Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Sanchez Energy Corp | sn-20160808ex991c4dcf8.htm |

| 8-K - 8-K - Sanchez Energy Corp | sn-20160808x8k.htm |

|

|

Legal Disclaimers Forward Looking Statements This presentation contains, and our officers and representatives may from time to time make, “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events, conditions or developments that Sanchez Energy Corporation (“Sancez Energy”, or the “Company”) expects, estimates, believes or anticipates will or may occur or exist in the future are forward-looking statements. These statements are based on certain assumptions made by the company based on management’s experience, perception of historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. When used in this presentation, words such as “will,” “potential,” “believe,” “estimate,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “predict,” “project,” “profile,” “model,” “strategy,” “future” or their negatives or the statements that include these words or other words that convey the uncertainty of future events or outcomes, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. In particular, statements, express or implied, concerning Sanchez Energy’s future operating results and returns, Sanchez Energy’s strategy and plans or view of the market, or Sanchez Energy’s ability to replace or increase reserves, increase production, generate income or cash flows are forward-looking statements. Forward-looking statements are not guarantees of performance. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Although Sanchez Energy believes that the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Important factors that could cause Sanchez Energy’s actual results to differ materially from the expectations reflected in its forward-looking statements include, among others: Sanchez Energy’s ability to successfully execute its business and financial strategies; the timing and extent of changes in prices for, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities; Sanchez Energy’s ability to utilize the services personnel and other assets of Sanchez Oil and Gas pursuant to existing services agreement; Sanchez Energy’s ability to replace the reserves it produces through drilling and property acquisitions; the realized benefits of Sanchez Energy’s various acquisitions and the liabilities assumed in connection with these acquisitions; the realized benefits of Sanchez Energy’s ventures, including with respect to our joint ventures with Targa Resources Corp.; the realized benefits of Sanchez Energy’s transactions with Sanchez Production Partners LP, including with respect to the Palmetto escalating working interest sale, divestiture of Western Catarina midstream assets and the Carnero Gathering transaction; the extent to which Sanchez Energy’s drilling plans are successful in economically developing its acreage in, and to produce reserves and achieve anticipated production levels from, its existing and future projects; the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; the extent to which Sanchez Energy can optimize reserve recovery and economically develop its plays utilizing horizontal and vertical drilling, advanced completion technologies and hydraulic fracturing; Sanchez Energy’s ability to successfully execute its hedging strategy and the resulting realized prices therefrom; The credit worthiness and performance of our counterparts including financial institutions, operating partners and other parties; competition in the oil and gas exploration and production industry for employees and other personnel, equipment, materials and services and, related thereto, the availability and cost of employees and other personnel, equipment, materials and services; Sanchez Energy’s ability to access the credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements; the availability, proximity and capacity of, and costs associated with, gathering, processing, compression and transportation facilities; Sanchez Energy’s ability to compete with other companies in the oil and natural gas industry; the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations, environmental laws and regulations relating to air emissions, waste disposal, hydraulic fracturing and access to and use of water, laws and regulations imposing conditions and restrictions on drilling and completion operations and laws and regulations with respect to derivatives and hedging activities; developments in oil-producing and natural-gas producing countries, the actions of the Organization of Petroleum Exporting Countries and other factors affecting the supply of oil and natural gas; Sanchez Energy’s ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; unexpected results of litigation filed against Sanchez Energy; the extent to which Sanchez Energy’s crude oil and natural gas properties operated by others are operated successfully and economically; the use of competing energy sources and the development of alternative energy sources; the extent to which Sanchez Energy incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage; and the other factors described under ITEM 1A, “Risk Factors,” in Sanchez Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and any updates to those factors set forth in its subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. In light of these risks, uncertainties and assumptions, the events anticipated by Sanchez Energy’s forward-looking statements may not occur, and, if any of such events do, Sanchez Energy may not have correctly anticipated the timing of their occurrence or the extent of their impact on its actual results. Accordingly, you should not place any undue reliance on any of Sanchez Energy’s forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made and Sanchez Energy undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Oil and Gas Reserves The Securities and Exchange Commission (“SEC”) requires oil and gas companies, in their filings with the SEC, to disclose “proved oil and gas reserves” (i.e., quantities of oil and gas that are estimated with reasonable certainty to be economically producible) and permits oil and gas companies to disclose “probable reserves” (i.e., quantities of oil and gas that are as likely as not to be recovered) and “possible reserves” (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). We may use certain terms in this presentation, such as “resource potential” that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. The calculation of resource potential, and any other estimates of reserves and resources that are not proved, probable or possible reserves are not necessarily calculated in accordance with SEC guidelines. Investors are urged to consider closely the disclosure in Sanchez Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015. Non-GAAP Measures Included in this presentation are certain non-GAAP financial measures as defined under Securities and Exchange Commission Regulation G. Investors are urged to consider closely the disclosure in Sanchez Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and the reconciliation to GAAP measures provided in this presentation. 2 |

|

|

Positioned to thrive in a period of volatile commodity prices Relentless focus on cost reduction optimizes financial flexibility Balanced reserve and production weighting between liquids and natural gas 69% of reserves are liquids(2) Eagle Ford is Flagship Asset ~3,000(2)+ net drilling locations across more than 200,000 net acres Tuscaloosa Marine Shale Upside Strong Liquidity ~$624 million liquidity(3) as of 6/30/16 Market Cap (1) ~$400 MM Enterprise Value (1) ~$2,100 MM Sanchez Energy Overview 3 Net Acreage: >200,000 acres (2) 1P Reserves: 128 MMBoe (2) Avg. 2Q 2016 Production: ~55,900 Boe/d Eagle Ford Shale Net Acreage: ~60,000 acres(2) Tuscaloosa Marine Shale (“TMS”) Based on a closing stock price of $6.29 as of 8/3/16 and 65.5 million shares outstanding. Enterprise Value includes convertible preferred stock at book value (~$254 million) As of 6/30/15 Liquidity includes $324 million of cash and cash equivalents plus elected commitment of $300 million on credit facility |

|

|

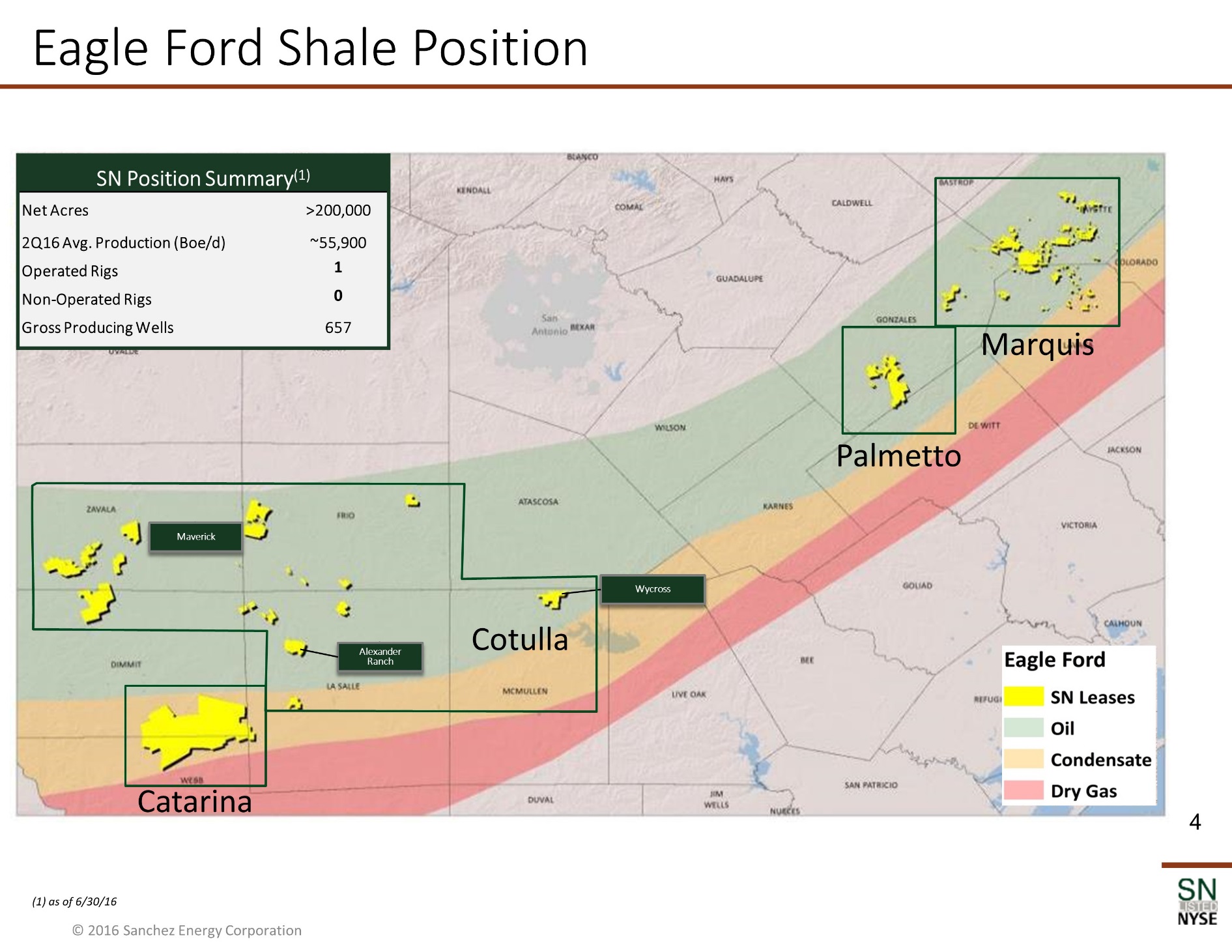

4 Eagle Ford Shale Position Alexander Ranch Maverick Wycross Marquis Palmetto Cotulla Catarina SN Position Summary(1) Net Acres >200,000 2Q16 Avg. Production (Boe/d) ~55,900 Operated Rigs 1 Non-Operated Rigs 0 Gross Producing Wells 657 (1) as of 6/30/16 |

|

|

5 Transformational Growth At IPO (12/31/11) Today (6/30/16) Production 609 Boe/d ~55,900 Boe/d(1) Proved Reserves 6.7 MMBoe 14% PD 128 MMBoe(2) 51% PD(2) PV-10 $152 million $594 million(2) LTM Revenue $15 million $415 million LTM Adj. EBITDA(3) $7 million $325 million Acreage 92,000 Eagle Ford >200,000 Eagle Ford ~60,000 TMS 92x 19x 3.9x 46x 2.2x Entered new basin(4) 28x Average daily production for 2Q 2016 As of 12/31/15 Adj. EBITDA represents a non-GAAP measure; please see the appendix of this presentation for an explanation and reconciliation to net income (loss) 2.2x growth figure represents increase in Eagle Ford Shale acreage as of 6/30/16 |

|

|

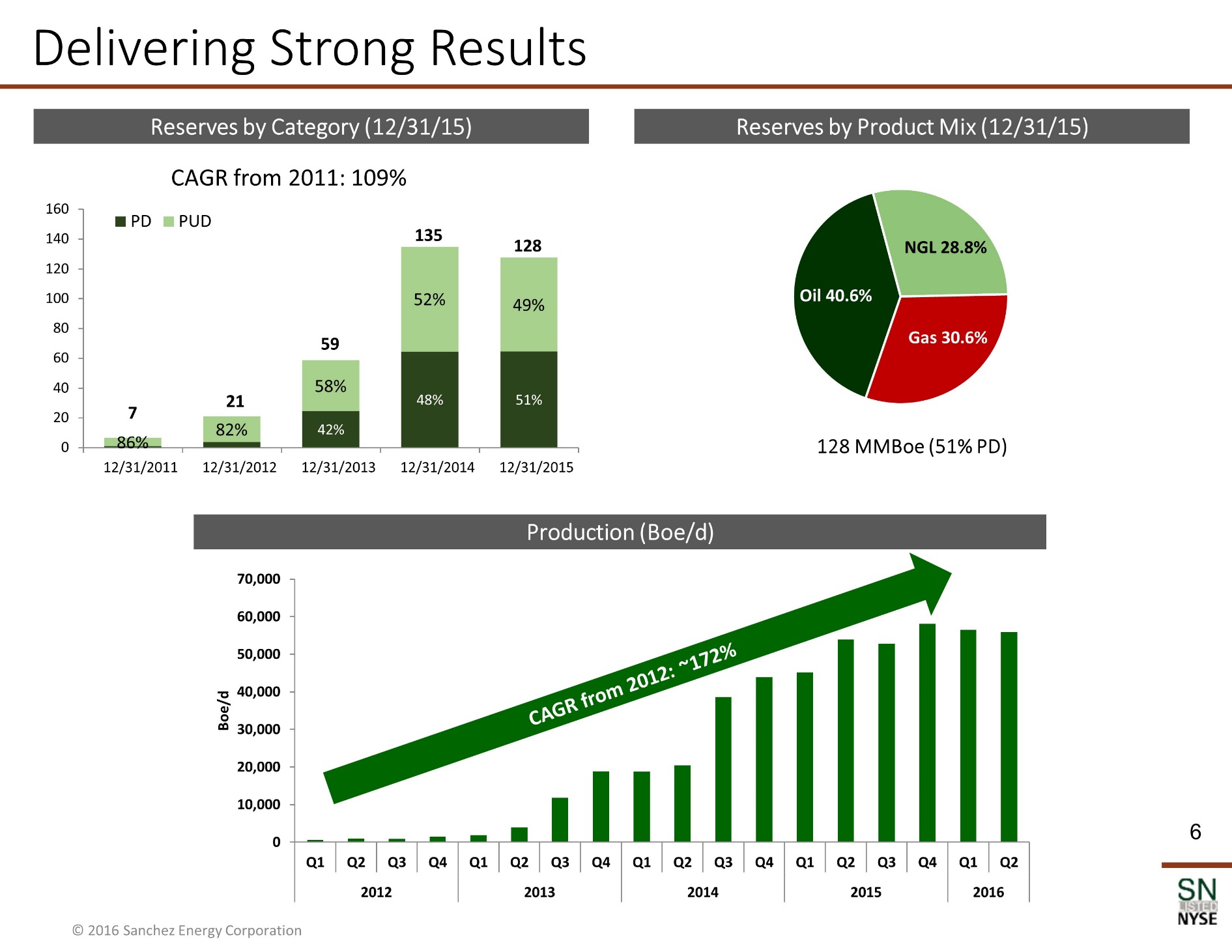

CAGR from 2011: 109% 42% 48% 51% 86% 82% 58% 52% 49% 0 20 40 60 80 100 120 140 160 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 PD PUD 6 Delivering Strong Results Reserves by Product Mix (12/31/15) 128 MMBoe (51% PD) Reserves by Category (12/31/15) Production (Boe/d) CAGR from 2012: ~172% 7 21 59 135 128 Oil 40.6% NGL 28.8% Gas 30.6% 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2012 2013 2014 2015 2016 Boe/d |

|

|

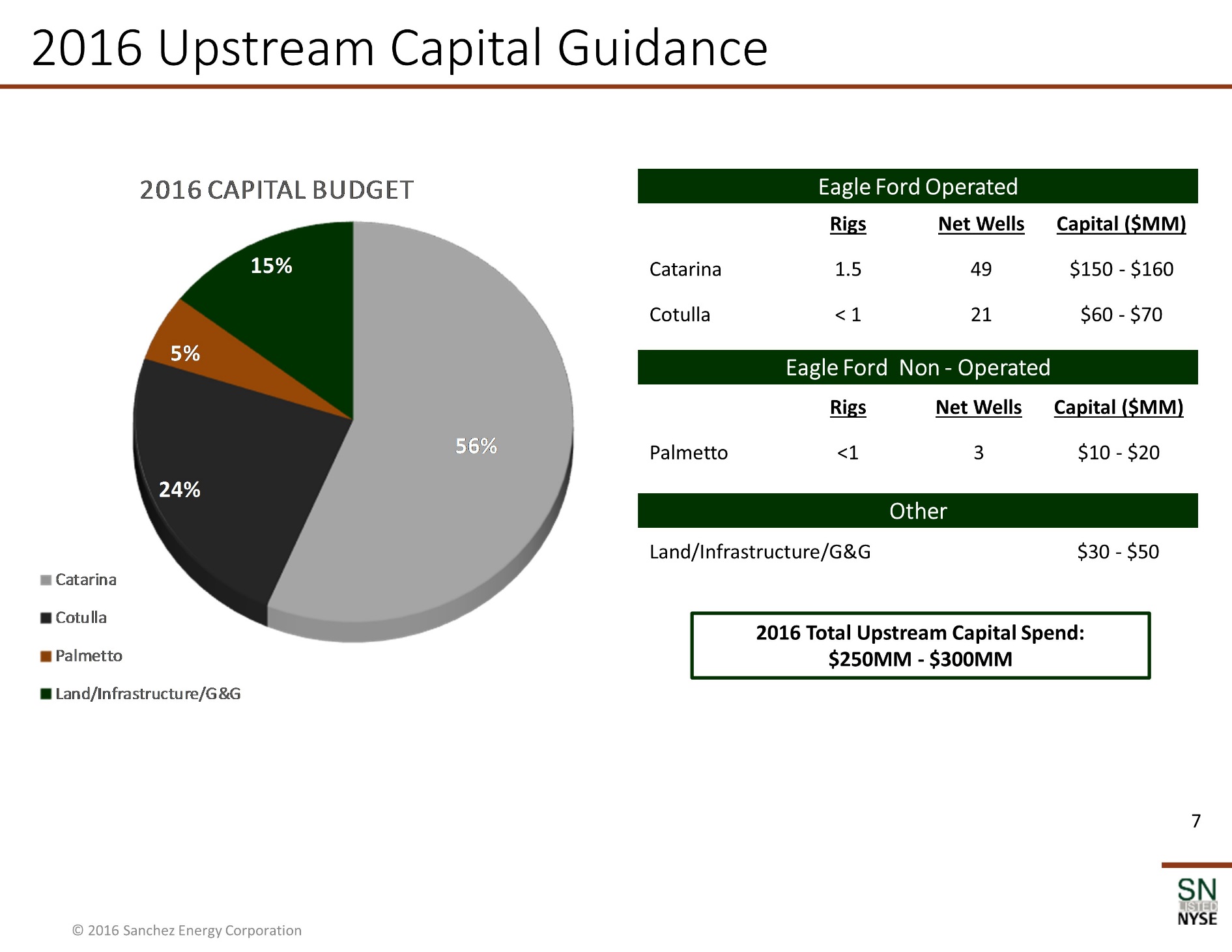

2016 Upstream Capital Guidance 7 Eagle Ford Operated Eagle Ford Non - Operated Other Rigs Net Wells Capital ($MM) Catarina 1.5 49 $150 - $160 Cotulla < 1 21 $60 - $70 Rigs Net Wells Capital ($MM) Palmetto <1 3 $10 - $20 Land/Infrastructure/G&G $30 - $50 2016 Total Upstream Capital Spend: $250MM - $300MM 56% 24% 5% 15% 2016 CAPITAL BUDGET Catarina Cotulla Palmetto Land/Infrastructure/G&G |

|

|

8 2016 Guidance Summary Expected 3Q2016 production to range between 50,000 and 52,000 Boe/d and expected FY16 production to range between 48,000 and 52,000 Boe/d Subsequent quarterly production may fluctuate due to the effects of pad drilling (typical pad size will vary between 5 and 10 wells per pad) Historic Results and 2016 Guidance: Assumes each quarter operates under ethane rejection Cash Production Expense guidance relates only to production expense as reported on the cash flow statement and does not include the effect from amortization of deferred gain Excludes stock based compensation Paid in common equity for the quarter ended June 30, 2016 Actuals 2Q 2016 3Q 2016 FY 2016 Production Volumes: Oil (Bbls/d) 17,967 16,500 - 17,160 16,000 - 17,333 NGLs (Bbls/d) 16,692 14,000 - 14,560 16,000 - 17,333 Natural Gas (Mcf/d) 127,495 117,000 - 121,680 96,000 - 104,000 Barrel of Oil Equivalent (Boe/d) 55,908 50,000 - 52,000 48,000 - 52,000 Operating Costs & Expenses : Cash Production Expense ($/Boe) (2) $9.56 $8.75 - $9.75 $8.75 - $9.75 Non-Cash Production Expense ($/Boe) $0.73 $0.80 - $0.90 $0.80 - $0.90 Production & Ad Valorem Taxes (% of O&G Revenue) 6% 5% - 6% 5% - 6% Cash G&A ($/Boe) (3) $2.77 $2.75 - $3.25 $2.75 - $3.25 DD&A Expense ($/Boe) $8.52 Interest Expense ($MM) $31.8 $30 $120 Preferred Dividend ($MM) (4) $4.0 $4 $16 Guidance (1) |

|

|

Operations A Manufacturing Transformation |

|

|

Low Cost Operator With Sustained Cost Reductions 10 2013, 2Q 2014, 3Q 2014 and 4Q 2015 cash G&A per Boe excludes $1.07/Boe, $0.48/Boe, $0.26/Boe and $0.71/Boe in non-recurring acquisition and divestiture expenses, respectively Includes preferred dividends paid in common equity in Interest and Dividends and excludes ~$0.73 of non-cash production expense from LOE Note: LOE represents oil and natural gas production expense. Total Cash Operating Cost Including Interest & Preferred Dividends ($/Boe) ~57% Decrease (1) (1) (1) (2) $30.91 $24.95 $6.73 $5.55 $6.47 $3.35 $3.90 $3.39 $2.87 $3.19 $2.27 $3.14 $2.77 $9.37 $7.26 $9.21 $9.41 $7.48 $9.68 $7.27 $8.39 $7.27 $8.30 $9.25 $8.69 $8.83 $4.78 $4.53 $4.47 $6.15 $4.21 $3.07 $2.14 $2.13 $1.69 $0.62 $1.28 $0.77 $1.22 $4.72 $10.99 $9.72 $10.76 $8.49 $8.38 $8.29 $6.88 $6.93 $6.30 $6.55 $6.65 $45.06 $41.46 $31.40 $30.84 $28.92 $24.59 $21.69 $22.20 $18.71 $19.04 $19.10 $19.15 $19.47 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 2011 2012 2013 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 Cash G&A LOE Taxes Interest & Dividends |

|

|

11 2016 Capital and Production Update Focus on high rate of return drilling areas and continued delineation of the Catarina and Cotulla areas of the Eagle Ford SN now expects to execute a 2016 capital plan between $250 million and $300 million Production is expected to remain relatively flat when compared to 2015, despite a 50% reduction in capital spending year-over-year 3Q 2016 production guidance of between 50,000 and 52,000 Boe/d Capital plan expected to be fully funded from cash and operating cash flows with a significant cash balance remaining at year-end 2016 SN’s revolving credit facility is expected to remain undrawn during 2016 2016 Capital and Production Guidance 2016 Guidance Range |

|

|

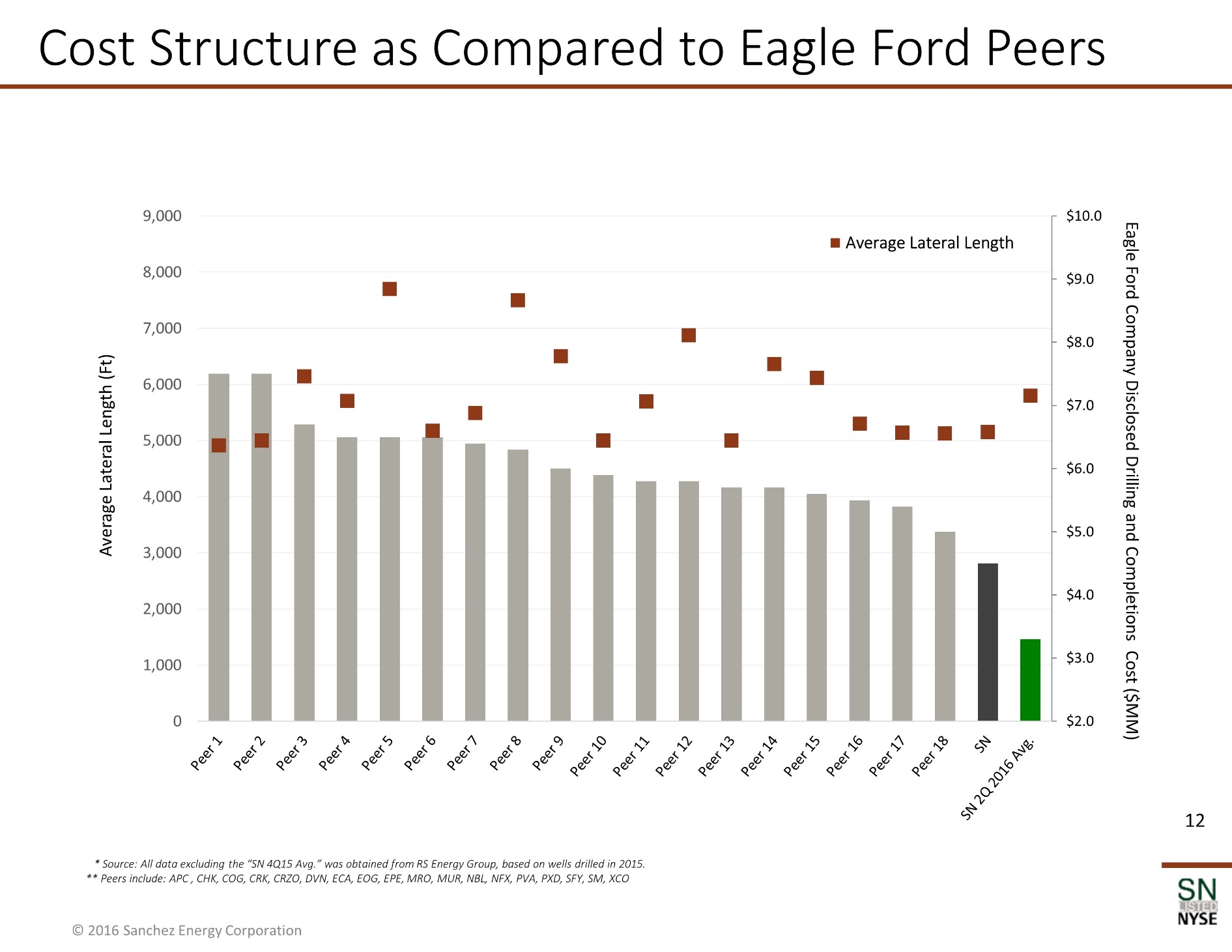

Cost Structure as Compared to Eagle Ford Peers 12 * Source: All data excluding the “SN 4Q15 Avg.” was obtained from RS Energy Group, based on wells drilled in 2015. ** Peers include: APC , CHK, COG, CRK, CRZO, DVN, ECA, EOG, EPE, MRO, MUR, NBL, NFX, PVA, PXD, SFY, SM, XCO $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Average Lateral Length (Ft) Eagle Ford Company Disclosed Drilling and Completions Cost ($MM) Average Lateral Length |

|

|

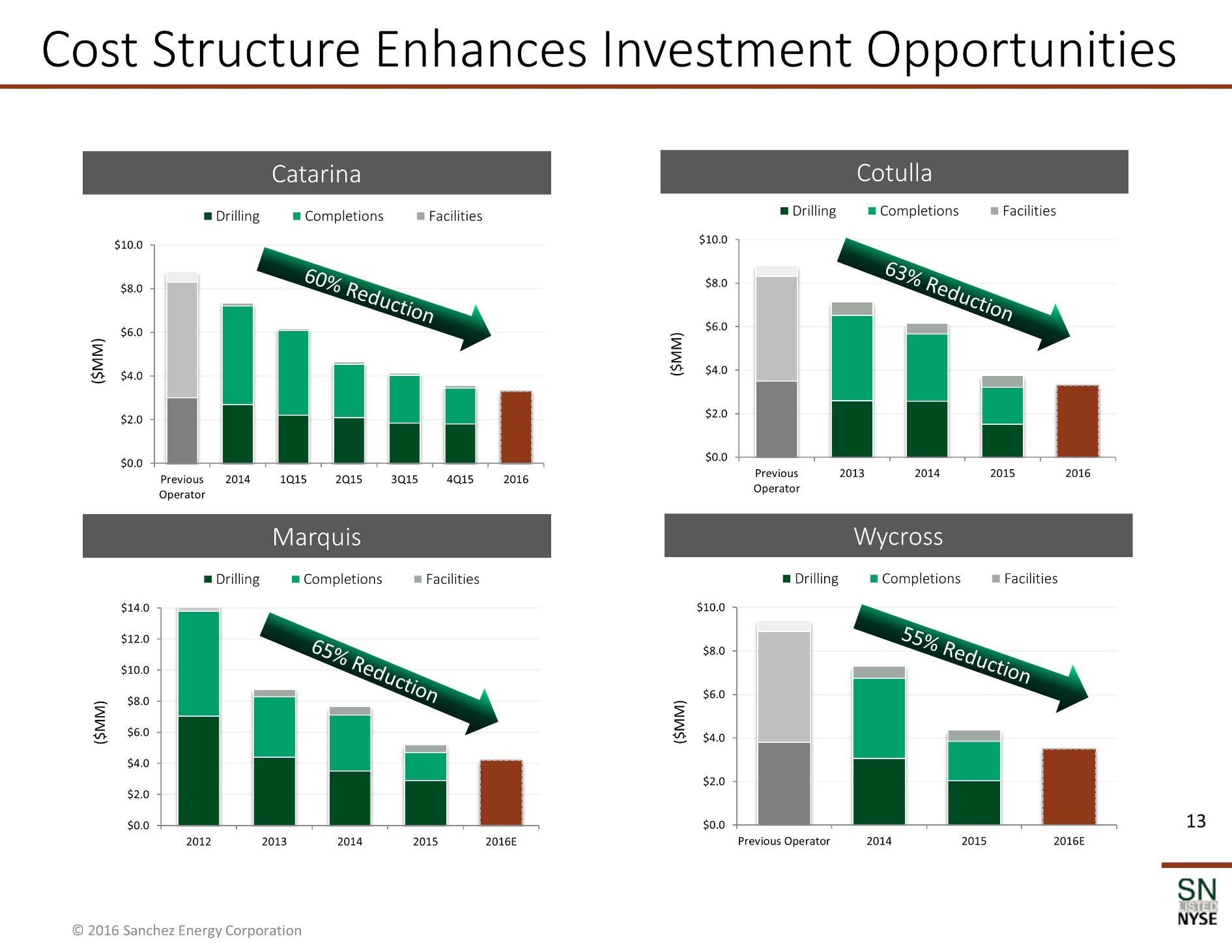

Cost Structure Enhances Investment Opportunities Cotulla Marquis Wycross Catarina 60% Reduction 65% Reduction 55% Reduction 63% Reduction 13 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Previous Operator 2013 2014 2015 2016 ($MM) Drilling Completions Facilities $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2012 2013 2014 2015 2016E ($MM) Drilling Completions Facilities $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Previous Operator 2014 2015 2016E ($MM) Drilling Completions Facilities $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Previous Operator 2014 1Q15 2Q15 3Q15 4Q15 2016 ($MM) Drilling Completions Facilities |

|

|

Asset Development |

|

|

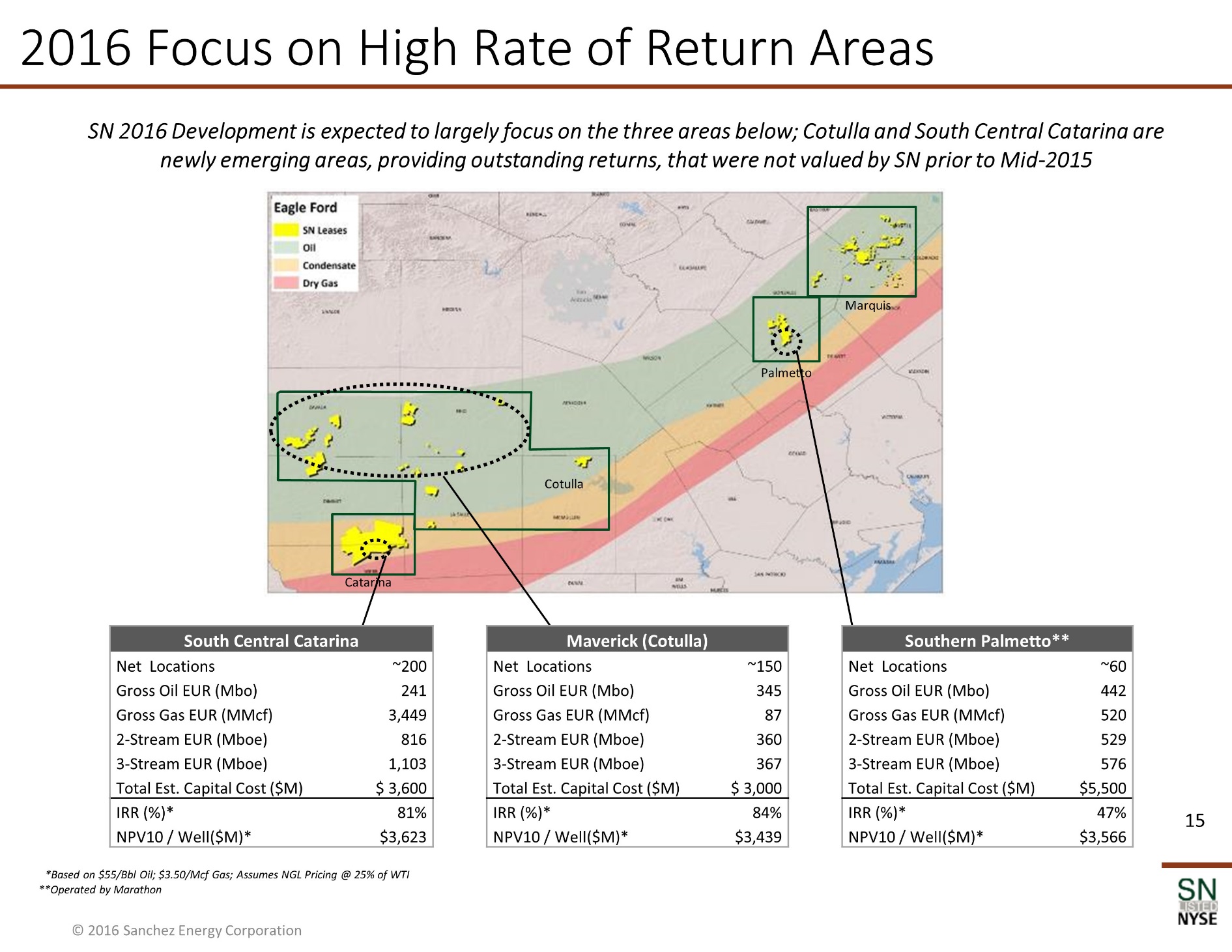

Marquis Palmetto Cotulla Catarina 15 2016 Focus on High Rate of Return Areas SN 2016 Development is expected to largely focus on the three areas below; Cotulla and South Central Catarina are newly emerging areas, providing outstanding returns, that were not valued by SN prior to Mid-2015 South Central Catarina Maverick (Cotulla) Southern Palmetto** Net Locations ~200 Net Locations ~150 Net Locations ~60 Gross Oil EUR (Mbo) 241 Gross Oil EUR (Mbo) 345 Gross Oil EUR (Mbo) 442 Gross Gas EUR (MMcf) 3,449 Gross Gas EUR (MMcf) 87 Gross Gas EUR (MMcf) 520 2-Stream EUR (Mboe) 816 2-Stream EUR (Mboe) 360 2-Stream EUR (Mboe) 529 3-Stream EUR (Mboe) 1,103 3-Stream EUR (Mboe) 367 3-Stream EUR (Mboe) 576 Total Est. Capital Cost ($M) $ 3,600 Total Est. Capital Cost ($M) $ 3,000 Total Est. Capital Cost ($M) $5,500 IRR (%)* 81% IRR (%)* 84% IRR (%)* 47% NPV10 / Well($M)* $3,623 NPV10 / Well($M)* $3,439 NPV10 / Well($M)* $3,566 *Based on $55/Bbl Oil; $3.50/Mcf Gas; Assumes NGL Pricing @ 25% of WTI **Operated by Marathon |

|

|

16 Catarina Overview Upper Eagle Ford 150+ Potential Locations 7 wells in stacked pilots drilled to date High oil yields of 250 Bbl/MMcf 500+ potential Locations Large Stacked Pay Application South-Central Catarina Outperforming ~1100 MBoe EUR Type Curve Middle Eagle Ford 700+ Potential Locations 600-1100 MBoe EUR Extension into South Central Lower Eagle Ford |

|

|

17 Catarina Well Results Actual results continue to outperform Ryder Scott PUD curves PUD curves are still conservative to allow for variation in results and future upwards technical revisions Results consist of 100 wells in Western Catarina and 24 wells in South Central Catarina 0 10 20 30 40 50 60 70 80 90 100 0 50 100 150 200 250 300 0 100 200 300 400 500 600 700 Well Count Cum MBOE Producing Days Western Actuals South Central Actuals 2014 RSC PUD 2015 RSC PUD Western Well Count South Central Well Count |

|

|

18 Western Catarina Development Mix of LEF & MEF infill locations depending upon prior well penetration Stacking in LEF and MEF for step outs Increase in type curve from ~600 MBoe to ~750 MBoe Eastern limit being extended into Central Area beyond LEF presence 650+ location inventory Gas Rate (Mcf/d) *Based on $55/Bbl Oil; $3.50/Mcf Gas; Assumes NGL Pricing @ 25% of WTI Western Catarina Type Curve WESTERN CATARINA Oil IP (Bbl/d) 200 Initial Decline (%) 65.0% Oil EUR (MBbl) 158 Gas IP (Mcf/d) 3,000 Initial Decline (%) 65.0% Gas EUR (MMcf) 2,363 NGL NGL Yield (bbl/MMcf) 125 NGL EUR (MBbl) 295 3 Stream EUR (Mboe) 748 % Oil 21% Well Cost ($M) $3,300 NPV10 ($M) $1,696 IRR (%) 37% Producing Days |

|

|

19 South Central Catarina Catarina South Central Type Curve SC CATARINA Oil IP (Bbl/d) 440 Initial Decline (%) 78.0% Oil EUR (MBbl) 241 Gas IP (Mcf/d) 4,900 Initial Decline (%) 72.0% Gas EUR (MMcf) 3,449 NGL NGL Yield (bbl/MMcf) 125 NGL EUR (MBbl) 431 3 Stream EUR (Mboe) 1,103 % Oil 22% Well Cost ($M) $3,600 NPV10 ($M) $3,623 IRR (%) 81% Excellent rates and projected EURs Unvalued at acquisition Stacking in LEF to MEF Southern rim transition from West to East Catarina Q4 2015 / 2016 Appraisal and Development Focus 200+ location inventory Gas Rate (Mcf/d) Producing Days *Based on $55/Bbl Oil; $3.50/Mcf Gas; Assumes NGL Pricing @ 25% of WTI |

|

|

20 Maverick Regional Oil Rate (Bo/d) Eagle Ford high porosity & oil saturation unlocked through completion design 2016 Appraisal focus 150+ well inventory Maverick Type Curve MAVERICK Oil IP (Bbl/d) 473 Initial Decline (%) 68.5% Oil EUR (MBbl) 345 Gas IP (Mcf/d) 125 Initial Decline (%) 70.0% Gas EUR (MMcf) 87 NGL NGL Yield (bbl/MMcf) 127 NGL EUR (MBbl) 11 3 Stream EUR (Mboe) 367 % Oil 94% Well Cost ($M) $3,000 NPV10 ($M) $3,439 IRR (%) 84% Producing Days *Based on $55/Bbl Oil; $3.50/Mcf Gas; Assumes NGL Pricing @ 25% of WTI |

|

|

Financial Highlights |

|

|

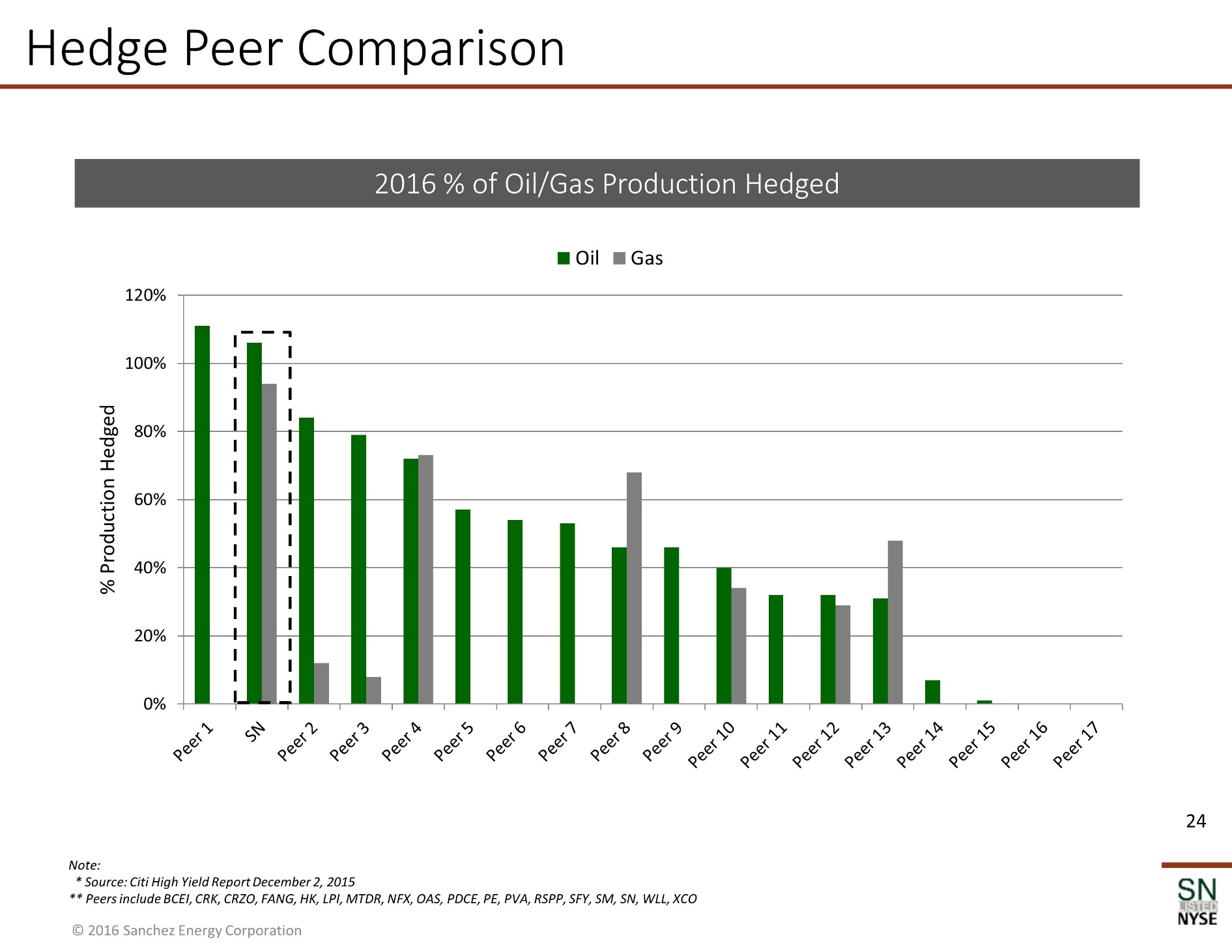

Conservative Financial Strategy 22 SN has worked diligently to bolster liquidity and ensure development funding for the foreseeable future 2016 capital program expected to be fully funded with FCF and cash on hand with no reliance on revolving credit facility Significant headroom to revolver covenant of 2.0x Net First Lien Debt / LTM EBITDA expected Strong financial position achieved through creative and accretive asset sales/dispositions Two 2015 divestitures have provided ~$430 million in cash without adding incremental debt or issuing equity Carnero Gathering JV interest sold in 2016 for ~$44.4 million in total consideration Active hedge program to protect cash flows(1) Oil hedges: Over 100% in 2016(2) ~36%-42% in 2017(2) Gas Hedges: ~99% in 2016(2) ~94% in 2017(2) ~40%-50% in 2018(2) ~20% in 2019(2) ~$30 million mark-to-market value of hedges(3) As of 8/8/16 Based upon the midpoint of 2016 guidance; includes hedges in place as of 8/8/16 As of 6/30/16 |

|

|

Extended Debt Maturity Runway 23 Note: 7.75% Senior Notes mature June 2021; 6.125% Senior Notes mature January 2023 No bonds maturing until 2021 Revolving credit facility currently undrawn Robust covenant headroom High Yield has no financial maintenance covenants Revolving credit facility financial maintenance covenants are: 1.0x Current Ratio 2.0x Net First Lien Debt/LTM EBITDA 7.75% Senior Notes 6.125% Senior Notes Undrawn Revolving Credit Facility |

|

|

Hedge Peer Comparison Note: * Source: Citi High Yield Report December 2, 2015 ** Peers include BCEI, CRK, CRZO, FANG, HK, LPI, MTDR, NFX, OAS, PDCE, PE, PVA, RSPP, SFY, SM, SN, WLL, XCO 2016 % of Oil/Gas Production Hedged 24 0% 20% 40% 60% 80% 100% 120% % Production Hedged Oil Gas |

|

|

25 Summary & Highlights Strong Asset Base (1) Over 200,000 net acres throughout the Eagle Ford shale with ~3,000+ net drilling locations Increased average EURs by over 40% from 2014 2Q 2016 production of ~55,900 Boe/d, exceeding the high end of guidance and representing a 4% increase over the same period in 2015 Runway of Liquidity(1) Liquidity of $624 million, consisting of $324 million of cash and a $300 million elected commitment on our revolving credit facility No outstanding debt maturities until 2021 No bank debt Strong hedge book(2): 18,000 Bbl/d of oil and 99,153 MMBtu/d of gas hedged in 2016, 6,000-7,000 Bbl/d of oil and 93,521 MMBtu/d of gas hedged in 2017, 40,000-50,000 MMBtu/d of gas hedged in 2018 and 20,000 MMBtu/d of gas hedged in 2019 Updated 2016 capital budget of $250-$300 million Strategic MLP Relationship(1) Strategic relationship with Sanchez Production Partners (“SPP”) provides potential capital and liquidity source Focusing on realized cash-on-cash returns ~$430 million of cash raised in 2015 through two asset sales to SPP Carnero Gathering JV interest sold in 2016 for ~$44.4 million in total consideration Results in added working capital discipline Extensive inventory of MLP suitable assets that potentially could be opportunistically divested in the future Low Cost Operations(1) Current average well costs of <$3.5 million Total wells costs have decreased ~60% since early 2015 As of 8/8/16 |

|

|

Appendix |

|

|

27 NOL “Rights Plan” SN had a $765 million Net Operating Loss as of 12/31/15 Valuable asset since NOL can offset future income taxes Significant changes in equity ownership could trigger IRS limitations on future NOL usage Particularly complicated rules around ownership of preferred shares In July 2015, SN implemented a NOL “Rights Plan” Highly visible message to potential shareholders who may buy or currently own > 4.9% of SN Any shareholder who buys > 4.9% of SN without prior board approval would be subject to significant dilution through the exercise of rights by other shareholders Automatically expires after 3 years from date of adoption Similar to NOL rights plans of other public companies with significant NOLs relative to their market capitalization For example, several large banks, home builders and automotive companies enacted similar plans during 2008-2010 financial crisis |

|

|

28 Capitalization Summary Revolving credit facility (due June 2019) $350 million borrowing base with an elected commitment of $300 million and an interest rate of LIBOR + 2.00% - 3.00% as of 6/30/16 Financial Maintenance Covenants: Maximum Net First Lien Debt to LTM EBITDA of 2.0x Minimum Current Ratio of 1.0x $600 million of 7.75% senior unsecured notes (due June 2021) No liquidity or financial maintenance covenants $1,150 million of 6.125% senior unsecured notes (due January 2023) No liquidity or financial maintenance covenants ~$92 million of 4.875% cumulative perpetual convertible preferred stock, series A Convertible into ~4.3 million shares of common stock ($21.51/share) Mandatorily convertible after 10/5/17 if common stock trades above $27.96 for at least 20 out of 30 trading days No liquidity or financial maintenance covenants ~$177 million of 6.50% cumulative perpetual convertible preferred stock, series B Convertible into ~8.3 million shares of common stock ($21.40/share) Mandatorily convertible after 4/6/18 if common stock trades above $27.82/share for at least 20 out of 30 trading days No liquidity or financial maintenance covenants Common shares outstanding as of 6/30/16: Basic: 65.5 million Fully diluted: 78.0 million (assuming full conversion of both series of preferred stock) |

|

|

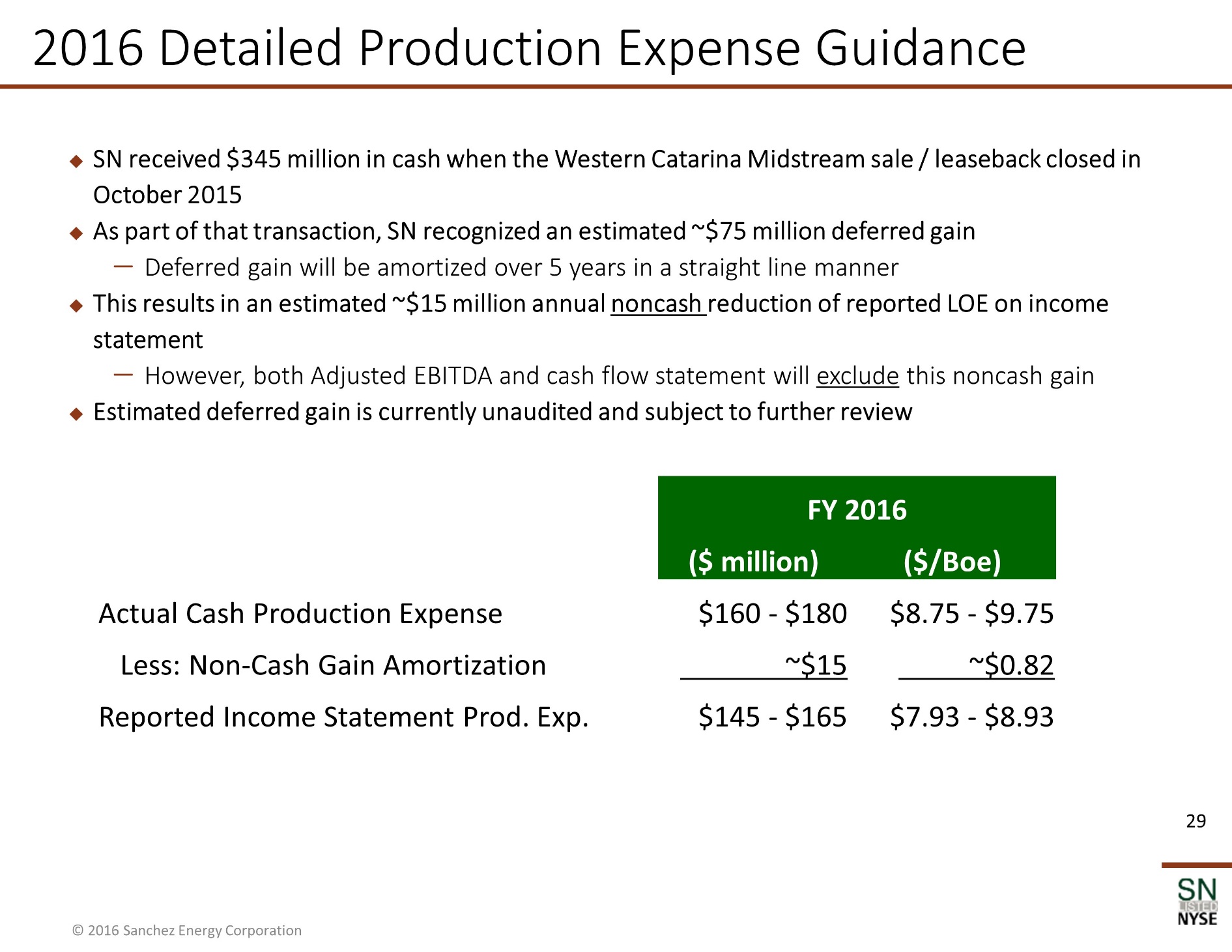

29 2016 Detailed Production Expense Guidance SN received $345 million in cash when the Western Catarina Midstream sale / leaseback closed in October 2015 As part of that transaction, SN recognized an estimated ~$75 million deferred gain Deferred gain will be amortized over 5 years in a straight line manner This results in an estimated ~$15 million annual noncash reduction of reported LOE on income statement However, both Adjusted EBITDA and cash flow statement will exclude this noncash gain Estimated deferred gain is currently unaudited and subject to further review FY 2016 ($ million) ($/Boe) Actual Cash Production Expense $160 - $180 $8.75 - $9.75 Less: Non-Cash Gain Amortization ~$15 ~$0.82 Reported Income Statement Prod. Exp. $145 - $165 $7.93 - $8.93 |

|

|

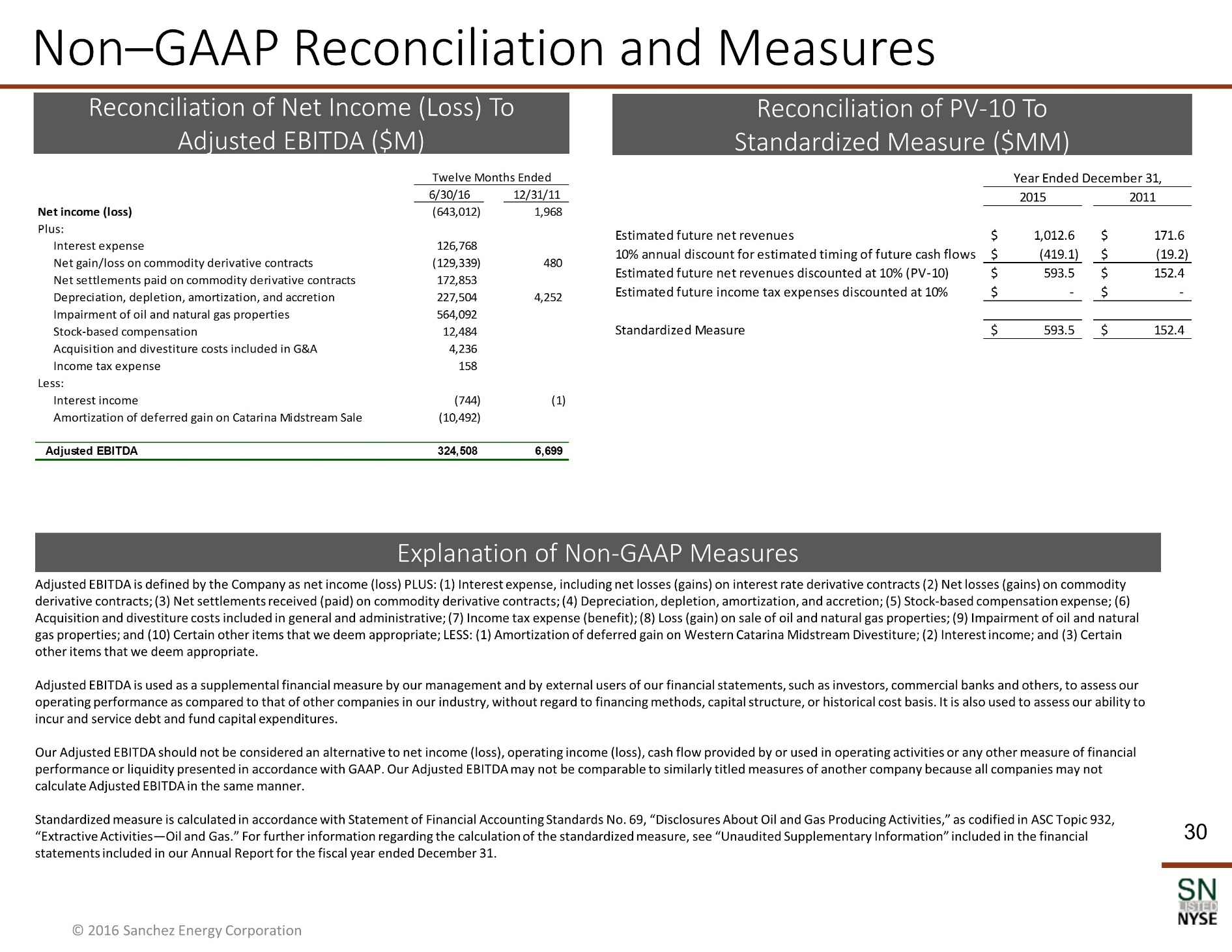

30 Non–GAAP Reconciliation and Measures Reconciliation of Net Income (Loss) To Adjusted EBITDA ($M) Reconciliation of PV-10 To Standardized Measure ($MM) Explanation of Non-GAAP Measures Adjusted EBITDA is defined by the Company as net income (loss) PLUS: (1) Interest expense, including net losses (gains) on interest rate derivative contracts (2) Net losses (gains) on commodity derivative contracts; (3) Net settlements received (paid) on commodity derivative contracts; (4) Depreciation, depletion, amortization, and accretion; (5) Stock‑based compensation expense; (6) Acquisition and divestiture costs included in general and administrative; (7) Income tax expense (benefit); (8) Loss (gain) on sale of oil and natural gas properties; (9) Impairment of oil and natural gas properties; and (10) Certain other items that we deem appropriate; LESS: (1) Amortization of deferred gain on Western Catarina Midstream Divestiture; (2) Interest income; and (3) Certain other items that we deem appropriate. Adjusted EBITDA is used as a supplemental financial measure by our management and by external users of our financial statements, such as investors, commercial banks and others, to assess our operating performance as compared to that of other companies in our industry, without regard to financing methods, capital structure, or historical cost basis. It is also used to assess our ability to incur and service debt and fund capital expenditures. Our Adjusted EBITDA should not be considered an alternative to net income (loss), operating income (loss), cash flow provided by or used in operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. Standardized measure is calculated in accordance with Statement of Financial Accounting Standards No. 69, “Disclosures About Oil and Gas Producing Activities,” as codified in ASC Topic 932, “Extractive Activities—Oil and Gas.” For further information regarding the calculation of the standardized measure, see “Unaudited Supplementary Information” included in the financial statements included in our Annual Report for the fiscal year ended December 31. 2015 2011 Estimated future net revenues 1,012.6 $ 171.6 $ 10% annual discount for estimated timing of future cash flows (419.1) $ (19.2) $ Estimated future net revenues discounted at 10% (PV-10) 593.5 $ 152.4 $ Estimated future income tax expenses discounted at 10% - $ - $ Standardized Measure 593.5 $ 152.4 $ Year Ended December 31, 6/30/16 12/31/11 Net income (loss) (643,012) 1,968 Plus: Interest expense 126,768 Net gain/loss on commodity derivative contracts (129,339) 480 Net settlements paid on commodity derivative contracts 172,853 Depreciation, depletion, amortization, and accretion 227,504 4,252 Impairment of oil and natural gas properties 564,092 Stock-based compensation 12,484 Acquisition and divestiture costs included in G&A 4,236 Income tax expense 158 Less: Interest income (744) (1) Amortization of deferred gain on Catarina Midstream Sale (10,492) Adjusted EBITDA 324,508 6,699 Twelve Months Ended |