Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LogMeIn, Inc. | d268041d8k.htm |

LogMeIn Roadshow Presentation January 2017 Exhibit 99.1

Safe Harbor Statement Forward-Looking Statements This communication contains “forward-looking statements” concerning LogMeIn, Inc. (“LogMeIn”), Citrix Systems, Inc. (“Citrix”), GetGo, Inc. (“GetGo”), the proposed transactions and other matters. All statements other than statements of historical fact contained in this report are forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook” and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based on the current expectations, beliefs and assumptions of the management of LogMeIn concerning future developments, business conditions, anticipated synergies, pro forma financial results, LogMeIn’s plans to issue dividends in connection with the transaction, and their potential effects. There can be no assurance that future developments affecting the parties will be those that the parties anticipate. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (2) the risk that LogMeIn’s stockholders may not approve the issuance of the LogMeIn common stock in connection with the proposed merger, (3) the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated, (4) risks that any of the closing conditions to the proposed merger, including Citrix’s distribution of the shares of GetGo, may not be satisfied in a timely manner, (5) risks related to disruption of management time from ongoing business operations due to the proposed transactions, (6) failure to realize the estimated synergies or growth from the proposed transactions or that such benefits may take longer to realize than expected, (7) risks related to unanticipated costs of integration of GetGo by LogMeIn, (8) the effect of the announcement of the proposed transactions or the consummation of the proposed transactions on the ability of LogMeIn and Citrix to retain and hire key personnel and maintain relationships with their key business partners and customers, and on their operating results and businesses generally, (9) the length of time necessary to consummate the proposed transactions, (10) adverse trends in economic conditions generally or in the industries in which the LogMeIn and Citrix operate, (11) adverse changes to, or interruptions in, relationships with third parties unrelated to the announcement, (12) LogMeIn’s ability to compete effectively and successfully and to add new products and services, (13) LogMeIn’s ability to successfully manage and integrate acquisitions, (14) the ability to attract new customers and retain existing customers in the manner anticipated, (15) unanticipated changes relating to competitive factors in the parties’ industries, and (16) the business interruptions in connection with the LogMeIn’s technology systems. Discussions of additional risks and uncertainties are contained in LogMeIn’s and Citrix’s filings with the U.S. Securities and Exchange Commission (the “SEC”). None of LogMeIn, Citrix or GetGo is under any obligation, and each expressly disclaim any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this announcement are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. Important Additional Information and Where to Find It In connection with the proposed transaction, LogMeIn filed a registration statement on Form S-4 with the SEC on September 16, 2016, as amended on October 20, 2016, November 18, 2016 and December 13, 2016, and which was declared effective on December 15, 2016. This registration statement includes a proxy statement that also constitutes a prospectus, which was sent to LogMeIn stockholders on or about December 20, 2016. Stockholders are urged to read the proxy statement/prospectus and any other relevant documents when they become available, because they will contain important information about LogMeIn, GetGo, Citrix and the proposed merger. The proxy statement/prospectus and other documents relating to the proposed transactions (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The proxy statement/prospectus and other documents (when they are available) can also be obtained free of charge from LogMeIn upon written request to LogMeIn, Inc., Investor Relations, 333 Summer Street, Boston, MA 02210 or by calling (781) 897-0694. Participants in the Solicitation This communication is not a solicitation of a proxy from any security holder of LogMeIn. However, LogMeIn, Citrix and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of LogMeIn in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Citrix may be found in its Annual Report on Form 10-K filed with the SEC on February 18, 2016, and its definitive proxy statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on April 29, 2016. Information about the directors and executive officers of LogMeIn may be found in its Annual Report on Form 10-K filed with the SEC on February 19, 2016, and its definitive proxy statement relating to its 2016 Annual Meeting of Stockholders filed with the SEC on April 8, 2016.

An Innovative Software as a Service Leader Leadership in Large and Growing Markets Delivering Growth, Margin Expansion and Strong Cash Flow Disciplined Capital Returns

Our Vision— possibilities increase with connectivity & Our Mission— to simplify the way people interact to drive meaningful insights, deeper relationships, and better outcomes

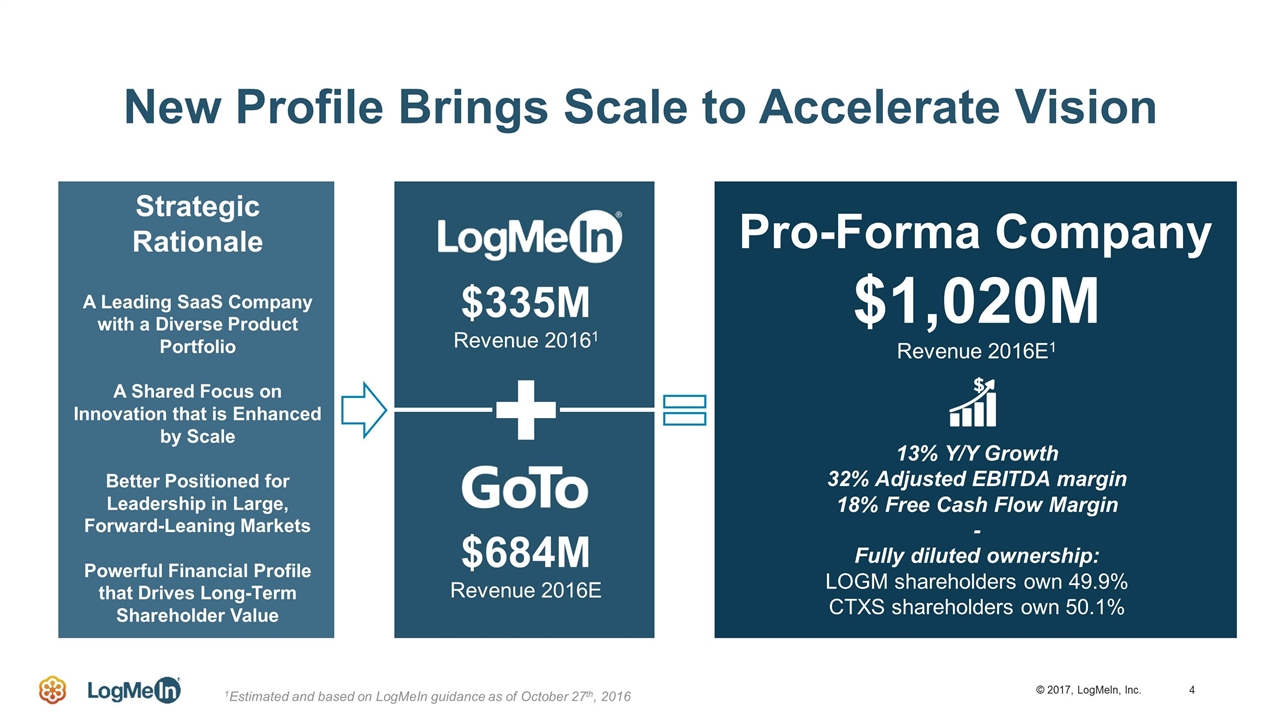

New Profile Brings Scale to Accelerate Vision $335M Revenue 20161 $684M Revenue 2016E $1,020M Revenue 2016E1 13% Y/Y Growth 32% Adjusted EBITDA margin 18% Free Cash Flow Margin - Fully diluted ownership: LOGM shareholders own 49.9% CTXS shareholders own 50.1% Pro-Forma Company 1Estimated and based on LogMeIn guidance as of October 27th, 2016 Strategic Rationale A Leading SaaS Company with a Diverse Product Portfolio A Shared Focus on Innovation that is Enhanced by Scale Better Positioned for Leadership in Large, Forward-Leaning Markets Powerful Financial Profile that Drives Long-Term Shareholder Value

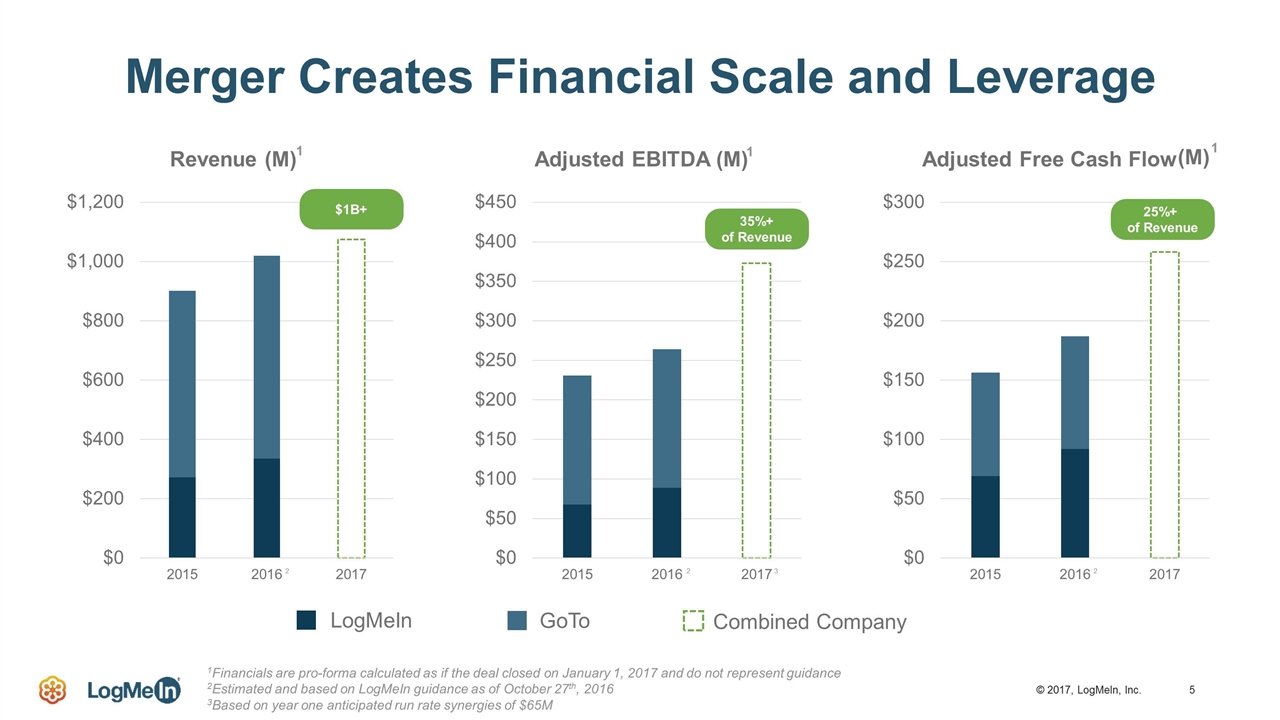

Merger Creates Financial Scale and Leverage LogMeIn GoTo Combined Company 1Financials are pro-forma calculated as if the deal closed on January 1, 2017 and do not represent guidance 2Estimated and based on LogMeIn guidance as of October 27th, 2016 3Based on year one anticipated run rate synergies of $65M 2 2 3 2 1 1 1 $1B+ 35%+ of Revenue 25%+ of Revenue (M)

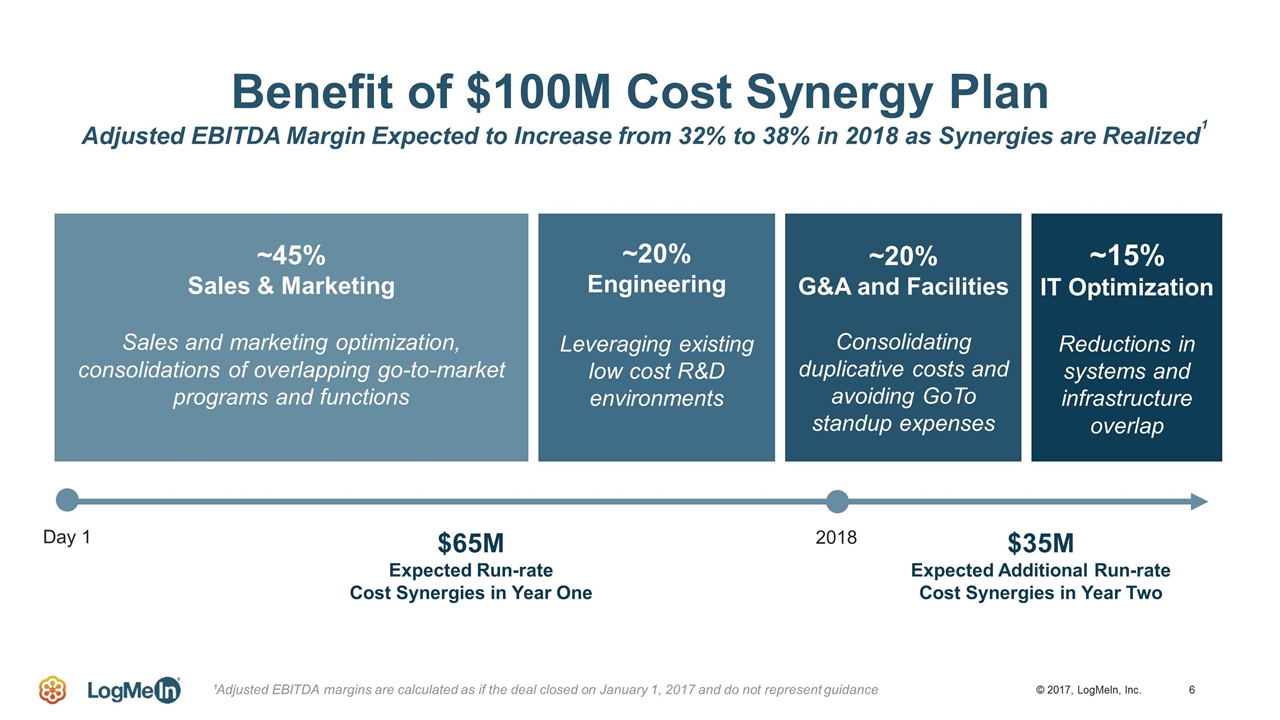

Benefit of $100M Cost Synergy Plan Adjusted EBITDA Margin Expected to Increase from 32% to 38% in 2018 as Synergies are Realized $65M Expected Run-rate Cost Synergies in Year One $35M Expected Additional Run-rate Cost Synergies in Year Two ~45% Sales & Marketing Sales and marketing optimization, consolidations of overlapping go-to-market programs and functions ~20% Engineering Leveraging existing low cost R&D environments ~15% Reductions in systems and infrastructure overlap ~20% G&A and Facilities Consolidating duplicative costs and avoiding GoTo standup expenses Day 1 2018 ¹Adjusted EBITDA margins are calculated as if the deal closed on January 1, 2017 and do not represent guidance 1 IT Optimization

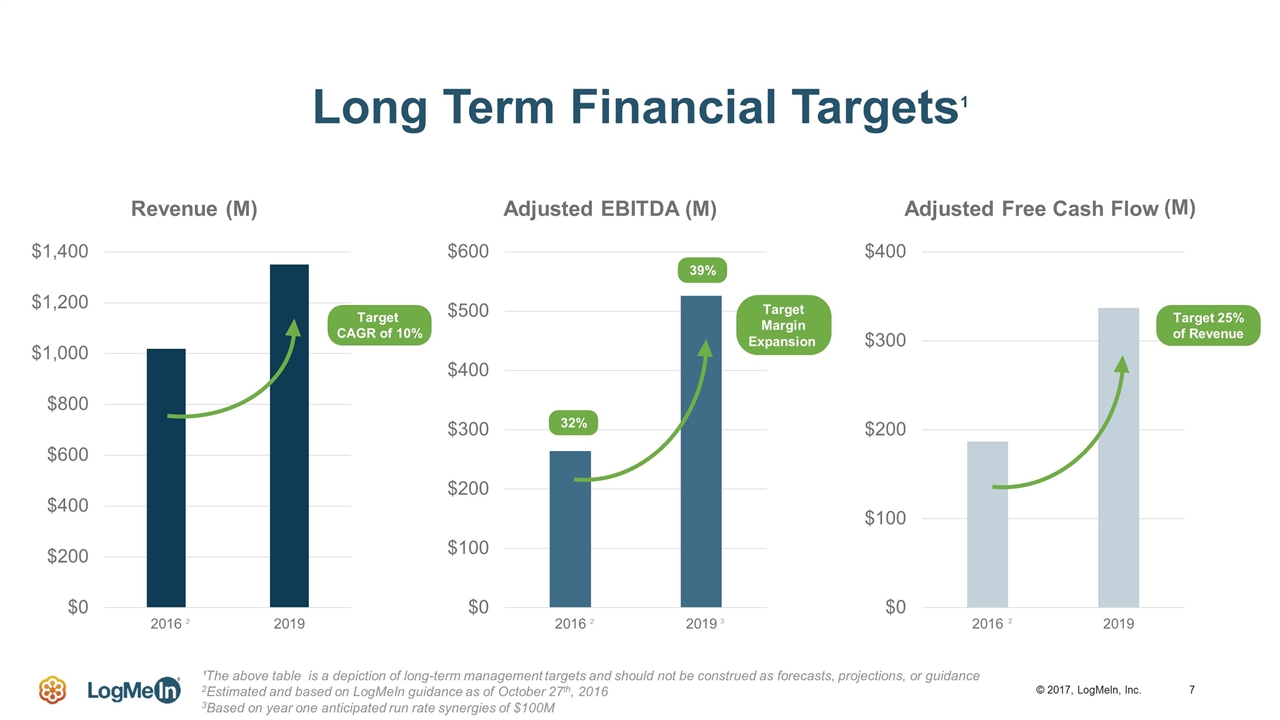

Long Term Financial Targets1 Target CAGR of 10% 39% Target 25% of Revenue Target Margin Expansion 32% ¹The above table is a depiction of long-term management targets and should not be construed as forecasts, projections, or guidance 2Estimated and based on LogMeIn guidance as of October 27th, 2016 3Based on year one anticipated run rate synergies of $100M 2 2 2 3 (M)

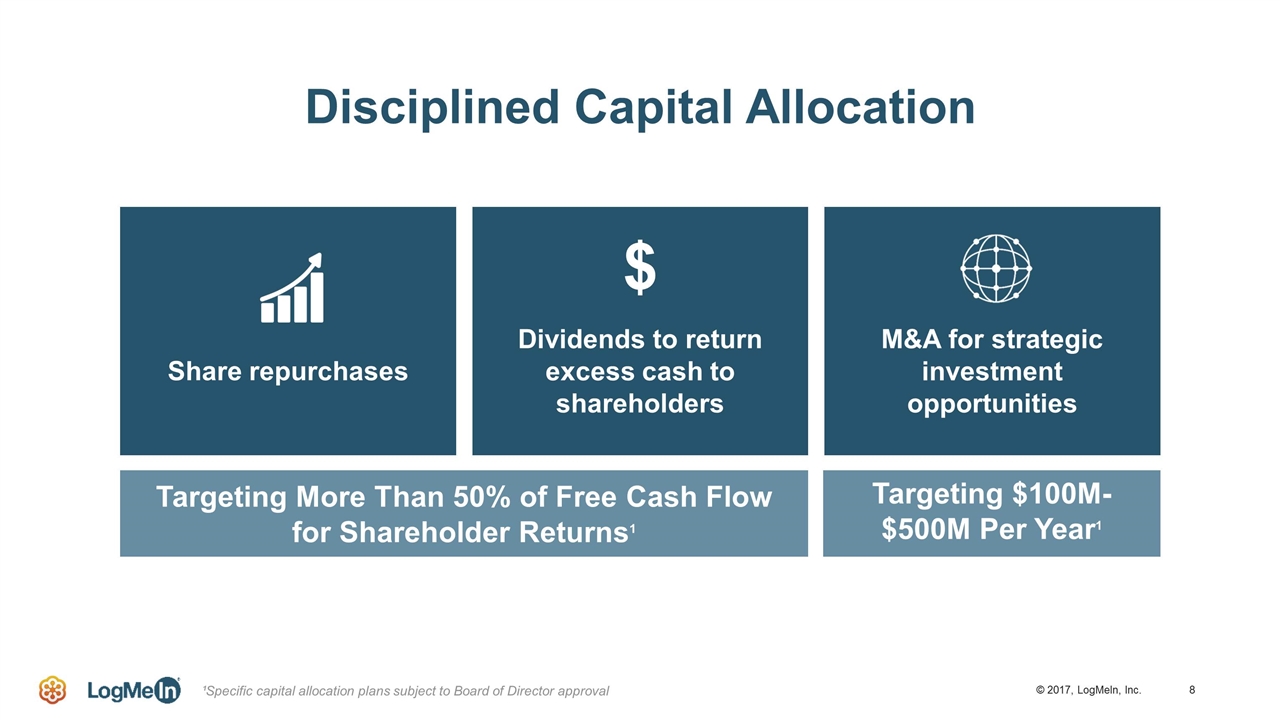

Disciplined Capital Allocation Share repurchases Dividends to return excess cash to shareholders M&A for strategic investment opportunities Targeting More Than 50% of Free Cash Flow for Shareholder Returns1 $ ¹Specific capital allocation plans subject to Board of Director approval Targeting $100M-$500M Per Year1

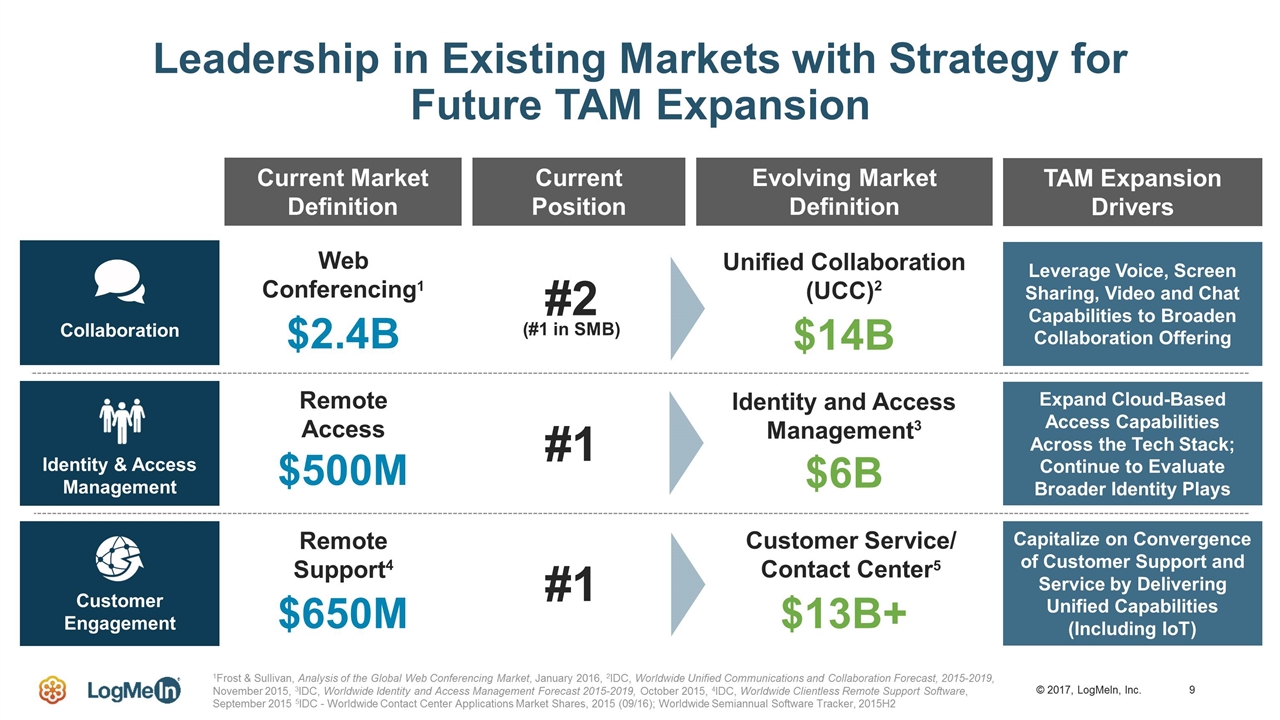

Leadership in Existing Markets with Strategy for Future TAM Expansion Collaboration Customer Engagement Identity & Access Management Current Market Definition Current Position Web Conferencing1 $2.4B #2 (#1 in SMB) Remote Access $500M #1 Remote Support4 $650M #1 Evolving Market Definition TAM Expansion Drivers Unified Collaboration (UCC)2 $14B Identity and Access Management3 $6B $13B+ Leverage Voice, Screen Sharing, Video and Chat Capabilities to Broaden Collaboration Offering Expand Cloud-Based Access Capabilities Across the Tech Stack; Continue to Evaluate Broader Identity Plays Capitalize on Convergence of Customer Support and Service by Delivering Unified Capabilities (Including IoT) Customer Service/ Contact Center5 1Frost & Sullivan, Analysis of the Global Web Conferencing Market, January 2016, 2IDC, Worldwide Unified Communications and Collaboration Forecast, 2015-2019, November 2015, 3IDC, Worldwide Identity and Access Management Forecast 2015-2019, October 2015, 4IDC, Worldwide Clientless Remote Support Software, September 2015 5IDC - Worldwide Contact Center Applications Market Shares, 2015 (09/16); Worldwide Semiannual Software Tracker, 2015H2

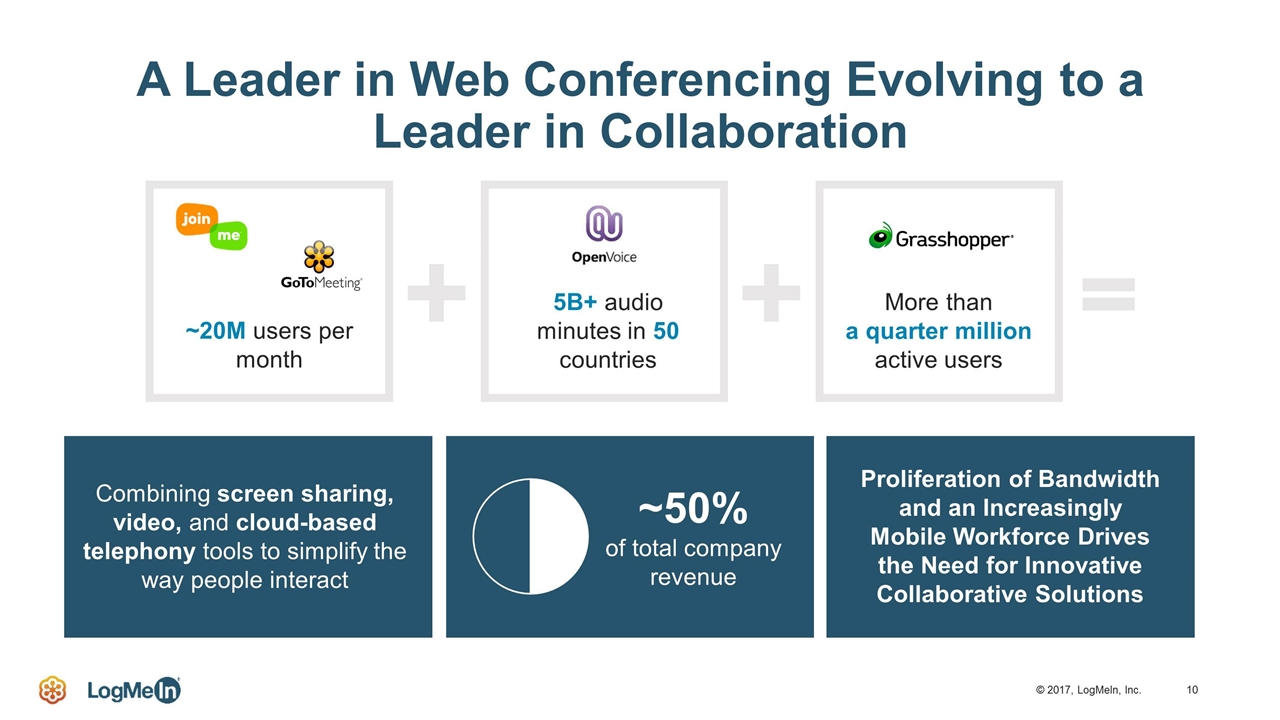

A Leader in Web Conferencing Evolving to a Leader in Collaboration 5B+ audio minutes in 50 countries ~20M users per month More than a quarter million active users Combining screen sharing, video, and cloud-based telephony tools to simplify the way people interact ~50% of total company revenue Proliferation of Bandwidth and an Increasingly Mobile Workforce Drives the Need for Innovative Collaborative Solutions

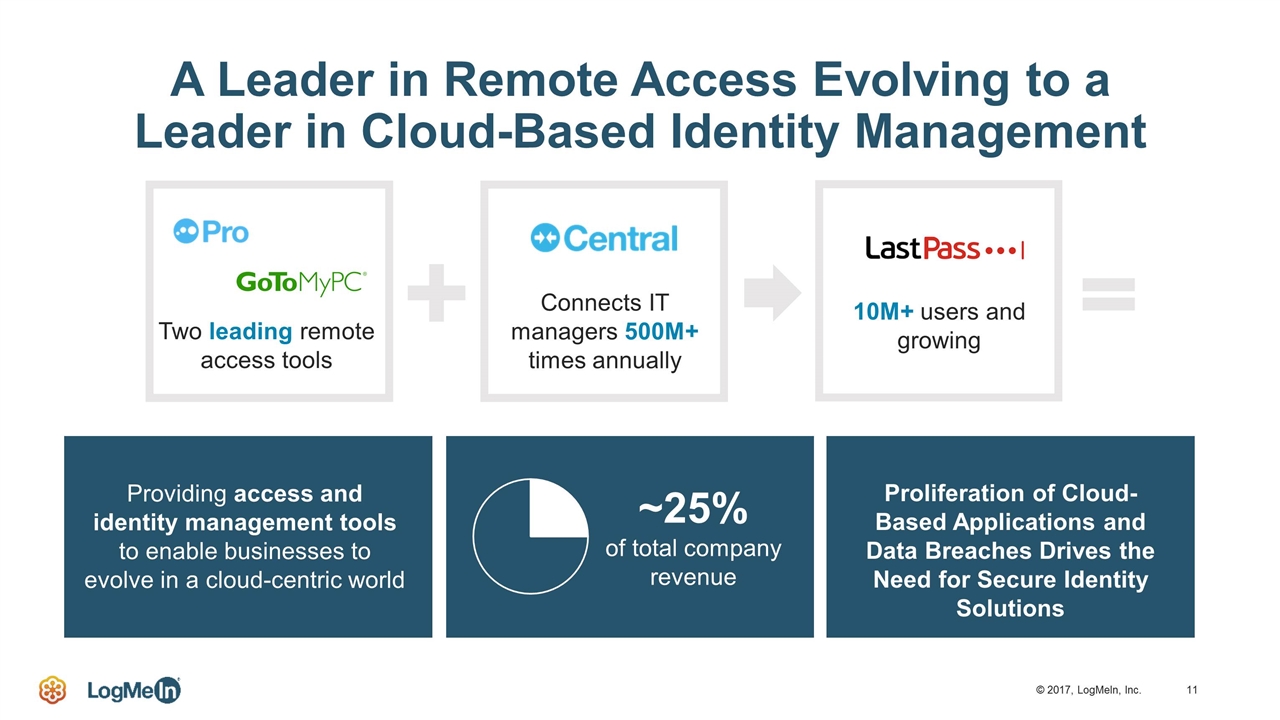

A Leader in Remote Access Evolving to a Leader in Cloud-Based Identity Management 10M+ users and growing Connects IT managers 500M+ times annually Providing access and identity management tools to enable businesses to evolve in a cloud-centric world ~25% of total company revenue Two leading remote access tools Proliferation of Cloud-Based Applications and Data Breaches Drives the Need for Secure Identity Solutions

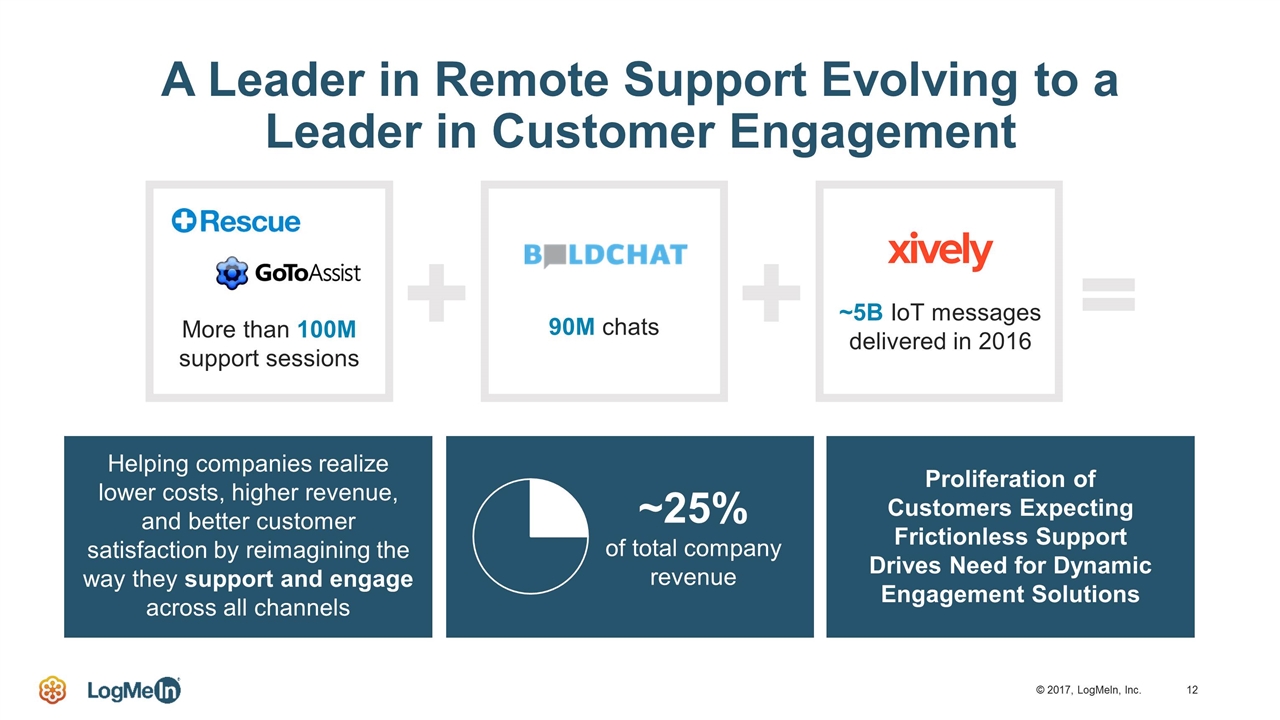

A Leader in Remote Support Evolving to a Leader in Customer Engagement 90M chats ~5B IoT messages delivered in 2016 Helping companies realize lower costs, higher revenue, and better customer satisfaction by reimagining the way they support and engage across all channels ~25% of total company revenue More than 100M support sessions Proliferation of Customers Expecting Frictionless Support Drives Need for Dynamic Engagement Solutions

Critical 2017 Priorities Seamlessly Integrate Employees, Customers, and Facilities Maintain Innovative and Dynamic Company Culture Deliver Cost Synergies Investing in Long-Term Growth Opportunities

Investor Takeaways Large, Growing Subscription Revenue Company With 35%+ EBITDA Margin And 25%+ Free Cash Flow Yield Financial Profile Opportunities For Meaningful TAM Expansion And Leadership Within New Markets Increased Scale Disciplined Return Of Excess Capital To Shareholders Capital Returns

Appendix

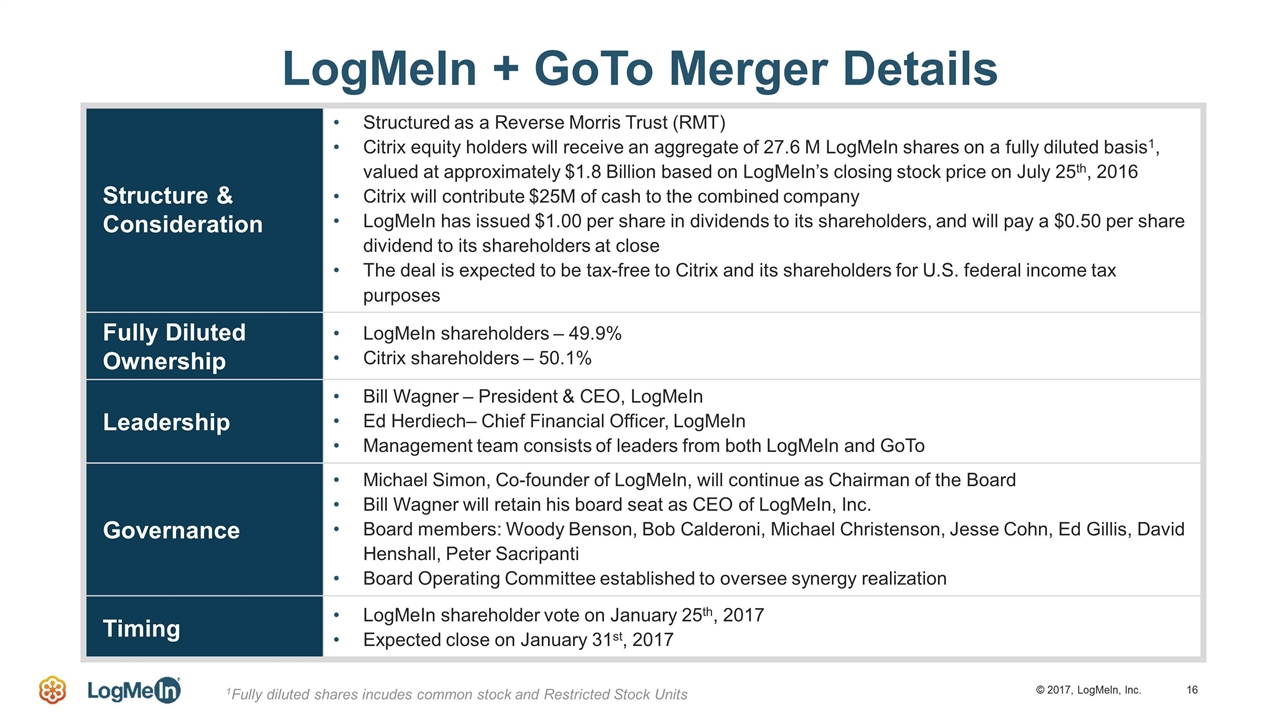

LogMeIn + GoTo Merger Details Structure & Consideration Structured as a Reverse Morris Trust (RMT) Citrix equity holders will receive an aggregate of 27.6 M LogMeIn shares on a fully diluted basis1, valued at approximately $1.8 Billion based on LogMeIn’s closing stock price on July 25th, 2016 Citrix will contribute $25M of cash to the combined company LogMeIn has issued $1.00 per share in dividends to its shareholders, and will pay a $0.50 per share dividend to its shareholders at close The deal is expected to be tax-free to Citrix and its shareholders for U.S. federal income tax purposes Fully Diluted Ownership LogMeIn shareholders – 49.9% Citrix shareholders – 50.1% Leadership Bill Wagner – President & CEO, LogMeIn Ed Herdiech– Chief Financial Officer, LogMeIn Management team consists of leaders from both LogMeIn and GoTo Governance Michael Simon, Co-founder of LogMeIn, will continue as Chairman of the Board Bill Wagner will retain his board seat as CEO of LogMeIn, Inc. Board members: Woody Benson, Bob Calderoni, Michael Christenson, Jesse Cohn, Ed Gillis, David Henshall, Peter Sacripanti Board Operating Committee established to oversee synergy realization Timing LogMeIn shareholder vote on January 25th, 2017 Expected close on January 31st, 2017 1Fully diluted shares incudes common stock and Restricted Stock Units

Path of a Market Leader 1997 2003 2004 2004 2006 2009 2010 Expertcity Founded LogMeIn Founded Citrix Acquired Expertcity GoToMeeting Launched Join.me Launched LogMeIn IPO July 2016 Merger Announced LogMeIn Highlights Total stock return of 426% since IPO1 24% revenue CAGR since 2009 Predictable business model and consistent track record of exceeding top and bottom line guidance2 SaaS pioneer in “freemium” software GoTo Highlights Profitably scaled to $680M in revenue Leader and most recognized brand in online meetings Broad portfolio addressing collaboration and communication LogMeIn Profitable and Cash Flow Positive3 2015 Cloud-Based Telephony Startup, Grasshopper Acquired 2015 Leading Password Manager, LastPass Acquired 1Through 12/31/2016, 2LogMeIn’s has met or exceeded guidance 29 of 29 quarters 3Profitability and cash flow as measured on a non-GAAP basis January 31, 2017 Expected Merger Close

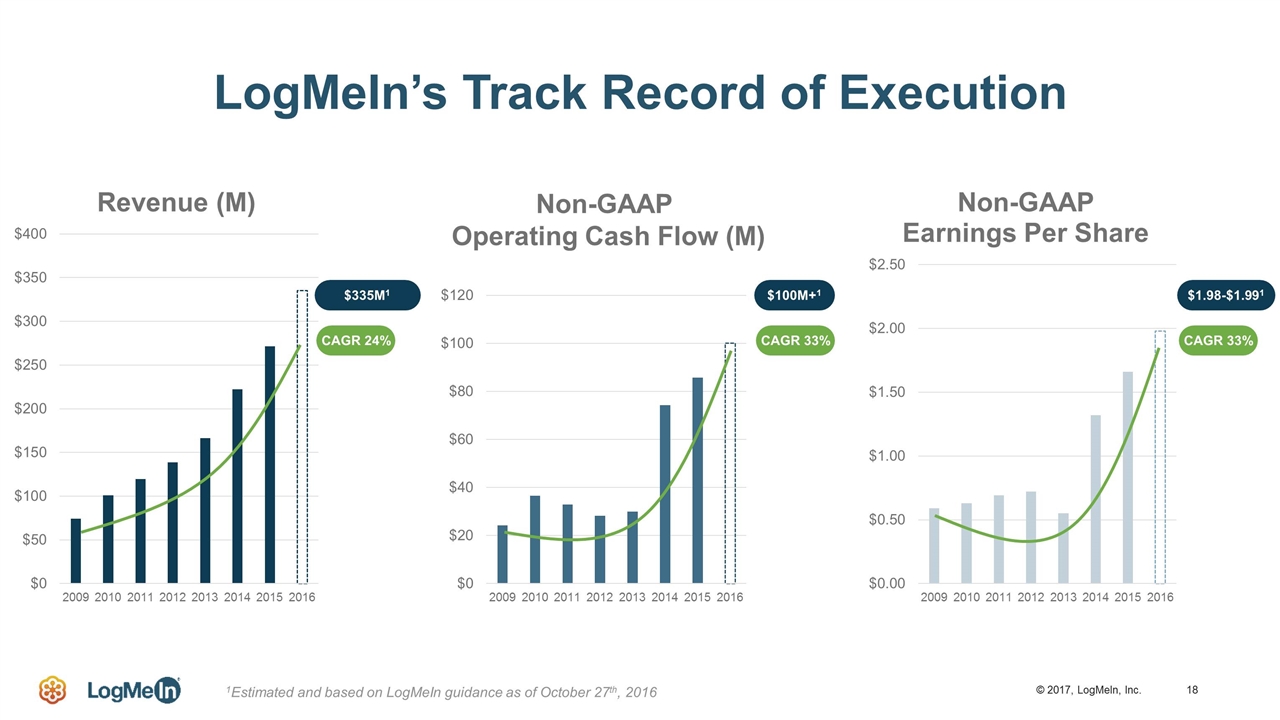

CAGR 24% LogMeIn’s Track Record of Execution $335M1 CAGR 33% $100M+1 CAGR 33% $1.98-$1.991 1Estimated and based on LogMeIn guidance as of October 27th, 2016 Non-GAAP Operating Cash Flow (M)

Definitions Adjusted EBITDA Margin refers to earnings before interest, taxes, depreciation and amortization (including amortization of acquired intangible assets), adjusted for acquisition-related costs, stock-based compensation expense, litigation-related expenses, and non-recurring expenses or benefits, as applicable. Non-GAAP Operating Cash Flow excludes payments and receipts-related to litigation-related costs and acquisition-related costs (excluding acquisition-related retention-based bonus payments). Adjusted Free Cash Flow refers to cash flow from operations less capital expenditures and capitalized software costs. Adjusted Unlevered Free Cash Flow After Tax refers to Adjusted Free Cash Flow less stock-based compensation expense and excluding the impact of interest income and expense and including certain tax adjustments. Non-GAAP Earnings Per Share excludes acquisition-related costs and amortization, stock-based compensation expense, litigation-related expense, and their-related tax impacts.