Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kindred Biosciences, Inc. | a8k-december2016investorpr.htm |

1 KindredBio

KindredBio

Best Medicines for Our Best Friends

2 KindredBio

Forward Looking Statements

This presentation contains forward-looking statements, including but not limited to statements regarding the

timing of development for our product candidates, expected commencement and completion of pivotal trials,

prospective product candidates, anticipated regulatory approvals for our product candidates, anticipated

commercialization of our product candidates, our financial position, business strategy, plans and objectives of

management for future operations and other similar statements. These forward-looking statements are based

on our current expectations and beliefs, as well as assumptions concerning future events. These statements

are subject to risks, uncertainties, and other factors, many of which are outside of our control, that could cause

actual results to differ materially from the results discussed in the forward-looking statements, including, but not

limited to, our limited operating history and lack of profitability, our lack of product revenue and potential need

to raise additional capital to achieve our goals, our dependence upon the success of our lead product

candidates, other companies’ ability to develop substantially similar products that may compete with our

product candidates, any inability to obtain regulatory approval for our existing or future product candidates, any

delay or discontinuance of our current or future pivotal trials, any inability to achieve market acceptance or

commercial success for our product candidates even if they are approved, inability to obtain adequate

intellectual property protection covering our product candidates, our dependence on third-party manufacturers

for supplies, and any inability to successfully identify, develop and commercialize additional product

candidates.

Any forward-looking statement made by us in this presentation speaks only as of the date of this presentation

and represents our estimates and assumptions only as of the date of this presentation. Except as required by

law, we assume no obligation to update these statements publicly, or to update the reasons actual results

could differ materially from those anticipated in these statements, even if new information becomes available in

the future.

November 7, 2016

3 KindredBio

$15.7 billion on veterinary care

$1.5 billion on dog knee

surgeries

$370 million on pet Halloween

costumes

$700 million on Valentine’s Day

gifts

Annually, U.S. pet parents estimated to spend:

We Love Our Pet Family Members

4 KindredBio

Bring the very best science and medicine

to our animal family members.

KindredBio

5 KindredBio

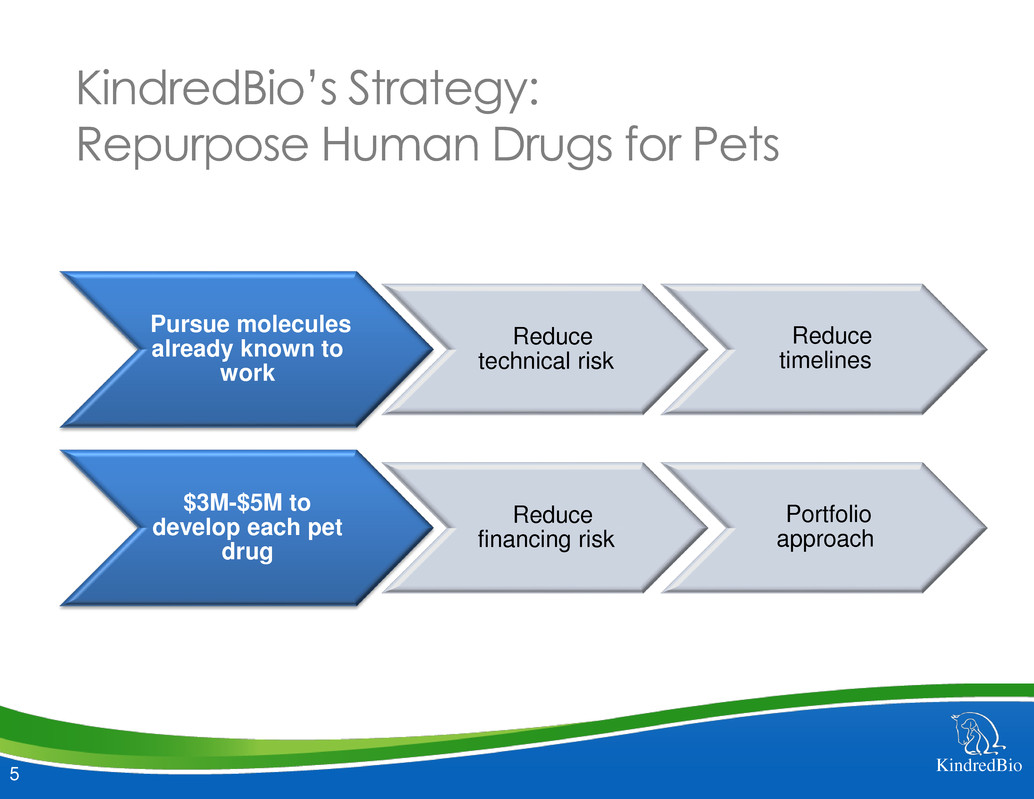

KindredBio’s Strategy:

Repurpose Human Drugs for Pets

Pursue molecules

already known to

work

Reduce

technical risk

Reduce

timelines

$3M-$5M to

develop each pet

drug

Reduce

financing risk

Portfolio

approach

6 KindredBio

KindredBio Highlights

Two launches

by 2017

Zimeta™ for fever in horses

Mirataz™ for mgmt. of weight loss in cats

~2 launches per year thereafter

Attractive

Markets

Rapidly growing

Few current competitors

World Class

Team

Extensive drug development experience

Human and veterinary experience

Deep Pipeline ~20 small molecule and biologic candidates

Strategic

Approach

Reduces technical risk

Reduces financing risk

7 KindredBio

Richard Chin, M.D.

Founder and Chief Executive Officer

Former Head of Clinical Research, BioTherapeutics, Genentech

Rhodes Scholar

World Class Leadership Team

7

Denise Bevers

Founder and Chief Operating Officer

Founder, SD Scientific; 25 years in biotech/pharma

Stephen Sundlof, D.V.M, Ph.D.

Chief Scientific Officer and Executive Vice President, Regulatory Affairs & Quality

Former Director, Center for Veterinary Medicine, FDA

Wendy Wee

Vice President, Finance

16 years of biotechnology finance experience

Hangjun Zhan, Ph.D.

Vice President, Biologics Research

20 years of drug discovery experience

8 KindredBio

Molecule Indication Discovery/Process Development

Pilot/Pivotal

Clinical Studies

NADA & Launch

Preparation

Biologic Product Candidates

epoCat™ (feline erythropoietin) Anemia in cats

Anti-Interleukin Antibodies Atopic dermatitis in dogs

Checkpoint Inhibitors Cancer in dogs

Anti-CD20 antibody

Cancer and autoimmune

diseases in dogs

KIND-Bodies Multiple indications

Anti-IgE antibody Allergic diseases in dogs

Anti-VEGF antibody Cancer in dogs

Anti-TNF Sick newborn foals

Molecule Indication Formulation

Laboratory

Pilot Studies

Field Pilot

Studies

Pivotal

Clinical

Study

NADA &

Launch

Preparation

Small Molecule Product Candidates

Mirataz™

(mirtazapine transdermal ointment)

Management of weight loss in

cats

NADA

Zimeta™

(dipyrone injection)

Fever in horses

KIND-014* Equine gastric ulcers

KIND-015* Metabolic syndrome in horses

Deep Product Pipeline

Rolling NADA

Being Filed

Rolling NADA

Being Filed

Not all programs are listed. Some are not disclosed for competitive reasons.

* Initial pilot studies completed. Final formulation being developed.

9 KindredBio

Market Opportunity

10 KindredBio

$9.3

[VALUE]

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

2006 2015

Sp

e

n

d

in

g

in

B

ill

ion

s

Veterinary Market is Growing Rapidly

The veterinary care market

grew 70% from 2006 to 2015

Source: APPA Pet Industry Market Size & Ownership Statistics 2015 &

TriMark Vet Health Market, June 2013

Estimated

11 KindredBio

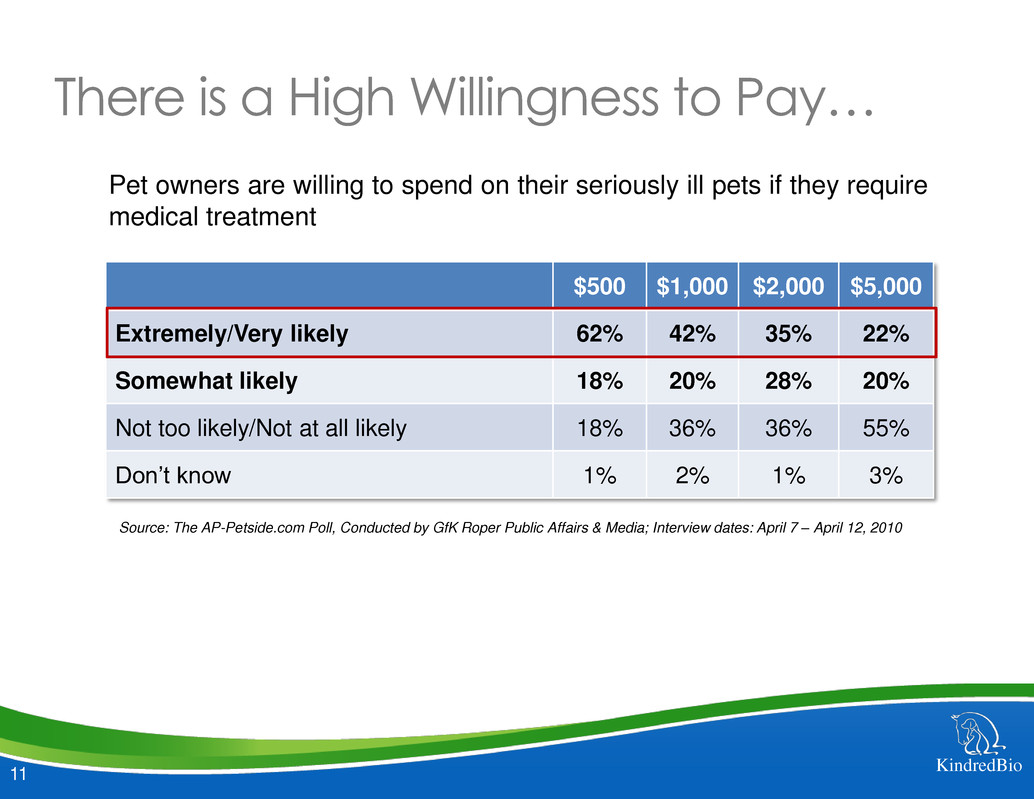

There is a High Willingness to Pay…

$500 $1,000 $2,000 $5,000

Extremely/Very likely 62% 42% 35% 22%

Somewhat likely 18% 20% 28% 20%

Not too likely/Not at all likely 18% 36% 36% 55%

Don’t know 1% 2% 1% 3%

Pet owners are willing to spend on their seriously ill pets if they require

medical treatment

Source: The AP-Petside.com Poll, Conducted by GfK Roper Public Affairs & Media; Interview dates: April 7 – April 12, 2010

12 KindredBio

…But Treatment Options are Limited

Underserved market with attractive growth

opportunities

Few competing biotechs

Large pharma focused on blockbusters

On average, less than a dozen pet drugs

are approved annually by the FDA

In 2015 the FDA approved:

0 novel pet drugs

45 novel humans drugs

13 KindredBio

Veterinary Pharmaceuticals Field

We believe there are similarities between veterinary pharmaceutical field

now and the human pharmaceutical field in its early stages:

Similar regulatory standards

Similar commercial and reimbursement landscape

Similar development costs

Numerous untapped opportunities (low hanging fruit)

Many years behind Pet

Therapeutics

Human

Pharmaceuticals

14 KindredBio

Veterinary vs. Human Markets

Can reach

market in

3-5 years Faster

Development

Lower

Development

Cost

Almost no

biotechs,

almost no

generics

Lower

Competition Self-Pay Very few

reimbursement

hurdles

Can develop

for $3M-$5M

per product

15 KindredBio

Programs

16 KindredBio

KindredBio Strategy

Already validated in

humans &

established

manufacturing

Customize species-

specific dosage and

formulate

flavored/convenient

delivery

Targets based on

approved human

drugs (e.g., Enbrel

and Orencia)

Create canine/

feline/equine

versions of biologics

with the same or

similar target

Small

Molecules

Biologics

17 KindredBio

Equine Products

• High willingness to pay

• Similar to human orphan drug market

• Efficient commercial structure

Biologics

• Atopic dermatitis

• Cancer

KindredBio’s Priority Areas

18 KindredBio

Equine Market

Fewer horses than cats or dogs, but higher willingness to pay –

similar to human orphan drug markets

Only 10-12 sales representatives required for full national

coverage

Underappreciated opportunity

KindredBio’s goal is to become dominant company in the equine

sector

19 KindredBio

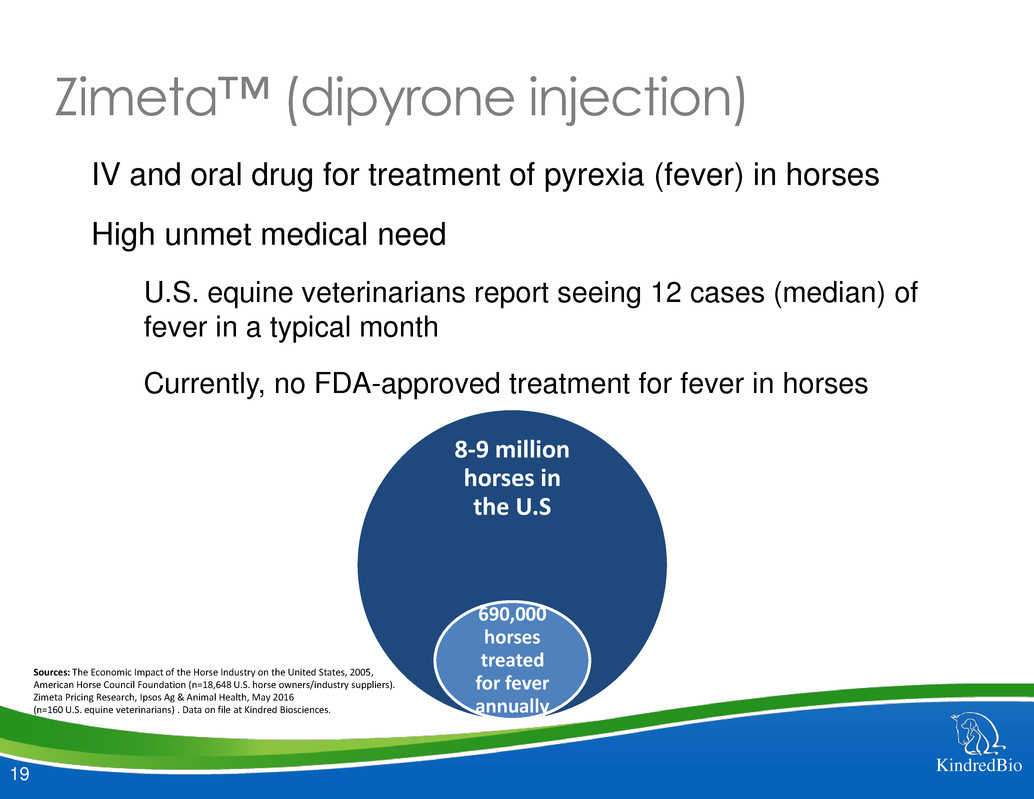

Zimeta™ (dipyrone injection)

IV and oral drug for treatment of pyrexia (fever) in horses

High unmet medical need

U.S. equine veterinarians report seeing 12 cases (median) of

fever in a typical month

Currently, no FDA-approved treatment for fever in horses

8-9 million

horses in

the U.S

690,000

horses

treated

for fever

annually

Sources: The Economic Impact of the Horse Industry on the United States, 2005,

American Horse Council Foundation (n=18,648 U.S. horse owners/industry suppliers).

Zimeta Pricing Research, Ipsos Ag & Animal Health, May 2016

(n=160 U.S. equine veterinarians) . Data on file at Kindred Biosciences.

20 KindredBio

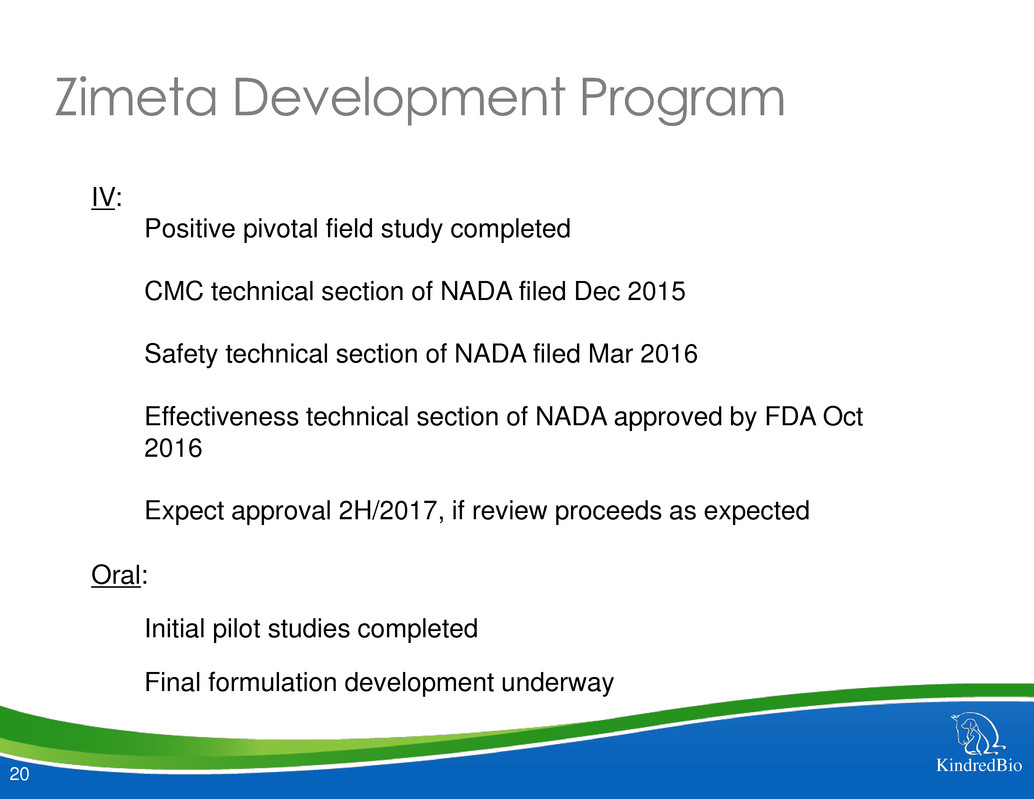

Zimeta Development Program

IV:

Positive pivotal field study completed

CMC technical section of NADA filed Dec 2015

Safety technical section of NADA filed Mar 2016

Effectiveness technical section of NADA approved by FDA Oct

2016

Expect approval 2H/2017, if review proceeds as expected

Oral:

Initial pilot studies completed

Final formulation development underway

21 KindredBio

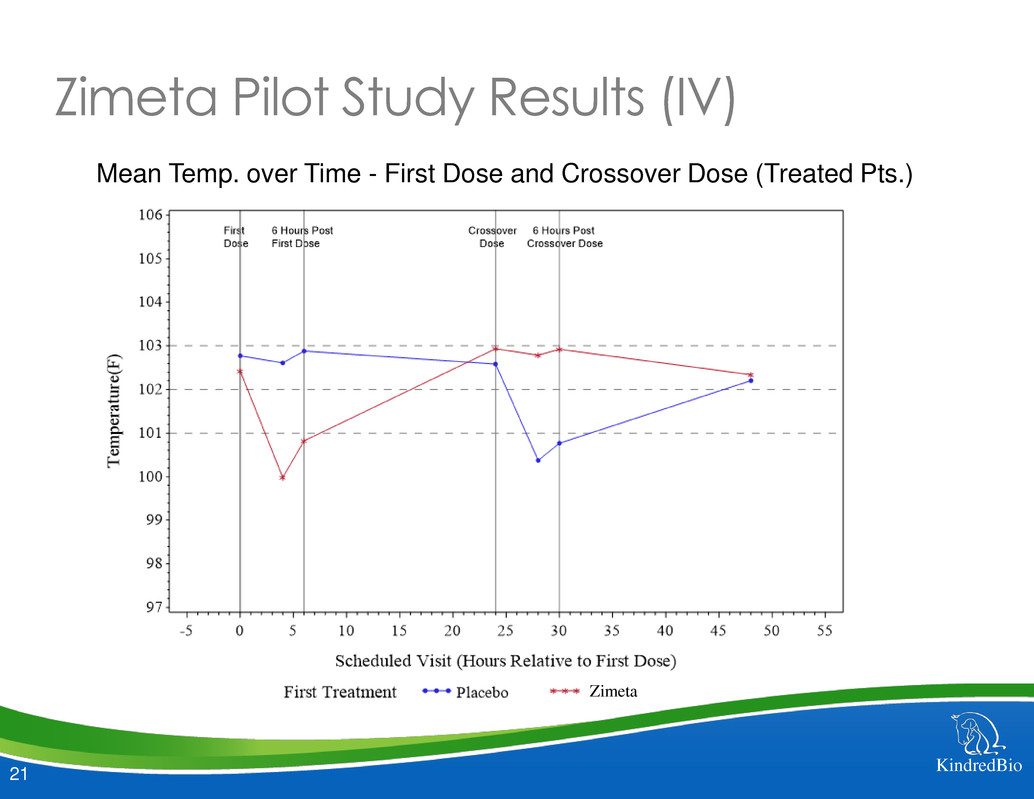

Zimeta Pilot Study Results (IV)

Mean Temp. over Time - First Dose and Crossover Dose (Treated Pts.)

Zimeta

22 KindredBio

Zimeta Pivotal Field Study Results (IV)

KB0120 study:

Randomized, double-blind, placebo-controlled (N=138)

Primary endpoint was improvement or resolution of fever

Placebo Zimeta

n 34 104

Success Rate (%) 7 (20.6) 78 (75.0)

p-value < 0.0001

23 KindredBio

Mirataz™

(mirtazapine transdermal ointment)

Transdermal drug for the management of weight loss in cats

Innovative Accusorb™ transdermal technology

High unmet medical need

Current drugs often not effective

90% of veterinarians treat cats with inappetence

(average of 7 cats per week)

9 million

cats are

inappetent

3 million cats

are treated

for

inappetence

References: 2012 U.S. Pet Ownership & Demographics Sourcebook

American Veterinary Medical Association (n=50,000 U.S. Households)

2016 U.S. Veterinarian Mirtazapine Research, Wise Insights

May 2016 (n=89 U.S. small animal veterinarians). Data on file at Kindred Biosciences.

24 KindredBio

Mirataz Development Program

Positive pivotal field study completed

CMC technical section of NADA filed May 2016

Effectiveness technical section of NADA filed Aug 2016

Safety technical section of NADA filed Sep 2016

Expect approval 2H/2017 if review proceeds as expected

25 KindredBio

Mirataz Pivotal Field Study Results

Randomized, double-blind, placebo-controlled study (N=231)

Primary endpoint was percentage change in body weight from

Day 1 to Week 2

Placebo Mirataz

Primary analysis population n=97 n=90

Mean % increase in body weight

from Day 1 to Week 2 (SE)

0.29 (0.35) 4.07 (0.56)

p-value <0.0001

26 KindredBio

Biologics

Highly experienced biologics team

Extensive experience developing Lucentis®, Xolair®, Tysabri®,

Avastin®, Rituxan®, Herceptin®, Enbrel®, and multiple other biologics

Internal caninization/felinization/equinization expertise

Promising biologics candidates

Feline erythropoietin

Checkpoint inhibitors

Interleukin antibodies

New technologies, including KIND-Bodies

27 KindredBio

New Scaffold Technology: KIND-Body

A proprietary, non-antibody scaffold technology being developed

by KindredBio

Binding affinity similar to antibodies

Bispecific binding possible

Could allow KindredBio to pursue biologics targets before other

parties’ antibody patents expire

28 KindredBio

KIND-510: Feline Erythropoietin

Proprietary recombinant feline erythropoietin (epoCat™)

Strong internal expertise in erythropoietin biology and

engineering

Initial laboratory study completed - positive efficacy signal, as

evidenced by increased reticulocyte formation

Pilot field study ongoing

High unmet medical need

Up to 30% of elderly cats (over 15 years) develop kidney failure,

leading to anemia

Human erythropoietin is immunogenic in cats

29 KindredBio

KIND-511: Anti-TNF for Newborn Foals

Sick newborn foals are challenging and difficult to treat

Approximately 50% mortality

Pilot field study for Anti-Tumor Necrosis Factor (Anti-TNF)

underway

Sick foals defined as sepsis score ≥ 11 or positive blood

culture

Of 5 foals enrolled, all survived to day 7 (primary endpoint of

study)

30 KindredBio

Key Focus Area: Atopic Dermatitis

Atopic dermatitis is a large market

Apoquel® projected peak sales >$200M

Multiple antibody candidates

Anti-IgE antibody

Anti-IL17a antibody

Anti-IL4Ra antibody

Anti-IL31 antibody

Anti-CD20 antibody

Multi-center, pilot field study underway to assess safety and

efficacy of several molecules

31 KindredBio

Key Focus Area: Cancer

Multiple antibody candidates

Anti-CTLA4 antibody

Anti-PD1 antibody

Anti-PDL1 antibody

Anti-CD20 antibody

32 KindredBio

Biologics Manufacturing Plant

In-house biologics manufacturing plant nearly complete

Single-use, state of the art system

Will allow full GMP commercial production of feline epo (epoCat™)

Will allow full GMP clinical and early commercial production of

antibodies

33 KindredBio

Commercialization

34 KindredBio

Commercialization

Equine Commercialization:

Launch and commercialize our U.S. products with

~10 person direct sales force

Dog/Cat Commercialization Options:

Self-Commercialization

Out-license

Partner for 3 – 5 years, and then transition to KindredBio

salesforce

35 KindredBio

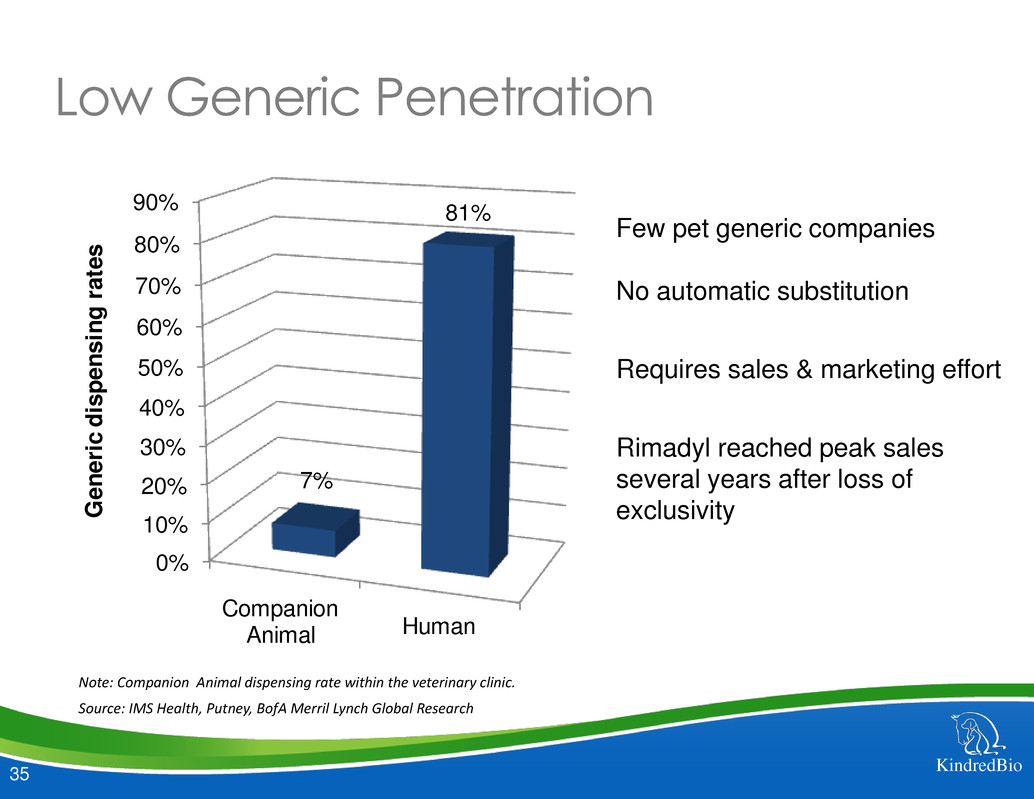

Few pet generic companies

No automatic substitution

Requires sales & marketing effort

Rimadyl reached peak sales

several years after loss of

exclusivity

Low Generic Penetration

Note: Companion Animal dispensing rate within the veterinary clinic.

Source: IMS Health, Putney, BofA Merril Lynch Global Research

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Companion

Animal Human

7%

81%

G

e

n

e

ri

c

d

is

p

e

n

s

in

g

r

a

te

s

36 KindredBio

Exclusivity and IP Position

Full intellectual property protection anticipated for

antibody portfolio

Use and formulation patents for small molecules

20 years of patent protection from date of filing

Regulatory Exclusivity

5 years in U.S.

10 years in E.U.

Lifecycle Management

New formulations, combinations and derivatives

37 KindredBio

Business Development

In active discussions about acquisitions of businesses

and/or assets, particularly of equine assets

Ideal candidate:

Revenue generating/accretive

Commercial infrastructure

Complementary assets

38 KindredBio

Financials

39 KindredBio

Select Summary Financials

$ millions

For the quarter

ended

September 30, 2016

Operating expenses:

Research and development $3.8

General and administrative $2.0

Total cash operating expenses

(excluding stock-based compensation)

$4.8

Total operating expenses

(including stock-based compensation)

$5.8

Total cash, cash equivalents and investments

(As of September 30, 2016)

$62.5

We believe that our cash and equivalents are sufficient to fund operations until

we start generating significant revenues.

40 KindredBio

Share Structure & 6 Month Stock History

19.9 M

Shares

Outstanding

3.6 M Options1

US$107.4 M Market Cap2

US$58.7 M

Working

Capital3

1 As of September 30, 2016; avg. $6.35

2 As of close of market October 31, 2016

3 As of September 30, 2016

Analyst Coverage

Alex Arfaei, BMO Capital Markets

Alex.Arfaei@BMO.com

Kevin DeGeeter, Ladenburg Thalmann

kdegeeter@Ladenburg.com

41 KindredBio

Summary

Validated Drugs and

Targets

$3M-$5M to Market

Multiple Approvals

Starting within 1 year

World Class Team

42 KindredBio

Thank You