Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d296619d8k.htm |

Goldman Sachs U.S. Financial Services Conference 2016 December 7, 2016 Andy Cecere, President and COO Terry Dolan, Vice Chairman and CFO Exhibit 99.1

Forward-looking statements and additional information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic recovery or another severe contraction could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and lead to a tightening of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, U.S. Bancorp’s business and financial performance is likely to be negatively impacted by recently enacted and future legislation and regulation. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions (which could result, in part, from the United Kingdom’s withdrawal from the European Union); changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2015, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, including the Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

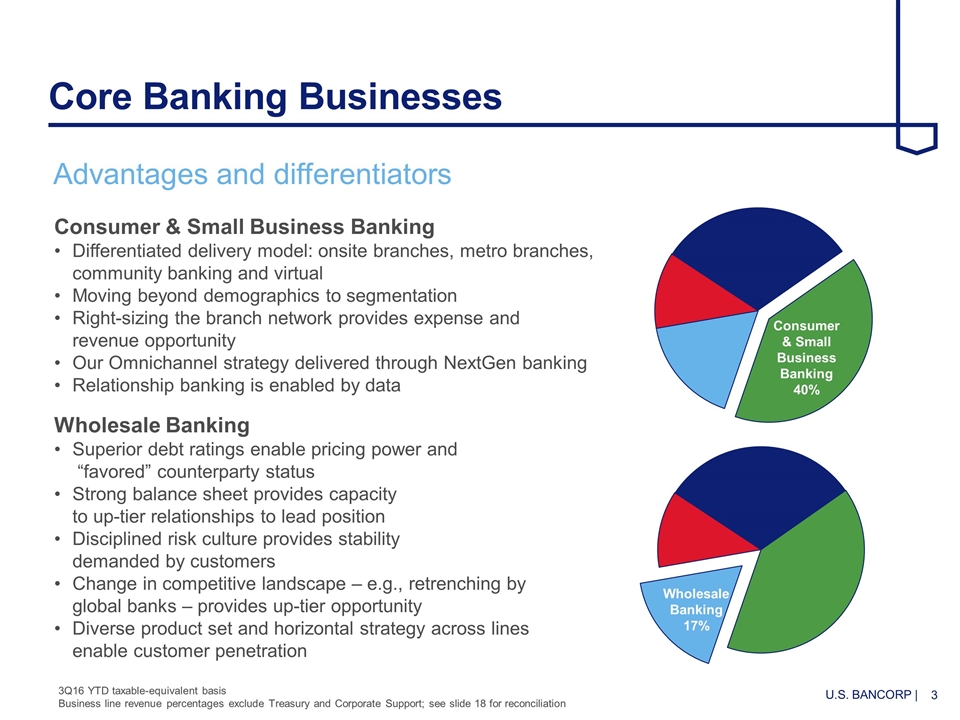

Core Banking Businesses Consumer & Small Business Banking Differentiated delivery model: onsite branches, metro branches, community banking and virtual Moving beyond demographics to segmentation Right-sizing the branch network provides expense and revenue opportunity Our Omnichannel strategy delivered through NextGen banking Relationship banking is enabled by data Wholesale Banking Superior debt ratings enable pricing power and “favored” counterparty status Strong balance sheet provides capacity to up-tier relationships to lead position Disciplined risk culture provides stability demanded by customers Change in competitive landscape – e.g., retrenching by global banks – provides up-tier opportunity Diverse product set and horizontal strategy across lines enable customer penetration Advantages and differentiators Consumer & Small Business Banking 40% 3Q16 YTD taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support; see slide 18 for reconciliation Wholesale Banking 17%

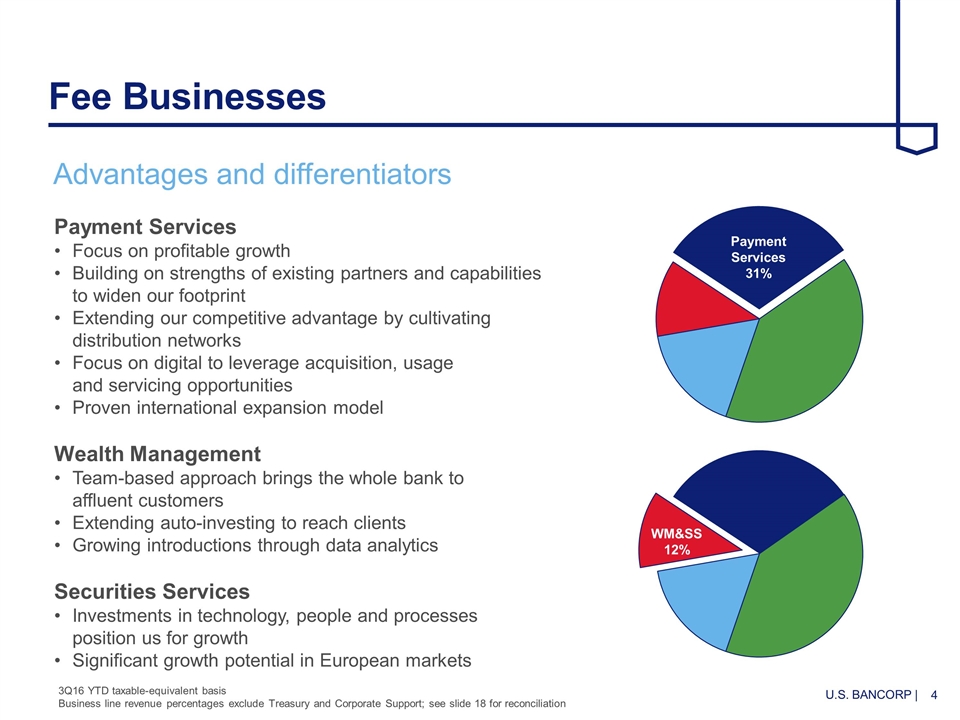

Fee Businesses Payment Services Focus on profitable growth Building on strengths of existing partners and capabilities to widen our footprint Extending our competitive advantage by cultivating distribution networks Focus on digital to leverage acquisition, usage and servicing opportunities Proven international expansion model Wealth Management Team-based approach brings the whole bank to affluent customers Extending auto-investing to reach clients Growing introductions through data analytics Securities Services Investments in technology, people and processes position us for growth Significant growth potential in European markets Advantages and differentiators Consumer & Small Business Banking 40% 3Q16 YTD taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support; see slide 18 for reconciliation Payment Services 31%

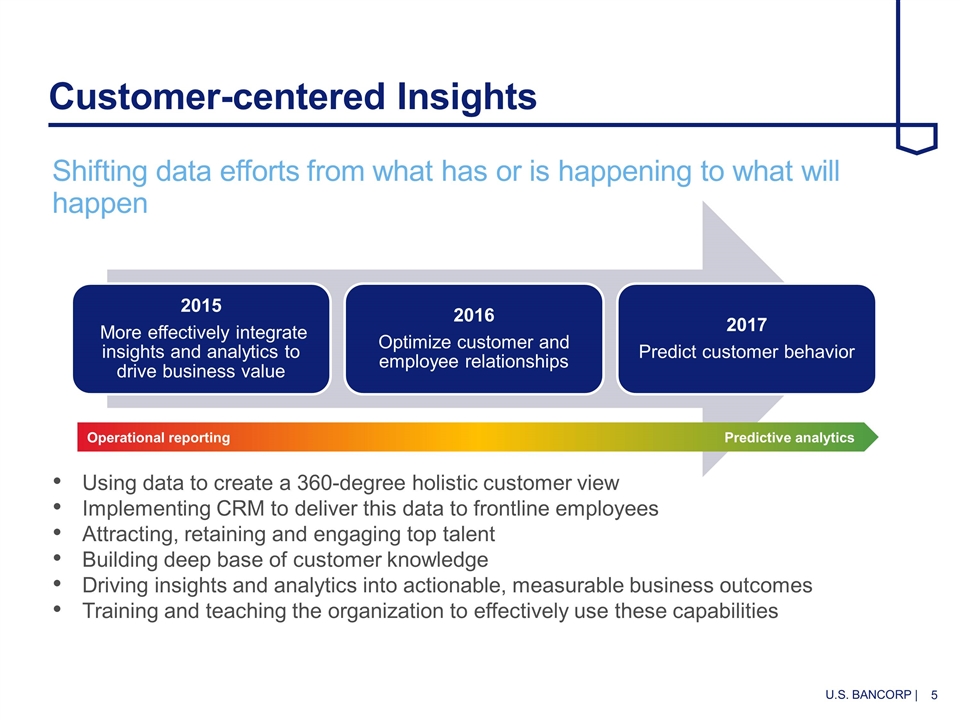

Customer-centered Insights Shifting data efforts from what has or is happening to what will happen Operational reporting Predictive analytics Using data to create a 360-degree holistic customer view Implementing CRM to deliver this data to frontline employees Attracting, retaining and engaging top talent Building deep base of customer knowledge Driving insights and analytics into actionable, measurable business outcomes Training and teaching the organization to effectively use these capabilities 2015 More effectively integrate insights and analytics to drive business value 2016 Optimize customer and employee relationships 2017 Predict customer behavior

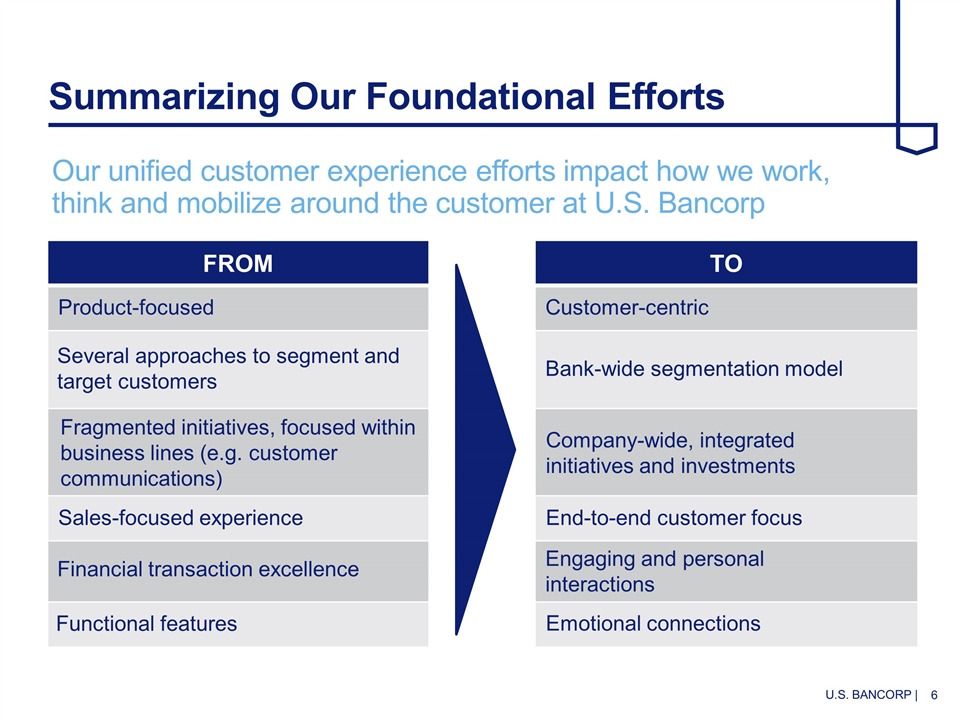

Summarizing Our Foundational Efforts Our unified customer experience efforts impact how we work, think and mobilize around the customer at U.S. Bancorp FROM TO Product-focused Several approaches to segment and target customers Fragmented initiatives, focused within business lines (e.g. customer communications) Sales-focused experience Financial transaction excellence Functional features Customer-centric Bank-wide segmentation model Company-wide, integrated initiatives and investments End-to-end customer focus Engaging and personal interactions Emotional connections

Bank-wide Culture of Innovation Engaging the FinTech community Our partnership with Plug and Play, a Silicon Valley innovation platform, keeps us connected to other forward-thinking leaders in financial technology. Bank Innovation and FiServ launched the INV FinTech Accelerator program. We were one of four financial service firm founding members. We have informal relationships with VC firms, such as Andreessen Horowitz, where we vet later stage FinTech startups to leverage in innovation initiatives. We are actively staying at the forefront of innovation and security.

Next Generation Banking aspiration: Define and deliver a brandable, differentiated consumer experience that delivers personalization and strengthens relationships through all touch points Efforts are channel-agnostic and focus initially on consumer banking (retail, small business and wealth), with intent to expand We will assess efficacy (e.g., branch format, website content, app functions) and scope (e.g., branch footprint) of each and every channel Define our ideal, as well as what we do not want to be, ensuring we build a scalable, efficient model PHOTO? Our Next Generation Banking Initiative

Innovation: Customer Experience Smart analytics and trade processing make client interactions more efficient and secure. Pivot: The Future Is Now CLIENTS Institutional clients use Pivot to replace existing platforms and processes. Trading capabilities available today can cut 30 minutes or more off of scenario analysis and trade initiation.

Geolocation – New Service Feature When cardholders transact in-store with their enrolled card, Visa compares cardholder’s mobile device to the merchant location in the authorization Service works in the background; cardholders can continue to travel and use their card more confidently Now available on all Elan, Co-brand partner and Flex Perks apps

Elavon + Poynt The latest in payment acceptance technology for small businesses Allows payment and security options for small businesses typically offered only at large retailers Terminals come equipped with Elavon’s Safe-T technology and a broad range of mobile capabilities Offers multi-payment acceptance, dual touch screens, enhanced mobility and connectivity and powerful security

Corporate Payments: AP Optimizer “New Product of the Year” – Business Intelligence Group Built-in partnership with Sage, a cloud accounting leader and MasterCard Enables corporate finance managers to compare performance to peers, manage cash flow, and optimize payments and cash flow

Distributed Ledger Pilots Several successful pilots completed as part of the R3/Distributed Ledger Group Consortium Capital Markets Loan Syndications 17 banks, custodians and asset managers participating Investors have direct access to an authoritative system of record for syndicated loan data Reduces manual reviews, data re-entry and systems reconciliation Digital Identity and Know Your Customer The project involved 10 global banks and simulated establishing the identity of both a legal entity and an individual using KYC data and identity attestations by third parties Research and development focused on streamlining customer experience, improving transparency and increasing efficiency

Hackathons: External Innovation Engagement 100 developers and designers on 24 teams

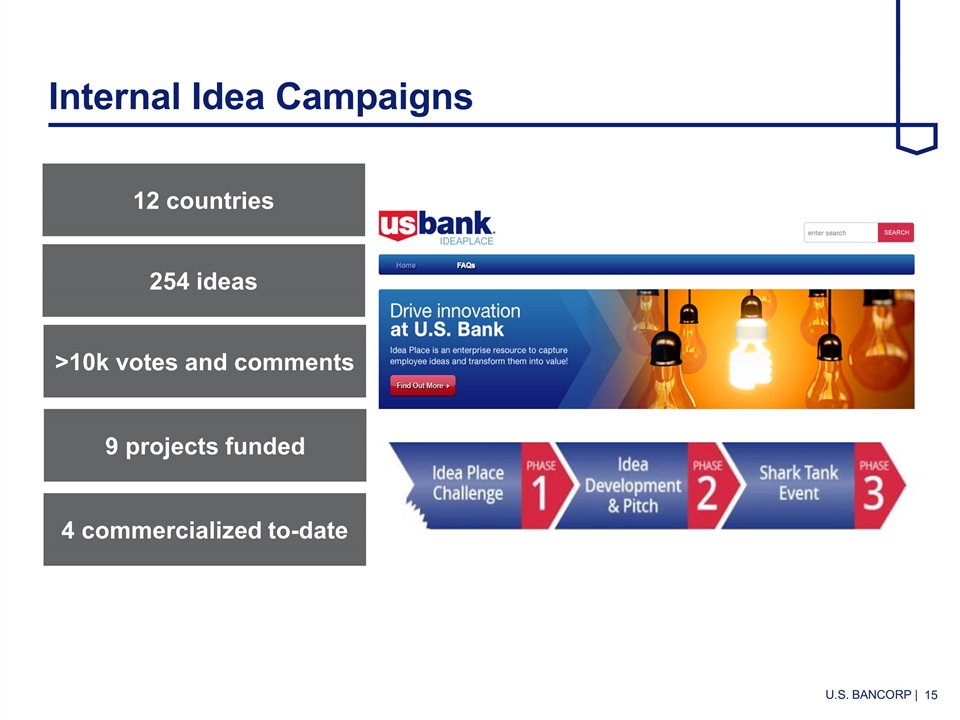

Internal Idea Campaigns 12 countries 254 ideas >10k votes and comments 9 projects funded 4 commercialized to-date

Fourth Quarter Update Loan growth:1.0 to 1.5% growth Credit quality:Stable to prior quarters Net Interest Margin:Stable to 3Q16 margin given rate environment Net Interest Income:Growth driven by average earning assets Mortgage revenues:Lower on linked basis by 25% to 30% Noninterest expenses:Seasonally higher; including tax credit amortization

Appendix

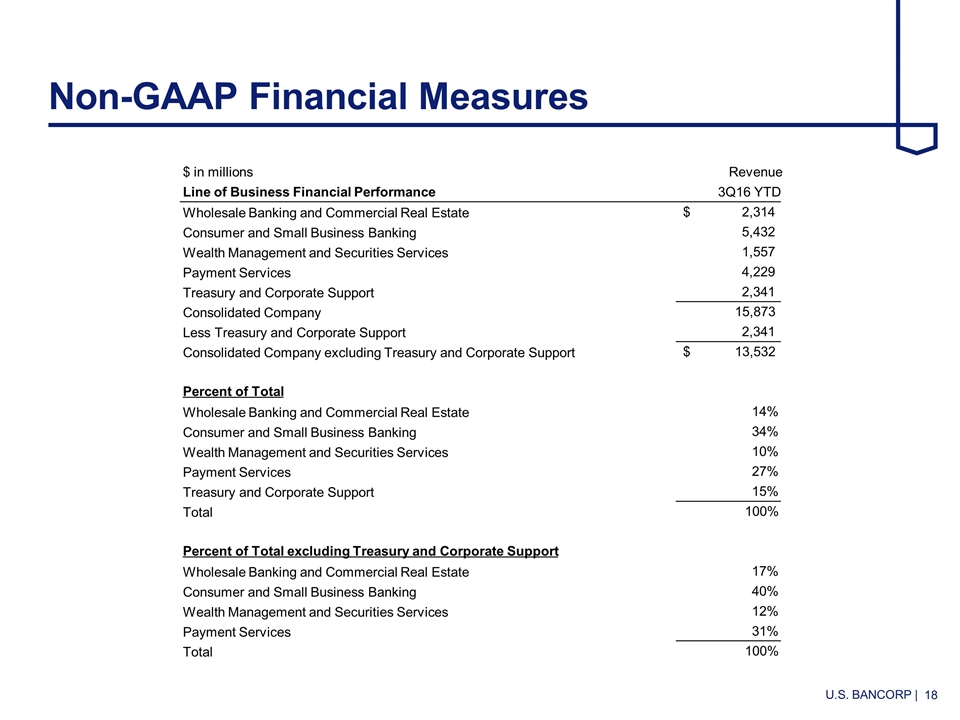

Non-GAAP Financial Measures $ in millions Revenue Line of Business Financial Performance 3Q16 YTD Wholesale Banking and Commercial Real Estate 2,314 $ Consumer and Small Business Banking 5,432 Wealth Management and Securities Services 1,557 Payment Services 4,229 Treasury and Corporate Support 2,341 Consolidated Company 15,873 Less Treasury and Corporate Support 2,341 Consolidated Company excluding Treasury and Corporate Support 13,532 $ Percent of Total Wholesale Banking and Commercial Real Estate 14% Consumer and Small Business Banking 34% Wealth Management and Securities Services 10% Payment Services 27% Treasury and Corporate Support 15% Total 100% Percent of Total excluding Treasury and Corporate Support Wholesale Banking and Commercial Real Estate 17% Consumer and Small Business Banking 40% Wealth Management and Securities Services 12% Payment Services 31% Total 100%