Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLINA HEALTHCARE, INC. | moh8-kjpmorganpresentation.htm |

© 2017 MOLINA HEALTHCARE, INC.

35th Annual JP Morgan Healthcare Conference

January 9-12, 2017

San Francisco, CA

Molina Healthcare

J. Mario Molina, MD

President & Chief Executive Officer

© 2017 MOLINA HEALTHCARE, INC.

2

Cautionary Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This slide presentation and our

accompanying oral remarks contain “forward-looking statements” regarding, without limitation: political uncertainty and future

potential legislative changes to the Medicaid, ACA Marketplace, and Medicare programs; the pending Aetna-Humana Medicare

Advantage divestiture transaction, including the Federal Court’s decision in the pending antitrust proceeding, and the timely

satisfaction of all closing conditions; 2017 Marketplace enrollment estimates; and various other matters. All of our forward-

looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to differ

materially. Anyone viewing or listening to this presentation is urged to read the risk factors and cautionary statements found

under Item 1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements in our quarterly reports

and in our other reports and filings with the Securities and Exchange Commission and available for viewing on its website at

sec.gov. Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward-

looking statements in future filings or communications regarding our business or operating results.

© 2017 MOLINA HEALTHCARE, INC.

3

Our mission

To provide quality health care to people receiving government assistance

© 2017 MOLINA HEALTHCARE, INC.

4

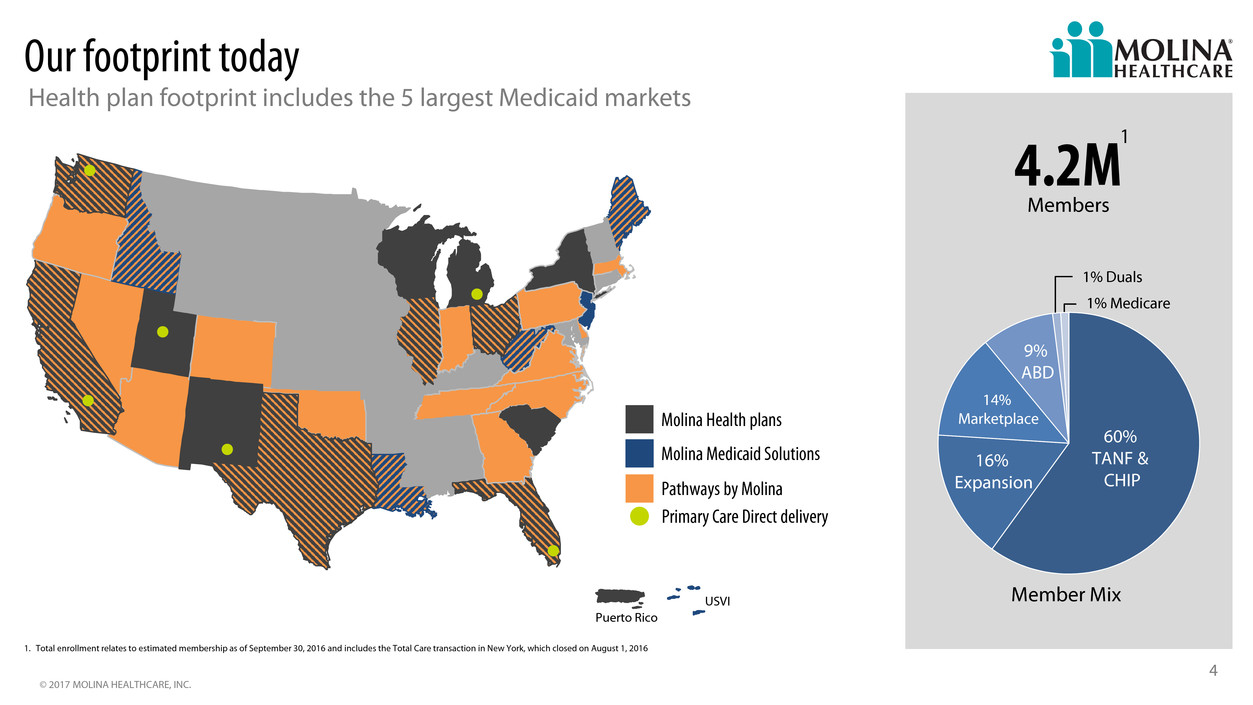

1. Total enrollment relates to estimated membership as of September 30, 2016 and includes the Total Care transaction in New York, which closed on August 1, 2016

Member Mix

4.2M

Members

Puerto Rico

USVI

1

Molina Health plans

Molina Medicaid Solutions

Primary Care Direct delivery

Pathways by Molina

1% Medicare

60%

TANF &

CHIP

16%

Expansion

9%

ABD

14%

Marketplace

1% Duals

Our footprint today

Health plan footprint includes the 5 largest Medicaid markets

© 2017 MOLINA HEALTHCARE, INC.

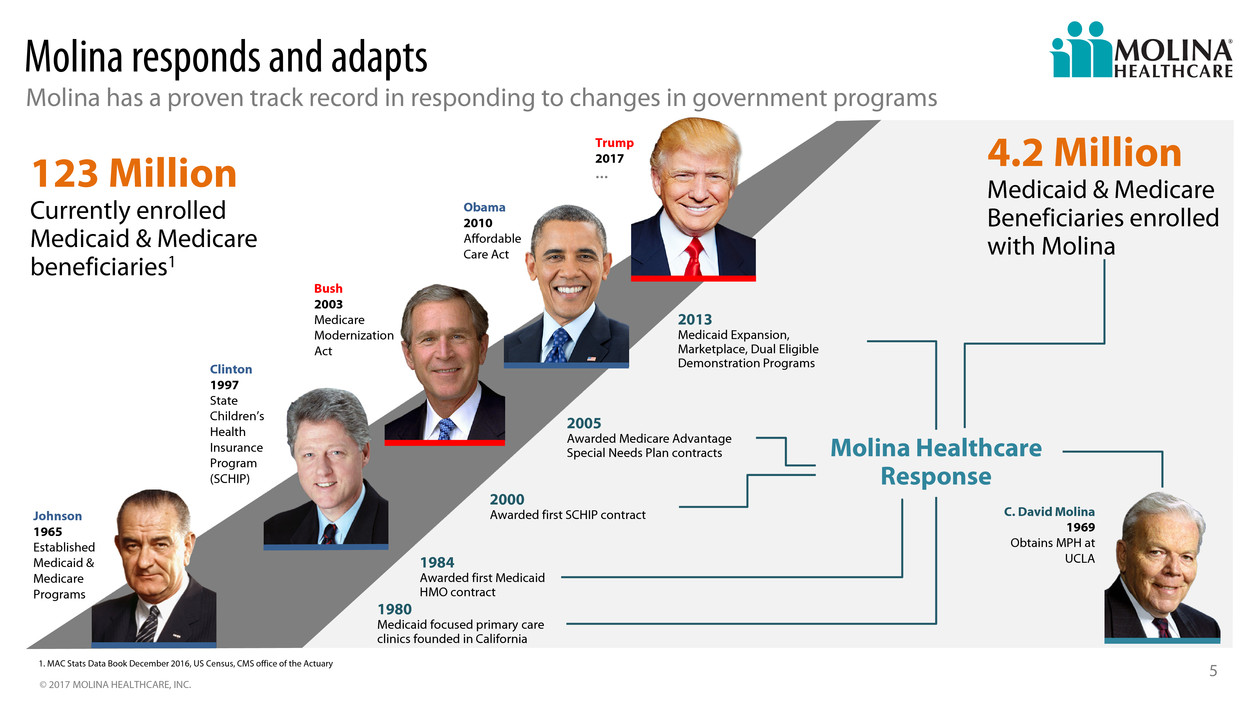

51. MAC Stats Data Book December 2016, US Census, CMS office of the Actuary

Johnson

1965

Established

Medicaid &

Medicare

Programs

Clinton

1997

State

Children’s

Health

Insurance

Program

(SCHIP)

Bush

2003

Medicare

Modernization

Act

Obama

2010

Affordable

Care Act

Trump

2017

…

Molina responds and adapts

Molina has a proven track record in responding to changes in government programs

C. David Molina

1969

Obtains MPH at

UCLA

1980

Medicaid focused primary care

clinics founded in California

2000

Awarded first SCHIP contract

2005

Awarded Medicare Advantage

Special Needs Plan contracts

2013

Medicaid Expansion,

Marketplace, Dual Eligible

Demonstration Programs

1984

Awarded first Medicaid

HMO contract

Molina Healthcare

Response

123 Million

Currently enrolled

Medicaid & Medicare

beneficiaries1

4.2 Million

Medicaid & Medicare

Beneficiaries enrolled

with Molina

© 2017 MOLINA HEALTHCARE, INC.

6

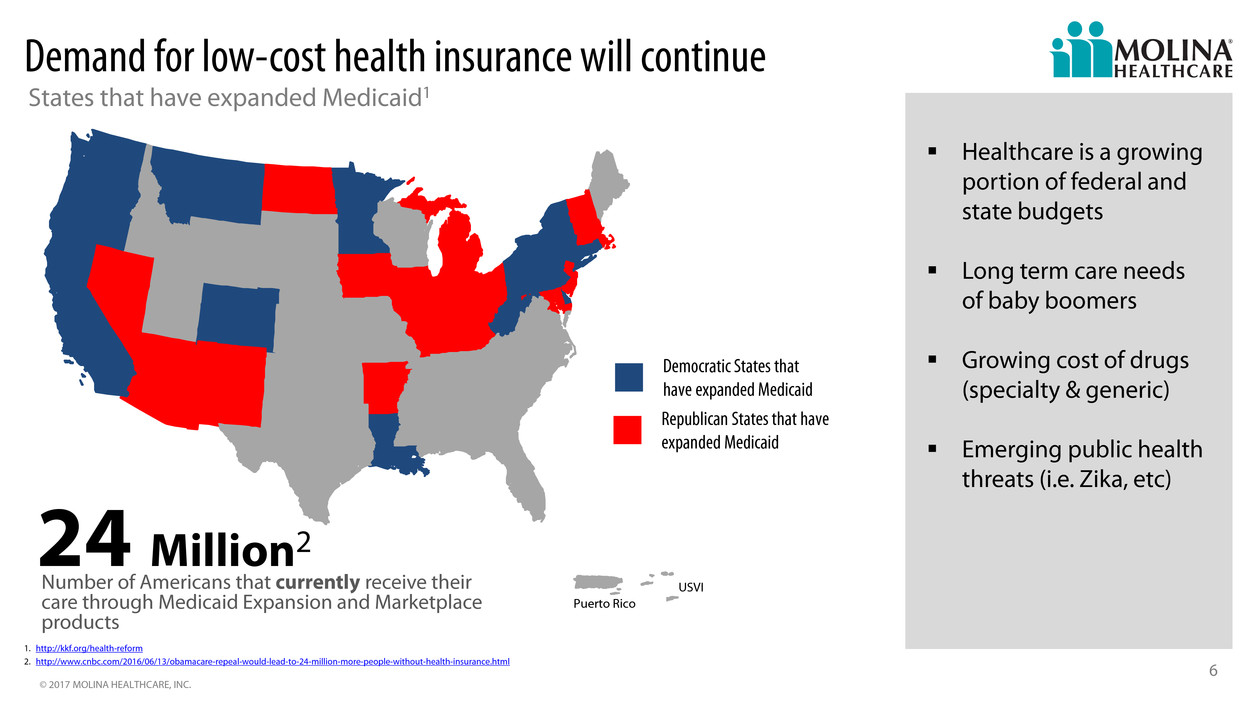

Demand for low-cost health insurance will continue

States that have expanded Medicaid1

1. http://kkf.org/health-reform

2. http://www.cnbc.com/2016/06/13/obamacare-repeal-would-lead-to-24-million-more-people-without-health-insurance.html

Puerto Rico

USVI Number of Americans that currently receive their

care through Medicaid Expansion and Marketplace

products

24 Million2

Democratic States that

have expanded Medicaid

Republican States that have

expanded Medicaid

Healthcare is a growing

portion of federal and

state budgets

Long term care needs

of baby boomers

Growing cost of drugs

(specialty & generic)

Emerging public health

threats (i.e. Zika, etc)

© 2017 MOLINA HEALTHCARE, INC.

7

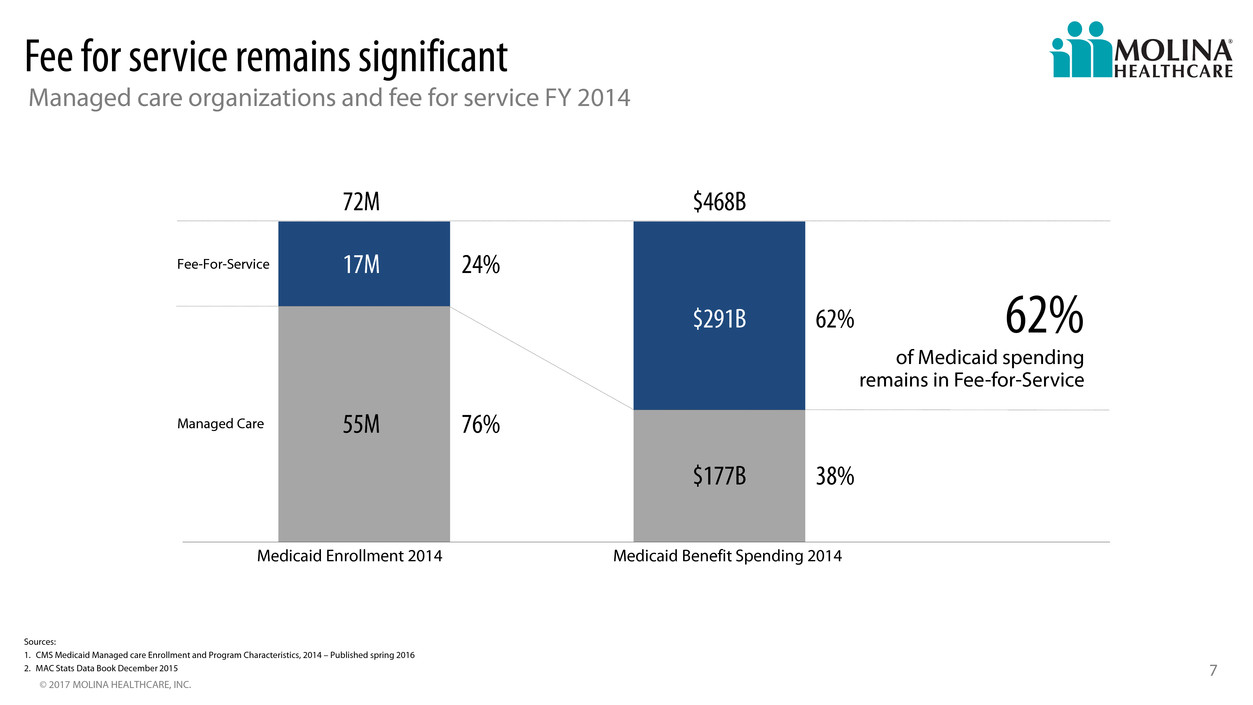

Fee for service remains significant

Managed care organizations and fee for service FY 2014

Sources:

1. CMS Medicaid Managed care Enrollment and Program Characteristics, 2014 – Published spring 2016

2. MAC Stats Data Book December 2015

62%

of Medicaid spending

remains in Fee-for-Service

$468B72M

24%

76%

62%

38%

55M

17M

$177B

$291B

Medicaid Enrollment 2014 Medicaid Benefit Spending 2014

Fee-For-Service

Managed Care

© 2017 MOLINA HEALTHCARE, INC.

8

Our toolkit for responding to industry changes & customer needs

Product portfolios

Risk-based health plan

outsourcing for Medicaid,

Medicare, and other

government programs.

Company owned and operated

primary care community clinics.

Medical Services

Primary Care

Provider network of outcome

based behavioral/mental

health and social services.

Medical Services

Behavioral Health

Government

Health Plans

Medicaid non-risk fee based

fiscal agent services, business

process outsourcing, and care

and utilization management.

Medicaid Health

Information Management

© 2017 MOLINA HEALTHCARE, INC.

9

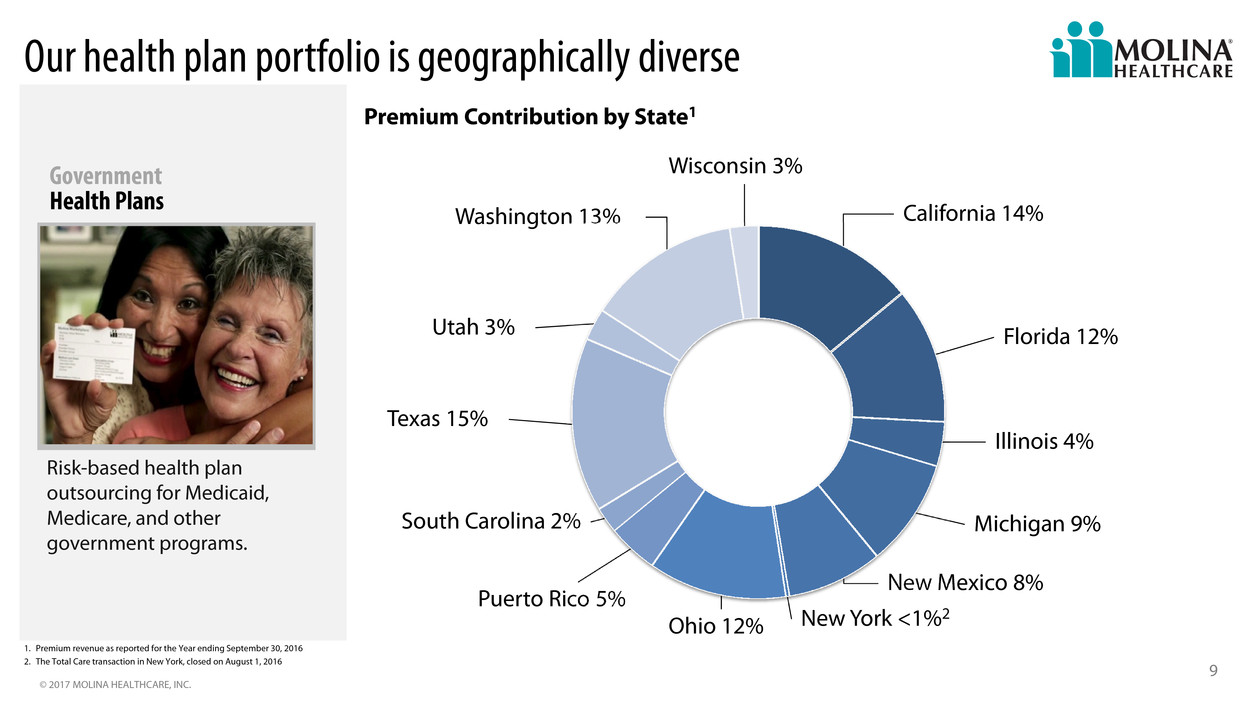

Our health plan portfolio is geographically diverse

1. Premium revenue as reported for the Year ending September 30, 2016

2. The Total Care transaction in New York, closed on August 1, 2016

Washington 13%

Utah 3%

Texas 15%

Ohio 12%

New Mexico 8%

Illinois 4%

Florida 12%

California 14%

Wisconsin 3%

New York <1%2

Puerto Rico 5%

South Carolina 2% Michigan 9%

Risk-based health plan

outsourcing for Medicaid,

Medicare, and other

government programs.

Government

Health Plans

Premium Contribution by State1

© 2017 MOLINA HEALTHCARE, INC.

Premium

Revenue

10

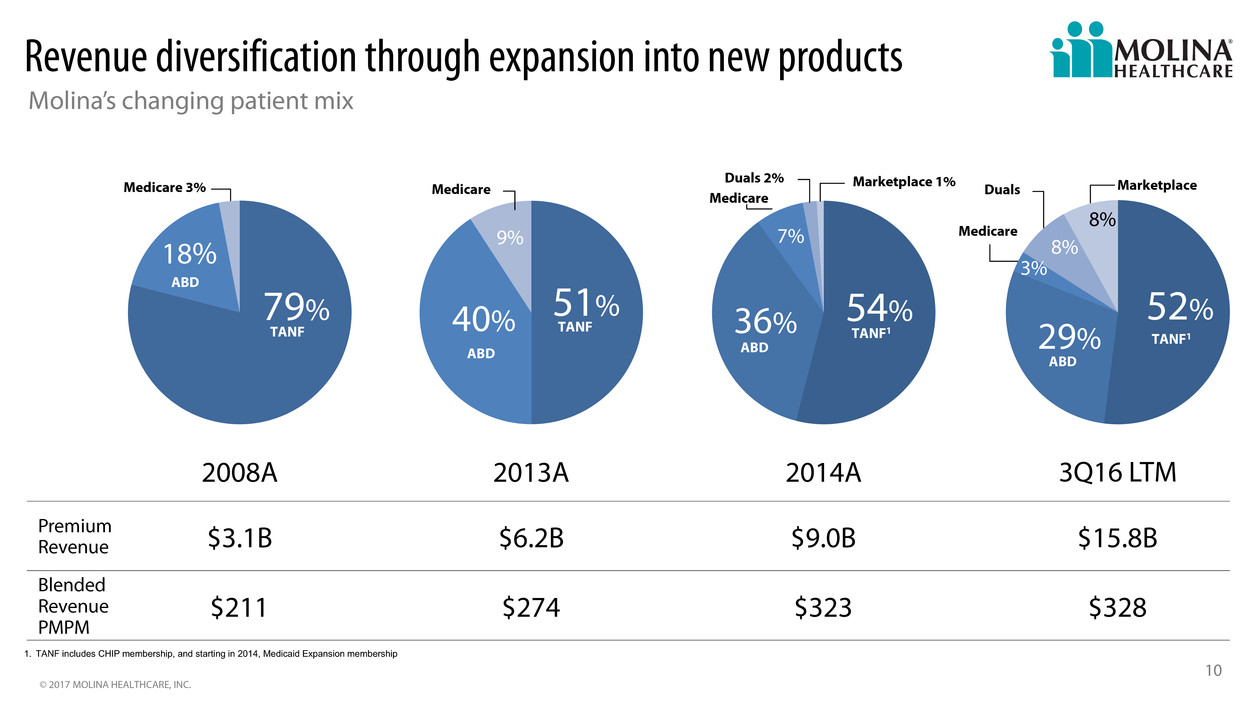

Revenue diversification through expansion into new products

Molina’s changing patient mix

1. TANF includes CHIP membership, and starting in 2014, Medicaid Expansion membership

$6.2B $9.0B$3.1B

$274 $323$211

Blended

Revenue

PMPM

2014A2013A2008A

54%

Marketplace 1%

TANF136%

ABD

Medicare

7%

Duals 2%

ABD

51%

TANF40%

Medicare

9%

$328

$15.8B

3Q16 LTM

TANF1

79%

TANF

18%

Medicare 3%

52%

MarketplaceDuals

8%

8%

29%

ABD

Medicare

3%

TANF1

ABD

ABD

© 2017 MOLINA HEALTHCARE, INC.

11

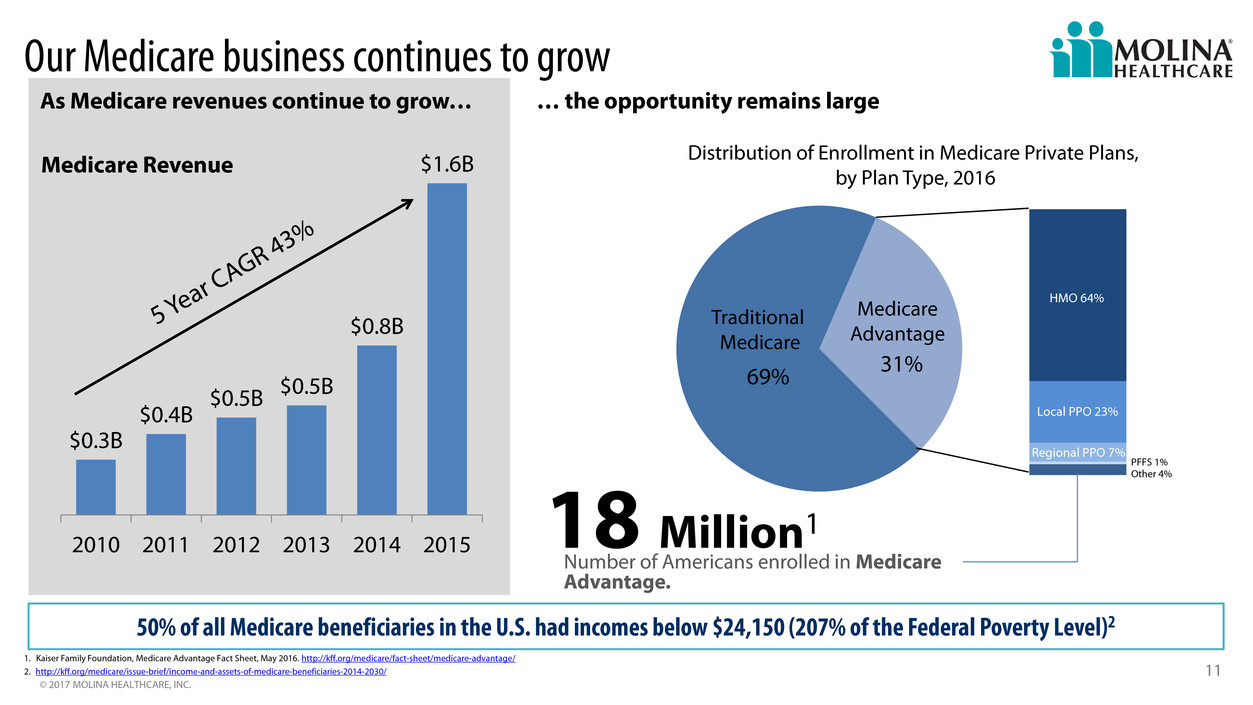

Our Medicare business continues to grow

1. Kaiser Family Foundation, Medicare Advantage Fact Sheet, May 2016. http://kff.org/medicare/fact-sheet/medicare-advantage/

2. http://kff.org/medicare/issue-brief/income-and-assets-of-medicare-beneficiaries-2014-2030/

$0.3B

$0.4B

$0.5B $0.5B

$0.8B

$1.6B

2010 2011 2012 2013 2014 2015

As Medicare revenues continue to grow…

69% 31%

Traditional

Medicare

Medicare

Advantage

HMO 64%

Local PPO 23%

Regional PPO 7%

PFFS 1%

Other 4%

Distribution of Enrollment in Medicare Private Plans,

by Plan Type, 2016

50% of all Medicare beneficiaries in the U.S. had incomes below $24,150 (207% of the Federal Poverty Level)2

… the opportunity remains large

Medicare Revenue

18 Million1

Number of Americans enrolled in Medicare

Advantage.

© 2017 MOLINA HEALTHCARE, INC.

12

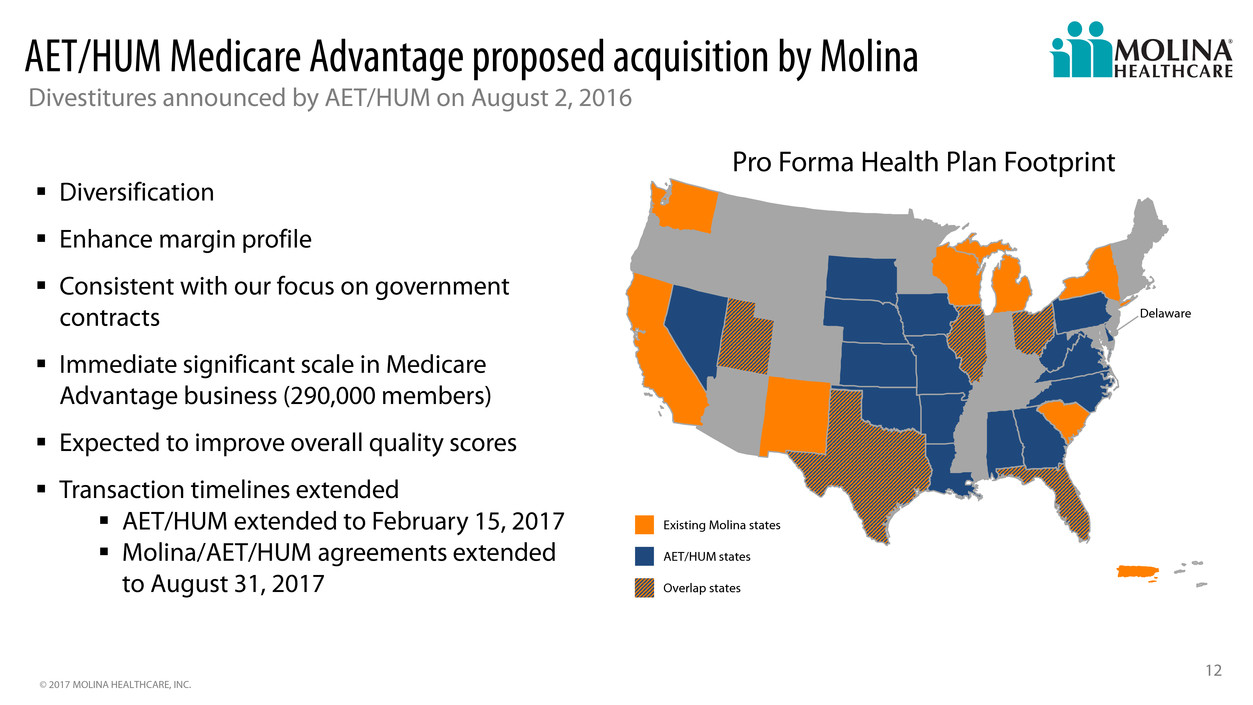

AET/HUM Medicare Advantage proposed acquisition by Molina

Divestitures announced by AET/HUM on August 2, 2016

Diversification

Enhance margin profile

Consistent with our focus on government

contracts

Immediate significant scale in Medicare

Advantage business (290,000 members)

Expected to improve overall quality scores

Transaction timelines extended

AET/HUM extended to February 15, 2017

Molina/AET/HUM agreements extended

to August 31, 2017

Delaware

Pro Forma Health Plan Footprint

Existing Molina states

AET/HUM states

Overlap states

© 2017 MOLINA HEALTHCARE, INC.

13

Direct delivery

Why provide services directly?

Dedicated network of providers

Provides additional primary care capacity

Greater control on quality and outcomes

Nurtures patient loyalty

Brand awareness & community engagement

Company owned and

operated primary care

community clinics.

Medical Services

Primary Care

© 2017 MOLINA HEALTHCARE, INC.

14

Direct delivery

A few of the services Molina Clinics provide include:

Pediatric, internal and family medicine

Immunizations and flu shots

Physical exams and health screenings

Acute care

Onsite childcare services

Interpretation and translation

Company owned and

operated primary care

community clinics.

Medical Services

Primary Care

© 2017 MOLINA HEALTHCARE, INC.

15

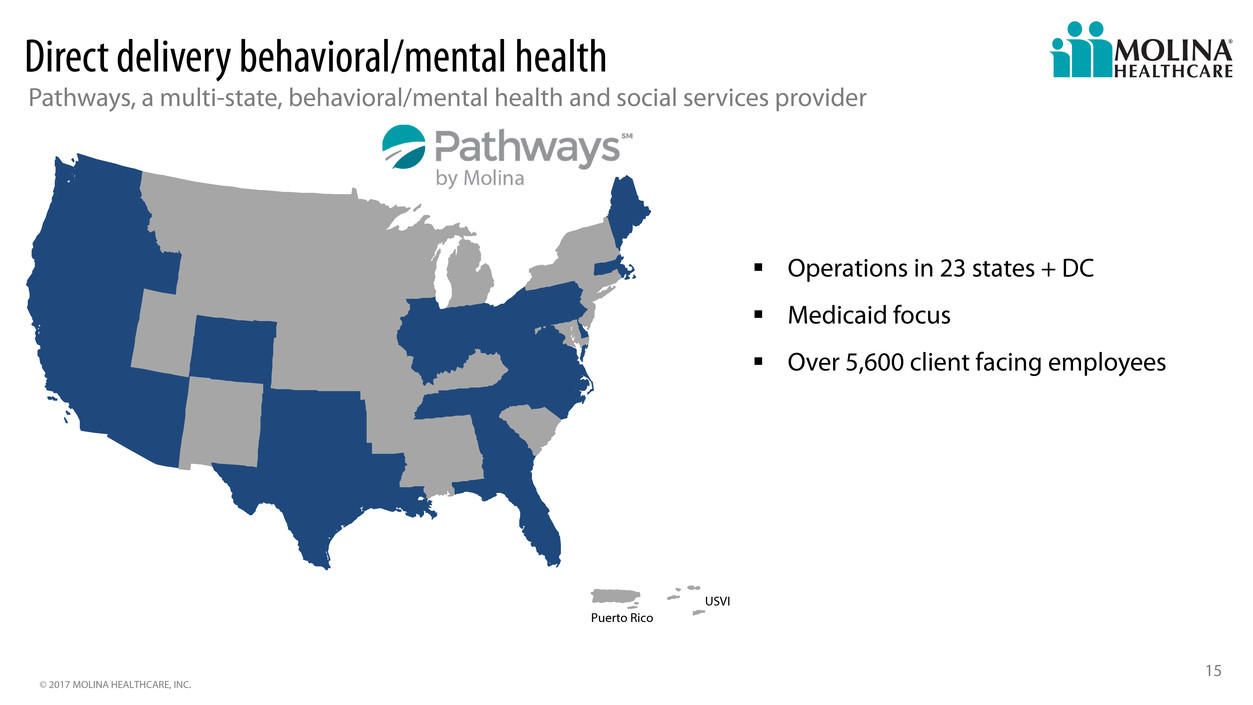

Direct delivery behavioral/mental health

Pathways, a multi-state, behavioral/mental health and social services provider

Operations in 23 states + DC

Medicaid focus

Over 5,600 client facing employees

Puerto Rico

USVI

© 2017 MOLINA HEALTHCARE, INC.

16

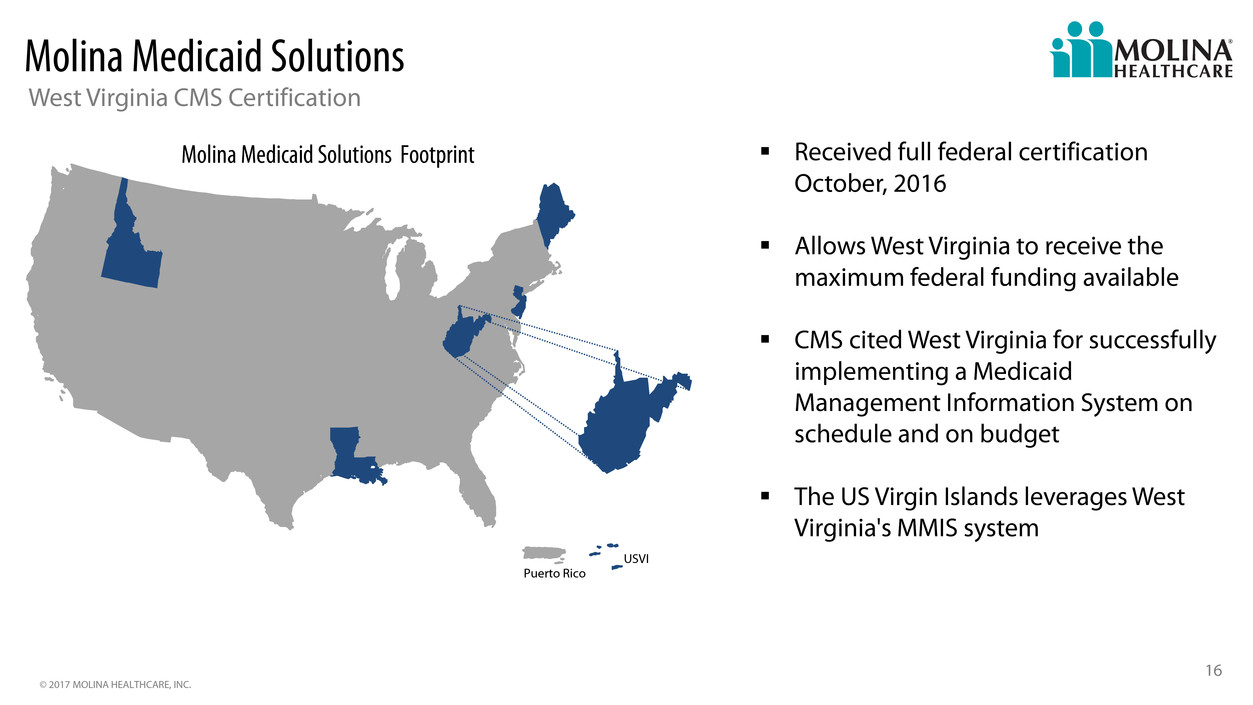

Molina Medicaid Solutions

West Virginia CMS Certification

Received full federal certification

October, 2016

Allows West Virginia to receive the

maximum federal funding available

CMS cited West Virginia for successfully

implementing a Medicaid

Management Information System on

schedule and on budget

The US Virgin Islands leverages West

Virginia's MMIS system

Puerto Rico

USVI

Molina Medicaid Solutions Footprint

© 2017 MOLINA HEALTHCARE, INC.

17

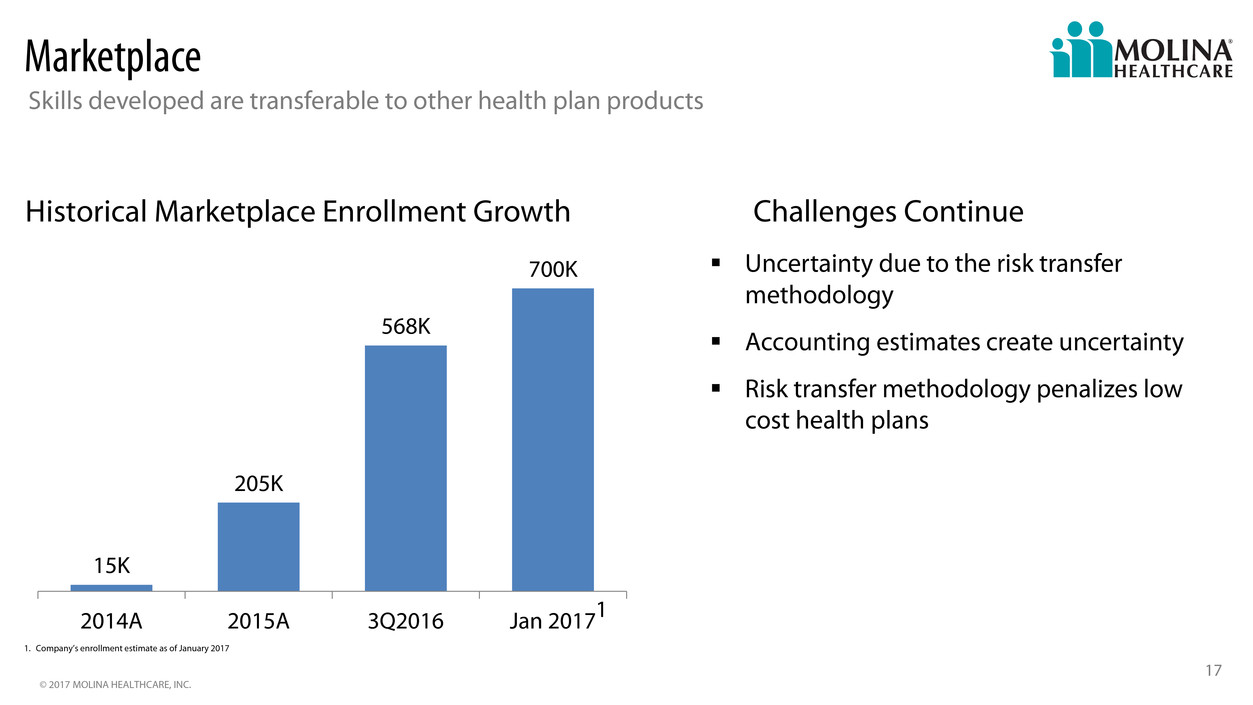

Marketplace

Skills developed are transferable to other health plan products

1. Company’s enrollment estimate as of January 2017

15K

205K

568K

700K

2014A 2015A 3Q2016 Jan 2017

Historical Marketplace Enrollment Growth

Uncertainty due to the risk transfer

methodology

Accounting estimates create uncertainty

Risk transfer methodology penalizes low

cost health plans

Challenges Continue

1

© 2017 MOLINA HEALTHCARE, INC.

18

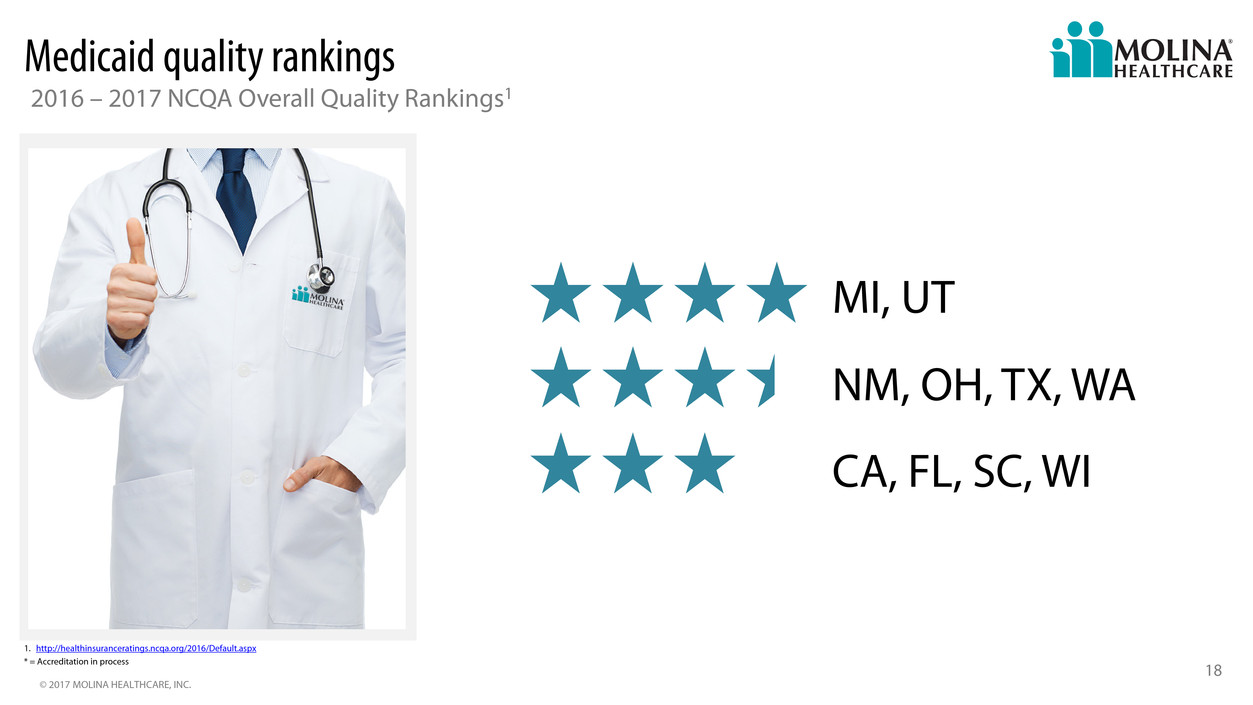

Medicaid quality rankings

1. http://healthinsuranceratings.ncqa.org/2016/Default.aspx

* = Accreditation in process

2016 – 2017 NCQA Overall Quality Rankings1

MI, UT

NM, OH, TX, WA

CA, FL, SC, WI

© 2017 MOLINA HEALTHCARE, INC.

19

2017 Medicare Star ratings

Low-income beneficiaries face unique challenges to achieving high star ratings1

1. http://healthaffairs.org/blog/2014/09/22/medicare-advantage-stars-systems-disproportionate-impact-on-ma-plans-focusing-on-low-income-populations/

NM

CA

FL, TX, UT, WA

© 2017 MOLINA HEALTHCARE, INC.

20

One of a kind

Adding capabilities that can impact social determinants of health care

Focused on people receiving government assistance

Scalable administrative infrastructure

Consistent national brand

Experienced management team

Mission driven culture