Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 1Q FY17 EARNINGS RELEASE - NEW JERSEY RESOURCES CORP | form8-kx1qfy17earningsrele.htm |

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE - NEW JERSEY RESOURCES CORP | pressrelease1q2017final.htm |

First Quarter Fiscal 2017 Update

February 8, 2017

2

Regarding Forward Looking Statements

Certain statements contained in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. New Jersey Resources (NJR or the Company) cautions readers that the

assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market

conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar

expressions may identify forward-looking statements and such forward-looking statements are made based upon management’s current expectations, assumptions and beliefs as of this

date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations

or that the effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this presentation include, but are not limited to, certain

statements regarding NJR’s Net Financial Earnings (NFE) guidance for fiscal 2017 and NFE growth beyond fiscal 2017, forecasted contribution of business segments to fiscal 2017 NFE

and to NFE beyond fiscal 2017, growing energy demand, future New Jersey Natural Gas Company (NJNG) customer growth, future capital plans and expenditures and infrastructure

investments, the effect of Solar Renewable Energy Certificate (SRECs) prices, supply, hedges and generation on NJR Clean Energy Ventures Corporation (NJRCEV), the long-term

outlook for NJCEV, diversification of NJRCEV’s strategy, the effects of a hypothetical corporate tax rate reduction, and the PennEast Pipeline project.

The factors that could cause actual results to differ materially from NJR’s expectations, assumptions and beliefs include, but are not limited to, weather and economic conditions;

demographic changes in NJR’s service territory and their effect on NJR’s customer growth; volatility of natural gas and other commodity prices and their impact on NJNG customer

usage, NJNG’s BGSS incentive programs, NJR Energy Services Company (NJRES) operations and on our risk management efforts; changes in rating agency requirements and/or

credit ratings and their effect on availability and cost of capital to our Company; the impact of volatility in the credit markets on our access to capital; the ability to comply with debt

covenants; the impact to the asset values and resulting higher costs and funding obligations of our pension and postemployment benefit plans as a result of potential downturns in the

financial markets, lower discount rates, revised actuarial assumptions or impacts associated with the Patient Protection and Affordable Care Act; accounting effects and other risks

associated with hedging activities and use of derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties, and

liquidity in the wholesale energy trading market; the ability to obtain governmental and regulatory approvals, land-use rights, electric grid connection (in the case of clean energy projects)

and/or financing for the construction, development and operation of our unregulated energy investments and NJNG’s infrastructure projects in a timely manner; risks associated with the

management of our joint ventures and partnerships, and investment in a master limited partnership; risks associated with our investments in clean energy projects, including the

availability of regulatory and tax incentives, the availability of viable projects, our eligibility for Investment Tax Credits (ITC) and Production Tax Credits (PTC), the future market for

SRECs and electricity prices, and operational risks related to projects in service; timing of qualifying for ITCs and PTCs due to delays or failures to complete planned solar and wind

energy projects and the resulting effect on our effective tax rate and earnings; the level and rate at which NJNG’s costs and expenses are incurred and the extent to which they are

allowed to be recovered from customers through the regulatory process, including through future base rate case filings; access to adequate supplies of natural gas and dependence on

third-party storage and transportation facilities for natural gas supply; operating risks incidental to handling, storing, transporting and providing customers with natural gas; risks related to

our employee workforce; the regulatory and pricing policies of federal and state regulatory agencies; the costs of compliance with present and future environmental laws, including

potential climate change-related legislation; the impact of a disallowance of recovery of environmental-related expenditures and other regulatory changes; environmental-related and

other litigation and other uncertainties; risks related to cyber-attack or failure of information technology systems; and the impact of natural disasters, terrorist activities and other extreme

events on our operations and customers. The aforementioned factors are detailed in the “Risk Factors” section of our Annual Report on Form 10-K filed with the Securities and

Exchange Commission (SEC) on November 22, 2016, which is available on the SEC’s website at sec.gov. Information included in this presentation is representative as of today only and

while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations and financial condition in connection with its preparation of management's

discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement,

assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

3

Disclaimer Regarding Non-GAAP Financial Measures

This presentation includes the non-GAAP measure, NFE. As an indicator of the Company’s operating performance, this measure should not be considered an

alternative to, or more meaningful than, GAAP measures, such as cash flow, net income, operating income or earnings per share.

NFE excludes unrealized gains or losses on derivative instruments related to the Company’s unregulated subsidiaries and certain realized gains and losses on

derivative instruments related to natural gas that has been placed into storage at NJRES, net of applicable tax adjustments, as described below. Volatility

associated with the change in value of these financial and physical commodity contracts is reported in the income statement in the current period. In order to

manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by changes in

value of these financial instruments and physical commodity contracts prior to the completion of the planned transaction because it shows changes in value

currently as opposed to when the planned transaction ultimately is settled. An annual estimated effective tax rate is calculated for NFE purposes and any

necessary quarterly tax adjustment is applied to NJRCEV, as such adjustment is related to tax credits generated by NJRCEV.

Management uses NFE as a supplemental measure to other GAAP results to provide a more complete understanding of the Company’s performance.

Management believes this non-GAAP measure is more reflective of the Company’s business model, provides transparency to investors and enables

period-to-period comparability of financial performance. In providing fiscal 2017 earnings guidance, management is aware that there could be

differences between reported GAAP earnings and NFE due to matters such as, but not limited to, the positions of our energy-related derivatives.

Management is not able to reasonably estimate the aggregate impact of these items on reported earnings and therefore is not able to provide a

reconciliation to the corresponding GAAP equivalent for its operating earnings guidance without unreasonable efforts. For a full discussion of our non-

GAAP financial measures, please see NJR’s most recent Form 10-K, Item 7. This information has been provided pursuant to the requirements of SEC

Regulation G.

4

Our Long-Term Average Annual NFE Growth Target Remains 5 to 9 Percent

New Jersey Natural Gas NJR Midstream NJR Energy Services NJR Home ServicesNJR Clean Energy Ventures

*A reconciliation from NFE to net income is set forth in the Appendix on Slide 19.

Reaffirming Fiscal 2017 NFE Guidance: $1.65 to $1.75 Per Share*

Our Growth Strategy

• Strong natural gas fundamentals

drive infrastructure and energy

services opportunities

• Clean energy benefits the

environment and provides new

investment opportunities

• Energy efficiency is the most cost-

effective option to improve the

environment and lower

customers’ bills

55-65%

5-10%

5-15%

1-3%

15-25%

60-75% of

2017 NFE

expected

from

regulated

sources

5

Fiscal First Quarter 2017 Results

Net Financial Earnings* ($MM)

Three Months Ended

December 31,

Company 2016 2015 Variance

New Jersey Natural Gas $30.3 $30.9 $(.6)

NJR Midstream 2.4 2.3 .1

Subtotal 32.7 33.2 (.5)

NJR Clean Energy Ventures 2.8 7.7 (4.9)

NJR Energy Services 3.5 10.3 (6.8)

NJR Home Services/Other 1.4 .1 1.3

Total $40.4 $51.3 $(10.9)

Per basic share $.47 $.60 ($.13)

Our Fiscal 2017 NFE Guidance is $1.65 to $1.75 Per Share

*A reconciliation from NFE to net income is set forth in the Appendix on Slide 19.

6

Change in Net Financial Earnings

-$6.5

-$2.5

-$.6

$40.4

$51.3

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

December 31, 2015 Lower NJRES Financial

Margin

Higher Tax

Expense/Lower Tax

Credits

SREC Monitization

Timing

NJNG/Other December 31, 2016

M

ill

io

n

s -$1.3

*A reconciliation from NFE to net income is set forth in the Appendix on Slide 19.

7

Our Path to Achieving Fiscal 2017 Guidance

New Jersey Resources NFE Per Share

September 30, 2016 $1.61

NJNG

Distribution Margin $.25

BGSS Margin (.03)

Depreciation/O&M/Interest (.09) .13

NJRCEV

Revenue $.09

Depreciation/O&M/Interest (.15)

ITC .03

PTC .04 .01

NJRES (.08)

NJR Midstream .02

Other .01

September 30, 2017* $1.70

* Based on midpoint of guidance

8

NJNG Capital Investment December 31, 2016 Update

CAPITAL

INVESTMENT

($MM)

1Q 2017E STATUS

NJNG 11

Customer Growth $8.9 $33.3 Added 1,866 customers in FY1Q2017; on target to add 8,300customers in FY2017

Maintenance 7.4 41.4 Capital spending on track to enhance system safety and reliability

Cost of Removal/Other 11.4 46.1 Capital spending on track to take replaced/retired pipe out of service

SAFE II 8.6 35.0 SAFE extension of $200 million to complete replacement of unprotected steel pipe approved by BPU

NJ RISE .2 15.8

The Sea Bright Horizontal Directional Drill and Ship Bottom regulator

flood hardening projects are on track to be completed in FY2017.

Installation of excess flow valves and engineering work continues.

Southern Reliability Link .9 6.0 Reducing FY2017 capital expenditure estimate at this time due to timing of permitting process

Total NJNG $37.4 $177.6

9

NJRCEV Capital Investment December 31, 2016 Update

CAPITAL

INVESTMENT

($MM)

1Q 2017E STATUS

NJRCEV 11

Commercial Solar - $65.3 Brick Board of Education (BOE) 2.5 MW project under construction. Three other projects totaling 24.4 MW planned for FY2017.

Residential Solar $8.3 35.4 Added 314 new customers in FY1Q2017. Approximately 5,400 Sunlight Advantage® program customers

Wind 88.9 88.9 Ringer Hill wind farm in service

Total NJRCEV* $97.2 $189.6

* Based on projects qualifying for federal tax credits

10

Effects of Hypothetical Corporate Tax Rate Reduction on NJR

Income Statement EPS Impact

NJNG net income* Flat

Non-regulated net income Annual Increase

Revaluation of net deferred tax liabilities, non-regulated One-Time Increase

Balance Sheet Balance Sheet Impact

Equity

(Impact of one-time revaluation of non-regulated deferred tax

liabilities + earnings increase)

Increase

Net deferred tax liabilities Decrease

Other Impact

Tax Appetite Decrease

* Assumes similar treatment as in 1986 corporate tax reduction

11

Our Growth Strategy

• Strong natural gas fundamentals

drive infrastructure and energy

services opportunities

• Clean energy benefits the

environment and provides new

investment opportunities

• Energy efficiency is the most cost-effective

option for improving the environment and

lowering customers’ bills

12

Natural Gas: The Foundation of Our Business

• NJNG is a growing, regulated natural gas

distribution business that anchors our portfolio

• Geographic and demographic advantages

provide a solid foundation for growth

• Infrastructure investments enhance safety

and reliability for customers

• Regulatory incentive programs benefit customers

and shareowners

• Growing wholesale demand offers new

opportunities for physical and producer natural

gas services for NJRES

• Increasing natural gas supply and growing

demand provide opportunities for investments

in midstream infrastructure

13

PennEast Pipeline

Project Description

• 20 percent ownership in 120-mile transmission pipeline connecting Marcellus shale

region supply to Northeast

Project Importance

• Demand pull project with capacity of

up to 1.1 MMdth/day

• Nearly fully subscribed by 12 shippers;

72 percent LDCs in Mid-Atlantic Region

• Pennsylvania Jersey Maryland Power

Pool (PJM) states PennEast “would

expand capacity and supply options

and improve grid reliability”

• Access to the lowest cost supply point

in North America benefiting customers and local economies

Current Status

• Draft Environmental Impact Study (EIS) issued by FERC on July 22, 2016; final EIS

expected April 2017

• Recent 6-week extension for final EIS not expected to impact planned in-service date

Source: Pennsylvania Jersey Maryland Power Pool (PJM)

14

Clean Energy Update

Commercial Solar

• Roof- and ground-mounted installations,

both grid-connected and net-metered

• 27 projects in service

• 104.2 MW

Residential Solar - The Sunlight Advantage®

• Approximately 5,400 customers added

since inception

• 48.2 MW

Onshore Wind

• Five projects in service

• 126.6 MW

Supports State and Federal Energy Goals While Benefiting the Environment

15

SREC Hedging Strategy Stabilizes Income

Pct. Hedged: 96% 96% 65%

Average Price: $229 $229 $203

Current Price (EY): $249 $222 $176

As of January 31, 2017. Source: InterContinental Exchange (ICE)

175 176

120

-

30

60

90

120

150

180

210

EY17 EY18 EY19

Th

ousa

n

ds

of SR

EC

s

Energy Year - Operational Facilities

Hedged Unhedged Operational

182 184184

16

• Using less energy is the best alternative for

improving the environment

• Energy efficiency benefits all stakeholders,

including customers and investors

• Conserve to Preserve® enables us to

encourage customers to use less

• The SAVEGREEN Project® offers customers

incentives to invest in energy efficiency while

creating growth opportunities

The Value of Energy Efficiency

18

APPENDIX

19

Reconciliation to Non-GAAP Measures

A reconciliation of NFE for the three months ended December 31, 2016 and 2015 to net income is provided below:

Three Months Ended

December 31,

(Thousands) 2016 2015

Net income $ 34,929 $ 50,282

Add:

Unrealized loss (gain) on derivative instruments and related transactions 28,302 (1,135)

Tax effect (9,757) 413

Effects of economic hedging related to natural gas inventory (17,939) 3,813

Tax effect 6,204 (1,385)

Net income to NFE tax adjustment (1,356) (721)

Net financial earnings $ 40,383 $ 51,267

Weighted Average Shares Outstanding

Basic 86,084 85,675

Diluted 86,855 86,676

Basic earnings per share $ 0.41 $ 0.59

Add:

Unrealized loss (gain) on derivative instruments and related transactions 0.33 (0.01)

Tax effect (0.11) 0.01

Effects of economic hedging related to natural gas inventory (0.21) 0.04

Tax effect 0.07 (0.02)

Net income to NFE tax adjustment (0.02) (0.01)

Basic NFE per share $ 0.47 $ 0.60

20

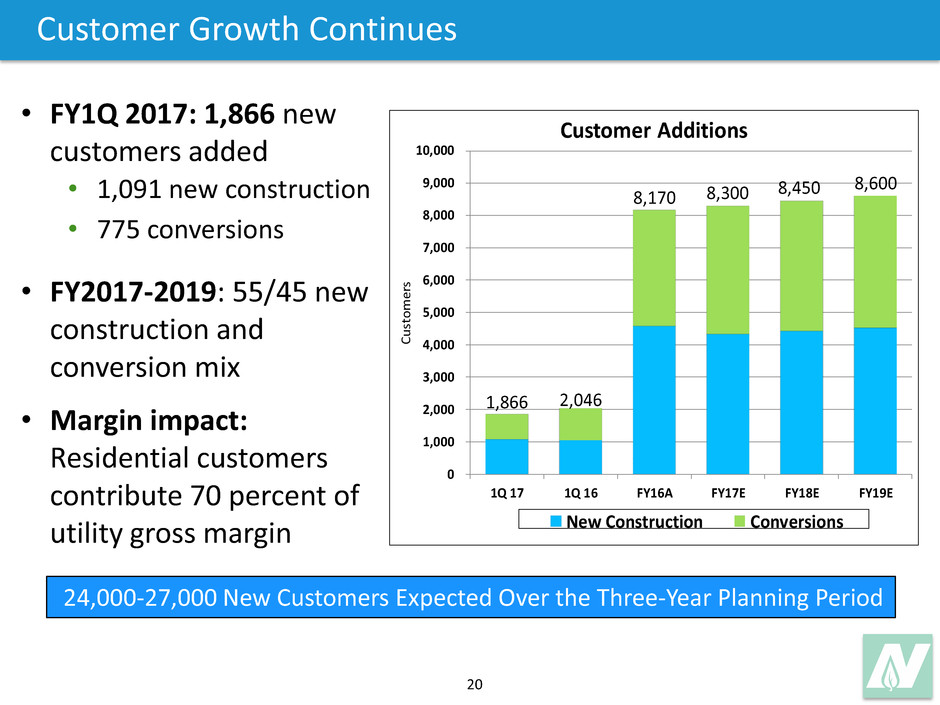

Customer Growth Continues

• FY1Q 2017: 1,866 new

customers added

• 1,091 new construction

• 775 conversions

• FY2017-2019: 55/45 new

construction and

conversion mix

• Margin impact:

Residential customers

contribute 70 percent of

utility gross margin

1,866 2,046

8,170 8,300

8,450 8,600

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

1Q 17 1Q 16 FY16A FY17E FY18E FY19E

Cu

st

om

er

s

Customer Additions

New Construction Conversions

24,000-27,000 New Customers Expected Over the Three-Year Planning Period

21

SREC Hedging Strategy Stabilizes Income - On an Expected Generation and Fiscal Year

Basis

Pct. Hedged: 96% 74% 35%

Average Price: $230 $222 $207

Current Price (EY): $249 $222 $176

As of January 31, 2017. Source: InterContinental Exchange (ICE)

180 171

87

187

232 246

-

50

100

150

200

250

300

FY17E FY18E FY19E

Th

ousa

n

ds

of SR

EC

s

Hedged Expected Generated