Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - NorthStar Healthcare Income, Inc. | nshiexhibit321-06302016.htm |

| EX-32.2 - EXHIBIT 32.2 - NorthStar Healthcare Income, Inc. | nshiexhibit322-06302016.htm |

| EX-31.2 - EXHIBIT 31.2 - NorthStar Healthcare Income, Inc. | nshiexhibit312-06302016.htm |

| EX-31.1 - EXHIBIT 31.1 - NorthStar Healthcare Income, Inc. | nshiexhibit311-06302016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2016

Commission File Number: 000-55190

NORTHSTAR HEALTHCARE INCOME, INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland | 27-3663988 |

(State or Other Jurisdiction of | (IRS Employer |

Incorporation or Organization) | Identification No.) |

399 Park Avenue, 18th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company ý | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 183,099,274 shares outstanding as of August 5, 2016.

NORTHSTAR HEALTHCARE INCOME, INC.

FORM 10-Q

TABLE OF CONTENTS

Index | Page | |

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders, our reliance on our advisor and our sponsor, the operating performance of our investments, our financing needs, the effects of our current strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

• | adverse economic conditions and the impact on the real estate industry, including healthcare real estate; |

• | our dependence on the resources and personnel of our advisor, our sponsor and their affiliates, including our advisor’s ability to manage our portfolio on our behalf; |

• | the performance of our advisor, our sponsor and their affiliates; |

• | our liquidity and access to capital; |

• | our use of leverage; |

• | our ability to make distributions to our stockholders; |

• | the lack of a public trading market for our shares; |

• | the effect of economic conditions on the valuation of our investments; |

• | the effect of paying distributions to our stockholders from sources other than cash flow provided by operations; |

• | the impact of our sponsor’s recently announced merger agreement with NorthStar Realty Finance Corp. and Colony Capital, Inc., including the ability to consummate the merger on the terms contemplated or at all; |

• | our advisor’s and its affiliates’ ability to attract and retain qualified personnel to support our growth and operations and potential changes to key personnel providing management services to us; |

• | our reliance on our advisor and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial fees to our advisor, the allocation of investments by our advisor and its affiliates among us and the other sponsored or managed companies and strategic vehicles of our sponsor and its affiliates, and various potential conflicts of interest in our relationship with our sponsor; |

• | a change in the ownership or management of our sponsor; |

• | the impact of market and other conditions influencing the performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments; |

• | changes in our business or investment strategy; |

• | the impact of economic conditions on the operators/tenants of the real property that we own as well as on borrowers of the debt we originate and acquire; |

• | the nature and extent of future competition, including new construction in the markets in which our assets are located; |

• | the ability of our tenants, operators and managers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and to generate sufficient income to make rent payments to us and, in turn, our ability to satisfy our obligations under our borrowings; |

3

• | the ability of our tenants, operators and managers, as applicable, to comply with laws, rules and regulations in the operation of our properties, to deliver high-quality services, to attract and retain qualified personnel and to attract residents and patients; |

• | the ability and willingness of our tenants, operators, managers and other third parties to satisfy their respective obligations to us, including in some cases their obligation to indemnify us from and against various claims and liabilities; |

• | the financial weakness of our tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding our ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans and/or expose us to additional liabilities and expenses; |

• | the impact of increased operating costs on our liquidity, financial condition and results of operations or that of our tenants, operators, managers and borrowers and our ability and the ability of our tenants, operators, managers and borrowers to accurately estimate the magnitude of those costs; |

• | changes in the value of our portfolio; |

• | the impact of fluctuations in interest rates; |

• | our ability to realize current and expected returns over the life of our investments; |

• | any failure in our advisor’s and its affiliates’ due diligence to identify relevant facts during our underwriting process or otherwise; |

• | investments in asset classes and structures with which we have less familiarity; |

• | illiquidity of properties or debt investments in our portfolio; |

• | our ability to finance our assets on terms that are acceptable to us, if at all, including our ability to complete securitization financing transactions; |

• | environmental compliance costs and liabilities; |

• | whether we will realize the benefits of the long-term partnership between our sponsor and James F. Flaherty III, a member of our Sponsor’s investment committee and our former director, and potential conflicts that may arise in connection with his interest in American Healthcare Investors, LLC; |

• | risks associated with our joint ventures and unconsolidated entities, including our reliance on joint venture partners, lack of decision making authority and the financial condition of our joint venture partners; |

• | increased rates of loss or default and decreased recovery on our investments; |

• | the degree and nature of our competition; |

• | the effectiveness of our portfolio management techniques and strategies; |

• | the potential failure to maintain effective internal controls and disclosure controls and procedures; |

• | regulatory requirements with respect to our business and the healthcare industry generally, as well as the related cost of compliance; |

• | the extent and timing of future healthcare reform and regulation, including changes in reimbursement policies, procedures and rates; |

• | legislative and regulatory changes, including changes to laws governing the taxation of real estate investment trusts, or REITs, and changes to laws affecting non-traded REITs and alternative investments generally; |

• | our ability to maintain our qualification as a REIT for federal income tax purposes and limitations imposed on our business by our status as a REIT; |

• | the loss of our exemption from registration under the Investment Company Act of 1940, as amended; |

• | availability of opportunities to acquire equity, debt and securities investments in the healthcare real estate sector; |

• | general volatility in capital markets; |

4

• | the adequacy of our cash reserves and working capital; and |

• | other risks associated with investing in our targeted investments, including changes in our industry, interest rates, the securities markets, the general economy or the capital markets and real estate markets specifically. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Quarterly Report on Form 10-Q are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the United States Securities and Exchange Commission, or the SEC, including Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and in Part II, Item 1A of this Quarterly Report on Form 10-Q under the heading “Risk Factors.” The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

5

PART I. Financial Information

Item 1. Financial Statements

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Per Share Data)

June 30, 2016 (Unaudited) | December 31, 2015 | ||||||

Assets | |||||||

Cash | $ | 144,165 | $ | 354,229 | |||

Restricted cash | 31,285 | 15,612 | |||||

Operating real estate, net | 1,720,933 | 832,253 | |||||

Investments in unconsolidated ventures (refer to Note 4) | 414,993 | 534,541 | |||||

Real estate debt investments, net | 193,004 | 192,934 | |||||

Receivables, net | 8,744 | 8,016 | |||||

Deferred costs and intangible assets, net | 35,661 | 44,261 | |||||

Other assets | 14,580 | 20,382 | |||||

Total assets(1) | $ | 2,563,365 | $ | 2,002,228 | |||

Liabilities | |||||||

Mortgage notes payable, net | $ | 1,216,643 | $ | 570,985 | |||

Due to related party | 56 | 443 | |||||

Escrow deposits payable | 3,646 | 2,046 | |||||

Distribution payable | 10,086 | 10,002 | |||||

Accounts payable and accrued expenses | 21,540 | 10,234 | |||||

Other liabilities | 3,889 | 3,018 | |||||

Total liabilities(1) | 1,255,860 | 596,728 | |||||

Commitments and contingencies | |||||||

Equity | |||||||

NorthStar Healthcare Income, Inc. Stockholders’ Equity | |||||||

Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of June 30, 2016 and December 31, 2015 | — | — | |||||

Common stock, $0.01 par value, 400,000,000 shares authorized, 182,307,094 and 179,137,202 shares issued and outstanding as of June 30, 2016 and December 31, 2015, respectively | 1,823 | 1,791 | |||||

Additional paid-in capital | 1,643,292 | 1,614,452 | |||||

Retained earnings (accumulated deficit) | (342,996 | ) | (216,099 | ) | |||

Total NorthStar Healthcare Income, Inc. stockholders’ equity | 1,302,119 | 1,400,144 | |||||

Non-controlling interests | 5,386 | 5,356 | |||||

Total equity | 1,307,505 | 1,405,500 | |||||

Total liabilities and equity | $ | 2,563,365 | $ | 2,002,228 | |||

__________________________________________________________

(1) | Represents the consolidated assets and liabilities of NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Operating Partnership is a consolidated variable interest entity (“VIE”), of which the Company is the sole general partner and owns approximately 99.99%. As of June 30, 2016, the assets and liabilities of the Operating Partnership include $472.5 million and $294.0 million of assets and liabilities, respectively, of certain VIEs that are consolidated by the Operating Partnership. Refer to Note 2. “Summary of Significant Accounting Policies”. |

Refer to accompanying notes to consolidated financial statements.

6

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

Revenues | |||||||||||||||

Resident fee income | $ | 25,244 | $ | 12,132 | $ | 50,285 | $ | 15,980 | |||||||

Rental income | 37,586 | 5,740 | 56,021 | 9,647 | |||||||||||

Interest income | 5,005 | 3,648 | 10,040 | 7,208 | |||||||||||

Other revenue | 194 | — | 469 | — | |||||||||||

Total revenues | 68,029 | 21,520 | 116,815 | 32,835 | |||||||||||

Expenses | |||||||||||||||

Property operating expenses | 34,982 | 8,739 | 58,379 | 11,486 | |||||||||||

Interest expense | 13,044 | 3,431 | 21,527 | 5,078 | |||||||||||

Transaction costs | 249 | 3,127 | 1,531 | 4,542 | |||||||||||

Asset management and other fees - related party | 8,452 | 17,829 | 28,080 | 20,543 | |||||||||||

General and administrative expenses | 8,722 | 4,224 | 16,558 | 7,101 | |||||||||||

Depreciation and amortization | 13,429 | 4,697 | 25,252 | 6,382 | |||||||||||

Total expenses | 78,878 | 42,047 | 151,327 | 55,132 | |||||||||||

Other income (loss) | |||||||||||||||

Realized gain (loss) on investments and other | 411 | — | 411 | — | |||||||||||

Gain (loss) on consolidation of unconsolidated venture (refer to Note 3) | — | — | 6,408 | — | |||||||||||

Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax benefit (expense) | (10,438 | ) | (20,527 | ) | (27,693 | ) | (22,297 | ) | |||||||

Equity in earnings (losses) of unconsolidated ventures | (17,432 | ) | (5,351 | ) | (31,469 | ) | (8,941 | ) | |||||||

Income tax benefit (expense) | (33 | ) | 208 | (7,124 | ) | 553 | |||||||||

Net income (loss) | (27,903 | ) | (25,670 | ) | (66,286 | ) | (30,685 | ) | |||||||

Net (income) loss attributable to non-controlling interests | 34 | 151 | 119 | 152 | |||||||||||

Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | $ | (27,869 | ) | $ | (25,519 | ) | $ | (66,167 | ) | $ | (30,533 | ) | |||

Net income (loss) per share of common stock, basic/diluted | $ | (0.15 | ) | $ | (0.22 | ) | $ | (0.37 | ) | $ | (0.27 | ) | |||

Weighted average number of shares of common stock outstanding, basic/diluted | 181,717,986 | 118,095,010 | 180,934,241 | 113,757,105 | |||||||||||

Distributions declared per share of common stock | $ | 0.17 | $ | 0.17 | $ | 0.34 | $ | 0.33 | |||||||

Refer to accompanying notes to consolidated financial statements.

7

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands)

Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Total Company’s Stockholders’ Equity | Non-controlling Interests | Total Equity | |||||||||||||||||||||

Shares | Amount | |||||||||||||||||||||||||

Balance as of December 31, 2014 | 97,972 | $ | 980 | $ | 875,205 | $ | (45,458 | ) | $ | 830,727 | $ | 1,258 | $ | 831,985 | ||||||||||||

Net proceeds from issuance of common stock | 76,761 | 767 | 696,724 | — | 697,491 | — | 697,491 | |||||||||||||||||||

Issuance and amortization of equity-based compensation | 12 | — | 115 | — | 115 | — | 115 | |||||||||||||||||||

Non-controlling interests - contributions | — | — | — | — | — | 4,472 | 4,472 | |||||||||||||||||||

Shares redeemed for cash | (407 | ) | (4 | ) | (3,924 | ) | — | (3,928 | ) | — | (3,928 | ) | ||||||||||||||

Distributions declared | — | — | — | (88,271 | ) | (88,271 | ) | — | (88,271 | ) | ||||||||||||||||

Proceeds from distribution reinvestment plan | 4,799 | 48 | 46,332 | — | 46,380 | — | 46,380 | |||||||||||||||||||

Net income (loss) | — | — | — | (82,370 | ) | (82,370 | ) | (374 | ) | (82,744 | ) | |||||||||||||||

Balance as of December 31, 2015 | 179,137 | $ | 1,791 | $ | 1,614,452 | $ | (216,099 | ) | $ | 1,400,144 | $ | 5,356 | $ | 1,405,500 | ||||||||||||

Net proceeds from issuance of common stock | 81 | 1 | 295 | — | 296 | — | 296 | |||||||||||||||||||

Issuance and amortization of equity-based compensation | 14 | — | 68 | — | 68 | — | 68 | |||||||||||||||||||

Non-controlling interests - contributions | — | — | — | — | — | 149 | 149 | |||||||||||||||||||

Shares redeemed for cash | (551 | ) | (6 | ) | (5,232 | ) | — | (5,238 | ) | — | (5,238 | ) | ||||||||||||||

Distributions declared | — | — | — | (60,730 | ) | (60,730 | ) | — | (60,730 | ) | ||||||||||||||||

Proceeds from distribution reinvestment plan | 3,626 | 37 | 33,709 | — | 33,746 | — | 33,746 | |||||||||||||||||||

Net income (loss) | — | — | — | (66,167 | ) | (66,167 | ) | (119 | ) | (66,286 | ) | |||||||||||||||

Balance as of June 30, 2016 (Unaudited) | 182,307 | $ | 1,823 | $ | 1,643,292 | $ | (342,996 | ) | $ | 1,302,119 | $ | 5,386 | $ | 1,307,505 | ||||||||||||

Refer to accompanying notes to consolidated financial statements.

8

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands)

(Unaudited)

Six Months Ended June 30, | |||||||

2016 | 2015 | ||||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | (66,286 | ) | $ | (30,685 | ) | |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||

Equity in (earnings) losses of unconsolidated ventures | 31,469 | 8,941 | |||||

Depreciation and amortization | 25,252 | 6,382 | |||||

Straight-line rental income | (686 | ) | (1,445 | ) | |||

Amortization of premium/accretion of discount on investments | (10 | ) | 92 | ||||

Amortization of deferred financing costs | 923 | 634 | |||||

Amortization of equity-based compensation | 68 | 48 | |||||

Deferred income tax (benefit) expense, net | 7,026 | (782 | ) | ||||

Realized (gain) loss on investments and other | (411 | ) | — | ||||

(Gain) loss on consolidation of unconsolidated venture (refer to Note 3) | (6,408 | ) | — | ||||

Distributions from unconsolidated ventures | — | 249 | |||||

Changes in assets and liabilities: | |||||||

Restricted cash | (1,787 | ) | (1,745 | ) | |||

Receivables, net | 778 | (3,134 | ) | ||||

Other assets | (1,018 | ) | 60 | ||||

Due to related party | (387 | ) | (789 | ) | |||

Escrow deposits payable | 563 | 1,142 | |||||

Accounts payable and accrued expenses | (375 | ) | 10,846 | ||||

Other liabilities | (135 | ) | 5,042 | ||||

Net cash provided by (used in) operating activities | (11,424 | ) | (5,144 | ) | |||

Cash flows from investing activities: | |||||||

Acquisition of operating real estate investments, net | (139,618 | ) | (591,708 | ) | |||

Improvement of operating real estate investments | (14,137 | ) | (2,642 | ) | |||

Deferred costs and intangible assets | — | (39,147 | ) | ||||

Acquisition of real estate debt investments | — | 188 | |||||

Repayment on real estate debt investments | (60 | ) | — | ||||

Investment in unconsolidated ventures | (18,911 | ) | (122,268 | ) | |||

Distributions from unconsolidated ventures | 10,393 | 12,010 | |||||

Change in restricted cash | (2,402 | ) | (6,848 | ) | |||

Other assets | 798 | (12,417 | ) | ||||

Net cash provided by (used in) investing activities | (163,937 | ) | (762,832 | ) | |||

Cash flows from financing activities: | |||||||

Borrowing from mortgage notes | — | 503,750 | |||||

Repayment of mortgage notes | (104 | ) | — | ||||

Payment of deferred financing costs | (3,371 | ) | (8,341 | ) | |||

Change in restricted cash | 356 | (9 | ) | ||||

Net proceeds from issuance of common stock | 405 | 235,991 | |||||

Net proceeds from issuance of common stock, related party | — | 1,617 | |||||

Shares redeemed for cash | (5,238 | ) | (1,145 | ) | |||

Distributions paid on common stock | (60,646 | ) | (35,996 | ) | |||

Proceeds from distribution reinvestment plan | 33,746 | 20,097 | |||||

Contributions from non-controlling interests | 149 | 4,308 | |||||

Net cash provided by (used in) financing activities | (34,703 | ) | 720,272 | ||||

Net increase (decrease) in cash | (210,064 | ) | (47,704 | ) | |||

Cash - beginning of period | 354,229 | 267,672 | |||||

Cash - end of period | $ | 144,165 | $ | 219,968 | |||

Refer to accompanying notes to consolidated financial statements.

9

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Dollars in Thousands)

(Unaudited)

Six Months Ended June 30, | |||||||

2016 | 2015 | ||||||

Supplemental disclosure of non-cash investing and financing activities: | |||||||

Accrued cost of capital (refer to Note 7) | $ | — | $ | 558 | |||

Subscriptions receivable, gross | — | 3,506 | |||||

Escrow deposits related to real estate debt investments | 34 | 39 | |||||

Distribution payable | 10,086 | 6,804 | |||||

Other liabilities | — | 2,475 | |||||

Transfer of non-controlling interest in joint venture for controlling interest in consolidated real estate investment (refer to Note 3) | 103,005 | — | |||||

Assumption of mortgage notes payable upon acquisition of operating real estate | 648,211 | — | |||||

Accrued capital expenditures | 361 | — | |||||

Accrued acquisition fees - unconsolidated ventures | — | 13,098 | |||||

Refer to accompanying notes to consolidated financial statements.

10

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. | Business and Organization |

NorthStar Healthcare Income, Inc. (the “Company”) was formed to acquire, originate and asset manage a diversified portfolio of equity, debt and securities investments in healthcare real estate, directly or through joint ventures, with a focus on the mid-acuity senior housing sector, which the Company defines as assisted living (“ALF”), memory care (“MCF”), skilled nursing (“SNF”), independent living (“ILF”) facilities and continuing care retirement communities (“CCRC”), which may have independent living, assisted living, skilled nursing and memory care available on one campus. The Company also invests in other healthcare property types, including medical office buildings (“MOB”), hospitals, rehabilitation facilities and ancillary healthcare services businesses. The Company’s investments are predominantly in the United States, but it also selectively makes international investments. The Company was formed in October 2010 as a Maryland corporation and commenced operations in February 2013. The Company elected to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), commencing with the taxable year ended December 31, 2013. The Company conducts its operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

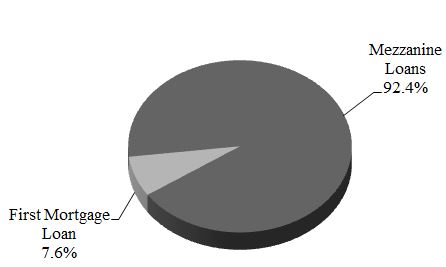

The Company’s equity investments are generally healthcare properties, which are either structured as net leases to healthcare operators or operated through management agreements with independent third-party operators, where applicable through the REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”) structures that permit the Company, through taxable REIT subsidiaries (“TRS”), to have direct exposure to resident fee income and incur related operating expenses. The Company’s debt investments consist of first mortgage loans and mezzanine loans. The Company currently owns no securities investments.

The Company is externally managed and has no employees. Prior to June 30, 2014, the Company was managed by an affiliate of NorthStar Realty Finance Corp. (NYSE: NRF) (“NorthStar Realty”). Effective June 30, 2014, NorthStar Realty spun-off its asset management business into a separate publicly traded company, NorthStar Asset Management Group Inc. (NYSE: NSAM) (the “Sponsor”). The Sponsor and its affiliates provide asset management and other services to the Company, NorthStar Realty, NorthStar Realty Europe Corp. (NYSE: NRE), other sponsored public retail-focused companies and any other companies the Sponsor and its affiliates may manage in the future (collectively, the “NSAM Managed Companies”), both in the United States and internationally. Concurrent with the spin-off, affiliates of the Sponsor entered into a new advisory agreement with the Company and each of the other NSAM Managed Companies. Pursuant to the Company’s advisory agreement, NSAM J-NSHC Ltd, an affiliate of the Sponsor (the “Advisor”), agreed to manage the day-to-day operations of the Company on terms substantially similar to those set forth in the Company’s prior advisory agreement with NorthStar Healthcare Income Advisor, LLC (the “Prior Advisor”). References to the “Prior Advisor” herein refer to the services performed by and fees paid and accrued to the Prior Advisor during the period prior to June 30, 2014. The spin-off of NorthStar Realty’s asset management business had no impact on the Company’s operations.

In June 2016, the Sponsor announced that it entered into a definitive merger agreement with NorthStar Realty and Colony Capital, Inc. (“Colony”), providing for the combination of the Sponsor, NorthStar Realty and Colony into a wholly-owned subsidiary of the Sponsor, as the surviving publicly-traded company for the combined organization that, upon and following the effective time of the mergers, will be named Colony NorthStar, Inc. (“Colony NorthStar”). As a result of the mergers, Colony NorthStar will be an internally-managed equity REIT, with a diversified real estate and investment management platform. In addition, following the mergers, the Advisor will be a subsidiary of Colony NorthStar. This transaction is expected to close in January 2017, subject to customary closing conditions, including regulatory approvals, and approval by the Sponsor’s, NorthStar Realty’s and Colony’s respective shareholders. There is no guarantee this transaction will close on the contemplated terms or within the anticipated timeframe, or at all. The Company does not expect that this transaction will have a material impact on its operations.

Substantially all the Company’s business is conducted through NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership. The limited partners of the Operating Partnership are the Prior Advisor and NorthStar Healthcare Income OP Holdings, LLC (the “Special Unit Holder”), each an affiliate of the Sponsor. The Prior Advisor invested $1,000 in the Operating Partnership in exchange for common units and the Special Unit Holder invested $1,000 in the Operating Partnership and was issued a separate class of limited partnership units (the “Special Units”), which are collectively recorded as non-controlling interests on the accompanying consolidated balance sheets as of June 30, 2016 and December 31, 2015. As the Company issued shares, it contributed substantially all of the proceeds from its continuous, public offerings to the Operating Partnership as a capital contribution. As of June 30, 2016, the Company’s limited partnership interest in the Operating Partnership was 99.99%.

The Company’s charter authorizes the issuance of up to 400.0 million shares of common stock with a par value of $0.01 per share and up to 50.0 million shares of preferred stock with a par value of $0.01 per share. The board of directors of the Company is

11

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

authorized to amend its charter, without the approval of the stockholders, to increase the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

The Company initially registered to offer up to 100.0 million shares pursuant to its primary offering to the public (the “Initial Primary Offering”) and up to 10.5 million shares pursuant to its distribution reinvestment plan (the “Initial DRP”), which are herein collectively referred to as the Initial Offering. The Initial Offering (including 8.6 million shares reallocated from the Initial DRP) was completed on February 2, 2015 by raising gross proceeds of $1.1 billion. All of the shares initially registered for the Initial Offering were issued.

On February 6, 2015, the Company’s registration statement on Form S-11 was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) for a follow-on public offering (the “Follow-on Offering”) of up to $700.0 million which included up to $500.0 million in shares pursuant to its follow-on primary offering (the “Follow-on Primary Offering”) and up to $200.0 million in shares pursuant to its follow-on distribution reinvestment plan (the “Follow-on DRP”). The Company stopped accepting subscriptions for the Follow-on Offering on December 17, 2015 and all of the shares initially registered (including $159.5 million of shares reallocated from the Follow-on DRP) for the Follow-on Offering were issued on or before January 19, 2016. The Company registered an additional 30.0 million shares to be offered pursuant to DRP beyond the completion of the Follow-on Offering and continues to offer such shares.

The Initial Primary Offering and the Follow-on Primary Offering are collectively referred to as the Primary Offering and the distribution reinvestment plan, including but not limited to, the Initial DRP and Follow-on DRP, are collectively referred to as the DRP. Additionally, the Primary Offering and the Initial DRP and Follow-on DRP are collectively referred to as the Offering.

The Company retained NorthStar Securities, LLC (the “Dealer Manager”), formerly a subsidiary of NorthStar Realty that became a subsidiary of the Sponsor upon completion of the spin-off, to serve as the dealer manager for the Primary Offering.

From inception through August 5, 2016, the Company raised total gross proceeds of $1.8 billion.

2. | Summary of Significant Accounting Policies |

Basis of Quarterly Presentation

The accompanying unaudited consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, the Operating Partnership and their consolidated subsidiaries. The Company consolidates variable interest entities (“VIE”) where the Company is the primary beneficiary and voting interest entities which are generally majority owned or otherwise controlled by the Company. All significant intercompany balances are eliminated in consolidation.

Variable Interest Entities

A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and the quantitative analysis on the forecasted cash flow of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

12

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents, has both the: (i) power to direct the activities that most significantly impact the VIE’s economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

The Company evaluates its investments and financings, including investments in unconsolidated ventures and securitization financing transactions, if any, to determine whether each investment or financing is a VIE. The Company analyzes new investments and financings, as well as reconsideration events for existing investments and financings, which vary depending on type of investment or financing.

The Company adopted the new consolidation guidance (refer to Recent Accounting Pronouncements) on January 1, 2016 which resulted in the identification of several VIEs. Prior to the adoption of the standard, these entities were consolidated under the voting interest model. The most significant consolidated VIEs are the Operating Partnership and certain properties that have non-controlling interests. These entities are VIEs because the non-controlling interests do not have substantive kick-out or participating rights. The Company consolidates these entities because it controls all significant business activities.

The Operating Partnership consolidates certain properties that have non-controlling interests. Included in operating real estate, net on the Company’s consolidated balance sheets as of June 30, 2016 is $427.6 million related to such consolidated VIEs. Included in mortgage notes payable, net on the Company’s consolidated balance sheets as of June 30, 2016 is $288.4 million, collateralized by the real estate assets of the related consolidated VIEs.

As of June 30, 2016, the Company identified unconsolidated VIEs related to its real estate equity investments with a carrying value of $415.0 million. The Company’s maximum exposure to loss as of June 30, 2016 would not exceed the carrying value of its investment in the VIEs and its investment in a $75.0 million mezzanine loan to a subsidiary of one of the VIEs. Based on management’s analysis, the Company determined that it is not the primary beneficiary. Accordingly, these VIEs are not consolidated in the Company’s financial statements as of June 30, 2016. The Company did not provide financial support to its unconsolidated VIEs during the six months ended June 30, 2016. As of June 30, 2016, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to its unconsolidated VIEs.

Voting Interest Entities

A voting interest entity is an entity in which the total equity investment at risk is sufficient to enable it to finance its activities independently and the equity holders have the power to direct the activities of the entity that most significantly impact its economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the Company has a majority voting interest in a voting interest entity, the entity will generally be consolidated. The Company does not consolidate a voting interest entity if there are substantive participating rights by other parties and/or kick-out rights by a single party or a simple majority vote.

The Company performs on-going reassessments of whether entities previously evaluated under the voting interest framework have become VIEs, based on certain events, and therefore subject to the VIE consolidation framework.

Investments in Unconsolidated Ventures

A non-controlling, unconsolidated ownership interest in an entity may be accounted for using the equity method, at fair value or the cost method.

Under the equity method, the investment is adjusted each period for capital contributions and distributions and its share of the entity’s net income (loss). Capital contributions, distributions and net income (loss) of such entities are recorded in accordance with the terms of the governing documents. An allocation of net income (loss) may differ from the stated ownership percentage interest in such entity as a result of preferred returns and allocation formulas, if any, as described in such governing documents. Equity method investments are recognized using a cost accumulation model in which the investment is recognized based on the

13

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

cost to the investor, which includes acquisition fees. The Company records as an expense certain acquisition costs and fees associated with consolidated investments deemed to be business combinations and capitalizes these costs for investments deemed to be acquisitions of an asset, including an equity method investment.

The Company may account for an investment in an unconsolidated entity at fair value by electing the fair value option. The Company may account for an investment that does not qualify for equity method accounting or for which the fair value option was not elected using the cost method if the Company determines the investment in the unconsolidated entity is insignificant. Under the cost method, equity in earnings is recorded as dividends are received to the extent they are not considered a return of capital, which is recorded as a reduction of cost of the investment.

Non-controlling Interests

A non-controlling interest in a consolidated subsidiary is defined as the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to the Company. A non-controlling interest is required to be presented as a separate component of equity on the consolidated balance sheets and presented separately as net income (loss) and comprehensive income (loss) attributable to controlling and non-controlling interests. An allocation to a non-controlling interest may differ from the stated ownership percentage interest in such entity as a result of a preferred return and allocation formula, if any, as described in such governing documents.

Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates and assumptions.

Comprehensive Income (Loss)

The Company had no items of other comprehensive income (loss) (“OCI”), so its comprehensive income (loss) is the same as the net income (loss) for all periods presented.

Operating Real Estate

The Company accounts for purchases of operating real estate that qualify as business combinations using the acquisition method, where the purchase price is allocated to tangible assets such as land, building, furniture and fixtures, improvements and other identified intangibles such as in place leases and goodwill. Major replacements and betterments which improve or extend the life of the asset are capitalized and depreciated over their useful life. Ordinary repairs and maintenance are expensed as incurred. Operating real estate is carried at historical cost less accumulated depreciation. Operating real estate is depreciated using the straight-line method over the estimated useful life of the assets, summarized as follows:

Category: | Term: | |

Building | 40 years | |

Building improvements | Lesser of the useful life or remaining life of the building | |

Tenant improvements | Lesser of the useful life or remaining term of the lease | |

Furniture and fixtures | 7 to 10 years | |

Land improvements | 15 years | |

Construction costs incurred in connection with the Company’s investments are capitalized and included in operating real estate, net on the consolidated balance sheets. Construction in progress is not depreciated until the development is substantially completed. Costs directly related to an acquisition deemed to be a business combination are expensed and included in transaction costs in the consolidated statements of operations. The Company evaluates whether a real estate acquisition constitutes a business and whether business combination accounting is appropriate.

When the Company acquires a controlling interest in an existing unconsolidated joint venture, the Company records the consolidated investment at the updated purchase price, which is reflective of fair value. The difference between the carrying value of the Company’s investment in the existing unconsolidated joint venture on the acquisition date and the Company’s share of the fair value of the investment is recorded in gain (loss) on consolidation of unconsolidated venture in the Company’s consolidated statements of operations.

14

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Real Estate Debt Investments

Debt investments are generally intended to be held to maturity and, accordingly, are carried at cost, net of unamortized loan fees, premium, discount and unfunded commitments. Debt investments that are deemed to be impaired are carried at amortized cost less a loan loss reserve, if deemed appropriate, which approximates fair value. Debt investments where the Company does not have the intent to hold the loan for the foreseeable future or until its expected payoff are classified as held for sale and recorded at the lower of cost or estimated value.

Real Estate Securities

The Company classifies its securities investments as available for sale on the acquisition date, which are carried at fair value. Unrealized gains (losses) are recorded as a component of accumulated OCI in the consolidated statements of equity. However, the Company may elect the fair value option for certain of its available for sale securities, and as a result, any unrealized gains (losses) on such securities are recorded in unrealized gain (loss) on investments and other in the consolidated statements of operations. As of June 30, 2016, the Company does not own any securities investments.

Deferred Costs and Intangible Assets

Deferred Costs

Deferred costs include deferred lease costs. Deferred financing costs represent commitment fees, legal and other third-party costs associated with obtaining financing. These costs are amortized to interest expense over the term of the financing using either the effective interest method or straight-line method depending on the type of financing. Unamortized deferred financing costs are expensed when the associated borrowing is repaid before maturity. Costs incurred in seeking financing transactions, which do not close, are expensed in the period in which it is determined that the financing will not occur. Deferred lease costs consist of fees incurred to initiate and renew operating leases, which are amortized on a straight-line basis over the remaining lease term and are recorded to depreciation and amortization in the consolidated statements of operations.

Identified Intangibles

The Company records acquired identified intangibles based on estimated fair value. In-place lease intangible assets are amortized into depreciation and amortization expense in the consolidated statements of operations on a straight-line basis over the remaining lease or resident agreement term.

Goodwill represents the excess of the purchase price over the fair value of net tangible and intangible assets acquired in a business combination and is not amortized. The Company performs an annual impairment test for goodwill and evaluates the recoverability whenever events or changes in circumstances indicate that the carrying value of goodwill may not be fully recoverable. In making such assessment, qualitative factors are used to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value. If the estimated fair value of the reporting unit is less than its carrying value, then an impairment charge is recorded.

Identified intangible assets are recorded in deferred costs and intangible assets, net on the consolidated balance sheets.

The following table presents a summary of deferred costs and intangible assets as of June 30, 2016 and December 31, 2015 (dollars in thousands):

June 30, 2016 (Unaudited) | December 31, 2015 | |||||||

Deferred costs and intangible assets: | ||||||||

In-place lease value, net | $ | 12,743 | $ | 21,307 | ||||

Goodwill | 22,112 | 22,112 | ||||||

Other intangible assets | 380 | 380 | ||||||

Subtotal intangible assets | 35,235 | 43,799 | ||||||

Deferred financing and other costs, net | 426 | 462 | ||||||

Total | $ | 35,661 | $ | 44,261 | ||||

15

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The Company recorded $3.5 million and $8.6 million of in-place lease and deferred lease cost amortization expense for the three and six months ended June 30, 2016, respectively. The Company recorded $1.7 million of in-place lease and deferred lease cost amortization expense for the three and six months ended June 30, 2015.

Acquisition Fees and Expenses

The total of all acquisition fees and expenses for an investment, including acquisition fees to the Advisor, cannot exceed, in the aggregate, 6.0% of the contract purchase price of such investment unless such excess is approved by a majority of the directors, including independent directors. For the six months ended June 30, 2016 and 2015, total acquisition fees and expenses did not exceed the allowed limit for any investment. An acquisition fee incurred related to an equity investment will generally be expensed as incurred. An acquisition fee paid to the Advisor related to the acquisition of an equity or debt investment in an unconsolidated joint venture is included in investments in unconsolidated ventures on the consolidated balance sheets. An acquisition fee paid to the Advisor related to the origination or acquisition of debt investments is included in debt investments, net on the consolidated balance sheets and is amortized to interest income over the life of the investment using the effective interest method. The Company records as an expense certain acquisition costs and fees associated with transactions deemed to be business combinations in which it consolidates the asset and capitalizes these costs for transactions deemed to be acquisitions of an asset, including an equity investment.

Other Assets

The following table presents a summary of other assets as of June 30, 2016 and December 31, 2015 (dollars in thousands):

June 30, 2016 (Unaudited) | December 31, 2015 | |||||||

Other assets: | ||||||||

Investment deposits and pending deal costs | $ | 6,683 | $ | 6,629 | ||||

Remainder interest in condominium units(1) | 4,964 | 5,401 | ||||||

Deferred tax assets | — | 7,026 | ||||||

Prepaid expenses | 1,949 | 790 | ||||||

Other | 984 | 536 | ||||||

Total | $ | 14,580 | $ | 20,382 | ||||

__________________________________________________________

(1) | Represents future interests in property subject to life estates (“Remainder Interest”). |

Revenue Recognition

Operating Real Estate

Rental income includes rental and escalation income from operating real estate and is derived from leasing of space to various types of tenants and healthcare operators. Rental revenue recognition commences when the tenant takes possession of the leased space and the leased space is substantially ready for its intended use. The leases are for fixed terms of varying length and generally provide for annual rentals and expense reimbursements to be paid in monthly installments. Rental income from leases is recognized on a straight-line basis over the term of the respective leases. The excess of rents recognized over amounts contractually due pursuant to the underlying leases are included in unbilled rent receivable on the consolidated balance sheets. The Company amortizes any tenant inducements as a reduction of revenue utilizing the straight-line method over the term of the lease. Escalation income represents revenue from tenant/operator leases which provide for the recovery of all or a portion of the operating expenses and real estate taxes paid by the Company on behalf of the respective property. This revenue is accrued in the same period as the expenses are incurred.

The Company also generates operating income from operating healthcare properties. Revenue related to operating healthcare properties includes resident room and care charges and other resident service charges. Revenue is recognized when such services are provided, generally defined per their resident agreement as the date upon which a resident occupies a room or uses the services and is recorded in resident fee income in the consolidated statements of operations.

In a situation in which a lease(s) associated with a significant tenant have been, or are expected to be, terminated early, the Company evaluates the remaining useful life of depreciable or amortizable assets in the asset group related to the lease that will be terminated (i.e., tenant improvements, above- and below-market lease intangibles, in-place lease value and deferred leasing costs). Based upon consideration of the facts and circumstances surrounding the termination, the Company may write-off or accelerate the

16

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

depreciation and amortization associated with the asset group. Such amounts are included within depreciation and amortization in the consolidated statements of operations.

Real Estate Debt Investments

Interest income is recognized on an accrual basis and any related premium, discount, origination costs and fees are amortized over the life of the investment using the effective interest method. The amortization is reflected as an adjustment to interest income in the consolidated statements of operations. The amortization of a premium or accretion of a discount is discontinued if such loan is reclassified to held for sale.

Real Estate Securities

Interest income is recognized using the effective interest method with any premium or discount amortized or accreted through earnings based on expected cash flow through the expected maturity date of the security. Changes to expected cash flow may result in a change to the yield which is then applied retrospectively for high-credit quality securities that cannot be prepaid or otherwise settled in such a way that the holder would not recover substantially all of the investment or prospectively for all other securities to recognize interest income. As of June 30, 2016, the Company does not own any securities investments.

Credit Losses and Impairment on Investments

Operating Real Estate

The Company’s real estate portfolio is reviewed on a quarterly basis, or more frequently as necessary, to assess whether there are any indicators that the value of its operating real estate may be impaired or that its carrying value may not be recoverable. A property’s value is considered impaired if the Company’s estimate of the aggregate expected future undiscounted cash flow generated by the property is less than the carrying value. In conducting this review, the Company considers U.S. macroeconomic factors, real estate and healthcare sector conditions, together with asset specific and other factors. To the extent an impairment has occurred, the loss is measured as the excess of the carrying value of the property over the estimated fair value and recorded in impairment on operating real estate in the consolidated statements of operations.

An allowance for a doubtful account for a tenant/operator/resident receivable is established based on a periodic review of aged receivables resulting from estimated losses due to the inability of tenant/operator/resident to make required rent and other payments contractually due. Additionally, the Company establishes, on a current basis, an allowance for future tenant/operator/resident credit losses on unbilled rent receivable based on an evaluation of the collectability of such amounts. The Company had an immaterial amount of allowance for doubtful accounts as of June 30, 2016.

Real Estate Debt Investments

Loans are considered impaired when, based on current information and events, it is probable that the Company will not be able to collect principal and interest amounts due according to the contractual terms. The Company assesses the credit quality of the portfolio and adequacy of loan loss reserves on a quarterly basis or more frequently as necessary. Significant judgment of the Company is required in this analysis. The Company considers the estimated net recoverable value of the loan as well as other factors, including but not limited to the fair value of any collateral, the amount and the status of any senior debt, the quality and financial condition of the borrower and the competitive situation of the area where the underlying collateral is located. Because this determination is based on projections of future economic events, which are inherently subjective, the amount ultimately realized may differ materially from the carrying value as of the balance sheet date. If upon completion of the assessment, the estimated fair value of the underlying collateral is less than the net carrying value of the loan, a loan loss reserve is recorded with a corresponding charge to provision for loan losses. The loan loss reserve for each loan is maintained at a level that is determined to be adequate by management to absorb probable losses.

Income recognition is suspended for a loan at the earlier of the date at which payments become 90-days past due or when, in the opinion of the Company, a full recovery of income and principal becomes doubtful. When the ultimate collectability of the principal of an impaired loan is in doubt, all payments are applied to principal under the cost recovery method. When the ultimate collectability of the principal of an impaired loan is not in doubt, contractual interest is recorded as interest income when received, under the cash basis method until an accrual is resumed when the loan becomes contractually current and performance is demonstrated to be resumed. A loan is written off when it is no longer realizable and/or legally discharged. As of June 30, 2016, the Company did not have any impaired real estate debt investments.

17

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Investments in Unconsolidated Ventures

The Company reviews its investments in unconsolidated ventures for which the Company did not elect the fair value option on a quarterly basis, or more frequently as necessary, to assess whether there are any indicators that the value may be impaired or that its carrying value may not be recoverable. An investment is considered impaired if the projected net recoverable amount over the expected holding period is less than the carrying value. In conducting this review, the Company considers global macroeconomic factors, including real estate sector conditions, together with investment specific and other factors. To the extent an impairment has occurred and is considered to be other than temporary, the loss is measured as the excess of the carrying value of the investment over the estimated fair value and recorded in equity in earnings (losses) of unconsolidated ventures in the consolidated statements of operations.

Real Estate Securities

Securities for which the fair value option is elected are not evaluated for other-than-temporary impairment (“OTTI”) as any change in fair value is recorded in the consolidated statements of operations. Realized losses on such securities are reclassified to realized gain (loss) on investments and other as losses occur.

Securities for which the fair value option is not elected are evaluated for OTTI quarterly. Impairment of a security is considered to be other-than-temporary when: (i) the holder has the intent to sell the impaired security; (ii) it is more likely than not the holder will be required to sell the security; or (iii) the holder does not expect to recover the entire amortized cost of the security. When a security has been deemed to be other-than-temporarily impaired due to (i) or (ii), the security is written down to its fair value and an OTTI is recognized in the consolidated statements of operations. In the case of (iii), the security is written down to its fair value and the amount of OTTI is then bifurcated into: (a) the amount related to expected credit losses; and (b) the amount related to fair value adjustments in excess of expected credit losses. The portion of OTTI related to expected credit losses is recognized in the consolidated statements of operations. The remaining OTTI related to the valuation adjustment is recognized as a component of accumulated OCI in the consolidated statements of equity. The portion of OTTI recognized through earnings is accreted back to the amortized cost basis of the security through interest income, while amounts recognized through OCI are amortized over the life of the security with no impact on earnings. Real estate securities which are not high-credit quality are considered to have an OTTI if the security has an unrealized loss and there has been an adverse change in expected cash flow. The amount of OTTI is then bifurcated as discussed above. As of June 30, 2016, the Company did not own any real estate securities.

Organization and Offering Costs

The Advisor, or its affiliates, was entitled to receive reimbursement for costs paid on behalf of the Company in connection with the Offering. The Company was obligated to reimburse the Advisor for organization and offering costs to the extent the aggregate of selling commissions, dealer manager fees and other organization and offering costs do not exceed 15% of gross offering proceeds from the Primary Offering. The Advisor did not expect reimbursable organization and offering costs, including costs incurred in connection with the Follow-on Offering but excluding selling commissions and dealer manager fees, to exceed $22.5 million, or 1.5% of the total proceeds available to be raised from the Primary Offering. Based on gross proceeds of $1.7 billion from the Primary Offering, the Company incurred reimbursable organizational and offering costs, excluding selling commissions and dealer manager fees, of 1.0%, which was less than the 1.5% expected. The Company recorded organization and offering costs each period based upon an allocation determined by the expectation of total organization and offering costs to be reimbursed. Organization costs were recorded as an expense in general and administrative expenses in the consolidated statements of operations and offering costs were recorded as a reduction to equity.

Income Taxes

The Company elected to be taxed as a REIT and to comply with the related provisions of the Internal Revenue Code beginning in its taxable year ended December 31, 2013. Accordingly, the Company will generally not be subject to U.S. federal income tax to the extent of its distributions to stockholders as long as certain asset, income and share ownership tests are met. To maintain its qualification as a REIT, the Company must annually distribute at least 90% of its REIT taxable income to its stockholders and meet certain other requirements. The Company may also be subject to certain state, local and franchise taxes. Under certain circumstances, federal income and excise taxes may be due on its undistributed taxable income. If the Company were to fail to meet these requirements, it would be subject to U.S. federal income tax, which could have a material adverse impact on its results of operations and amounts available for distributions to its stockholders. The Company believes that all of the criteria to maintain the Company’s REIT qualification have been met for the applicable periods, but there can be no assurance that these criteria will continue to be met in subsequent periods.

18

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The Company made a joint election to treat certain subsidiaries as TRS which may be subject to U.S. federal, state and local income taxes. In general, a TRS of the Company may perform non-customary services for tenants/operators/residents of the Company, hold assets that the Company cannot hold directly and may engage in any real estate or non-real estate-related business.

Certain subsidiaries of the Company are subject to taxation by federal, state and foreign authorities for the periods presented. The Company and its U.S. subsidiaries will file a consolidated federal income tax return. Income taxes are accounted for by the asset/liability approach in accordance with U.S. GAAP. Deferred taxes, if any, represent the expected future tax consequences when the reported amounts of assets and liabilities are recovered or paid. Such amounts arise from differences between the financial reporting and tax bases of assets and liabilities and are adjusted for changes in tax laws and tax rates in the period which such changes are enacted. A provision for income tax represents the total of income taxes paid or payable for the current period, plus the change in deferred taxes. Current and deferred taxes are provided on the portion of earnings (losses) recognized by the Company with respect to its interest in the TRS. Deferred income tax assets and liabilities are calculated based on temporary differences between the Company’s U.S. GAAP consolidated financial statements and the federal and state income tax basis of assets and liabilities as of the consolidated balance sheet date. The Company evaluates the realizability of its deferred tax assets (e.g., net operating loss and capital loss carryforwards) and recognizes a valuation allowance if, based on the available evidence, it is more likely than not that some portion or all of its deferred tax assets will not be realized. When evaluating the realizability of its deferred tax assets, the Company considers estimates of expected future taxable income, existing and projected book/tax differences, tax planning strategies available and the general and industry specific economic outlook. This realizability analysis is inherently subjective, as it requires the Company to forecast its business and general economic environment in future periods. Changes in estimate of deferred tax asset realizability, if any, are included in provision for income tax benefit (expense) in the consolidated statements of operations. In the first quarter of 2016, the Company recorded a $7.0 million valuation allowance as it determined it will be unable to utilize a $7.0 million deferred tax asset. As of June 30, 2016, there are no changes in the facts and circumstances to indicate that the Company should release the valuation allowance.

The Company recorded a net income tax expense of less than $0.1 million and $7.1 million for the three and six months ended June 30, 2016, respectively. The Company recorded an income tax benefit of $0.2 million and $0.6 million for the three and six months ended June 30, 2015, respectively.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued an accounting update requiring a company to recognize as revenue the amount of consideration it expects to be entitled to in connection with the transfer of promised goods or services to customers. The accounting standard update will replace most of the existing revenue recognition guidance currently promulgated by U.S. GAAP. In July 2015, the FASB decided to delay the effective date of the new revenue standard by one year. The effective date of the new revenue standard for the Company will be January 1, 2018. The Company is in the process of evaluating the impact, if any, of the update on its consolidated financial position, results of operations and financial statement disclosures.

In February 2015, the FASB issued updated guidance that changes the rules regarding consolidation. The pronouncement eliminates specialized guidance for limited partnerships and similar legal entities and removes the indefinite deferral for certain investment funds. The new guidance is effective for annual periods and interim periods within those annual periods beginning after December 15, 2015, with early adoption permitted. The Company adopted this guidance in the first quarter 2016 and determined the Company’s Operating Partnership is considered a VIE. The Company is the primary beneficiary of the VIE, the VIE’s assets can be used for purposes other than the settlement of the VIE’s obligations and the Company’s partnership interest is considered a majority voting interest. As such, this standard resulted in the identification of additional VIEs, however it did not have a material impact on the Company’s consolidated financial position or results of operations.

In January 2016, the FASB issued an accounting update that addresses certain aspects of recognition, measurement, presentation, and disclosure of financial instruments. The new guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2017. The Company is currently assessing the impact, if any, of the guidance on the Company’s consolidated financial position, results of operations and financial statement disclosures.

In February 2016, the FASB issued an accounting update that requires lessees to present right-of-use assets and lease liabilities on the balance sheet. The new guidance is to be applied using a modified retrospective approach at the beginning of the earliest comparative period in the financial statements and is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption is permitted. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

19

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

In March 2016, the FASB issued guidance which eliminates the requirement for an investor to retroactively apply the equity method when its increase in ownership interest (or degree of influence) in an investee triggers equity method accounting. The update requires that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor’s previously held interest and adopt the equity method of accounting as of the date the investment become qualified for equity method accounting. The update should be applied prospectively upon their effective date to increases in the level of ownership interests or degree of influence that results in the adoption of the equity method. The guidance is effective for fiscal years beginning after December 15, 2016 and interim periods within those fiscal years. Early adoption is permitted. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In March 2016, the FASB issued guidance which amends several aspects of the accounting for equity-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statements of cash flows. The guidance is effective for interim and annual reporting periods in fiscal years beginning after December 15, 2017. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In June 2016, the FASB issued guidance which changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. Additionally, entities will have to disclose significantly more information including information used to track credit quality by year of origination for most financing receivables. The new guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2019. Early adoption is permitted. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

3. | Operating Real Estate |

The following table presents operating real estate, net as of June 30, 2016 and December 31, 2015 (dollars in thousands):

June 30, 2016 (Unaudited) | December 31, 2015 | |||||||

Land | $ | 318,901 | $ | 140,734 | ||||

Land improvements | 8,425 | 8,384 | ||||||

Buildings and improvements | 1,378,113 | 664,555 | ||||||

Tenant improvements | 3,214 | 1,522 | ||||||

Construction in progress | 18,319 | 9,119 | ||||||

Furniture and fixtures | 29,997 | 27,325 | ||||||

Subtotal | 1,756,969 | 851,639 | ||||||

Less: Accumulated depreciation | (36,036 | ) | (19,386 | ) | ||||

Operating real estate, net | $ | 1,720,933 | $ | 832,253 | ||||

Real Estate Acquisitions

In March 2016, the Company acquired NorthStar Realty’s 60.0% interest in a joint venture (the “Winterfell JV”) which owned 32 private pay independent living facilities (the “Winterfell portfolio”) for a purchase price of $534.5 million, excluding escrows and subject to customary proration and adjustments. The transaction was approved by the Company’s board of directors, including all of its independent directors, and validated by an independent third-party appraisal for the Winterfell portfolio. The Company originally acquired a 40.0% equity interest in the Winterfell JV in May 2015. The Company accordingly now owns 100.0% of the equity in the Winterfell portfolio as of March 1, 2016 and consolidates the portfolio. Prior to March 1, 2016, the Company accounted for its equity investment in the Winterfell JV as an unconsolidated venture under the equity method and as of December 31, 2015, the carrying value of the Company’s investment was $95.7 million. For the three months ended March 31, 2016, the Company recognized $1.4 million in equity in earnings and received $0.6 million cash distributions.

20

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

The following table summarizes operating real estate acquisitions for the six months ended June 30, 2016 (dollars in thousands):

Acquisition Date | Type | Portfolio | Amount(1) | Properties | Units | Location | Financing | Company’s Equity | Ownership Interest | Transaction Costs | ||||||||||||||||||

March 2016 | Operating Facilities | Winterfell | $ | 904,985 | 32 | 3,985 | Various | $ | 648,211 | $ | 261,484 | 100.0% | $ | 1,347 | ||||||||||||||

_________________________________________________

(1) | Represents the purchase price for 100% of the Winterfell JV equity interests, including deferred costs and other assets, and may be adjusted upon completion of the final purchase price allocation. |

The preliminary allocation of the purchase price of the assets acquired and liabilities assumed from the acquisition of the Winterfell portfolio was allocated 20% to land and 80% to buildings. In connection with the consolidation of the Winterfell portfolio on March 1, 2016, the Company recognized a gain on consolidation of unconsolidated venture of $6.4 million, which was calculated as the difference between the carrying value of the Company’s investment in the existing unconsolidated joint venture on the acquisition date and the Company’s share of the fair value of the retained equity interest.

For business combinations achieved in stages, the acquisition date fair value of the Company’s unconsolidated venture immediately before the acquisition date is determined through the Company’s underwriting process, which includes the use of estimated cash flows projections and available market data, such as relevant discount and capitalization rates. Refer to Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional details of the Company’s underwriting process. The acquisition-date fair value of the equity interest in the Winterfell portfolio immediately before the acquisition date, as well as the gain on consolidation of unconsolidated venture, are as follows (dollars in thousands):

Winterfell Portfolio | ||||

Contract purchase price | $ | 890,834 | ||

Net consideration funded at closing, excluding consideration financed by debt | (139,618 | ) | ||

Debt assumed | (648,211 | ) | ||

Fair value of retained equity interest | 103,005 | |||