Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Horsehead Holding Corp | d236839dex321.htm |

| EX-31.2 - EX-31.2 - Horsehead Holding Corp | d236839dex312.htm |

| EX-31.1 - EX-31.1 - Horsehead Holding Corp | d236839dex311.htm |

| EX-21.1 - EX-21.1 - Horsehead Holding Corp | d236839dex211.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File Number: 001-33658

Horsehead Holding Corp.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware

|

20-0447377

| |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 4955 Steubenville Pike, Suite 405 Pittsburgh, Pennsylvania 15205 |

(724) 774-1020 | |

| (Address of Principal Executive Offices, including Zip Code) | (Registrant’s Telephone Number, Including Area Code) | |

Securities registered pursuant to Section 12(b) of the Act:

None.

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated Filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $584 million (based upon the closing sale price of the common stock on that date on The NASDAQ Global Select Market, the exchange on which the common stock traded as of such date). For this purpose, all shares held by directors, executive officers and stockholders beneficially owning ten percent or more of the registrant’s common stock have been treated as held by affiliates.

The number of shares of the registrant’s common stock outstanding as of September 29, 2016 was 60,352,479.

Table of Contents

| PART I | ||||||||

| Item 1. |

1 | |||||||

| 13 | ||||||||

| 21 | ||||||||

| Item 2 |

21 | |||||||

| Item 3 |

22 | |||||||

| Item 4 |

23 | |||||||

| PART II | ||||||||

| Item 5 |

Market for Registrant’s Common Equity, Related Stockholders Matters and Issuer Purchases of Equity Securities | 24 | ||||||

| Item 6 |

28 | |||||||

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

29 | ||||||

| Item 8 |

53 | |||||||

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

53 | ||||||

| 54 | ||||||||

| 57 | ||||||||

| PART III | ||||||||

| Item 10 |

58 | |||||||

| Item 11 |

63 | |||||||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

74 | ||||||

| Item 13 |

Certain Relationships and Related Transactions and Director Independence |

75 | ||||||

| Item 14 |

75 | |||||||

| PART IV | ||||||||

| Item 15 |

77 | |||||||

| E-1 | ||||||||

i

Table of Contents

CAUTIONARY STATEMENT FOR PURPOSES OF THE SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report contains forward-looking statements within the meaning of the federal securities laws. These statements relate to analyses and other information, which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies.

These forward looking statements are identified by the use of terms and phrases such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, and similar terms and phrases, including references to assumptions. However, these words are not the exclusive means of identifying such statements. These statements are contained in many sections of this report (including “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”). Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that we will achieve those plans, intentions or expectations. We believe that the following factors, among others (including those described in “Part I, Item 1A. Risk Factors”), could affect our future performance and cause our actual results to differ materially from those expressed or implied by forward-looking statements made by us or on our behalf: our filing of voluntary petitions for relief under the Bankruptcy Code and the attendant difficulties of operating our business while attempting to reorganize in bankruptcy; our ability to maintain sufficient financing sources to fund our business and meet obligations during the Chapter 11 Cases; our ability to secure confirmation of the Plan and emerge from bankruptcy; our ability to continue as a going concern and the uncertainty regarding the eventual outcome of our restructuring; our ability to implement our business plan and financial restructuring strategy successfully; declines in the prices of zinc and nickel-based products; our ability to resolve the operational issues at our idled Mooresboro facility if it resumes operations and if it becomes fully operational; our ability to produce Special High Grade zinc; our ability to reduce certain operating costs; the cyclical nature of the metals industry; and competition from global zinc and nickel manufacturers.

There may be other factors that may cause our actual results to differ materially from the forward-looking statements. Our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking statements. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them does, what impact they will have on our results of operations and financial condition. You should carefully read the factors described in the “Risk Factors” section of this report for a description of certain risks that could, among other things, cause our actual results to differ from these forward-looking statements.

All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this Annual Report on Form 10-K to reflect events or circumstances after the date hereof.

ii

Table of Contents

Unless stated otherwise or unless the context otherwise requires, all references in this annual report to the “Company,” “we,” “our,” and “us” are to Horsehead Holding Corp., a Delaware corporation, and its consolidated subsidiaries.

Company Overview

Horsehead Holding Corp. is the parent company of: (i) Horsehead Corporation, a U.S. producer of zinc products and, we believe, the largest North American recycler of electric arc furnace (“EAF”) dust (“Horsehead”); (ii) The International Metals Reclamation Company, LLC, a leading recycler of nickel-bearing wastes and nickel-cadmium (“Ni-Cd”) batteries in North America (“INMETCO”); and (iii) Zochem Inc., which we believe is the largest single-site producer of zinc oxide in North America (“Zochem”). Horsehead is the parent company of Horsehead Metal Products, LLC, which owns our idled zinc facility in Mooresboro, North Carolina.

We currently have production and/or recycling operations at five facilities (excluding the Mooresboro facility) located in four states in the United States. Zochem operates from one facility located in Canada. Our products are used in a wide variety of applications, including in the galvanizing of sheet and fabricated steel products, as components in rubber tires, alkaline batteries, paint, chemicals and pharmaceuticals and as a remelt alloy in the production of stainless steel.

We, together with our predecessors, have been operating in the zinc industry for more than 150 years and in the nickel-bearing waste industry for more than 30 years. On January 22, 2016, we announced the idling of our Mooresboro, North Carolina zinc production facility. The decision to idle the Mooresboro facility was the result of many factors, including a depressed zinc price and our liquidity situation. A small workforce has been retained to manage the facility. To date, the Mooresboro facility remains in an idled state.

During the year ended December 31, 2015, we sold approximately 243 million pounds of zinc finished products, 222 million pounds of waelz oxide (“WOX”) and zinc calcine and 24 million pounds of nickel-based products, generally priced at amounts based on zinc and nickel prices on the London Metals Exchange (“LME”). For the year ended December 31, 2015, we generated sales and recorded a net loss of $414.9 million and $665.4 million, respectively.

Chapter 11 Bankruptcy Filings

On February 2, 2016 (the “Petition Date”), Horsehead Holding Corp. and certain of its direct and indirect wholly owned subsidiaries (collectively, the “Debtors”), filed voluntary petitions (the “Bankruptcy Petitions”) under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). On the same date, Zochem, as foreign representative of the Debtors, commenced a proceeding under Part IV of the Companies’ Creditors Arrangement Act in the Ontario Superior Court of Justice (Commercial List) (the “Canadian Court”) to recognize the Debtors’ Chapter 11 cases as a foreign main proceeding (the “Canadian Proceedings”). The Chapter 11 cases are being jointly administered by the Bankruptcy Court under the caption In re Horsehead Holding Corp., Case No. 16-10287 (the “Chapter 11 Cases”). The Debtors entered Chapter 11 to protect their assets and to formulate a balance sheet restructuring and deleveraging of the Debtors’ current capital structure. The Debtors continue to operate as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court.

On March 3, 2016, the Bankruptcy Court entered a final order approving the Debtors’ debtor-in-possession financing in an aggregate principal amount of up to $90 million (the “DIP Facility”) set forth in a debtor-in-possession Credit Agreement (as amended from time to time, the “DIP Credit Agreement”) and the Canadian Court entered an order recognizing and giving effect to the Bankruptcy Court’s order in Canada.

The Debtors have filed a plan of reorganization (as may be amended, modified or supplemented from time to time, the “Plan”) and a related proposed disclosure statement (as may be amended, modified or supplemented from time to time, the “Disclosure Statement”) with the Bankruptcy Court. On July 11, 2016, the Bankruptcy Court entered an order approving the Disclosure Statement, and on July 12, 2016, the Canadian Court recognized and gave effect to such order in Canada. On or about July 18, 2016, the Debtors commenced solicitation of the Plan. On September 9, 2016, the Bankruptcy Court entered an order confirming the Plan and on September 12, 2016, the Canadian Court recognized and gave effect to such order in Canada.

1

Table of Contents

On July 11, 2016, we, on behalf of the Debtors, entered into a Unit Purchase and Support Agreement (the “UPA”) with certain holders of claims against the Debtors that are listed therein as plan sponsors (collectively, the “Plan Sponsors”). The UPA was entered into in connection with the Debtors’ Plan filed with the Bankruptcy Court.

Pursuant to the UPA, and subject to approvals, terms, and conditions set forth therein, upon emergence from Chapter 11, (i) we will issue units of limited liability company interests of the reorganized Company to the Plan Sponsors who will purchase such Plan Sponsor’s respective percentage of an aggregate amount equal to $160 million (the “Emergence Equity Units”), and (ii) the Plan Sponsors had the right to elect, on or prior to July 29, 2016, to commit to purchase up to an additional $100 million units of limited liability company interests of the reorganized Company (the “Additional Capital Commitment Units”), with such commitment being exercisable at the election of the reorganized Company’s board of directors pursuant to the terms and subject to the conditions of the UPA, following the effectiveness of the Plan. The additional capital commitment was fully subscribed.

The UPA was approved by the Bankruptcy Court on September 9, 2016 and on September 12, 2016, the Canadian Court recognized and gave effect to such order.

The UPA was amended on August 30, 2016, to, among other things, (i) add an additional Plan Sponsor as a signatory to the UPA and correspondingly amends the respective schedules and purchase commitments to reflect such addition, (ii) allow the reorganized Company to call up to $15 million of Additional Capital Commitment Units for working capital needs and other general purposes, and (iii) amend various provisions of the UPA to reflect, among other milestone changes, that the effective date of the Plan shall occur by 5:00 PM, New York City time, on September 30, 2016.

Our ability to continue as a going concern is dependent on many factors, including our ability to maintain adequate cash on hand and generate cash from operations for the duration of the Chapter 11 Cases, access to the DIP Facility, the consummation of the Plan in a timely manner, and our ability to achieve profitability following emergence from bankruptcy.

For the duration of the Chapter 11 Cases, our operations and our ability to develop and execute our business plan are subject to the risks and uncertainties associated with the Chapter 11 process as described in Item 1A, “Risk Factors.” As a result of these risks and uncertainties, the description of our operations, properties and obligations included in this Annual Report on Form 10-K may not accurately reflect our operations, properties and obligations following the Chapter 11 Cases.

Notice of Delisting from NASDAQ

On February 2, 2016, we received notice from The NASDAQ Stock Market LLC (“NASDAQ”) that trading of our common stock was to be suspended at the opening of business on February 11, 2016. NASDAQ’s decision to delist our common stock was a result of our filing of the Bankruptcy Petitions. On February 23, 2016, NASDAQ filed a Form 25, “Notification of Removal from Listing Under Section 12(b) of the Securities Exchange Act of 1934,” with respect to our common stock. Our common stock currently trades in the over-the-counter (“OTC”) market under the symbol ZINCQ.

Operations

We operate in three distinct, but related, lines of business: (a) the processing of EAF dust and other zinc-bearing material to produce and sell zinc and other metals undertaken by Horsehead Corporation; (b) the production and sale of zinc oxide undertaken by Zochem; and (c) the processing of a variety of metal-bearing waste materials and the production of nickel-bearing alloys undertaken by INMETCO. The Horsehead Corporation segment generated 70%, 56% and 58% of our revenues in 2013, 2014 and 2015, respectively; the Zochem segment generated 18%, 32% and 31% of our revenues in 2013, 2014 and 2015, respectively; and the INMETCO segment generated 12%, 12% and 11% of our revenues in 2013, 2014 and 2015, respectively.

2

Table of Contents

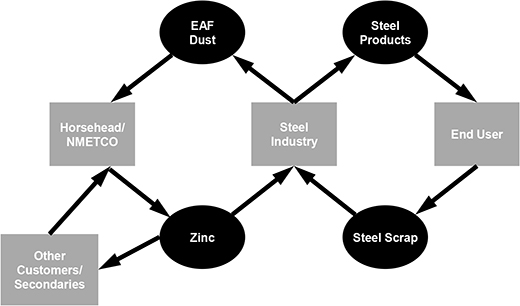

Our recycling and production operations in 2015, including the currently idled Mooresboro facility, formed a complete recycling loop, as illustrated below, from recycled metals to finished zinc or nickel-bearing products.

Horsehead Corporation and Zochem

Horsehead Corporation

Recycling Operations, Products and Services

Horsehead operates four hazardous waste recycling facilities for the recovery of zinc from EAF dust. Our predecessor company created the market for EAF dust recycling for carbon steel mini-mill producers with the development of our recycling technology in the early 1980’s. Our recycling process has been designated by the U.S. Environmental Protection Agency (“EPA”) as a “Best Demonstrated Available Technology” for the processing of EAF dust. Our recycling facilities are strategically located near sources of EAF dust production. These facilities recover zinc from EAF dust generated primarily by carbon steel mini-mill manufacturers during the melting of steel scrap, as well as from other waste material.

We are one of the leading environmental service providers to the U.S. steel industry, having recycled to date, together with our predecessors, 11.8 million tons of EAF dust since 1990, which is equivalent to approximately 2.4 million tons of zinc, and represents the dust generated in the production of over 690 million tons of steel. Horsehead Corporation’s recycling and conversion of EAF dust reduces a steel mini-mill’s exposure to environmental liabilities that may arise if EAF dust is sent to a landfill and not recycled. In 2015, we processed 579,000 tons of EAF dust and other zinc-bearing materials compared to 593,000 tons in 2014.

We extract zinc from EAF dust, and recycle the other components of EAF dust into non-hazardous materials, using our proprietary “Waelz Kiln” process at our Palmerton, Pennsylvania, Barnwell, South Carolina, Rockwood, Tennessee, and Calumet, Illinois facilities. Our Waelz Kiln recycling process blends, conditions, adds carbon to and pelletizes EAF dust, and then feeds it into the kiln itself, a refractory-lined tube that is typically 160 feet in length and 12 feet in diameter. During the passage through the kiln, the material is heated under reducing conditions at temperatures exceeding 1,100 degrees Celsius, thereby volatilizing the nonferrous metals, including zinc. The resulting volatized gas stream is oxidized and collected as WOX, which has a zinc content between 55% and 65%. In addition, we produce iron-rich material that we sell for use as an aggregate in asphalt and as an iron source in cement.

3

Table of Contents

Currently, the WOX generated at our Palmerton, Pennsylvania facility and at times, WOX generated at our other EAF dust recycling facilities, is further refined in a process, called “calcining,” whereby we heat the material to drive off impurities. Through this rotary kiln process, which is fired with natural gas, the zinc content is further increased from approximately 55% to 65% to approximately 65% to 70%, and the product is collected as zinc calcine in granular form.

In 2015, we sold $58.7 million and $1.3 million of calcine and WOX, respectively, to third parties as the Mooresboro facility was not able to utilize the total amount of EAF tons processed by our recycling facilities.

Zinc Operations, Products and Services

Horsehead Corporation is a producer of zinc products, including zinc metal, used in the galvanizing of steel, in zinc die castings, and zinc-bearing alloys in the United States. Horsehead Corporation also produces WOX and zinc calcine for sale to other zinc producers. Horsehead Corporation uses WOX, the primary product of its recycling operations, as a low-cost, raw material feedstock in the production of zinc metal and value-added zinc products, which yields a competitive cost advantage. Our EAF dust recycling operations provide us with a reliable, cost-effective source of recycled feedstock without relying on third-party sellers.

Prior to the Petition Date, Horsehead Corporation conducted its zinc production (as opposed to recycling) operations from its facility located in Mooresboro, North Carolina, which we began constructing in September 2011 to replace our former zinc smelter located in Monaca, Pennsylvania. We permanently shut down the Monaca facility in April 2014 and subsequently demolished it, and sold the land in June 2015, although we retain ownership of a non-hazardous captive landfill located near that site.

Since operations began at the Mooresboro facility in May 2014, we have experienced a number of significant operational, production, and equipment issues associated with the attempted ramp-up of the Mooresboro facility. For example, it was discovered that the bleed treatment section of the facility was undersized causing a bottleneck to production. Additionally, electrolyte quality deteriorated causing significant corrosion to electrodes in the cell house due, in part, to poor control of solids carryover into the solvent extraction units combined with equipment issues related to faulty organic filters and the HCl regeneration units. Also, several pumps and lines were improperly designed for their intended application. The Mooresboro facility was operating at approximately 25% of capacity during the fourth quarter of 2015. While we ultimately expected to realize substantial operating efficiencies from the Mooresboro facility once it became fully operational, we have publicly identified ongoing challenges with respect to the Mooresboro facility on numerous occasions. In total, we have invested approximately $575.0 million in the construction and development of the Mooresboro facility, excluding capitalized interest and internal labor, as of the Petition Date. On January 22, 2016, due to financial constraints, we issued notices to our employees at the Mooresboro facility under the Worker Adjustment and Retraining Notification Act and publicly announced our intention to transition the Mooresboro facility from fully operational status to operating on a “care and maintenance level” only by February 8, 2016. To date, the Mooresboro facility remains in an idled state.

During the year ended December 31, 2015, our operations were significantly impacted due to the dramatic decline in zinc, nickel and other commodity prices, continuing issues that delayed the ramp-up of the Mooresboro zinc facility, and lower EAF dust receipts reflecting weaker steel production. Additionally, on January 22, 2016 when we temporarily idled the Mooresboro facility in the face of severe liquidity constraints and our determination that the facility was incapable of generating positive cash flow in the future without significant additional capital investment and/or a recovery in commodity prices, we determined a triggering event occurred related to our Mooresboro facility which required us to assess if the carrying amount of this long-lived asset may not be recoverable. We performed the required first step of the impairment test and determined the carrying amount of our Mooresboro asset group exceeded the sum of the expected undiscounted cash flows. We proceeded to the second step of the impairment test where we were required to determine a fair value for the Mooresboro asset group and recognize an impairment loss if the carrying value exceeded fair value. Fair value of the Mooresboro asset group was determined using i) published prices of our publicly traded debt and equity coupled with ii) the latest twelve months revenue multiples of selected comparable guideline companies to isolate the Mooresboro asset group’s fair value. The income approach was not considered an appropriate fair value measurement due to the absence of reliable forecast data as the facility was idled indefinitely in early 2016 as a result of uncertainty around timing of future capital inflows necessary to make required capital improvements to generate positive cash flows stemming from the Chapter 11 proceedings as well as uncertainty around recovery timing of commodity prices. As a result of the impairment test, we recorded a non-cash, pretax long-lived asset impairment loss of $527.6 million for the Mooresboro asset group. The total amount of this write-down is included in Loss from operations in the Consolidated Statement of Operations for the year ended December 31, 2015. Following the write-down of the asset group, the remaining net book value of the Mooresboro asset group was $87.6 million at December 31, 2015. The impairment charge did not impact our business operation or future cash flows nor did it result in any cash expenditures. In assessing the recoverability of our long-lived assets, we are required to make assumptions regarding estimated future cash flows and other factors to determine the fair value of the respective assets. This process is subjective and requires judgment at many points throughout the analysis. If our estimates or their related assumptions change in subsequent periods or if actual cash flows or other market measures are below management’s estimates, we may be required to record impairment charges for these assets not previously recorded or additional impairments on assets already recorded.

4

Table of Contents

The Mooresboro facility’s design is intended to allow us to produce special high grade (“SHG”) zinc, continuous galvanizing grade (“CGG”) zinc, and high grade zinc, in addition to the prime western zinc we formerly produced at the Monaca facility. The Mooresboro facility’s design is intended to use sustainable manufacturing practices to produce zinc solely from recycled materials. The Mooresboro facility is designed to use significantly less fossil fuel, primarily in the form of metallurgical coke, than the Monaca facility, which we believe will allow us to reduce greenhouse gas emissions and particulates into the atmosphere. The Mooresboro facility is designed to process a wide range of recycled oxidic zinc materials.

Once fully operational, we believe the Mooresboro facility will eliminate the need to calcine WOX prior to its use, thereby reducing our manufacturing conversion and logistics costs in our recycling facilities. In addition, we expect that the Mooresboro facility, once fully operational, will have lower conversion costs than the Monaca facility previously had, allow us to realize a higher premium on the sale of SHG and CGG zinc and recover value from the lead and silver contained in WOX in addition to increasing the total output of zinc metal from the same.

Our zinc powder is sold for use in a variety of chemical, metallurgical and battery applications as well as for use in corrosion-resistant coating applications. Zinc powder is manufactured by the atomization of molten zinc. We manufacture the following basic lines of powders at our Palmerton facility.

| • | Special Zinc Powders. These are used in general chemical and metallurgical applications, and in friction applications, such as brake linings for automobiles. |

| • | Battery Grade Zinc Powders. These are used in most types of alkaline batteries, as well as mercuric oxide, silver oxide and zinc-air batteries. |

Zochem

Our Zochem facility, which we acquired on November 1, 2011, is located in Brampton, Ontario, Canada and produces zinc oxide. We believe Zochem is the largest single-site producer of zinc oxide in North America. The production process uses SHG zinc as raw material which is added to the melting section of the furnaces. The melted zinc is then boiled and the zinc vapor is combusted as it enters an oxidation chamber. The zinc oxide is then collected and packaged for shipment. The Zochem facility has the capacity to produce approximately 72,000 tons of zinc oxide a year. Zinc oxide is used as an additive in various materials and products, including plastics, ceramics, glass, rubbers, cement, lubricants, pigments, sealants, ointments, fire retardants, and batteries.

We sell over 20 different grades of zinc oxide with differing particle sizes, shapes, coatings and purity levels. Various end uses for zinc oxide include the following:

| • | Tire and rubber applications. Zinc oxide aids in the vulcanization process, acts as a strengthening and reinforcing agent, provides ultra-violet (“UV”) protection, and enhances thermal and electrical properties. There is approximately a half pound of zinc oxide in a typical automobile tire. |

| • | Chemical applications. In motor oil, zinc oxide is used to reduce oxidation, inhibit corrosion and extend the wear of automotive engines. In plastics, zinc oxide is an effective UV stabilizer for polypropylene and polyethylene. |

| • | Ceramics. Ceramics containing zinc oxide are used in electronic components. For example, in ceramic varistors (surge protectors), zinc oxide allows for high temperature stability, resistance to electrical load, current shock and humidity. |

| • | Other applications. In paints, zinc oxide provides mold and mildew protection, functions as a white pigment and provides UV protection and chalking resistance. In pharmaceutical applications, zinc oxide operates as a sunscreen, a vitamin supplement and a medicinal ointment. |

5

Table of Contents

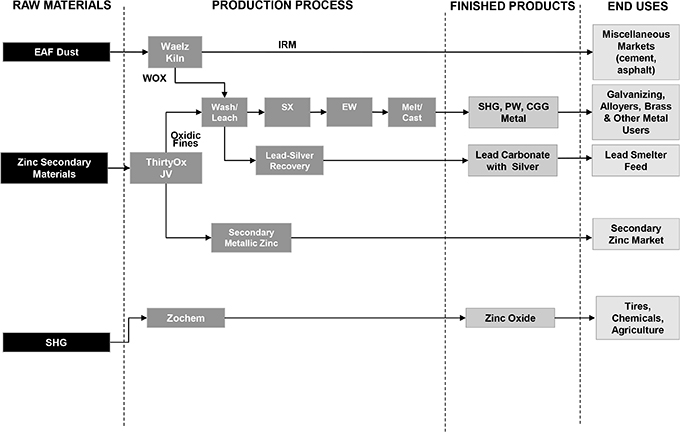

Zinc Production Process

The chart below describes the designed flow of operations for our zinc facilities in 2015, including the process with respect to the currently idled Mooresboro facility. The chart begins with the input of raw materials, continuing through the production processes and identifying finished products and end uses for each such raw material.

Sales and Marketing

Zinc products and services sales and marketing staff consists of:

| • | a sales and marketing group comprised of sales professionals whose goal is to develop and maintain excellent customer relationships and provide key market analysis; and |

| • | a customer service department responsible for processing zinc orders, scheduling product shipments and answering customer inquiries |

Our process engineering group provides additional technical assistance to our EAF clients with monthly EAF analytical information and assistance with any problems encountered on EAF dust chemistry, transportation and environmental matters. Our quality assurance department provides extensive laboratory services critical to maintaining in-plant process control and providing customer support by certifying compliance to hundreds of unique product specifications. Our laboratory also offers sales and technical services support by assisting in new product developments and troubleshooting various application and processing issues both in-plant and with specific customers. We also rely on a network of distributors with warehouses and third party warehouses throughout North America and Europe that provide shorter delivery times for certain customers.

Customers

The Mooresboro facility produced high grade zinc, and to a lesser extent SHG zinc, primarily for customers throughout the United States and Canada prior to being idled in January 2016.

6

Table of Contents

We sell zinc oxide to over 250 different customers under contract as well as on a spot basis, principally to manufacturers of tire and rubber products, lubricating oils, chemicals, paints, ceramics, plastics and pharmaceuticals and have supplied zinc oxide to the majority of our largest customers for over 10 years.

We typically enter into multi-year service contracts with steel mini-mills to recycle their EAF dust. We provide our EAF dust recycling services to over 45 steel producing facilities.

In 2015, we derived 58% of our consolidated sales from Horsehead Corporation customers and 31% of our consolidated sales from Zochem customers.

Raw Material

Prior to being idled, the feedstock for the Mooresboro facility was supplied by our EAF dust recycling plants. In the future, it is intended that any additional raw material feed needed will be comprised of purchased zinc secondaries, which are principally zinc-containing remnants of steel galvanizing processes, including skimmings produced by several of our metal customers. The prices of zinc secondaries vary according to the amount of recoverable zinc contained and the LME zinc price and provide us with a diverse portfolio of low cost inputs from which to choose. In addition to the skims from the galvanizing industry, we can purchase other types of zinc-bearing residues from the zinc, brass and alloying industries. Many of these materials can be acquired from our own customers.

In December 2013, we entered into a joint venture known as ThirtyOx, LLC (“ThirtyOx”) with Imperial Acquisitions LLC for the acquisition and processing of zinc bearing secondary materials. The processing operation is located in North Carolina near the Mooresboro facility and became operational in August 2014. The majority of feedstock used by ThirtyOx consists of galvanizer skimmings and other zinc-containing secondary materials.

Raw materials used in our Zochem facility consist entirely of SHG zinc metal purchased from several suppliers. The price of this material is based on the LME zinc price.

Intellectual Property

We possess proprietary technical expertise and know-how related to EAF dust recycling and zinc production, particularly zinc production using recycled feedstocks. Our proprietary know-how includes production methods for zinc oxide and micro-fine zinc oxides and widely varying customer specifications. As a major supplier of zinc metal and other zinc-based products to industrial and commercial markets, we emphasize developing intellectual property and protecting our rights in our processes. However, the scope of protection afforded by intellectual property rights, including ours, is often uncertain and involves complex legal and factual issues. Also, there can be no assurance that intellectual property rights will not be infringed or designed around by others. In addition, we may not elect to pursue an infringer due to the high costs and uncertainties associated with litigation. Further, there can be no assurance that courts will ultimately hold issued intellectual property rights to be valid and enforceable.

Competition

Our primary zinc oxide competitors are U.S. Zinc, located in the southern United States and G.H. Chemicals, located in Eastern Canada.

Historically, the majority of the zinc metal consumed in the United States has been imported. Before idling the Mooresboro facility, we had no direct competitor recycling similar secondary materials into finished zinc products in North America. Domestic producers like us enjoy a freight and reliability advantage over foreign competitors with respect to U.S. customers. Hudbay Mining and Smelting Co. Limited, Teck Cominco Limited, Nyrstar, Glencore and Penoles are the primary zinc metal producers in the North American market. The vast majority of the metal produced by these companies is used by continuous galvanizers in the coating of steel sheet products. In addition, these producers have mining and smelting operations. We have neither mining operations nor smelting operations.

We compete for EAF dust management contracts primarily with Steel Dust Recycling and its parent company, Zinc Nacional, of Monterrey, Mexico and to a lesser extent with landfill operators. Our proven reliability, expanded processing capacity and customer service have helped us maintain long-standing customer relationships. Many of our EAF dust customers have been under contract with us since our predecessor began recycling EAF dust in the 1980’s.

7

Table of Contents

INMETCO

Operations, Products and Services

INMETCO is a leading recycler of nickel-bearing waste generated by the stainless and specialty steel producers, and a leading recycler of nickel-cadmium and other types of batteries in North America. INMETCO operates out of a facility located in Ellwood City, Pennsylvania, which produces nickel-bearing products by using 100% recycled materials. Additionally, INMETCO collects and recycles batteries through its own collection programs and Call2Recycle, which was founded in 1994 by five major rechargeable battery makers. INMETCO also provides environmental services to generators of nickel-containing waste products, such as filter cake, spent pickle liquor, grinding swarf, and mill scale.

INMETCO operates a high temperature metals recovery facility, which utilizes a combination rotary hearth furnace and electric arc smelting furnace to recover nickel, chromium and iron, along with smaller amounts of other metals, from a variety of metal-bearing waste materials, generated primarily by the specialty steel industry. INMETCO’s main product is a nickel-chromium-iron (“Ni-Cr-Fe”) remelt alloy ingot that is used as a feedstock to produce stainless and specialty steels. INMETCO also recycles alkaline batteries in conjunction with Horsehead.

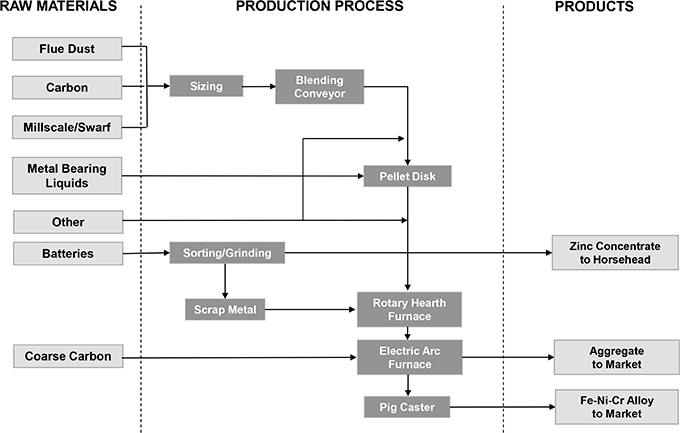

The INMETCO process for treating Ni-Cr-Fe metals waste is comprised of feed preparation, blending and pelletizing, thermal reduction and smelting and casting. The first portion of the INMETCO process consists of material preparation, storage, blending, feeding and pelletizing. INMETCO receives the various wastes and pretreats them when necessary to ensure a uniform size of the raw material. These materials, as well as flue dust and carbon, are pelletized. Pellets are transferred to the rotary hearth furnace for the reduction of some oxidized metal to its metallic form. Reduced pellets are fed to the EAF for production of Ni-Cr-Fe remelt alloy. Slag discharged from the EAF is processed and sold primarily as road aggregate.

8

Table of Contents

The chart below describes the INMETCO flow of operations, beginning with raw materials, continuing through the process and identifying products.

INMETCO provides recycling services to its customers under two types of fee arrangements: toll processing arrangements and environmental services arrangements.

Tolling Services

Under the tolling arrangement, INMETCO charges a processing fee per ton of waste received and returns a remelt alloy product based on the waste’s metal content and INMETCO’s historical metal recovery factors for similar waste products. INMETCO serves almost all of the major austenitic stainless steel manufacturers in the United States in its tolling segment. We believe INMETCO is the only recycler of stainless steel wastes in North America and that INMETCO’s customers rely on its services to promote sustainable business practices, to avoid potential environmental liabilities associated with disposing of hazardous wastes at landfills and to take advantage of the return of valuable metals from their metal-bearing waste products. INMETCO receives four main nickel-containing waste materials from the specialty steel industry, which support the “tolling” segment of the business. These materials are flue dust, mill scale, grinding swarf and shot blast dust and are received either in a dry form or a wet form containing oil and/or water. Furnace baghouse dust or flue dust is generated during the melting and refining steps in the manufacture of stainless steel.

Environmental Services

Under the environmental fee arrangement, INMETCO acquires waste materials and processes those materials with no obligation to return any product to the customer. Depending on the state of the metals markets, INMETCO either charges a fee or pays to acquire environmental services materials. These materials include batteries and specialty steel industry wastes. All battery chemistries are accommodated. Batteries with chemistry compatible with the INMETCO process are processed directly while non-compatible types are sent to third party recyclers for processing. Recycling of household alkaline batteries has become a growing market that results in scrap steel as a feed to INMETCO and zinc concentrate used by Horsehead. Specialty steel industry wastes include flue dust, mill scale, grinding swarf and pickling filter cake along with a wide variety of other nickel-bearing wastes. Revenues are derived from these materials through the sale of the derived products into the appropriate markets as well as scrap sales and brokerage activities. No materials are sent to landfills.

9

Table of Contents

INMETCO also sells its remelt alloy product produced from waste under environmental services, back to the stainless steel industry. Because the sale of remelt alloy product is based on metals market prices, INMETCO’s revenues and profits fluctuate with prevailing metal prices. In addition to the production of the remelt alloy in 30-pound ingot size, INMETCO also produces a larger 1000-pound ingot on request.

Sales and Marketing

INMETCO’s marketing team consists of a sales manager and two inside sales assistants. The marketing team provides in-house INMETCO seminars in which current applicable regulations regarding storage and treatment of wastes, manifesting and transporting wastes and the recycling process are discussed. These seminars conclude with a tour of the INMETCO facility. INMETCO has also been active in exhibiting or presenting papers at outside seminars and trade shows to promote the capabilities of the business segment. The marketing team supplements these activities with advertisements in applicable industry publications, as well as on the Internet.

Customers

While INMETCO has over 200 customers in total, approximately 78% of its sales were made to its top four customers during the year ended December 31, 2015. INMETCO has had a long-term relationship with most of its major customers. Two of INMETCO’s top five customers have been customers since INMETCO commenced operations in the late 1970’s, one has been a customer since the mid 1990’s and two others have been customers since their own start-up in the early 2000’s and 2012.

Intellectual Property

The INMETCO process enables the business to treat and reclaim Ni-Cr-Fe bearing hazardous and non-hazardous materials in a low cost, environmentally safe manner. The INMETCO process is recognized by the EPA as the “Best Demonstrated Available Technology” for the treatment of steelmaking dust (i.e., low zinc KO61, KO62 and F006 designated hazardous waste).

Competition

We believe that our recycling facilities provide an environmentally favorable alternative for disposing of hazardous waste. Since 1978, INMETCO has provided a recycling alternative for a wide variety of hazardous waste products produced by the specialty steel industry, including steelmaking dust, mill scale and grinding swarf. Stainless steel producers are faced with the same dust disposal problems as carbon steel producers. However, the process requirements and economics of stainless steelmaking dust processing are different, since the cost of treating the dust may be substantially offset by the recovery of valuable metals such as nickel, chromium and iron, which are recycled and returned to the specialty steel industry under toll arrangements.

In the metal processing industry, the most commonly used techniques for managing and disposing of hazardous waste are land disposal facilities and recycling facilities such as INMETCO’s. We believe the INMETCO process offers three key advantages over landfill: (1) it is a preferred solution from an environmental and product stewardship perspective, (2) it offers potential cost advantages through the return of valuable metals and (3) it avoids exposure to long-term contingent liabilities associated with sending waste to landfill facilities. Accordingly, we expect the INMETCO process to continue to remain the alternative of choice for the specialty steel industry. We believe INMETCO is the largest recycler of nickel-bearing hazardous waste in North America.

We believe INMETCO provides new potential platforms for growth, including increasing capacity of the existing facility, growing our share of the battery recycling market, recycling other industrial wastes to recover metals in addition to nickel and enabling us to expand internationally. We believe there are further opportunities to increase capacity at INMETCO to service additional growth in nickel-bearing industrial wastes generated by U.S. stainless steel producers. We are also currently evaluating opportunities outside the United States for the use of INMETCO’s technology.

10

Table of Contents

Governmental Regulation and Environmental Issues

Our facilities and operations are subject to various federal, state and local governmental laws and regulations with respect to the protection of the environment, including regulations relating to air and water quality and solid and hazardous waste management and disposal. These laws include the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or “Superfund”), the Superfund Amendment Reauthorization Act, the Resource Conservation and Recovery Act (“RCRA”), the Clean Air Act (“CAA”), the Clean Water Act (“CWA”), and their state equivalents. We are also subject to various other laws and regulations, including those administered by the Department of Labor, the Surface Transportation Board, the Occupational Health and Safety Administration, the Department of Transportation and the Federal Railroad Administration, as well as certain of their state and provincial equivalents. We believe that we are in material compliance with applicable laws and regulations, including environmental laws and regulations governing our ongoing operations, and that we have obtained or applied in a timely manner for all material permits and approvals necessary for the operation of our business.

Our operations fully utilize recycled feedstocks. The use of recycled zinc feedstocks preserves natural resources, precluding the need for mining and land reclamation and thereby operating in a manner consistent with the principles of sustainable development. Our recycling services avoid the potential environmental impacts that are associated with land filling hazardous wastes. EAF dust itself is a listed hazardous waste created from the melting of steel scrap in electric arc furnaces by the steel mini-mill industry. High temperature metal recovery technology, which we employ in our recycling process, has been designated by the EPA as “Best Demonstrated Available Technology” for the recycling of EAF dust.

We maintain surety bonds to address financial assurance requirements for potential future remediation costs and RCRA permit termination for several facilities. Financial assurance is required under RCRA permit requirements for the Ellwood City, Pennsylvania, Palmerton, Pennsylvania and Barnwell, South Carolina facilities. Financial assurance, through a surety bond, is also required for eventual closure of our residual landfill at the Monaca, Pennsylvania facility, addressed below.

We permanently shut down our zinc production facility in Monaca, Pennsylvania in April 2014 and subsequently demolished it and sold the land in June 2015, although we retained ownership of a co-located non-hazardous captive landfill. Since December 2009, the landfill has been subject to a federal consent judgment under the CWA, requiring compliance with established effluent limitations under the applicable wastewater discharge permit. In June 2015, we entered into a consent order with the state, which requires compliance with new permit-based effluent limitations. The June 2015 consent order further requires submission of a revised closure plan for the landfill, which remains pending. We have established a total capital budget of $0.5 million for 2016 and 2017 for closure of the Monaca facility and maintain a bond in the amount of $0.4 million securing this obligation.

In Bartlesville, Oklahoma, our predecessor formerly operated a primary zinc processing facility which was closed in the 1990’s and subsequently dismantled. Environmental remediation work was completed in 2003 in connection with closing this former facility under a consent agreement with the Oklahoma Department of Environmental Quality. We currently manage this facility including groundwater monitoring and other maintenance activities under a RCRA post-closure permit. We, along with two other responsible parties, provide financial assurance for future post closure care activities at the Bartlesville facility. At December 31, 2015, a reserve on our balance sheet in the amount of $0.6 million has been established for our share of future costs associated with this matter.

Our Palmerton, Pennsylvania property is part of a CERCLA, or “Superfund,” site that was added to the National Priorities List in 1983, and has been subject to EPA investigation ever since. When the Palmerton, Pennsylvania facility’s assets were purchased out of bankruptcy in December 2003, we acquired only those assets, including real property, needed to support the ongoing recycling and metal powders businesses at that location. We currently hold approximately 160 acres within an area of the approximately 1,600 acres that was previously owned by the bankrupt estate of Horsehead Industries, Inc. Subject to certain limited exceptions, a third party has contractually assumed responsibility for certain historical site contamination and associated remediation of the Palmerton site, including the vast majority of the obligations arising under a 2003 consent decree with the United States related to the Superfund site, and has indemnified us against certain liabilities related to environmental conditions at the property, including natural resource damages. With respect to the approximately 160 acres owned by us, we have assumed responsibility for environmental obligations resulting from our ongoing operations as well as obligations under a 1995 consent decree with the United States, which imposed multimedia obligations under RCRA, the CAA and CWA.

Also at our Palmerton, Pennsylvania facility, the Company has responded to certain information requests from EPA relating to air emissions and maintenance activities at that facility, pursuant to Section 114 of the CAA. No notices of violation have been issued to date, but the Company cannot yet determine whether it will be required to pay fines or penalties or undertake additional action to resolve any alleged compliance deficiencies in the future.

11

Table of Contents

Our Barnwell, South Carolina facility and our Rockwood, Tennessee facility have been the subject of EPA and state agency investigations alleging violations under RCRA . We have entered into consent orders with each of the state agencies for issuance of RCRA permits. In addition, in connection with these investigations, we are currently working on a settlement with the U.S. Department of Justice, EPA Region 4 and the state agencies with respect to both facilities. Although the various agencies have acknowledged our efforts to cooperate with these investigations and the improvements and investments made at the facilities to address the identified issues, if settlements are not reached, the government may seek penalties and/or issue permanent injunctions against us. We cannot guarantee that we will be able to reach a satisfactory settlement on these matters, nor can we anticipate the amount of penalties, if any, that may be involved, or other actions or expenditures that may be required.

Our Ellwood, Pennsylvania facility suffered a fire at a permitted storage building in November 2015. Since then, the Pennsylvania Department of Environmental Protection has conducted several waste inspections and issued notices alleging violations of state and federal waste management and storage requirements. Although we do not believe that these allegations represent a material risk for us, we believe that entry into a consent order is possible in this case. We cannot speculate as to the content of the consent order or in any other way guarantee our view of the impact it could have on our environmental compliance costs.

Our Mooresboro, North Carolina facility was subject to a waste inspection led by EPA Region 4 and the North Carolina Department of Environmental Quality in October 2015. In February 2016, EPA Region 4 issued an inspection report, identifying alleged RCRA violations. We have taken measures to address the alleged violations, and negotiations with EPA remain pending. Although we do not believe that these allegations represent a material risk for us, it is possible that EPA may bring some form of an enforcement action. We cannot guarantee that we will be able to reach a satisfactory settlement on this matter, nor can we anticipate the amount of penalties, if any, that may be involved, or other actions or expenditures that may be required.

Our Chicago, Illinois facility received a notice and findings of violation in April 2014, from Illinois EPA and EPA Region 5 alleging violations of certain provisions of our Chicago, Illinois facility’s Title V Operating Permit and state and federal air regulations. Although we do not believe that the EPA’s allegations represent a material risk for us, we believe that the entry into a consent order with EPA Region 5 and the Department of Justice is possible in this case. We cannot speculate as to the content of the consent order or in any other way guarantee the outcome of these investigations and the impact they could have on our environmental compliance costs. In addition, in accordance with a recent City of Chicago ordinance, the facility is constructing a coke storage building to prevent the potential release of particulate coke to the environment. We have established a total capital budget of $1.7 million for 2016 and 2017, for this project.

We may also incur costs related to future compliance with or violations of applicable environmental laws and regulations, including, but not limited to, air emission regulations under possible future “Maximum Achievable Control Technology” rules relating to our operations such as regulations relating to non-ferrous secondary metals production. Our total cost of environmental compliance at any time depends on a variety of regulatory, legal, technical and factual issues, some of which cannot be anticipated. Additional environmental issues could arise, or laws and regulations could be passed and promulgated, resulting in additional costs, which our reserves may not cover and which could materially harm our operating results.

Employees

As of December 31, 2015, we employed 716 persons at the following locations.

|

Location |

Salaried Personnel |

Hourly Personnel |

Union Contract Expiration |

|||||||||

| Pittsburgh, Pennsylvania |

48 | — | N/A | |||||||||

| Bartlesville, Oklahoma |

1 | — | N/A | |||||||||

| Calumet, Illinois |

14 | 52 | 08/04/17 | |||||||||

| Palmerton, Pennsylvania |

20 | 80 | 04/27/19 | |||||||||

| Palmerton (Chestnut Ridge Railroad), Pennsylvania |

— | 3 | 12/15/16 | |||||||||

| Rockwood, Tennessee |

13 | 49 | 07/01/19 | |||||||||

| Barnwell, South Carolina |

11 | 45 | N/A | |||||||||

| Ellwood City, Pennsylvania |

28 | 66 | 10/31/16 | |||||||||

| Mooresboro, North Carolina (a) |

63 | 179 | N/A | |||||||||

| Brampton, Ontario Canada |

19 | 25 | 06/30/20 | |||||||||

|

|

|

|

|

|||||||||

|

Total |

217 | 499 | ||||||||||

12

Table of Contents

(a) The Mooresboro facility was idled on January 22, 2016 and is currently at a “care and maintenance level” only. The facility currently employs approximately 29 salary and 3 hourly persons.

There have not been any other material changes since December 31, 2015 in the number or mix of our employees.

The majority of our hourly personnel are unionized. Hourly workers receive medical, dental and prescription drug benefits. We do not have defined benefit plans for hourly or salaried employees, except at our Brampton, Ontario Canada site, which was acquired on November 1, 2011. These defined benefit plans include 30 active employees and are currently frozen to additional participants. We have a 401(k) plan for both our hourly and salaried employees at all sites in the United States. Employees at our Brampton, Ontario Canada facility hired after June 30, 2012 are eligible to participate in a retirement plan similar to a 401(k). We have no company-paid medical plan for retirees. Our labor contracts provide for a company contribution and in most cases a company match, which varies from contract to contract. We believe we have satisfactory relations with our employees.

In addition to the other information in this Annual Report on Form 10-K, the following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. Any of the following risks could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which we have made forward-looking statements in this Annual Report on Form 10-K. There may be additional risks and uncertainties that are not presently known or that we do not currently consider to be significant that may adversely affect our business, performance or financial condition in the future.

Risks Related to the Chapter 11 Cases

We have filed voluntary petitions for relief under the Bankruptcy Code and are subject to the risks and uncertainties associated with bankruptcy cases.

On the Petition Date, we and certain of our direct and indirect wholly owned subsidiaries filed voluntary petitions for reorganization under Chapter 11 of the Bankruptcy Code. As a result, our business and operations are subject to various risks, including but not limited to the following: (i) incurring substantial costs for fees and other expenses associated with the Chapter 11 Cases and the Canadian Proceedings, (ii) the attendant difficulties of operating our business while attempting to reorganize the business in bankruptcy, (iii) potential increased difficulty in retaining and motivating our key executives and employees through the process of reorganization, and potential increased difficulty in attracting new employees, and (iv) the effects of significant time and effort required to be spent by our senior management with respect to the bankruptcy and restructuring activities rather than focusing exclusively on business operations.

We may not be able to respond timely to certain events or take advantage of certain opportunities due to the need for Bankruptcy Court approval.

Transactions by us outside the ordinary course of business are subject to the prior approval of the Bankruptcy Court and with respect to property located in Canada, the Canadian Court, which may limit our ability to respond timely to certain events or take advantage of certain opportunities. We may not be able to obtain Bankruptcy Court approval or such approval may be delayed or conditioned with respect to actions we seek to undertake during the pendency of the Chapter 11 Cases or Canadian Proceedings.

There can be no assurance as to our ability to maintain sufficient financing sources to fund our business and meet future obligations during the Chapter 11 Cases.

There can be no assurance as to our ability to maintain sufficient financing sources to fund our business and meet future obligations during the Chapter 11 Cases. We intend to finance our operations during our reorganization using funds from operations and from the DIP Facility. There can be no assurance that we will be able to operate pursuant to the terms of the DIP Facility, including the financial covenants and restrictions contained therein, or to negotiate and obtain necessary approvals, amendments, waivers, or other types of modifications, and to otherwise fund and execute our business plans throughout the duration of the Chapter 11 Cases and Canadian Proceedings.

13

Table of Contents

We May Not Be Able to Consummate our Plan and Emerge from Chapter 11

Although the Bankruptcy Court entered an order confirming the Plan on September 9, 2016, we are obliged to take additional steps to consummate the Plan and emerge from Chapter 11 protection. There can be no guaranty that such steps can be achieved and/or that we will be able to emerge from Chapter 11 within the milestones filed by our DIP Credit Agreement or the Unit Purchase Agreement, respectively.

To the extent that the terms or conditions of the DIP Credit Agreement or the Unit Purchase Agreement, respectively, are not satisfied, or events giving rise to the termination of such agreements occur, the Debtors could be unable to emerge from Chapter 11 and/or may be obliged to liquidate.

We are subject to risks and uncertainties with respect to the actions and decisions of our creditors and other third parties who have interests in our Chapter 11 Cases that may be inconsistent with our plans.

We are subject to risks and uncertainties with respect to the actions and decisions of creditors and other third parties who have interests in our Chapter 11 Cases that may be inconsistent with our plans. These risks and uncertainties could affect our business and operations in various ways and may significantly increase the duration of the Chapter 11 Cases. Because of the risks and uncertainties associated with Chapter 11 Cases, we cannot predict or quantify the ultimate impact that events occurring during the Chapter 11 Cases may have on our business, cash flows, liquidity, financial condition and results of operations, nor can we predict the ultimate impact that events occurring during the Chapter 11 Cases may have on our corporate or capital structure.

Additionally, third parties may seek and obtain Bankruptcy Court approval to terminate or shorten the exclusivity period for us to propose and confirm the Plan or to convert the cases to Chapter 7 cases.

We may be unable to continue as a going concern.

The Chapter 11 Cases may adversely affect our business prospects and our ability to operate. The uncertainty regarding the eventual outcome of our restructuring, and the effect of other unknown adverse factors could threaten our existence as a going-concern. Continuing on a going-concern basis of our business is dependent upon, among other things, obtaining Bankruptcy Court approval of the Plan and Canadian Court recognition of the same, maintaining the support of key vendors and customers, and retaining key personnel, along with financial, business, and other factors, many of which are beyond our control.

The accompanying consolidated financial statements to this Annual Report on Form 10-K have been prepared assuming that we will continue as a going concern. As discussed in Note A to the financial statements, the Company has experienced working capital deficits, losses from continuing operations, and defaults and cross-defaults under various credit agreements and filed for bankruptcy protection on February 2, 2016. Our independent registered public accountants, BDO USA, LLP have included an emphasis of matter paragraph in their auditors’ report which states certain conditions exist which raise substantial doubt about our ability to continue as a going concern in relation to the foregoing. Our plans in regard to these matters are described in Note A. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. See “Report of Independent Registered Public Accounting Firm” included elsewhere in this Annual Report on Form 10-K.

Risks Related to our Business

Declines in the prices of zinc and nickel have had a significant adverse impact on our liquidity, operating results and financial condition.

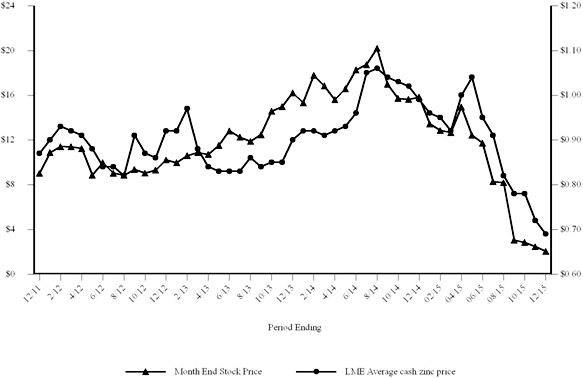

In 2015, we derived most of our revenue from the sale of zinc and a portion of our revenue from nickel-based products. Changes in the market prices of zinc and nickel impact the selling prices of our products, and therefore our liquidity and profitability are significantly affected by decreased zinc and nickel prices. For example, from May 2015 through December 31, 2015, the price of zinc fell approximately 39%, reaching a six-year low in December 2015. The price of nickel fell approximately 59% from May 2014 to December 2015. Although prices have recently improved, if the prices of zinc and nickel do not return to historical levels and we are unable to restart and improve the production rate and operational capabilities at the Mooresboro facility, our liquidity, financial condition and results of operations will be materially and adversely affected.

Market prices of zinc and nickel are dependent upon a variety of factors over which we have no control, including:

| • | the balance between supply and demand; |

| • | availability and relative pricing of metal substitutes; |

| • | labor costs; |

| • | import and export restrictions; |

| • | energy prices; |

| • | economic conditions in the U.S., China, and elsewhere in the world; |

| • | environmental laws and regulations; |

| • | weather; and |

| • | the effect of financial commodity speculations. |

14

Table of Contents

Declines in the price of zinc have had a negative impact on our operations in the past and in the months leading up to the Petition Date, and future declines could have further negative impact on our future financial condition or results of operations. Market conditions beyond our control determine the prices for our products, and the price for any one or more of our products may fall below our production costs, requiring us to either incur short-term losses and/or idle or permanently shut down production capacity.

If we fail to implement our business plan and financial restructuring strategy, our financial condition and results of operations could be materially and adversely affected.

Our ability to achieve our business plan and financial restructuring strategy is subject to a variety of factors, many of which are beyond our control. For example, following restructuring, factors such as increased competition, legal and regulatory developments, general economic conditions or increased operating costs could prevent us from increasing our capacity, implementing further productivity improvements, investing in technology upgrades or continuing to enhance our business and product mix. In addition, the restart and remediation of the issues existing at the Mooresboro facility may take longer and prove to be substantially more expensive than we currently estimate. In such event, we may be unable to restructure our debt or be forced to sell all or parts of our business, develop and implement further restructuring plans, or become subject to further insolvency proceedings.

Any failure to successfully implement our business plan and financial restructuring strategy, including for any of the above reasons, could materially and adversely affect our financial condition and results of operations. We may, in addition, decide to alter or discontinue certain aspects of our business strategy at any time.

Impairment charges could adversely affect our results of operations.

Long lived assets, which include property, plant and equipment as well as definite life intangible assets, are reviewed for impairment when events and circumstances indicate that the carrying amount of an asset may not be recoverable. If we determine that the fair value of any of these assets is less than the value recorded on our balance sheet, we will incur non-cash impairment charges that could adversely affect our results of operations.

During the fourth quarter of 2015, we assessed the carrying value of the Mooresboro Facilities’ fixed assets, and determined that the future estimated cash flow did not support the carrying amount. Therefore, we recorded a pre-tax, non-cash asset impairment charge of $527 million. During the year ended December 31, 2015, the Company’s operation were significantly impacted due to the dramatic decline in zinc nickel and other commodity prices, continuing issues that delayed ramp-up of the Mooresboro zinc facility, and lower EAF dust receipts reflecting weaker steel production. If such estimates or their related assumptions change in subsequent periods or if actual cash flows or other market measures are below management’s estimates, the Company may be required to record impairment charges for these assets not previously recorded or additional impairments on assets already recorded.

We may be unable to resolve the operational issues with respect to our Mooresboro facility and/we may experience new issues that may cause further delays, each of which would materially harm our profitability, liquidity, financial condition and operations.

The Mooresboro facility experienced significant operational difficulties prior to its idling that resulted in low production and several interruptions, and prevented it from achieving its design capacity. Some of the difficulties that we have faced are a bleed treatment system with insufficient capacity, inadequate removal of solids from the leach clarifier overflow, poor current efficiency caused by occasional excursion in electrolyte chemistry, and intermittent equipment reliability issues related to plugging and failure of process lines, pumps and filters.

Although we believe that we can succeed in making the necessary repairs and upgrades to the Mooresboro facility, which will enable us to ultimately operate at or near full capacity, there are significant risks that such efforts will be unsuccessful and that we will continue to suffer a loss of cash flow due to operational issues at the Mooresboro facility. We cannot foresee the severity of known issues, guarantee that our efforts to remediate known issues will be sufficient, or guarantee that we will be able to remediate such issues in a timely or cost-effective manner. In addition, we cannot guarantee that we will not encounter additional issues that result in further delays and unexpected costs. In that event, we may be unable to restructure our debt or be forced to sell all or parts of our business, develop and implement further restructuring plans, or become subject to further insolvency proceedings. The Mooresboro facility is in an idle state and currently there is no definitive plan to resume operations in the near future.

We may not have sufficient funds to correct operational issues experienced by our Mooresboro facility, such as the remediation of equipment failures and the replacement or design of portions of the facility.

Correcting some of the operational issues experienced by our Mooresboro facility requires remediating equipment failures and replacing or redesigning portions of the facility. We may not be able to correct these operational issues, new unforeseen operational issues may appear and the costs of correcting such issues may be greater than expected. We may not have the financial resources necessary, or be able to obtain financing, to address any operational issues at our Mooresboro facility. In that case, our liquidity, financial condition and operations would continue to be materially adversely affected.

The projected benefits from the Mooresboro facility may fail to materialize.

The Mooresboro facility is in an idle state and currently there is no definitive plan to resume operations in the near future. Even if we are able to restart the Mooresboro facility and resume operations, the benefits that we have projected to receive from the Mooresboro facility are based on numerous assumptions that, if incorrect, could negatively impact such projected benefits. Specifically, the technology used at the Mooresboro facility has only been implemented in a limited number of production environments, and our assumptions with regard to this technology have proved incorrect in certain instances in the past. Some

15

Table of Contents

aspects of this technology have not been tested in exactly the same manner or on a similar scale as compared to the Mooresboro facility. In addition, the equipment in the Mooresboro facility may not be operated in exactly the same manner as in other production environments. We may also not be able to realize the reduced recycling costs or the logistical benefits originally anticipated from the Mooresboro facility operations and may also be unable to penetrate the markets for certain grades of zinc metal that the Mooresboro facility was designed to produce.

The metals industry is highly cyclical. Fluctuations in the availability of zinc and nickel and in levels of customer demand have historically been severe, and future changes and/or fluctuations could cause us to experience lower sales volumes, which would negatively impact our profit margins.

The metals industry is highly cyclical. The length and magnitude of industry cycles have varied over time and by product but generally reflect changes in macroeconomic conditions, levels of industry capacity and availability of usable raw materials. The overall levels of demand for our products containing zinc or nickel reflect fluctuations in levels of end-user demand, which depend in large part on general macroeconomic conditions in North America and regional economic conditions in our markets. For example, many of the principal end consumers of zinc metal and zinc-related products operate in industries such as transportation, construction or general manufacturing, which themselves are heavily dependent on general economic conditions, including the availability of affordable energy sources, employment levels, interest rates, consumer confidence and housing demand. These cyclical shifts in our customers’ industries tend to result in significant fluctuations in demand and pricing for our products and services. As a result, in periods of recession or low economic growth, metals companies, including ours, have generally tended to under-perform compared to other industries. We generally have high fixed costs, so changes in industry demand that impact our production volume also can significantly impact our profit margins and our overall financial condition. Economic downturns in the national and international economies and prolonged recessions in our principal industry segments have had a negative impact on our operations and a continuation or further deterioration of current economic conditions could have a negative impact on our future financial condition or results of operations.

Some of our products and services are vulnerable to long-term declines in demand due to competing technologies, materials or imports, which would significantly reduce our sales.

Our zinc and nickel-based products compete with other materials in many of their applications. For example, PW zinc is used by steel fabricators in the hot dip galvanizing process, in which steel is coated with zinc in order to protect it from corrosion. Steel fabricators can also use paint, which we do not sell, for corrosion protection. Demand for our zinc as a galvanizing material may shift depending on how customers view the respective merits of hot dip galvanizing and paint. In addition, SHG zinc and CGG zinc are used by continuous galvanizers to produce galvanized flat-rolled sheet steel for the automotive market. Some automotive companies have begun to use lighter weight aluminum sheet to meet fuel efficiency standards by reducing vehicle weight, and to meet recycling standards. Any such shifts in industry uses could affect our sales.

Our nickel-bearing products are used in the stainless steel industry, and demand for our products and services may decline if demand for stainless steel lessens. Nickel-bearing stainless steel faces competition from stainless steels containing a lower level of nickel or no nickel. Domestic production of stainless steel may be negatively impacted by imports.

In addition, in periods of high zinc and nickel prices, consumers of these metals may have additional incentives to invest in the development of technologically viable substitutes for zinc and nickel-based products. Similarly, customers may develop ways to manufacture their products by using less zinc and nickel-based material than they do currently. If one or more of our customers successfully identify alternative products that can be substituted for our zinc or nickel-based products, or find ways to reduce their zinc or nickel consumption, our sales to those and other customers would likely decline.

Demand for our EAF dust or nickel-bearing waste recycling operations may decline to the extent that steel mini-mill producers identify less expensive or more convenient alternatives for the disposal of their EAF dust or nickel-bearing waste or if the EPA were to no longer classify EAF dust as a listed hazardous waste. In the future, we may face increased competition from other EAF dust or nickel-bearing waste recyclers, including new entrants into those recycling markets, or from landfills implementing more effective disposal techniques. Furthermore, our current recycling customers may seek to capitalize on the value of the EAF dust or nickel-bearing waste produced by their operations, or may seek to recycle their material themselves, or reduce the price they pay to us for the material they deliver to us.