Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Spotlight Innovation Inc. | stlt_ex322.htm |

| EX-32.1 - CERTIFICATION - Spotlight Innovation Inc. | stlt_ex321.htm |

| EX-31.2 - CERTIFICATION - Spotlight Innovation Inc. | stlt_ex312.htm |

| EX-31.1 - CERTIFICATION - Spotlight Innovation Inc. | stlt_ex311.htm |

| EX-10.29 - CONVERTIBLE NOTE - Spotlight Innovation Inc. | stlt_ex1029.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Mark One

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

| ¨ | ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 333-141060

Spotlight Innovation Inc. |

(Name of small business issuer in its charter) |

Nevada | 98-0518266 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

6750 Westown Parkway, Suite 200-226 West Des Moines, IA 50266 |

(Address of principal executive offices) |

(515) 274-9087 |

(Issuer's telephone number) |

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $0.001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant has (i) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (ii) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filed | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of the common equity, as of the last business of the registrant's most recently completed second fiscal quarter was $5,549,941.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: As of August 25, 2016, there were 15,856,974 shares of the Company's common stock outstanding.

SPOTLIGHT INNOVATION INC.

FORM 10-K

| 2 |

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of the Securities Exchange Act of 1934 and the Securities Act of 1933, that involve risks and uncertainties. Forward-looking statements convey our current expectations or forecasts of future events. All statements contained in this Annual Report other than statements of historical fact are forward-looking statements. Forward-looking statements include statements regarding our future financial position, business strategy, budgets, projected costs, plans and objectives of management for future operations. The words "may," "continue," "estimate," "intend," "plan," "will," "believe," "project," "expect," "seek," "anticipate," "should," "could," "would," "potential," or the negative of those terms and similar expressions may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. All of these forward-looking statements are based on information available to us at this time, and we assume no obligation to update any of these statements. Actual results could differ from those projected in these forward-looking statements as a result of many factors, including those identified in "Business," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere. We urge you to review and consider the various disclosures made by us in this report, and those detailed from time to time in our filings with the Securities and Exchange Commission, that attempt to advise you of the risks and factors that may affect our future results.

Overview

We are a bioscience company focused on acquiring the rights, via acquisition, license or otherwise, to innovative and proprietary technologies. We place a premium on identifying and targeting technology candidates including: cancer drugs and treatment therapies for leading disease states; drug and related treatment therapies for leading infectious diseases; and other specialty innovative and proprietary technology candidates. We provide value-added development capability and funding in order to achieve rapid approvals for investigational new drugs to commence human clinical trials. We seek to commercialize, for each technology candidate, one or more indications via: sale, out-license and or strategic relationships/marketing agreements while continuing to retain, where practical, rights/"field of use" to other indications for future commercialization. Our capabilities are intended to provide our candidates: development guidance; regulatory expertise; communications and public relations; and networking with global and U.S. pharmaceutical and biopharmaceutical companies, contract research organizations, and various other funding sources.

Going forward, we will expand our focus on diseases that are either rare (so called "orphan diseases") or new or common but underserved (e.g. feline chronic kidney disease). We believe that indications such as these offer an accelerated path to market, support form nonprofit advocacy groups, scarcity of competition, and pricing leverage (Medicare and third-party insurers). High prices for these drugs are justified by the sponsor's willingness to treat small, underserved patient populations).

We combine innovative thinking with the proven ability to:

· | Identify categories of IP that have the attributes of future growth, scalability and profit potential. | |

|

|

|

· | Provide accurate, defensible and actionable business analysis. | |

|

|

|

· | Identify existing healthcare IP companies with significant growth potential. | |

|

|

|

· | Time entry into each category based on technological and cultural readiness. | |

|

|

|

· | Identify and overcome barriers to successful commercialization and adoption. | |

|

|

|

· | Implement repeatable processes that bring speed, accuracy and efficiency to commercialization. |

As of December 31, 2015, we have three subsidiaries: Celtic Biotech Iowa, Inc., CDT Veterinary Therapeutics, Inc., and Memcine Pharmaceuticals, Inc. A description of each subsidiary and it technologies are set forth below.

| 3 |

Intellectual Property

Our goal is to protect the proprietary technologies that we believe are key to our strategy. We seek to maintain patent protection to cover our product candidates, their methods of use, related technology and other inventions that we feel important to our business. We also rely on trade secrets and monitoring of our proprietary information to protect the aspects of our business that are necessarily appropriate for patent protection. A third party may hold intellectual property, including patent rights, which are important or necessary to the development of our technologies. It may be necessary for us to use the patented or proprietary technology of third parties to commercialize our products, in which case we would be required to obtain a license from these third parties on commercially reasonable terms, or our business could be harmed, possibly materially. If we were not able to obtain a license, or were not able to obtain a license on commercially reasonable terms, our business could be harmed, possibly materially. The scope of coverage claimed in a patent application can be significantly reduced and or modified before and after the patent is issued. Consequently, we do not know whether any of our technology candidates will be protectable or remain protected by enforceable patents. We cannot predict whether the patent applications we are currently pursuing will issue as patents or whether the claims of any issued patents will provide sufficient proprietary protection from competitors. Any patents that we hold may be challenged, circumvented or invalidated by third parties.

Research and Development

Our business is dependent on conducting research and development. We have spent and continue to spend significant time and capital on conducting research and development. Our research and development expenses were $274,894 and $8,944 for 2015 and 2014, respectively. We anticipate that our research and development expenses will continue to be substantial and to significantly increase as we continue the development of our existing technologies.

Celtic Biotech Iowa, Inc.

On June 4, 2014, Celtic Biotech Iowa, Inc. (hereinafter "Celtic Iowa," a subsidiary of the Company) acquired Celtic Biotech Limited (hereinafter "Celtic Limited"). Celtic Limited was founded in 2003 in Dublin, Ireland and is developing novel and highly specialized treatment therapies for the treatment of solid cancers and pain in humans derived from snake venom. These compounds possess specific anti-cancer and analgesic properties which apply to a broad spectrum of treatments for solid cancerous tumors and pain management. These compounds possess specific anti-cancer and analgesic cancer indications (solid cancerous tumors) and pain management. Celtic Iowa's main focus has been the development of two specific snake venom toxins: crotoxin, as a pain and cancer therapeutic, and cardiotoxin, for cancer and chronic kidney disease. Derived from naturally specialized receptor-binding proteins, these products have the potential to reduce treatment costs, and increase survivability.

In March 2015, Celtic Iowa licensed worldwide (excluding China) rights to develop and market Cardiotoxin for the treatment of chronic kidney disease. The patent-pending invention, licensed from Zheng-Hong Qin of Soochow University, China, is titled "Use of Cardiotoxin for the Treatment of Chronic Kidney Disease." Per terms of the licensing agreement, Celtic Iowa will pay a seven percent (7%) royalty on any eventual sales of a product developed with the licensed technology. The license expires on a country-by-country basis upon the expiration date of the last valid patent claim covering the manufacture, use, importation, or sale of each product in such country, unless earlier terminated.

In March 2015, Celtic Iowa entered into an exclusive license agreement in American territories for a patent held by Instituto Butantan, São Paulo, Brazil, related to the use of Crotamine as an imaging agent for cancer and potentially for gene therapy. Pursuant to this license Celtic Iowa agreed to pay Instituto Butantan, (located in São Paulo, Brazil) $30,000 and a 10% royalty on gross sales of Crotamine. This license expires upon the expiration of the patent.

In March 2015, EPISORB, a topical gel for use as a transdermal drug delivery agent with analgesic and scar reduction creams, developed by Celtic Iowa, was registered with the U.S. Food and Drug Administration and was incorporated into the Pharmacy Benefit Managers database referenced by health insurance companies when reimbursing drugs. The product makes use of the attributes of cardiotoxin as a cell penetrating peptide and is intended for distribution through the compounding pharmacy industry.

| 4 |

In June 2015, Celtic Iowa entered into a Research Agreement with Emory University to conduct a research study titled "Development and Preclinical Validation of a Novel Fluorine-18 Labelled Crotamine Radiotracer for the Noninvasive Imaging of Lung Cancer" ("Study") in accordance with the Study protocol. The preclinical study will be designed and conducted by an Emory University research team with the specific aim of demonstrating that the cell penetrating peptide Crotamine can be made into a suitable radiopharmaceutical for imaging lung cancer tumors with positron emission tomography in a clinical setting.

In July 2015, Celtic Iowa entered into a Clinical Study Management Agreement (the "Agreement") with ImmunoClin Ltd. ("ImmunoClin") whereby ImmunoClin is to manage, on behalf of Celtic Iowa, the second part of the study Open Label Phase I Clinical Trial of Crotoxin in Patients with Advanced Cancer using an Intravenous Route of Administration". Pursuant to the Agreement the timing of the Study is expected to be 18 months, and Celtic Iowa has agreed to pay ImmunoClin an aggregate of Euro 525,330 ($576,865 USD based on current conversion rates) payable in installments (as defined in the Agreement) during the course of the Study.

In August 2015, Celtic Iowa started preparations to conduct Part 2 of the Phase I clinical study, Crotoxin in Patients with Advanced Cancer using an Intravenous Route of Administration. Crotoxin is a neurotoxin derived from the venom of the South American rattlesnake Crotalus durissus. It is expected that Part 2 of the Phase I clinical study will commence in the third quarter of 2016.

The table below shows the drug candidates being developed by Celtic Limited:

DRUG CANDIDATE | INDICATIONS | MECHANISM OF ACTION | ||

Crotoxin | Solid cancers (melanoma, breast cancer and non-small cell lung cancer) | Attacks cell membrane and triggers apoptosis (cell death). The compound also provides analgesic effects. Operates as a single product therapeutic. | ||

|

|

|

|

|

Cardiotoxin | Chronic Kidney Disease | Kidney damage resulting from chronic inflammation is "blocked" by the anti-inflammatory properties of Cardiotoxin. | ||

|

|

|

|

|

VRCTC310 (Combination of Crotoxin and Cardiotoxin) | Hematological (blood-based) cancers and pancreatic cancer | A combination product formulated to address "difficult to treat cancers" that are non-responsive to Crotoxin alone. | ||

|

|

|

|

|

Crotamine* | Cancer diagnostics (imaging, location, staging/metastasis, | When administered, Crotamine naturally seeks out and enters malignant cells, signaling the location, size and status of the tumor. |

_________________

| * | Being developed in cooperation with Emory University. |

CDT Veterinary Therapeutics, Inc.

CDT Veterinary Therapeutics, Inc. ("CDT"), was formed by the Company in November 2015 to create reformulated variants of Celtic's compounds, modified to meet the needs of the veterinary market. The specific properties of these compounds also apply to solid cancerous tumors and pain management for animals. We are researching, evaluating and developing strategic treatments for therapeutic chronic kidney disease in felines.

CDT's overall strategy is to develop products, through approval to market, and then out-license or enter into distribution arrangements with one or more companies. Current products in the veterinary market are focused on antibiotics, anti-parasitics, and vaccines. We anticipate CDT will introduce a series of therapeutic products. We anticipate commencing operations in 2016.

| 5 |

The table below shows the drug candidates being researched by CDT:

DRUG CANDIDATE | INDICATIONS | MECHANISM OF ACTION | ||

Cobramine (a less purified version of Cardiotoxin) | Feline Chronic Kidney Disease (Chronic Kidney Disease is largely non-prevalent in dogs) | Kidney damage resulting from chronic inflammation is "blocked" by the anti-inflammatory properties of Cobramine. |

Memcine Pharmaceuticals, Inc.

The Company acquired approximately eighty two percent (82%) of Memcine Pharmaceuticals, Inc. ("Memcine") in June 2015. The Company agreed to provide Memcine with up to $3,000,000 to fund the operations of Memcine via investment, grants or other means over the course of operations, upon the achievement of certain milestones, as determined by the board of directors of Memcine. Memcine, founded in 2010, holds the exclusive worldwide rights to Immunoplex,™, a vaccine platform technology developed at the University of Iowa, with universal application to numerous antigens developed to improve vaccine efficacy by using more efficient targeting and delivery.

Immunoplex™

Immunoplex™ is an immune complex consisting of an antigen which is "bound" by one or more antibodies. This technology utilizes a "universal" antibody, in conjunction with a proprietary epitope "adapter," that binds to targeted antigens to facilitate the use of asingle universal antibody to form an immune complex with any antigen, to be used as a vaccine for truly personalized cancer treatments and for prevention of specific infectious diseases. Applications for the technology are solid cancerous tumors (a broad range of cancer indications) and a virtually unlimited number of viral and bacterial infections. We believe Immunoplex™ is the first truly personalized tumor cancer treatment for any cancer indication, derived from a patient's own tumor, for which a biopsy or lumpectomy can be performed, or where ~0.1mg of cancer cells can be culled. Preliminary test data indicates that Immunoplex™ may be delivered intranasally (needle-free). We believe that this technology will provide improved safety, compliance, and vaccine efficacy, particularly for individuals with compromised immune systems.

We anticipate that this disruptive technologywillallows pharmaceutical companies to overcome the current obstacles pertaining to immune complex vaccine production:

| · | Antigen-specific antibody identification | |

|

| |

| · | Antigen-specific antibody production | |

|

| |

| · | Antigen-specific antibody testing |

| 6 |

The chart below indicates the therapy indications.

INDICATIONS | MECHANISM OF ACTION | |

CANCER (PERSONALIZED MEDICINE) |

| |

Breast cancer Melanoma Pancreatic cancer Non-small cell lung cancer | Immune complexes are recognized by Antigen Presenting Cells (APCs) through antibody-specific receptors called Fc Receptors. The immune complexes stimulate APCs that then subsume the immune complexes. The APCs use the subsumed material to educate the adaptive arm of the immune response (T and B cells) to attack the disease-related antigens. |

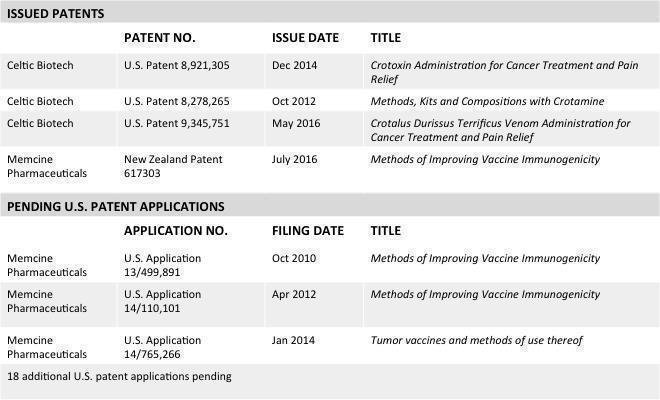

The tables below reflect the Intellectual Property of the Company:

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. While we believe that our technology, knowledge, experience and scientific resources provide us with competitive advantages, we face potential competition from many different sources, including large pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, and medical technology companies. Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future.

| 7 |

There are a large number of companies developing or marketing pain therapies for the indications that we are pursuing. Many of our competitors have substantially greater financial, technical and human resources than we do and significantly greater experience in the development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Small or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. We also compete with these companies in recruiting and retaining qualified scientific personnel and establishing clinical trial sites and patient registration for clinical trials.

FDA Approval Process

(a) Investigational New Drug Application ("IND") - At IND, the FDA decides whether it is reasonably safe for the company to move forward with testing the drug in humans after evaluating the results of preclinical testing in laboratory animals and what they propose to do for human testing.

(b) Clinical Trials- Drug studies in humans can begin only after an IND is reviewed by the FDA and a local institutional review board. At the commencement of clinical trials, they approve the clinical trial protocols, which describe the type of people who may participate in the clinical trial, the schedule of tests and procedures, the medications and dosages to be studied, the length of the study, the study's objectives, and other details.

(c) Phase 1- Phase 1 studies are usually conducted in healthy volunteers. The goal here is to determine what the drug's most frequent side effects are and, often, how the drug is metabolized and excreted. Phase 1 focuses on safety.

(d) Phase 2- Phase 2 studies begin if Phase 1 studies do not reveal unacceptable toxicity. Phase 2 focuses on effectiveness. This phase aims to obtain preliminary data on whether the drug works in people who have a certain disease or condition. For controlled trials, patients receiving the drug are compared with similar patients receiving a different treatment--usually an inactive substance (placebo).

(e) Phase 3- Phase 3 studies begin if evidence of effectiveness is shown in Phase 2. These studies gather more information about safety and effectiveness, studying different populations in a larger group and different dosages and using the drug in combination with other drugs.

(f) New Drug Application ("NDA") - The NDA is the formal step a drug sponsor takes to ask that the FDA consider approving a new drug for marketing in the United States. An NDA includes all animal and human data and analyses of the data, as well as information about how the drug behaves in the body and how it is manufactured.

Employees

We employ one person on a full-time basis (Cristopher Grunewald, our President/Chief Executive Officer) and one on a part-time basis (William Pim our Chief Financial Officer). These individuals are primarily responsible for all of our day-to-day operations. Other services are provided by outsourcing and consultant and special purpose contracts.

Investing in our common stock involves a high degree of risk. Before making an investment decision you should carefully consider the risks described below with all of the other information we include in this report and the additional information we include in the other reports we file with the Securities and Exchange Commission (the "SEC" or the "Commission"). These risks may result in material harm to our business and our financial condition and results of operations. In this event, the market price of our common stock may decline and you can lose part or all of your investment.

| 8 |

Risks Related to Our Business and Industry

We are dependent on the commercial success of our technologies which may never be successfully commercialized.

All of our product candidates are in early stages of development and subject to the risks of failure inherent in developing drug products. Accordingly, we do not have the ability to generate product revenues in the near term. Successful commercialization will depend on whether we can adequately protect against and effectively respond to any claims by holders of patents and other intellectual property rights that our products infringe their rights, whether any unanticipated adverse effects or unfavorable publicity develops in respect of our products, as well as the emergence of new or existing products as competition, which may be proven to be more clinically effective and cost-effective. If we are unable to successfully complete these tasks, we may not be able to commercialize our products at all, in which case we may be unable to generate sufficient revenues to sustain and grow our business.

We are dependent on the success of our product candidates, which may never receive regulatory approval or be successfully commercialized.

To date, we have expended significant time, resources, and effort on the development of our product candidates. All of our product candidates are in early stages of development and subject to the risks of failure inherent in developing drug products.

The ability to successfully commercialize any of our products candidates will depend on, among other things, the ability to:

| · | receive marketing approvals from the FDA and similar foreign regulatory authorities; | |

|

| |

| · | produce, through a validated process, sufficiently large quantities of our product candidates to permit successful commercialization; | |

|

| |

| · | establish commercial manufacturing arrangements with third-party manufacturers; | |

|

| |

| · | build and maintain strong sales, distribution and marketing capabilities sufficient to launch commercial sales of our product candidates; | |

|

| |

| · | establish collaborations with third parties for the commercialization of our product candidates in countries outside the United States, and such collaborators' ability to obtain regulatory and reimbursement approvals in such countries; | |

|

| |

| · | secure acceptance of our product candidates from physicians, health care payors, patients and the medical community; | |

|

| |

| · | successfully complete our clinical trials; and | |

|

| |

| · | manage our spending as costs and expenses increase due to commercialization and clinical trials. |

There are no guarantees that we will be successful in completing these tasks. If we are unable to successfully complete these tasks, we may not be able to commercialize any of our product candidates in a timely manner, or at all, in which case we may be unable to generate sufficient revenues to sustain and grow our business. In addition, if we experience unanticipated delays or problems, development costs could substantially increase and our business, financial condition and results of operations will be adversely affected.

We have limited sales and marketing experience and resources, and we may not be able to effectively market and sell our products or product candidates, if approved, in the United States.

We have limited sales and marketing experience. Further, we could face a number of additional risks in establishing internal sales and marketing capabilities, including:

| · | we may not be able to attract talented and qualified personnel to build an effective marketing or sales force capability; | |

|

| |

| · | the cost of establishing a marketing and sales force capability may not be justifiable in light of the potential revenues generated by any of our products if they were to receive final approval by the FDA; and | |

|

| |

| · | our direct sales and marketing efforts may not be successful. |

If we are unable to establish adequate sales and marketing capabilities or are unable to do so in a timely manner, we may not be able to generate product revenues and may never become profitable.

| 9 |

The commercial success of our products and product candidates, if approved, depends upon attaining market acceptance by physicians, patients, third-party payors and the medical community.

Physicians may not prescribe any of our product candidates if approved by the FDA, in which case we would not generate the revenues we anticipate. Market acceptance of any of our products or product candidates by physicians, patients, third-party payors and the medical community depends on, among other things:

| · | our ability to provide acceptable evidence of safety and efficacy; | |

|

| |

| · | acceptance by physicians and patients of each product or product candidate as a safe and effective treatment; | |

|

| |

| · | perceived advantages of our products or product candidates over alternative treatments; | |

|

| |

| · | relative convenience and ease of administration of our products or product candidates compared to existing treatments; | |

|

| |

| · | any labeling restrictions placed upon each product or product candidate in connection with its approval; | |

|

| |

| · | the prevalence and severity of the adverse side effects of each of our products or product candidates; | |

|

| |

| · | the clinical indications for which each of our products or product candidates are approved, including any potential additional restrictions placed upon each product or product candidate in connection with its approval; | |

|

| |

| · | prevalence of the disease or condition for which each product or product candidate is approved; | |

|

| |

| · | the cost of treatment in relation to alternative treatments, including generic products; | |

|

| |

| · | the extent to which each product or product candidate is approved for inclusion on formularies of hospitals and managed care organizations; | |

|

| |

| · | any negative publicity related to our or our competitors' products or product candidates, including as a result of any related adverse side effects; | |

|

| |

| · | the effectiveness of our or any current or future collaborators' sales, marketing and distribution strategies; | |

|

| |

| · | pricing and cost effectiveness; and | |

|

| |

| · | the availability of adequate reimbursement by third parties. |

If our product candidates do not achieve an adequate level of acceptance by physicians, third-party payors and patients, we may not generate sufficient revenues from these products or product candidates to become or remain profitable on a timely basis, if at all.

Final marketing approval of any of our product candidates by the FDA or other regulatory authorities may be delayed, limited, or denied, any of which would adversely affect our ability to generate operating revenues.

Our business depends on the successful development and commercialization of our products and product candidates. We are not permitted to market any of our product candidates in the United States until we receive approval of a new drug application, or NDA, from the FDA, or in any foreign jurisdiction until we receive the requisite approvals from such jurisdiction. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. We cannot predict whether or when we will obtain regulatory approval to commercialize our product candidates and we cannot, therefore, predict the timing of any future revenues from these product candidates, if any.

| 10 |

The FDA requires submission of information needed to support any changes to a previously approved drug, such as published data or new studies conducted by the applicant or clinical trials demonstrating safety and effectiveness. The FDA could refuse to file or approve our NDA submissions, request additional information before accepting our submissions for filing or require additional information to sufficiently demonstrate safety and effectiveness. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example, the FDA:

| · | could determine that we cannot rely on Section 505(b)(2) for any of our product candidates; | |

|

| |

| · | could determine that the information provided by us was inadequate, contained clinical deficiencies or otherwise failed to demonstrate the safety and effectiveness of any of our product candidates for any indication; | |

|

| |

| · | may not find the data from bioequivalence studies and/or clinical trials sufficient to support the submission of an NDA or to obtain marketing approval in the United States, including any findings that the clinical and other benefits of our product candidates outweigh their safety risks; | |

|

| |

| · | may disagree with our trial design or our interpretation of data from preclinical studies, bioequivalence studies and/or clinical trials, or may change the requirements for approval even after it has reviewed and commented on the design for our trials; | |

|

| |

| · | may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the supply of the active pharmaceutical ingredient, or API, used in our product candidates; | |

|

| |

| · | may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the manufacturing of our product candidates; | |

|

| |

| · | may approve our product candidates for fewer or more limited indications than we request, or may grant approval contingent on the performance of costly post-approval clinical trials; | |

|

| |

| · | may change its approval policies or adopt new regulations; or | |

|

| |

| · | may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of our product candidates. |

Notwithstanding the approval of many products by the FDA pursuant to Section 505(b)(2), over the last few years, some pharmaceutical companies and others have objected to the FDA's interpretation of Section 505(b)(2). If the FDA changes its interpretation of Section 505(b)(2), or if the FDA's interpretation is successfully challenged in court, this could delay or even prevent the FDA from approving any Section 505(b)(2) application that we submit. Any failure to obtain regulatory approval of our product candidates would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

Our trials may fail to demonstrate acceptable levels of safety, efficacy or any other requirements of our product candidates, which could prevent or significantly delay regulatory approval.

We may be unable to sufficiently demonstrate the safety and efficacy of our product candidates to obtain regulatory approval. We must demonstrate with substantial evidence gathered in well-controlled studies, and to the satisfaction of the FDA with respect to approval in the United States (and to the satisfaction of similar regulatory authorities in other jurisdictions with respect to approval in those jurisdictions), that each product candidate is safe and effective for use in the target indication. The FDA may require us to conduct or perform additional studies or trials to adequately demonstrate safety and efficacy, which could prevent or significantly delay our receipt of regulatory approval and, ultimately, the commercialization of that product candidate.

In addition, the results from the trials that we have completed for our product candidates may not be replicated in future trials, or we may be unable to demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals for our product candidates. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced development, even after promising results in earlier trials. If our product candidates are not shown to be safe and effective, our clinical development programs could be delayed or might be terminated.

Our product candidates may cause undesirable side effects or have other properties that delay or prevent their regulatory approval or limit their commercial potential.

Undesirable side effects caused by any of our product candidates could cause us or regulatory authorities to interrupt, delay or halt development and could result in the denial of regulatory approval by the FDA or other regulatory authorities, and potential products liability claims. Any undesirable side effects that are caused by any of our product candidates could have a material adverse effect upon that product candidate's development program and our business as a whole.

| 11 |

In addition, if any of our product candidates receive marketing approval, and we or others later identify undesirable side effects caused by the product candidate, a number of potentially significant negative consequences could result, including:

| · | regulatory authorities may withdraw approvals of the product candidate or otherwise require us to take the approved product off the market; | |

|

| |

| · | regulatory authorities may require additional warnings, or a narrowing of the indication, on the product label; | |

|

| |

| · | we may be required to create a medication guide outlining the risks of such side effects for distribution to patients; | |

|

| |

| · | we may be required to modify the product in some way; | |

|

| |

| · | the FDA may require us to conduct additional clinical trials or costly post-marketing testing and surveillance to monitor the safety or efficacy of the product; | |

|

| |

| · | sales of approved products may decrease significantly; | |

|

| |

| · | we could be sued and held liable for harm caused to patients; and | |

|

| |

| · | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining the commercial success of our products and product candidates and could substantially increase commercialization costs.

Delays or failures in the completion of testing of our product candidates would increase our costs and delay or limit our ability to generate revenues.

Delays or failures in the completion of clinical trials for our product candidates could significantly raise our product development costs. We do not know whether current or planned trials will be completed on schedule, if at all. The commencement and completion of clinical development can be delayed or halted for a number of reasons, including:

| · | difficulties obtaining regulatory approval to commence a clinical trial or complying with conditions imposed by a regulatory authority regarding the scope or term of a clinical trial; | |

|

| |

| · | delays in reaching or failure to reach agreement on acceptable terms with prospective clinical research organizations, or CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; | |

|

| |

| · | insufficient or inadequate supply or quantity of a product candidate for use in trials; | |

|

| |

| · | difficulties obtaining institutional review board or ethics committee approval to conduct a trial at a prospective site; | |

|

| |

| · | challenges recruiting and enrolling patients to participate in clinical trials for a variety of reasons, including competition from other programs for the treatment of similar conditions; | |

|

| |

| · | severe or unexpected drug-related side effects experienced by patients in a clinical trial; | |

|

| |

| · | difficulty retaining patients who have initiated a clinical trial but may be prone to withdraw due to side effects from the therapy, lack of efficacy or personal issues; and | |

|

| |

| · | clinical holds imposed by the FDA. |

| 12 |

Clinical trials may also be delayed as a result of ambiguous or negative interim results. In addition, clinical trials may be suspended or terminated by us, an institutional review board or ethics committee overseeing the clinical trial at a trial site (with respect to that site), the FDA or other regulatory authorities due to a number of factors, including:

| · | failure to conduct the clinical trial in accordance with regulatory requirements or the trial protocols; | |

|

| |

| · | observations during inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities that ultimately result in the imposition of a clinical hold; | |

|

| |

| · | unforeseen safety issues; or | |

|

| |

| · | lack of adequate funding to continue the trial. |

In addition, failure to conduct the clinical trial in accordance with regulatory requirements or the trial protocols may also result in the inability to use the data to support product approval. Changes in regulatory requirements and guidance may occur, and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to institutional review boards or ethics committees for reexamination, which may impact the costs, timing or successful completion of a clinical trial. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates. If we experience delays in completion of, or if we terminate any of our clinical trials, our ability to obtain regulatory approval for our product candidates may be materially harmed, and our commercial prospects and ability to generate product revenues will be diminished.

We expect intense competition and, if our competitors develop or market alternatives for treatments of our target indications, our commercial opportunities will be reduced or eliminated.

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary therapeutics. We face competition from a number of sources, some of which may target the same indications as our products and product candidates, including large pharmaceutical companies, smaller pharmaceutical companies, biotechnology companies, academic institutions, government agencies and private and public research institutions. The availability of competing products will limit the demand and the price we are able to charge for any of our products or product candidates that are commercialized unless we are able to differentiate them. We anticipate that we will face intense competition when/if our product candidates are approved by regulatory authorities and we begin the commercialization process for our products.

In addition to already marketed competing products, we believe certain companies are developing other products which could compete with our product candidates should they be approved by regulatory authorities. Further, new developments, including the development of other drug technologies, may render our product candidates obsolete or noncompetitive. As a result, our product candidates may become obsolete before we recover expenses incurred in connection with their development or realize revenues from any commercialized product.

Further, many competitors have substantially greater:

| · | capital resources; | |

|

| |

| · | research and development resources and experience, including personnel and technology; | |

|

| |

| · | drug development, clinical trial and regulatory resources and experience; | |

|

| |

| · | sales and marketing resources and experience; | |

|

| |

| · | manufacturing and distribution resources and experience; | |

|

| |

| · | name recognition; and | |

|

| |

| · | resources, experience and expertise in prosecution and enforcement of intellectual property rights. |

As a result of these factors, our competitors may obtain regulatory approval of their products more rapidly than we are able to or may obtain patent protection or other intellectual property rights that limit or block us from developing or commercializing our product candidates. Our competitors may also develop drugs that are more effective, more useful, better tolerated, subject to fewer or less severe side effects, more widely prescribed or accepted or less costly than ours and may also be more successful than us in manufacturing and marketing their products. If we are unable to compete effectively with the products of our competitors or if such competitors are successful in developing products that compete with any of our product candidates that are approved, our business, results of operations, financial condition and prospects may be materially adversely affected. Mergers and acquisitions in the pharmaceutical industry may result in even more resources being concentrated at competitors. Competition may increase further as a result of advances made in the commercial applicability of technologies and greater availability of capital for investment.

| 13 |

Our products and our product candidates, if they receive regulatory approval, may be subject to restrictions or withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements.

Even if U.S. regulatory approval is obtained, the FDA may still impose significant restrictions on a product's indicated uses or marketing or impose ongoing requirements for potentially costly post-approval studies. Our product candidates would also be, and our approved product and our collaborators' approved products are, subject to ongoing FDA requirements governing the labeling, packaging, storage, advertising, promotion, recordkeeping and submission of safety and other post-market information. In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current Good Manufacturing Practices, or cGMP regulations. If we, our collaborators or a regulatory authority discovers previously unknown problems with a product, such as side effects of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory authority may impose restrictions on that product or the manufacturer, including requiring withdrawal of the product from the market or suspension of manufacturing. If we or our collaborators, or our or our collaborators' approved products or product candidates, or the manufacturing facilities for our or our collaborators' approved products or product candidates fail to comply with applicable regulatory requirements, a regulatory authority may:

| · | issue warning letters or untitled letters; | |

|

| |

| · | impose civil or criminal penalties; | |

|

| |

| · | suspend regulatory approval; | |

|

| |

| · | suspend any ongoing bioequivalence and/or clinical trials; | |

|

| |

| · | refuse to approve pending applications or supplements to applications filed by us; | |

|

| |

| · | impose restrictions on operations, including costly new manufacturing requirements, or suspension of production; or | |

|

| |

| · | seize or detain products or require us to initiate a product recall. |

In addition, our product labeling, advertising and promotion of our product candidates upon FDA approval, will be subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription products. In particular, a product may not be promoted for uses that are not approved by the FDA as reflected in the product's approved labeling. Physicians may nevertheless prescribe our products and, upon receiving FDA approval, our product candidates to their patients in a manner that is inconsistent with the approved label. The FDA and other authorities actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant sanctions. The federal government has levied large civil and criminal fines against companies for alleged improper promotion and has enjoined several companies from engaging in off-label promotion. If we are found to have promoted off-label uses, we may be enjoined from such off-label promotion and become subject to significant liability, which would have an adverse effect on our reputation, business and revenues, if any.

If we fail to produce our products and product candidates in the volumes that we require on a timely basis, or fail to comply with stringent regulations applicable to pharmaceutical drug manufacturers, we may face delays in the development and commercialization of our products and product candidates.

We do not currently own or operate manufacturing facilities for the production of any of our product candidates beyond Phase II clinical trials, nor do we have plans to develop our own manufacturing operations for Phase III clinical materials or commercial products in the foreseeable future. We will currently depend on third-party contract manufacturers for the supply of the APIs for our product candidates, including drug substance for our preclinical research and clinical trials. Any future curtailment in the availability of raw materials could result in production or other delays with consequent adverse effects on us. In addition, because regulatory authorities must generally approve raw material sources for pharmaceutical products, changes in raw material suppliers may result in production delays or higher raw material costs.

The manufacture of pharmaceutical products requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Pharmaceutical companies often encounter difficulties in manufacturing, particularly in scaling up production of their products. These problems include manufacturing difficulties relating to production costs and yields, quality control, including stability of the product and quality assurance testing, shortages of qualified personnel, as well as compliance with federal, state and foreign regulations. If we are unable to demonstrate stability in accordance with commercial requirements, or if our manufacturers were to encounter difficulties or otherwise fail to comply with their obligations to us, our ability to obtain FDA approval and market our products and product candidates would be jeopardized. In addition, any delay or interruption in the supply of clinical trial supplies could delay or prohibit the completion of our bioequivalence and/or clinical trials, increase the costs associated with conducting our bioequivalence and/or clinical trials and, depending upon the period of delay, require us to commence new trials at significant additional expense or to terminate a trial.

| 14 |

Manufacturers of pharmaceutical products need to comply with cGMP requirements enforced by the FDA through their facilities inspection programs. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. Manufacturers of our products and product candidates may be unable to comply with these cGMP requirements and with other FDA and foreign regulatory requirements. A failure to comply with these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval. If the safety of any of our products or product candidates is compromised due to failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for such product candidate or successfully commercialize such products or product candidates, and we may be held liable for any injuries sustained as a result. Any of these factors could cause a delay in clinical developments, regulatory submissions, approvals or commercialization of our products or product candidates, entail higher costs or result in our being unable to effectively commercialize our product candidates.

We intend to rely on third-party collaborators to market and commercialize our product candidates, who may fail to effectively commercialize our product candidates.

We currently plan to utilize strategic partners or contract sales forces, where appropriate, to assist in the commercialization of our product candidates, if approved. We currently possess limited resources and may not be successful in establishing collaborations or co-promotion arrangements on acceptable terms, if at all. We also face competition in our search for collaborators and co-promoters. By entering into strategic collaborations or similar arrangements, we will rely on third parties for financial resources and for development, commercialization, sales and marketing and regulatory expertise. Our collaborators may fail to develop or effectively commercialize our product candidates because they cannot obtain the necessary regulatory approvals, they lack adequate financial or other resources or they decide to focus on other initiatives. Any failure of our third-party collaborators to successfully market and commercialize our product candidates outside of the United States would diminish our revenues and harm our results of operations.

Limitations on our patent rights relating to our product candidates may limit our ability to prevent third parties from competing against us.

Our success will depend on our ability to obtain and maintain patent protection for our proprietary technologies and our product candidates, preserve our trade secrets, prevent third parties from infringing upon our proprietary rights and operate without infringing upon the proprietary rights of others. To that end, we seek patent protection in the United States and internationally for our product candidates. Our policy is to actively seek to protect our proprietary position by, among other things, filing patent applications in the United States and abroad (including Europe, Canada and certain other countries when appropriate) relating to proprietary technologies that are important to the development of our business.

The strength of patents in the pharmaceutical industry involves complex legal and scientific questions and can be uncertain. Patent applications in the United States and most other countries are confidential for a period of time until they are published, and publication of discoveries in scientific or patent literature typically lags actual discoveries by several months or more. As a result, we cannot be certain that we were the first to conceive inventions covered by our patents and pending patent applications or that we were the first to file patent applications for such inventions. In addition, we cannot be certain that our patent applications will be granted, that any issued patents will adequately protect our intellectual property or that such patents will not be challenged, narrowed, invalidated or circumvented.

We also rely upon unpatented trade secrets, unpatented know-how and continuing technological innovation to develop and maintain our competitive position, which we seek to protect, in part, by confidentiality agreements with our employees and our collaborators and consultants. We also have agreements with our employees and selected consultants that obligate them to assign their inventions to us. It is possible that technology relevant to our business will be independently developed by a person that is not a party to such an agreement. Furthermore, if the employees and consultants that are parties to these agreements breach or violate the terms of these agreements, we may not have adequate remedies, and we could lose our trade secrets through such breaches or violations. Further, our trade secrets could otherwise become known or be independently discovered by our competitors. Any failure to adequately prevent disclosure of our trade secrets and other proprietary information could have a material adverse impact on our business.

In addition, the laws of certain foreign countries do not protect proprietary rights to the same extent or in the same manner as the United States, and therefore, we may encounter problems in protecting and defending our intellectual property in certain foreign jurisdictions.

| 15 |

If we are sued for infringing intellectual property rights of third parties, it will be costly and time consuming, and an unfavorable outcome in that litigation would have a material adverse effect on our business.

Our commercial success depends upon our ability and the ability of our collaborators to develop, manufacture, market and sell their approved products and our product candidates and use our proprietary technologies without infringing the proprietary rights of third parties. Numerous U.S. and foreign issued patents and pending patent applications, which are owned by third parties, exist in the fields in which we and our collaborators are developing product candidates. As the pharmaceutical industry expands and more patents are issued, the risk increases that our collaborators' approved products and our product candidates may give rise to claims of infringement of the patent rights of others. There may be issued patents of third parties of which we are currently unaware, that may be infringed by our product candidates, which could prevent us from being able to commercialize any of our product candidates. Because patent applications can take many years to issue, there may be currently pending applications which may later result in issued patents that our collaborators' approved products or our product candidates may infringe.

We may be exposed to, or threatened with, future litigation by third parties alleging that our collaborators' approved products or our products or product candidates infringe their intellectual property rights. If one of our collaborators' approved products or our products or product candidates is found to infringe the intellectual property rights of a third party, we or our collaborators could be enjoined by a court and required to pay damages and could be unable to commercialize the applicable approved products and product candidates unless we obtain a license to the patent. A license may not be available to us on acceptable terms, if at all. In addition, during litigation, the patent holder could obtain a preliminary injunction or other equitable relief which could prohibit us from making, using or selling our approved products, pending a trial on the merits, which may not occur for several years.

There is a substantial amount of litigation involving patent and other intellectual property rights in the pharmaceutical industry generally. If a third party claims that we or our collaborators infringe its intellectual property rights, we may face a number of issues, including, but not limited to:

| · | infringement and other intellectual property claims which, regardless of merit, may be expensive and time-consuming to litigate and may divert our management's attention from our core business; | |

|

| |

| · | substantial damages for infringement, which we may have to pay if a court decides that the product at issue infringes on or violates the third party's rights, and, if the court finds that the infringement was willful, we could be ordered to pay treble damages and the patent owner's attorneys' fees; | |

|

| |

| · | a court prohibiting us from selling Oxtellar XR, Trokendi XR, or any product candidate approved in the future, if any, unless the third party licenses its rights to us, which it is not required to do; | |

|

| |

| · | if a license is available from a third party, we may have to pay substantial royalties, fees or grant cross-licenses to our intellectual property rights; and | |

|

| |

| · | redesigning any of our product candidates so they do not infringe, which may not be possible or may require substantial monetary expenditures and time. |

We may become involved in lawsuits to protect or enforce our patents, which could be expensive, time consuming and unsuccessful.

Competitors may infringe our patents. To counter infringement or unauthorized use, we may be required to file infringement claims, which can be expensive and time consuming. In any infringement proceeding, a court may decide that a patent of ours is not valid or is unenforceable, or may refuse to stop the other party from using the technology at issue on the grounds that our patents do not cover the technology in question. An adverse result in any litigation or defense proceedings could put one or more of our patents at risk of being invalidated or interpreted narrowly and could put our patent application at risk of not issuing.

| 16 |

Interference proceedings brought by the U.S. Patent and Trademark Office, or USPTO, may be necessary to determine the priority of inventions with respect to our patents and patent applications or those of our collaborators. An unfavorable outcome could require us to cease using the technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if a prevailing party does not offer us a license on terms that are acceptable to us. Litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distraction of our management and other employees. We may not be able to prevent, alone or with our collaborators, misappropriation of our proprietary rights, particularly in countries where the laws may not protect those rights as fully as in the United States.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. In addition, there could be public announcements of the results of hearings, motions or other interim proceeding or developments. If securities analysts or investors perceive these results to be negative, it could have a substantial adverse effect on the price of our common stock. There can be no assurance that our product candidate will not be subject to same risks.

We rely and will continue to rely on outsourcing arrangements for certain of our activities, including clinical research of our product candidates and manufacturing of our compounds and product candidates beyond Phase II clinical trials.

We rely on outsourcing arrangements for some of our activities, including manufacturing, preclinical and clinical research, data collection and analysis. We may have limited control over these third parties and we cannot guarantee that they will perform their obligations in an effective and timely manner. Our reliance on third parties, including third-party CROs and CMOs entails risks including, but not limited to:

| · | non-compliance by third parties with regulatory and quality control standards; | |

|

| |

| · | sanctions imposed by regulatory authorities if compounds supplied or manufactured by a third party supplier or manufacturer fail to comply with applicable regulatory standards; | |

|

| |

| · | the possible breach of the agreements by the CROs or CMOs because of factors beyond our control or the insolvency of any of these third parties or other financial difficulties, labor unrest, natural disasters or other factors adversely affecting their ability to conduct their business; and | |

|

| |

| · | termination or non-renewal of an agreement by the third parties, at a time that is costly or inconvenient for us, because of our breach of the manufacturing agreement or based on their own business priorities. |

We do not own or operate manufacturing facilities for the production of any of our product candidates, nor do we have plans to develop our own manufacturing operations for clinical materials or commercial products in the foreseeable future. We currently depend on third-party CMOs for all of our required raw materials and drug substance for our preclinical research and clinical trials. If any of these vendors are unable to perform its obligations to us, including due to violations of the FDA's requirements, our ability to meet regulatory requirements or projected timelines and necessary quality standards for successful manufacture of the various required lots of material for our development and commercialization efforts would be adversely affected. Further, if we were required to change vendors, it could result in delays in our regulatory approval efforts and significantly increase our costs. Accordingly, the loss of any of our current or future third-party manufacturers or suppliers could have a material adverse effect on our business, results of operations, financial condition and prospects.

We do not have contractual relationships for the manufacture of commercial supplies of all of our product candidates. The number of third-party manufacturers with the expertise, required regulatory approvals and facilities to manufacture drug substance and final drug product on a commercial scale is limited. Therefore, we may not be able to enter into such arrangements with third-party manufacturers in a timely manner, on acceptable terms or at all. Failure to secure such contractual arrangements would harm the commercial prospects for our product candidates, our costs could increase and our ability to generate revenues could be delayed.

| 17 |

Even if our product candidates receive regulatory approval in the United States, we or our collaborators may never receive approval to commercialize our product candidates outside of the United States.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other jurisdictions regarding safety and efficacy. Approval procedures vary among jurisdictions and can involve product testing and administrative review periods different from, and greater than those in the United States. The time required to obtain approval in other jurisdictions might differ from that required to obtain FDA approval. The regulatory approval process in other jurisdictions may include all of the risks detailed above regarding FDA approval in the United States as well as other risks. For example, legislation analogous to Section 505(b)(2) of the FDCA in the United States, which relates to the ability of an NDA applicant to use published data not developed by such applicant, may not exist in other countries. In territories where data is not freely available, we may not have the ability to commercialize our products without negotiating rights from third parties to refer to their clinical data in our regulatory applications, which could require the expenditure of significant additional funds.

In addition, regulatory approval in one jurisdiction does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one jurisdiction may have a negative effect on the regulatory processes in others. Failure to obtain regulatory approvals in other jurisdictions or any delay or setback in obtaining such approvals could have the same adverse effects detailed above regarding FDA approval in the United States. As described above, such effects include the risks that any of our product candidates may not be approved for all indications requested, which could limit the uses of our product candidates and have an adverse effect on their commercial potential or require costly post-marketing studies.

Guidelines and recommendations published by various organizations can reduce the use of our products and product candidates.

Government agencies promulgate regulations and guidelines directly applicable to us and to our products and product candidates. In addition, professional societies, practice management groups, private health and science foundations and organizations involved in various diseases from time to time may also publish guidelines or recommendations to the health care and patient communities. Recommendations of government agencies or these other groups or organizations may relate to such matters as usage, dosage, route of administration and use of concomitant therapies. Recommendations or guidelines suggesting the reduced use of our products or product candidates or the use of competitive or alternative products that are followed by patients and health care providers could result in decreased use of our products or product candidates.

We are subject to uncertainty relating to payment or reimbursement policies which, if not favorable for our products or product candidates, could hinder or prevent our commercial success.

Our ability or our collaborators' ability to successfully commercialize our product candidates, will depend in part on the coverage and reimbursement levels set by governmental authorities, private health insurers, managed care organizations and other third-party payors. As a threshold for coverage and reimbursement, third-party payors generally require that drug products have been approved for marketing by the FDA. Third-party payors also are increasingly challenging the effectiveness of and prices charged for medical products and services. Government authorities and these third-party payors have attempted to control costs, in some instances, by limiting coverage and the amount of reimbursement for particular medications or encouraging the use of lower-cost generic AEDs. We cannot be sure that reimbursement will be available for any of the products that we develop and, if reimbursement is available, the level of reimbursement. Reduced or partial payment or reimbursement coverage could make our product candidates, less attractive to patients and prescribing physicians. We also may be required to sell our products or product candidates at a discount, which would adversely affect our ability to realize an appropriate return on our investment in our products or product candidates or compete on price.

We expect that private insurers and managed care organizations will consider the efficacy, cost effectiveness and safety of our product candidates, in determining whether to approve reimbursement for such products or product candidates and at what level. Because each third-party payor individually approves payment or reimbursement, obtaining these approvals can be a time consuming and expensive process that could require us to provide scientific or clinical support for the use of each of our products or product candidates separately to each third-party payor. In some cases, it could take several months or years before a particular private insurer or managed care organization reviews a particular product, and we may ultimately be unsuccessful in obtaining coverage. Our competitors generally have larger organizations, as well as existing business relationships with third-party payors relating to their products. Our business would be materially adversely affected if we do not receive approval for reimbursement of our products or product candidates from private insurers on a timely or satisfactory basis. Our products and product candidates, may not be considered cost-effective, and coverage and reimbursement may not be available or sufficient to allow us to sell our products or product candidates on a profitable basis. Our business would also be adversely affected if private insurers, managed care organizations, the Medicare program or other reimbursing bodies or payors limit the indications for which our products or product candidates will be reimbursed to a smaller set than we believe they are effective in treating.

| 18 |

In some foreign countries, particularly Canada and the countries of Europe, the pricing of prescription pharmaceuticals is subject to strict governmental control. In these countries, pricing negotiations with governmental authorities can take six to 12 months or longer after the receipt of regulatory approval and product launch. To obtain favorable reimbursement for the indications sought or pricing approval in some countries, we may be required to conduct a clinical trial that compares the cost-effectiveness of our products or product candidates to other available therapies. If reimbursement for our products or product candidates is unavailable in any country in which reimbursement is sought, limited in scope or amount, or if pricing is set at unsatisfactory levels, our business could be materially harmed.

In addition, many managed care organizations negotiate the price of products and develop formularies which establish pricing and reimbursement levels. Exclusion of a product from a formulary can lead to its sharply reduced usage in the managed care organization's patient population. If our products or product candidates are not included within an adequate number of formularies or adequate payment or reimbursement levels are not provided, or if those policies increasingly favor generic products, our market share and gross margins could be negatively affected, which would have a material adverse effect on our overall business and financial condition.

We expect to experience pricing pressures due to the potential healthcare reforms discussed elsewhere in this prospectus, as well as the trend toward programs aimed at reducing health care costs, the increasing influence of health maintenance organizations and additional legislative proposals.

We face potential product liability exposure, and, if successful claims are brought against us, we may incur substantial liabilities.

The use of our product candidates in clinical trials and the sale of any of our products will expose us to the risk of product liability claims. Product liability claims might be brought against us by consumers, healthcare providers or others selling or otherwise coming into contact with our products and product candidates. If we cannot successfully defend ourselves against product liability claims, we could incur substantial liabilities. In addition, product liability claims may result in:

| · | decreased demand for any product or product candidate that has received approval and is being commercialized; | |

|

| |

| · | impairment of our business reputation and exposure to adverse publicity; | |

|

| |

| · | withdrawal of bioequivalence and/or clinical trial participants; | |

|

| |

| · | initiation of investigations by regulators; | |

|

| |

| · | costs of related litigation; | |

|

| |

| · | distraction of management's attention from our primary business; | |

|

| |

| · | substantial monetary awards to patients or other claimants; | |

|

| |

| · | loss of revenues; and | |

|

| |

| · | the inability to commercialize any of our product candidates for which we obtain marketing approval. |

Insurance coverage is becoming increasingly expensive, and we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses. We intend to expand our insurance coverage to include the sale of commercial products prior to the commercialization of our products. On occasion, large judgments have been awarded in class action lawsuits based on drugs that had unanticipated side effects. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

| 19 |

Our failure to successfully develop and market product candidates would impair our ability to grow.

As part of our growth strategy, we intend to develop and market product candidates. We are pursuing various therapeutic opportunities through our pipeline. We may spend several years completing our development of any particular current or future internal product candidate, and failure can occur at any stage. The product candidates to which we allocate our resources may not end up being successful. In addition, because our internal research capabilities are limited, we may be dependent upon pharmaceutical companies, academic scientists and other researchers to sell or license products or technology to us. The success of this strategy depends partly upon our ability to identify, select, discover and acquire promising pharmaceutical product candidates and products.

The process of proposing, negotiating and implementing a license or acquisition of a product candidate or approved product is lengthy and complex. Other companies, including some with substantially greater financial, marketing and sales resources, may compete with us for the license or acquisition of product candidates and approved products. We have limited resources to identify and execute the acquisition or in-licensing of third-party products, businesses and technologies and integrate them into our current infrastructure. Moreover, we may devote resources to potential acquisitions or in-licensing opportunities that are never completed, or we may fail to realize the anticipated benefits of such efforts. We may not be able to acquire the rights to additional product candidates on terms that we find acceptable, or at all.

In addition, future acquisitions may entail numerous operational and financial risks, including:

| · | exposure to unknown liabilities; | |

|

| |