Attached files

| file | filename |

|---|---|

| EX-99.2 - EARNINGS CALL TRANSCRIPT, DATED FEBRUARY 6, 2017 - PARK CITY GROUP INC | ex99-2.htm |

| 8-K - FORM 8-K - PARK CITY GROUP INC | pcyg8k_feb62017.htm |

Exhibit

99.1

Park

City Group Reports Fiscal Second Quarter 2017 Results

35% Year-Over-Year Revenue Growth, Profitability Continues to

Scale

Adoption Accelerated with Annual Connection Goal Achieved in Six

Months

ReposiTrak Increasingly Recognized as the Industry’s Food

Safety and Compliance Solution

SALT LAKE CITY, UT – February 6,

2017 – Park

City Group (NASDAQ: PCYG), a cloud-based software company that uses

big data management to help retailers and their suppliers

‘sell

more, stock less and see everything’, today announced

results for its fiscal second quarter ended December 31,

2016.

Strategic

and Financial Highlights:

●

Fiscal second quarter revenue increased 35%

year-over-year, reaching a record $4.8 million. “We

continue to see strong revenue growth driven by demand for our new

applications including ReposiTrak and our Vendor Portal,”

said Randall K. Fields, Park City Group’s Chairman and CEO.

“Total revenue was $4.8 million, our largest quarter ever,

and an increase of 35% year over year, while revenue in the first

half was $9 million, an increase of 36% from $6.6 million last

year.”

●

Net income was a record $1.4 million with

incremental contribution margin exceeding 75%. “With

net income margin of 29%, we continued to generate improving

operating leverage in the second quarter. We are capitalizing on

past investments in processes and technology, and the convergence

of our businesses,” said Mr. Fields. “Given the

benefits we are seeing to execution and profitability; we are

planning another round of infrastructure enhancements to handle our

expected growth.”

●

Burgeoning customer network and accelerating

connections reflect growing mandate. “During the

quarter, we added new large retail customers to our network and

launched applications that enhance our value proposition,”

said Mr. Fields. “Our growing network puts us in touch with

more and more industry participants. At the same time, improvements

in our processes are allowing us to onboard suppliers at an

accelerating rate, enabling our HUBs to achieve higher levels of

compliance even faster."

●

ReposiTrak positioned as industry’s

leading compliance management platform. “Food safety

enjoys broad, bi-partisan support and existing regulations under

the new Food Safety Modernization Act have not been impacted by the

new administration’s regulatory position,” said Mr.

Fields. “In addition to being the standard food safety

solution, ReposiTrak is increasingly being viewed as a broader

platform for overall compliance and risk management. Integration

with SQF has made us the leading platform for food safety audits,

and we are becoming deeply imbedded in our customers’

business processes.”

●

Expanded applications and business convergence

provide support for multi-year growth. “The

convergence of our business has created greater opportunities and

increasing demand for our supply-chain services,” said Mr.

Fields. “In addition to strong demand for our Vendor Portal,

which is a unified service delivery platform, we are making a

series of significant new product introductions that enhance our

offering and which will make us increasingly important to our

customers.”

●

Outlook for continued positive financial

momentum in fiscal 2017. “Looking forward, we expect

revenue and profitability in the second half of the fiscal year to

be stronger than the first half,” said Mr. Fields. “We

have already exceeded our fiscal 2017 goal of doubling supplier

connections, and we are seeing this momentum translate into

accelerated revenue growth and operating leverage. As a result, we

are confident that fiscal 2017 will be a record year, by a

substantial margin.”

Financial

Results Summary:

Fiscal Second Quarter 2017 Results:

Total revenue increased 35% to $4.8 million for the three months

ended December 31, 2016, as compared to $3.5 million during the

same period a year ago. Total operating expenses were $3.4 million,

a 4% increase from $3.3 million a year ago. Net income for the quarter was $1.4 million, versus

$281,000 a year ago, and net income to common shareholders

for the quarter was $1.2 million, or $0.06 per common share, as

compared to $111,000, or $0.01 per share, a year ago.

Fiscal 2017 Year-to-Date Results: Total

revenue increased 36% to $9.0 million for the first six months of

fiscal 2017, as compared to $6.6 million during the same period a

year ago. Total operating expenses were $6.9 million, a 2% increase

from $6.8 million a year ago. Net

income for the first six months of fiscal 2017 was $2 million,

versus a loss of ($126,000) a year ago, and net income to

common shareholders was $1.6 million, or $0.08 per share, versus a

loss of ($496,000), or ($0.03) per share, a year ago.

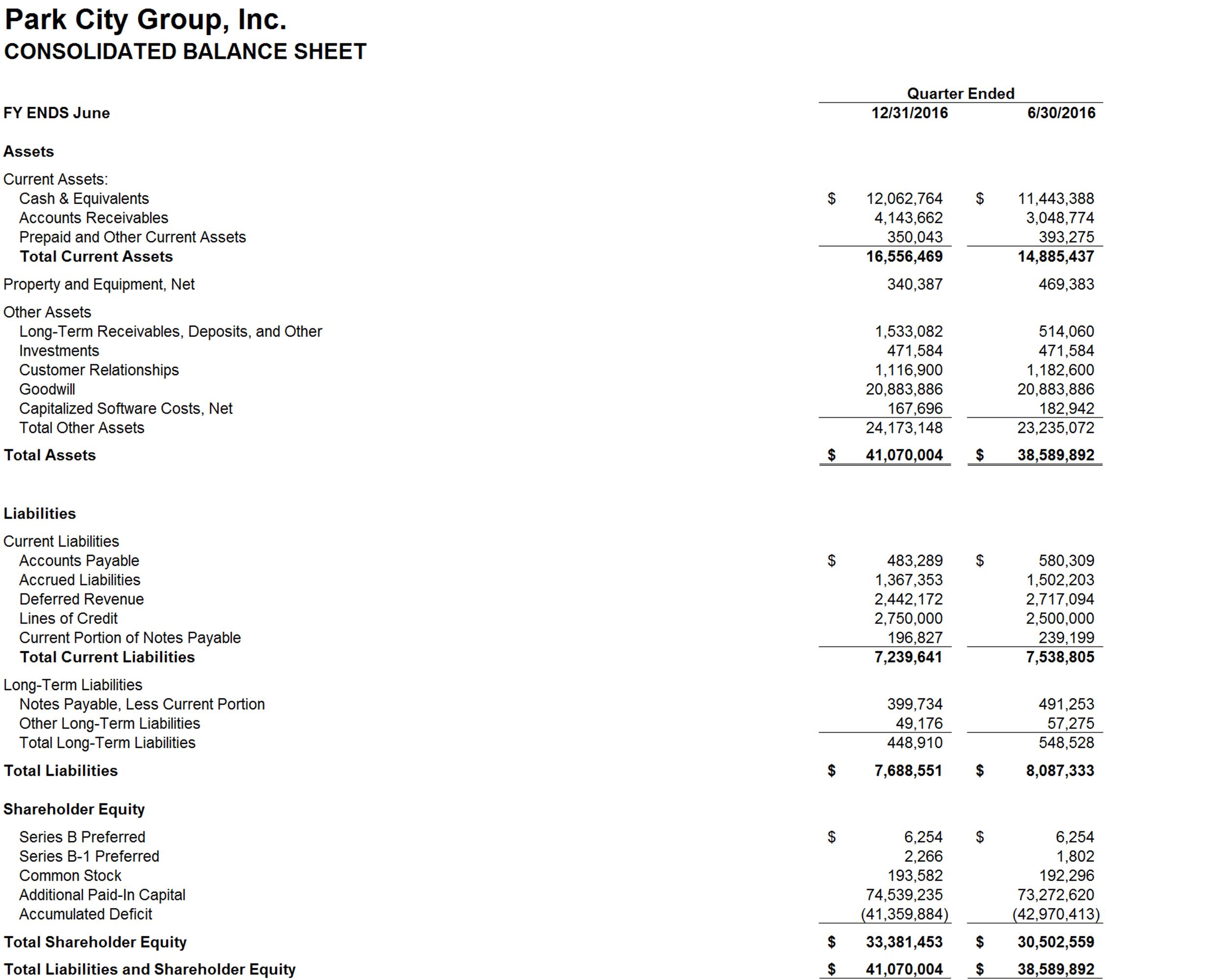

Cash and Liquidity: The Company ended

the fiscal second quarter of 2017 with $12.1 million in cash and

cash equivalents, versus $11.4 million at the end of the fiscal

2016.

Conference

Call:

The

Company will host a conference call at 4:15 P.M. Eastern today,

February 6, 2017 to discuss the results. Investors and interested parties may

participate in the call by dialing 1-877-879-6217 and referring to Conference ID: 4426539

The conference call is also being webcast and is available via the

investor relations section of the Company’s website,

www.parkcitygroup.com.

About

Park City Group:

Park

City Group (PCYG) is a Software-as-a-Service (“SaaS”)

provider that brings unique visibility to the consumer goods supply

chain, delivering actionable information to ensure products are

available when and where consumers demand them, helping retailers

and suppliers to ‘Sell More, Stock

Less, and See Everything’. Park City Group’s

technology also assists all participants in the food and drug

supply chains to comply with food and drug safety regulations

through the Company’s ReposiTrak subsidiary. More information

is available at www.parkcitygroup.com

and www.repositrak.com.

Specific disclosure

relating to Park City Group, including management’s analysis

of results from operations and financial condition, are contained

in the Company’s quarterly report on Form 10-Q for the

quarter ended December 31, 2016 and other reports filed with the

Securities and Exchange Commission. Investors are encouraged

to read and consider such disclosure and analysis contained in the

Company’s Form 10-Q and other reports, including the risk

factors contained in the Form 10-Q.

Investor

Relations Contact:

Jeff

Elliott

Three

Part Advisors, LLC

972-423-7070

Dave

Mossberg

Three

Part Advisors, LLC

817-310-0051

Non-GAAP

Financial Measures

While

this press release does not include non-GAAP financial measures,

the financial presentation below contains certain financial

measures defined as “non-GAAP financial measures” by

the Securities and Exchange Commission, including non-GAAP EBITDA

and non-GAAP earnings per share. These measures may be different

from non-GAAP financial measures used by other companies. The

presentation of this financial information, which is not prepared

under any comprehensive set of accounting rules or principles, is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

generally accepted accounting principles. Reconciliations of these

non-GAAP financial measures to the nearest comparable GAAP measures

will be provided upon the completion of the Company’s annual

audit.

Non-GAAP EBITDA

excludes items such as impairment charges, allowance for doubtful

accounts, non-cash stock based compensation and other one-time cash

and non-cash charges. Non-GAAP EPS excludes items such as non-cash

stock based compensation, amortization of acquired intangible

assets and other one-time cash and non-cash charges. The Company

believes the non-GAAP measures provide useful information to both

management and investors by excluding certain expenses, gains and

losses or net purchases of property and equipment, as the case may

be, which may not be indicative of its core operation results and

business outlook. Because Park City Group has historically reported

certain non-GAAP results to investors, the Company believes that

the inclusion of non-GAAP measures in the financial presentation

below allows investors to compare the Company’s financial

results with the Company’s historical financial results

reported using non-GAAP financial measures, as well as with the

financial results reported by others.

Forward-Looking

Statement

Any

statements contained in this document that are not historical facts

are forward-looking statements as defined in the U.S. Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate,” “believe,”

“estimate,” “expect,”

“forecast,” “intend,” “may,”

“plan,” “project,” “predict,”

“if”, “should” and “will” and

similar expressions as they relate to Park City Group, Inc.

(“Park City Group”) are intended to identify such

forward-looking statements. Park City Group may from time to time

update these publicly announced projections, but it is not

obligated to do so. Any projections of future results of operations

should not be construed in any manner as a guarantee that such

results will in fact occur. These projections are subject to change

and could differ materially from final reported results. For a

discussion of such risks and uncertainties, see “Risk

Factors” in Park City’s annual report on Form 10-K, its

quarterly report on Form 10-Q, and its other reports filed with the

Securities and Exchange Commission under the Securities Exchange

Act of 1934, as amended. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the dates on which they are made.