Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Carbonite Inc | ex991-doublextakepressrele.htm |

| EX-10.1 - EXHIBIT 10.1 - Carbonite Inc | fourthamendmenttocreditagr.htm |

| EX-2.2 - EXHIBIT 2.2 - Carbonite Inc | ex22-doublextakeregrights.htm |

| EX-2.1 - EXHIBIT 2.1 - Carbonite Inc | ex21-doublextakespa.htm |

| 8-K - 8-K - Carbonite Inc | double-take8xk.htm |

CARBONITE ACQUIRES

DOUBLE-TAKE SOFTWARE

Safe Harbor Statement

2

These slides and the accompanying oral presentation contain "forward-looking statements" within the meaning of the Securities Act of 1933 and

the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. These forward-looking statements

represent the Company's views as of the date they were first made based on the current intent, belief or expectations, estimates, forecasts,

assumptions and projections of the Company and members of our management team. Words such as "expect," "anticipate," "should," "believe,"

"hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend," variations of these terms or the negative

of these terms and similar expressions are intended to identify these forward-looking statements. Those statements include, but are not limited to,

statements regarding guidance on our future financial results and other projections or measures of future performance; the expected future results

of the acquisition of Double-Take Software, including revenues, non-GAAP EPS and growth rates; the Company’s ability to successfully integrate

Double-Take Software’s business; and the Company’s expectations regarding its future performance. Forward-looking statements are subject to a

number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The Company's actual

results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including, but not limited to, the

Company's ability to profitably attract new customers and retain existing customers, the Company's dependence on the market for cloud backup

services, the Company's ability to manage growth, and changes in economic or regulatory conditions or other trends affecting the Internet and the

information technology industry. These and other important risk factors are discussed under the heading "Risk Factors" in our Annual Report on

Form 10-K for the fiscal year ended December 31, 2015 filed with the Securities and Exchange Commission, which is available on www.sec.gov.

Except as required by law, we do not undertake any obligation to update our forward-looking statements to reflect future events, new information or

circumstances.

This presentation contains non-GAAP financial measures including, but not limited to, non-GAAP Revenue and non-GAAP Net Income Per Share.

The definitions of Bookings and these non-GAAP financial measures is included in this presentation. Additional information regarding non-GAAP

financial measures can be found in the accompanying press release announcing the acquisition of Double-Take software and in the financial

schedules included in our most recent financial results press release, which can be found on Carbonite’s website, investor.carbonite.com, or with

the SEC at www.sec.gov.

Carbonite Acquires Double-Take Software

3

Expands Carbonite’s

offerings in data

protection for SMB

Acquiring Double-Take high availability solutions that support physical,

virtual or cloud-based servers across Windows and Linux

Adds customers,

partners and

employees to

Carbonite business

6000+ customers

500+ partners

140+ employees

Strengthens Carbonite’s overall leadership position in the

data protection market by adding high availability (HA) and

migration technology to our solution portfolio

Why Double-Take Software?

4

Delivers customer

proven solutions

today

Brings robust customer-proven high availability (HA) and migration solutions

to the Carbonite portfolio.

Broad platform support complements breadth of current data protection

portfolio, especially Carbonite EVault products.

Increases penetration

in SMB and expands

opportunity

Adds considerable strength and credibility to positioning Carbonite

as leader in data protection for medium and small businesses.

Expands our market reach through active network of more than 500

channel partners.

Adds value to our

business

Adds strong brand to overall Carbonite business.

Provides immediate cross-sell opportunities

Expect that Double-Take Software will contribute approximately

$22.5 million - $27.5 million in 2017 bookings

Expanding Market Opportunity

Data Protection & Recovery software revenue is $7 Billion expected to

grow at a 5.5% CAGR

1. Cloud Data Protection market growing at 12% CAGR

2. Disaster Recover as a Service (DRaaS) market growing at 53%

CAGR

Sources: IDC, MarketsandMarkets

5

Carbonite participates in two high growth sectors of the market:

Data Protection Solutions: From Backup to HA

Endpoint & Servers

Restore

Servers

Failover HA

TARGET

RTO/RPO

<24 Hours Minutes - Hours Immediate - Minutes

SIZE Up to 1TB 1T – 50T 1T – 50T

TYPE Cloud Cloud/Hybrid/On-site Cloud/On-Site

Servers

6

BACKUP DISASTER RECOVERY HIGH AVAILABILITY

BUSINESSES

PROTECTED

Very Small and

Small Businesses

Small Businesses

and Mid-Market

Mid-Market and

Enterprise

ASP ~$500 ~$10,000 ~$4,500

OPPORTUNITY

Candidates for up-

sell to EVault and

DoubleTake

Candidates for

cross-sell of

Carbonite

DoubleTake

Candidates for cross-

sell of Carbonite

EVault

Significant Cross-Sell and Up-Sell Opportunities

+

BACKUP DISASTER RECOVERY HIGH AVAILABILITY

7

Transaction Details

8

The Deal Acquire Double-Take Software in a carve-out transaction

Purchase Price

Total purchase price $65.25 M:

$59.75 M in cash

$5.50 M in newly issued equity (~332,000 shares)

Source of Funds

$20.55 M cash on hand

$39.20 M revolving credit facility through Silicon Valley Bank

Transaction Closing Simultaneous sign and close

2017 Expected Financial Impact

9

Expected Double-Take

Contribution

Bookings $22.5 - $27.5 million

Non-GAAP revenue $20.0 - $25.0 million

Non-GAAP Net Income Per Share $0.08 - $0.12

*Reference Definitions of Non-GAAP Measures slide and the accompanying press release issued January 31, 2017 and posted to

investor.carbonite.com for more information regarding GAAP and non-GAAP financial measures

Summary

10

• Significantly expands market opportunity

• Portfolio of data protection solutions from backup to high

availability (HA)

• Allows us to better serve mid-market and new use cases

• Provides immediate cross-sell opportunity

• Great technology, great team

• Strong financial contribution

Definitions of Non-GAAP Measures

11

Bookings: Bookings represent the aggregate dollar value of customer subscriptions and software arrangements, which may

include multiple revenue elements, such as software licenses, hardware, professional services and post-contractual support,

received during a period and are calculated as revenue recognized during a particular period plus the change in total deferred

revenue, excluding deferred revenue recorded in connection with acquisitions, net of foreign exchange during the same period.

Non-GAAP revenue: Excludes the impact of purchase accounting adjustments for acquisitions.

Non-GAAP net income per share: Non-GAAP net income per share excludes the impact of purchase accounting adjustments,

amortization expense on intangible assets, stock-based compensation expense, litigation-related expense, restructuring-related

expense, acquisition-related expense, hostile takeover-related expense, CEO transition expense, and the income tax effect of

non-GAAP adjustments.

ADDITIONAL

SLIDES

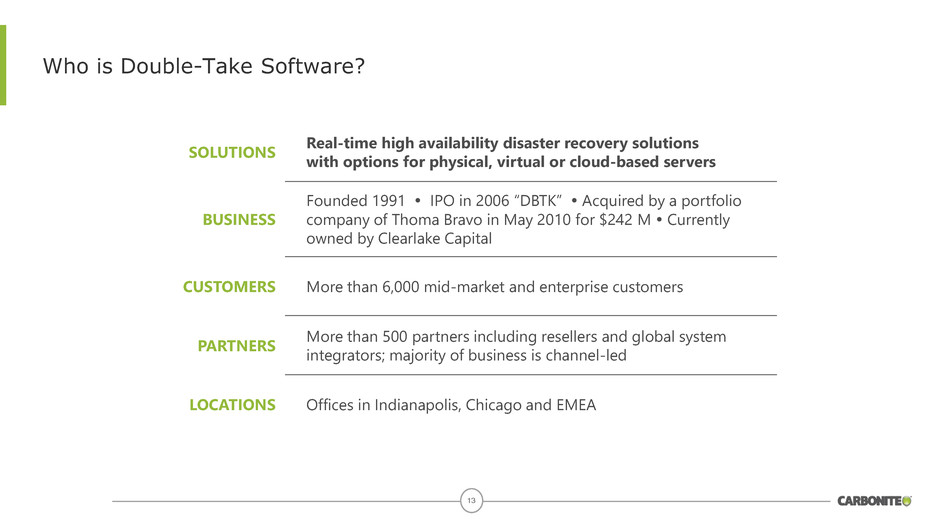

Who is Double-Take Software?

13

SOLUTIONS

Real-time high availability disaster recovery solutions

with options for physical, virtual or cloud-based servers

BUSINESS

Founded 1991 IPO in 2006 “DBTK” Acquired by a portfolio

company of Thoma Bravo in May 2010 for $242 M Currently

owned by Clearlake Capital

CUSTOMERS More than 6,000 mid-market and enterprise customers

PARTNERS

More than 500 partners including resellers and global system

integrators; majority of business is channel-led

LOCATIONS Offices in Indianapolis, Chicago and EMEA

Double-Take Product Portfolio

14

HIGH

AVAILABILITY

DISASTER

RECOVERY

MOVE

CLOUD

MIGRATION

SQL MIGRATION

High Availability in Action

15

PRODUCTION REPLICA

Source

Physical

Servers

Source

Cloud

Servers

Source

Virtual

Servers

Recovery

Physical

Servers

Recovery

Cloud

Servers

Recovery

Virtual

Servers

High Availability in Action

16

PRODUCTION

Source

Physical

Servers

Source

Cloud

Servers

Source

Virtual

Servers

Recovery

Physical

Servers

Recovery

Cloud

Servers

Recovery

Virtual

Servers