Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CCO HOLDINGS LLC | ccoh9302016exh991-quarterl.htm |

| EX-32.2 - EXHIBIT 32.2 - CCO HOLDINGS LLC | ccoh9302016exh-322.htm |

| EX-32.1 - EXHIBIT 32.1 - CCO HOLDINGS LLC | ccoh9302016exh-321.htm |

| EX-31.2 - EXHIBIT 31.2 - CCO HOLDINGS LLC | ccoh9302016exh-312.htm |

| EX-31.1 - EXHIBIT 31.1 - CCO HOLDINGS LLC | ccoh9302016exh-311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-Q

______________

(Mark One) | ||

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended September 30, 2016 | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Transition Period From to

Commission File Number: | 001-37789 |

333-112593-01 | |

CCO Holdings, LLC

CCO Holdings Capital Corp.

(Exact name of registrant as specified in its charter)

Delaware | 86-1067239 | |

Delaware | 20-0257904 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

400 Atlantic Street Stamford, Connecticut 06901 | (203) 905-7801 | |

(Address of principal executive offices including zip code) | (Registrant’s telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer x Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Number of shares of common stock of CCO Holdings Capital Corporation outstanding as of September 30, 2016: 1

CCO HOLDINGS, LLC

CCO HOLDINGS CAPITAL CORP.

QUARTERLY REPORT ON FORM 10-Q FOR THE PERIOD ENDED SEPTEMBER 30, 2016

QUARTERLY REPORT ON FORM 10-Q FOR THE PERIOD ENDED SEPTEMBER 30, 2016

TABLE OF CONTENTS

Page No. | ||||

This quarterly report on Form 10-Q is for the three and nine months ended September 30, 2016. The United States Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you directly to those documents. In this quarterly report, “CCO Holdings,” “we,” “us” and “our” refer to CCO Holdings, LLC and its subsidiaries.

i

Explanatory Note

On May 18, 2016, Charter Communications, Inc. (formerly known as CCH I, LLC, or “Charter,” an indirect parent company of CCO Holdings, LLC) completed its previously reported merger transactions among Charter, Time Warner Cable Inc. (“Legacy TWC”), Charter Communications, Inc. (“Legacy Charter”), and certain other subsidiaries of Charter (the “TWC Transaction”). Also on May 18, 2016, Charter completed its previously reported acquisition of Bright House Networks, LLC (“Legacy Bright House”) from Advance/Newhouse Partnership (the “Bright House Transaction,” and, together with the TWC Transaction, the “Transactions”). As a result of the Transactions, Charter became the new public parent company that holds the combined operations of Legacy Charter, Legacy TWC and Legacy Bright House and was renamed Charter Communications, Inc. Substantially all of the operations acquired in the Transactions were contributed down to CCO Holdings. The financial statements presented in this quarterly report reflect the operations of CCO Holdings as a subsidiary of Legacy Charter through May 17, 2016 and CCO Holdings as a subsidiary of Charter on and after May 18, 2016. See Part I, Item 1. Financial Statements, Notes to Consolidated Financial Statements, Note 2, “Mergers and Acquisitions - Selected Pro Forma Financial Information” for certain financial information presented as if the Transactions had closed on January 1, 2015. Also see Exhibit 99.1 in this Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2016 for pro forma financial information for each quarter of 2015 and the first and second quarter of 2016. Throughout this report references to the “Company” or to “CCO Holdings” refer to the combined company following the completion of the Transactions.

Upon closing of the TWC Transaction, the CCOH Safari, LLC notes became obligations of CCO Holdings and CCO Holdings Capital Corp., and the CCO Safari II, LLC notes and CCO Safari III, LLC credit facilities became obligations of Charter Communications Operating, LLC (“Charter Operating”) and Charter Communications Operating Capital Corp. CCOH Safari, LLC merged into CCO Holdings and CCO Safari II, LLC and CCO Safari III, LLC merged into Charter Operating.

ii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:

This quarterly report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial including, without limitation, the forward-looking statements set forth in the “Results of Operations” and “Liquidity and Capital Resources” sections under Part I, Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this quarterly report. Although we believe that our plans, intentions and expectations as reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions including, without limitation, the factors described under “Risk Factors” under Part II, Item 1A of this quarterly report on Form 10-Q. Many of the forward-looking statements contained in this quarterly report may be identified by the use of forward-looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning,” “designed,” “create,” “predict,” “project,” “initiatives,” “seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases” and “potential,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this quarterly report are set forth in this quarterly report on Form 10-Q, in our annual report on Form 10-K, and in other reports or documents that we file from time to time with the SEC, and include, but are not limited to:

Risks Related to the recently completed Transactions:

• | our ability to promptly, efficiently and effectively integrate acquired operations; |

• | managing a significantly larger company than before the completion of the Transactions; |

• | our ability to achieve the synergies and value creation contemplated by the Transactions; |

• | diversion of management time on issues related to the integration of the Transactions; |

• | changes in Legacy Charter, Legacy TWC or Legacy Bright House operations’ businesses, future cash requirements, capital requirements, results of operations, revenues, financial condition and/or cash flows; |

• | disruption in our business relationships as a result of the Transactions; |

• | the increase in indebtedness as a result of the Transactions, which will increase interest expense and may decrease our operating flexibility; |

• | operating costs and business disruption that may be greater than expected; |

• | the ability to retain and hire key personnel and maintain relationships with providers or other business partners; and |

• | costs, disruptions and possible limitations on operating flexibility related to, and our ability to comply with, regulatory conditions applicable to us as a result of the Transactions. |

Risks Related to Our Business

• | our ability to sustain and grow revenues and cash flow from operations by offering video, Internet, voice, advertising and other services to residential and commercial customers, to adequately meet the customer experience demands in our markets and to maintain and grow our customer base, particularly in the face of increasingly aggressive competition, the need for innovation and the related capital expenditures; |

• | the impact of competition from other market participants, including but not limited to incumbent telephone companies, direct broadcast satellite operators, wireless broadband and telephone providers, digital subscriber line (“DSL”) providers, fiber to the home providers, video provided over the Internet by (i) market participants that have not historically competed in the multichannel video business, (ii) traditional multichannel video distributors, and (iii) content providers that have historically licensed cable networks to multichannel video distributors, and providers of advertising over the Internet; |

• | general business conditions, economic uncertainty or downturn, unemployment levels and the level of activity in the housing sector; |

• | our ability to obtain programming at reasonable prices or to raise prices to offset, in whole or in part, the effects of higher programming costs (including retransmission consents); |

• | our ability to develop and deploy new products and technologies including our cloud-based user interface, Spectrum Guide®, and downloadable security for set-top boxes, and any other cloud-based consumer services and service platforms; |

• | the effects of governmental regulation on our business or potential business combination transactions; |

• | any events that disrupt our networks, information systems or properties and impair our operating activities or our reputation; |

• | the availability and access, in general, of funds to meet our debt obligations prior to or when they become due and to fund our operations and necessary capital expenditures, either through (i) cash on hand, (ii) free cash flow, or (iii) access to the capital or credit markets; and |

iii

• | our ability to comply with all covenants in our indentures and credit facilities, any violation of which, if not cured in a timely manner, could trigger a default of our other obligations under cross-default provisions. |

All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this quarterly report.

iv

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

CCO HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

September 30, 2016 | December 31, 2015 | ||||||

(unaudited) | |||||||

ASSETS | |||||||

CURRENT ASSETS: | |||||||

Cash and cash equivalents | $ | 996 | $ | 5 | |||

Accounts receivable, less allowance for doubtful accounts of | |||||||

$134 and $21, respectively | 1,229 | 264 | |||||

Prepaid expenses and other current assets | 351 | 55 | |||||

Total current assets | 2,576 | 324 | |||||

INVESTMENT IN CABLE PROPERTIES: | |||||||

Property, plant and equipment, net of accumulated | |||||||

depreciation of $9,486 and $6,509, respectively | 32,657 | 8,317 | |||||

Franchises | 66,245 | 6,006 | |||||

Customer relationships, net | 15,439 | 856 | |||||

Goodwill | 30,165 | 1,168 | |||||

Total investment in cable properties, net | 144,506 | 16,347 | |||||

LOANS RECEIVABLE - RELATED PARTY | — | 693 | |||||

OTHER NONCURRENT ASSETS | 1,172 | 116 | |||||

Total assets | $ | 148,254 | $ | 17,480 | |||

LIABILITIES AND MEMBER’S EQUITY | |||||||

CURRENT LIABILITIES: | |||||||

Accounts payable and accrued liabilities | $ | 6,004 | $ | 1,476 | |||

Current portion of long-term debt | 2,050 | — | |||||

Payables to related party | 399 | 331 | |||||

Total current liabilities | 8,453 | 1,807 | |||||

LONG-TERM DEBT | 59,946 | 13,945 | |||||

LOANS PAYABLE - RELATED PARTY | 640 | 333 | |||||

DEFERRED INCOME TAXES | 32 | 28 | |||||

OTHER LONG-TERM LIABILITIES | 2,905 | 45 | |||||

MEMBER’S EQUITY: | |||||||

Member’s equity | 76,261 | 1,335 | |||||

Accumulated other comprehensive loss | (8 | ) | (13 | ) | |||

Total CCO Holdings member’s equity | 76,253 | 1,322 | |||||

Noncontrolling interests | 25 | — | |||||

Total member’s equity | 76,278 | 1,322 | |||||

Total liabilities and member’s equity | $ | 148,254 | $ | 17,480 | |||

The accompanying notes are an integral part of these consolidated financial statements.

1

CCO HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in millions)

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in millions)

Unaudited

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

REVENUES | $ | 10,037 | $ | 2,450 | $ | 18,728 | $ | 7,242 | |||||||

COSTS AND EXPENSES: | |||||||||||||||

Operating costs and expenses (exclusive of items shown separately below) | 6,490 | 1,620 | 12,173 | 4,802 | |||||||||||

Depreciation and amortization | 2,435 | 538 | 4,409 | 1,580 | |||||||||||

Other operating (income) expenses, net | 193 | 19 | (20 | ) | 69 | ||||||||||

9,118 | 2,177 | 16,562 | 6,451 | ||||||||||||

Income from operations | 919 | 273 | 2,166 | 791 | |||||||||||

OTHER EXPENSES: | |||||||||||||||

Interest expense, net | (729 | ) | (192 | ) | (1,391 | ) | (648 | ) | |||||||

Loss on extinguishment of debt | — | — | (110 | ) | (126 | ) | |||||||||

Gain (loss) on financial instruments, net | 71 | (5 | ) | 16 | (10 | ) | |||||||||

Other expense, net | (2 | ) | — | (2 | ) | — | |||||||||

(660 | ) | (197 | ) | (1,487 | ) | (784 | ) | ||||||||

Income before income taxes | 259 | 76 | 679 | 7 | |||||||||||

Income tax benefit | 7 | 219 | — | 212 | |||||||||||

Consolidated net income | 266 | 295 | 679 | 219 | |||||||||||

Less: Net income attributable to noncontrolling interests | (1 | ) | (13 | ) | (1 | ) | (34 | ) | |||||||

Net income attributable to CCO Holdings member | $ | 265 | $ | 282 | $ | 678 | $ | 185 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

CCO HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(dollars in millions)

Unaudited

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Consolidated net income | $ | 266 | $ | 295 | $ | 679 | $ | 219 | |||||||

Net impact of interest rate derivative instruments, net of tax | 2 | 2 | 6 | 7 | |||||||||||

Foreign currency translation adjustment | (1 | ) | — | (1 | ) | — | |||||||||

Consolidated comprehensive income | 267 | 297 | 684 | 226 | |||||||||||

Less: Net income attributable to noncontrolling interests | (1 | ) | (13 | ) | (1 | ) | (34 | ) | |||||||

Comprehensive income attributable to CCO Holdings member | $ | 266 | $ | 284 | $ | 683 | $ | 192 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

CCO HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN MEMBER’S EQUITY

CONSOLIDATED STATEMENTS OF CHANGES IN MEMBER’S EQUITY

(dollars in millions)

Unaudited

Member’s Equity | Accumulated Other Comprehensive Loss | Total CCO Holdings Member’s Equity | Noncontrolling Interests | Total Member’s Equity | |||||||||||

BALANCE, December 31, 2014 | $ | 534 | $ | (22 | ) | $ | 512 | $ | 436 | $ | 948 | ||||

Net income | 185 | — | 185 | 34 | 219 | ||||||||||

Changes in accumulated other comprehensive loss, net | — | 7 | 7 | — | 7 | ||||||||||

Stock compensation expense, net | 58 | — | 58 | — | 58 | ||||||||||

Contributions from parent | 15 | — | 15 | — | 15 | ||||||||||

Distributions to parent | (73 | ) | — | (73 | ) | — | (73 | ) | |||||||

BALANCE, September 30, 2015 | $ | 719 | $ | (15 | ) | $ | 704 | $ | 470 | $ | 1,174 | ||||

BALANCE, December 31, 2015 | $ | 1,335 | $ | (13 | ) | $ | 1,322 | $ | — | $ | 1,322 | ||||

Net income | 678 | — | 678 | 1 | 679 | ||||||||||

Changes in accumulated other comprehensive loss, net | — | 5 | 5 | — | 5 | ||||||||||

Stock compensation expense, net | 168 | — | 168 | — | 168 | ||||||||||

Accelerated vesting of equity awards | 202 | — | 202 | — | 202 | ||||||||||

Contributions from parent | 478 | — | 478 | — | 478 | ||||||||||

Distributions to parent | (3,084 | ) | — | (3,084 | ) | — | (3,084 | ) | |||||||

Contribution of net assets acquired in the TWC Transaction | 87,530 | — | 87,530 | — | 87,530 | ||||||||||

Contribution of net assets acquired in the Bright House Transaction | 12,156 | — | 12,156 | — | 12,156 | ||||||||||

Merger of parent companies and the Safari Escrow Entities | (23,202 | ) | — | (23,202 | ) | — | (23,202 | ) | |||||||

Contribution of noncontrolling interests | — | — | — | 24 | 24 | ||||||||||

BALANCE, September 30, 2016 | $ | 76,261 | $ | (8 | ) | $ | 76,253 | $ | 25 | $ | 76,278 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

4

CCO HOLDINGS, LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Unaudited

Nine Months Ended September 30, | ||||||||

2016 | 2015 | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

Consolidated net income | $ | 679 | $ | 219 | ||||

Adjustments to reconcile consolidated net income to net cash flows from operating activities: | ||||||||

Depreciation and amortization | 4,409 | 1,580 | ||||||

Stock compensation expense | 168 | 58 | ||||||

Accelerated vesting of equity awards | 202 | — | ||||||

Noncash interest (income) expense, net | (148 | ) | 21 | |||||

Other pension benefits | (533 | ) | — | |||||

Loss on extinguishment of debt | 110 | 126 | ||||||

(Gain) loss on financial instruments, net | (16 | ) | 10 | |||||

Deferred income taxes | (14 | ) | (216 | ) | ||||

Other, net | (10 | ) | 4 | |||||

Changes in operating assets and liabilities, net of effects from acquisitions: | ||||||||

Accounts receivable | (2 | ) | (4 | ) | ||||

Prepaid expenses and other assets | 105 | (20 | ) | |||||

Accounts payable, accrued liabilities and other | 483 | 15 | ||||||

Receivables from and payables to related party, including deferred management fees | 105 | 28 | ||||||

Net cash flows from operating activities | 5,538 | 1,821 | ||||||

CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

Purchases of property, plant and equipment | (3,437 | ) | (1,292 | ) | ||||

Change in accrued expenses related to capital expenditures | 86 | 11 | ||||||

Purchases of cable systems, net of cash acquired | (7 | ) | — | |||||

Change in restricted cash and cash equivalents | — | 3,514 | ||||||

Other, net | (8 | ) | (15 | ) | ||||

Net cash flows from investing activities | (3,366 | ) | 2,218 | |||||

CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

Borrowings of long-term debt | 5,997 | 3,771 | ||||||

Repayments of long-term debt | (4,120 | ) | (7,411 | ) | ||||

Repayments loans payable - related parties | (253 | ) | (317 | ) | ||||

Payments for debt issuance costs | (283 | ) | (24 | ) | ||||

Contributions from parent | 478 | 15 | ||||||

Distributions to parent | (3,084 | ) | (73 | ) | ||||

Proceeds from termination of interest rate derivatives | 88 | — | ||||||

Other, net | (4 | ) | — | |||||

Net cash flows from financing activities | (1,181 | ) | (4,039 | ) | ||||

NET INCREASE IN CASH AND CASH EQUIVALENTS | 991 | — | ||||||

CASH AND CASH EQUIVALENTS, beginning of period | 5 | — | ||||||

CASH AND CASH EQUIVALENTS, end of period | $ | 996 | $ | — | ||||

CASH PAID FOR INTEREST | $ | 1,479 | $ | 657 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

5

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

1. Organization and Basis of Presentation

Organization

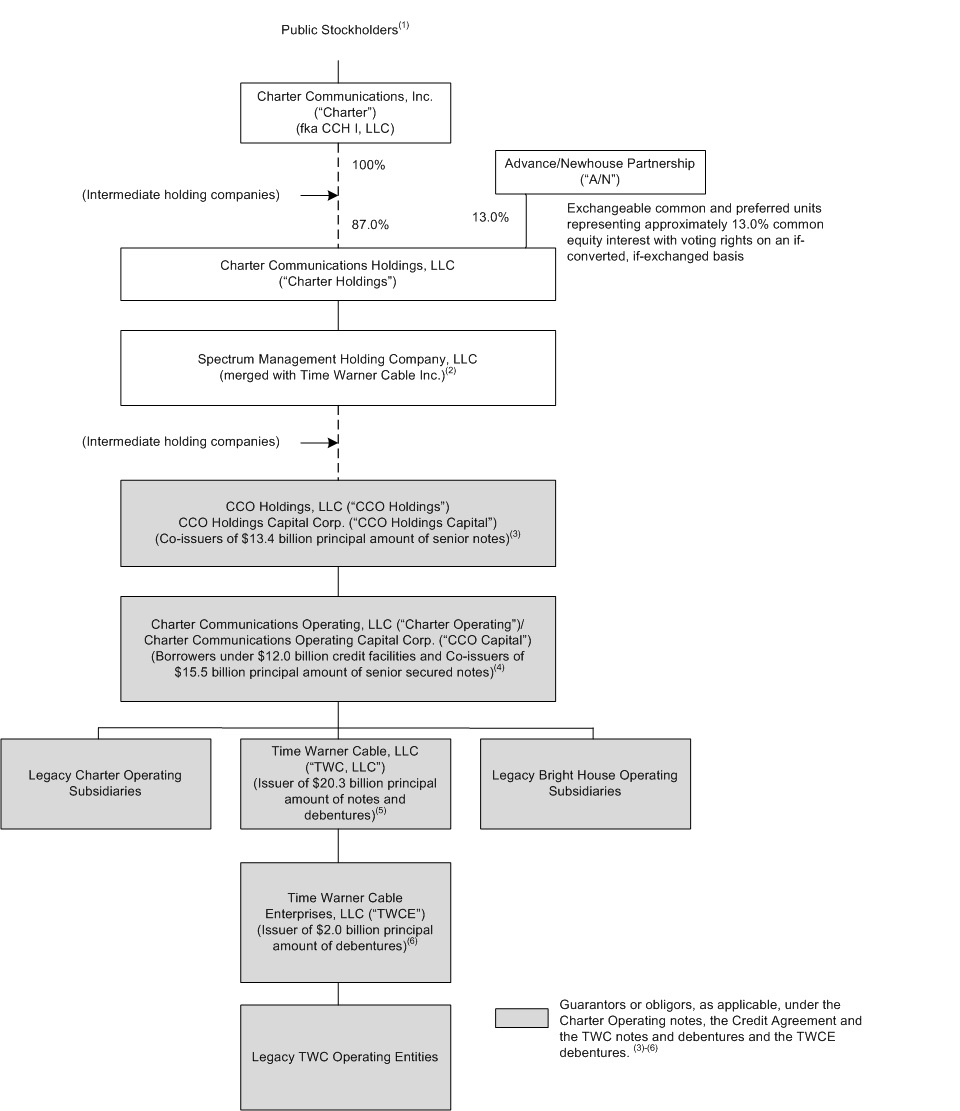

CCO Holdings, LLC (“CCO Holdings”) is a holding company whose principal assets are the equity interests in its operating subsidiaries. CCO Holdings is a direct subsidiary of CCH I Holdings, LLC (“CCH I”), which is an indirect subsidiary of Charter Communications, Inc. (“Charter”), Charter Communications Holdings, LLC (“Charter Holdings”) and Spectrum Management Holding Company, LLC (“Spectrum Holdings”). The consolidated financial statements include the accounts of CCO Holdings and all of its subsidiaries where the underlying operations reside, which are collectively referred to herein as the “Company.” All significant intercompany accounts and transactions among consolidated entities have been eliminated. Charter, Charter Holdings and Spectrum Holdings have performed financing, cash management, treasury and other services for CCO Holdings on a centralized basis. Changes in member’s equity in the consolidated balance sheets related to these activities have been considered cash receipts (contributions) and payments (distributions) for purposes of the consolidated statements of cash flows and are reflected in financing activities.

The Company is the second largest cable operator in the United States and a leading broadband communications company providing video, Internet and voice services to residential and business customers. The Company also sells video and online advertising inventory to local, regional and national advertising customers, and networking and enterprise-class, cloud-enabled hosting, managed applications and transport services to business customers and owns and operates regional sports networks and local sports, news and lifestyle channels. The Company’s residential services also include security and home management services.

The Company’s operations are managed and reported to its Chief Executive Officer (“CEO”), the Company’s chief operating decision maker, on a consolidated basis. The CEO assesses performance and allocates resources based on the consolidated results of operations. Under this organizational and reporting structure, the Company has one reportable segment, cable services.

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, certain information and footnote disclosures typically included in the Company’s Annual Report filed as Exhibit 99.2 in the Company’s Current Report on Form 8-K filed with the SEC on June 6, 2016 have been condensed or omitted for this quarterly report. The accompanying consolidated financial statements are unaudited and are subject to review by regulatory authorities. However, in the opinion of management, such financial statements include all adjustments, which consist of only normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. Interim results are not necessarily indicative of results for a full year.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Areas involving significant judgments and estimates include capitalization of labor and overhead costs; depreciation and amortization costs; purchase accounting valuations of assets and liabilities including, but not limited to, property, plant and equipment, intangibles and goodwill; pension benefits; income taxes; contingencies and programming expense. Actual results could differ from those estimates.

2. Mergers and Acquisitions

TWC Transaction

On May 18, 2016, the transactions contemplated by the Agreement and Plan of Mergers dated as of May 23, 2015 (the “Merger Agreement”), by and among Time Warner Cable Inc. (“Legacy TWC”), Charter Communications, Inc. prior to the closing of the Merger Agreement (“Legacy Charter”), CCH I, LLC, previously a wholly owned subsidiary of Legacy Charter (“New Charter”) and certain other subsidiaries of New Charter were completed (the “TWC Transaction,” and together with the Bright House Transaction described below, the “Transactions”). As a result of the TWC Transaction, New Charter became the new public parent company that holds the operations of the combined companies and was renamed Charter Communications, Inc.

6

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

Pursuant to the terms of the Merger Agreement, upon consummation of the TWC Transaction, each outstanding share of Legacy TWC common stock (other than Legacy TWC common stock held by Liberty Broadband Corporation (“Liberty Broadband”) and Liberty Interactive Corporation (“Liberty Interactive” and, collectively, the “Liberty Parties”)), was converted into the right to receive, at the option of each such holder of Legacy TWC common stock, either (a) $100 in cash and Charter Class A common stock equivalent to 0.5409 shares of Legacy Charter Class A common stock (the “Option A Consideration”) or (b) $115 in cash and Charter Class A common stock equivalent to 0.4562 shares of Legacy Charter Class A common stock (the “Option B Consideration”). The actual number of shares of Charter Class A common stock that Legacy TWC stockholders received, excluding the Liberty Parties, was calculated by multiplying the exchange ratios of 0.5409 or 0.4562 specified above by 0.9042 (the “Parent Merger Exchange Ratio”), which was also the exchange ratio that was used to determine the number of shares of Charter Class A common stock that Legacy Charter stockholders received per share of Legacy Charter Class A common stock. Such exchange ratio did not impact the aggregate value represented by the shares of Charter Class A common stock issued in the TWC Transaction; however, it did impact the actual number of shares issued in the TWC Transaction.

Out of approximately 277 million shares of TWC common stock outstanding at the closing of the TWC Transaction, excluding TWC common stock held by the Liberty Parties, approximately 274 million shares were converted into the right to receive the Option A Consideration and approximately 3 million shares were converted into the right to receive the Option B Consideration. The Liberty Parties received approximately one share of Charter Class A common stock for each share of Legacy TWC common stock they owned (equivalent to 1.106 shares of Legacy Charter Class A common stock multiplied by the Parent Merger Exchange Ratio).

As of the date of completion of the Transactions, the total value of the TWC Transaction was approximately $85 billion, including cash, equity and Legacy TWC assumed debt. The purchase price also included an estimated pre-combination vesting period fair value of $514 million for Legacy TWC equity awards converted into Charter awards upon closing of the TWC Transaction (“Converted TWC Awards”) and $69 million of cash paid to former Legacy TWC employees and non-employee directors who held equity awards, whether vested or not vested.

Bright House Transaction

Also, on May 18, 2016, Legacy Charter and Advance/Newhouse Partnership (“A/N”), the former parent of Bright House Networks, LLC (“Bright House”), completed their previously announced transaction, pursuant to a definitive Contribution Agreement (the “Contribution Agreement”), under which Charter acquired Bright House (the “Bright House Transaction”). Pursuant to the Bright House Transaction, Charter became the owner of the membership interests in Bright House and the other assets primarily related to Bright House (other than certain excluded assets and liabilities and non-operating cash). As of the date of acquisition, the purchase price totaled approximately $12.2 billion consisting of (a) $2.0 billion in cash, (b) 25 million convertible preferred units of Charter Holdings with a face amount of $2.5 billion that pay a 6% annual preferential dividend, (c) approximately 31.0 million common units of Charter Holdings that are exchangeable into Charter Class A common stock on a one-for-one basis and (d) one share of Charter Class B common stock.

Liberty Transaction

In connection with the TWC Transaction, Legacy Charter and Liberty Broadband completed their previously announced transactions pursuant to their investment agreement, in which Liberty Broadband purchased for cash approximately 22.0 million shares of Charter Class A common stock valued at $4.3 billion at the closing of the TWC Transaction to partially finance the cash portion of the TWC Transaction consideration, and in connection with the Bright House Transaction, Liberty Broadband purchased approximately 3.7 million shares of Charter Class A common stock valued at $700 million at the closing of the Bright House Transaction (the “Liberty Transaction”).

Financing for the Transactions

Charter partially financed the cash portion of the purchase price of the Transactions with additional indebtedness and cash on hand. In 2015, Legacy Charter issued $15.5 billion aggregate principal amount of CCO Safari II, LLC (“CCO Safari II”) senior secured notes, $3.8 billion aggregate principal amount of CCO Safari III, LLC (“CCO Safari III”) senior secured bank loans and $2.5 billion aggregate principal amount of CCOH Safari, LLC (“CCOH Safari” and collectively with CCO Safari II and CCO Safari III, the “Safari Escrow Entities”) senior unsecured notes. The net proceeds were initially deposited into escrow accounts. Upon closing of the TWC Transaction, the proceeds were released from escrow and the CCOH Safari notes became obligations of CCO

7

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

Holdings and CCO Holdings Capital Corp. (“CCO Holdings Capital”), and the CCO Safari II notes and CCO Safari III credit facilities became obligations of Charter Communications Operating, LLC (“Charter Operating”) and Charter Communications Operating Capital Corp. CCOH Safari merged into CCO Holdings and CCO Safari II and CCO Safari III merged into Charter Operating. In connection with the closing of the Bright House Transaction, Charter Operating closed on a $2.6 billion aggregate principal amount term loan A facility (“Term Loan A”). See Note 7.

Acquisition Accounting

The Transactions enable Charter to apply its operating strategy to a larger set of assets, accelerate product development and innovation through greater scale as well as more effectively compete in medium and large commercial markets. Substantially all of the operations acquired in the Transactions were contributed down to the Company. The operating results of Legacy TWC and Legacy Bright House have been included in the Company’s consolidated statements of operations for the period from the date of the Transactions through September 30, 2016. For the three and nine months ended September 30, 2016, revenues included in the Company’s consolidated statements of operations were $6.4 billion and $9.5 billion, respectively, and consolidated net income was $62 million and $434 million, respectively, for Legacy TWC. For the three and nine months ended September 30, 2016, revenues included in the Company’s consolidated statements of operations were $1.0 billion and $1.5 billion, respectively, and consolidated net income was $126 million and $167 million, respectively, for Legacy Bright House. Consolidated net income includes non-operating expenses such as interest expense and income taxes based on what is included in the respective legal entities and does not include allocations of additional corporate level non-operating expenses.

Charter applied acquisition accounting to the Transactions. The total purchase price was allocated to the identifiable tangible and intangible assets acquired and the liabilities assumed based on their estimated fair values. The fair values were primarily based on third-party valuations using assumptions developed by management and other information compiled by management including, but not limited to, future expected cash flows. The excess of the purchase price over those fair values was recorded as goodwill. Goodwill recognized in the Transactions is representative of resources that do not meet the definition of an identifiable intangible asset and include buy-side synergies, economies of scale of the combined operations, increased market share, assembled workforces and improved credit rating.

The fair values of the assets acquired and liabilities assumed were preliminarily determined using the income, cost and market approaches. The fair values were primarily based on significant inputs that are not observable in the market and thus represent a Level 3 measurement, other than long-term debt assumed in the TWC Transaction which represents a Level 1 measurement. See Note 10.

Property, plant and equipment was valued utilizing the cost approach. The cost approach considers the amount required to replace an asset by constructing or purchasing a new asset with similar utility, then adjusts the value in consideration of all forms of depreciation as of the appraisal date as described below:

• | Physical depreciation - the loss in value or usefulness attributable solely to use of the asset and physical causes such as wear and tear and exposure to the elements. |

• | Functional obsolescence - the loss in value due to factors inherent in the asset itself and due to changes in technology, design or process resulting in inadequacy, overcapacity, lack of functional utility or excess operating costs. |

• | Economic obsolescence - the loss in value due to unfavorable external conditions such as economics of the industry or geographic area, or change in ordinances. |

The cost approach relies on assumptions regarding current material and labor costs required to rebuild and repurchase significant components of property, plant and equipment along with assumptions regarding the age and estimated useful lives of property, plant and equipment.

Franchise rights and customer relationships were valued using an income approach model based on the present value of the estimated discrete future cash flows attributable to each of the intangible assets identified. See Note 6 to the consolidated financial statements in Exhibit 99.2 in the Company’s Current Report on Form 8-K filed with the SEC on June 6, 2016 for more information on the income approach model. The weighted average life of customer relationships acquired in the TWC Transaction and Bright House Transaction was 11 years and 10 years, respectively.

8

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

The fair value of equity investments was based on either applying implied multiples to estimated cash flows or utilizing a discounted cash flow model. The implied multiples were estimated based on precedent transactions and comparable companies. The discounted cash flow model required estimating the present value of future cash flows of the investee.

Legacy TWC long-term debt assumed was adjusted to fair value based on quoted market prices. At the acquisition date, the quoted market values of all but two of Legacy TWC’s bonds were higher than the principal amount of the related debt instrument, which resulted in the recognition of a net debt premium of approximately $2.4 billion. The quoted market value of a debt instrument is higher than the principal amount of the debt when the market interest rates are lower than the stated interest rate of the debt. This debt premium is amortized as a reduction to interest expense over the remaining life of the applicable debt.

Generally, no fair value adjustments were reflected in current assets and current liabilities as carrying value is estimated to approximate fair value because of the short-term nature of the items. However, fair value adjustments were reflected in other noncurrent assets and other long-term liabilities relating to contract-based assets and liabilities, capital lease obligations, deferred liabilities and pension liabilities. Out-of-market contract-based assets and liabilities relating to non-cancelable executory contracts and operating leases were recognized based on discounted cash flow models to the extent the terms of the non-cancelable contracts are favorable or unfavorable compared with the relative market terms of the same or similar contract at the acquisition date. The out-of-market element will be amortized as if the contract were consummated at market terms on the acquisition date. Capital lease obligations were measured at fair value based on the present value of amounts to be paid under the lease agreement using a market participant discount rate. Deferred liabilities were not recorded in acquisition accounting to the extent there was no associated payment obligation or substantive performance obligation. The pension liabilities assumed in the TWC Transaction are measured at fair value based on an actuarially determined projected benefit obligation, less the fair value of pension investments, as of the acquisition date. See Note 17 for fair value assumptions considered in acquisition accounting for the pension liabilities.

An adjustment was recorded for the deferred tax impact of acquisition accounting adjustments primarily related to property, plant and equipment, franchises, customer relationships and assumed Legacy TWC long-term debt. The incremental deferred tax liabilities were calculated primarily based on the tax effect of the step-up in book basis of net assets of Legacy TWC excluding the amount attributable to nondeductible goodwill. Deferred tax liabilities are recorded at Charter and not contributed down as the Company, and majority of its indirect subsidiaries, are limited liability companies that are not subject to income tax.

The Charter Class A common stock issued to Legacy TWC stockholders and Charter Holdings common units issued to A/N were valued based on the opening share price of Charter Class A common stock on the acquisition date. The convertible preferred units of Charter Holdings issued to A/N were valued at approximately $3.2 billion based on a binomial lattice model for convertible bonds that models the future changes in the common equity value of Charter. The valuation relies on management’s assumptions including risk-free interest rate, volatility and discount yield. The pre-combination vesting period fair value of the Converted TWC Awards was based on the portion of the requisite service period completed at the acquisition date by Legacy TWC employee award holders applied to the total fair value of the Converted TWC Awards. See Note 16 for fair value assumptions considered in acquisition accounting for the Converted TWC Awards.

9

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

The allocation of the purchase price to tangible and intangible assets and certain liabilities is preliminary and is subject to change based on finalization and review of such valuations. During the measurement period, the Company will continue to obtain information to assist in finalizing the fair value of net assets acquired, which may differ materially from the preliminary estimates. The Company will apply any measurement period adjustments, including any related impacts to net income (loss), in the reporting period in which the adjustments are determined. The tables below present the calculation of the purchase price and the preliminary allocation of the purchase price to the assets acquired and liabilities assumed in the Transactions.

TWC Purchase Price

Shares of Charter Class A common stock issued (including the Liberty Parties) (in millions) | 143.0 | ||

Charter Class A common stock closing price per share | $ | 224.91 | |

Fair value of Charter Class A common stock issued | $ | 32,164 | |

Cash paid to Legacy TWC stockholders (excluding the Liberty Parties) | $ | 27,770 | |

Pre-combination vesting period fair value of Converted TWC Awards | 514 | ||

Cash paid for Legacy TWC non-employee equity awards | 69 | ||

Total purchase price | $ | 60,517 | |

TWC Preliminary Allocation of Purchase Price

Cash and cash equivalents | $ | 1,058 | |

Current assets | 1,309 | ||

Property, plant and equipment | 21,431 | ||

Franchises | 53,395 | ||

Customer relationships | 13,700 | ||

Goodwill | 28,459 | ||

Other noncurrent assets | 1,061 | ||

Accounts payable and accrued liabilities | (3,752 | ) | |

Debt | (24,900 | ) | |

Deferred income taxes | (28,071 | ) | |

Other long-term liabilities | (3,169 | ) | |

Noncontrolling interests | (4 | ) | |

$ | 60,517 | ||

During the three months ended September 30, 2016, the Company made measurement period adjustments to the fair value of certain assets acquired and liabilities assumed in the TWC Transaction, including a decrease of $145 million to property, plant and equipment; an increase of $25 million to accrued liabilities; a decrease of $81 million to deferred income taxes; and an increase in other long-term liabilities of $2 million resulting in a net increase of $91 million to goodwill. The measurement period adjustment to property, plant and equipment also resulted in an increase of $12 million in depreciation expense relating to the prior quarter that was recorded in the third quarter of 2016. The Company expects to record additional measurement period adjustments in future periods.

10

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

Bright House Purchase Price

Charter Holdings common units issued to A/N (in millions) | 31.0 | ||

Charter Class A common stock closing price per share | $ | 224.91 | |

Fair value of Charter Holdings common units issued to A/N | $ | 6,971 | |

Fair value of Charter Holdings convertible preferred units issued to A/N | 3,163 | ||

Cash paid to A/N | 2,022 | ||

Total purchase price | $ | 12,156 | |

Bright House Preliminary Allocation of Purchase Price

Current assets | $ | 132 | |

Property, plant and equipment | 2,884 | ||

Franchises | 6,844 | ||

Customer relationships | 2,040 | ||

Goodwill | 534 | ||

Other noncurrent assets | 86 | ||

Accounts payable and accrued liabilities | (330 | ) | |

Other long-term liabilities | (12 | ) | |

Noncontrolling interests | (22 | ) | |

$ | 12,156 | ||

During the three months ended September 30, 2016, the Company made measurement period adjustments to the fair value of certain assets acquired and liabilities assumed in the Bright House Transaction, including a decrease of $382 million to property, plant and equipment and a corresponding increase of $382 million to goodwill. The measurement period adjustment to property, plant and equipment had an inconsequential impact on depreciation expense recorded in the prior quarter. The Company expects to record additional measurement period adjustments in future periods.

In connection with the Transactions, Charter contributed down to the Company the net assets and liabilities of TWC and Bright House except for the deferred tax liabilities of Charter, as noted above, and net assets of approximately $1.0 billion primarily comprised of cash and cash equivalents used as a source for the cash portion of the TWC purchase price.

11

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

Selected Pro Forma Financial Information

The following unaudited pro forma financial information of the Company is based on the historical consolidated financial statements of CCO Holdings, Legacy TWC and Legacy Bright House and is intended to provide information about how the Transactions and related financing may have affected the Company’s historical consolidated financial statements if they had closed as of January 1, 2015. The pro forma financial information below is based on available information and assumptions that the Company believes are reasonable. The pro forma financial information is for illustrative and informational purposes only and is not intended to represent or be indicative of what the Company’s financial condition or results of operations would have been had the transactions described above occurred on the date indicated. The pro forma financial information also should not be considered representative of the Company’s future financial condition or results of operations.

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2015 | 2016 | 2015 | |||||||||

Revenues | $ | 9,342 | $ | 29,748 | $ | 27,813 | |||||

Net income attributable to CCO Holdings member | $ | 253 | $ | 1,112 | $ | 342 | |||||

3. Property, Plant and Equipment

Property, plant and equipment consists of the following as of September 30, 2016 and December 31, 2015:

September 30, 2016 | December 31, 2015 | ||||||

Cable distribution systems | $ | 22,942 | $ | 8,158 | |||

Customer premise equipment and installations | 11,916 | 4,632 | |||||

Vehicles and equipment | 1,178 | 379 | |||||

Buildings and improvements | 3,108 | 540 | |||||

Furniture, fixtures and equipment | 2,999 | 1,117 | |||||

42,143 | 14,826 | ||||||

Less: accumulated depreciation | (9,486 | ) | (6,509 | ) | |||

$ | 32,657 | $ | 8,317 | ||||

The Company periodically evaluates the estimated useful lives used to depreciate its assets and the estimated amount of assets that will be abandoned or have minimal use in the future. A significant change in assumptions about the extent or timing of future asset retirements, or in the Company’s use of new technology and upgrade programs, could materially affect future depreciation expense.

Depreciation expense for the three and nine months ended September 30, 2016 was $1.7 billion and $3.2 billion, respectively, and was $471 million and $1.4 billion for the three and nine months ended September 30, 2015, respectively. Property, plant and equipment preliminarily increased by $24.3 billion as a result of the Transactions. See Note 2.

12

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

4. Franchises, Goodwill and Other Intangible Assets

Indefinite-lived and finite-lived intangible assets consist of the following as of September 30, 2016 and December 31, 2015:

September 30, 2016 | December 31, 2015 | |||||||||||||||||||||||

Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | |||||||||||||||||||

Indefinite-lived intangible assets: | ||||||||||||||||||||||||

Franchises | $ | 66,245 | $ | — | $ | 66,245 | $ | 6,006 | $ | — | $ | 6,006 | ||||||||||||

Goodwill | 30,165 | — | 30,165 | 1,168 | — | 1,168 | ||||||||||||||||||

Other intangible assets | 4 | — | 4 | 4 | — | 4 | ||||||||||||||||||

$ | 96,414 | $ | — | $ | 96,414 | $ | 7,178 | $ | — | $ | 7,178 | |||||||||||||

Finite-lived intangible assets: | ||||||||||||||||||||||||

Customer relationships | $ | 18,356 | $ | (2,917 | ) | $ | 15,439 | $ | 2,616 | $ | (1,760 | ) | $ | 856 | ||||||||||

Other intangible assets | 635 | (120 | ) | 515 | 173 | (82 | ) | 91 | ||||||||||||||||

$ | 18,991 | $ | (3,037 | ) | $ | 15,954 | $ | 2,789 | $ | (1,842 | ) | $ | 947 | |||||||||||

Amortization expense related to customer relationships and other intangible assets for the three and nine months ended September 30, 2016 was $748 million and $1.2 billion, respectively, and was $67 million and $205 million for the three and nine months ended September 30, 2015, respectively. Franchises, goodwill and customer relationships preliminarily increased by $60.2 billion, $29.0 billion and $15.7 billion, respectively, as a result of the Transactions. See Note 2.

The Company expects amortization expense on its finite-lived intangible assets will be as follows:

Three months ended December 31, 2016 | $ | 741 | ||

2017 | 2,773 | |||

2018 | 2,488 | |||

2019 | 2,201 | |||

2020 | 1,906 | |||

Thereafter | 5,845 | |||

$ | 15,954 | |||

Actual amortization expense in future periods will differ from these estimates as a result of new intangible asset acquisitions or divestitures, changes in useful lives, purchase accounting adjustments, impairments and other relevant factors.

5. Investments

In connection with the Transactions, the Company acquired approximately $508 million of Legacy TWC and Legacy Bright House equity-method and cost-method investments, which were adjusted to fair value as a result of applying acquisition accounting. The equity-method investments acquired and related ownership percentages as of September 30, 2016 include Sterling Entertainment Enterprises, LLC (“Sterling” - d/b/a SportsNet New York - 26.8% owned), MLB Network, LLC (“MLB Network” - 6.4% owned), iN Demand L.L.C. (“iN Demand” - 39.8% owned) and National Cable Communications LLC (“NCC” - 20.0% owned), among other less significant equity-method and cost-method investments acquired. Sterling and MLB Network are primarily engaged in the development of sports programming services. iN Demand provides programming on a video on demand, pay-per-view and subscription basis. NCC represents multi-video program distributors to advertisers.

13

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

The Company applies the equity method of accounting to these and other less significant equity-method investments, all of which are recorded in other noncurrent assets in the consolidated balance sheets as of September 30, 2016 and December 31, 2015. For each of the three and nine months ended September 30, 2016, net losses from equity-method investments were $2 million which were recorded in other expense, net in the consolidated statements of operations, and for both the three and nine months ended September 31, 2015, gains (losses) from equity-method investments were insignificant.

Noncontrolling interests assumed in the Transactions were recorded at fair value on the acquisition date and primarily relate to the third-party interest in CV of Viera, LLP, the Company’s consolidated joint venture in a small cable system in Florida. For both the three and nine months ended September 30, 2016, net income attributable to noncontrolling interest was $1 million.

In 2015, noncontrolling interest included the 2% accretion of the preferred membership interests in CC VIII, LLC (“CC VIII”) plus approximately 18.6% of CC VIII’s income, net of accretion. On December 31, 2015, the CC VIII preferred interest held by CCH I, LLC was contributed to CC VIII and subsequently canceled.

6. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consist of the following as of September 30, 2016 and December 31, 2015:

September 30, 2016 | December 31, 2015 | |||||||

Accounts payable – trade | $ | 447 | $ | 112 | ||||

Accrued capital expenditures | 611 | 296 | ||||||

Deferred revenue | 346 | 96 | ||||||

Accrued liabilities: | ||||||||

Interest | 841 | 167 | ||||||

Programming costs | 1,768 | 451 | ||||||

Franchise-related fees | 242 | 65 | ||||||

Compensation | 770 | 118 | ||||||

Other | 979 | 171 | ||||||

$ | 6,004 | $ | 1,476 | |||||

14

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

7. Long-Term Debt

Long-term debt consists of the following as of September 30, 2016 and December 31, 2015:

September 30, 2016 | December 31, 2015 | ||||||||||||||

Principal Amount | Accreted Value | Principal Amount | Accreted Value | ||||||||||||

CCO Holdings, LLC: | |||||||||||||||

7.000% senior notes due January 15, 2019 | $ | — | $ | — | $ | 600 | $ | 594 | |||||||

7.375% senior notes due June 1, 2020 | — | — | 750 | 744 | |||||||||||

5.250% senior notes due March 15, 2021 | 500 | 496 | 500 | 496 | |||||||||||

6.500% senior notes due April 30, 2021 | — | — | 1,500 | 1,487 | |||||||||||

6.625% senior notes due January 31, 2022 | 750 | 741 | 750 | 740 | |||||||||||

5.250% senior notes due September 30, 2022 | 1,250 | 1,231 | 1,250 | 1,229 | |||||||||||

5.125% senior notes due February 15, 2023 | 1,000 | 991 | 1,000 | 990 | |||||||||||

5.125% senior notes due May 1, 2023 | 1,150 | 1,141 | 1,150 | 1,140 | |||||||||||

5.750% senior notes due September 1, 2023 | 500 | 496 | 500 | 495 | |||||||||||

5.750% senior notes due January 15, 2024 | 1,000 | 991 | 1,000 | 990 | |||||||||||

5.875% senior notes due April 1, 2024 | 1,700 | 1,684 | — | — | |||||||||||

5.375% senior notes due May 1, 2025 | 750 | 744 | 750 | 744 | |||||||||||

5.750% senior notes due February 15, 2026 | 2,500 | 2,459 | — | — | |||||||||||

5.500% senior notes due May 1, 2026 | 1,500 | 1,487 | — | — | |||||||||||

5.875% senior notes due May 1, 2027 | 800 | 794 | 800 | 794 | |||||||||||

Charter Communications Operating, LLC: | |||||||||||||||

3.579% senior notes due July 23, 2020 | 2,000 | 1,982 | — | — | |||||||||||

4.464% senior notes due July 23, 2022 | 3,000 | 2,972 | — | — | |||||||||||

4.908% senior notes due July 23, 2025 | 4,500 | 4,457 | — | — | |||||||||||

6.384% senior notes due October 23, 2035 | 2,000 | 1,980 | — | — | |||||||||||

6.484% senior notes due October 23, 2045 | 3,500 | 3,466 | — | — | |||||||||||

6.834% senior notes due October 23, 2055 | 500 | 495 | — | — | |||||||||||

Credit facilities | 8,965 | 8,863 | 3,552 | 3,502 | |||||||||||

Time Warner Cable, LLC: | |||||||||||||||

5.850% senior notes due May 1, 2017 | 2,000 | 2,050 | — | — | |||||||||||

6.750% senior notes due July 1, 2018 | 2,000 | 2,157 | — | — | |||||||||||

8.750% senior notes due February 14, 2019 | 1,250 | 1,430 | — | — | |||||||||||

8.250% senior notes due April 1, 2019 | 2,000 | 2,292 | — | — | |||||||||||

5.000% senior notes due February 1, 2020 | 1,500 | 1,624 | — | — | |||||||||||

4.125% senior notes due February 15, 2021 | 700 | 742 | — | — | |||||||||||

4.000% senior notes due September 1, 2021 | 1,000 | 1,059 | — | — | |||||||||||

5.750% sterling senior notes due June 2, 2031 (a) | 810 | 879 | — | — | |||||||||||

6.550% senior debentures due May 1, 2037 | 1,500 | 1,693 | — | — | |||||||||||

7.300% senior debentures due July 1, 2038 | 1,500 | 1,797 | — | — | |||||||||||

6.750% senior debentures due June 15, 2039 | 1,500 | 1,731 | — | — | |||||||||||

5.875% senior debentures due November 15, 2040 | 1,200 | 1,259 | — | — | |||||||||||

5.500% senior debentures due September 1, 2041 | 1,250 | 1,258 | — | — | |||||||||||

5.250% sterling senior notes due July 15, 2042 (b) | 843 | 811 | — | — | |||||||||||

4.500% senior debentures due September 15, 2042 | 1,250 | 1,135 | — | — | |||||||||||

15

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

Time Warner Cable Enterprises LLC: | |||||||||||||||

8.375% senior debentures due March 15, 2023 | 1,000 | 1,282 | — | — | |||||||||||

8.375% senior debentures due July 15, 2033 | 1,000 | 1,327 | — | — | |||||||||||

Total debt | 60,168 | 61,996 | 14,102 | 13,945 | |||||||||||

Less current portion: | |||||||||||||||

5.850% senior notes due May 1, 2017 | 2,000 | 2,050 | — | — | |||||||||||

Long-term debt | $ | 58,168 | $ | 59,946 | $ | 14,102 | $ | 13,945 | |||||||

(a) | Principal amount includes £625 million valued at $810 million as of September 30, 2016 using the exchange rate at that date. |

(b) | Principal amount includes £650 million valued at $843 million as of September 30, 2016 using the exchange rate at that date. |

The accreted values presented in the table above represent the principal amount of the debt less the original issue discount at the time of sale, deferred financing costs, and, (i) in regards to the Legacy TWC debt assumed, a fair value premium adjustment as a result of applying acquisition accounting plus the accretion of those amounts to the balance sheet date and (ii) in regards to the fixed-rate British pound sterling denominated notes (the “Sterling Notes”), a remeasurement of the principal amount of the debt and any premium or discount into US dollars as of the balance sheet date. See Note 9. However, the amount that is currently payable if the debt becomes immediately due is equal to the principal amount of the debt. The Company has availability under the Charter Operating credit facilities of approximately $2.8 billion as of September 30, 2016.

As discussed in Note 2, upon consummation of the Transactions, CCOH Safari merged into CCO Holdings and CCO Safari II and CCO Safari III merged into Charter Operating and, as a result, the Company assumed $21.8 billion aggregate principal amount of debt. During the three and nine months ended September 30, 2015, Charter incurred interest expense on this debt of approximately $163 million and $275 million, respectively.

CCO Holdings

In February 2016, CCO Holdings and CCO Holdings Capital jointly issued $1.7 billion aggregate principal amount of 5.875% senior notes due 2024 (the “2024 Notes”) and, in April 2016, they issued $1.5 billion aggregate principal amount of 5.500% senior notes due 2026 (the “2026 Notes”) at a price of 100.075% of the aggregate principal amount. The net proceeds from both issuances were used to repurchase all of CCO Holdings’ 7.000% senior notes due 2019, 7.375% senior notes due 2020 and 6.500% senior notes due 2021 and to pay related fees and expenses and for general corporate purposes. These debt repurchases resulted in a loss on extinguishment of debt of $110 million for the nine months ended September 30, 2016.

The 2024 Notes and 2026 Notes are senior debt obligations of CCO Holdings and CCO Holdings Capital and rank equally with all other current and future unsecured, unsubordinated obligations of CCO Holdings and CCO Holdings Capital. They are structurally subordinated to all obligations of subsidiaries of CCO Holdings.

CCO Holdings may redeem some or all of the 2024 Notes and 2026 Notes at any time with a make-whole premium. Beginning in 2019 for the 2024 notes and 2021 for the 2026 notes, the optional redemption price declines to 100% of the respective series’ principal amount, plus accrued and unpaid interest, if any.

In addition, at any time prior to April 1, 2019 in regards to the 2024 Notes and May 1, 2019 in regards to the 2026 Notes, CCO Holdings may redeem up to 40% of the aggregate principal amount of the 2024 Notes and 2026 Notes at a premium plus accrued and unpaid interest to the redemption date, with the net cash proceeds of one or more equity offerings (as defined in the indenture); provided that certain conditions are met. In the event of specified change of control events, CCO Holdings must offer to purchase the outstanding CCO Holdings notes from the holders at a purchase price equal to 101% of the total principal amount of the notes, plus any accrued and unpaid interest.

In April 2015, CCO Holdings and CCO Holdings Capital closed on transactions in which they issued $1.15 billion aggregate principal amount of 5.125% senior unsecured notes due 2023 (the “2023 Notes”), $750 million aggregate principal amount of 5.375% senior unsecured notes due 2025 (the “2025 Notes”) and $800 million aggregate principal amount of 5.875% senior unsecured notes due 2027 (the “2027 Notes” and collectively, the “Notes”). The net proceeds from the issuance of the 2023 Notes

16

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

and 2025 Notes were used to finance tender offers and a subsequent call in which $1.0 billion aggregate principal amount of CCO Holdings’ outstanding 7.250% senior notes due 2017 and $700 million aggregate principal amount of CCO Holdings’ outstanding 8.125% senior notes due 2020 were repurchased, as well as for general corporate purposes. The net proceeds from the issuance of the 2027 Notes were used to call $800 million of the $1.4 billion aggregate principal amount of CCO Holdings’ outstanding 7.000% senior notes due 2019. These debt repurchases resulted in a loss on extinguishment of debt of $123 million for the nine months ended September 30, 2015.

The Company also recorded a loss on extinguishment of debt of approximately $3 million for the nine months ended September 30, 2015 as a result of the repayment of debt upon termination of the proposed transactions with Comcast Corporation (“Comcast”).

Charter Operating

In connection with the closing of the TWC Transaction, Charter Operating replaced its existing revolving credit facility with a new $3.0 billion senior secured revolving credit facility under Charter Operating’s Amended and Restated Credit Agreement dated May 18, 2016 (the “Credit Agreement”). As of September 30, 2016, $220 million of the revolving credit facility was utilized to collateralize $325 million of letters of credit issued on the Company’s behalf. In connection with the closing of the Bright House Transaction, Charter Operating closed on a $2.6 billion aggregate principal amount Term Loan A pursuant to the terms of the Credit Agreement of which $2.0 billion was used to fund the cash portion of the Bright House Transaction and of which $638 million was used to prepay and terminate Charter Operating’s existing Term A-1 Loans. Interest on Term Loan A was set at LIBOR plus 2%. As of September 30, 2016, the aggregate principal amount of Charter Operating’s credit facilities was $9.0 billion, which includes $3.8 billion aggregate principal amount of CCO Safari III credit facilities that became obligations of Charter Operating upon the closing of the TWC Transaction.

The Credit Agreement and the Charter Operating senior notes are guaranteed by CCO Holdings, TWC, LLC (as defined below), TWCE (as defined below) and substantially all of the operating subsidiaries of Charter Operating (collectively, the “Subsidiary Guarantors”). Term Loan A and borrowings under the incremental revolving credit facility are secured by a perfected first priority security interest in substantially all of the assets of Charter Operating and the Subsidiary Guarantors, subject to certain customary exceptions and the liens rank equally with the liens on the collateral securing obligations under the Charter Operating notes and credit facilities and the Time Warner Cable, LLC (the successor to Legacy TWC outstanding debt obligations, “TWC, LLC”) senior notes and debentures and the Time Warner Cable Enterprises LLC (“TWCE”) senior debentures assumed in the TWC Transaction.

Assumed Legacy TWC Indebtedness

The Company assumed approximately $22.4 billion in aggregate principal amount of TWC, LLC senior notes and debentures and TWCE senior debentures with varying maturities. The Company applied acquisition accounting to Legacy TWC, and as a result, the debt assumed was adjusted to fair value using quoted market values as of the closing date. This fair value adjustment resulted in recognition of a net debt premium of approximately $2.4 billion.

TWC, LLC Senior Notes and Debentures

The TWC, LLC senior notes and debentures are guaranteed by CCO Holdings, Charter Operating, TWCE and the Subsidiary Guarantors and rank equally with the liens on the collateral securing obligations under the Charter Operating notes and credit facilities. Interest on each series of TWC, LLC senior notes and debentures is payable semi-annually (with the exception of the Sterling Notes, which is payable annually) in arrears.

The TWC, LLC indenture contains customary covenants relating to restrictions on the ability of TWC, LLC or any material subsidiary to create liens and on the ability of TWC, LLC and TWCE to consolidate, merge or convey or transfer substantially all of their assets. The TWC, LLC indenture also contains customary events of default.

The TWC, LLC senior notes and debentures may be redeemed in whole or in part at any time at TWC, LLC’s option at a redemption price equal to the greater of (i) all of the applicable principal amount being redeemed and (ii) the sum of the present values of the remaining scheduled payments on the applicable TWC, LLC senior notes and debentures discounted to the redemption date on a semi-annual basis (with the exception of the Sterling Notes, which are on an annual basis), at a comparable government bond rate

17

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

plus a designated number of basis points as further described in the indenture and the applicable note or debenture, plus, in each case, accrued but unpaid interest to, but not including, the redemption date.

The Company may offer to redeem all, but not less than all, of the Sterling Notes in the event of certain changes in the tax laws of the U.S. (or any taxing authority in the U.S.). This redemption would be at a redemption price equal to 100% of the principal amount, together with accrued and unpaid interest on the Sterling Notes to, but not including, the redemption date.

TWCE Senior Debentures

The TWCE senior debentures are guaranteed by CCO Holdings, Charter Operating, TWC, LLC and the Subsidiary Guarantors and rank equally with the liens on the collateral securing obligations under the Charter Operating notes and credit facilities. Interest on each series of TWCE senior debentures is payable semi-annually in arrears. The TWCE senior debentures are not redeemable before maturity.

The TWCE indenture contains customary covenants relating to restrictions on the ability of TWCE or any material subsidiary to create liens and on the ability of TWC, LLC and TWCE to consolidate, merge or convey or transfer substantially all of their assets. The TWCE indenture also contains customary events of default.

Liquidity and Future Principal Payments

The Company continues to have significant amounts of debt, and its business requires significant cash to fund principal and interest payments on its debt, capital expenditures and ongoing operations. As set forth below, the Company has significant future principal payments. The Company continues to monitor the capital markets, and it expects to undertake refinancing transactions and utilize free cash flow and cash on hand to further extend or reduce the maturities of its principal obligations. The timing and terms of any refinancing transactions will be subject to market conditions.

Based on outstanding indebtedness as of September 30, 2016, the amortization of term loans, and the maturity dates for all senior and subordinated notes and debentures, total future principal payments on the total borrowings under all debt agreements as of September 30, 2016 are as follows:

Year | Amount | |||

Three months ended December 31, 2016 | $ | 49 | ||

2017 | 2,197 | |||

2018 | 2,197 | |||

2019 | 3,546 | |||

2020 | 5,216 | |||

Thereafter | 46,963 | |||

$ | 60,168 | |||

8. Loans Receivable (Payable) - Related Party

Loans payable - related party as of September 30, 2016 consists of loans from Charter Communications Holdings Company, LLC (“Charter Holdco”) to the Company of $640 million. Interest accrues on loans payable - related party at LIBOR plus 2%.

Loans receivable - related party as of December 31, 2015 consists of loans from the Company to CCOH Safari II, LLC, CCOH Safari, CCO Safari II and CCO Safari III of $96 million, $34 million, $508 million and $55 million, respectively, which were settled with the Company upon the merger of the Safari Escrow Entities into the Company. Loans payable-related party as of December 31, 2015 consists of loans from Charter Holdco and CCH II, LLC to the Company of $48 million and $285 million, respectively.

18

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

9. Accounting for Derivative Instruments and Hedging Activities

The Company uses derivative instruments to manage interest rate risk on variable debt and foreign exchange risk on the Sterling Notes, and does not hold or issue derivative instruments for speculative trading purposes.

Interest rate derivative instruments are used to manage interest costs and to reduce the Company’s exposure to increases in floating interest rates. The Company manages its exposure to fluctuations in interest rates by maintaining a mix of fixed and variable rate debt. Using interest rate derivative instruments, the Company agrees to exchange, at specified intervals through 2017, the difference between fixed and variable interest amounts calculated by reference to agreed-upon notional principal amounts. As of September 30, 2016 and December 31, 2015, the Company had $1.1 billion in notional amounts of interest rate derivative instruments outstanding. The notional amounts of interest rate derivative instruments do not represent amounts exchanged by the parties and, thus, are not a measure of exposure to credit loss. The amounts exchanged were determined by reference to the notional amount and the other terms of the contracts.

Upon closing of the TWC Transaction, the Company acquired interest rate derivative instrument assets with a fair value of $85 million (excluding accrued interest), which were terminated and settled with their respective counterparties in the second quarter of 2016 with an $88 million cash payment to the Company of which $14 million was for interest accrued through the date of termination. The termination resulted in an $11 million loss for the nine months ended September 30, 2016 which was recorded in gain (loss) on financial instruments, net in the consolidated statements of operations.

Upon closing of the TWC Transaction, the Company assumed cross-currency derivative instrument liabilities with a fair value of $72 million (excluding accrued interest). Cross-currency derivative instruments are used to effectively convert £1.275 billion aggregate principal amount of fixed-rate British pound sterling denominated debt, including annual interest payments and the payment of principal at maturity, to fixed-rate U.S. dollar denominated debt. The cross-currency swaps have maturities of June 2031 and July 2042. The Company is required to post collateral on the cross-currency derivative instruments when the derivative contracts are in a liability position. In May 2016, the Company entered into a collateral holiday agreement for 80% of both the 2031 and 2042 cross-currency swaps, which eliminates the requirement to post collateral for three years.

The effect of derivative instruments on the consolidated balance sheets is presented in the table below:

September 30, 2016 | December 31, 2015 | ||||||

Interest Rate Derivatives | |||||||

Accrued interest | $ | 1 | $ | 3 | |||

Other long-term liabilities | $ | 7 | $ | 10 | |||

Accumulated other comprehensive loss | $ | (7 | ) | $ | (13 | ) | |

Cross-Currency Derivatives | |||||||

Other long-term liabilities | $ | 240 | $ | — | |||

The Company’s interest rate and cross-currency derivative instruments are not designated as hedges and are marked to fair value each period, with the impact recorded as a gain or loss on financial instruments, net in the consolidated statements of operations. While these derivative instruments are not designated as cash flow hedges for accounting purposes, management continues to believe such instruments are closely correlated with the respective debt, thus managing associated risk.

19

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)

The effect of financial instruments on the consolidated statements of operations is presented in the table below.

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Gain (loss) on Financial Instruments, Net: | |||||||||||||||

Change in fair value of interest rate derivative instruments | $ | 7 | $ | (3 | ) | $ | 5 | $ | (3 | ) | |||||

Change in fair value of cross-currency derivative instruments | 17 | — | (168 | ) | — | ||||||||||

Remeasurement of Sterling Notes to U.S. dollars | 49 | — | 196 | — | |||||||||||

Termination of interest rate derivative instruments | — | — | (11 | ) | — | ||||||||||

Loss reclassified from accumulated other comprehensive loss due to discontinuance of hedge accounting | (2 | ) | (2 | ) | (6 | ) | (7 | ) | |||||||

$ | 71 | $ | (5 | ) | $ | 16 | $ | (10 | ) | ||||||

10. Fair Value Measurements

The accounting guidance establishes a three-level hierarchy for disclosure of fair value measurements, based on the transparency of inputs to the valuation of an asset or liability as of the measurement date, as follows:

• | Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

• | Level 2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

• | Level 3 – inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

Financial Assets and Liabilities

The Company has estimated the fair value of its financial instruments as of September 30, 2016 and December 31, 2015 using available market information or other appropriate valuation methodologies. Considerable judgment, however, is required in interpreting market data to develop the estimates of fair value. Accordingly, the estimates presented in the accompanying consolidated financial statements are not necessarily indicative of the amounts the Company would realize in a current market exchange.

The carrying amounts of cash and cash equivalents, receivables, payables and other current assets and liabilities approximate fair value because of the short maturity of those instruments.

The Company’s cash and cash equivalents as of September 30, 2016 were primarily invested in money market funds. Money market funds are valued at the closing price reported by the fund sponsor from an actively traded exchange which approximates fair value. The money market funds potentially subject the Company to concentration of credit risk. The amount invested within any one financial instrument did not exceed $250 million as of September 30, 2016. As of September 30, 2016, there were no significant concentrations of financial instruments in a single investee, industry or geographic location.

Interest rate derivative instruments are valued using a present value calculation based on an implied forward LIBOR curve (adjusted for Charter Operating’s and counterparties’ credit risk). The weighted average pay rate for the Company’s currently effective interest rate derivative instruments was 1.61% at September 30, 2016 and December 31, 2015 (exclusive of applicable spreads). The cross-currency derivative instruments are valued using a present value calculation based on expected forward interest and exchange rates (adjusted for Charter Operating’s and counterparties’ credit risk).

20

CCO HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(dollars in millions, except where indicated)