Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - TUESDAY MORNING CORP/DE | tues-ex322_10.htm |

| EX-32.1 - EX-32.1 - TUESDAY MORNING CORP/DE | tues-ex321_7.htm |

| EX-31.2 - EX-31.2 - TUESDAY MORNING CORP/DE | tues-ex312_6.htm |

| EX-31.1 - EX-31.1 - TUESDAY MORNING CORP/DE | tues-ex311_11.htm |

| EX-23.1 - EX-23.1 - TUESDAY MORNING CORP/DE | tues-ex231_9.htm |

| EX-10.37 - EX-10.37 - TUESDAY MORNING CORP/DE | tues-ex1037_437.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2016

or

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0‑19658

Tuesday Morning Corporation

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

75‑2398532 (I.R.S. Employer Identification No.) |

|

6250 LBJ Freeway Dallas, Texas 75240 (972) 387‑3562 (Address, zip code and telephone number, including area code, of registrant’s principal executive offices) |

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.01 par value per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S‑T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment of this Form 10‑K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer o |

Accelerated filer x |

Non‑accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes o No x

The aggregate market value of shares of the registrant’s common stock held by non‑affiliates of the registrant at December 31, 2015 was approximately $207,870,865 based upon the closing sale price on the Nasdaq Global Select Market reported for such date.

As of the close of business on August 17, 2016, there were 44,551,846 outstanding shares of the registrant’s common stock.

Documents Incorporated By Reference:

Portions of the Registrant’s Definitive Proxy Statement to be filed in connection with the 2016 Annual Meeting of Stockholders are incorporated herein by reference (to the extent indicated) into Part III of this Form 10‑K.

2

Cautionary Statement Regarding Forward‑Looking Statements

This Form 10‑K contains forward‑looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995, which are based on management’s current expectations, estimates and projections. These statements may be found throughout this Form 10‑K, particularly under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” among others. Forward‑looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “estimate,” “intend” and similar words, although some forward‑looking statements are expressed differently. You should consider statements that contain these words carefully because they describe our current expectations, plans, strategies and goals and our beliefs concerning future business conditions, our future results of operations, our future financial positions, and our current business outlook or state other “forward‑looking” information.

The factors listed below under the heading “Risk Factors” and in other sections of this Form 10‑K provide examples of risks, uncertainties and events that could cause our actual results to differ materially from the expectations expressed in our forward‑looking statements. These risks, uncertainties and events also include, but are not limited to, the following:

|

|

· |

our ability to successfully implement our long‑term business strategy; |

|

|

· |

changes in economic and political conditions which may adversely affect consumer spending; |

|

|

· |

our failure to identify and respond to changes in consumer trends and preferences; |

|

|

· |

our ability to continuously attract buying opportunities for off‑price merchandise and anticipate consumer demand; |

|

|

· |

our ability to successfully manage our inventory balances profitably; |

|

|

· |

loss of, disruption in operations, or increased costs in the operation of our distribution center facilities; |

|

|

· |

loss or departure of one or more members of our senior management or other key management; |

|

|

· |

increased or new competition; |

|

|

· |

our ability to successfully execute our strategy of opening new stores and relocating and expanding existing stores; |

|

|

· |

increases in fuel prices and changes in transportation industry regulations or conditions; |

|

|

· |

our ability to generate strong cash flows from operations and to continue to access credit markets; |

|

|

· |

increases in the cost or a disruption in the flow of our imported products; |

|

|

· |

the success of our marketing, advertising and promotional efforts; |

|

|

· |

our ability to attract, train and retain quality employees in appropriate numbers, including key employees and management; |

|

|

· |

seasonal and quarterly fluctuations; |

|

|

· |

our ability to maintain and protect our information technology systems and technologies and related improvements to support our growth; |

|

|

· |

our ability to protect the security of information about our business and our customers, suppliers, business partners and employees; |

|

|

· |

our ability to comply with existing, changing and new government regulations; |

|

|

· |

our ability to manage litigation risks from our customers, employees and other third parties; |

|

|

· |

our ability to manage risks associated with product liability claims and product recalls; |

|

|

· |

the impact of adverse local conditions, natural disasters and other events; and |

|

|

· |

our ability to manage the negative effects of inventory shrinkage. |

The forward‑looking statements made in this Form 10‑K relate only to events as of the date on which the statements are made. Except as may be required by law, we disclaim obligations to update any forward‑looking statements to reflect events or circumstances after the date on which the statements were made or to reflect the occurrence of unanticipated events. Investors are cautioned not to place undue reliance on any forward‑looking statements.

3

The terms “Tuesday Morning,” “the Company,” “we,” “us,” and “our” as used in this Form 10‑K refer to Tuesday Morning Corporation and its subsidiaries.

4

Business Overview

We are a leading off‑price retailer specializing in selling deeply-discounted, upscale decorative home accessories, housewares, seasonal goods and famous‑maker gifts. We are nationally known for providing a fresh selection of brand-name, high-quality merchandise – never seconds or irregulars – at prices generally below those of department and specialty stores, catalogs and online retailers. We opened our first store in 1974 and operated 751 stores in 40 states as of June 30, 2016. Our strong everyday value proposition is also supported with periodic circulars and direct mail that keep customers familiar with Tuesday Morning.

We carry an ever changing assortment of products in a wide array of categories such as home décor, furniture, bed and bath, kitchen, toys, crafts, pets and seasonal goods. In categories where brands are important, we carry first quality, high end brand-name merchandise such as Peacock Alley, Sferra, Lenox, Waterford and Hartmann. In addition to branded goods, we also carry unique home furnishings items made around the world. We buy our inventory opportunistically which allows us to offer great value to our customers.

The Tuesday Morning store environment is a treasure hunt of ever changing product, with new merchandise arriving weekly. We buy our inventory broad and shallow which gives us the flexibility to take advantage of great buys in the market. The opportunities that we find in the market come from a variety of sources, including direct from manufacturer, closeout sellers and occasionally other retailers.

Our key strengths are:

|

|

- |

Ever changing assortment of high quality merchandise at great values |

|

|

- |

Strong supplier partnerships that allow us to access deals in the market |

|

|

- |

Broad and shallow buying model that allows us the flexibility to react to deals and current trends |

|

|

- |

Strong loyal customer base that has been shopping Tuesday Morning for many years |

|

|

- |

Predominantly female customer base that has above average discretionary spend |

|

|

- |

Experienced management team |

|

|

- |

Financial strength and liquidity |

We believe that our customers are attracted to our stores primarily because of our limited quantities of first quality, brand-name merchandise which we offer at attractive prices. Our stores operate in both primary and secondary locations of major suburban markets, such as strip malls, near our middle and upper‑income customers. We are generally able to obtain favorable lease terms because of our flexibility regarding site selection and our “no frills” format, allowing us to use a wide variety of space configurations. We operate our business as a single operating segment.

Business Strategy

Several years ago, we began a transformation of our Company in order to regain our position as a leader in off‑price retail. We executed on a number of critical steps under our business turnaround strategy. These steps included exiting certain categories, refreshing and reorganizing stores, reducing the level of clearance merchandise, modifying company policies, and eliminating assets that were no longer needed. During this phase, we took specific steps to improve our inventory management process, sourcing of inventory, merchandise offerings and sales productivity.

In fiscal year 2014, we substantially completed work on the final phase of our turnaround strategy and moved into our rebuilding phase, in which we have focused on continued improvement of merchandise assortment, supply chain efficiency, inventory turns, marketing strategy and store demographics and infrastructure.

As a key component of this rebuilding phase, we are focused on improving store locations and the in-store experience for our customers. In this regard, we are closing unproductive stores with limited foot traffic and relocating some of these stores to, or opening new stores in, better locations with footprints that are on average two to three thousand square feet larger. In some cases, we are also expanding existing productive stores to this larger footprint. In addition, we are improving the finishes in these relocated, new and expanded stores, such as polished concrete floors, simple but attractive fixture packages and new lighting and color palettes, in an effort to match the in-store experience for our customers with the quality of our products.

5

We believe the principal factors by which we compete are brand names, price and breadth of product offerings. Our prices are generally below department stores and specialty and on‑line retailer prices and we offer a broad assortment of high‑end, first quality, brand-name merchandise. We currently compete against a diverse group of retailers, including department and discount stores, specialty, e‑commerce and catalog retailers and mass merchants, which sell, among other products, home furnishings, housewares and related products. We also compete in particular markets with a substantial number of retailers that specialize in one or more types of home furnishing and houseware products that we sell. Some of these competitors have substantially greater financial resources that may, among other things, increase their ability to purchase inventory at lower costs or to initiate and sustain aggressive price competition.

Our business is subject to seasonality, with a higher level of our net sales and operating income generated during the quarter ending December 31, which includes the holiday shopping season. Net sales in the quarters ended December 31, 2015, 2014, and 2013 accounted for approximately 33% of our annual net sales for each of the 2016, 2015 and 2014 fiscal years.

Working Capital Items

Because of the seasonal nature of our business, our working capital needs are greater in the months leading up to our peak sales period from Thanksgiving to the end of December. The increase in working capital needs during this time is typically financed with cash flow provided by operations and our revolving credit facility. Additional details are provided in the Liquidity and Capital Resources section in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Inventory is the largest asset on our balance sheet. Efficient inventory management is a key component of our business success and profitability. To be successful, we must maintain sufficient inventory levels to meet our customers’ demands while keeping the inventory fresh and turning the inventory appropriately to optimize profitability.

Purchasing

We provide an outlet for manufacturers and other sources looking for effective ways to reduce excess inventory resulting from order cancellations by retailers, manufacturing overruns, bankruptcies and excess capacity. Since our inception, we have not experienced significant difficulty in obtaining first quality, brand-name off‑price merchandise in adequate volumes and at competitive prices. We utilize a mix of both domestic and international suppliers. We pay our suppliers timely and generally do not request special consideration for markdowns, advertising or returns. During fiscal 2016, our top ten vendors accounted for approximately 11% of total purchases, with no single vendor accounting for more than 3% of total purchases.

Low Cost Operations

We operate with a low cost structure in comparison to many other retailers. We place great emphasis on expense management throughout the Company. Our stores have a “no frills” format and we are flexible in our site selection in order to maintain favorable lease terms.

Customer Shopping Experience

While we offer a “no frills” format in our stores, we have made progress in reorganizing and refreshing our stores to enhance the customers’ shopping experience. We offer a flexible return policy and we accept all major payment methods including cash, checks and all major credit cards. We continue to work on initiatives we believe will enhance our customers’ shopping experience.

Distribution

We utilize 1.4 million square feet of distribution center facilities in Dallas, Texas and a 0.6 million square foot distribution center in Phoenix, Arizona which service all of our stores throughout the United States. The Phoenix distribution center commenced operations during the fourth quarter of fiscal 2016. We shipped approximately 118 million units to our stores during fiscal 2016.

Pricing

Our pricing policy is to sell merchandise generally below retail prices charged by department stores and specialty and on‑line retailers. Prices are determined centrally and are uniform at all of our stores. Once a price is determined for a particular item, labels displaying two‑tiered pricing are affixed to the product. A typical price tag displays a “Compare At” price, and “Our Price”. Our buyers determine and verify retail “Compare At” prices by reviewing prices published in advertisements, catalogs, on‑line and manufacturers’ suggested retail price lists and by visiting department or specialty stores selling similar merchandise. Our information

6

systems provide daily sales and inventory information, which enables us to evaluate our prices and inventory levels and to adjust prices on unsold merchandise in a timely manner and on a periodic basis as dictated by sales volumes and incoming purchases, thereby effectively managing our inventory levels and offering competitive pricing.

Employees

As of June 30, 2016, we employed 1,934 persons on a full‑time basis and 7,133 persons on a part‑time basis. Our employees are not represented by any labor unions. We have not experienced any work stoppage due to labor disagreements, and we believe that our employee relations are strong.

Intellectual Property

The trade name “Tuesday Morning” is material to our business. We have registered the name “Tuesday Morning” as a service mark with the United States Patent and Trademark office. We have also registered other trademarks including but not limited to “Tuesday Morning Perks®”. Solely for convenience, trademarks and trade names referred to in this Form 10‑K may appear without the ® or tm symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor, to these trademarks and trade names.

Corporate Information

Tuesday Morning Corporation is a Delaware corporation incorporated in 1991. Our principal executive offices are located at 6250 LBJ Freeway, Dallas, Texas 75240, and our telephone number is (972) 387‑3562.

We maintain a website at www.tuesdaymorning.com. Copies of our Annual Reports on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K and any amendments to such reports filed with, or furnished to, the Securities and Exchange Commission (the “SEC”) are available free of charge on our internet website under the Investor Relations section as soon as reasonably practicable after we electronically file such reports and amendments with, or furnish them to, the SEC.

The reports we file or furnish to the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1‑800‑SEC‑0330. In addition, the SEC maintains a website, www.sec.gov, which contains the reports, proxy and information statements and other information which we file with, or furnish to, the SEC.

7

Store Locations. As of June 30, 2016, we operated 751 stores in the following 40 states:

|

State |

|

# of Stores |

|

|

State |

|

# of Stores |

|

||

|

Alabama |

|

|

23 |

|

|

Missouri |

|

|

19 |

|

|

Arizona |

|

|

22 |

|

|

Nebraska |

|

|

4 |

|

|

Arkansas |

|

|

13 |

|

|

Nevada |

|

|

7 |

|

|

California |

|

|

64 |

|

|

New Jersey |

|

|

11 |

|

|

Colorado |

|

|

21 |

|

|

New Mexico |

|

|

7 |

|

|

Delaware |

|

|

2 |

|

|

New York |

|

|

11 |

|

|

Florida |

|

|

65 |

|

|

North Carolina |

|

|

28 |

|

|

Georgia |

|

|

34 |

|

|

North Dakota |

|

|

1 |

|

|

Idaho |

|

|

5 |

|

|

Ohio |

|

|

24 |

|

|

Illinois |

|

|

19 |

|

|

Oklahoma |

|

|

11 |

|

|

Indiana |

|

|

13 |

|

|

Oregon |

|

|

13 |

|

|

Iowa |

|

|

5 |

|

|

Pennsylvania |

|

|

20 |

|

|

Kansas |

|

|

10 |

|

|

South Carolina |

|

|

21 |

|

|

Kentucky |

|

|

13 |

|

|

South Dakota |

|

|

1 |

|

|

Louisiana |

|

|

19 |

|

|

Tennessee |

|

|

22 |

|

|

Maryland |

|

|

18 |

|

|

Texas |

|

|

109 |

|

|

Massachusetts |

|

|

2 |

|

|

Utah |

|

|

6 |

|

|

Michigan |

|

|

9 |

|

|

Virginia |

|

|

35 |

|

|

Minnesota |

|

|

9 |

|

|

Washington |

|

|

13 |

|

|

Mississippi |

|

|

14 |

|

|

Wisconsin |

|

|

8 |

|

Site Selection. We continually evaluate our current store base for potential enhancement or relocation of our store locations. As a result of this ongoing evaluation, we intend to pursue attractive relocation opportunities in our existing store base, close certain stores by allowing leases to expire for underperforming stores or where alternative locations in similar trade areas are not available at acceptable lease rates, and, when appropriate, open new stores. For both new stores and relocations, we negotiate for upgraded sites. We believe that this strategy will better position us for long‑term profitable growth. We expect to upgrade both the appearance and operation of our new and relocated stores compared to our existing stores and do not anticipate difficulty in locating additional store locations in areas with our target customer demographics.

Store Leases. Except for one store adjacent to our existing distribution center in Dallas, Texas, we lease our store locations under operating leases that typically include renewal options. Some of our leases also provide for contingent rent based upon store sales exceeding stipulated amounts.

Our store leases typically include “kick clauses,” which allow us, at our option, to exit the lease with no penalty 24 to 60 months after entering into the lease if store sales do not reach a stipulated amount stated in the lease. These kick clauses provide us with flexibility in opening new stores and relocating existing stores by allowing us to quickly and cost‑effectively vacate a site that does not meet our sales expectations. As a result, we generally do not operate locations with continued store‑level operating losses.

Store Layout. Our site selection process and “no frills” approach to presenting merchandise allow us to use a wide variety of space configurations. The size of our stores ranges from approximately 5,000 to 30,900 square feet, averaging on a per store basis approximately 11,000 square feet as of June 30, 2016. Historically, we have designed our stores to be functional, with less emphasis placed upon fixtures and leasehold aesthetics. With our current real estate strategy, we continue to be focused on designing a very functional, easy to shop environment that also highlights the quality of the merchandise. We display all merchandise on counters, shelves, or racks while maintaining minimum inventory in our stockrooms.

Store Operations. Our stores are generally open seven days a week, excluding certain holidays. We continue to maintain the frequency of shipments of merchandise which results in improved efficiency of receiving and restocking activities at our stores. We attempt to align our part‑time employees’ labor hours with anticipated workload and with current customer sales. We conduct annual physical counts of our merchandise staggered throughout the year, except during the holiday selling season of November and December, primarily when stores are closed.

Store Management. Each store has a manager who is responsible for recruiting, training and supervising store personnel and assuring that the store is managed in accordance with our established guidelines and procedures. Store managers are full‑time

8

employees. Our store managers are supported by district and regional level support. Store managers are responsible for centrally directed store disciplines and routines. The store manager is assisted primarily by part‑time employees who generally serve as assistant managers, cashiers, and help with merchandise stocking efforts. Members of our management visit selected stores periodically to review inventory levels and presentation, personnel performance, expense controls, security and adherence to our policies and procedures. In addition, district and regional field managers periodically meet with senior management to review store policies and discuss purchasing, merchandising, advertising and other operational issues.

Our business is subject to significant risks, including the risks and uncertainties described below. These risks and uncertainties and the other information in this Form 10‑K, including our consolidated financial statements and the notes to those statements, should be carefully considered. If any of the events described below actually occur, our business, financial condition or results of operations could be adversely affected in a material way.

Risks Related to Our Business

We may not be successful in the implementation of our long‑term business strategy, which could adversely affect our business and our results of operations.

Our success depends, to a significant degree, on our ability to successfully implement our long‑term business strategy. Our ability to successfully implement our business strategies depends upon a significant number of factors, including but not limited to:

|

|

· |

our ability to access an adequate supply of top‑quality merchandise from suppliers at a competitive price; |

|

|

· |

our ability to deliver profitable sales; |

|

|

· |

our ability to make adjustments as market conditions change; |

|

|

· |

customer acceptance of our marketing and merchandise strategies; |

|

|

· |

our ability to respond to competitive pressures in our industry; |

|

|

· |

the ability of our management team to properly respond to the dynamics and demands of our market; |

|

|

· |

our ability to achieve positive cash flow, particularly during our peak inventory build‑ups in advance of the holiday selling season; and |

|

|

· |

our employees’ ability to adapt to our new strategic initiatives. |

Changes in economic and political conditions may adversely affect consumer spending, which could significantly harm our business, results of operations, cash flows and financial condition.

The success of our business depends, to a significant extent, upon the level of consumer spending. A number of factors beyond our control affect the level of consumer spending on merchandise that we offer, including, among other things:

|

|

· |

general economic and industry conditions; |

|

|

· |

unemployment; |

|

|

· |

the housing market; |

|

|

· |

deterioration in consumer confidence; |

|

|

· |

crude oil prices that affect gasoline and diesel fuel, as well as, increases in other fuels used to support utilities; |

|

|

· |

the effect of food prices on consumer discretionary spending; |

|

|

· |

efforts by our customers to reduce personal debt levels; |

|

|

· |

interest rates; |

|

|

· |

fluctuations in the financial markets; |

|

|

· |

tax rates and policies; |

9

|

|

· |

consumer confidence in future economic conditions. |

The merchandise we sell generally consists of discretionary items. Reduced consumer confidence and spending cut backs may result in reduced demand for our merchandise, including discretionary items, and may force us to take significant inventory markdowns. Reduced demand also may require increased selling and promotional expenses. Adverse economic conditions and any related decrease in consumer demand for our merchandise could have a material adverse effect on our business, results of operations, cash flows and financial condition.

Any failure to identify and respond to changes in consumer trends and preferences could significantly harm our business.

The retail home furnishings and housewares industry is subject to sudden shifts in consumer trends and consumer spending. Our sales and results of operations depend in part on our ability to predict or respond to changes in trends and consumer preferences in a timely manner. Although our business model allows us greater flexibility than many traditional retailers to meet consumer preferences and trends, we may not successfully do so. Any sustained failure to anticipate, identify and respond to emerging trends in consumer preferences could negatively affect our business and results of operations.

We must continuously attract buying opportunities for off‑price merchandise and anticipate consumer demand as off‑price merchandise becomes available, and our failure to do so could adversely affect our performance.

By its nature, specific off‑price merchandise items are available from manufacturers or vendors generally on a non‑recurring basis. As a result, we do not have long‑term contracts with our vendors for supply, pricing or access to products, but make individual purchase decisions, which may be for large quantities. Due to economic uncertainties, some of our manufacturers and suppliers may cease operations or may otherwise become unable to continue supplying off‑price merchandise on terms acceptable to us. We cannot assure that manufacturers or vendors will continue to make off‑price merchandise available to us in quantities acceptable to us or that our buyers will continue to identify and take advantage of appropriate buying opportunities. In addition, if we misjudge consumer demand for products, we may significantly overstock unpopular products and be forced to take significant markdowns and miss opportunities to sell more popular products. An inability to acquire suitable off‑price merchandise in the future or to accurately anticipate consumer demand for such merchandise would have an adverse effect on our business, results of operations, cash flows and financial condition.

Our results of operations will be negatively affected if we are not successful in managing our inventory profitably.

Inventory is the largest asset on our balance sheet and represented approximately 67%, 63% and 62% of our total assets at June 30, 2016, 2015 and 2014, respectively. Efficient inventory management is a key component of our business success and profitability. To be successful, we must maintain sufficient inventory levels to meet our customers’ demands without allowing those levels to increase to such an extent that the costs to store and hold the goods unduly impact our financial results. If our buying decisions do not accurately predict customer trends or purchasing actions, we may have to take unanticipated markdowns to dispose of the excess inventory, which also can adversely impact our financial results. We continue to focus on ways to reduce these risks, but we cannot assure that we will be successful in our inventory management. If we are not successful in managing our inventory balances, our results of operations may be negatively affected. We have recorded significant inventory write‑downs from time to time in the past and there can be no assurances that we will not record additional inventory charges in the future.

The loss of, disruption in the operation of, or increased costs in the operation of our distribution center facilities would have a material adverse effect on our business and operations.

With few exceptions, all inventory is shipped directly from suppliers either to our distribution center in the Dallas, Texas metropolitan area, or our new Phoenix distribution center, where the inventory is then processed, sorted and shipped to our stores. We depend in large part on the orderly operation of this receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective management of the distribution center. We may not anticipate all of the changing demands which our expanding operations will impose on our receiving and distribution system. We may also experience delays in or increased costs in ramping up our new Phoenix distribution center or integrating the center with our existing distribution operations. In addition, events beyond our control, such as disruptions in operations due to fire or other catastrophic events, labor disagreements or shipping problems, may result in delays in the delivery of merchandise to our stores. We also cannot assure that our insurance will be sufficient, or that insurance proceeds will be timely paid to us, in the event a distribution center is shut down for any reason.

10

The loss or departure of one or more members of our senior management or other key employees could have a material adverse effect on our business.

Our future performance will depend in large part upon the efforts and abilities of our senior management and other key employees. The loss of service of these persons could have a material adverse effect on our business and future prospects. We do not maintain key person life insurance for our senior management. In addition, we have recently experienced turnover of a number of members of senior management. We cannot provide any assurance that we will not experience future turnover related to our senior management team.

Our business is intensely competitive, and a number of different competitive factors could have a material adverse effect on our business, results of operations, cash flows and financial condition.

The retail home furnishings and housewares industry is intensely competitive. As an off‑price retailer of home furnishings and housewares, we currently compete against a diverse group of retailers, including department stores and discount stores, specialty, on‑line, and catalog retailers and mass merchants, which sell, among other products, home furnishing, houseware and related products similar and often identical to those we sell. We also compete in particular markets with a substantial number of retailers that specialize in one or more types of home furnishing and houseware products that we sell. Many of these competitors have substantially greater financial resources that may, among other things, increase their ability to purchase inventory at lower costs or to initiate and sustain aggressive price competition.

A number of different competitive factors could have a material adverse effect on our business, results of operations, cash flows and financial condition, including:

|

|

· |

increased operational efficiencies of competitors; |

|

|

· |

competitive pricing strategies, including deep discount pricing by a broad range of retailers during periods of poor consumer confidence or economic uncertainty; |

|

|

· |

continued and prolonged promotional activity by competitors; |

|

|

· |

liquidation sales by a number of our competitors who have filed or may file in the future for bankruptcy; |

|

|

· |

expansion by existing competitors; |

|

|

· |

entry by new competitors into markets in which we currently operate; and |

|

|

· |

adoption by existing competitors of innovative store formats or retail sales methods. |

We cannot assure that we will be able to continue to compete successfully with our existing or new competitors, or that prolonged periods of deep discount pricing by our competitors will not materially harm our business. We compete for customers, employees, locations, merchandise, services and other important aspects of our business with many other local, regional, national and international retailers. We also face competition from alternative retail distribution channels such as catalogs and, increasingly, e‑commerce websites. Changes in the merchandising, pricing and promotional activities of those competitors, and in the retail industry, in general, may adversely affect our performance.

If we are unable to successfully execute our strategy of relocating and expanding existing stores and when appropriate, opening new stores, our operating performance could be adversely impacted.

As part of our business strategy, we intend to pursue relocation opportunities to improve our existing store base as well as open new stores that will offset the closing of lower performing stores as they come up for renewal. However, we cannot assure that we will be able to achieve our relocation goals or that we will be able to operate any new or relocated stores profitably. Further, we cannot assure that any new or relocated store will achieve similar operating results to those of our existing stores or that new, relocated or expanded stores opened in markets in which we operate will not have a material adverse effect on the net sales and profitability of our existing store base.

The success of our store development strategy will be dependent upon numerous factors, many of which are beyond our control, including the following:

|

|

· |

the ability of our personnel to adequately analyze and identify suitable markets and individual store sites within those markets; |

|

|

· |

the competition for suitable store sites; |

11

|

|

· |

our ability to obtain governmental and other third‑party consents, permits and licenses needed to operate our stores; |

|

|

· |

the availability of employees to staff new stores and our ability to hire, train, motivate and retain store personnel; |

|

|

· |

the availability of adequate management and financial resources to properly manage a large volume of stores; |

|

|

· |

our ability to adapt our distribution and other operational and management systems to a changing network of stores; and |

|

|

· |

our ability to attract customers and generate sales sufficient to operate new, relocated or expanded stores profitably. |

While we opened stores in existing markets during fiscal 2016, 2015, and 2014, we also opened stores in new markets during that time period. These markets may have different competitive conditions, consumer trends and discretionary spending patterns than our existing markets, which may cause our new stores in these markets to be less successful than stores in our existing markets.

Increases in fuel prices and changes in transportation industry regulations or conditions may increase our freight costs and thus our cost of sales, which could have a material adverse effect on our business and operations.

Our freight cost is impacted by changes in fuel prices through surcharges. Fuel prices and surcharges affect freight cost both on inbound freight from vendors to our distribution center and outbound freight from our distribution center to our stores. In addition, the U.S. government requires drivers of over‑the‑road trucks to take certain rest periods which reduces the available amount of time they can drive during a 24‑hour period. Changes in trucking industry conditions, such as truck driver shortages and highway congestion, could increase freight costs. High fuel prices or surcharges, as well as stringent driver regulations and changes in transportation industry conditions, may increase freight costs and thereby increase our cost of sales.

If we are not able to generate strong cash flows from our operations or to continue to access credit markets, we will not be able to support capital expansion, operations or debt repayment.

Our business is dependent upon our operations generating strong cash flows to support capital expansion requirements and general operating activities. In addition, we have a credit agreement providing for a revolving credit facility in the amount of up to $180.0 million. The revolving credit facility contains certain restrictive covenants, and if borrowing availability falls below certain thresholds, a financial covenant. If we are unable to comply with the revolving credit facility, we may not be able to obtain an alternate source of funding on satisfactory terms, if at all. Our inability to continue to generate sufficient cash flows to support these activities or the lack of availability of financing in adequate amounts and on appropriate terms could adversely affect our financial performance.

An increase in the cost or a disruption in the flow of our imported products may significantly decrease our sales and profits.

Merchandise manufactured and imported from overseas represents the majority of our total product purchases acquired both domestically and internationally. A disruption in the shipping of imported merchandise or an increase in the cost of those products may significantly decrease our sales and profits. In addition, if imported merchandise becomes more expensive or unavailable, the transition to alternative sources may not occur in time to meet our demands. Products from alternative sources may also be of lesser quality and more expensive than those we currently import.

Risks associated with our reliance on imported products include disruptions in the shipping and importation or increases in the costs of imported products because of factors such as:

|

|

· |

raw material shortages; |

|

|

· |

work stoppages; |

|

|

· |

strikes and political unrest; |

|

|

· |

problems with oceanic shipping, including shipping container shortages; |

|

|

· |

increased customs inspections of import shipments or other factors causing delays in shipments; |

|

|

· |

economic crises; |

|

|

· |

international disputes and wars; loss of “most favored nation” trading status by the United States in relation to a particular foreign country; |

|

|

· |

import duties; |

12

|

|

· |

increases in shipping rates. |

The products we buy abroad are sometimes priced in foreign currencies and, therefore, we are affected by fluctuating exchange rates. In the past, we have entered into foreign currency exchange contracts with major financial institutions to hedge these fluctuations. We might not be able to successfully protect ourselves in the future against currency rate fluctuations, and our financial performance could suffer as a result.

Our success depends upon our marketing, advertising and promotional efforts. If we are unable to implement them successfully, or if our competitors are more effective than we are, our results of operations may be adversely affected.

We use marketing and promotional programs to attract customers to our stores and to encourage purchases by our customers. We use various media for our promotional efforts, including print, database marketing, email, direct marketing, and other electronic communications such as online social networks. If we fail to choose the appropriate medium for our efforts, or fail to implement and execute new marketing opportunities, our competitors may be able to attract some of our customers and cause them to decrease purchases from us and increase purchases elsewhere, which would negatively impact our net sales. Changes in the amount and degree of promotional intensity or merchandising strategy by our competitors could cause us to have some difficulties in retaining existing customers and attracting new customers.

If we do not attract, train and retain quality employees in appropriate numbers, including key employees and management, our performance could be adversely affected.

Our performance is dependent on recruiting, developing, training and retaining quality sales, distribution center and other employees in large numbers, as well as, experienced buying and management personnel. Many of our employees are in entry level or part‑time positions with historically high rates of turnover. Our ability to meet our labor needs while controlling costs is subject to external factors, such as unemployment levels, prevailing wage rates, minimum wage legislation, changes in rules governing eligibility for overtime and changing demographics. In the event of increasing wage rates, if we do not increase our wages competitively, our customer service could suffer because of a declining quality of our workforce, or our earnings would decrease if we increase our wage rates whether in response to market demands or new minimum wage legislation. Changes that adversely impact our ability to attract and retain quality employees and management personnel could adversely affect our performance.

Our results of operations are subject to seasonal and quarterly fluctuations, which could have a material adverse effect on our operating results or the market price of our common stock.

Our business is subject to seasonality with a higher level of net sales and operating income generated during the quarter ended December 31, which includes the holiday shopping season. Net sales in the quarters ended December 31, 2015, 2014, and 2013, accounted for approximately 33% of our annual net sales for each of the 2016, 2015, and 2014 fiscal years. For more information about our seasonality, please read Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quarterly Results and Seasonality.”

Because a significant percentage of our net sales and operating income are generated in the quarter ending December 31, we have limited ability to compensate for shortfalls in December quarter sales or earnings by changes in our operations or strategies in other quarters. A significant shortfall in results for the quarter ending December 31 of any year could have a material adverse effect on our annual results of operations and on the market price of our common stock. In addition, in anticipation of higher sales during this period, we purchase substantial amounts of seasonal inventory and hire many temporary employees. An excess of seasonal merchandise inventory could result if our net sales during this principal selling season were to fall below either seasonal norms or expectations. If our December quarter sales results were substantially below expectations, our financial performance and operating results could be adversely affected by unanticipated markdowns, particularly in seasonal merchandise. Lower than anticipated sales in the principal selling season would also negatively affect our ability to absorb the increased seasonal labor costs.

Our quarterly results of operations may also fluctuate significantly based on additional factors, such as:

|

|

· |

the timing of new store openings; |

|

|

· |

the amount of net sales contributed by new and existing stores; |

|

|

· |

the success of our store expansion and relocation program; |

|

|

· |

the timing of certain holidays and advertised events; |

13

|

|

· |

general economic, industry and weather conditions that affect consumer spending; and |

|

|

· |

actions of competitors, including promotional activity. |

These factors could also have a material adverse effect on our annual results of operations and on the market price of our common stock.

If we are unable to maintain and protect our information technology systems and technologies, we could suffer disruptions in our business, damage to our reputation, increased costs and liability, and obstacles to our growth.

The operation of our business is heavily dependent upon the implementation, integrity, security, and successful functioning of our computer networks and information systems, including the point‑of‑sale systems in our stores, data centers that process transactions, and various software applications used in our operations. Our systems are subject to damage or interruption from weather events, power outages, telecommunications or computer failures, computer viruses, security breaches, employee errors and similar occurrences. A failure of our systems to operate effectively as a result of damage to, interruption, or failure of any of these systems could result in data loss, a failure to meet our reporting obligations, or material misstatements in our consolidated financial statements, or cause losses due to disruption of our business operations and loss of customer confidence. These adverse situations could also lead to loss of sales or profits or cause us to incur additional repair, replacement and development costs. Our inability to improve our information technology systems and technologies may fail to support our growth and may limit opportunities.

If we fail to protect the security of information about our business and our customers, suppliers, business partners and employees, we could damage our reputation and our business, incur substantial additional costs and become subject to litigation and government investigations and enforcement actions.

In the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information and that of our customers, suppliers and business partners, and personally identifiable information of our customers and employees, on our computer networks and information systems. The secure processing, maintenance and transmission of this information is critical to our operations. Despite our security measures, our information technology and infrastructure and that of our service providers may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Cyber threats are rapidly evolving and are becoming increasingly sophisticated. Any such attack or breach could compromise our security and remain undetected for a period of time, and confidential information could be misappropriated, resulting in a loss of customers’, suppliers’, business partners’ or employees’ personal information, negative publicity, harm to our business and reputation, and potentially causing us to incur costs to reimburse third parties for damages and potentially subjecting us to government investigations and enforcement actions. In addition, the regulatory environment surrounding data and information security and privacy is increasingly demanding, as new and revised requirements are frequently imposed across our business. For example, during 2015, we were required to comply with new chip card standards. Compliance with more demanding privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes, and implementing new initiatives could result in system disruptions. We maintain cyber risk insurance, but this insurance may not be sufficient to cover all of our losses from any future breaches of our systems.

We are subject to various government regulations, changes in the existing laws and regulations and new laws and regulations which may adversely affect our operations and financial performance.

The development and operation of our stores are subject to various federal, state and local laws and regulations in many areas of our business, including, but not limited to, those that impose restrictions, levy a fee or tax, or require a permit or license, or other regulatory approval, and building and zoning requirements. Difficulties or failures in obtaining required permits, licenses or other regulatory approvals could delay or prevent the opening of a new store, and the suspension of, or inability to renew, a license or permit could interrupt operations at an existing store. We are also subject to laws governing our relationship with employees, including minimum wage requirements, overtime, health insurance mandates, working and safety conditions, and immigration status requirements. In May 2016, the Department of Labor released its final rule increasing the minimum salary that employees must be paid to qualify as exempt from the overtime requirements under the Fair Labor Standards Act, which will likely increase our labor costs. Additionally, potential changes in federal labor laws, including “card check” regulations, could result in portions of our workforce being subjected to greater organized labor influence. This could result in an increase to our labor costs. A significant portion of our store personnel are paid at rates related to the minimum wage established by federal, state and municipal law. Additionally, we are subject to certain laws and regulations that govern our handling of customers’ personal information. A failure to protect the integrity and security of our customers’ personal information could expose us to private litigation and government investigations and enforcement actions, as well as materially damage our reputation with our customers. While we endeavor to comply with all applicable laws and regulations, governmental and regulatory bodies may change such laws and regulations in the future

14

which may require us to incur substantial cost increases. If we fail to comply with applicable laws and regulations, we may be subject to various sanctions, penalties or fines and may be required to cease operations until we achieve compliance which could have a material adverse effect on our consolidated financial results and operations.

We face litigation risks from customers, employees, and other third parties in the ordinary course of business.

Our business is subject to the risk of litigation by customers, current and former employees, suppliers, stockholders and others through private actions, class actions, administrative proceedings, regulatory actions, or other litigation. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify. Plaintiffs in these types of lawsuits may seek recovery of very large or indeterminate amounts, and the magnitude of the potential loss relating to such lawsuits may remain unknown for substantial periods of time. The cost to defend future litigation may be significant. There may also be adverse publicity associated with litigation that could decrease customer acceptance of merchandise offerings, regardless of whether the allegations are valid or whether we are ultimately found liable.

We face risks with respect to product liability claims and product recalls, which could adversely affect our reputation, our business, and our consolidated results of operations.

We purchase merchandise from third parties and offer this merchandise to customers for sale. In addition, as discussed above, we currently expect to develop and manufacture certain merchandise for sale, initially on a very limited basis. Merchandise could be subject to recalls and other actions by regulatory authorities. Changes in laws and regulations could also impact the type of merchandise we offer to customers. We have experienced, and may in the future experience, issues that result in recalls of merchandise. In addition, individuals have asserted claims, and may in the future assert claims, that they have sustained injuries from third‑party merchandise offered by us, and we may be subject to future lawsuits relating to these claims. There is a risk that these claims or liabilities may exceed, or fall outside the scope of, our insurance coverage. Any of the issues mentioned above could result in damage to our reputation, diversion of development and management resources, or reduced sales and increased costs, any of which could harm our business.

Our stores may be adversely affected by local conditions, natural disasters, and other events.

Certain regions in which our stores are located may be subject to adverse local conditions, natural disasters, and other events. If severe weather, such as heavy snowfall or extreme temperatures, discourages or restricts customers in a particular region from traveling to our stores, our sales could be adversely affected. If severe weather conditions occur during the second quarter of our fiscal year, the adverse impact to our sales and profitability could be even greater than at other times during the year because we generate a significant portion of our sales and profits during these periods. Natural disasters including tornados, hurricanes, floods, and earthquakes may damage our stores or other operations, which may adversely affect our consolidated financial results. Additionally, demographic shifts in the areas where our stores are located could adversely impact our consolidated financial results and operations.

Our results of operations may be negatively affected by inventory shrinkage.

We are subject to the risk of inventory loss and theft. Although our inventory shrinkage rates have not fluctuated significantly in recent years, we cannot assure that actual rates of inventory loss and theft in the future will be within our estimates or that the measures we are taking will effectively reduce the problem of inventory shrinkage. Although some level of inventory shrinkage is an unavoidable cost of doing business, if we were to experience higher rates of inventory shrinkage or incur increased security costs to combat inventory theft, our results of operations could be affected adversely.

Risks Related to Our Common Stock

Our certificate of incorporation, and bylaws and Delaware law contain provisions that could make it more difficult for a third party to acquire us without the consent of our Board of Directors.

Provisions in our certificate of incorporation and bylaws will have the effect of delaying or preventing a change of control or changes in our management. These provisions include the following:

|

|

· |

the ability of our Board of Directors to issue shares of our common stock and preferred stock without stockholder approval (subject to applicable NASDAQ requirements); |

|

|

· |

a requirement that stockholder meetings may only be called by our President, Chief Executive Officer, the Chairman of the Board or at the written request of a majority of the directors then in office and not our stockholders; |

15

|

|

· |

a prohibition of cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates; |

|

|

· |

the ability of our Board of Directors to make, alter or repeal our bylaws without further stockholder approval; and |

|

|

· |

the requirement for advance notice for nominations for directors to our Board of Directors and for proposing matters that can be acted upon by stockholders at stockholder meetings. |

Because we do not presently have any plans to pay dividends on our common stock, stockholders must look solely to appreciation of our common stock to realize a gain on their investment.

We have not paid a regular cash dividend since 2008 and do not presently have any plans to pay dividends. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur.

The price of our common stock has fluctuated substantially over the past several years and may continue to fluctuate substantially in the future.

From July 1, 2015 to June 30, 2016, the trading prices of our common stock ranged from a low of $4.86 per share to a high of $11.45 per share. We expect our stock to continue to be subject to fluctuations as a result of a variety of factors, including factors beyond our control, which have been included throughout this Annual Report on Form 10‑K. We may fail to meet the expectations of our stockholders or securities analysts at some time in the future, and our stock price could decline as well.

Item 1B. Unresolved Staff Comments

None.

Stores. We lease all of our stores from unaffiliated third parties, except one Company‑owned store located adjacent to our existing distribution facility in Dallas, Texas. A description of the location of our stores is provided in Item 1, “Business—Stores and Store Operations.” At June 30, 2016, the remaining terms of the majority of our store leases range from one month to five years. The average initial term of a store lease is approximately five years, typically with options available for renewal. We intend to continue to lease all of our new stores from unaffiliated third parties. Our store leases typically include “kick clauses,” which allow us, at our option, to exit the lease with no penalty 24 to 60 months after entering into the lease if store sales do not reach a stipulated amount stated in the lease.

Distribution Facilities and Corporate Headquarters.

We own a 104,675 square foot building which houses our corporate office in Dallas, Texas. Our Dallas distribution center utilizes approximately 1.4 million square feet of which 1.2 million square feet is owned and 0.2 million square feet, which we do not consider part of our long-term distribution network, is leased through December 2017 in connection with a sale-leaseback transaction executed in the fourth quarter of fiscal 2016. During fiscal 2015, we executed a lease for approximately 0.6 million square feet related to our new, additional distribution center in Phoenix, Arizona which started operations in the fourth quarter of fiscal 2016.

We lease from unaffiliated third parties two parcels of land of approximately 301,600 square feet, for trailer storage and parking.

We are continuing to evaluate the reorganization of our distribution network and facilities to accommodate our distribution requirements for our existing store base as well as for future growth.

From time to time, we are involved in litigation which is incidental to our business. In our opinion, no litigation to which we are currently a party is likely to have a material adverse effect on our consolidated financial condition, results of operations, or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

16

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the NASDAQ Global Select Market under the symbol “TUES.” The following table sets forth for the periods indicated the high and low sales prices per share as reported on the NASDAQ Select Global Market:

|

|

|

High |

|

|

Low |

|

||

|

Fiscal Year Ended June 30, 2016 |

|

|

|

|

|

|

|

|

|

First quarter |

|

$ |

11.45 |

|

|

$ |

4.86 |

|

|

Second quarter |

|

$ |

7.36 |

|

|

$ |

5.11 |

|

|

Third quarter |

|

$ |

8.47 |

|

|

$ |

5.01 |

|

|

Fourth quarter |

|

$ |

9.23 |

|

|

$ |

6.15 |

|

|

Fiscal Year Ended June 30, 2015 |

|

|

|

|

|

|

|

|

|

First quarter |

|

$ |

19.90 |

|

|

$ |

16.01 |

|

|

Second quarter |

|

$ |

22.82 |

|

|

$ |

17.47 |

|

|

Third quarter |

|

$ |

22.88 |

|

|

$ |

14.90 |

|

|

Fourth quarter |

|

$ |

17.58 |

|

|

$ |

11.20 |

|

As of August 17, 2016, there were approximately 249 holders of record of our common stock.

Dividend Policy

During the fiscal years ended June 30, 2016 and 2015, we did not declare or pay any cash dividends on our common stock. We do not presently have plans to pay dividends on our common stock. Our revolving credit facility may, in some instances, limit our ability to pay cash dividends and repurchase our common stock. Additional details are provided in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—New Revolving Credit Facility.”

Repurchases of Common Equity

On August 22, 2011, our Board of Directors adopted a share repurchase program pursuant to which we are authorized to repurchase from time to time shares of Common Stock, up to a maximum of $5.0 million in aggregate purchase price for all such shares (the “Repurchase Program”). On January 20, 2012, our Board of Directors increased the authorization for stock repurchases under the Repurchase Program from $5.0 million to a maximum of $10.0 million. The Repurchase Program does not have an expiration date and may be amended, suspended or discontinued at any time. The Board will periodically evaluate the Repurchase Program and there can be no assurances as to the number of shares of Common Stock we will repurchase. During the twelve month period ended June 30, 2016, 18,166 shares were repurchased under the Repurchase Program at an average cost of $7.07 per share and for a total cost (excluding commissions) of approximately $129,000. All of such shares were purchased by us in connection with the vesting of equity awards under our equity incentive plans.

Repurchases of equity securities during the three months ended June 30, 2016 are listed in the following table:

|

Period |

|

Total Number of Shares Repurchased |

|

|

Average Price Paid per Share |

|

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

|

|

Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs(1) |

|

||||

|

April 1 through April 30, 2016 |

|

|

2,314 |

|

|

$ |

8.68 |

|

|

|

2,314 |

|

|

$ |

3,242,959 |

|

|

May 1 through May 31, 2016 |

|

|

2,314 |

|

|

$ |

6.80 |

|

|

|

2,314 |

|

|

$ |

3,227,223 |

|

|

June 1 through June 30, 2016 |

|

|

2,313 |

|

|

$ |

7.02 |

|

|

|

2,313 |

|

|

$ |

3,210,981 |

|

|

Total |

|

|

6,941 |

|

|

$ |

7.50 |

|

|

|

6,941 |

|

|

$ |

3,210,981 |

|

|

(1) |

As of June 30, 2016, 1.8 million shares have been repurchased under the Repurchase Program for a total cost (excluding commissions) of approximately $6.8 million. |

17

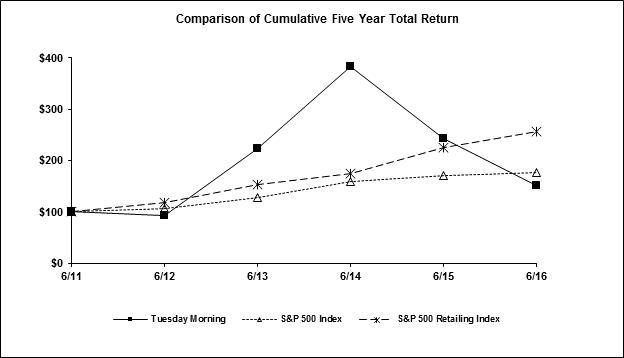

The following graph illustrates a comparison of the cumulative total stockholder return (change in stock price plus reinvested dividends) for the fiscal years ended June 30, 2016, 2015, 2014, 2013 and 2012, of (1) our common stock, (2) the S&P 500 Index, and (3) the S&P 500 retailing index, a pre‑established industry index. The chart assumes that $100 was invested on June 30, 2011, in our common stock and each of the comparison indices, and assumes that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Tuesday Morning, the S&P 500 Index

and the S&P 500 Retailing Index

|

* |

$100 invested on 6/30/11 in stock or index, including reinvestment of dividends. |

Fiscal year ending June 30.

Copyright© 2014 S&P, a division of The McGraw‑Hill Companies Inc. All rights reserved.

These indices are included for comparative purposes only and do not necessarily reflect management’s opinion that such indices are an appropriate measure of the relative performance of the stock involved, and are not intended to forecast or be indicative of possible future performance of our common stock.

The performance graph and related text are being furnished to and not filed with the SEC, and will not be deemed to be “soliciting material” under Regulation 14A or 14C under the Securities Exchange Act of 1934 or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate such information by reference into such a filing.

18

Item 6. Selected Financial Data

The following table sets forth the selected consolidated financial and operating data for the fiscal years ended June 30, 2016, 2015, 2014, 2013, and 2012.

The selected consolidated financial and operating data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto included elsewhere in this Form 10‑K.

|

|

|

Fiscal Year Ended June 30, |

|

|||||||||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|||||

|

|

|

(in thousands, except per share, per square foot, square foot per store amounts and number of stores) |

|

|||||||||||||||||

|

Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

956,396 |

|

|

$ |

906,365 |

|

|

$ |

864,844 |

|

|

$ |

838,314 |

|

|

$ |

812,782 |

|

|

Cost of sales |

|

|

614,594 |

|

|

|

579,746 |

|

|

|

562,692 |

|

|

|

578,876 |

|

|

|

503,918 |

|

|

Gross profit |

|

|

341,802 |

|

|

|

326,619 |

|

|

|

302,152 |

|

|

|

259,438 |

|

|

|

308,864 |

|

|

Selling, general and administrative expenses |

|

|

339,398 |

|

|

|

314,263 |

|

|

|

310,205 |

|

|

|

315,933 |

|

|

|

301,427 |

|

|

Operating income/(loss) |

|

|

2,404 |

|

|

|

12,356 |

|

|

|

(8,053 |

) |

|

|

(56,495 |

) |

|

|

7,437 |

|

|

Interest expense |

|

|

(1,068 |

) |

|

|

(1,445 |

) |

|

|

(1,500 |

) |

|

|

(1,677 |

) |

|

|

(2,254 |

) |

|

Other income/(expense), net |

|

|

2,640 |

|

|

|

(495 |

) |

|

|

(582 |

) |

|

|

(5,236 |

) |

|

|

224 |

|

|

Income/(loss) before income taxes |

|

|

3,976 |

|

|

|

10,416 |

|

|

|

(10,135 |

) |

|

|

(63,408 |

) |

|

|

5,407 |

|

|

Income tax provision/(benefit) |

|

|

263 |

|

|

|

31 |

|

|

|

41 |

|

|

|

(7,032 |

) |

|

|

1,494 |

|

|

Net income/(loss) |

|

$ |

3,713 |

|

|

$ |

10,385 |

|

|

$ |

(10,176 |

) |

|

$ |

(56,376 |

) |

|

$ |

3,913 |

|

|

Earnings/(loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.08 |

|

|

$ |

0.24 |

|

|

$ |

(0.24 |

) |

|

$ |

(1.33 |

) |

|

$ |

0.09 |

|

|

Diluted |

|

$ |

0.08 |

|

|

$ |

0.24 |

|

|

$ |

(0.24 |

) |

|

$ |

(1.33 |

) |

|

$ |

0.09 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

43,705 |

|

|

|

43,480 |

|

|

|

42,943 |

|

|

|

42,248 |

|

|

|

41,986 |

|

|

Diluted |

|

|

43,736 |

|

|

|

43,770 |

|

|

|

42,943 |

|

|

|

42,248 |

|

|

|

42,536 |

|

|

Dividends per common share |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of stores: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

769 |

|

|

|

810 |

|

|

|

828 |

|

|

|

852 |

|

|

|

861 |

|

|

Opened during period |

|

|

16 |

|

|

|

5 |

|

|

|

9 |

|

|

|

10 |

|

|

|

24 |

|

|

Closed during period |

|

|

(34 |

) |

|

|

(46 |

) |

|

|

(27 |

) |

|

|

(34 |

) |

|

|

(33 |

) |

|

Open at end of period |

|

|

751 |

|

|

|

769 |

|

|

|

810 |

|

|

|

828 |

|

|

|

852 |

|

|

Comparable store sales increase/(decrease)(1) |

|

|

7.8 |

% |

|

|

7.2 |

% |

|

|

6.1 |

% |

|

|

3.9 |

% |

|

|

(3.1 |

)% |

|

Average sales per store(2) |

|

$ |

1,263 |

|

|

$ |

1,148 |

|

|

$ |

1,058 |

|

|

$ |

1,000 |

|

|

$ |

950 |

|

|

Inventory turnover(3) |

|

|

2.5 |

|

|

|

2.6 |

|

|

|

2.6 |

|

|

|

2.2 |

|

|

|