Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EUROSITE POWER INC. | eusp110416shareholderlette.htm |

November 4, 2016

Dear Shareholder,

We are writing to you today as we turn a new chapter in our history as a fully independent company. EuroSite Power

is committed to delivering clean, reliable, and affordable energy services to customers via our unique, efficient, and

environmentally friendly on-site power solutions. Guided by the vision of our experienced board of directors and

with the ongoing support of our most dedicated shareholders, our expert team of managers could not be better

positioned to succeed as we enter our new phase of growth and expansion with a strong balance sheet and robust

business fundamentals.

Given opportunity we see ahead, it makes sense to take a step back and reflect on the work it took to bring the

company to this inflection point for growth.

Early History:

EuroSite Power Inc. was formed in 2010, as the European subsidiary of American DG Energy Inc. (although we are

now a deconsolidated and fully independent company), to deploy comprehensive power purchase style energy

solutions for commercial and industrial customers in the UK and Europe. We own and operate highly efficient, clean,

on-site energy systems that produce electricity, hot water, heat and cooling, thereby saving customers money on

their energy bills and reducing their carbon footprint. Via our On-Site Utility model, commercial buildings’

expenditures to install, operate and replace their energy, heating and cooling equipment are eliminated – providing

a seamless integrated energy solution with zero capital cost for the customer.

How are we able to achieve this?

Using efficient, natural-gas engine

driven cogeneration (also known as

“combined heat and power” or

“CHP”), chillers, and heat pumps

installed at the customer’s facility,

EuroSite Power is able to offer an

alternative to traditional utility grid-

supplied energy at a guaranteed discount to prevailing utility prices. Locating the energy supply close to the user’s

demand provides a number of benefits including – eliminating lost power from long distance transmission;

harnessing the free waste heat from the electric generating process and putting it to useful purpose inside the

facility; reducing carbon dioxide (CO2) emissions; and improving building resiliency via system redundancy. Under

the terms of a typical 15 year On-Site Utility agreement, highly efficient CHP systems are installed and commissioned

at a customer's facility at no upfront cost to the customer with discounted energy being sold to the facility. The

reliable clean power technology is owned, operated, and maintained by EuroSite Power and the customer is billed

according to their usage, just like receiving a regular bill from their local utility.

The Four Pillars:

In the past twelve months significant steps have been taken to position the company to aggressively ramp the

business. First introduced in the third quarter 2015, the EuroSite Power team implemented our “Four Pillars”

strategy to build a strong base of operations, laying the foundation for future growth. These Four Pillars included: 1)

securing a stable source of project financing; 2) launching an in-house maintenance team; 3) developing a European

partner to aid in expansion of our offering to that territory; and 4) establishing a long term gas purchase/supply

arrangement. All four of these key pillars were completed in less than six months and have established a base for

future success.

Project Financing – During our initial phase of business development, the company relied on private

placements, equity sales, and debt to finance projects. Because EuroSite Power assumes all the upfront expense of

equipment purchase and installation, in the past the company was constrained by availability of funds in pursuit of

appropriate customer installation projects. To address this natural capital constraint, project financing agreements

were signed in March 2016 with Societe Generale Equipment Finance (SGEF) and Macquarie Equipment Finance (UK)

Ltd. (Macquarie).

Providing a frame-work for financing qualifying On-Site

Utility installations, the agreements allow EuroSite Power the

flexibility to pursue larger and more varied opportunities –

including aggressively targeting bigger customers with multiple

or more complex sites. The benefit of these financing

relationships has already been demonstrated with two significant

UK-based project wins this year. A 331kW TEDOM CHP system

was contracted and installed at The Dome leisure centre in

Doncaster while The Celtic Manor Resort in Newport, South

Wales has signed an agreement for a 400kW CHP system slated

for commissioning later this year. With reliable, unlimited

financing from Macquarie and SGEF, we are well placed to

aggressively pursue further large-scale high-margin projects.

European Expansion - EuroSite Power has been successful

in deploying our On-Site Utility model throughout the UK, as is

well demonstrated by more than 30 operational systems and total installed capacity near 3.5 megawatts. While

European continental expansion has always been a long term objective, we realized having the right partner in

Europe to help us source customers would be of paramount importance.

After a thorough examination of the market opportunity and deployment potential, a collaboration

agreement was executed with Czech CHP manufacturer TEDOM a.s. this spring. With more than 900 MW sold and

25 years' experience, TEDOM is one of the world's leading CHP manufacturers. The agreement allows their network

of 31 dealers throughout Europe and Turkey to offer our On-Site Utility solution to their customers as an alternative

to buying a CHP system outright. As a result of the TEDOM collaboration, we have begun talks with both German and

Italian dealers and are optimistic about the new market potential.

Maintenance – As part of the On-Site Utility offering, EuroSite Power not only handles system design and

installation, but also on-going equipment maintenance, ensuring the customer has a truly hassle-free experience.

Maintenance was previously performed by outsourced contractors, adding significantly to our expense and

depressing operating margins. We began migrating maintenance of our installed fleet to an in-house team beginning

in September of last year and by December the migration of the Tecogen fleet was complete.

Bringing maintenance in-house not only reduced maintenance costs but we are also enjoying improved reliability

from our equipment. Reliability is important as it improves fleet utilization, efficiency and operating run rates – all of

which we optimize to generate maximum revenue from the installed fleet. We are now migrating maintenance of

our installed TEDOM units as they roll off their initial 2-year warranty terms and expect to achieve similar margin

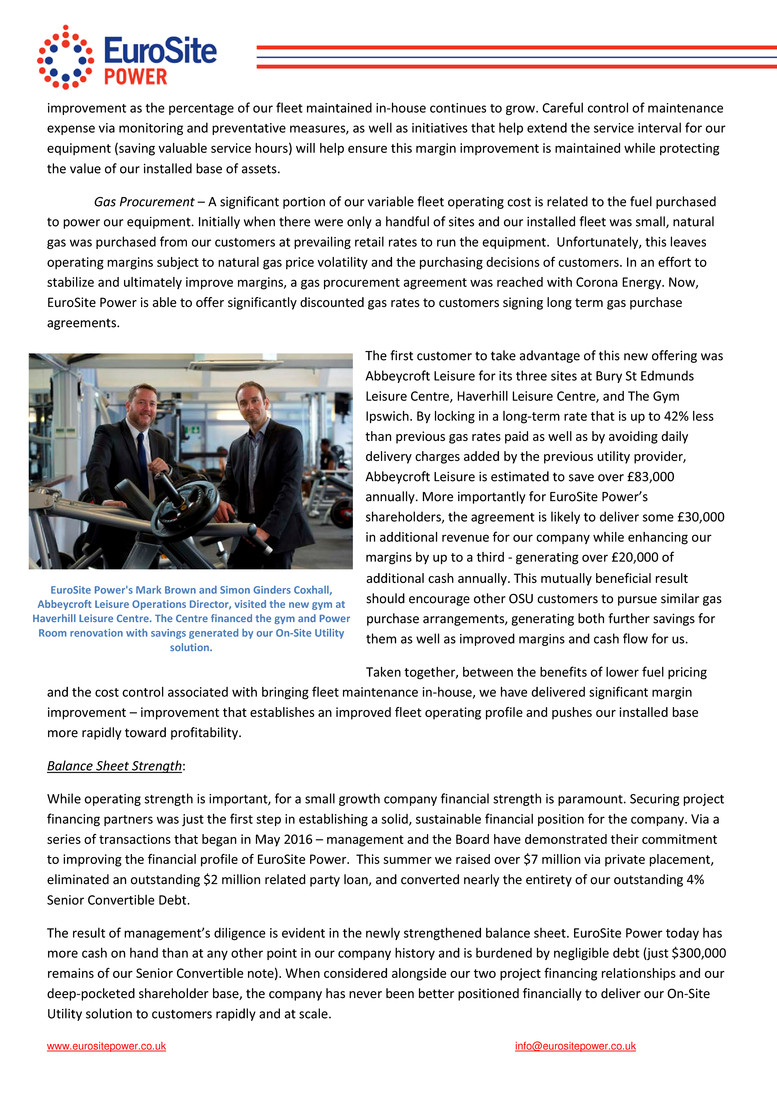

In July 2016 The Celtic Manor Resort signed a 15-year

On-Site Utility agreement, financed by Societe Generale,

worth approximately £4.11 million. The 400kW TEDOM

CHP system will produce up to 2.17 GW of electricity and

2.6 GW of heat annually while saving up to 751 tonnes of

CO2 each year.

www.eurositepower.co.uk info@eurositepower.co.uk

improvement as the percentage of our fleet maintained in-house continues to grow. Careful control of maintenance

expense via monitoring and preventative measures, as well as initiatives that help extend the service interval for our

equipment (saving valuable service hours) will help ensure this margin improvement is maintained while protecting

the value of our installed base of assets.

Gas Procurement – A significant portion of our variable fleet operating cost is related to the fuel purchased

to power our equipment. Initially when there were only a handful of sites and our installed fleet was small, natural

gas was purchased from our customers at prevailing retail rates to run the equipment. Unfortunately, this leaves

operating margins subject to natural gas price volatility and the purchasing decisions of customers. In an effort to

stabilize and ultimately improve margins, a gas procurement agreement was reached with Corona Energy. Now,

EuroSite Power is able to offer significantly discounted gas rates to customers signing long term gas purchase

agreements.

The first customer to take advantage of this new offering was

Abbeycroft Leisure for its three sites at Bury St Edmunds

Leisure Centre, Haverhill Leisure Centre, and The Gym

Ipswich. By locking in a long-term rate that is up to 42% less

than previous gas rates paid as well as by avoiding daily

delivery charges added by the previous utility provider,

Abbeycroft Leisure is estimated to save over £83,000

annually. More importantly for EuroSite Power’s

shareholders, the agreement is likely to deliver some £30,000

in additional revenue for our company while enhancing our

margins by up to a third - generating over £20,000 of

additional cash annually. This mutually beneficial result

should encourage other OSU customers to pursue similar gas

purchase arrangements, generating both further savings for

them as well as improved margins and cash flow for us.

Taken together, between the benefits of lower fuel pricing

and the cost control associated with bringing fleet maintenance in-house, we have delivered significant margin

improvement – improvement that establishes an improved fleet operating profile and pushes our installed base

more rapidly toward profitability.

Balance Sheet Strength:

While operating strength is important, for a small growth company financial strength is paramount. Securing project

financing partners was just the first step in establishing a solid, sustainable financial position for the company. Via a

series of transactions that began in May 2016 – management and the Board have demonstrated their commitment

to improving the financial profile of EuroSite Power. This summer we raised over $7 million via private placement,

eliminated an outstanding $2 million related party loan, and converted nearly the entirety of our outstanding 4%

Senior Convertible Debt.

The result of management’s diligence is evident in the newly strengthened balance sheet. EuroSite Power today has

more cash on hand than at any other point in our company history and is burdened by negligible debt (just $300,000

remains of our Senior Convertible note). When considered alongside our two project financing relationships and our

deep-pocketed shareholder base, the company has never been better positioned financially to deliver our On-Site

Utility solution to customers rapidly and at scale.

EuroSite Power's Mark Brown and Simon Ginders Coxhall,

Abbeycroft Leisure Operations Director, visited the new gym at

Haverhill Leisure Centre. The Centre financed the gym and Power

Room renovation with savings generated by our On-Site Utility

solution.

www.eurositepower.co.uk info@eurositepower.co.uk

Growth Opportunity:

With the four pillars now in place providing a platform for further growth as well as a fortified balance sheet backed

by a strong base of large scale investors and institutions, EuroSite Power is in prime position for future success. The

team is pursuing a number of new growth opportunities with the potential to propel the company into the next

exciting phase of expansion.

First, new On-Site Utility customer targets. Very large projects and customer relationships take time and dedicated

resources to develop – resources which EuroSite Power now has to deploy. With our expanded sales team and

strong strategic alliances, we are now working hard to secure more and bigger projects. Customers with multiple

sites, like the National Health Service (NHS) and private health care operators, have been targeted in particular.

Winning these types of customers will bring larger and more profitable projects - as larger scale projects tend to

have better economics via installation of larger energy systems, benefitting from economies of scale – driving

EuroSite Power toward profitability.

Second, acquisitions that can grow the portfolio and/or our capabilities. Code named “Project Lantern,” we have

hired a strategic advisor to source and research potential acquisition targets. Similar to large customer development,

acquisition initiatives take time. So far we have completed our initial phase of research and identified a number of

potential candidates for acquisition both in the UK and mainland Europe. While we are not at a point with any of

these targets to make an announcement, investigations are underway and progress will be shared when

appropriate. Acquisition candidates with existing portfolios of distributed generation assets, service networks, and

those operating in new geographies are all attractive potential targets with the capacity to drive our company

toward scale and profitability.

Finally, our new independence. For various reasons outside the scope of this letter, American DG Energy executed a

series of transactions which culminated on September 30th with the deconsolidation of EuroSite Power. We went

from being a controlled subsidiary to a fully independent company able to pursue our own strategic growth

initiatives unencumbered. As such, American DG Energy has joined the ranks of our other shareholders by

maintaining a small 2% stake in our company. This new freedom gives our team the flexibility to more rapidly pursue

any and all growth opportunities meeting our stringent return requirements – a flexibility we are already taking

advantage of.

For our shareholders, this is a monumental point in our corporate history. EuroSite Power is now operating from a

position of incredible strength facing a compelling set of growth opportunities. With our newly strengthened balance

sheet, strategic partnerships, improved operational efficiencies driving ongoing margin improvement, financing

arrangements, and the diligent guidance of our extremely experienced Board of Directors, the company is on a

strong path to success and eventual profitability. We hope that as we execute on these growth plans, you our long-

term shareholders, will share in our success,

Best Regards,

Dr. Elias Samaras, Paul Hamblyn, Jacques de Saussure,

Chief Executive Officer Managing Director Chairman

www.eurositepower.co.uk info@eurositepower.co.uk