Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRINKS CO | a2016098kinvestorpresentat.htm |

Investor Overview

NYSE: BCO

September 2016

Forward Looking Statements

These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan," "believe," "potential,"

"may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to: 2016 GAAP and non-

GAAP outlook, including revenue, organic growth, operating profit, earnings per share, currency translation impact, tax rate and capital expenditures; margin rate outlook (including for

the U.S. and Mexico businesses); adjusted EBITDA and multiple; and expectations regarding future cash payments to the primary U.S. pension plan and related to UMWA liabilities; and

expected costs related to the company’s Ireland operations. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies,

which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated.

These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: Our ability to improve profitability in our largest five markets; our

ability to identify and execute further cost and operational improvements and efficiencies in our core businesses; our ability to improve service levels and quality in our core business;

continuing market volatility and commodity price fluctuations and their impact on the demand for our services; our ability to maintain or improve volumes at favorable pricing levels

and increase cost and productivity efficiencies, particularly in the United States and Mexico; investments in information technology and adjacent businesses and their impact on revenue

and profit growth; our ability to develop and implement solutions for our customers and gain market acceptance of those solutions; our ability to maintain an effective IT infrastructure

and safeguard confidential information; risks customarily associated with operating in foreign countries including changing labor and economic conditions, currency restrictions and

devaluations, safety and security issues, political instability, restrictions on, and cost of, repatriation of earnings and capital, nationalization, expropriation and other forms of restrictive

government actions; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; regulatory and labor issues in many of our global operations,

including negotiations with organized labor and the possibility of work stoppages; our ability to integrate successfully recently acquired companies and improve their operating profit

margins; costs related to dispositions and market exits; our ability to identify evaluate and pursue acquisitions and other strategic opportunities, including those in the home security

industry and emerging markets; the willingness of our customers to absorb fuel surcharges and other future price increases; our ability to obtain necessary information technology and

other services at favorable pricing levels from third party service providers; variations in costs or expenses and performance delays of any public or private sector supplier, service

provider or customer; our ability to obtain appropriate insurance coverage, positions taken by insurers with respect to claims made and the financial condition of insurers, safety and

security performance, our loss experience, and changes in insurance costs; costs associated with the purchase and implementation of cash processing and security equipment; employee

and environmental liabilities in connection with our former coal operations, including black lung claims incidence; the impact of the Patient Protection and Affordable Care Act on

UMWA and black lung liability and the Company's ongoing operations; changes to estimated liabilities and assets in actuarial assumptions due to payments made, investment returns,

interest rates and annual actuarial revaluations, the funding requirements, accounting treatment, investment performance and costs and expenses of our pension plans, the VEBA and

other employee benefits, mandatory or voluntary pension plan contributions; the nature of our hedging relationships; counterparty risk; changes in estimates and assumptions

underlying our critical accounting policies; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public

perception of the Company's business and reputation; access to the capital and credit markets; seasonality, pricing and other competitive industry factors; and the promulgation and

adoption of new accounting standards and interpretations, new government regulations and interpretation of existing regulations.

This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-

looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2015, and in our other public filings with the

Securities and Exchange Commission. The forward-looking information discussed today and included in these materials is representative as of July 28, 2016. The Brink's Company

undertakes no obligation to update any information contained in this document.

These materials are copyrighted and may not be used without written permission from Brink's.

Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are provided in the appendix.

1

Why Brink’s?

Premier Global Brand

Symbol of security, service, trust

Global footprint: #1 or #2 in key markets

New Leadership

Track record of value creation

Focused on increasing EBITDA and trading multiple

Instilling sense of urgency throughout company

Value Creation Opportunities

Organic growth in cash management

Brink’s Global Services

Operational & income improvement, focus on U.S. & Mexico

Leverage IT

Deliver operational excellence & differentiated customer-

facing solutions

Accretive core acquisitions

Restore credibility with all stakeholders

2

Track record of value creation in global businesses

Experience in route-based logistics businesses serving financial institutions

Leveraging IT to drive internal productivity and expand customer offerings

Leading the turnaround efforts in the U.S.

Pursuing growth through acquisitions

New Leadership…New Focus

Restoring Credibility and Confidence Among All Stakeholders

Ron Domanico

CFO

Doug Pertz

CEO

Rohan Pal

CIO

3

Vision, Mission & Strategy

“We will create value by leveraging our brand,

enhancing the customer experience, and

aggressively pursuing growth opportunities.”

Doug Pertz – CEO

VISION

To be the world’s premier provider of cash

management, secure logistics and payment

services.

MISSION

Exceed expectations, every time.

STRATEGY

Achieve operational excellence, offer

differentiated services, make accretive

acquisitions.

4

Brink’s at a Glance

Operations in 41

Countries

2015 non-GAAP

EPS $1.69

2015 Adjusted

EBITDA $291M

Notes: See reconciliation to GAAP results in Appendix.

As of 12/31/2015 (see form 10-K for all information excluding Adjusted EBITDA)

2015 Revenue

$3.0B

(75% International)

Customers in over

100 Countries

59,900

Employees

1,100

Facilities

12,000

Vehicles

5

Lines of Business

Core Services

53%

$1.6B

High Value Services

39%

$1.2B

Guarding

8%

$.2B

2015 Non-GAAP Revenue $3.0B

High-Value Services

• Brink’s Global

Services (BGS)

• Money processing

• CompuSafe® Service

• Payments

• Cash-in-transit (CIT)

• ATM services

Core Services

75% of Revenue Outside of U.S.

Note: See reconciliation to GAAP results in Appendix.

6

High-Value Services…A Key Growth Driver

Brink’s Global Services (BGS) Money Processing

Payments CompuSafe®

Diamonds Jewelry

Banknotes Precious Metals

7

Global Operations Serving Customers in More Than 100 Countries*

*Operations in 41 countries

ARGENTINA

CHILE

BOLIVIA

PANAMA

COLOMBIA

UK ITALY

LUXEMBOURG

SWITZERLAND

POLAND

TURKEY

GERMANY GREECERUSSIA

S. AFRICA

BELGIUM

BOTSWANAMOROCCOISRAELUAE

IRELAND

JAPANSINGAPORE VIETNAMCHINA KOREA AUSTRALIA INDIA

U.S. FRANCE MEXICO CANADABRAZIL

8

VENEZUELA

KENYA

MADAGASCAR

MAURITIUS

REUNION

HONG KONG

TAIWAN

GSI

Other

Loomis

Garda

Other

Strong Position in Our Largest Markets

Source: Internal estimates reflect market share of CIT/ATM market

Estimated Market Share of Competitors in Our Top Five Markets

These markets represent ~65% of Brink’s 2015 revenue

9

Loomis

Prosegur Other

Prosegur

Protégé

Other

Other

Garda

FRANCE

BRAZIL CANADA

MEXICOU.S.

#1 or #2 Position in Key Markets

A Clear Path to Value Creation*

Our Strategy

Achieve Operational Excellence…Offer Differentiated Services…Make Accretive Acquisitions

Incremental Improvements

Breakthrough Initiatives

* For illustrative purposes only 10

Sales &

New Business

Branch

Standardization

Lean

Technology

Investments

Accretive

Acquisitions

OtherFleet One-Person

Vehicles

Optimize

Network

Current

Margin

Target

Margin

Financial Strength to Pursue Growth

Strong Balance Sheet

• Investment grade credit rating

• $323 million net debt

• Ample additional debt capacity

• Minimal cash outflow expected for legacy

liabilities

• No U.S. pension payments until 2020

• No payments to UMWA until 2027

Cash Flow Will Support Strategy, With Strong

Returns

• Investing in fleet and cost reduction equipment

• Operational and customer-facing IT

• Acquisitions

11*Net debt as of 6/30/2016

Capex Spend(a)

($ Millions, except ratio)

($)

(a) Excluding Venezuela

(b) As of July 28, 2016

$176

$169

$143

$116

$130 - $140

1.3

1.1

1.0

0.9

~1.0

0.00. 10.02. 30.04. 5

0.06. 70.08. 90.10. 1

0.12. 30.14. 50.16. 7

0.18. 90.20. 10.22. 3

0.24. 50.26. 70.28. 9

0.30. 10.32. 30.34. 5

0.36. 70.38. 90.40. 1

0.42. 30.44. 50.46. 7

0.48. 90.50. 10.52. 3

0.54. 50.56. 70.58. 9

0.60. 10.62. 30.64. 5

0.66. 70.68. 90.70. 1

0.72. 30.74. 50.76. 7

0.78. 90.80. 10.82. 3

0.84. 50.86. 70.88. 9

0.90. 10.92. 30.94. 5

0.96. 70.98. 91.00. 1

1.02. 31.04. 51.06. 7

1.08. 91.10. 11.12. 3

1.14. 51.16. 71.18. 9

1.20. 11.223. 41.25. 6

1.27. 81.29.301. 1.32

1. 3.341. 5.361. 7.38

1. 9.401. 1.421. 3.44

1. 5.461. 7.481. 9.50

1. 1.521. 3.541. 5.56

1. 7.581. 9.601. 1.62

1. 3.641. 5.661. 7.681 9

.70

100

150

200

250

300

2012 2013 2014 2015 2016 Outlook

Reinvestment Ratio

Depreciation (a) $150$134 $147 $132 $125 - $135

12

(b)

Summary of 2Q16 Non-GAAP Results

$31

2Q15 2Q16

$748

2Q15 2Q16

$0.30

2Q15 2Q16

EPSRevenue

Organic Growth 5%

Currency (7)%

Operating Profit

Margin 4.1% 5.3%

($ Millions, except % and per share amounts)

Organic Growth 53%

Currency (33)%

$38 Reported $ 0.38 Reported

$ 717 Reported

$ 773 Constant Currency

(56) Currency

$ 47 Constant Currency

(9) Currency

Note: See reconciliation to GAAP results in Appendix

13

$ 0.48 Constant Currency

(0.10) Currency

Continued Improvement Expected in 2016

124

157

185 - 200

3.7%

5.3%

6.4% - 6.9%

2014 2015 2016 Outlook

-20

-15

-10

-5

0

5

10

-25

25

75

125

175

225

275

2014 2015 2016 Outlook

Note: See reconciliation to GAAP results in Appendix

Non-GAAP Operating Profit

Margin

2016 Non-GAAP Outlook (as of July 28, 2016)

• 5% organic revenue growth to $2.9 billion, offset by negative

currency and dispositions

• Margin 6.4% - 6.9%, up 110 - 160 bps from 5.3% in 2015

• Adjusted EBITDA $305 - $330 million, up 5% - 13% from 2015

• EPS $1.95 - $2.10, up 15% - 24% from $1.69 in 2015

• Negative currency impact: $182 million on revenue; $20 million

on operating profit; $.24 on EPS

• Operating profit of $185 - $200

• U.S. operating profit $5 - $15....4Q approaching 5%

margin rate

• Mexico margin rate ~7%

• Currency uncertainty could negatively impact

($ Millions, except % and per share amounts)

As of July 28, 2016

14

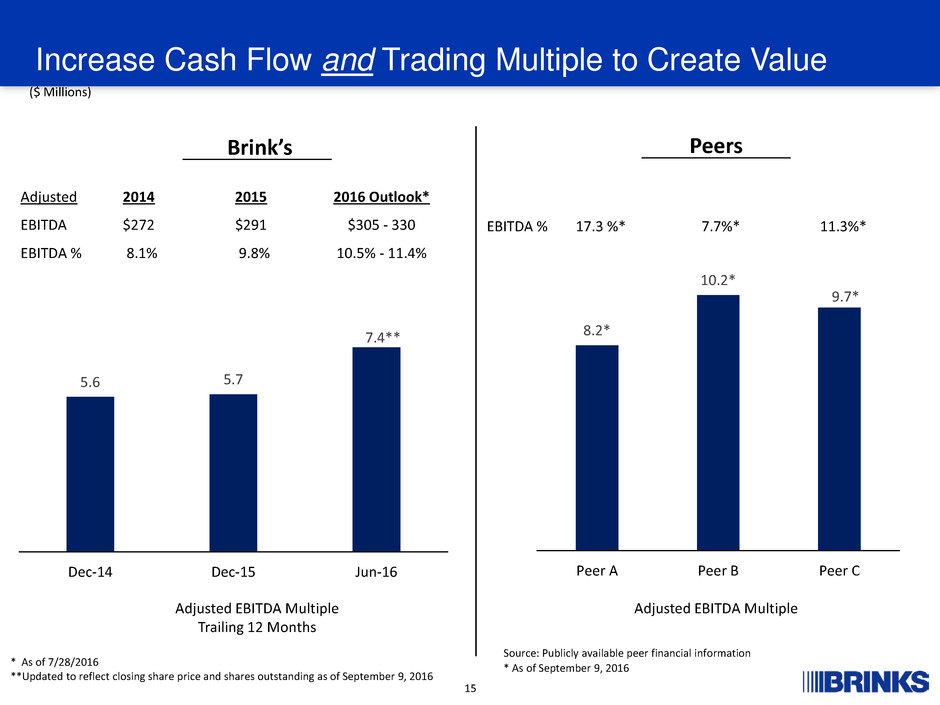

Increase Cash Flow and Trading Multiple to Create Value

Adjusted 2014 2015 2016 Outlook*

EBITDA $272 $291 $305 - 330

EBITDA % 8.1% 9.8% 10.5% - 11.4%

Adjusted EBITDA Multiple

Trailing 12 Months

* As of September 9, 2016

Brink’s

Adjusted EBITDA Multiple

($ Millions)

Source: Publicly available peer financial information

Peers

15

5.6 5.7

7.4**

Dec-14 Dec-15 Jun-16

* As of 7/28/2016

**Updated to reflect closing share price and shares outstanding as of September 9, 2016

EBITDA % 17.3 %* 11.3%*7.7%*

8.2*

10.2*

9.7*

Peer A Peer B Peer C

Why Brink’s?

Premier Global Brand

Symbol of security, service, trust

Global footprint: #1 or #2 in key markets

New Leadership

Track record of value creation

Focused on increasing EBITDA and trading multiple

Instilling sense of urgency throughout company

Value Creation Opportunities

Accelerate profitable growth (APG)

• Organic growth, accretive acquisitions

Close the margin gap (CTG)

• Achieve operational excellence, exceed customer service metrics

Deliver differentiated services

• End-to-end cash solutions

• Leverage common global technology base to deliver best-in-class

logistics, customer-facing technology (customer portal), and value-

added fee-based services

Restore credibility with all stakeholders

16

Appendix

Page

Executive Bios 19

Non-GAAP Outlook 20

2015 Revenue and Operating Profit 21

Brink’s Historical Non-GAAP Results 22-23

Legacy Liabilities & Estimated Cash Payments 24-25

Other Items Not Allocated to Segments 26-28

Non-GAAP to GAAP Reconciliations 29-36

Index

18

Executive Bios

Doug Pertz

President and Chief Executive Officer

Douglas A. Pertz is the President and Chief Executive Officer and a director of The Brink’s Company and has served in these roles since June 2016. He has led

several global companies as CEO over the past 20 years and throughout his career has guided multinational organizations operating in complex environments.

Most recently, he was President and Chief Executive Officer of Recall Holdings Limited (a global provider of digital and physical information management and

security services), having led the company from its initial public offering in 2013 through the successful negotiation of its sale to Iron Mountain in 2016.

Prior to joining Recall, Mr. Pertz served from 2011 to 2013 as a partner with Bolder Capital, LLC (a private equity firm specializing in acquisitions and

investments in middle market companies). He also served as CEO at IMC Global (the predecessor company to The Mosaic Company), Culligan Water

Technologies and Clipper Windpower, and as Group Executive and Corporate Vice President at Danaher Corporation. In these roles, Mr. Pertz honed his

operational expertise in branch-based, route-based logistics and in the areas of secure storage and business-to-business services.

He holds a degree in mechanical engineering from Purdue University, Indiana.

Ron Domanico

Executive Vice President and Chief Financial Officer

Ronald J. Domanico is Executive Vice President and Chief Financial Officer of Brink’s. Ron also is responsible for Brink’s Global Payments operations and global

procurement functions. Prior to joining Brink’s, Ron was the SVP Strategic Initiatives & Capital Markets at Recall Holdings Limited from April 2014 to May 2016.

From 2010 to 2014, Ron served as Senior Vice President and Chief Financial Officer of HD Supply, Inc. He joined HD Supply in 2010 from Caraustar Industries,

Inc., where he served as its Chief Financial Officer from 2002 to 2009 and Senior Vice President from 2005 to 2009. Before that, Ron held various international

financial leadership positions at AHL Services, Inc., Nabisco, Inc. and Kraft Inc. Ron serves on the Board of Directors for First Advantage, NanoLumens, Ltd. and

multiple non-profit organizations. He holds an M.B.A. and a Bachelor of Science from the University of Illinois in Urbana-Champaign.

19

Non-GAAP 2016 Outlook (as of July 28, 2016)

Note: See reconciliation to GAAP results in Appendix

(a) Attributable to Brink’s

20152014

2016

Outlook

Revenue $3,351 $2,977 ~$2,900

Op profit 124 157 185 – 200

Interest/Other

Income (22) (15) (17)

Taxes (47) (52) (66– 71)

Noncontrolling

interests (6) (5) (5 -7)

Income from

continuing ops (a) 49 84 97– 107

EPS Range $1.01 $1.69 $1.95 – $2.10

2015

2016

Outlook2014

Key Metrics

Revenue change

Organic $85 3% $140 5%

Acq./Disp 9 - (35) (1)%

Currency (467) (14)% (182) (6)%

Total $(374) (11)% $(77) (3)%

Margin 3.7% 5.3% 6.4% - 6.9%

Tax rate 45.7% 37.0% 39.0%

U.S. margin 3.1% 2.1% 0.7% - 2%

Mexico margin 2.5% 7.3% ~7%

Adjusted EBITDA $272 $291 $305 - $330

Adjusted ETBITDA % 8.1% 9.8% 10.5% - 11.4%

($ Millions, except as noted)

20

2015 Revenue and Operating Profit

($ Millions)

Organic Acquisitions /

YTD '14 Change Dispositions(a) Currency(b) YTD '15 Total Organic

Revenues:

U.S. 728 3 — — 730 — —

France 517 — — (86) 432 (17) —

Mexico 388 9 — (64) 333 (14) 2

Brazil 364 18 — (111) 270 (26) 5

Canada 180 (2) — (24) 154 (14) (1)

Largest 5 Markets 2,177 27 — (285) 1,919 (12) 1

Latin America 381 58 — (69) 370 (3) 15

EMEA 556 (38) — (74) 445 (20) (7)

Asia 140 18 9 (10) 157 13 13

Global Markets 1,077 39 9 (153) 972 (10) 4

Payment Services 97 19 — (30) 86 (11) 20

Revenues - non-GAAP 3,351 85 9 (467) 2,977 (11) 3

Other items not allocated to segments(d) 212 297 — (424) 85 (60) fav

Revenues - GAAP 3,562 381 9 (891) 3,061 (14) 11

Operating profit:

U.S. 23 (8) — — 15 (34) (34)

France 39 2 — (7) 35 (12) 5

Mexico 10 19 — (5) 24 fav fav

Brazil 34 — — (11) 24 (30) —

Canada 13 — — (2) 11 (16) (2)

Largest 5 Markets 119 13 — (23) 109 (9) 11

Latin America 50 39 — (13) 76 51 76

EMEA 53 (14) — (3) 36 (32) (26)

Asia 23 6 1 (1) 29 24 26

Global Markets 126 31 1 (17) 141 12 25

Payment Services (5) (1) — (1) (7) 47 29

Corporate items(c) (116) 39 — (9) (85) (26) (34)

Operating profit - non-GAAP 124 82 1 (50) 157 26 66

Other items not allocated to segments(d) (152) 53 (55) 54 (100) (34) (35)

Operating profit (loss) - GAAP (28) 135 (54) 3 57 fav fav

% Change

21

Amounts may not add due to rounding.

a) Includes operating results and gains/losses on acquisitions, sales and exits of businesses. The 2014 divestiture of an equity interest in a business in Peru is included in “Other items not allocated to segments”.

b) The amounts in the “Currency” column consist of the amortization of Venezuela non-monetary assets not devalued under highly inflationary accounting rules and the sum of monthly currency changes. Monthly currency

changes represent the accumulation throughout the year of the impact on current period results of changes in foreign currency rates from the prior year period.

c) Corporate expenses are not allocated to segment results. Corporate expenses include salaries and other costs to manage the global business and to perform activities required by public companies.

d) See slides 26-28 for more information.

Historical Non-GAAP Revenue

Note: See reconciliation to GAAP results in Appendix

($ Millions)

Revenue

$818

$837 $847 $848

$756 $748 $740 $733

$689

$717

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

22

Historical Non-GAAP Operating Profit and EPS

Note: See reconciliation to GAAP results starting on slide 29

($ Millions, except per share amounts)

($)

Margin

Operating Profit EPS

$0.15 $0.16

$0.12

$0.58

$0.44

$0.30

$0.40

$0.55

$0.30

$0.38

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

$21

$24

$21

$59

$41

$31

$37

$49

$31

$38

2.5% 2.9% 2.5%

6.9%

5.4% 4.1% 5.0%

6.6%

4.5% 5.3%

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

23

Legacy Liabilities – Underfunding at December 31

($ Millions)

Primary U.S. Pension UMWA

$(113)

$(108)

$(114)

2013 2014 2015

Primary U.S. Pension

$(142)

$(197)

$(206)

2013 2014 2015

UMWA

24

Estimated Cash Payments: $0 to Primary U.S. Pension until 2020

$0 to UMWA until 2027

($ Millions)

Payments to Primary U.S. Pension Payments to UMWA

$0

$9

$21

$17

$5

2015 2020 2021 2022 2023

$0

$3

2015 2027

25

Note: Projections based on actuarial assumptions as of 12/31/2015

Other Items Not Allocated to Segments

The Brink’s Company and subsidiaries

Other Items Not Allocated to Segments (Unaudited)

(In millions)

Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. A summary of the other items

not allocated to segment results is below.

2015 2016

1Q 2Q 3Q 4Q Full Year 1Q 2Q First Half

Revenues:

Venezuela operations $ 20.5 12.2 19.3 32.5 84.5 $ 32.1 21.5 53.6

Acquisitions and dispositions - - - - - 0.8 1.5 2.3

Revenues $ 20.5 12.2 19.3 32.5 84.5 $ 32.9 23.0 55.9

Operating profit:

Venezuela operations $ (17.9) (39.1) (0.8) 10.1 (47.7) $ 1.8 0.9 2.7

Reorganization and

Restructuring (1.5) 1.2 (2.9) (12.1) (15.3) (6.0) (2.1) (8.1)

U.S. and Mexican retirement

plans (8.3) (7.6) (8.0) (7.3) (31.2) (7.3) (8.1) (15.4)

Acquisitions and dispositions - 0.3 - (6.3) (6.0) (5.8) (6.5) (12.3)

Operating profit $ (27.7) (45.2) (11.7) (15.6) (100.2) $ (17.3) (15.8) (33.1)

26

Other Items Not Allocated to Segments

The Brink’s Company and subsidiaries

Other Items Not Allocated to Segments (Unaudited)

Venezuela operations We have excluded from our segment results all of our Venezuela operating results, including expenses related to currency devaluations

of $7.4 million and $26.6 million in the first half of 2016 and 2015, respectively, and $34.3 million and $142.7 million for the full year 2015 and 2014,

respectively, due to management’s inability to allocate, generate or redeploy resources in-country or globally. In light of these unique circumstances, our

operations in Venezuela are largely independent of the rest of our global operations. As a result, the Chief Executive Officer, the Company's Chief Operating

Decision Maker ("CODM"), assesses segment performance and makes resource decisions by segment excluding Venezuela operating results. Additionally,

management believes excluding Venezuela from segment results makes it possible to more effectively evaluate the company’s performance between

periods.

• Factors considered by management in excluding Venezuela results include:

• Continued inability to repatriate cash to redeploy to other operations or dividend to shareholders

• Highly inflationary environment

• Fixed exchange rate policy

• Continued currency devaluations and

• Difficulty raising prices and controlling costs

Reorganization and Restructuring Brink’s reorganized and restructured its business in December 2014, eliminating the management roles and structures in its

former Latin America and EMEA regions and implementing a plan to reduce the cost structure of various country operations by eliminating approximately

1,700 positions across its global workforce. Severance costs of $21.8 million associated with these actions were recognized in 2014. An additional $0.3 million

was recognized in the first half of 2015 related to the 2014 restructuring. The restructuring saved annual direct costs of approximately $50 million in 2015

compared to 2014, excluding charges for severance, lease termination and accelerated depreciation. Brink's initiated an additional restructuring of its

business in the third quarter of 2015. We recognized $4.4 million of costs in the first six months of 2016 related to employee severance, contract

terminations and lease terminations associated with the 2015 restructuring, which is expected to reduce the global workforce by approximately 1,000

positions and is projected to result in $20 to $25 million in 2016 cost savings. In the fourth quarter of 2015, we recognized $1.8 million in charges related to

Executive Leadership and Board of Directors restructuring actions, which were announced in January 2016. We recognized $3.8 million in charges in the first

six months of 2016 related to these restructuring actions. All expenses related to the Executive Leadership and Board of Directors restructuring actions have

been paid in cash as of June 30, 2016.

U.S. and Mexican retirement plans Because our U.S. retirement plans are frozen, costs related to these plans have not been allocated to segment

results. Brink’s primary U.S. pension plan settled a portion of its obligation in the fourth quarter of 2014 under a lump sum buy-out offer. Approximately

4,300 terminated participants were paid about $150 million of plan assets under this offer in lieu of receiving their pension benefit. A $56 million settlement

loss was recognized as a result of the settlement. Mexico is the only operating segment in which employee termination benefits are accounted for as

retirement benefits under FASB ASC Topic 715, Compensation — Retirement Benefits. As a result, settlement charges related to these termination benefits

have not been allocated to segment results.

27

Other Items Not Allocated to Segments

The Brink’s Company and subsidiaries

Other Items Not Allocated to Segments (Unaudited)

Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the business and are special in

nature are consistently excluded from non-GAAP results. In 2014, Brink’s sold an equity investment in a CIT business in Peru and recognized a $44.3 million

gain. In 2015, Brink's sold its 70% interest in a cash management business in Russia and recognized a $5.9 million loss on the sale. Due to management's

decision in the first quarter of 2016 to exit the Republic of Ireland, the prospective impacts of shutting down this operation are included in items not allocated

to segments and are excluded from the operating segments effective March 1, 2016. This activity is also excluded from the consolidated non-GAAP

results. Beginning May 1, 2016, due to management's decision to also exit Northern Ireland, the results of shutting down these operations are treated

similarly to the Republic of Ireland. Revenues from both Ireland operations to be shut down in 2016 were approximately $20 million in 2015. Charges

included in our GAAP results include $4.6 million in severance costs, $1.8 million in property impairment charges and an additional $4.0 million in operating

and other exit costs. These costs have been excluded from our segment and our consolidated non-GAAP results. Brink's expects it could recognize additional

operating and disposition-related costs of up to approximately $5 million later this year. International shipments to and from Ireland will continue to be

provided through Brink’s Global Services. We also recognized a $2.0 million loss related to the sale of corporate assets in the second quarter of 2016.

Share-based compensation adjustment Accounting adjustments related to share-based compensation have not been allocated to segment results ($4.2

million expense in the second quarter of 2014 and a $1.8 million benefit in the third quarter of 2014). The accounting adjustments revised the accounting for

certain share-based awards from fixed to variable fair value accounting. As of July 11, 2014, all outstanding equity awards had met the conditions for a grant

date as defined in ASC Topic 718 and have since been accounted for as fixed share-based compensation expense.

28

Non-GAAP Reconciled to GAAP

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP (Unaudited)

(In millions, except for percentages and per share amounts)

Amounts may not add due to rounding. See slide 30 for footnote explanations.

2015 2016

1Q 2Q 3Q 4Q Full Year 1Q 2Q First Half

Revenues:

Non-GAAP $755.6 748.1 739.9 733.3 2,976.9 $688.9 716.5 1,405.4

Other items not allocated to segments(a) 20.5 12.2 19.3 32.5 84.5 32.9 23.0 55.9

GAAP $776.1 760.3 759.2 765.8 3,061.4 $721.8 739.5 1,461.3

Operating profit (loss):

Non-GAAP $40.6 30.6 37.0 48.6 156.8 $31.1 37.9 69.0

Other items not allocated to segments(a) (27.7) (45.2) (11.7) (15.6) (100.2) (17.3) (15.8) (33.1)

GAAP $12.9 (14.6) 25.3 33.0 56.6 $13.8 22.1 35.9

Taxes:

Non-GAAP $13.4 9.7 12.2 17.0 52.3 $10.2 13.1 23.3

Other items not allocated to segments(a) (3.9) - (1.5) 19.6 14.2 (2.0) 0.6 (1.4)

Income tax rate adjustment(b) 6.0 (2.1) 3.4 (7.3) - 1.2 0.8 2.0

GAAP $15.5 7.6 14.1 29.3 66.5 $9.4 14.5 23.9

Noncontrolling interests:

Non-GAAP $0.8 1.8 0.8 1.5 4.9 $1.1 1.6 2.7

Other items not allocated to segments(a) (6.2) (16.5) (1.4) 2.9 (21.2) 1.1 1.2 2.3

Income tax rate adjustment(b) (1.1) 1.2 0.2 (0.3) - 0.4 0.3 0.7

GAAP $(6.5) (13.5) (0.4) 4.1 (16.3) $2.6 3.1 5.7

Non-GAAP Margin 5.4% 4.1% 5.0% 6.6% 5.3% 4.5% 5.3% 4.9%

29

Non-GAAP Reconciled to GAAP

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP (Unaudited)

(In millions, except for percentages and per share amounts)

a) See “Other Items Not Allocated To Segments” on slides 26-28 for pretax amounts and details. Other Items Not Allocated To Segments for noncontrolling interests, income from continuing

operations attributable to Brink's and EPS are the effects of the same items at their respective line items of the consolidated statements of operations.

b) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income

tax rate. The full-year non-GAAP effective tax rate is estimated at 39.0% for 2016 and was 37.0% for 2015.

c) For non-GAAP EPS on a constant currency basis, EPS is calculated for the most recent period at the prior period's foreign currency rates to eliminate the currency impact on EPS.

Amounts may not add due to rounding.

2015 2016

Income from continuing operations attributable to Brink's: 1Q 2Q 3Q 4Q Full Year 1Q 2Q First Half

Non-GAAP $ 21.9 14.8 20.1 27.4 84.2 $ 14.9 19.0 33.9

Other items not allocated to segments(a) (17.6) (28.7) (8.8) (38.2) (93.3) (16.4) (17.6) (34.0)

Income tax rate adjustment(b) (4.9) 0.9 (3.6) 7.6 - (1.6) (1.1) (2.7)

GAAP (0.6) (13.0) 7.7 (3.2) (9.1) (3.1) 0.3 (2.8)

Reconciliation to net income (loss):

Discontinued operations (2.4) 0.1 (0.1) (0.4) (2.8) - - -

Net income (loss) attributable to Brink's $ (3.0) (12.9) 7.6 (3.6) (11.9) $ (3.1) 0.3 (2.8)

EPS:

Non-GAAP $ 0.44 0.30 0.40 0.55 1.69 $ 0.30 0.38 0.68

Other items not allocated to segments(a) (0.36) (0.58) (0.18) (0.77) (1.87) (0.33) (0.34) (0.68)

Income tax rate adjustment(b) (0.10) 0.02 (0.07) 0.15 - (0.03) (0.02) (0.05)

GAAP $ (0.01) (0.26) 0.16 (0.07) (0.19) $ (0.06) 0.01 (0.06)

30

Non-GAAP Reconciled to GAAP

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP (Unaudited)

(In millions, except for percentages and per share amounts)

Amounts may not add due to rounding. See slide 30 for footnote explanations.

1H'15 1H'16

Pre-tax Tax

Effective tax

rate Pre-tax Tax

Effective tax

rate

Effective Income Tax Rate

Non-GAAP $ 62.4 23.1 37.0% $ 59.9 23.3 38.9%

Other items not allocated to segments(a) (72.9) (3.9) (33.1) (1.4)

Income tax rate adjustment(b) - 3.9 - 2.0

GAAP $ (10.5) 23.1 (220.0%) $ 26.8 23.9 89.2%

2016

2Q

EPS:

Constant currency basis - Non-GAAP $ 0.48

Effect of changes in currency exchange rates(c) (0.10)

Non-GAAP 0.38

Other items not allocated to segments(a) (0.34)

Income tax rate adjustment(b) (0.02)

GAAP $ 0.01

31

Non-GAAP Reconciliation – Outlook as of July 28, 2016

The Brink’s Company and subsidiaries

Reconciliation of Non-GAAP to GAAP 2016 Outlook (Unaudited)

(In millions)

Amounts may not add due to rounding.

a) Non-GAAP outlook excludes the impacts of Venezuela operations and acquisitions and dispositions.

b) Non-GAAP outlook excludes the impacts of Venezuela operations, reorganization and restructuring, U.S. and Mexican retirement plans, and acquisitions and dispositions.

c) Non-GAAP outlook excludes the impacts of Venezuela operations.

d) The 2016 Non-GAAP outlook amounts for provision for income taxes, income (loss) from continuing operations, EPS from continuing operations, the effective income tax rate and Adjusted EBITDA cannot be reconciled

to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the tax impact of Venezuela operations and the related exchange rates used to measure

those operations. The impact of Venezuela operations and related exchange rates during the remainder of 2016 could be significant to our full-year GAAP provision for income taxes, and, therefore, to income (loss)

from continuing operations, EPS from continuing operations, the effective income tax rate and Adjusted EBITDA.

2016 Non-GAAP

Outlook(d)

Other Items Not

Allocated to

Segments

2016 GAAP

Outlook

Revenues(a) ~2,900 50 ~2,950

Operating profit (loss)(b) 185 – 200 (50) 135 – 150

Nonoperating expense(a) (17) — (17)

Provision for income taxes(b) (66) – (71) — —

Noncontrolling interests(c) (5) – (7) (3) (8) – (10)

Income (loss) from continuing operations(b) 97– 107 — —

EPS from continuing operations(b) 1.95 – 2.10 — —

Operating profit margin(b) 6.4% – 6.9% (1.8)% 4.6% – 5.1%

Effective income tax rate(b) 39.0% — —

Fixed asset acquired

Capital expenditures(c) 95 – 105 5 100 – 110

Capital leases 35 — 35

Total 130 – 140 5 135 – 145

Depreciation and amortization of fixed assets 125 – 135 — 125 – 135

Adjusted EBITDA 305– 330 — —

32

Non-GAAP Reconciliation – Net Debt

The Brink’s Company and subsidiaries

Non-GAAP Reconciliations – Net Debt (Unaudited)

(In millions)

a) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to customers’

accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in our computation of Net

Debt.

Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage. We believe

that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in accordance with GAAP and

should be reviewed in conjunction with our consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly

comparable financial measure calculated and reported in accordance with GAAP.

Net Debt excluding cash and debt in Venezuelan operations was $330 million at June 30, 2016, and $348 million at June 30, 2015. Net Debt decreased by $21 million primarily due to positive

cash flows over the last 12 months to fund investing activities and pay down long-term debt.

June 30, June 30,

(In millions) 2016 2015

Debt:

Short-term debt 77.2$ 40.5

Long-term debt 405.3 449.6

Total Debt 482.5 490.1

Less:

Cash and cash equivalents 169.6 173.2

Amounts held by Cash Management Services operations(a) (9.6) (26.4)

Cash and cash equivalents available for general corporate purposes 160.0 146.8

Net Debt 322.5$ 343.3

33

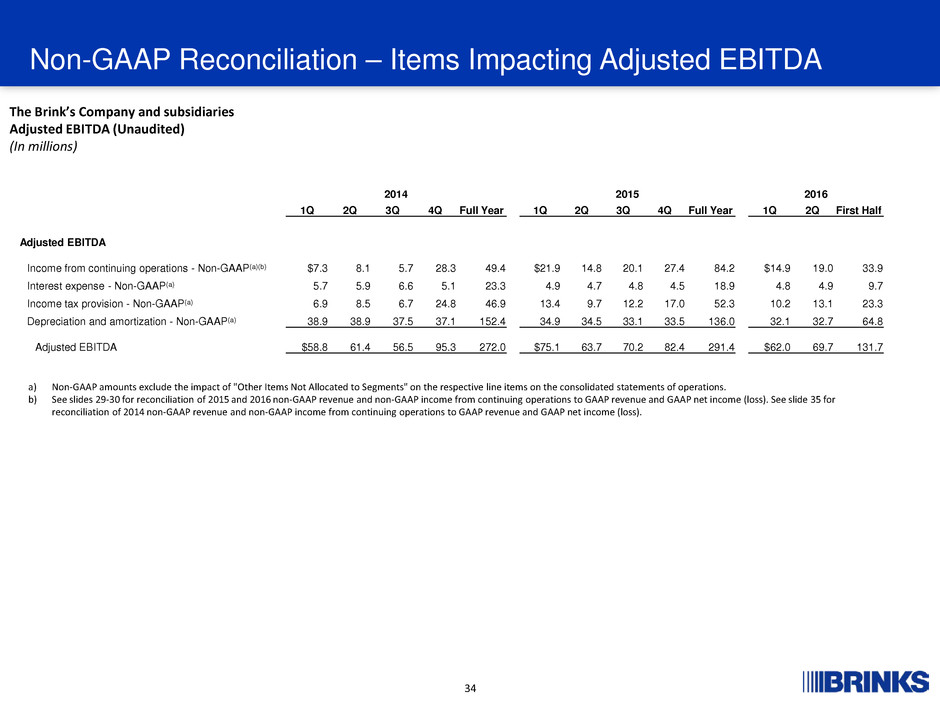

Non-GAAP Reconciliation – Items Impacting Adjusted EBITDA

The Brink’s Company and subsidiaries

Adjusted EBITDA (Unaudited)

(In millions)

a) Non-GAAP amounts exclude the impact of "Other Items Not Allocated to Segments" on the respective line items on the consolidated statements of operations.

b) See slides 29-30 for reconciliation of 2015 and 2016 non-GAAP revenue and non-GAAP income from continuing operations to GAAP revenue and GAAP net income (loss). See slide 35 for

reconciliation of 2014 non-GAAP revenue and non-GAAP income from continuing operations to GAAP revenue and GAAP net income (loss).

2014 2015 2016

1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q 4Q Full Year 1Q 2Q First Half

Adjusted EBITDA

Income from continuing operations - Non-GAAP(a)(b) $7.3 8.1 5.7 28.3 49.4 $21.9 14.8 20.1 27.4 84.2 $14.9 19.0 33.9

Interest expense - Non-GAAP(a) 5.7 5.9 6.6 5.1 23.3 4.9 4.7 4.8 4.5 18.9 4.8 4.9 9.7

Income tax provision - Non-GAAP(a) 6.9 8.5 6.7 24.8 46.9 13.4 9.7 12.2 17.0 52.3 10.2 13.1 23.3

Depreciation and amortization - Non-GAAP(a) 38.9 38.9 37.5 37.1 152.4 34.9 34.5 33.1 33.5 136.0 32.1 32.7 64.8

Adjusted EBITDA $58.8 61.4 56.5 95.3 272.0 $75.1 63.7 70.2 82.4 291.4 $62.0 69.7 131.7

34

Non-GAAP Reconciliation – Items Impacting Adjusted EBITDA

The Brink’s Company and subsidiaries

Non-GAAP Results Reconciled to GAAP - Other (Unaudited)

(In millions)

a) Refer to the 2015 Fourth Quarter press release exhibit 99.1 on Form 8-K filed February 4, 2016 for details

b) Non-GAAP income from continuing operations has been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-

year non-GAAP effective tax rate was 45.7% for 2014.

2014

1Q 2Q 3Q 4Q Full Year

Revenues:

Non-GAAP $ 818.3 836.7 847.4 848.1 3,350.5

Other items not allocated to segments(a) 131.3 22.3 25.1 33.1 211.8

GAAP $ 949.6 859.0 872.5 881.2 3,562.3

Income from continuing operations attributable to Brink's:

Non-GAAP $ 7.3 8.1 5.7 28.3 49.4

Other items not allocated to segments(a) (59.9) (10.3) 20.5 (54.5) (104.2)

Income tax rate adjustment(b) (6.4) 3.1 2.6 0.7 -

GAAP (59.0) 0.9 28.8 (25.5) (54.8)

Reconciliation to net income (loss):

Discontinued operations 0.5 0.7 (8.6) (21.7) (29.1)

Net income (loss) attributable to Brink's $ (58.5) 1.6 20.2 (47.2) (83.9)

35

Non-GAAP Reconciliation – Other

The Brink’s Company and subsidiaries

Non-GAAP Reconciliations – Other Amounts (Unaudited)

(In millions)

Fixed Assets Acquired

2012 2013 2014 2015 2015 2016

Capital expenditures - GAAP 170.8 172.9 136.1 101.1 35.2 45.0

Assets aquired under capital lease - GAAP 18.2 5.4 12.1 18.9 6.2 12.7

Fixed assets acquired - GAAP 189.0 178.3 148.2 120.0 41.4 57.7

Venezuela fixed assets acquired (12.6) (9.0) (5.4) (4.3) (0.9) (2.5)

Fixed assets acquired - Non-GAAP 176.4 169.3 142.8 115.7 40.5 55.2

Depreciation

Depreciation - GAAP 141.2 159.4 156.4 135.7

Venezuela depreciation (7.6) (9.0) (9.5) (3.9)

Depreciation - Non-GAAP 133.6 150.4 146.9 131.8

Reinvestment Ratio 1.3 1.1 1.0 0.9

Full Year Six Months

36