Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | a8-kinvestorpresentation2x.htm |

D A T A A S O F D E C E M B E R 3 1 , 2 0 1 6

U N L E S S O T H E R W I S E N O T E D

INVESTOR PRESENTATION

FORWARD-LOOKING STATEMENTS

This presentation may contain forward-looking statements with respect to Fulton Financial Corporation’s financial

condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking

statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,”

“potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends” and similar expressions which

are intended to identify forward-looking statements. Management’s “2017 Outlook” contained herein is comprised of

forward-looking statements.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some

of which are beyond the Corporation’s control and ability to predict, that could cause actual results to differ materially

from those expressed in the forward-looking statements. The Corporation undertakes no obligation, other than as

required by law, to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the

Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found

in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2015 and Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, which have

been filed with the Securities and Exchange Commission and are available in the Investor Relations section of the

Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures

are reconciled to the most comparable GAAP measures at the end of this presentation.

2

WHY FULTON?

• Risk Management Foundation

• Management Depth and Experience

• Stability of Geographic Markets / Franchise Value

• Strong Capital & Reserves

• Commitment to Enhancing Shareholder Value

• Relationship Banking Strategy / Customer Experience

• Quality Loan Growth / Solid Asset Quality

• Attractive Core Deposit Profile

• Prudent Expense Management

• Balance Sheet Is Positioned for Rising Interest Rates

3

A VALUABLE FRANCHISE

• 243 community banking offices across

the Mid-Atlantic

• Asset size: $18.9 billion

• 3,700+ team members (3,490 FTEs (1))

• Market capitalization: $3.3 billion (2)

4

(1) Full-time equivalent employees.

(2) Based on shares outstanding and the closing price as of December 31, 2016.

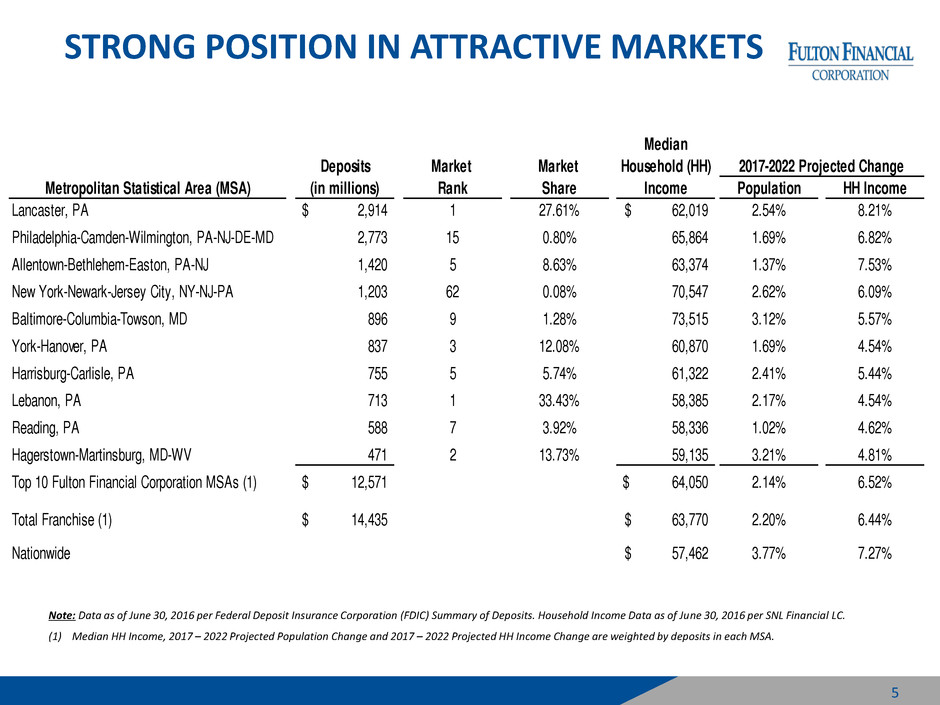

STRONG POSITION IN ATTRACTIVE MARKETS

5

Note: Data as of June 30, 2016 per Federal Deposit Insurance Corporation (FDIC) Summary of Deposits. Household Income Data as of June 30, 2016 per SNL Financial LC.

(1) Median HH Income, 2017 – 2022 Projected Population Change and 2017 – 2022 Projected HH Income Change are weighted by deposits in each MSA.

Median

Deposits Market Market Household (HH)

Metropolitan Statistical Area (MSA) (in millions) Rank Share Income Population HH Income

Lancaster, PA 2,914$ 1 27.61% 62,019$ 2.54% 8.21%

Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 2,773 15 0.80% 65,864 1.69% 6.82%

Allentown-Bethlehem-Easton, PA-NJ 1,420 5 8.63% 63,374 1.37% 7.53%

New York-Newark-Jersey City, NY-NJ-PA 1,203 62 0.08% 70,547 2.62% 6.09%

Baltimore-Columbia-Towson, MD 896 9 1.28% 73,515 3.12% 5.57%

York-Hanover, PA 837 3 12.08% 60,870 1.69% 4.54%

Harrisburg-Carlisle, PA 755 5 5.74% 61,322 2.41% 5.44%

Lebanon, PA 713 1 33.43% 58,385 2.17% 4.54%

Reading, P 588 7 3.92% 58,336 1.02% 4.62%

Hagerstown-Martinsburg, MD-WV 471 2 13.73% 59,135 3.21% 4.81%

Top 10 Fulton Financial Corporation MSAs (1) 12,571$ 64,050$ 2.14% 6.52%

Total Franchise (1) 14,435$ 63,770$ 2.20% 6.44%

Nationwide 57,462$ 3.77% 7.27%

2017-2022 Projected Change

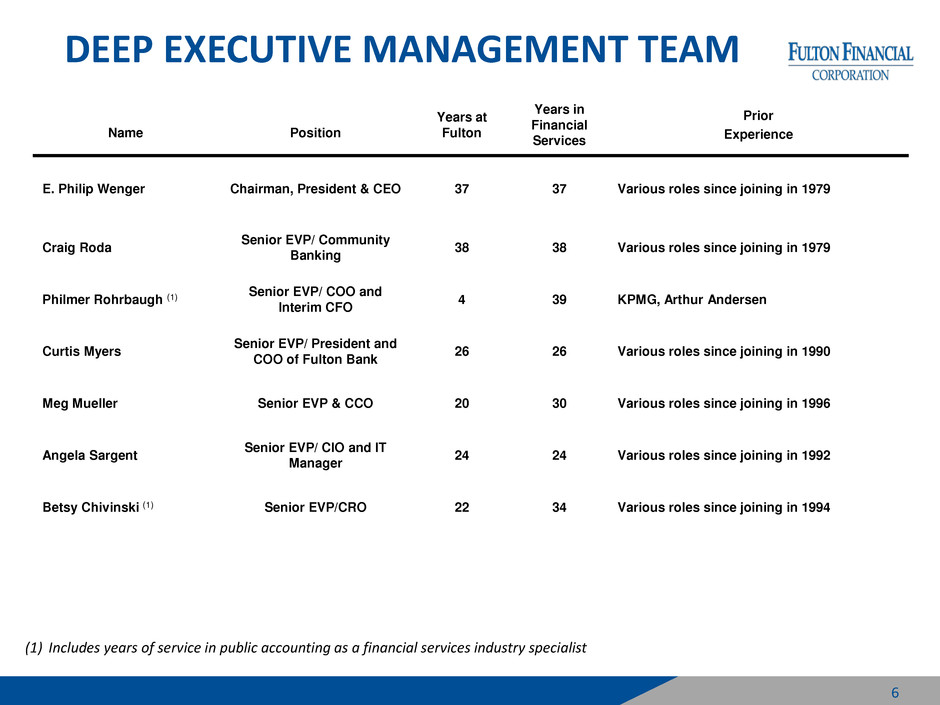

Name

Position

Years at

Fulton

Years in

Financial

Services

Prior

Experience

E. Philip Wenger Chairman, President & CEO 37 37 Various roles since joining in 1979

Craig Roda

Senior EVP/ Community

Banking

38 38 Various roles since joining in 1979

Philmer Rohrbaugh (1)

Senior EVP/ COO and

Interim CFO

4 39 KPMG, Arthur Andersen

Curtis Myers

Senior EVP/ President and

COO of Fulton Bank

26 26 Various roles since joining in 1990

Meg Mueller Senior EVP & CCO 20 30 Various roles since joining in 1996

Angela Sargent

Senior EVP/ CIO and IT

Manager

24 24 Various roles since joining in 1992

Betsy Chivinski (1) Senior EVP/CRO 22 34 Various roles since joining in 1994

DEEP EXECUTIVE MANAGEMENT TEAM

6

(1) Includes years of service in public accounting as a financial services industry specialist

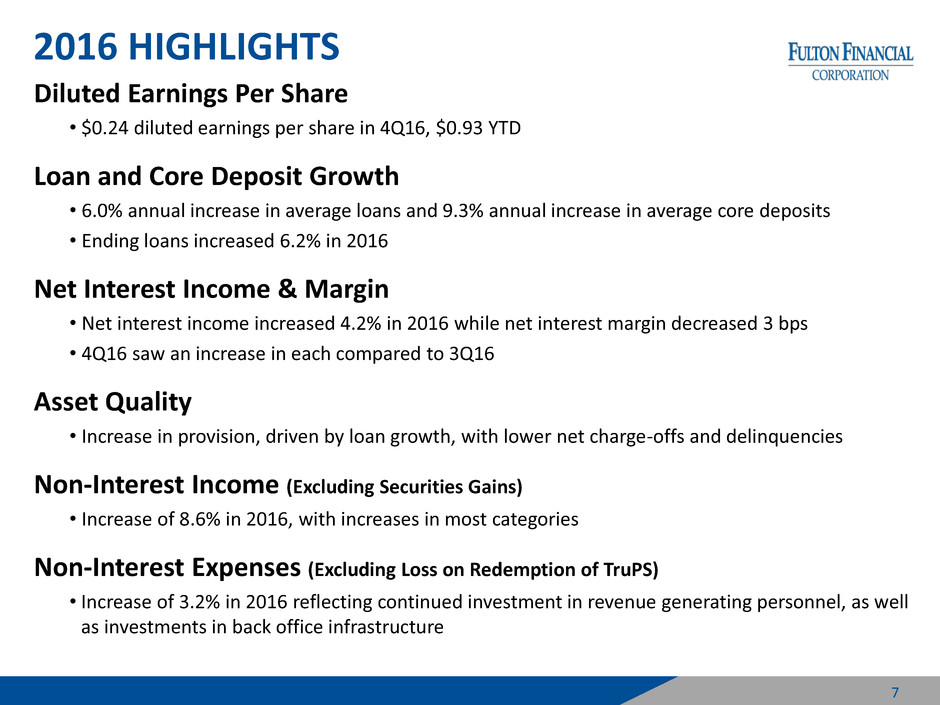

2016 HIGHLIGHTS

Diluted Earnings Per Share

• $0.24 diluted earnings per share in 4Q16, $0.93 YTD

Loan and Core Deposit Growth

• 6.0% annual increase in average loans and 9.3% annual increase in average core deposits

• Ending loans increased 6.2% in 2016

Net Interest Income & Margin

• Net interest income increased 4.2% in 2016 while net interest margin decreased 3 bps

• 4Q16 saw an increase in each compared to 3Q16

Asset Quality

• Increase in provision, driven by loan growth, with lower net charge-offs and delinquencies

Non-Interest Income (Excluding Securities Gains)

• Increase of 8.6% in 2016, with increases in most categories

Non-Interest Expenses (Excluding Loss on Redemption of TruPS)

• Increase of 3.2% in 2016 reflecting continued investment in revenue generating personnel, as well

as investments in back office infrastructure

7

INCOME STATEMENT SUMMARY – ANNUAL COMPARISON

(1) ROA is return an average assets determined by dividing net income for the period indicated by average assets

(2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation.

Net Income of $161.6 million, up 8.1% due

primarily to higher net interest income and non-

interest income, partially offset by higher loan loss

provision and higher non-interest expense

Net Interest Income

Net interest income up 4.2%, due to 5.4% increase

in average interest earning assets, partially offset by

lower net interest margin

Loan Loss Provision

$13.2 million provision in 2016, driven by loan

growth

Non-Interest Income

Increase of 8.6% driven primarily by commercial

loan interest rate swap fees, SBA loan sale gains,

IMTS, mortgage banking income and merchant fees

Non-Interest Expense

Increase of 3.2% largely driven by higher salaries

and benefits and software amortization expense,

partially offset by lower outside services

Effective Tax Rate

Declined due to higher net tax credits in 2016 arising

from community development investments

2016 2015 Change

Net Interest Income 520,772$ 499,994$ 20,778$

Loan Loss Provision 13,182 2,250 10,932

Non-Interest Income 187,628 172,773 14,855

Securities Gains 2,550 9,066 (6,516)

Non-Interest Expense 489,519 474,534 14,985

Loss on redemption of TruPS - 5,626 (5,626)

Income before Income Taxes 208,249 199,423 8,826

Income Taxes 46,624 49,921 (3,297)

Net Income 161,625$ 149,502$ 12,123$

Per Share (Diluted) 0.93$ 0.85$ 0.08$

ROA (1) 0.88% 0.86% 0.02%

ROE (tangible) (2) 10.30% 10.01% 0.29%

Efficiency ratio (2) 67.2% 68.6% (1.4%)

(dollars in thousands, except per-share data)

8

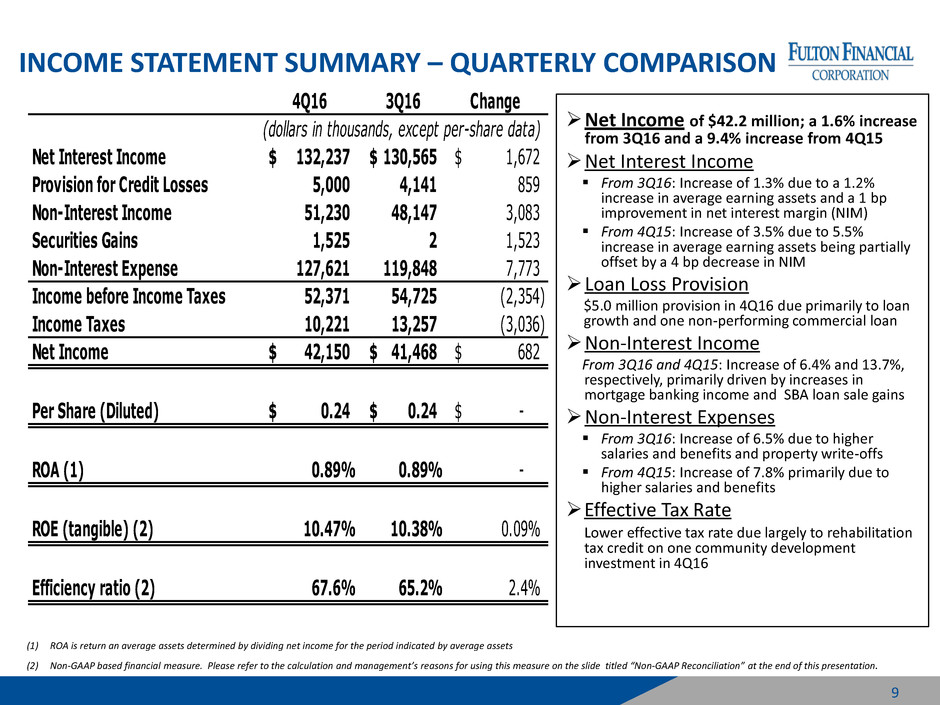

INCOME STATEMENT SUMMARY – QUARTERLY COMPARISON

Net Income of $42.2 million; a 1.6% increase

from 3Q16 and a 9.4% increase from 4Q15

Net Interest Income

From 3Q16: Increase of 1.3% due to a 1.2%

increase in average earning assets and a 1 bp

improvement in net interest margin (NIM)

From 4Q15: Increase of 3.5% due to 5.5%

increase in average earning assets being partially

offset by a 4 bp decrease in NIM

Loan Loss Provision

$5.0 million provision in 4Q16 due primarily to loan

growth and one non-performing commercial loan

Non-Interest Income

From 3Q16 and 4Q15: Increase of 6.4% and 13.7%,

respectively, primarily driven by increases in

mortgage banking income and SBA loan sale gains

Non-Interest Expenses

From 3Q16: Increase of 6.5% due to higher

salaries and benefits and property write-offs

From 4Q15: Increase of 7.8% primarily due to

higher salaries and benefits

Effective Tax Rate

Lower effective tax rate due largely to rehabilitation

tax credit on one community development

investment in 4Q16

(1) ROA is return an average assets determined by dividing net income for the period indicated by average assets

(2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation.

4Q16 3Q16 Change

Net Interest Income 132,237$ 130,565$ 1,672$

Provision for Credit Losses 5,000 4,141 859

Non-Interest Income 51,230 48,147 3,083

Securities Gains 1,525 2 1,523

Non-Interest Expense 127,621 119,848 7,773

Income before Income Taxes 52,371 54,725 (2,354)

Income Taxes 10,221 13,257 (3,036)

Net Income 42,150$ 41,468$ 682$

Per Share (Diluted) 0.24$ 0.24$ -$

ROA (1) 0.89% 0.89% -

ROE (tangible) (2) 10.47% 10.38% 0.09%

Efficiency ratio (2) 67.6% 65.2% 2.4%

(dollars in thousands, except per-share data)

9

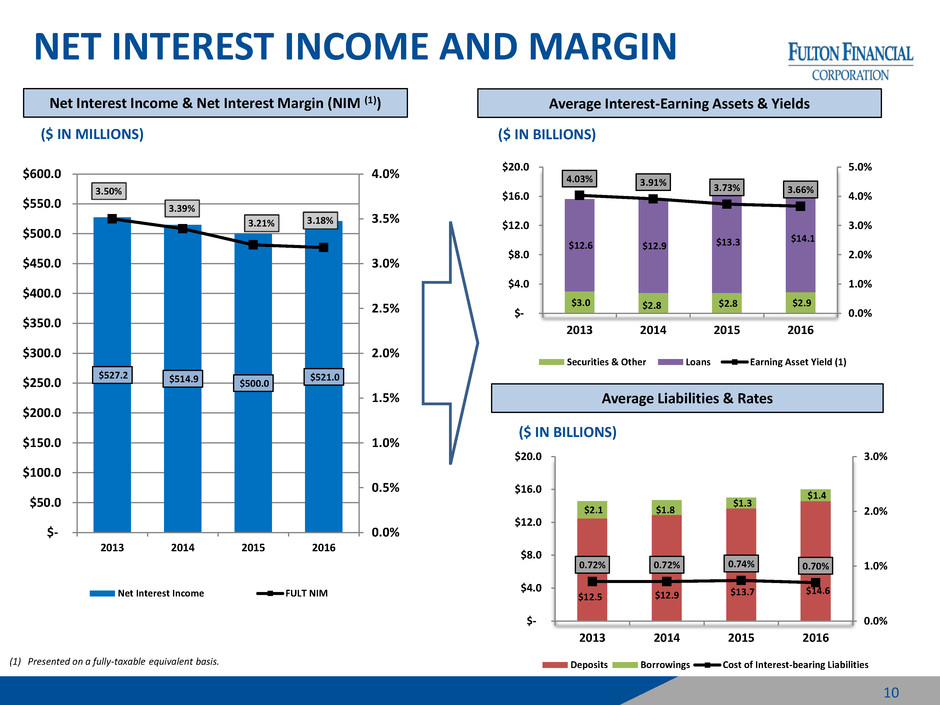

NET INTEREST INCOME AND MARGIN

10

Net Interest Income & Net Interest Margin (NIM (1))

~ $730

million

~ $610

million

$527.2 $514.9 $500.0

$521.0

3.50%

3.39%

3.21% 3.18%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

$450.0

$500.0

$550.0

$600.0

2013 2014 2015 2016

Net Interest Income FULT NIM

Average Interest-Earning Assets & Yields

Average Liabilities & Rates

$3.0 $2.8 $2.8 $2.9

$12.6 $12.9 $13.3

$14.1

4.03% 3.91%

3.73% 3.66%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

$-

$4.0

$8.0

$12.0

$16.0

$20.0

2013 2014 2015 2016

Securities & Other Loans Earning Asset Yield (1)

$12.5 $12.9 $13.7

$14.6

$2.1 $1.8

$1.3

$1.4

0.72% 0.72% 0.74% 0.70%

0.0%

1.0%

2.0%

3.0%

$-

$4.0

$8.0

$12.0

$16.0

$20.0

2013 2014 2015 2016

Deposits Borrowings Cost of Interest-bearing Liabilities(1) Presented on a fully-taxable equivalent basis.

($ IN BILLIONS)

($ IN MILLIONS) ($ IN BILLIONS)

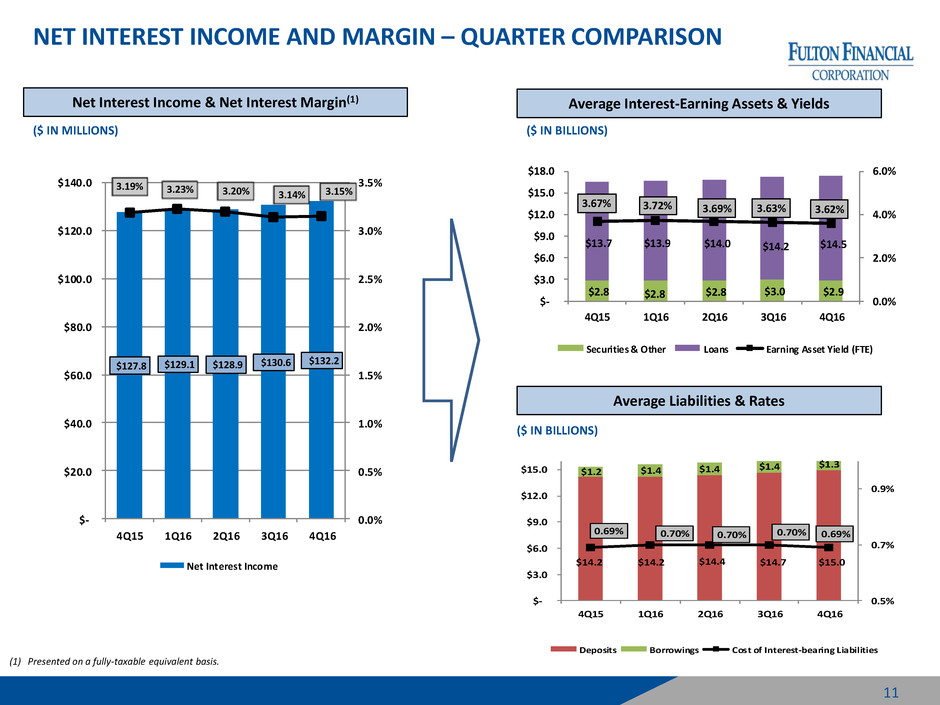

NET INTEREST INCOME AND MARGIN – QUARTER COMPARISON

Net Interest Income & Net Interest Margin(1)

~ $730

million

~ $610

million

$127.8 $129.1 $128.9 $130.6 $132.2

3.19% 3.23% 3.20% 3.14% 3.15%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

4Q15 1Q16 2Q16 3Q16 4Q16

Net Interest Income

Average Interest-Earning Assets & Yields

Average Liabilities & Rates

$2.8 $2.8 $2.8 $3.0 $2.9

$13.7 $13.9 $14.0 $14.2 $14.5

3.67% 3.72% 3.69% 3.63% 3.62%

0.0%

2.0%

4.0%

6.0%

$-

$3.0

$6.0

$9.0

$12.0

$15.0

$18.0

4Q15 1Q16 2Q16 3Q16 4Q16

Securities & Other Loans Earning Asset Yield (FTE)

$14.2 $14.2 $14.4 $14.7 $15.0

$1.2 $1.4 $1.4

$1.4 $1.3

0.69% 0.70% 0.70% 0.70% 0.69%

0.5%

0.7%

0.9%

$-

$3.0

$6.0

$9.0

$12.0

$15.0

4Q15 1Q16 2Q16 3Q16 4Q16

Deposits Borrowings Cost of Interest-bearing Liabilities

($ IN MILLIONS) ($ IN BILLIONS)

($ IN BILLIONS)

11

(1) Presented on a fully-taxable equivalent basis.

LOAN PORTFOLIO COMPOSITION & YIELD

12

Note: Loan portfolio composition is based on average balances for the years ended December 31, 2012 to 2016.

(1) Presented on a fully-taxable equivalent basis.

$4.6 $4.9

$5.1 $5.2

$5.6

$3.6 $3.7 $3.7 $3.9 $4.1

$1.6

$1.7 $1.7

$1.7

$1.7 $1.2

$1.3

$1.4

$1.4

$1.5

$0.6

$0.6

$0.6

$0.7

$0.8

$0.4

$0.4

$0.4

$0.4

$0.4

4.81%

4.39% 4.21% 4.04% 3.95%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

2012 2013 2014 2015 2016

Comm'l Mtg Comm'l Home Equity Res Mtg Construction Consumer/Other FTE loan yield (1)

$12.9

A

ve

ra

ge

Loa

n

Po

rtf

o

lio

B

al

an

ce

s,

in

b

ill

io

n

s

To

tal

Loa

n

Po

rtf

o

lio

Y

ie

ld

(1

)

Average loans are up 6.0% compared to 2015.

$12.0

$12.6

$13.3

$14.1

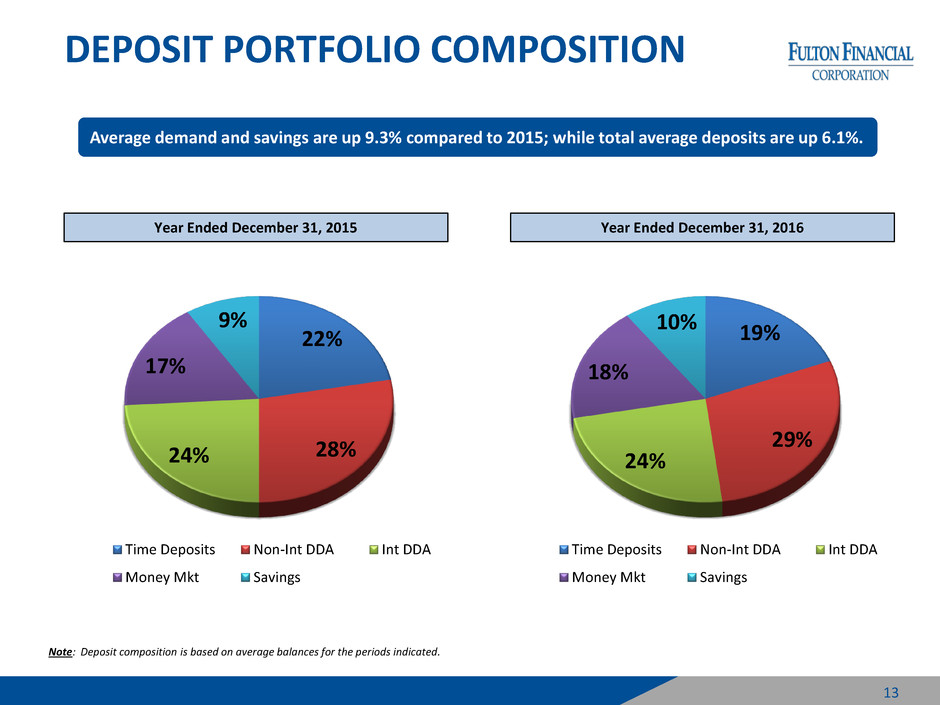

DEPOSIT PORTFOLIO COMPOSITION

13

Note: Deposit composition is based on average balances for the periods indicated.

Average demand and savings are up 9.3% compared to 2015; while total average deposits are up 6.1%.

19%

29%

24%

18%

10%

Time Deposits Non-Int DDA Int DDA

Money Mkt Savings

Year Ended December 31, 2016

22%

28% 24%

17%

9%

Time Deposits Non-Int DDA Int DDA

Money Mkt Savings

Year Ended December 31, 2015

1) A variety of interest rate scenarios are used to measure the effects of sudden and gradual movements upward and downward in the yield curve. These results are

compared to the results obtained in a flat or unchanged interest rate scenario. Simulation of net interest income is used primarily to measure the Corporation’s short-

term earnings exposure to rate movements. The Corporation’s policy limits the potential exposure of net interest income, in a non-parallel instantaneous shock, to

10% of the base case net interest income for a 100 basis point shock in interest rates, 15% for a 200 basis point shock and 20% for a 300 basis point shock. A "shock" is

an immediate upward or downward movement of interest rates. The shocks do not take into account changes in customer behavior that could result in changes to mix

and/or volumes in the balance sheet, nor do they account for competitive pricing over the forward 12-month period. These results include the effect of implicit and

explicit floors that limit further reduction in interest rates.

2) The actual impact of changes in interest rates on the Corporation’s net interest income may differ materially from the anticipated amounts presented above.

Rate Annual Change in %

Change (1) Net Interest Income (2) Change

+300 bps $ 87.4 million 15.3%

+200 bps $ 59.6 million 10.4%

+100 bps $ 28.3 million 4.9%

- 100 bps $ (33.2) million -5.8%

POSITIONED FOR RISING INTEREST RATE ENVIRONMENT

DECEMBER 31, 2016

14

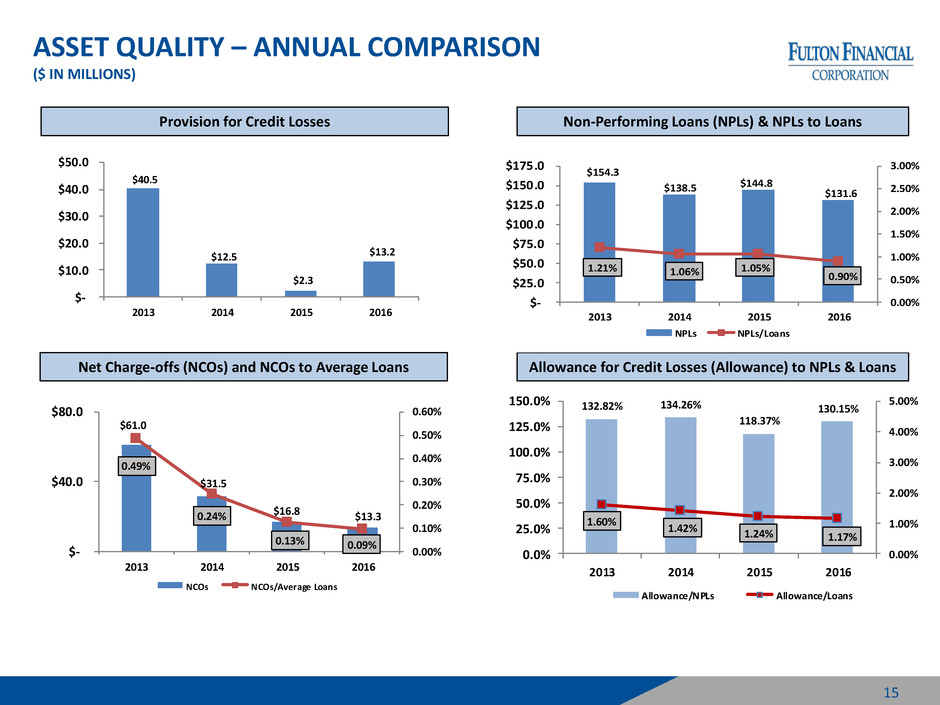

ASSET QUALITY – ANNUAL COMPARISON

($ IN MILLIONS)

$40.5

$12.5

$2.3

$13.2

$-

$10.0

$20.0

$30.0

$40.0

$50.0

2013 2014 2015 2016

Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans 132.82% 134.26%

118.37%

130.15%

1.60%

1.42% 1.24% 1.17%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

0.0%

25.0%

50.0%

75.0%

100.0%

125.0%

150.0%

2013 2014 2015 2016

Allowance/NPLs Allowance/Loans

Net Charge-offs (NCOs) and NCOs to Average Loans Allowance for Credit Losses (Allowance) to NPLs & Loans

$61.0

$31.5

$16.8 $13.3

0.49%

0.24%

0.13% 0.09%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

$-

$40.0

$80.0

2013 2014 2015 2016

NCOs NCOs/Average Loans

$154.3

$138.5 $144.8 $131.6

1.21 1.06% 1.05% 0.90%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

$-

$25.0

$50.0

$75.0

$100.0

$125.0

$150.0

$175.0

2013 2014 2015 2016

NPLs NPLs/Loans

15

$30.6

$17.1 $18.2 $19.4

1.63%

1.19%

1.35%

1.67%

0.0%

0.5%

1.0%

1.5%

2.0%

$(5.0)

$5.0

$15.0

$25.0

$35.0

$45.0

2013 2014 2015 2016

Ga ins on Sale s Servicing Income Spre ad on Sale s (1 )

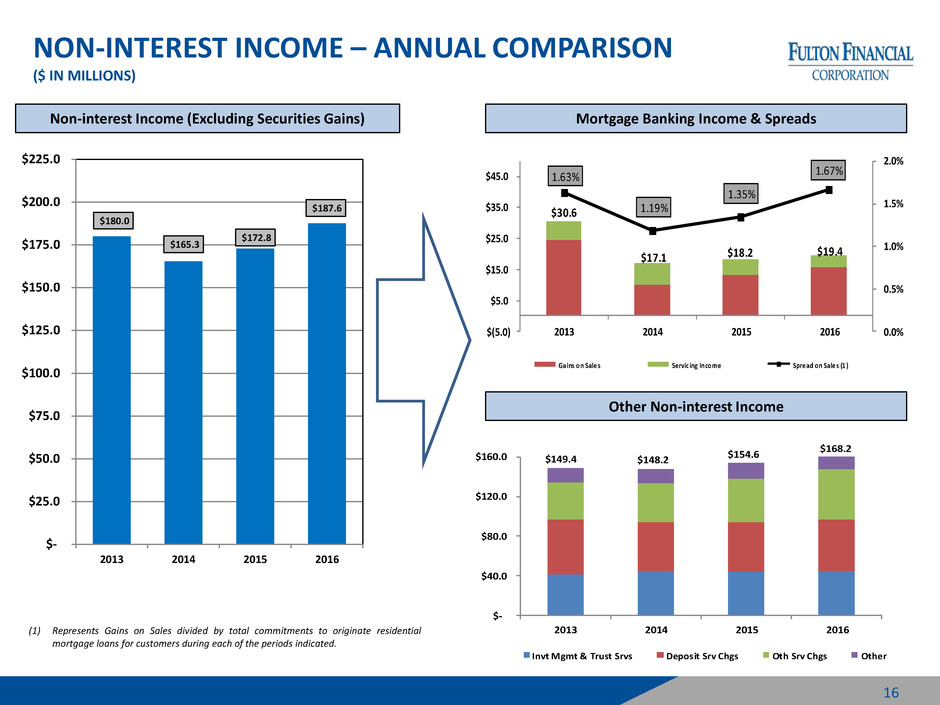

NON-INTEREST INCOME – ANNUAL COMPARISON

($ IN MILLIONS)

16

Non-interest Income (Excluding Securities Gains)

$180.0

$165.3

$172.8

$187.6

$-

$25.0

$50.0

$75.0

$100.0

$125.0

$150.0

$175.0

$200.0

$225.0

2013 2014 2015 2016

Mortgage Banking Income & Spreads

Other Non-interest Income

(1) Represents Gains on Sales divided by total commitments to originate residential

mortgage loans for customers during each of the periods indicated.

$-

$40.0

$80.0

$120.0

$160.0

2013 2014 2015 2016

Invt Mgmt & Trust Srvs Deposit Srv Chgs Oth Srv Chgs Other

$149.4 $148.2

$154.6

$168.2

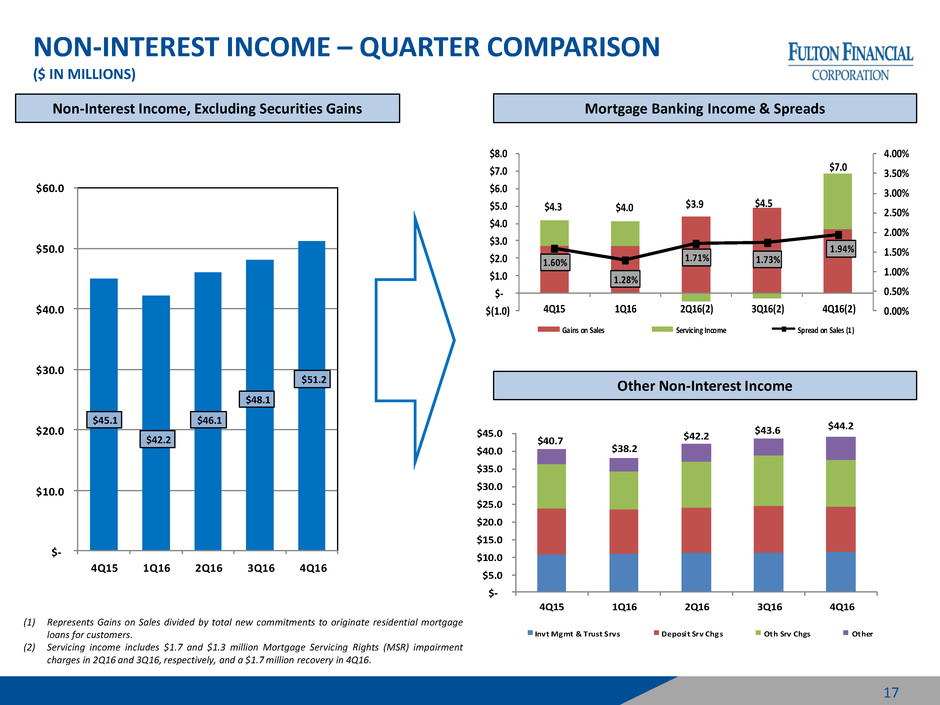

NON-INTEREST INCOME – QUARTER COMPARISON

($ IN MILLIONS)

Non-Interest Income, Excluding Securities Gains

~ $730

million

~ $610

million

$45.1

$42.2

$46.1

$48.1

$51.2

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

4Q15 1Q16 2Q16 3Q16 4Q16

Mortgage Banking Income & Spreads

Other Non-Interest Income

1.60%

1.28%

1.71% 1.73%

1.94%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

$(1.0)

$-

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

4Q15 1Q16 2Q16(2) 3Q16(2) 4Q16(2)

Gains on Sales Servicing Income Spread on Sales (1)

$4.3 $4.0 $3.9 $4.5

$7.0

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

4Q15 1Q16 2Q16 3Q16 4Q16

Invt Mgmt & Trust Srvs Deposit Srv Chgs Oth Srv Chgs Other

$40.7

$38.2

$42.2

$43.6 $44.2

(1) Represents Gains on Sales divided by total new commitments to originate residential mortgage

loans for customers.

(2) Servicing income includes $1.7 and $1.3 million Mortgage Servicing Rights (MSR) impairment

charges in 2Q16 and 3Q16, respectively, and a $1.7 million recovery in 4Q16.

17

$-

$50.0

$100.0

$150.0

$200.0

$250.0

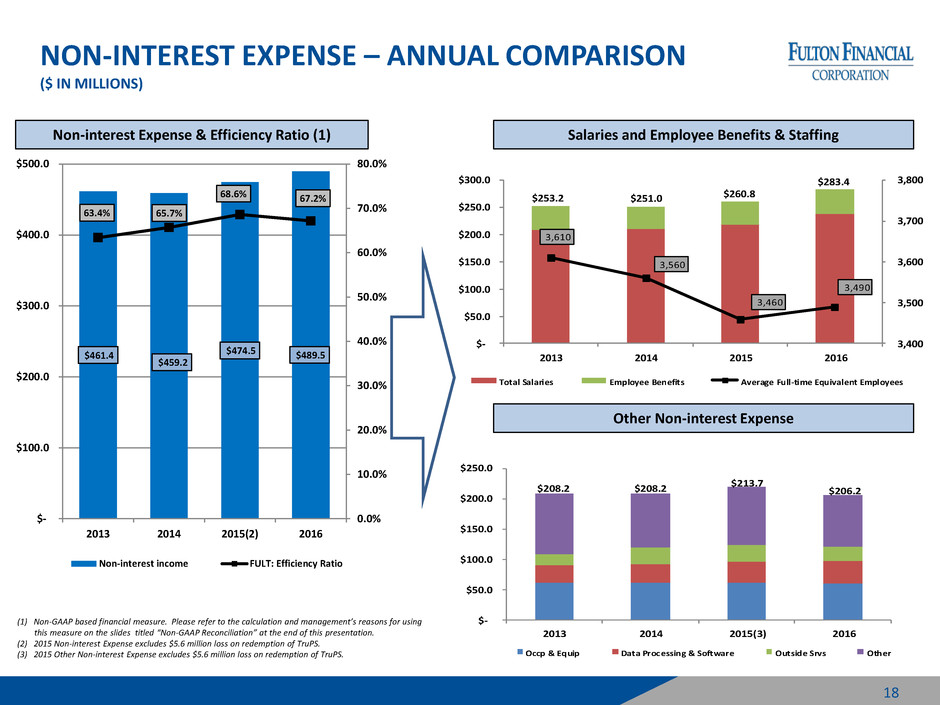

2013 2014 2015(3) 2016

Occp & Equip Data Processing & Software Outside Srvs Other

$208.2 $208.2

$213.7

$206.2

3,610

3,560

3,460

3,490

3,400

3,500

3,600

3,700

3,800

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2013 2014 2015 2016

Total Salaries Employee Benefits Average Full-time Equivalent Employees

$253.2 $251.0 $260.8

$283.4

NON-INTEREST EXPENSE – ANNUAL COMPARISON

($ IN MILLIONS)

18

Non-interest Expense & Efficiency Ratio (1) Salaries and Employee Benefits & Staffing

Other Non-interest Expense

(1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using

this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation.

(2) 2015 Non-interest Expense excludes $5.6 million loss on redemption of TruPS.

(3) 2015 Other Non-interest Expense excludes $5.6 million loss on redemption of TruPS.

$461.4

$459.2

$474.5 $489.5

63.4% 65.7%

68.6% 67.2%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

$-

$100.0

$200.0

$300.0

$400.0

$500.0

2013 2014 2015(2) 2016

Non-interest income FULT: Efficiency Ratio

NON-INTEREST EXPENSES – QUARTER COMPARISON

($ IN MILLIONS)

Non-Interest Expense & Efficiency Ratio (1)

~ $730

million

~ $610

million

$118.4

$120.4 $121.6 $119.8

$127.6

66.6%

68.3%

67.6%

65.2%

67.6%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

4Q15 1Q16 2Q16 3Q16 4Q16

Salaries and Employee Benefits & Staffing

Other Non-Interest Expenses

3,520 3,491

-

2,000

4,000

6,000

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

4Q15 1Q16 2Q16 3Q16 4Q16

Total Salaries Employee Benefits Average Full-time Equivalent Employees

$65.5

$69.4 $70.0 $70.7

$73.3

$-

$10.0

$20.0

$30.0

$40.0

$5 .0

$60.0

4Q15 1Q16 2Q16 3Q16 4Q16

Occp & Equip Data Processing & Software Outside Srvs Other

$52.9

$51.0 $51.6 $49.1

$54.4

(1) Non-GAAP based financial measure. Please refer to the calculation and

management’s reasons for using this measure on the slide titled “Non-

GAAP Reconciliation” at the end of this presentation.

19

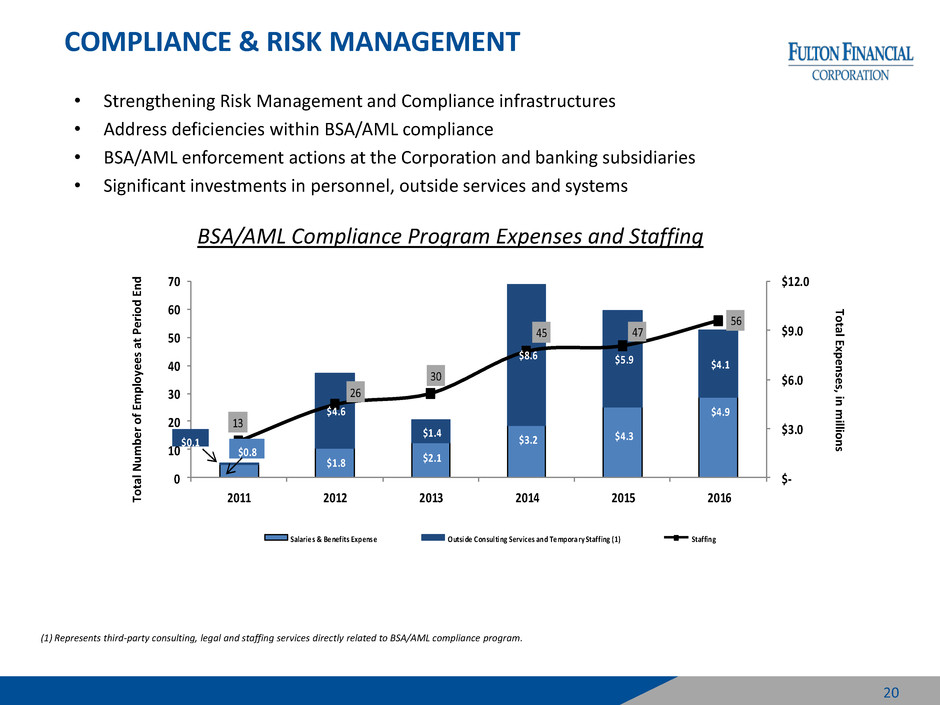

$1.8 $2.1

$3.2 $4.3

$4.9 $4.6

$1.4

$8.6 $5.9 $4.1

13

26

30

45 47

56

$-

$3.0

$6.0

$9.0

$12.0

0

10

20

30

40

50

60

70

2011 2012 2013 2014 2015 2016

Salarie s & Be nefits Expense Outsi de Consul ti ng Services and Te mpora ry Staffing (1) Staffing

$0.8

$0.1

COMPLIANCE & RISK MANAGEMENT

(1) Represents third-party consulting, legal and staffing services directly related to BSA/AML compliance program.

To

tal

Exp

e

n

se

s, in

m

illio

n

s

• Strengthening Risk Management and Compliance infrastructures

• Address deficiencies within BSA/AML compliance

• BSA/AML enforcement actions at the Corporation and banking subsidiaries

• Significant investments in personnel, outside services and systems

BSA/AML Compliance Program Expenses and Staffing

To

tal

N

u

m

b

e

r

o

f

Em

p

lo

ye

e

s

at

Pe

ri

o

d

E

n

d

20

10.76% 10.31% 10.01% 10.30%

0.00%

4.00%

8.00%

12.00%

2013 2014 2015 2016

PROFITABILITY & CAPITAL

ROA ROE (tangible) (1)

Regulatory Capital Ratios & TCE Ratio (1) Diluted Earnings Per Common Share

$ 0.83 $ 0.84

$ 0.85

$0.93

$-

$0.25

$0.50

$0.75

$1.00

2013 2014 2015 2016

15.0% 14.5%

13.3% 13.3% 13.1%

12.2%

10.3% 10.5%

9.3%

8.8% 8.7% 8.6%

0.0%

4.0%

8.0%

12.0%

16.0%

2013 2014 2015 2016

Total Risk-Based Capital Ratio (2) Tier 1 Risk-Based Capital Ratio (2) TCE Ratio

Note: ROA is return an average assets determined by dividing net income for the period indicated by average assets.

(1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slides titled “Non-GAAP Reconciliation” at the end of this presentation.

(2) Estimates for 2016

0.96% 0.93%

0.86% 0.88%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

2013 2014 2015 2016

21

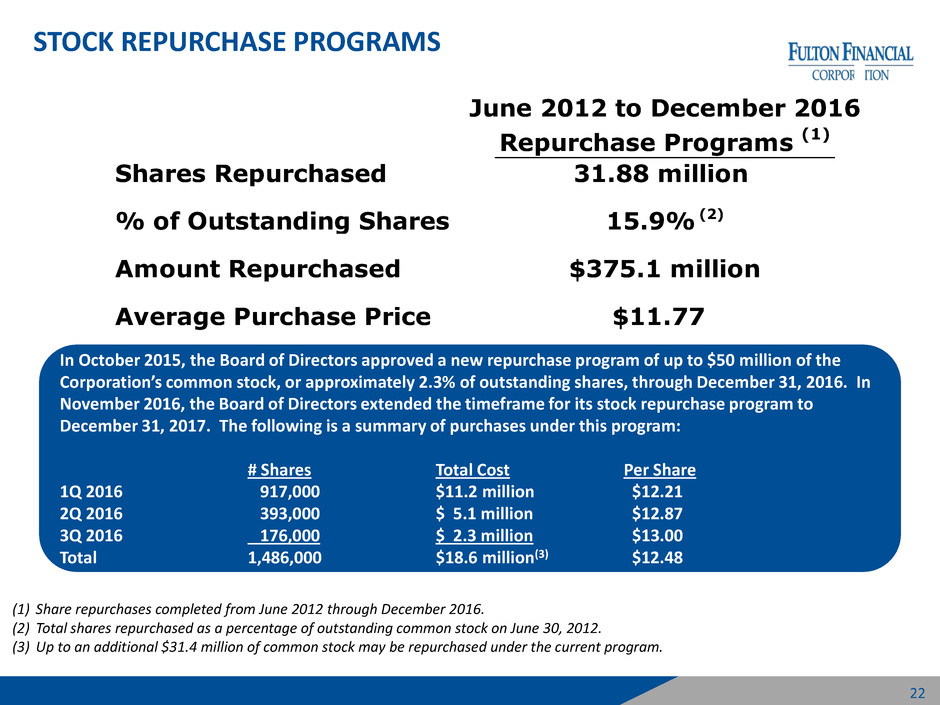

STOCK REPURCHASE PROGRAMS

June 2012 to December 2016

Repurchase Programs (1)

Shares Repurchased 31.88 million

% of Outstanding Shares 15.9% (2)

Amount Repurchased $375.1 million

Average Purchase Price $11.77

demand and savings

(1) Share repurchases completed from June 2012 through December 2016.

(2) Total shares repurchased as a percentage of outstanding common stock on June 30, 2012.

(3) Up to an additional $31.4 million of common stock may be repurchased under the current program.

In October 2015, the Board of Directors approved a new repurchase program of up to $50 million of the

Corporation’s common stock, or approximately 2.3% of outstanding shares, through December 31, 2016. In

November 2016, the Board of Directors extended the timeframe for its stock repurchase program to

December 31, 2017. The following is a summary of purchases under this program:

# Shares Total Cost Per Share

1Q 2016 917,000 $11.2 million $12.21

2Q 2016 393,000 $ 5.1 million $12.87

3Q 2016 176,000 $ 2.3 million $13.00

Total 1,486,000 $18.6 million(3) $12.48

22

AVERAGE ASSETS AND ROA, BY BANK

Year Ended

Dec 31, 2016

Average Assets

($ Millions) 2016 2015

Fulton Bank, N.A. $10,206 1.08% 1.03%

The Columbia Bank 2,191 0.94% 0.88%

Lafayette Ambassador Bank 1,534 0.92% 0.91%

Fulton Bank of New Jersey 3,777 0.67% 0.76%

FNB Bank, N.A. 354 0.62% 0.46%

Swineford National Bank 311 0.55% 0.87%

Fulton Financial Corporation $18,371 0.88% 0.86%

Year Ended Dec 31,

Return on Average Assets (1)

(1) Net Income divided by average assets, annualized.

23

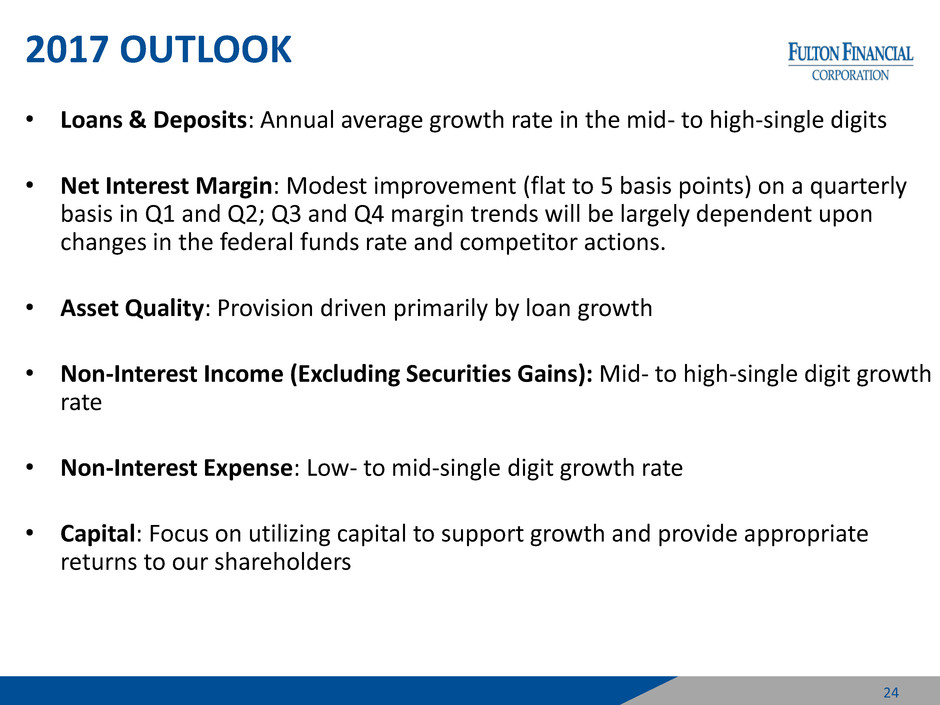

2017 OUTLOOK

• Loans & Deposits: Annual average growth rate in the mid- to high-single digits

• Net Interest Margin: Modest improvement (flat to 5 basis points) on a quarterly

basis in Q1 and Q2; Q3 and Q4 margin trends will be largely dependent upon

changes in the federal funds rate and competitor actions.

• Asset Quality: Provision driven primarily by loan growth

• Non-Interest Income (Excluding Securities Gains): Mid- to high-single digit growth

rate

• Non-Interest Expense: Low- to mid-single digit growth rate

• Capital: Focus on utilizing capital to support growth and provide appropriate

returns to our shareholders

24

APPENDIX

AVERAGE LOAN PORTFOLIO AND YIELDS

26

Note: Yields presented on a fully taxable-equivalent basis, using a 35% federal tax rate and statutory interest expense disallowances.

Average loan portfolio yield is for the three months ended December 31, 2016.

Balance Yield 3Q 2016 4Q 2015 3Q 2016 4Q 2015

Comm'l Mort 5,828$ 3.90% 158$ 462$ (0.09%) (0.15%)

Commercial 4,081 3.74% 15 46 (0.02%) 0.00%

Home Equity 1,634 4.05% (7) (60) (0.03%) (0.02%)

Resid Mort 1,573 3.75% 70 196 (0.01%) (0.04%)

Construction 846 3.78% 8 80 0.02% 0.03%

Cons./Other 514 5.32% 20 93 0.26% (0.25%)

Total Loans 14,476$ 3.90% 264$ 817$ (0.03%) (0.06%)

(dollars in millions)

Balance From4Q 2016

Change in

Yield From

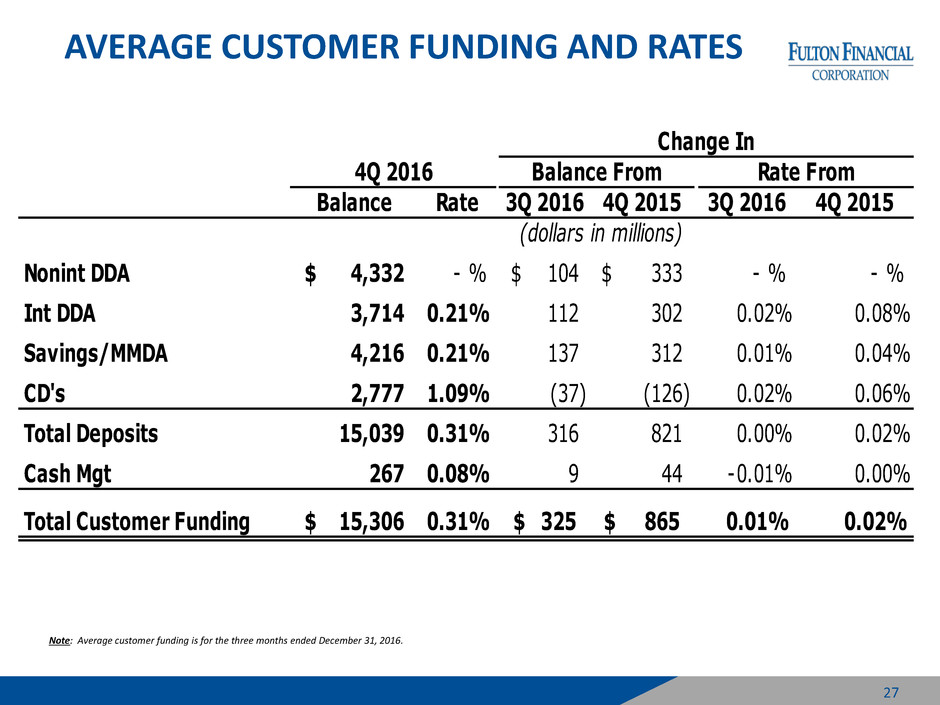

AVERAGE CUSTOMER FUNDING AND RATES

27

Balance Rate 3Q 2016 4Q 2015 3Q 2016 4Q 2015

Nonint DDA 4,332$ - % 104$ 333$ - % - %

Int DDA 3,714 0.21% 112 302 0.02% 0.08%

Savings/MMDA 4,216 0.21% 137 312 0.01% 0.04%

CD's 2,777 1.09% (37) (126) 0.02% 0.06%

Total Deposits 15,039 0.31% 316 821 0.00% 0.02%

Cash Mgt 267 0.08% 9 44 -0.01% 0.00%

Total Customer Funding 15,306$ 0.31% 325$ 865$ 0.01% 0.02%

(dollars in millions)

Balance From4Q 2016

Change In

Rate From

Note: Average customer funding is for the three months ended December 31, 2016.

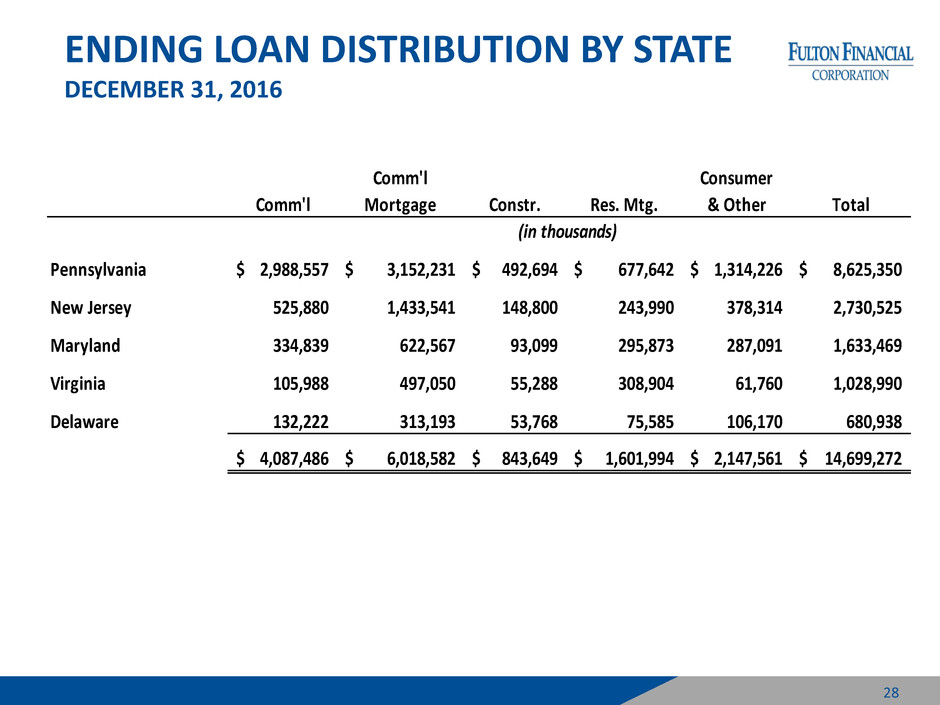

ENDING LOAN DISTRIBUTION BY STATE

DECEMBER 31, 2016

28

Comm'l Consumer

Comm'l Mortgage Constr. Res. Mtg. & Other Total

(in thousands)

Pennsylvania 2,988,557$ 3,152,231$ 492,694$ 677,642$ 1,314,226$ 8,625,350$

New Jersey 525,880 1,433,541 148,800 243,990 378,314 2,730,525

Maryland 334,839 622,567 93,099 295,873 287,091 1,633,469

Virginia 105,988 497,050 55,288 308,904 61,760 1,028,990

Delaware 132,222 313,193 53,768 75,585 106,170 680,938

4,087,486$ 6,018,582$ 843,649$ 1,601,994$ 2,147,561$ 14,699,272$

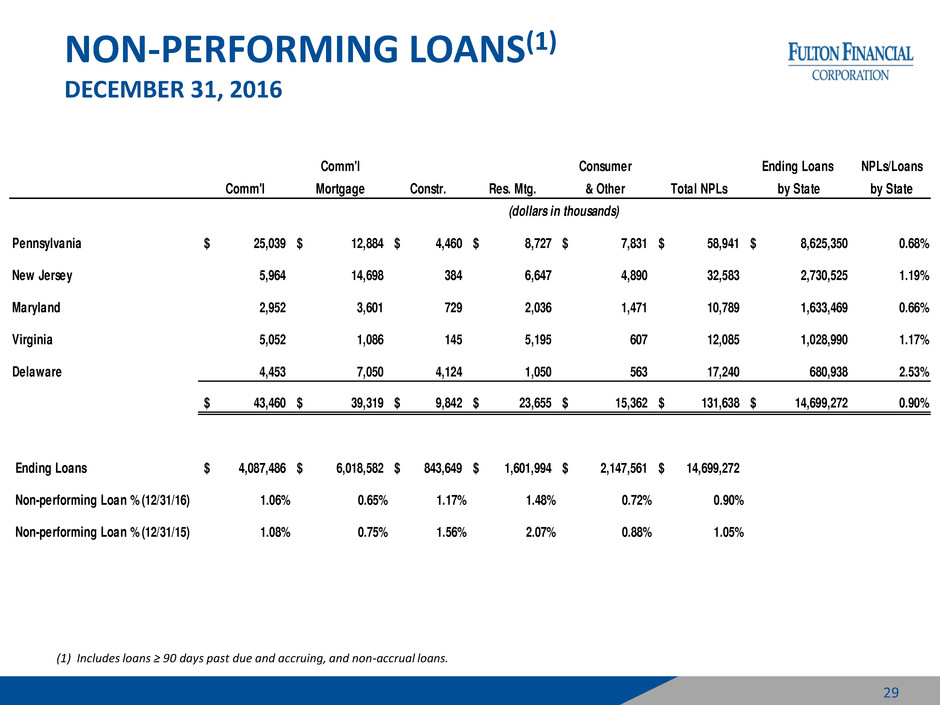

NON-PERFORMING LOANS(1)

DECEMBER 31, 2016

29

Comm'l Consumer Ending Loans NPLs/Loans

Comm'l Mortgage Constr. Res. Mtg. & Other Total NPLs by State by State

Pennsylvania 25,039$ 12,884$ 4,460$ 8,727$ 7,831$ 58,941$ 8,625,350$ 0.68%

New Jersey 5,964 14,698 384 6,647 4,890 32,583 2,730,525 1.19%

Maryland 2,952 3,601 729 2,036 1,471 10,789 1,633,469 0.66%

Virginia 5,052 1,086 145 5,195 607 12,085 1,028,990 1.17%

Delaware 4,453 7,050 4,124 1,050 563 17,240 680,938 2.53%

43,460$ 39,319$ 9,842$ 23,655$ 15,362$ 131,638$ 14,699,272$ 0.90%

Ending Loans 4,087,486$ 6,018,582$ 843,649$ 1,601,994$ 2,147,561$ 14,699,272$

Non-performing Loan % (12/31/16) 1.06% 0.65% 1.17% 1.48% 0.72% 0.90%

Non-performing Loan % (12/31/15) 1.08% 0.75% 1.56% 2.07% 0.88% 1.05%

(dollars in thousands)

(1) Includes loans ≥ 90 days past due and accruing, and non-accrual loans.

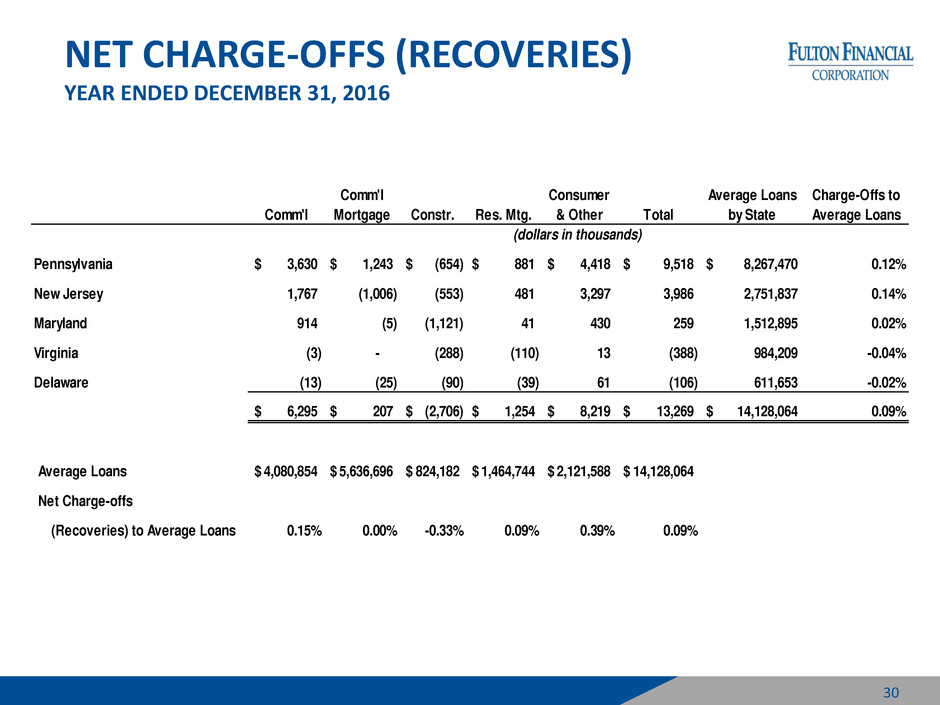

NET CHARGE-OFFS (RECOVERIES)

YEAR ENDED DECEMBER 31, 2016

30

Comm'l Consumer Average Loans Charge-Offs to

Comm'l Mortgage Constr. Res. Mtg. & Other Total by State Average Loans

Pennsylvania 3,630$ 1,243$ (654)$ 881$ 4,418$ 9,518$ 8,267,470$ 0.12%

New Jersey 1,767 (1,006) (553) 481 3,297 3,986 2,751,837 0.14%

Maryland 914 (5) (1,121) 41 430 259 1,512,895 0.02%

Virginia (3) - (288) (110) 13 (388) 984,209 -0.04%

Delaware (13) (25) (90) (39) 61 (106) 611,653 -0.02%

6,295$ 207$ (2,706)$ 1,254$ 8,219$ 13,269$ 14,128,064$ 0.09%

Average Loans 4,080,854$ 5,636,696$ 824,182$ 1,464,744$ 2,121,588$ 14,128,064$

Net Charge-offs

(Recoveries) to Average Loans 0.15% 0.00% -0.33% 0.09% 0.39% 0.09%

(dollars in thousands)

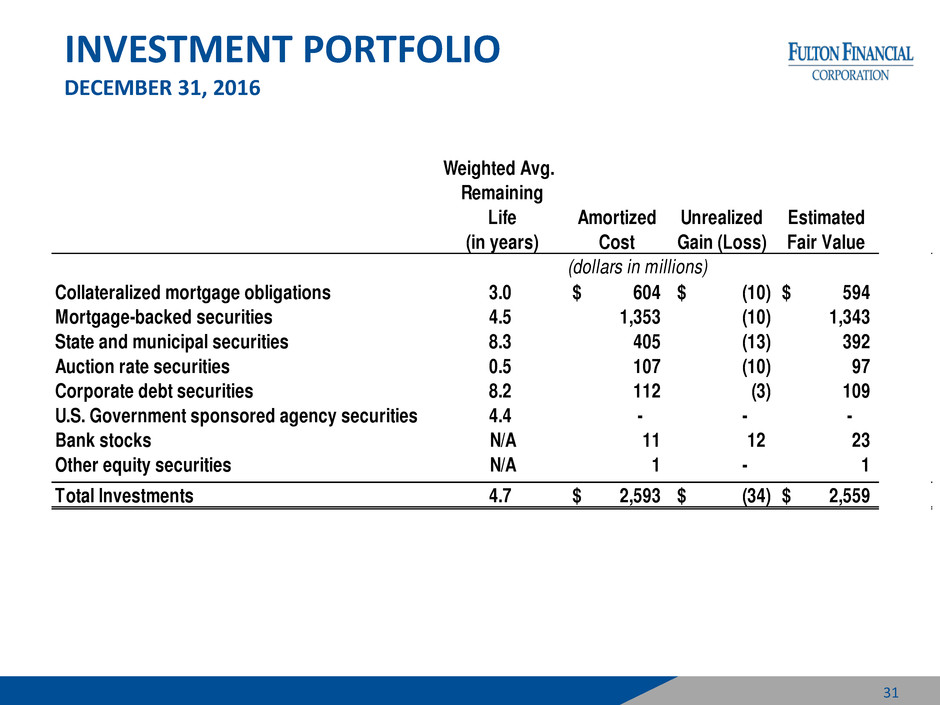

INVESTMENT PORTFOLIO

DECEMBER 31, 2016

31

Weighted Avg.

Remaining

Life Amortized Unrealized Estimated

(in years) Cost Gain (Loss) Fair Value

(dollars in millions)

Collateralized mortgage obligations 3.0 604$ (10)$ 594$

Mortgage-backed securities 4.5 1,353 (10) 1,343

State and municipal securities 8.3 405 (13) 392

Auction rate securities 0.5 107 (10) 97

Corporate debt securities 8.2 112 (3) 109

U.S. Government sponsored agency securities 4.4 - - -

Bank stocks N/A 11 12 23

Other equity securities N/A 1 - 1

Total Investments 4.7 2,593$ (34)$ 2,559$

A SUSTAINABLE PAYOUT

$0.20

$0.30

$0.32

$0.34

$0.38

$0.41

2.04%

3.12%

2.44%

2.75%

2.92%

2.18%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

$0.00

$0.04

$0.08

$0.12

$0.16

$0.20

$0.24

$0.28

$0.32

$0.36

$0.40

$0.44

2011 2012 2013 2014 2015 2016

Cash Dividend Yield

32

(1) Annual dividend per share divided by period-end stock price.

(2) Compounded annual growth rate from December 31, 2011 to December 31 , 2016.

Cash Dividend Per Common Share & Yield

CAGR (2) = 15.4%

Cas

h

D

iv

id

e

n

d

Pe

r

C

o

m

m

o

n

S

h

ar

e

D

ivid

e

n

d

Y

ie

ld

(1

)

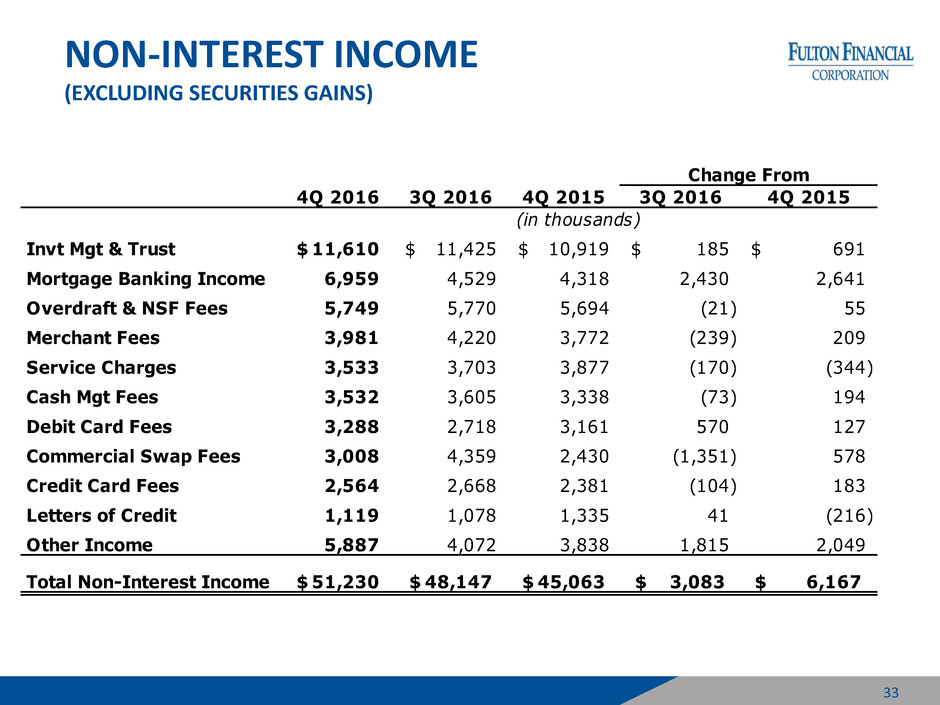

NON-INTEREST INCOME

(EXCLUDING SECURITIES GAINS)

33

4Q 2016 3Q 2016 4Q 2015 3Q 2016 4Q 2015

Invt Mgt & Trust 11,610$ 11,425$ 10,919$ 185$ 691$

Mortgage Banking Income 6,959 4,529 4,318 2,430 2,641

Overdraft & NSF Fees 5,749 5,770 5,694 (21) 55

Merchant Fees 3,981 4,220 3,772 (239) 209

Service Charges 3,533 3,703 3,877 (170) (344)

Cash Mgt Fees 3,532 3,605 3,338 (73) 194

Debit Card Fees 3,288 2,718 3,161 570 127

Commercial Swap Fees 3,008 4,359 2,430 (1,351) 578

Credit Card Fees 2,564 2,668 2,381 (104) 183

Letters of Credit 1,119 1,078 1,335 41 (216)

Other Income 5,887 4,072 3,838 1,815 2,049

Total Non-Interest Income 51,230$ 48,147$ 45,063$ 3,083$ 6,167$

(in thousands)

Change From

NON-INTEREST EXPENSE

34

4Q 2016 3Q 2016 4Q 2015 3Q 2016 4Q 2015

Salaries & Benefits 73,256$ 70,696$ 65,467$ 2,560$ 7,789$

Occupancy & Equipment 15,206 14,919 15,192 287 14

Data Proc. & Software 9,442 8,727 9,195 715 247

Outside Services 6,536 5,783 6,537 753 (1)

Professional fees 2,783 2,535 2,814 248 (31)

Supplies & Postage 2,447 2,559 2,399 (112) 48

FDIC Insurance 2,067 1,791 2,896 276 (829)

Marketing 1,730 1,774 1,754 (44) (24)

Telecommunications 1,345 1,411 1,430 (66) (85)

Operating Risk Loss 733 556 987 177 (254)

OREO & Repo Expenses, net 181 742 1,123 (561) (942)

Other Expenses 11,894 8,355 8,645 3,539 3,249

Total Non-Interest Expenses 127,620$ 119,848$ 118,439$ 7,772$ 9,181$

(in thousands)

Change From

NON-GAAP RECONCILIATION

Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes

that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition.

Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-

GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the

Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be

comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP

basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety.

35

Dec 31 Mar 31 Jun 30 Sep 30 Dec 31

2015 2016 2016 2016 2016 2013 2014 2015 2016

Efficiency ratio

Non-interest expense 118,439$ 120,413$ 121,637$ 119,848$ 127,621$ 461,433$ 459,246$ 480,160$ 489,519$

Less: Intangible amortization (6) - - - - (2,438) (1,259) (247) -

Less: Loss on redemption of TruPS - - - - - - - (5,626) -

Numerator 118,433$ 120,413$ 121,637$ 119,848$ 127,621$ 458,995$ 457,987$ 474,287$ 489,519$

Net interest income (fully taxable equivalent) 132,683$ 134,026$ 133,890$ 135,784$ 137,571$ 544,474$ 532,322$ 518,464$ 541,271$

Plus: Total Non-interest income 45,839 43,137 46,137 48,149 52,755 187,664 167,379 181,839 190,178

Less: Investment securities gains (776) (947) (76) (2) (1,525) (8,004) (2,041) (9,066) (2,550)

Denominator 177,746$ 176,216$ 179,951$ 183,931$ 188,801$ 724,134$ 697,660$ 691,237$ 728,899$

Efficiency ratio 66.6% 68.3% 67.6% 65.2% 67.6% 63.4% 65.6% 68.6% 67.2%

Dec 31 Mar 31 Jun 30 Sep 30 Dec 31

2015 2016 2016 2016 2016 2013 2014 2015 2016

Return on Average Shareholders' Equity (ROE) (Tangible)

Net income 38,535$ 38,257$ 39,750$ 41,468$ 42,150$ 161,840$ 157894 149,502$ 161,625$

Plus: Intangible amortization, net of tax 4 - - - - 1,585 818 161 -

umer tor 38,539$ 38,257$ 39,750$ 41,468$ 42,150$ 163,425$ 158,712$ 149,663$ 161,625$

Av rage shareholders' equity 2,036,769$ 2,058,799$ 2,089,915$ 2,120,596$ 2,132,655$ 2,053,821$ 2071640 2,026,883$ 2,100,634$

Less: Average goodwill and intangible assets (531,559) (531,556) (531,556) (531,556) (531,556) (534,431) -532425 (531,618) (531,556)

Average tangible shareholders' equity (denominator) 1,505,210$ 1,527,243$ 1,558,359$ 1,589,040$ 1,601,099$ 1,519,390$ 1,539,215$ 1,495,265$ 1,569,078$

Return on average common shareholders' equity (tangible), annualized 10.16% 10.07% 10.26% 10.38% 10.47% 10.76% 10.31% 10.01% 10.30%

Three Months Ended

Three Months Ended

(dollars in thousands)

(dollars in thousands)

Year ended Dec 31,

Year ended Dec 31,

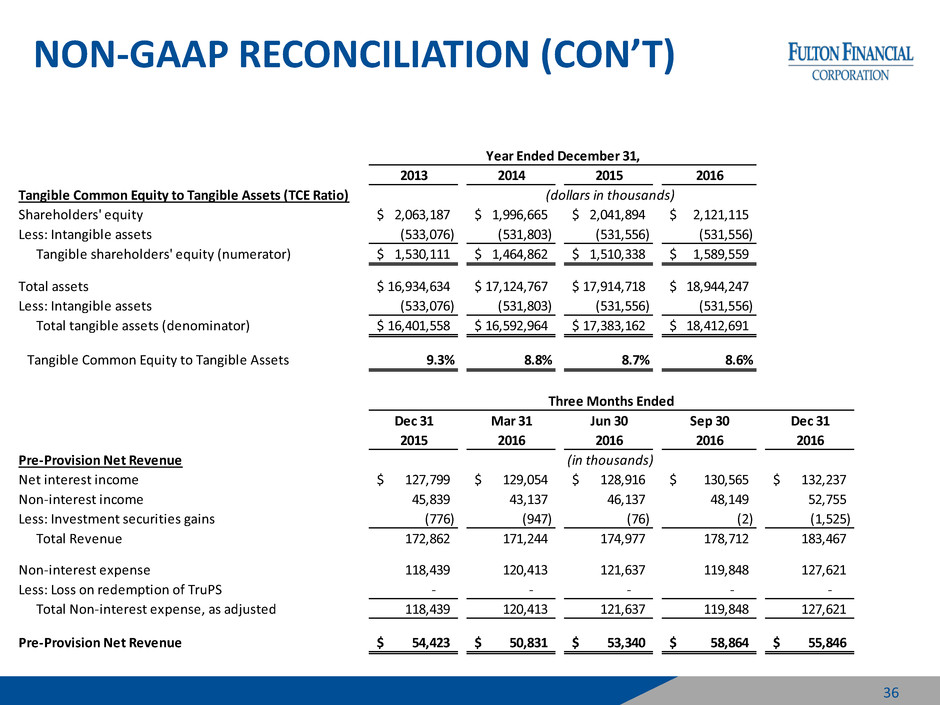

NON-GAAP RECONCILIATION (CON’T)

36

2013 2014 2015 2016

Tangible Common Equity to Tangible Assets (TCE Ratio)

Shareholders' equity 2,063,187$ 1,996,665$ 2,041,894$ 2,121,115$

Less: Intangible assets (533,076) (531,803) (531,556) (531,556)

Tangible shareholders' equity (numerator) 1,530,111$ 1,464,862$ 1,510,338$ 1,589,559$

Total assets 16,934,634$ 17,124,767$ 17,914,718$ 18,944,247$

Less: Intangible assets (533,076) (531,803) (531,556) (531,556)

Total tangible assets (denominator) 16,401,558$ 16,592,964$ 17,383,162$ 18,412,691$

Tangible Common Equity to Tangible Assets 9.3% 8.8% 8.7% 8.6%

Dec 31 Mar 31 Jun 30 Sep 30 Dec 31

2015 2016 2016 2016 2016

Pre-Provision Net Revenue

Net interest income 127,799$ 129,054$ 128,916$ 130,565$ 132,237$

Non-interest income 45,839 43,137 46,137 48,149 52,755

Less: Investment securities gains (776) (947) (76) (2) (1,525)

Total Revenue 172,862 171,244 174,977 178,712 183,467

Non-interest expense 118,439 120,413 121,637 119,848 127,621

Less: Loss on redemption of TruPS - - - - -

Total Non-interest expense, as adjusted 118,439 120,413 121,637 119,848 127,621

Pre-Provision Net Revenue 54,423$ 50,831$ 53,340$ 58,864$ 55,846$

Three Months Ended

(dollars in thousands)

(in thousands)

Year Ended December 31,

www.fult.com