Attached files

| file | filename |

|---|---|

| EX-32.1 - RULE 13A-14(B) CERTIFICATION - WINHA INTERNATIONAL GROUP LTD | exh32_1.htm |

| EX-31.1 - RULE 13A-14(A) CERTIFICATION - CEO AND CFO - WINHA INTERNATIONAL GROUP LTD | exh31_1.htm |

U. S. Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

|

|

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the quarterly period ended June 30, 2016

|

|

|

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____ to _____

Commission File No. 333-191063

|

WINHA INTERNATIONAL GROUP LIMITED

(Name of Registrant in its Charter)

|

|

|

Nevada

|

47-2450462

|

|

(State of Other Jurisdiction of incorporation or organization)

|

(I.R.S. Employer I.D. No.)

|

|

|

|

|

3rd Floor, No. 19 Changyi Road, Changmingshui Village

Wuguishan Town, Zhongshan City, P.R. China 528458

|

|

|

(Address of Principal Executive Offices)

|

|

Issuer's Telephone Number: 86-760-8896-3655

|

Yile Center, 5 Xinzhong Avenue, Suite 918

Shiqi District, Zhongshan, P.R. China 528400

|

|

(Former Address, if Changed Since Last Report)

|

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer☐ Smaller reporting company ☒

APPLICABLE ONLY TO CORPORATE ISSUERS: Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of the latest practicable date:

August 19, 2016

Common Voting Stock: 49,989,500

WINHA INTERNATIONAL GROUP LIMITED

QUARTERLY REPORT ON FORM 10-Q

FOR THE FISCAL QUARTER ENDED JUNE 30, 2016

TABLE OF CONTENTS

|

|

Page No

|

|

|

Part I

|

Financial Information

|

|

|

Item 1.

|

Financial Statements (unaudited):

|

|

|

Consolidated Balance Sheets (Unaudited) – June 30, 2016 and March 31, 2016

|

1

|

|

|

Consolidated Statements of Income and Other Comprehensive Income (Unaudited) - for the Three Months Ended June 30, 2016 and 2015

|

3

|

|

|

Consolidated Statement of Changes in Stockholders Equity (Unaudited) for the Three Months Ended June 30, 2016

|

5

|

|

|

Consolidated Statements of Cash Flows (Unaudited) – for the Three Months Ended June 30, 2016 and 2015

|

6

|

|

|

Notes to Consolidated Financial Statements (Unaudited)

|

8

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

31

|

|

Item 3

|

Quantitative and Qualitative Disclosures about Market Risk

|

36

|

|

Item 4.

|

Controls and Procedures

|

36

|

|

Part II

|

Other Information

|

|

|

Item 1.

|

Legal Proceedings

|

37

|

|

Items 1A.

|

Risk Factors

|

37

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

37

|

|

Item 3.

|

Defaults upon Senior Securities

|

38

|

|

Item 4.

|

Mine Safety Disclosures

|

38

|

|

Item 5.

|

Other Information

|

38

|

|

Item 6.

|

Exhibits

|

38

|

|

Signatures

|

38

|

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (IN U.S. $)

|

ASSETS

|

June 30,

2016

|

March 31,

2016

|

||||||

|

(Unaudited)

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

26,524,122

|

$

|

21,548,630

|

||||

|

Accounts receivable

|

1,515,323

|

1,417,860

|

||||||

|

Inventory

|

1,195,161

|

1,523,959

|

||||||

|

Advances to suppliers

|

88,592

|

151,230

|

||||||

|

Prepaid expenses

|

109,688

|

174,010

|

||||||

|

Deferred tax assets

|

7,069

|

32,810

|

||||||

|

Total current assets

|

29,439,955

|

24,848,499

|

||||||

|

Property, plant and equipment, net

|

1,691,974

|

1,847,977

|

||||||

|

Website - net

|

43,338

|

45,676

|

||||||

|

Deferred registration cost

|

235,705

|

212,312

|

||||||

|

TOTAL ASSETS

|

$

|

31,410,972

|

$

|

26,954,464

|

||||

See accompanying notes to the consolidated financial statements.

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (IN U.S. $) (CONTINUED)

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

June 30,

2016

|

March 31,

2016

|

||||||

|

(Unaudited)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

203,069

|

$

|

208,866

|

||||

|

Convertible debt

|

5,276,350

|

5,435,466

|

||||||

|

Advances from customers

|

1,254,490

|

769,814

|

||||||

|

Taxes payable

|

1,757,543

|

1,683,909

|

||||||

|

Accrued expenses

|

256,557

|

246,387

|

||||||

|

Loan from stockholder

|

580,581

|

477,199

|

||||||

|

Total current liabilities

|

9,328,590

|

8,821,641

|

||||||

|

Stockholders' equity:

|

||||||||

|

Common stock, $0.001 par value per share, 200,000,000 shares authorized; 49,989,500 shares issued and outstanding as of June 30, 2016 and March 31, 2016

|

49,990

|

49,990

|

||||||

|

Additional paid-in capital

|

21,626,775

|

21,626,775

|

||||||

|

Statutory reserve

|

773,881

|

497,443

|

||||||

|

Retained earnings (deficit)

|

(8,447,536

|

)

|

(11,096,421

|

)

|

||||

|

Other comprehensive (loss)

|

(786,171

|

)

|

(230,584

|

)

|

||||

|

Sub-total

|

13,216,939

|

10,847,203

|

||||||

|

Noncontrolling interests

|

8,865,443

|

7,285,620

|

||||||

|

Total stockholders' equity

|

22,082,382

|

18,132,823

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

31,410,972

|

$

|

26,954,464

|

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

|

Three Months Ended

June 30,

|

||||||||

|

2016

|

2015

|

|||||||

|

Revenues

|

$

|

13,917,834

|

$

|

5,640,893

|

||||

|

Cost of goods sold

|

6,422,736

|

3,012,853

|

||||||

|

Gross profit

|

7,495,098

|

2,628,040

|

||||||

|

Operating expenses:

|

||||||||

|

Selling and marketing

|

560,612

|

199,708

|

||||||

|

General and administrative

|

531,886

|

358,788

|

||||||

|

Total operating expenses

|

1,092,498

|

558,496

|

||||||

|

Income from operations

|

6,402,600

|

2,069,544

|

||||||

|

Other income (expense):

|

||||||||

|

Other income

|

4,082

|

1,414

|

||||||

|

Total other income (expenses)

|

4,082

|

1,414

|

||||||

|

Income before provision for income taxes

|

6,406,682

|

2,070,958

|

||||||

|

Provision for income taxes

|

1,531,143

|

555,537

|

||||||

|

Net income before noncontrolling interests

|

4,875,539

|

1,515,421

|

||||||

|

Noncontrolling interests

|

1,950,216

|

-

|

||||||

|

Net income attributable to common stockholders

|

$

|

2,925,323

|

$

|

1,515,421

|

||||

|

Income earnings per common share, basic and diluted

|

$

|

0.06

|

$

|

0.03

|

||||

|

Weighted average shares outstanding, basic and diluted

|

49,989,500

|

49,989,500

|

||||||

See accompanying notes to the consolidated financial statements.

3

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED) (CONTINUED)

|

Three Months Ended

June 30,

|

||||||||

|

|

2016

|

2015

|

||||||

|

Comprehensive income:

|

||||||||

|

Net income

|

$

|

4,875,539

|

$

|

1,515,421

|

||||

|

Foreign currency translation adjustment

|

(925,980

|

)

|

100,082

|

|||||

|

Comprehensive income

|

3,949,559

|

1,615,503

|

||||||

|

Comprehensive income attributable to noncontrolling interests

|

1,579,823

|

-

|

||||||

|

Comprehensive income attributable to common stockholders

|

$

|

2,369,736

|

$

|

1,615,503

|

||||

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (IN U.S. $)

|

Common

Stock

|

Additional

Paid-in

Capital

|

Retained

Earnings

(Deficit)

|

Other

Comprehensive Income

|

Statutory

Reserve Fund

|

Non-

controlling

Interests

|

Total

|

||||||||||||||||||||||

|

Balance, March 31, 2016

|

$

|

49,990

|

$

|

21,626,775

|

$

|

(11,096,421

|

)

|

$

|

(230,584

|

)

|

$

|

497,443

|

$

|

7,285,620

|

$

|

18,132,823

|

||||||||||||

|

Net (loss) income

|

-

|

-

|

2,925,323

|

-

|

-

|

1,950,216

|

4,875,539

|

|||||||||||||||||||||

|

Appropriation of statutory reserve

|

-

|

-

|

(276,438

|

)

|

-

|

276,438

|

-

|

-

|

||||||||||||||||||||

|

Other comprehensive (loss)

|

-

|

-

|

-

|

(555,587

|

)

|

-

|

(370,393

|

)

|

(925,980

|

)

|

||||||||||||||||||

|

Balance, June 30, 2016

|

$

|

49,990

|

$

|

21,626,775

|

$

|

(8,447,536

|

)

|

$

|

(786,171

|

)

|

$

|

773,881

|

$

|

8,865,443

|

$

|

22,082,382

|

||||||||||||

See accompanying notes to the consolidated financial statements

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

|

Three Months Ended

June 30,

|

||||||||

|

2016

|

2015

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

4,875,539

|

$

|

1,515,421

|

||||

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities:

|

||||||||

|

Depreciation and amortization

|

106,941

|

35,298

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

(Increase) in accounts receivable

|

(97,463

|

)

|

(301,773

|

)

|

||||

|

Decrease in inventory

|

328,798

|

280,303

|

||||||

|

Decrease (increase) in advances to suppliers

|

62,638

|

(171,490

|

)

|

|||||

|

Decrease in prepaid expenses

|

64,322

|

54,634

|

||||||

|

Decrease in deferred tax assets

|

25,741

|

-

|

||||||

|

(Decrease) increase in accounts payable

|

(5,798

|

)

|

182,239

|

|||||

|

Increase (decrease) in advances from customers

|

484,676

|

(577,604

|

)

|

|||||

|

Increase in taxes payable

|

73,634

|

202,335

|

||||||

|

Increase in accrued expenses

|

10,171

|

23,335

|

||||||

|

Net cash provided by operating activities

|

5,929,199

|

1,242,698

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Payments for website expansion

|

-

|

(13,082

|

)

|

|||||

|

Purchase of fixed assets

|

(2,265

|

)

|

(304,650

|

)

|

||||

|

Net cash (used in) investing activities

|

(2,265

|

)

|

(317,732

|

)

|

||||

See accompanying notes to the consolidated financial statements.

6

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED) (CONTINUED)

|

Three Months Ended

June 30,

|

||||||||

|

2016

|

2015

|

|||||||

|

Cash flows from financing activities:

|

||||||||

|

Additional capital contribution

|

-

|

489,601

|

||||||

|

Proceeds from stockholder loan-net

|

103,382

|

(7,167

|

)

|

|||||

|

Deferred registration costs

|

(23,393

|

)

|

-

|

|||||

|

Net cash provided by financing activities

|

79,989

|

482,434

|

||||||

|

Effect of exchange rate changes on cash

|

(1,031,431

|

)

|

99,758

|

|||||

|

Net change in cash

|

4,975,492

|

1,507,158

|

||||||

|

Cash, beginning of period

|

21,548,630

|

1,103,726

|

||||||

|

Cash, end of period

|

$

|

26,524,122

|

$

|

2,610,884

|

||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid for:

|

||||||||

|

Interest

|

$

|

-

|

$

|

-

|

||||

|

Income taxes

|

$

|

1,461,930

|

$

|

354,885

|

||||

|

Noncash financing activities:

|

||||||||

|

Payment of accrued expenses and other payables by shareholder in the form of a loan

|

$

|

54,388

|

$

|

19,919

|

||||

See accompanying notes to the consolidated financial statements.

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

1. ORGANIZATION AND BUSINESS

Winha International Group Limited ("Winha International") was incorporated in Nevada on April 15, 2013. The subsidiaries of the Company and their principal activities are described as follows:

Winha International and its subsidiaries are collectively referred to as the "Company". The Company retails local specialty products from different regions across China through its seven self-operated physical stores. The stores are supplemented by two restaurants, the first of which the Company opened in April 2015. In addition, the Company has granted 26 franchises to use the Company's tradename, store dress, and other resources. The Company plans to open additional stores and restaurants and add additional franchisees during fiscal 2017. The Company also plans to develop its website and mobile store, as it expands its sales platform. The Company's business model utilizes a multi-channel shopping platform to sell locally-produced food, beverages, and arts and crafts that are well-known across China. Through this comprehensive shopping platform, the Company will provide customers with access to a variety of local products that can typically only be found in local stores or markets in specific regions of China.

Until November 27, 2015, the Company operated its business through a variable interest entity, Zhongshan Winha Electronic Commerce Company Limited ("Zhongshan Winha"), which has two wholly owned limited liability subsidiaries, Zhongshan Supermarket Limited ("Zhongshan Supermarket") and Zhongshan Winha Catering Management Co., Ltd. ("Winha Catering"), as well as three incorporated branches. The Company had the controlling interest in Zhongshan Winha via its wholly owned subsidiary Shenzhen Winha Information Technologies Company Ltd. ("Shenzhen Winha") through a series of contractual arrangements. On November 27, 2015, the shareholders of Zhongshan Winha transferred their stock to Shenzhen Winha upon the exercise of its option to purchase all of the registered equity. The purchase price was $0.16. Zhongshan Winha, therefore, is now a wholly owned subsidiary of Shenzhen Winha.

In May 2015, C&V International Company Limited ("C&V"), a wholly owned subsidiary of Winha International, set up a wholly owned subsidiary, Australia Winha Commerce and Trade Limited ("Australian Winha"). In February 2016, Sanmei International Investment Co., Ltd ("Sanmei Investment"), a company incorporated in Anguilla on April 23, 2013, transferred 100% of its shares to Winha International. Subsequently, Winha International transferred the shares of C&V to Sanmei Investment, and C&V transferred the shares of Australian Winha to Sanmei Investment.

8

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

1. ORGANIZATION AND BUSINESS (CONTINUED)

In March 2016, 40% of the 72,000,000 shares of Australian Winha were transferred from the sole shareholder of Sanmei Investment to the following individuals and entities, which have direct or indirect relationships with the major shareholder and consultants of the Company: 5% to Beijing Ruihua Future, 5% to Donghe Group, 7% to Zhuowei Zhong, 5% to Xinxi Zhong, 4% to Zhifei Huang and 3% to Chun Yan Winne Lam. Immediately after the transfer, 20,880,000 bonus shares were issued at no consideration for every existing share held as follows:

|

Percentage

of

Shares

|

Bonus

shares

issued

|

|||||||

|

Zhuowei Zhong

|

7

|

%

|

5,040,000

|

|||||

|

Beijing Ruihua Future Investment Management Co. Ltd.

|

5

|

%

|

3,600,000

|

|||||

|

Donghe Group Limited

|

5

|

%

|

3,600,000

|

|||||

|

Xinxi Zhong.

|

5

|

%

|

3,600,000

|

|||||

|

Zhifei Huang

|

4

|

%

|

2,880,000

|

|||||

|

Chun Yan Winne Lam

|

3

|

%

|

2,160,000

|

|||||

|

Total

|

29

|

%

|

20,880,000

|

|||||

9

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

1. ORGANIZATION AND BUSINESS (CONTINUED)

In addition, 11 individuals, suppliers of Zhongshan Winha, were each sold 1% of Australian Winha shares for $0.0001 per share as follows:

|

Shares Sold

|

||||

|

Huizhen Li

|

720,000

|

|||

|

Jianxin Cen

|

720,000

|

|||

|

Zongxun Zhang

|

720,000

|

|||

|

Xinxi Zhong.

|

720,000

|

|||

|

Yixiang Qu

|

720,000

|

|||

|

Qianxin Chen

|

720,000

|

|||

|

Senhong He

|

720,000

|

|||

|

Zidong Chen

|

720,000

|

|||

|

Haolin Zhou

|

720,000

|

|||

|

Weicheng Zheng

|

720,000

|

|||

|

Ruicheng Li

|

720,000

|

|||

|

Total

|

7,920,000

|

|||

The effect of this transaction was to reduce the interest of the Company in its Australian subsidiary by 40%. The Company used the Australian Winha offering price for its initial public offering in Australia to approximate the fair value of the 40% stock issued. The Company recognized stock compensation to the shareholder and consultants of $19,695,000 and $2,188,000, respectively, during the year ended March 31, 2016 in general and administrative expenses.

10

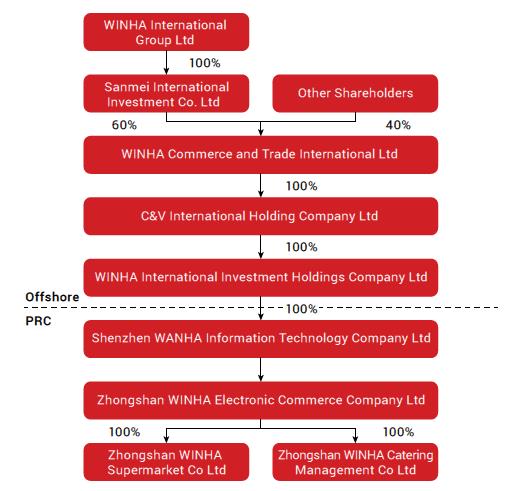

The following chart illustrates the Company's current corporate structure.

11

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Presentation

The accompanying consolidated financial statements of the Company have been prepared on the accrual basis.

Until November 27, 2015, the consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries and Zhongshan Winha, its VIE, for which it was deemed the primary beneficiary. On November 27, 2015, the VIE structure was terminated upon Shenzhen Winha exercising its option to purchase all of the registered equity of Zhongshan Winha. Shenzhen Winha became the sole owner of Zhongshan Winha. All significant inter-company accounts and transactions have been eliminated in consolidation.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars ("US Dollar" or "US$" or "$").

Foreign Currency Translation

Almost all Company assets and operations are located in the PRC. The functional currency for the majority of the Company's operations is the Renminbi ("RMB"). For Winha International Investment Holdings Company, the functional currency for the majority of its operations is the Hong Kong Dollar ("HKD"). For Australian Winha, the functional currency is the Australian Dollar ("AUD"). The Company uses the United States Dollar ("US Dollar" or "US$" or "$") for financial reporting purposes. The financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, "Foreign Currency Matters."

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of operations, changes in stockholders' equity and cash flow amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company's financial statements are recorded as other comprehensive income (loss).

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign Currency Translation (continued)

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the financial statements are as follows:

|

June 30,

2016

|

March 31,

2016

|

|||||||

|

Balance sheet items, except for stockholders' equity, as of period end

|

$

|

0.1505

|

$

|

0.1550

|

||||

|

For the

three month

ended

June 30,

2016

|

For the

three month

ended

June 30,

2015

|

|||||||

|

Amounts included in the statements of operations, statements of changes in stockholders' equity and statements of cash flows

|

$

|

0.1531

|

$

|

0.1633

|

||||

The exchange rates used to translate amounts in AUD into US dollars for the purposes of preparing the consolidated financial statements are as follows:

|

June 30,

2016

|

March 31,

2016

|

|||||||

|

Balance sheet items, except for stockholders' equity, as of period end

|

$

|

0.7441

|

$

|

0.7668

|

||||

|

For the

three month

ended

June 30,

2016

|

For the

three month

ended

June 30,

2015

|

|||||||

|

Amounts included in the statements of operations, statements of changes in stockholders' equity and statements of cash flows

|

$

|

0.7455

|

$

|

0.7772

|

||||

13

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign Currency Translation (continued)

For the three months ended June 30, 2016 and 2015, foreign currency translation adjustments of $(925,980) and $100,082, respectively, have been reported as other comprehensive (loss) income. Other comprehensive (loss) income of the Company consists entirely of foreign currency translation adjustments. Pursuant to ASC 740-30-25-17, "Exceptions to Comprehensive Recognition of Deferred Income Taxes," the Company does not recognize deferred U.S. taxes related to the undistributed earnings of its foreign subsidiaries and, accordingly, recognizes no income tax expense or benefit from foreign currency translation adjustments.

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC's political and economic conditions. Any significant revaluation of the RMB may materially affect the Company's financial condition in terms of US dollar reporting. The PRC has devalued the RMB by approximately 3.5 % subsequent to June 30, 2015. Further devaluations could occur in the future.

Vulnerability Due To Operations in PRC

The Company's operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC's political, economic and social conditions. There is also no guarantee that the PRC government's pursuit of economic reforms will be consistent, effective or will continue.

14

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Prepaid Expenses

Prepaid expenses as of June 30, 2016 and March 31, 2016 of approximately $110,000 and $174,000, respectively, mainly represent the prepayments for decoration expenses of the Company's new stores.

Advances from Customers

Advances from customers represents prepaid cards purchased by customers at our retail locations. We believe that prepaid cards are principally purchased for gift purposes and usually used quickly. Accordingly the Company records the related obligation as a current liability.

Advances from customers was $1,254,490 and $769,814 as of June 30, 2016 and March 31, 2016, respectively.

Website Development Costs

The Company accounts for website development costs in accordance with ASC 350-50, "Accounting for Website Development Costs", wherein website development costs are segregated into three activities:

|

1.

|

Initial stage (planning), whereby the related costs are expensed.

|

|

2.

|

Development stage (web application, infrastructure, graphics), whereby the related costs are capitalized and amortized once the website is ready for use. Costs for development content of the website may be expensed or capitalized depending on the circumstances of the expenditures.

|

15

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Website Development Costs (continued)

|

3.

|

Operating stage, whereby the related costs are expensed as incurred. Upgrades are usually expensed, unless they add additional functionality.

|

The Company has a website and ongoing website development costs of $43,338 and $45,676 as of June 30, 2016 and March 31, 2016, respectively. The online sales platform is currently in use and the related costs are being amortized over five years. Amortization expense was $1,403 and $206 for the three months ended June 30, 2016 and 2015, respectively.

Revenue Recognition

The Company recognizes revenue from the following channels:

|

a)

|

Retail stores - The Company recognizes sales revenue from its seven retail stores, net of sales taxes and estimated sales returns at the time it sells merchandise to the customer. Customer purchases of shopping cards are not recognized as revenue until the card is redeemed when the customer purchases merchandise by using the shopping card.

|

|

b)

|

Custom-made sales - The Company started "Custom-made" sales in August 2014. The target customers are commercial customers who can order online or in the Company's local stores and make full payment on site. All orders are forwarded to Zhongshan Winha immediately, which arranges the delivery. Revenue from the sale of products is recognized upon delivery to customers provided that there are no uncertainties regarding customer acceptance, there is persuasive evidence of an arrangement, and the sales price is fixed and determinable. Revenue generated from custom-made sales was $9,816,177 and $4,608,664, respectively, for the three months ended June 30, 2016 and 2015.

|

16

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition (continued)

|

c)

|

Franchise and management fees

|

|

During the three months ended September 30, 2015, the Company commenced franchising the use of the Company's trademark, name identification and other business resources. The franchisee is required to pay franchise fees and management fees to Zhongshan Winha. Franchise fee revenue from franchise sales is recognized only when all material services or conditions relating to the sale have been substantially performed or satisfied by the Company. The franchise and management fees recognized by the Company were $1,492,731 for the three months ended June 30, 2016 and are included in revenue.

|

|

Zhongshan Winha grants certain commercial customers limited rights to return products and provides price protection for inventories held by resellers at the time of published price reductions. Zhongshan Winha establishes an estimated allowance for future product returns based upon historical return experience when the related revenue is recorded and provides for appropriate price protection reserves when pricing adjustments are approved.

Zhongshan Winha's return policy allows customers to return their merchandise in the original box and/or packaging within 7 days of purchase. The Company has not experienced material returns.

Fair Value of Financial Instruments

FASB ASC 820, "Fair Value Measurement," specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

Level 1 Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

Level 2 Inputs – Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements.

17

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Fair Value of Financial Instruments (continued)

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of June 30, 2016 and March 31, 2016, none of the Company's assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, accounts receivable, inventory, advances to suppliers, accounts payable and accrued expenses, and advances from customers approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

Accounts receivable is stated at cost, net of an allowance for doubtful accounts, if required. Receivables outstanding longer than the payment terms are considered past due. The Company maintains an allowance for doubtful accounts for estimated losses when necessary resulting from the failure of customers to make required payments. The Company reviews the accounts receivable on a periodic basis and makes allowances where there is doubt as to the collectability of individual balances.

In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, the customer's payment history, its current credit-worthiness and current economic trends. The Company considers all accounts receivable at June 30, 2016 and March 31, 2016 to be fully collectible and, therefore, did not provide an allowance for doubtful accounts. For the periods presented, the Company did not write off any accounts receivable as bad debts.

18

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Inventory

Inventory, comprised principally of merchandise and food products, is stated at the lower of cost or market. The value of inventory is determined using the weighted average cost method.

The Company estimates an inventory allowance for excessive or unusable inventories. Inventory amounts are reported net of such allowances, if any. There was no allowance for excessive or unusable inventories as of June 30, 2016 and March 31, 2016.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditure that substantially increases the asset's value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred.

The estimated useful lives for property, plant and equipment categories are as follows:

|

Furniture, fixtures and equipment

|

3 to 5 years

|

|

Leasehold improvements

|

Over the shorter of the remaining lease term or estimated useful life of the improvements.

|

|

Motor vehicles

|

5 years

|

Impairment of Long-Lived Assets

The Company applies FASB ASC 360, "Accounting for the Impairment and Disposal of Long-Lived Assets," which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

19

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, "Income Taxes" ("ASC 740"), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized. ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements.

Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on the de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with these tax positions. As of June 30, 2016 and March 31, 2016, the Company did not record any liabilities for unrecognized income tax benefits.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States

The Company is subject to United States tax at graduated rates from 15% to 35%. No provision for income tax in the United States has been made as the Company had no U.S. taxable income for the three months ended June 30, 2016 and 2015.

Anguilla

Sanmei International Investment Co, Ltd is incorporated in Anguilla and is governed by the income tax laws of Anguilla. According to current Anguilla income tax law, the applicable income tax rate for the Company is 0%.

20

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Income Taxes (continued)

Australia

Winha Commerce and Trade Limited is incorporated in Australia. Pursuant to the income tax laws of Australia, the Company is not subject to tax on non-Australian source income.

Cayman Islands

C&V International Holdings Company Limited is incorporated in Cayman Islands and is governed by the income tax laws of the Cayman Islands. According to current Cayman Islands income tax law, the applicable income tax rate for the Company is 0%.

Hong Kong

Winha International Investment Holdings Company Limited is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

PRC

Shenzhen Winha, Zhongshan Winha Electronic Commerce Company Limited together with Zhongshan Winha Catering Management Company Limited and Zhongshan Supermarket Limited are subject to an Enterprise Income Tax at 25% and each files its own tax return.

The Company computes net income (loss) per common share in accordance with FASB ASC 260, "Earnings Per Share" ("ASC 260"). Under the provisions of ASC 260, basic net income (loss) per common share is computed by dividing the net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted income per common share is computed by dividing the net income by the weighted average number of shares of common stock outstanding plus the effect of any potential dilutive shares outstanding during the period. There were no dilutive shares outstanding during the three months ended June 30, 2016 and 2015. Accordingly, the number of weighted average shares outstanding as well as the amount of net income per share are presented for basic and diluted per share calculations for the period reflected in the accompanying consolidated statement of income and other comprehensive income.

21

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Statutory Reserve

The Company's China-based subsidiaries and related entities are required to make appropriations of retained earnings for certain non-distributable reserve funds.

Pursuant to the China Foreign Investment Enterprises laws, the Company's China-based subsidiaries, are required to make appropriations from their after-tax profit as determined under generally accepted accounting principles in the PRC (the "after-tax-profit under PRC GAAP") to a general non-distributable reserve fund. Each year, at least 10% of each entities after-tax-profit under PRC GAAP is required to be set aside as a general reserve fund until the fund equals 50% of the registered capital of the applicable entity.

The statutory reserve fund is restricted as to use and can only be used to set-off against losses, expansion of production and operations and increasing registered capital of the respective company. The fund is not allowed to be transferred to the Company in terms of cash dividends, loans or advances, nor is it allowed for distribution except under liquidation.

The required transfer to the statutory reserve fund was $276,438 and $172,666, respectively, for the three months ended June 30, 2016 and 2015.

Reclassification

Certain amounts in the prior period presented have been reclassified to conform to the current period financial statement presentation.

3. RECENTLY ISSUED ACCOUNTING STANDARDS

In April 2016, the FASB issued Accounting Standards Update No. 2016-12, Revenue from Contracts with Customers. In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606).'' This guidance supersedes current guidance on revenue recognition in Topic 605, "Revenue Recognition.'' In addition, there are disclosure requirements related to the nature, amount, timing, and uncertainty of revenue recognition. In August 2015, the FASB issued ASU No.2015-14 to defer the effective date of ASU No. 2014-09 for all entities by one year. For public business entities that follow U.S. GAAP, the deferral results in the new revenue standard are being effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, with early adoption permitted for interim and annual periods beginning after December 15, 2016. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

22

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

3. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases. The new standard establishes a right-of-use ("ROU") model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. We are currently evaluating the impact of our pending adoption of the new standard on our consolidated financial statements.

In November 2015, the FASB issued Accounting Standards Update No. 2015-17, Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes (ASU 2015-17), which simplifies the presentation of deferred income taxes by requiring deferred tax assets and liabilities be classified as noncurrent on the balance sheet. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

In September 2015, the FASB issued Accounting Standards Update ("ASU") 2015-16: Simplifying the Accounting for Measurement-Period Adjustments ("ASU 2015-16"), which eliminates the requirement to restate prior period financial statements for measurement period adjustments. The new guidance requires that the cumulative impact of a measurement period adjustment (including the impact on prior periods) be recognized in the reporting period in which the adjustment is identified. ASU 2015-16 is effective for interim and annual periods beginning after December 15, 2015. Early adoption is permitted. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date. The amendment in this ASU defers the effective date of ASU No. 2014-09 for all entities for one year. Public business entities, certain not-for-profit entities, and certain employee benefit plans should apply the guidance in ASU 2014-09 to annual reporting periods beginning December 15, 2017, including interim reporting periods within that reporting period. Earlier application is permitted only as of annual reporting periods beginning after December 31, 2016, including interim reporting periods within that reporting period. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

23

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

3. RECENTLY ISSUED ACCOUNTING STANDARDS (CONTINUED)

In March 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2015-03 – Interest – Imputation of Interest (Subtopic 835-30). This ASU addressed the simplification of debt issuance costs presentation by presenting debt issuance costs in the balance sheet as a direct deduction from the carrying amount of the debt, consistent with debt discounts or premiums. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

In January 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2015-01 – Income Statement – Extraordinary and Unusual Items (Subtopic 225-20). This ASU addressed the simplification of income statement presentation by eliminating the concept of extraordinary items. The amendments in this update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. A reporting entity also may apply the amendments retrospectively to all prior periods presented in the financial statements. Early adoption is permitted provided that the guidance is applied from the beginning of the fiscal year of adoption. This accounting standard update is not expected to have a material impact on the Company's consolidated financial statements.

4. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are summarized as follows:

|

June 30,

2016

|

March 31,

2016

|

|||||||

|

(Unaudited)

|

||||||||

|

Furniture, fixtures and equipment

|

$

|

1,100,239

|

$

|

1,131,124

|

||||

|

Leasehold improvements

|

611,107

|

629,536

|

||||||

|

Motor vehicles

|

351,370

|

361,967

|

||||||

|

2,062,716

|

2,122,627

|

|||||||

|

Less: accumulated depreciation

|

(370,742

|

)

|

(274,650

|

)

|

||||

|

$

|

1,691,974

|

$

|

1,847,977

|

|||||

For the three months ended June 30, 2016 and 2015, depreciation and amortization expense was $105,923 and $35,298, respectively.

24

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

5. LEASES

The Company leases its offices, warehouse and stores under operating leases expiring in various years through 2023.

The total future minimum lease payments as of June 30, 2016 are as follows:

|

Year Ending March 31,

|

Amount

|

|||

|

2017

|

$

|

286,528

|

||

|

2018

|

332,368

|

|||

|

2019

|

305,577

|

|||

|

2020

|

246,055

|

|||

|

Thereafter

|

465,291

|

|||

|

Total

|

$

|

1,635,819

|

||

Rent expense was $93,282 and $67,654 for the three months ended June 30, 2016 and 2015, respectively.

6. CONVERTIBLE NOTES

In May 2015, C&V International Company Limited, a wholly owned subsidiary of Winha International Group Limited, set up a wholly owned subsidiary, Australia Winha Commerce and Trade Limited ("Australian Winha").

On September 1, 2015, Australia Winha borrowed $542,570 (AUD$750,000) in the form of a twelve month convertible promissory note with interest at 6% per annum. The note is convertible into 750,000 shares of Australia Winha at $0.70401 per share (AUD$1.00) and is convertible at the option of the Company. The accrued interest of $ 27,129, which including in the accrued expense in consolidate financial statement was not paid prior to June 30, 2016.

On December 17, 2015, Australia Winha borrowed another $4,892,896 (AUD$6,750,000) in the form of a twelve month convertible promissory note with interest at 6% per annum. The note is convertible into 6,750,000 shares of Australia Winha at $0.71012 per share (AUD$1.00) and is convertible at the option of the Company. The accrued interest of $146,786, which including in the accrued expense in consolidate financial statement was not paid as of June 30, 2016.

There was no beneficial conversion feature associated with both notes.

On June 27, 2016, the Company issued a notice to redeem the notes convertible into 750,000 and 6,750,000 shares of Australian Winha in accordance with the convertible note subscription agreements signed between the noteholders and the Company on September 1, 2015 and December 17, 2015. As of June 30, 2016, the Company had not paid any principal or interest to the noteholders.

25

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

7. RELATED PARTY TRANSACTIONS

The Company obtained demand loans from the chairman of the board, which are non-interest bearing. The loans of $580,581 and $477,199 as of June 30, 2016 and March 31, 2016, respectively, are reflected as loan from stockholder in the consolidated balance sheets.

8. INCOME TAXES

The Company is required to file income tax returns in both the United States and the PRC. Its operations in the United States have been insignificant and income taxes have not been accrued.

The provision for income taxes consisted of the following for the three months ended June 30:

|

Three Months Ended

June 30,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Current

|

$

|

1,556,884

|

$

|

555,537

|

||||

|

Deferred

|

(25,741

|

)

|

-

|

|||||

|

$

|

1,531,143

|

$

|

555,537

|

|||||

The following table reconciles the effective income tax rates with the statutory rates for the three month ended June 30, respectively:

|

Three Months Ended

June 30,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Statutory rate - PRC

|

25.0

|

%

|

25.0

|

%

|

||||

|

Change in valuation allowance

|

-

|

(2.9

|

)

|

|||||

|

Benefit of carryforward losses

|

(1.1

|

)

|

-

|

|||||

|

Other

|

-

|

1.7

|

||||||

|

Effective income tax rate

|

23.9

|

%

|

23.8

|

%

|

||||

26

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

8. INCOME TAXES (CONTINUED)

Deferred tax assets and liabilities are recognized for expected future tax consequences of differences between the carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates in effect for the year in which the differences are expected to reverse. The laws of China permit the carry-forward of net operating losses for a period of five years. U.S. federal net operating losses can generally be carried forward twenty years.

Deferred tax assets are comprised of the following:

|

June 30,

2016

|

March 31,

2016

|

|||||||

|

(Unaudited)

|

||||||||

|

Net operating loss carryforwards

|

$

|

6,394,280

|

$

|

6,333,864

|

||||

|

Inventory intercompany profit

|

7,069

|

2,596

|

||||||

|

Less: valuation allowance

|

(6,394,280

|

)

|

(6,303,650

|

)

|

||||

|

Net deferred tax asset

|

$

|

7,069

|

$

|

32,810

|

||||

At June 30, 2016 and March 31, 2016, the Company had unused operating loss carry-forwards of approximately $16,149,615 and $16,214,870 respectively, expiring in various years through 2019. The Company has established a valuation allowance of $6,394,280 and $6,303,650 against the deferred tax asset related to net operating loss carry-forwards at June 30, 2016 and March 31, 2016, respectively, due to the uncertainty of realizing the benefit. The carryforwards are principally in China and the United States.

The Company's tax filings are subject to examination by the tax authorities. The tax years for 2015, 2014 and 2013 remain open to examination by the tax authorities in the PRC. The Company's U.S. tax returns are subject to examination by the tax authorities for the years ended March 31, 2015, 2014, 2013 and 2012.

27

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

9. CONCENTRATION OF CREDIT RISK

Substantially all of the Company's bank accounts are located in The People's Republic of China and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

10. PARENT COMPANY ONLY CONDENSED FINANCIAL INFORMATION

The following is the condensed financial information of Winha International Group Limited only, the US parent, balance sheet as of March 31, 2016 and the related statements of income and cash flows for the twelve months ended March 31, 2016:

Condensed Balance Sheet

|

ASSETS

|

March 31,

2016

|

|||

|

Investment in subsidiaries

|

$

|

11,050,554

|

||

|

TOTAL ASSETS

|

$

|

11,050,554

|

||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

March 31,

2016

|

|||

|

Accrued Expenses

|

45,000

|

|||

|

Stockholder loans

|

158,351

|

|||

|

Total Liabilities

|

$

|

203,351

|

||

|

Stockholders' equity

|

||||

|

Common stock, $0.0001 par value; 200,000,000 shares authorized; 49,989,500 shares issued and outstanding as of March 31, 2016

|

49,990

|

|||

|

Additional paid-in capital

|

21,626,775

|

|||

|

Statutory reserve

|

497,443

|

|||

|

Retained earnings (deficit)

|

(11,096,421

|

)

|

||

|

Other comprehensive income (loss)

|

(230,584

|

)

|

||

|

Total stockholders' equity

|

10,847,203

|

|||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

11,050,554

|

28

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

10. PARENT COMPANY ONLY CONDENSED FINANCIAL INFORMATION (CONTINUED)

Condensed Statement of Income

|

Year Ended

|

||||

|

March 31,

2016

|

||||

|

Revenues

|

||||

|

Share of earnings from investment in subsidiaries

|

$

|

7,761,602

|

||

|

Operating expenses

|

||||

|

Stock compensation

|

(15,865,042

|

)

|

||

|

General and administrative

|

(161,732

|

)

|

||

|

Net (loss)

|

$

|

(8,265,172

|

)

|

|

Condensed Statement of Cash Flows

|

Year Ended

March 31,

2016

|

||||

|

Cash flows from operating activities

|

||||

|

Net income

|

$

|

(8,265,172

|

)

|

|

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities

|

||||

|

Share of earnings from investment in subsidiaries

|

(7,761,602

|

)

|

||

|

Stock compensation

|

15,865,042

|

|||

|

Increase in accrued expenses and other payables

|

161,732

|

|||

|

Net cash provided by (used in) operating activities

|

-

|

|||

|

Net change in cash

|

-

|

|||

|

Cash, beginning of period

|

-

|

|||

|

Cash, end of period

|

$

|

-

|

||

|

Noncash financing activities:

|

||||

|

Payment of accrued expenses and other payables by shareholder

|

$

|

116,732

|

||

29

WINHA INTERNATIONAL GROUP LIMITED AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED JUNE 30, 2016 AND 2015 (IN U.S. $) (UNAUDITED)

10. PARENT COMPANY ONLY CONDENSED FINANCIAL INFORMATION (CONTINUED)

Basis of Presentation

The Company records its investment in its subsidiaries under the equity method of accounting. Such investments are presented as "Investment in subsidiaries" on the condensed balance sheet and the subsidiaries' profits are presented as "Share of earnings from investment in subsidiaries" in the condensed statement of income.

Certain information and footnote disclosures normally included in financial statements prepared in conformity with accounting principles generally accepted in the United States of America have been condensed or omitted. The parent only financial information has been derived from the Company's consolidated financial statements and should be read in conjunction with the Company's consolidated financial statements.

There were no cash transactions in the US parent company during the three months ended June 30, 2016.

Restricted Net Assets

Under PRC laws and regulations, the Company's PRC subsidiaries are restricted in their ability to transfer certain of their net assets to the Company in the form of dividend payments, loans or advances. The restricted net assets of the Company's PRC subsidiaries amounted to approximately $11,050,554 as of March 31, 2016.

The Company's operations and revenues are conducted and generated in the PRC, and all of the Company's revenues being earned and currency received are denominated in RMB. RMB is subject to the foreign exchange control regulations in China, and, as a result, the Company may be unable to distribute any dividends outside of China due to PRC foreign exchange control regulations that restrict the Company's ability to convert RMB into US Dollars.

11. SUBSEQUENT EVENT

On June 27, 2016, the Company issued a notice to redeem the notes convertible into 750,000 and 6,750,000 shares of Australian Winha in accordance with the convertible note subscription agreements signed between the noteholders and the Company on September 1, 2015 and December 17, 2015. The principal and interest were paid to the noteholders on July 13, 2016.

In July 2016, the Company entered into agreements to lease approximately 117 acres of farm land from three individuals. The leases have a term of ten years, expiring in July 2026, and provide for annual payment of RMB735,880 (approximately USD$110,750), and a onetime payment for the crop that had been planted on the land, totaling RMB6,589,000 (approximately USD$992,000). The Company also entered into agreements to lease approximately 11 acres of farm land from another three individuals for the term of one year expiring in July 2017, with an annual payment of RMB1,458,850 (approximately USD$223,600).

30

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

The following management's discussion and analysis of financial condition and results of operations provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Events Affecting Consolidation

We operate our business in China through Zhongshan Winha. We expect that virtually all of our revenue will be derived from Zhongshan Winha. On August 1, 2013, our subsidiary, Shenzhen Winha, entered into a set of contractual agreements with Zhongshan Winha and its equity owners, including an exclusive business cooperation agreement, exclusive option agreement, loan agreement, share pledge agreement, power of attorney and spousal consents. Shenzhen Winha, through these arrangements, assumed operational control of Zhongshan Winha and became the primary beneficiary of those operations. As a result, Zhongshan Winha was considered a variable interest entity with respect to Shenzhen Winha and, as a result, from August 1, 2013 through November 27, 2015, the financial statements of Zhongshan Winha were consolidated with our Company's financial statements.

The control of our operations through these contractual arrangements created risks for our business. If Zhongshan Winha and its shareholders failed to perform their obligations under the contractual arrangements, or if we suffered significant delay or other obstacles in the process of enforcing these contractual arrangements, or if legal remedies under PRC laws that we relied on were not available or effective, our business and operations could have been severely disrupted, which could have materially and adversely affected our results of operations and our ability to generate revenue in the PRC and could have damaged our reputation. To avoid such risk, on November 27, 2015, Shenzhen Winha exercised its option to purchase the registered equity of Zhongshan Winha from the shareholders of Zhongshan Winha. Upon the exercise of the purchase option, Zhongshan Winha became a wholly owned subsidiary of Shenzhen Winha. The financial statements of Zhongshan Winha remain consolidated with our Company's financial statements, but now as a subsidiary.

In May 2015, C&V International Company Limited ("C&V"), a wholly owned subsidiary of Winha International, set up a wholly owned subsidiary, Australia Winha Commerce and Trade Limited ("Australian Winha"). In February 2016, 100% of the outstanding shares of Sanmei International Investment Co., Ltd ("Sanmei Investment"), a company incorporated in Anguilla on April 23, 2013, were transferred to Winha International Group Limited. Winha International Group Limited then transferred the shares of its wholly owned subsidiary, C&V, to Sanmei Investment.

In March 2016, C&V transferred the shares of Australian Winha to Sanmei Investment. Subsequently, Sanmei Investment transferred 29% of the outstanding shares of Australian Winha to persons and entities who were either affiliates of, or consultants to, the Company (5% to Beijing Ruihua Future, 5% to Donghe Group, 7% to Zhuowei Zhong, 5% to Xinxi Zhong, 4% to Zhifei Huang and 3% to Chun Yan Winne Lam), and transferred 11% of the shares of Australian Winha to persons who are suppliers to Zhongshan Winha. The effect of above transaction reduced the interest of the Company in its Australian subsidiary, and indirectly in Zhongshan Winha, by 40%.

31

Results of Operations

The following tables set forth key components of our results of operations during the quarters ended June 30, 2016 and 2015, and the percentage changes between 2016 and 2015.

|

|

June 30,

|

June 30,

|

%

|

|||||||||

|

|

2016

|

2015

|

Change

|

|||||||||

|

Revenue

|

$

|

13,917,834

|

$

|

5,640,893

|

147

|

%

|

||||||

|

Cost of Goods Sold

|

6,422,736

|

|

3,012,853

|

113

|

%

|

|||||||

|

Gross profit

|

7,495,098

|

2,628,040

|

185

|

%

|

||||||||

|

Total operating expenses

|

1,092,498

|

558,496

|

96

|

%

|

||||||||

|

Income from operations

|

6,402,600

|

2,069,544

|

209

|

%

|

||||||||

|

Income before provision for income taxes

|

6,406,682

|

2,070,958

|

209

|

%

|

||||||||

|

Provision for income taxes

|

1,531,143

|

555,537

|

176

|

%

|

||||||||

|

Net income before noncontrolling interest

|

4,875,539

|

1,515,421

|

222

|

%

|

||||||||

|

Net income attributable to common stockholders

|

$

|

2,925,323

|

$

|

1,515,421

|

93

|

%

|

||||||

Revenue

We commenced operations during the quarter ended June 30, 2014. During the year ended March 31, 2015, our revenue increased to $9,023,642 due to the opening of new retail stores and the initiation of custom-made sales. Our revenue continued to grow during fiscal year 2016, as recognition of our brand developed and we introduced additional revenue streams. During the year ended March 31, 2016, our total revenue increased to $42,442,485. In particular, during the year ended March 31, 2016 we sold 26 franchises and recognized revenue of $3,055,692, consisting of upfront franchise fees and monthly administrative fees.

During the quarter ended June 30, 2016, we had total revenue of $13,917,834, representing an increase of 147% when compared with the quarter ended June 30, 2015. The following table shows the components of revenue:

|

|

June 30,

|

June 30,

|

||||||

|

|

2016

|

2015

|

||||||

|

Retail stores

|

$

|

2,608,926

|

$

|

1,032,229

|

||||

|

Custom-made

|

9,816,177

|

4,608,664

|

||||||

|

Franchises

|

1,492,731