Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - IMMUNOMEDICS INC | immu-20170630ex3222e676e.htm |

| EX-32.1 - EX-32.1 - IMMUNOMEDICS INC | immu-20170630ex32114ec3d.htm |

| EX-31.2 - EX-31.2 - IMMUNOMEDICS INC | immu-20170630ex312146a47.htm |

| EX-31.1 - EX-31.1 - IMMUNOMEDICS INC | immu-20170630ex31130c459.htm |

| EX-23.1 - EX-23.1 - IMMUNOMEDICS INC | immu-20170630ex2311dfb26.htm |

| EX-21.1 - EX-21.1 - IMMUNOMEDICS INC | immu-20170630ex2111d8d6d.htm |

| EX-10.37 - EX-10.37 - IMMUNOMEDICS INC | immu-20170630ex103752071.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2017.

or

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ________.

Commission file number: 0-12104

IMMUNOMEDICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

61-1009366 |

|

(State of incorporation) |

(I.R.S. Employer Identification No.) |

|

|

|

|

300 The American Road, Morris Plains, New Jersey |

07950 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (973) 605-8200

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.01 par value |

|

NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ☑ No ◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ◻

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§299.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer |

◻ |

Accelerated Filer |

☑ |

|

Non-Accelerated Filer |

◻ |

Smaller Reporting Company |

◻ |

|

Emerging Growth Company |

◻ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Act). Yes ◻ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates computed by reference to the price at which the common stock was last sold as of December 31, 2016 was $388,989,000. The number of shares of the registrant’s common stock outstanding as of August 15, 2017 was 111,279,090.

Documents Incorporated by Reference:

Certain information required in Part III of this Annual Report on Form 10-K will be set forth in, and incorporated from the registrant’s Proxy Statement for the 2017 Annual Meeting of Stockholders, which will be filed by the registrant with the Securities and Exchange Commission not later than 120 days after the end of the registrant’s fiscal year ended June 30, 2017.

In this Form 10-K, we use the words "Immunomedics, Inc." to refer to Immunomedics, Inc., a Delaware corporation, and we use the words "Company," "Immunomedics," "Immunomedics, Inc.," "we," "us" and "our" to refer to Immunomedics, Inc. and its subsidiaries.

PART I

Item 1. Business

Immunomedics is a clinical-stage biopharmaceutical company developing monoclonal antibody-based products for the targeted treatment of cancer, autoimmune disorders and other serious diseases. Our proprietary technologies allow us to create humanized antibodies that can be used either alone in unlabeled or “naked” form, or conjugated with radioactive isotopes, chemotherapeutics, cytokines or toxins. Using these technologies, we have built a pipeline of six clinical-stage product candidates. Our most advanced product candidate is IMMU-132 (sacituzumab govitecan), an antibody-drug conjugate (“ADC”) that has received Breakthrough Therapy Designation (“BTD”) from the United States Food and Drug Administration (“FDA”) for the treatment of patients with metastatic triple-negative breast cancer (“mTNBC”) who have failed at least two prior therapies for metastatic disease. BTD has provided us with ready access to the FDA to discuss its Expedited Programs for Serious Conditions for IMMU-132, including the Accelerated Approval Program.

At our Annual Meeting of Stockholders for 2016, a new Board of Directors was elected to embark on a new development plan for IMMU-132. After conducting a multifaceted assessment of the Company’s people, processes, and data to confirm the status of IMMU-132 development, the new Board, having recognized the significant potential of IMMU-132 and the Company’s capabilities, immediately adopted a new corporate strategy focused on bringing IMMU-132 to the market on its own for the benefit of patients with mTNBC and the creation of value for our shareholders.

To the best of our knowledge, IMMU-132 is the only antibody-based product candidate currently in clinical development that targets the cancer marker Trop-2. We chose this target because it internalizes rapidly into cancer cells following binding by the antibody, making it an ideal target for the delivery of toxic drugs with an ADC. Another reason is that Trop-2 is highly expressed by many and varied types of solid cancers. We believe that if IMMU-132 works in one of the Trop-2-expressing cancers, there is a good chance that it may work in other cancer types that contain the same marker. While this hypothesis is being evaluated in our Phase 2 basket trial, our current focus is to bring IMMU-132 to market for patients with mTNBC expeditiously via the FDA’s Accelerated Approval Program. To that end, our foremost goals for IMMU-132 during fiscal year 2018 are as follows:

|

1. |

Submit a Biologics License Application (“BLA”) to the FDA for accelerated approval of IMMU-132 in mTNBC between December 2017 and March 2018. Per FDA guidance, the following steps need to be addressed for the filing:; |

|

a. |

Complete the review of treatment responses by an independent, third-party blinded group of radiologists and finalize the full data set of approximately 100 assessable patients from the Phase 2 trial of IMMU-132 in mTNBC. Enrollment of the full complement of more than 100 assessable patients was completed in December 2016; |

|

b. |

Initiate the Phase 3 confirmatory trial of IMMU-132 in patients with mTNBC. We have a Special Protocol Assessment (“SPA”) in place for the study and clinical trial materials have been manufactured. In addition, we have engaged a Clinical Research Organization (“CRO”) and site selection and planning are currently underway; |

|

c. |

Validate all Chemistry, Manufacturing and Controls (“CMC”) processes on commercial manufacturing. We are required to validate all or part of CMC at the time of the BLA filing. The level of CMC validation required by the FDA at the time of submission will be a determining factor in the filing timeline. |

|

2. |

Demonstrate CMC preparedness for large-scale manufacturing in anticipation of a potential commercial launch in the U.S. for IMMU-132 in early 2019. Although we have enough capability with our in-house manufacturing facility to produce commercial materials to support the launch and initial commercial |

2

operations, our goal is to transition manufacturing of the antibody from in-house to a large-scale Contract Manufacturing Organizations (“CMO”) for longer term commercial production. |

We believe our current focus on commercializing IMMU-132 as a third-line therapy for patients with mTNBC is also the key to opening the door to further commercial opportunities in the future including developing IMMU-132 in earlier lines of therapy in mTNBC, as a monotherapy or in combination therapies, as well as expansion into other indications beyond TNBC, such as urothelial cancer (“UC”), small-cell lung cancer (“SCLC’), and non-small-cell lung cancer (“NSCLC”). It’s only by proving IMMU-132 in TNBC that we can explore, expand into, and potentially capitalize on these new opportunities. While our immediate focus on commercializing IMMU-132, on our own, in the U.S. and European markets; we are alert to opportunities to commercialize IMMU-132 in certain other regional markets; and we are also open to business development opportunities to develop other pipeline assets.

Our Clinical and Preclinical Programs

We believe that each of our antibodies has therapeutic potential either when administered as a naked antibody or when conjugated with chemotherapeutics, therapeutic radioisotopes (radiolabeled), cytokines or other toxins to create unique and potentially more effective treatment options. The attachment of various compounds to antibodies is intended to allow the delivery of these therapeutic agents to tumor sites with better specificity than conventional chemotherapy or radiation therapy approaches. This treatment method is designed to reduce the total exposure of the patient to the therapeutic agents, which ideally minimizes debilitating side effects.

Our portfolio of investigational products includes ADCs that are designed to deliver a specific payload of a chemotherapeutic directly to the tumor while reducing overall toxic effects that are usually found with conventional administration of these chemotherapy agents. In addition toIMMU-132, labetuzumab govitecan (“IMMU-130”), is in a Phase 2 trial for metastatic colorectal cancer (“mCRC”). These two ADCs facilitate targeted delivery of SN-38, the active metabolite of irinotecan, an effective, yet toxic chemotherapeutic, more directly to tumor cells. While sacituzumab govitecan and labetuzumab govitecan are circulating in the blood stream, our novel and proprietary ADC linking system keeps SN-38 conjugated to the antibody and in an inactive form, thereby reducing toxicity to normal tissues. The clinical safety and efficacy results obtained with sacituzumab govitecan and labetuzumab govitecan suggest that this half-life is long enough for the ADCs to reach their targets on the surface of tumor cells, without causing significant harm to the rest of the body. More importantly, the pH-sensitive nature of the linker allows the continuous release of SN-38 from the tumor-bound ADCs, regardless of whether the ADC is internalized or remains on the surface of the tumor cell leading to a locally enhanced concentration of SN-38 within or near the tumor. We believe this selective delivery enhances SN-38’s bioavailability at the tumor, which may improve efficacy while also reducing toxicity.

We have a research collaboration with Bayer to study epratuzumab as a thorium-227-labeled antibody. We have other ongoing collaborations in oncology with independent cancer study groups. The IntreALL Inter-European study group is conducting a large, randomized, Phase 3 trial combining epratuzumab with chemotherapy in children with relapsed acute lymphoblastic leukemia at clinical sites in Australia, Europe, and Israel.

We also have a number of other product candidates that target solid tumors and hematologic malignancies, as well as other diseases, in various stages of clinical and pre-clinical development. These include combination therapies involving antibody-drug conjugates, bispecific antibodies targeting cancers and infectious diseases as T-cell redirecting immunotherapies, as well as bispecific antibodies for next-generation cancer and autoimmune disease therapies, created using our patented DOCK-AND-LOCK® (“DNL®”) protein conjugation technology.

3

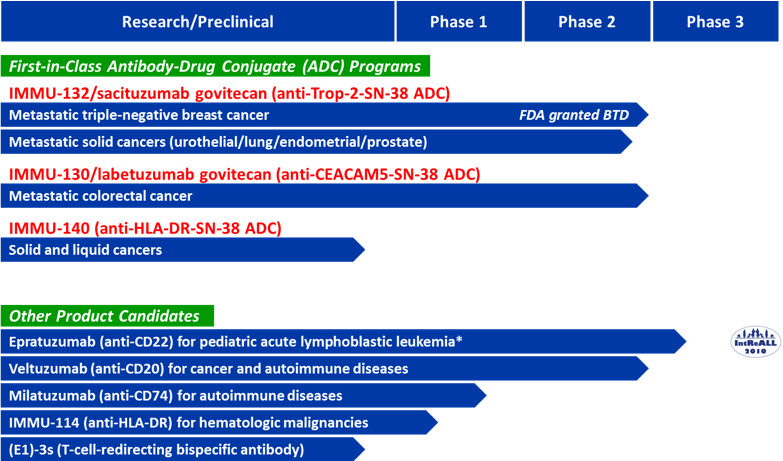

Below is our pipeline chart of late-stage antibody-based therapies including ADCs and other antibodies.

* The International clinical trial on childhood relapsed acute lymphoblastic leukemia (“IntReALL”) is funded by the European Commission.

Antibody-Drug Conjugates

The targeted delivery of drug by an antibody is an exciting approach in cancer treatment that has gained significant interest over the past few years. ADCs are designed to deliver a specific payload of a chemotherapeutic directly to the tumor while reducing overall toxic effects that are usually found with conventional administration of these chemotherapy agents. We have a unique approach to ADC design that has allowed us to develop a platform technology with solid tumor therapy in mind. ADCs have three critical components – the antibody, linker and payload. Beginning with antibody, we have a suite of proprietary humanized antibodies, which are the result of 30 years of research and development in the field, and have selected highly cancer-specific antibodies to deliver moderately potent drugs to the tumors. We believe this approach permits a greater delivery of drug over repeated cycles of therapy, thereby improving the therapeutic index. Secondly, our patented linker technology is designed specifically for SN-38, which keeps SN-38 conjugated to the antibody and in an inactive form, thereby reducing toxicity to normal tissues. In addition, the pH-sensitive nature of the linker allows for rapid and continuous release of the drug once the ADC reaches a tumor. A high drug-to-antibody ratio also enhances the drug’s bioavailability within or near the tumor, which may improve efficacy while also reducing toxicity. Our payload drug of choice is SN-38, which is the active form of irinotecan, but is about 1,000-fold more potent. SN-38 cannot be administered directly to patients because it is not water soluble, and is too toxic. However, our unique CL-2A linker allows antibody-SN-38 conjugates to be soluble in water. Furthermore, there is no loss of antibody binding or drug activity.

As a result, all of our ADC product candidates have relatively lower toxicity and are capable of delivering greater doses of drug to tumor. They offer patients and physicians an opportunity for longer-term, repeated treatments. Two of our ADCs have completed Phase 2 studies in solid cancers. IMMU-132 targets a variety of solid tumors that over-express Trop-2, while our second ADC, IMMU-130 (labetuzumab govitecan), binds the CEACAM5 antigen,

4

expressed on colorectal and other solid cancers. We are also positioned to expand our ADC Program to treat liquid cancers with the creation of IMMU-140 that targets HLA-DR.

Sacituzumab govitecan or IMMU-132

Sacituzumab govitecan is our lead investigational product for the treatment of patients with solid cancers. It is an ADC that contains SN-38, the active metabolite of irinotecan, approved by many health authorities, including the FDA, as a chemotherapeutic for patients with cancer. As noted earlier, SN-38 cannot be given directly to patients because of its toxicity and poor water solubility. Sacituzumab govitecan was created at Immunomedics by conjugating SN-38 site-specifically and at a high ratio of drug to hRS7, our anti-Trop-2 antibody. Trop-2 is a cell-surface receptor that while over-expressed by many human tumors, including cancers of the breast, urinary bladder, and lung, has limited expression in normal human tissues. It internalizes rapidly into cancer cells following binding by hRS7, making it a suitable target for the delivery of cytotoxic drugs.

Sacituzumab govitecan has received BTD from the FDA for the treatment of patients with mTNBC who have failed prior therapies for their disease. The regulatory agency has also granted this ADC Fast Track designation for patients with TNBC and for patients with SCLC, or NSCLC. Fast Track designation is designed to expedite the development and review of applications for products intended for the treatment of a serious or life-threatening disease or condition. This ADC has also been designated as an orphan drug by the FDA for the treatment of patients with SCLC or pancreatic cancer in the United States and by the European Medicines Agency (“EMA”) for the treatment of patients with pancreatic cancer in the European Union.

Our Phase 2 basket trial of sacituzumab govitecan has now treated over 500 patients in more than 15 types of solid cancers, with the dose of 10 mg/kg given on days 1 and 8 of repeated 21-day cycles being the established dose regimen. TNBC is the furthest along with the most patients enrolled. In December 2016, we achieved the goal of enrolling 100 TNBC patients as requested by the FDA for a BLA filing. Interim results in 85 assessable patients with mTNBC were presented by our clinical investigator at an Investor R&D Day conducted during January 2017. Overall, 81% of patients treated with IMMU-132 showed tumor shrinkage from baseline measurements. Two of these patients experienced complete responses (“CRs”) and 23 reported partial responses (“PRs”), while an additional three patients with initial PRs are awaiting confirmation. The clinical benefit rate (CR and PR, and patients with stable disease (“SD”)) at six months or later was 44% and the median duration of response (“DOR”) for those with objective responses was 10.8 months. Median progression-free survival (“PFS”) and median overall survival (“OS”) for all 85 patients were 6.0 months and 18.8 months, respectively. To put these results in perspective, based on what has been reported in the medical literature, the current standard of care offers mTNBC patients a PFS of 1.7 to 3.7 months and about 12 months of median survival.

The major toxicity (grade >3) has been neutropenia (39%) in this and most cancer patient cohorts, which has been managed by dose reduction, dose delays, or giving a hematopoietic cytokine. Diarrhea, which is the major side effect with irinotecan, has been much less, such as a grade >3 of 13%.

As per FDA requirements, radiological scans from patients with at least 20% tumor shrinkage are being reviewed by an independent third-party group in a blinded fashion. The centrally adjudicated results will be part of a BLA submission for the accelerated approval of sacituzumab govitecan in mTNBC. The FDA also requires a confirmatory Phase 3 trial to be underway at the time of BLA submission. We have a SPA in place for the study and clinical trial materials have been manufactured. In addition, we have engaged a CRO and site selection and planning are currently underway. Details of this confirmatory trial can be obtained from clinicaltrials.gov website using the identifier NCT02574455.

In addition to TNBC, we are making progress with IMMU-132 across three other advanced indications: UC, SCLC and NSCLC.

In patients with UC, especially metastatic urinary bladder cancer, updated results were reported at the 2017 Genitourinary Cancers Symposium by our clinical investigator. A total of 44 patients with metastatic UC had been enrolled into this open-label multicenter study. Sites of metastases included liver (N=9; 25%), lymph nodes (N=14; 39%), lungs (N=14; 39%, pelvis (N=9, 25%), and bone (N=4; 11%). Patients received a median of six doses (range, 1-50) of sacituzumab govitecan, which was administered at 8 or 10 mg/kg on days 1 and 8 of 3-week cycles. Despite

5

repeated dosing, grade 3 or higher adverse events were limited to neutropenia (30%), febrile neutropenia (11%), fatigue (11%), and diarrhea (3%). The objective response rate (“ORR”) in 36 response-assessable patients was 31%, including one confirmed CR and ten confirmed PRs. For the 41 intention-to-treat (“ITT”) patients, median PFS was 7.2 months and median OS was 15.5 months.

For SCLC, despite the aggressive nature of the disease, encouraging ORR in 50 ITT patients was published online in Clinical Cancer Research on July 5, 2017. The median number of prior chemotherapies for this group of patients was 2 (range, 1-7). All patients had metastatic (stage IV) disease and had been previously treated with platinum-based therapy and etoposide, with 11 having received topotecan. Notable findings from patients after receiving treatment with sacituzumab govitecan at the dose level of 8 mg/kg or 10 mg/kg include:

|

· |

Ninety-two percent of the patients evaluated for expression of the target for sacituzumab govitecan, Trop-2, had elevated levels in their archived tumor specimens; |

|

· |

Patients given repeated treatment cycles had manageable toxicity, mostly Grade >3 neutropenia (34%), and 60% of those patients experienced tumor shrinkage from baseline computed tomography (“CT”) measurements; |

|

· |

ORR was 17% at the optimal dose schedule; the median DOR and OS were 5.7 and 7.5 months, respectively; and |

|

· |

Activity was observed in patients who were chemosensitive or chemoresistant to frontline chemotherapy, in patients who failed second-line topotecan, and in a subset who relapsed after immune checkpoint inhibitor therapy. |

Phase 2 results with sacituzumab govitecan in patients with NSCLC were published online in the Journal of Clinical Oncology on May 26, 2017. In 54 heavily-pretreated patients with metastatic NSCLC who received either 8 or 10 mg/kg sacituzumab govitecan on days 1 and 8 of 21-day cycles. The primary endpoints were safety and ORR. PFS and OS were secondary endpoints. Notable findings from the study include:

|

· |

In the response-assessable study population (N = 47), which had a median of 3 prior therapies (range, 2-7), 67% of patients showed a shrinkage from baseline CT measurements; |

|

· |

The confirmed ORR was 19.1%, the median DOR 6.0 months, and the clinical benefit rate (CR+PR+SD>4 months) was 43%. Responses occurred with a median onset of 3.8 months, including patients who had relapsed or progressed after immune checkpoint inhibitor therapy; |

|

· |

Median ITT PFS was 5.2 months (95% CI, 3.2, 7.1), and median ITT OS was 9.5 months; |

|

· |

Grade 3 or higher adverse events included neutropenia (28%), diarrhea (7%), nausea (7%), fatigue (6%), and febrile neutropenia (4%); and |

|

· |

Over 90% of 26 assessable archival tumor specimens were highly positive for Trop-2 by immunohistochemistry. |

Sacituzumab govitecan has a tolerable safety profile in these patients with diverse, advanced, heavily-pretreated solid cancers. No prophylactic diarrhea or granulocyte colony-stimulating factor medication to stimulate the production of neutrophils was given. More importantly, repeated doses can be given over months without evoking interfering anti-sacituzumab govitecan antibodies from patients’ own immune system.

We have an extensive intellectual property portfolio protecting sacituzumab govitecan. Specifically, 35 patents were issued in the U.S. and 21 foreign patents were issued covering composition of matter, synthesis and uses. Certain patents relating to the protein sequence of the hRS7 antibody used in sacituzumab govitecan expire in 2017 in the United States and 2023 overseas. Patents to compositions and use of the CL2A linker incorporated in sacituzumab govitecan expire between 2023 and 2029 in the U.S. and overseas. Other patents relating to use of hRS7 for cancer therapy, including the SN-38 conjugated form of hRS7 used in sacituzumab govitecan, extend to 2033. Additionally, we are entitled to extend the term of our key patent for up to 5 more years. Outside the U.S., patents were issued in Australia, Canada, China, Europe, Israel, Japan, Mexico, South Korea and other key global markets.

IMMU-130 or Labetuzumab Govitecan

Our second investigational solid-tumor ADC involves our anti-CEACAM5 antibody, labetuzumab, conjugated to SN-38. The agent is currently being studied in patients with metastatic colorectal cancer (“mCRC”) who had received

6

at least one prior irinotecan-containing regimen and had an elevated blood titer of carcinoembryonic antigen (“CEA”). Several dosing schedules were evaluated in three Phase 1 studies. IMMU-130 showed therapeutic activity in all three trials, but a more frequent dosing schedule, with administrations of the ADC once or twice-weekly for two weeks followed by a week off, appeared to be more active in patients with mCRC than when administered every other week.

In the expanded Phase 2 study, patients were being treated in 3-week cycles, receiving IMMU-130 at 8 or 10 mg/kg once-weekly or twice a week at 4 or 6 mg/kg for the first two weeks followed by one week of rest. Updated results were presented at the 2016 American Association for Cancer Research Annual Meeting. A total of 82 patients were enrolled into the open-label study.

Since there was no significant difference in safety and efficacy between the two once-weekly dosing schedules, for patient’s convenience, the once-a-week dose of 10 mg/kg was chosen for future studies in mCRC patients.

Certain patents relating to labetuzumab used in IMMU-130 expired in 2016. Other patents relating to use of labetuzumab for cancer therapy, including the SN-38 conjugated form of labetuzumab used in labetuzumab govitecan, extend to 2033.

IMMU-140

Our third ADC, IMMU-140, is comprised of the humanized anti-HLA-DR antibody, IMMU-114, conjugated to SN-38, through the Company’s proprietary linker, CL2A. When given subcutaneously, the parental antibody, IMMU-114, has shown promising activity in patients with non-Hodgkin lymphoma (“NHL”) and chronic lymphocytic leukemia (“CLL”), and with a relatively safe profile. Thus, IMMU-140 is a dual-therapeutic, combining the signaling functions of the parental antibody, IMMU-114, with the cytotoxicity of SN-38. However, acute myelocytic leukemia (“AML”), despite having high expression levels of HLA-DR, has proven to be resistant to the antitumor effects of IMMU-114 in vitro. As a result, the potential treatment of AML, acute lymphocytic leukemia (“ALL”), and multiple myeloma (“MM”), continue to challenging for IMMU-114.

We conducted a preclinical study to determine if SN-38, a drug not commonly used in liquid malignancies, would prove to be an effective and safe therapeutic when targeted with the IMMU-114 antibody, which could then improve the antitumor activity of IMMU-114. A total of four human cancer cell lines, AML, ALL, MM, and CLL, were used to examine the in vitro and in vivo activity of IMMU-140 versus parental IMMU-114. The results were presented at the 2016 Annual Meeting of the American Society of Hematology.

In seven human disease models in mice ALL, CLL, MM, AML, diffuse large B-cell lymphoma (“DLBCL”), Hodgkin lymphoma (“HL”), and melanoma), IMMU-140 treatment at 25 mg/kg twice weekly for 4 weeks (human equivalent dose (“HED”) = 2 mg/kg) provided significant therapeutic efficacy compared to non-specific control ADCs. Of note, in intractable AML and ALL, IMMU-140 imparted a >140% and 80% increase in survival, respectively, compared to IMMU-114 therapy. Even a dose reduction to 12.5 mg/kg (HED = 1 mg/kg), produced significant antitumor effects compared to all controls in AML and malignant melanoma. Though not significant, in MM IMMU-140 improved survival approximately 60% compared to IMMU-114 while in CLL, this treatment was significantly better than IMMU-114. Therapy with IMMU-140 was well tolerated by the mice with no appreciable loss in body weight.

These preclinical results demonstrated IMMU-140’s higher potency than naked IMMU-114 in ALL and AML; and an added, if not significant, survival benefit in experimental MM and CLL. More importantly, the dual-therapeutic potential of IMMU-140 allows for the ability to treat a range of HLA-DR-positive hematopoietic and solid cancers, and therefore warrants further clinical development.

Other Product Candidates

We have additional potential products for the treatment of cancer and autoimmune diseases including epratuzumab, our anti-CD22 antibody; veltuzumab, our anti-CD20 antibody; milatuzumab, our anti-CD74 antibody; and IMMU-114, a humanized anti-HLA-DR antibody.

7

Epratuzumab

Epratuzumab is a humanized antibody that targets CD22, an antigen found on the surface of B lymphocytes, a type of white blood cell critical to proper immune system function. Elevated expression of CD22 and other B-cell receptor-associated (“BCR”) proteins on B lymphocytes has been associated with blood cancers and autoimmune diseases. Epratuzumab’s mechanism of action includes the transfer of BCR-proteins to helper cells called effector cells, thereby reducing B-cell destruction and the impact of epratuzumab on the immune system. We believe epratuzumab is the only antibody in development targeting the reduction of these proteins without severely depleting B-cells through a process known as trogocytosis.

We have a research collaboration with The Bayer Group (“Bayer”) to study epratuzumab as a thorium-227 labeled antibody. Bayer is currently enrolling patients with relapsed or refractory CD22-positive NHL into a Phase 1 study evaluating epratuzumab labeled with thorium-227. This study is focusing on patients with diffuse large B-cell lymphoma and potentially follicular lymphomas who have been previously treated with, or are not considered candidates for available therapies.

In addition, the IntreALL Inter-European study group is conducting a large, randomized, Phase 3 trial combining epratuzumab with chemotherapy in children with relapsed ALL at clinical sites in Australia, Europe, and Israel. This Phase 3 study, which is partially funded by the European Commission, assesses the efficacy and safety of this combination therapy using event-free survival as the surrogate for survival, the primary endpoint.

Although certain patents to the epratuzumab protein sequence expired in 2014 in the United States and in 2015 overseas, other patents issued to therapeutic use of epratuzumab extend to 2018-2023 for cancer and 2020 for autoimmune disease. The method of preparing concentrated epratuzumab for subcutaneous administration is covered by another patent family with expiration in the United States in 2032.

Veltuzumab

Veltuzumab is a humanized monoclonal antibody targeting CD20 receptors on B lymphocytes currently under development for the treatment of NHL and autoimmune diseases. The Office of Orphan Products Development of the FDA has granted orphan status for the use of veltuzumab for the treatment of patients with immune thrombocytopenia (“ITP”). We have studied the subcutaneous formulation of veltuzumab in patients with ITP in a Phase 1/2 trial, which was designed to evaluate different dosing schedules. This trial has completed patient accrual and patients are being followed for up to five years.

We are currently evaluating various options for further clinical development of veltuzumab in ITP and other autoimmune disease indications, as well as in oncology, including licensing arrangements and collaborations with outside study groups.

Milatuzumab

Milatuzumab is a humanized monoclonal antibody targeting tumors that express the CD74 antigen, which is present on a variety of hematological tumors and even on some solid cancers, with restricted expression by normal tissues. It has received orphan drug designation from the FDA for the treatment of patients with multiple myeloma or CLL. Milatuzumab is the first anti-CD74 antibody that has entered into human testing and we have completed initial Phase 1 studies in patients with relapsed multiple myeloma, NHL or CLL.

The anti-CD74 antibody is currently being studied subcutaneously in autoimmune disease in a Phase 1b study in patients with active SLE supported by a three-year research grant from the United States Department of Defense with a potential funding of $2 million.

Our interest in pursuing milatuzumab in immune diseases is driven by the observations that implicated CD74 in antigen presentation, particularly by dendritic and other immune cells—and as a survival factor for rapidly proliferating malignant cells. Recent findings have determined that CD74 is a receptor for the pro-inflammatory chemokine, macrophage migration-inhibitory factor, and that binding of the factor to CD74 initiates a signaling cascade resulting in proliferation and survival of normal and malignant B cells, such as in CLL. Migration-inhibitory factor is widely expressed by immune cells, particularly macrophages, and is known to play a role in autoimmune disease. Thus, we

8

believe that milatuzumab, by blocking the function of CD74, could be useful in the management of immune diseases either alone or in combination with other agents including other B-cell antibodies, such as epratuzumab and veltuzumab.

First results from the open-label Phase 1b study of subcutaneously administered milatuzumab in an initial cohort of ten adult patients with moderate lupus disease activity but not severe flares (at least 2 BILAG B scores, but no A's) were presented at a poster session during the 2016 annual European League Against Rheumatism (“EULAR”) Congress. Based on the early encouraging results, we have expanded the study into a double-blind, placebo-controlled 30-patient randomized trial to confirm the activity of milatuzumab in this population and have received approval from the Department of Defense for an increased budget to support the expansion.

IMMU-114

IMMU-114 is a novel humanized antibody directed against an immune response target, HLA-DR, under development for the treatment of patients with B-cell and other cancers. HLA-DR is a receptor located on the cell surface and its role is to present foreign objects to the immune system for the purpose of eliciting an immune response. Increased presence of HLA-DR in hematologic cancers has made it a prime target for antibody therapy.

Although other anti-HLA-DR antibodies have been developed, IMMU-114 is distinguished by having a different immunoglobulin class, IgG4, which does not function by the usual effector-cell activities of antibodies, such as complement-dependent cytotoxicity (“CDC”) and antibody-dependent cellular cytotoxicity (“ADCC”). As a result, IMMU-114 does not rely on an intact immune system in the patient to kill tumor cells. Furthermore, because ADCC and CDC are believed to play a major role in causing the side effects of antibody therapy, we expect IMMU-114 to be less toxic to patients.

By targeting HLA-DR, a receptor that is different from the antigen targeted by rituximab or other antibodies in development for NHL and other B-cell malignancies, IMMU-114 may represent a new tool in the arsenal to combat these cancers. The anti-HLA-DR antibody is being evaluated as a subcutaneously-administered monotherapy for patients with NHL or CLL in a Phase 1 study.

Subcutaneous injections of IMMU-114 produced encouraging efficacy in a Phase 1 first-in-man study in patients with advanced, relapsed NHL and CLL. The injections were well tolerated by patients, with only local skin reactions at the injection sites, which were all mild to moderate and transient. Furthermore, only one patient had evidence of immunogenicity of uncertain significance and no other cytopenias or changes in routine safety laboratory results occurred.

Our Platform Technologies

In our drive to improve targeted therapies of diseases, we have built significant expertise in antibody engineering, particularly proprietary CDR-grafting methods, antibody production and formulation, immunochemistry, molecular biology, antibody conjugation, peptide chemistry, synthetic organic chemistry, and protein engineering.

Beginning with our unique grafting technique to engineer humanized antibodies, our antibody humanization platform has produced a diverse portfolio of therapeutic agents that are in multiple stages of clinical trials for the therapy of cancer and autoimmune diseases, as detailed above. These humanized antibodies are well tolerated and also have a low incidence of immunogenicity.

With the successful humanized antibody platform as a foundation, we have built a robust ADC program using our own proprietary ADC linker technology. Finally, our protein engineering platform technology called DOCK-AND-LOCK® combines conjugation chemistry and genetic engineering to produce bioactive molecules of increasing complexity.

ADC Linker Technology

We developed a novel ADC platform using our proprietary linker, CL2A, which was designed with targeted delivery of SN-38 in mind. SN-38 is about 3 orders of magnitude (100 to 1,000 times) more potent than irinotecan, its

9

parent drug, but it cannot be administered systemically to patients because of its poor water solubility and toxicity. Our linker, CL2A, allows us to produce SN-38 conjugates that are soluble in water with excellent yields while preserving antibody binding and drug activity.

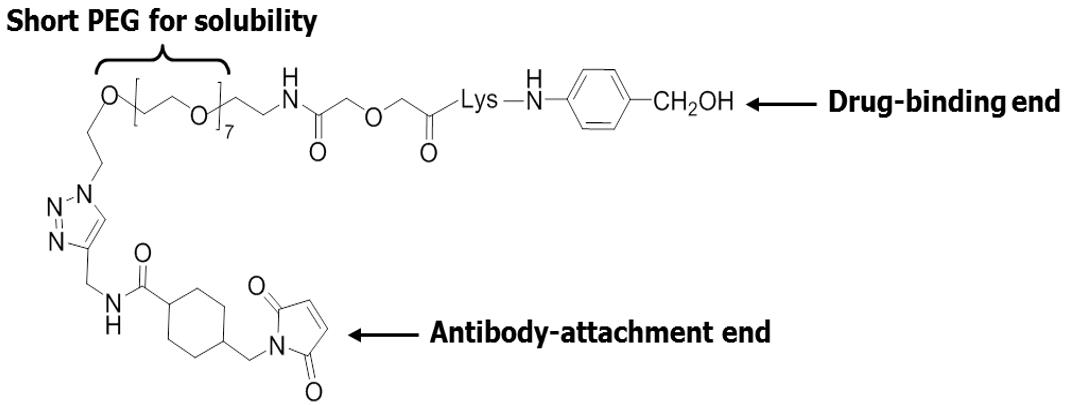

CL2A contains an antibody coupling group on one end and a chemical group on the other for binding with a drug. We have also added a short polyethylene glycol to improve the solubility of CL2A.

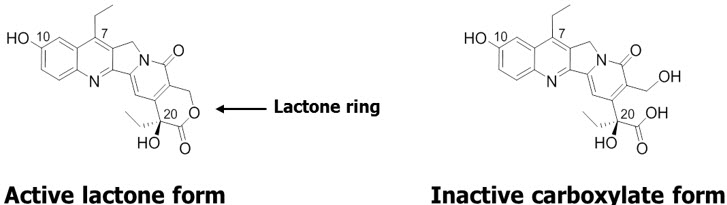

Furthermore, because SN-38 can be converted from its active lactone form to the inactive carboxylate form, CL2A was designed to attach close to the lactone ring to prevent it from opening up, thereby maintaining the activity of SN-38. Another key feature of our ADC platform is that the linkage between CL2A and SN-38 is sensitive to both acidic and alkaline conditions and will allow the detachment of SN-38 at a rate of about 50% per day in vivo.

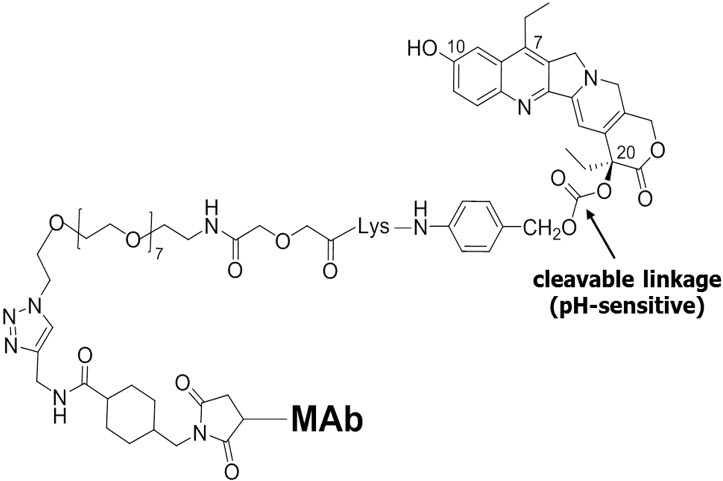

The final structure of our ADC is depicted below, with the pH-sensitive cleavable linkage highlighted. What differentiates our ADC platform from other companies is the high drug-to-antibody ratio of about seven to eight molecules of drug per antibody. That is to say, when our ADCs bind to their targets on cancer cells, they are delivering up to eight molecules of SN-38 per antibody molecule into the blood or at the vicinity of the tumor, which may explain why our ADCs can deliver more than 120-times the amount of SN-38 to the tumor when studied in an animal model, as compared to irinotecan, the parent compound. We can deliver this drug concentration because our drug is not supertoxic, thus permitting us to give higher antibody doses, in repeated therapy cycles, that we believe provide a better therapeutic index.

10

DOCK-AND-LOCK® Platform Technology

We developed a platform technology, called the DOCK-AND-LOCK® method, which has the potential for making a considerable number of bioactive molecules of increasing complexity. DNL® utilizes the natural interaction between two human proteins, cyclic AMP-dependent protein kinase A (“PKA”) and A-kinase anchoring proteins (“AKAPs”). The region that is involved in such interaction for PKA is called the dimerization and docking domain, (“DDD”), which always is produced in pairs. Its binding partner in AKAPs is the anchoring domain (“AD”). When mixed together, DDD and AD will bind with each other spontaneously to form a binary complex, a process termed docking. Once “docked,” certain amino acid residues incorporated into DDD and AD will react with each other to “lock” them into a stably-tethered structure. The outcome of the DNL® method is the exclusive generation of a stable complex, in a quantitative manner that retains the full biological activities of its individual components.

DNL® combines conjugation chemistry and genetic engineering to enable the creation of novel human therapeutics, and the potential construction of improved recombinant products over those currently on the market. Diverse drugs, chemical polymers, proteins, peptides, and nucleic acids are among suitable components that can be linked to either DDD or AD. Since the invention of DNL®, we have created multivalent, mono- or multi-specific antibodies, DNL-PEGylated cytokines; and cytokine-antibody conjugates.

We have employed DNL® to create bispecific antibodies targeting cancers as a T-cell redirecting immunotherapy. This is one of several new methods of cancer immunotherapy being studied both clinically and preclinically by many other commercial and academic groups. In contrast to hematological tumors, little progress has been made in this approach to treat the more challenging solid cancers, including pancreatic and gastric cancers, two malignancies with very high rates of mortality.

In this regard, we are developing a novel investigational T-cell redirecting bispecific antibody, (E1)-3s, created using DNL® for the potential treatment of pancreatic and gastric cancers. These and various other solid cancers express high-levels of Trop-2, a target recognized by the bispecific (E1)-3s, which also binds to the CD3 antigen on T cells. (E1)-3s effectively induced a potent and specific T-cell-mediated killing of human pancreatic and gastric cancer cell lines.

11

Furthermore, in animal models of human pancreatic or gastric cancer, treatment with (E1)-3s significantly inhibited tumor growth, which resulted in improved survival compared with the control groups. Adding IFNα enhanced the tumor-growth-inhibition activity of (E1)-3s.

As with all candidate therapeutic molecules developed by us, the safety and potential efficacy cannot be predicted until sufficient trials in humans have been conducted.

Immuno-Oncology

Harnessing the patient's own immune system to control metastatic disease has become an exciting approach in cancer therapy, particularly inhibitors of programmed cell death, such as PD-1. The approval of two such agents, as well as an antibody that inhibits T lymphocyte-associated antigen 4 (“CTLA4”), has spurred interest in their combination with other therapies in order to achieve synergy, whereby superior effects are achieved. We have begun to develop our own PD-1 antibody to evaluate its use in combination with our other anticancer agents in preclinical studies, such as the ADCs described above.

Another immunotherapy of current interest is utilizing chimeric antigen receptors (“CARs”) to direct T cells known as natural killer cells. The engineering of chimeric antigen receptors on the surface of such cells combines the potent functions of the effector cells with the tumor-targeting properties of the antibodies. To-date, clinical results using CAR-redirected immunotherapy have appeared to be more successful in liquid (hematological) tumors than in solid cancers. Using our own genetic engineering technology, our scientists have begun work on a more universal approach to direct effector cells to a variety of cancer types by a next-generation targeting model. Preclinical studies are in progress while patents to protect the intellectual property are being prosecuted.

Finally, as described above under DOCK-AND-LOCK® platform technology, we are developing an investigational T-cell redirected bispecific antibody that takes advantage of our Trop-2 antibody targeting, and has shown biological activity in our preclinical animal studies. We have now begun work to develop the constructs needed for translation into candidates for human clinical trials.

Diagnostic Imaging Products

We transitioned away from the development and commercialization of new diagnostic imaging products in order to accelerate the development of our therapeutic product candidates, although we continue to manufacture and sell, distribute and support LeukoScan® (sulesomab) in territories where regulatory approvals have previously been granted. LeukoScan® is indicated for diagnostic imaging to determine the location and extent of infection/inflammation in bone in patients with suspected osteomyelitis, including patients with diabetic foot ulcers.

Research and Development Expense

We have historically invested heavily in our research and development programs, spending approximately $51.8 million, $53.5 million and $41.7 million for these programs during the fiscal years ended June 30, 2017, 2016, and 2015, respectively. The expense decrease during the 2017 fiscal year resulted primarily from the closure of the Phase 3 pancreatic cancer “PANCRIT Trial” in the 2016 fiscal year, partially offset by higher spending in product development expense related to the manufacturing IMMU-132. The expense increases during the 2016 and 2015 fiscal years resulted primarily from higher spending for clinical trials, particularly for the PANCRIT Trial and the ADC clinical trials.

12

Patents and Proprietary Rights

Our Patents

We have accumulated a sizeable portfolio of patents and patent applications in the course of our research, which we believe constitutes a valuable business asset. Our key patents relate primarily to our therapeutic product candidates as well as our technologies and other discoveries for which no product candidate has yet been identified. As of August 4, 2017, our portfolio included approximately 316 active United States patents. In addition, as of such date, the portfolio included more than 400 foreign patents, with a number of United States and foreign patent applications pending.

The chart below highlights our material patents and product groups as of August 4, 2017, the major jurisdictions, and relevant expiration periods. Additional patents have been filed to extend the patent life on some of these products, but there can be no assurance that these will be issued as filed.

|

Program & Product Group |

|

Targeted |

|

Patent |

|

Major |

|

|

Antibody-Drug Conjugates |

|

Trop-2, CEA/CEACAM5 and HLA-DR |

|

2023-2033 |

|

U.S., Europe, Japan |

|

|

Subcutaneous Formulation |

|

All Antibodies |

|

2032 |

|

U.S., Europe, Japan |

|

|

Epratuzumab |

|

CD22 |

|

2017-2032 |

|

U.S., Europe, Japan |

|

|

Veltuzumab |

|

CD20 |

|

2023-2029 |

|

U.S., Europe, Japan |

|

|

Milatuzumab |

|

CD74 |

|

2018-2032 |

|

U.S., Europe, Japan |

|

|

IMMU-114 |

|

HLA-DR |

|

2026 |

|

U.S., Europe, Japan |

|

|

DNL® Program – (E1)-3s |

|

Trop-2 |

|

2033 |

|

U.S., Europe, Japan |

|

Our Licenses

We have obtained licenses from various parties for rights to use, develop and commercialize proprietary technologies and compounds. Currently, we have the following licenses:

Medical Research Council (“MRC”) – We entered into a license agreement with MRC in May 1994, whereby we have obtained a license for certain patent rights with respect to the genetic engineering on monoclonal antibodies. Our agreement does not require any milestone payments, nor have we made any payments to MRC to date. Our agreement with MRC, which expires at the expiration of the last of the licensed patents in 2020, provides for future royalty payments to be made based on a percentage of product sales.

Center for Molecular Medicine and Immunology (“CMMI”) – We entered into a license agreement with CMMI in December 2004, whereby we have licensed certain rights with respect to patents and patent applications owned by CMMI. Dr. Goldenberg, our Chief Scientific Officer and Chief Patent Officer and former Chairman of our Board of Directors, founded and was the President and member of the Board of Trustees of CMMI. No license or milestone payments are required under this agreement. Under the license agreement, which expires at the expiration of the last of the licensed patents in 2031, CMMI will receive future royalty payments in the low single digits based on a percentage of sales of products that are derived from the CMMI patents. Inventions made independently of us by CMMI are the property of CMMI. CMMI has ceased operations and is in the process of dissolution. Please see the section entitled “Other Collaborations” for a description of the current status of the relationship.

Our Trademarks

The mark “IMMUNOMEDICS” is registered in the United States and 19 foreign countries and a European Community Trademark has been granted. Our logo is also registered in the United States and in one foreign country. The mark “IMMUSTRIP” is registered in the United States and Canada. The mark “LEUKOSCAN” is registered in the

13

United States and eight foreign countries, and a European Community Trademark has been granted. In addition, we have applied for registration in the United States for several other trademarks for use on products now in development or testing, and for corresponding foreign and/or European Community Trademarks for certain of those marks. The marks “EPRATUCYN,” “VELTUCYN,” “CLIVATUCYN” and “MILATUCYN” have been registered in the U.S. International Trademark Registrations and Canadian applications which claim priority to the respective United States applications have been filed for “EPRATUCYN” and “VELTUCYN.” The International Registrations request registration in China, Japan and the European Union. The marks “DOCK-AND-LOCK,” “DNL,” and “PANCRIT” have been registered in the United States.

Our Trade Secrets

We also rely upon unpatented trade secrets, and there is no assurance that others will not independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose such technology, or that such rights can be meaningfully protected. We require our employees, consultants, outside scientific collaborators, sponsored researchers and other advisers to execute confidentiality agreements upon the commencement of employment or consulting relationships with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual's relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of our employees, the agreement provides that all inventions conceived by such employees shall be our exclusive property. There can be no assurance, however, that these agreements will provide meaningful protection or adequate remedies for our trade secrets in the event of unauthorized use or disclosure of such information.

Third Party Rights

Our success also depends in part on our ability to gain access to third party patent and proprietary rights and to operate our business without infringing on third party patent rights. We may be required to obtain licenses to patents or other proprietary rights from third parties to develop, manufacture and commercialize our product candidates. Licenses required under third-party patents or proprietary rights may not be available on terms acceptable to us, if at all. If we do not obtain the required licenses, we could encounter delays in product development while we attempt to redesign products or methods or we could be unable to develop, manufacture or sell products requiring these licenses at all.

Corporate Collaboration

In January 2013, we entered into a collaboration agreement with Algeta ASA, subsequently acquired by Bayer, for the development of epratuzumab conjugated with Algeta’s proprietary thorium-227 alpha-pharmaceutical payload. Under the terms of this agreement, we have manufactured and supplied clinical-grade epratuzumab to Bayer, which has rights to evaluate the potential of a conjugated thorium-227 epratuzumab for the treatment of cancer. Bayer will fund all nonclinical and clinical development costs up to the end of Phase 1 clinical testing. Upon successful completion of Phase 1 clinical testing, the parties shall negotiate terms for a license agreement at Bayer’s request. We have agreed with Bayer to certain parameters to be included in the license agreement. This agreement has been extended to December 30, 2018.

Other Collaborations

In previous years, we conducted research on a number of our programs in collaboration with CMMI and its clinical unit, the Garden State Cancer Center. CMMI performed contracted pilot and pre-clinical trials in scientific areas of importance to us and also conducted basic research and pre-clinical evaluations in a number of areas of potential interest to us. Dr. David M. Goldenberg, our Chief Scientific Officer, Chief Patent Officer and former Chairman of our Board of Directors, was the President and a Member of the Board of Trustees of CMMI. CMMI has ceased operations and is in the process of dissolution.

We also collaborate with numerous other academic and research centers. Our academic collaborators have included such institutions as the Erasme University Hospital, Brussels, Belgium; University of Nijmegen, The Netherlands; Institut National de la Sante et de la Recherche Medicale, Nantes, France; University Medical Center Göttingen, Germany; Karolinska Institutet, Stockholm, Sweden; New York Presbyterian Hospital – Weill Cornell Medical College; University of Ohio Cancer Center; University of Texas M.D. Anderson Cancer Center. We believe such academic research collaboration may identify new and improved products and techniques for diagnosing and treating various cancers, autoimmune and infectious diseases.

14

Government Regulation

Regulatory Compliance

Our research and development activities, including testing in laboratory animals and in humans, our manufacture of antibodies, as well as the design, manufacturing, safety, efficacy, handling, labeling, storage, record-keeping, advertising, promotion and marketing of the product candidates that we are developing and our marketed products, are all subject to stringent regulation, primarily by the FDA in the United States under the Federal Food, Drug, and Cosmetic Act (“FFDCA”), and its implementing regulations, and the Public Health Service Act (“PHSA”), and its implementing regulations, and by comparable authorities under similar laws and regulations in other countries. If for any reason we do not comply with applicable requirements, such noncompliance can result in various adverse consequences, including one or more delays in approval of, or even the refusal to approve, product licenses or other applications, the suspension or termination of clinical investigations, the revocation of approvals previously granted, as well as fines, criminal prosecution, recall or seizure of products, injunctions against shipping products and total or partial suspension of production and/or refusal to allow us to enter into governmental supply contracts.

Product Approval

In the United States, our product candidates are regulated as biologic pharmaceuticals, or biologics. The process required by the FDA before biologic product candidates may be marketed in the United States generally involves the following:

|

· |

completion of preclinical laboratory tests and animal studies performed in accordance with the FDA’s current Good Laboratory Practices (“GLP”) regulations; |

|

· |

submission to the FDA of an Investigational New Drug Application (“IND”), which must become effective before human clinical trials may begin and must be updated annually; |

|

· |

approval by an independent Institutional Review Board (“IRB”), the ethics committee at each clinical site before the trial is initiated. |

|

· |

performance of adequate and well-controlled clinical trials to establish the safety, purity and potency of the proposed biologic, and the safety and efficacy of the proposed drug for each indication; |

|

· |

preparation of and submission to the FDA of a BLA, for a new biologic, after completion of all pivotal clinical trials; |

|

· |

satisfactory completion of an FDA Advisory Committee review, if applicable; |

|

· |

a determination by the FDA within 60 days of its receipt of a BLA to file the application for review; |

|

· |

satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities to assess compliance with current Good Manufacturing Practice (“cGMP”), regulations; and |

|

· |

FDA review and approval of a BLA for a new biologic, prior to any commercial marketing or sale of the product in the United States. |

Preclinical tests assess the potential safety and efficacy of a product candidate in animal models. Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with current Good Clinical Practices (“cGCPs”), which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. Additionally, approval must also be obtained from each clinical trial site’s IRB before the trials may be initiated, and the IRB must monitor the study until completed. There are also requirements governing the reporting of ongoing clinical trials and clinical trial results to public registries.

15

The clinical investigation of a pharmaceutical, including a biologic, is generally divided into three phases. Although the phases are usually conducted sequentially, they may overlap or be combined.

|

· |

Phase 1 studies are designed to evaluate the safety, dosage tolerance, metabolism and pharmacologic actions of the investigational product in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. |

|

· |

Phase 2 includes controlled clinical trials conducted to preliminarily or further evaluate the effectiveness of the investigational product for a particular indication(s) in patients with the disease or condition under study, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety risks associated with the product. |

|

· |

Phase 3 clinical trials are generally controlled clinical trials conducted in an expanded patient population generally at geographically dispersed clinical trial sites, and are intended to further evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the investigational product, and to provide an adequate basis for product approval. |

The FDA may place clinical trials on hold at any point in this process if, among other reasons, it concludes that clinical subjects are being exposed to an unacceptable health risk. Trials may also be terminated by IRBs, which must review and approve all research involving human subjects. Side effects or adverse events that are reported during clinical trials can delay, impede or prevent marketing authorization.

The results of the preclinical and clinical testing, along with information regarding the manufacturing of the product and proposed product labeling, are evaluated and, if determined appropriate, submitted to the FDA through a BLA. The application includes all relevant data available from pertinent preclinical and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Once the BLA submission has been accepted for filing, the FDA’s standard goal is to review applications within ten months of the filing date or, if the application relates to an unmet medical need in a serious or life-threatening indication, six months from the filing date. The review process is often significantly extended by FDA requests for additional information or clarification. The FDA offers certain programs, such as Fast Track designation, designed to expedite the development and review of applications for products intended for the treatment of a serious or life-threatening disease or condition. If Fast Track designation is obtained, the FDA may initiate review of sections of a BLA before the application is complete, and the product may be eligible for accelerated approval. However, receipt of Fast Track designation for a product candidate does not ensure that a product will be developed or approved on an expedited basis, and such designation may be rescinded if the product candidate is found to no longer meet the qualifying criteria.

The FDA reviews the BLA to determine, among other things, whether the proposed product is safe, pure and potent, which includes determining whether it is effective for its intended use, and whether the product is being manufactured in accordance with cGMP, to assure and preserve the product’s identity, strength, quality, potency and purity. The FDA may refer the application to an advisory committee for review, evaluation and recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it typically follows such recommendations.

After the FDA evaluates the BLA and conducts inspections of manufacturing facilities, it may issue an approval letter or a Complete Response Letter. An approval letter authorizes commercial marketing of the biologic with specific prescribing information for specific indications. A Complete Response Letter indicates that the review cycle of the application is complete and the application is not ready for approval. A Complete Response Letter may require additional clinical data and/or an additional pivotal Phase 3 clinical trial(s), and/or other significant, expensive and time-consuming requirements related to clinical trials, preclinical studies or manufacturing. Even if such additional information is submitted, the FDA may ultimately decide that the BLA does not satisfy the criteria for approval. The FDA could approve the BLA with a Risk Evaluation and Mitigation Strategy, or REMS, plan to mitigate risks, which could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. The FDA also may condition approval on,

16

among other things, changes to proposed labeling, development of adequate controls and specifications, or a commitment to conduct one or more post-market studies or clinical trials. Such post-market testing may include Phase 4 clinical trials and surveillance to further assess and monitor the product’s safety and effectiveness after commercialization.

The Biologics Price Competition and Innovation Act of 2009 (“BPCIA”) created an abbreviated pathway for the approval of biosimilar and interchangeable biologic products. The abbreviated pathway establishes legal authority for the FDA to review and approve biosimilar biologics, including the possible designation of a biosimilar as “interchangeable” based on its similarity to an existing brand product. Under the BPCIA, an application for a biosimilar product cannot be approved by the FDA until 12 years after the original branded product was approved under a BLA. In March 2015, the FDA approved Novartis’s Zarxio as a biosimilar product to Amgen’s Neupogen. The approval, the first biosimilar product approved for distribution in the United States, could usher in lower prices for biologic products from increased competition.

Expedited Review and Approval

The FDA has four program designations — Fast Track, Breakthrough Therapy, Accelerated Approval, and Priority Review — to facilitate and expedite development and review of new drugs to address unmet medical needs in the treatment of serious or life-threatening conditions. The Fast Track designation provides pharmaceutical manufacturers with opportunities for frequent interactions with FDA reviewers during the product’s development and the ability for the manufacturer to do a rolling submission of the BLA. A rolling submission allows completed portions of the application to be submitted and reviewed by the FDA on an ongoing basis. The Breakthrough Therapy designation provides manufacturers with all of the features of the Fast Track designation as well as intensive guidance on implementing an efficient development program for the product and a commitment by the FDA to involve senior managers and experienced review staff in the review. The Accelerated Approval designation allows the FDA to approve a product based on an effect on a surrogate or intermediate endpoint that is reasonably likely to predict a product’s clinical benefit and generally requires the manufacturer to conduct required post-approval confirmatory trials to verify the clinical benefit. The Priority Review designation means that the FDA’s goal is to take action on the BLA within six months, compared to ten months under standard review. In February 2016, sacituzumab govitecan was granted Breakthrough Therapy designation from the FDA for the treatment of patients with TNBC who have failed at least two prior therapies for metastatic disease.

Post-Approval Requirements

Any products manufactured or distributed by us or on our behalf pursuant to FDA approvals are subject to continuing regulation by the FDA and certain state agencies, including requirements for record-keeping, reporting of adverse experiences with the biologic, submitting biological product deviation reports to notify the FDA of unanticipated changes in distributed products, establishment registration, compliance with cGMP standards (including investigation and correction of any deviations from cGMP), and certain state chain of distribution pedigree requirements. Additionally, any significant change in the approved product or in how it is manufactured, including changes in formulation or the site of manufacture, generally require prior FDA approval. The packaging and labeling of all products developed by us are also subject to FDA approval and ongoing regulation. Noncompliance with any regulatory requirements can result in, among other things, issuance of warning letters, civil and criminal penalties, seizures, and injunctive action. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with cGMP and other aspects of regulatory compliance.

Orphan Drug Act

To date, we have successfully obtained Orphan Drug designation by the FDA under the Orphan Drug Act of 1983 for epratuzumab for NHL, yttrium-90-labeled clivatuzumab tetraxetan for pancreatic cancer, sacituzumab govitecan for SCLC and pancreatic cancer, labetuzumab for ovarian, pancreatic and SCLCs, milatuzumab for multiple myeloma and CLL, and veltuzumab for ITP and pemphigus. Under the Orphan Drug Act, the FDA may grant orphan drug designation to drugs intended to treat a rare disease or condition, which is generally defined as a disease or condition that affects fewer than 200,000 individuals in the United States. Orphan drug designation must be requested before submitting a BLA. In the United States, orphan drug designation entitles a party to financial incentives such as opportunities for grant funding towards clinical trial costs, tax advantages, and user-fee waivers. Orphan drug

17

designation does not convey any advantage in, or shorten the duration of, the regulatory review and approval process. The first BLA applicant to receive FDA approval for a particular active ingredient to treat a particular disease with FDA orphan drug designation is entitled to a seven-year exclusive marketing period in the United States for that product, for that indication. During the seven-year exclusivity period, the FDA may not approve any other applications to market the same drug for the same orphan indication, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity or where the manufacturer of the approved product cannot assure sufficient quantities. As a result, there can be no assurance that our competitors will not receive approval of drugs or biologics that have a different active ingredient for treatment of the diseases for which our products and product candidates are targeted.

Foreign Regulation

In addition to regulations in the United States, we are subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution of our product candidates being developed, and products being marketed outside of the United States. We must obtain approval by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of our products in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required by the FDA for BLA licensure. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country. As in the United States, we are subject to post-approval regulatory requirements, such as those regarding product manufacturing, marketing, or distribution.

Other Regulatory Considerations

We are also subject to regulation under the Occupational Safety and Health Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act, The Clean Air Act, New Jersey Department of Environmental Protection and other current and potential future federal, state, or local regulations. Our research and development activities involve the controlled use of hazardous materials, chemicals, biological materials and various radioactive compounds. We believe that our procedures comply with the standards prescribed by state and federal regulations; however, the risk of injury or accidental contamination cannot be completely eliminated.

We may also be subject to healthcare regulation and enforcement by the federal government and the states and foreign governments where we may market our products and product candidates, if approved. These laws include, without limitation, state and federal anti-kickback, fraud and abuse, false claims, privacy, and security and physician sunshine laws and regulations.

The federal Anti-Kickback Statute prohibits, among other things, any person from knowingly and willfully offering, soliciting, receiving or providing remuneration, directly or indirectly, to induce either the referral of an individual, for an item or service or the purchasing or ordering of a good or service, for which payment may be made under federal healthcare programs, such as the Medicare and Medicaid programs. The Anti-Kickback Statute is subject to evolving interpretations. In the past, the government has enforced the Anti-Kickback Statute to reach large settlements with healthcare companies, based on sham consulting and other financial arrangements with physicians. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. In addition, the government may assert that a claim, including items or services resulting from a violation of the federal Anti-Kickback Statute, constitutes a false or fraudulent claim for purposes of the federal False Claims Act. The majority of states also have anti-kickback laws, which establish similar prohibitions and, in some cases, may apply to items or services reimbursed by any third-party payor, including commercial insurers.

Additionally, the civil False Claims Act prohibits knowingly presenting or causing the presentation of a false, fictitious or fraudulent claim for payment to the United States government. Actions under the False Claims Act may be brought by the Attorney General or as a qui tam action by a private individual in the name of the government. Violations of the False Claims Act can result in very significant monetary penalties and treble damages. The federal government is using the False Claims Act, and the accompanying threat of significant liability, in its investigation and prosecution of pharmaceutical and biotechnology companies throughout the United States, for example, in connection with the promotion of products for unapproved uses and other sales and marketing practices. The government has obtained multi-million and multi-billion dollar settlements under the False Claims Act in addition to individual criminal convictions under applicable criminal statutes. Given the significant size of actual and potential settlements, it is expected that the

18

government will continue to devote substantial resources to investigating compliance of healthcare providers and manufacturers with applicable fraud and abuse laws.

The federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) also created new federal criminal statutes that prohibit, among other actions, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

We may also be subject to data privacy and security regulation by both the federal government and the states in which we conduct our business. HIPAA, as amended by the Health Information Technology and Clinical Health Act (“HITECH”), and their respective implementing regulations, including the final omnibus rule published on January 25, 2013, imposes specified requirements relating to the privacy, security and transmission of individually identifiable health information. Among other things, HITECH makes HIPAA’s privacy and security standards directly applicable to “business associates,” defined as independent contractors or agents of covered entities that create, receive, maintain or transmit protected health information in connection with providing a service for or on behalf of a covered entity. HITECH also increased the civil and criminal penalties that may be imposed against covered entities, business associates and possibly other persons, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorney’s fees and costs associated with pursuing federal civil actions. In addition, state laws govern the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways, thus complicating compliance efforts.

We are subject to the United States Foreign Corrupt Practices Act, which prohibits corporations and individuals from engaging in certain activities to obtain or retain business or to influence a person working in an official capacity. Under this act, it is illegal to pay, offer to pay, or authorize the payment of anything of value to any foreign government official, government staff member, political party or political candidate in an attempt to obtain or retain business or to otherwise influence a person working in an official capacity. Our present and future business has been and will continue to be subject to various other laws and regulations.

Pricing Controls

The levels of revenues and profitability of biopharmaceutical companies may be affected by the continuing efforts of government and third party payers to contain or reduce the costs of health care through various means. For example, in certain foreign markets, pricing reimbursement or profitability of therapeutic and other pharmaceutical products is subject to governmental control. In the U. S., there have been, and we expect that there will continue to be, a number of federal and state proposals to implement similar governmental pricing control. While we cannot predict whether any such legislative or regulatory proposals will be adopted, the adoption of such proposals could have a material adverse effect on our business, financial condition and profitability.

Third Party Coverage and Reimbursement

In addition, in the United States and elsewhere, sales of therapeutic and other pharmaceutical products are dependent in part on the availability of reimbursement to the consumer from third party payers such as government and private insurance plans. Third party payers are increasingly challenging the prices charged for medical products and services. We cannot assure you that any of our products will be considered cost effective and that reimbursement to the consumer will be available or will be sufficient to allow us to sell our products on a competitive and profitable basis.

Competition

Competition in the biopharmaceutical industry is intense and based significantly on scientific and technological factors such as the availability of patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain governmental approval for testing, manufacturing and marketing.

19