Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LEGG MASON, INC. | item701.htm |

For internal use only. Not for distribution to the public. For internal use only. Not for distribution to the public.

Sell Side Analyst Lunch and Investor Call

Brandywine Global | Clarion Partners | ClearBridge Investments | EnTrustPermal | Martin Currie | QS Investors | RARE Infrastructure | Royce & Associates | Western Asset

September 8, 2016

Joseph A. Sullivan

Chairman and Chief Executive Officer

Peter H. Nachtwey

Chief Financial Officer

Page 1

Important Disclosures

Forward-Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995.

These forward-looking statements are not statements of facts or guarantees of future

performance, and are subject to risks, uncertainties and other factors that may cause actual

results to differ materially from those discussed in the statements.

For a discussion of these risks and uncertainties, please see “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s

Annual Report on Form 10-K for the fiscal year ended March 31, 2016 and in the Company’s

quarterly reports on Form 10-Q.

Non-GAAP Financial Measures

This presentation includes non-GAAP financial information. This non-GAAP information is in

addition to, not a substitute for or superior to, measures of financial performance or liquidity

determined in accordance with GAAP. The company undertakes no obligation to update the

information contained in this presentation to reflect subsequently occurring events or

circumstances.

Agenda

• Strategy Overview

• Strategic Capital Update

• Non-GAAP Financial Measures

• Tax Shield

• Closing

• Q&A

Page 2

Strategy Overview

Remaking Legg Mason

Page 4

Strategic Transactions 2013-2016

Three Priorites Strategic Transactions Description Year

Permal MEP Management Equity Plan 2013

ClearBridge MEP Management Equity Plan 2014

LM Global Distribution Invested in Growth of LMGD 2015

ETF Team Hired Vanguard Team 2015

Royce MEP Management Equity Plan 2016

LMCM Combined w/ClearBridge 2013

Esemplia Closed/Wind Down 2013

PCM Divestiture 2013

LM Australian Equities Combined w/ Martin Currie 2014

LMIC Divestiture 2014

Fauchier Partners Acquisition - Bolt-on for Permal 2013

QS Investors Acquisition - Combination w/ LMGAA and Batterymarch 2014

Martin Currie Acquisition 2014

RARE Infrastructure Acquisition 2015

EZ-IRA Strategic Minority Investment 2015

PKIM Acquisition - Bolt-on for Martin Currie 2015

Precidian Strategic Minority Investment 2016

Clarion Partners Acquisition 2016

EnTrust Acquisition - Merge w/ Permal 2016

Financial Guard Acquisition 2016

Focus on

Strengthening

Core Capabilities

Portfolio

Rationalization

Add Capabilities

in High Growth

Areas

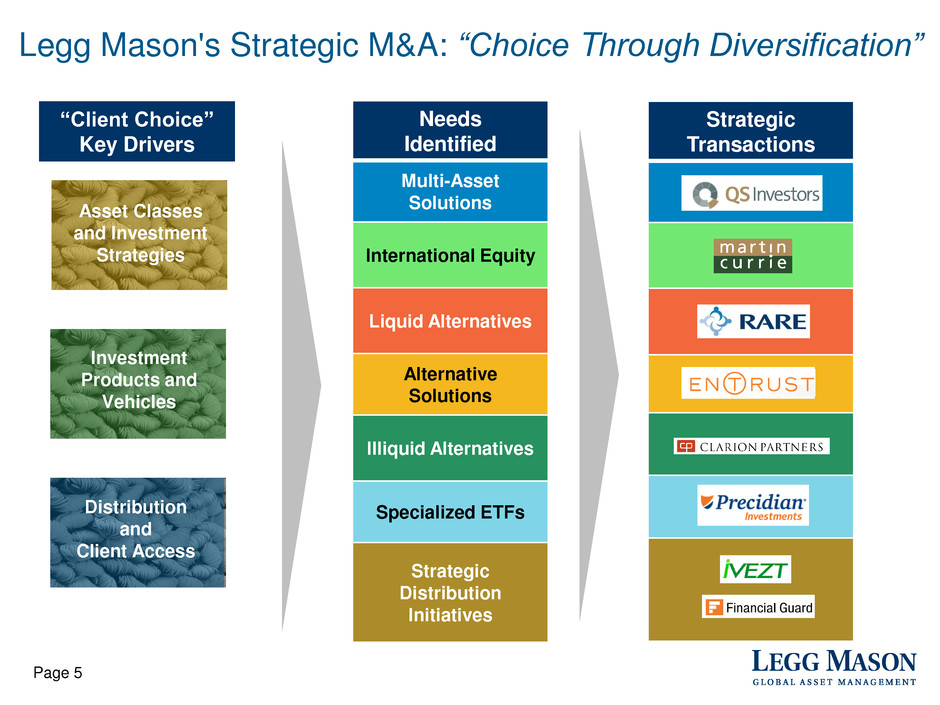

Legg Mason's Strategic M&A: “Choice Through Diversification”

Page 5

Asset Classes

and Investment

Strategies

Investment

Products and

Vehicles

Distribution

and

Client Access

Needs

Identified

Multi-Asset

Solutions

International Equity

Liquid Alternatives

Alternative

Solutions

Illiquid Alternatives

Specialized ETFs

Strategic

Distribution

Initiatives

Strategic

Transactions

“Client Choice”

Key Drivers

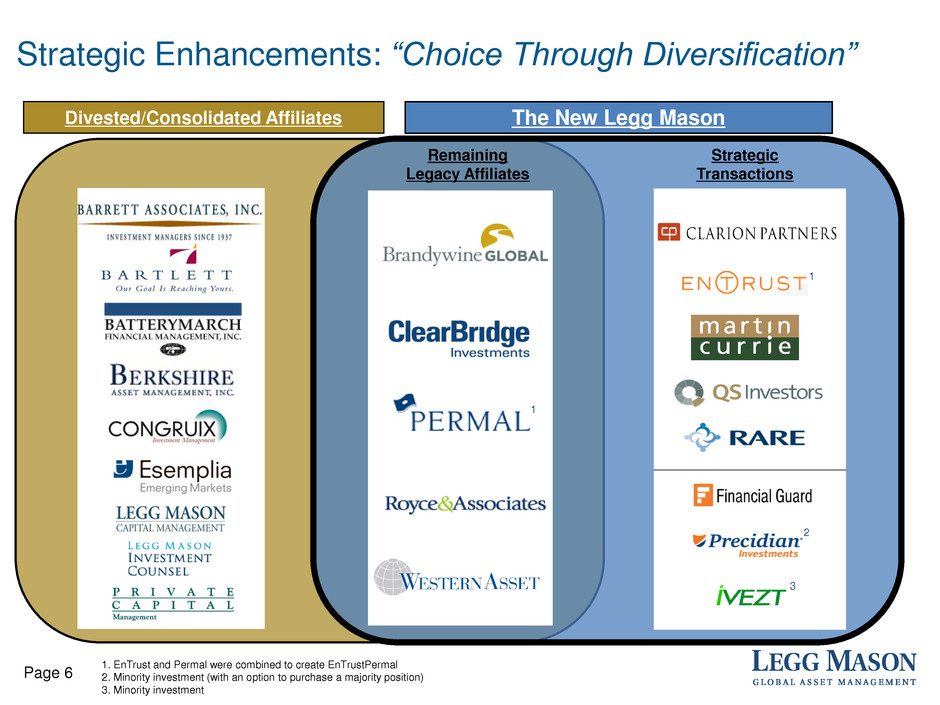

Divested/Consolidated Affiliates

Strategic Enhancements: “Choice Through Diversification”

Page 6

1. EnTrust and Permal were combined to create EnTrustPermal

2. Minority investment (with an option to purchase a majority position)

3. Minority investment

Remaining

Legacy Affiliates

The New Legg Mason

1

2

3

Strategic

Transactions

1

Strategic Capital Update

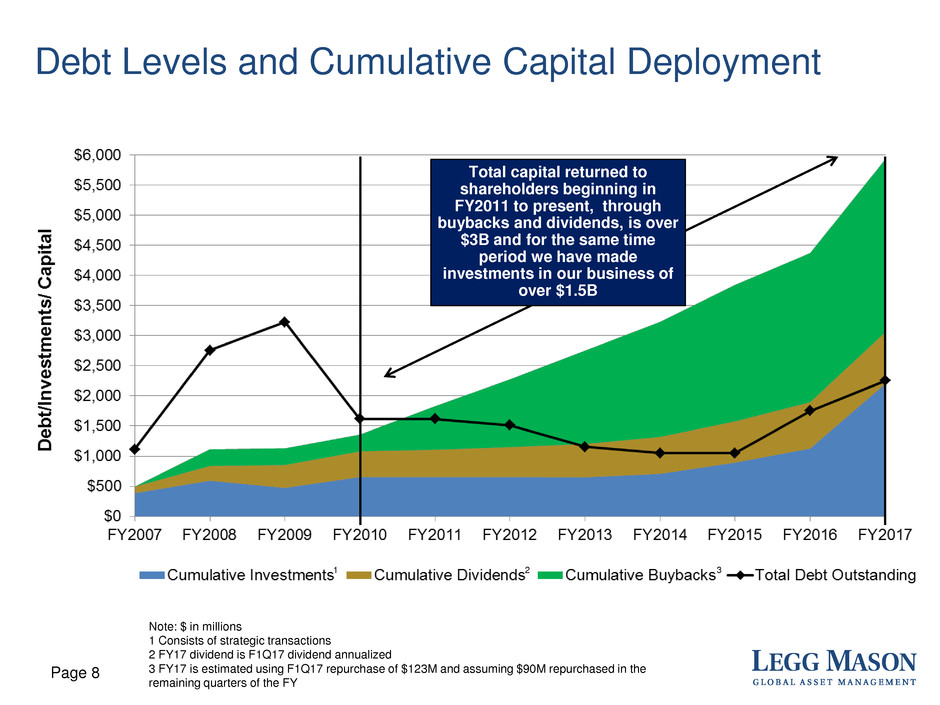

Debt Levels and Cumulative Capital Deployment

Page 8

Note: $ in millions

1 Consists of strategic transactions

2 FY17 dividend is F1Q17 dividend annualized

3 FY17 is estimated using F1Q17 repurchase of $123M and assuming $90M repurchased in the

remaining quarters of the FY

1 2 3

Total capital returned to

shareholders beginning in

FY2011 to present, through

buybacks and dividends, is over

$3B and for the same time

period we have made

investments in our business of

over $1.5B

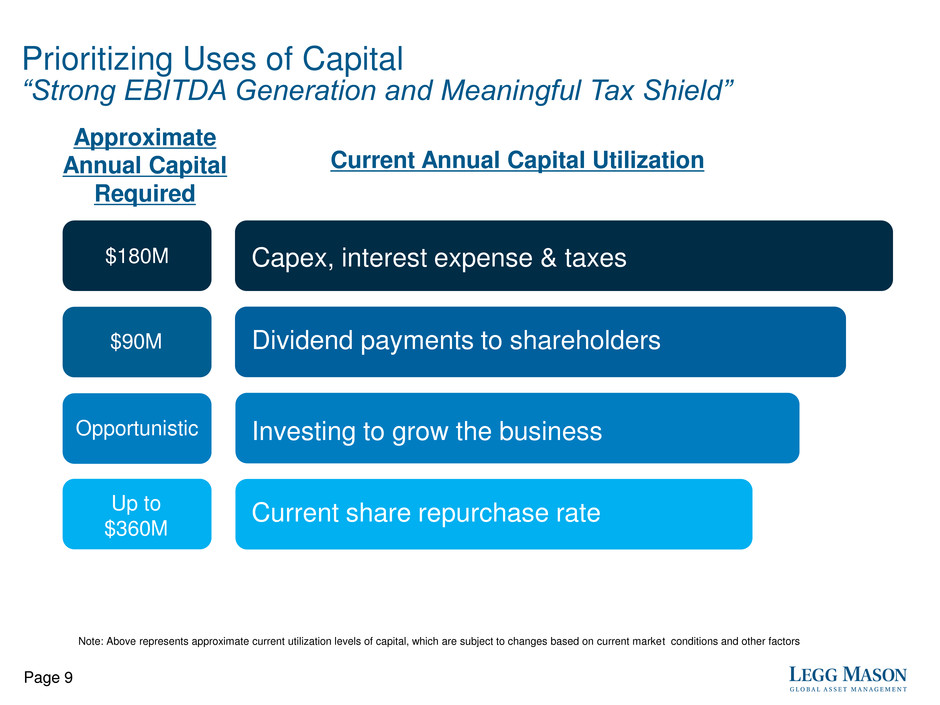

Prioritizing Uses of Capital

“Strong EBITDA Generation and Meaningful Tax Shield”

Page 9

Capex, interest expense & taxes

Investing to grow the business

Dividend payments to shareholders

Current share repurchase rate

Approximate

Annual Capital

Required

$180M

$90M

Opportunistic

Up to

$360M

Current Annual Capital Utilization

Note: Above represents approximate current utilization levels of capital, which are subject to changes based on current market conditions and other factors

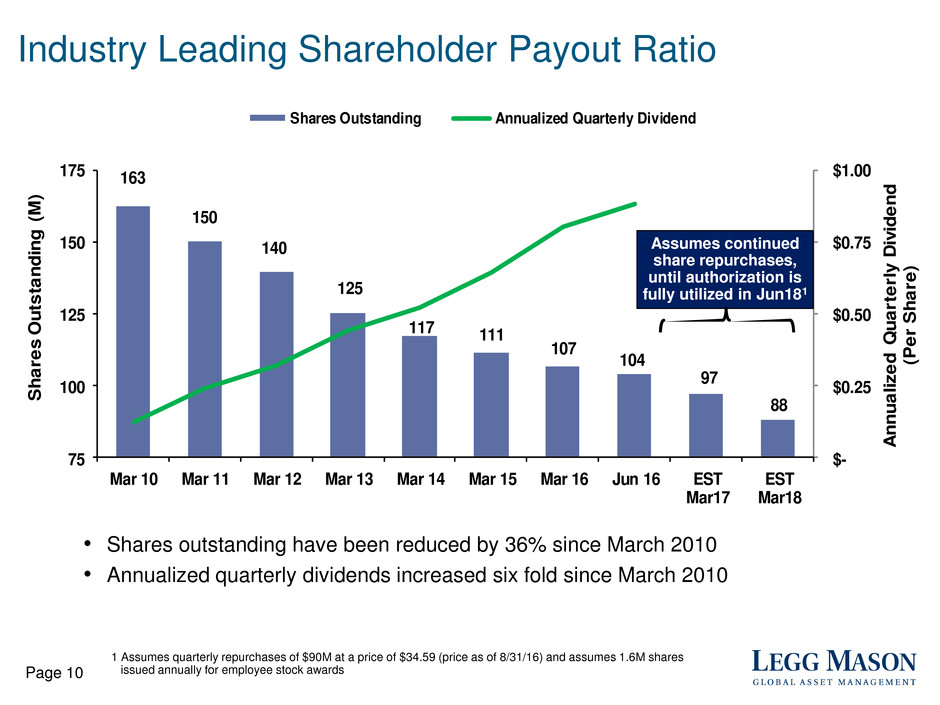

163

150

140

125

117 111

107

104

97

88

$-

$0.25

$0.50

$0.75

$1.00

75

100

125

150

175

Mar 10 Mar 11 Mar 12 Mar 13 Mar 14 Mar 15 Mar 16 Jun 16 EST

Mar17

EST

Mar18

An

nu

ali

ze

d Q

ua

rte

rly

Di

vid

en

d

(Pe

r S

ha

re)

Sh

are

s O

uts

tan

din

g (

M)

Shares Outstanding Annualized Quarterly Dividend

Industry Leading Shareholder Payout Ratio

Page 10

1 Assumes quarterly repurchases of $90M at a price of $34.59 (price as of 8/31/16) and assumes 1.6M shares

issued annually for employee stock awards

Assumes continued

share repurchases,

until authorization is

fully utilized in Jun181

• Shares outstanding have been reduced by 36% since March 2010

• Annualized quarterly dividends increased six fold since March 2010

Non-GAAP Financial Measures

New Non-GAAP Measures

Page 12

Introducing new measures to enhance understanding of our financial performance. We believe

these additional metrics will be useful to investors in evaluating our operating results

Additional Non-GAAP Measures:

• Adjusted EBITDA

• Parent Operating Margin

Usefulness:

• Adjusted EBITDA1 provides additional information with regard to Legg Mason’s ability to

meet working capital requirements, service debt principal, pay for capital expenditures and

return capital to our shareholders

• Parent Operating Margin provides a measure of the revenues that accrue to the benefit of the

Parent from affiliates in support of Parent-level expenses

Frequency:

• Adjusted EBITDA will be disclosed quarterly in our earnings release materials and 10Q, and

annually in our 10K

• Parent Operating Margin will be disclosed at least annually in our investor relations materials

1 Legg Mason has previously disclosed Adjusted EBITDA (also referred to as “EBITDA, bank defined” in the past) that

conformed to calculations required by our debt covenants, which adjusted for certain items that required cash

settlement that are not part of the current definition

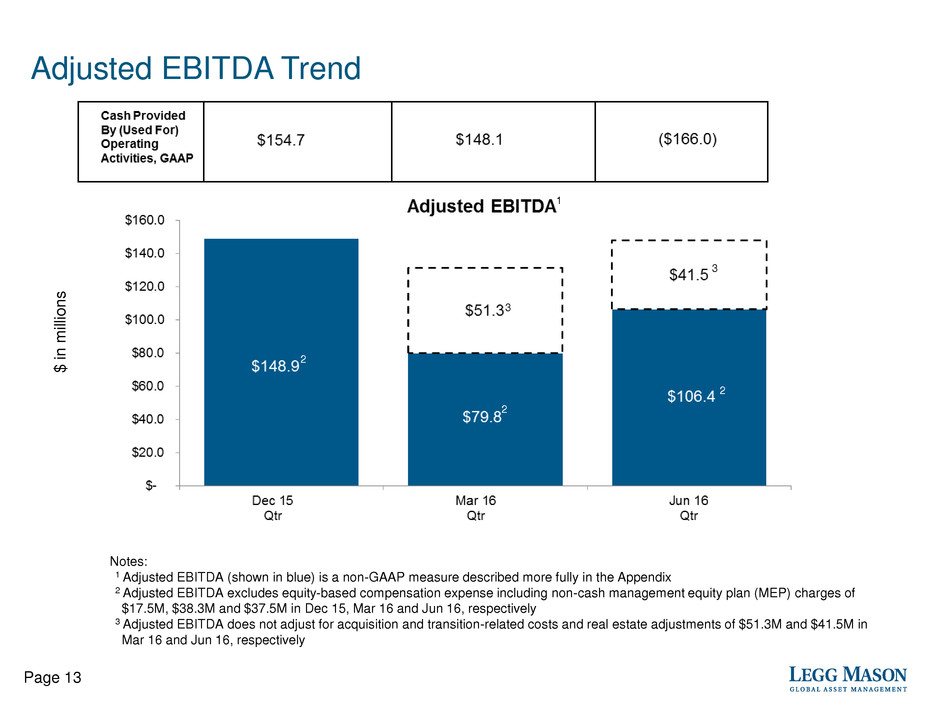

Adjusted EBITDA Trend

Page 13

Notes:

1 Adjusted EBITDA (shown in blue) is a non-GAAP measure described more fully in the Appendix

2 Adjusted EBITDA excludes equity-based compensation expense including non-cash management equity plan (MEP) charges of

$17.5M, $38.3M and $37.5M in Dec 15, Mar 16 and Jun 16, respectively

3 Adjusted EBITDA does not adjust for acquisition and transition-related costs and real estate adjustments of $51.3M and $41.5M in

Mar 16 and Jun 16, respectively

2

3

3

2

2

1

$

in

m

ill

io

n

s

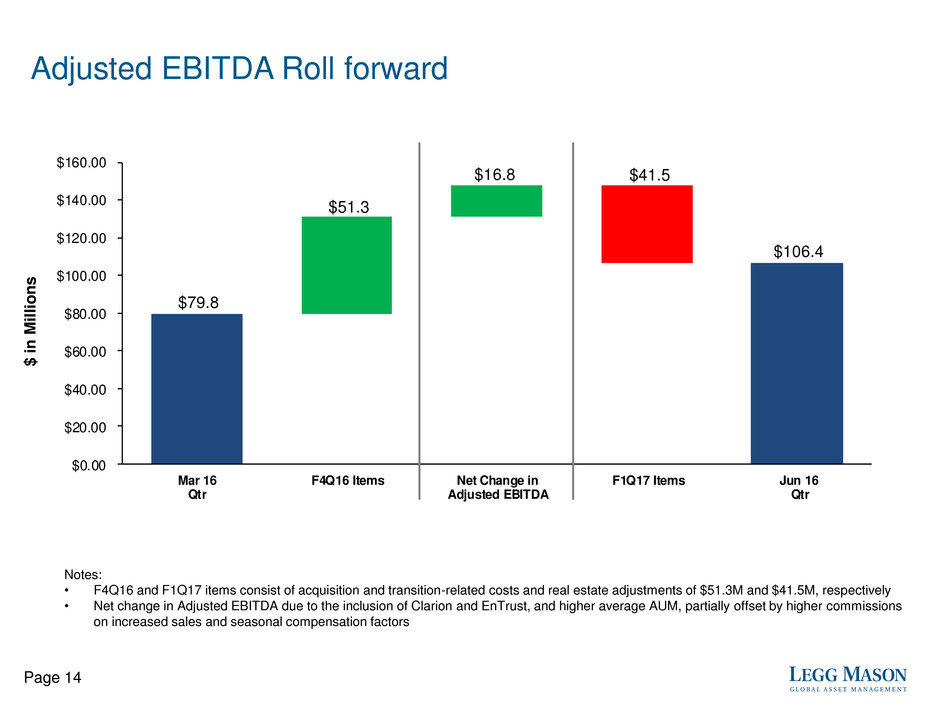

Adjusted EBITDA Roll forward

$79.8

$106.4

$51.3

$16.8 $41.5

$0.00

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

$140.00

$160.00

Mar 16

Qtr

F4Q16 Items Net Change in

Adjusted EBITDA

F1Q17 Items Jun 16

Qtr

Notes:

• F4Q16 and F1Q17 items consist of acquisition and transition-related costs and real estate adjustments of $51.3M and $41.5M, respectively

• Net change in Adjusted EBITDA due to the inclusion of Clarion and EnTrust, and higher average AUM, partially offset by higher commissions

on increased sales and seasonal compensation factors

Page 14

$

in

M

il

li

on

s

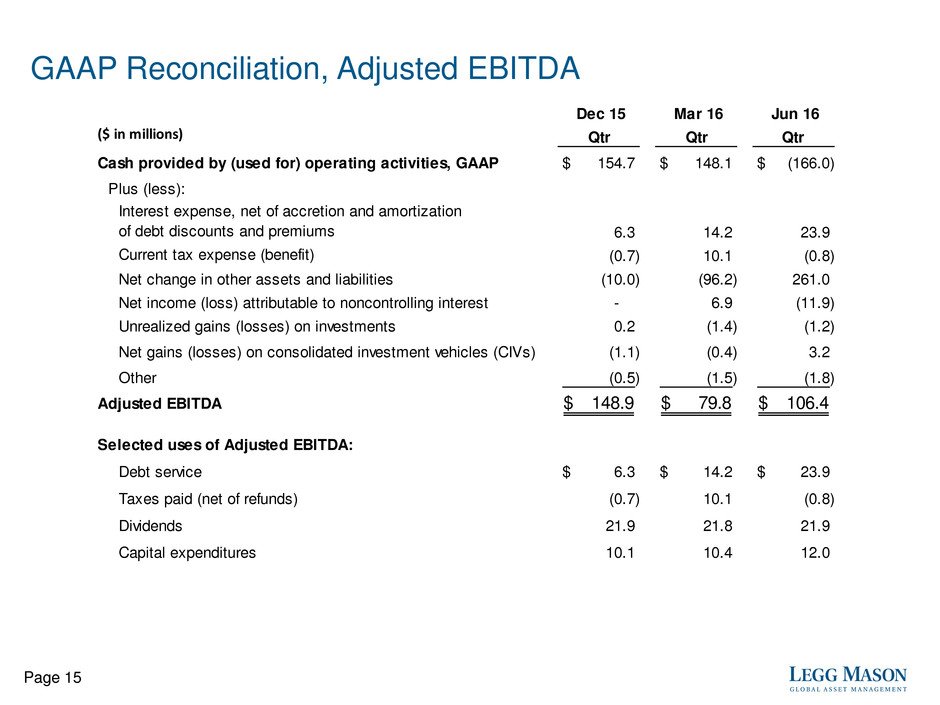

GAAP Reconciliation, Adjusted EBITDA

Page 15

($ in millions)

Dec 15

Qtr

Mar 16

Qtr

Jun 16

Qtr

Cash provided by (used for) operating activities, GAAP 154.7$ 148.1$ (166.0)$

Plus (less):

Interest expense, net of accretion and amortization

of debt discounts and premiums 6.3 14.2 23.9

Current tax expense (benefit) (0.7) 10.1 (0.8)

Net change in other assets and liabilities (10.0) (96.2) 261.0

Net income (loss) attributable to noncontrolling interest - 6.9 (11.9)

Unrealized gains (losses) on investments 0.2 (1.4) (1.2)

Net gains (losses) on consolidated investment vehicles (CIVs) (1.1) (0.4) 3.2

Other (0.5) (1.5) (1.8)

Adjusted EBITDA 148.9$ 79.8$ 106.4$

Selected uses of Adjusted EBITDA:

Debt service 6.3$ 14.2$ 23.9$

Taxes paid (net of refunds) (0.7) 10.1 (0.8)

Dividends 21.9 21.8 21.9

Capital expenditures 10.1 10.4 12.0

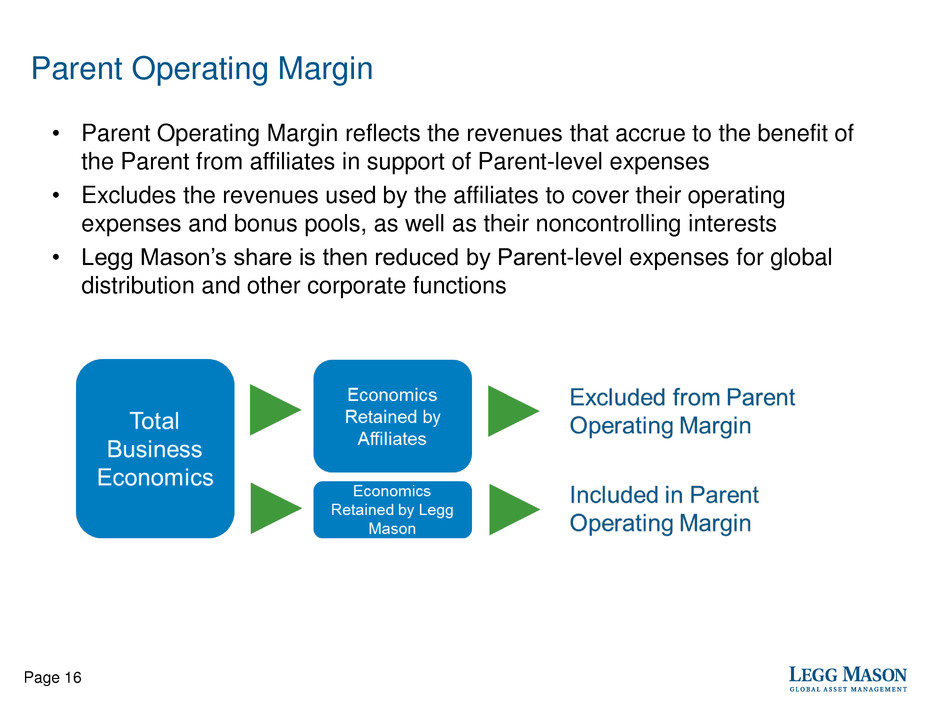

Parent Operating Margin

• Parent Operating Margin reflects the revenues that accrue to the benefit of

the Parent from affiliates in support of Parent-level expenses

• Excludes the revenues used by the affiliates to cover their operating

expenses and bonus pools, as well as their noncontrolling interests

• Legg Mason’s share is then reduced by Parent-level expenses for global

distribution and other corporate functions

Page 16

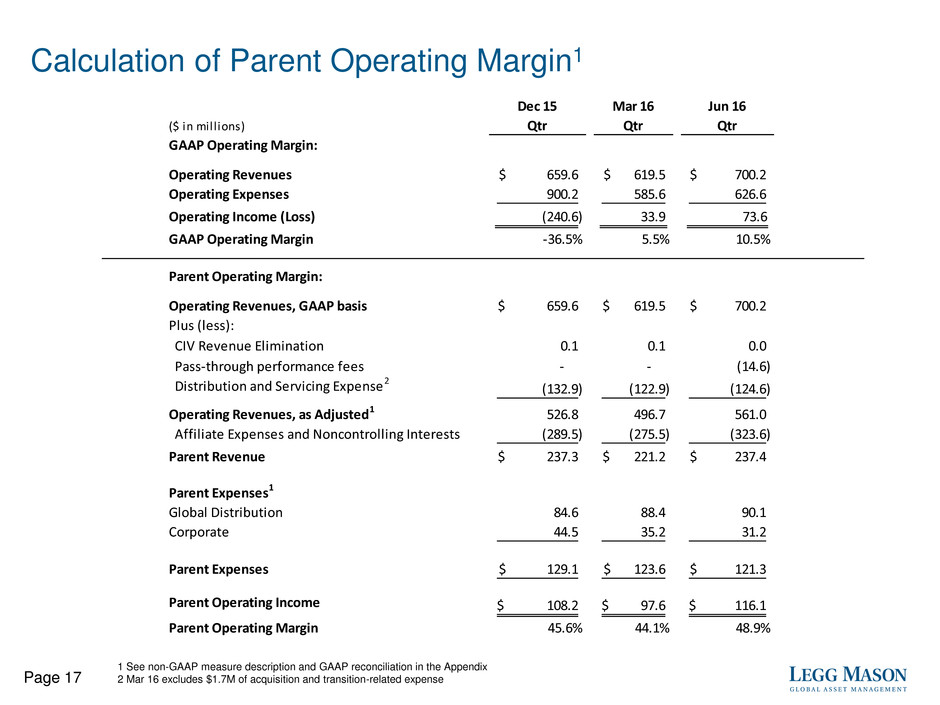

Calculation of Parent Operating Margin1

Page 17

1 See non-GAAP measure description and GAAP reconciliation in the Appendix

2 Mar 16 excludes $1.7M of acquisition and transition-related expense

($ in mill ions)

Dec 15

Qtr

Mar 16

Qtr

Jun 16

Qtr

GAAP Operating Margin:

Operating Revenues 659.6$ 619.5$ 700.2$

Operating Expenses 900.2 585.6 626.6

Operating Income (Loss) (240.6) 33.9 73.6

GAAP Operating Margin -36.5% 5.5% 10.5%

Parent Operating Margin:

Operating Revenues, GAAP basis 659.6$ 619.5$ 700.2$

Plus (less):

CIV Revenue Elimination 0.1 0.1 0.0

Pass-through performance fees - - (14.6)

Distribution and Servicing Expense2 (132.9) (122.9) (124.6)

Operating Revenues, as Adjusted1 526.8 496.7 561.0

Affiliate Expenses and Noncontrolling Interests (289.5) (275.5) (323.6)

Parent Revenue 237.3$ 221.2$ 237.4$

Parent Expenses1

Global Distribution 84.6 88.4 90.1

Corporate 44.5 35.2 31.2

Parent Expenses 129.1$ 123.6$ 121.3$

Parent Operating Income 108.2$ 97.6$ 116.1$

Parent Operating Margin 45.6% 44.1% 48.9%

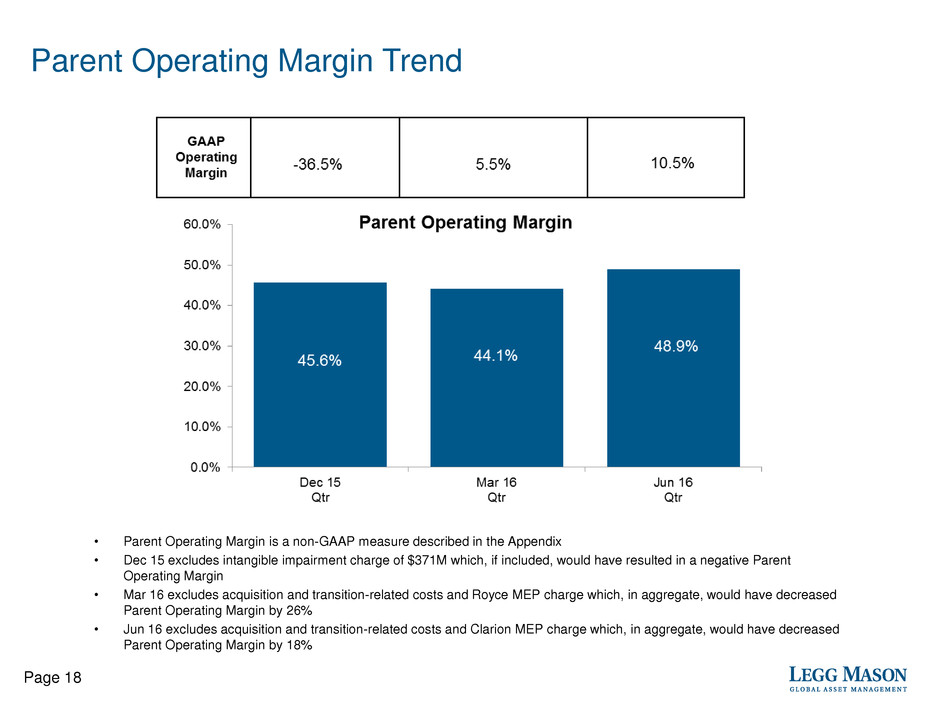

Parent Operating Margin Trend

Page 18

• Parent Operating Margin is a non-GAAP measure described in the Appendix

• Dec 15 excludes intangible impairment charge of $371M which, if included, would have resulted in a negative Parent

Operating Margin

• Mar 16 excludes acquisition and transition-related costs and Royce MEP charge which, in aggregate, would have decreased

Parent Operating Margin by 26%

• Jun 16 excludes acquisition and transition-related costs and Clarion MEP charge which, in aggregate, would have decreased

Parent Operating Margin by 18%

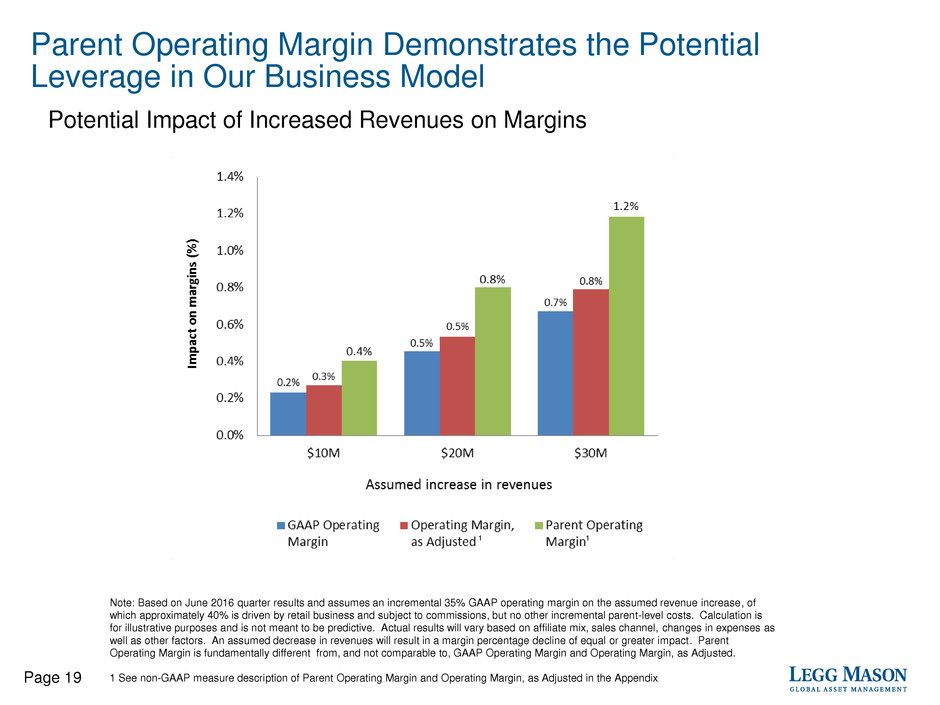

Parent Operating Margin Demonstrates the Potential

Leverage in Our Business Model

Page 19

Note: Based on June 2016 quarter results and assumes an incremental 35% GAAP operating margin on the assumed revenue increase, of

which approximately 40% is driven by retail business and subject to commissions, but no other incremental parent-level costs. Calculation is

for illustrative purposes and is not meant to be predictive. Actual results will vary based on affiliate mix, sales channel, changes in expenses as

well as other factors. An assumed decrease in revenues will result in a margin percentage decline of equal or greater impact. Parent

Operating Margin is fundamentally different from, and not comparable to, GAAP Operating Margin and Operating Margin, as Adjusted.

1 See non-GAAP measure description of Parent Operating Margin and Operating Margin, as Adjusted in the Appendix

Potential Impact of Increased Revenues on Margins

1 1

Tax Shield

Page 21

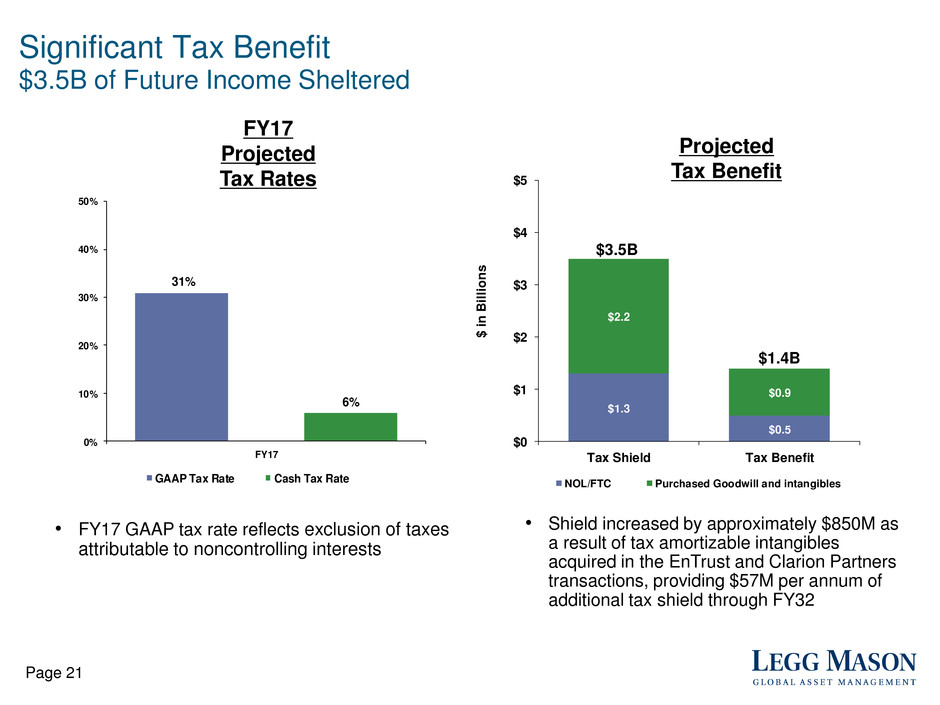

Significant Tax Benefit

$3.5B of Future Income Sheltered

$1.3

$0.5

$2.2

$0.9

$0

$1

$2

$3

$4

$5

Tax Shield Tax Benefit

$

in

B

ill

io

ns

NOL/FTC Purchased Goodwill and intangibles

• Shield increased by approximately $850M as

a result of tax amortizable intangibles

acquired in the EnTrust and Clarion Partners

transactions, providing $57M per annum of

additional tax shield through FY32

$3.5B

$1.4B

FY17

Projected

Tax Rates

Projected

Tax Benefit

31%

6%

0%

10%

20%

30%

40%

50%

FY17

GAAP Tax Rate Cash Tax Rate

• FY17 GAAP tax rate reflects exclusion of taxes

attributable to noncontrolling interests

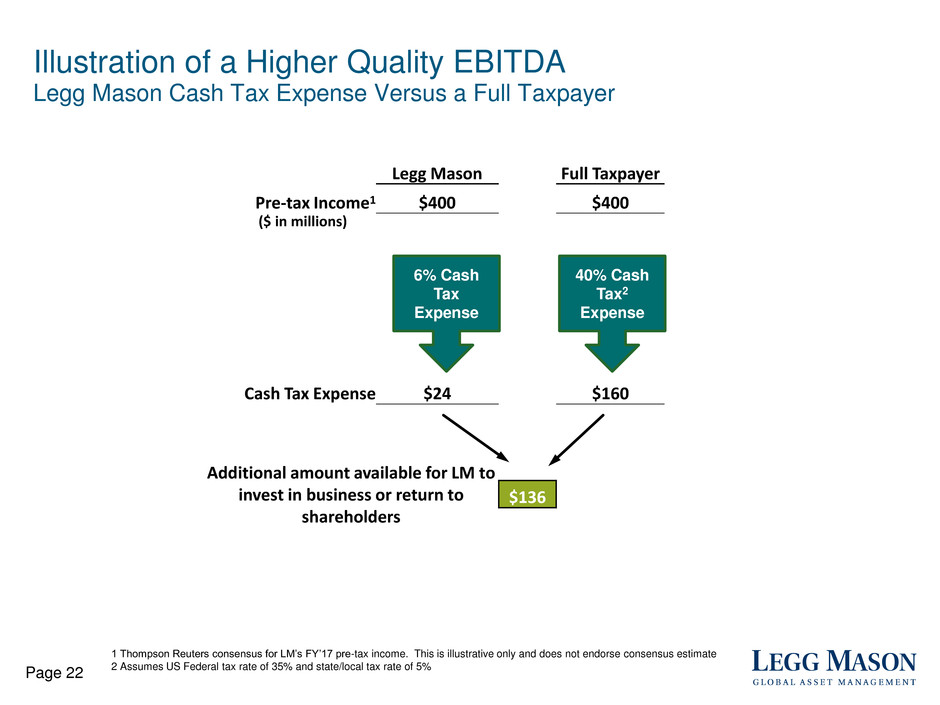

Illustration of a Higher Quality EBITDA

Legg Mason Cash Tax Expense Versus a Full Taxpayer

Page 22

1 Thompson Reuters consensus for LM’s FY’17 pre-tax income. This is illustrative only and does not endorse consensus estimate

2 Assumes US Federal tax rate of 35% and state/local tax rate of 5%

Legg Mason Full Taxpayer

Pre-tax Income1 $400 $400

Cash Tax Expense $24 $160

Additional amount available for LM to

invest in business or return to

shareholders

$136

6% Cash

Tax

Expense

40% Cash

Tax2

Expense

($ in millions)

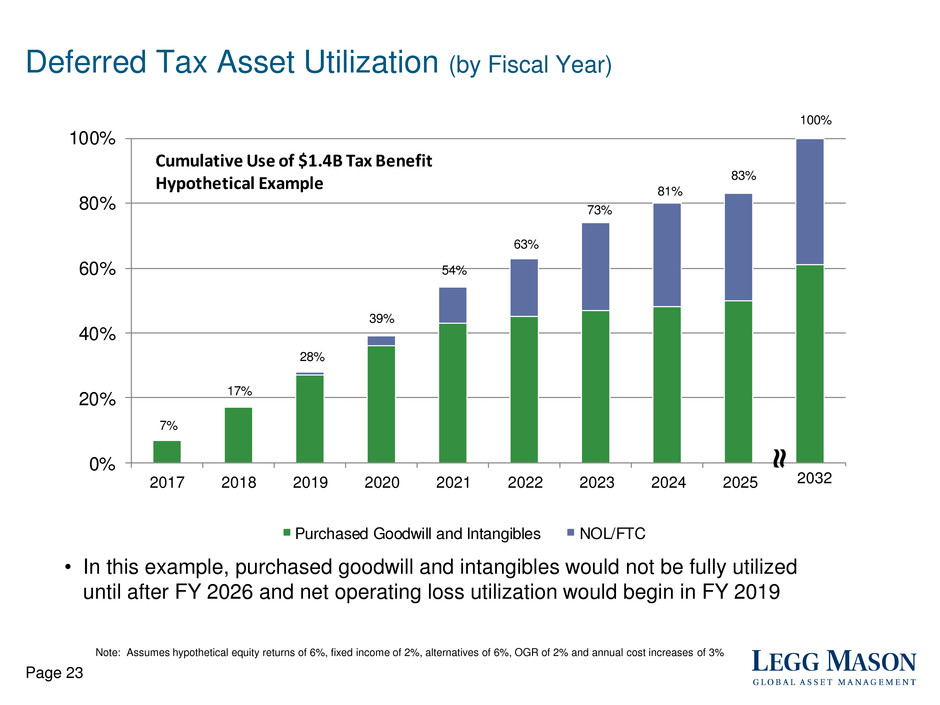

0%

20%

40%

60%

80%

100%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026&

Beyond

Purchased Goodwill and Intangibles NOL/FTC

17%

100%

83%

81%

73%

63%

7%

54%

39%

28%

Cumulative Use of $1.4B Tax Benefit

Hypothetical Example

≈

Page 23

Deferred Tax Asset Utilization (by Fiscal Year)

• In this example, purchased goodwill and intangibles would not be fully utilized

until after FY 2026 and net operating loss utilization would begin in FY 2019

Note: Assumes hypothetical equity returns of 6%, fixed income of 2%, alternatives of 6%, OGR of 2% and annual cost increases of 3%

2032

Closing

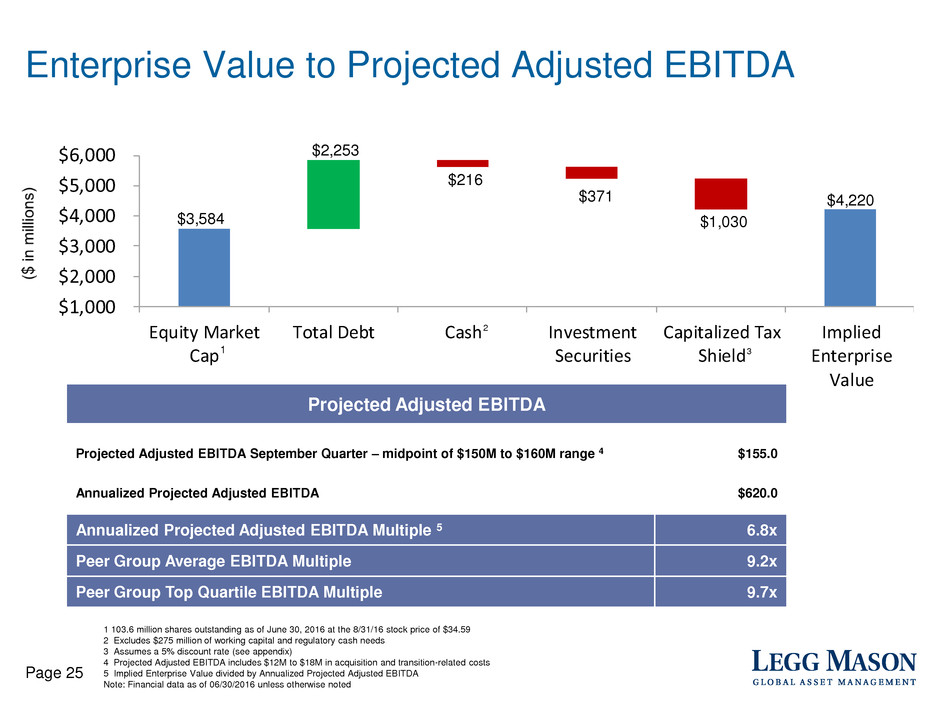

$3,584

$4,220

$2,253

$216

$371

$1,030

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Equity Market

Cap

Total Debt Cash Investment

Securities

Capitalized Tax

Shield

Implied

Enterprise

Value

Enterprise Value to Projected Adjusted EBITDA

3

Page 25

2

1

Projected Adjusted EBITDA

Projected Adjusted EBITDA September Quarter – midpoint of $150M to $160M range 4 $155.0

Annualized Projected Adjusted EBITDA $620.0

Annualized Projected Adjusted EBITDA Multiple 5 6.8x

Peer Group Average EBITDA Multiple 9.2x

Peer Group Top Quartile EBITDA Multiple 9.7x

1 103.6 million shares outstanding as of June 30, 2016 at the 8/31/16 stock price of $34.59

2 Excludes $275 million of working capital and regulatory cash needs

3 Assumes a 5% discount rate (see appendix)

4 Projected Adjusted EBITDA includes $12M to $18M in acquisition and transition-related costs

5 Implied Enterprise Value divided by Annualized Projected Adjusted EBITDA

Note: Financial data as of 06/30/2016 unless otherwise noted

For internal use only. Not for distribution to the public.

Products &

Vehicles

Distribution &

Client Access

Investment

Capabilities

A tapestry is not formed from a

single thread. It is formed by

combining many threads,

uniquely and distinctly, into

something greater than its parts.

Providing Global Investors an Expanding Amount of Choice

Page 26

Appendix

Appendix - Non-GAAP Adjusted EBITDA

Page 28

We define Adjusted EBITDA1 as cash provided by operating activities plus (minus) (i) interest expense, net of accretion and

amortization of debt discounts and premiums, (ii) current income tax expense (benefit), (iii) the net change in other assets and

liabilities, (iv) net income (loss) attributable to noncontrolling interests, (v) unrealized gains (losses) on investments, (vi) net gains

(losses) on CIVs, and (vii) other. The net change in other assets and liabilities adjustment aligns with the Consolidated Statements of

Cash Flows. Adjusted EBITDA is not reduced by equity-based compensation expense, including Management Equity Plan (MEP)

non-cash issuance-related charges. Most MEP units may be put to or called by Legg Mason for cash payment, although the terms of

the MEP units do not require this to occur.

We believe that this measure is useful to investors and Legg Mason as it provides additional information with regard to our ability to

meet working capital requirements, service our debt, and return capital to our shareholders. This measure is provided in addition to

Cash provided by operating activities and may not be comparable to non-GAAP performance measures or liquidity measures of other

companies, including their measures of EBITDA or Adjusted EBITDA. Further, this measure is not to be confused with Net income,

Cash provided by operating activities or other measures of earnings or cash flows under GAAP, and are provided as a supplement

to, and not in replacement of, GAAP measures.

1 Legg Mason has previously disclosed Adjusted EBITDA (also referred to as “EBITDA, bank defined” in the past) that

conformed to calculations required by our debt covenants, which adjusted for certain items that required cash

settlement that are not part of the current definition.

Appendix – Non-GAAP Parent Operating Margin

Page 29

Parent Operating Margin is a performance measure calculated by dividing “Parent Operating Income” by “Parent Revenue.” Parent

Revenue is calculated from our Operating Revenues, adjusted to add back net investment advisory fees eliminated upon consolidation

of investment vehicles, less Distribution and Servicing Expenses, which we use as an approximate measure of revenues that are

passed through to third parties, and less affiliates’ operating expenses and noncontrolling interests, and adjusted for certain affiliate

expenses, such as those that arise from acquisitions, related restructurings, MEP issuances and impairment charges. These

adjustments include acquisition charges and transition/restructuring charges. We reduce revenues by certain operating expenses of

our affiliates to represent the portion of revenues used by the affiliates to pay expenses and thus generating a measure of revenues

that accrue to the parent company as profits from our affiliates. Parent Operating Income is calculated as Parent Revenue, less all

corporate level expenses, also adjusted to exclude certain expenses such as those that arise from acquisitions, related restructurings,

MEP issuances and impairment charges. Our corporate level (“Parent”) expenses consist of the expenses of our centralized

distribution operations and other holding company functions.

We believe that Parent Operating Margin is a useful assessment of our performance because it provides a measure of the revenues

that accrue to the benefit of the parent from affiliates to support parent-level expenses. Legg Mason uses Parent Operating Margin as

a measure of management’s effectiveness with the portion of revenues or profits it receives from affiliates. Our business model

provides our affiliates the ability to operate with autonomy through revenue share and other arrangements. From time-to-time, Legg

Mason may adjust its affiliate revenue share arrangements such that the affiliates incur more expenses, or retain more revenues than

provided for by their revenue share arrangements. These adjustments appear in affiliate expenses. Non-revenue sharing affiliates are

subject to a parent oversight budgeting process.

Parent Operating Margin excludes items that have no net impact on Net Income (Loss) Attributable to Legg Mason, Inc. and indicates

the operating margin of our Parent operations without the distribution revenues that are passed through to third parties as a direct cost

of selling our products, the portion of revenues aligned to the operating expenses incurred by our advisory affiliates, and the impact of

the consolidation of certain investment vehicles described above.

This measure is not intended to indicate the margin of our business as a whole and is provided in addition to measures applicable to

the entire business such as operating margin calculated under GAAP, but is not a substitute for calculations of margins under GAAP,

Parent Operating Margin is not comparable to non-GAAP performance measures, including measures of adjusted margins of other

companies, because Parent Operating Margin is fundamentally different from these measures because it excludes all expenses of our

affiliates.

Appendix – Non-GAAP Operating Margin, as Adjusted

Page 30

We calculate “Operating Margin, as Adjusted,” by dividing (i) Operating Income (Loss), adjusted to exclude the impact on

compensation expense of gains or losses on investments made to fund deferred compensation plans, the impact on compensation

expense of gains or losses on seed capital investments by our affiliates under revenue sharing agreements, amortization related to

intangible assets, income (loss) of consolidated investment vehicles, the impact of fair value adjustments of contingent consideration

liabilities, if any, and impairment charges by (ii) our operating revenues, adjusted to add back net investment advisory fees eliminated

upon consolidation of investment vehicles, less distribution and servicing expenses which we use as an approximate measure of

revenues that are passed through to third parties, and less performance fees that are passed through as compensation expenses or

net income (loss) attributable to non-controlling interests, which we refer to as “Operating Revenues, as Adjusted”. The compensation

items are removed from Operating Income (Loss) in the calculation because they are offset by an equal amount in Other non-operating

income (expense), and thus have no impact on Net Income (Loss) Attributable to Legg Mason, Inc. We adjust for the impact of

amortization of management contract assets and the impact of fair value adjustments of contingent consideration liabilities, if any,

which arise from acquisitions to reflect the fact that these items distort comparison of our operating results with results of other asset

management firms that have not engaged in significant acquisitions. Impairment charges and income (loss) of consolidated

investment vehicles are removed from Operating Income (Loss) in the calculation because these items are not reflective of our core

asset management operations. We use Operating Revenues, as Adjusted in the calculation to show the operating margin without

distribution and servicing expenses, which we use to approximate our distribution revenues that are passed through to third parties as

a direct cost of selling our products, although distribution and servicing expenses may include commissions paid in connection with the

launching of closed-end funds for which there is no corresponding revenue in the period. We also use Operating Revenues, as

Adjusted in the calculation to show the operating margin without performance fees, which are passed through as compensation

expense or net income (loss) attributable to non-controlling interests per the terms of certain more recent acquisitions. Operating

Revenues, as Adjusted, also include our advisory revenues we receive from consolidated investment vehicles that are eliminated in

consolidation under GAAP.

We believe that Operating Margin, as Adjusted, is a useful measure of our performance because it provides a measure of our core

business activities. It excludes items that have no impact on Net Income (Loss) Attributable to Legg Mason, Inc. and indicates what

our operating margin would have been without the distribution revenues that are passed through to third parties as a direct cost of

selling our products, performance fees that are passed through as compensation expense or net income (loss) attributable to non-

controlling interests per the terms of certain more recent acquisitions, amortization related to intangible assets, changes in the fair

value of contingent consideration liabilities, if any, impairment charges, and the impact of the consolidation of certain investment

vehicles described above. The consolidation of these investment vehicles does not have an impact on Net Income (Loss) Attributable

to Legg Mason, Inc. This measure is provided in addition to our operating margin calculated under GAAP, but is not a substitute for

calculations of margins under GAAP and may not be comparable to non-GAAP performance measures, including measures of

adjusted margins of other companies.

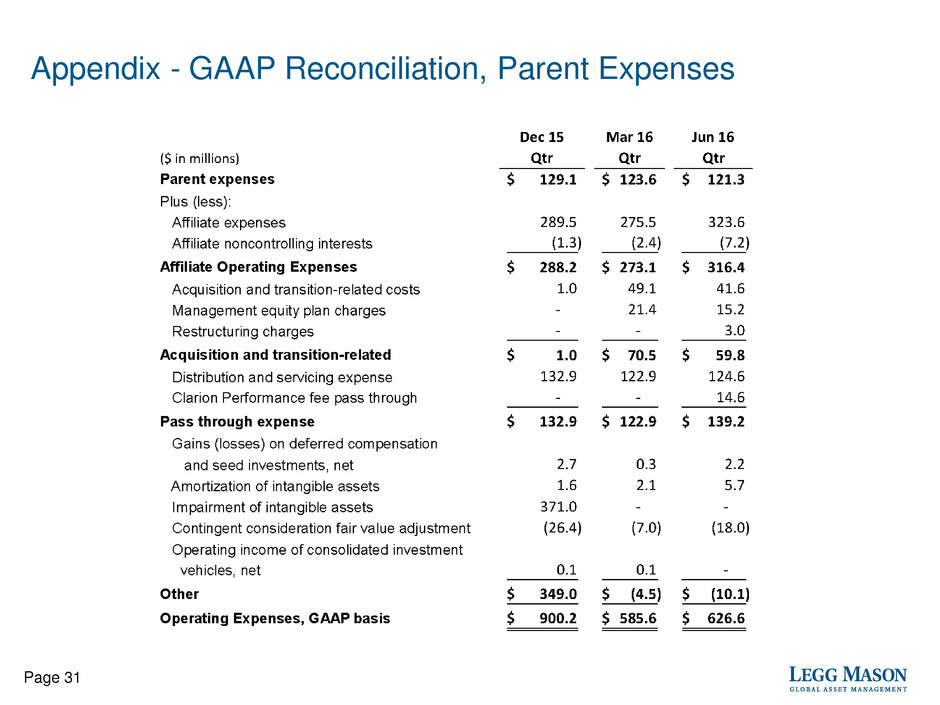

Appendix - GAAP Reconciliation, Parent Expenses

Page 31

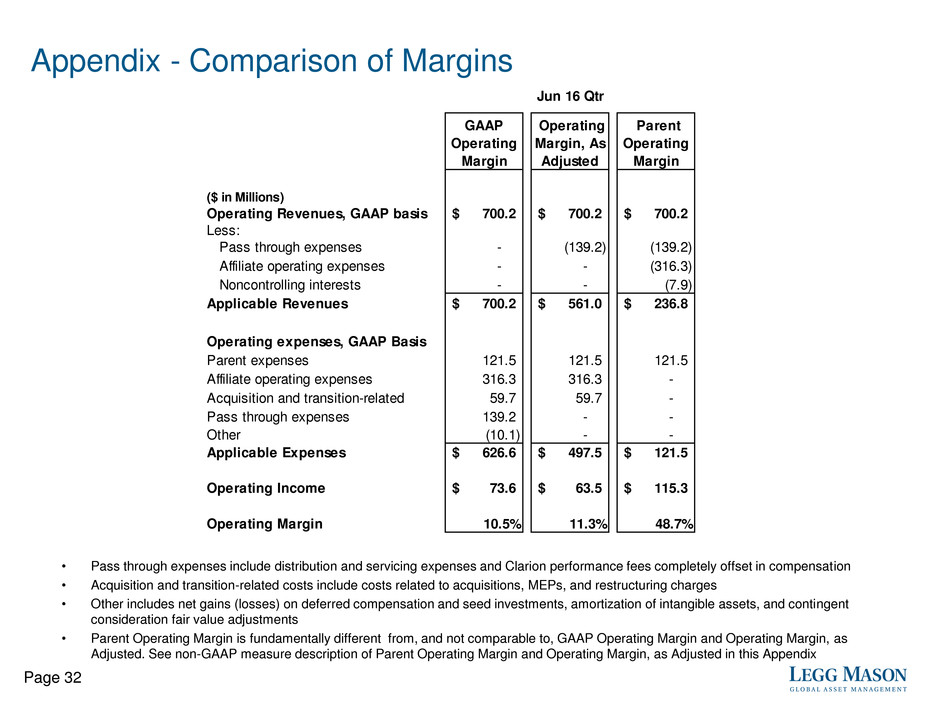

Appendix - Comparison of Margins

Page 32

• Pass through expenses include distribution and servicing expenses and Clarion performance fees completely offset in compensation

• Acquisition and transition-related costs include costs related to acquisitions, MEPs, and restructuring charges

• Other includes net gains (losses) on deferred compensation and seed investments, amortization of intangible assets, and contingent

consideration fair value adjustments

• Parent Operating Margin is fundamentally different from, and not comparable to, GAAP Operating Margin and Operating Margin, as

Adjusted. See non-GAAP measure description of Parent Operating Margin and Operating Margin, as Adjusted in this Appendix

($ in Millions)

Operating Revenues, GAAP basis 700.2$ 700.2$ 700.2$

Less:

Pass through expenses - (139.2) (139.2)

Affiliate operating expenses - - (316.3)

Noncontrolling interests - - (7.9)

Applicable Revenues 700.2$ 561.0$ 236.8$

Operating expenses, GAAP Basis

Parent expenses 121.5 121.5 121.5

Affiliate operating expenses 316.3 316.3 -

Acquisition and transition-related 59.7 59.7 -

Pass through expenses 139.2 - -

Other (10.1) - -

Applicable Expenses 626.6$ 497.5$ 121.5$

Operating Income 73.6$ 63.5$ 115.3$

Operating Margin 10.5% 11.3% 48.7%

GAAP

Operating

Margin

Operating

Margin, As

Adjusted

Parent

Operating

Margin

Jun 16 Qtr

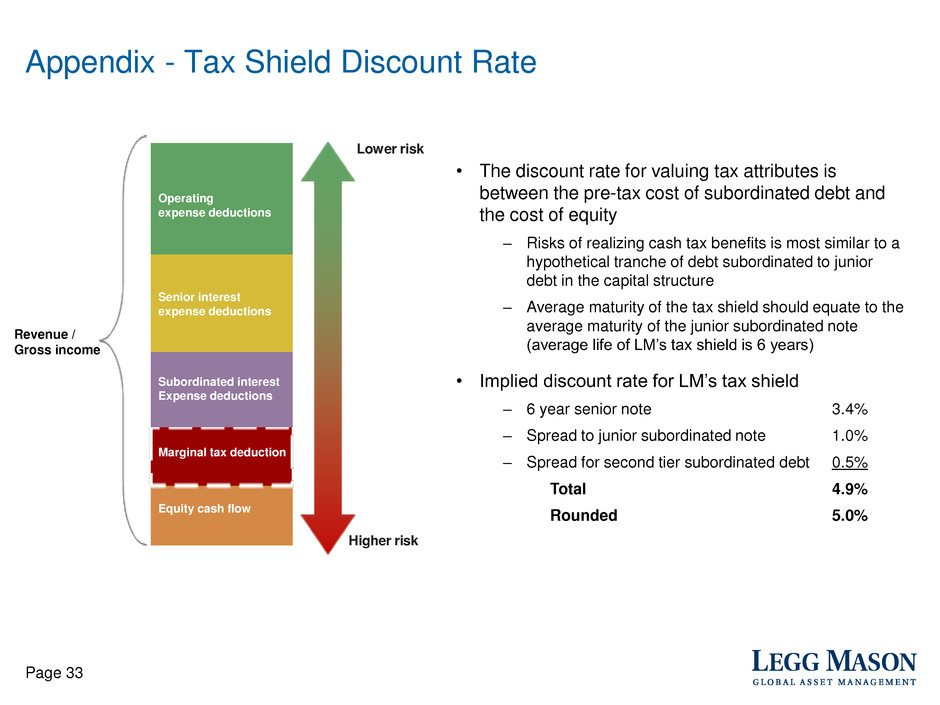

Appendix - Tax Shield Discount Rate

Revenue /

Gross income

Page 33

• The discount rate for valuing tax attributes is

between the pre-tax cost of subordinated debt and

the cost of equity

‒ Risks of realizing cash tax benefits is most similar to a

hypothetical tranche of debt subordinated to junior

debt in the capital structure

‒ Average maturity of the tax shield should equate to the

average maturity of the junior subordinated note

(average life of LM’s tax shield is 6 years)

• Implied discount rate for LM’s tax shield

‒ 6 year senior note 3.4%

‒ Spread to junior subordinated note 1.0%

‒ Spread for second tier subordinated debt 0.5%

Total 4.9%

Rounded 5.0%

Low r risk

Higher risk

Operating

expense deductions

Senior interest

expense deductions

Subordinated interest

Expense deductions

Marginal tax deduction

Equity cash flow