Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Univar Solutions Inc. | a8-kq4earningsreleasefeb22.htm |

| EX-99.1 - EXHIBIT 99.1 - Univar Solutions Inc. | ex991-enr_q42016.htm |

Fourth Quarter 2016

Earnings Conference Call

February 22, 2017

Forward-Looking Statements

This presentation includes certain statements relating to future events and our intentions, beliefs, expectations,

and predictions for the future which are “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking

statements are subject to known and unknown risks and uncertainties, many of which may be beyond our

control. We caution you that the forward-looking information presented in this press release is not a guarantee of

future events or results, and that actual events or results may differ materially from those made in or suggested

by the forward-looking information contained in this press release. In addition, forward-looking statements

generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “comfortable

with,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations

thereon or similar terminology. Any forward-looking information presented herein is made only as of the date of

this press release, and we do not undertake any obligation to update or revise any forward-looking information to

reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

Regulation G: Non-GAAP Measures

The information presented herein regarding certain unaudited non-GAAP measures does not conform to

generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an

alternative to the reported results determined in accordance with U.S. GAAP. Univar has included this non-

GAAP information to assist in understanding the operating performance of the company and its operating

segments.The non-GAAP information provided may not be consistent with the methodologies used by other

companies. All non-GAAP information related to previous Univar filings with the SEC has been reconciled with

reported U.S. GAAP results.

2

Fourth Quarter 2016 Highlights

Margin Expansion and Strong Cash Flow

Q4 GAAP EPS ($0.43) loss vs. ($0.02) loss prior year

Ÿ $67.3 million ($0.35 per share after tax) non-cash pension mark-to-market, net of curtailment

Ÿ $47.3 million ($0.35 per share) non-cash revaluation of deferred taxes due to tax law change

Ÿ Excluding these non-cash adjustments, earnings per share were $0.27

Q4 Adjusted EBITDA(1) $134.5 million vs. $129.6 million in 2015

Ÿ First quarter of Adjusted EBITDA growth in 7 consecutive quarters

Ÿ 21% growth outside of USA

Ÿ USA delivered gross profit (3) increased 2%

Adjusted Operating Cash Flow (2) $216.7 million vs. $215.1 million in 2015

Ÿ Cash operating margin of 12.0% (4)

(1) Variances to Q4 2015

(2) Adjusted EBITDA plus cash flows from changes in AR, Inventory, and AP, less cash used to purchase PP&E

(3) Gross Profit less delivery expense

(4) Adjusted Operating Cash Flow / Sales

3

Univar – Consolidated Highlights

Adjusted EBITDA

growth of 4%

• Volumes declined due to lower

upstream oil & gas and one less

billing day

• Gross margin increased

150 bps

• Gross profit per lb. increased 2%

• Delivery costs were lower;

WS&A (2) were flat

• Adjusted EBITDA margin

increased 80 bps

KEY METRICS

(In millions)

(1) Conversion Ratio defined as Adjusted EBITDA / Gross Profit

(2) Warehousing, selling and administrative

Three months ended

December 31, 2016 2015 Y/Y %

Net Sales $1,812.5 $1,966.3 (7.8)%

Currency Neutral -- -- (7.0)%

Gross Profit $413.3 $419.8 (1.5)%

Currency Neutral -- -- (0.7)%

Gross Margin 22.8% 21.3% +150 bps

Adjusted EBITDA $134.5 $129.6 3.8%

Currency Neutral -- -- 5.1%

Adjusted

EBITDA Margin 7.4% 6.6% +80 bps

Conversion Ratio (1) 32.5% 30.9% +160 bps

4

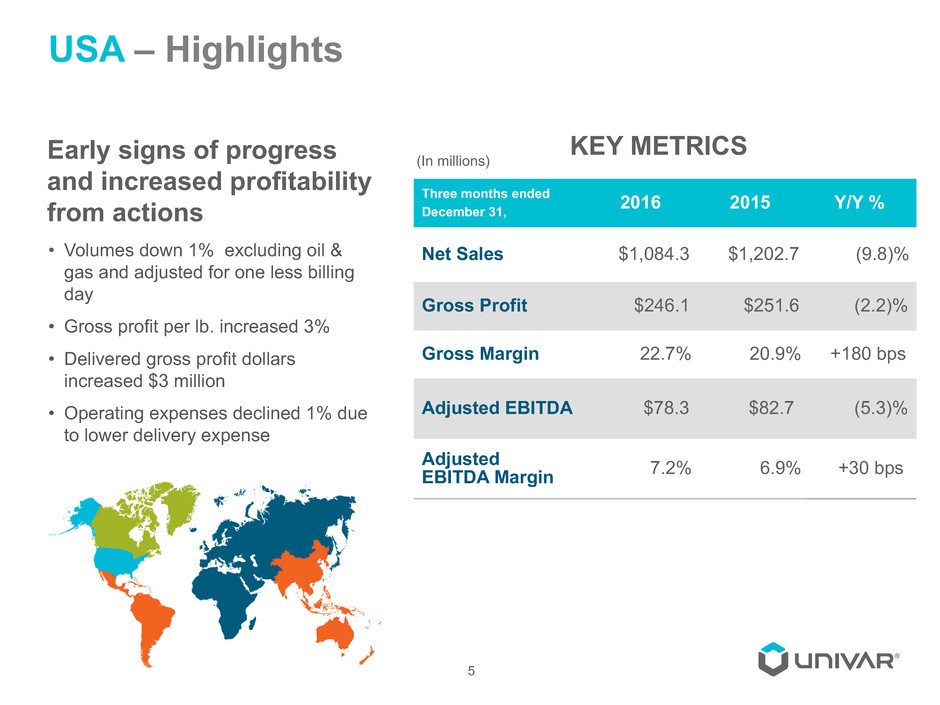

USA – Highlights

Early signs of progress

and increased profitability

from actions

• Volumes down 1% excluding oil &

gas and adjusted for one less billing

day

• Gross profit per lb. increased 3%

• Delivered gross profit dollars

increased $3 million

• Operating expenses declined 1% due

to lower delivery expense

5

Three months ended

December 31, 2016 2015 Y/Y %

Net Sales $1,084.3 $1,202.7 (9.8)%

Gross Profit $246.1 $251.6 (2.2)%

Gross Margin 22.7% 20.9% +180 bps

Adjusted EBITDA $78.3 $82.7 (5.3)%

Adjusted

EBITDA Margin 7.2% 6.9% +30 bps

(In millions)

KEY METRICS

CANADA – Highlights

Ag and lower costs boost

profit and margin

• Volumes declined 1% due to one less

billing day

• Gross margin increased 150 bps due to

favorable product and market mix

• Operating expense declined 7% from

productivity gains

6

Three months ended

December 31, 2016 2015 Y/Y %

Net Sales $242.1 $258.1 (6.2)%

Currency Neutral -- -- (8.1)%

Gross Profit $55.1 $55.0 0.2%

Currency Neutral -- -- (0.2)%

Gross Margin 22.8% 21.3% +150 bps

Adjusted EBITDA $24.8 $22.6 9.7%

Currency Neutral -- -- 9.3%

Adjusted

EBITDA Margin 10.2% 8.7% +150 bps

(In millions)

KEY METRICS

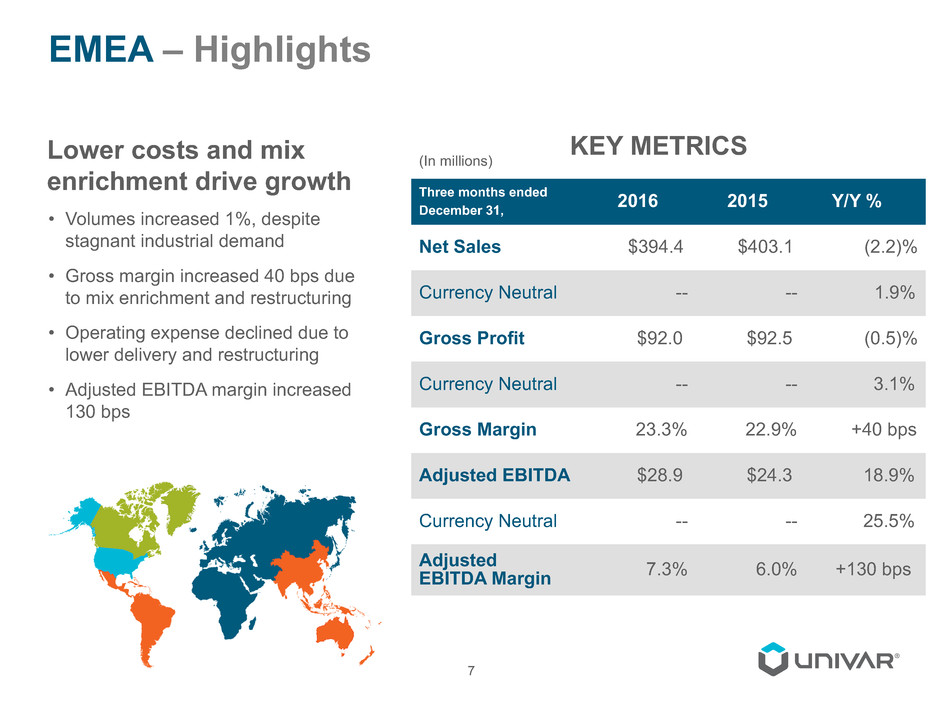

EMEA – Highlights

Lower costs and mix

enrichment drive growth

• Volumes increased 1%, despite

stagnant industrial demand

• Gross margin increased 40 bps due

to mix enrichment and restructuring

• Operating expense declined due to

lower delivery and restructuring

• Adjusted EBITDA margin increased

130 bps

7

Three months ended

December 31, 2016 2015 Y/Y %

Net Sales $394.4 $403.1 (2.2)%

Currency Neutral -- -- 1.9%

Gross Profit $92.0 $92.5 (0.5)%

Currency Neutral -- -- 3.1%

Gross Margin 23.3% 22.9% +40 bps

Adjusted EBITDA $28.9 $24.3 18.9%

Currency Neutral -- -- 25.5%

Adjusted

EBITDA Margin 7.3% 6.0% +130 bps

(In millions)

KEY METRICS

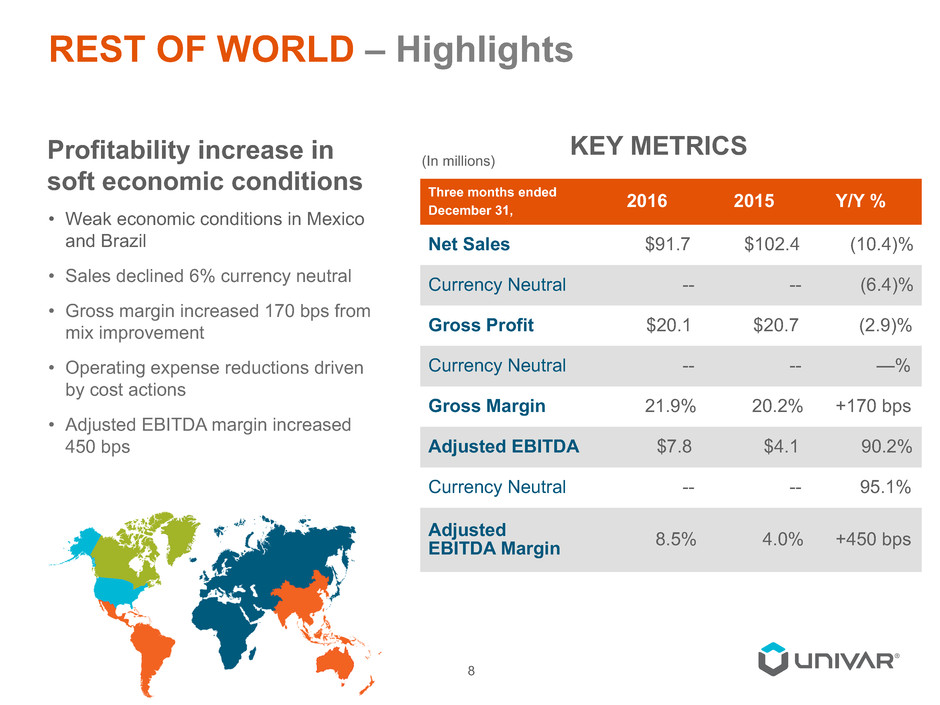

REST OF WORLD – Highlights

Profitability increase in

soft economic conditions

• Weak economic conditions in Mexico

and Brazil

• Sales declined 6% currency neutral

• Gross margin increased 170 bps from

mix improvement

• Operating expense reductions driven

by cost actions

• Adjusted EBITDA margin increased

450 bps

8

Three months ended

December 31, 2016 2015 Y/Y %

Net Sales $91.7 $102.4 (10.4)%

Currency Neutral -- -- (6.4)%

Gross Profit $20.1 $20.7 (2.9)%

Currency Neutral -- -- —%

Gross Margin 21.9% 20.2% +170 bps

Adjusted EBITDA $7.8 $4.1 90.2%

Currency Neutral -- -- 95.1%

Adjusted

EBITDA Margin 8.5% 4.0% +450 bps

(In millions)

KEY METRICS

Cash Flow Highlights

9

(1) Adjusted Operating Cash Flow equals Adjusted EBITDA plus cash flows from changes in AR, inventory,

and AP, less cash used to purchase PP&E, see Appendix C

(2) Excludes additions from capital leases

3 months ended

12/31/2016

3 months ended

12/31/2015 Y/Y %

Adj. Operating Cash Flow (1) $216.7 $215.1 0.7%

Change in Net Working Capital $106.4 $127.2 (16.4)%

Capital Expenditures (2) ($24.2) ($41.7) (42.0)%

Cash Taxes (net) ($4.1) ($4.5) (8.9)%

Cash Interest (net) ($28.1) ($35.7) (21.3)%

Pension Contribution ($7.7) ($16.5) (53.3)%

(In millions)

Balance Sheet Highlights

10

(1) Net Debt defined as Total Debt (Long term debt, inclusive of debt discount and unamortized debt issuance costs, plus short term financing) less cash and

cash equivalents

(2) Net Debt divided by trailing 12 month Adjusted EBITDA

(3) Interest coverage defined as LTM Adjusted EBITDA / LTM Cash Interest (net of interest income)

(4) LTM Adjusted EBITDA inclusive of Depreciation divided by trailing 13 month average of net PP&E plus net working capital (accounts receivable plus

inventory less accounts payable)

LTM ended

12/31/16

LTM ended

12/31/15 Y/Y%

Net Debt (1) $2,642.9 $2,962.7 (10.8)%

Leverage (2) 4.7x 4.9x (4.1)%

Interest Coverage (3) 3.9x 3.6x 8.3%

Return on Assets Deployed (4) 19.9% 21.3% -140 bps

(In millions)

• Converted 80% of floating rate debt to fixed rate

• Re-priced $2.2 billion of Term Loans, lowering annual interest costs by 50 bps

11

Full Year Adjusted EBITDA

mid single digit growth

Q1 2017 Adjusted EBITDA

slightly above Q1 2016

Advance Commercial Greatness and

Operational Excellence initiatives

Selective commercial and technology

investments

FX translation headwinds

Modest Adjusted EBITDA growth in the

first half year

Accelerating Adjusted EBITDA growth in

the second half approaching double

digits by year end

Q1 2017 & Full Year 2017

OUTLOOK

2017

EXPECTATIONS

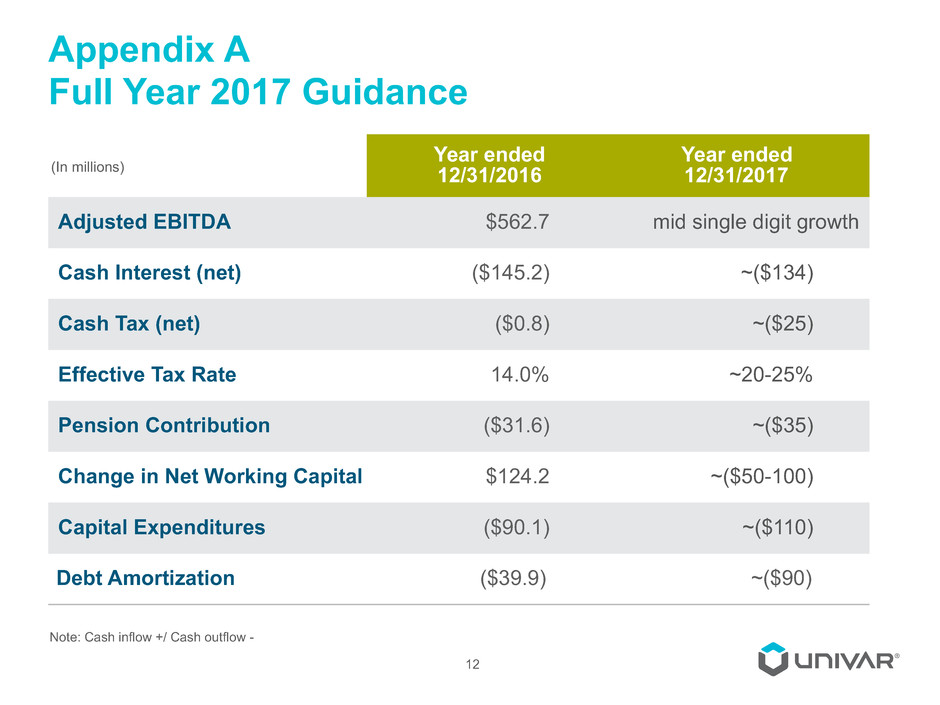

Appendix A

Full Year 2017 Guidance

12

Year ended

12/31/2016

Year ended

12/31/2017

Adjusted EBITDA $562.7 mid single digit growth

Cash Interest (net) ($145.2) ~($134)

Cash Tax (net) ($0.8) ~($25)

Effective Tax Rate 14.0% ~20-25%

Pension Contribution ($31.6) ~($35)

Change in Net Working Capital $124.2 ~($50-100)

Capital Expenditures ($90.1) ~($110)

Debt Amortization ($39.9) ~($90)

(In millions)

Note: Cash inflow +/ Cash outflow -

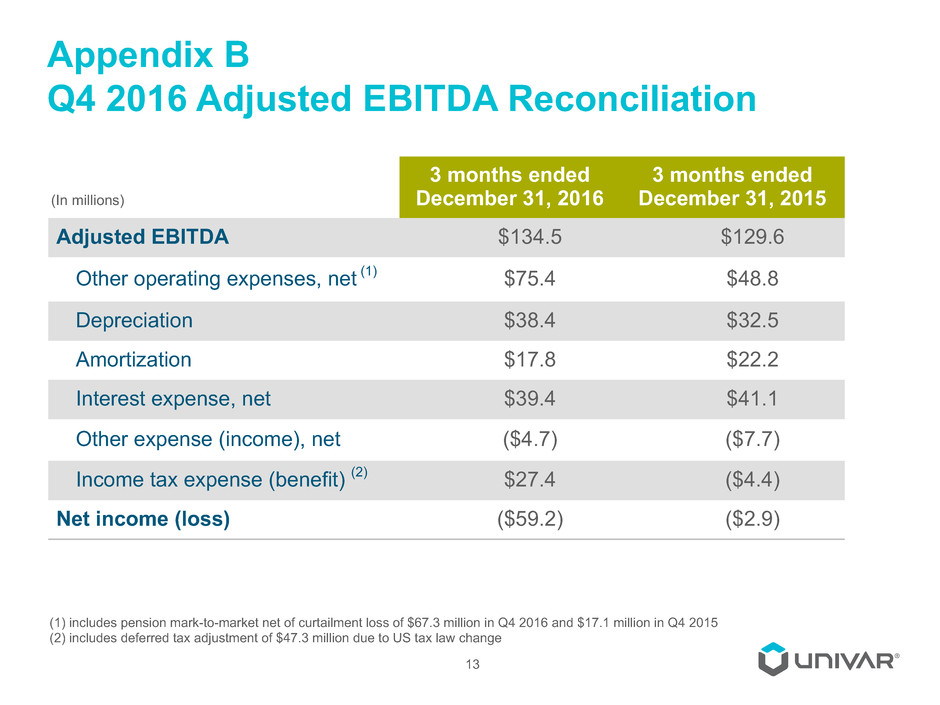

Appendix B

Q4 2016 Adjusted EBITDA Reconciliation

13

3 months ended

December 31, 2016

3 months ended

December 31, 2015

Adjusted EBITDA $134.5 $129.6

Other operating expenses, net (1) $75.4 $48.8

Depreciation $38.4 $32.5

Amortization $17.8 $22.2

Interest expense, net $39.4 $41.1

Other expense (income), net ($4.7) ($7.7)

Income tax expense (benefit) (2) $27.4 ($4.4)

Net income (loss) ($59.2) ($2.9)

(In millions)

(1) includes pension mark-to-market net of curtailment loss of $67.3 million in Q4 2016 and $17.1 million in Q4 2015

(2) includes deferred tax adjustment of $47.3 million due to US tax law change

Appendix C

Adjusted Operating Cash Flow

14

3 months ended

December 31, 2016

3 months ended

December 31, 2015

Adjusted EBITDA $134.5 $129.6

Change in

$153.4 $220.7Trade accounts receivable, net

Inventories ($18.2) $46.4

Trade accounts payable ($28.8) ($139.9)

Purchase of PP&E ($24.2) ($41.7)

Adjusted operating cash flow $216.7 $215.1