Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PREMIER FINANCIAL CORP | v447510_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - PREMIER FINANCIAL CORP | v447510_ex2-1.htm |

| 8-K - 8-K - PREMIER FINANCIAL CORP | v447510_8k.htm |

Exhibit 99.2

Merger Announcement Commercial Bancshares, Inc . August 23, 2016 Filed by First Defiance Financial Corp. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 under the Securities Exchange Act of 1934 Subject Company: Commercial Bancshares, Inc. Commission File No. 000 - 27894

2 Important Legal Considerations • This communication contains forward - looking statements with respect to the proposed merger between First Defiance Financial Corp. (“First Defiance”) and Commercial Bancshares, Inc. (“Commercial”) and the timing of consummation of the merger that are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates”, “projects”, “intends”, “estimates”, “expects”, “believes”, “plans”, “may”, “will”, “should”, “could” and other similar expressions are intended to identify such forward - looking statements. These forward - looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. Actual results could differ materially from such forward - looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward - looking statements: (1) the business of First Defiance and Commercial may not be combined successfully, or such combination may take longer, be more difficult, time - consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) the regulatory approvals required for the merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the shareholders of Commercial may fail to approve the merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which First Defiance and Commercial are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; and (9) competition from other financial services companies in First Defiance’s and Commercial’s markets could adversely affect operations. First Defiance and Commercial caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward - looking statements concerning the proposed transaction or other matters attributable to First Defiance or Commercial or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. First Defiance and Commercial do not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statements are made.

3 • Extends franchise in northwestern and north central Ohio • Both banks have similar strategy with an emphasis on commercial banking • Enhances core deposit composition • Ability to expand Commercial’s current relationships with increased legal lending limit and more comprehensive services High Level of Strategic Fit • Accretive to first full year core earnings per share • Tangible book value dilution earn back period of ~2 years • High teens to low twenties internal rate of return • Pro forma capital ratios above “well - capitalized” guidelines Attractive Financial Returns • Grows balance sheet with high - quality loans and core deposits • Conservative credit and risk culture is consistent with First Defiance • Non complex business lines that are easily integrated Low Risk Profile Transaction Rationale

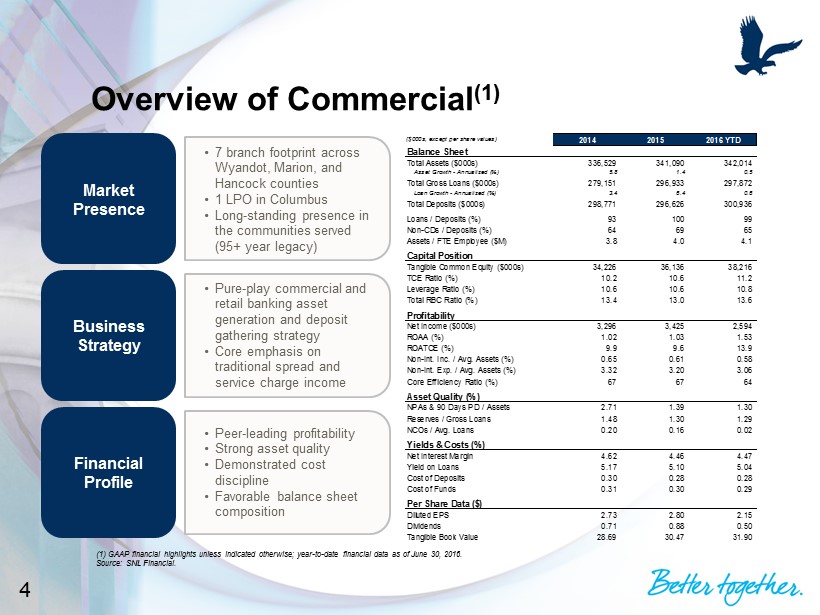

4 ($000s, except per share values) 2014 2015 2016 YTD Balance Sheet Total Assets ($000s) 336,529 341,090 342,014 Asset Growth - Annualized (%) 5.8 1.4 0.5 Total Gross Loans ($000s) 279,151 296,933 297,872 Loan Growth - Annualized (%) 3.4 6.4 0.6 Total Deposits ($000s) 298,771 296,626 300,936 Loans / Deposits (%) 93 100 99 Non-CDs / Deposits (%) 64 69 65 Assets / FTE Employee ($M) 3.8 4.0 4.1 Capital Position Tangible Common Equity ($000s) 34,226 36,136 38,216 TCE Ratio (%) 10.2 10.6 11.2 Leverage Ratio (%) 10.6 10.6 10.8 Total RBC Ratio (%) 13.4 13.0 13.6 Profitability Net Income ($000s) 3,296 3,425 2,594 ROAA (%) 1.02 1.03 1.53 ROATCE (%) 9.9 9.6 13.9 Non-Int. Inc. / Avg. Assets (%) 0.65 0.61 0.58 Non-Int. Exp. / Avg. Assets (%) 3.32 3.20 3.06 Core Efficiency Ratio (%) 67 67 64 Asset Quality (%) NPAs & 90 Days PD / Assets 2.71 1.39 1.30 Reserves / Gross Loans 1.48 1.30 1.29 NCOs / Avg. Loans 0.20 0.16 0.02 Yields & Costs (%) Net Interest Margin 4.62 4.46 4.47 Yield on Loans 5.17 5.10 5.04 Cost of Deposits 0.30 0.28 0.28 Cost of Funds 0.31 0.30 0.29 Per Share Data ($) Diluted EPS 2.73 2.80 2.15 Dividends 0.71 0.88 0.50 Tangible Book Value 28.69 30.47 31.90 (1) GAAP financial highlights unless indicated otherwise; year - to - date financial data as of June 30 , 2016. Source : SNL Financial. Market Presence Business Strategy • 7 branch footprint across Wyandot, Marion, and Hancock counties • 1 LPO in Columbus • Long - standing presence in the communities served (95+ year legacy) • Pure - play commercial and retail banking asset generation and deposit gathering strategy • Core emphasis on traditional spread and service charge income Financial Profile • Peer - leading profitability • Strong asset quality • Demonstrated cost discipline • Favorable balance sheet composition Overview of Commercial (1)

5 Market Strengths Depth of Management and In - Market Relationships Enhanced Pro Forma Growth and Profitability • #1 or #2 community bank in two strategically valuable adjacent markets • #2 pro forma market share in Hancock county • LPO in Columbus • Potential opportunities for branch efficiencies • Meaningful, immediate accretion to EPS, ROAA, and ROATCE • Brings a 95+ year legacy of serving these markets • Quality relationships support a strong core deposit franchise and low cost of funds Financial and Business Merits • Immediately accretive to core EPS • IRR well in excess of the pro forma cost of capital • Accretive to both the earning asset and funding mix Columbus FDEF Banking Office (34) CMOH Banking Offices ( 7 ) CMOH LPO (1) CMOH Operations Center (1) Fort Wayne Toledo Findlay Lima Defiance Marion Upper Sandusky Bowling Green Opportunities for FDEF

6 Total 1 - 4 Family 409,740 19% Total CRE 767,556 35% Multi - family 209,442 10% C&D 154,341 7% C&I 408,856 19% Agricultural 53,346 2% Consumer 27,221 1% All Other 141,915 7% Non - Interest 510,086 23% Int - DDA, MM, Savings 1,191,302 53% CDs < $100K 324,614 15% CDs > $100K 211,123 9% Non - Interest 51,909 17% Int - DDA, MM, Savings 145,437 48% CDs < $100K 52,093 18% CDs > $100K 52,050 17% Total 1 - 4 Family 336,208 18% Total CRE 659,436 35% Multi - family 192,749 10% C&D 139,945 8% C&I 382,248 20% Agricultural 42,579 2% Consumer 15,065 1% All Other 106,315 6% Non - Interest 458,177 24% Int - DDA, MM, Savings 1,045,865 54% CDs < $100K 272,521 14% CDs > $100K 159,073 8% First Defiance Financial Corp. Commercial Bancshares, Inc. Pro Forma First Defiance Financial Corp. Commercial Bancshares, Inc. Pro Forma Loan Composition ($000s) Total Deposits: $1,935,636 Total Deposits: $301,489 Total Deposits: $2,237,125 Total Loans & Leases: $1,874,545 Total Loans & Leases: $297,872 Total Loans & Leases: $2,172,417 Deposit Composition ($000s) Note: Values shown as provided in each respective company’s Q2 2016 bank call reports; pro forma values shown as the sum of t he two companies’ respective stand - alone values and do not include any merger adjustments. Source : SNL Financial. Pro Forma Loan and Deposit Composition Total 1 - 4 Family 73,532 25% Total CRE 108,120 36% Multi - family 16,693 5% C&D 14,396 5% C&I 26,608 9% Agricultural 10,767 4% Consumer 12,156 4% All Other 35,600 12%

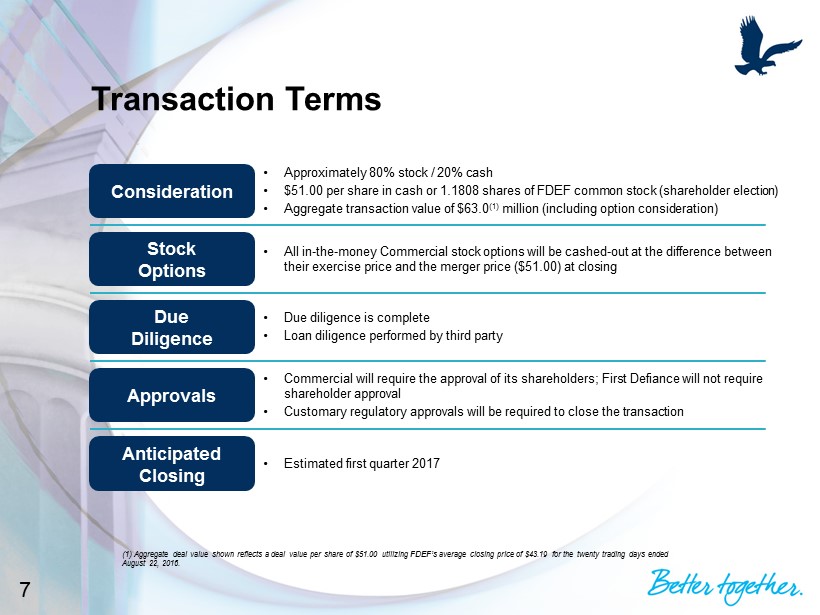

7 • Approximately 80% stock / 20% cash • $51.00 per share in cash or 1.1808 shares of FDEF common stock (shareholder election) • Aggregate transaction value of $ 63.0 (1) million (including option consideration) Consideration Stock Options Due Diligence Approvals Anticipated Closing • All in - the - money Commercial stock options will be cashed - out at the difference between their exercise price and the merger price ($51.00) at closing • Due diligence is complete • Loan diligence performed by third party • Commercial will require the approval of its shareholders; First Defiance will not require shareholder approval • Customary regulatory approvals will be required to close the transaction • Estimated first quarter 2017 Transaction Terms (1) Aggregate deal value shown reflects a deal value per share of $51.00 utilizing FDEF’s average closing price of $43.19 for the tw enty trading days ended August 22, 2016.

8 • Assumptions based on meaningful due diligence • Estimated cost saves of 40 %, phased in 75% in 2017 and 100% thereafter • Assumed a 2.00% gross credit mark offset by a positive loan interest rate mark Assumptions Pricing Multiples (1) Pro Forma Impact • Purchase Price / Tang. Book Value: 160% (2) • Purchase Price / LTM Earnings: 14.0x (2) • Tangible Book Premium / Core Deposits: 10.0% • Accretive to first full - year core earnings per share (mid - single digit EPS accretion estimated) • Tangible book value dilution earn back period of ~2 years • High teens to low twenties internal rate of return • Pro forma capital ratios above “well - capitalized” guidelines Transaction Overview (1) All pricing multiples reflect GAAP financial statements as of or for the twelve months ended June 30, 2016 and are based on a deal value per share of $51.00 utilizing FDEF’s average closing price of $43.19 for the twenty trading days ended August 22, 2016. (2 ) Shown on a per share basis. Source : SNL Financial.

9 Important Information for Investors and Shareholders This document does not constitute an offer to sell or the solicitation of an offer to buy securities of First Defiance. First Defiance will file a registration statement on Form S - 4 and other documents regarding the proposed transaction referenced in this news release with the Securities and Exchange Commission (“SEC”) to register the shares of First Defiance's common stock to be issued to the shareholders of Commercial. The registration statement will include a proxy statement/prospectus, which will be sent to the shareholders of Commercial in advance of its special meeting of shareholders to be held to consider the proposed merger. Investors and security holders are urged to read the proxy statement/prospectus and any other relevant documents to be filed with the SEC in connection with the proposed transaction because they contain important information about First Defiance, Commercial and the proposed transaction. Investors and security holders may obtain a free copy of these documents (when available) through the website maintained by the SEC at www.sec.gov. These documents may also be obtained, without charge, by directing a request to First Defiance Financial Corp., 601 Clinton Street, Defiance, Ohio 43512, Attn.: Investor Relations, or by accessing First Defiance’s Internet site(http://www.fdef.com/docs). First Defiance and Commercial and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Commercial in connection with the proposed merger. Information about the directors and executive officers of First Defiance is set forth in the proxy statement for First Defiance's 2016 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 10, 2016. Information about the directors and executive officers of Commercial is set forth in the proxy statement for Commercial’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 7, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Additional Information

10 Donald P. Hileman , President and CEO (419) 785 - 2210 dhileman@first - fed.com Kevin T. Thompson , Executive Vice President and CFO (419) 783 - 1098 kthompson@first - fed.com Contact Information