Attached files

| file | filename |

|---|---|

| EX-99.2 - JOINT PRESS RELEASE - Alon USA Energy, Inc. | jointpressrelease.htm |

| EX-99.3 - LETTER TO EMPLOYEES - Alon USA Energy, Inc. | ceolettertoalonemployees.htm |

| EX-2.4 - VOTING AGREEMENT-MORRIS - Alon USA Energy, Inc. | votingagreement-morris.htm |

| EX-2.3 - VOTING AGREEMENT-WIESSMAN - Alon USA Energy, Inc. | votingagreement-wiessman.htm |

| EX-2.2 - VOTING AGREEMENT-PARENT - Alon USA Energy, Inc. | votingagreement-parent.htm |

| EX-2.1 - MERGER AGREEMENT - Alon USA Energy, Inc. | mergeragreementfinal.htm |

| 8-K - 8-K - Alon USA Energy, Inc. | alj2017mergeragreement8-k.htm |

January 3, 2017

Delek US Holdings Inc. to Acquire Remaining Shares of Alon USA

2

Cautionary Statements

Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (defined as “we”, “our”) are traded on the New York Stock Exchange in the United States

under the symbols “DK” and ”DKL” respectively, and, as such, are governed by the rules and regulations of the United States Securities and Exchange

Commission. These slides and any accompanying oral and written presentations contain forward-looking statements that are based upon our current

expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about our future results,

performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that

term is defined under United States securities laws. These forward-looking statements include, but are not limited to, statements regarding the proposed merger

with Alon, integration and transition plans, synergies, opportunities, anticipated future performance and financial positon, and other factors.

Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not

limited to: risks and uncertainties related to the expected timing and likelihood of completion of the proposed merger, including the timing, receipt and terms

and conditions of any required governmental and regulatory approvals of the proposed merger that could reduce anticipated benefits or cause the parties to

abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to

the termination of the merger agreement, the possibility that stockholders of Delek US may not approve the issuance of new shares of common stock in the

merger or that stockholders of Alon may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed

transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the

risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Delek US' common stock or Alon's common

stock, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Delek US and Alon to retain customers and

retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk that

problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and

efficiently as expected, the risk that the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those

synergies, uncertainty related to timing and amount of future share repurchases and dividend payments, risks and uncertainties with respect to the quantities

and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; gains and losses from derivative instruments;

management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired

assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in

the scope, costs, and/or timing of capital and maintenance projects; operating hazards inherent in transporting, storing and processing crude oil and

intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we

operate; general economic and business conditions affecting the southern United States; and other risks contained in Delek US’ and Alon’s filings with the United

States Securities and Exchange Commission.

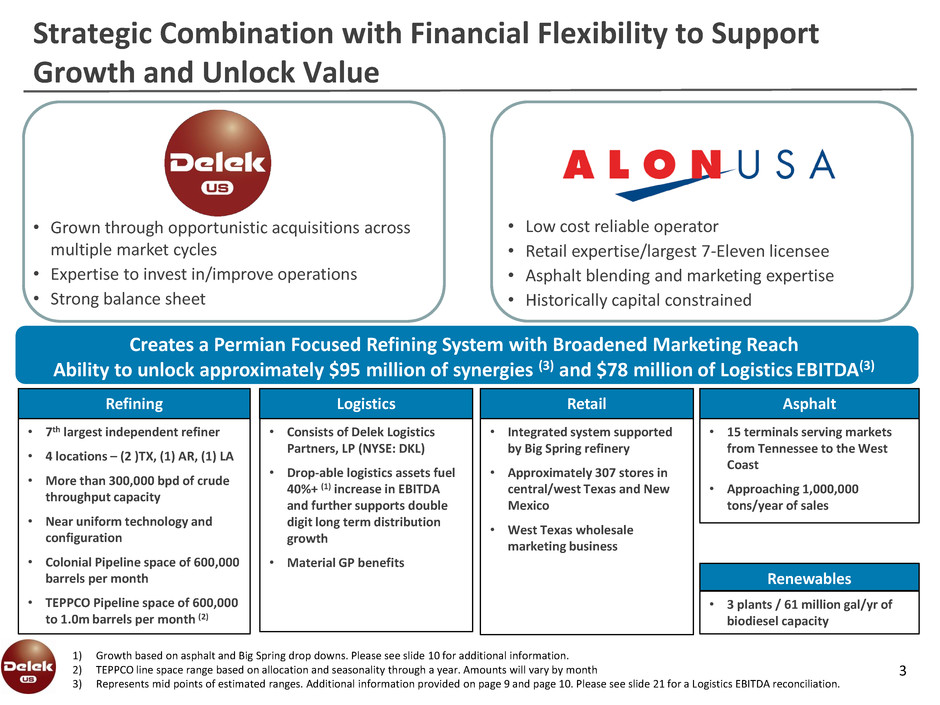

Strategic Combination with Financial Flexibility to Support

Growth and Unlock Value

3

• Grown through opportunistic acquisitions across

multiple market cycles

• Expertise to invest in/improve operations

• Strong balance sheet

• Low cost reliable operator

• Retail expertise/largest 7-Eleven licensee

• Asphalt blending and marketing expertise

• Historically capital constrained

Creates a Permian Focused Refining System with Broadened Marketing Reach

Ability to unlock approximately $95 million of synergies (3) and $78 million of Logistics EBITDA(3)

Refining

• 7th largest independent refiner

• 4 locations – (2 )TX, (1) AR, (1) LA

• More than 300,000 bpd of crude

throughput capacity

• Near uniform technology and

configuration

• Colonial Pipeline space of 600,000

barrels per month

• TEPPCO Pipeline space of 600,000

to 1.0m barrels per month (2)

Retail

• Integrated system supported

by Big Spring refinery

• Approximately 307 stores in

central/west Texas and New

Mexico

• West Texas wholesale

marketing business

Asphalt

• 15 terminals serving markets

from Tennessee to the West

Coast

• Approaching 1,000,000

tons/year of sales

Logistics

• Consists of Delek Logistics

Partners, LP (NYSE: DKL)

• Drop-able logistics assets fuel

40%+ (1) increase in EBITDA

and further supports double

digit long term distribution

growth

• Material GP benefits

Renewables

• 3 plants / 61 million gal/yr of

biodiesel capacity

1) Growth based on asphalt and Big Spring drop downs. Please see slide 10 for additional information.

2) TEPPCO line space range based on allocation and seasonality through a year. Amounts will vary by month

3) Represents mid points of estimated ranges. Additional information provided on page 9 and page 10. Please see slide 21 for a Logistics EBITDA reconciliation.

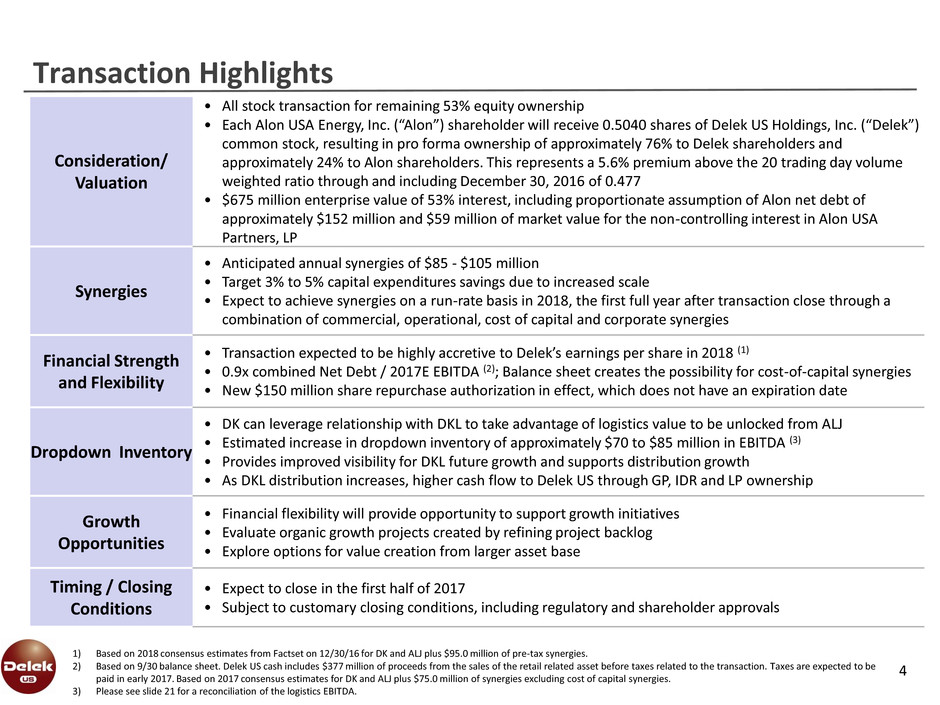

Consideration/

Valuation

• All stock transaction for remaining 53% equity ownership

• Each Alon USA Energy, Inc. (“Alon”) shareholder will receive 0.5040 shares of Delek US Holdings, Inc. (“Delek”)

common stock, resulting in pro forma ownership of approximately 76% to Delek shareholders and

approximately 24% to Alon shareholders. This represents a 5.6% premium above the 20 trading day volume

weighted ratio through and including December 30, 2016 of 0.477

• $675 million enterprise value of 53% interest, including proportionate assumption of Alon net debt of

approximately $152 million and $59 million of market value for the non-controlling interest in Alon USA

Partners, LP

Synergies

• Anticipated annual synergies of $85 - $105 million

• Target 3% to 5% capital expenditures savings due to increased scale

• Expect to achieve synergies on a run-rate basis in 2018, the first full year after transaction close through a

combination of commercial, operational, cost of capital and corporate synergies

Financial Strength

and Flexibility

• Transaction expected to be highly accretive to Delek’s earnings per share in 2018 (1)

• 0.9x combined Net Debt / 2017E EBITDA (2); Balance sheet creates the possibility for cost-of-capital synergies

• New $150 million share repurchase authorization in effect, which does not have an expiration date

Dropdown Inventory

• DK can leverage relationship with DKL to take advantage of logistics value to be unlocked from ALJ

• Estimated increase in dropdown inventory of approximately $70 to $85 million in EBITDA (3)

• Provides improved visibility for DKL future growth and supports distribution growth

• As DKL distribution increases, higher cash flow to Delek US through GP, IDR and LP ownership

Growth

Opportunities

• Financial flexibility will provide opportunity to support growth initiatives

• Evaluate organic growth projects created by refining project backlog

• Explore options for value creation from larger asset base

Timing / Closing

Conditions

• Expect to close in the first half of 2017

• Subject to customary closing conditions, including regulatory and shareholder approvals

Transaction Highlights

4

1) Based on 2018 consensus estimates from Factset on 12/30/16 for DK and ALJ plus $95.0 million of pre-tax synergies.

2) Based on 9/30 balance sheet. Delek US cash includes $377 million of proceeds from the sales of the retail related asset before taxes related to the transaction. Taxes are expected to be

paid in early 2017. Based on 2017 consensus estimates for DK and ALJ plus $75.0 million of synergies excluding cost of capital synergies.

3) Please see slide 21 for a reconciliation of the logistics EBITDA.

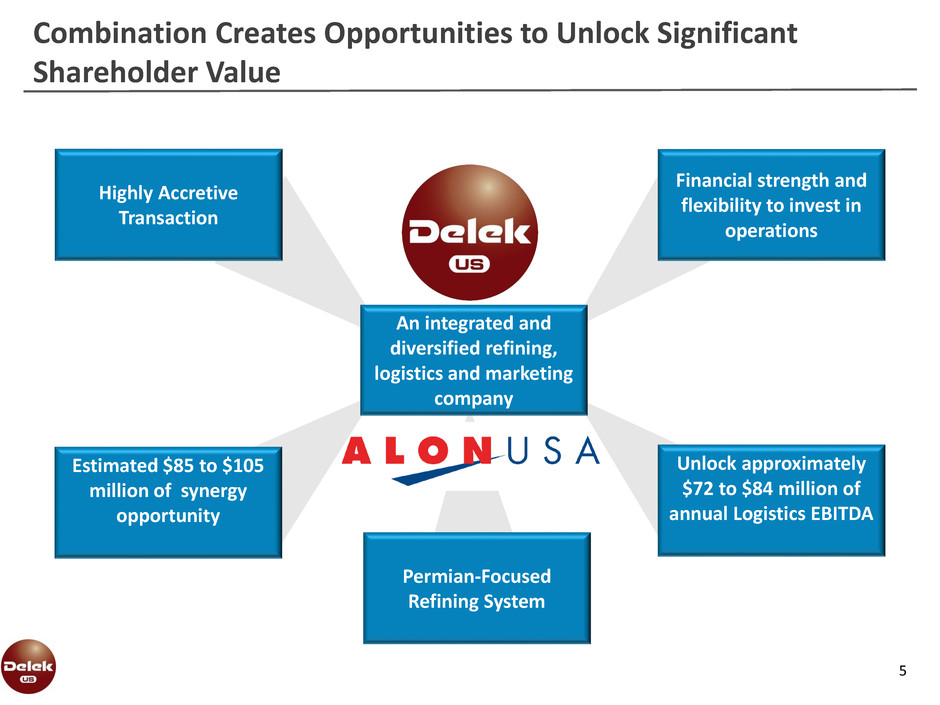

5

Financial strength and

flexibility to invest in

operations

Highly Accretive

Transaction

Combination Creates Opportunities to Unlock Significant

Shareholder Value

Unlock approximately

$72 to $84 million of

annual Logistics EBITDA

Estimated $85 to $105

million of synergy

opportunity

An integrated and

diversified refining,

logistics and marketing

company

Permian-Focused

Refining System

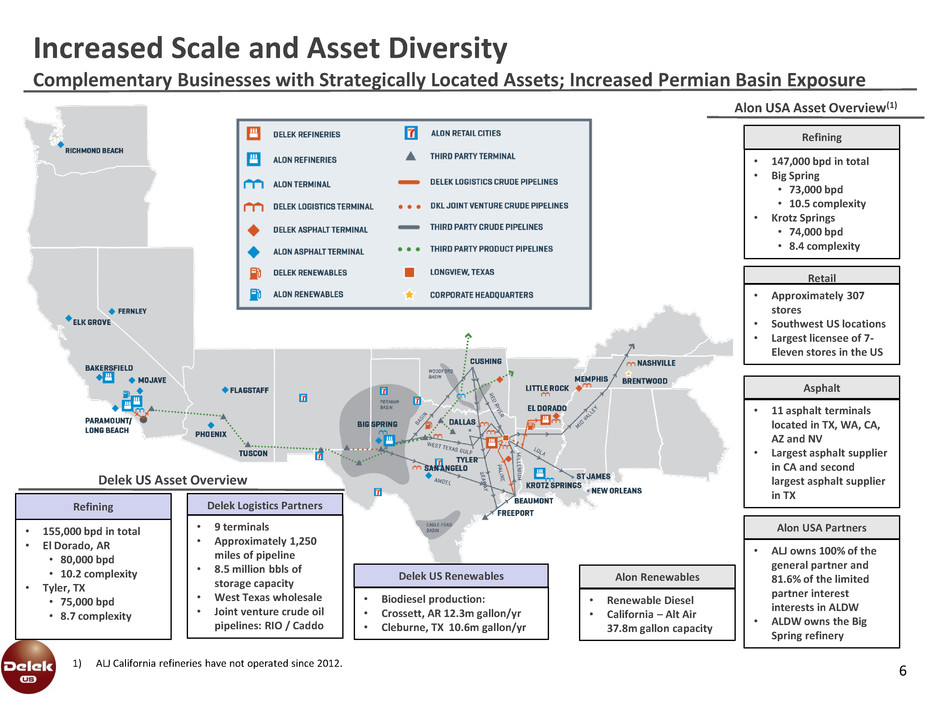

Increased Scale and Asset Diversity

Complementary Businesses with Strategically Located Assets; Increased Permian Basin Exposure

6

Alon USA Asset Overview(1)

Refining

• 147,000 bpd in total

• Big Spring

• 73,000 bpd

• 10.5 complexity

• Krotz Springs

• 74,000 bpd

• 8.4 complexity

Retail

• Approximately 307

stores

• Southwest US locations

• Largest licensee of 7-

Eleven stores in the US

Asphalt

• 11 asphalt terminals

located in TX, WA, CA,

AZ and NV

• Largest asphalt supplier

in CA and second

largest asphalt supplier

in TX

Alon USA Partners

• ALJ owns 100% of the

general partner and

81.6% of the limited

partner interest

interests in ALDW

• ALDW owns the Big

Spring refinery

Delek US Asset Overview

Refining

• 155,000 bpd in total

• El Dorado, AR

• 80,000 bpd

• 10.2 complexity

• Tyler, TX

• 75,000 bpd

• 8.7 complexity

Delek Logistics Partners

• 9 terminals

• Approximately 1,250

miles of pipeline

• 8.5 million bbls of

storage capacity

• West Texas wholesale

• Joint venture crude oil

pipelines: RIO / Caddo

1) ALJ California refineries have not operated since 2012.

Delek US Renewables

• Biodiesel production:

• Crossett, AR 12.3m gallon/yr

• Cleburne, TX 10.6m gallon/yr

Alon Renewables

• Renewable Diesel

• California – Alt Air

37.8m gallon capacity

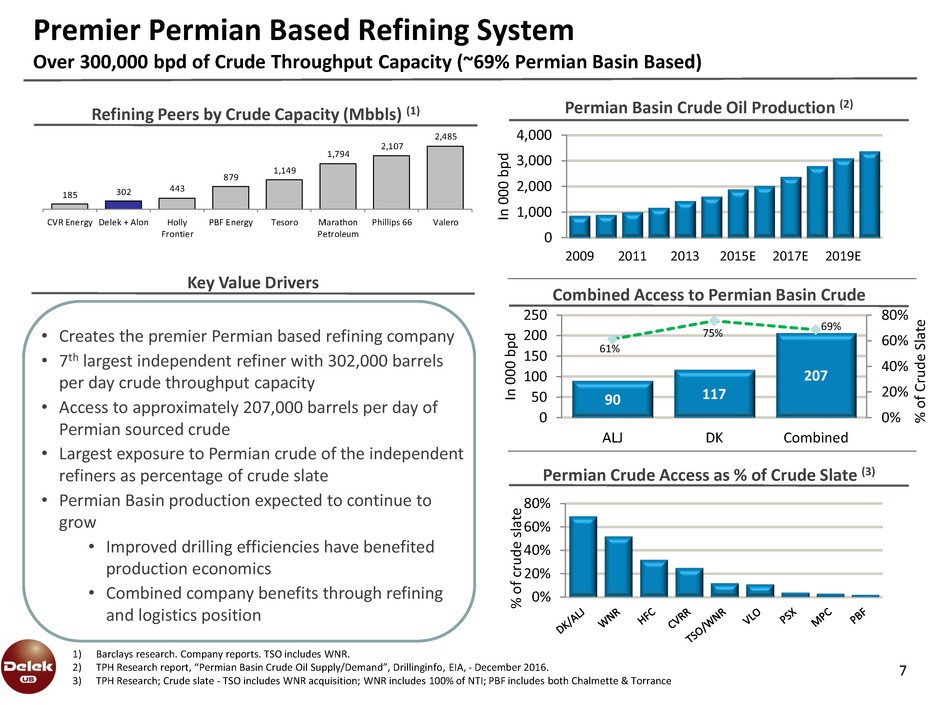

Premier Permian Based Refining System

Over 300,000 bpd of Crude Throughput Capacity (~69% Permian Basin Based)

7

Key Value Drivers

• Creates the premier Permian based refining company

• 7th largest independent refiner with 302,000 barrels

per day crude throughput capacity

• Access to approximately 207,000 barrels per day of

Permian sourced crude

• Largest exposure to Permian crude of the independent

refiners as percentage of crude slate

• Permian Basin production expected to continue to

grow

• Improved drilling efficiencies have benefited

production economics

• Combined company benefits through refining

and logistics position

Permian Basin Crude Oil Production (2)

Combined Access to Permian Basin Crude

Permian Crude Access as % of Crude Slate (3)

1) Barclays research. Company reports. TSO includes WNR.

2) TPH Research report, “Permian Basin Crude Oil Supply/Demand”, Drillinginfo, EIA, - December 2016.

3) TPH Research; Crude slate - TSO includes WNR acquisition; WNR includes 100% of NTI; PBF includes both Chalmette & Torrance

90 117

207

61%

75%

69%

0%

20%

40%

60%

80%

0

50

100

150

200

250

ALJ DK Combined

%

o

f

Cr

u

d

e

Sl

at

e

In

0

0

0

b

p

d

Refining Peers by Crude Capacity (Mbbls) (1)

185 302

443

879

1,149

1,794

2,107

2,485

CVR Energy Delek + Alon Holly

Frontier

PBF Energy Tesoro Marathon

Petroleum

Phillips 66 Valero

0

1,000

2,000

3,000

4,000

2009 2011 2013 2015E 2017E 2019E

In

0

0

0

b

p

d

0%

20%

40%

60%

80%

%

o

f

cr

u

d

e

sl

at

e

$-

$2

$4

$6

$8

$10

$12

V

L

O

/N

o

rth

A

tl

a

n

tic

(Q

u

e

b

e

c,

U

K

)

V

L

O

/M

id

-C

o

n

tin

e

n

t (O

K

, T

N,

T

X

)

P

A

R

R

/H

a

wai

i

V

L

O

/G

u

lf C

o

a

s

t (L

A

, T

X

)

P

S

X

/G

u

lf C

o

a

s

t

D

e

lek

/T

yl

e

r, T

X

D

e

lek

/E

l

D

o

ra

d

o

, A

R

A

lo

n

/B

ig

S

p

rin

g

, T

X

W

N

R

/E

l P

a

s

o

, T

X

T

S

O

/P

a

cific N

o

rth

we

s

t (A

K

, W

A

)

A

lo

n

/K

ro

tz

S

p

rin

g

s,

L

A

C

V

R

R

/Co

ffe

yvi

lle

, K

S

P

S

X

/A

tl

a

n

tic

B

a

sin

-E

u

ro

p

e

T

S

O

/M

id

-Co

n

ti

n

e

n

t (N

D

, U

T

)

M

P

C/G

u

lf C

o

a

s

t

P

B

F

/M

id

-C

o

n

H

F

C/

S

o

u

th

wes

t (N

M

)

P

B

F

/E

a

st

Co

a

s

t

M

P

C/

T

o

ta

l

(M

W

, G

C

)

W

N

R

/S

t P

a

u

l

P

a

rk

H

F

C/

M

id

-Co

n

(O

K

, K

S

)

P

B

F

/G

u

lf C

o

a

s

t

M

P

C/

M

id

we

s

t

V

L

O

/We

s

t C

o

a

s

t

C

V

R

R

/W

y

n

n

e

w

o

o

d

, O

K

P

S

X

/C

e

n

tra

l C

o

rrid

o

r

P

S

X

/We

s

te

rn

-P

a

cifi

c

T

S

O

/C

a

lifo

rn

ia

H

S

E

/M

idw

e

s

t

C

V

E

/U

S

W

N

R

/G

a

llu

p

, N

M

H

F

C/R

o

ckie

s

(U

T

, W

Y

)

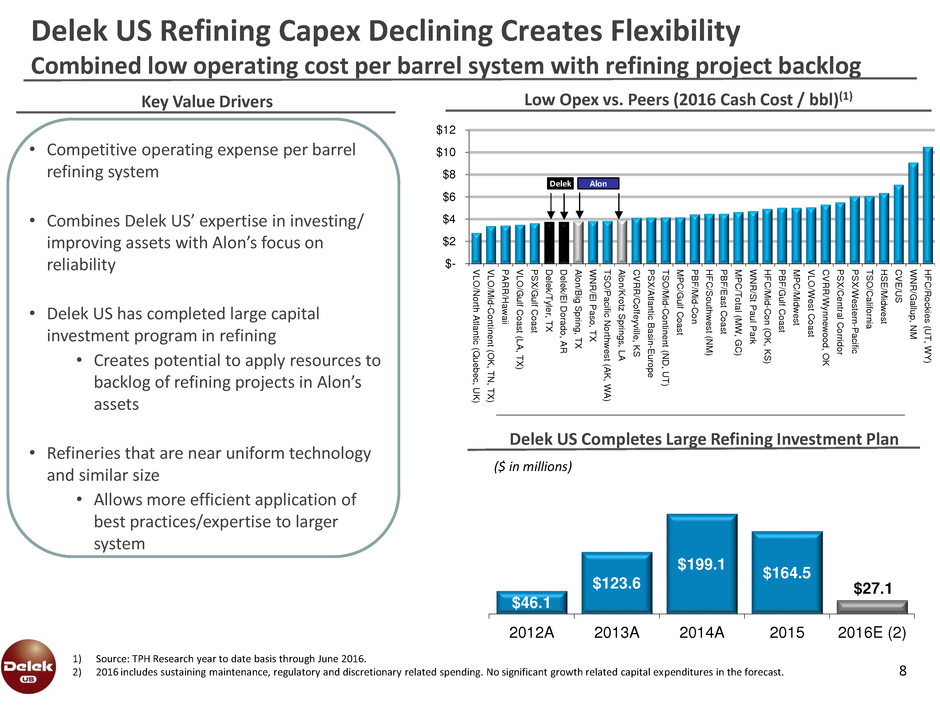

Delek US Refining Capex Declining Creates Flexibility

Combined low operating cost per barrel system with refining project backlog

8

Key Value Drivers

• Competitive operating expense per barrel

refining system

• Combines Delek US’ expertise in investing/

improving assets with Alon’s focus on

reliability

• Delek US has completed large capital

investment program in refining

• Creates potential to apply resources to

backlog of refining projects in Alon’s

assets

• Refineries that are near uniform technology

and similar size

• Allows more efficient application of

best practices/expertise to larger

system

Low Opex vs. Peers (2016 Cash Cost / bbl)(1)

Delek Alon

1) Source: TPH Research year to date basis through June 2016.

2) 2016 includes sustaining maintenance, regulatory and discretionary related spending. No significant growth related capital expenditures in the forecast.

Delek US Completes Large Refining Investment Plan

$46.1

$123.6

$199.1

$164.5

$27.1

2012A 2013A 2014A 2015 2016E (2)

($ in millions)

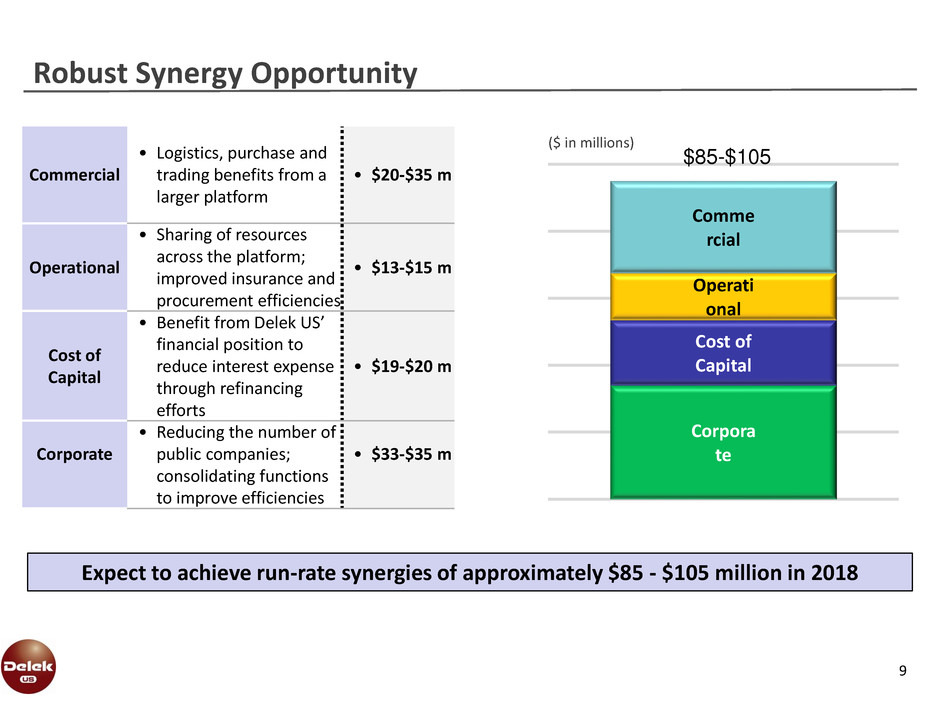

Robust Synergy Opportunity

9

Expect to achieve run-rate synergies of approximately $85 - $105 million in 2018

Commercial

• Logistics, purchase and

trading benefits from a

larger platform

• $20-$35 m

Operational

• Sharing of resources

across the platform;

improved insurance and

procurement efficiencies

• $13-$15 m

Cost of

Capital

• Benefit from Delek US’

financial position to

reduce interest expense

through refinancing

efforts

• $19-$20 m

Corporate

• Reducing the number of

public companies;

consolidating functions

to improve efficiencies

• $33-$35 m

Corpora

te

Cost of

Capital

Operati

onal

Comme

rcial

$85-$105

($ in millions)

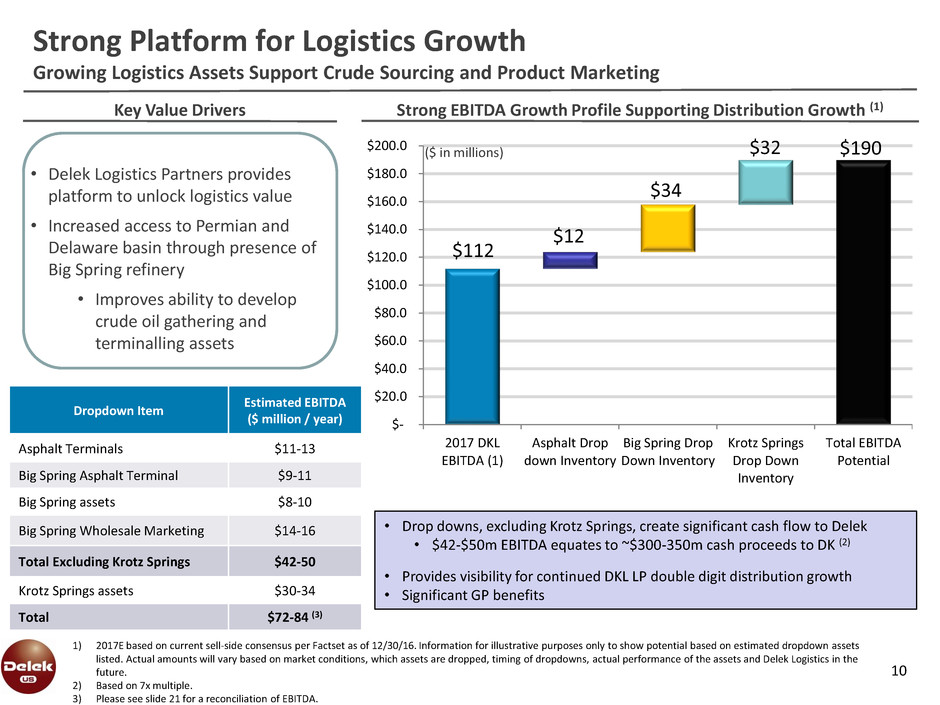

Strong Platform for Logistics Growth

Growing Logistics Assets Support Crude Sourcing and Product Marketing

10

Key Value Drivers

• Delek Logistics Partners provides

platform to unlock logistics value

• Increased access to Permian and

Delaware basin through presence of

Big Spring refinery

• Improves ability to develop

crude oil gathering and

terminalling assets

1) 2017E based on current sell-side consensus per Factset as of 12/30/16. Information for illustrative purposes only to show potential based on estimated dropdown assets

listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the

future.

2) Based on 7x multiple.

3) Please see slide 21 for a reconciliation of EBITDA.

Strong EBITDA Growth Profile Supporting Distribution Growth (1)

$112

$12

$34

$32 $190

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2017 DKL

EBITDA (1)

Asphalt Drop

down Inventory

Big Spring Drop

Down Inventory

Krotz Springs

Drop Down

Inventory

Total EBITDA

Potential

• Drop downs, excluding Krotz Springs, create significant cash flow to Delek

• $42-$50m EBITDA equates to ~$300-350m cash proceeds to DK (2)

• Provides visibility for continued DKL LP double digit distribution growth

• Significant GP benefits

Dropdown Item

Estimated EBITDA

($ million / year)

Asphalt Terminals $11-13

Big Spring Asphalt Terminal $9-11

Big Spring assets $8-10

Big Spring Wholesale Marketing $14-16

Total Excluding Krotz Springs $42-50

Krotz Springs assets $30-34

Total $72-84 (3)

($ in millions)

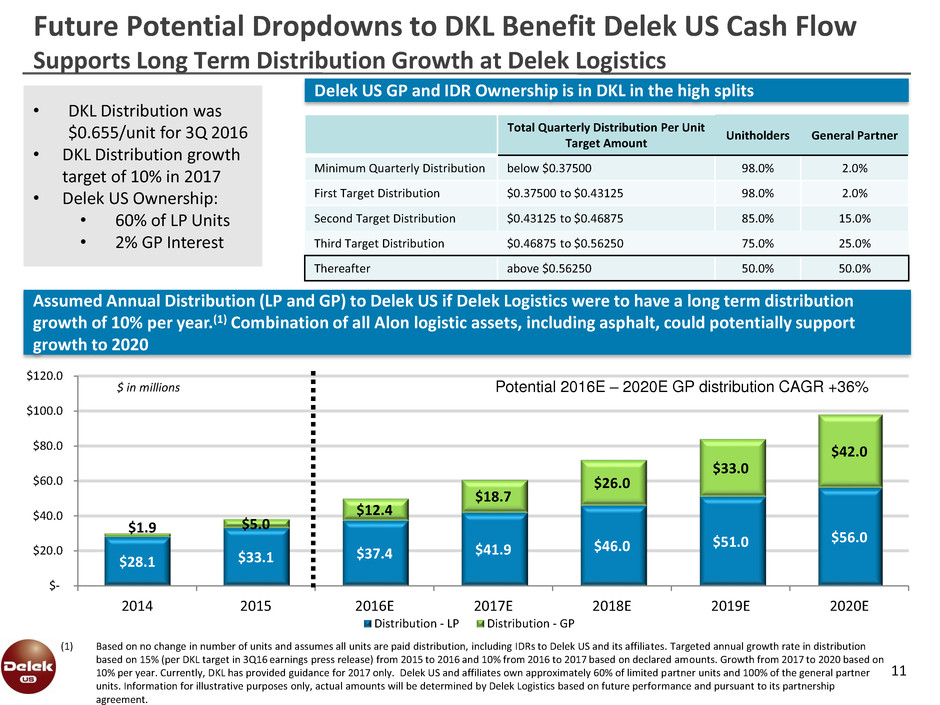

11

Delek US GP and IDR Ownership is in DKL in the high splits

Future Potential Dropdowns to DKL Benefit Delek US Cash Flow

Supports Long Term Distribution Growth at Delek Logistics

Total Quarterly Distribution Per Unit

Target Amount

Unitholders General Partner

Minimum Quarterly Distribution below $0.37500 98.0% 2.0%

First Target Distribution $0.37500 to $0.43125 98.0% 2.0%

Second Target Distribution $0.43125 to $0.46875 85.0% 15.0%

Third Target Distribution $0.46875 to $0.56250 75.0% 25.0%

Thereafter above $0.56250 50.0% 50.0%

• DKL Distribution was

$0.655/unit for 3Q 2016

• DKL Distribution growth

target of 10% in 2017

• Delek US Ownership:

• 60% of LP Units

• 2% GP Interest

(1) Based on no change in number of units and assumes all units are paid distribution, including IDRs to Delek US and its affiliates. Targeted annual growth rate in distribution

based on 15% (per DKL target in 3Q16 earnings press release) from 2015 to 2016 and 10% from 2016 to 2017 based on declared amounts. Growth from 2017 to 2020 based on

10% per year. Currently, DKL has provided guidance for 2017 only. Delek US and affiliates own approximately 60% of limited partner units and 100% of the general partner

units. Information for illustrative purposes only, actual amounts will be determined by Delek Logistics based on future performance and pursuant to its partnership

agreement.

Assumed Annual Distribution (LP and GP) to Delek US if Delek Logistics were to have a long term distribution

growth of 10% per year.(1) Combination of all Alon logistic assets, including asphalt, could potentially support

growth to 2020

$28.1 $33.1

$37.4 $41.9 $46.0

$51.0 $56.0

$1.9 $5.0

$12.4

$18.7

$26.0

$33.0

$42.0

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2014 2015 2016E 2017E 2018E 2019E 2020E

Distribution - LP Distribution - GP

$ in millions Potential 2016E – 2020E GP distribution CAGR +36%

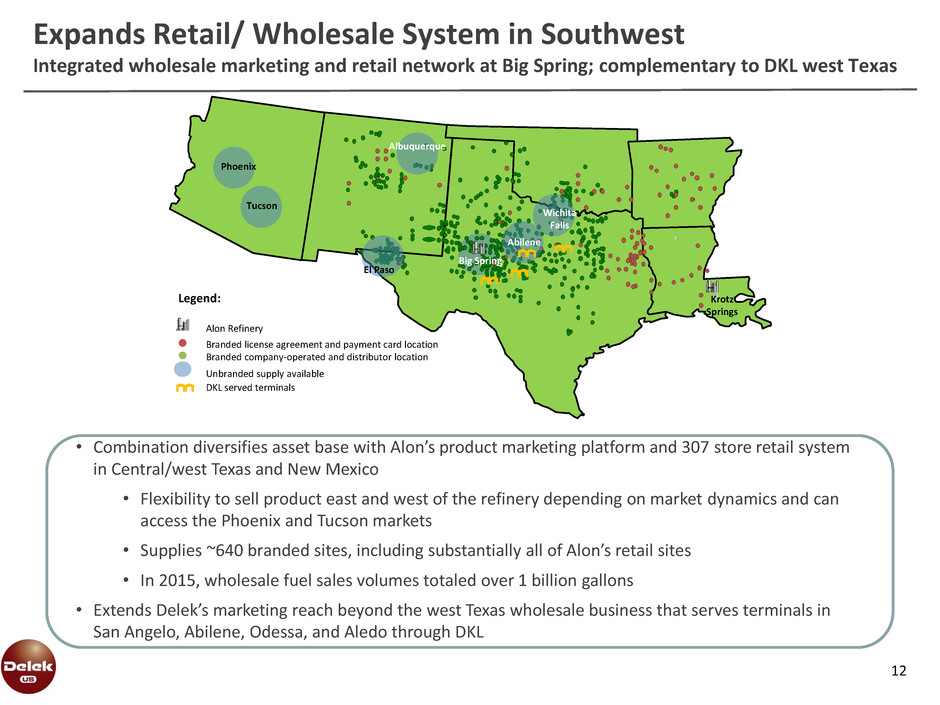

Expands Retail/ Wholesale System in Southwest

Integrated wholesale marketing and retail network at Big Spring; complementary to DKL west Texas

12

Alon Refinery

Legend:

Big Spring

Krotz

Springs

Branded license agreement and payment card location

Branded company-operated and distributor location

Unbranded supply available

Phoenix

Tucson

El Paso

Abilene

Wichita

Falls

Albuquerque

DKL served terminals

• Combination diversifies asset base with Alon’s product marketing platform and 307 store retail system

in Central/west Texas and New Mexico

• Flexibility to sell product east and west of the refinery depending on market dynamics and can

access the Phoenix and Tucson markets

• Supplies ~640 branded sites, including substantially all of Alon’s retail sites

• In 2015, wholesale fuel sales volumes totaled over 1 billion gallons

• Extends Delek’s marketing reach beyond the west Texas wholesale business that serves terminals in

San Angelo, Abilene, Odessa, and Aledo through DKL

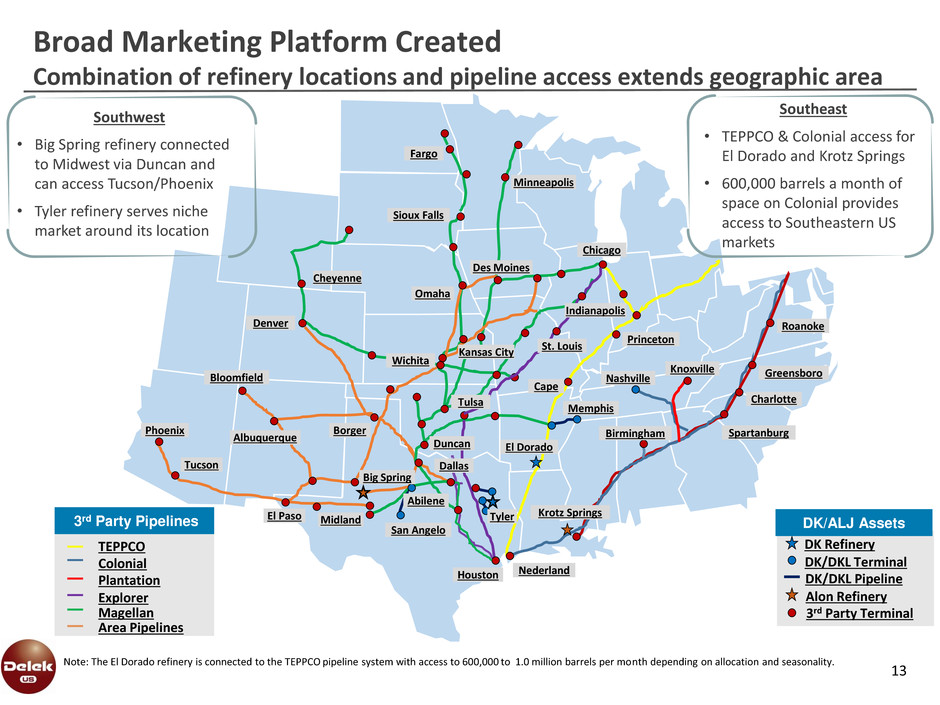

Broad Marketing Platform Created

Combination of refinery locations and pipeline access extends geographic area

DK/ALJ Assets

DK Refinery

DK/DKL Terminal

DK/DKL Pipeline

Alon Refinery

3rd Party Terminal

Krotz Springs

El Dorado

Tyler

Big Spring

Memphis

Nashville

Knoxville

Midland

Phoenix

Tucson

Bloomfield

Abilene

San Angelo

Houston

Duncan

Princeton

Roanoke

Greensboro

Charlotte

Spartanburg

Nederland

El Paso

Birmingham

Minneapolis

Chicago

St. Louis

Denver

Wichita

Indianapolis

Kansas City

Des Moines

Omaha

Sioux Falls

Fargo

Borger

Albuquerque

Tulsa

Dallas

Cape

Cheyenne

TEPPCO

Colonial

Plantation

Explorer

Area Pipelines

Magellan

3rd Party Pipelines

Southeast

• TEPPCO & Colonial access for

El Dorado and Krotz Springs

• 600,000 barrels a month of

space on Colonial provides

access to Southeastern US

markets

Southwest

• Big Spring refinery connected

to Midwest via Duncan and

can access Tucson/Phoenix

• Tyler refinery serves niche

market around its location

13

Note: The El Dorado refinery is connected to the TEPPCO pipeline system with access to 600,000 to 1.0 million barrels per month depending on allocation and seasonality.

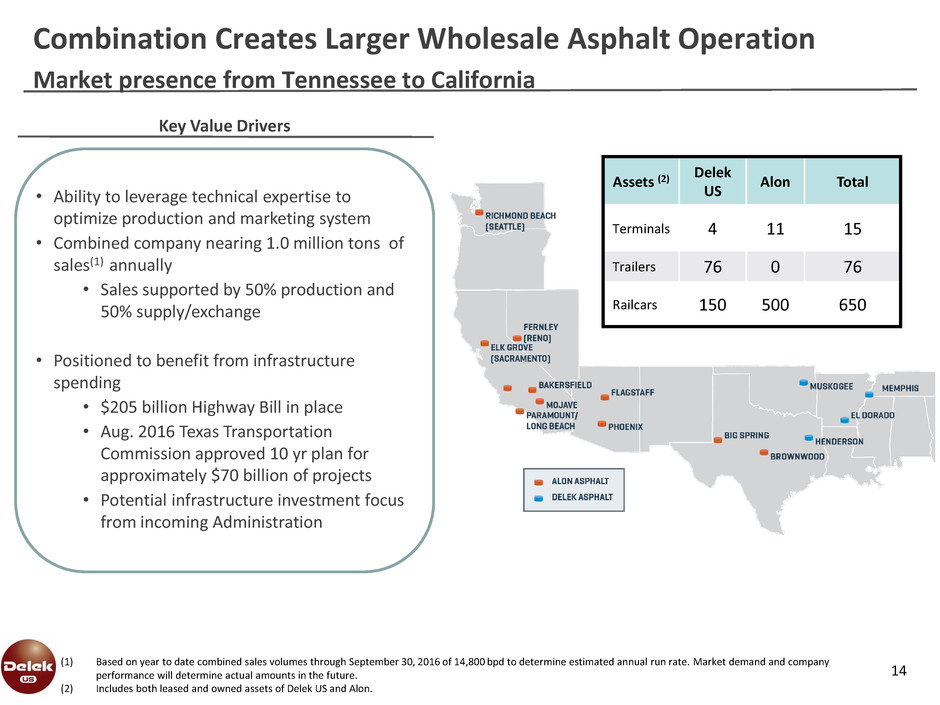

14

Combination Creates Larger Wholesale Asphalt Operation

Market presence from Tennessee to California

Key Value Drivers

• Ability to leverage technical expertise to

optimize production and marketing system

• Combined company nearing 1.0 million tons of

sales(1) annually

• Sales supported by 50% production and

50% supply/exchange

• Positioned to benefit from infrastructure

spending

• $205 billion Highway Bill in place

• Aug. 2016 Texas Transportation

Commission approved 10 yr plan for

approximately $70 billion of projects

• Potential infrastructure investment focus

from incoming Administration

(1) Based on year to date combined sales volumes through September 30, 2016 of 14,800 bpd to determine estimated annual run rate. Market demand and company

performance will determine actual amounts in the future.

(2) Includes both leased and owned assets of Delek US and Alon.

Assets (2)

Delek

US

Alon Total

Terminals 4 11 15

Trailers 76 0 76

Railcars 150 500 650

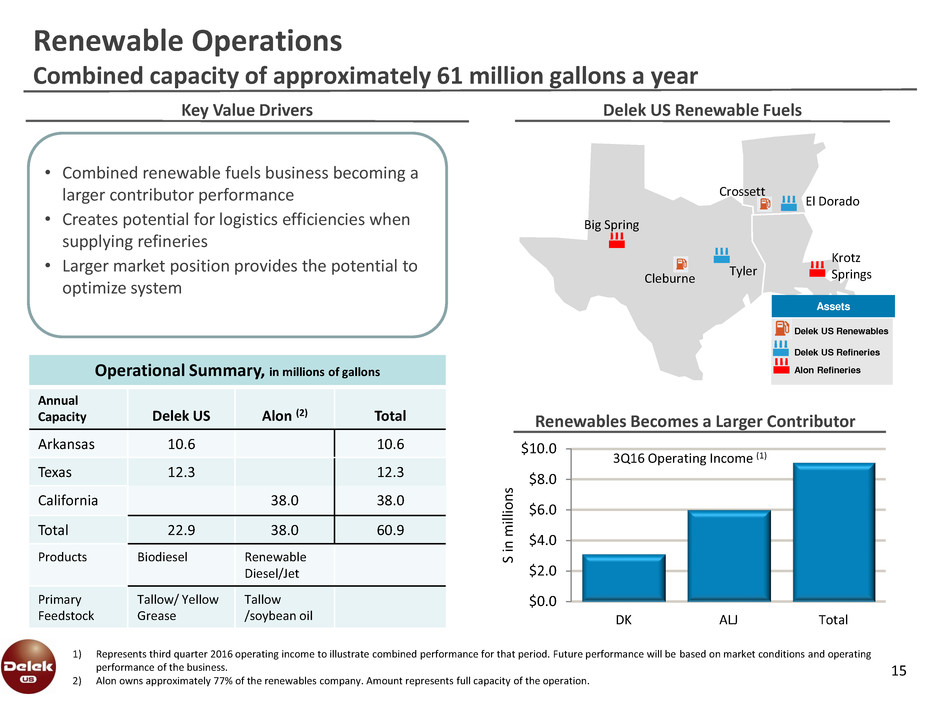

15

Renewable Operations

Combined capacity of approximately 61 million gallons a year

Key Value Drivers

• Combined renewable fuels business becoming a

larger contributor performance

• Creates potential for logistics efficiencies when

supplying refineries

• Larger market position provides the potential to

optimize system

Renewables Becomes a Larger Contributor

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

DK ALJ Total

S

in

milli

o

n

s

3Q16 Operating Income (1)

Operational Summary, in millions of gallons

Annual

Capacity Delek US Alon (2) Total

Arkansas 10.6 10.6

Texas 12.3 12.3

California 38.0 38.0

Total 22.9 38.0 60.9

Products Biodiesel Renewable

Diesel/Jet

Primary

Feedstock

Tallow/ Yellow

Grease

Tallow

/soybean oil

Big Spring

Krotz

Springs

El Dorado

Crossett

Cleburne

Tyler

Delek US Renewable Fuels

Delek US Refineries

Assets

Alon Refineries

Delek US Renewables

1) Represents third quarter 2016 operating income to illustrate combined performance for that period. Future performance will be based on market conditions and operating

performance of the business.

2) Alon owns approximately 77% of the renewables company. Amount represents full capacity of the operation.

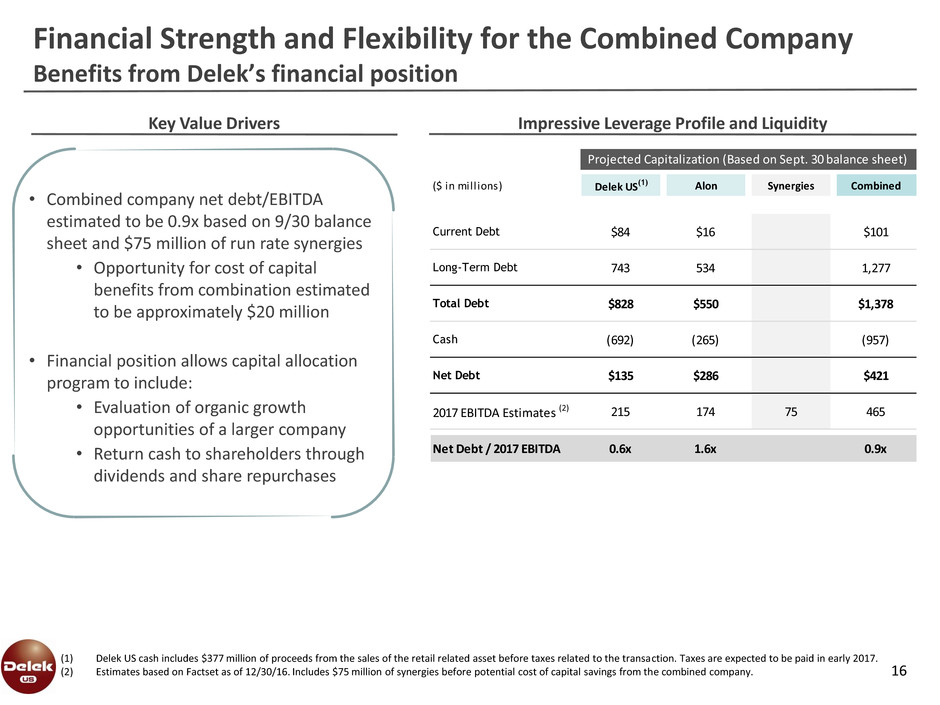

Financial Strength and Flexibility for the Combined Company

Benefits from Delek’s financial position

16

Key Value Drivers

• Combined company net debt/EBITDA

estimated to be 0.9x based on 9/30 balance

sheet and $75 million of run rate synergies

• Opportunity for cost of capital

benefits from combination estimated

to be approximately $20 million

• Financial position allows capital allocation

program to include:

• Evaluation of organic growth

opportunities of a larger company

• Return cash to shareholders through

dividends and share repurchases

(1) Delek US cash includes $377 million of proceeds from the sales of the retail related asset before taxes related to the transaction. Taxes are expected to be paid in early 2017.

(2) Estimates based on Factset as of 12/30/16. Includes $75 million of synergies before potential cost of capital savings from the combined company.

Impressive Leverage Profile and Liquidity

Projected Capitalization (Based on Sept. 30 balance sheet)

($ in mill ions) Delek US(1) Alon Synergies Combined

Current Debt $84 $16 $101

Long-Term Debt 743 534 1,277

Total Debt $828 $550 $1,378

Cash (692) (265) (957)

Net Debt $135 $286 $421

2017 EBITDA Estimates (2) 215 174 75 465

Net Debt / 2017 EBITDA 0.6x 1.6x 0.9x

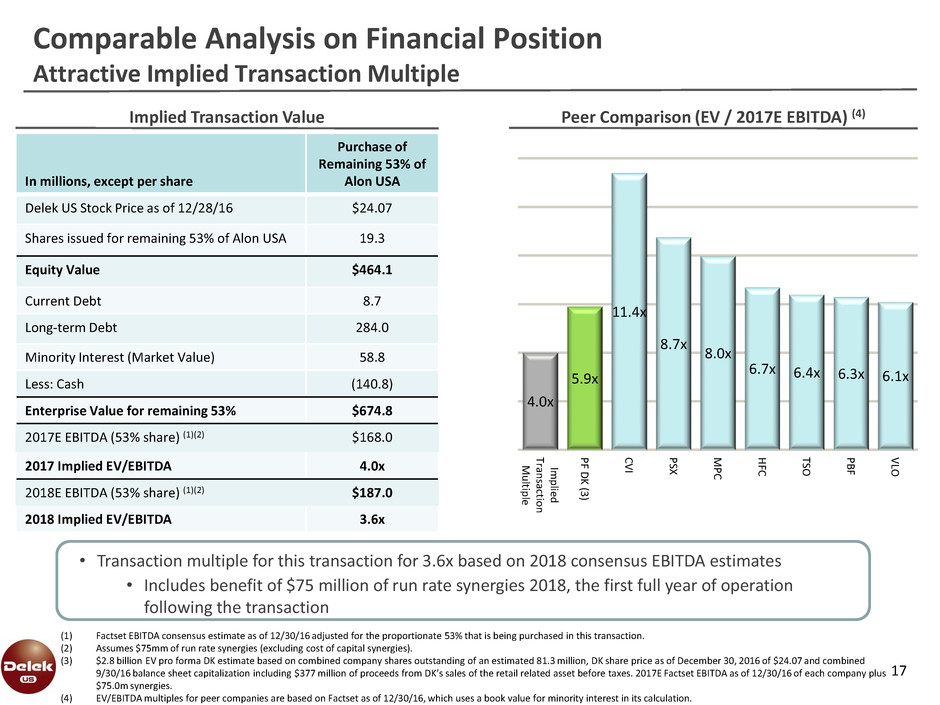

Comparable Analysis on Financial Position

Attractive Implied Transaction Multiple

17

Implied Transaction Value

(1) Factset EBITDA consensus estimate as of 12/30/16 adjusted for the proportionate 53% that is being purchased in this transaction.

(2) Assumes $75mm of run rate synergies (excluding cost of capital synergies).

(3) $2.8 billion EV pro forma DK estimate based on combined company shares outstanding of an estimated 81.3 million, DK share price as of December 30, 2016 of $24.07 and combined

9/30/16 balance sheet capitalization including $377 million of proceeds from DK’s sales of the retail related asset before taxes. 2017E Factset EBITDA as of 12/30/16 of each company plus

$75.0m synergies.

(4) EV/EBITDA multiples for peer companies are based on Factset as of 12/30/16, which uses a book value for minority interest in its calculation.

Peer Comparison (EV / 2017E EBITDA) (4)

• Transaction multiple for this transaction for 3.6x based on 2018 consensus EBITDA estimates

• Includes benefit of $75 million of run rate synergies 2018, the first full year of operation

following the transaction

4.0x

5.9x

11.4x

8.7x

8.0x

6.7x 6.4x 6.3x 6.1x

Imp

lied

Tra

n

sactio

n

M

u

ltip

le

PF

D

K

(3

)

C

V

I

PS

X

MP

C

H

FC

TSO

P

B

F

V

LO

In millions, except per share

Purchase of

Remaining 53% of

Alon USA

Delek US Stock Price as of 12/28/16 $24.07

Shares issued for remaining 53% of Alon USA 19.3

Equity Value $464.1

Current Debt 8.7

Long-term Debt 284.0

Minority Interest (Market Value) 58.8

Less: Cash (140.8)

Enterprise Value for remaining 53% $674.8

2017E EBITDA (53% share) (1)(2) $168.0

2017 Implied EV/EBITDA 4.0x

2018E EBITDA (53% share) (1)(2) $187.0

2018 Implied EV/EBITDA 3.6x

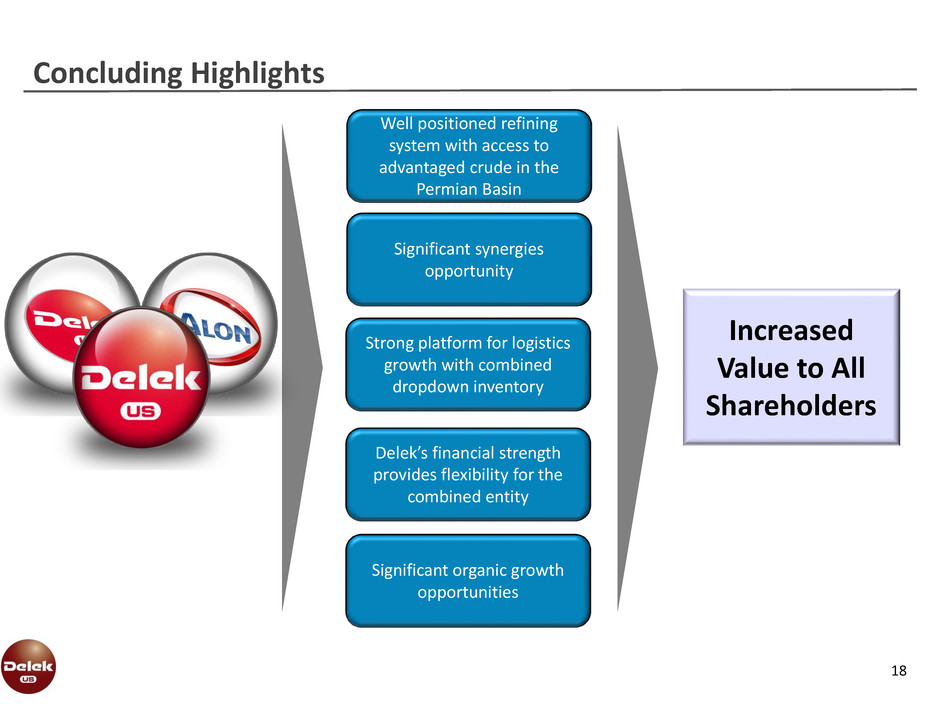

Well positioned refining

system with access to

advantaged crude in the

Permian Basin

Concluding Highlights

18

Significant synergies

opportunity

Strong platform for logistics

growth with combined

dropdown inventory

Delek’s financial strength

provides flexibility for the

combined entity

Increased

Value to All

Shareholders

Significant organic growth

opportunities

Appendix

19

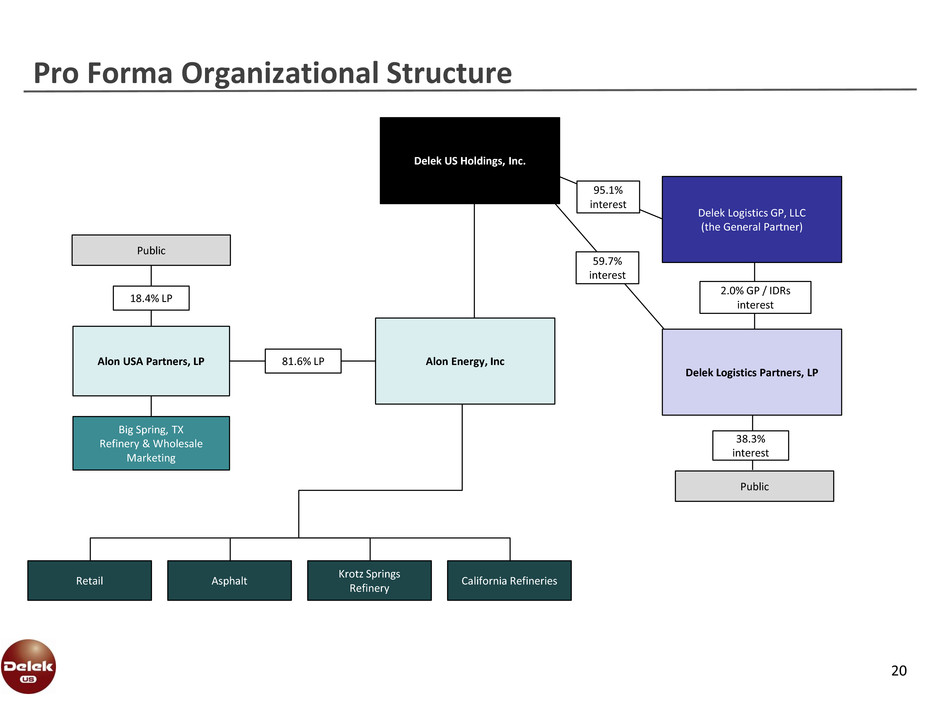

Pro Forma Organizational Structure

20

Public

Big Spring, TX

Refinery & Wholesale

Marketing

Retail Asphalt

Krotz Springs

Refinery

California Refineries

18.4% LP

81.6% LP Alon USA Partners, LP

Delek Logistics GP, LLC

(the General Partner)

Alon Energy, Inc

Delek Logistics Partners, LP

Delek US Holdings, Inc.

95.1%

interest

59.7%

interest

2.0% GP / IDRs

interest

Public

38.3%

interest

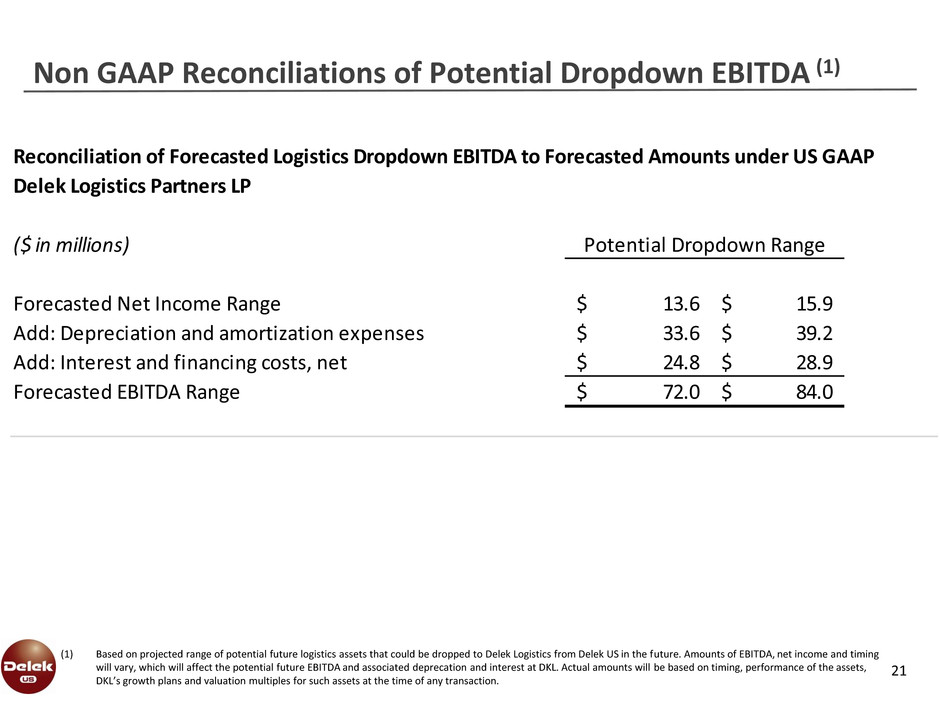

Non GAAP Reconciliations of Potential Dropdown EBITDA (1)

21

(1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing

will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets,

DKL’s growth plans and valuation multiples for such assets at the time of any transaction.

Reconciliation of Forecasted Logistics Dropdown EBITDA to Forecasted Amounts under US GAAP

Delek Logistics Partners LP

($ in millions)

Forecasted Net Income Range 13.6$ 15.9$

Add: Depreciation and amortization expenses 33.6$ 39.2$

Add: Interest and financing costs, net 24.8$ 28.9$

Forecasted EBITDA Range 72.0$ 84.0$

Potential Dropdown Range

22

Additional Information

No Offer or Solicitation

This communication relates to a proposed business combination between Delek US and Alon. This announcement is for informational purposes only

and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the

proposed transactions or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable

law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as

amended.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction between Delek US and Alon. In connection with

the proposed transaction, Delek US and/or Alon may file one or more proxy statements, registration statements, proxy statement/prospectuses or

other documents with the SEC. This communication is not a substitute for the proxy statement, registration statement, proxy statement/prospectus or

any other documents that Delek US or Alon may file with the SEC or send to stockholders in connection with the proposed transaction.

STOCKHOLDERS OF DELEK US AND ALON ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE

PROXY STATEMENT(S), REGISTRATION STATEMENT(S) AND/OR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement(s) (if and when available) will be mailed to

stockholders of Delek US and/or Alon, as applicable. Investors and security holders will be able to obtain copies of these documents, including the

proxy statement/prospectus, and other documents filed with the SEC (when available) free of charge at the SEC's website, http://www.sec.gov.

Copies of documents filed with the SEC by Delek US will be made available free of charge on Delek US’ website at http://www.delekus.com or by

contacting Delek US’ Investor Relations Department by phone at 615-435-1366. Copies of documents filed with the SEC by Alon will be made

available free of charge on Alon's website at http://www.alonusa.com or by contacting Alon's Investor Relations Department by phone at 972-367-

3808.

Participants in the Solicitation

Delek US and its directors and executive officers, and Alon and its directors and executive officers, may be deemed to be participants in the

solicitation of proxies from the holders of Delek US common stock and Alon common stock in respect of the proposed transaction. Information about

the directors and executive officers of Delek US is set forth in the proxy statement for Delek US’ 2016 Annual Meeting of Stockholders, which was

filed with the SEC on April 5, 2016, and in the other documents filed after the date thereof by Delek US with the SEC. Information about the directors

and executive officers of Alon is set forth in the proxy statement for Alon's 2016 Annual Meeting of Shareholders, which was filed with the SEC on

April 1, 2016, and in the other documents filed after the date thereof by Alon with the SEC. Investors may obtain additional information regarding the

interests of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may

obtain free copies of these documents as described in the preceding paragraph.

Investor Relations Contact:

Assi Ginzburg Keith Johnson

Chief Financial Officer Vice President of Investor Relations

615-435-1452 615-435-1366