Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 1Q FY17 EARNINGS RELEASE - NEW JERSEY RESOURCES CORP | form8-kx1qfy17earningsrele.htm |

| EX-99.2 - EXHIBIT 99.2 - PRESENTATION - NEW JERSEY RESOURCES CORP | njr1qfy2017final.htm |

-more-

Date: February 8, 2017

Media Contact: Investor Contacts:

Michael Kinney Joanne Fairechio

732-938-1031 732-378-4967

mkinney@njresources.com jfairechio@njresources.com

- or -

Dennis Puma

732-938-1229

dpuma@njresources.com

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

WALL, N.J. — New Jersey Resources (NYSE: NJR) today reported results for the first quarter of fiscal 2017

and reaffirmed net financial earnings (NFE) guidance for fiscal 2017 of $1.65 to $1.75 per share.

Net income for the first quarter of fiscal 2017 totaled $34.9 million, or $.41 per share, compared with $50.3

million, or $.59 per share, during the same period in fiscal 2016. First-quarter fiscal 2017 NFE totaled $40.4

million, or $.47 per share, compared with $51.3 million, or $.60 per share, during the first quarter of fiscal

2016.

“Our results for the first quarter were consistent with our expectations, and we are confident in our ability to

achieve our fiscal 2017 earnings guidance,” said Laurence M. Downes, chairman and CEO of New Jersey

Resources. “Our outlook is supported by our new base rates, continued customer growth and our growing

portfolio of clean energy assets that will allow us to deliver expected performance this year.”

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 2 of 16

-more-

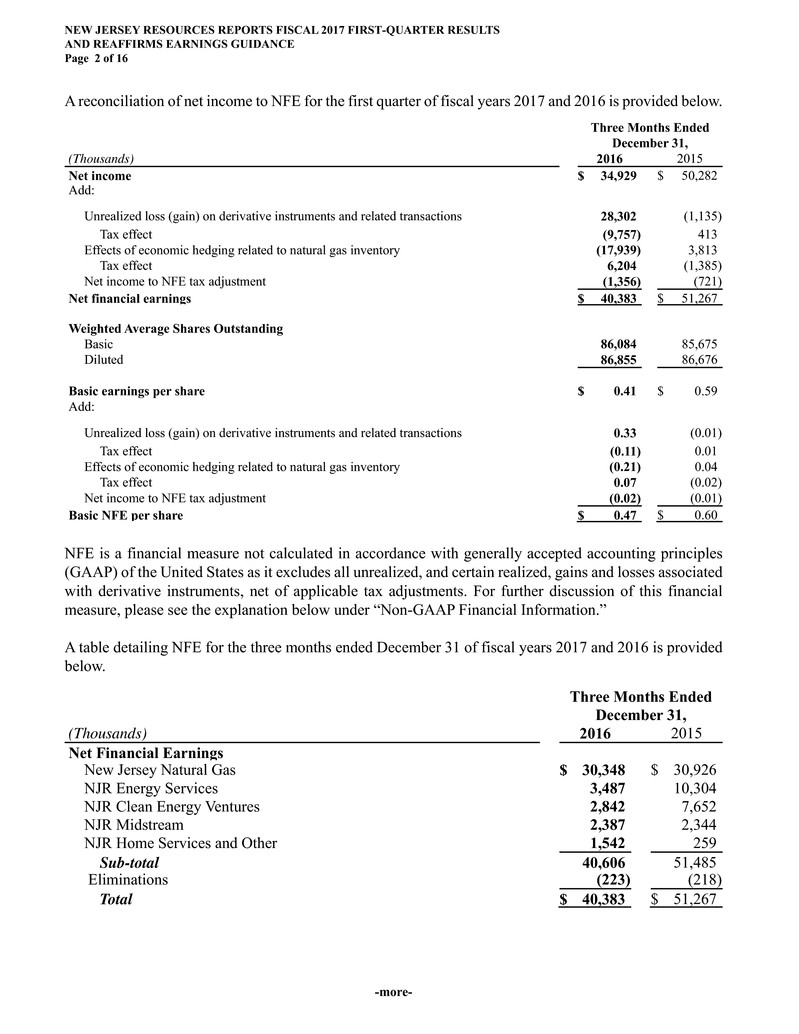

A reconciliation of net income to NFE for the first quarter of fiscal years 2017 and 2016 is provided below.

Three Months Ended

December 31,

(Thousands) 2016 2015

Net income $ 34,929 $ 50,282

Add:

Unrealized loss (gain) on derivative instruments and related transactions 28,302

(1,135)

Tax effect (9,757) 413

Effects of economic hedging related to natural gas inventory (17,939) 3,813

Tax effect 6,204 (1,385)

Net income to NFE tax adjustment (1,356) (721)

Net financial earnings $ 40,383 $ 51,267

Weighted Average Shares Outstanding

Basic 86,084 85,675

Diluted 86,855 86,676

Basic earnings per share $ 0.41 $ 0.59

Add:

Unrealized loss (gain) on derivative instruments and related transactions 0.33

(0.01)

Tax effect (0.11) 0.01

Effects of economic hedging related to natural gas inventory (0.21) 0.04

Tax effect 0.07 (0.02)

Net income to NFE tax adjustment (0.02) (0.01)

Basic NFE per share $ 0.47 $ 0.60

NFE is a financial measure not calculated in accordance with generally accepted accounting principles

(GAAP) of the United States as it excludes all unrealized, and certain realized, gains and losses associated

with derivative instruments, net of applicable tax adjustments. For further discussion of this financial

measure, please see the explanation below under “Non-GAAP Financial Information.”

A table detailing NFE for the three months ended December 31 of fiscal years 2017 and 2016 is provided

below.

Three Months Ended

December 31,

(Thousands) 2016 2015

Net Financial Earnings

New Jersey Natural Gas $ 30,348 $ 30,926

NJR Energy Services 3,487 10,304

NJR Clean Energy Ventures 2,842 7,652

NJR Midstream 2,387 2,344

NJR Home Services and Other 1,542 259

Sub-total 40,606 51,485

Eliminations (223) (218)

Total $ 40,383 $ 51,267

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 3 of 16

-more-

▪ NJR Reaffirms Fiscal 2017 NFE Guidance

NJR reaffirmed fiscal 2017 NFE guidance of $1.65 to $1.75 per share, subject to the risks and uncertainties

identified below under “Forward-Looking Statements.” In providing fiscal 2017 NFE guidance,

management is aware there could be differences between reported GAAP earnings and NFE due to matters

such as, but not limited to, the positions of our energy-related derivatives. Management is not able to

reasonably estimate the aggregate impact of these items on reported earnings and, therefore, is not able to

provide a reconciliation to the corresponding GAAP equivalent for its operating earnings guidance without

unreasonable efforts.

NJR expects its regulated businesses to generate between 60 to 75 percent of total NFE, with New Jersey

Natural Gas (NJNG) continuing to be the largest contributor. The following chart represents NJR’s current

expected contributions from its subsidiaries for fiscal 2017:

Company

Expected Fiscal 2017

Net Financial Earnings Contribution

New Jersey Natural Gas 55 to 65 percent

NJR Midstream 5 to 10 percent

Total Regulated 60 to 75 percent

NJR Clean Energy Ventures 15 to 25 percent

NJR Energy Services 5 to 15 percent

NJR Home Services 1 to 3 percent

▪ New Jersey Natural Gas Reports Steady Performance; Expects Solid Year-Over-Year Growth

NJNG, the company’s regulated utility, reported first-quarter fiscal 2017 NFE of $30.3 million, compared

with $30.9 million during the same period in fiscal 2016. The modestly lower results were driven primarily

by lower Basic Gas Service Supply (BGSS) incentive margin and higher operating and maintenance

expenses, which were mostly offset by increases in utility gross margin from higher base rates and customer

growth.

Through our Conservation Incentive Program (CIP) rate mechanism, which insulates the company from

declines in utility gross margin related to weather and customer usage, NJNG earns gross margin on the

basis of throughput. As such, approximately 65 percent of utility firm gross margin is earned during the

heating season of November through March. NJNG generated 28 percent of its utility gross margin during

the first quarter. NJNG typically earns approximately 42 percent of its utility gross margin during the second

fiscal quarter. As a result, the majority of the benefit of the base rate case will be realized in the second fiscal

quarter.

For fiscal 2017, using the midpoint of our guidance range for NJNG, compared with the prior year’s

financial results, we expect to achieve year-over-year NFE growth of approximately 10 to 15 percent.

During the first quarter of fiscal 2017, NJNG added 1,866 new customers compared with 2,046 during the

same period of fiscal 2016. The slightly lower customer additions, compared with the prior year, reflects

timing associated with adding planned residential conversion customers. For fiscal 2017, NJNG plans to

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 4 of 16

-more-

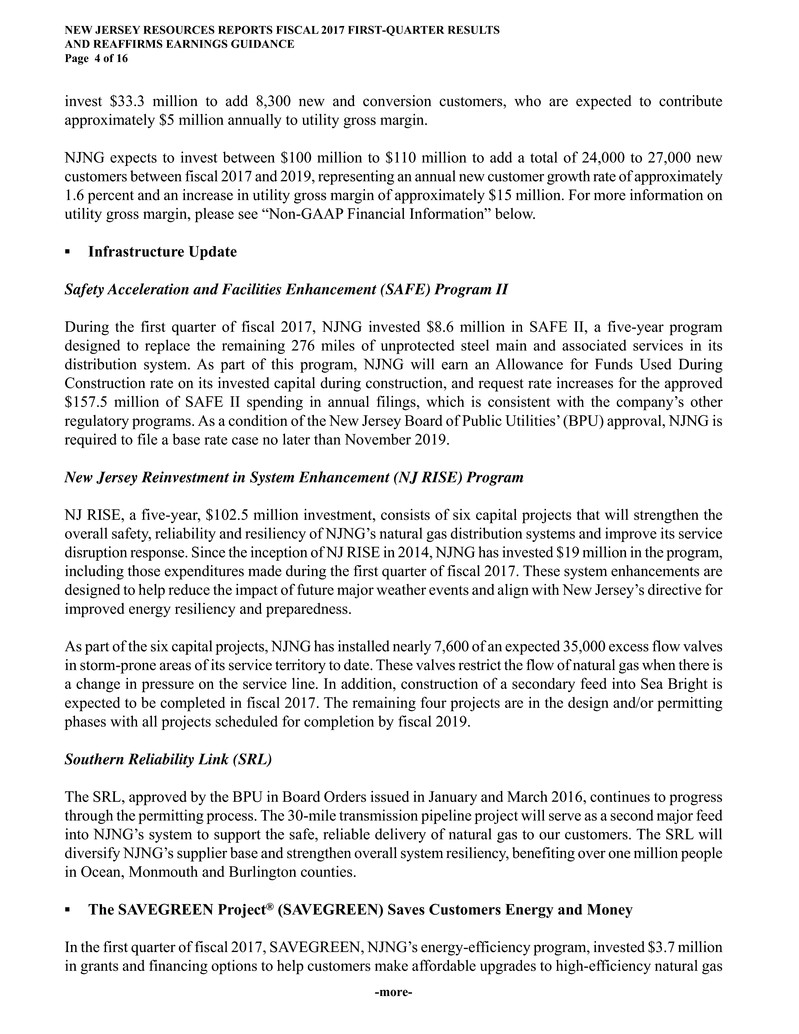

invest $33.3 million to add 8,300 new and conversion customers, who are expected to contribute

approximately $5 million annually to utility gross margin.

NJNG expects to invest between $100 million to $110 million to add a total of 24,000 to 27,000 new

customers between fiscal 2017 and 2019, representing an annual new customer growth rate of approximately

1.6 percent and an increase in utility gross margin of approximately $15 million. For more information on

utility gross margin, please see “Non-GAAP Financial Information” below.

▪ Infrastructure Update

Safety Acceleration and Facilities Enhancement (SAFE) Program II

During the first quarter of fiscal 2017, NJNG invested $8.6 million in SAFE II, a five-year program

designed to replace the remaining 276 miles of unprotected steel main and associated services in its

distribution system. As part of this program, NJNG will earn an Allowance for Funds Used During

Construction rate on its invested capital during construction, and request rate increases for the approved

$157.5 million of SAFE II spending in annual filings, which is consistent with the company’s other

regulatory programs. As a condition of the New Jersey Board of Public Utilities’ (BPU) approval, NJNG is

required to file a base rate case no later than November 2019.

New Jersey Reinvestment in System Enhancement (NJ RISE) Program

NJ RISE, a five-year, $102.5 million investment, consists of six capital projects that will strengthen the

overall safety, reliability and resiliency of NJNG’s natural gas distribution systems and improve its service

disruption response. Since the inception of NJ RISE in 2014, NJNG has invested $19 million in the program,

including those expenditures made during the first quarter of fiscal 2017. These system enhancements are

designed to help reduce the impact of future major weather events and align with New Jersey’s directive for

improved energy resiliency and preparedness.

As part of the six capital projects, NJNG has installed nearly 7,600 of an expected 35,000 excess flow valves

in storm-prone areas of its service territory to date. These valves restrict the flow of natural gas when there is

a change in pressure on the service line. In addition, construction of a secondary feed into Sea Bright is

expected to be completed in fiscal 2017. The remaining four projects are in the design and/or permitting

phases with all projects scheduled for completion by fiscal 2019.

Southern Reliability Link (SRL)

The SRL, approved by the BPU in Board Orders issued in January and March 2016, continues to progress

through the permitting process. The 30-mile transmission pipeline project will serve as a second major feed

into NJNG’s system to support the safe, reliable delivery of natural gas to our customers. The SRL will

diversify NJNG’s supplier base and strengthen overall system resiliency, benefiting over one million people

in Ocean, Monmouth and Burlington counties.

▪ The SAVEGREEN Project® (SAVEGREEN) Saves Customers Energy and Money

In the first quarter of fiscal 2017, SAVEGREEN, NJNG’s energy-efficiency program, invested $3.7 million

in grants and financing options to help customers make affordable upgrades to high-efficiency natural gas

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 5 of 16

-more-

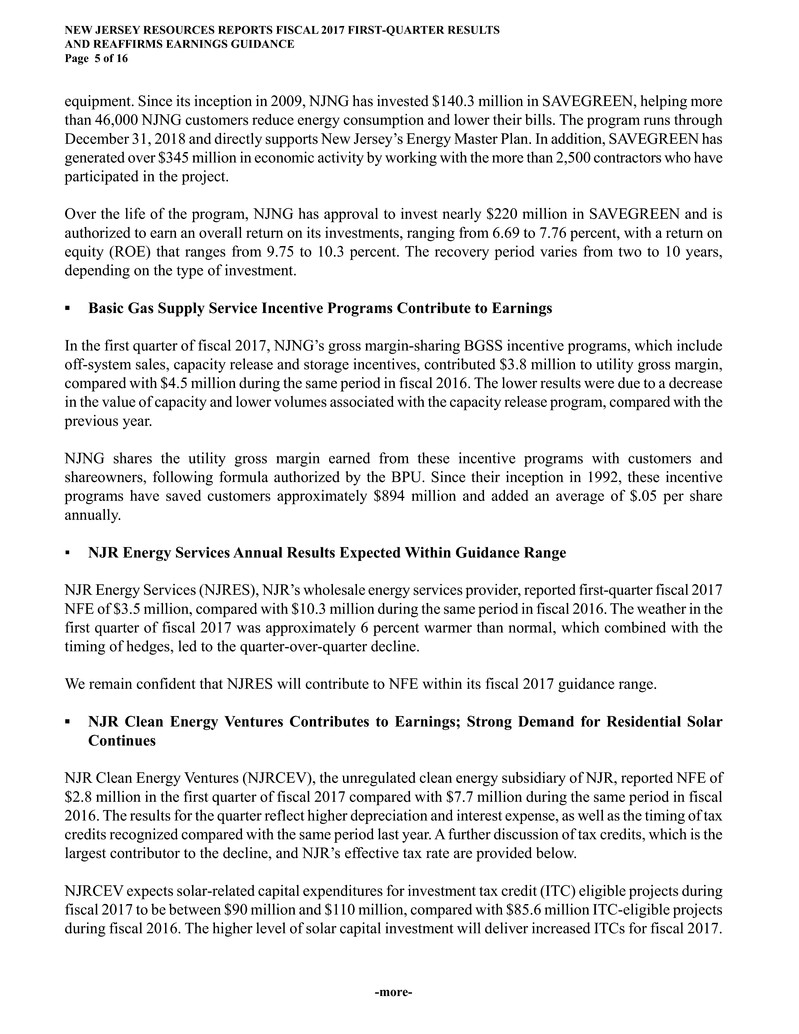

equipment. Since its inception in 2009, NJNG has invested $140.3 million in SAVEGREEN, helping more

than 46,000 NJNG customers reduce energy consumption and lower their bills. The program runs through

December 31, 2018 and directly supports New Jersey’s Energy Master Plan. In addition, SAVEGREEN has

generated over $345 million in economic activity by working with the more than 2,500 contractors who have

participated in the project.

Over the life of the program, NJNG has approval to invest nearly $220 million in SAVEGREEN and is

authorized to earn an overall return on its investments, ranging from 6.69 to 7.76 percent, with a return on

equity (ROE) that ranges from 9.75 to 10.3 percent. The recovery period varies from two to 10 years,

depending on the type of investment.

▪ Basic Gas Supply Service Incentive Programs Contribute to Earnings

In the first quarter of fiscal 2017, NJNG’s gross margin-sharing BGSS incentive programs, which include

off-system sales, capacity release and storage incentives, contributed $3.8 million to utility gross margin,

compared with $4.5 million during the same period in fiscal 2016. The lower results were due to a decrease

in the value of capacity and lower volumes associated with the capacity release program, compared with the

previous year.

NJNG shares the utility gross margin earned from these incentive programs with customers and

shareowners, following formula authorized by the BPU. Since their inception in 1992, these incentive

programs have saved customers approximately $894 million and added an average of $.05 per share

annually.

▪ NJR Energy Services Annual Results Expected Within Guidance Range

NJR Energy Services (NJRES), NJR’s wholesale energy services provider, reported first-quarter fiscal 2017

NFE of $3.5 million, compared with $10.3 million during the same period in fiscal 2016. The weather in the

first quarter of fiscal 2017 was approximately 6 percent warmer than normal, which combined with the

timing of hedges, led to the quarter-over-quarter decline.

We remain confident that NJRES will contribute to NFE within its fiscal 2017 guidance range.

▪ NJR Clean Energy Ventures Contributes to Earnings; Strong Demand for Residential Solar

Continues

NJR Clean Energy Ventures (NJRCEV), the unregulated clean energy subsidiary of NJR, reported NFE of

$2.8 million in the first quarter of fiscal 2017 compared with $7.7 million during the same period in fiscal

2016. The results for the quarter reflect higher depreciation and interest expense, as well as the timing of tax

credits recognized compared with the same period last year. A further discussion of tax credits, which is the

largest contributor to the decline, and NJR’s effective tax rate are provided below.

NJRCEV expects solar-related capital expenditures for investment tax credit (ITC) eligible projects during

fiscal 2017 to be between $90 million and $110 million, compared with $85.6 million ITC-eligible projects

during fiscal 2016. The higher level of solar capital investment will deliver increased ITCs for fiscal 2017.

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 6 of 16

-more-

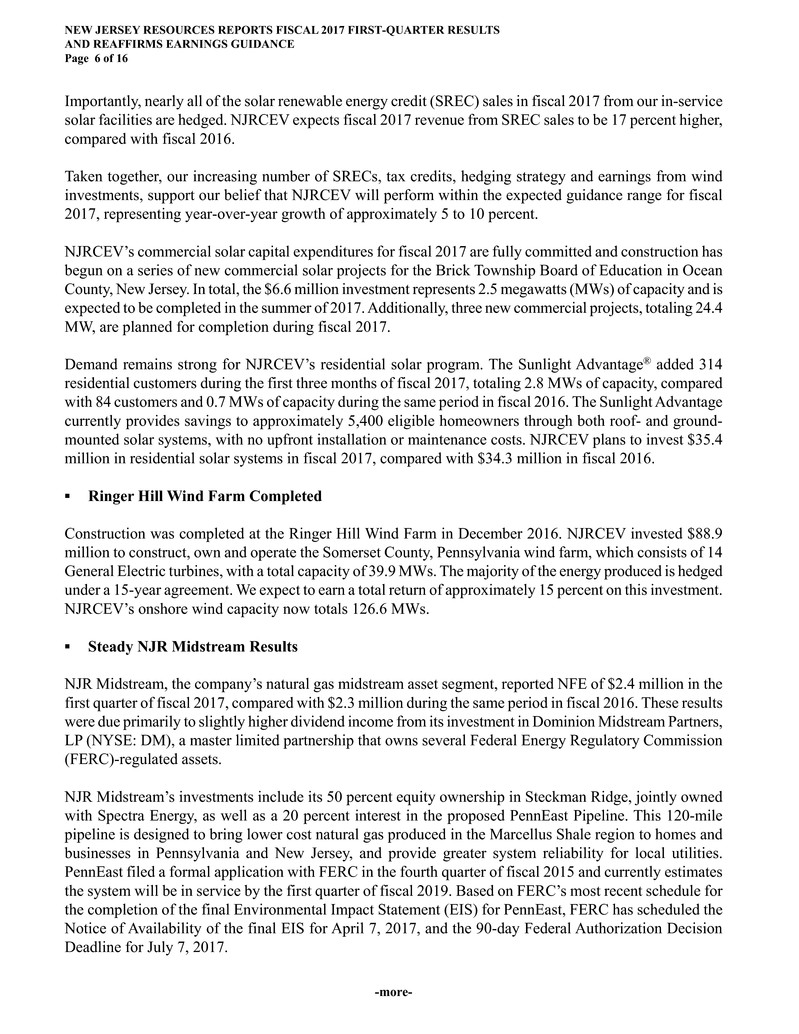

Importantly, nearly all of the solar renewable energy credit (SREC) sales in fiscal 2017 from our in-service

solar facilities are hedged. NJRCEV expects fiscal 2017 revenue from SREC sales to be 17 percent higher,

compared with fiscal 2016.

Taken together, our increasing number of SRECs, tax credits, hedging strategy and earnings from wind

investments, support our belief that NJRCEV will perform within the expected guidance range for fiscal

2017, representing year-over-year growth of approximately 5 to 10 percent.

NJRCEV’s commercial solar capital expenditures for fiscal 2017 are fully committed and construction has

begun on a series of new commercial solar projects for the Brick Township Board of Education in Ocean

County, New Jersey. In total, the $6.6 million investment represents 2.5 megawatts (MWs) of capacity and is

expected to be completed in the summer of 2017. Additionally, three new commercial projects, totaling 24.4

MW, are planned for completion during fiscal 2017.

Demand remains strong for NJRCEV’s residential solar program. The Sunlight Advantage® added 314

residential customers during the first three months of fiscal 2017, totaling 2.8 MWs of capacity, compared

with 84 customers and 0.7 MWs of capacity during the same period in fiscal 2016. The Sunlight Advantage

currently provides savings to approximately 5,400 eligible homeowners through both roof- and ground-

mounted solar systems, with no upfront installation or maintenance costs. NJRCEV plans to invest $35.4

million in residential solar systems in fiscal 2017, compared with $34.3 million in fiscal 2016.

▪ Ringer Hill Wind Farm Completed

Construction was completed at the Ringer Hill Wind Farm in December 2016. NJRCEV invested $88.9

million to construct, own and operate the Somerset County, Pennsylvania wind farm, which consists of 14

General Electric turbines, with a total capacity of 39.9 MWs. The majority of the energy produced is hedged

under a 15-year agreement. We expect to earn a total return of approximately 15 percent on this investment.

NJRCEV’s onshore wind capacity now totals 126.6 MWs.

▪ Steady NJR Midstream Results

NJR Midstream, the company’s natural gas midstream asset segment, reported NFE of $2.4 million in the

first quarter of fiscal 2017, compared with $2.3 million during the same period in fiscal 2016. These results

were due primarily to slightly higher dividend income from its investment in Dominion Midstream Partners,

LP (NYSE: DM), a master limited partnership that owns several Federal Energy Regulatory Commission

(FERC)-regulated assets.

NJR Midstream’s investments include its 50 percent equity ownership in Steckman Ridge, jointly owned

with Spectra Energy, as well as a 20 percent interest in the proposed PennEast Pipeline. This 120-mile

pipeline is designed to bring lower cost natural gas produced in the Marcellus Shale region to homes and

businesses in Pennsylvania and New Jersey, and provide greater system reliability for local utilities.

PennEast filed a formal application with FERC in the fourth quarter of fiscal 2015 and currently estimates

the system will be in service by the first quarter of fiscal 2019. Based on FERC’s most recent schedule for

the completion of the final Environmental Impact Statement (EIS) for PennEast, FERC has scheduled the

Notice of Availability of the final EIS for April 7, 2017, and the 90-day Federal Authorization Decision

Deadline for July 7, 2017.

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 7 of 16

-more-

▪ NJR Home Services Reports Results

NJR Home Services (NJRHS), the company’s unregulated retail and appliance service subsidiary, reported a

net financial loss of $848,000 in the first quarter of fiscal 2017, compared with a net financial loss of

$443,000 during the same period in fiscal 2016. Net financial losses are typical for NJRHS during the first

six months of the fiscal year due to the timing of service contract revenue recognition.

NJRHS offers home comfort solutions including service contracts for heating and cooling systems, HVAC

installations, plumbing and electrical services, standby generators and solar lease and purchase plans.

NJRHS’ service territory includes Monmouth, Ocean, Middlesex, Morris, Sussex, Warren and Hunterdon

counties in New Jersey.

▪ Tax Credits and NJR’s Effective Tax Rate

NJR’s effective tax rate is significantly impacted by the amount of tax credits that are forecasted to be earned

during the fiscal year. GAAP requires NJR to estimate its annual effective tax rate and use this rate to

calculate its year-to-date tax provision. Based on projects completed in the first quarter, NJRCEV’s forecast

of projects to be completed for the balance of the fiscal year and related ITCs, as well as projected GAAP

pre-tax income for the year, NJR’s estimated annual effective tax rate is 8.7 percent, compared with 14.7

percent during the same period the previous year. Accordingly, $7.4 million related to tax credits, net of

deferred taxes, were recognized in the first quarter of fiscal 2017, compared with $10.1 million, net of

deferred taxes, in the same period last year.

For NFE purposes, the effective tax rate for fiscal 2017 is estimated at 14.7 percent and $7.1 million of tax

credits were recognized in the first fiscal quarter, compared with $9.6 million last year. For a further

discussion of this tax adjustment and reconciliation to the most comparable GAAP measure, please see the

explanation below under “Non-GAAP Financial Information.”

The estimated effective tax rate is based on information and assumptions that are subject to change, and may

have a material impact on quarterly and annual NFE. Factors considered by management in estimating

completion of projects during the fiscal year include, but are not limited to, board of directors’ approval,

regulatory approval, execution of various contracts, including power purchase agreements, construction

logistics, permitting and interconnection completion. See the “Forward-Looking Statements” section of this

news release for further information regarding the inherent risks associated with solar investments.

Webcast Information

NJR will host a live webcast to discuss its financial results today at 10 a.m. EST. A few minutes prior to the

webcast, go to njresources.com and select “Investor Relations,” then scroll down to the “Events &

Presentations” section and click on the webcast link.

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 8 of 16

-more-

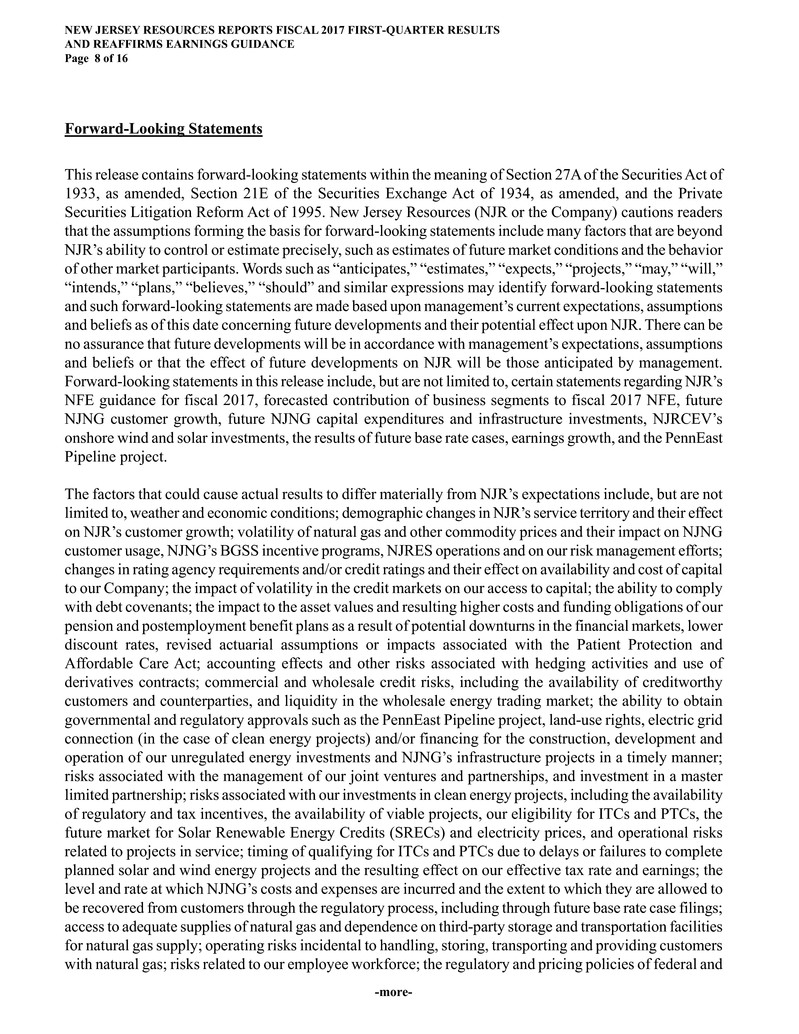

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. New Jersey Resources (NJR or the Company) cautions readers

that the assumptions forming the basis for forward-looking statements include many factors that are beyond

NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior

of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,”

“intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking statements

and such forward-looking statements are made based upon management’s current expectations, assumptions

and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be

no assurance that future developments will be in accordance with management’s expectations, assumptions

and beliefs or that the effect of future developments on NJR will be those anticipated by management.

Forward-looking statements in this release include, but are not limited to, certain statements regarding NJR’s

NFE guidance for fiscal 2017, forecasted contribution of business segments to fiscal 2017 NFE, future

NJNG customer growth, future NJNG capital expenditures and infrastructure investments, NJRCEV’s

onshore wind and solar investments, the results of future base rate cases, earnings growth, and the PennEast

Pipeline project.

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not

limited to, weather and economic conditions; demographic changes in NJR’s service territory and their effect

on NJR’s customer growth; volatility of natural gas and other commodity prices and their impact on NJNG

customer usage, NJNG’s BGSS incentive programs, NJRES operations and on our risk management efforts;

changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital

to our Company; the impact of volatility in the credit markets on our access to capital; the ability to comply

with debt covenants; the impact to the asset values and resulting higher costs and funding obligations of our

pension and postemployment benefit plans as a result of potential downturns in the financial markets, lower

discount rates, revised actuarial assumptions or impacts associated with the Patient Protection and

Affordable Care Act; accounting effects and other risks associated with hedging activities and use of

derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy

customers and counterparties, and liquidity in the wholesale energy trading market; the ability to obtain

governmental and regulatory approvals such as the PennEast Pipeline project, land-use rights, electric grid

connection (in the case of clean energy projects) and/or financing for the construction, development and

operation of our unregulated energy investments and NJNG’s infrastructure projects in a timely manner;

risks associated with the management of our joint ventures and partnerships, and investment in a master

limited partnership; risks associated with our investments in clean energy projects, including the availability

of regulatory and tax incentives, the availability of viable projects, our eligibility for ITCs and PTCs, the

future market for Solar Renewable Energy Credits (SRECs) and electricity prices, and operational risks

related to projects in service; timing of qualifying for ITCs and PTCs due to delays or failures to complete

planned solar and wind energy projects and the resulting effect on our effective tax rate and earnings; the

level and rate at which NJNG’s costs and expenses are incurred and the extent to which they are allowed to

be recovered from customers through the regulatory process, including through future base rate case filings;

access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities

for natural gas supply; operating risks incidental to handling, storing, transporting and providing customers

with natural gas; risks related to our employee workforce; the regulatory and pricing policies of federal and

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 9 of 16

-more-

state regulatory agencies; the costs of compliance with present and future environmental laws, including

potential climate change-related legislation; the impact of a disallowance of recovery of environmental-

related expenditures and other regulatory changes; environmental-related and other litigation and other

uncertainties; risks related to cyber-attack or failure of information technology systems; and the impact of

natural disasters, terrorist activities and other extreme events on our operations and customers. The

aforementioned factors are detailed in the “Risk Factors” sections of our Form 10-K that we filed with the

Securities and Exchange Commission (SEC) on November 22, 2016, which is available on the SEC’s

website at sec.gov. Information included in this release is representative as of today only, and while NJR

periodically reassesses material trends and uncertainties affecting NJR’s results of operations and financial

condition in connection with its preparation of management’s discussion and analysis of results of operations

and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by

including this statement, assume any obligation to review or revise any particular forward-looking statement

referenced herein in light of future events.

Non-GAAP Financial Information

This news release includes the non-GAAP financial measures NFE (losses), financial margin and utility

gross margin. A reconciliation of these non-GAAP financial measures to the most directly comparable

financial measures calculated and reported in accordance with GAAP can be found below. As an indicator of

the NJR’s operating performance, these measures should not be considered an alternative to, or more

meaningful than, net income or operating revenues as determined in accordance with GAAP. This

information has been provided pursuant to the requirements of SEC Regulation G.

NFE (losses) and financial margin exclude unrealized gains or losses on derivative instruments related to the

company’s unregulated subsidiaries and certain realized gains and losses on derivative instruments related to

natural gas that has been placed into storage at NJRES, net of applicable tax adjustments as described below.

Volatility associated with the change in value of these financial instruments and physical commodity

contracts is reported on the income statement in the current period. In order to manage its business, NJR

views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses,

caused by changes in value of these financial instruments and physical commodity contracts prior to the

completion of the planned transaction because it shows changes in value currently instead of when the

planned transaction ultimately is settled. An annual estimated effective tax rate is calculated for NFE

purposes and any necessary quarterly tax adjustment is applied to NJRCEV, as such adjustment is related to

tax credits generated by NJRCEV.

NJNG’s utility gross margin represents the results of revenues less natural gas costs, sales, expenses and

other taxes and regulatory rider expenses, which are key components of NJR’s operations that move in

relation to each other. Natural gas costs, sales, expenses and other taxes and regulatory rider expenses are

passed through to customers and, therefore, have no effect on gross margin. Management uses these non-

GAAP financial measures as supplemental measures to other GAAP results to provide a more complete

understanding of NJR’s performance. Management believes these non-GAAP financial measures are more

reflective of NJR’s business model, provide transparency to investors and enable period-to-period

comparability of financial performance. A reconciliation of all non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in accordance with GAAP, can be found

below. For a full discussion of NJR’s non-GAAP financial measures, please see NJR’s 2016 Form 10-K,

Item 7.

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 10 of 16

-more-

About New Jersey Resources

New Jersey Resources (NYSE: NJR) is a Fortune 1000 company that, through its subsidiaries, provides

safe and reliable natural gas and clean energy services, including transportation, distribution, asset

management and home services. NJR is comprised of five primary businesses:

• New Jersey Natural Gas, NJR’s principal subsidiary, operates and maintains over 7,300 miles of

natural gas transportation and distribution infrastructure to serve over half a million customers in

New Jersey’s Monmouth, Ocean and parts of Burlington, Morris and Middlesex counties.

• NJR Energy Services manages a diversified portfolio of natural gas transportation and storage

assets and provides physical natural gas services and customized energy solutions to its customers

across North America.

• NJR Clean Energy Ventures invests in, owns and operates solar and onshore wind projects with a

total capacity of nearly 280 megawatts, providing residential and commercial customers with low-

carbon solutions.

• NJR Midstream serves customers from local distributors and producers to electric generators and

wholesale marketers through its 50 percent equity ownership in the Steckman Ridge natural gas

storage facility and its stake in Dominion Midstream Partners, L.P., as well as its 20 percent equity

interest in the PennEast Pipeline Project.

• NJR Home Services provides service contracts as well as heating, central air conditioning, water

heaters, standby generators, solar and other indoor and outdoor comfort products to residential

homes throughout New Jersey.

NJR and its more than 1,000 employees are committed to helping customers save energy and money by

promoting conservation and encouraging efficiency through Conserve to Preserve® and initiatives such as

The SAVEGREEN Project® and The Sunlight Advantage®.

For more information about NJR:

Visit www.njresources.com.

Follow us on Twitter @NJNaturalGas.

“Like” us on facebook.com/NewJerseyNaturalGas.

Download our free NJR investor relations app for iPad, iPhone and Android.

NJR-E

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 11 of 16

-more-

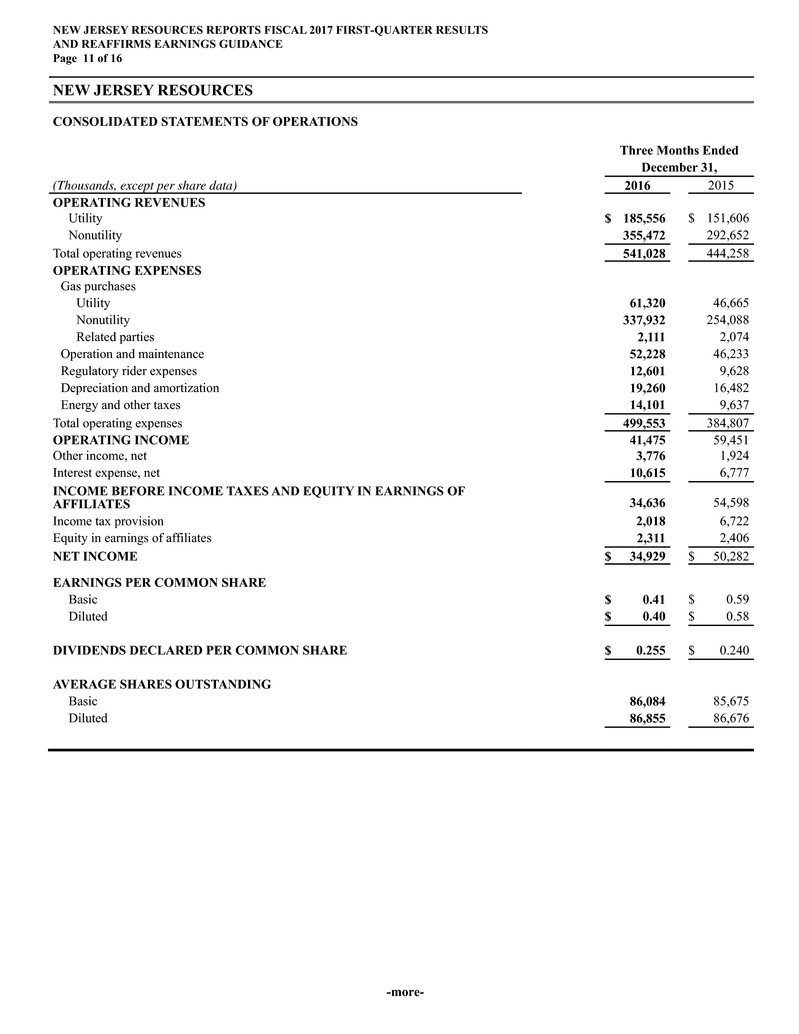

NEW JERSEY RESOURCES

CONSOLIDATED STATEMENTS OF OPERATIONS

Three Months Ended

December 31,

(Thousands, except per share data) 2016 2015

OPERATING REVENUES

Utility $ 185,556 $ 151,606

Nonutility 355,472 292,652

Total operating revenues 541,028 444,258

OPERATING EXPENSES

Gas purchases

Utility 61,320 46,665

Nonutility 337,932 254,088

Related parties 2,111 2,074

Operation and maintenance 52,228 46,233

Regulatory rider expenses 12,601 9,628

Depreciation and amortization 19,260 16,482

Energy and other taxes 14,101 9,637

Total operating expenses 499,553 384,807

OPERATING INCOME 41,475 59,451

Other income, net 3,776 1,924

Interest expense, net 10,615 6,777

INCOME BEFORE INCOME TAXES AND EQUITY IN EARNINGS OF AFFILIATES 34,636 54,598

Income tax provision 2,018 6,722

Equity in earnings of affiliates 2,311 2,406

NET INCOME $ 34,929 $ 50,282

EARNINGS PER COMMON SHARE

Basic $ 0.41 $ 0.59

Diluted $ 0.40 $ 0.58

DIVIDENDS DECLARED PER COMMON SHARE $ 0.255 $ 0.240

AVERAGE SHARES OUTSTANDING

Basic 86,084 85,675

Diluted 86,855 86,676

NEW JERSEY RESOURCES REPORTS FISCAL 2016 RESULTS AND

ANNOUNCES FISCAL 2017 EARNINGS GUIDANCE

Page 12 of 16

RECONCILIATION OF NON-GAAP PERFORMANCE MEASURES

Three Months Ended

December 31,

(Thousands) 2016 2015

NEW JERSEY RESOURCES

A reconciliation of net income, the closest GAAP financial measurement, to net financial earnings, is as follows:

Net income $ 34,929 $ 50,282

Add:

Unrealized loss (gain) on derivative instruments and related transactions 28,302 (1,135)

Tax effect (9,757) 413

Effects of economic hedging related to natural gas inventory (17,939) 3,813

Tax effect 6,204 (1,385)

Net income to NFE tax adjustment (1,356) (721)

Net financial earnings $ 40,383 $ 51,267

Weighted Average Shares Outstanding

Basic 86,084 85,675

Diluted 86,855 86,676

A reconciliation of basic earnings per share, the closest GAAP financial measurement, to basic net financial earnings per share, is as follows:

Basic earnings per share $ 0.41 $ 0.59

Add:

Unrealized loss (gain) on derivative instruments and related transactions $ 0.33 $ (0.01)

Tax effect $ (0.11) $ 0.01

Effects of economic hedging related to natural gas inventory $ (0.21) $ 0.04

Tax effect $ 0.07 $ (0.02)

Net income to NFE tax adjustment $ (0.02) $ (0.01)

Basic NFE per share $ 0.47 $ 0.60

NATURAL GAS DISTRIBUTION

A reconciliation of operating revenue, the closest GAAP financial measurement, to utility gross margin is as follows:

Operating revenues $ 185,556 $ 151,606

Less:

Gas purchases 64,186 45,243

Energy and other taxes 10,882 6,908

Regulatory rider expense 12,601 9,628

Utility gross margin $ 97,887 $ 89,827

NEW JERSEY RESOURCES REPORTS FISCAL 2016 RESULTS AND

ANNOUNCES FISCAL 2017 EARNINGS GUIDANCE

Page 13 of 16

Three Months Ended

December 31,

(Thousands) 2016 2015

NJR ENERGY SERVICES

The following table is a computation of financial margin:

Operating revenues $ 337,181 $ 278,693

Less: Gas purchases 339,087 260,239

Add:

Unrealized loss (gain) on derivative instruments and related transactions 30,592 (2,387)

Effects of economic hedging related to natural gas inventory (17,939) 3,813

Financial margin $ 10,747 $ 19,880

A reconciliation of operating income, the closest GAAP financial measurement, to financial margin is as follows:

Operating (loss) income $ (7,395) $ 14,437

Add:

Operation and maintenance expense 5,018 3,757

Depreciation and amortization 16 23

Other taxes 455 237

Subtotal (1,906) 18,454

Add:

Unrealized loss (gain) on derivative instruments and related transactions 30,592 (2,387)

Effects of economic hedging related to natural gas inventory (17,939) 3,813

Financial margin $ 10,747 $ 19,880

A reconciliation of net income to net financial earnings, is as follows:

Net (loss) income $ (4,790) $ 9,396

Add:

Unrealized loss (gain) on derivative instruments and related transactions 30,592 (2,387)

Tax effect (10,580) 867

Effects of economic hedging related to natural gas, net of taxes (17,939) 3,813

Tax effect 6,204 (1,385)

Net financial earnings $ 3,487 $ 10,304

CLEAN ENERGY VENTURES

A reconciliation of net income to net financial earnings, is as follows:

Net income $ 4,198 $ 8,373

Add:

Net income to NFE tax adjustment (1,356) (721)

Net financial earnings $ 2,842 $ 7,652

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 14 of 16

Three Months Ended

December 31,

(Thousands, except per share data) 2016 2015

NEW JERSEY RESOURCES

Operating Revenues

Natural Gas Distribution $ 185,556 $ 151,606

Energy Services 337,181 278,693

Clean Energy Ventures 7,567 7,794

Midstream — —

Home Services and Other 10,006 9,573

Sub-total 540,310 447,666

Eliminations 718 (3,408)

Total $ 541,028 $ 444,258

Operating Income (Loss)

Natural Gas Distribution $ 51,372 $ 47,707

Energy Services (7,395) 14,437

Clean Energy Ventures (4,293) (1,426)

Midstream (156) (151)

Home Services and Other (1,456) (1,030)

Sub-total 38,072 59,537

Eliminations 3,403 (86)

Total $ 41,475 $ 59,451

Equity in Earnings of Affiliates

Midstream $ 3,331 $ 3,545

Eliminations (1,020) (1,139)

Total $ 2,311 $ 2,406

Net Income (Loss)

Natural Gas Distribution $ 30,348 $ 30,926

Energy Services (4,790) 9,396

Clean Energy Ventures 4,198 8,373

Midstream 2,387 2,344

Home Services and Other 1,542 259

Sub-total 33,685 51,298

Eliminations 1,244 (1,016)

Total $ 34,929 $ 50,282

Net Financial Earnings

Natural Gas Distribution $ 30,348 $ 30,926

Energy Services 3,487 10,304

Clean Energy Ventures 2,842 7,652

Midstream 2,387 2,344

Home Services and Other 1,542 259

Sub-total 40,606 51,485

Eliminations (223) (218)

Total $ 40,383 $ 51,267

Throughput (Bcf)

NJNG, Core Customers 32.8 30.0

NJNG, Off System/Capacity Management 43.6 55.9

NJRES Fuel Mgmt. and Wholesale Sales 126.2 132.7

Total 202.6 218.6

Common Stock Data

Yield at December 31 2.9% 2.9%

Market Price

High $ 37.30 $ 34.07

Low $ 30.46 $ 28.02

Close at December 31 $ 35.50 $ 32.96

Shares Out. at December 31 86,196 85,809

Market Cap. at December 31 $ 3,059,966 $ 2,828,268

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 15 of 16

Three Months Ended

(Unaudited) December 31,

(Thousands, except customer & weather data) 2016 2015

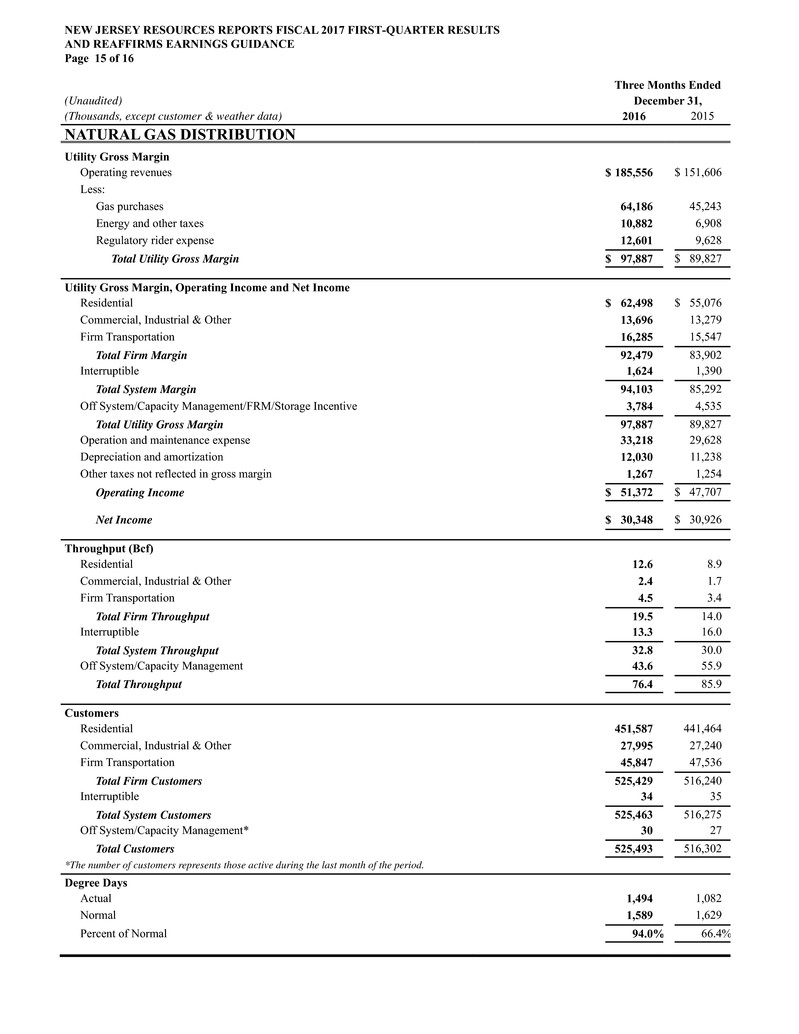

NATURAL GAS DISTRIBUTION

Utility Gross Margin

Operating revenues $ 185,556 $ 151,606

Less:

Gas purchases 64,186 45,243

Energy and other taxes 10,882 6,908

Regulatory rider expense 12,601 9,628

Total Utility Gross Margin $ 97,887 $ 89,827

Utility Gross Margin, Operating Income and Net Income

Residential $ 62,498 $ 55,076

Commercial, Industrial & Other 13,696 13,279

Firm Transportation 16,285 15,547

Total Firm Margin 92,479 83,902

Interruptible 1,624 1,390

Total System Margin 94,103 85,292

Off System/Capacity Management/FRM/Storage Incentive 3,784 4,535

Total Utility Gross Margin 97,887 89,827

Operation and maintenance expense 33,218 29,628

Depreciation and amortization 12,030 11,238

Other taxes not reflected in gross margin 1,267 1,254

Operating Income $ 51,372 $ 47,707

Net Income $ 30,348 $ 30,926

Throughput (Bcf)

Residential 12.6 8.9

Commercial, Industrial & Other 2.4 1.7

Firm Transportation 4.5 3.4

Total Firm Throughput 19.5 14.0

Interruptible 13.3 16.0

Total System Throughput 32.8 30.0

Off System/Capacity Management 43.6 55.9

Total Throughput 76.4 85.9

Customers

Residential 451,587 441,464

Commercial, Industrial & Other 27,995 27,240

Firm Transportation 45,847 47,536

Total Firm Customers 525,429 516,240

Interruptible 34 35

Total System Customers 525,463 516,275

Off System/Capacity Management* 30 27

Total Customers 525,493 516,302

*The number of customers represents those active during the last month of the period.

Degree Days

Actual 1,494 1,082

Normal 1,589 1,629

Percent of Normal 94.0% 66.4%

NEW JERSEY RESOURCES REPORTS FISCAL 2017 FIRST-QUARTER RESULTS

AND REAFFIRMS EARNINGS GUIDANCE

Page 16 of 16

Three Months Ended

(Unaudited) December 31,

(Thousands, except customer, SREC and megawatt) 2016 2015

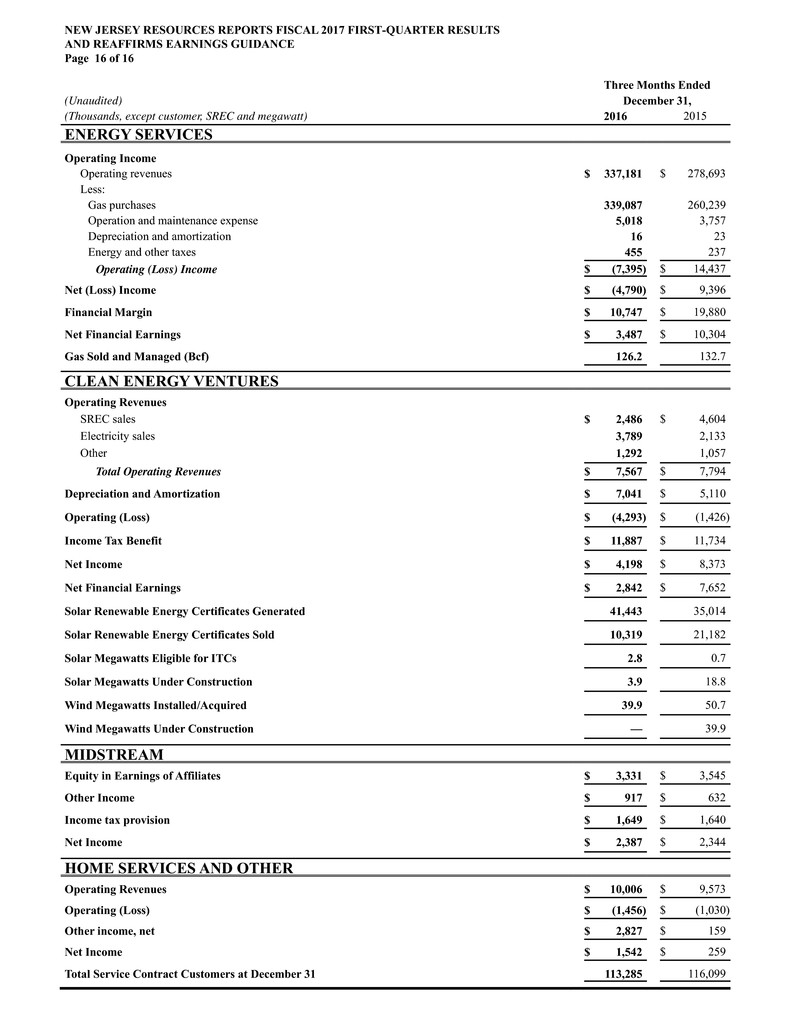

ENERGY SERVICES

Operating Income

Operating revenues $ 337,181 $ 278,693

Less:

Gas purchases 339,087 260,239

Operation and maintenance expense 5,018 3,757

Depreciation and amortization 16 23

Energy and other taxes 455 237

Operating (Loss) Income $ (7,395) $ 14,437

Net (Loss) Income $ (4,790) $ 9,396

Financial Margin $ 10,747 $ 19,880

Net Financial Earnings $ 3,487 $ 10,304

Gas Sold and Managed (Bcf) 126.2 132.7

CLEAN ENERGY VENTURES

Operating Revenues

SREC sales $ 2,486 $ 4,604

Electricity sales 3,789 2,133

Other 1,292 1,057

Total Operating Revenues $ 7,567 $ 7,794

Depreciation and Amortization $ 7,041 $ 5,110

Operating (Loss) $ (4,293) $ (1,426)

Income Tax Benefit $ 11,887 $ 11,734

Net Income $ 4,198 $ 8,373

Net Financial Earnings $ 2,842 $ 7,652

Solar Renewable Energy Certificates Generated 41,443 35,014

Solar Renewable Energy Certificates Sold 10,319 21,182

Solar Megawatts Eligible for ITCs 2.8 0.7

Solar Megawatts Under Construction 3.9 18.8

Wind Megawatts Installed/Acquired 39.9 50.7

Wind Megawatts Under Construction — 39.9

MIDSTREAM

Equity in Earnings of Affiliates $ 3,331 $ 3,545

Other Income $ 917 $ 632

Income tax provision $ 1,649 $ 1,640

Net Income $ 2,387 $ 2,344

HOME SERVICES AND OTHER

Operating Revenues $ 10,006 $ 9,573

Operating (Loss) $ (1,456) $ (1,030)

Other income, net $ 2,827 $ 159

Net Income $ 1,542 $ 259

Total Service Contract Customers at December 31 113,285 116,099