Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Catalent, Inc. | a8-krefdmaterialsdraft6jan.htm |

35th Annual J.P. Morgan

Healthcare Conference

John Chiminski

Chairman & CEO

January 9, 2017

1

Forward Looking Statements

This presentation contains both historical and forward-looking statements. All statements other than statements of historical fact are, or

may be deemed to be, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally can be identified by the use

of statements that include phrases such as “believe,” “expect,” “anticipate”, “intend”, “estimate”, “plan”, “project”, “foresee”, “likely”,

“may”, “will”, “would” or other words or phrases with similar meanings. Similarly, statements that describe our objectives, plans or goals

are, or may be, forward-looking statements. These statements are based on current expectations of future events. If underlying

assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our expectations and

projections. Some of the factors that could cause actual results to differ include, but are not limited to, the following: general industry

conditions and competition; product or other liability risk inherent in the design, development, manufacture and marketing of our offerings;

inability to enhance our existing or introduce new technology or services in a timely manner; economic conditions, such as interest rate and

currency exchange rate fluctuations; technological advances and patents attained by competitors; and our substantial debt and debt service

requirements that restrict our operating and financial flexibility and impose significant interest and financial costs; or difficulty in integrating

acquisitions into our existing business, thereby reducing or eliminating the anticipated benefits of the acquisition. For a more detailed

discussion of these and other factors, see the information under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended June 30, 2016 filed with the Securities and Exchange Commission. All forward-looking statements in this presentation speak

only as of the date of this presentation or as of the date they are made, and we do not undertake to update any forward-looking statement

as a result of new information or future events or developments unless and to the extent required by law.

Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Non-GAAP Financial Measures

Management measures operating performance based on consolidated earnings from continuing operations before interest expense,

expense/ (benefit) for income taxes and depreciation and amortization and is adjusted for the income or loss attributable to non-

controlling interest (“EBITDA from continuing operations”). EBITDA from continuing operations is not defined under U.S. GAAP and is not a

measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP and is subject to important

limitations. Management believes these non-GAAP financial measures provide useful supplemental information for its investors’ evaluation

of the Company’s business performance and are useful for period-over-period comparisons of the performance of the Company’s business.

2

Non-GAAP Financial Measures (cont.)

We believe that the presentation of EBITDA from continuing operations enhances an investor’s understanding of our financial performance. We believe this

measure is a useful financial metric to assess our operating performance from period to period by excluding certain items that we believe are not representative of

our core business and we use this measure for business planning purposes. In addition, given the significant investments that we have made in the past in

property, plant and equipment, depreciation and amortization expenses represent a meaningful portion of our cost structure. We believe that EBITDA from

continuing operations will provide investors with a useful tool for assessing the comparability between periods of our ability to generate cash from operations

sufficient to pay taxes, service debt and undertake capital expenditures because it eliminates depreciation and amortization. We present EBITDA from continuing

operations in order to provide supplemental information that we consider relevant for the readers of our financial statements, and such information is not meant to

replace or supersede U.S. GAAP measures. Our definition of EBITDA from continuing operations may differ from similarly titled measures used by other companies.

As changes in exchange rates are an important factor in understanding period-to-period comparisons, we believe the presentation of results on a constant currency

basis in addition to reported results helps improve investors’ ability to understand our operating results and evaluate our performance in comparison to prior

periods. Constant currency information compares results between periods, as if exchange rates had remained constant period-over-period. We use results on a

constant currency basis as one measure to evaluate our performance. We calculate constant currency by calculating current-year results using prior-year foreign

currency exchange rates. We generally refer to such amounts calculated on a constant currency basis as excluding the impact of foreign exchange translation.

These results should be considered in addition to, not as a substitute for, results reported in accordance with GAAP. Results on a constant currency basis, as we

present them, may not be comparable to similarly titled measures used by other companies.

In addition, the Company evaluates the performance of its segments based on segment earnings before non-controlling interest, other (income) expense,

impairments, restructuring costs, interest expense, income tax (benefit)/expense, and depreciation and amortization (“Segment EBITDA”).

Under our credit agreement, our ability to engage in certain activities such as incurring certain additional indebtedness, making certain investments and paying

certain dividends is tied to ratios based on Adjusted EBITDA (which is defined as “Consolidated EBITDA” in the credit agreement). Adjusted EBITDA is based on the

definitions in the our credit agreement, is not defined under U.S. GAAP, and is subject to important limitations. We have included the calculations of Adjusted

EBITDA for the periods presented. Adjusted EBITDA is the covenant compliance measure used in certain covenants under our credit agreement, particularly those

governing debt incurrence and restricted payments. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be

comparable to other similarly titled measures of other companies.

The Company does not provide a reconciliation of forward-looking non-GAAP financial measures to their comparable GAAP financial measures because it could not

do so without unreasonable effort due to the unavailability of the information needed to calculate reconciling items and due to the variability, complexity and

limited visibility of the adjusting items that would be excluded from the non-GAAP financial measures in future periods. When planning, forecasting and analyzing

future periods, the Company does so primarily on a non-GAAP basis without preparing a GAAP analysis as that would require estimates for various cash and non-

cash reconciling items that would be difficult to predict with reasonable accuracy. For example, equity compensation expense would be difficult to estimate because

it depends on the company’s future hiring and retention needs, as well as the future fair market value of the company’s common stock, all of which are difficult to

predict and subject to constant change. It is equally difficult to anticipate the need for or magnitude of a presently unforeseen one-time restructuring expense or

the values of end-of-period foreign currency exchange rates. As a result, the Company does not believe that a GAAP reconciliation would provide meaningful

supplemental information about the Company’s outlook.

Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Jan 2017 (C) Catalent Inc. 2017 All rights reserved 3

Every year we reliably supply:

? 70 billion+ doses of 7,000 products

? 1 in every 20 doses taken globally –

Rx and consumer

? 1,000+ customers in 80+ countries

? 165+ new product launches

Working to be the world’s most trusted, reliable and innovative drug

dev’t and delivery partner, operating with a Patient First mindset!

Catalent is the leading global provider of advanced dosage

delivery technologies and drug development solutions

4

Catalent’s Business Segments

Softgel

Technologies

Drug Delivery

Solutions

Clinical Supply

Services

Sales1 $308M

EBITDA2 $53M

EBITDA

Margin 17%

Sales1 $806M

EBITDA2 $215M

EBITDA

Margin 27%

Sales1 $775M

EBITDA2 $164M

EBITDA

Margin 21%

Soft capsules for the pharmaceutical and

consumer health markets

Complex dosage forms and development

solutions for drugs and biologics

Product supply solutions for global

clinical trials of drugs and biologics

Note: All amounts reflect results for Catalent’s fiscal year ended of June 30, 2016 . Dollar amounts are in millions of U.S. dollars. Segment results exclude corporate and unallocated costs.

OptiShell™Vegicaps®Liqui-Gels®

(1) Segment revenues include $40.8M of inter-segment revenue

(2) See Appendix for reconciliation of non-GAAP financial measures to the most directly comparable GAAP measure

#1 Rx

#1 overall

#1 complex oral dose

#1 inhalation

#1 complex BFS

#2 clinical trial supply

Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Jan 2017 5

Market Trends Accelerating Future CDMO Demand

(C) Catalent Inc. 2017 All rights reserved

End-market demand is

strengthening

+2%

2011-’16

CAGR

+6%

2016-’21

forecast

CAGR

All sectors forecast to grow

faster vs last five years

Key growth drivers:

? Biologics +9%, up 1%

? Consumer +4%, up 6%

? VC/small cap +13%, up 11%

R&D pipelines up 50%

over last five years

More than half of R&D spend

now preclin, first in a decade

Key growth drivers:

? Biologics 40%/+11% CAGR

? Small mol. 60%/+7% CAGR

? VC/small cap ~75%

8,441

programs

in 2011

12,489

programs

in 2016

Finished Dose Form

outsourcing growing

~30% volume outsourced

today, ~40% by 2020

? High formulation complexity

? Greater VC/small cap share

? Large co’s – cost pressures,

surges in demand

+7%

o/s FDF

2011-’16

CAGR

+10%

o/s FDF

2016-’20

CAGR

Sources: EvaluatePharma, Pharmaprojects, Frost & Sullivan

Stronger, more diverse

growth – sectors, regions

Growth in all molecule

types for all company types

R&D, manufacturing share

outsourced expanding

Branded

Drugs

40%

Generics

12%

Biologics

13%

OTC

13%

VMS /

Other

22%

Jan 2017 6

Diverse Revenue Base

(C) Catalent Inc. 2017 All rights reserved

US

45%

Europe

39%

RoW

16%

Geography Product Type Products

Top 20

25%

All

Other

75%

Top product

<3% of

sales

Consistent

with the

industry

50%+ not

exposed to

patent cliffs

Top 20

25%

All

Other

75%

7

Extensive Customer Relationships

Spanning Full Breadth of Industry

(C) Catalent Inc. 2017 All rights reserved

87

of top 100

drug marketers

22

of top 25

generics companies

24

of top 25

biologics companies

21

of top 25 consumer

health companies

Top

customer

<10% of

total sales

1,000+ customers in 80+ countries

Jan 2017

Jan 2017 8

Our Follow the Molecule Strategy Drives

Long-Duration, Predictable Revenues

Catalent’s technologies and Follow the

Molecule™ approach yield long-duration

revenues with strong customer retention

● Included in customers’ regulatory filings

● 1,100+ patents/applications, 125+

families

● Extensive dev’t and manufacturing know-

how from > 1,000 past launches

● Contracting excellence: 65%+ of long-cycle

revenues covered by long-term contracts

● Follow the molecule approach provides

multiple entry points with multiple

parties throughout a molecule’s life

(C) Catalent Inc. 2017 All rights reserved

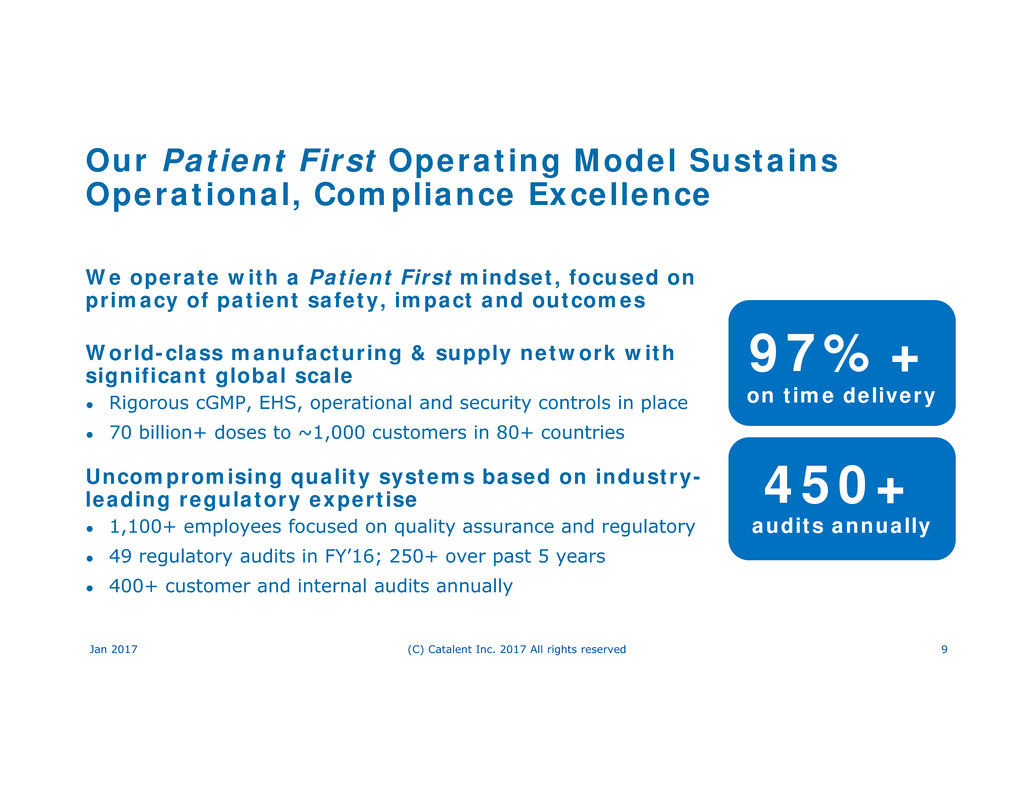

Our Patient First Operating Model Sustains

Operational, Compliance Excellence

We operate with a Patient First mindset, focused on

primacy of patient safety, impact and outcomes

World-class manufacturing & supply network with

significant global scale

● Rigorous cGMP, EHS, operational and security controls in place

● 70 billion+ doses to ~1,000 customers in 80+ countries

Uncompromising quality systems based on industry-

leading regulatory expertise

● 1,100+ employees focused on quality assurance and regulatory

● 49 regulatory audits in FY’16; 250+ over past 5 years

● 400+ customer and internal audits annually

Jan 2017 (C) Catalent Inc. 2017 All rights reserved 9

97%+

on time delivery

450+

audits annually

Jan 2017 10

Our Fast-Growing Biologics Business

Serves Critical Industry Needs

(C) Catalent Inc. 2017 All rights reserved

Proven GPEx® cell-line technology

• Extensive early-stage access – 600+ to date

• Two GPEx-based NBEs in Phase III

• 7 GPEx biosimilars launched, many more in dev’t

Strong demand for biomanufacturing

• Single-use bioreactor based Madison, WI facility

• Revenues tripled; new $34M investment ? 3rd Train

• Diversified base – antibodies, recombinant, mRNA

Expanding biologics analytical services ($500M mkt)

Next-generation SMARTag® antibody-drug

conjugation ramping and meeting milestones

• 12+ agreements to date

• Out-licensed CD22 SMARTag-based compound

Jan 2017 11

Investing for Growth

(C) Catalent Inc. 2017 All rights reserved

• Biomanufacturing in

Madison, WI

• Controlled Release in

Winchester, KY

• Inhalation (MDI) build-out

in RTP, NC

• 1st approvals of new tech:

ADVASEPT®, OptiShell™

• Creation of OptiForm®

Solutions Suite

• Introduction of Fastchain™

clinical supply solutions

Increased Capacity Innovative Technologies

• Micron Technologies

• Redwood Biosciences

SMARTag®

• Pharmatek Laboratories

• Accucaps (expected to close

2H FY’17)

M&A

Creating value for customers, patients, and shareholders

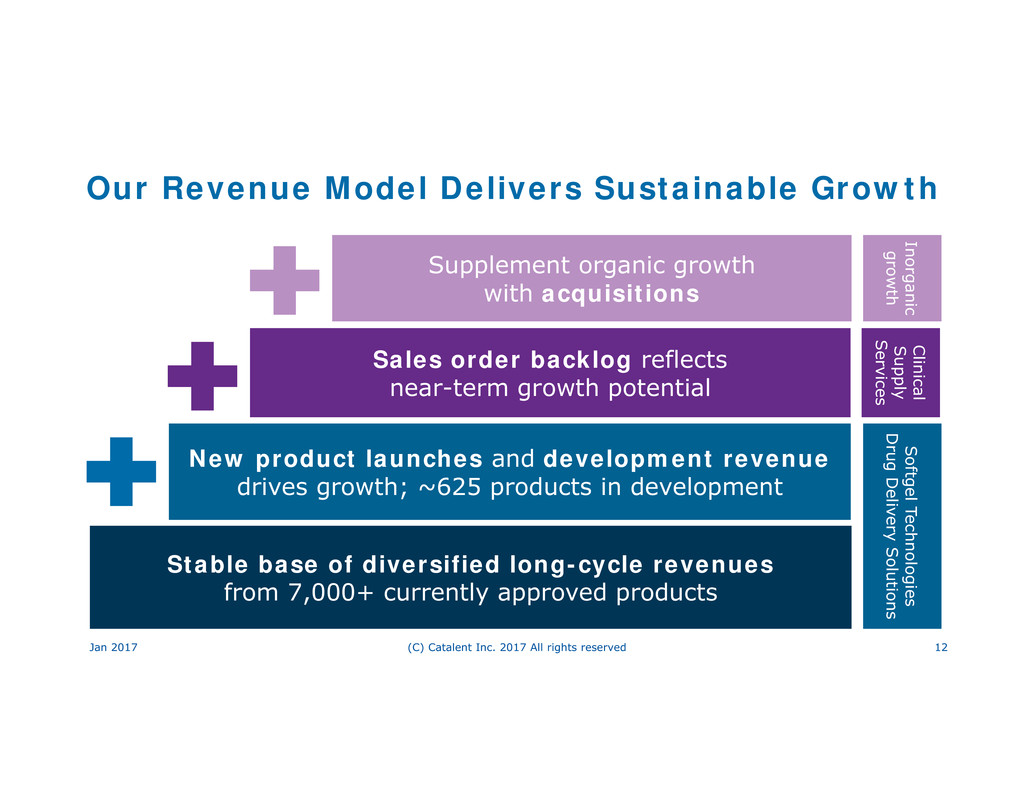

Our Revenue Model Delivers Sustainable Growth

Jan 2017 (C) Catalent Inc. 2017 All rights reserved 12

Supplement organic growth

with acquisitions

Inorganic

grow

th

C

linical

S

upply

S

ervices

S

oftgel Technologies

Drug

Deli

very

Solution

s

Sales order backlog reflects

near-term growth potential

New product launches and development revenue

drives growth; ~625 products in development

Stable base of diversified long-cycle revenues

from 7,000+ currently approved products

13

Strong Historical Financial Performance

Net Revenue ($M) Adjusted EBITDA ($M)

See Appendix for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measure

$1,399

$1,848

$1,920

-

$1,995

FY’09 FY’16 FY’17

Guidance

$274

$401

$430 -

$455

FY’09 FY’16 FY’17

Guidance

Revenue and Adj. EBITDA CAGRs negatively impacted by FX translation and

temporary suspension of Beinheim facility in FY’16

4% - 8%

Growth

7% - 13%

Growth

7% @

const. FX

8% @

const. FX

Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Jan 2017 14

Recent Developments

(C) Catalent Inc. 2017 All rights reserved

Operational highlights

‒ Announced that Triphase Accelerator obtained worldwide rights to an oncology treatment

developed using Catalent's proprietary SMARTag® technology

‒ Reached an agreement with Moderna Therapeutics to support near-term GMP efforts for

Phase 1/2 clinical studies for its personalized cancer vaccines

‒ OPKO Health's RAYALDEE® has launched using our proprietary OptiShell™ technology

Inorganic activity

‒ Acquired Pharmatek Laboratories, a specialist in drug development and clinical

manufacturing; adds extensive formulation and development capabilities

‒ Agreed to acquire Accucaps, a developer and manufacturer of Over-the-Counter (OTC) and

pharmaceutical softgels

Capital structure enhancements

‒ Issued €380M, 8-year, 4.75% notes; proceeds used to fund acquisitions and pay down debt

‒ Re-priced Term Loan: 50 bps reduction in USD tranche, 75 bps reduction in EUR tranche

Jan 2017 15

Capitalization and Allocation

(C) Catalent Inc. 2017 All rights reserved

Capital allocation priorities:

• Capex to drive organic growth

• M&A to supplement organic growth

• Share repurchase

• Debt reduction

Improving free cash flow

generation expected in FY’17:

~60%-70% of Adj. Net Income

Deleveraging of ~.75x per year through EBITDA growth

Organic Revenue Growth • 4 – 6% CAGR

Organic Adj. EBITDA Growth • 6 – 8% CAGR

Leverage

• Long-term target of 3.5x

• Ability to increase for acquisitions

16

Strategic plans targeting long-term growth

(1) These goals are forward-looking, are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of

the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may

be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of our Form 10-K for the year ended June

30, 2016. Nothing in this presentation should be regarded as a representation by any person that these goals will be achieved, and the Company undertakes no duty to update its

goals

(2) The most directly comparable GAAP measure to adjusted EBITDA is earnings/(loss) from continuing operations. An example of the factors involved in the reconciliation is provided in

an appendix to this presentation.

Catalent’s Financial Objectives1,2

Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Appendix

17

Adjusted EBITDA Reconciliation

Actual

(US $M) 2009 2010 2011 2012 2013 2014 2015 2016

Earnings / (loss) from continuing operations (197.6) (216.8) (29.1) 18.1 (50.9) 17.9 210.2 111.2

Interest expense, net 182.1 161.0 165.5 183.2 203.2 163.1 105.0 88.5

Income tax (benefit) / provision 16.9 1.4 23.7 0.5 27.0 49.5 (97.7) 33.7

Depreciation and amortization 124.6 117.6 115.4 129.7 152.2 142.9 140.8 140.6

Non-controlling interest 0.6 (2.6) (3.9) (1.2) 0.1 1.0 1.9 0.3

EBITDA from continuing operations 126.6 60.6 271.6 330.3 331.6 374.4 360.2 374.3

Non-cash stock compensation (0.3) 2.6 4.0 3.7 2.8 4.5 9.0 10.8

Impairment charges and (gain) / loss on sale

of assets 139.5 214.8 3.6 1.8 5.2 3.2 4.7 2.7

Financing related expenses -- -- -- -- 16.9 11.0 21.8 --

US GAAP restructuring 11.3 17.7 12.5 19.5 18.4 19.7 13.4 9.0

Acquisition, integration and other special

items 4.6 11.6 14.4 33.1 15.5 9.8 13.8 18.2

Property and casualty losses -- -- 11.6 (8.8) -- -- -- --

Foreign exchange (gain) / loss (18.7) (3.8) 25.5 (4.6) 5.7 (3.5) (2.7) (10.5)

Other (non-cash) 10.8 10.5 10.6 13.2 16.6 13.2 22.9 (3.3)

Total adjustments 147.2 253.4 82.2 57.9 81.1 57.9 82.9 26.9

Adjusted EBITDA 273.8 314.0 353.8 388.2 412.7 432.3 443.1 401.2

18Jan 2017 (C) Catalent Inc. 2017 All rights reserved

Jan 2017 19

Our Offerings are Well-Aligned with

Market Growth Accelerators

(C) Catalent Inc. 2017 All rights reserved

Increasingly complex pipeline:

harder to formulate and deliver

? 75% current, ~90%+ of pre-clinical

? Broadest toolkit, proven know-how

? Extensive IP

Rapid growth in biologics drives

dev’t and manufacturing demand

? Key growth area: <5,000L BR capacity

? GPEx®, SMARTag® feed biomanufacturing

? New 3rd suite expansion

Fast-growing consumer market

offers new opportunities

? Strong base – 35% of our FY’16 rev

? Limited US/Canada participation today

? Accucaps buy: fit-for-purpose capacity

Increasing outsourcing demand

for development & CMC

? We lead CMC R&D – FY’16 rev up 19%

? Small/mid-cap pipeline, market share

? Large-cap in-house: do more with less

discover more.

CATALENT PHARMA SOLUTIONS

14 SCHOOLHOUSE ROAD

SOMERSET, NJ 08873

+ 1 866 720 3148

WWW.CATALENT.COM