Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CASTLIGHT HEALTH, INC. | a8-k01182017investorpresen.htm |

CASTLIGHT HEALTH

Strategic acquisition

of Jiff

January 2017

2 Confidential

This presentation contains forward-looking statements regarding our trends, our strategies and the anticipated

performance of our business, including, but not limited to, the closing of the proposed transaction, contributions that we

expect Jiff’s business to make to Castlight’s business, the anticipated benefits of the proposed transaction, anticipated

future combined operations, products and services, expected quarter and year ended December 31, 2016 financial

results for Jiff and Castlight and expected pro forma financial results of the combined business. These statements are

made as of the date of this presentation and reflect management’s current views and expectations, and are subject to

various risks, uncertainties and assumptions. Factors that could cause actual results to differ materially include risks and

uncertainties such as those relating to the ability of the parties to complete the proposed transaction, obtaining Castlight

and Jiff stockholder approval and required regulatory clearances, and customer and partner reception to the proposed

transaction. Given these risks and uncertainties, you should not place undue reliance on these forward-looking

statements.

Please refer to the press release dated January 4, 2017 and the risk factors included in the company’s Form 10-Q filed

on November 2, 2016, and other filings with the Securities and Exchange Commission, for discussion of important

factors that may cause actual events or results to differ materially from those contained in our forward-looking

statements.

Forward-looking statements made in this presentation are being made as of the date of this presentation. After the date

of this presentation, the information contained in this presentation may no longer be current or accurate. We disclaim

any obligation to update or revise any forward-looking statements. This presentation contains guidance but we will not

provide any further guidance or updates on our performance during the quarter unless we do so in a public forum.

This presentation also includes certain non-GAAP metrics, including, but not limited to, non-GAAP revenue, non-GAAP

operating loss, non-GAAP net loss and free cash flow that we believe aid in the understanding of our financial results.

For more information about our use of non-GAAP metrics, please see our press release dated January 4, 2017, which is

available on our website and as an exhibit to the Form 8-K filed with the Securities and Exchange Commission.

SAFE HARBOR

3 Confidential

LEGEND

|

3

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the proposed transaction between Castlight Health, Inc. (“Castlight”) and Jiff, Inc. (“Jiff”), Castlight

intends to file a registration statement on Form S-4 with the Securities and Exchange Commission ("SEC"). This

registration statement will contain a joint proxy statement/prospectus/information statement and relevant materials

concerning the proposed transaction. Additionally, Castlight intends to file with the SEC other relevant materials in

connection with the proposed transaction. After the registration statement is declared effective by the SEC, Castlight

and Jiff will deliver a definitive joint proxy statement/prospectus/information statement to their respective stockholders.

STOCKHOLDERS OF CASTLIGHT AND JIFF ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH

THE SEC, INCLUDING THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS/INFORMATION STATEMENT,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors

and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov.

Documents will also be available for free from Castlight at www.castlighthealth.com.

This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of

securities in connection with the proposed transaction shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended.

Castlight and its executive officers and directors may be deemed to be participants in the solicitation of proxies from

Castlight’s stockholders with respect of the matters relating to the proposed transaction. Jiff and its officers and

directors may also be deemed a participant in such solicitation. Information regarding any interest that Castlight, Jiff or

any of the executive officers or directors of Castlight or Jiff may have in the proposed transaction with Jiff will be set

forth in the joint proxy statement/prospectus/information statement that Castlight intends to file with the SEC in

connection with its stockholder vote on matters relating to the proposed transaction. Information about the directors and

executive officers of Castlight, including their respective interest in security holding of Castlight, is set forth in the proxy

statement for Castlight’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 29, 2016.

Stockholders may obtain additional information regarding the interest of such participants by reading the definitive joint

proxy statement/prospectus/information statement regarding the proposed transaction when it becomes available.

These documents can be obtained free of charge from the sources indicated above.

4 Confidential

TRANSACTION TERMS

Consideration • Castlight to issue approximately 27M shares and options

Earnout

• Issuance of up to 4M shares issuable upon achievement of specific

growth objectives for the Jiff business in FY 2017

‐ 3M additional shares upon Jiff achieving $25M in net new bookings

‐ 1M additional shares upon Jiff achieving $25M in GAAP revenue

Pro Forma

Ownership

• Castlight shareholders to own ~80% of Company and Jiff shareholders

to own ~20% of the combined company on a fully-diluted basis

Leadership /

Board

Changes at

Closing

• John Doyle to become CEO of combined company

• Derek Newell to become President of combined company

• Giovanni Colella will continue in role of executive chairman

• Two members of current Jiff board will be appointed to Castlight board

Closing

Conditions

• Subject to Castlight and Jiff shareholder approval

• Expected to close in the first half of 2017

5 Confidential

• Castlight and Jiff are strong businesses focused on delivering a

health benefits platform to large employers

• Consumerism and proliferation of point solutions are driving

employers and consultants to seek a comprehensive health

benefits platform solution

• Prior to this combination, no single firm was well positioned to

offer a comprehensive platform solution spanning wellbeing

and decision support

• Together, Castlight and Jiff will offer the most comprehensive

health benefits platform in the market

• The combined business creates a clear path to larger scale,

faster growth, and cost efficiencies driven by highly

complementary business models

EXECUTIVE SUMMARY

| 5

6 Confidential

• Approximately 35% revenue growth to $102 million in 2016

• Gross margin reached long-term target of 70% to 75% in Q3 2016

• Operating loss in Q4’16 of <$3 million was 75% lower than Q4’15

• Stand alone business on track to reach cash flow breakeven in H2 2017

• Platform product accounted for 2/3rds of new logo wins in 2016

• Forecasted ~20% revenue growth in 2017 pre-acquisition

• Strong channel relationships, including Anthem and SAP, expected to

drive reacceleration of net new bookings in 2017 and 2018, respectively

CASTLIGHT CREATED A STRONG FOUNDATION IN 2016

Strong financial and strategic position in an accelerating platform market

7 Confidential

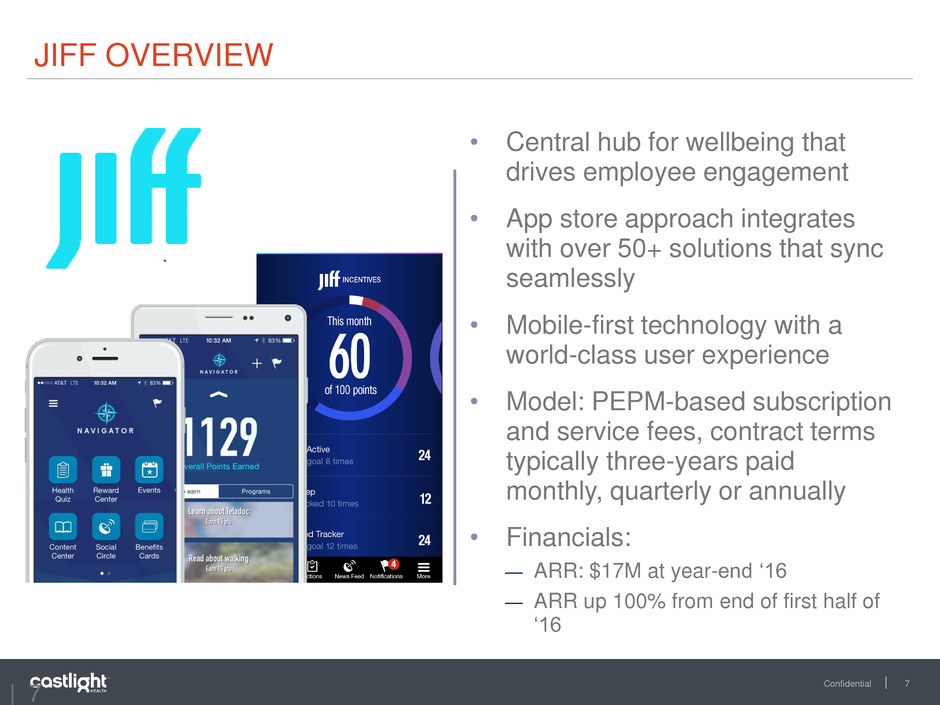

• Central hub for wellbeing that

drives employee engagement

• App store approach integrates

with over 50+ solutions that sync

seamlessly

• Mobile-first technology with a

world-class user experience

• Model: PEPM-based subscription

and service fees, contract terms

typically three-years paid

monthly, quarterly or annually

• Financials:

— ARR: $17M at year-end ‘16

— ARR up 100% from end of first half of

‘16

JIFF OVERVIEW

| 7

8 Confidential

• Total population solution

that spans wellbeing and

decision support

• Data infrastructure enables

deep personalization

• Ecosystem partnerships

streamline experience for

employers and employees

• The most comprehensive

health benefits platform in

the market

COMPREHENSIVE HEALTH BENEFITS PLATFORM

9 Confidential

END-TO-END ENGAGEMENT SOLUTION

Castlight and Jiff serve different ends of the care spectrum but are

converging towards an engagement platform. Combining the two platforms

allows us to offer the most comprehensive platform in the market.

Wellbeing

Decision Support

Comprehensive

Engagement

Platform

• Decision support/

“cost” wallet

• Personalization

• Data assets

• Communication

channels (email,

push, social, etc.)

• Content

• Wellness wallet

• Mobile-First Platform

• Ecosystem

• International & non-

benefits eligible

populations

Shared Capabilities

• Program “hub”

• Insights dashboard

10 Confidential

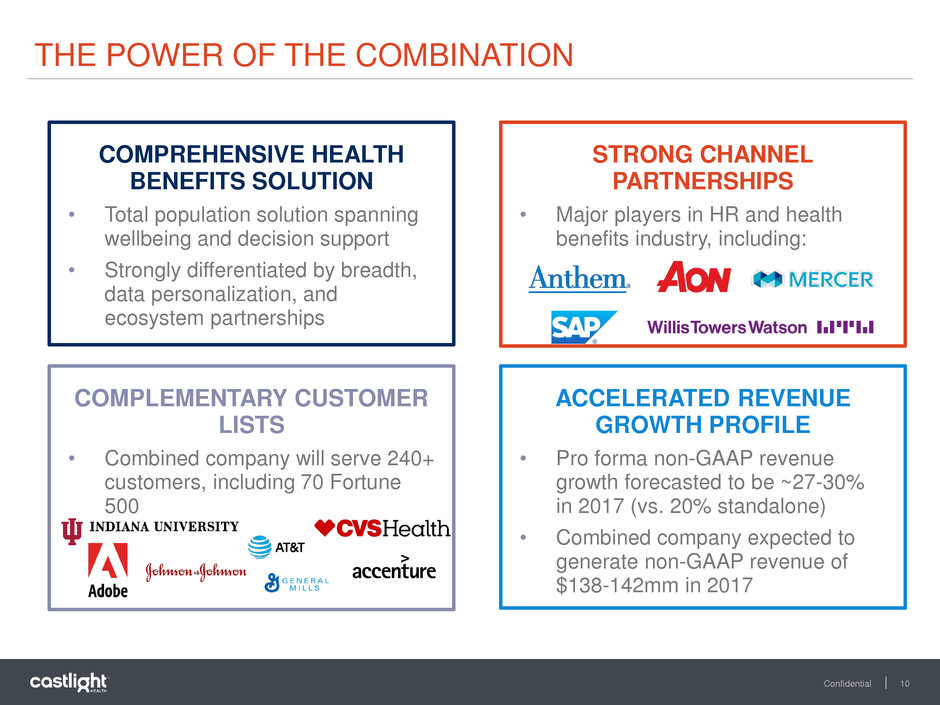

COMPREHENSIVE HEALTH

BENEFITS SOLUTION

• Total population solution spanning

wellbeing and decision support

• Strongly differentiated by breadth,

data personalization, and

ecosystem partnerships

THE POWER OF THE COMBINATION

COMPLEMENTARY CUSTOMER

LISTS

• Combined company will serve 240+

customers, including 70 Fortune

500

STRONG CHANNEL

PARTNERSHIPS

• Major players in HR and health

benefits industry, including:

ACCELERATED REVENUE

GROWTH PROFILE

• Pro forma non-GAAP revenue

growth forecasted to be ~27-30%

in 2017 (vs. 20% standalone)

• Combined company expected to

generate non-GAAP revenue of

$138-142mm in 2017

11 Confidential

$102

$123

$7

$19

$109

2016E 2017E

ACCELERATED REVENUE GROWTH PROFILE

($ in Millions)

Castlight Jiff

$122

$17

$139

2016YE

$138 - $142

Pro-Forma Non-GAAP Revenue Annual Recurring Revenue (ARR)

($ in Millions)

12 Confidential

• Castlight and Jiff are strong businesses focused on delivering a

health benefits platform to large employers

• Consumerism and proliferation of point solutions are driving

employers and consultants to seek a comprehensive health

benefits platform solution

• Prior to this combination, no single firm was well positioned to

offer a comprehensive platform solution spanning wellbeing

and decision support

• Together, Castlight and Jiff will offer the most comprehensive

health benefits platform in the market

• The combined business creates a clear path to larger scale,

faster growth, and cost efficiencies driven by highly

complementary business models

EXECUTIVE SUMMARY

|

12