Attached files

| file | filename |

|---|---|

| 8-K - 8-K - First NBC Bank Holding Co | investorconferencecall8k.htm |

2015 Financial Statement Conference Call

September 8, 2016

NASDAQ: FNBC

Forward Looking Statements

Statements contained in this presentation that are not historical facts, including statements accompanied by words

such as “will,” “believe,” “anticipate,” “expect,” “estimate,” “preliminary,” or similar words, constitute “forward-

looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-

looking statements are based on management’s estimates, assumptions, and projections as of the date of the

presentation and are not guarantees of future performance. Actual results may differ materially from the results

expressed or implied by these forward-looking statements as the result of risks, uncertainties and other factors,

including, but are not limited to, those discussed in the company’s periodic reports and filings with the Securities

and Exchange Commission (SEC). Copies of the company’s SEC filings may be downloaded from the Internet at

no charge from www.sec.gov or ir.firstnbcbank.com/sec.cfm. First NBC Bank Holding Company cautions you

not to place undue reliance on the forward-looking statements contained in this presentation, which the company

undertakes no obligation to update or revise to reflect future events, information or circumstances arising after the

date of this presentation.

Market data used in this presentation has been obtained from independent industry sources and publications as

well as from research reports prepared for other purposes. Industry publications and surveys and forecasts

generally state that the information contained therein has been obtained from sources believed to be reliable. The

company has not independently verified the data obtained from these sources. Forward-looking information

obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the

other forward-looking statements in this presentation.

2

First NBC at a Glance

• Chartered in 2006

• Successor in culture to First National Bank of Commerce

• Commercial bank on the asset side

• Commercial real estate loans (30% of assets and 42% are owner occupied)

• Commercial and industrial loans (26% of assets)

• Consistent growth history (see pages 14 – 17)

• Total asset growth of 26% per year

• 10% deposit market share in New Orleans MSA

• Historically strong profitability in ROA and ROE

• Tax credit business

• Low income housing tax credits

• New Markets tax credits

• Historic rehabilitation tax credits

• Substantial enhancement to return

• National expertise

• Reduces loan risk

Note: Financial information as of December 31, 2015, except deposit market share information (Source: www.fdic.gov, as of June 30, 2015)

3

First NBC at a Glance

• First NBC strategic approach

• Community bank

• Relationship banking

• Personal service

• Pursue share of wallet

• Tiered pricing on all deposits

• Segment focus

• Small to medium business

• Private banking

• Specialty focus

• Institutional segment

• Labor union

• Outstanding CRA rating

4

New Orleans Market Opportunity

• Strong economy

• Katrina recovery: 2007-2012

• Core economic expansion: 2013-current

• Economic drivers

• Hospitality

• Convention tourism

• Festival initiative

• Petrochemical industry

• Low natural gas prices

• $40 billion expansion

• Port of New Orleans

• Top 3 U.S. port

• Panama Canal effect

• Mississippi River

• Oil and gas exploration

• Most of impact south of New Orleans

• Oil service business

5

New Orleans Market Opportunity

• Competition

• Capital One

• Whitney/Hancock

• JP Morgan Chase Bank

• Regions Bank

• Iberiabank

6

Events in 2015

• Collapse of oil prices

• Energy exposure – 4.5%

• $90 million exploration and production credit at December 31, 2015

• Year end status

• Low prices at year end through February 2016

• Borrower was in the process of drilling a new well in its major field

• Proved undeveloped status of borrower’s oil and gas reserves in major field

• $30 million reserve provided in 2015

• Current status

• $112 million debt outstanding at June 30, 2016

• $206 million PV10 of reserves at June 30, 2016 per independent engineering report

• Proved producing at 1,200 barrels/day per company reports

• Prices at $46-50 per barrel

• Strong cash flow

7

Events in 2015

• Tax credit accounting change – Historic tax credits

• 2009-2014

• Cost method

• Amortization of investment over the expected holding period

• 2015 and later

• Equity method

• Impairment

• Impact of change in accounting method

• $36 million in 2015 ($24 million, net of tax effect) in impairment charges on Historic tax credit

investments

• Restatement of prior years by $20 million ($13 million, net of tax effect)

• Impact of new structure beginning in late 2013

• Original structure – direct investment

• New structure – master tenant, two tiers

• Residual ownership at 1%

• Revised approach to Historic tax credit investment

• Mixture of direct and master tenant structures

• Syndication

• Back to former pricing – 10% residual ownership

8

Events in 2015

• Default on investment in short-term receivables

• Investment through The Receivables Exchange

• 7 year history – no prior defaults

• $69.9 million investment in ethanol manufacturer

• Examination findings – fully reserve due to litigation required

• Litigation beginning to recover investment from

• Obligor in U.S.

• Seller of receivable with repurchase agreement and make whole agreement

• Spanish parent with guaranty

• Investment in receivables discontinued

• Remaining balance of investment in short-term receivables at 12/31/15 paid in full

9

Capital Status

• History of strong capital position

• Support growth opportunity

• Relationship with regulators

• Frequent capital raises to support growth

• 7 raises totaling $369 million in 10 years

• Regulatory capital condition at December 31, 2015

• “Well capitalized” on

• Tier 1 leverage capital ratio

• Common equity tier 1 risk-based capital ratio

• “Adequately capitalized” on Tier 1 risk-based and total risk-based capital ratios

• Capital planning

• Return to “well capitalized” status

• Board considering various capital instruments at holding company and bank levels

• Considerations include market conditions, cost of capital and dilution, among others

• Continued earnings

• Reduced growth rate of assets

• Ongoing capital planning

10

Deferred Tax Asset (DTA)

• Change in treatment after Basel III

• Deduction of certain deferred tax assets from Tier 1 capital (phase-in through 2018)

• For 2016, 60% is eliminated

• By 2018, 100% is eliminated

• Bank has always monitored impact on capital

• Tax credit business

• Impairment charges

• Loan loss provision

• Models built to evaluate

• Capital impact

• Test for valuation reserve

• No valuation reserve at year-end 2015

• Major impact in 2015

• Short-term receivable

• Historic tax credit (HTC) impairment

• Use of tax planning strategies

• Mix of syndications vs. investment for historic tax credits

• Restructure of HTC transactions for lower impairment

• Larger commitment to core banking operations

11

Asset Quality

• Historical ratios at December 31, 2015

• 5 year past due ratio – 0.69%

• 5 year average NPA’s/assets – 1.17%

• 5 year net charge-offs/loans – 0.17%

• 2015 issues

• Large increase in non-performing assets

• Exploration and production credit ($90 million)

• Concrete crushing company ($16 million)

• Downtown Baton Rouge land on riverfront ($11 million)

• Reserve of $30 million on exploration and production credit

• Reserve of $8 million on concrete crushing company

• Baton Rouge property appraised at $21 million with active market

• Total loan loss reserve of $78 million, or 2.27% of gross loans

• Total oil and gas exposure

• $158 million (4.5% of portfolio), with $7 million in outstanding loan commitments

• Loan loss allowance attributable to oil and gas exposure: $34 million

• Past due ratios remain low

• 0.63% at December 31, 2015

12

Internal Control Enhancements

• Governance changes

• Committed to splitting Chairman/CEO roles with independent Chairman

• Independent director committee

• Appointed additional independent director to Audit Committee

• Committed to identifying and appointing an additional director to Board and Audit Committee with significant public company

financial reporting experience

• Organizational changes

• Add Chief Operating Officer after national search

• Split Chief Financial Officer role

• Chief Financial Officer with strong GAAP expertise

• Treasurer focused on A/L management, investments, hedging, etc.

• Added Chief Accounting Officer

• Split Controller role

• Controller with broader GAAP knowledge

• Asset/liability management manager

• Strengthen internal loan review

• Enhance external loan review process

• Objectives

• Significantly increase knowledge of GAAP at every level

• Build organization to handle continued growth for future

• Prepare for transition of management in accord with succession plan

• Adopt best practices for governance

13

14

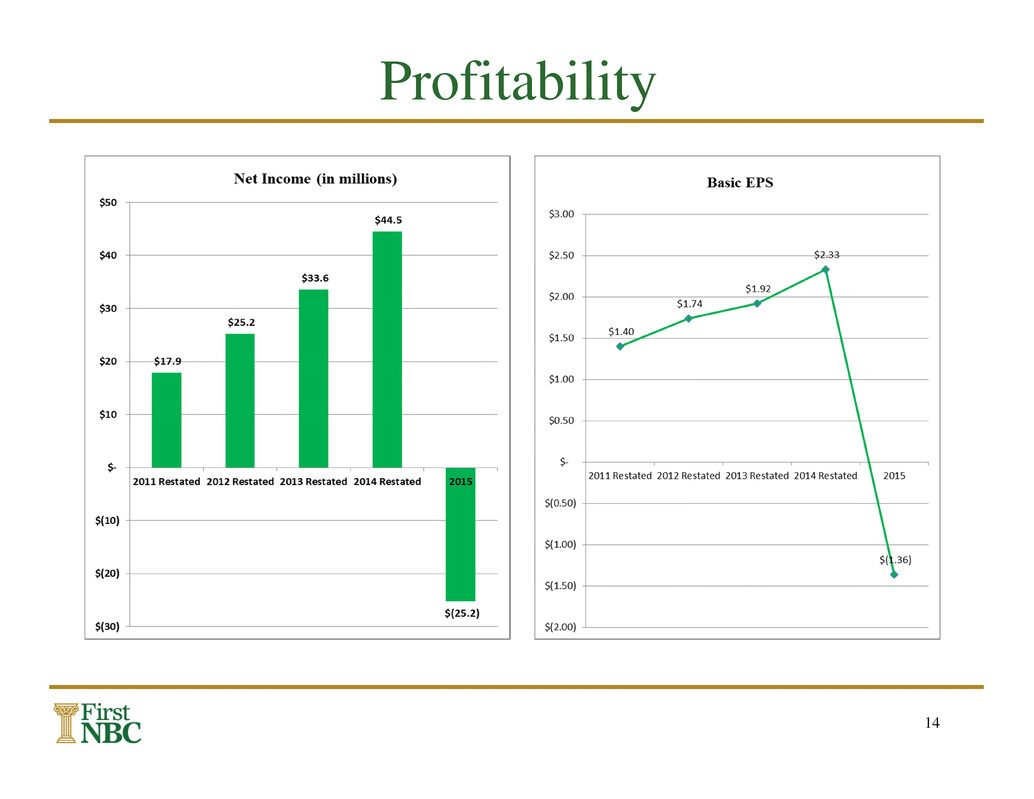

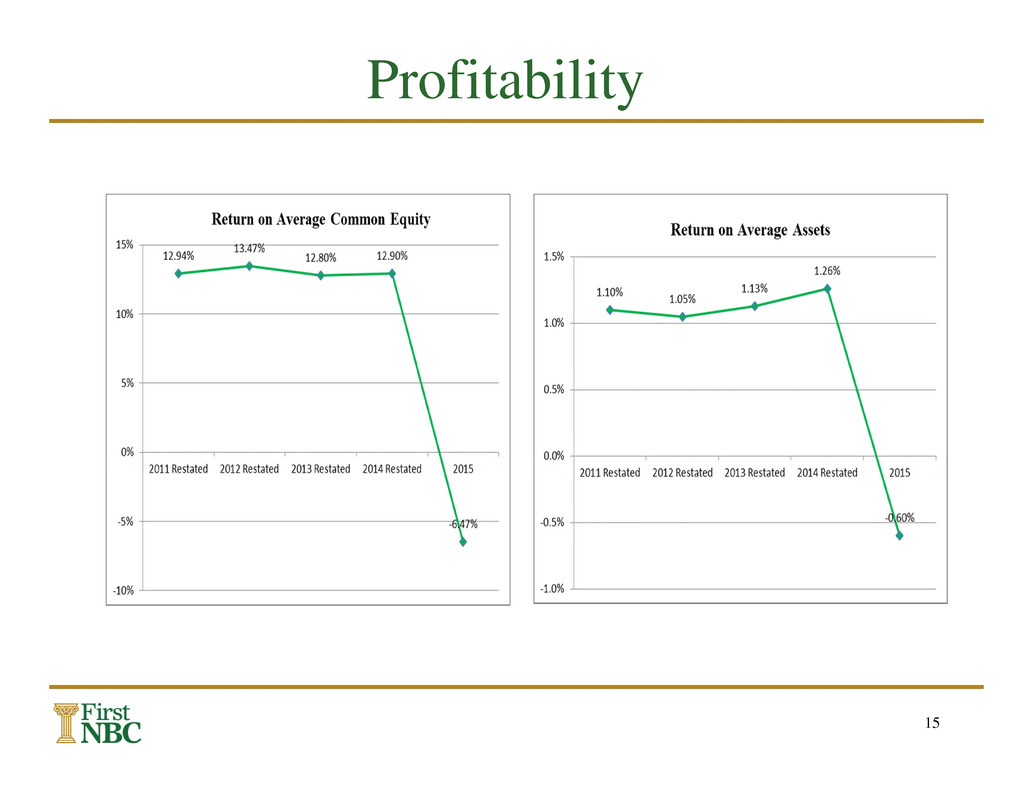

Profitability

15

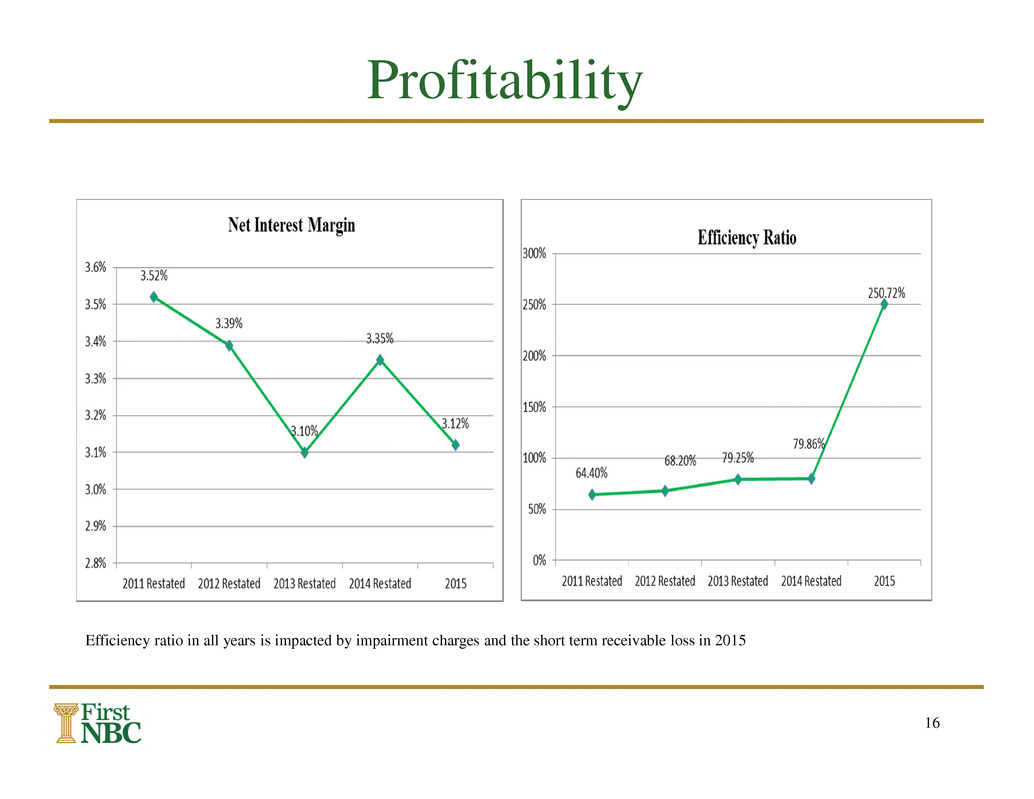

Profitability

16

Profitability

Efficiency ratio in all years is impacted by impairment charges and the short term receivable loss in 2015

17

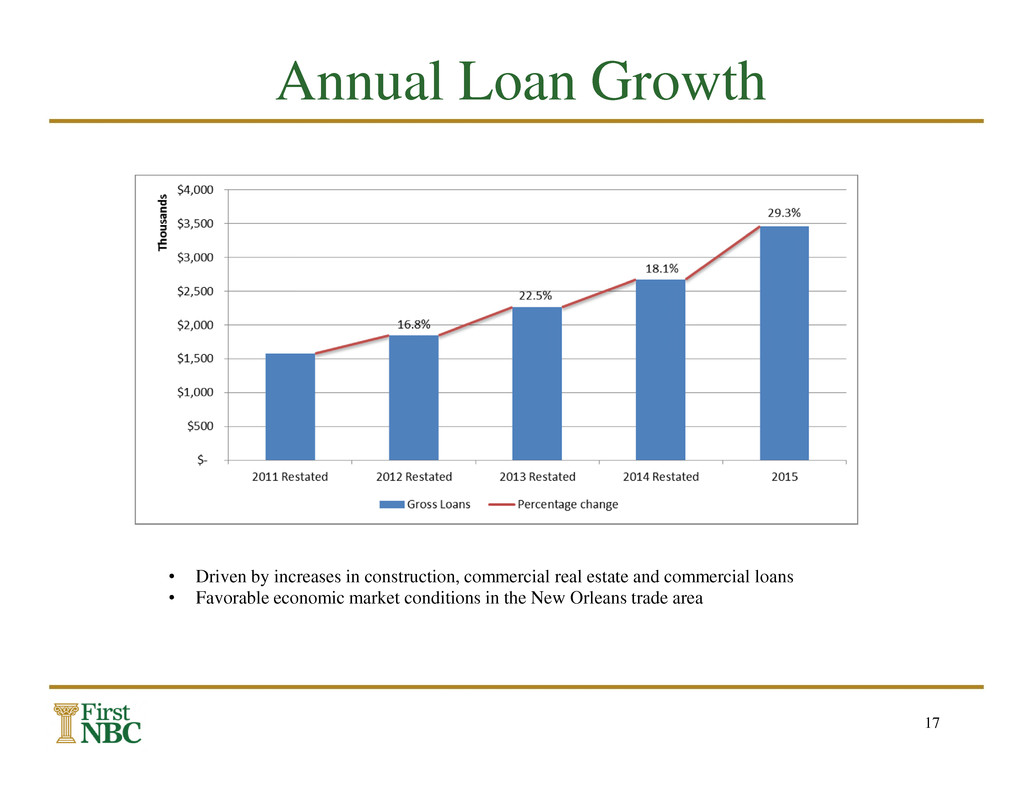

Annual Loan Growth

• Driven by increases in construction, commercial real estate and commercial loans

• Favorable economic market conditions in the New Orleans trade area

Summary

• Community bank with $4.7 billion in assets at December 31, 2015

• Located in a market with strong economic expansion

• Healthy growth in loans/deposits expected to continue

• Core bank earnings drivers remain in place

• Tax credit activity provides opportunity to enhance business and returns

• Historically strong profitability impacted in 2015 by oil price collapse and short –term receivable loss

• Historically strong asset quality impacted in 2015, in large part, by one exploration and production credit

• Extensive local market knowledge and expertise

• Organization focused on enhancements to personnel, control processes and governance framework

18