Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Zeecol International, Inc. | v455564_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Zeecol International, Inc. | v455564_ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Zeecol International, Inc. | v455564_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ______________

Commission file number 000-53379

GREEN DRAGON WOOD PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| Florida | 26-1133266 |

|

(State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

Unit 312, 3rd Floor, New East Ocean Centre

9 Science Museum Road

Kowloon, Hong Kong

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: + (852) 2482-5168

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, par value $0.001 per share.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨ Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of September 30, 2014 was $858,000, which was computed by reference to the closing price of $0.24 on January 26, 2015.

As of June 30, 2015, there were 23,725,000 shares of common stock, par value $0.001 issued and outstanding. As of December 22, 2016 there are presently 23,725,000 shares of common stock, par value $0.001 issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

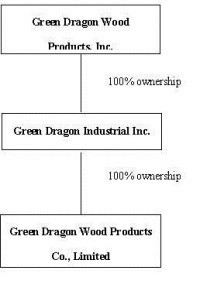

In this annual report, references to “Green Dragon,” “GDWP,” “the Company,” “we,” “our,” and “us” refer to Green Dragon Wood Products, Inc. and, unless the context otherwise implies, its wholly-owned subsidiaries, Green Dragon Industrial Inc. (“GDI”) and Green Dragon Wood Products Company Limited (“GDWPCL”).

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 3 |

| Item 1. | Business. |

Corporate History

The Company was incorporated under the laws of the State of Florida on September 26, 2007.

On September 26, 2007, GDWP entered into a share exchange transaction with the equity owners of Green Dragon Industrial Inc. (“GDI”) (formerly Fit Sum Group Limited). Pursuant to the share exchange transaction, GDI’s equity owners transferred 100% of the equity interest in GDI in exchange for 200,000 shares of common stock of the Company. Upon completion of the share exchange, GDI became a wholly-owned subsidiary of the Company, and GDWPCL, through GDI, became an indirect wholly-owned operating subsidiary of the Company.

GDWPCL was incorporated as a limited liability company in Hong Kong Special Administrative Region of the People’s Republic of China (“the PRC” or “China”) on March 14, 2000. The principal activity of GDWPCL is trading of wood logs, wood lumber, wood veneers and other wood products in Hong Kong.

GDI was incorporated as a limited liability company in the British Virgin Islands (“BVI”) on May 30, 2007, for the purpose of holding 100% equity interest in GDWPCL. On May 30, 2007, GDI entered into an exchange agreement with the equity owners of GDWPCL, whereby GDI transferred 37,500 shares of its common stock to the shareholders of GDWPCL in exchange for 5,000,000 ordinary shares of GDWPCL. Upon the completion of the share exchange, GDWPCL became a wholly-owned subsidiary of GDI.

The following diagram sets forth the current corporate structure of Green Dragon:

The Company, through its subsidiaries, mainly engages in the re-sale and trading of wood logs, wood lumber, wood veneer and other wood products in Hong Kong.

Neither GDWP nor GDI has any operations or plans to have any operations in the future other than acting as a holding company and management company for GDWPCL and raising capital for its operations. However, we reserve the right to change our operating plans regarding GDWP and GDI.

| 4 |

Our Business

Overview

Since inception, the Company has engaged in the import/export of various species of wood logs, veneers and lumber from the United States, Africa, Europe and Southern China. As a natural resource, wood is available in many different species and in anywhere in the world. We spend time researching the various species that will best fit the needs of our customers and the availability of the raw wood. Different woods have different geographical, seasonal, and cutting season variables. The decisions we make regarding these three differences are crucial to our business.

Our business is comprised of trading raw material such as logs, lumber and veneer. We collect information from our customers and their demands for specific wood products, then we will determine where the best sources are to obtain the needed wood products for our customers. Since wood has historically been susceptible to trends in interior design, as a result, the species and type of wood will change from time to time, it is necessary for us to keep abreast of the current market trends in specific wood products. As a result of the ever changing trend in demand for wood, identification of the right source of the demanded wood products by our customers, negotiation of prices and the terms of trade must be completed prior to the execution of any purchase.

The raw wood materials we import/export are used in furniture, molding, flooring, furnishings, doors, and musical instruments. We trade our products primarily to importers or distributors.

Principal Products

We import wood logs, lumber and veneer from various countries and regions, including the United States, Africa, Europe and Southern China. These imports are used in wood products such as furniture, flooring, wooden doors and musical instruments. Currently we export approximately 40% of our products to several distributors in China, with the remaining 60% exported to approximately a dozen of customers located throughout the world, including India, Italy, South Korea, Vietnam and the Middle East.

Approximately 25% of the wood products we trade are various species of logs, 60% are veneer and 15% are lumber.

The sale of our logs and lumber represents approximately 55% of our total sales. The remaining 45% of our sales are in our veneer product line. Although we import veneer from all parts of the world to China, they are primarily from North America, Africa and Europe. We also export veneer produced in China to various regions including India, Europe, the Middle East and South Korea.

When we import our wood products, we always act as the principal in the transaction. Prior to importing our wood logs and veneers, we receive a purchase order from our client. We are occasionally required by suppliers to put up deposit or advance payment for some of the purchase of highly demanded species of logs. Most of our export sales are by Letter of Credit terms and Telegraphic Transfer basis from our clients.

Due to the special relationships that have been built by our President, Mr. Kwok Leung Lee, a client may, under special circumstances, be granted different terms. This is the exception to our policy.

When the cargo is shipped and payment is made, title and responsibility for the product transfer to the client. The client may insure his shipment with the carrier or not. We will take the responsibility if the quality or shortage of volume becomes an issue. We will also take the claim to our suppliers.

Distribution of our Products

The primary delivery of our wood products is through our office location in Hong Kong. Shipping and delivery of our products to locations within geographical driving distance are via truck. Products that are shipped internationally are shipped by containers via maritime vessels.

Competition

In order to compete effectively in the wood products industry, a company must understand and respond to the needs of its customers. Many of our competitors have greater financial resources than we have, enabling them to finance and purchase in a quick fashion and in greater volume to meet their needs to address rising demands and to reap unexpected business opportunity and economic benefits. In addition, many of these companies can offer additional products and services not provided by us such as open credit terms to their customers, and more variety of wood species. Our competitors may have the luxury of sacrificing profitability in order to capture a greater portion of the market. They may also be in a position to accept lower fees than we would for the same customer. Consequently, we may encounter significant competition in our efforts to achieve our internal and external growth objectives.

| 5 |

With our limited financial capacity, we are not able to offer a great variety of species of wood products or services such as open credit and warehouse facilities to make us stand above our competition, however we have chosen to refine and enhance the availability of the number of types of wood logs, lumber and veneers that fall within our capability to import/export.

Sources and Availability of Raw Materials

While there are many suppliers of logs, lumber and veneer, weather conditions can play a major role in availability. In times of heavy rain we find that there is limited availability. However, we try to import higher volume and encourage our customers to purchase more wood product in times of good weather. At this time we do not see a critical dependence on any supplier(s) that could adversely affect our operations. Over the years we have developed good relationships with mutual trust among many of our customers and suppliers.

Since we are dealing with mostly a primary source of wood in log form in the forest, the supply of such raw material can be adversely affected by seasonal change such as winter, summer, dry and rainy season, as well as by government change of regulation such as ban on log exports. However, we are trying to tackle these risks exposures by engaging only sustainable forest sources. Our major suppliers include Westwood Logs BV which is located in the Netherlands and JAF Group which is located in Austria.

Customers

For this fiscal year we focus on three major customers, two in China and one in Middle East. While approximately 35% of our business is generated from these three distributors, these relationships are long-term and have become mutually beneficial. We have also expanded our business with India which is also in shortage of wood resource to meet its increasing demand.

Suppliers

We work with more than 30 different suppliers throughout the world. We maintain a strong relationship with our suppliers and their trust and willingness to work with us has given us a competitive edge over other companies in our industry.

For the years ended March 31, 2015 and 2014, our principal suppliers, which accounted for 26% and 34% of our purchases from China and Europe respectively.

Research and Development

During the last two fiscal years no money was spent directly on research and development.

We have, however, spent more than $80,000 for our President and other personnel to inspect wood from different suppliers and develop new sourcing in Africa, Europe, New Zealand, and for business development in China and India.

Intellectual Property

We own the domain name www.greendragonglobal.com. We do not own any patents, trademarks, licenses (other than the usual business license in Hong Kong), franchises, concessions, royalty agreements or labor contracts. In the future, our success may depend in part upon our ability to preserve our trade secrets, obtain and maintain patent protection for our technologies, products and processes, and operate without infringing upon the proprietary rights of other parties. However, we may rely on certain proprietary technologies, trade secrets, and know-how that are not patentable. Although we may take action to protect our unpatented trade secrets and our proprietary information, in part, by the use of confidentiality agreements with our employees, consultants and certain of our contractors, we cannot guaranty that:

| 6 |

(a) these agreements will not be breached;

(b) we would have adequate remedies for any breach; or

(c) our proprietary trade secrets and know-how will not otherwise become known or be independently developed or discovered by competitors.

We cannot guarantee that our actions will be sufficient to prevent imitation or duplication of our products and services by others.

Government Approval of Principal Products or Services

None of the wood products we import/export require specific governmental approval. The current regulations in Hong Kong and the People’s Republic of China do not place a burden on us. Permits may be obtained from our suppliers as needed.

Government Regulation

The import/export of our wood logs to and from the United States is subject to a number of U.S. laws, including the National Environmental Policy Act (NEPA) and the National Forest Management Act (NFMA). We are most impacted by NFMA. This act dictates that the forest service can sell timber on national forest land to private entities only under the following conditions:

| ● | They can sell timber at no less than its appraised value; |

| ● | They must advertise all sales unless extraordinary conditions exist or the appraised value is less than $10,000; |

| ● | They must provide a prospectus with detailed information to prospective buyers; |

| ● | They must ensure open and fair competition in the bidding process and eliminate collusive bidding practices; and |

| ● | They must promote orderly harvesting (usually requiring harvesting within a 3-5 year period). |

Our U.S. suppliers must comply with NFMA before any of their logs or lumber can be exported out of the United States.

Logs that are transported to Congo are subject to the appropriate tax and valid documentation must be presented. The Congo Forestry Law requires that the quota for processing is 85% local and only 15% exported. Additionally, all Congo exporters, including GDWP’s suppliers, must be registered with SGS Group, a quality control company, for inspection services.

The International Tropical Timber Agreement of 1994, signed by 58 countries, specifically governs the export of logs, sawn wood, veneer sheets and plywood. The primary objectives of this Agreement were to provide a forum for consultation, international cooperation and policy development with regard to all relevant aspects of the world timber economy and to contribute to the process of sustainable development.

The International Tropical Timber Agreement of 1994 currently does not affect our import of wood logs and veneers. Government regulation may change in the future and could place a burden on us to conform with various government agencies in various countries. Should there be a change in government regulations, we will endeavor to remain in compliance at all times.

Environmental Regulation

As an import/export company we are not directly subject to any federal, state or local environmental laws and regulations. The companies that ship us the wood and veneer that we ship to our customers do have a duty to comply with any environmental impact rules and regulations pertaining to the wood products that we import/export.

Employees

As of March 31, 2015, we have 7 regular paid full-time employees. We currently have no key employees, other than Mr. Lee, our President and Chairman of the Board, and Ms. Law, a Director. Our employees are paid regular salaries for their employment with GDWPCL.

| 7 |

We use commissioned sales/distribution representatives to sell and distribute our wood logs. These representatives are not employed by the Company and are not permitted to act on behalf of the Company without our express approval. These outside sales representatives are used only for selling our wood logs. Their commission is based on the total sale amount. We have different payment arrangements with each representative. Due to the nature of our business being based on mutual trust, we do not have any written agreements with our key sales representatives.

Our key outside sales representatives may be terminated at any time for any reason without prior notice. Conversely, our outside representatives may choose not to sell our wood logs at any time any for any reason.

Executive Offices

Our executive offices are located at Unit 312, 3rd Floor, New East Ocean Centre, 9 Science Museum Road, Kowloon, Hong Kong. Our telephone number is (011) 852-2482-5168.

| Item 1A. | Risk Factors. |

Our business, financial condition, operating results and cash flows can be affected by a number of factors, including, but not limited to, those set forth below, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results. The risks described below are not the only ones we face, but those we currently consider to be material. There may be other risks which we now consider immaterial, or which are unknown or unpredictable, with respect to our business, our competition, the regulatory environment or otherwise that could have a material adverse effect on our business.

Risks Related To Our Business

We engage in importing/exporting wood products which involves a high degree of risk.

The wood importing/exporting industry is significantly affected by changes in economic and other conditions, such as:

| ● | Geographical availability; |

| ● | Seasonal availability; |

| ● | Cutting seasons; |

| ● | The popularity of a wood species at any a given time; and |

| ● | Macroeconomic cycles. |

These factors can negatively affect the supply of, demand for and pricing of our wood products. We are also subject to a number of factors, many of which are beyond our control, including:

| ● | Delays in suppliers’ delivery of the raw materials to us; |

| ● | Changes in governmental regulations regarding the importing and exporting of our products; |

| ● | Increases in shipping costs; and |

| ● | A shortage of raw wood. |

Our dependence on a small number of key third party sales agents to distribute our products may affect our profitability.

Most of our logs and lumber are sold to importers, however, for our export sales of veneer from China we are selling more to end uses who are factories producing the fancy plywood. Our profitability might be negatively affected if our present relationships with our key sales agents or customers were disrupted or became unstable.

| 8 |

We are dependent on the furniture and construction industries; lower than expected growth or a downturn in demand for our products in those industries could adversely affect our results of operations.

The sales of our products are dependent to a significant degree on the level of activity in the furniture manufacturing and construction industries. Because of the cyclical demand for our products, we may have short or long-term overcapacity. A decreased demand for wood products may result in an inability to maximize our resources. Furthermore, it is possible that our expected growth in demand from companies in the furniture manufacturing and construction industries may not occur. The demand for such products can be adversely affected by several factors, including decreases in the level of new residential construction activity, which is subject to changes in economic conditions; increases in interest rates; decreases in population; and other factors. Additionally, weakness in the economies of countries in which we sell our products, as well as any downturn or continuation of current downturns in these economies, are likely to have a material adverse effect on the construction, home building, and remodeling industries, as well as on the demand for furniture items manufactured by our third party mill with our wood logs, lumber and veneers.

Our dependence, to a large extent, on maritime transport may affect our ability to deliver products to our offshore markets.

We are highly dependent on maritime means to transport products to our offshore markets. Space on international maritime shipping vessels is limited and difficult to secure sometimes. We have at times experienced difficulty in arranging shipping to our export markets. We may not be able to secure in the future adequate container space on ships that deliver our products to our offshore markets. We have no control over established marine shipping routes and the present routes that transport ships use may not continue to be used by maritime transport services. Increases in fuel prices may also increase our shipping costs. In addition, the products we transport may not reach our markets in marketable condition. Moreover, strict security measures regarding maritime transport may be implemented in the future and may increase the cost of shipping our products. These challenges to the maritime transport of our products to our offshore markets could cause an adverse effect on our profitability.

We may face significant competition in the markets in which we sell our products, which could adversely affect both our share of those markets as well as the price at which we sell our products.

Currently, we face strong competition from competitors in all of the countries and regions in which we operate. In the case of our wood products, we face competition from foreign competitors in other regions of the world, such as West Africa and China. In the future we may face increased competition in other countries in which we operate from domestic or foreign competitors, some of which may have greater financial resources than we do. In addition, we may face increased competition as a result of existing competitors increasing their production capacity. An increase in competition in the wood market or other value added wood products markets could adversely affect both our share of those markets and the price at which we are able to sell our products.

We depend on free international trade and the absence of import and export restrictions in our principal markets.

Our ability to compete effectively in our principal markets could be materially and adversely affected by a number of factors relating to government regulation of trade. Exchange rate manipulation, subsidies or the imposition of increased tariffs, or other trade barriers could materially affect our ability to move raw materials and/or finished products across national borders. If our ability to have our third party mill make, transport, or sell our products competitively in one or more of our principal export markets became impaired by any of these developments, it could be difficult for us to re-allocate our products to other markets on equally favorable terms. Thus, our business, financial condition, and results of operations could be adversely affected.

Some of our key products, such as wood veneer, may be subject to price volatility, and prolonged or severe weakness in the markets for wood veneer could adversely affect our financial condition and results of operations.

Wood veneer is a globally traded commodity product and is subject to competition from manufacturers worldwide. We, like other participants in the industry, have limited influence over the timing and extent of price changes for wood veneer. Product pricing is significantly affected by the relationship between supply and demand in the primary raw material industry. Demand is also subject to fluctuations due to changes in economic conditions, interest rates, population growth, weather conditions, and other factors. We are not able to predict with certainty market conditions and selling prices for our products and prices for wood veneer may decline from current levels. A prolonged and severe weakness in the markets for wood veneer could adversely affect our financial condition and results of operations.

The majority of raw wood materials used to produce our wood products are supplied by outside mills and companies.

We procure the majority of the raw wood materials that we use in our products from unaffiliated companies in West Africa, United States, Europe and Southern China in accordance with long standing relationships between us and the suppliers. We may not be able to maintain these relationships and continue to secure the raw materials to have our contracted manufacturers produce our products. In addition, the prices we pay for raw materials may increase as a result of higher fuel costs paid by our suppliers. An inability to secure the raw materials used in the production of our wood products or to transport such materials in a cost-effective manner could have an adverse effect on our operations.

| 9 |

We may not be able to maintain present favorable tax treatment or exemptions from certain tax payments in certain jurisdictions in which we operate.

One driving force behind some of our efforts has been the goal of achieving more favorable tax treatment in certain jurisdictions in which we operate. It is possible that local governments in certain municipalities may levy higher taxes on us or our products in the future. In addition, we may not be able to maintain important exemptions from certain tax regimes in the various jurisdictions in which we operate. Unfavorable tax treatment of our company in the future or an increase in the taxes levied on us may cause an adverse effect on our results of operations.

Adverse climate conditions, wind storms, fires, disease, pests, and other natural threats could adversely affect forests.

Forests that produce our wood are subject to a number of naturally occurring threats such as adverse climate conditions, wind, fire, disease and other pests. Damage caused by strong windstorms, such as uprooting and stems breakage, is considered by management to be a major natural risk to the forests that produce our wood. Fire is a risk to all forests and our warehouses and operations. Accumulation of combustible raw materials and possible deficiencies in our preparation for fires could cause fire hazards and no preventative measures can provide assurance that fires will not occur. We may experience fire in the future and such a fire may materially adversely affect us. Disease and pests are another risk to forests and plantations. Disease or pests may have a material adverse effect on forests and plantations in the future. Other risks to forests that produce our wood include, but are not limited to, losses caused by earthquakes, floods, and other non-man-made catastrophic events.

Energy shortages and increased energy costs could adversely affect our business.

Any shortage of energy could cause disruptions in our manufacturers operations as well as our operations. Higher electricity costs or disruptions in the supply of electricity or natural gas could adversely affect our financial condition and results of operations.

A downturn in the Chinese economy may adversely affect us.

We sell a large part of our products to China, and accordingly, the results of our operations and financial condition are sensitive to and dependent upon the level of economic activity in China. China's recent rates of gross domestic product growth may not continue in the future, and future developments in or affecting the Chinese economy could impair our ability to proceed with our business plan or materially adversely affect our business, financial condition, or results of operations.

We currently rely on two customers for a majority of our revenue.

We currently rely on 2 customers for approximately 34% and 60% of our revenue for the fiscal year ended March 31, 2015 and 2014, respectively. Any disruption in the relationships between us and these clients would adversely affect our business. In the event of any disruption and loss of business from one or both of these clients, purchasers of our stock would be at risk to lose most or all of their investment.

GDWPCL’s failure to compete effectively may adversely affect our ability to generate revenue.

Through GDWPCL, we compete in a highly developed market with companies that have significantly greater experience and history in our industry. If we do not compete effectively, we could lose market share and experience falling prices, adversely affecting our financial results. Our competitors will expand in the key markets and implement new technologies making them more competitive. There is also the possibility that competitors will be able to offer additional products, services, lower prices, or other incentives that we cannot or will not. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

We may not be able to effectively control and manage the growth of GDWPCL.

If GDWPCL’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on existing management, workforce and facilities. Failure to satisfy such increased demands and administrative inefficiencies could interrupt or adversely affect our operations and cause delay in delivery of our wood products.

| 10 |

We may require additional financing in the future and a failure to obtain such required financing will inhibit our ability to grow.

The continued growth of our business requires additional funding, unfortunately we have not any success in the private placement to raise the fund we needed to expand our business and therefore our business growth will be somewhat affected in this regards but we will try our outmost to overcome the shortage of funding by trying to streamline our cash flow management.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of our business more difficult because the lender's consent could be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

We, through our subsidiaries GDI or GDWPCL, may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We, through our subsidiaries GDI or GDWPCL, may review acquisition and strategic investment prospects that we believe would complement the current product offerings of GDWPCL, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time we review investments in new businesses and we, through our subsidiaries, GDI or GDWPCL, expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor. In the event of any future acquisitions, we could:

| ● | issue equity securities which would dilute current stockholders’ percentage ownership; |

| ● | incur substantial debt; |

| ● | assume contingent liabilities; or |

| ● | expend significant cash. |

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if through our subsidiaries GDI or GDWPCL, we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

| ● | difficulties in the assimilation of acquired operations, technologies and/or products; |

| ● | unanticipated costs associated with the acquisition or investment transaction; |

| ● | the diversion of management’s attention from other business concerns; |

| ● | adverse effects on existing business relationships with suppliers and customers; |

| ● | risks associated with entering markets in which GDWPCL has no or limited prior experience; |

| ● | the potential loss of key employees of acquired organizations; and |

| ● | substantial charges for the amortization of certain purchased intangible assets, deferred stock compensation or similar items. |

| 11 |

We cannot ensure that we will be able to successfully integrate any businesses, products, technology, or personnel that we might acquire in the future and our failure to do so could have a material adverse effect on our and/or GDWPCL’s business, operating results and financial condition.

We are responsible for the indemnification of our officers and directors.

Our Articles of Incorporation provides for the indemnification and/or exculpation of our directors, officers, employees, agents and other entities which deal with it to the maximum extent provided, and under the terms provided, by the laws and decisions of the courts of the state of Florida. Since we do not hold any indemnification insurance, these indemnification provisions could result in substantial expenditures, which we may be unable to recoup, which could adversely affect our business and financial conditions. Kwok Leung Lee, our President and Chairman of the Board, and Mei-Ling Law, our director, are key personnel with rights to indemnification under our Articles of Incorporation.

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal control over financial reporting. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis .

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and operational expertise of key personnel. Kwok Leung Lee, our President, and Mei-Ling Law, one of our directors, perform key functions in the operation of our business.

In addition, to execute our growth plan, we must attract and retain highly qualified personnel. Competition for these employees is intense, and we may not be successful in attracting and retaining qualified personnel. We could also experience difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have. If we fail to attract new personnel, or fail to retain and motivate our current personnel, our business and future growth prospects could be severely harmed.

We may not be able to hire and retain qualified personnel to support our growth and if we are unable to retain or hire these personnel in the future, our ability to improve our products and implement our business objectives could be adversely affected.

Competition for senior management and senior personnel in Hong Kong is intense, the pool of qualified candidates in the Hong Kong is very limited, and we may not be able to retain the services of our senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition.

| 12 |

Our operating results may fluctuate as a result of factors beyond our control.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond our control. These factors include:

| ● | the costs of wood products; |

| ● | seasonality or effect of natural disasters on the availability of our raw materials; |

| ● | the relative speed and success with which we can obtain and maintain customers, merchants and vendors for our products; |

| ● | capital expenditure for equipment; |

| ● | marketing and promotional activities and other costs; |

| ● | changes in our pricing policies, suppliers and competitors; |

| ● | the ability of our suppliers to provide products in a timely manner to their customers; |

| ● | changes in operating expenses; |

| ● | increased competition in the import/export markets; and |

| ● | other general economic and seasonal factors. |

Risks Related To Doing Business in The PRC

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Due to our significant business in Southern China, our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

| 13 |

A slowdown, inflation or other adverse developments in the PRC economy may harm our customers and the demand for our services and products.

A significant amount of our operations and sales are conducted or generated in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. A slowdown in overall economic growth, an economic downturn, a recession or other adverse economic developments in the PRC could significantly reduce the demand for our products and harm our business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may harm our profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth.

Because our principal assets are located outside of the United States and most of our directors and all of our officers reside outside of the United States, it may be difficult for you to enforce your rights based on U.S. federal securities laws against us and our officers or to enforce U.S. court judgment against us or them in Hong Kong.

Most of our directors and all of our officers reside outside of the United States. In addition, our operating company is located in Hong Kong and substantially all of our assets are located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or Hong Kong and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in Hong Kong courts. Further, it is unclear if extradition treaties now in effect between the United States and Hong Kong would permit effective enforcement against us or our officers and directors of criminal penalties, under the U.S. Federal securities laws or otherwise.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. The individuals who now constitute our senior management have not previously had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

RISKS RELATED TO OUR COMMON STOCK

Our officers and directors control us through their positions and stock ownership and their interests may differ from other stockholders.

As of July 8, 2014, there were 23,725,000 shares of our common stock issued and outstanding. Our officers and directors beneficially own approximately 85% of our common stock. Mr. Kwok Leung Lee, our President, beneficially owns approximately 60% of our common stock. As a result, he is able to influence the outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions including business combinations. Yet Mr. Lee’s interests may differ from those of other stockholders. Furthermore, ownership of 85% of our common stock by our officers and directors reduces the public float and liquidity, and may affect the market price, of our common stock as quoted on the middle tier of the OTC Markets Group, Inc., or OTCQB.

We are not likely to pay cash dividends in the foreseeable future.

We intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions.

| 14 |

Investors may have difficulty liquidating their investment because our common stock is subject to the "penny stock" rules, which require delivery of a schedule explaining the penny stock market and the associated risks before any sale.

Our common stock may be subject to regulations prescribed by the SEC relating to "penny stocks." The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price (as defined in such regulations) of less than $5 per share, subject to certain exceptions. These regulations impose additional sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 and individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 (individually) or $300,000 (jointly with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of these securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Legal remedies, which may be available to the investor, are as follows:

| ● | If penny stocks are sold in violation of the investor's rights listed above, or other federal or state securities laws, the investor may be able to cancel his purchase and get his money back. |

| ● | If the stocks are sold in a fraudulent manner, the investor may be able to sue the persons and firms that caused the fraud for damages. |

| ● | If the investor has signed an arbitration agreement, however, s/he may have to pursue a claim through arbitration. |

If the person purchasing the securities is someone other than an accredited investor or an established customer of the broker-dealer, the broker-dealer must also approve the potential customer's account by obtaining information concerning the customer's financial situation, investment experience and investment objectives. The broker-dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the SEC's rules may limit the number of potential purchasers of the shares of our common stock and stockholders may have difficulty selling their securities.

A large number of shares may be eligible for future sale and may depress our stock price.

We may be required, under terms of future financing arrangements, to offer a large number of common shares to the public, or to register for sale by future private investors a large number of shares sold in private sales to them.

Sales of substantial amounts of common stock, or a perception that such sales could occur, and the existence of options or warrants to purchase shares of common stock at prices that may be below the then-current market price of our common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities, either of which would decrease the value of any earlier investment in our common stock.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

Our principal business location is at Unit 312, 3rd Floor, New East Ocean Centre, 9 Science Museum Road, Kowloon, Hong Kong. We own our furniture, computers, ancillary equipment, and office supplies. We occupy approximately 1,296 square feet under a two-year lease, expiring in February 2017 that costs $32,400 Hong Kong dollars or approximately $4,181 USD per month. At the present time we do not have a showroom for our customers.

We do not own or lease any warehouse space. In the event we have an overstock of wood logs or veneers, we rent space on a daily basis from one of our distributors. This allows us to avoid long term contracts that are expensive for the short term needs that occur for requisite storage of our products when we are overstocked. Because overstocking occurs on an irregular basis, management believes that the daily rental fees paid are in the best financial interests of the Company.

| 15 |

| Item 3 . | Legal Proceedings. |

On February 12, 2009, a claim was filed by Chi Yim Yip, Roger (“Mr. Yip”) and Characters Capital Group Limited (“CCGL”) against Mr. Kwok Leung Lee (“Mr. Lee”), a director of the Company, and GDWPCL alleging (i) breach of contract by GDWP concerning the engagement of CCGL to assist GDWPCL in securing GDWP’s listing on the OTC Bulletin Board and (ii) defamation by Mr. Lee related to the contract dispute. Damages being sought include $31,287 in liquidated damages from GDWPCL, aggravated/exemplary damages and injunction from further defamation. The claim was filed with the High Court of the Hong Kong Special Administrative Region, Court of First Instance.

On April 9, 2009, Mr. Lee and GDWPCL filed a Defense and Counterclaim. GDWPCL asserted a breach of contract claim against CCGL, alleging that CCGL failed to fulfill its obligations pursuant to the CCGL agreement to effect the listing of GDWP through a reverse merger by the use of a company that was listed on the Pink Sheets. Mr. Lee additionally asserted a breach of contract claim against Mr.Yip for the Stock Purchase Agreement dated March 31, 2007, for failing to deliver a shell company, Tabatha V, Inc., that was listed on the Pink Sheets, which, pursuant to the Stock Purchase Agreement, was to be purchased by Mr. Lee. Both Mr. Lee and GDWPCL also claimed damages for fraudulent misrepresentation related to the failure to deliver the Pink Sheet shell company. On May 22, 2009, Mr.Yip and CCGL replied to the counterclaim.

On January 26, 2011, the High Court of the Hong Kong Special Administrative Region granted leave to Mr. Yip and CCGL to set the case down for a 7-day trial. The hearing occurred in October 2012 and the parties are waiting for the judgment of the court. At March 31, 2014, in the opinion of Company management, the resolution of this matter will not have a material effect on the Company’s financial statements in the foreseeable future.

On March 17, 2014, Paul Stamper (“Plaintiff”) filed a complaint (the “Complaint”) against, among other parties, GDWPCL, in the Hendricks Superior Court located in Hendricks County in the State of Indiana, Case No. 32D05-1403-MI-70, seeking, among other things, enforcement of a judgment entered into against all defendants on December 8, 2011 in Wabash County Circuit Court, Case No. 85C01-1112-MI-1013, in the aggregate principal amount of $42,697.14 plus interest and costs (the “Judgment”). The Company, its officers and directors deny the material allegations of the Complaint since the Company does not conduct business in the State of Indiana and intend to vigorously defend itself in this action. As of March 31, 2015, in the opinion of Company management, the resolution of this matter will not have a material effect on the Company’s financial statements in the foreseeable future.

Other than as disclosed above, we know of no material, active, pending or threatened proceeding against us or our subsidiaries, nor are we, or any subsidiary, involved as a plaintiff or defendant in any material proceeding or pending litigation.

| Item 4. | Mine Safety Disclosures. |

Not Applicable.

| 16 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

There is no established public trading market for our securities and a regular trading market may not develop or, if developed, may not be sustained. We have no plans, proposals, arrangements or understandings with any person with regard to the development of a trading market in any of our securities. Our securities are currently qualified for quotation on the middle tier of the OTC Markets, Inc., or OTCQB, under the symbol “GDWP”, but are unpriced and have not traded.

As of June 30, 2015, we had approximately 33 shareholders of record of our common stock, including the shares held in street name by brokerage firms. And as of December 22, 2016, we had approximately 34 shareholders of record of our common stock, including the shares held in street name by brokerage firms

Penny Stock Regulations

The SEC has adopted regulations which generally define "penny stock" to be an equity security that has a market price of less than $5.00 per share. Our common stock, falls within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the "penny stock" rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

Dividends

Cash dividends have not been paid during the fiscal years ended March 31, 2015 and 2014. In the near future, we intend to retain any earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. The declaration and payment of cash dividends by us are subject to the discretion of our board of directors. Any future determination to pay cash dividends will depend on our results of operations, financial condition, capital requirements, contractual restrictions and other factors deemed relevant at the time by the board of directors. We are not currently subject to any contractual arrangements that restrict our ability to pay cash dividends.

Recent Sales of Unregistered Securities

We did not sell any unregistered securities during the fiscal year ended March 31, 2015.

Equity Compensation Plan Information

The table set forth below provides information as of March 31, 2015 with respect to shares of common stock that may be issued under the Company’s existing equity plans. For additional information, see “Item 11 – Executive Compensation”.

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights in US Dollars | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 3,525,000 | - | 475,000 | |||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | 3,525,000 | $ | - | 475,000 | ||||||||

| 17 |

Issuer Purchases of Equity Securities.

None.

| Item 6 . | Selected Financial Data. |

Not applicable.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Cautionary Note Regarding Forward-Looking Statements

We make certain forward-looking statements in this report. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings), demand for our services, and other statements of our plans, beliefs, or expectations, including the statements contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” as well as captions elsewhere in this document, are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can”, “could,” “may,” “should,” “will,” “would,” and similar expressions. The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. You are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC should be considered in evaluating forward-looking statements.

The nature of our business makes predicting the future trends of our revenue, expenses, and net income difficult. Thus, our ability to predict results or the actual effect of our future plans or strategies is inherently uncertain. The risks and uncertainties involved in our business could affect the matters referred to in any forward-looking statements and it is possible that our actual results may differ materially from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, without limitation, the following:

| · | the effect of political, economic, and market conditions and geopolitical events; |

| · | legislative and regulatory changes that affect our business; |

| · | the availability of funds and working capital; |

| · | the actions and initiatives of current and potential competitors; |

| · | investor sentiment; and |

| · | our reputation. |

We do not undertake any responsibility to publicly release any revisions to these forward-looking statements to take into account events or circumstances that occur after the date of this report, except as required by law.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto as filed with the SEC and other financial information contained elsewhere in this report.

Except as otherwise indicated by the context, references in this Form 10-Q to “we,” “us,” “our,” “the Registrant”, “Green Dragon”, “our Company,” or “the Company” are to Green Dragon Wood Products, Inc., a Florida corporation and its consolidated subsidiaries. Unless the context otherwise requires, all references to (i) “BVI” are to British Virgin Islands; (ii) “PRC” and “China” are to the People’s Republic of China; (iii) “U.S. dollar,” “$” and “US$” are to United States dollars; (iv) “RMB” are to Yuan Renminbi of China; (v) “Securities Act” are to the Securities Act of 1933, as amended; and (vi) “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

| 18 |

Critical Accounting Policies and Estimates

Our consolidated financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ("US GAAP"). US GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expenses amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of consolidated our financial statements.

We believe the following is among the most critical accounting policies that impact our consolidated financial statements. We suggest that our significant accounting policies, as described in our consolidated financial statements in the Summary of Significant Accounting Policies, be read in conjunction with this Management's Discussion and Analysis of Financial Condition and Results of Operations.

Accounts receivable and allowance for doubtful accounts

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 60 to 180 days from shipment. The Company extends unsecured credit to its customers in the ordinary course of business, based on evaluation of a customer's financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 180 days and those over a specified amount are reviewed individually for collectability. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

The credit terms of our two major customers are summarized as below:

| Major Customers | Contractual Credit Term | Repayment Term # | ||

| Customer A | 60 to 90 days | Accounts receivable are repaid on a regular basis to the Company and the cash receipt is made to Customer B upon the instruction of the Company. | ||

| Customer B (also a major supplier) | 90 to 180 days | Customer B receives the cash settlement from Customer A and the aggregate receivable will offset against its trade payable. |

In March 2010, the Company entered into a tri-parties settlement arrangement among Customer A and Customer B. Under such arrangement, Customer A agreed to transfer its accounts receivable balance to Customer B and Customer B agreed to receive such accounts receivable balance from Customer A, on behalf of the Company, to offset against its trade payable due to the Company.

Accounting Standard Codification ("ASC") Topic 605

We recognize revenue in accordance with ASC Topic 605, “Revenue Recognition” when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collectability is reasonably assured.

The majority of the Company's revenue results from sales contracts with direct customers and revenues are generated upon the shipment of goods. The Company's pricing structure is fixed and there are no rebate or discount programs. Management conducts credit background checks for new customers as a means to reduce the subjectivity of assuring collectability. Based on these factors, the Company believes that it can apply the provisions of ASC Topic 605 with minimal subjectivity.

| 19 |

Results of Operations

For the Year Ended March 31, 2015 as Compared to the Year Ended March 31, 2014

The following table summarizes the results of our operations during the years ended March 31, 2015 and 2014, and provides information regarding the dollar and percentage increase or (decrease) from the year ended March 31, 2015 to the year ended March 31, 2014.

| Year Ended | ||||||||||||||||

| March 31, | $Increase/ | %Increase/ | ||||||||||||||

| 2015 | 2014 | (Decrease) | (Decrease) | |||||||||||||

| Revenue, net | $ | 10,451,225 | $ | 9,296,384 | $ | 1,154,841 | 12 | % | ||||||||

| Cost of Revenue | (9,540,987 | ) | (8,586,820 | ) | 954,167 | 11 | % | |||||||||

| Gross Profit | 910,238 | 709,564 | 200,674 | 28 | % | |||||||||||

| General and Administrative Expenses | 977,808 | 923,799 | 54,009 | 6 | % | |||||||||||

| Total Operating Expenses | 977,808 | 923,799 | 54,009 | 6 | % | |||||||||||

| Loss from Operations | (67,570 | ) | (214,235 | ) | 146,665 | (68 | )% | |||||||||

| Other Income / (Expense) | 4,885 | (196,012 | ) | 200,897 | (102 | )% | ||||||||||

| Loss before Income Tax | (62,685 | ) | (410,247 | ) | 347,562 | (85 | )% | |||||||||

| Income Tax Expense | - | (9,104 | ) | 9,104 | (100 | )% | ||||||||||

| Net Loss | $ | (62,685 | ) | $ | (419,351 | ) | $ | 356,666 | (85 | )% | ||||||

Revenue

Revenue for the year ended March 31, 2015 was $10,451,225, an increase of $1,154,841 or 12% from $9,296,384 for the comparable period in 2014. This increase was primarily attributable to the increase of European logs trading to China.

Cost of revenue and gross profit

Cost of revenue for the year ended March 31, 2015 was $9,540,987, an increase of $954,167 or 11% from $8,586,820 for the comparable period in 2014. This increase was primarily attributable to an increase in sales of European logs.

Gross profit for the year ended March 31, 2015 was $910,238, an increase of $200,674 or 28% from $709,564 for the comparable period in 2014. This increase was primarily attributable to an increase in revenue. The gross profit margin for the year ended March 31, 2015 increased to 8.7% from 7.6% for the comparable period in 2014. The increase was primarily attributable to increase in sales of higher profit margin products such as more special veneer sales like ebony, walnut to India.

General and Administrative

General and administrative expenses for the year ended March 31, 2015 was $977,808, an increase of $54,009 or 6% from $923,799 for the comparable period in 2014. This increase was primarily attributable to increase of marketing development fee of $44,100.

Other Income/(Expense)

Other income for the year ended March 31, 2015 was $4,885, an increase $200,897 in other income or around 18 times from other expense of $196,012 for the comparable period in 2014. The increase in income was primarily attributable to gain in foreign exchange currency.

| 20 |

Loss before income tax

Loss before income tax for the year ended March 31, 2015 was $62,685, a decrease in loss of $347,562 or around 85% from $410,247 for the comparable year in 2014. The decrease in loss was due to an increase in sales to cover the general and administrative expenses.

Net loss

Net loss for the year ended March 31, 2015 was $62,685, a decrease in loss of $356,666 or around 85% from loss of $419,351 for the comparable period in 2014. This decrease loss was due primarily to the increase from other income.

Liquidity and Capital Resources

Cash and Cash Equivalents

Our cash and cash equivalents as at the year ended March 31, 2015 was $101,506, an increase of $66,909 or 2 times compared of $34,597 for the comparable year in 2014. The increase was primarily attributable to increase in accrued liabilities and other payables.

Net cash provided by / (used in) operating activities

Net cash provided by operating activities for the year ended 31, 2015 was $88,613, an increase in cash inflow of $1,572,646 set off by cash used in operating activities of $1,484,033 for the comparable period in 2014. The increase was primarily attributable a decrease in cash outflow of $705,246 in accounts receivable and $621,673 in accounts payable.

Net cash (used in) / provided by investing activities

Net cash outflow used in investing activities was $7,752 and inflow provided by investing activities was $1,060,928 for the year ended March 31, 2015 and 2014, respectively. The decrease was primarily attributable to $393,362 in proceeds from the disposal of available-for-sales securities and $667,630 in proceeds from the surrender of key man life insurance.

Net cash (used in) /provided by financing activities

Net cash used in financing activities for the year ended March 31, 2015 was $4,260, a decrease in cash outflow of $107,300 or 104% from cash provided by financing activities of $103,040 for the comparable period in 2014. The decrease in cash used in financing activities was primarily attributable to change in restricted cash.

Non-cash transaction

In March 2010, the Company entered into a tri-partite settlement arrangement among two major customers, Customer A and Party B. Under such arrangement, Customer A agreed to transfer its accounts receivable balance to Party B and Party B agreed to receive such accounts receivable balance from Customer A, on behalf of the Company, to offset against its trade payable due to the Company.

Pursuant to the terms of the Tri-parties Settlement Arrangement among Customer A, Party B and us;

| 1. | Customer A agrees to make cash payments directly to the designated bank accounts of Party B, per our monthly instruction; |

| 2. | We and Party B agree to offset the cash proceeds against the accounts payable which we owe to Party B, and; |

| 3. | In any event if Party B is not reimbursed by Customer A, we are responsible to chase Customer A for the settlement under obligation among the sales contracts. Meanwhile, we are legally liable to repay the accounts payable to Party B under the purchase contract. |

Under this arrangement, we can assure the collection from Customer A to meet with the purchase payable due to Party B on a timely basis. We also can reduce the time and costs to handle the fund remittance among Customer A, Party B and ourselves. As we continue to make the purchase orders to Party B, the accounts receivable originally due from Customer A will be gradually eliminated and offset by our future accounts payable due to Party B.

| 21 |

We have developed a prolonged business relationship with Party B in the sale and purchase of wood veneer and related products over 10 years. In the normal course of business, Party B is acting as a “customer” or a “vendor”, who generally sells and buys different types of wood products to and from us on an arm-length basis. These sale and purchases transactions are independent.

We expect to sustain and continue this prolonged business relationship with Party B, because;