Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WPX ENERGY, INC. | d247076dex991.htm |

| 8-K - FORM 8-K - WPX ENERGY, INC. | d247076d8k.htm |

January 12, 2017 Delaware Basin Panther Energy Acquisition Exhibit 99.2

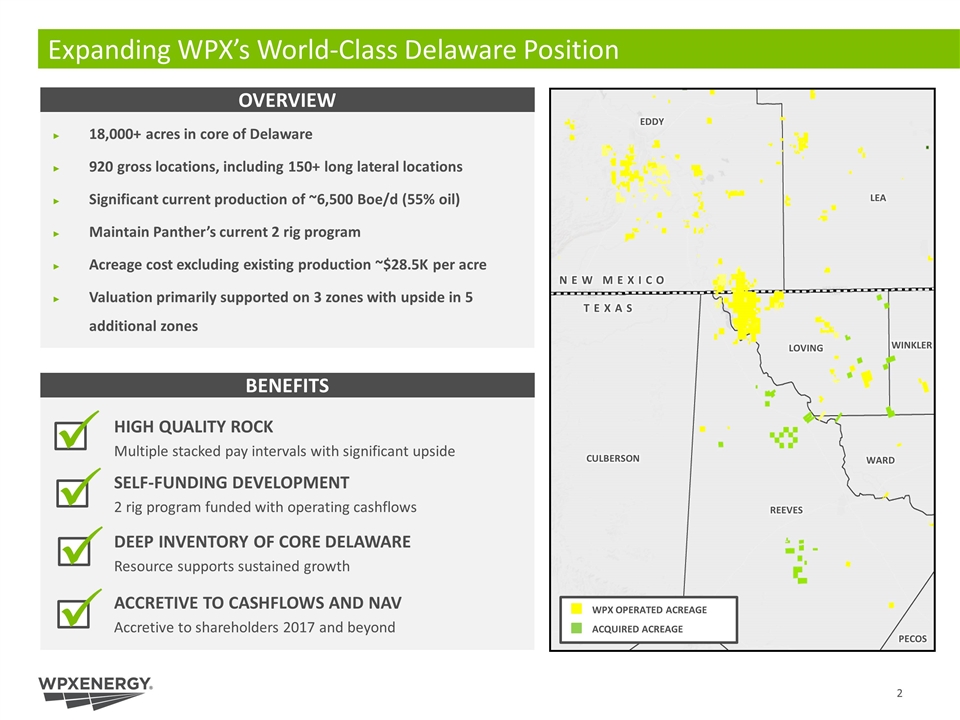

Expanding WPX’s World-Class Delaware Position OVERVIEW 18,000+ acres in core of Delaware 920 gross locations, including 150+ long lateral locations Significant current production of ~6,500 Boe/d (55% oil) Maintain Panther’s current 2 rig program Acreage cost excluding existing production ~$28.5K per acre Valuation primarily supported on 3 zones with upside in 5 additional zones NEW MEXICO TEXAS CULBERSON LEA EDDY WARD REEVES LOVING PECOS WINKLER WPX OPERATED ACREAGE ACQUIRED ACREAGE SELF-FUNDING DEVELOPMENT 2 rig program funded with operating cashflows DEEP INVENTORY OF CORE DELAWARE Resource supports sustained growth HIGH QUALITY ROCK Multiple stacked pay intervals with significant upside ACCRETIVE TO CASHFLOWS AND NAV Accretive to shareholders 2017 and beyond BENEFITS

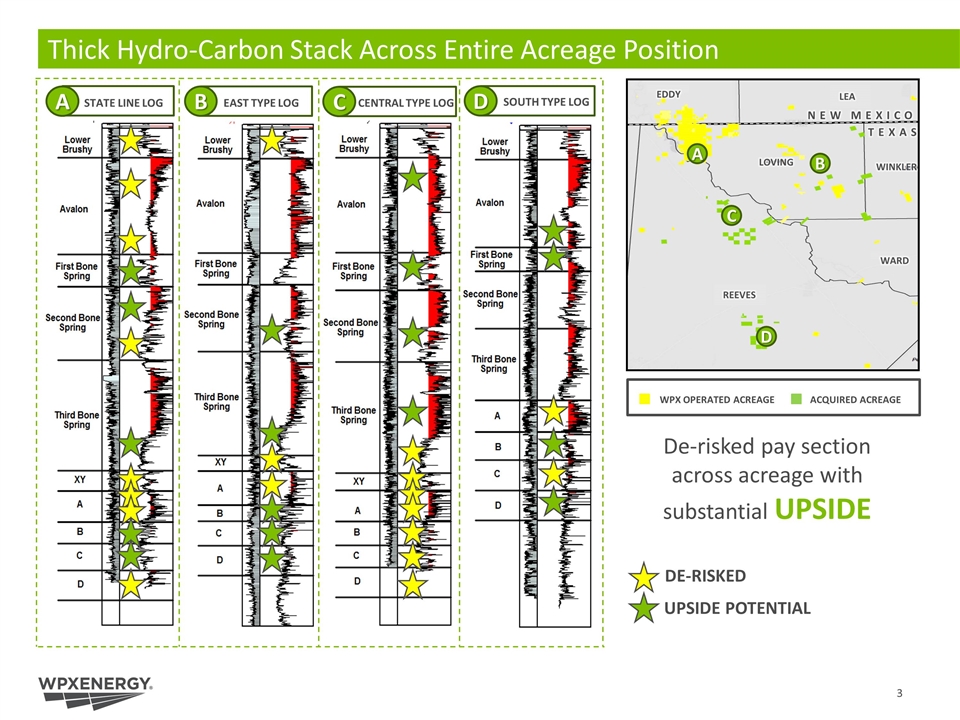

Thick Hydro-Carbon Stack Across Entire Acreage Position A STATE LINE LOG B EAST TYPE LOG C CENTRAL TYPE LOG D SOUTH TYPE LOG NEW MEXICO TEXAS WARD LEA EDDY REEVES LOVING WINKLER A B C D DE-RISKED UPSIDE POTENTIAL De-risked pay section across acreage with substantial UPSIDE WPX OPERATED ACREAGE ACQUIRED ACREAGE

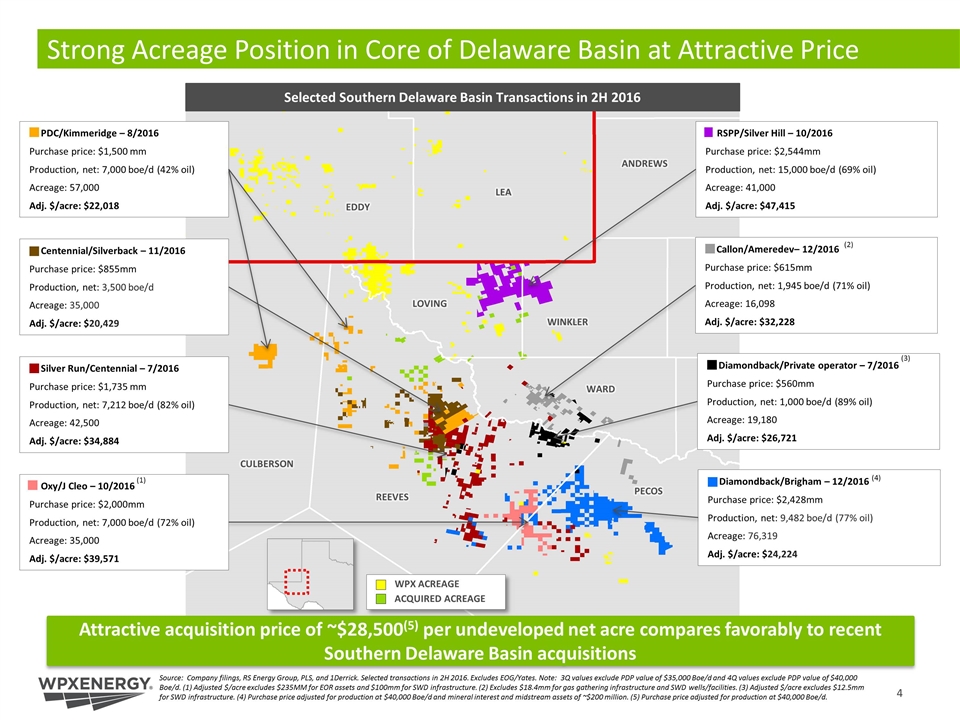

Strong Acreage Position in Core of Delaware Basin at Attractive Price Source: Company filings, RS Energy Group, PLS, and 1Derrick. Selected transactions in 2H 2016. Excludes EOG/Yates. Note: 3Q values exclude PDP value of $35,000 Boe/d and 4Q values exclude PDP value of $40,000 Boe/d. (1) Adjusted $/acre excludes $235MM for EOR assets and $100mm for SWD infrastructure. (2) Excludes $18.4mm for gas gathering infrastructure and SWD wells/facilities. (3) Adjusted $/acre excludes $12.5mm for SWD infrastructure. (4) Purchase price adjusted for production at $40,000 Boe/d and mineral interest and midstream assets of ~$200 million. (5) Purchase price adjusted for production at $40,000 Boe/d. RSPP/Silver Hill – 10/2016 Purchase price: $2,544mm Production, net: 15,000 boe/d (69% oil) Acreage: 41,000 Adj. $/acre: $47,415 Callon/Ameredev– 12/2016 Purchase price: $615mm Production, net: 1,945 boe/d (71% oil) Acreage: 16,098 Adj. $/acre: $32,228 (2) Diamondback/Private operator – 7/2016 Purchase price: $560mm Production, net: 1,000 boe/d (89% oil) Acreage: 19,180 Adj. $/acre: $26,721 (3) Attractive acquisition price of ~$28,500(5) per undeveloped net acre compares favorably to recent Southern Delaware Basin acquisitions Diamondback/Brigham – 12/2016 Purchase price: $2,428mm Production, net: 9,482 boe/d (77% oil) Acreage: 76,319 Adj. $/acre: $24,224 (4) Selected Southern Delaware Basin Transactions in 2H 2016 Lea Winkler Oxy/J Cleo – 10/2016 Purchase price: $2,000mm Production, net: 7,000 boe/d (72% oil) Acreage: 35,000 Adj. $/acre: $39,571 (1) PDC/Kimmeridge – 8/2016 Purchase price: $1,500 mm Production, net: 7,000 boe/d (42% oil) Acreage: 57,000 Adj. $/acre: $22,018 Silver Run/Centennial – 7/2016 Purchase price: $1,735 mm Production, net: 7,212 boe/d (82% oil) Acreage: 42,500 Adj. $/acre: $34,884 Centennial/Silverback – 11/2016 Purchase price: $855mm Production, net: 3,500 boe/d Acreage: 35,000 Adj. $/acre: $20,429 WPX ACREAGE ACQUIRED ACREAGE LOVING LEA EDDY REEVES CULBERSON WINKLER WARD PECOS ANDREWS

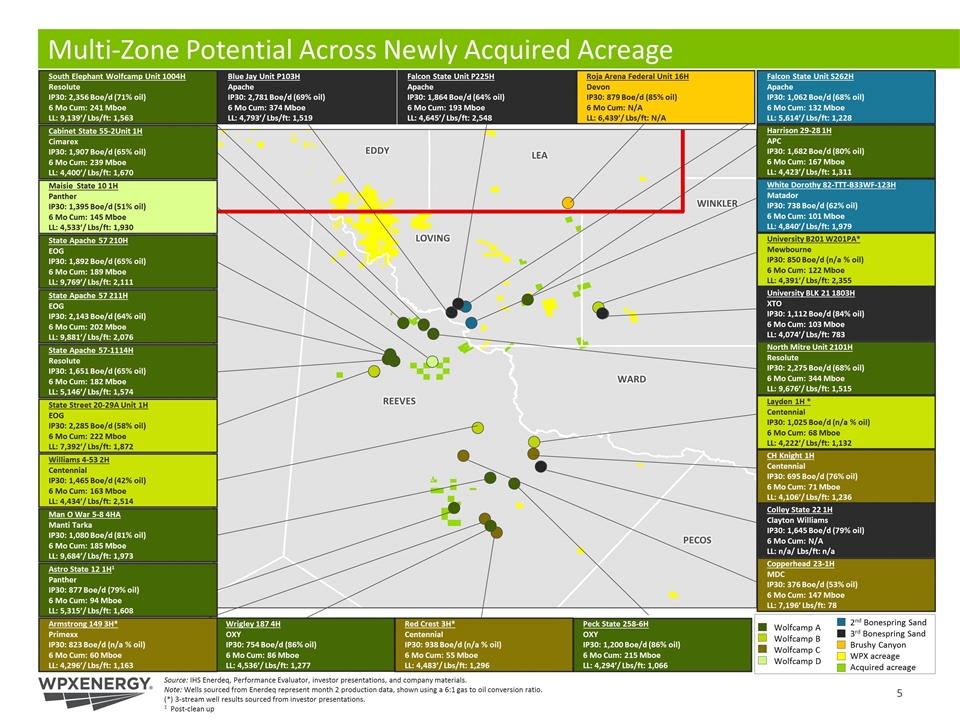

Multi-Zone Potential Across Newly Acquired Acreage Source: IHS Enerdeq, Performance Evaluator, investor presentations, and company materials. Note: Wells sourced from Enerdeq represent month 2 production data, shown using a 6:1 gas to oil conversion ratio. (*) 3-stream well results sourced from investor presentations. 1 Post-clean up Wolfcamp A Wolfcamp B Wolfcamp C Wolfcamp D 2nd Bonespring Sand 3rd Bonespring Sand Brushy Canyon WPX acreage Acquired acreage LOVING LEA EDDY REEVES WINKLER WARD PECOS Cabinet State 55-2Unit 1H Cimarex IP30: 1,907 Boe/d (65% oil) 6 Mo Cum: 239 Mboe LL: 4,400’/ Lbs/ft: 1,670 State Apache 57-1114H Resolute IP30: 1,651 Boe/d (65% oil) 6 Mo Cum: 182 Mboe LL: 5,146’/ Lbs/ft: 1,574 Harrison 29-28 1H APC IP30: 1,682 Boe/d (80% oil) 6 Mo Cum: 167 Mboe LL: 4,423’/ Lbs/ft: 1,311 University BLK 21 1803H XTO IP30: 1,112 Boe/d (84% oil) 6 Mo Cum: 103 Mboe LL: 4,074’/ Lbs/ft: 783 Maisie State 10 1H Panther IP30: 1,395 Boe/d (51% oil) 6 Mo Cum: 145 Mboe LL: 4,533’/ Lbs/ft: 1,930 University B201 W201PA* Mewbourne IP30: 850 Boe/d (n/a % oil) 6 Mo Cum: 122 Mboe LL: 4,391’/ Lbs/ft: 2,355 Astro State 12 1H1 Panther IP30: 877 Boe/d (79% oil) 6 Mo Cum: 94 Mboe LL: 5,315’/ Lbs/ft: 1,608 Red Crest 3H* Centennial IP30: 938 Boe/d (n/a % oil) 6 Mo Cum: 55 Mboe LL: 4,483’/ Lbs/ft: 1,296 CH Knight 1H Centennial IP30: 695 Boe/d (76% oil) 6 Mo Cum: 71 Mboe LL: 4,106’/ Lbs/ft: 1,236 Wrigley 187 4H OXY IP30: 754 Boe/d (86% oil) 6 Mo Cum: 86 Mboe LL: 4,536’/ Lbs/ft: 1,277 White Dorothy 82-TTT-B33WF-123H Matador IP30: 738 Boe/d (62% oil) 6 Mo Cum: 101 Mboe LL: 4,840’/ Lbs/ft: 1,979 Roja Arena Federal Unit 16H Devon IP30: 879 Boe/d (85% oil) 6 Mo Cum: N/A LL: 6,439’/ Lbs/ft: N/A State Apache 57 211H EOG IP30: 2,143 Boe/d (64% oil) 6 Mo Cum: 202 Mboe LL: 9,881’/ Lbs/ft: 2,076 Falcon State Unit P225H Apache IP30: 1,864 Boe/d (64% oil) 6 Mo Cum: 193 Mboe LL: 4,645’/ Lbs/ft: 2,548 Blue Jay Unit P103H Apache IP30: 2,781 Boe/d (69% oil) 6 Mo Cum: 374 Mboe LL: 4,793’/ Lbs/ft: 1,519 Colley State 22 1H Clayton Williams IP30: 1,645 Boe/d (79% oil) 6 Mo Cum: N/A LL: n/a/ Lbs/ft: n/a State Street 20-29A Unit 1H EOG IP30: 2,285 Boe/d (58% oil) 6 Mo Cum: 222 Mboe LL: 7,392’/ Lbs/ft: 1,872 Williams 4-53 2H Centennial IP30: 1,465 Boe/d (42% oil) 6 Mo Cum: 163 Mboe LL: 4,434’/ Lbs/ft: 2,514 North Mitre Unit 2101H Resolute IP30: 2,275 Boe/d (68% oil) 6 Mo Cum: 344 Mboe LL: 9,676’/ Lbs/ft: 1,515 State Apache 57 210H EOG IP30: 1,892 Boe/d (65% oil) 6 Mo Cum: 189 Mboe LL: 9,769’/ Lbs/ft: 2,111 Man O War 5-8 4HA Manti Tarka IP30: 1,080 Boe/d (81% oil) 6 Mo Cum: 185 Mboe LL: 9,684’/ Lbs/ft: 1,973 Layden 1H * Centennial IP30: 1,025 Boe/d (n/a % oil) 6 Mo Cum: 68 Mboe LL: 4,222’/ Lbs/ft: 1,132 South Elephant Wolfcamp Unit 1004H Resolute IP30: 2,356 Boe/d (71% oil) 6 Mo Cum: 241 Mboe LL: 9,139’/ Lbs/ft: 1,563 Peck State 258-6H OXY IP30: 1,200 Boe/d (86% oil) 6 Mo Cum: 215 Mboe LL: 4,294’/ Lbs/ft: 1,066 Armstrong 149 3H* Primexx IP30: 823 Boe/d (n/a % oil) 6 Mo Cum: 60 Mboe LL: 4,296’/ Lbs/ft: 1,163 Falcon State Unit S262H Apache IP30: 1,062 Boe/d (68% oil) 6 Mo Cum: 132 Mboe LL: 5,614’/ Lbs/ft: 1,228 Copperhead 23-1H MDC IP30: 376 Boe/d (53% oil) 6 Mo Cum: 147 Mboe LL: 7,196’ Lbs/ft: 78

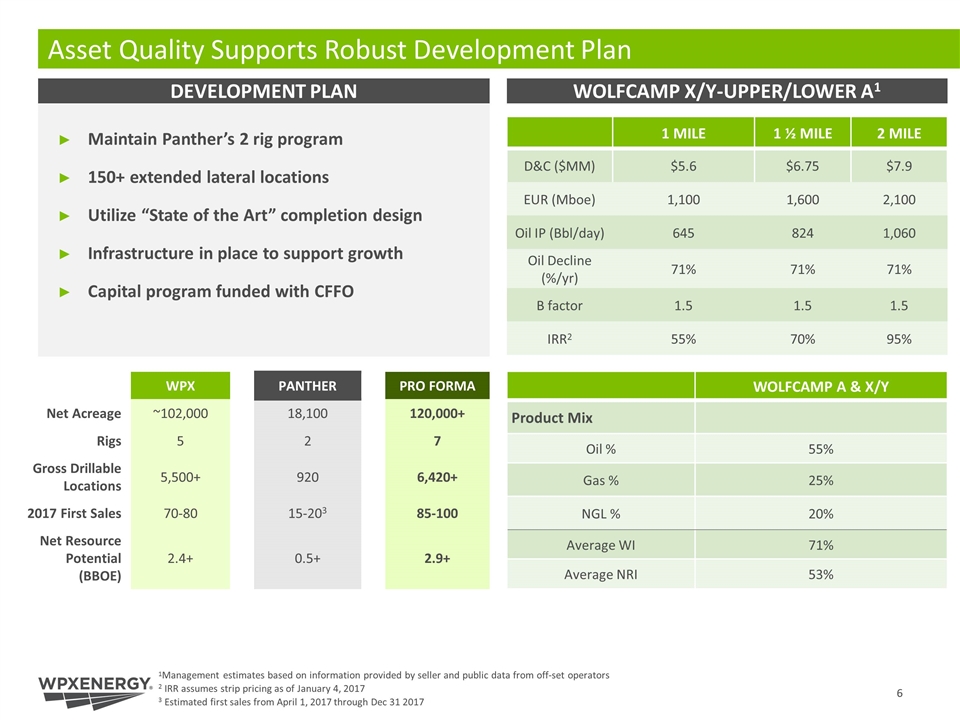

Asset Quality Supports Robust Development Plan 1 MILE 1 ½ MILE 2 MILE D&C ($MM) $5.6 $6.75 $7.9 EUR (Mboe) 1,100 1,600 2,100 Oil IP (Bbl/day) 645 824 1,060 Oil Decline (%/yr) 71% 71% 71% B factor 1.5 1.5 1.5 IRR2 55% 70% 95% Maintain Panther’s 2 rig program 150+ extended lateral locations Utilize “State of the Art” completion design Infrastructure in place to support growth Capital program funded with CFFO DEVELOPMENT PLAN WPX PANTHER PRO FORMA Net Acreage ~102,000 18,100 120,000+ Rigs 5 2 7 Gross Drillable Locations 5,500+ 920 6,420+ 2017 First Sales 70-80 15-203 85-100 Net Resource Potential (BBOE) 2.4+ 0.5+ 2.9+ WOLFCAMP A & X/Y Product Mix Oil % 55% Gas % 25% NGL % 20% Average WI 71% Average NRI 53% WOLFCAMP X/Y-UPPER/LOWER A1 1Management estimates based on information provided by seller and public data from off-set operators 2 IRR assumes strip pricing as of January 4, 2017 3 Estimated first sales from April 1, 2017 through Dec 31 2017 \

Increasing Core Inventory and Enhancing Shareholder Value VALUE-DRIVEN STRONG ASSETS SHAREHOLDER VALUE FINANCIAL STRENGTH Added ~32,000 net acres in the core of the Delaware for ~$18,600 per acre since RKI acquisition1 Large core Delaware acreage position with significant upside Expected to be accretive on cashflow and NAV basis Accelerates deleveraging goal and expands margins 1Includes Panther acquisition and other bolt-on acquisitions made since July 2015

Appendix

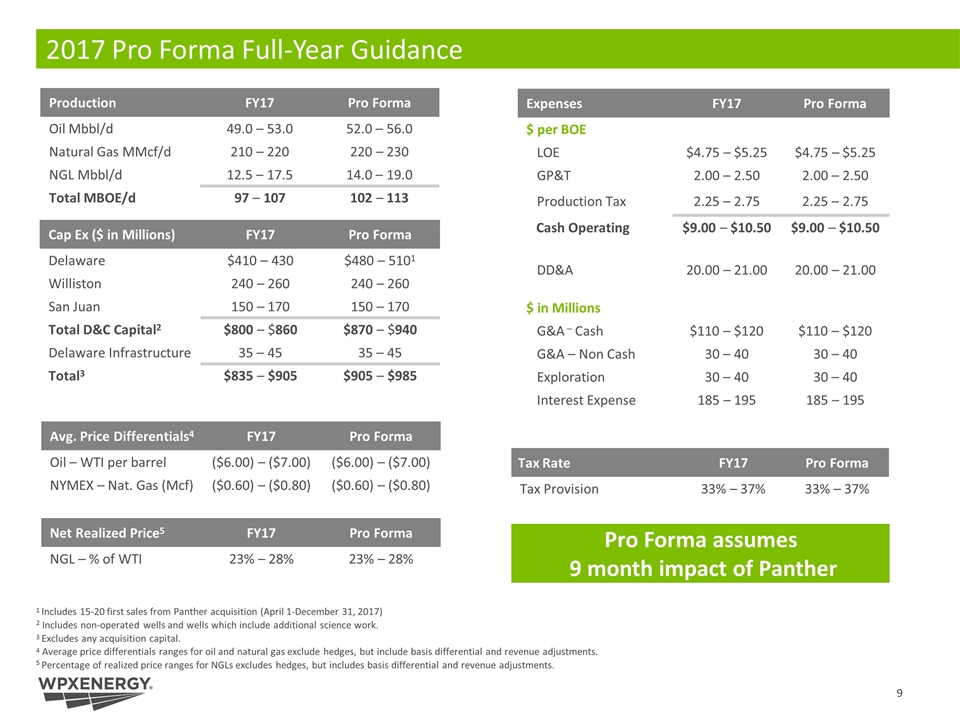

Production FY17 Pro Forma Oil Mbbl/d 49.0 – 53.0 52.0 – 56.0 Natural Gas MMcf/d 210 – 220 220 – 230 NGL Mbbl/d 12.5 – 17.5 14.0 – 19.0 Total MBOE/d 97 – 107 102 – 113 Expenses FY17 Pro Forma $ per BOE LOE $4.75 – $5.25 $4.75 – $5.25 GP&T 2.00 – 2.50 2.00 – 2.50 Production Tax 2.25 – 2.75 2.25 – 2.75 Cash Operating $9.00 – $10.50 $9.00 – $10.50 DD&A 20.00 – 21.00 20.00 – 21.00 $ in Millions G&A – Cash $110 – $120 $110 – $120 G&A – Non Cash 30 – 40 30 – 40 Exploration 30 – 40 30 – 40 Interest Expense 185 – 195 185 – 195 2017 Pro Forma Full-Year Guidance Tax Rate FY17 Pro Forma Tax Provision 33% – 37% 33% – 37% Net Realized Price5 FY17 Pro Forma NGL – % of WTI 23% – 28% 23% – 28% Cap Ex ($ in Millions) FY17 Pro Forma Delaware $410 – 430 $480 – 5101 Williston 240 – 260 240 – 260 San Juan 150 – 170 150 – 170 Total D&C Capital2 $800 – $860 $870 – $940 Delaware Infrastructure 35 – 45 35 – 45 Total3 $835 – $905 $905 – $985 1 Includes 15-20 first sales from Panther acquisition (April 1-December 31, 2017) 2 Includes non-operated wells and wells which include additional science work. 3 Excludes any acquisition capital. 4 Average price differentials ranges for oil and natural gas exclude hedges, but include basis differential and revenue adjustments. 5 Percentage of realized price ranges for NGLs excludes hedges, but includes basis differential and revenue adjustments. Avg. Price Differentials4 FY17 Pro Forma Oil – WTI per barrel ($6.00) – ($7.00) ($6.00) – ($7.00) NYMEX – Nat. Gas (Mcf) ($0.60) – ($0.80) ($0.60) – ($0.80) Pro Forma assumes 9 month impact of Panther

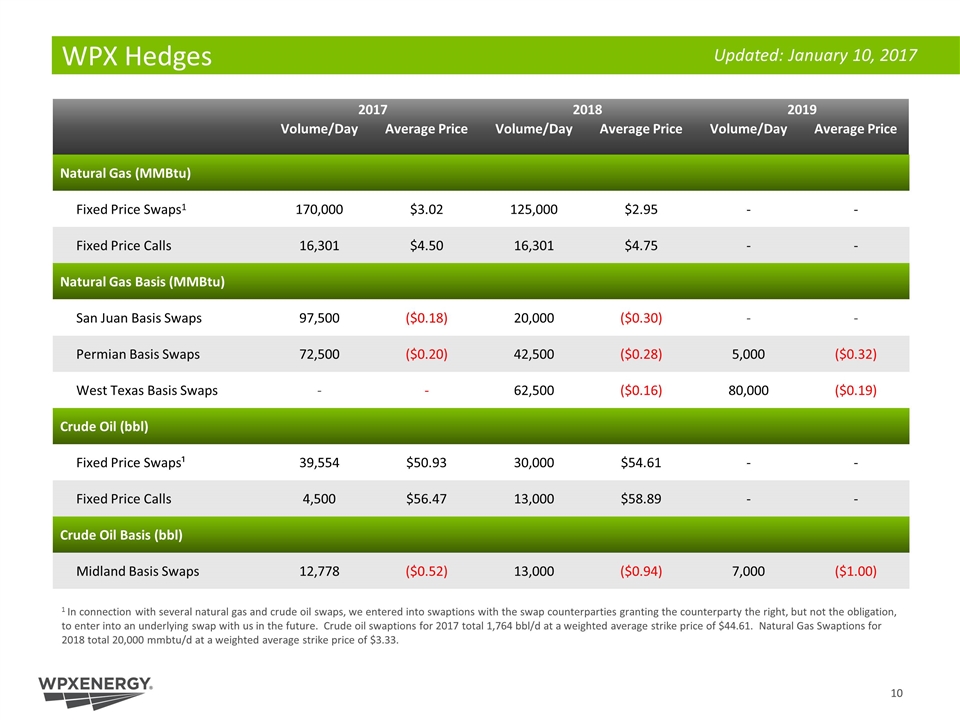

WPX Hedges 2017 2018 2019 Volume/Day Average Price Volume/Day Average Price Volume/Day Average Price 1 In connection with several natural gas and crude oil swaps, we entered into swaptions with the swap counterparties granting the counterparty the right, but not the obligation, to enter into an underlying swap with us in the future. Crude oil swaptions for 2017 total 1,764 bbl/d at a weighted average strike price of $44.61. Natural Gas Swaptions for 2018 total 20,000 mmbtu/d at a weighted average strike price of $3.33. Natural Gas (MMBtu) Fixed Price Swaps1 170,000 $3.02 125,000 $2.95 - - Fixed Price Calls 16,301 $4.50 16,301 $4.75 - - Natural Gas Basis (MMBtu) San Juan Basis Swaps 97,500 ($0.18) 20,000 ($0.30) - - Permian Basis Swaps 72,500 ($0.20) 42,500 ($0.28) 5,000 ($0.32) West Texas Basis Swaps - - 62,500 ($0.16) 80,000 ($0.19) Crude Oil (bbl) Fixed Price Swaps¹ 39,554 $50.93 30,000 $54.61 - - Fixed Price Calls 4,500 $56.47 13,000 $58.89 - - Crude Oil Basis (bbl) Midland Basis Swaps 12,778 ($0.52) 13,000 ($0.94) 7,000 ($1.00) Updated: January 10, 2017

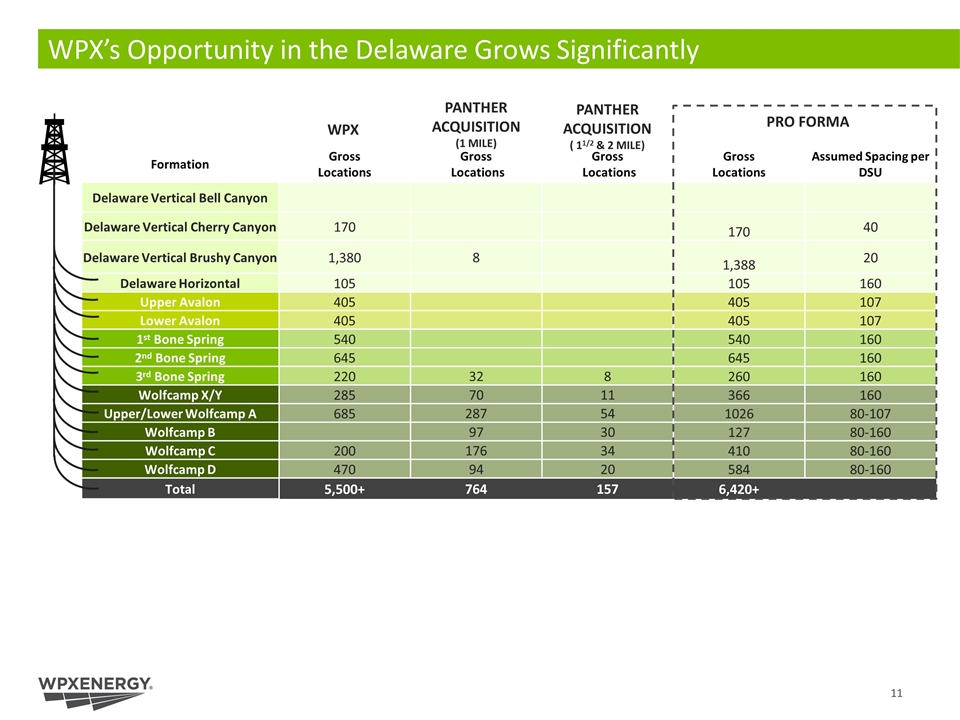

WPX’s Opportunity in the Delaware Grows Significantly Formation Gross Locations Gross Locations Gross Locations Gross Locations Assumed Spacing per DSU Delaware Vertical Bell Canyon Delaware Vertical Cherry Canyon 170 170 40 Delaware Vertical Brushy Canyon 1,380 8 1,388 20 Delaware Horizontal 105 105 160 Upper Avalon 405 405 107 Lower Avalon 405 405 107 1st Bone Spring 540 540 160 2nd Bone Spring 645 645 160 3rd Bone Spring 220 32 8 260 160 Wolfcamp X/Y 285 70 11 366 160 Upper/Lower Wolfcamp A 685 287 54 1026 80-107 Wolfcamp B 97 30 127 80-160 Wolfcamp C 200 176 34 410 80-160 Wolfcamp D 470 94 20 584 80-160 Total 5,500+ 764 157 6,420+ WPX PANTHER ACQUISITION ( 11/2 & 2 MILE) PRO FORMA PANTHER ACQUISITION (1 MILE)

Reserves Disclaimer The SEC requires oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible – from a given date forward, from known reservoirs, under existing economic conditions, operating methods, and governmental regulations. The SEC permits the optional disclosure of probable and possible reserves. We have elected to use in this presentation “probable” reserves and “possible” reserves, excluding their valuation. The SEC defines “probable” reserves as “those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.” The SEC defines “possible” reserves as “those additional reserves that are less certain to be recovered than probable reserves.” The Company has applied these definitions in estimating probable and possible reserves. Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC’s reserves reporting guidelines. Investors are urged to consider closely the disclosure regarding our business that may be accessed through the SEC’s website at www.sec.gov. The SEC’s rules prohibit us from filing resource estimates. Our resource estimations include estimates of hydrocarbon quantities for (i) new areas for which we do not have sufficient information to date to classify as proved, probable or even possible reserves, (ii) other areas to take into account the low level of certainty of recovery of the resources and (iii) uneconomic proved, probable or possible reserves. Resource estimates do not take into account the certainty of resource recovery and are therefore not indicative of the expected future recovery and should not be relied upon. Resource estimates might never be recovered and are contingent on exploration success, technical improvements in drilling access, commerciality and other factors.

Disclaimer The information contained in this summary has been prepared to assist you in making your own evaluation of the Company and does not purport to contain all of the information you may consider important in deciding whether to invest in shares of the Company’s common stock. In all cases, it is your obligation to conduct your own due diligence. All information contained herein, including any estimates or projections, is based upon information provided by the Company. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. No persons have been authorized to make any representations other than those contained in this summary, and if given or made, such representations should not be considered as authorized. Certain statements, estimates and financial information contained in this summary constitute forward-looking statements or information. Such forward-looking statements or information involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results implied or expressed in such forward-looking statements or information. While presented with numerical specificity, certain forward-looking statements or information are based (1) upon assumptions that are inherently subject to significant business, economic, regulatory, environmental, seasonal, competitive uncertainties, contingencies and risks including, without limitation, the ability to obtain debt and equity financings, capital costs, construction costs, well production performance, operating costs, commodity pricing, differentials, royalty structures, field upgrading technology, and other known and unknown risks, all of which are difficult to predict and many of which are beyond the Company's control, and (2) upon assumptions with respect to future business decisions that are subject to change. There can be no assurance that the results implied or expressed in such forward-looking statements or information or the underlying assumptions will be realized and that actual results of operations or future events will not be materially different from the results implied or expressed in such forward-looking statements or information. Under no circumstances should the inclusion of the forward-looking statements or information be regarded as a representation, undertaking, warranty or prediction by the Company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the Company will achieve or is likely to achieve any particular results. The forward-looking statements or information are made as of the date hereof and the Company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements or information, whether as a result of new information, future events or otherwise. Recipients are cautioned that forward-looking statements or information are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements or information due to the inherent uncertainty therein.