this Annual Report.

Net sales were $940.8 million in 2016 compared to $1.018 billion in 2015 and $1.167 billion in 2014. The 7.6% decrease in net sales dollars in 2016 versus 2015 is the result of a 7.9% decrease in copper wire sales and a 3.9% decrease in aluminum wire sales. Sales dollars were driven lower primarily by decreases in average selling prices of 10.1% and 10.7% of copper and aluminum wire, respectively, offset somewhat by a 2.4% increase in copper wire pounds shipped and a 7.6% increase in aluminum wire pounds shipped. Average selling prices for wire sold were driven lower by the fact that the average price of a pound of copper purchased decreased 13.2% in 2016 versus 2015, while aluminum purchase prices decreased 9.2% during the same time period. Aluminum wire constituted 10.3% of total net sales in 2016, compared to 9.9% of total net sales in 2015.

In the fourth quarter of 2016, net sales dollars decreased 4.6% versus the fourth quarter of 2015. The decrease in net sales was due to a 4.6% decrease in copper net sales and a 4.6% decrease in aluminum net sales, driven by a decrease in unit sales volume of copper of 8.7% and an increase in unit sales volume of aluminum of 2.0%, offset by an average selling price increase of 4.4% in copper wire and an average selling price decrease of 6.5% in aluminum wire in the fourth quarter of 2016 versus the fourth quarter of 2015. Aluminum net sales comprised 10.2% of net sales in the fourth quarter of 2016, compared to 10.2% in the fourth quarter of 2015.

On a sequential quarter comparison, net sales dollars in the fourth quarter of 2016 increased 0.9% versus the third quarter of 2016, due primarily to an 8.2% increase in average copper wire selling prices, offset somewhat by a 6.4% decrease in copper wire unit sales. Average selling prices were driven higher by a 7.1% increase in the cost of copper purchased. Margins in the fourth quarter of 2016 were up versus those of the third quarter of 2016, producing $11.4 million of net income in the fourth quarter of 2016 versus $6.0 million in the third quarter of 2016.

Comparing the full year of 2016 to 2015, the decrease in gross profit margin percentage was primarily the result of a decrease in the spread between the average price paid for a pound of raw copper and the average sales price for a pound of copper in 2016 versus 2015, due primarily to competitive industry pricing. Fluctuations in sales prices are primarily a result of changing copper raw material prices and product price competition. The margin declines were due primarily to the competitive pricing environment in the industry. There were two notable competitive factors at work in the market in 2016. First, our largest competitor announced the purchase of a smaller competitor during the third quarter. While these industry consolidations generally lead to better industry

15

margin discipline in the long term, they can lead to erratic pricing in the short term. Historically, the acquired companies appear to “window dress” themselves by pumping up sales figures pre-sale with low prices while dropping unit cost figures with high production volumes and then dumping excess inventory in the market post-sale. In addition, we believe a different, financially stressed competitor was acting erratically in the aluminum wire market. We believe both of these factors impacted our spreads negatively in 2016. The copper spread decreased 4.1% in 2016 versus 2015. The spread contracted as a result of the 10.1% decline in the average sales price per copper pound sold while the per pound cost of raw copper decreased 13.2%. In nominal dollars, the sales price declined more than the cost of copper. Aluminum wire followed that trend, with the spread decreasing 11.5% in the same year-to-date comparison. Fluctuations in sales prices are primarily a result of changing copper and other raw material prices and product price competition.

The 12.8% decrease in net sales in 2015 versus 2014 is the result of a 13.8% decrease in copper wire sales and a 2.8% decrease in aluminum wire sales. Sales dollars were driven lower primarily by decreases in average selling prices of 12.5% and 2.3% of copper and aluminum wire, respectively, and also slightly by a 1.5% decrease in copper wire pounds shipped and a 0.5% decrease in aluminum wire pounds shipped. Average selling prices for wire sold were driven lower by the fact that the average price of a pound of copper purchased decreased 19.3% in 2015 versus 2014, while aluminum purchase prices decreased 12.3% during the same time period. In the fourth quarter of 2015, net sales decreased 12.1% versus the fourth quarter of 2014. The decrease in net sales was due to the 13.1% decrease in copper net sales and a 2.4% decrease in aluminum net sales, driven by the decrease in purchase prices of copper of 25.3% and aluminum of 27.2%. These lower prices were offset somewhat by unit sales volume increases of 5.1% in copper wire and 5.0% in aluminum wire in the fourth quarter of 2015 versus the fourth quarter of 2014. Aluminum net sales comprised 10.2% of net sales in the fourth quarter of 2015, compared to 9.2% in the fourth quarter of 2014. On a sequential quarter comparison, net sales in the fourth quarter of 2015 decreased 4.5% versus the third quarter of 2015, due primarily to a 7.5% decrease in average copper wire selling prices, offset somewhat by a 3.4% increase in copper wire unit sales. Average selling prices were driven lower by a 7.6% decrease in the cost of copper purchased. Margins in the fourth quarter of 2015 were down versus those of the third quarter of 2015, producing $11.0 million of net income in the fourth quarter of 2015 versus $14.5 million in the third quarter of 2015.

Comparing the full year of 2015 to 2014, the average sales price of wire that contained a pound of copper decreased less than the average price of a pound of copper purchased during the period. Therefore, margins increased as the spread between the price of wire sold and the cost of raw copper purchased increased by 5.2%, due primarily to somewhat improved industry pricing discipline. Aluminum wire margins also increased from 2014 to 2015, with the spread between the price of wire sold and the cost of raw aluminum purchased increasing by 4.0%. Fluctuations in sales prices are primarily a result of changing copper and other raw material prices and product price competition.

Cost of goods sold was $820.7 million in 2016, compared to $880.9 million in 2015 and $1.042 billion in 2014. The copper costs included in cost of goods sold were $535.4 million in 2016 compared to $635.2 million in 2015 and $778.1 million in 2014. Copper costs as a percentage of net sales decreased to 56.9% in 2016 compared to 62.4% in 2015 and 66.7% in 2014. The decrease from 2015 to 2016 of copper costs as a percentage of net sales was due to copper costs decreasing while other components of cost of sales increased. As noted above, copper costs are the largest component of costs and therefore the most significant driver of sales prices of copper wire. Accordingly, the decrease in copper prices in 2016 and 2015 caused most of the other costs to grow in terms of their percentage of net sales dollars. The cost of other raw materials as a percentage of net sales rose from 13.2% in 2014 and 14.9% in 2015 to 15.0% in 2016. The consistent increase over the period is primarily due to the Company's increasing production of aluminum wire. Although aluminum is much cheaper than copper, the increased aluminum production drove the other materials category up as a percentage of net sales because aluminum is higher in cost than most of the other items in this category. Material cost percentages in 2016 were increased by a 1.2% LIFO debit (expense), and decreased in 2015 by a 3.1% LIFO credit (income), and decreased in 2014 by a 0.8% LIFO credit (income). Adding the LIFO adjustment to the cost of copper and other materials, the total materials cost in 2016 was 73.1% of net sales versus 74.2% in 2015 and 79.1% in 2014.

The decrease from 2014 to 2015 of copper costs as a percentage of net sales was due to copper costs decreasing while other components of cost of sales increased. As noted above, copper costs are the largest component of costs and therefore the most significant driver of sales prices of wire. Accordingly, the decrease in copper prices in 2015 and 2014 caused most of the other costs to grow in terms of their percentage of net sales dollars. The cost of other raw materials as a percentage of net sales rose from 13.2% in 2014 to 14.9% in 2015. The consistent increase over the period is primarily due to the Company's increasing production of aluminum wire. Although aluminum is much cheaper than copper, the increased aluminum production drove the other materials category up as a percentage of net sales because aluminum is higher in cost than most of the other items in this category. Material cost percentages in 2015 decreased due to a 3.1% LIFO credit (income) and in 2014 decreased due to a 0.8% LIFO credit (income). Adding the LIFO adjustment to the cost of copper and other materials, the total materials cost in 2015 was 74.2% of net sales versus 79.1% in 2014.

16

Depreciation, labor and overhead costs as a percentage of net sales were 14.1% in 2016 compared to 12.3% in 2015 and 10.2% in 2014. The percentage increase of depreciation, labor and overhead costs in 2016 and 2015 versus 2014 was due primarily to the decrease in copper driven sales dollars providing a smaller denominator for these costs to be divided into. This upward trend in percentages is also somewhat due to the fact that depreciation, labor and overhead costs have fixed or semi-fixed components and do not vary directly with sales dollars or unit volumes.

Inventories consist of the following at December 31 (in thousands):

2016 | 2015 | 2014 | |||||||||

Raw materials | $ | 23,144 | $ | 26,245 | $ | 28,283 | |||||

Work-in-process | 20,889 | 20,155 | 19,169 | ||||||||

Finished goods | 81,764 | 70,348 | 84,020 | ||||||||

Total | 125,797 | 116,748 | 131,472 | ||||||||

Adjust to LIFO cost | (32,523 | ) | (21,494 | ) | (53,221 | ) | |||||

Inventory | $ | 93,274 | $ | 95,254 | $ | 78,251 | |||||

In 2016, copper traded in a range lower than 2015, while exhibiting some volatility as shown in the COMEX copper closing price tables above. Following the global collapse of many commodities that began in 2015, copper prices continued to drop in 2016, but then rallied in the fourth quarter and finished higher than at the end of 2015. The quantity of total copper inventory on hand increased nominally in 2016, compared to 2015. The other materials category, which includes a large number of raw materials, had quantity changes that included increases and decreases in various other materials. These factors resulted in the 2016 year-end inventory value of all inventories using the LIFO method being $32.5 million less than the FIFO value, and the 2016 year end LIFO reserve balance being $11.0 million higher than at the end of 2015. This resulted in a LIFO adjustment increasing cost of sales by $11.0 million in 2016.

In 2015, copper traded in a range significantly lower than 2014, while exhibiting some volatility as shown in the copper table above. Following the global collapse of many commodities, copper prices in 2015 finished much lower than at the end of 2014. However, the quantity of total copper inventory on hand increased somewhat in 2015, compared to 2014. The other materials category, which includes a large number of raw materials, had quantity changes that included increases and decreases in various other materials. These factors resulted in the 2015 year-end inventory value of all inventories using the LIFO method being $21.5 million less than the FIFO value, and the 2015 year end LIFO reserve balance being $31.7 million lower than at the end of 2014. This resulted in a LIFO adjustment decreasing cost of sales by $31.7 million in 2015.

Based on the current copper and other raw material prices, there is no LCM adjustment necessary in the periods presented above. Future reductions in the price of copper and other raw materials could require the Company to record an LCM adjustment against the related inventory balance, which would result in a negative impact on net income.

Gross profit was $120.1 million, or 12.8% of net sales, in 2016 compared to $136.7 million, or 13.4% of net sales, in 2015 and $125.0 million, or 10.7% of net sales, in 2014. The changes in gross profit were due to the factors discussed above.

Selling expenses, which are made up of freight and sales commissions, were $47.7 million in 2016, $47.2 million in 2015 and $52.5 million in 2014. As a percentage of net sales, selling expenses increased to 5.1% in 2016 versus 4.6% in 2015 and 4.5% in 2014. General and administrative expenses, as a percentage of net sales, increased to 2.3% in 2016 versus 1.7% in 2015 and 1.4% in 2014. Percentages to sales of these costs rose slightly as the metal driven sales dollars declined. Accounts receivable write-offs were $29,000 in 2016 and zero in 2015 and 2014. The Company did not increase the bad debt reserve in 2016, 2015 and 2014.

Interest expenses were $0.2 million in 2016, $0.3 million in 2015 and $0.3 million in 2014.

The Company’s effective tax rate was 33.4% in 2016, 34.2% in 2015 and 33.9% in 2014. The differences between the provisions for income taxes and the income taxes computed using the federal income tax statutory rate are due to changes in the effects of permanent differences between transactions reported for financial reporting and tax purposes, primarily the domestic production activity deduction. The domestic production activity deduction reduced the 2016 effective tax rate approximately 3.4%, compared to 1.2% and 3.0% in 2015 and 2014, respectively.

As a result of the foregoing factors, the Company’s net income was $33.8 million in 2016, $47.6 million in 2015 and $37.1 million in 2014.

17

Off-Balance Sheet Arrangements

The Company does not currently have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Liquidity and Capital Resources

The following table summarizes the Company’s cash flow activities (in thousands):

Year Ended December 31, | |||||||||||

2016 | 2015 | 2014 | |||||||||

Net cash provided by operating activities | $ | 58,560 | $ | 70,768 | $ | 63,122 | |||||

Net cash used in investing activities | (41,582 | ) | (43,469 | ) | (44,231 | ) | |||||

Net cash used in financing activities | (377 | ) | (2,811 | ) | (1,005 | ) | |||||

Net increase in cash and cash equivalents | $ | 16,601 | $ | 24,488 | $ | 17,886 | |||||

Annual dividends paid | $ | 1,656 | $ | 1,657 | $ | 1,657 | |||||

The Company maintains a substantial inventory of finished products to satisfy customers’ prompt delivery requirements. As is customary in the industry, the Company provides payment terms to most of its customers that exceed terms that it receives from its suppliers. In general, the Company’s standard payment terms result in the collection of a significant majority of net sales within approximately 75 days of the date of the invoice. Therefore, the Company’s liquidity needs have generally consisted of working capital necessary to finance receivables and inventory. Capital expenditures have historically been necessary to expand and update the production capacity of the Company’s manufacturing operations. The Company has historically satisfied its liquidity and capital expenditure needs with cash generated from operations, borrowings under its various debt arrangements and sales of its common stock.

At December 31, 2016 and 2015, the Company had no debt outstanding.

The Company is party to a Credit Agreement (as amended, the “Credit Agreement”) with two banks, Bank of America, N.A., as administrative agent and letter of credit issuer, and Wells Fargo Bank, National Association as syndication agent. The Credit Agreement extends through October 1, 2021, and provides for maximum borrowings of $150.0 million. In the third quarter of 2016, the Company signed a Third Amendment to the Credit Agreement, which, along with other minor changes, eliminated the restriction of maximum borrowings based on the amount of eligible accounts receivable plus the amount of eligible finished goods and raw materials, less any reserves established by the banks. Additionally, at our request and subject to certain conditions, the commitments under the Credit Agreement may be increased by a maximum of up to $100.0 million as long as existing or new lenders agree to provide such additional commitments. Borrowings under the line of credit bear interest, at the Company’s option, at either (1) LIBOR plus a margin that varies from 0.875% to 1.75% depending upon the Leverage Ratio (as defined in the Credit Agreement), or (2) the base rate (which is the highest of the federal funds rate plus 0.5%, the prime rate, or LIBOR plus 1.0%) plus 0% to 0.25% (depending upon the Leverage Ratio). A commitment fee ranging from 0.15% to 0.30% (depending upon the Leverage Ratio) is payable on the unused line of credit. At December 31, 2016, there were no borrowings outstanding under the Credit Agreement, and letters of credit outstanding in the amount of $1.0 million left $149.0 million of credit available under the Credit Agreement. Obligations under the Credit Agreement are the only contractual borrowing obligations or commercial borrowing commitments of the Company.

Obligations under the Credit Agreement are unsecured and contain customary covenants and events of default. The Company was in compliance with the covenants as of December 31, 2016.

The Company paid interest totaling $0.2 million, $0.3 million and $0.3 million in 2016, 2015 and 2014, respectively, none of which was capitalized.