Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - COLUMBIA BANKING SYSTEM, INC. | d286123dex993.htm |

| EX-99.2 - EX-99.2 - COLUMBIA BANKING SYSTEM, INC. | d286123dex992.htm |

| EX-99.1 - EX-99.1 - COLUMBIA BANKING SYSTEM, INC. | d286123dex991.htm |

| EX-2.1 - EX-2.1 - COLUMBIA BANKING SYSTEM, INC. | d286123dex21.htm |

| 8-K - 8-K - COLUMBIA BANKING SYSTEM, INC. | d286123d8k.htm |

Acquisition of

Pacific Continental Corporation

January 10, 2017

Investor Presentation

Exhibit 99.4 |

Cautionary Note: Forward-looking Statements

This presentation includes forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause

Columbia Banking System, Inc.’s (“Columbia”) or Pacific Continental Corporation’s (“PCBK”) performance or achievements to be materially different from any expected future results, performance, or achievements.

Forward-looking statements speak only as of the date they are

made and neither Columbia nor PCBK assumes any duty to update forward-looking statements. We caution readers that a number of important factors could cause actual results to differ materially from those expressed

in, or implied or projected by, such forward-looking

statements. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Columbia and PCBK, including future financial and operating results, the

combined company’s plans, objectives, expectations and

intentions and other statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: (i) the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or

satisfied on a timely basis or at all; (ii) changes in

Columbia’s stock price before closing, including as a result of the financial performance of PCBK prior to closing, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies; (iii) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of

changes in general economic and market conditions, interest and

exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Columbia and PCBK operate; (iv) the ability to promptly and effectively

integrate the businesses of Columbia and PCBK; (v) the reaction

to the transaction of the companies’ customers, employees and counterparties; (vi) diversion of management time on merger-related issues; (vii) lower than expected revenues, credit quality deterioration or a reduction in real

estate values or a reduction in net earnings; and (viii) other

risks that are described in Columbia’s and PCBK’s public filings with the Securities and Exchange Commission (the “SEC”). For more information, see the risk factors described in each of Columbia’s and PCBK’s Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and

other filings with the SEC. Annualized, pro forma, projected and

estimated numbers and percentages are used for illustrative purposes only, are not forecasts and may not reflect actual results. 2 |

Transaction Highlights

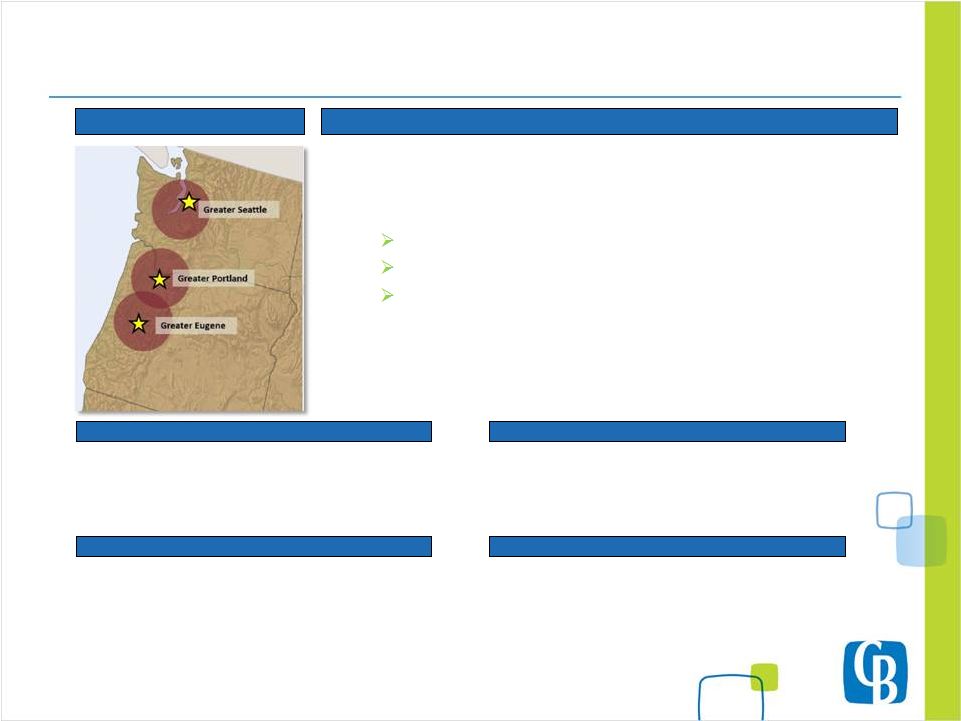

Transaction Rationale Attractive Financial Returns • Strengthens COLB’s presence in key metropolitan markets in the Northwest

Significantly increases COLB’s market share in the Eugene MSA and

provides opportunities to enhance efficiency in the Seattle and

Portland markets •

PCBK is the 2

largest community bank headquartered in Oregon with $2.5 billion in

assets •

Solidifies Columbia as the largest bank solely focused on the NW with ~$12

billion in assets •

Complementary community-focused banking models built around strong core

deposit cultures Noninterest bearing deposits of 49% and 42% for

COLB and PCBK, respectively •

Expands healthcare lending platform

• Delivers COLB’s expanded product suite and higher lending capacity to PCBK’s customer base

• ~8% earnings accretion in 2018 and ~10% earnings accretion in 2019 • > 15% IRR • Tangible Book Value Earnback of ~3.7 years • ~6% TBV Dilution at Close Risk Management • Pro forma assumptions driven by significant due diligence • COLB is well-positioned to cross the $10 billion asset threshold • Track record of 9 successfully integrated acquisitions over the last 9 years 3 nd |

(1) Based on COLB’s closing stock price as of 1/9/17. Merger consideration value and price per share will change, and partial cash

consideration may be included, based on the fluctuation in

COLB’s stock price. Please see Appendix. (2)

Includes aggregate stock consideration of $629.5 million paid to PCBK

shareholders and aggregate cash consideration of $14.6 million to cash out all outstanding stock options, stock appreciation rights (“SARs”) and restricted stock units (“RSUs”) at close.

Transaction Overview

Aggregate transaction value of ~$644.1 million

Transaction Value

(1)(2) Price per Share (1) Consideration Pro Forma Ownership Board Due Diligence Termination Fee Required Approvals Targeted Closing $27.85 Fixed exchange ratio of 0.6430; subject to adjustments described below 100% stock consideration to PCBK shareholders 80.0% COLB / 20.0% PCBK One current community-based board member from PCBK to join COLB Board of

Directors; pro forma board will have 12 members

Completed, including an extensive loan review

$18.75 million for superior offer and other customary events

Customary regulatory and shareholder approvals

Mid-2017 Collars & Walkaway Fixed exchange ratio when COLB stock is between $27.76 and $37.56; Outside the range, price fixes if COLB outperforms (above the range)/underperforms

(below the range) the KBW Regional Bank Index by 15% or more;

COLB and PCBK have termination rights should COLB stock drop below $26.13

(with PCBK’s right to reinstate by including per share cash

consideration of $1.05) 4 |

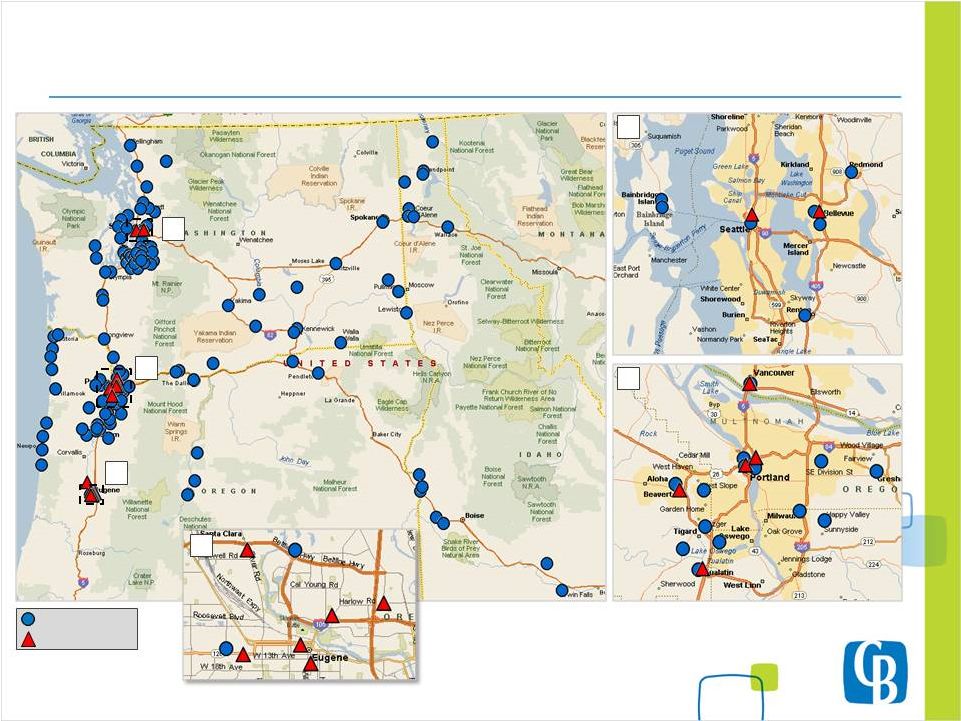

*Note: PCBK branches excludes branch in Bellevue that is expected to be

closed in January 2017. Source: SNL Financial, company websites,

and Microsoft MapPoint. COLB (143)

PCBK (14)* 3 2 1 1 2 5 3 Compelling Northwest Footprint |

Pacific Continental Corporation (NASDAQ:

PCBK) Profitability (MRQ)

(%) ROAA, Adjusted (2) 1.02 ROATCE, Adjusted (2) 10.96 Net Interest Margin 4.22 Efficiency Ratio, Adjusted (2) 54.8 Asset Quality (%) NPAs (3) / Assets 0.90 NPAs (3) / (Loans + OREO) 1.25 Reserves / Loans HFI 1.14 LTM NCOs / Avg. Loans 0.01 Balance Sheet & Capital (%) Loans / Deposits 83.5 Securities / Assets 19.2 Noninterest-bearing Deposits / Deposits 41.7 TCE / TA 8.34 Total Risk-based Capital Ratio 12.55 Financials as of 9/30/2016 Assets ($mm) 2,539 Deposits ($mm) 2,163 Gross Loans ($mm) 1,807 Tangible Common Equity ($000) 206 PCBK Market Presence 6 Overview of PCBK • Founded in 1972 with headquarters in Eugene, OR • Completed 4 acquisitions since 2005 • Specialized business segments Community-based business Healthcare and professional services Nonprofit clients • 14 branch offices (1) , 2 loan production offices • Average deposits per branch of $155 million • “PLUS” – loans for dental acquisition, practice finance, and owner occupied CRE in 42 states (1) PCBK branches excludes branch in Bellevue that is expected to be closed in January 2017.

(2) Adjusted to exclude impact from Foundation Bancorp, Inc. acquisition. (3) Excludes troubled debt restructurings. Source: SNL Financial. Data for the quarter ended 9/30/2016. |

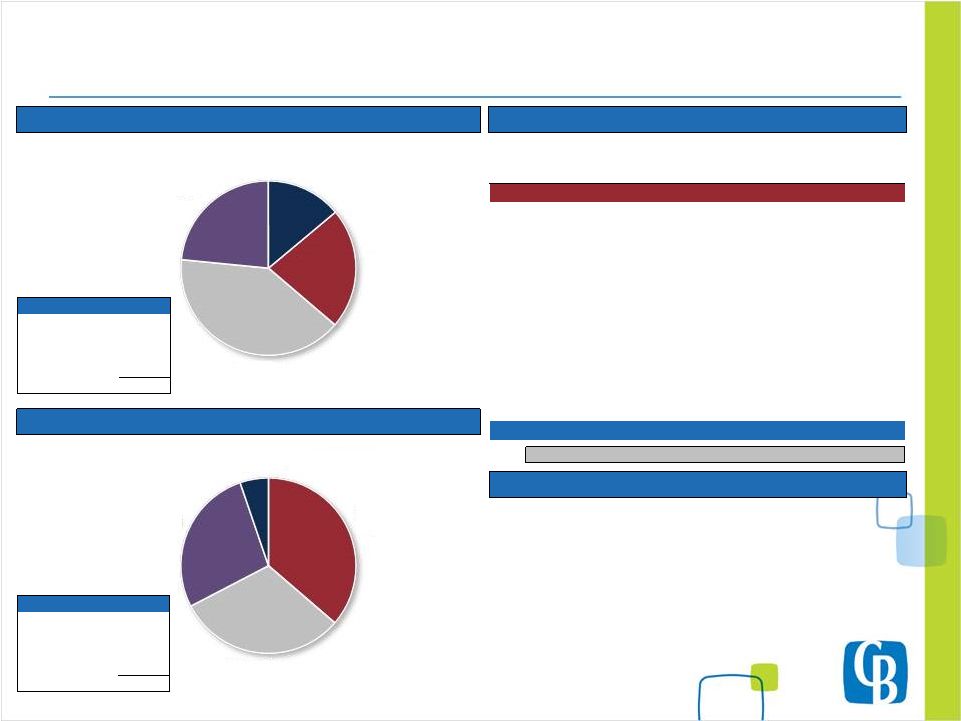

Source: SNL Financial. Deposit market share data pro forma per FDIC S.O.D. as of

6/30/2016. Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Pacific Continental Corp. (OR) 7 855 17.1 2 Umpqua Holdings Corp. (OR) 9 833 16.7 3 U.S. Bancorp (MN) 19 802 16.0 4 Wells Fargo & Co. (CA) 9 628 12.6 5 Bank of America Corp. (NC) 3 334 6.7 6 Banner Corp. (WA) 10 329 6.6 7 JPMorgan Chase & Co. (NY) 8 327 6.5 8 KeyCorp (OH) 7 238 4.8 9 Summit Bank (OR) 1 226 4.5 10 Oregon Pacific Bancorp (OR) 3 136 2.7 11 Washington Federal Inc. (WA) 3 121 2.4 12 Cascade Bancorp (OR) 2 86 1.7 13 Citizens Bancorp (OR) 2 54 1.1 14 Columbia Banking System Inc. (WA) 2 30 0.6 Totals (1-14) 85 5,000 100.0 PCBK’s Geographic Footprint 7 Loan Mix by Geography Eugene MSA Deposit Market Share • Eugene is the 2 largest MSA in Oregon by number of households • Home to the University of Oregon, the Eugene market is known for supporting entrepreneurial investment, which is locally referred to as the Silicon Shire, representing dozens of start-up technology companies • Unemployment in the Eugene market is less than 5% Stronghold in the Eugene Market Deposit Mix by Geography Loan Mix ($mm) Eugene 405 Portland 729 Puget Sound 424 Nat'l Healthcare 251 Gross Loans 1,809 Deposit Mix ($mm) Eugene 785 Portland 672 Puget Sound 593 Non-core 113 Total Deposits 2,163 Eugene 22% Portland 40% Puget Sound 24% Nat'l Healthcare 14% Eugene 36% Portland 31% Puget Sound 28% Non-core 5% nd |

Note: Period end dollars in millions.

Pacific Continental’s Dental and Healthcare Niche

8 Demonstrated Dental Expertise • 10 plus years demonstrated expertise • More than 500 practices • Since 2008, annual loan losses less than 0.20% • Represents 26.6% of loan portfolio Demonstrated Healthcare Expertise • Veterinary services • Ophthalmology • Podiatry $122 $160 $158 $166 $192 $179 $159 $146 $150 $152 $151 $20 $42 $79 $129 $147 $194 $201 $218 $219 $10 $25 $54 $62 $69 $73 $72 $80 $8 $9 $23 $29 $33 $32 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Other Healthcare National Other Healthcare Local Dental National Dental Local |

Pro Forma Financial Impact |

(1) Based on COLB’s closing stock price as of 1/9/17. Merger consideration value and price per share will change, and partial cash

consideration may be included, based on the fluctuation in

COLB’s stock price. Please see Appendix. (2)

Per 3 party loan review. (3) Core deposits equal to all non-time deposits. (4) Adjustments based on projected balances at close. 10 Cost Savings Deal Related Expenses Revenue Enhancements • Estimated Core Deposit Intangible equaling 1.75% of PCBK’s core deposits (3) • Estimated Fixed Asset markup of $2.8 million; estimated OREO markdown of $2.3 million • Estimated Subordinated debt markup of $1.1 million • Trust Preferred Redemption of $14.0 million; reversal of the $2.6 million

Foundation Trust Preferred Mark

• Estimated PCBK Durbin pre-tax annual impact of $300 thousand starting

July 2018 Estimated Fair Value and Pro Forma Adjustments (4) • Not included • Approximately $30.4 million, pre-tax • Estimated at approximately $19.4 million or 34% of PCBK’s 2017e NIE

• Expected to be phased 50% in 2017, 85% in 2018 and 100% thereafter • Estimated gross loan mark of $33.1 million or 1.70% of loans (2) Loan Mark (4) Transaction Value (1) • ~$644.1 million Transaction Assumptions and Pro Forma Adjustments rd |

(1) Per FactSet Research Systems. • Cost savings of ~34% of PCBK’s 2017e consensus street noninterest expense (1) Expense Items Approximate Value in Millions Salary & Benefits $13.1 Occupancy, Equipment & Amortization $0.8 Data processing & Communications $1.6 General & Administrative $3.2 Other $0.7 TOTAL $19.4 11 Cost Savings |

(1) Date of the U.S. Presidential Election. COLB’s stock price has increased by 30.5% and the KRX index price has increased by

24.8% since the U.S. Presidential Election.

(2) Core deposits equal to all non-time deposits. (3) Assumes 85% phase-in of cost savings. (4) Assumes 100% phase-in of cost savings. (5) Tangible Book Value Earnback Period measures the number of years required for the pro forma company’s projected TBVPS to exceed the

projected TBVPS of the standalone Columbia.

(6) Assumes conversion of COLB’s convertible preferred equity. 12 Pro Forma Financial Impact PCBK Acquisition as of Transasction Multiples (as of 9/30/2016) 11/8/2016 (1) 1/9/2017 Price / Tangible Book Value Per Share: 2.34x 3.06x Price / 2017e EPS: 16.2x 21.2x Core Deposit Premium (2) : 13.8% 21.1% One-Day Market Premium: 28.6% 33.9% Transaction Metrics 2018 Estimated EPS Accretion (3) : ~8% 2019 Estimated EPS Accretion (4) : ~10% Internal Rate of Return: > 15% Tangible Book Value Per Share Earnback (5) : ~3.7 years Consolidated Capital Ratios (Estimated as of 6/30/2017) (6) Pro Forma TCE / TA: 9.3% 8.3% 8.7% Leverage Ratio: 9.6% 8.9% 8.9% Common Equity Tier 1 Capital Ratio: 11.6% 9.6% 10.7% Tier 1 Ratio: 11.6% 10.1% 10.7% Total Risk-based Capital Ratio: 12.6% 12.7% 11.8% |

• Accelerates our growth over $10 billion in total assets into mid-2017

• COLB started preparing to cross $10 billion in January 2013. Significant infrastructure

expenses have already been built into our run rate; efforts to date

include: Implemented a robust Compliance Management Program with

area compliance experts embedded within the various functional

areas of the bank resulting in an enhanced

compliance-oriented culture

Developed and implemented in 2014 a DFAST compliant stress test

model Expanded the Executive Management team with the addition of

the General Counsel function Various shifts in the senior and

middle management organizational structure to more efficiently

manage across a larger asset base Implemented various Board level

corporate governance initiatives, including the addition of new

directors with diversified professional backgrounds and expanded geographic reach, and improved utilization of board committees Continue to develop and mature our Enterprise Risk Management program • Subjects COLB to Durbin Amendment in Q3 of 2018 resulting in an annual estimated

loss of pre-tax interchange revenue on a combined proforma basis of

approximately $9.8 million

13 Surpassing the $10 Billion Asset Threshold |

• Acquisition is in line with COLB’s strategic plan, and meets COLB’s investment

criteria • PCBK provides COLB a solid foothold in the Eugene market with #1 market share

rank and the opportunity to combine some branches in the Seattle and Portland

markets

• Culturally compatible banks with similar core deposit bases and commercial

banking orientation

• Increased size and scale favorably positions COLB for further growth strategies

• Transaction expected to enhance COLB’s long-term shareholder value

14 Attractive Investment Opportunity |

APPENDIX |

Per PCBK Common Share

Price Change Price Ex Ratio Total Value Shares Equity Awards Total Value (%) ($) (x) ($) (#) ($000) ($000) Price on 1/9/2017 43.31 0.6430 27.85 14,535,729 14,572 644,115 15.0% $37.56 0.6430 $24.15 14,535,729 $11,791 $557,753 12.5% 36.74 0.6430 23.62 14,535,729 11,394 545,437 10.0% 35.93 0.6430 23.10 14,535,729 11,002 533,271 7.5% 35.11 0.6430 22.58 14,535,729 10,606 520,955 5.0% 34.29 0.6430 22.05 14,535,729 10,209 508,639 2.5% 33.48 0.6430 21.53 14,535,729 9,817 496,474 Price on 9/6/2016 (1) 32.66 0.6430 21.00 14,535,729 9,421 484,158 (2.5%) 31.84 0.6430 20.47 14,535,729 9,024 471,842 (5.0%) 31.03 0.6430 19.95 14,535,729 8,632 459,676 (7.5%) 30.21 0.6430 19.43 14,535,729 8,236 447,360 (10.0%) 29.39 0.6430 18.90 14,535,729 7,839 435,044 (12.5%) 28.58 0.6430 18.38 14,535,729 7,447 422,878 (15.0%) 27.76 0.6430 17.85 14,535,729 7,050 410,562 Aggregate Merger Consideration 16 The chart below illustrates the impact of various hypothetical COLB stock prices on the value of the per share merger consideration

and aggregate merger consideration.

Illustrative Impact of Hypothetical Columbia Stock Price

Note I: Outside the + or - 15% collar, the purchase price fixes at $24.15 or $17.85, respectively, if COLB outperforms (above the range)/underperforms (below the range) the KBW Regional Bank Index by 15% or more. If the price fixes at $17.85, COLB can decide whether to fill with cash or increase the

exchange ratio. Note II: COLB and PCBK have termination rights

should COLB stock drop below $26.13 (with PCBK’s right to reinstate by including per share cash consideration of $1.05). (1) Date when the collar was established. |

Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 U.S. Bancorp (MN) 195 14,838 20.8 2 Wells Fargo & Co. (CA) 123 11,901 16.7 3 Bank of America Corp. (NC) 51 9,506 13.4 4 Umpqua Holdings Corp. (OR) 102 7,438 10.5 5 JPMorgan Chase & Co. (NY) 113 6,099 8.6 6 KeyCorp (OH) 73 4,108 5.8 Pro Forma 69 4,070 5.7 7 Columbia Banking System Inc. (WA) 58 2,730 3.8 8 Cascade Bancorp (OR) 30 1,889 2.7 9 Washington Federal Inc. (WA) 48 1,821 2.6 10 Banner Corp. (WA) 44 1,686 2.4 11 BNP Paribas USA Inc. (NY) 23 1,558 2.2 12 Pacific Continental Corp. (OR) 11 1,340 1.9 Totals (1-12) 871 64,915 91.2 Totals (1-46) 1,004 71,189 100.0 Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Bank of America Corp. (NC) 171 30,395 21.3 2 Wells Fargo & Co. (CA) 158 17,582 12.3 3 JPMorgan Chase & Co. (NY) 204 15,192 10.6 4 U.S. Bancorp (MN) 185 15,029 10.5 5 KeyCorp (OH) 155 9,903 6.9 6 Washington Federal Inc. (WA) 82 5,224 3.7 Pro Forma 76 5,072 3.6 7 Umpqua Holdings Corp. (OR) 96 4,896 3.4 8 Columbia Banking System Inc. (WA) 73 4,386 3.1 9 Banner Corp. (WA) 91 4,227 3.0 10 W.T.B. Financial Corp. (WA) 27 3,812 2.7 28 Pacific Continental Corp. (OR) 3 686 0.5 Totals (1-10) 1,242 110,644 77.3 Totals (1-78) 1,750 143,052 100.0 Washington Oregon (1) Includes Idaho, Oregon and Washington. (2) PCBK branches excludes branch in Bellevue that is expected to be closed in January 2017.

Source: SNL Financial. Deposit market share data pro forma per FDIC S.O.D. as of

6/30/2016. Northwest

(1) Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Bank of America Corp. (NC ) 225 40,648 17.2 2 Wells Fargo & Co. (CA ) 367 34,356 14.5 3 U.S. Bancorp (MN ) 477 33,796 14.3 4 JPMorgan Chase & Co. (NY ) 337 21,965 9.3 5 KeyCorp (OH ) 255 15,466 6.5 6 Umpqua Holdings Corp. (OR ) 214 12,751 5.4 Pro Forma 157 9,678 4.1 7 Washington Federal Inc. (WA ) 155 7,763 3.3 8 Columbia Banking System Inc. (WA ) 143 7,651 3.2 9 Banner Corp. (WA ) 148 6,272 2.7 10 W.T.B. Financial Corp. (WA ) 45 4,494 1.9 11 Mitsubishi UFJ Financial Group Inc. (- ) 26 3,254 1.4 12 Heritage Financial Corp. (WA ) 65 3,176 1.3 13 HomeStreet Inc. (WA ) 38 3,094 1.3 14 Cascade Bancorp (OR ) 51 2,662 1.1 15 Zions Bancorp. (UT ) 26 2,421 1.0 16 Pacific Continental Corp. (OR ) 14 2,026 0.9 17 BNP Paribas USA Inc. (NY ) 37 1,936 0.8 18 Glacier Bancorp Inc. (MT ) 37 1,621 0.7 19 Yakima Federal S&L Assc. (WA ) 10 1,354 0.6 20 Peoples Bancorp (WA ) 26 1,328 0.6 21 Opus Bank (CA ) 22 1,318 0.6 22 East West Bancorp Inc. (CA ) 4 1,242 0.5 23 Cashmere Valley Bank (WA ) 11 1,208 0.5 24 D.L. Evans Bancorp (ID ) 28 1,023 0.4 25 Olympic Bancorp Inc. (WA ) 21 983 0.4 26 Riverview Bancorp Inc. (WA ) 21 928 0.4 27 HSBC Holdings Plc (- ) 4 855 0.4 28 Bank of Commerce (ID ) 15 791 0.3 29 Skagit Bancorp Inc. (WA ) 11 735 0.3 30 Pacific Financial Corp. (WA ) 18 734 0.3 Totals (1-30) 2,851 217,852 92.2 Totals (1-114) 3,253 236,169 100.0 17 Combined Deposit Market Share in Northwest (2) (2) |

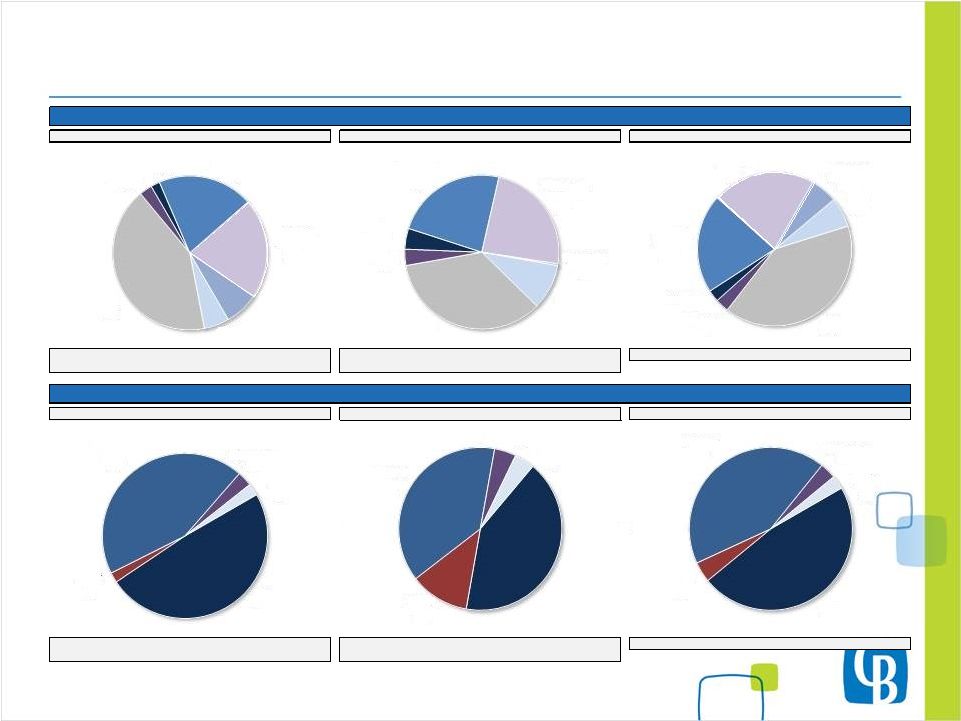

Source: SNL Financial as of 9/30/2016.

Note: All dollars in thousands.

18 Pro Forma Loan and Deposit Composition + = + = Gross Loans (Incl. HFS): $6,263,118 Gross Loans (Incl. HFS): $1,806,736 Gross Loans (Incl. HFS): $8,069,854 Loan Composition: Columbia Banking System, Inc. Pacific Continental Corporation Pro Forma Company Yield on Loans: 4.93% Yield on Loans: 5.11% Deposit Composition: Columbia Banking System, Inc. Pacific Continental Corporation Pro Forma Company Total Deposits: $8,057,816 Total Deposits: $2,162,633 Total Deposits: $10,220,449 Cost of Deposits: 0.04% Cost of Deposits: 0.22% C&D 5% C&I 42% Res. RE 3% Multifamily 2% Owner- occupied CRE 20% Nonowner- occupied CRE 21% Consumer & Other 7% C&D 10% C&I 35% Res. RE 3% Multifamily 4% Owner- occupied CRE 24% Nonowner- occupied CRE 24% Consumer & Other 0% C&D 6% C&I 40% Res. RE 3% Multifamily 2% Owner- occupied CRE 21% Nonowner- occupied CRE 22% Consumer & Other 6% DDA 49% NOW & Other 2% MMDA & Sav. 44% Retail Time 3% Jumbo Time 2% DDA 42% NOW & Other 12% MMDA & Sav. 38% Retail Time 4% Jumbo Time 4% DDA 47% NOW & Other 4% MMDA & Sav. 43% Retail Time 3% Jumbo Time 3% |

Mount Rainier Bank (July

2007) $266 million

Town Center Bank (July 2007)

$166 million

FDIC-assisted acquisitions:

• Columbia River Bank (January 2010)

$913 million

• American Marine Bank (January 2010)

$308 million

• Summit Bank (May 2011) $131 million • First Heritage Bank (May 2011) $165 million • Bank of Whitman (August 2011) $438 million West Coast Bancorp (April 2013)

$ 2.6 billion

Intermountain Community Bancorp (November

2014) $964 million

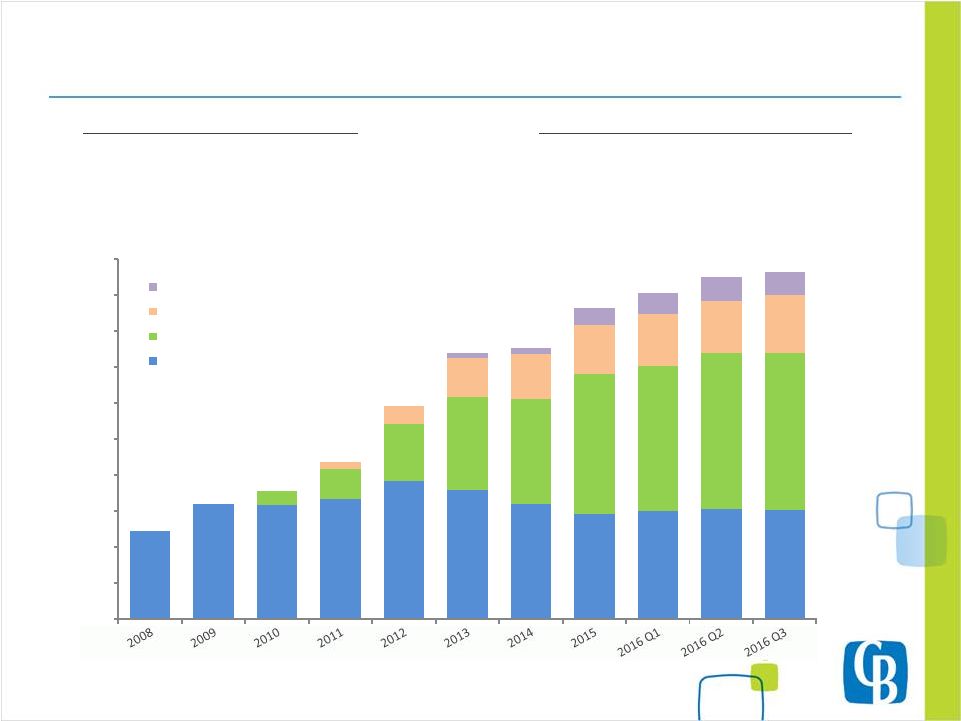

Assets Nine Acquisitions in the last 9 Years COLB’s M&A Criteria • Meets financial hurdles consistent with shareholder expectations TBV Earnback, Earnings Accretion and IRR • Expands geographic footprint • Culturally compatible • Strong core deposits 19 Seasoned Acquirer with Proven Integration Track Record |

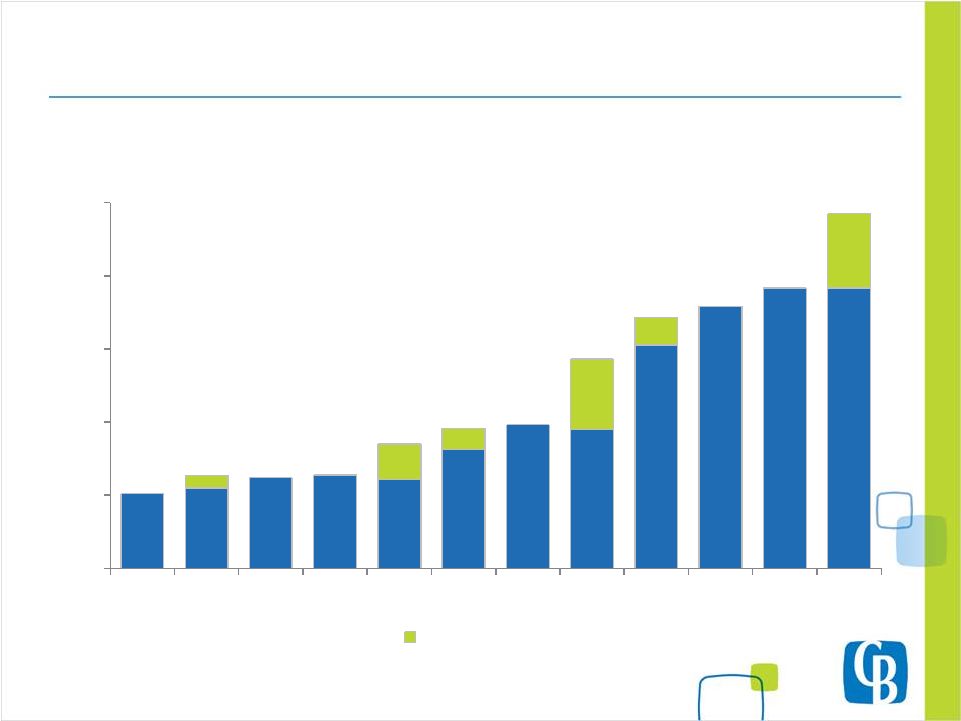

20 Columbia’s Growth of Total Assets 2006 - 2016 Intermountain Community Bancorp West Coast Bancorp Bank of Whitman* First Heritage* Summit* Columbia River* American Marine* Town Center Mount Rainier *FDIC Assisted Acquisition $2,553 $3,179 $3,097 $3,201 $4,256 $4,786 $4,906 $7,162 $8,579 $8,952 $9,587 $12,126 $0 $2,500 $5,000 $7,500 $10,000 $12,500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q3-16 Pro Forma Acquisitions $ in Millions Pacific Continental Corporation 10 Year CAGR (1) = 14% (1) CAGR calculation from 9/30/2006 to 9/30/2016. |

Shareholders are urged to carefully review and consider each of Columbia’s

and Pacific Continental’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly

Reports on Form 10-Q. In

connection with the proposed transaction, Columbia will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Columbia and PCBK and a Prospectus of Columbia, as well as other relevant documents concerning the proposed

transaction. Shareholders of Columbia and PCBK are urged to

carefully read the Registration Statement and the Joint Proxy Statement/Prospectus regarding the transaction in their entirety when they become available and any other relevant documents filed with the SEC, as well as any amendments

or supplements

to those documents, because they will contain important information. A definitive Joint Proxy Statement/Prospectus will be sent to the shareholders of each institution seeking any required shareholder approvals. The Joint Proxy Statement/Prospectus and other

relevant materials (when they become available) filed with the

SEC may be obtained free of charge at the SEC’s website at http://www.sec.gov. Both Columbia and PCBK shareholders are urged to read the Joint Proxy Statement/Prospectus and the other relevant materials before voting on

the transaction.

Investors will also be able to obtain these documents, free of charge, from PCBK by accessing its website at www.therightbank.com under the link to “Investor Relations” or from Columbia at www.columbiabank.com under the tab “About Us” and then under the heading “Investor Relations.” Copies can also be obtained, free of charge, by directing a written request to Columbia Banking System, Inc., Attention: Corporate

Secretary, 1301 A Street, Suite 800, Tacoma, Washington

98401-2156 or to Pacific Continental Corporation, Attention: Corporate Secretary 111 West Seventh Avenue, P.O. Box 10727, Eugene, Oregon 97440-2727. PCBK and Columbia and their directors and executive officers and certain other persons may be deemed to be participants in the

solicitation of proxies from the shareholders of Columbia and

PCBK in connection with the merger. Information about the directors and executive officers of Columbia and their ownership of Columbia common stock is set forth in the proxy statement for Columbia’s 2016 annual meeting of

shareholders, as filed with the SEC on a Schedule 14A on March

16, 2016. Information about the directors and executive officers of PCBK and their ownership of PCBK common stock is set forth in the proxy statement for PCBK’s 2016 annual meeting of shareholders, as filed with the SEC on a

Schedule 14A on March 15, 2016. Additional information

regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the merger when it becomes available. Free

copies of this document may be obtained as described in the

preceding paragraph. 21

Additional Information |

Melanie J. Dressel

President & Chief Executive Officer

253-305-1911; mdressel@columbiabank.com

Clint E. Stein EVP & Chief Financial Officer 253-593-8304; cstein@columbiabank.com Roger S. Busse President & Chief Executive Officer 541-686-8685; roger.busse@therightbank.com |