Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF IMMUNOMEDICS, INC., DATED JANUARY 30, 2017, TITLED "IMMUNOMEDIC - IMMUNOMEDICS INC | f8k013017ex99i_immunomed.htm |

| 8-K - CURRENT REPORT - IMMUNOMEDICS INC | f8k013017_immunomedics.htm |

Exhibit 99.2

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 IMMUNOMEDICS, INC. Advanced Antibody - Based Therapeutics Oncology Autoimmune Diseases January 2017 Setting the Record Straight: Immunomedics is Acting in the Best Interests of All Stockholders to Maximize Near - Term Value

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Important Additional Information / Forward Looking Statements Important Additional Information Immunomedics , Inc. (the “Company”), its directors and certain of its executive officers will be deemed to be participants in the solicita tio n of proxies from Company stockholders in connection with the matters to be considered at the Company’s 2016 Annual Meeting. Th e Company has filed a definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (th e “SEC”) in connection with any such solicitation of proxies from Company stockholders. COMPANY STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND THE SUPPLEMENT FILED ON JANUARY 9, 2017 (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS), THE ACCOMPANYING WHITE PROXY CARD AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY FILES WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, is set for th in the proxy statement and other materials filed by the Company with the SEC. Stockholders will be able to obtain the proxy statement, an y amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the S EC’ s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at www.immunomedics.com, by writi ng to Immunomedics , Inc. at 300 The American Road, Morris Plains, New Jersey 07950, or by calling the Company’s proxy solicitor, or by calling Dr. Chau Cheng, Senior Director, Investor Relations & Corporate Secretary, (973) 605 - 8200, extension 123. Forward - Looking Statements This presentation, in addition to historical information, may contain forward - looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Such statements, including statements regarding clinical trials (including the funding therefo r, anticipated patient enrollment, trial outcomes, timing or associated costs), regulatory applications and related timelines, out - licensing ar rangements (including the timing and amount of contingent payments), forecasts of future operating results, potential collaborations, an d c apital raising activities, involve significant risks and uncertainties and actual results could differ materially from those express ed or implied herein. Factors that could cause such differences include, but are not limited to, the Company’s dependence on business colla bor ations or availability of required financing from capital markets, or other sources on acceptable terms, if at all, in order to further de velop our products and finance our operations, new product development (including clinical trials outcome and regulatory requirements/a cti ons), the risk that we or any of our collaborators may be unable to secure regulatory approval of and market our drug candidates, r isk s associated with the outcome of pending litigation and competitive risks to marketed products, and the Company’s ability to re pay its outstanding indebtedness, if and when required, as well as the risks discussed in the Company’s filings with the Securities a nd Exchange Commission. The Company is not under any obligation, and the Company expressly disclaims any obligation, to update or alter a ny forward - looking statements, whether as a result of new information, future events or otherwise. 2

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Setting the Record Straight on venBio’s Presentation Filed on January 26, 2017 • In response to venBio’s presentation filed on January 26, 2017, which was filled with serious mischaracterizations and inaccuracies, Immunomedics’ new Board simply wants to correct the record and provide the facts • At the Annual Meeting of Stockholders on February 16, Immunomedics stockholders will be asked to make a decision that will dramatically affect the immediate future of the Company’s ongoing robust strategic process, imminent Phase 3 trial initiation and near - term BLA filing for IMMU - 132 • Immunomedics’ new Board remains focused on successfully completing the strategic process, maximizing value for stockholders and providing stockholders with the information needed to make a decision when voting 3

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 4 Immunomedics’ New Board Formed in Response to Stockholder Requests and is Truly Independent • Immunomedics listened to its stockholders and understood the need for change • The Board began its search for new directors in advance of the venBio nominations • New independent Directors Dr. Geoffrey Cox, Robert Forrester and Bob Oliver were identified by an independent search firm • New independent Director and Vice Chairman Jason Aryeh was highly recommended and sought after for his reputation for stockholder advocacy . In the past, he has worked successfully with the other new Board members to create value for stockholders Your Board accelerated the appointment of its four new directors and implemented a leadership succession plan after listening to the requests of stockholders and determining that a reasonable settlement with venBio was not achievable

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 5 Right Process Underway, Being Overseen by a New Board with the Right Experience • Independent third - party experts have conducted a full commercial assessment of the U.S. and European market opportunities for IMMU - 132, as well as an independent audit of Phase 3 and commercial manufacturing facilities, processes, and other relevant manufacturing and regulatory areas – The Company has engaged an independent, ex - FDA consultant to audit facilities and manufacturing documents, all in preparation for the Biologics License Application (BLA) for accelerated FDA approval of IMMU - 132 in patients with metastatic triple - negative breast cancer (TNBC) – To validate clinical results, an independent third - party review is well underway, looking at pertinent radiological scan results in a blinded fashion, as per FDA requirements – The Company’s clinical investigators are confirming the patient results of IMMU - 132 in TNBC and urinary bladder cancer (UC) in several articles recently published, scheduled to publish or under review for publication in major cancer journals; these articles confirm the results provided to the Company’s stockholders – Immunomedics offered a non - disclosure agreement to venBio under which it would share its independent expert analysis and demonstrate the credibility of its process, which venBio refused • Immunomedics will — and must — accomplish its timeline to start the Phase 3 trial of IMMU - 132 and submit the BLA filing in mid - 2017 Independent Board members Dr. Geoffrey Cox , Brian Markison and Bob Oliver have experience assembling a drug application and/or manufacturing complex biologic therapeutics at commercial scale

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 6 Right Process Underway, Being Overseen by a New Board with the Right Experience • Dr . Geoffrey Cox has 30+ years of experience in senior management of biologics GMP manufacturing operations and deep experience supporting pharmaceutical development, commercial manufacturing and organizational infrastructure in a regulated environment – 13 years at Genzyme Corporation — EVP of worldwide manufacturing operations; responsible for establishing U.S. manufacturing capabilities, specifically for Ceredase and Cerezyme , which became a $1.3BN product for Gauchers disease – As Chairman, President and CEO of GTC Biotherapeutics , helped Company become first in the world to develop and achieve EU and U.S. regulatory approval for a transgenically manufactured human therapeutic protein – Previously served as interim CEO and director of QLT while Company conducted a strategic process, culminating in the acquisition of Aegerion and formation of new company, Novelion Therapeutics • Robert Forrester is CEO and a director of Verastem , Inc., a late clinical - stage oncology biopharma company, with relevant experience from both private and public life sciences companies, as well as business development, M&A and financial expertise – Verastem is a biopharma company with a Phase 3 oncology drug, with the Phase 3 data due shortly and the goal of filing with the FDA this year • Bob Oliver is CEO of Otsuka America Pharmaceutical and over the past 6+ years, has managed its Oncology business, including the promotion of Sprycel ® in partnership with Bristol - Myers Squibb for the treatment of CML – Direct experience helping to commercialize a major drug – ABILIFY ® ( aripiprazole ), which grew to the #1 pharmaceutical in the U.S. – and led the transfer of the ABILIFY® (aripiprazole) commercial responsibilities from Bristol - Myers Squibb to Otsuka – As VP & Global Business Manager, Oncology at Wyeth Pharmaceuticals, led the global launch of Torisel ® for the treatment of renal cell carcinoma

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 • Ligand Pharmaceuticals, Inc . (NASDAQ: LGND): – At request of activist hedge fund Third Point LLC, Mr. Aryeh became an advisor engaged to lead Ligand's strategic process. He successfully completed the task in five weeks and for no remuneration – Mr . Aryeh was then elected to serve on and successfully reconstituted a new stockholder - focused Board, hired an exceptional CEO, and co - created an acutely cash - flow focused business model – Ligand then expeditiously distributed $250M, or $15.00/share adjusted for the Company’s stock split, of cash tax - free to its stockholders, which venBio neglects to include in its fabricated performance claims – Ligand has evolved from a Company generating substantial losses into a massively profitable stock; Ligand was named Fortune’s highest - earning growth stock over the past three years and the sixth - highest growth stock in any industry – During 2016, Ligand's valuation had increased ~17X over past ~7 years – During Mr. Aryeh's Board tenure, Ligand has added ~150 externally funded corporate partnerships with more than 90 different pharmaceutical partners, all while reducing expenses by more than 90% • Novelion Therapeutics Inc. (NASDAQ: NVLN) (TSX: NVLN ): – NVLN 's stock performance since Mr. Aryeh's Chairmanship began on 12/2/16 is actually up 4% (from $9.00 to $9.38). v enBio is being completely dishonest in claiming that NVLN has lost 50% of its value since Mr. Aryeh became Chairman – Furthermore , NVLN beat analysts’ expectations in its only quarter during Mr. Aryeh's Chairmanship 7 Jason Aryeh : Proven Track Record of Creating Value & Advocating for Stockholders’ Interests “Life After Loeb: Ligand Pharmaceuticals Prospers In Stripped - Down Mode” - Forbes, July 1, 2015 “#6 Ligand Pharmaceuticals – ‘This biotech licensor’s two hit drugs – Krypolis , used to treat blood cancer, and Promacta , used to prevent bleeding episodes – injected big royalties last year .’” - Fortune, 100 Fastest Growing Companies 2016

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 • QLT Inc. (formerly NASDAQ: QLTI) (formerly TSX: QLT) : – Thirty - five days after Mr. Aryeh became Chairman, QLT implemented a strategic repositioning significantly lowering the company’s cost structure, including reducing its employee base by 68%, amongst other shareholder - focused initiatives – Less than four months later, Mr. Aryeh sold QLT's competitively inferior AMD drug, Visudyne , for $112.5 million plus milestones – Then Chairman Aryeh quickly helped return $3.92/share in QLT's first of two tax - free distributions of capital to shareholders. That was the first tax - free distribution of capital ever allowed by Canadian tax authorities – Mr . Aryeh has orchestrated the only two tax - free distributions of capital ever permitted by Canada when QLT later returned an additional $1.14/share to shareholders, in the form of cash and shares of Aralez Pharmaceuticals – QLT's stock closed out its existence on 11/29/16 at $1.95/share. Thus $3.92 + $1.14 + $1.95 = $7.01 is higher than the stock price of $6.69 on May 22, 2012, when Mr. Aryeh became involved with QLT. Thus, venBio's claim that QLT lost 50% of its value during Mr. Aryeh's tenure is a complete misrepresentation as stocks decline proportionally to the amount of a capital distribution. Furthermore, the true economic value of returning cash tax - free is considerably higher than the taxable sale of stock or a regular taxable dividend. – Not included in Mr. Aryeh's /QLT's creation of shareholder value are two exceptional mergers that Mr. Aryeh led, both of which were trumped by interlopers ~one month before their expected closings. QLT, at no fault of its own, lost a merger deal with Auxilium Pharmaceuticals, which had valued QLT at over $7/share, post its previously completed $3.92 distribution (some QLT shareholders took advantage of the announced AUXL transaction and sold QLT above $7, thus returning more than $11/QLT share) – Mr . Aryeh also executed multiple other returns of capital to shareholders via stock buybacks – QLT was actually up, despite losing two incredible mergers to interlopers, Endo for Auxilium & Sun Pharma for Insite Vision, at 85% & 97% premiums, respectively – Mr . Aryeh ultimately helped merge QLT with Aegerion Pharmaceuticals, a commercial - stage orphan drug company trading for only ~1.6X revenues 8 Jason Aryeh : Proven Track Record of Creating Value & Advocating for Stockholders’ Interests

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Jason Aryeh : Proven Track Record of Creating Value & Advocating for Stockholders’ Interests • Aralez Pharmaceuticals (NASDAQ: ARLZ ): – Aralez is a new specialty pharmaceutical company (formed in 2016) led by a world - class CEO Adrian Adams – In its few quarters of its existence, ARLZ has consistently exceeded analysts' earnings estimates and has completed two universally praised product acquisitions • Derma Sciences, Inc . (NASDAQ: DSCI): – During an activist campaign led by Broadfin Capital , Mr. Aryeh was contracted as a consultant to maximize shareholder value – Mr . Aryeh expeditiously helped the Company make a very effective leadership change and recommended a review of strategic alternatives led by Greenhill & Co. that resulted in the acquisition of BioD , which created significant value for shareholders – With Mr. Aryeh's assistance, Derma was recently sold by Greenhill & Co. for a 40% one - day premium, and a 135 % premium to its low price after its lead development program failed (a program that began years before Mr. Aryeh's hiring ) • Myrexis , Inc. (formerly NASDAQ: MYRX): – During an activist campaign, Mr. Aryeh was appointed to the Board to stop the Company’s wasteful spending on inferior oncology development programs – With Director Robert Forrester's assistance, Mr. Aryeh expeditiously shut down all of Myrexis ' programs and then returned $ 2.86/share of cash tax - free to shareholders. Again, venBio completely neglects to include Myrexis ' large capital distribution in its fictitious performance claims – Mr . Aryeh then championed the sale of the MYRX shell/listing for additional value, creating positive shareholder value during his tenure on the Myrexis Board 9

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Jason Aryeh : Proven Track Record of Creating Value & Advocating for Stockholders’ Interests • Nabi Biopharmaceuticals (formerly NASDAQ: NABI): – Mr . Aryeh was placed on the Board as two of 10 Directors via activism led by Third Point LLC – Mr . Aryeh forced Nabi's decision to partner NicVax with GlaxoSmithKline – Nabi then distributed $ 1.11/share tax - free to shareholders, again not included in venBio's performance misrepresentation – Nabi subsequently sold its listing plus $27 million of cash to Biota Pharmaceuticals for a significant premium, completing Mr. Aryeh's Board service on November 9, 2012. Again, as opposed to venBio's completely fabricated assertions, Mr. Aryeh had absolutely no involvement with Biota or Aviragen Therapeutics • The Cystic Fibrosis Foundation: – Mr . Aryeh is extremely proud and honored to have served on the CF Foundation’s Therapeutics Board since 2011 – The CF Foundation is renowned for having created "venture philanthropy“, and is universally recognized as one of the world's best healthcare charities – Mr . Aryeh helped the CF Foundation turn its $150M funding used to help Vertex Pharmaceuticals develop transformative CF medications, into a $3.3B cash payment from Royalty Pharma 10 Mr. Aryeh is clearly the Director whom shareholders would want to lead any strategic process and corporate reorganization

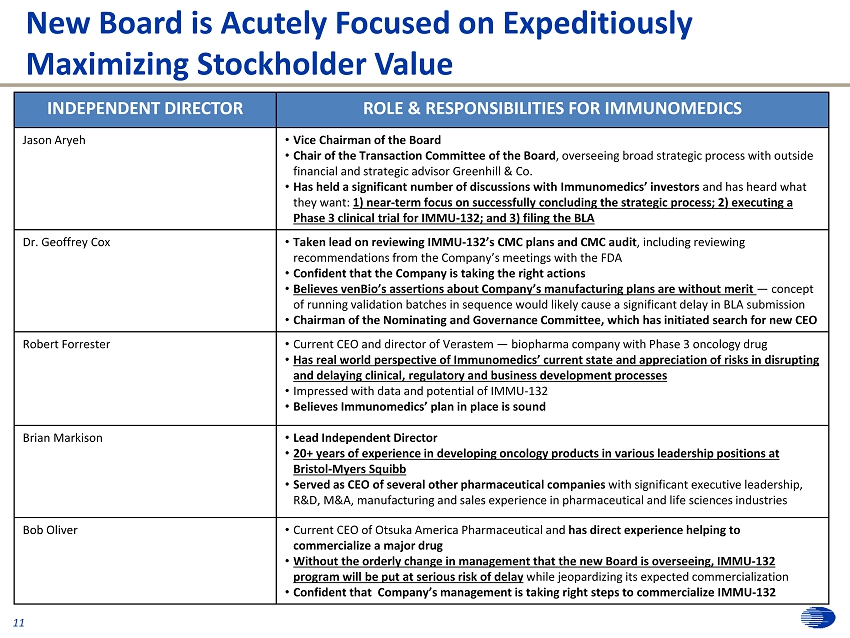

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 11 New Board is Acutely Focused on Expeditiously Maximizing Stockholder Value INDEPENDENT DIRECTOR ROLE & RESPONSIBILITIES FOR IMMUNOMEDICS Jason Aryeh • Vice Chairman of the Board • Chair of the Transaction Committee of the Board , overseeing broad strategic process with outside financial and strategic advisor Greenhill & Co. • Has held a significant number of discussions with Immunomedics’ investors and has heard what they want: 1) near - term focus on successfully concluding the strategic process; 2) executing a Phase 3 clinical trial for IMMU - 132; and 3) filing the BLA Dr. Geoffrey Cox • Taken lead on reviewing IMMU - 132’s CMC plans and CMC audit , including reviewing recommendations from the Company’s meetings with the FDA • Confident that the Company is taking the right actions • Believes venBio’s assertions about Company’s manufacturing plans are without merit — concept of running validation batches in sequence would likely cause a significant delay in BLA submission • Chairman of the Nominating and Governance Committee, which has initiated search for new CEO Robert Forrester • Current CEO and director of Verastem — biopharma company with Phase 3 oncology drug • Has real world perspective of Immunomedics’ current state and appreciation of risks in disrupting and delaying clinical, regulatory and business development processes • Impressed with data and potential of IMMU - 132 • Believes Immunomedics’ plan i n place is sound Brian Markison • Lead Independent Director • 20+ years of experience in developing oncology products in various leadership positions at Bristol - Myers Squibb • Served as CEO of several other pharmaceutical companies with significant executive leadership, R&D, M&A, manufacturing and sales experience in pharmaceutical and life sciences industries Bob Oliver • Current CEO of Otsuka America Pharmaceutical and has d irect experience helping to commercialize a major drug • Without the orderly change in management that the new Board is overseeing, IMMU - 132 program will be put at serious risk of delay while jeopardizing its expected commercialization • Confident that Company’s management is taking right steps to commercialize IMMU - 132

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 12 IMMU - 132 Data is Solid and Since ASCO 2016, Patient Results Continue to Improve • IMMU - 132 data in TNBC patients is solid – Phase 2 clinical data now up to 85 of 100 assessable patients needed for BLA filing to FDA – C linical investigators are publishing their results in major cancer journals – Data to date show 81% of patients had tumor shrinkage from baseline measurements – These results and those for tumors other than TNBC were presented by independent clinical investigators at the Company's Investor R&D Day on January 18, 2017 • TNBC presentation at ASCO 2016 included new data , and despite Company disputing the decision, ASCO committee ruled some data was identical to prior presentation from April 2016 and breached embargo rules • Immunomedics made two other presentations at ASCO 2016 on IMMU - 132 in SCLC and NSCLC indications , which were also presented at the April 2016 meeting but were not considered as breaching the embargo rules • After ASCO 2016, new TNBC data accepted and presented at peer - reviewed San Antonio Breast Cancer Symposium in December 2016

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 13 Robust Pipeline, Strong Relationships and Solid Development Program • Contrary to what venBio stated in its presentation: – Immunomedics has engaged in seven licensing deals and received multiple grant awards from the National Institutes of Health (NIH) and U.S. Department of Defense (DOD) supporting Company programs and product development – The Company has launched five Phase 3 clinical trials , including for Leuko - Scan®, CEA - Scan®, two for epratuzumab and clivatuzumab – Immuomedics ’ relationship with Bayer continues ; in fact, Bayer is testing epratuzumab in a clinical trial as a therapy for patients with lymphoma using product manufactured by the Company and supplied to Bayer – Veltuzumab continues to generate out - licensing interest , but to date has never been in a registration trial – Immunomedics has manufactured and continues to manufacture all antibody products for Phase 1 - 3 clinical trials venBio overlooks Immunomedics’ strong pipeline and the important relationships the Company has formed over the years

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Stockholder Support Evidenced by Increasing Value Upon Achieving Recent Milestones 14 Immunomedics ’ stock has increased 116% since the announced hiring of Greenhill & Co. and 24.7% since appointing a new Board 10/24/16 10/31/16 11/7/16 11/14/16 11/21/16 11/28/16 12/5/16 12/12/16 12/19/16 12/26/16 1/2/17 1/9/17 1/16/17 1/23/17 1/30/17 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 1/9/17: Immunomedics Announces Reconstituted BoardofDirectors andLeadership SuccessionPlan 1/12/17: Immunomedics MailsLetterto Stockholders Highlighting Unprecedented ProgressToward EnhancedValue Creation 1/18/17:R&DDay Highlights IMMU-132and StrengthofPipeline 10/24/16: Immunomedics Announces Greenhill&Co.as StrategicAdvisor 11/16/16:venBio SelectAdvisor Reportsa9%Stake inIMMUandFiles PreliminaryProxy toElectaNew Board 11/14/16: Immunomedics AnnouncesClinical Updateon IMMU-132inTNBC tobePresentedat SanAntonioBreast CancerSymposium 12/6/16: Immunomedics AnnouncesNew Antibody-Dryg Conjugate IMMU-140at AnnualMeetingof AmericanSocietyof Hematology 12/12/16:Immunomedics AnnouncesUpdatedPhaseII ResultsofIMMU-32inmTNBC, WhichWerePresentedinaPoster PresentationattheSanAnotnio BreastCancerSymposium 116.3% +

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 Immunomedics Stock Appreciation vs. Industry Peer Group & Biotech Index Small / Mid Cap Biotech Oncology Peers Peer 1 - YR Stock Return ( Mean) ( as of 1/27/17 close ) Karyopharm (KPTI) 82.5% Seattle Genetics (SGEN) 73.7% Genmab (GEN) 57.8% AB Science (AB) 42.6% MacroGenics (MGNX) (5.6%) Merrimack (MACK) (48.0%) CTI Biopharma (CTIC) (59.1%) Celldex (CLDX) (60.0%) ImmunoGen (IMGN) (71.6%) Peer Group (excluding IMMU) 1.4% NBI NASDAQ Biotech Index 4.1% IMMU 161.2% 15 Immunomedics’ Stock Has Appreciated Significantly Over the Past Year

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 16 venBio’s Plan is to Make a Plan In venBio’s own words from Slides 28 and 30 of their presentation , their objectives are to: • “ Understand key open items…” • “ Evaluate strategic options to advance ‘132 as rapidly as possible…” • “ Evaluate and identify key talent to focus on IMMU - 132” • “ Evaluate key operating processes – clinical, manufacturing, regulatory, commercial, etc.” • “ Audit and evaluate finances, budgets, & resource allocation” • “ Evaluate financing needs and options” How do venBio’s “ clear objectives ” put Immunomedics’ stockholders closer to realizing the value of their investment in the near term? Immunomedics is already executing on a plan overseen by a new independent Board; the time needed for venBio to develop a plan will cause dramatic and unnecessary value destruction and delay

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 17 venBio’s Other Misleading Assertions IMMUNOMEDICS STATEMENTS VENBIO ASSERTIONS THE FACTS • “ venBio’s demands for representation and unilateral veto rights are especially unreasonable relative to the size of its stake in the company.” • “ venBio rejected [. . .] alternative proposals, stating that it will not back down from its full demands.” “As IMMU’s largest stockholder, our interests are directly aligned with investors, which is why we are fighting for truly independent representation at the Board level, as evidenced by the fact that three of our four nominees are independent of venBio ” “We have negotiated in good faith, and it was the company that unilaterally ended negotiations the night after soliciting our proposal for resolving this situation called off the negotiations and appointed a new unqualified board” x venBio has declined any settlement proposal that denies venBio and its principals the power to unilaterally block any business transaction that they do not support • “In fact, our newly appointed Vice Chairman and future Chairman, Jason Aryeh , was initially sought out by venBio as a potential candidate for the venBio slate of nominees.” “We never asked Jason Aryeh to join our slate of nominees. We DO NOT support Mr. Aryeh as a director or Chairman, and we view him as unqualified based on his past track record and lack of understanding of an R&D - stage oncology biotech company” x venBio contacted Jason Aryeh beginning on November 11 through text messages and phone calls, asking him to lead their proxy contest and serve on their slate. After Mr. Aryeh rejected their proposal, venBio later told Immunomedics and Greenhill & Co. that they were considering Mr. Aryeh and respected him highly. Believing it would please venBio , Immunomedics then reached out to Mr. Aryeh directly to offer a Board seat • “We believe that, the venBio nominees, if elected, would delay the progress of IMMU - 132 by up to two years…” “This claim is completely baseless and false, and any delay would be the direct result of intentional steps taken by the current management team” x venBio has stated that they want the immediate resignation of Dr. Goldenberg, and the immediate termination of Ms. Sullivan, who have been vital to the continued advancement of IMMU - 132, including critical interactions with clinical investigators and regulatory agencies, including the FDA and the EMA in Europe • “…they shockingly don't even want to allow any stockholders besides them to have the right to vote on any strategic transaction.” “This statement is designed to confuse stockholders and belies a complete misunderstanding of how pharmaceutical partnership deals are forged “ x venBio insists on the unilateral right to block any transaction. To break a potential Board stalemate on a transaction, Immunomedics proposed submitting a stalemate to a stockholder vote to attempt to resolve a standstill and reach a settlement to avoid a proxy contest

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 18 IMMU Stockholders Have a Clear Choice – Vote the WHITE Proxy Card x Imminent Phase 3 trial and clear path to accelerated approval of IMMU - 132 in TNBC patients x Broad strategic process led by independent directors with assistance of outside financial advisor, Greenhill & Co. Continued progress toward value creation × Seeking control without offering stockholders a control premium × Insists on unilateral veto right on significant transactions Risk and potential value destruction × No detailed plan or new ideas to improve upon the Company’s publicly stated strategy x Your new Board is committed to doing right by all stockholders Immunomedics × No concern about disrupting the Company’s strategy at a critical juncture with significant opportunity for near - term value creation and expected accelerated approval of IMMU - 132 x Committed to best practices for corporate governance for stockholder democracy × Refuses to engage in any reasonable settlement x Your new Board and financial advisor have orchestrated and overseen a significant number of successful M&A transactions venBio

0 57 166 0 36 108 31 63 125 215 208 196 255 76 0 252 145 63 252 174 113 0 24 70 175 165 147 171 176 186 131 126 116 114 90 48 242 242 242 213 227 255 VOTE THE WHITE PROXY CARD TODAY Vote FOR all the Immunomedics director nominees If you have already voted for venBio on a gold proxy card, it is not too late to change your vote by using the WHITE proxy card to vote for ALL of your Immunomedics director nominees

– only your latest vote counts! 19