Attached files

| file | filename |

|---|---|

| EX-99.2 - PROPOSAL LETTER PRESS RELEASE ISSUED ON FEBRUARY 21, 2017 - ASHFORD HOSPITALITY TRUST INC | as36659584-ex99_2.htm |

| EX-99.3 - NOTICE OF NOMINATION PRESS RELEASE ISSUED ON FEBRUARY 21, 2017 - ASHFORD HOSPITALITY TRUST INC | as36659584-ex99_3.htm |

| 8-K - CURRENT REPORT - ASHFORD HOSPITALITY TRUST INC | as36659584-8k.htm |

Filed by Ashford Hospitality Trust, Inc.

(Commission File No. 001-31775) pursuant

to Rule 425 under the Securities Act of

1933 and deemed filed pursuant to

Rule 14a-12 under the Securities Exchange

Act of 1934

Subject Company: FelCor Lodging Trust Incorporated

Commission File No. 001-14236

Exhibit 99.1

Merger Proposal to Create Leading Lodging REIT and Unlock Value for ShareholdersAshford Hospitality Trust & FelCor Lodging TrustFebruary 21, 2017

Safe Harbor 2 Additional Information This communication does not constitute an offer to buy or solicitation of any offer to sell securities. This communication relates to a proposal which Ashford Hospitality Trust, Inc. (“Ashford Trust”) has made for a business combination transaction with FelCor Lodging Trust Incorporated (“FelCor”). In furtherance of this proposal and subject to future developments, Ashford Trust (and, if a negotiated transaction is agreed, FelCor) may file one or more registration statements, prospectuses, proxy statements or other documents with the SEC. This communication is not a substitute for any registration statement, prospectus, proxy statement or other document Ashford Trust or FelCor may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ASHFORD TRUST AND FELCOR ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT(S), PROSPECTUS(ES), PROXY STATEMENT(S) AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ASHFORD TRUST, FELCOR AND THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents (if and when they become available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov or by directing a request to Ashford Trust’s Investor Relations department at Ashford Hospitality Trust, Inc., Attention: Investor Relations, 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254 or by calling Ashford Trust’s Investor Relations department at (972) 490-9600. Investors and security holders may obtain free copies of the documents filed with the SEC on Ashford Trust’s website at www.ahtreit.com under the “Investor”link, at the “SEC Filings” tab.Certain Information Regarding Participants Ashford Trust and Ashford Inc. and their respective directors and executive officers may be deemed participants in the solicitation of proxies in connection with the proposed transaction. You can find information about Ashford Trust’s directors and executive officers in Ashford Trust’s definitive proxy statement for its most recent annual meeting filed with the SEC on April 25, 2016. You can find information about Ashford Inc.’s directors and executive officers in Ashford Inc.’s definitive proxy statements for its most recent annual meeting and special meeting filed with the SEC on April 28, 2016 and October 7, 2016, respectively. You can find information about FelCor’s directors and executive officers in FelCor’s definitive proxy statement for its most recent annual meeting filed with the SEC on April 14, 2016. These documents are available free of charge at the SEC’s web site at www.sec.gov and (with respect to documents and information relating to Ashford Trust) from Investor Relations at Ashford Trust, as described above. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other related documents filed with the SEC if and when they become available.

Safe Harbor 3 Forward Looking StatementsIn keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the ability to successfully integrate Ashford Hospitality Trust, Inc. and FelCor Lodging Trust Incorporated; and the ability to recognize the anticipated benefits from the proposed combination of Ashford Hospitality Trust, Inc. and FelCor Lodging Trust Incorporated, including the anticipated synergies resulting from the proposed combination.Non-GAAP Financial MeasuresThis presentation includes certain non-GAAP financial measures, including but not limited to net operating income and EBITDA (collectively, “non-GAAP financial measures”). These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.Ashford Trust believes that the presentation of these financial measures enhances an investor’s understanding of Ashford Trust’s and FelCor’s financial performance. Ashford Trust further believes that these financial measures are useful financial metrics to assess operating performance from period to period by excluding certain items that it believes are not representative of Ashford Trust’s and FelCor’s respective core businesses. Ashford Trust also believes that these financial measures provide investors with a useful tool for assessing the comparability between periods of Ashford Trust’s and FelCor’s respective abilities to generate cash from operations sufficient to pay taxes, to service debt and to undertake capital expenditures. Ashford Trust believes these financial measures are commonly used by investors in our industry to evaluate companies’ performance. However, the use of these non-GAAP financial measures in this presentation may vary from that of other companies in Ashford Trust’s and FelCor’s industry. These non-GAAP financial measures should not be considered as alternatives to performance measures derived in accordance with GAAP.

4 Background to the Proposal Since early October 2016, Ashford Hospitality Trust, Inc. ("Ashford Trust", "AHT", or "We") has engaged in discussions with the Board of Directors of FelCor Lodging Trust Incorporated ("FelCor") regarding a business combination We strongly believe that a transaction between Ashford Trust and FelCor has compelling strategic, operational, and financial merits and aligns both companies' shareholders and management interests to deliver compelling long-term value to both Ashford Trust and FelCor shareholdersWe expect value creation of up to ~70% - 100% for FelCor shareholders and up to ~45% – 70% for Ashford Trust shareholdersWe are fully prepared to proceed immediately to complete due diligence and merger agreement negotiations, and are already among FelCor's largest shareholders, holding 4.5% of shares outstandingWe requested multiple times that FelCor share customary due diligence information with Ashford Trust, including historical property level financial information and hotel management agreements. FelCor was unwilling to do so even though we executed a mutual non-disclosure agreement on January 11, 2017. In addition, we also asked for an extension of the deadline to deliver notice of director nominations in order to facilitate further discussionsWe can only reasonably assume from FelCor's actions, including announcing the hiring of a new CEO and extending brand management contracts that we believe will adversely impact value, that FelCor is unwilling to engage in good faith discussions and seriously consider our proposal to create long-term value for all shareholdersGiven what we view as the FelCor board's long track record of underperformance, value impairment, and its unwillingness to engage with us in good faith, Ashford Trust has nominated a slate of highly qualified independent directors (see Appendix) to ensure that FelCor appropriately considers the sale of the company and our proposal and acts in the best interest of all FelCor shareholdersAs a result of our unsuccessful private attempts, we have decided our only path forward is to involve the shareholders of both companies through this public approach so that they can evaluate the merits of a combinationWe encourage shareholders to review the press release and our letter to the FelCor Board dated February 21, 2017, that we released for the full background on the history of the discussions FelCor shareholders would receive a fixed exchange ratio of 1.192 Ashford Trust shares per FelCor share, a total of 400,000 shares of Ashford Inc., and a total of 100,000 warrants to purchase Ashford Inc. shares, which implies a purchase price of $9.27 per share1, representing:A substantial 28% premium to FelCor's current share price2 1. Based on closing prices of AHT and AINC as of 2/17/172. As of 2/17/17

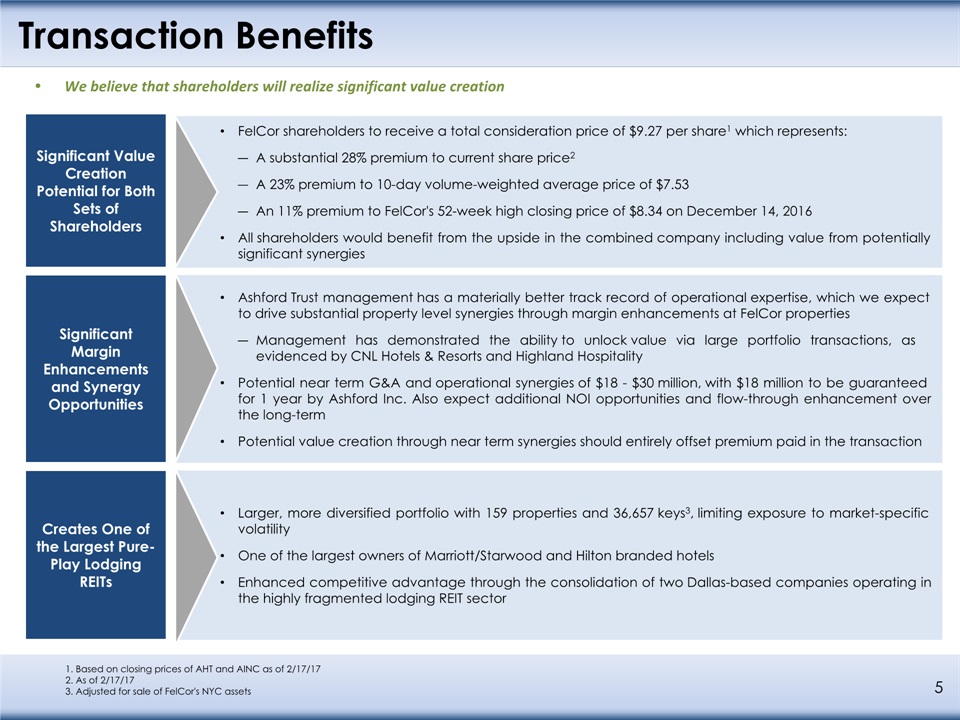

Transaction Benefits 5 Significant Margin Enhancements and Synergy Opportunities Significant Value Creation Potential for Both Sets of Shareholders FelCor shareholders to receive a total consideration price of $9.27 per share1 which represents:A substantial 28% premium to current share price2A 23% premium to 10-day volume-weighted average price of $7.53An 11% premium to FelCor's 52-week high closing price of $8.34 on December 14, 2016All shareholders would benefit from the upside in the combined company including value from potentially significant synergies 1. Based on closing prices of AHT and AINC as of 2/17/172. As of 2/17/173. Adjusted for sale of FelCor's NYC assets Ashford Trust management has a materially better track record of operational expertise, which we expect to drive substantial property level synergies through margin enhancements at FelCor propertiesManagement has demonstrated the ability to unlock value via large portfolio transactions, as evidenced by CNL Hotels & Resorts and Highland Hospitality Potential near term G&A and operational synergies of $18 - $30 million, with $18 million to be guaranteed for 1 year by Ashford Inc. Also expect additional NOI opportunities and flow-through enhancement over the long-termPotential value creation through near term synergies should entirely offset premium paid in the transaction Creates One of the Largest Pure-Play Lodging REITs Larger, more diversified portfolio with 159 properties and 36,657 keys3, limiting exposure to market-specific volatilityOne of the largest owners of Marriott/Starwood and Hilton branded hotelsEnhanced competitive advantage through the consolidation of two Dallas-based companies operating in the highly fragmented lodging REIT sector We believe that shareholders will realize significant value creation

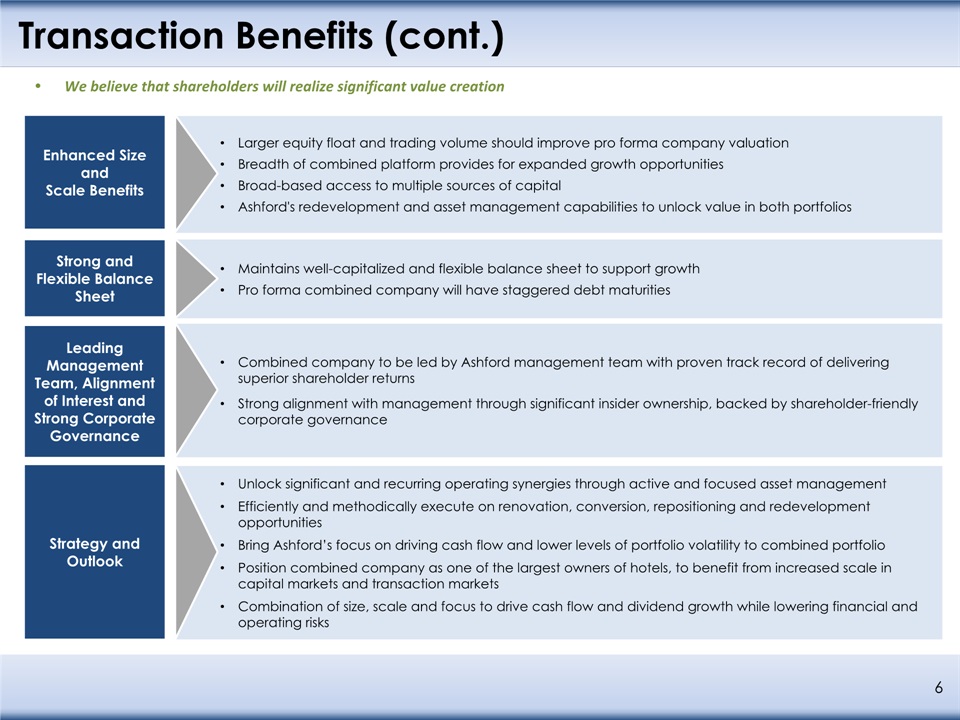

Transaction Benefits (cont.) 6 Strong and Flexible Balance Sheet Leading Management Team, Alignment of Interest and Strong Corporate Governance Maintains well-capitalized and flexible balance sheet to support growthPro forma combined company will have staggered debt maturities Combined company to be led by Ashford management team with proven track record of delivering superior shareholder returnsStrong alignment with management through significant insider ownership, backed by shareholder-friendly corporate governance Strategy and Outlook Enhanced Size and Scale Benefits Larger equity float and trading volume should improve pro forma company valuationBreadth of combined platform provides for expanded growth opportunitiesBroad-based access to multiple sources of capitalAshford's redevelopment and asset management capabilities to unlock value in both portfolios Unlock significant and recurring operating synergies through active and focused asset management Efficiently and methodically execute on renovation, conversion, repositioning and redevelopment opportunitiesBring Ashford’s focus on driving cash flow and lower levels of portfolio volatility to combined portfolioPosition combined company as one of the largest owners of hotels, to benefit from increased scale in capital markets and transaction marketsCombination of size, scale and focus to drive cash flow and dividend growth while lowering financial and operating risks We believe that shareholders will realize significant value creation

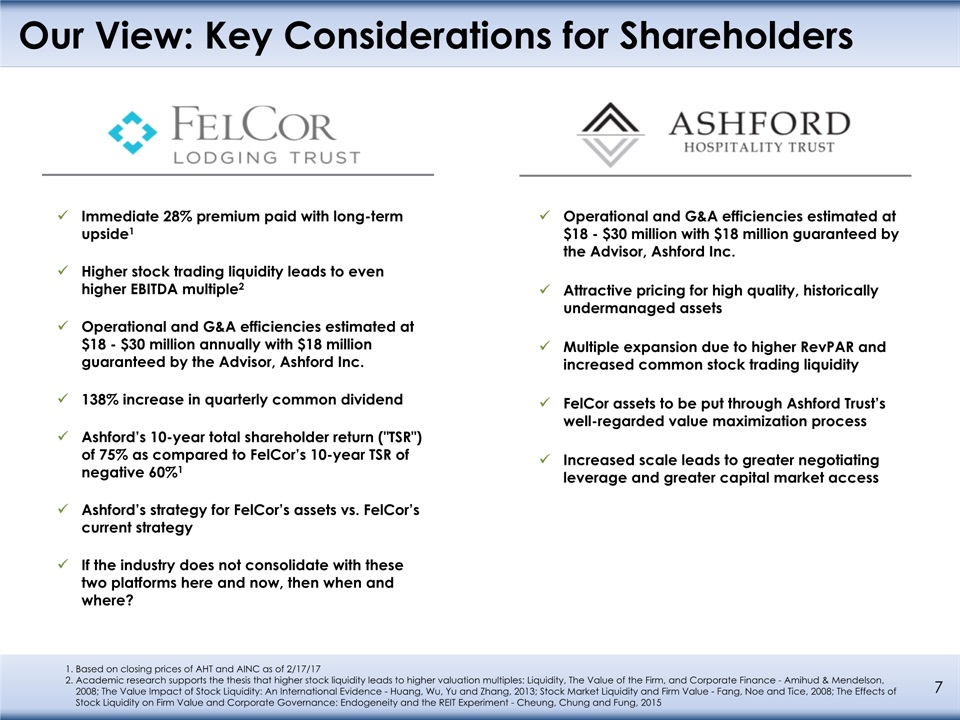

Our View: Key Considerations for Shareholders 7 Immediate 28% premium paid with long-term upside1Higher stock trading liquidity leads to even higher EBITDA multiple2Operational and G&A efficiencies estimated at $18 - $30 million annually with $18 million guaranteed by the Advisor, Ashford Inc. 138% increase in quarterly common dividendAshford’s 10-year total shareholder return ("TSR") of 75% as compared to FelCor’s 10-year TSR of negative 60%1Ashford’s strategy for FelCor’s assets vs. FelCor’s current strategyIf the industry does not consolidate with these two platforms here and now, then when and where? Operational and G&A efficiencies estimated at $18 - $30 million with $18 million guaranteed by the Advisor, Ashford Inc.Attractive pricing for high quality, historically undermanaged assetsMultiple expansion due to higher RevPAR and increased common stock trading liquidityFelCor assets to be put through Ashford Trust’s well-regarded value maximization processIncreased scale leads to greater negotiating leverage and greater capital market access 1. Based on closing prices of AHT and AINC as of 2/17/172. Academic research supports the thesis that higher stock liquidity leads to higher valuation multiples: Liquidity, The Value of the Firm, and Corporate Finance - Amihud & Mendelson, 2008; The Value Impact of Stock Liquidity: An International Evidence - Huang, Wu, Yu and Zhang, 2013; Stock Market Liquidity and Firm Value - Fang, Noe and Tice, 2008; The Effects of Stock Liquidity on Firm Value and Corporate Governance: Endogeneity and the REIT Experiment - Cheung, Chung and Fung, 2015

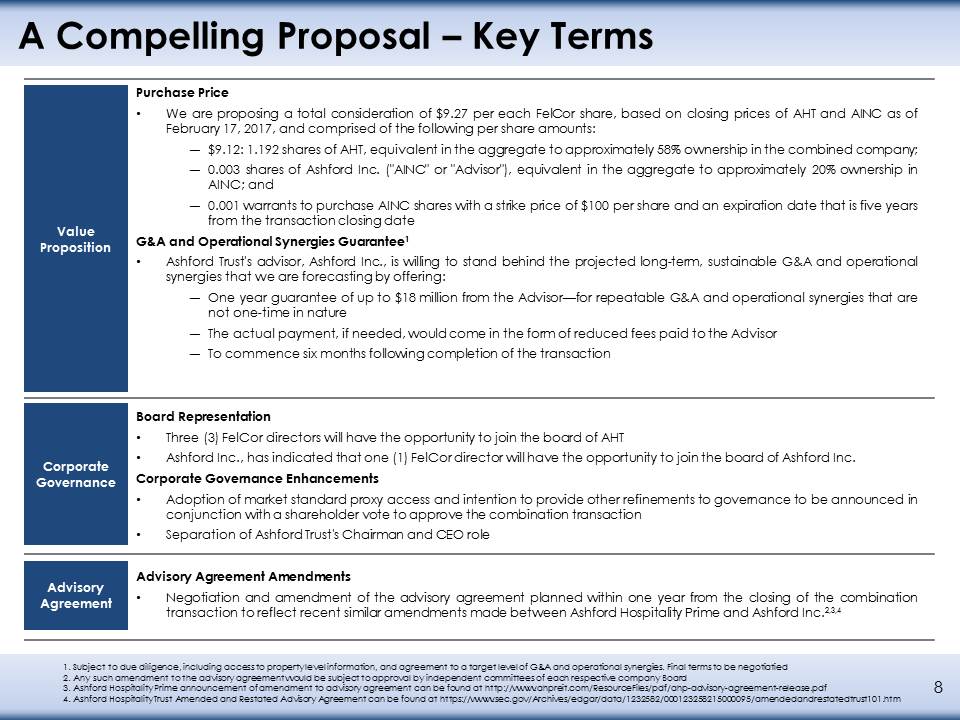

A Compelling Proposal – Key Terms Value Proposition Purchase PriceWe are proposing a total consideration of $9.27 per each FelCor share, based on closing prices of AHT and AINC as of February 17, 2017, and comprised of the following per share amounts:$9.12: 1.192 shares of AHT, equivalent in the aggregate to approximately 58% ownership in the combined company;0.003 shares of Ashford Inc. ("AINC" or "Advisor"), equivalent in the aggregate to approximately 20% ownership in AINC; and0.001 warrants to purchase AINC shares with a strike price of $100 per share and an expiration date that is five years from the transaction closing dateG&A and Operational Synergies Guarantee1 Ashford Trust's advisor, Ashford Inc., is willing to stand behind the projected long-term, sustainable G&A and operational synergies that we are forecasting by offering:One year guarantee of up to $18 million from the Advisor—for repeatable G&A and operational synergies that are not one-time in natureThe actual payment, if needed, would come in the form of reduced fees paid to the AdvisorTo commence six months following completion of the transaction 1. Subject to due diligence, including access to property level information, and agreement to a target level of G&A and operational synergies. Final terms to be negotiatied2. Any such amendment to the advisory agreement would be subject to approval by independent committees of each respective company Board3. Ashford Hospitality Prime announcement of amendment to advisory agreement can be found at http://www.ahpreit.com/ResourceFiles/pdf/ahp-advisory-agreement-release.pdf4. Ashford Hospitality Trust Amended and Restated Advisory Agreement can be found at https://www.sec.gov/Archives/edgar/data/1232582/000123258215000095/amendedandrestatedtrust101.htm Corporate Governance Board RepresentationThree (3) FelCor directors will have the opportunity to join the board of AHTAshford Inc., has indicated that one (1) FelCor director will have the opportunity to join the board of Ashford Inc.Corporate Governance EnhancementsAdoption of market standard proxy access and intention to provide other refinements to governance to be announced in conjunction with a shareholder vote to approve the combination transactionSeparation of Ashford Trust's Chairman and CEO role Advisory Agreement AmendmentsNegotiation and amendment of the advisory agreement planned within one year from the closing of the combination transaction to reflect recent similar amendments made between Ashford Hospitality Prime and Ashford Inc.2,3,4 Advisory Agreement 8

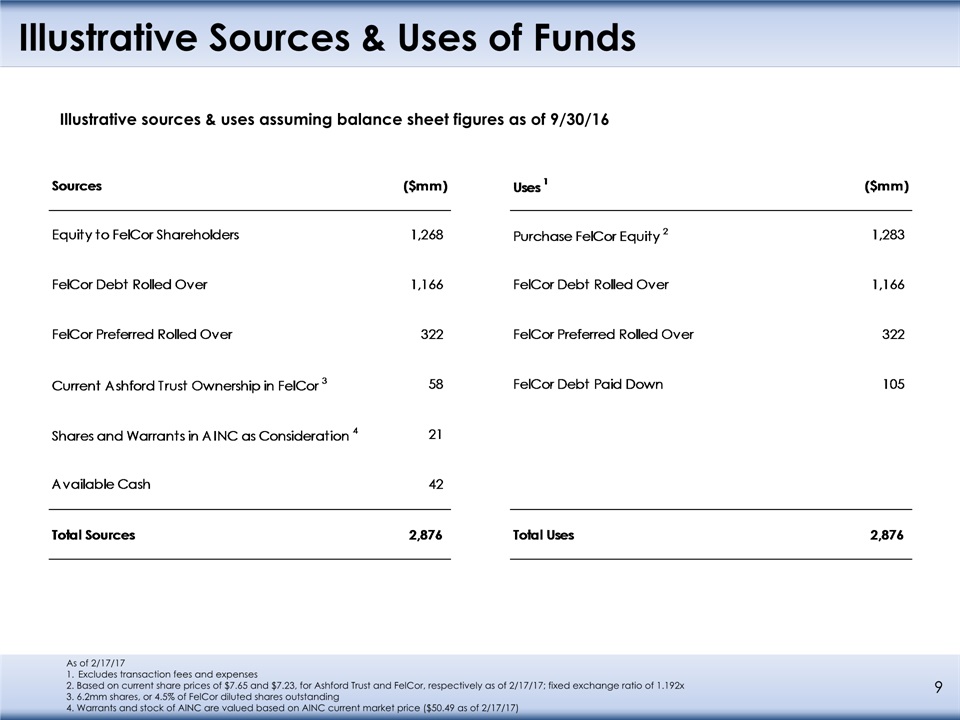

Illustrative Sources & Uses of Funds 9 As of 2/17/171. Excludes transaction fees and expenses 2. Based on current share prices of $7.65 and $7.23, for Ashford Trust and FelCor, respectively as of 2/17/17; fixed exchange ratio of 1.192x3. 6.2mm shares, or 4.5% of FelCor diluted shares outstanding4. Warrants and stock of AINC are valued based on AINC current market price ($50.49 as of 2/17/17) Illustrative sources & uses assuming balance sheet figures as of 9/30/16

+ = Enterprise Value3 $5.0bn $2.7bn $7.3bn Equity Market Capitalization3 $0.9bn $1.0bn $1.9bn TTM Q3 2016 Revenue $1,503mm $877mm $2,350mm TTM Q3 2016 Hotel EBITDA $493mm $250mm4 $762mm5 TTM Q3 2016 Adjusted Corporate EBITDA $441mm $238mm $697mm5 Hotels6 123 39 159 Guestrooms 25,988 11,268 36,657 2015 Comparable Hotels RevPAR $114.30 $144.404 $125.30 States 31 14 34 Brands Hilton: 29%, Marriott: 59%, Other: 12% Hilton: 50%, Wyndham: 22%, Other: 28% Hilton: 36%, Marriott: 46%, Other: 19% 10 Source: Company Filings as of 2/17/171. Not adjusted for the sale of FelCor's NYC assets2. Reflects transaction adjustments, including the sale of FelCor's NYC assets and estimated operational synergies; percentage changes reflect impact to Ashford Trust 3. Based on closing price as of 2/17/17 Creation of a Leading, High Quality Lodging REIT 2 The combination of Ashford Trust and FelCor is expected to create a stronger, more competitive REITAccretive growth opportunitiesGreater access to capitalEnhanced operational leverageLarger equity float 1 +56% +55% +58% +29% +41% +10% +10% +48% +116% 4. Excludes FelCor's The Knickerbocker5. Includes $18 million of operational and G&A synergies for illustrative purposes6. Includes consolidated and unconsolidated hotels

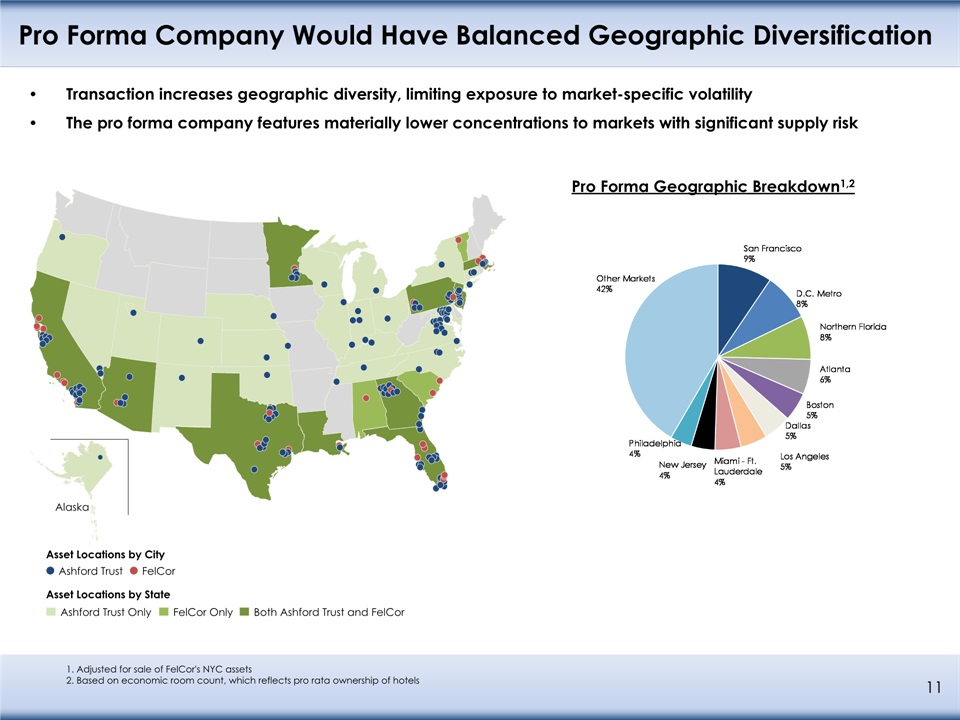

Pro Forma Company Would Have Balanced Geographic Diversification 11 1. Adjusted for sale of FelCor's NYC assets2. Based on economic room count, which reflects pro rata ownership of hotels Transaction increases geographic diversity, limiting exposure to market-specific volatilityThe pro forma company features materially lower concentrations to markets with significant supply risk Pro Forma Geographic Breakdown1,2 Asset Locations by City Ashford Trust FelCor Asset Locations by State Ashford Trust Only FelCor Only Both Ashford Trust and FelCor Alaska

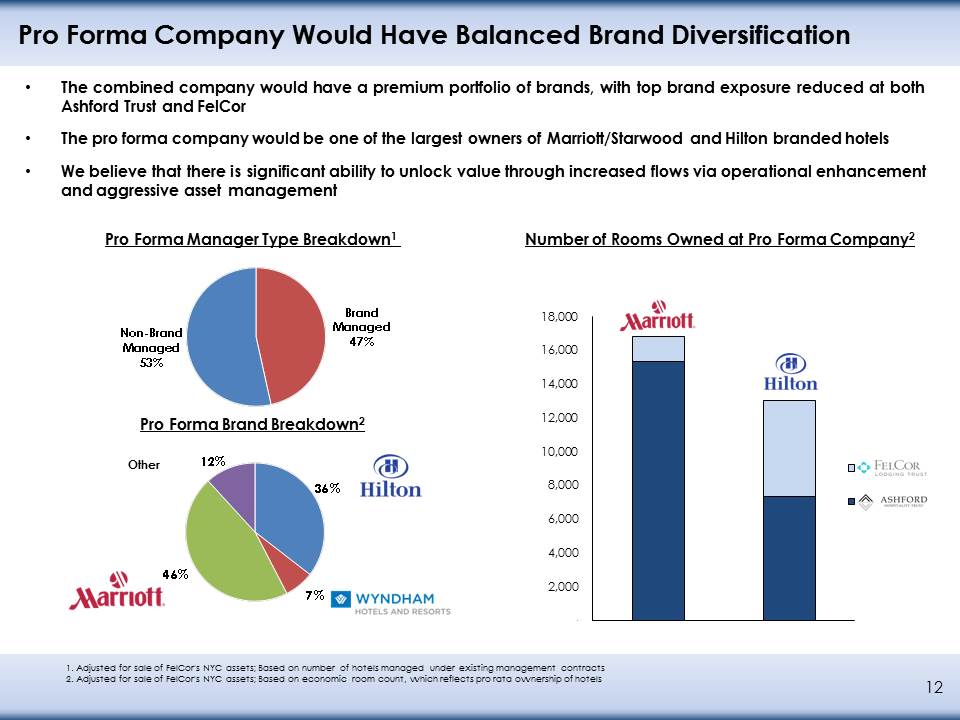

Pro Forma Company Would Have Balanced Brand Diversification 12 The combined company would have a premium portfolio of brands, with top brand exposure reduced at both Ashford Trust and FelCorThe pro forma company would be one of the largest owners of Marriott/Starwood and Hilton branded hotelsWe believe that there is significant ability to unlock value through increased flows via operational enhancement and aggressive asset management Pro Forma Brand Breakdown2 1. Adjusted for sale of FelCor's NYC assets; Based on number of hotels managed under existing management contracts2. Adjusted for sale of FelCor's NYC assets; Based on economic room count, which reflects pro rata ownership of hotels Number of Rooms Owned at Pro Forma Company2 Other Pro Forma Manager Type Breakdown1

Larger Balance Sheet, Improved Liquidity and Prudent Debt Strategy 13 Source: Company Filings as of 2/17/171. Adjusted for sale of FelCor's NYC assets Ashford Trust has successfully executed its leverage policy, strategically using debt to maximize shareholder returnsProactive management of leverage through non-recourse, longer duration, mix of fixed and hedged floating-rate debt with laddered maturities Targeted cash balance of 25% to 30% of market capitalizationStrong liquidity position affords optionality in balance sheet strategyHedges in place against economic shocks provide additional layer of downside protection Opportunistically look to replace FelCor corporate bonds Net Debt / LTM EBITDA Pro Forma Capital Structure1 Liquidity / Risk Management Peer Avg.= 3.3x

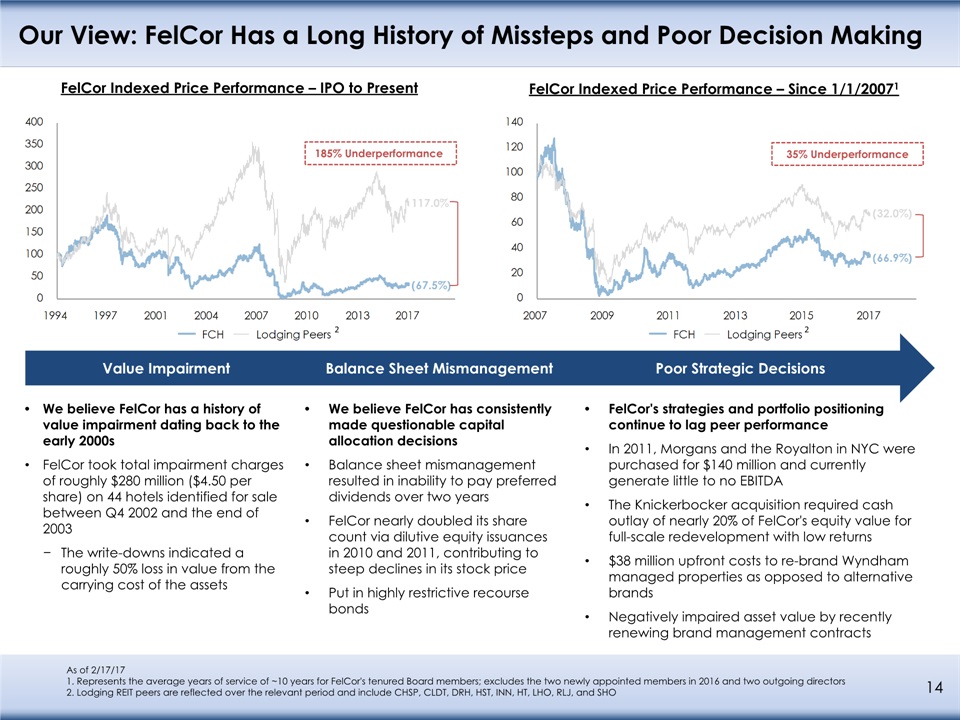

We believe FelCor has a history of value impairment dating back to the early 2000sFelCor took total impairment charges of roughly $280 million ($4.50 per share) on 44 hotels identified for sale between Q4 2002 and the end of 2003The write-downs indicated a roughly 50% loss in value from the carrying cost of the assets Our View: FelCor Has a Long History of Missteps and Poor Decision Making FelCor Indexed Price Performance – IPO to Present 14 185% Underperformance As of 2/17/171. Represents the average years of service of ~10 years for FelCor's tenured Board members; excludes the two newly appointed members in 2016 and two outgoing directors2. Lodging REIT peers are reflected over the relevant period and include CHSP, CLDT, DRH, HST, INN, HT, LHO, RLJ, and SHO FelCor's strategies and portfolio positioning continue to lag peer performanceIn 2011, Morgans and the Royalton in NYC were purchased for $140 million and currently generate little to no EBITDA The Knickerbocker acquisition required cash outlay of nearly 20% of FelCor's equity value for full-scale redevelopment with low returns$38 million upfront costs to re-brand Wyndham managed properties as opposed to alternative brands Negatively impaired asset value by recently renewing brand management contracts Value Impairment Balance Sheet Mismanagement Poor Strategic Decisions We believe FelCor has consistently made questionable capital allocation decisionsBalance sheet mismanagement resulted in inability to pay preferred dividends over two yearsFelCor nearly doubled its share count via dilutive equity issuances in 2010 and 2011, contributing to steep declines in its stock pricePut in highly restrictive recourse bonds 2 FelCor Indexed Price Performance – Since 1/1/20071 2 35% Underperformance

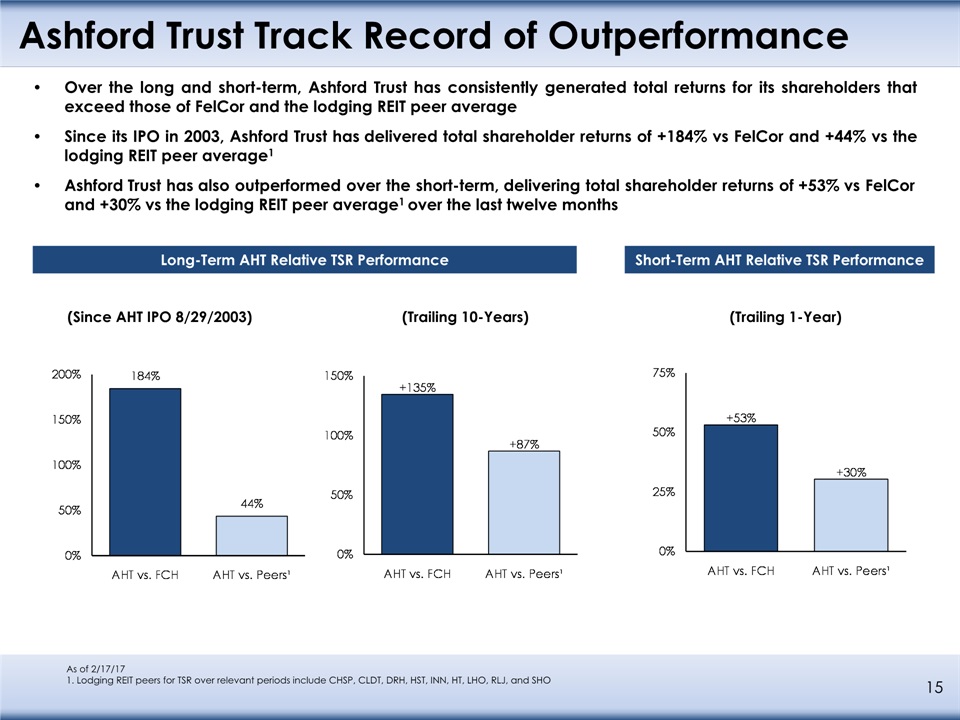

Ashford Trust Track Record of Outperformance Over the long and short-term, Ashford Trust has consistently generated total returns for its shareholders that exceed those of FelCor and the lodging REIT peer averageSince its IPO in 2003, Ashford Trust has delivered total shareholder returns of +184% vs FelCor and +44% vs the lodging REIT peer average1 Ashford Trust has also outperformed over the short-term, delivering total shareholder returns of +53% vs FelCor and +30% vs the lodging REIT peer average1 over the last twelve months Long-Term AHT Relative TSR Performance As of 2/17/171. Lodging REIT peers for TSR over relevant periods include CHSP, CLDT, DRH, HST, INN, HT, LHO, RLJ, and SHO 15 Short-Term AHT Relative TSR Performance (Trailing 1-Year) (Since AHT IPO 8/29/2003) (Trailing 10-Years)

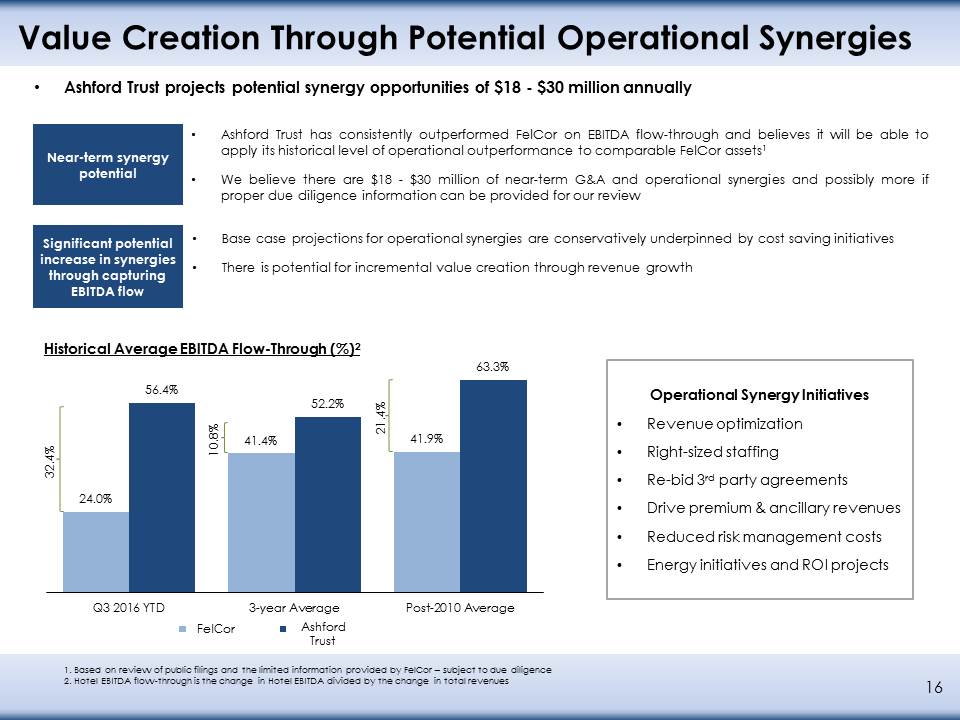

16 Value Creation Through Potential Operational Synergies Historical Average EBITDA Flow-Through (%)2 Ashford Trust projects potential synergy opportunities of $18 - $30 million annually Near-term synergy potential Significant potential increase in synergies through capturing EBITDA flow Base case projections for operational synergies are conservatively underpinned by cost saving initiativesThere is potential for incremental value creation through revenue growth Ashford Trust has consistently outperformed FelCor on EBITDA flow-through and believes it will be able to apply its historical level of operational outperformance to comparable FelCor assets1We believe there are $18 - $30 million of near-term G&A and operational synergies and possibly more if proper due diligence information can be provided for our review 32.4% 10.8% 21.4% FelCor AshfordTrust 1. Based on review of public filings and the limited information provided by FelCor – subject to due diligence2. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues Operational Synergy InitiativesRevenue optimizationRight-sized staffingRe-bid 3rd party agreementsDrive premium & ancillary revenuesReduced risk management costsEnergy initiatives and ROI projects

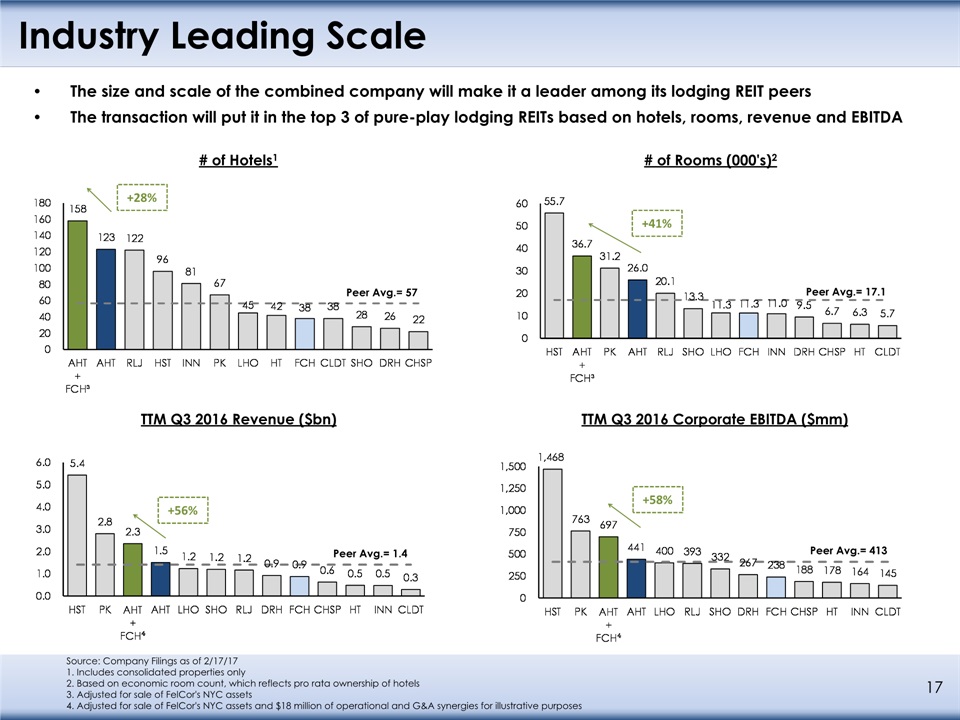

TTM Q3 2016 Revenue ($bn) +28% # of Hotels1 Peer Avg.= 57 +41% +58% Peer Avg.= 17.1 TTM Q3 2016 Corporate EBITDA ($mm) # of Rooms (000's)2 Industry Leading Scale 17 Peer Avg.= 1.4 Peer Avg.= 413 Source: Company Filings as of 2/17/171. Includes consolidated properties only2. Based on economic room count, which reflects pro rata ownership of hotels3. Adjusted for sale of FelCor's NYC assets4. Adjusted for sale of FelCor's NYC assets and $18 million of operational and G&A synergies for illustrative purposes +56% The size and scale of the combined company will make it a leader among its lodging REIT peers The transaction will put it in the top 3 of pure-play lodging REITs based on hotels, rooms, revenue and EBITDA

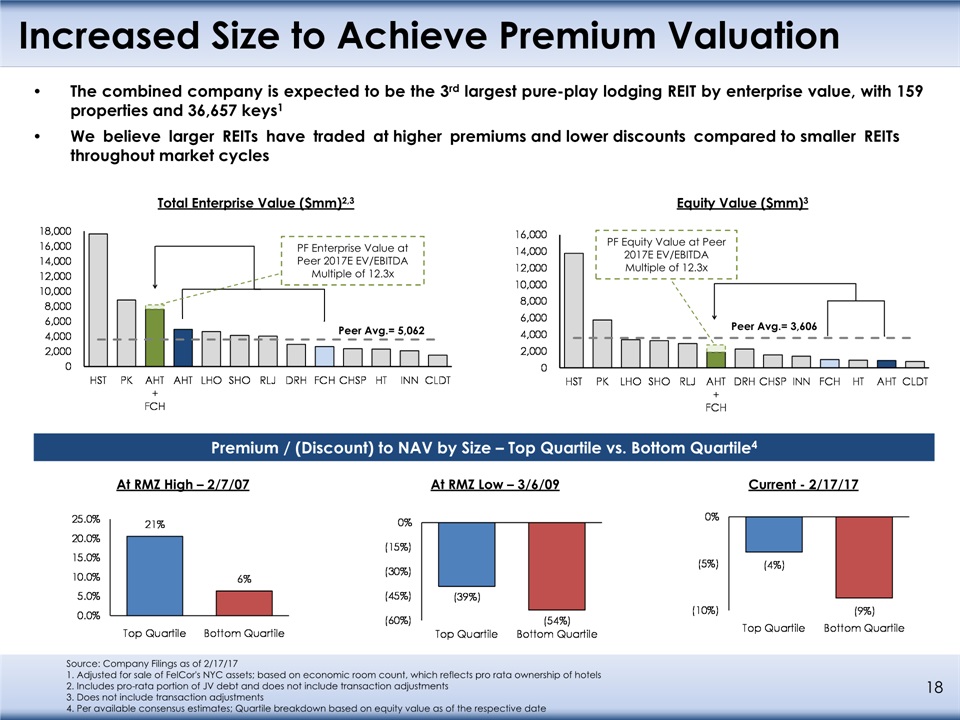

Increased Size to Achieve Premium Valuation 18 The combined company is expected to be the 3rd largest pure-play lodging REIT by enterprise value, with 159 properties and 36,657 keys1We believe larger REITs have traded at higher premiums and lower discounts compared to smaller REITs throughout market cycles Source: Company Filings as of 2/17/171. Adjusted for sale of FelCor's NYC assets; based on economic room count, which reflects pro rata ownership of hotels2. Includes pro-rata portion of JV debt and does not include transaction adjustments3. Does not include transaction adjustments 4. Per available consensus estimates; Quartile breakdown based on equity value as of the respective date Total Enterprise Value ($mm)2,3 Premium / (Discount) to NAV by Size – Top Quartile vs. Bottom Quartile4 At RMZ High – 2/7/07 At RMZ Low – 3/6/09 Current - 2/17/17 Equity Value ($mm)3 Peer Avg.= 3,606 Peer Avg.= 5,062 PF Equity Value at Peer 2017E EV/EBITDA Multiple of 12.3x PF Enterprise Value at Peer 2017E EV/EBITDA Multiple of 12.3x

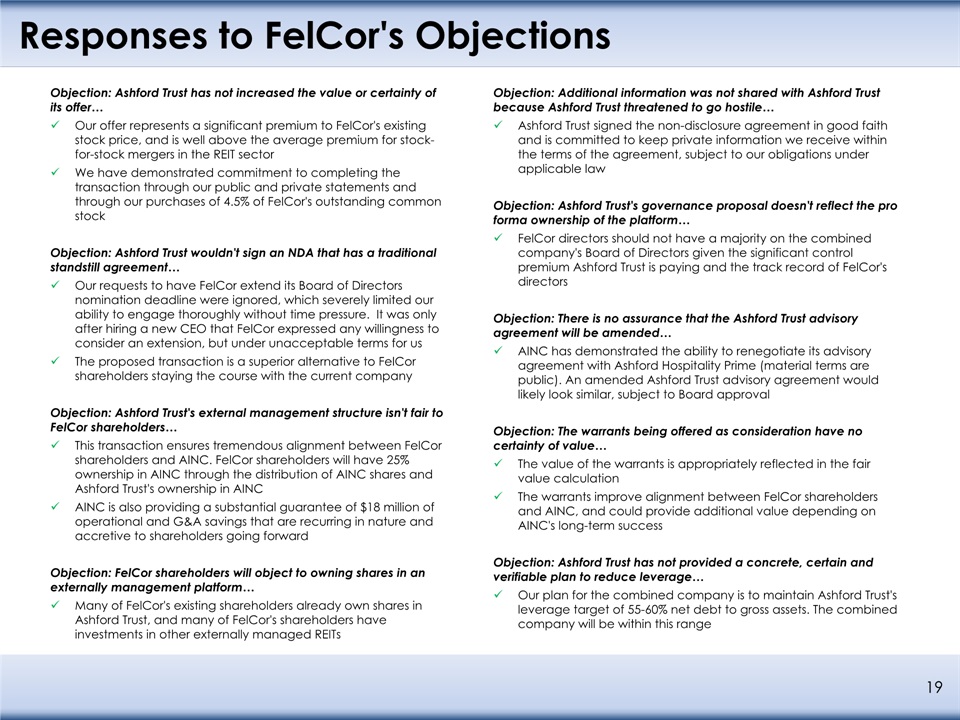

19 Responses to FelCor's Objections Objection: Ashford Trust has not increased the value or certainty of its offer…Our offer represents a significant premium to FelCor's existing stock price, and is well above the average premium for stock-for-stock mergers in the REIT sectorWe have demonstrated commitment to completing the transaction through our public and private statements and through our purchases of 4.5% of FelCor's outstanding common stockObjection: Ashford Trust wouldn't sign an NDA that has a traditional standstill agreement…Our requests to have FelCor extend its Board of Directors nomination deadline were ignored, which severely limited our ability to engage thoroughly without time pressure. It was only after hiring a new CEO that FelCor expressed any willingness to consider an extension, but under unacceptable terms for usThe proposed transaction is a superior alternative to FelCor shareholders staying the course with the current company Objection: Ashford Trust's external management structure isn't fair to FelCor shareholders…This transaction ensures tremendous alignment between FelCor shareholders and AINC. FelCor shareholders will have 25% ownership in AINC through the distribution of AINC shares and Ashford Trust's ownership in AINCAINC is also providing a substantial guarantee of $18 million of operational and G&A savings that are recurring in nature and accretive to shareholders going forwardObjection: FelCor shareholders will object to owning shares in an externally management platform…Many of FelCor's existing shareholders already own shares in Ashford Trust, and many of FelCor's shareholders have investments in other externally managed REITs Objection: Additional information was not shared with Ashford Trust because Ashford Trust threatened to go hostile…Ashford Trust signed the non-disclosure agreement in good faith and is committed to keep private information we receive within the terms of the agreement, subject to our obligations under applicable lawObjection: Ashford Trust's governance proposal doesn't reflect the pro forma ownership of the platform…FelCor directors should not have a majority on the combined company's Board of Directors given the significant control premium Ashford Trust is paying and the track record of FelCor's directorsObjection: There is no assurance that the Ashford Trust advisory agreement will be amended…AINC has demonstrated the ability to renegotiate its advisory agreement with Ashford Hospitality Prime (material terms are public). An amended Ashford Trust advisory agreement would likely look similar, subject to Board approvalObjection: The warrants being offered as consideration have no certainty of value…The value of the warrants is appropriately reflected in the fair value calculationThe warrants improve alignment between FelCor shareholders and AINC, and could provide additional value depending on AINC's long-term success Objection: Ashford Trust has not provided a concrete, certain and verifiable plan to reduce leverage…Our plan for the combined company is to maintain Ashford Trust's leverage target of 55-60% net debt to gross assets. The combined company will be within this range

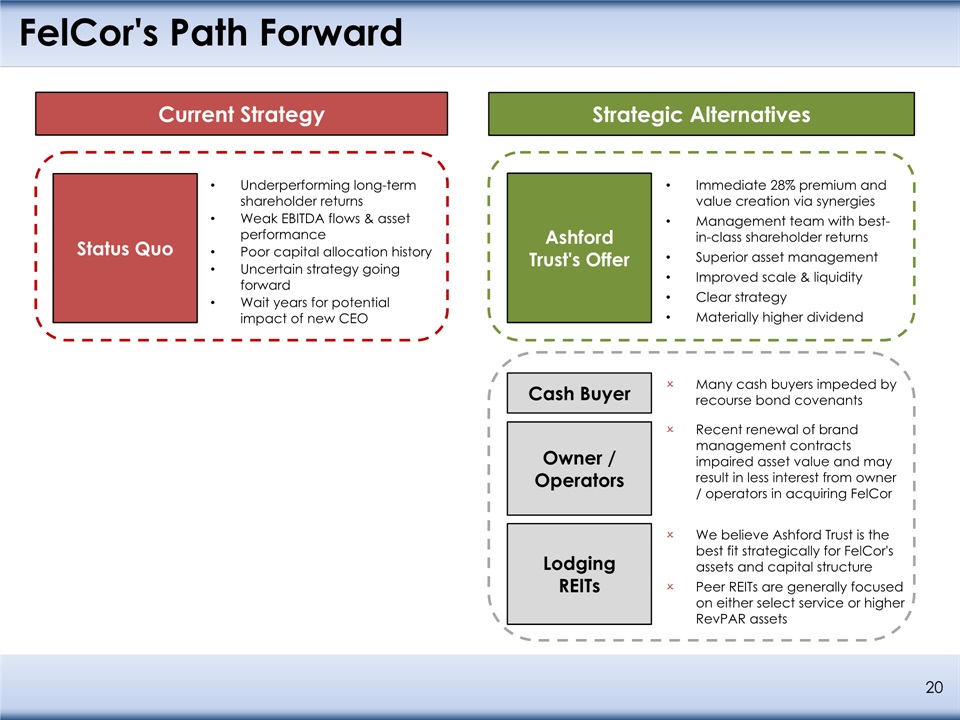

20 FelCor's Path Forward Status Quo Ashford Trust's Offer Cash Buyer Owner / Operators Lodging REITs Underperforming long-term shareholder returnsWeak EBITDA flows & asset performancePoor capital allocation historyUncertain strategy going forwardWait years for potential impact of new CEO Immediate 28% premium and value creation via synergiesManagement team with best-in-class shareholder returnsSuperior asset managementImproved scale & liquidityClear strategyMaterially higher dividend Many cash buyers impeded by recourse bond covenants Recent renewal of brand management contracts impaired asset value and may result in less interest from owner / operators in acquiring FelCor We believe Ashford Trust is the best fit strategically for FelCor's assets and capital structurePeer REITs are generally focused on either select service or higher RevPAR assets Strategic Alternatives Current Strategy

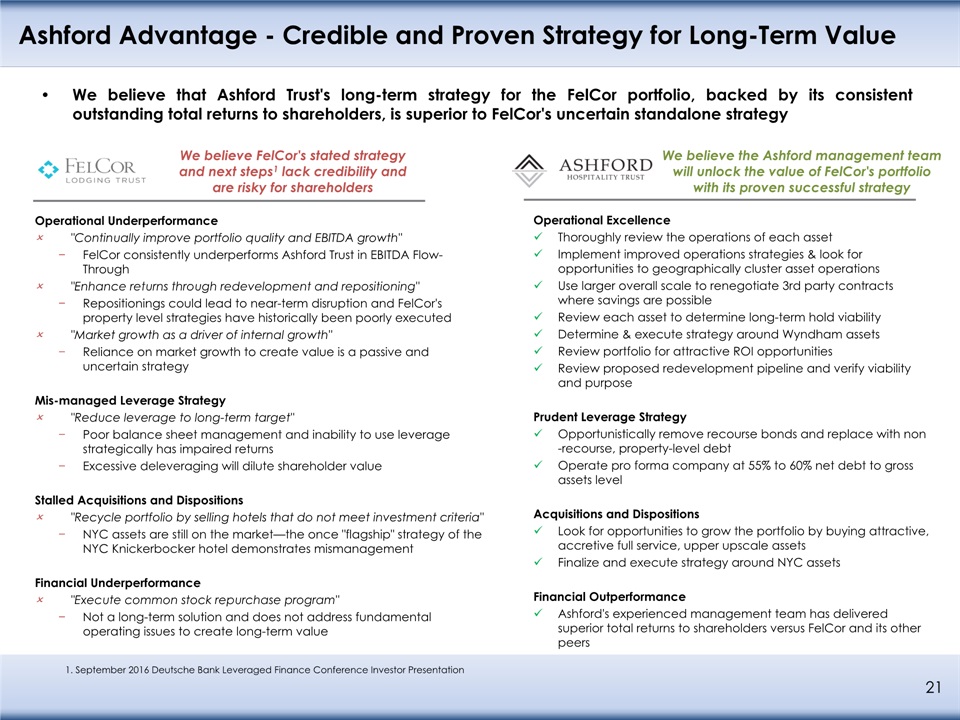

21 Ashford Advantage - Credible and Proven Strategy for Long-Term Value We believe FelCor's stated strategy and next steps1 lack credibility and are risky for shareholders We believe the Ashford management team will unlock the value of FelCor's portfolio with its proven successful strategy Operational ExcellenceThoroughly review the operations of each assetImplement improved operations strategies & look for opportunities to geographically cluster asset operationsUse larger overall scale to renegotiate 3rd party contracts where savings are possibleReview each asset to determine long-term hold viabilityDetermine & execute strategy around Wyndham assetsReview portfolio for attractive ROI opportunitiesReview proposed redevelopment pipeline and verify viability and purposePrudent Leverage StrategyOpportunistically remove recourse bonds and replace with non-recourse, property-level debtOperate pro forma company at 55% to 60% net debt to gross assets levelAcquisitions and DispositionsLook for opportunities to grow the portfolio by buying attractive, accretive full service, upper upscale assetsFinalize and execute strategy around NYC assetsFinancial OutperformanceAshford's experienced management team has delivered superior total returns to shareholders versus FelCor and its other peers We believe that Ashford Trust's long-term strategy for the FelCor portfolio, backed by its consistent outstanding total returns to shareholders, is superior to FelCor's uncertain standalone strategy Operational Underperformance"Continually improve portfolio quality and EBITDA growth"FelCor consistently underperforms Ashford Trust in EBITDA Flow-Through"Enhance returns through redevelopment and repositioning"Repositionings could lead to near-term disruption and FelCor's property level strategies have historically been poorly executed"Market growth as a driver of internal growth"Reliance on market growth to create value is a passive and uncertain strategyMis-managed Leverage Strategy"Reduce leverage to long-term target"Poor balance sheet management and inability to use leverage strategically has impaired returnsExcessive deleveraging will dilute shareholder valueStalled Acquisitions and Dispositions"Recycle portfolio by selling hotels that do not meet investment criteria"NYC assets are still on the market—the once "flagship" strategy of the NYC Knickerbocker hotel demonstrates mismanagementFinancial Underperformance"Execute common stock repurchase program"Not a long-term solution and does not address fundamental operating issues to create long-term value 1. September 2016 Deutsche Bank Leveraged Finance Conference Investor Presentation

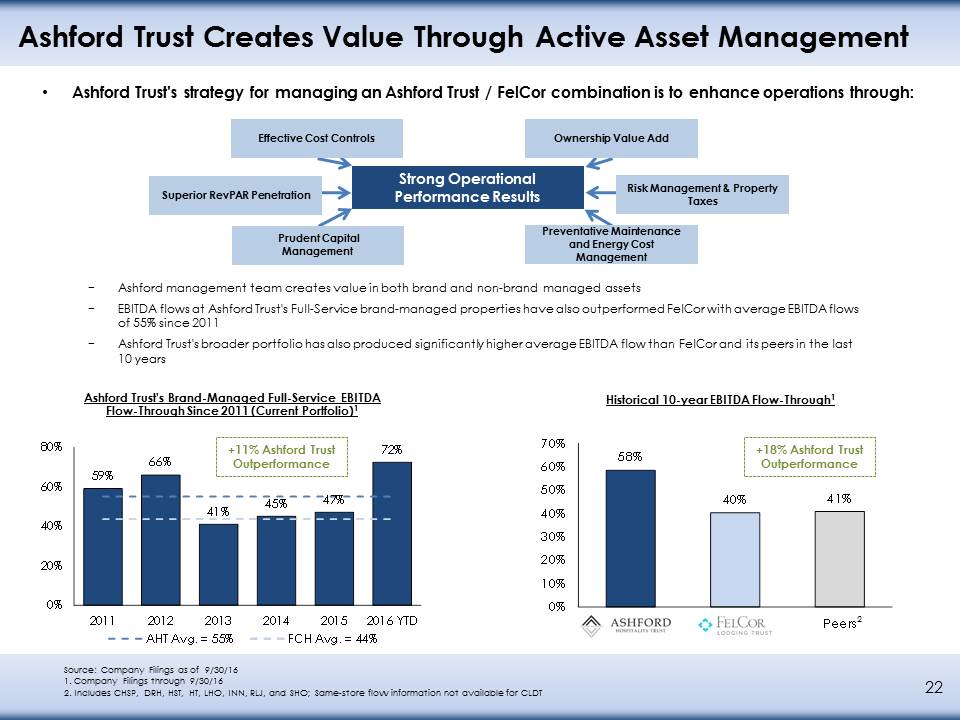

22 Ashford Trust Creates Value Through Active Asset Management Historical 10-year EBITDA Flow-Through1 Ashford Trust's Brand-Managed Full-Service EBITDA Flow-Through Since 2011 (Current Portfolio)1 Source: Company Filings as of 9/30/161. Company Filings through 9/30/162. Includes CHSP, DRH, HST, HT, LHO, INN, RLJ, and SHO; Same-store flow information not available for CLDT 2 +18% Ashford Trust Outperformance +11% Ashford Trust Outperformance Ashford Trust's strategy for managing an Ashford Trust / FelCor combination is to enhance operations through: Ashford management team creates value in both brand and non-brand managed assetsEBITDA flows at Ashford Trust's Full-Service brand-managed properties have also outperformed FelCor with average EBITDA flows of 55% since 2011Ashford Trust's broader portfolio has also produced significantly higher average EBITDA flow than FelCor and its peers in the last 10 years Preventative Maintenance and Energy Cost Management Risk Management & Property Taxes Ownership Value Add Strong Operational Performance Results Effective Cost Controls Superior RevPAR Penetration Cost Management

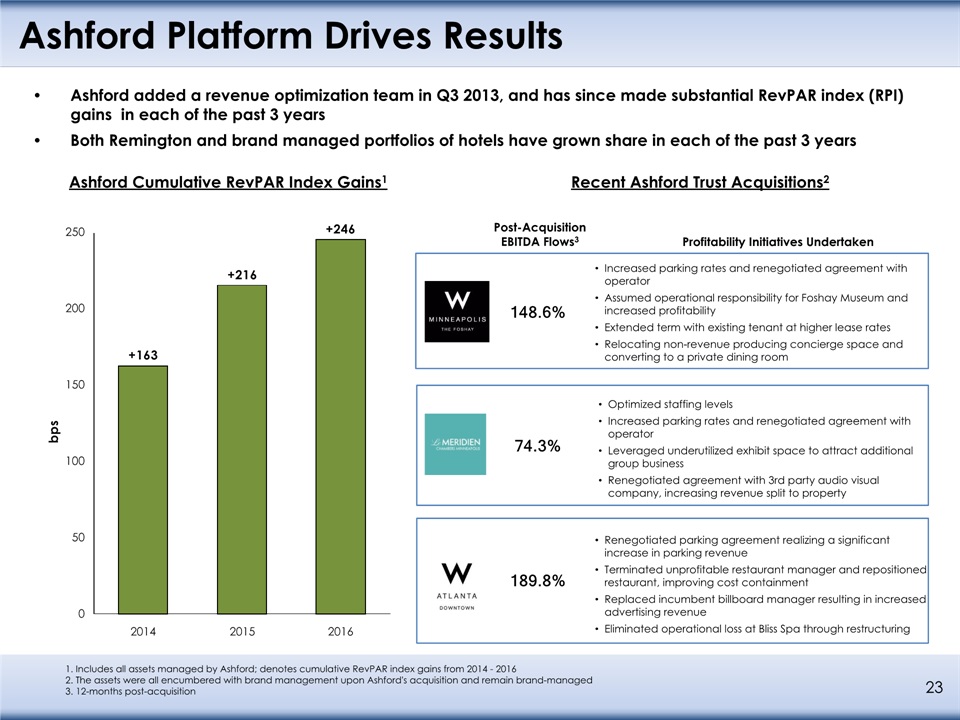

Ashford added a revenue optimization team in Q3 2013, and has since made substantial RevPAR index (RPI) gains in each of the past 3 yearsBoth Remington and brand managed portfolios of hotels have grown share in each of the past 3 years Ashford Cumulative RevPAR Index Gains1 Ashford Platform Drives Results 23 1. Includes all assets managed by Ashford; denotes cumulative RevPAR index gains from 2014 - 20162. The assets were all encumbered with brand management upon Ashford's acquisition and remain brand-managed3. 12-months post-acquisition 148.6% 74.3% 189.8% Post-Acquisition EBITDA Flows3 Profitability Initiatives Undertaken Recent Ashford Trust Acquisitions2 Increased parking rates and renegotiated agreement with operatorAssumed operational responsibility for Foshay Museum and increased profitabilityExtended term with existing tenant at higher lease ratesRelocating non-revenue producing concierge space and converting to a private dining room Optimized staffing levelsIncreased parking rates and renegotiated agreement with operatorLeveraged underutilized exhibit space to attract additional group businessRenegotiated agreement with 3rd party audio visual company, increasing revenue split to property Renegotiated parking agreement realizing a significant increase in parking revenueTerminated unprofitable restaurant manager and repositioned restaurant, improving cost containment Replaced incumbent billboard manager resulting in increased advertising revenueEliminated operational loss at Bliss Spa through restructuring

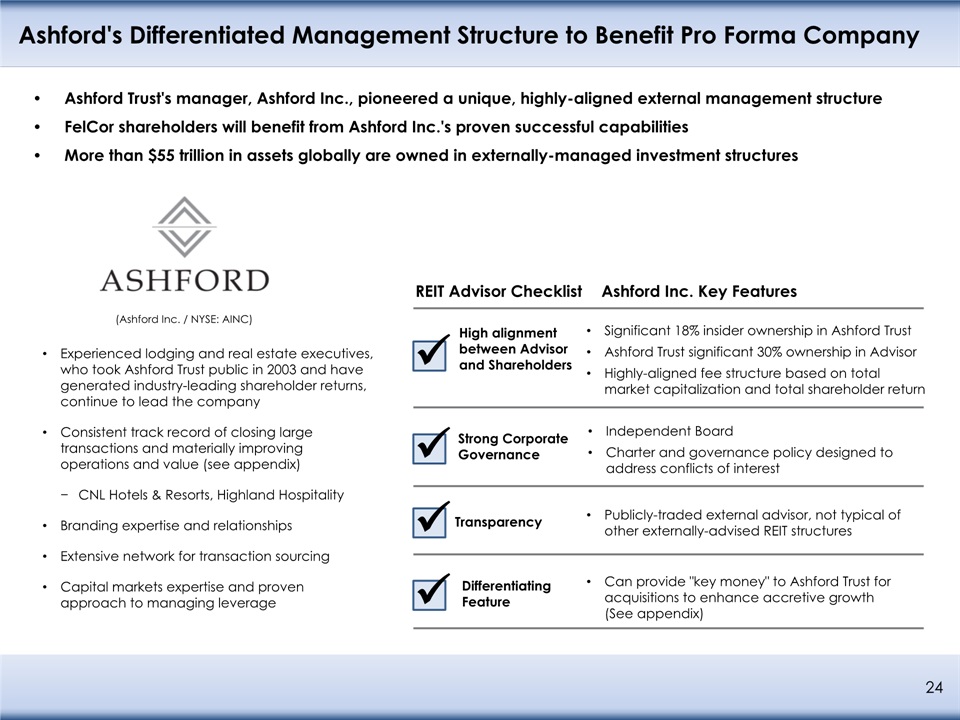

24 Ashford's Differentiated Management Structure to Benefit Pro Forma Company Ashford Trust's manager, Ashford Inc., pioneered a unique, highly-aligned external management structureFelCor shareholders will benefit from Ashford Inc.'s proven successful capabilitiesMore than $55 trillion in assets globally are owned in externally-managed investment structures Experienced lodging and real estate executives, who took Ashford Trust public in 2003 and have generated industry-leading shareholder returns, continue to lead the companyConsistent track record of closing large transactions and materially improving operations and value (see appendix)CNL Hotels & Resorts, Highland HospitalityBranding expertise and relationshipsExtensive network for transaction sourcingCapital markets expertise and proven approach to managing leverage (Ashford Inc. / NYSE: AINC) Transparency Strong Corporate Governance High alignment between Advisor and Shareholders Can provide "key money" to Ashford Trust for acquisitions to enhance accretive growth (See appendix) Significant 18% insider ownership in Ashford TrustAshford Trust significant 30% ownership in AdvisorHighly-aligned fee structure based on total market capitalization and total shareholder return Publicly-traded external advisor, not typical of other externally-advised REIT structures Independent BoardCharter and governance policy designed to address conflicts of interest Differentiating Feature Ashford Inc. Key Features REIT Advisor Checklist

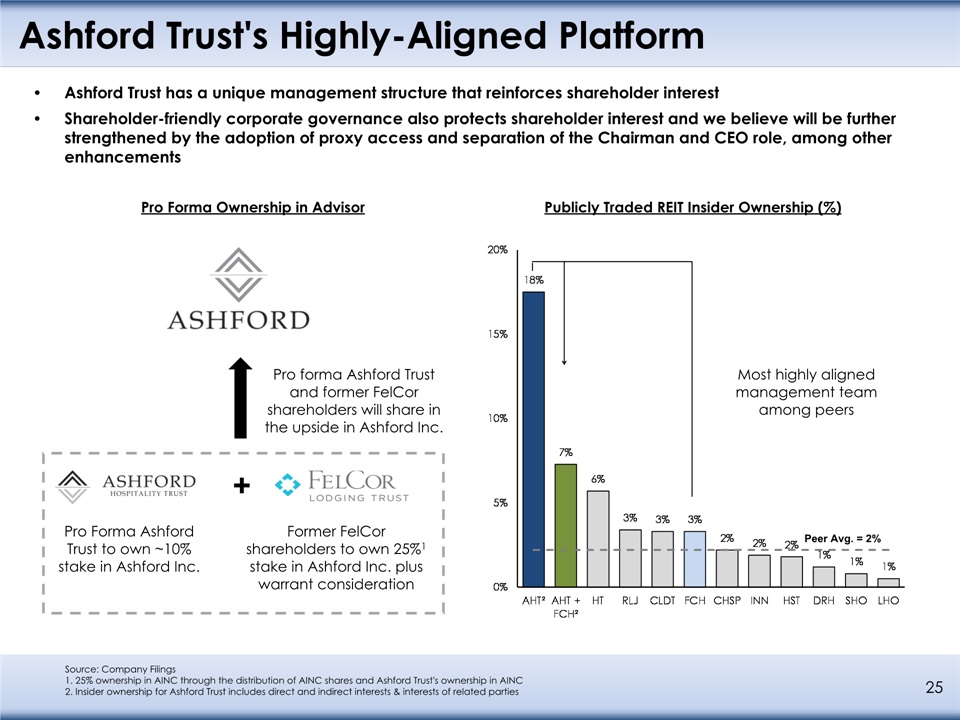

Most highly aligned management team among peers 25 Ashford Trust's Highly-Aligned Platform Ashford Trust has a unique management structure that reinforces shareholder interestShareholder-friendly corporate governance also protects shareholder interest and we believe will be further strengthened by the adoption of proxy access and separation of the Chairman and CEO role, among other enhancements Pro Forma Ashford Trust to own ~10% stake in Ashford Inc. Former FelCor shareholders to own 25%1 stake in Ashford Inc. plus warrant consideration + Pro Forma Ownership in Advisor Publicly Traded REIT Insider Ownership (%) Pro forma Ashford Trust and former FelCor shareholders will share in the upside in Ashford Inc. Peer Avg. = 2% Source: Company Filings1. 25% ownership in AINC through the distribution of AINC shares and Ashford Trust's ownership in AINC2. Insider ownership for Ashford Trust includes direct and indirect interests & interests of related parties

Shared Benefit of Potential Long-Term Upside As of 2/17/171. Based on current share prices of $7.65 and $7.23, for Ashford Trust and FelCor, respectively as of 2/17/172. Assumes $18mm in 2017E synergies capitalized at discount rate of 8.5%, pro forma ownership stake in illustrative value creation for Ashford Inc. due to managing FelCor portfolio; excludes transaction fees and expenses3. Based on 2021E EBITDA flow through synergy capitalized at discount rate of 8.5%, assumes 2000-bps EBITDA flow through improvement A combination of Ashford Trust and FelCor presents a unique, deep value investment opportunity with a strong growth trajectory that we believe will create value for both sets of shareholdersOperational ImprovementsFundamental operating improvements to FelCor's assetsAchievable Multiple Expansion(i) enhanced scale; (ii) increased liquidity; (iii) lower cost of capital; (iv) improved asset management; and (v) enhanced corporate governance Denotes value creation to FelCor shareholders from direct ownership of common shares and warrants in Ashford Inc. Value Creation ($bn) 26 Near-Term Value Creation Long-Term Value Creation Potential multiple expansion Capitalized near term synergies2 Uplift in Ashford Inc.2Sale of NYC Assets Assumes 3.0% Avg. Revenue Growth Rate3 Assumes 5.0% Avg. Revenue Growth Rate3 Up to ~70% - 100% Value Creation Up to ~45% - 70% Value Creation

Long-Term Strategy for the Combined Company 27 Industry-leading size, scale and diversity of the combined portfolioOpportunities to grow through accretive acquisitionsWell-capitalized and flexible balance sheet to support future growthValue creation through increased flows from operational enhancement and aggressive asset managementLeverage Ashford's platform to further drive upside at the combined companyCommitment to strong corporate governance and alignment with all shareholders

28 Key Takeaways We strongly believe that Ashford Trust's proposal offers FelCor shareholders an immediate, significant premium and long-term value creation Ashford Trust’s demonstrated track record of delivering outsized returns would maximize value for both shareholder bases FelCor properties will have the opportunity to benefit from Ashford Trust's leading operational expertise, which we believe will drive substantial property level synergies The combined company will have a diverse portfolio of brands, with top brand exposure reduced at both Ashford Trust and FelCor Positive financial impact while maintaining balance sheet strength, improving equity float and stock liquidity for shareholders

29 Appendix

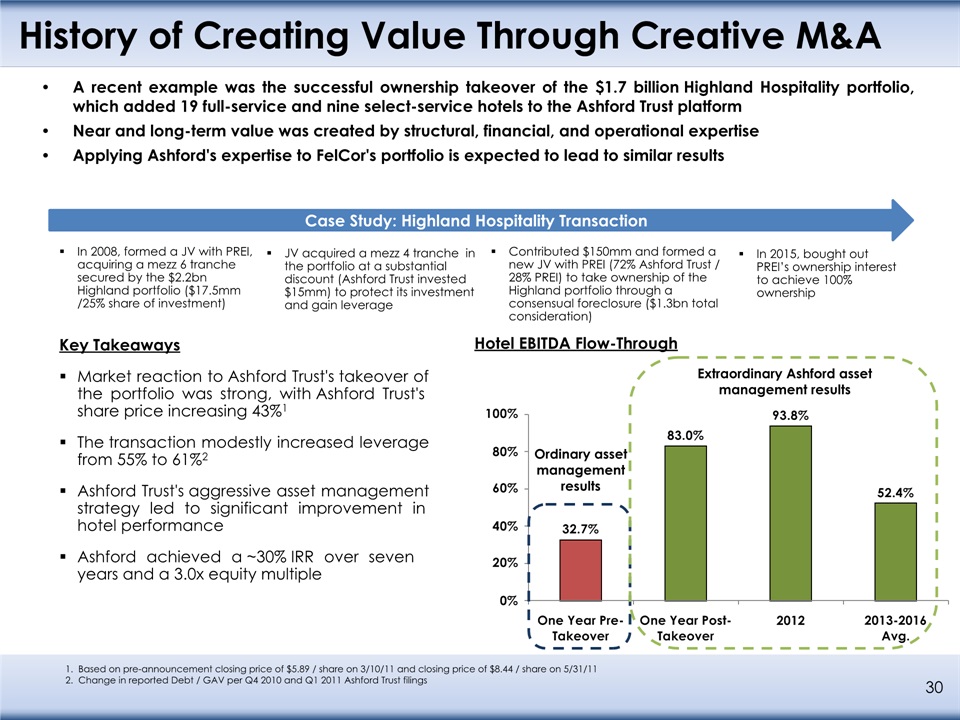

Key TakeawaysMarket reaction to Ashford Trust's takeover of the portfolio was strong, with Ashford Trust's share price increasing 43%1The transaction modestly increased leverage from 55% to 61%2Ashford Trust's aggressive asset management strategy led to significant improvement in hotel performanceAshford achieved a ~30% IRR over seven years and a 3.0x equity multiple History of Creating Value Through Creative M&A 30 A recent example was the successful ownership takeover of the $1.7 billion Highland Hospitality portfolio, which added 19 full-service and nine select-service hotels to the Ashford Trust platformNear and long-term value was created by structural, financial, and operational expertiseApplying Ashford's expertise to FelCor's portfolio is expected to lead to similar results 1. Based on pre-announcement closing price of $5.89 / share on 3/10/11 and closing price of $8.44 / share on 5/31/112. Change in reported Debt / GAV per Q4 2010 and Q1 2011 Ashford Trust filings In 2008, formed a JV with PREI, acquiring a mezz 6 tranche secured by the $2.2bn Highland portfolio ($17.5mm /25% share of investment) JV acquired a mezz 4 tranche in the portfolio at a substantial discount (Ashford Trust invested $15mm) to protect its investment and gain leverage Contributed $150mm and formed a new JV with PREI (72% Ashford Trust / 28% PREI) to take ownership of the Highland portfolio through a consensual foreclosure ($1.3bn total consideration) In 2015, bought out PREI’s ownership interest to achieve 100% ownership Case Study: Highland Hospitality Transaction Extraordinary Ashford asset management results Hotel EBITDA Flow-Through Ordinary asset management results

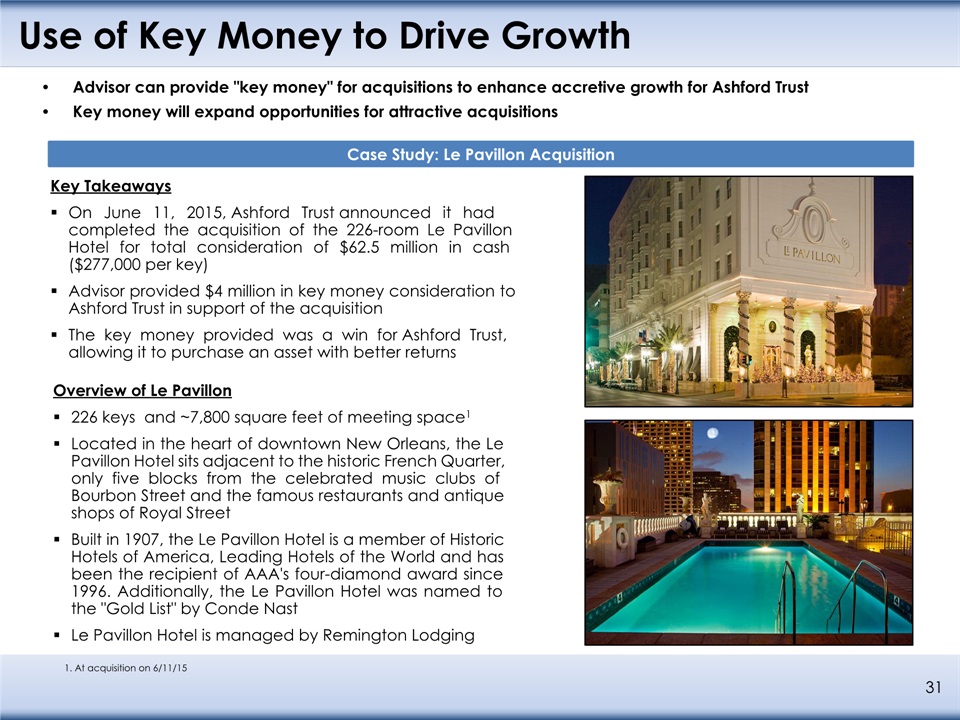

Use of Key Money to Drive Growth Advisor can provide "key money" for acquisitions to enhance accretive growth for Ashford TrustKey money will expand opportunities for attractive acquisitions Overview of Le Pavillon226 keys and ~7,800 square feet of meeting space1Located in the heart of downtown New Orleans, the Le Pavillon Hotel sits adjacent to the historic French Quarter, only five blocks from the celebrated music clubs of Bourbon Street and the famous restaurants and antique shops of Royal StreetBuilt in 1907, the Le Pavillon Hotel is a member of Historic Hotels of America, Leading Hotels of the World and has been the recipient of AAA's four-diamond award since 1996. Additionally, the Le Pavillon Hotel was named to the "Gold List" by Conde NastLe Pavillon Hotel is managed by Remington Lodging 1. At acquisition on 6/11/15 31 Case Study: Le Pavillon Acquisition Key TakeawaysOn June 11, 2015, Ashford Trust announced it had completed the acquisition of the 226-room Le Pavillon Hotel for total consideration of $62.5 million in cash ($277,000 per key)Advisor provided $4 million in key money consideration to Ashford Trust in support of the acquisitionThe key money provided was a win for Ashford Trust, allowing it to purchase an asset with better returns

A New and Highly Qualified Board to Serve All Shareholders Keith O. Cowan 16 years of experience as telecommunications executiveCEO of Cowan Consulting Corporation LLCSpecializes in capital markets, M&A, corporate transactions, executive leadership, risk oversight and management, government relations, marketing and consumer products Spent 14 years as an attorney at a major US law firm; public and private board member experience 32 Ashford Trust has nominated a slate of independent directors Marvin Banks30 years of real estate experience President of M Banks Realty Partners Chairman of BluTrend, a technology firm focused on back office automation for multifamily real estate firmsSpent 15 years at Gables Residential as CFO and a member of the Executive CommitteeCertified public accountant Jeffrey N. Lavine25 years of experience in commercial real estate President of Deerwood Real Estate Capital, a commercial mortgage brokerage firmFormer Principal of JN Lavine Advisors, providing consulting and advisory services to clients in real estate and capital marketsFormer Managing Director and Co-Head of the US, European and Japanese Commercial Real Estate Group of SNB StabFund, a workout fund of distressed commercial real estate assets Christos Megalou30 years of experience in management, banking, mergers and acquisitions, and capital markets Founder and Managing Director of Tite Capital Limited, a private financial consultancy companyFormer CEO and Chairman of the Executive Board of Eurobank Ergasias SA, one of the four systemic banks in GreeceCurrently a Distinguished Fellow of the Global Federation of Competitiveness Councils in Washington, D.C. and Deputy Chairman of the Hellenic Bank Association of Greece

A New and Highly Qualified Board to Serve All Shareholders Daniel E. Schmerin8 years of investment experience and over 5 years of government experience Director of Investment Research at Fairholme Capital ManagementPreviously COO for the Legacy Securities Public-Private Investment Program in the TreasuryServed in the Executive Office of the President at the White House and in the Bureau of Economic and Business Affairs at the US Department of State 33 Ashford Trust has nominated a slate of independent directors Gregory Z. Rush24 years of experience in institutional real estate; Board member experience at public REITManaging Member of Rush Capital Partners LLC, an investment firm that focuses on value-add and opportunistic real estate investments Former Partner, Managing Director and investment committee member for Dune Real Estate PartnersFull Member of the Urban Land Institute John Mark Ramsey19 years combined real estate healthcare experience totaling over $4.0bnPresident and Chief Executive Officer of Sentio Healthcare Properties, Inc. Co-Founder and Chief Executive Officer of Sentio Investments, LLC, which offers flexible real estate capital solutions Former SVP of Investments for CNL Retirement Properties (now Health Care Property Investors, Inc.; NYSE: HCP)

Merger Proposal to Create Leading Lodging REIT and Unlock Value for ShareholdersAshford Hospitality Trust & FelCor Lodging TrustFebruary 21, 2017