Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Federal Home Loan Bank of Pittsburgh | d205177d8k.htm |

Member Audio/Web Conference November 1, 2016 Exhibit 99.1

Statements contained in these slides, including statements describing the objectives, projections, estimates, or predictions of the future of the Bank, may be “forward-looking statements.” These statements may use forward-looking terms, such as “anticipates,” “believes,” “could,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. The Federal Home Loan Bank of Pittsburgh (the Bank) cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, the following: economic and market conditions, including, but not limited to, real estate, credit and mortgage markets; volatility of market prices, rates, and indices related to financial instruments; political, legislative, regulatory, litigation, or judicial events or actions; changes in assumptions used in the quarterly Other-Than-Temporary Impairment (OTTI) process; risks related to mortgage-backed securities; changes in the assumptions used in the allowance for credit losses; changes in the Bank’s capital structure; changes in the Bank’s capital requirements; membership changes; changes in the demand by Bank members for Bank advances; an increase in advances’ prepayments; competitive forces, including the availability of other sources of funding for Bank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; changes in the FHLBank System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which the Bank has joint and several liability; applicable Bank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; the Bank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology risks; and timing and volume of market activity. We do not undertake to update any forward-looking information. Some of the data set forth herein is unaudited. Cautionary Statement Regarding Forward-Looking Information 2

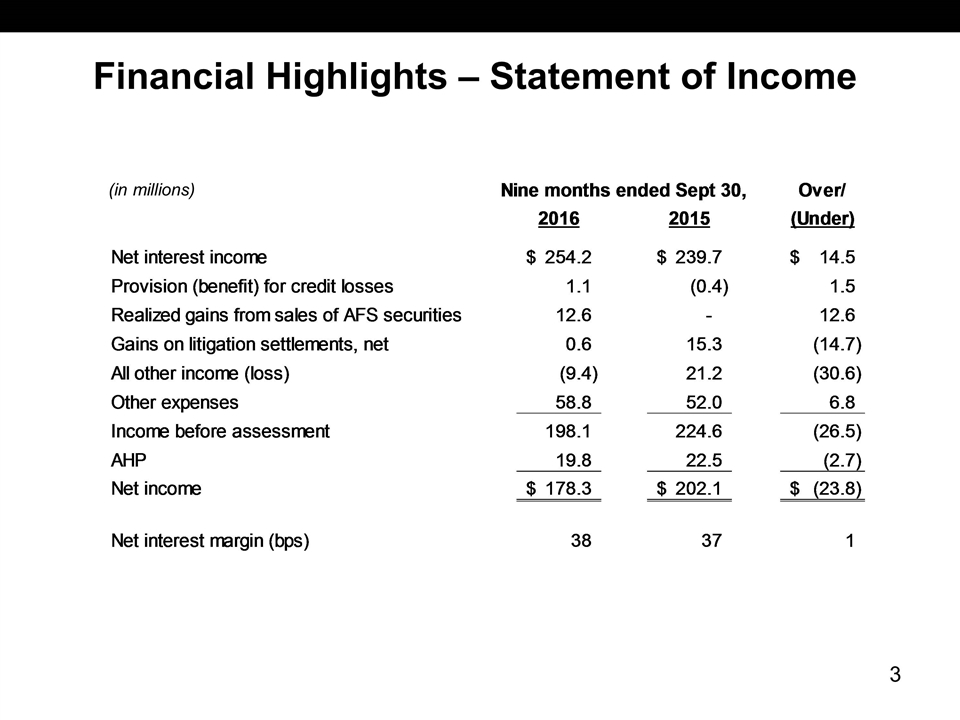

Financial Highlights – Statement of Income (in millions) 3

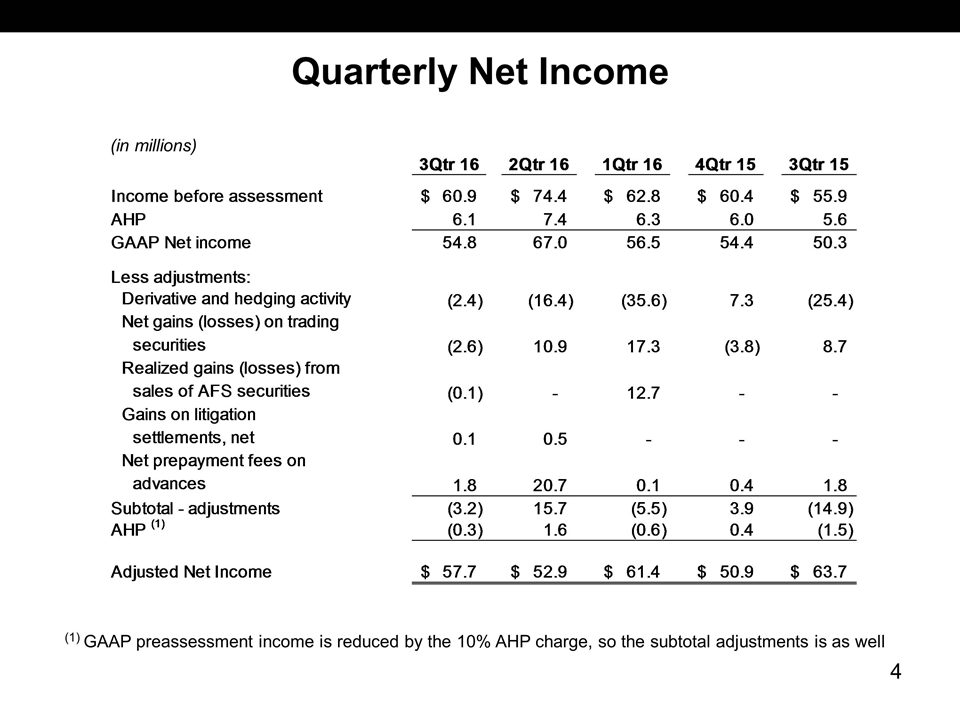

Quarterly Net Income (in millions) (1) GAAP preassessment income is reduced by the 10% AHP charge, so the subtotal adjustments is as well 4

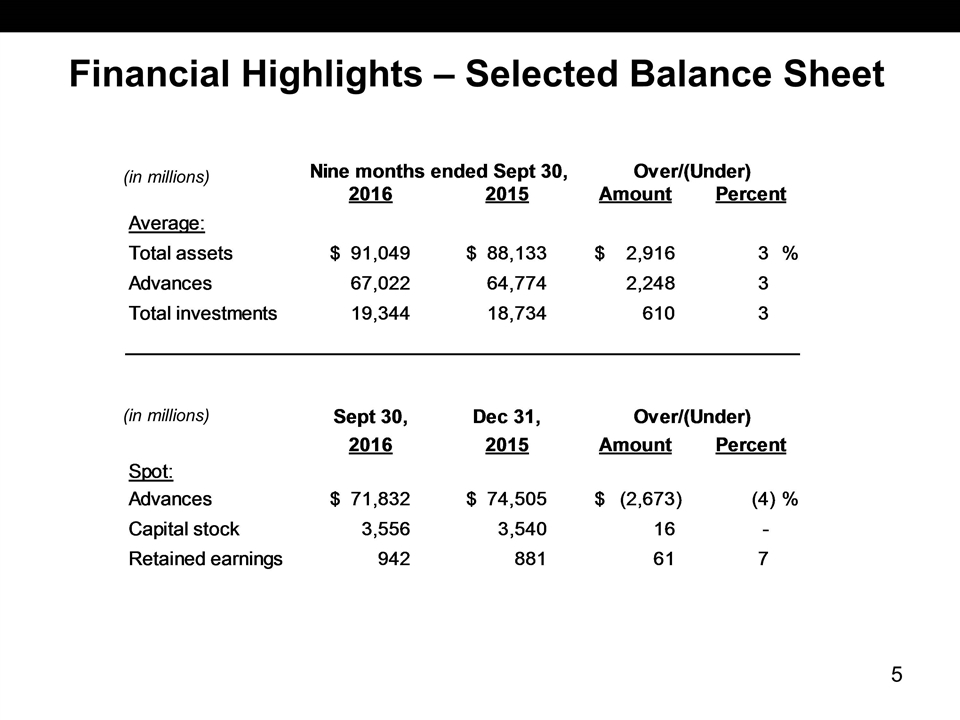

Financial Highlights – Selected Balance Sheet (in millions) (in millions) 5

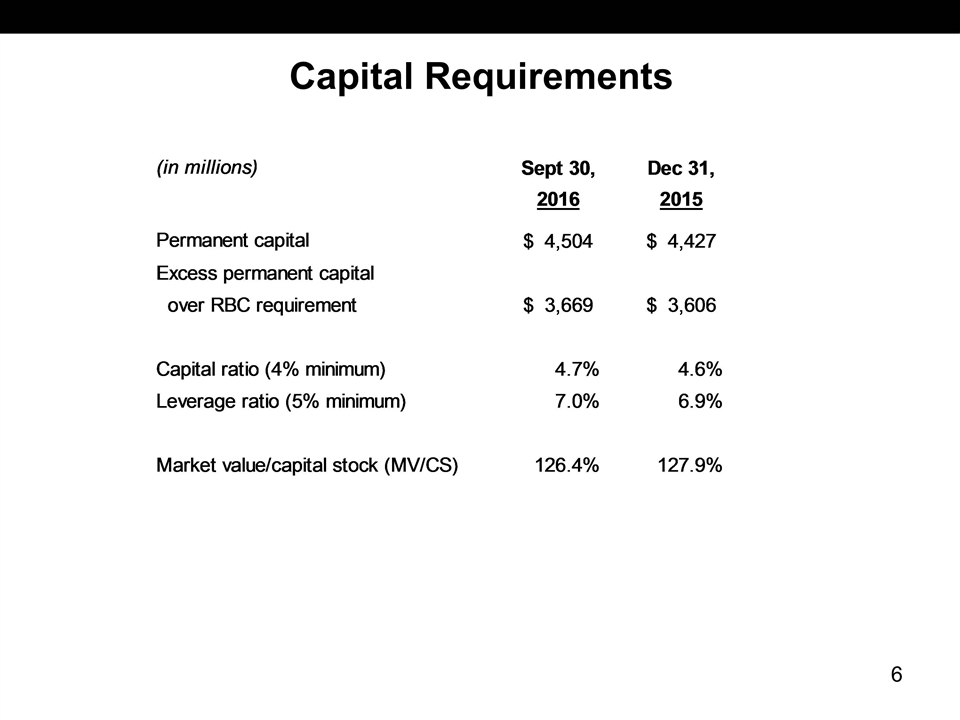

Capital Requirements 6

Cyber-Security Update Kris Williams 7

Cyber-Security Risks Malware Social Engineering Third Parties and Cloud Services Portable Computing Devices Employees Compromise of Customer’s Systems 8

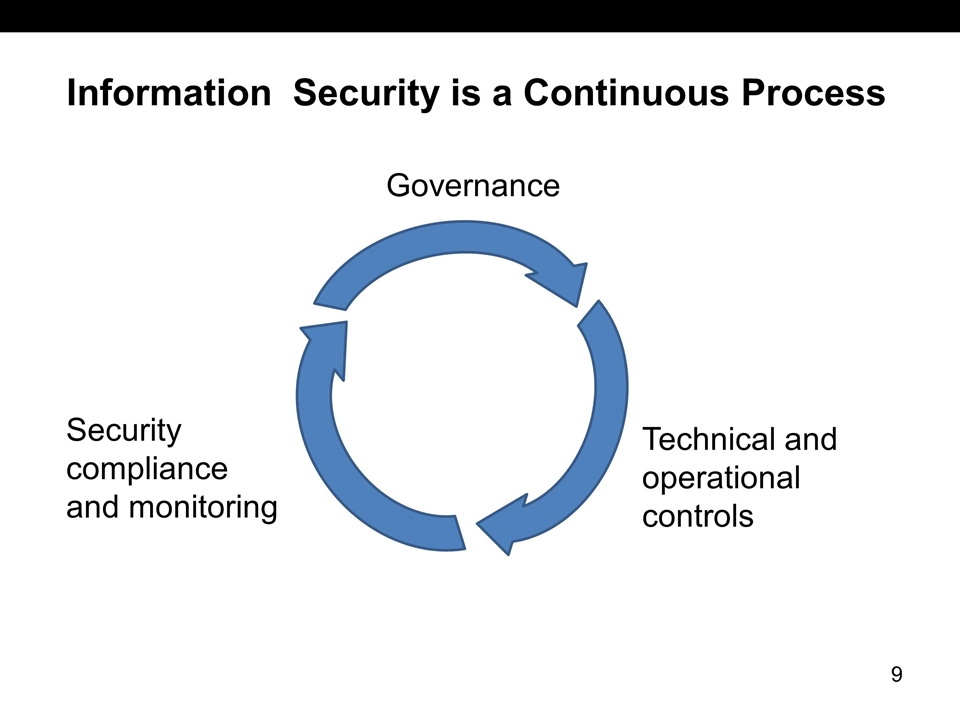

Information Security is a Continuous Process Governance Technical and operational controls Security compliance and monitoring 9

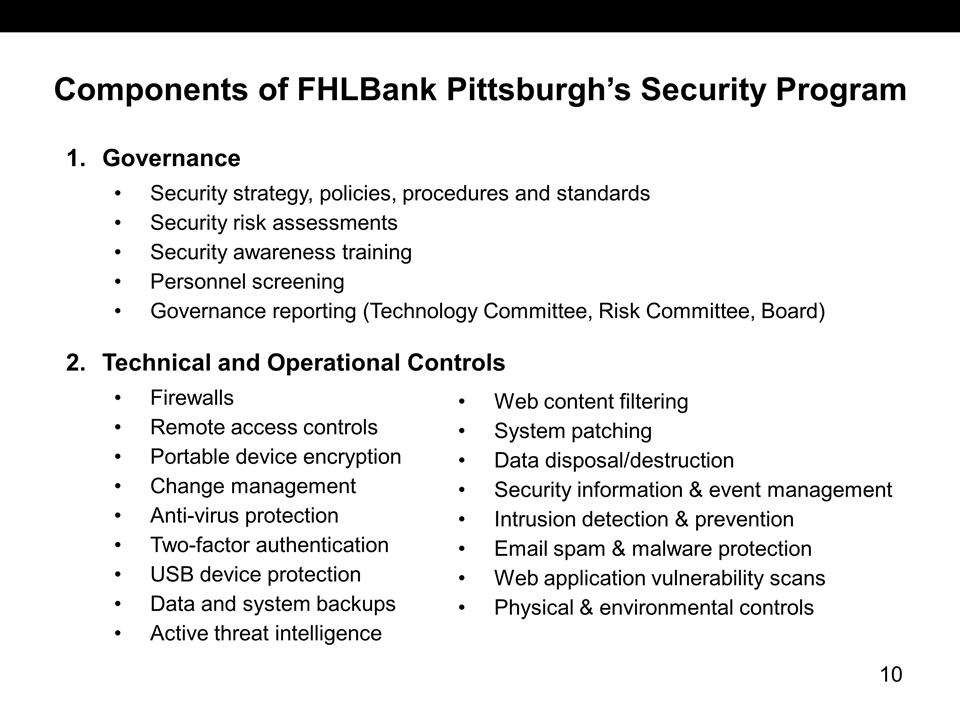

Components of FHLBank Pittsburgh’s Security Program Governance Security strategy, policies, procedures and standards Security risk assessments Security awareness training Personnel screening Governance reporting (Technology Committee, Risk Committee, Board) Technical and Operational Controls Firewalls Remote access controls Portable device encryption Change management Anti-virus protection Two-factor authentication USB device protection Data and system backups Active threat intelligence Web content filtering System patching Data disposal/destruction Security information & event management Intrusion detection & prevention Email spam & malware protection Web application vulnerability scans Physical & environmental controls 10

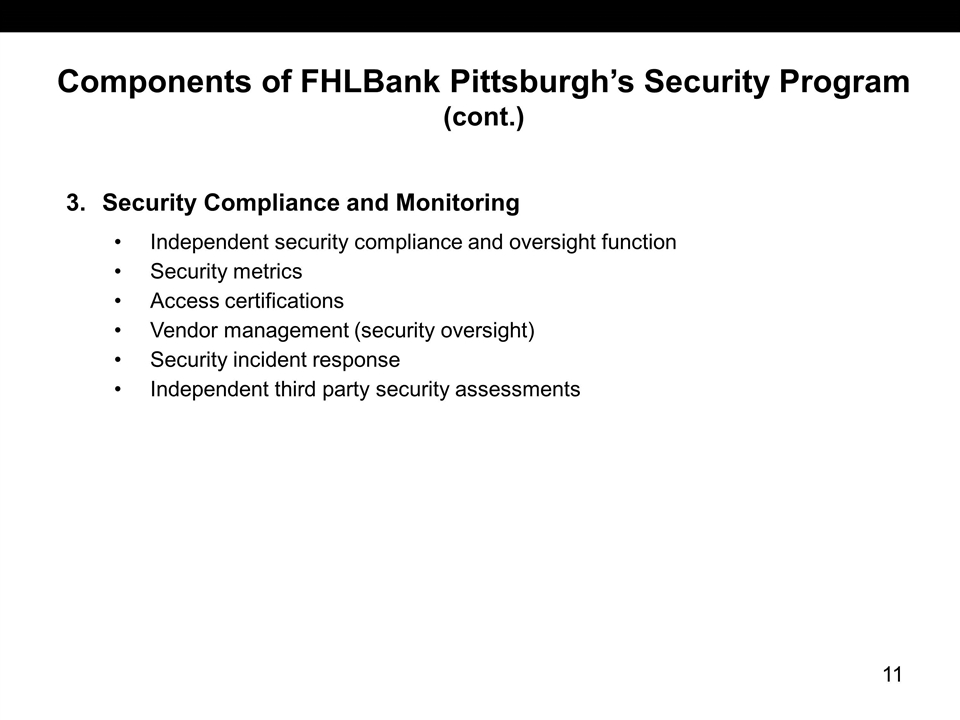

Components of FHLBank Pittsburgh’s Security Program (cont.) Security Compliance and Monitoring Independent security compliance and oversight function Security metrics Access certifications Vendor management (security oversight) Security incident response Independent third party security assessments 11

Wrap-up Bad guys are out there Bad things happen Your FHLBank has taken steps to prevent/prepare A Security and Business Continuity Program overview document is available that provides additional detail 12

Member Audio/Web Conference November 1, 2016