Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RENASANT CORP | form8-k_q12017investorpres.htm |

Q1 2017 Investor Presentation

This presentation contains various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995

about Renasant Corporation (“Renasant”) that are subject to risks and uncertainties. Congress passed the Private Securities Litigation Reform

Act of 1995 in an effort to encourage companies to provide information about their anticipated future financial performance. This act provides a

safe harbor for such disclosure, which protects a company from unwarranted litigation if actual results are different from management

expectations. Forward-looking statements include information concerning our future financial performance, business strategy, projected plans

and objectives. These statements are based upon the current beliefs and expectations of our management and are inherently subject to

significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-

looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results

may differ from those indicated or implied in the forward-looking statements, and such differences may be material. Statements preceded by,

followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plans,” “may increase,” “may

fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” and “could,” are

generally forward-looking in nature and not historical facts. You should understand that the following important factors, in addition to those

discussed elsewhere in this presentation as well as in reports we file with the Securities and Exchange Commission could cause actual results to

differ materially from those expressed in such forward-looking statements: (i) our ability to efficiently integrate acquisitions into our operations,

retain the customers of these businesses and grow the acquired operations, including with respect to our recently-announced proposed business

combination between Renasant and Metropolitan BancGroup, Inc. discussed in more detail in this presentation; (ii) the timing of the

implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iii) competitive pressures in the consumer finance,

commercial finance, insurance, financial services, asset management, retail banking, mortgage lending and auto lending industries; (iv) the

financial resources of, and products available to, competitors; (v) changes in laws and regulations, including changes in accounting standards;

(vi) changes in regulatory policy; (vii) changes in the securities and foreign exchange markets; (viii) our potential growth, including our entrance

or expansion into new markets, and the need for sufficient capital to support that growth; (ix) changes in the quality or composition of our loan

or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; (x) an

insufficient allowance for loan losses as a result of inaccurate assumptions; (xi) general market or business conditions; (xii) changes in demand

for loan products and financial services; (xiii) concentration of credit exposure; (xiv) changes or the lack of changes in interest rates, yield curves

and interest rate spread relationships; and (xv) other circumstances, many of which are beyond management’s control.

Our management believes the forward-looking statements about us are reasonable. However, you should not place undue reliance on

them. Any forward-looking statements in this presentation are not guarantees of future performance. They involve risks, uncertainties and

assumptions, and actual results, developments and business decisions may differ from those contemplated by those forward-looking

statements. Many of the factors that will determine these results are beyond our ability to control or predict. We disclaim any duty to update

any forward-looking statements, all of which are expressly qualified by the statements in this section.

More than 175 banking, lending, financial services and insurance offices

3

Western

29%

Northern

22%

Eastern

27%

Central

22%

Portfolio Loans*

Western

44%

Northern

13%

Eastern

25%

Central

18%

Total Deposits*

*As of December 31, 2016

4

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

Nashville

Memphis

TENNESSEE

Tupelo

Jackson

MISSISSIPPI

Birmingham

Huntsville

Montgomery

Atlanta

GEORGIA

ALABAMA

Source: SNL Financial

5

Financial Highlights

Assets $3.59 Billion

Gross Loans $2.28 Billion

Deposits $2.69 Billion

6

De novo expansion:

Columbus, MS

2010

De novo expansion:

Montgomery, AL

Starkville, MS

Tuscaloosa, AL

De novo expansion:

Maryville, TN

Jonesborough,

TN

FDIC-Assisted

Transaction:

Crescent Bank and

Trust

Jasper, GA

Assets: $1.0 billion

FDIC-Assisted

Transaction:

American Trust

Bank

Roswell, GA

Assets: $145 million

Trust Acquisition:

RBC (USA) Trust

Unit

Birmingham, AL

Assets: $680 million

Whole Bank

Transaction:

First M&F

Corporation

Kosciusko, MS

Assets: $1.6 billion

2011 2013

De novo expansion:

Bristol, TN

Johnson City, TN

2015

Whole Bank

Transaction:

Heritage Financial

Group, Inc.

Albany, GA

Assets: $1.8 billion

2012 2016

Whole Bank

Transaction:

KeyWorth Bank

Atlanta, GA

Assets: $390

million

2017

Whole Bank

Transaction

Announcement:

Metropolitan

BancGroup

Ridgeland, MS

Assets: $1.2 billion

De novo expansion:

Mobile, AL

Over 175 banking, lending, financial services and insurance offices

7

Assets $8.7 billion

Gross Loans $6.2 billion

Deposits $7.1 billion

Highlights*

*As of December 31, 2016

Merger of Renasant Corporation and

Metropolitan BancGroup, Inc.

January 17, 2017

8

(1) Based on RNST’s closing price of $38.77 as of January 17, 2017

(2) Aggregate value includes the value of options which will be cashed out at closing

(3) Transaction multiples on per share basis using financial data as of and for the year ending December 31, 2016

Consideration

Implied Price per Share

Aggregate Transaction Value

Transaction Multiples (3)

Options

Management and Board of Directors

Due Diligence

Termination Fee

Required Approvals

Expected Closing

100% stock

Fixed exchange ratio of 0.6066x shares of RNST common stock for each share of

Metropolitan common stock

$23.52 (1)

$190.2 million (2)

Price / Tangible Book: 201.5%

Price / 2016 Earnings: 25.5x

Core Deposit Premium: 14.4%

Metropolitan options will be cashed out

Metropolitan’s CEO and other key executives will maintain senior positions with RNST

One Metropolitan director will be appointed to the Renasant board

Completed

$6.8 million

Customary regulatory approval; Metropolitan shareholder approval

Early third quarter 2017

9

Metropolitan BancGroup, Inc. is co-headquartered

in Memphis, TN and Ridgeland, MS (Jackson, MS

MSA)

Approximately 70% of loans in Tennessee;

30% of loans in Mississippi

8 banking offices in key metropolitan markets:

• Memphis, TN (2)

• Nashville, TN (2)

• Jackson, MS (4)

Targeted focus on meeting the needs of small

commercial, middle market and private clients

Organic growth strategy – “talent centric, branch

lite”

As of December 31, 2016

Total assets: $1.2 billion Efficiency Ratio: 67.8%

Total deposits: $888 million ROAA: 0.69%

TCE/TA: 7.54% ROAE: 8.11%

$348

$411

$483

$564

$653

$743

$918

$200

$400

$600

$800

$1,000

$1.4

$3.2 $3.1

$3.9

$5.2

$6.3

$7.1

$0.0

$2.0

4.

$6.0

$8.0

Gross Loans ($mm)

Net Income ($mm)

10

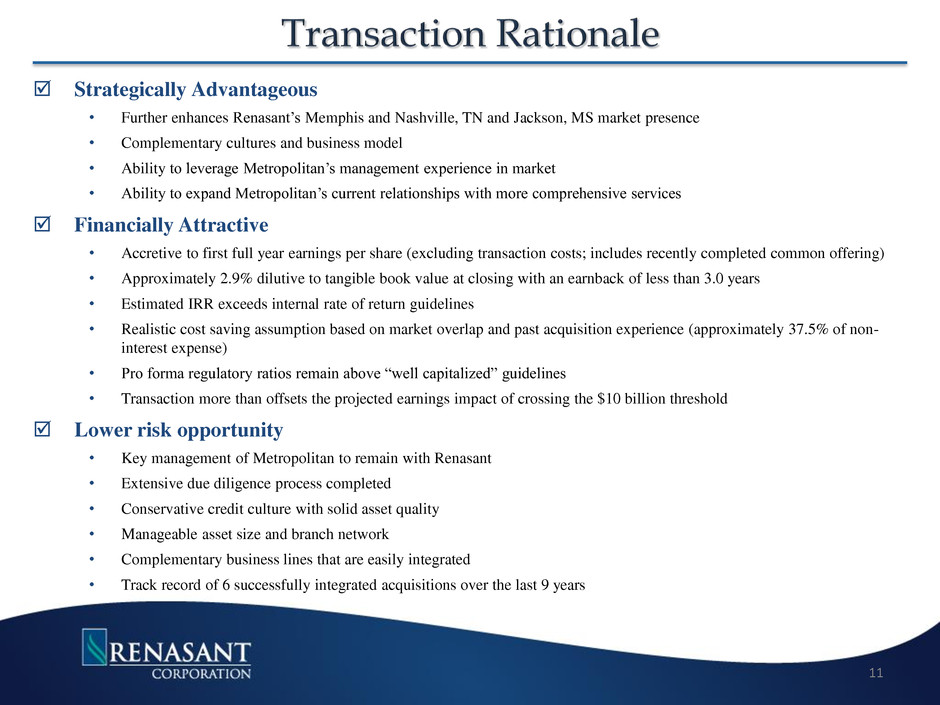

Strategically Advantageous

• Further enhances Renasant’s Memphis and Nashville, TN and Jackson, MS market presence

• Complementary cultures and business model

• Ability to leverage Metropolitan’s management experience in market

• Ability to expand Metropolitan’s current relationships with more comprehensive services

Financially Attractive

• Accretive to first full year earnings per share (excluding transaction costs; includes recently completed common offering)

• Approximately 2.9% dilutive to tangible book value at closing with an earnback of less than 3.0 years

• Estimated IRR exceeds internal rate of return guidelines

• Realistic cost saving assumption based on market overlap and past acquisition experience (approximately 37.5% of non-

interest expense)

• Pro forma regulatory ratios remain above “well capitalized” guidelines

• Transaction more than offsets the projected earnings impact of crossing the $10 billion threshold

Lower risk opportunity

• Key management of Metropolitan to remain with Renasant

• Extensive due diligence process completed

• Conservative credit culture with solid asset quality

• Manageable asset size and branch network

• Complementary business lines that are easily integrated

• Track record of 6 successfully integrated acquisitions over the last 9 years

11

GEORGIA

ALABAMA

TENNESSEE

FLORIDA

MISSISSIPPI

Atlanta

Montgomery

Auburn

Tupelo

Huntsville

Birmingham

Jackson

Albany

Gainesville

Ocala

Memphis

Nashville

Knoxville

Johnson City

Savannah

55

59

65

10

10

95

75

75

75

20

20

40

65

24

40

16

59

75

12

Pro Forma Franchise

RNST Branches

Metropolitan Branches

Olive Branch

Collierville

Horn Lake

Germantown

West

Memphis

Pleasant Hill

MISSISSIPPI

TENNESSEE

Memphis

Fisherville

Bartlett

Cayce

Victoria

240 55

240

40

40

385

64

64

61

385

55

Nashville

Gallatin

Pegram

Belle Meade

Ashland City

Rural Hill

Mount Juliet

Forest Hills

Lakewood

Goodlettsville

Millersville

Smyrna

Franklin

La Vergne

Nolensville

Brentwood

24

24

40

40

65

65

386

440

31E

Jackson

Clinton

Pearl

Ridgeland

Guide

Hazelhurst

Hoodtown

Crystal

Springs

Raymond

Florence

Utica

Edwards

Fannin

20

20

55

55

220

49

Sloan

Memphis MSA

Nashville MSA

Jackson MSA

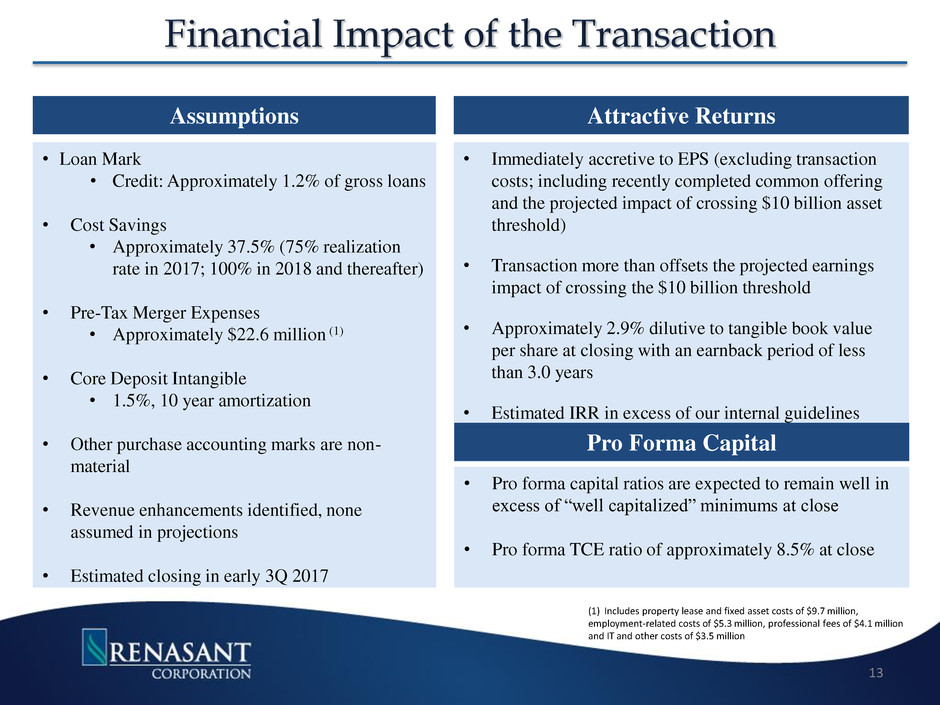

Assumptions

• Loan Mark

• Credit: Approximately 1.2% of gross loans

• Cost Savings

• Approximately 37.5% (75% realization

rate in 2017; 100% in 2018 and thereafter)

• Pre-Tax Merger Expenses

• Approximately $22.6 million (1)

• Core Deposit Intangible

• 1.5%, 10 year amortization

• Other purchase accounting marks are non-

material

• Revenue enhancements identified, none

assumed in projections

• Estimated closing in early 3Q 2017

Attractive Returns

• Immediately accretive to EPS (excluding transaction

costs; including recently completed common offering

and the projected impact of crossing $10 billion asset

threshold)

• Transaction more than offsets the projected earnings

impact of crossing the $10 billion threshold

• Approximately 2.9% dilutive to tangible book value

per share at closing with an earnback period of less

than 3.0 years

• Estimated IRR in excess of our internal guidelines

Pro Forma Capital

• Pro forma capital ratios are expected to remain well in

excess of “well capitalized” minimums at close

• Pro forma TCE ratio of approximately 8.5% at close

(1) Includes property lease and fixed asset costs of $9.7 million,

employment-related costs of $5.3 million, professional fees of $4.1 million

and IT and other costs of $3.5 million

13

14

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

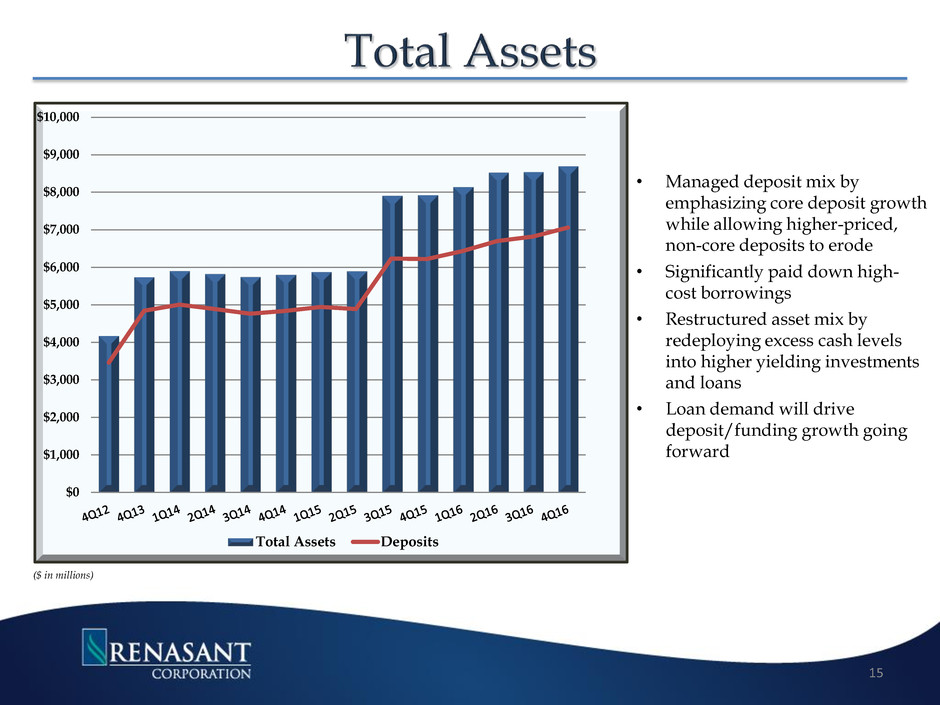

• Managed deposit mix by

emphasizing core deposit growth

while allowing higher-priced,

non-core deposits to erode

• Significantly paid down high-

cost borrowings

• Restructured asset mix by

redeploying excess cash levels

into higher yielding investments

and loans

• Loan demand will drive

deposit/funding growth going

forward

($ in millions)

15

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

Total Assets Deposits

($ in millions) 2011 2012 2013 2014 4Q15 1Q16 2Q16 3Q16 4Q16

Not Acquired $2,242 $2,573 $2,886 $3,268 $3,830 $4,075 $4,292 $4,526 $4,711

Acquired

Covered*

$339 $237 $182 $143 $93 $45 $42 $30 $0

Acquired

Not Covered

- - $813 $577 $1,490 $1,453 $1,631 $1,549 $1,489

Total Loans $2,581 $2,810 $3,881 $3,988 $5,413 $5,573 $5,965 $6,105 $6,200

• Loans not acquired increased

$184M or 16% (annualized)

during 4Q16

• Company maintained strong

pipelines throughout all

markets which will continue to

drive further loan growth

Loss-share agreements with

FDIC were terminated in 4Q16

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Not Acquired Acquired Covered Acquired

($ in thousands)

16

*Covered loans are subject to loss-share agreements with FDIC

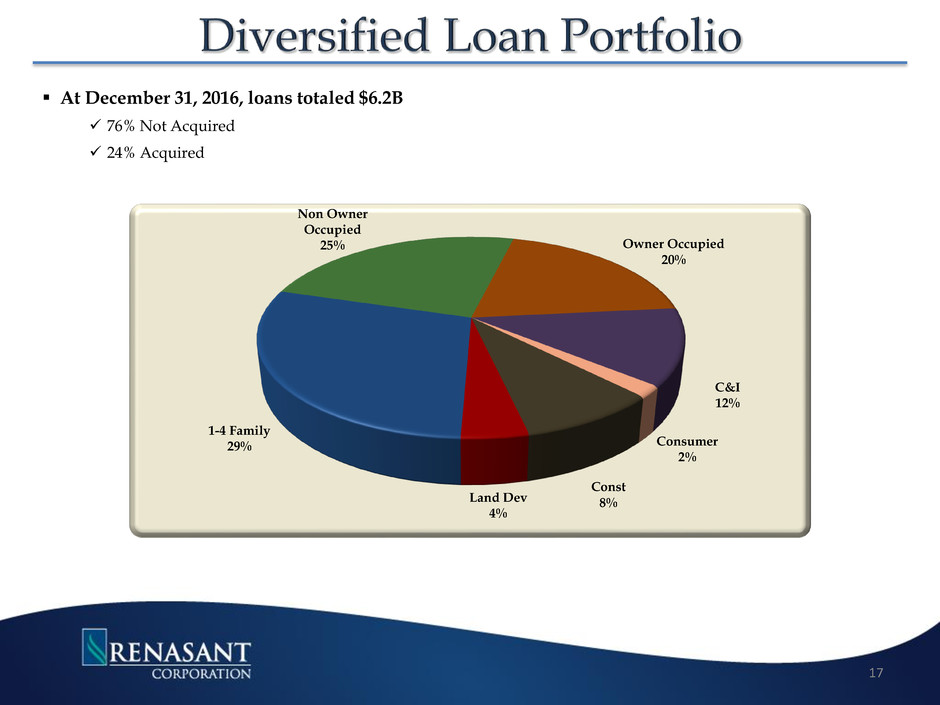

At December 31, 2016, loans totaled $6.2B

76% Not Acquired

24% Acquired

Const

8% Land Dev

4%

1-4 Family

29%

Non Owner

Occupied

25% Owner Occupied

20%

C&I

12%

Consumer

2%

17

18

Acquisition, Development & Construction (ADC) and Commercial Real Estate (CRE)

C&D and CRE Loan Concentration Levels

82% 83%

87%

91%

82% 81%

0%

20%

40%

60%

80%

100%

3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16

265%

258%

267%

277%

251%

231%

0%

50%

100%

150%

200%

250%

300%

3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q16

ADC Loans as a Percentage of

Risk Based Capital

CRE Loans (Construction & Perm) as a

Percentage of Risk Based Capital

DDA

9%

Other Int

Bearing

Accts

26%

Time

Deposits

37% Borrowed

Funds

28%

4Q 2008

Cost of Funds

2.81%

$3.28B

Non

Interest

DDA

21%

Other Int

Bearing

Accts

53%

Time

Deposits

22%

Borrowed

Funds

4%

4Q 2016

$7.4B

Cost of Funds

.42%

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

1,800,000

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Non Interest Bearing Demand Deposits

($ in thousands)

• Non-interest bearing deposits

represent 22% of deposits, up

from 12% at year end 2008

• Less reliance on borrowed

funds

Borrowed funds as a percentage

of funding sources declined

from 28% at year end 2008 to

4% at the end of 4Q16

19

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2012 2013 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Marg

in

Y

ie

ld

/C

os

t

Yield on Earning Assets Cost of Funds Margin

($ in thousands) 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Net Interest

Income

$133,338 $157,133 $202,482 $48,781 $51,614 $68,612 $72,351 $70,054 $77,157 $75,731 $78,049

Net Interest

Margin

3.94% 3.96% 4.12% 4.02% 4.17% 4.09% 4.33% 4.21% 4.29% 4.15% 4.24%

Yield on

Earning Assets

4.67% 4.53% 4.59% 4.45% 4.57% 4.42% 4.65% 4.57% 4.66% 4.54% 4.66%

Cost of Funds 0.72% 0.57% 0.47% 0.43% 0.41% 0.33% 0.32% 0.37% 0.38% 0.40% 0.42%

20

27% 7%

28%

9% 15%

14%

4Q16

$30M*

Svc Chgs

Insurance

Mtg Inc

Wealth Mgmt

Fees & Comm

Other

• Diversified sources of noninterest income

Less reliant on NSF

• Opportunities for growing Non Interest Income

Expansion of Trust Division Wealth Management

Services into larger, metropolitan markets

Expansions within our de novo operations

Expansion of the Mortgage Division within new

markets

Fees derived from higher penetration and usage of

debit cards and deposit charges

*Non interest income excludes gains from securities transactions and gains from acquisitions

39%

6%

11%

5%

27%

12%

1Q08

$14M*

Svc Chgs

Insurance

Mtg Inc

Wealth Mgmt

Fees & Comm

Other

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Non Interest Income*

($ in thousands)

21

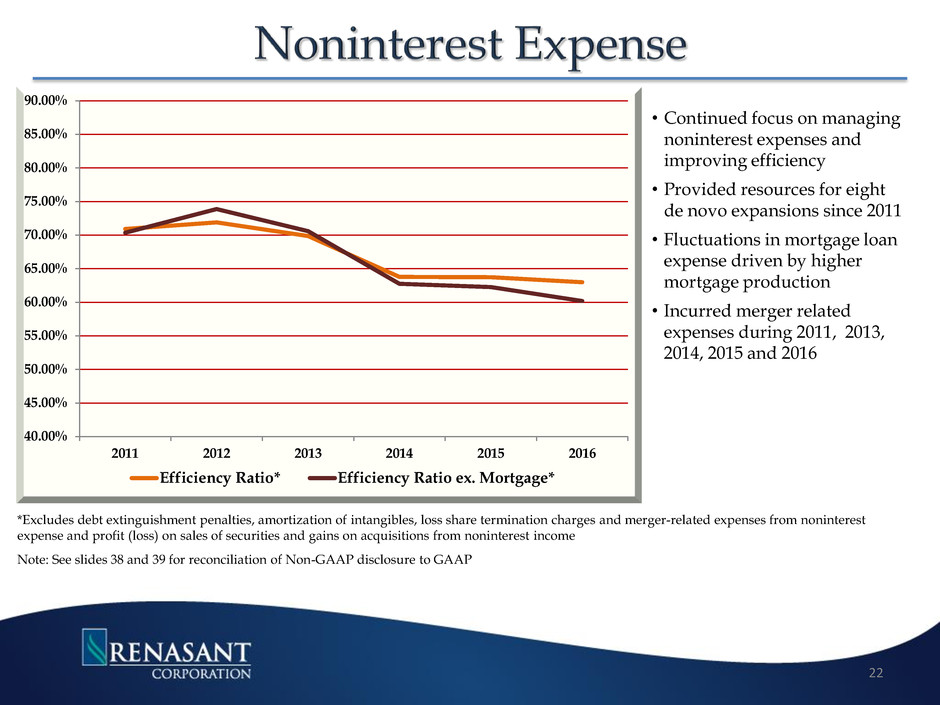

• Continued focus on managing

noninterest expenses and

improving efficiency

• Provided resources for eight

de novo expansions since 2011

• Fluctuations in mortgage loan

expense driven by higher

mortgage production

• Incurred merger related

expenses during 2011, 2013,

2014, 2015 and 2016

22

40.00%

45.00%

50.00%

55.00%

60.00%

65.00%

70.00%

75.00%

80.00%

85.00%

90.00%

2011 2012 2013 2014 2015 2016

Efficiency Ratio* Efficiency Ratio ex. Mortgage*

*Excludes debt extinguishment penalties, amortization of intangibles, loss share termination charges and merger-related expenses from noninterest

expense and profit (loss) on sales of securities and gains on acquisitions from noninterest income

Note: See slides 38 and 39 for reconciliation of Non-GAAP disclosure to GAAP

23

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

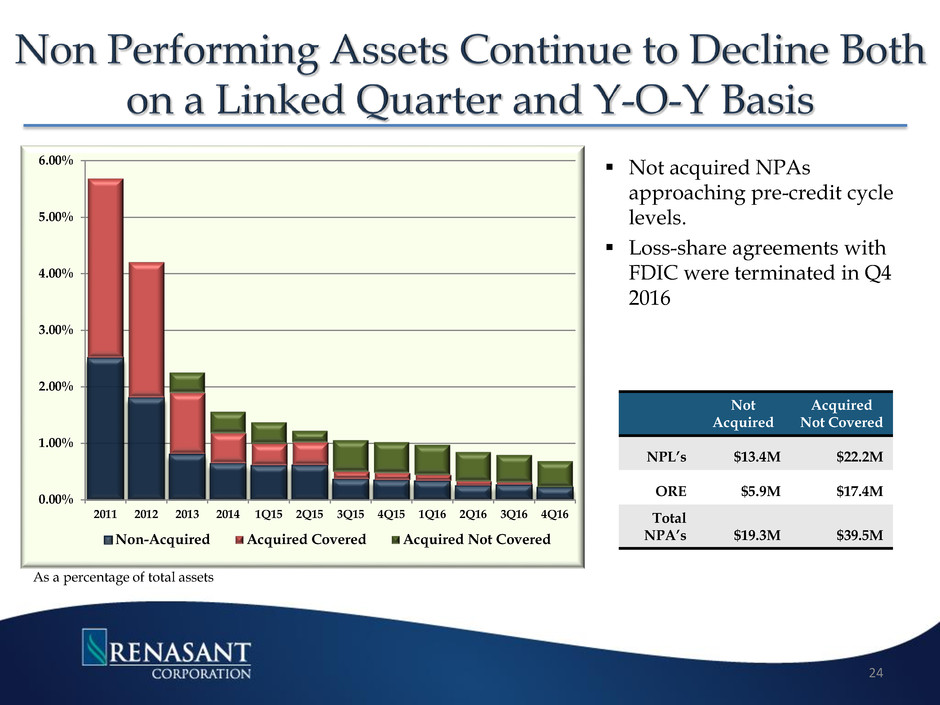

Not acquired NPAs

approaching pre-credit cycle

levels.

Loss-share agreements with

FDIC were terminated in Q4

2016

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Non-Acquired Acquired Covered Acquired Not Covered

As a percentage of total assets

24

Not

Acquired

Acquired

Not Covered

NPL’s $13.4M $22.2M

ORE $5.9M $17.4M

Total

NPA’s $19.3M $39.5M

*Ratios excludes loans and assets acquired in connection with the recent acquisitions or loss share transactions

0.00%

50.00%

100.00%

150.00%

200.00%

250.00%

300.00%

350.00%

400.00%

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

($)Provision for Loan Losses ($)Net Charge Offs Coverage Ratio*

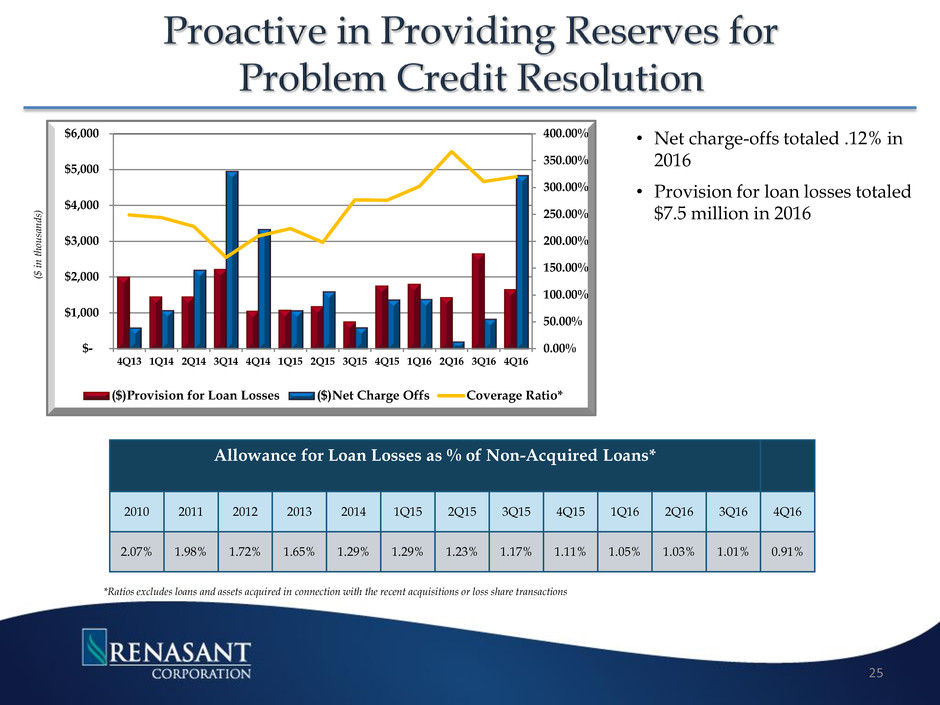

• Net charge-offs totaled .12% in

2016

• Provision for loan losses totaled

$7.5 million in 2016

Allowance for Loan Losses as % of Non-Acquired Loans*

2010 2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

2.07% 1.98% 1.72% 1.65% 1.29% 1.29% 1.23% 1.17% 1.11% 1.05% 1.03% 1.01% 0.91%

25

($

i

n

t

h

ou

san

d

s)

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

NPLs

30-89

Days

Continued Improvement

NPLs and Early Stage Delinquencies

(30-89 Days Past Due Loans)*

• NPL’s to total loans were 0.28%

26

*Ratios excludes loans and assets acquired in connection with recent acquisitions or loss-share transactions

($

i

n

t

h

ou

san

d

s)

27

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

4.50%

5.00%

5.50%

6.00%

6.50%

7.00%

7.50%

8.00%

8.50%

9.00%

9.50%

2011 2012 2013 2014 2015 1Q16 2Q16 3Q16 4Q16

Tangible Common Equity Ratio*

Renasant

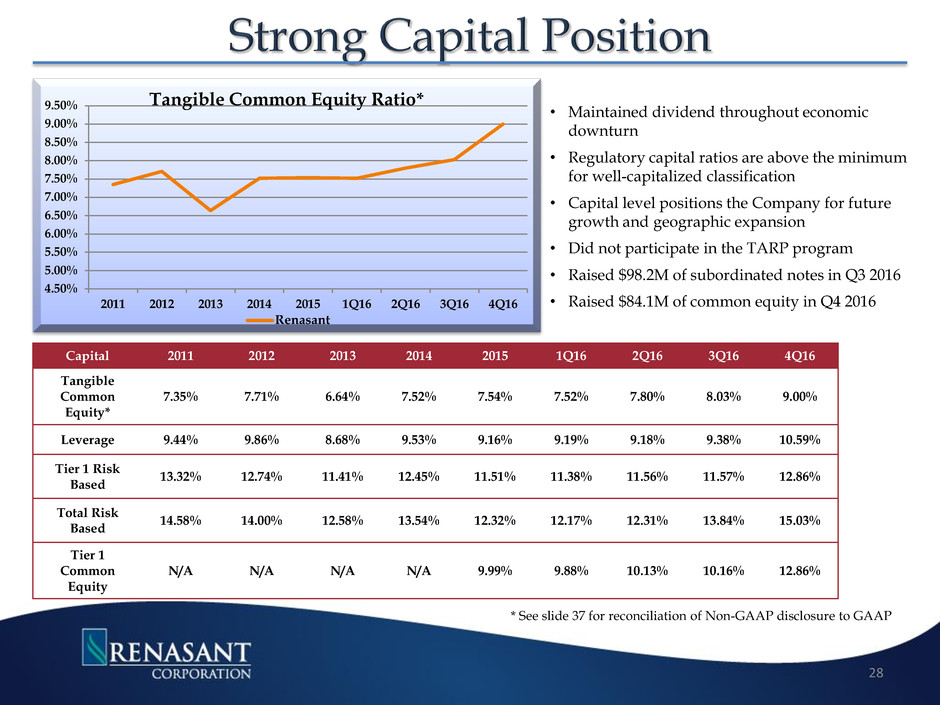

Capital 2011 2012 2013 2014 2015 1Q16 2Q16 3Q16 4Q16

Tangible

Common

Equity*

7.35% 7.71% 6.64% 7.52% 7.54% 7.52% 7.80% 8.03% 9.00%

Leverage 9.44% 9.86% 8.68% 9.53% 9.16% 9.19% 9.18% 9.38% 10.59%

Tier 1 Risk

Based

13.32% 12.74% 11.41% 12.45% 11.51% 11.38% 11.56% 11.57% 12.86%

Total Risk

Based

14.58% 14.00% 12.58% 13.54% 12.32% 12.17% 12.31% 13.84% 15.03%

Tier 1

Common

Equity

N/A N/A N/A N/A 9.99% 9.88% 10.13% 10.16% 12.86%

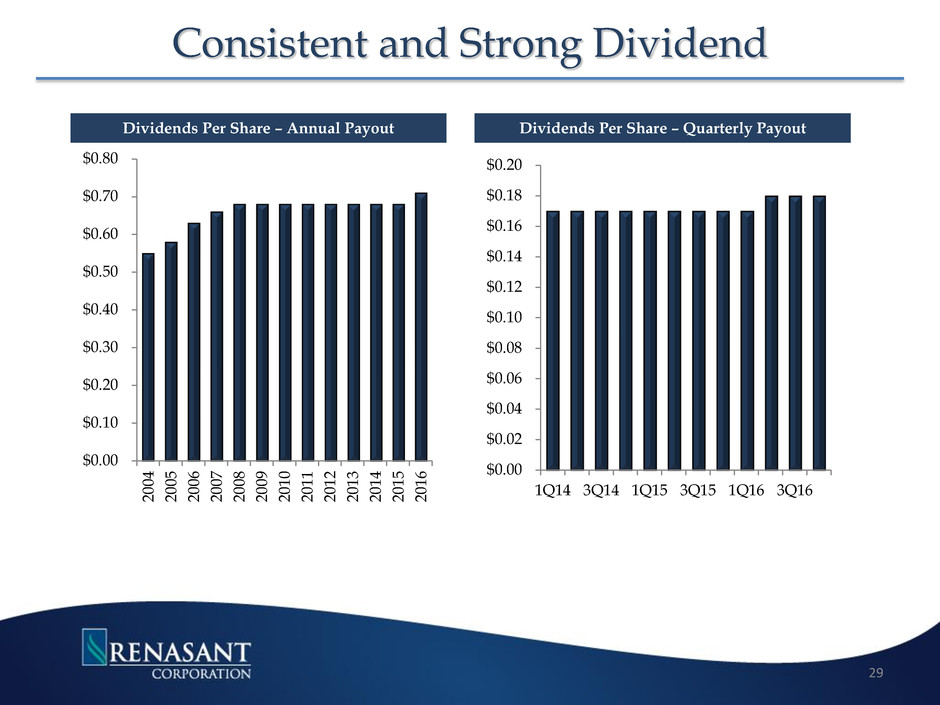

• Maintained dividend throughout economic

downturn

• Regulatory capital ratios are above the minimum

for well-capitalized classification

• Capital level positions the Company for future

growth and geographic expansion

• Did not participate in the TARP program

• Raised $98.2M of subordinated notes in Q3 2016

• Raised $84.1M of common equity in Q4 2016

28

* See slide 37 for reconciliation of Non-GAAP disclosure to GAAP

29

Dividends Per Share – Annual Payout

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

200

4

200

5

200

6

2

0

0

7

200

8

200

9

201

0

201

1

201

2

201

3

201

4

201

5

201

6

Consistent and Strong Dividend

$0.00

$0.02

$0.04

$0.06

$0.08

$0.10

$0.12

$0.14

$0.16

$0.18

$0.20

1Q14 3Q14 1Q15 3Q15 1Q16 3Q16

Dividends Per Share – Quarterly Payout

30

$8.6B franchise well positioned in attractive

markets in the Southeast

Announced merger with Metropolitan

BancGroup, Inc. will add $1.2B in assets,

$888M in deposits and $918M in loans

Strategic focus on expanding footprint

• Acquisition

• De Novo

• New lines of business

Opportunity for further profitability

improvement

Organic loan growth

Core deposit growth

Revenue growth

Declining credit costs

Strong capital position

Consistent dividend payment history

Appendix

31

12.4%

0.3% 0.5%

1.5% 1.0%

17.3%

6.2%

7.1%

0.9%

0.0%

5.0%

10.0%

15.0%

20.0%

Ch

am

be

rs

Je

ffe

rs

on Le

e

M

ad

iso

n

M

on

tg

om

er

y

M

or

ga

n

Sh

elb

y

Ta

lla

de

ga

Tu

sc

al

oo

sa

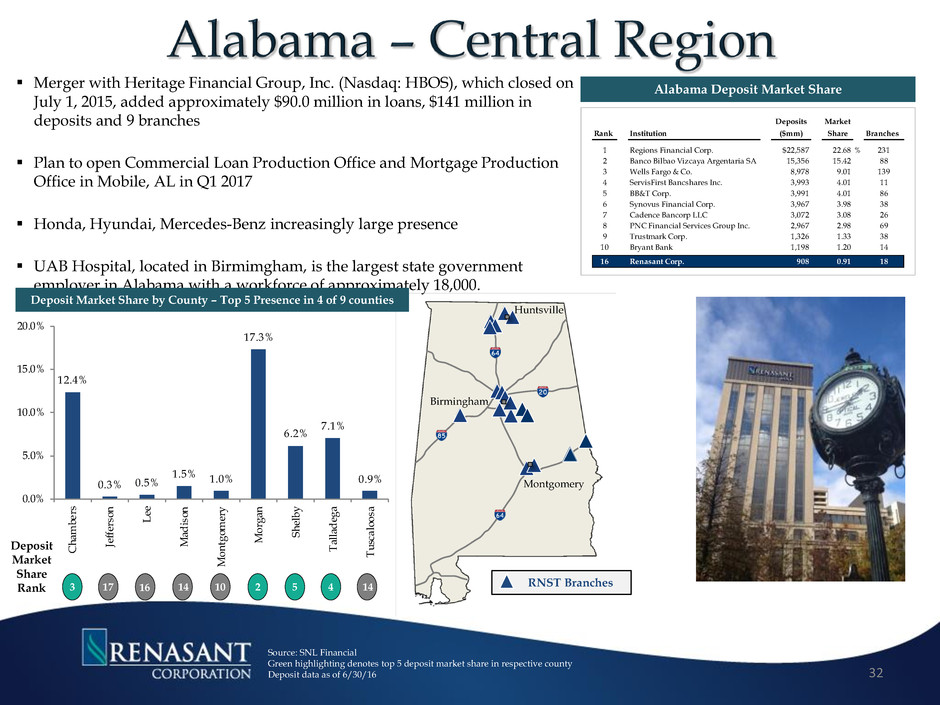

Merger with Heritage Financial Group, Inc. (Nasdaq: HBOS), which closed on

July 1, 2015, added approximately $90.0 million in loans, $141 million in

deposits and 9 branches

Plan to open Commercial Loan Production Office and Mortgage Production

Office in Mobile, AL in Q1 2017

Honda, Hyundai, Mercedes-Benz increasingly large presence

UAB Hospital, located in Birmimgham, is the largest state government

employer in Alabama with a workforce of approximately 18,000.

Montgomery

Huntsville

Birmingham

32

Deposit Market Share by County – Top 5 Presence in 4 of 9 counties

3 5 4 2

Deposit

Market

Share

Rank 16 17 10 14 14

Alabama Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

RNST Branches

Deposits Market

Rank Institution ($mm) Share Branches

1 Regions Financial Corp. $22,587 22.68 % 231

2 Banco Bilbao Vizcaya Argentaria SA 15,356 15.42 88

3 Wells Fargo & Co. 8,978 9.01 139

4 ServisFirst Bancshares Inc. 3,993 4.01 11

5 BB&T Corp. 3,991 4.01 86

6 Synovus Financial Corp. 3,967 3.98 38

7 Cadence Bancorp LLC 3,072 3.08 26

8 PNC Financial Services Group Inc. 2,967 2.98 69

9 Trustmark Corp. 1,326 1.33 38

10 Bryant Bank 1,198 1.20 14

16 Renasant Corp. 908 0.91 18

Jacksonville

Miami

Tallahassee

Tampa

Orlando

RNST Branches

10

10

95

Gainesville

Ocala

Entered the Florida market through the acquisition of HBOS

Moved into FL with 8 full-services branches along I-75

Plan to expand Mortgage Production Offices throughout Florida in 2017

Florida has the fourth largest economy in the United States

The unemployment rate in Florida is 4.90%, with job growth of 1.71%. Future job

growth over the next ten years is predicted to be 38.52%.

33

Deposit Market Share by County – Top 5 Presence in 0 of 3 counties

Deposit

Market

Share

Rank

10

Florida Deposit Market Share

6 11

Source: SNL Financial

Deposit data as of 6/30/16

2.2%

2.5%

2.0%

0.0%

1.0%

2.0%

3.0%

4.0%

Alachua Columbia Marion

Deposits Market

Rank Institution ($mm) Share Branches

1 Bank of America Corp. $102,957 19.18 % 573

2 Wells Fargo & Co. 79,086 14.73 648

3 SunTrust Banks Inc. 48,251 8.99 484

4 JPMorgan Chase & Co. 28,837 5.37 397

5 TIAA Board of Overseers 18,934 3.53 12

6 Regions Financial Corp. 18,817 3.51 347

7 BB&T Corp. 17,509 3.26 322

8 Citigroup Inc. 16,531 3.08 54

9 BankUnited Inc. 14,951 2.79 96

10 Raymond James Financial Inc. 14,241 2.65 1

129 Renasant Corp. 226 0.04 8

4

Entered the North GA market through two FDIC loss share transactions

12 full-service locations

Expanded services include mortgage and wealth management personnel

Grew GA presence by completing acquisition of Heritage Financial Group, Inc. ($1.7 billion in assets)

Added 20 full-service branches and 4 mortgage offices

Significantly ramps up our mortgage division

Enhanced GA presence by acquisition of KeyWorth Bank ($399 million in assets), which closed on April 1, 2016

Approximately $284 million in loans, $347 million in deposits, and 4 full-service branches

Company’s Small Business Administration, Middle Market Commercial and Asset Based Lending

teams are headquartered in Atlanta, GA.

34

Deposit Market Share by County – Top 5 Presence in 10 of 22 counties

5 6 9 7

Deposit

Market

Share

Rank

4 25 1 12 13 3

Georgia Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

4 11 15 22 2 16 2 4 13

Atlanta

Savannah

Albany

11.6%

7.2%

1.3%

12.4%

0.5%

4.9%

0.0%

20.7%

0.4%

21.4%

26.9%

2.2%

0.3% 0.9%

25.6%

10.8%

2.2%

0.0%

13.3%

9.1%

1.1%

15.4%

0.0%

8.0%

16.0%

24.0%

32.0%

Ap

plin

g

Bar

tow Bib

b

Bul

loc

h

Ch

ath

am

Ch

ero

kee Cob

b

Coo

k

DeK

alb

Do

ugh

erty

Eff

ing

ham

For

syt

h

Ful

ton

Gw

inn

ett

Jeff

Da

vis Lee

Low

nde

s

Mu

sco

gee

Pic

ken

s

Tat

tna

ll

Tro

up

Wo

rth

4 2 20

RNST Branches

Deposits Market

Rank Institution ($mm) Share Branches

1 SunTrust Banks Inc. $49,481 19.94 % 243

2 Wells Fargo & Co. 35,245 14.21 278

3 Bank of America Corp. 32,878 13.25 172

4 Synchrony Financial 22,707 9.15 1

5 Synovus Financial Corp. 13,788 5.56 116

6 BB&T Corp. 12,369 4.99 157

7 Regions Financial Corp. 5,868 2.37 129

8 United Community Banks Inc. 5,348 2.16 70

9 Bank of the Ozarks Inc. 4,031 1.62 73

10 Royal Bank of Canada 3,434 1.38 2

18 Renasant Corp. 1,739 0.70 37

Macon

35

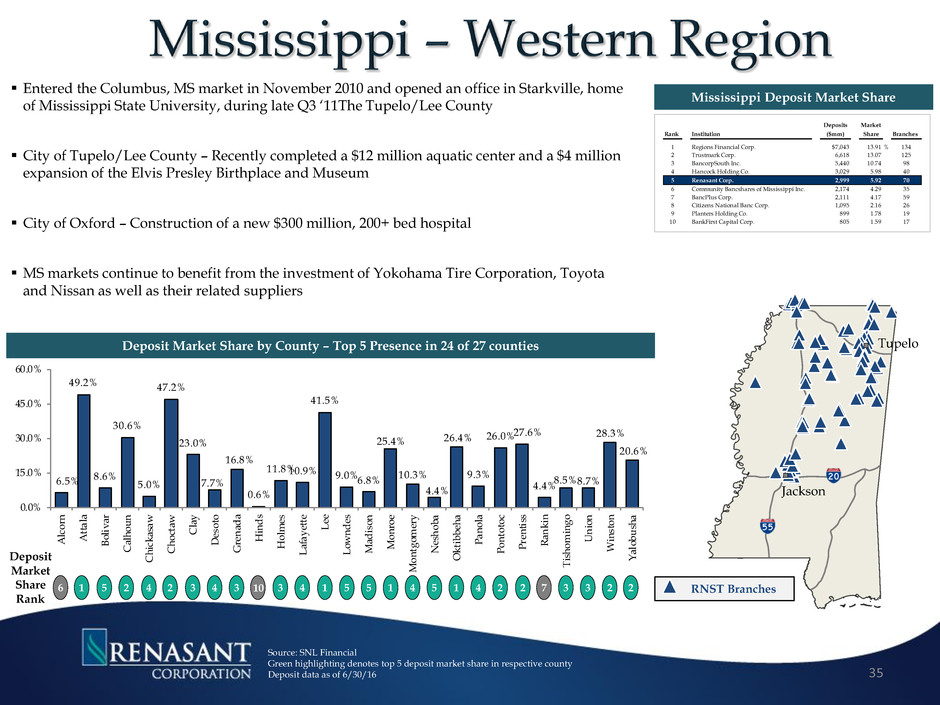

Deposit Market Share by County – Top 5 Presence in 24 of 27 counties

6 1

Entered the Columbus, MS market in November 2010 and opened an office in Starkville, home

of Mississippi State University, during late Q3 ‘11The Tupelo/Lee County

City of Tupelo/Lee County – Recently completed a $12 million aquatic center and a $4 million

expansion of the Elvis Presley Birthplace and Museum

City of Oxford – Construction of a new $300 million, 200+ bed hospital

MS markets continue to benefit from the investment of Yokohama Tire Corporation, Toyota

and Nissan as well as their related suppliers

5 2 4 2 3 4 3

Deposit

Market

Share

Rank

2 3 4 1 5 5 1 4 5 1 4 2 7 3 3 2 2 10

Mississippi Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

RNST Branches

Tupelo

Jackson

6.5%

49.2%

8.6%

30.6%

5.0%

47.2%

23.0%

7.7%

16.8%

0.6%

11.8%10.9%

41.5%

9.0%

6.8%

25.4%

10.3%

4.4%

26.4%

9.3%

26.0%27.6%

4.4%

8.5%8.7%

28.3%

20.6%

0.0%

15.0%

30.0%

45.0%

60.0%

Alc

orn Atta

la

Boli

var

Cal

hou

n

Chi

cka

saw

Cho

ctaw Cla

y

Des

oto

Gre

nad

a

Hin

ds

Hol

mes

Lafa

yett

e Lee

Low

nde

s

Mad

ison

Mo

nro

e

Mo

ntg

ome

ry

Nes

hob

a

Okt

ibbe

ha

Pan

ola

Pon

toto

c

Pre

ntis

s

Ran

kin

Tish

om

ingo Uni

on

Win

ston

Yal

obu

sha

Deposits Market

Rank Institution ($mm) Share Branches

1 Regions Financial Corp. $7,043 13.91 % 134

2 Trustmark Corp. 6,618 13.07 125

3 BancorpSouth Inc. 5,440 10.74 98

4 Hancock Holding Co. 3,029 5.98 40

5 Renasant Corp. 2,999 5.92 70

6 Community Bancshares of Mississippi Inc. 2,174 4.29 35

7 BancPlus Corp. 2,111 4.17 59

8 Citizens National Banc Corp. 1,095 2.16 26

9 Planters Holding Co. 899 1.78 19

10 BankFirst Capital Corp. 805 1.59 17

Our Tennessee Operations

The Knoxville/Maryville MSA location opened in late Q2 ‘12

East Tennessee operations currently have 4 full-service branches, $255

million in loans and $107 million in deposits

New lending teams added in both Memphis and Nashville during 2013

New Healthcare Lending Group added in Nashville during 2015

Economic development and site selector magazine Business Facilities named

Tennessee its 2014 “State of the Year” pointing to its emphasis on infrastructure

and educations supportive to companies’ growth.

In 2013, Nashville ranked No. 5 on Forbes’ list of the Best Places for Business and

Careers.

36

Deposit Market Share by County – Top 5 Presence in 1 of 8 counties

Deposit

Market

Share

Rank

3 11 15 13 17 9

Tennessee Deposit Market Share

12 22

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

In 2015, Business Facilities’ 11Annual Rankings report named Nashville the

number one city for Economic Growth Potential.

Nashville ranks third in the country based on the rate of growth of the gross

metropolitan product, or GMP.

As of 2014, Memphis was the home of three Fortune 500 companies: FedEx (no.

63), International Paper (no. 107), and AutoZone (no. 306).

Nashville

Knoxville

Memphis

RNST Branches

40

2.4%

11.3%

1.1% 1.2% 0.6%

1.5%

2.5%

0.5%

0.0%

3.0%

6.0%

9.0%

12.0%

Bl

ou

nt

Cr

oc

ke

tt

Da

vi

ds

on

Sh

elb

y

Su

lli

va

n

Su

m

ne

r

W

as

hi

ng

to

n

W

ill

iam

so

n

Deposits Market

Rank Institution ($mm) Share Branches

1 First Horizon National Corp. $19,774 14.29 % 152

2 Regions Financial Corp. 17,748 12.82 236

3 SunTrust Banks Inc. 13,436 9.71 138

4 Bank of America Corp. 10,929 7.90 57

5 Pinnacle Financial Partners Inc. 8,297 5.99 45

6 U.S. Bancorp 2,941 2.12 104

7 BB&T Corp. 2,419 1.75 49

8 Franklin Financial Network Inc. 2,365 1.71 14

9 FB Financial Corp 2,316 1.67 48

10 Wells Fargo & Co. 1,941 1.40 19

23 Renasant Corp. 835 0.60 15

37

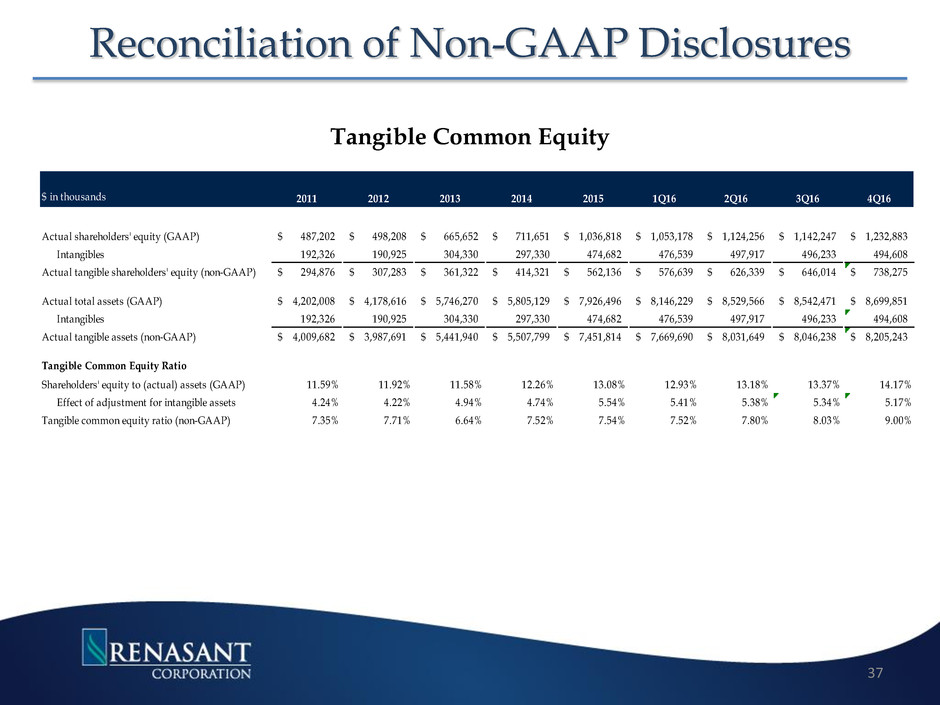

2011 2012 2013 2014 2015 1Q16 2Q16 3Q16 4Q16

Actual shareholders' equity (GAAP) 487,202$ 498,208$ 665,652$ 711,651$ 1,036,818$ 1,053,178$ 1,124,256$ 1,142,247$ 1,232,883$

Intangibles 192,326 190,925 304,330 297,330 474,682 476,539 497,917 496,233 494,608

294,876$ 307,283$ 361,322$ 414,321$ 562,136$ 576,639$ 626,339$ 646,014$ 738,275$

Actual total assets (GAAP) 4,202,008$ 4,178,616$ 5,746,270$ 5,805,129$ 7,926,496$ 8,146,229$ 8,529,566$ 8,542,471$ 8,699,851$

Intangibles 192,326 190,925 304,330 297,330 474,682 476,539 497,917 496,233 494,608

Actual tangible assets (non-GAAP) 4,009,682$ 3,987,691$ 5,441,940$ 5,507,799$ 7,451,814$ 7,669,690$ 8,031,649$ 8,046,238$ 8,205,243$

Tangible Common Equity Ratio

11.59% 11.92% 11.58% 12.26% 13.08% 12.93% 13.18% 13.37% 14.17%

Effect of adjustment for intangible assets 4.24% 4.22% 4.94% 4.74% 5.54% 5.41% 5.38% 5.34% 5.17%

7.35% 7.71% 6.64% 7.52% 7.54% 7.52% 7.80% 8.03% 9.00%

$ in thousands

Shareholders' equity to (actual) assets (GAAP)

Actual tangible shareholders' equity (non-GAAP)

Tangible common equity ratio (non-GAAP)

Tangible Common Equity

Reconciliation of Non-GAAP Disclosures

38

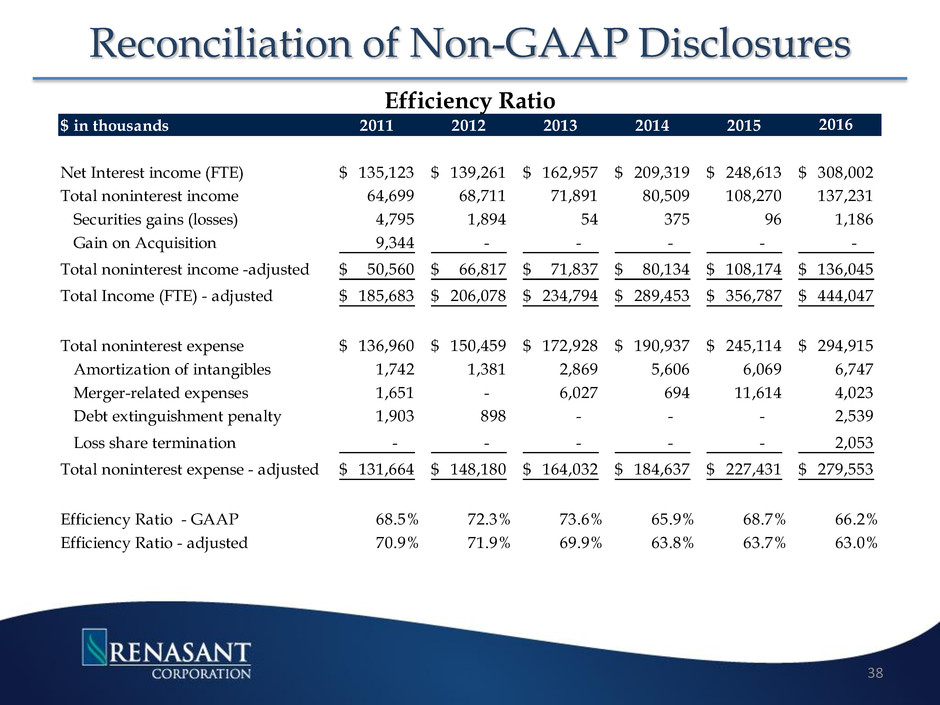

$ in thousands 2011 2012 2013 2014 2015 2016

Net Interest income (FTE) 135,123$ 139,261$ 162,957$ 209,319$ 248,613$ 308,002$

Total noninterest income 64,699 68,711 71,891 80,509 108,270 137,231

Securities gains (losses) 4,795 1,894 54 375 96 1,186

Gain on Acquisition 9,344 - - - - -

Total noninterest income -adjusted 50,560$ 66,817$ 71,837$ 80,134$ 108,174$ 136,045$

Total Income (FTE) - adjusted 185,683$ 206,078$ 234,794$ 289,453$ 356,787$ 444,047$

Total noninterest expense 136,960$ 150,459$ 172,928$ 190,937$ 245,114$ 294,915$

Amortization of intangibles 1,742 1,381 2,869 5,606 6,069 6,747

Merger-related expenses 1,651 - 6,027 694 11,614 4,023

Debt extinguishment penalty 1,903 898 - - - 2,539

Loss share termination - - - - - 2,053

Total noninterest expense - adjusted 131,664$ 148,180$ 164,032$ 184,637$ 227,431$ 279,553$

Efficiency Ratio - GAAP 68.5% 72.3% 73.6% 65.9% 68.7% 66.2%

Efficiency Ratio - adjusted 70.9% 71.9% 69.9% 63.8% 63.7% 63.0%

Reconciliation of Non-GAAP Disclosures

Efficiency Ratio

39

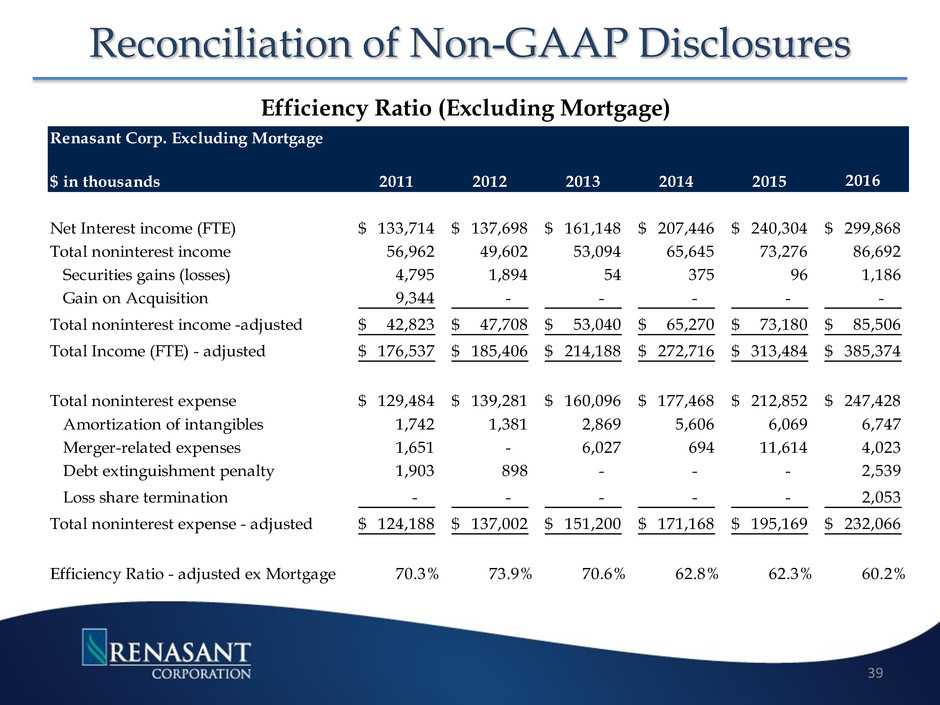

Renasant Corp. Excluding Mortgage

$ in thousands 2011 2012 2013 2014 2015 2016

Net Interest income (FTE) 133,714$ 137,698$ 161,148$ 207,446$ 240,304$ 299,868$

Total noninterest income 56,962 49,602 53,094 65,645 73,276 86,692

Securities gains (losses) 4,795 1,894 54 375 96 1,186

Gain on Acquisition 9,344 - - - - -

Total noninterest income -adjusted 42,823$ 47,708$ 53,040$ 65,270$ 73,180$ 85,506$

Total Income (FTE) - adjusted 176,537$ 185,406$ 214,188$ 272,716$ 313,484$ 385,374$

Total noninterest expense 129,484$ 139,281$ 160,096$ 177,468$ 212,852$ 247,428$

Amortization of intangibles 1,742 1,381 2,869 5,606 6,069 6,747

Merger-related expenses 1,651 - 6,027 694 11,614 4,023

Debt extinguishment penalty 1,903 898 - - - 2,539

Loss share termination - - - - - 2,053

Total noninterest expense - adjusted 124,188$ 137,002$ 151,200$ 171,168$ 195,169$ 232,066$

Efficiency Ratio - adjusted ex Mortgage 70.3% 73.9% 70.6% 62.8% 62.3% 60.2%

Efficiency Ratio (Excluding Mortgage)

Reconciliation of Non-GAAP Disclosures

Renasant intends to file a registration statement on Form S-4 that will include a proxy statement for Metropolitan and a

prospectus of Renasant, and Renasant will file relevant documents concerning the merger with the Securities and

Exchange Commission (the “SEC”). This presentation does not constitute an offer to sell or the solicitation of an offer to buy

any securities. METROPOLITAN INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND

ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR

INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT RENASANT, METROPOLITAN AND THE PROPOSED MERGER. When

available, the proxy statement/prospectus will be mailed to stockholders of Metropolitan. Investors will also be able to obtain

copies of the proxy statement/prospectus and other relevant documents (when they become available) free of charge at the

SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by Renasant will be available free of charge from

Kevin Chapman, Executive Vice President and Chief Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo,

Mississippi 38804-4827, telephone: (662) 680-1450.

40

E. Robinson McGraw

Chairman and

Chief Executive Officer

Kevin D. Chapman

Executive Vice President and

Chief Financial Officer

209 TROY STREET

TUPELO, MS 38804-4827

PHONE: 1-800-680-1601

FACSIMILE: 1-662-680-1234

WWW.RENASANT.COM

WWW.RENASANTBANK.COM

41