Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RITCHIE BROS AUCTIONEERS INC | v447881_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - RITCHIE BROS AUCTIONEERS INC | v447881_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - RITCHIE BROS AUCTIONEERS INC | v447881_ex99-1.htm |

Exhibit 99.3

August 29, 2016 Acquisition of IronPlanet

2 Forward looking statements and non - GAAP measures Caution Regarding Forward - Looking Statements This presentation contains forward - looking statements and forward - looking information within the meaning of applicable U.S. and Canadian securities legislation (collectively, “forward - looking statements”), including, in particular, statements regarding the terms and potential benefits of the proposed transaction between Ritchie Bros. and IronPlanet , the terms and conditions of the proposed transaction, the expected timetable for completing the proposed transaction, benef its and synergies of the proposed transaction, future opportunities for the combined businesses of Ritchie Bros. and IronPlanet , future financial and operational results and any other statements regarding events or developments that Ritchie Bros. believes or anticipates will or may occur in the future. Forward - looking sta tements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan, “anticipate”, “project” , “ target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or statements that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward - looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward - looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Ritchie Bros.’s control, including risks and uncertainties related to: general economic conditions and conditions affecting the industries in which Ritchie Bros., IronPlanet and Caterpillar operate; obtaining regulatory approvals in connection with the proposed transaction; each of Ritchie Bros.’ and IronPlanet's ability to satisfy the merger agreement conditions and consummate the transaction on the anticipated timetable, or at all; Ritchie Bros.’ ability to successfully integrate IronPlanet's operations and employees with Ritchie Bros.’ existing business; the ability to realize anticipated growth, synergies and cost savings in the proposed transaction; the maintenance of important business rel ati onships; the effects of the IronPlanet transaction on relationships with employees, customers, other business partners or governmental entities; transaction costs; det erioration of or instability in the economy, the markets we serve or the financial markets generally; as well as the risks and uncertainties set forth in Ritchie Bros.’ A nnu al Report on Form 10 - K for the year ended December 31, 2015, which is available on the SEC, SEDAR, and Ritchie Bros.’ website. The foregoing list is not exhaustive of the factors that may affect Ritchie Bros.’ forward - looking statements. There can be no assurance that forward - looking statements will prove to be accurate, and actual results may differ materially from those expressed in, or implied by, these forward - looking statements. Forward - looking statements are made as of the date of this presentation and Rit chie Bros. does not undertake any obligation to update the information contained herein unless required by applicable securities legislation. For the reasons s et forth above, you should not place undue reliance on forward - looking statements. This presentation contains certain non - GAAP financial measures. For a discussion of non - GAAP measures and the most directly comparable GAAP financial measures, see the Appendix to this presentation as well as our earnings release and our Form 10 - Q interim report, which are avai lable at: investor.ritchiebros.com. These non - GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are sig nificant in understand and assessing our financial condition and results. Therefore, these measures should not be considered in isolation or as alternatives to me asu res of profitability, liquidity or other performance under GAAP. These measures may not be comparable to similarly - titled measures used by other companies . This presentation also includes certain forward - looking non - GAAP financial measures . We are unable to present a quantitative reconciliation of this forward - looking non - GAAP financial information because management cannot reliably predict all of the necessary components of such measur es. Accordingly, investors are cautioned not to place undue reliance on this information. All figures are in US dollars, unless otherwise noted.

3 Strategy enhances customer choice IronPlanet ® is a trusted online auction/marketplace brand for transacting heavy equipment and other durable assets, with GMV¹ of $956 TTM² (June 30, 2016) • Multiple formats, core being weekly unreserved auctions • Focus on construction sector • Through their core model, equipment consignors do not have to move equipment • Have a world - class inspection system (‘ IronClad ® Assurance equipment inspection certification’) Complementary brand to RB, makes combination attractive • IronPlanet is at an inflection point – growing rapidly, albeit from a smaller base • Caterpillar partnership has been a key growth catalyst • Provides access to a different type of customer • Complementary customer bases • Buyer base is more tech savvy • Recent growth driven by corporate accounts, OEM dealers and OEMs, and new sectors • Strong, customer friendly technology platform • Tracks and enables the entire transaction life cycle • Scalable; technology drives the entire process • Expands penetration into largely untapped sectors, such as Government surplus and Oil & Gas • Combined company can accelerate international expansion • RB scale and infrastructure with IronPlanet’s model can appeal to customers in regions such as Germany, Japan and China Ritchie Bros. to buy IronPlanet : next logical step of diversification (1) Gross Merchandise Value – total value of assets sold through IronPlanet sales channels. (2) Trailing 12 months June 30, 2016 IRONPLANET BRANDS:

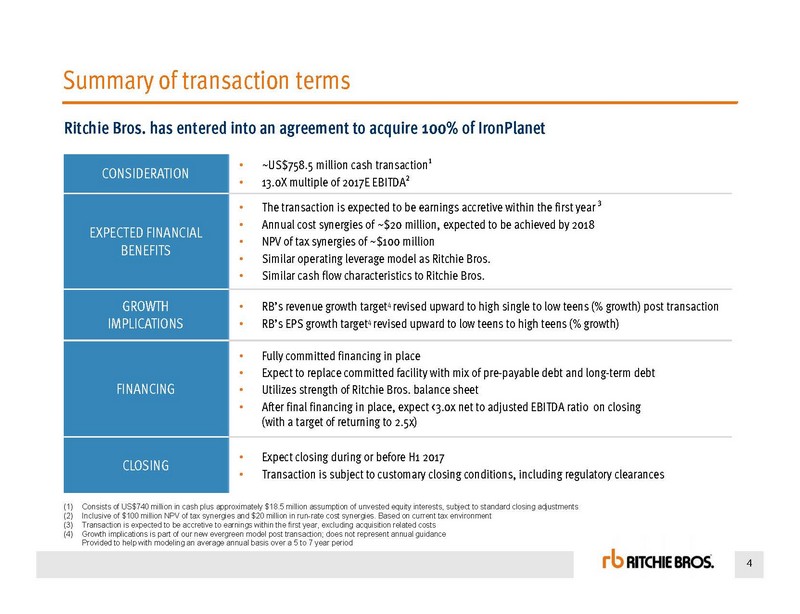

4 Summary of transaction terms CONSIDERATION • ~US$758.5 million cash transaction¹ • 13.0X multiple of 2017E EBITDA² EXPECTED FINANCIAL BENEFITS • The transaction is expected to be earnings accretive within the first year ³ • Annual cost synergies of ~$ 20 million , expected to be achieved by 2018 • NPV of tax synergies of ~$ 100 million • Similar operating leverage model as Ritchie Bros. • Similar cash flow characteristics to Ritchie Bros. GROWTH IMPLICATIONS • RB’s revenue growth target 4 revised upward to high single to low teens (% growth) post post transaction • RB’s EPS growth target 4 revised upward to low teens to high teens (% growth) FINANCING • Fully committed financing in place • Expect to replace committed facility with mix of pre - payable debt and long - term debt debt • Utilizes strength of Ritchie Bros. balance sheet • After final financing in place, expect <3.0x net to adjusted EBITDA ratio on closing (with a target of returning to 2.5x) CLOSING • Expect closing during or before H1 2017 • Transaction is subject to customary closing conditions, including regulatory clearances clearances Ritchie Bros. has entered into an agreement to acquire 100% of IronPlanet (1) Consists of US$740 million in cash plus approximately $18.5 million assumption of unvested equity interests, subject to standard closi ng adjustments (2) Inclusive of $100 million NPV of tax synergies and $20 million in run - rate cost synergies. Based on current tax environment (3) Transaction is expected to be accretive to earnings within the first year, excluding acquisition related costs (4) Growth implications is part of our new evergreen model post transaction; does not represent annual guidance Provided to help with modeling an average annual basis over a 5 to 7 year period

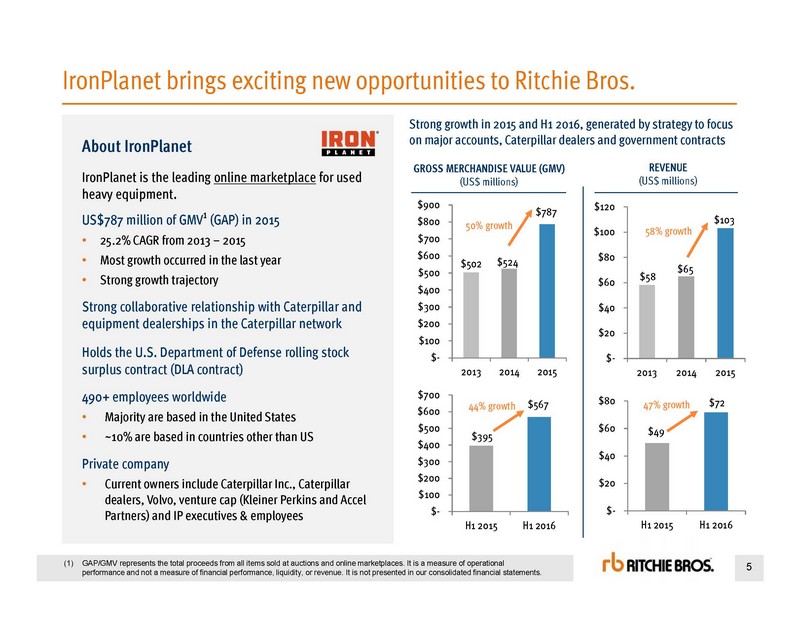

5 $49 $72 $- $20 $40 $60 $80 H1 2015 H1 2016 $395 $567 $- $100 $200 $300 $400 $500 $600 $700 H1 2015 H1 2016 IronPlanet brings exciting new opportunities to Ritchie Bros. About IronPlanet IronPlanet is the leading online marketplace for used heavy equipment. US$787 million of GMV ¹ (GAP) in 2015 • 25.2% CAGR from 2013 – 2015 • Most growth occurred in the last year • Strong growth trajectory Strong collaborative relationship with Caterpillar and equipment dealerships in the Caterpillar network Holds the U.S. Department of Defense rolling stock surplus contract (DLA contract) 490+ employees worldwide • Majority are based in the United States • ~10% are based in countries other than US Private company • Current owners include Caterpillar Inc., Caterpillar dealers, Volvo , venture cap ( Kleiner Perkins and Accel Partners) and IP executives & employees $502 $524 $787 $- $100 $200 $300 $400 $500 $600 $700 $800 $900 2013 2014 2015 $58 $65 $103 $- $20 $40 $60 $80 $100 $120 2013 2014 2015 GROSS MERCHANDISE VALUE (GMV ) ( US$ millions) REVENUE ( US$ millions) Strong growth in 2015 and H1 2016, generated by strategy to focus on major accounts, Caterpillar dealers and government contracts 50% growth 58% growth 44% growth 47% growth (1) GAP/GMV represents the total proceeds from all items sold at auctions and online marketplaces. It is a measure of operational performance and not a measure of financial performance, liquidity, or revenue. It is not presented in our consolidated financial statemen ts.

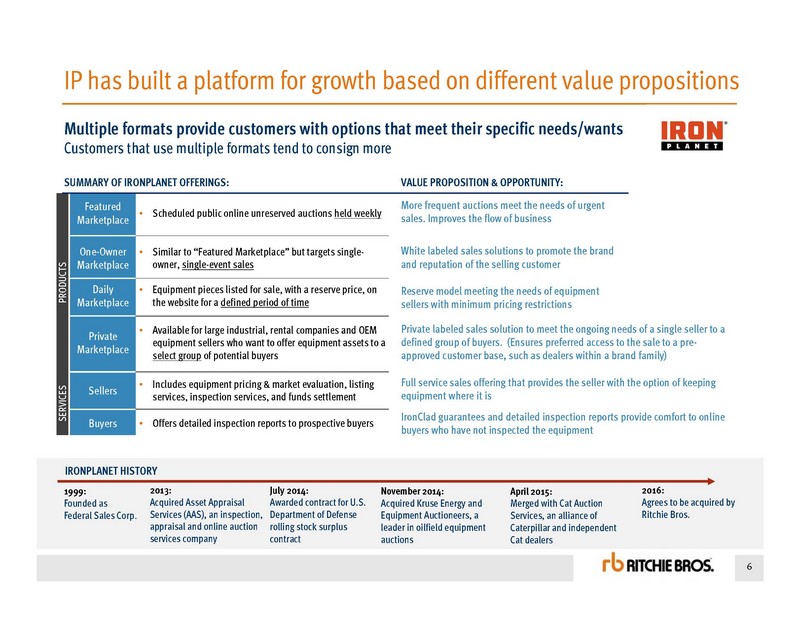

6 IP has built a platform for growth based on different value propositions PRODUCTS Featured Marketplace • Scheduled public online unreserved auctions held weekly One - Owner Marketplace • Similar to “Featured Marketplace” but targets single - owner, single - event sales Daily Marketplace • Equipment pieces listed for sale, with a reserve price, on the website for a defined period of time Private Marketplace • Available for large industrial, rental companies and OEM equipment sellers who want to offer equipment assets to a select group of potential buyers SERVICES Sellers • Includes equipment pricing & market evaluation, listing services, inspection services, and funds settlement Buyers • Offers detailed inspection reports to prospective buyers SUMMARY OF IRONPLANET OFFERINGS: IRONPLANET HISTORY 1999: Founded as Federal Sales Corp . 2013: Acquired Asset Appraisal Services (AAS), an inspection, appraisal and online auction services company November 2014: Acquired Kruse Energy and Equipment Auctioneers, a leader in oilfield equipment auctions April 2015: Merged with Cat Auction Services, an alliance of Caterpillar and independent Cat dealers 2016: Agrees to be acquired by Ritchie Bros. More frequent auctions meet the needs of urgent sales. Improves the flow of business VALUE PROPOSITION & OPPORTUNITY: White labeled sales solutions to promote the brand and reputation of the selling customer Reserve model meeting the needs of equipment sellers with minimum pricing restrictions Private labeled sales solution to meet the ongoing needs of a single seller to a defined group of buyers. (Ensures preferred access to the sale to a pre - approved customer base, such as dealers within a brand family) Full service sales offering that provides the seller with the option of keeping equipment where it is IronClad guarantees and detailed inspection reports provide comfort to online buyers who have not inspected the equipment Multiple formats provide customers with options that meet their specific needs/wants Customers that use multiple formats tend to consign more July 2014: Awarded contract for U.S. Department of Defense rolling stock surplus contract

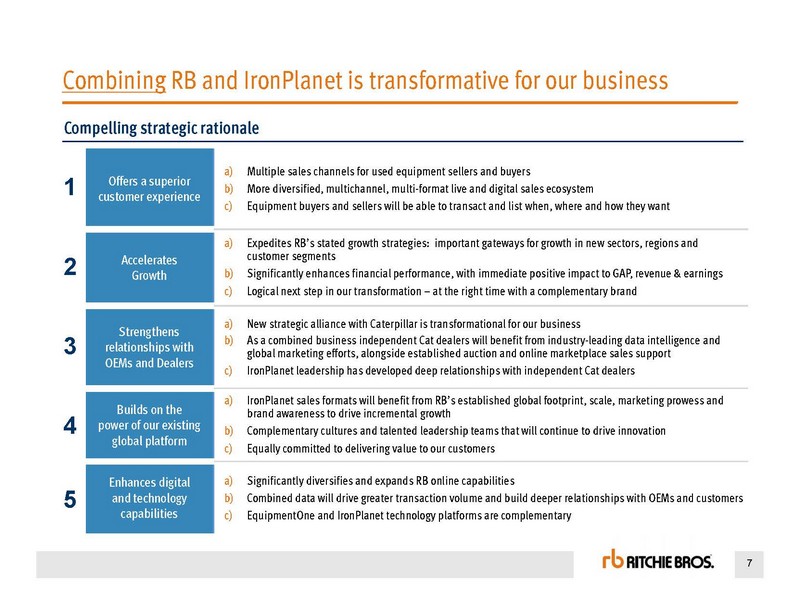

7 Combining RB and IronPlanet is transformative for our business Offers a superior customer experience a) Multiple sales channels for used equipment sellers and buyers b) More diversified, multichannel, multi - format live and digital sales ecosystem c) Equipment buyers and sellers will be able to transact and list when , where and how they want Accelerates Growth a) Expedites RB’s stated growth strategies: important gateways for growth in new sectors, regions and customer segments b) Significantly enhances financial performance, with immediate positive impact to GAP, revenue & earnings c) Logical next step in our transformation – at the right time with a complementary brand Strengthens relationships with OEMs and Dealers a) New strategic alliance with Caterpillar is transformational for our business b) As a combined business independent Cat dealers will benefit from industry - leading data intelligence and global marketing efforts, alongside established auction and online marketplace sales support c) IronPlanet leadership has developed deep relationships with independent Cat dealers Builds on the power of our existing global platform a) IronPlanet sales formats will benefit from RB’s established global footprint, scale, marketing prowess and brand awareness to drive incremental growth b) Complementary cultures and talented leadership teams that will continue to drive innovation c) Equally committed to delivering value to our customers Enhances digital and technology capabilities a) Significantly diversifies and expands RB online capabilities b) Combined data will drive greater transaction volume and build deeper relationships with OEMs and customers c) EquipmentOne and IronPlanet technology platforms are complementary 1 2 3 4 5 Compelling strategic rationale

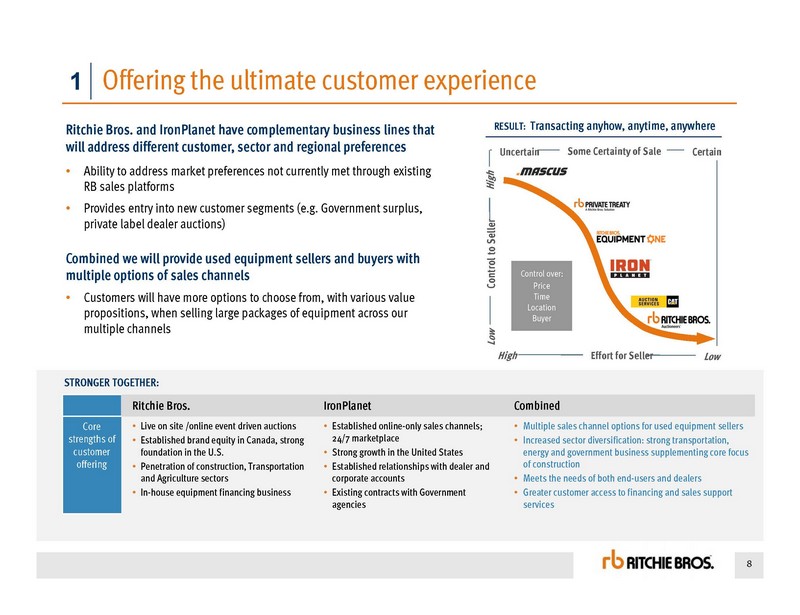

8 Offering the ultimate customer experience Ritchie Bros. IronPlanet Combined Core strengths of customer offering • Live on site /online event driven auctions • Established brand equity in Canada, strong foundation in the U.S. • Penetration of construction, Transportation and Agriculture sectors • In - house equipment financing business • Established online - only sales channels; 24/7 marketplace • Strong growth in the United States • Established relationships with dealer and corporate accounts • Existing contracts with Government agencies • Multiple sales channel options for used equipment sellers • Increased sector diversification: strong transportation, energy and government business supplementing core focus of construction • Meets the needs of both end - users and dealers • Greater customer access to financing and sales support services 1 Ritchie Bros. and IronPlanet have complementary business lines that will address different customer, sector and regional preferences • Ability to address market preferences not currently met through through existing RB sales platforms • Provides entry into new customer segments (e.g. Government surplus, Government surplus, private label dealer auctions) Combined we will provide used equipment sellers and buyers with multiple options of sales channels • Customers will have more options to choose from, with various value various value propositions, when selling large packages of equipment equipment across our multiple channels STRONGER TOGETHER: High Control to Seller Low Effort for Seller Control over: Price Time Location Buyer Low High Uncertain Certain Some Certainty of Sale RESULT: Transacting anyhow, anytime, anywhere

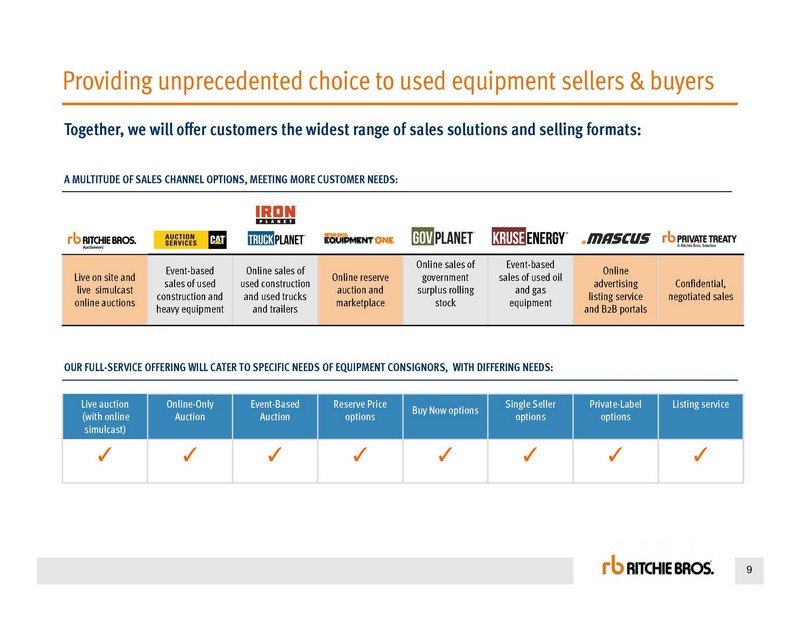

9 Live on site and live simulcast online auctions Event - based sales of used construction and heavy equipment Online sales of used construction and used trucks and trailers Online reserve auction and marketplace Online sales of government surplus rolling stock Event - based sales of used oil and gas equipment Online advertising listing service and B2B portals Confidential, negotiated sales Providing unprecedented choice to used equipment sellers & buyers Together, we will offer customers the widest range of sales solutions and selling formats: Live auction (with online simulcast) Online - Only Auction Event - Based Auction Reserve Price options Buy Now options Single Seller options Private - Label options Listing service ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ A MULTITUDE OF SALES CHANNEL OPTIONS, MEETING MORE CUSTOMER NEEDS: OUR FULL - SERVICE OFFERING WILL CATER TO SPECIFIC NEEDS OF EQUIPM ENT CONSIGNORS, WITH DIFFERING NEEDS:

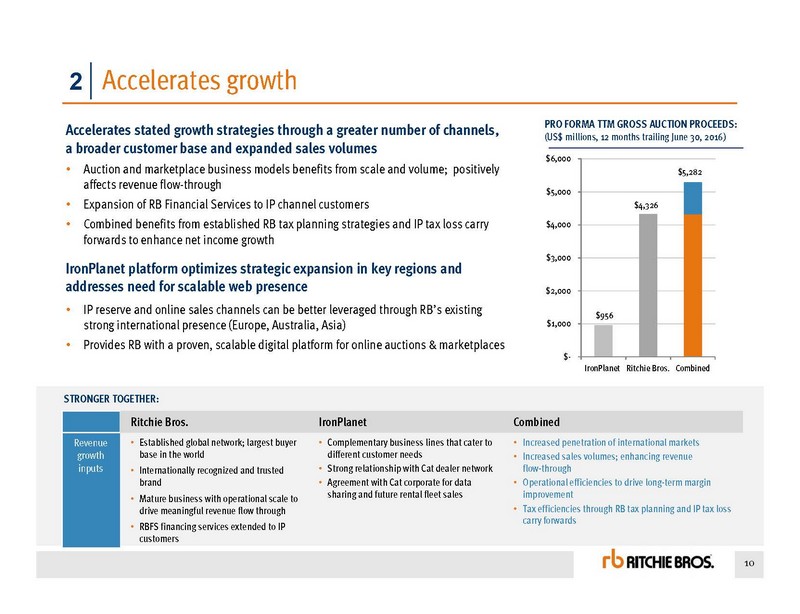

10 Accelerates growth Ritchie Bros. IronPlanet Combined Revenue growth inputs • Established global network; largest buyer base in the world • Internationally recognized and trusted brand • Mature business with operational scale to drive meaningful revenue flow through • RBFS financing services extended to IP customers • Complementary business lines that cater to different customer needs • Strong relationship with Cat dealer network • Agreement with Cat corporate for data sharing and future rental fleet sales • Increased penetration of international markets • Increased sales volumes; enhancing revenue flow - through • Operational efficiencies to drive long - term margin improvement • Tax efficiencies through RB tax planning and IP tax loss carry forwards 2 Accelerates stated growth strategies through a greater number of channels, a broader customer base and expanded sales volumes • Auction and marketplace business models benefits from scale and volume; volume; positively affects revenue flow - through • Expansion of RB Financial Services to IP channel customers • Combined benefits from established RB tax planning strategies and IP tax loss carry tax loss carry forwards to enhance net income growth IronPlanet platform optimizes strategic expansion in key regions and addresses need for scalable web presence • IP reserve and online sales channels can be better leveraged through RB’s existing RB’s existing strong international presence (Europe, Australia, Asia) • Provides RB with a proven, scalable digital platform for online auctions & & marketplaces STRONGER TOGETHER: PRO FORMA TTM GROSS AUCTION PROCEEDS: (US$ millions, 12 months trailing June 30, 2016) $956 $4,326 $5,282 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 IronPlanet Ritchie Bros. Combined

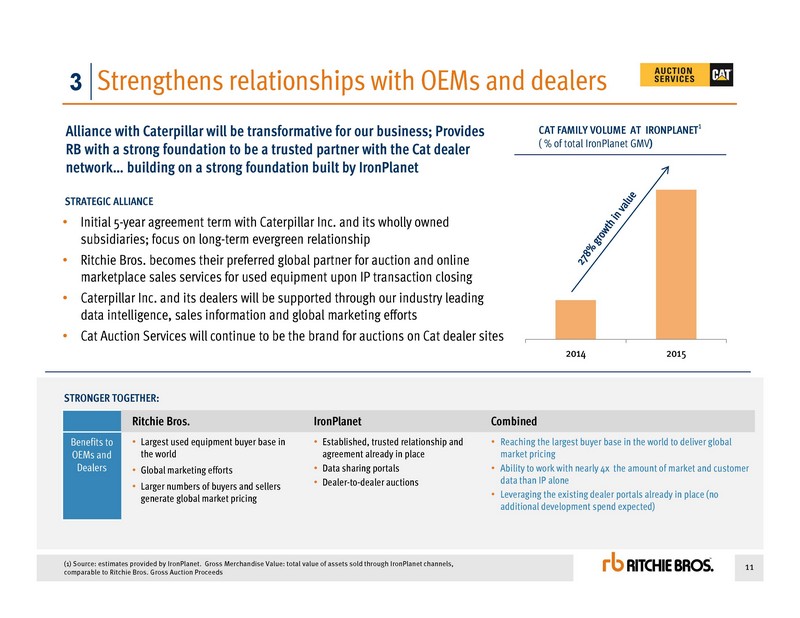

11 Strengthens relationships with OEMs and dealers Ritchie Bros. IronPlanet Combined Benefits to OEMs and Dealers • Largest used equipment buyer base in the world • Global marketing efforts • Larger numbers of buyers and sellers generate global market pricing • Established, trusted relationship and agreement already in place • Data sharing portals • Dealer - to - dealer auctions • Reaching the largest buyer base in the world to deliver global market pricing • Ability to work with nearly 4x the amount of market and customer data than IP alone • Leveraging the existing dealer portals already in place (no additional development spend expected) • More effectively meeting the needs of Caterpillar corporate • Builds enduring relationships with Cat dealers around the world 3 Alliance with Caterpillar will be transformative for our business; Provides RB with a strong foundation to be a trusted partner with the Cat dealer network… building on a strong foundation built by IronPlanet STRONGER TOGETHER: • Minimum 5 year commitment with Caterpillar Inc., Cat Finance and independent Cat dealers – focus is on a long - term, evergreen relationship relationship • Ritchie Bros. becomes their preferred global partner for auction and online online marketplace sales services for used equipment upon IP transaction transaction closing • Cat will be supported through our industry leading data intelligence, sales sales information and global marketing efforts • Cat Auction Services will continue to be the brand catering specifically to the specifically to the needs of independent Cat dealers holding auctions on dealer on dealer sites STRATEGIC ALLIANCE $41 $155 2014 2015 CAT (DEALER/CORPORATE) VOLUME AT IP (US$ millions, % of total IronPlanet GMV¹ ) 8 % 20% % of total GMV¹ grew 1200 bps, largely as a result of IronPlanet’s agreement with Caterpillar (1) Gross Merchandise Value: total value of assets sold through IronPlanet channels, comparable to Ritchie Bros. Gross Auction Proceeds

12 Source: Internal estimates; based on historical OEM unit sales, estimates of fleet turnover, and average selling prices at RB auctions. Allocation by geography based on sector GDP Builds on the power of our strong global p latform Ritchie Bros. IronPlanet Combined Leveraging our strong core capabilities • Global reach and scale • Strong, established global platform and bidder reach already generating results for customers • Proven marketing and operational prowess • Established brand (strong awareness in Canada ) • Strong end - user base • Solution selling focused on different customer needs • Nimble business and team adapts quickly to pursue market opportunities • Strong technology platform; customer friendly • Ability to appeal to a broader international customer base with IP online formats and solutions • Opportunities to leverage tech platforms across both companies • Opens new customers to RB channels (e.g. government) 4 RB’s global network can be leveraged to grow IP’s sales platforms/formats internationally Complementary corporate cultures and leadership teams will continue to drive innovation • RB’s experience, proven operational and marketing prowess and long - and long - established customer focus combine well with IP’s innovation innovation driven, fast - moving, tech - based culture to create a complementary team that can learn from each other Equally committed to delivering customer value • Different yet complementary core customer bases combine to create a create a more robust marketplace (RB: end users, IP: dealers/government/corporate accounts) • Only ~15% of RB GAP was generated from all OEM dealers in 2015 2015 STRONGER TOGETHER: RITCHIE BROS. GLOBAL NETWORK: Opportunities to increase penetration in certain countries where reserve auction or online options better suit customer preferences

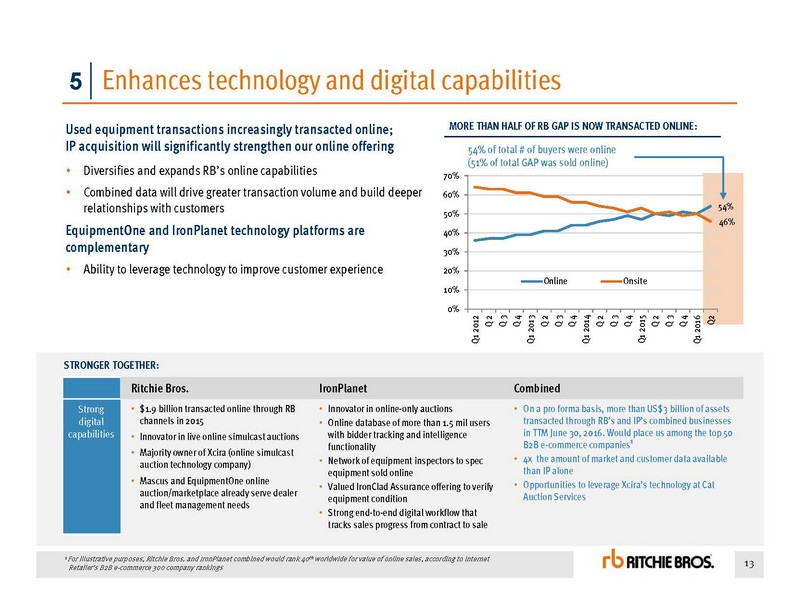

13 54% 46% 0% 10% 20% 30% 40% 50% 60% 70% Q1 2012 Q 2 Q 3 Q 4 Q1 2013 Q 2 Q 3 Q 4 Q1 2014 Q 2 Q 3 Q 4 Q1 2015 Q 2 Q 3 Q 4 Q1 2016 Q2 Online Onsite ¹ For illustrative purposes, Ritchie Bros. and IronPlanet combined would rank 40 th worldwide for value of online sales, according to Internet Retailer’s B2B e - commerce 300 company rankings Enhances technology and digital c apabilities Ritchie Bros. IronPlanet Combined Strong digital capabilities • $1.9 billion transacted online through RB channels in 2015 • Innovator in live online simulcast auctions • Majority owner of Xcira (online simulcast auction technology company) • Mascus and EquipmentOne online auction/marketplace already serve dealer and fleet management needs • Innovator in online - only auctions • Online database of more than 1.5 mil users with bidder tracking and intelligence functionality • Network of equipment inspectors to spec equipment sold online • Valued IronClad Assurance offering to verify equipment condition • Strong end - to - end digital workflow that tracks sales progress from contract to sale • On a pro forma basis, more than US$3 billion of assets transacted through RB’s and IP’s combined businesses in TTM June 30, 2016. Would place us among the top 50 B2B e - commerce companies¹ • 4x the amount of market and customer data available than IP alone • Opportunities to leverage Xcira’s technology at Cat Auction Services 5 Used equipment transactions increasingly transacted online; IP acquisition will significantly strengthen our online offering • Diversifies and expands RB’s online capabilities • Combined data will drive greater transaction volume and build deeper build deeper relationships with customers EquipmentOne and IronPlanet technology platforms are complementary • Ability to leverage technology to improve customer experience experience STRONGER TOGETHER: 54% of total # of buyers were online (51% of total GAP was sold online) MORE THAN HALF OF RB GAP IS NOW TRANSACTED ONLINE:

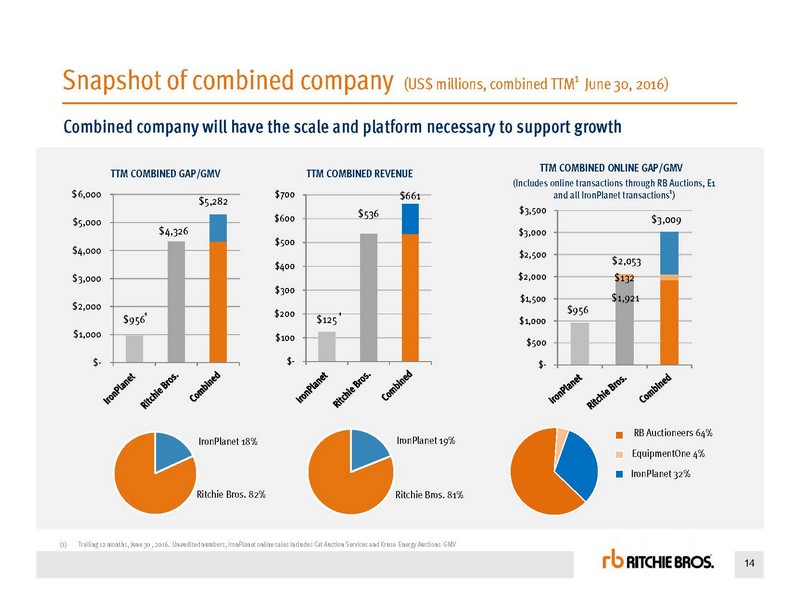

14 RB Auctions EquipmentOn e Snapshot of combined company (US$ millions, combined TTM¹ June 30, 2016) Combined company will have the scale and platform necessary to support growth T TM COMBINED GAP/GMV (Includes online transactions through RB Auctions, E1 and all IronPlanet transactions¹) T TM COMBINED REVENUE IronPlanet 18 % IronPlanet 19 % Ritchie Bros. 82% Ritchie Bros. 81% (1) Trailing 12 months, June 30 , 2016. Unaudited numbers, IronPlanet online sales includes Cat Auction Services and Kruse Energy Auctions GMV $956 $4,326 $5,282 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $125 $536 $661 $- $100 $200 $300 $400 $500 $600 $700 IronPlanet 32% EquipmentOne 4% RB Auctioneers 64% $956 $1,921 $3,009 $132 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $2,053 T TM COMBINED ONLINE GAP/ GMV ¹ ¹

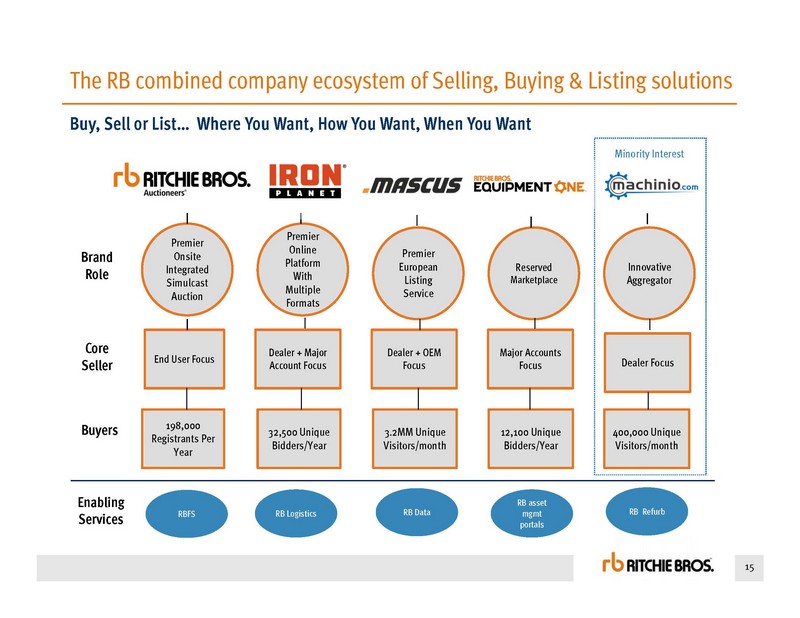

15 The RB combined company ecosystem of Selling, Buying & Listing solutions Buy, Sell or List… Where You Want, How You Want, When You Want Premier Onsite Integrated Simulcast Auction Premier Online Platform With Multiple Formats Premier European Listing Service Reserved Marketplace Innovative Aggregator End User Focus Dealer + Major Account Focus Dealer + OEM Focus Major Accounts Focus Dealer Focus 198,000 Registrants Per Year 32,500 Unique Bidders/Year 3.2MM Unique Visitors/month 12,100 Unique Bidders/Year 400,000 Unique Visitors/month Brand Role Core Seller Buyers RBFS RB Data RB asset mgmt portals Enabling Services Minority Interest RB Logistics RB Refurb

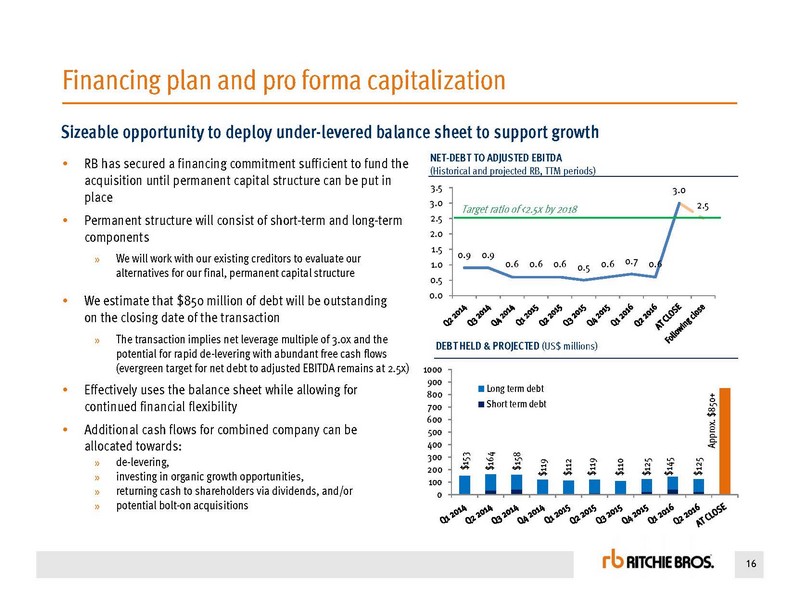

16 0.9 0.9 0.6 0.6 0.6 0.5 0.6 0.7 0.6 3.0 2.5 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 FINANCING PLAN AND PRO FORMA CAPITALIZATION Financing plan and pro forma capitalization • RB has secured a financing commitment sufficient to fund the acquisition until permanent capital structure can be put in place • Permanent structure will consist of short - term and long - term components » We will work with our existing creditors to evaluate our alternatives for our final, permanent capital structure • We estimate that $850 million of debt will be outstanding on the closing date of the transaction » The transaction implies net leverage multiple of 3.0x and the potential for rapid de - levering with abundant free cash flows (evergreen target for net debt to adjusted EBITDA remains at 2.5x) • Effectively uses the balance sheet while allowing for continued financial flexibility • Additional cash flows for combined company can be allocated towards: » de - levering , » investing in organic growth opportunities, » returning cash to shareholders via dividends, and/or » potential bolt - on acquisitions Sizeable opportunity to deploy under - levered balance sheet to support growth NET - DEBT TO ADJUSTED EBITDA (Historical and projected RB, TTM periods) Target ratio of <2.5x by 2018 $153 $164 $158 $119 $112 $119 $110 $125 $145 $125 Approx. $850+ 0 100 200 300 400 500 600 700 800 900 1000 Long term debt Short term debt DEBT HELD & PROJECTED (US $ millions )

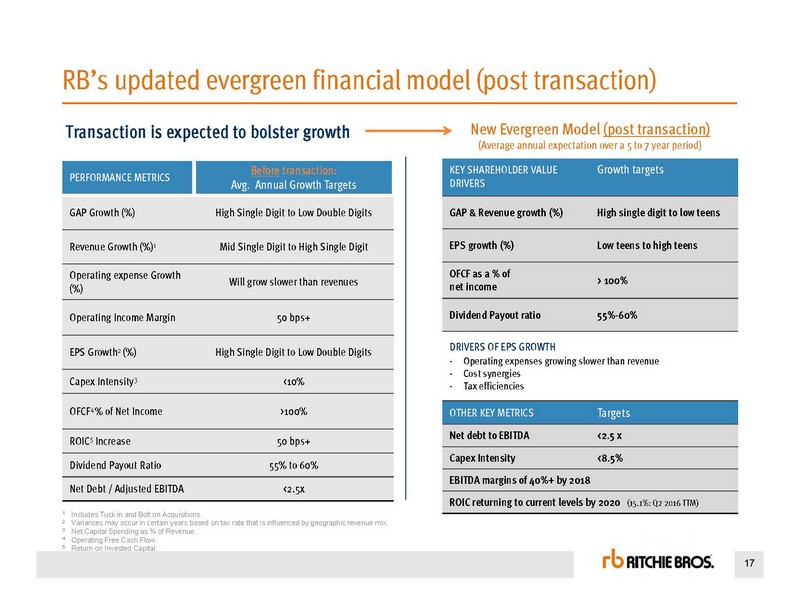

17 PERFORMANCE METRICS Before transaction: Avg . Annual Growth Targets GAP Growth (%) High Single Digit to Low Double Digits Revenue Growth (%) 1 Mid Single Digit to High Single Digit Operating expense Growth (%) Will grow slower than revenues Operating Income Margin 50 bps+ EPS Growth 2 (%) High Single Digit to Low Double Digits Capex Intensity 3 <10% OFCF 4 % of Net Income >100% ROIC 5 Increase 50 bps+ Dividend Payout Ratio 55% to 60% Net Debt / Adjusted EBITDA <2.5x 1 Includes Tuck in and Bolt on Acquisitions. 2 Variances may occur in certain years based on tax rate that is influenced by geographic revenue mix. 3 Net Capital Spending as % of Revenue. RB’s updated evergreen financial model (post transaction) 4 Operating Free Cash Flow. 5 Return on Invested Capital. Transaction is expected to bolster growth New Evergreen Model (post transaction) (Average annual expectation over a 5 to 7 year period) KEY SHAREHOLDER VALUE DRIVERS Growth targets GAP & Revenue growth (%) High single digit to low teens EPS growth (%) Low teens to high teens OFCF as a % of net income > 100% Dividend Payout ratio 55% - 60% DRIVERS OF EPS GROWTH - Operating expenses growing slower than revenue - Cost synergies - Tax efficiencies OTHER KEY METRICS Targets Net debt to EBITDA <2.5 x Capex Intensity <8.5% EBITDA margins of 40%+ by 2018 ROIC returning to current levels by 2020 (15.1%: Q2 2016 TTM)

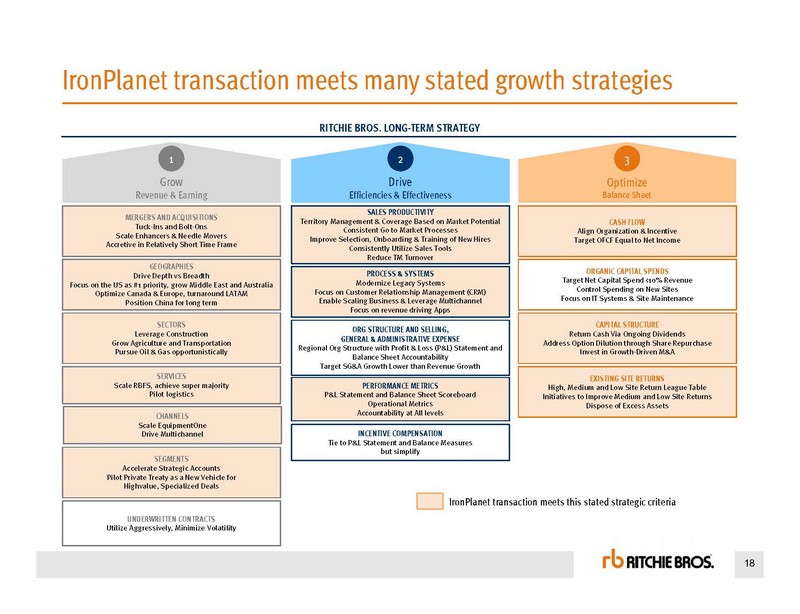

18 MERGERS AND ACQUISITIONS Tuck - Ins and Bolt - Ons Scale Enhancers & Needle Movers Accretive in Relatively Short Time Frame GEOGRAPHIES Drive Depth vs Breadth Focus on the US as #1 priority, grow Middle East and Australia Optimize Canada & Europe, turnaround LATAM Position China for long term SECTORS Leverage Construction Grow Agriculture and Transportation Pursue Oil & Gas opportunistically SERVICES Scale RBFS, achieve super majority Pilot logistics SEGMENTS Accelerate Strategic Accounts Pilot Private Treaty as a New Vehicle for Highvalue , Specialized Deals UNDERWRITTEN CONTRACTS Utilize Aggressively, Minimize Volatility SALES PRODUCTIVITY Territory Management & Coverage Based on Market Potential Consistent Go to Market Processes Improve Selection, Onboarding & Training of New Hires Consistently Utilize Sales Tools Reduce TM Turnover PROCESS & SYSTEMS Modernize Legacy Systems Focus on Customer Relationship Management (CRM) Enable Scaling Business & Leverage Multichannel Focus on revenue driving Apps ORG STRUCTURE AND SELLING, GENERAL & ADMINISTRATIVE EXPENSE Regional Org Structure with Profit & Loss (P&L) Statement and Balance Sheet Accountability Target SG&A Growth Lower than Revenue Growth PERFORMANCE METRICS P&L Statement and Balance Sheet Scoreboard Operational Metrics Accountability at All levels INCENTIVE COMPENSATION Tie to P&L Statement and Balance Measures but simplify CASH FLOW Align Organization & Incentive Target OFCF Equal to Net Income ORGANIC CAPITAL SPENDS Target Net Capital Spend <10% Revenue Control Spending on New Sites Focus on IT Systems & Site Maintenance CAPITAL STRUCTURE Return Cash Via Ongoing Dividends Address Option Dilution through Share Repurchase Invest in Growth - Driven M&A EXISTING SITE RETURNS High, Medium and Low Site Return League Table Initiatives to Improve Medium and Low Site Returns Dispose of Excess Assets Grow Revenue & Earning 1 Drive Efficiencies & Effectiveness 2 Optimize Balance Sheet 3 IronPlanet transaction meets many stated growth strategies IronPlanet transaction meets this stated strategic criteria CHANNELS Scale EquipmentOne Drive Multichannel RITCHIE BROS. LONG - TERM STRATEGY

Highly Confidential Draft As of 16 - Aug - 2016 Appendix Revenue by region Size of used equipment market Ritchie Bros. family of brand (post transaction)

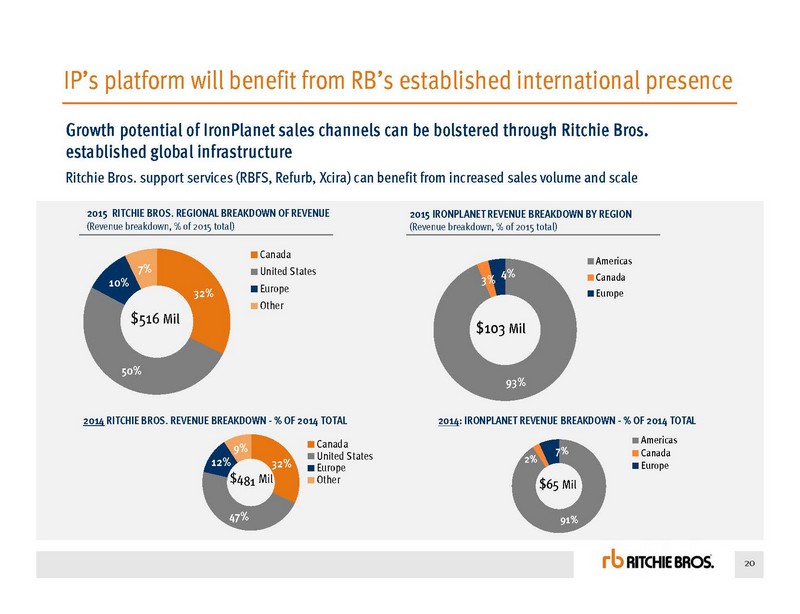

20 93% 3% 4% Americas Canada Europe IP’s platform will benefit from RB’s established international presence Growth potential of IronPlanet sales channels can be bolstered through Ritchie Bros. established global infrastructure Ritchie Bros. support services (RBFS, Refurb , Xcira ) can benefit from increased sales volume and scale 91% 2% 7% Americas Canada Europe 2014 : IRONPLANET REVENUE BREAKDOWN - % OF 2014 TOTAL 2015 IRONPLANET REVENUE BREAKDOWN BY REGION (Revenue breakdown, % of 2015 total) 32% 50% 10% 7% Canada United States Europe Other 32% 47% 12% 9% Canada United States Europe Other $4 81 Mil 2014 RITCHIE BROS. REVENUE BREAKDOWN - % OF 2014 TOTAL $516 Mil $103 Mil $65 Mil 2015 RITCHIE BROS. REGIONAL BREAKDOWN OF REVENUE (Revenue breakdown, % of 2015 total)

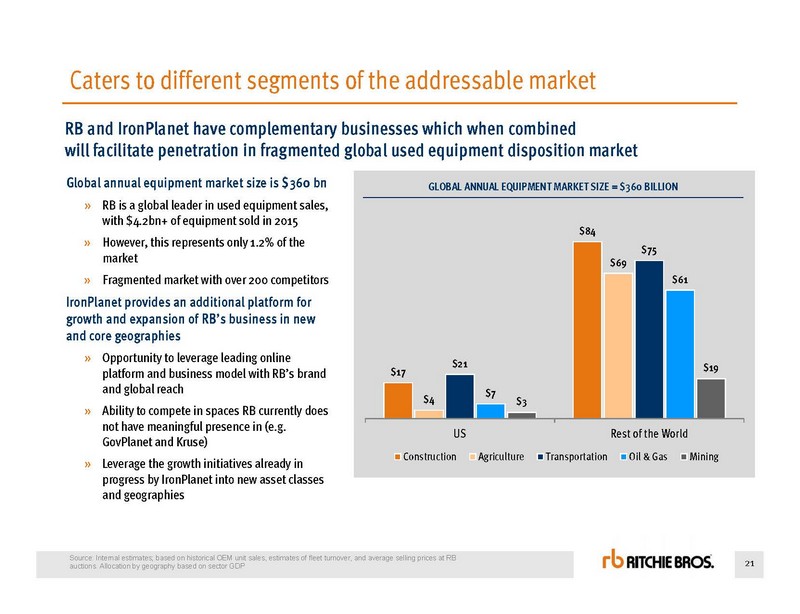

21 Caters to different segments of the addressable market RB and IronPlanet have complementary businesses which when combined will facilitate penetration in fragmented global used equipment disposition market Global annual equipment market size is $ 360 bn » RB is a global leader in used equipment sales, with $4.2bn+ of equipment sold in 2015 » However, this represents only 1.2% of the market » Fragmented market with over 200 competitors IronPlanet provides an additional platform for growth and expansion of RB’s business in new and core geographies » Opportunity to leverage leading online platform and business model with RB’s brand and global reach » Ability to compete in spaces RB currently does not have meaningful presence in (e.g. GovPlanet and Kruse) » Leverage the growth initiatives already in progress by IronPlanet into new asset classes and geographies GLOBAL ANNUAL EQUIPMENT MARKET SIZE = $ 360 BILLION $17 $84 $4 $69 $21 $75 $7 $61 $3 $19 US Rest of the World Construction Agriculture Transportation Oil & Gas Mining Source: Internal estimates; based on historical OEM unit sales, estimates of fleet turnover, and average selling prices at RB auctions. Allocation by geography based on sector GDP

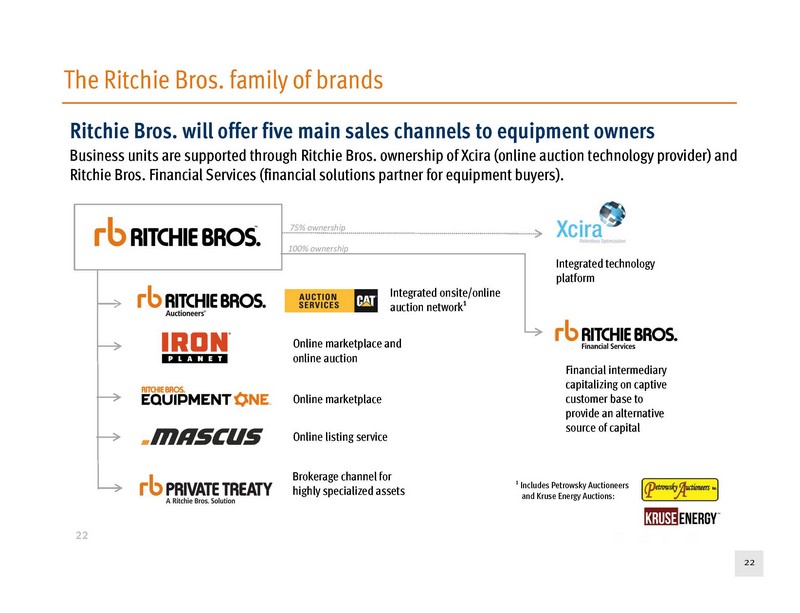

22 The Ritchie Bros. family of brands Ritchie Bros. will offer five main sales channels to equipment owners Business units are supported through Ritchie Bros. ownership of Xcira (online auction technology provider) and Ritchie Bros. Financial Services (financial solutions partner for equipment buyers). 22 75% ownership 100% ownership Integrated technology platform Financial intermediary capitalizing on captive customer base to provide an alternative source of capital Integrated onsite/online auction network¹ Online marketplace Online listing service Brokerage channel for highly specialized assets ¹ Includes Petrowsky Auctioneers and Kruse Energy Auctions: Online marketplace and online auction

Highly Confidential Draft As of 16 - Aug - 2016 Question & Answer session Available for questions on Investor Call: Ravi Saligram, CEO – Ritchie Bros. Sharon Driscoll, CFO – Ritchie Bros. Greg Owens, CEO – IronPlanet

Highly Confidential Draft As of 16 - Aug - 2016 Reconciliation of non - GAAP measures The following tables reconcile non - GAAP measures referred to in this presentation to the most directly comparable GAAP measure reflected in the Company’s financial statements

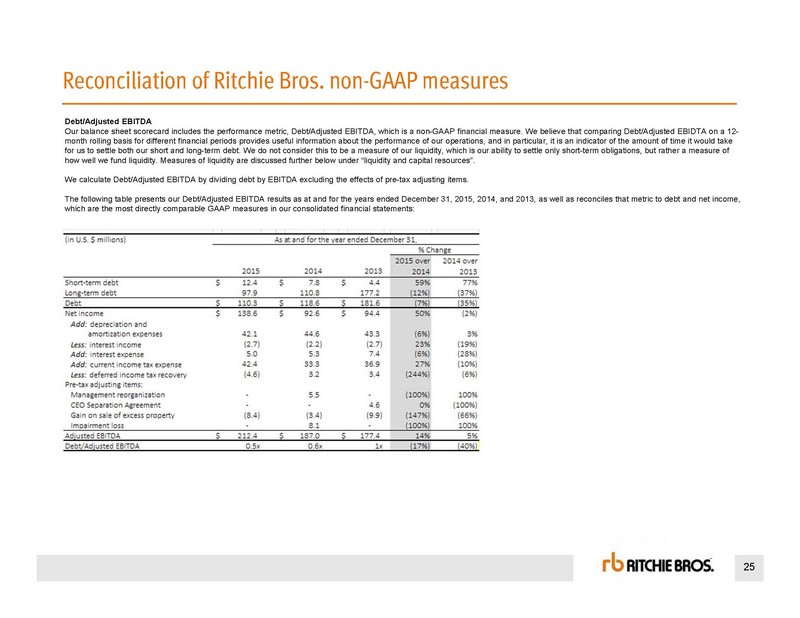

25 Reconciliation of Ritchie Bros. non - GAAP measures Debt/Adjusted EBITDA Our balance sheet scorecard includes the performance metric, Debt/Adjusted EBITDA, which is a non - GAAP financial measure. We bel ieve that comparing Debt/Adjusted EBIDTA on a 12 - month rolling basis for different financial periods provides useful information about the performance of our operations, and in particular, it is an indicator of the amount of time it would take for us to settle both our short and long - term debt. We do not consider this to be a measure of our liquidity, which is our abili ty to settle only short - term obligations, but rather a measure of how well we fund liquidity. Measures of liquidity are discussed further below under “liquidity and capital resources”. We calculate Debt/Adjusted EBITDA by dividing debt by EBITDA excluding the effects of pre - tax adjusting items. The following table presents our Debt/Adjusted EBITDA results as at and for the years ended December 31, 2015, 2014, and 2013 , a s well as reconciles that metric to debt and net income, which are the most directly comparable GAAP measures in our consolidated financial statements:

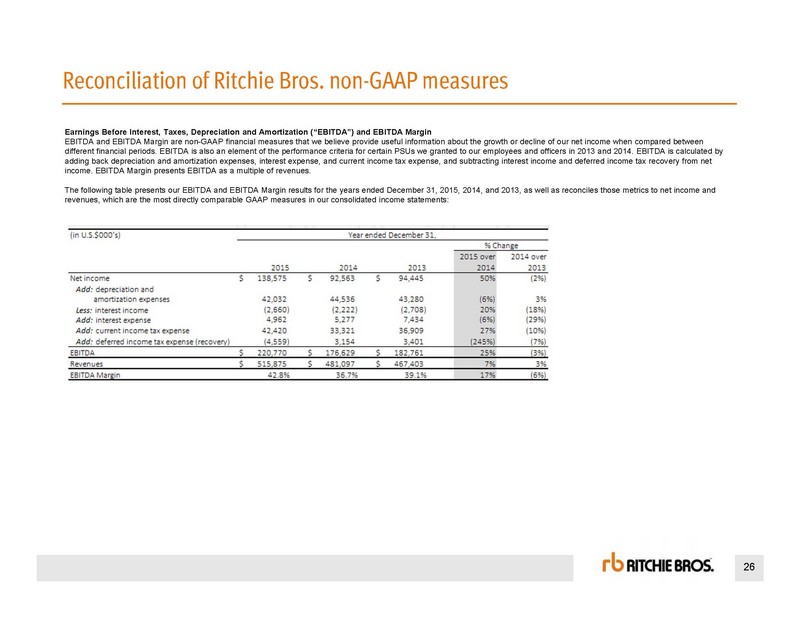

26 Reconciliation of Ritchie Bros. non - GAAP measures Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and EBITDA Margin EBITDA and EBITDA Margin are non - GAAP financial measures that we believe provide useful information about the growth or decline of our net income when compared between different financial periods. EBITDA is also an element of the performance criteria for certain PSUs we granted to our employe es and officers in 2013 and 2014. EBITDA is calculated by adding back depreciation and amortization expenses, interest expense, and current income tax expense, and subtracting interes t i ncome and deferred income tax recovery from net income. EBITDA Margin presents EBITDA as a multiple of revenues. The following table presents our EBITDA and EBITDA Margin results for the years ended December 31, 2015, 2014, and 2013, as w ell as reconciles those metrics to net income and revenues, which are the most directly comparable GAAP measures in our consolidated income statements :