Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GI DYNAMICS, INC. | d233326d8k.htm |

| Exhibit 99.1

|

GI Dynamics, Inc.

Q2 16 Quarterly Shareholder Brief

8/11/16

|

|

Forward-Looking Statements

Currency References

Financial amounts in this presentation are expressed in US Dollars, except where specifically noted.

Forward-Looking Statements

This presentation contains forward-looking statements concerning: our development and commercialization plans; our potential revenues and revenue growth, costs, excess inventory, profitability and financial performance; our ability to obtain reimbursement for our products; our clinical trials, and associated regulatory submissions and approvals; the number and location of commercial centers offering the EndoBarrier®; and our intellectual property position. These forward-looking statements are based on the current estimates and expectations of future events by the management of GI Dynamics, Inc. as of the date of this presentation and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those indicated in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: risks associated with the consequences of terminating the ENDO Trial and the possibility that future clinical trials will not be successful or confirm earlier results; risks associated with obtaining funding from third parties; risks relating to the timing and costs of clinical trials, the timing of regulatory submissions, the timing, receipt and maintenance of regulatory approvals, the timing and amount of other expenses, and the timing and extent of third-party reimbursement; risks associated with commercial product sales, including product performance; competition; risks related to market acceptance of products; intellectual property risks; risks related to excess inventory; risks related to assumptions regarding the size of the available market, benefits of our products, product pricing, timing of product launches, future financial results and other factors including those described in our filings with the U.S. Securities and Exchange Commission. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We do not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Disclaimer

This presentation and any supplemental materials have been prepared by GI Dynamics, Inc. based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of GI Dynamics,

Inc., or any of its members, directors, officers, employees, or agents or advisors, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of GI Dynamics, Inc. or any of its directors, officers, employees or agents.

8/11/2016 GI Dynamics, Inc. 2

|

|

Conference Call Agenda

Q2 ‘16 results

Cash flow and cash runway update

EndoBarrier Overview

T2D Treatment Options

Safety profile update

Clinical data

Regulatory progress

Update on corporate priorities

Looking ahead

8/11/2016 GI Dynamics, Inc. 3

|

|

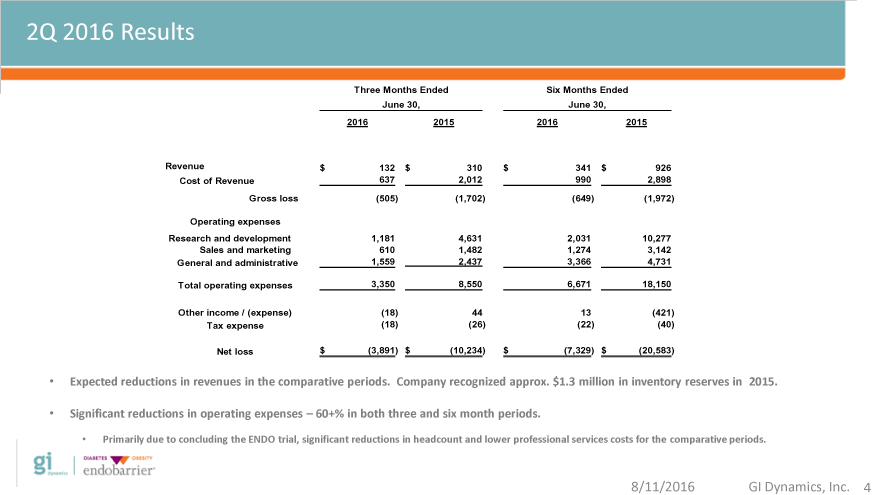

2Q 2016 Results

Three Months Ended Six Months Ended

June 30, June 30,

2Q 2016 2016 2015 2016 2015

Revenue $ 132 $ 310 $ 341 $ 926

Cost of Revenue 637 2,012 990 2,898

Gross loss(505)(1,702)(649)(1,972)

Operating expenses

Research and development 1,181 4,631 2,031 10,277

Sales and marketing 610 1,482 1,274 3,142

General and administrative 1,559 2,437 3,366 4,731

Total operating expenses 3,350 8,550 6,671 18,150

Other income / (expense)(18) 44 13(421)

Tax expense(18)(26)(22)(40)

Net loss $(3,891) $(10,234) $(7,329) $(20,583)

Expected reductions in revenues in the comparative periods. Company recognized approx. $ 1.3 million in inventory reserves in 2015.

Significant reductions in operating expenses – 60+% in both three and six month periods.

Primarily due to concluding the ENDO trial, significant reductions in headcount and lower professional services costs for the comparative periods.

8/11/2016 GI Dynamics, Inc. 4

|

|

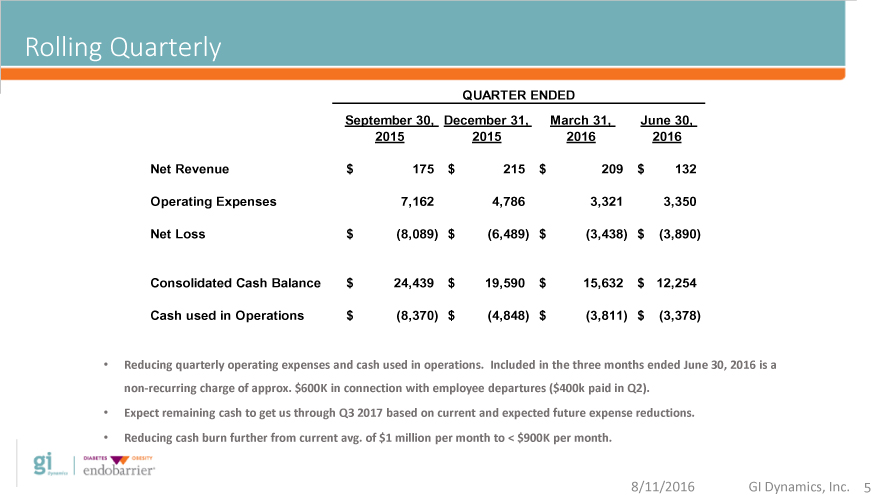

Rolling Quarterly

QUARTER ENDED

Rolling September 30, December 31, March 31, June 30,

2015 2015 2016 2016

Net Revenue $ 175 $ 215 $ 209 $ 132

Operating Expenses 7,162 4,786 3,321 3,350

Net Loss $(8,089) $(6,489) $(3,438) $(3,890)

Consolidated Cash Balance $ 24,439 $ 19,590 $ 15,632 $ 12,254

Cash used in Operations $(8,370) $(4,848) $(3,811) $(3,378)

Reducing quarterly operating expenses and cash used in operations. Included in the three months ended June 30, 2016 is a

non-recurring charge of approx. $600K in connection with employee departures ($ 400k paid in Q2).

Expect remaining cash to get us through Q3 2017 based on current and expected future expense reductions.

Reducing cash burn further from current avg. of $1 million per month to < $900K per month.

8/11/2016 GI Dynamics, Inc. 5

|

|

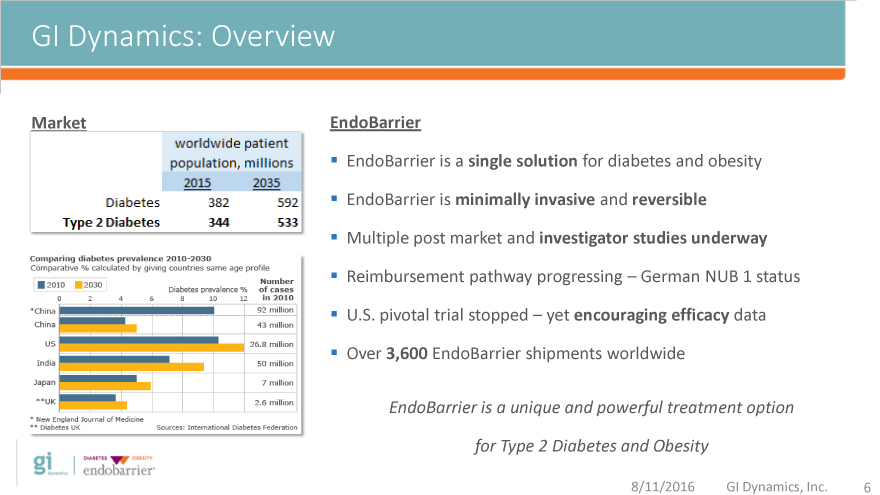

GI Dynamics: Overview

Market EndoBarrier

EndoBarrier is a single solution for diabetes and obesity

EndoBarrier is minimally invasive and reversible

Multiple post market and investigator studies underway

Reimbursement pathway progressing – German NUB 1 status

U.S. pivotal trial stopped – yet encouraging efficacy data

Over 3,600 EndoBarrier shipments worldwide

EndoBarrier is a unique and powerful treatment option

for Type 2 Diabetes and Obesity

8/11/2016 GI Dynamics, Inc. 6

|

|

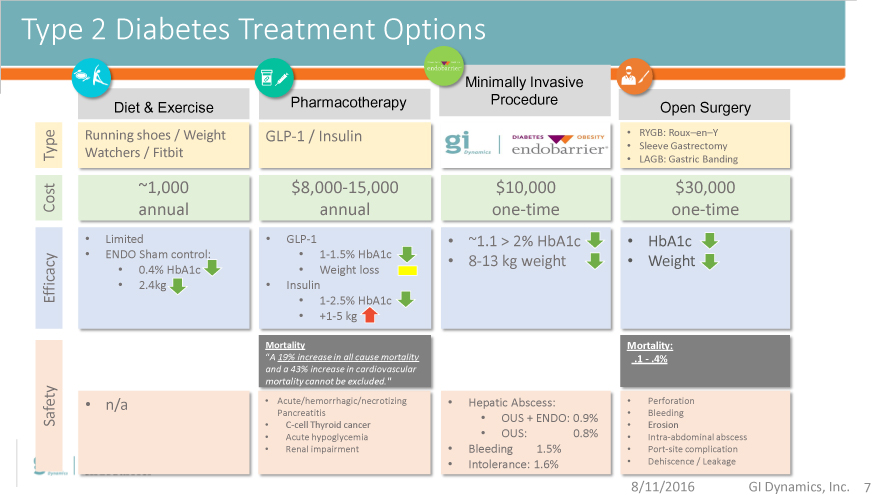

Type 2 Diabetes Treatment Options

Minimally Invasive

Diet & Exercise Pharmacotherapy Procedure Open Surgery

Running shoes / Weight GLP-1 / Insulin RYGB: Roux–en–Y

Type Watchers / Fitbit Sleeve Gastrectomy

LAGB: Gastric Banding

~1,000 $8,000-15,000 $10,000

Cost annual annual one-time one-time

Limited GLP-1 ~1.1 > 2% HbA1c HbA1c

ENDO Sham control: 1-1.5% HbA1c 8-13 kg weight Weight

0.4% HbA1c Weight loss

Efficacy 2.4kg Insulin

1-2.5% HbA1c

+1-5 kg

Mortality Mortality:

“A 19% increase in all cause mortality .1—.4%

and a 43% increase in cardiovascular

mortality cannot be excluded.”

n/a Acute/hemorrhagic/necrotizing Hepatic Abscess: Perforation

Safety Pancreatitis OUS + ENDO: 0.9% Bleeding

C-cell Thyroid cancer Erosion

Acute hypoglycemia OUS: 0.8% Intra-abdominal abscess

Renal impairment Bleeding 1.5% Port-site complication

Intolerance: 1.6% Dehiscence / Leakage

8/11/2016 GI Dynamics, Inc. 7

|

|

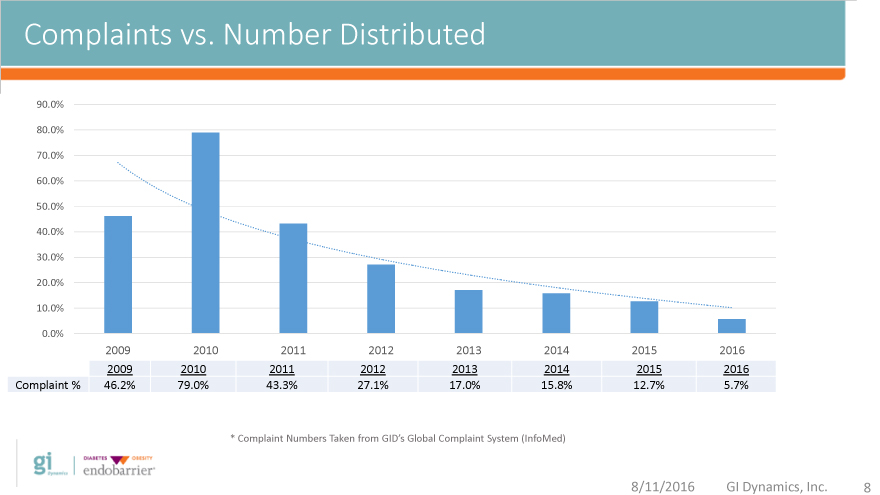

Complaints vs. Number Distributed

90.0%

80.0%

70.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

2009 2010 2011 2012 2013 2014 2015 2016

2009 2010 2011 2012 2013 2014 2015 2016

Complaint % 46.2% 79.0% 43.3% 27.1% 17.0% 15.8% 12.7% 5.7%

* Complaint Numbers Taken from GID’s Global Complaint System (InfoMed)

8/11/2016 GI Dynamics, Inc. 8

|

|

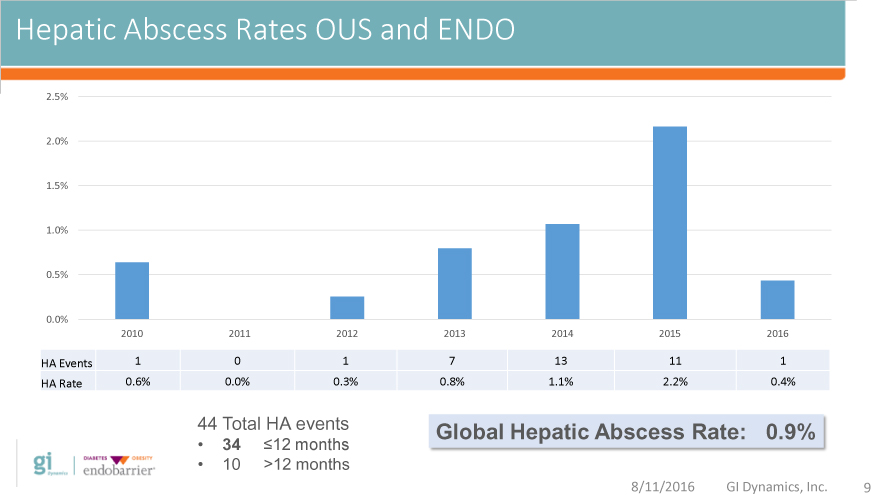

Hepatic Abscess Rates OUS and ENDO

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2010 2011 2012 2013 2014 2015 2016

HA Events 1 0 1 7 13 11 1

HA Rate 0.6% 0.0% 0.3% 0.8% 1.1% 2.2% 0.4%

44 Total HA events Global Hepatic Abscess Rate: 0.9%

34 12 months

10 >12 months

8/11/2016 GI Dynamics, Inc. 9

|

|

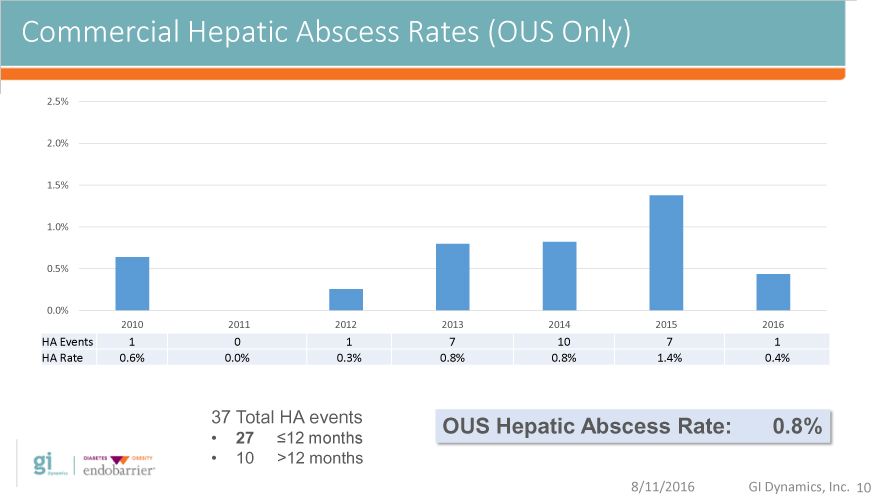

Commercial Hepatic Abscess Rates (OUS Only)

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2010 2011 2012 2013 2014 2015 2016

HA Events 1 0 1 7 10 7 1

HA Rate 0.6% 0.0% 0.3% 0.8% 0.8% 1.4% 0.4%

37 Total HA events OUS Hepatic Abscess Rate: 0.8%

27 12 months

10 >12 months

8/11/2016 GI Dynamics, Inc. 10

|

|

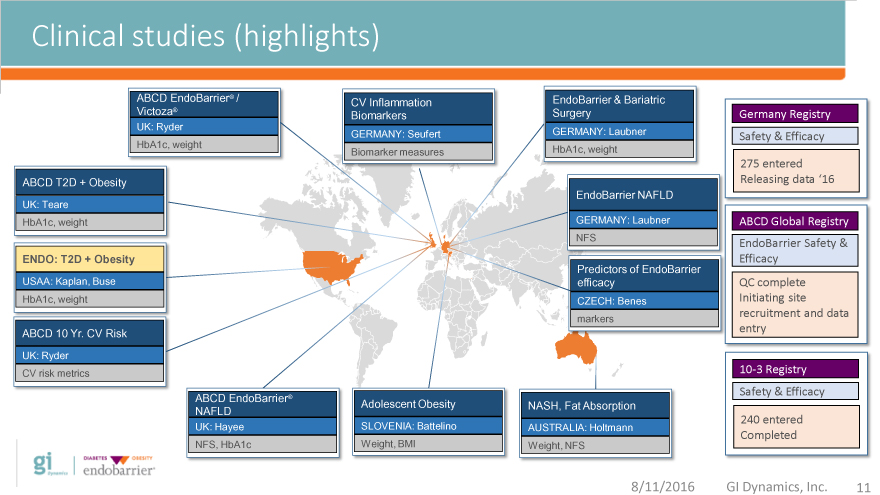

Clinical studies (highlights)

ABCD EndoBarrier® / CV Inflammation EndoBarrier & Bariatric

Victoza® Biomarkers Surgery Germany Registry

UK: Ryder GERMANY: Seufert GERMANY: Laubner Safety & Efficacy

HbA1c, weight Biomarker measures HbA1c, weight

275 entered

ABCD T2D + Obesity Releasing data ‘16

EndoBarrier NAFLD

UK: Teare

HbA1c, weight GERMANY: Laubner ABCD Global Registry

NFS EndoBarrier Safety &

ENDO: T2D + Obesity Efficacy

Predictors of EndoBarrier

USAA: Kaplan, Buse efficacy QC complete

HbA1c, weight CZECH: Benes Initiating site

markers recruitment and data

ABCD 10 Yr. CV Risk entry

UK: Ryder

CV risk metrics 10-3 Registry

Safety & Efficacy

ABCD EndoBarrier® Adolescent Obesity NASH, Fat Absorption

NAFLD

UK: Hayee SLOVENIA: Battelino AUSTRALIA: Holtmann 240 entered

Completed

NFS, HbA1c Weight, BMI Weight, NFS

8/11/2016 GI Dynamics, Inc. 11

|

|

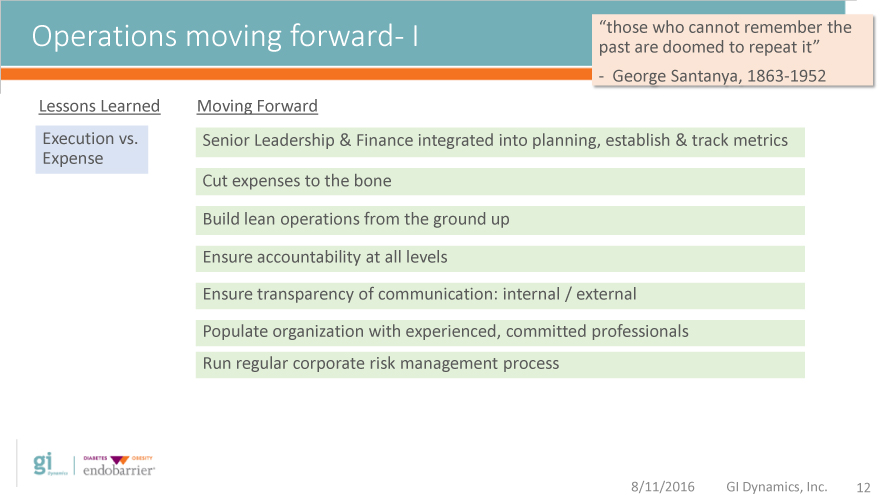

Operations moving forward- I past “those are who doomed cannot to remember repeat it” the

—George Santanya, 1863-1952

Lessons Learned Moving Forward

Execution vs. Senior Leadership & Finance integrated into planning, establish & track metrics

Expense

Cut expenses to the bone

Build lean operations from the ground up

Ensure accountability at all levels

Ensure transparency of communication: internal / external

Populate organization with experienced, committed professionals

Run regular corporate risk management process

8/11/2016 GI Dynamics, Inc. 12

|

|

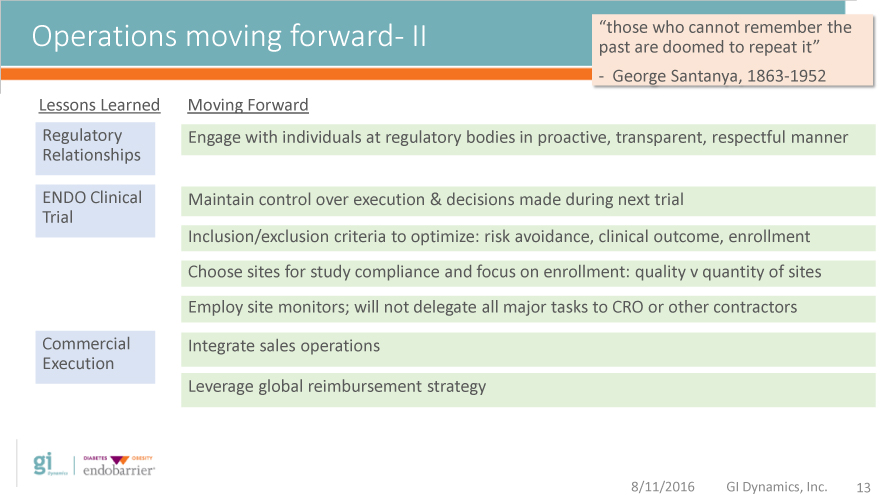

Operations moving forward- II “those who cannot remember the

past are doomed to repeat it”

—George Santanya, 1863-1952

Lessons Learned Moving Forward

Regulatory Engage with individuals at regulatory bodies in proactive, transparent, respectful manner

Relationships

ENDO Clinical Maintain control over execution & decisions made during next trial

Trial

Inclusion/exclusion criteria to optimize: risk avoidance, clinical outcome, enrollment

Choose sites for study compliance and focus on enrollment: quality v quantity of sites

Employ site monitors; will not delegate all major tasks to CRO or other contractors

Commercial Integrate sales operations

Execution

Leverage global reimbursement strategy

8/11/2016 GI Dynamics, Inc. 13

|

|

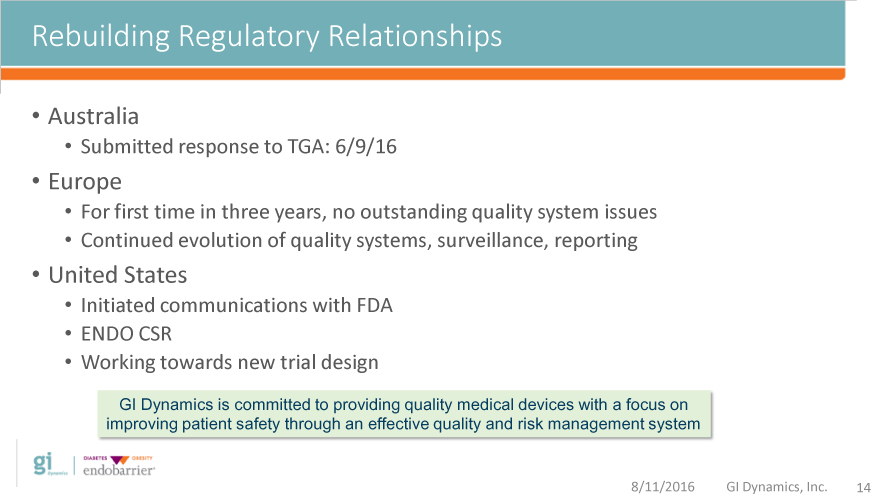

Rebuilding Regulatory Relationships

Australia

Submitted response to TGA: 6/9/16

Europe

For first time in three years, no outstanding quality system issues

Continued evolution of quality systems, surveillance, reporting

United States

Initiated communications with FDA

ENDO CSR

Working towards new trial design

GI Dynamics is committed to providing quality medical devices with a focus on

improving patient safety through an effective quality and risk management system

8/11/2016 GI Dynamics, Inc. 14

|

|

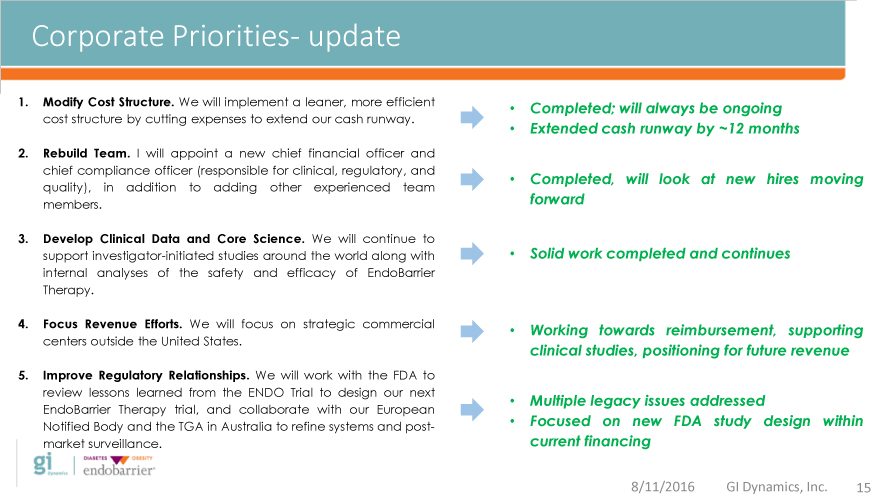

Corporate Priorities- update

1. Modify Cost Structure. We will implement a leaner, more efficient Completed; will always be ongoing

cost structure by cutting expenses to extend our cash runway. Extended cash runway by ~12 months

2. Rebuild Team. I will appoint a new chief financial officer and

chief compliance officer (responsible for clinical, regulatory, and Completed, will look at new hires moving

quality), in addition to adding other experienced team

members. forward

3. Develop Clinical Data and Core Science. We will continue to

support investigator-initiated studies around the world along with Solid work completed and continues

internal analyses of the safety and efficacy of EndoBarrier

Therapy.

4. Focus Revenue Efforts. We will focus on strategic commercial Working towards reimbursement, supporting

centers outside the United States. clinical studies, positioning for future revenue

5. Improve Regulatory Relationships. We will work with the FDA to

review lessons learned from the ENDO Trial to design our next Multiple legacy issues addressed

EndoBarrier Therapy trial, and collaborate with our European

Notified Body and the TGA in Australia to refine systems and post- Focused on new FDA study design within

market surveillance. current financing

8/11/2016 GI Dynamics, Inc. 15

|

|

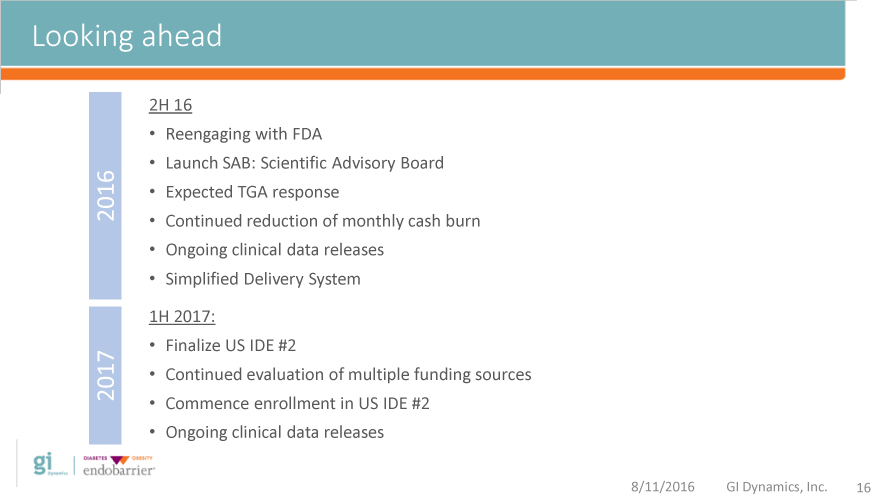

Looking ahead

2H 16

Reengaging with FDA

Launch SAB: Scientific Advisory Board

2016 Expected TGA response

Continued reduction of monthly cash burn

Ongoing clinical data releases

Simplified Delivery System

1H 2017:

Finalize US IDE #2

2017 Continued evaluation of multiple funding sources

Commence enrollment in US IDE #2

Ongoing clinical data releases

8/11/2016 GI Dynamics, Inc. 16

|

|

Thank you

Investor Inquiries: Media Inquiries:

Investor relations Media relations

United States: United States/Europe/Australia:

James Murphy investor@gidynamics.com

Chief Financial Officer +1 (781) 357-3250

+1 (781) 357-3281

Australia: United States/Australia:

David Allen or John Granger Catie Corcoran

Hawkesbury Partners Pty Limited WE Buchan

+61 2 9325 9046 +1 (813) 895-4575

8/11/2016 GI Dynamics, Inc. 17