Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mead Johnson Nutrition Co | form8-kxseptember72016.htm |

September 7, 2016

Barclays Global

Consumer Staples

Conference

Michel Cup

Executive VP and CFO

Safe Harbor Statement

2

Forward-Looking Statements

Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements

may be identified by the fact they use words such as “should,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe” and

other words and terms of similar meaning and expression. Such statements are likely to relate to, among other things, a discussion of goals, plans and projections

regarding financial position, results of operations, cash flows, market position, market growth and trends, product development, product approvals, sales efforts,

expenses, capital expenditures, performance or results of current and anticipated products and the outcome of contingencies such as legal proceedings and

financial results. Forward-looking statements can also be identified by the fact that they do not relate strictly to historical or current facts. Such forward-looking

statements are based on current expectations that involve inherent risks, uncertainties and assumptions that may cause actual results to differ materially from

expectations as of the date of this presentation. These risks include, but are not limited to: (1) the ability to sustain brand strength, particularly the Enfa family of

brands; (2) the effect on the company's reputation of real or perceived quality issues; (3) the effect of regulatory restrictions related to the company’s products; (4)

the adverse effect of commodity costs; (5) increased competition from branded, private label, store and economy-branded products; (6) the effect of an economic

downturn on consumers' purchasing behavior and customers' ability to pay for product; (7) inventory reductions by customers; (8) the adverse effect of changes in

foreign currency exchange rates; (9) the effect of changes in economic, political and social conditions in the markets where we operate; (10) changing consumer

preferences; (11) the possibility of changes in the Women, Infant and Children (WIC) program, or participation in WIC; (12) legislative, regulatory or judicial action

that may adversely affect the company's ability to advertise its products, maintain product margins, or negatively impact the company’s reputation or result in fines

or penalties that decrease earnings; and (13) the ability to develop and market new, innovative products. For additional information regarding these and other

factors, see the company’s filings with the United States Securities and Exchange Commission (the SEC), including its most recent Annual Report on Form 10-K,

which filings are available upon request from the SEC or at www.meadjohnson.com. The company cautions readers not to place undue reliance on any forward-

looking statements, which speak only as of the date made. The company undertakes no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events or otherwise.

Factors Affecting Comparability – Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures. The items included in GAAP measures, but excluded for the purpose of determining the non-GAAP

financial measures, include significant income/expenses not indicative of underlying operating results, including the related tax effect and, at times, the impact of

foreign exchange. The non-GAAP measures represent an indication of the company’s underlying operating results and are intended to enhance an investor’s

overall understanding of the company’s financial performance and ability to compare the company’s performance to that of its peer companies. In addition, this

information is among the primary indicators the company uses as a basis for evaluating company performance, setting incentive compensation targets and

planning and forecasting of future periods. This information is not intended to be considered in isolation or as a substitute for financial measures prepared in

accordance with GAAP. Tables that reconcile non-GAAP to GAAP disclosure are included in the Appendix.

For more information:

Kathy MacDonald, Vice President – Investor Relations, Mead Johnson Nutrition Company, 847-832-2182, kathy.macdonald@mjn.com

Virtuous Circle of Financial Discipline and Growth

3

Our Core Growth Strategies

• Continue investment in science and innovation

• Create superior brands

• Create compelling, value-added propositions for consumers

• Lead digital marketing conversion

Financial

Discipline

Investment

Growth

Strategic Roadmap Outlined at 2015 Investor Day

4

2017 2018 & Beyond2016

• Financial discipline

• Focused investments

• Expand China distribution in

growth channels

• Contribution from new

growth initiatives

• Emerging Markets expected

to stabilize

• Drive Toddler scale in North

America to offset WIC risks

• China Portfolio and Channel

transition completed and

regulatory environment

rebalances

• Southeast Asia rebound

expected and other

emerging market growth

expected to normalize

Transition Building Growth Momentum

Drive Profitable

Growth

First Year Progress of Our Strategic Roadmap

5

Building short-term growth

momentum is slower than

previously expected

• Fuel for Growth ahead of

schedule

• Launching Run4Cash program

Focused demand-generating investments:

• Increasing digital marketing

• Expanding in China’s growing channels

• Developing value-added offerings

Financial

Discipline

Investment

Growth

6

Growth

Momentum

Financial

Discipline

Focused

Investment

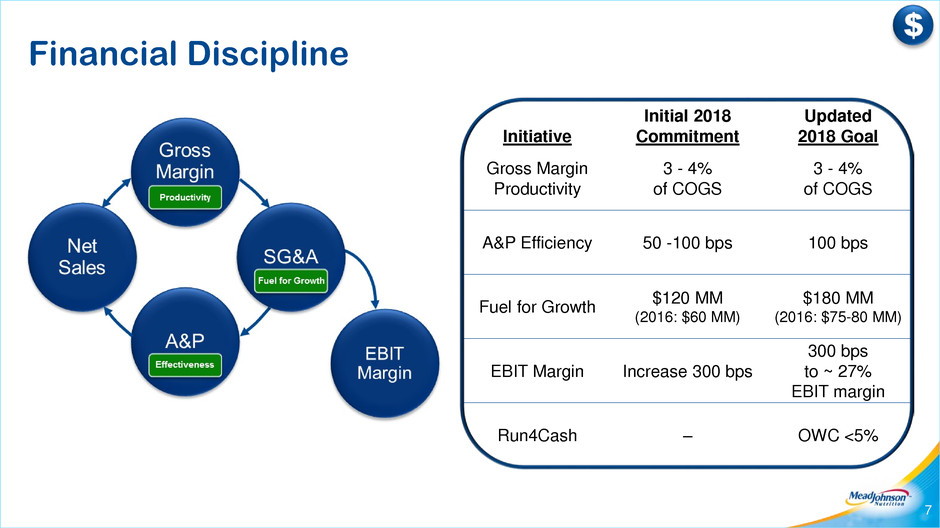

Financial Discipline

7

Initiative

Initial 2018

Commitment

Updated

2018 Goal

Gross Margin

Productivity

3 - 4%

of COGS

3 - 4%

of COGS

A&P Efficiency 50 -100 bps 100 bps

Fuel for Growth $120 MM

(2016: $60 MM)

$180 MM

(2016: $75-80 MM)

EBIT Margin Increase 300 bps

300 bps

to ~ 27%

EBIT margin

Run4Cash ‒ OWC <5%

Initiating Run4Cash Program

Focusing on Operating Working Capital (OWC)*

* Operating Working Capital is defined as Inventory plus Accounts Receivable less Accounts Payable balance. 8

• 3Q program initiated

for accounts payable

• Focused on supply

chain opportunities

• Expect < 5% OWC

by 2018

Fuel for Growth Expected to Deliver $180 Million

by 2018

9

Original

$ 120 MM

Incremental

$ 60 MM

• Renegotiate key vendor contracts

• Eliminate discretionary spend

• Organizational optimization

• Reduce outside services (e.g. consultants)

• Simplification + standardization

• Increase span of control

• Move key operational responsibilities

closer to markets

• Increase demand management

effectiveness

A&P Efficiency of 100bps Expected by 2018

10

A&P as % of Net Sales

Actions to Optimize A&P:

• Prioritize investment choices to maximize ROI

of key influence drivers

• Optimize non-working media expenses

• Leverage decision support tools better

• Strengthen our focus on digital

Investment # 1

Increasing Digital Marketing

(1) Trade investments represents Sales Discounts reported in Gross-to-Net Sales Adjustments.

(2) Tencent, May 2016.

Focused Investments

11

Demand-Generating Investments

Trade

Investments(1)

Advertising

& Promotion

% of

Gross Sales

Digital: Nearly 30% of advertising spend

Catch: Get Her Attention

4 Mil

# of WeChat Fans(2)

Connect: Engage with Her

Close: Drive Her to Purchase

Precision

Targeting

Investment # 3

Developing Value-Added Offering

Investment # 2

Expanding in China’s Growing Channels

* MJN estimates based on multiple sources. Includes cross-channel sales; total of all channels exceeds 100%.

Focused Investments

12

% of Category*

Category Value

MAT rates

Aug.

2015

July

2016

Baby Stores +22% +8%

B2C +68% +47%

C2C +9% (22%)

Modern Trade (8%) (13%)

Highest Value China U.S.

Now MJN’s

largest channel

and rapidly

growing

= Introduced in last 12 months

(1) Nielsen

(2) MJN Offtake data

Enfinitas is Gaining Momentum

13

Impactful Launch

Retail Uptake(2)Distribution Reach in

Baby Store(1)

Building Short-term Growth Momentum

is Slower Than Expected

14

• China strategy is working

• Enfinitas and Enspire are gaining positive response

• Corrective actions in Mexico result in improved

sales growth

• Strong market share gain in Canada

• New U.S. innovation roll out

• Macro economic challenges continue

• Recent stronger competitor pricing activities,

including U.S.

• Category weakness in several markets such as

Thailand

• Regulatory changes and 2Q import process delays

in China

• Continued HK channel weakness

• U.S. Specialty and Solutions market share losses

Good Progress Challenges

(1) Guidance provided in the company’s earnings release on July 28, 2016.

(2) GAAP EPS is likely to be impacted by future mark-to-market pension adjustments which cannot be estimated.

2016 Guidance

15

Net Sales

GAAP EPS(2)

Non-GAAP EPS

Guidance(1)

Constant $

0% to (2%)

Reported $

(5%) to (7%)

Commentary

$2.91 - $3.03

$3.48 - $3.60

Towards the lower end

of our

guidance range

Strategic Roadmap Progress

16

2017 2018 & Beyond2016

Transition Building Growth Momentum

Drive Profitable

Growth

• Strategy Remains Compelling

• Continue to Invest in Our Future

• Disciplined Approach to Cost Management

• Creating an Stronger and More Agile Company

• Commitment to Shareholder Value Creation

Key Messages

Reconciliation of Non-GAAP to GAAP Results

This presentation contains non-GAAP financial measures, each of which is listed in the tables below. The items included in GAAP measures,

but excluded for the purpose of determining non-GAAP financial measures, include significant income/expenses not indicative of underlying

operating results, including the related tax effect and, at times, the impact of foreign exchange. The non-GAAP measures represent an

indication of the company’s underlying operating results and are intended to enhance an investor’s overall understanding of the company’s

financial performance and ability to compare the company’s performance to that of its peer companies. In addition, this information is among

the primary indicators the company uses as a basis for evaluating company performance, setting incentive compensation targets and

planning and forecasting of future periods. This information is not intended to be considered in isolation or as a substitute for financial

measures prepared in accordance with GAAP. Tables that reconcile non-GAAP to GAAP disclosure follow and appear elsewhere in this

presentation.

Constant Dollar

Certain measures in this presentation are presented excluding the impact of foreign currency exchange (constant dollar). To present this

information, current period results for entities reporting in currencies other than United States dollars are translated into United States dollars

at the average exchange rates in effect during the corresponding period of the prior fiscal year, rather than the actual average exchange

rates in effect during the current fiscal year. The Company believes that these constant dollar measures provide useful information to

investors because they provide transparency to underlying performance by excluding the effect that foreign currency exchange rate

fluctuations have on period-to-period comparability given volatility in foreign currency exchange markets. The primary currencies which

impact the Company are: the Chinese renminbi, the Hong Kong dollar, the Mexican peso and the Philippine peso.

Specified Items

Non-GAAP measures presented within this presentation exclude Specified Items. The Company considers Specified Items to be significant

income/expense items as not indicative of underlying operating results, including the related tax effect.

17

Appendix

Reconciliation of 2016 Guidance

Low End High End

Reported Sales (7%) (5%)

Less impact of Foreign Currency (5%) (5%)

Constant Dollar Sales (2%) 0%

GAAP Earnings per Share * 2.91$ 3.03$

Less Specified Items 0.57 0.57

Non-GAAP Earnings per Share 3.48$ 3.60$

* GAAP guidance is likely to be impacted by potentially significant future mark-to-market

pension adjustments which cannot be estimated and are classified as a Specified Item.

18