Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - STEVEN MADDEN, LTD. | shoo-20160630x10q.htm |

| EX-32.2 - EXHIBIT 32.2 - STEVEN MADDEN, LTD. | shoo-20160630xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - STEVEN MADDEN, LTD. | shoo-20160630xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - STEVEN MADDEN, LTD. | shoo-20160630xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - STEVEN MADDEN, LTD. | shoo-20160630xex311.htm |

Steve Madden Announces Second Quarter 2016 Results

LONG ISLAND CITY, N.Y., August 2, 2016 - Steve Madden (Nasdaq: SHOO), a leading designer and marketer of fashion footwear and accessories for women, men and children, today announced financial results for the second quarter ended June 30, 2016.

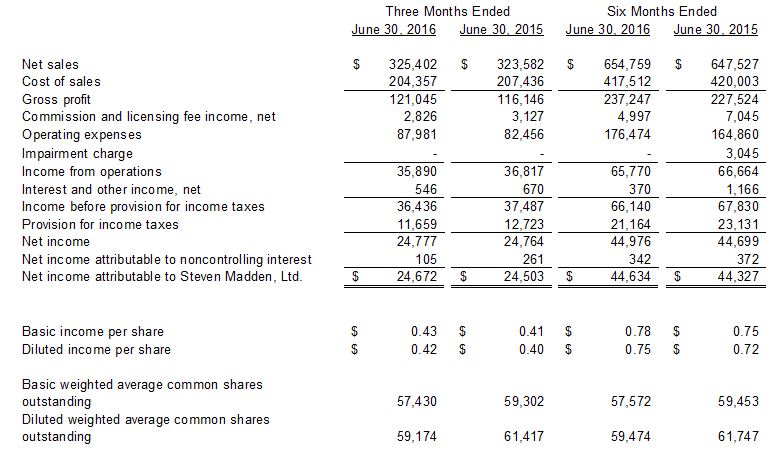

For the Second Quarter 2016:

• | Net sales increased 0.6% to $325.4 million compared to $323.6 million in the same period of 2015. |

• | Gross margin expanded 130 basis points to 37.2% as compared to 35.9% in the same period last year. |

• | Operating expenses as a percentage of sales were 27.0% compared to 25.5% of sales in the same period of 2015. |

• | Operating income totaled $35.9 million, or 11.0% of net sales, compared with operating income of $36.8 million, or 11.4% of net sales, in the same period of 2015. |

• | Net income was $24.7 million, or $0.42 per diluted share, compared to $24.5 million, or $0.40 per diluted share, in the prior year's second quarter. |

Edward Rosenfeld, Chairman and Chief Executive Officer, commented, “We were pleased with our second quarter performance, which was highlighted by robust gains in our Steve Madden Women’s and Dolce Vita wholesale footwear divisions as well as continued strong comparable store sales growth in our retail segment. While these core businesses are meeting or exceeding expectations, we are seeing softer than anticipated trends in our private label footwear business and with certain international distributors. Therefore, we are adjusting our sales outlook and now expect net sales for 2016 to increase 0% to 1% compared to 2015. Despite the lower sales expectation, we continue to expect that diluted EPS will be in the range of $1.93 to $2.03 due to better than anticipated gross margin trends and a reduction in our forecasted full year tax rate.”

Second Quarter 2016 Segment Results

Net sales for the wholesale business were $262.9 million in the second quarter of 2016 compared to $266.7 million in the second quarter of 2015. Gross margin in the wholesale business increased to 31.1% compared to 29.8% in last year’s second quarter driven by improvement in the wholesale footwear segment.

Retail net sales in the second quarter were $62.5 million compared to $56.9 million in the second quarter of the prior year. Same store sales increased 5.4% for the second quarter. Retail gross margin decreased to 62.8% in the second quarter of 2016 compared to 64.5% in the second quarter of 2015 due to the positive impact in the second quarter of 2015 of insurance proceeds related to prior period losses as well as the negative impact in the second quarter of 2016 of a stronger U.S. dollar on the Company’s international retail businesses.

During the second quarter, the Company opened 2 full price stores and 7 outlet locations. The Company ended the quarter with 180 company-operated retail locations, including 4 Internet stores.

The effective tax rate for the second quarter of 2016 was 32.0% compared to 33.9% in the second quarter of the prior year.

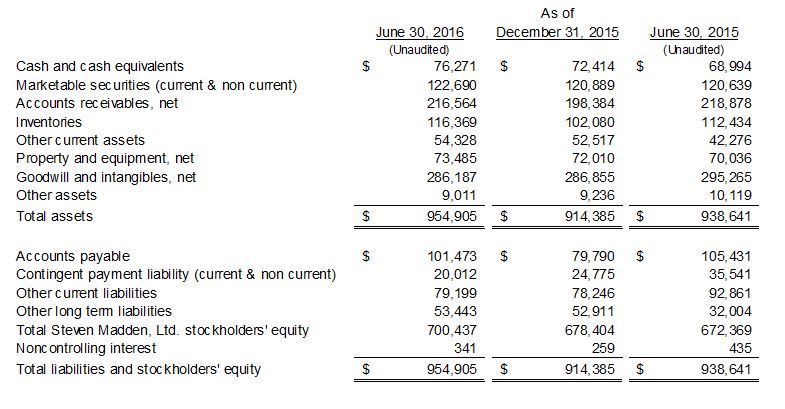

Balance Sheet and Cash Flow

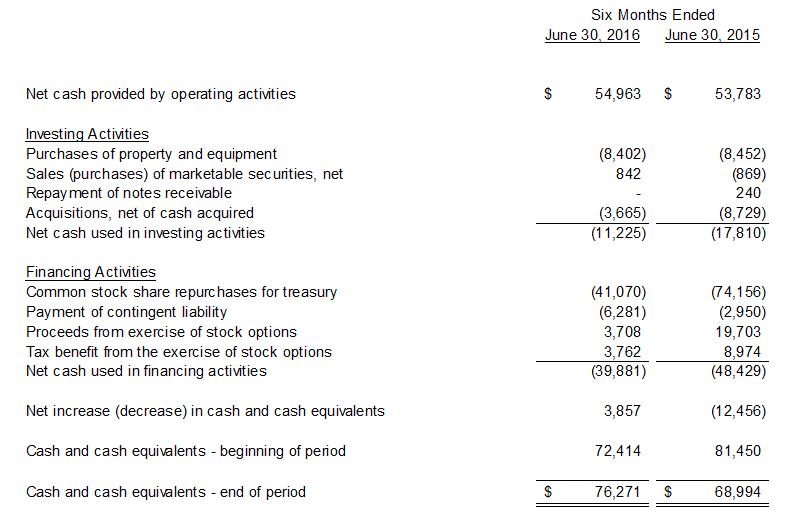

During the second quarter of 2016, the Company repurchased 792,933 shares of the Company’s common stock for approximately $27.0 million, which includes shares acquired through the net settlement of employee stock awards.

As of June 30, 2016, cash, cash equivalents, and current and non-current marketable securities totaled $199.0 million.

Company Outlook

The Company has adjusted its sales outlook for fiscal year 2016. The Company now expects that net sales will increase 0% to 1% over net sales in 2015. The Company continues to expect diluted EPS for fiscal year 2016 to be in the range of $1.93 to $2.03.

Conference Call Information

Interested stockholders are invited to listen to the second quarter earnings conference call scheduled for today, August 2, 2016, at 8:30 a.m. Eastern Time. The call will be broadcast live over the Internet and can be accessed by logging onto http://www.stevemadden.com. An online archive of the broadcast will be available within one hour of the conclusion of the call and will be accessible for a period of 30 days following the call. Additionally, a replay of the call can be accessed by dialing 1-877-870-5176 (U.S.) and 1-858-384-5517 (international), passcode 8289304, and will be available until September 2, 2016.

About Steve Madden

Steve Madden designs, sources and markets fashion-forward footwear and accessories for women, men and children. In addition to marketing products under its own brands including Steve Madden®, Dolce Vita®, Betsey Johnson®, Report®, Big Buddha®, Brian Atwood®, Cejon®, Blondo® and Mad Love®, Steve Madden is the licensee of various brands, including Superga® for footwear in North America. Steve Madden also designs and sources products under private label brand names for various retailers. Steve Madden's wholesale distribution includes department stores, specialty stores, luxury retailers, national chains and mass merchants. Steve Madden also operates 180 retail stores (including Steve Madden's four Internet stores). Steve Madden licenses certain of its brands to third parties for the marketing and sale of certain products, including for ready-to-wear, outerwear, intimate apparel, hosiery, jewelry, luggage and bedding and bath products. For local store information and the latest Steve Madden booties, pumps, men’s and women’s boots, dress shoes, sandals and more, visit http://www.stevemadden.com/

Safe Harbor

This press release and oral statements made from time to time by representatives of the Company contain certain “forward looking statements” as that term is defined in the federal securities laws. The events described in forward looking statements may not occur. Generally, these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of the Company's plans or strategies, projected or anticipated benefits from acquisitions to be made by the Company, or projections involving anticipated revenues, earnings or other aspects of the Company's operating results. The words "may," "will," "expect," "believe," "anticipate," "project," "plan," "intend," "estimate," and "continue," and their opposites and similar expressions are intended to identify forward looking statements. The Company cautions you that these statements concern current expectations about the Company’s future results and condition and are not guarantees of future performance or events and are subject to a number of uncertainties, risks and other influences, many of which are beyond the Company's control, that may influence the accuracy of the statements and the projections upon which the statements are based. Factors which may affect the Company's results include, but are not limited to, the risks and uncertainties discussed in the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission. Any one or more of these uncertainties, risks and other influences could materially

affect the Company's results of operations and financial condition and whether forward looking statements made by the Company ultimately prove to be accurate and, as such, the Company's actual results, performance and achievements could differ materially from those expressed or implied in these forward looking statements. The Company undertakes no obligation to publicly update or revise any forward looking statements, whether as a result of new information, future events or otherwise.

STEVEN MADDEN, LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS DATA

(In thousands, except per share amounts)

Unaudited

STEVEN MADDEN, LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

STEVEN MADDEN, LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED CASH FLOW DATA

(In thousands)

Unaudited

Contact

ICR, Inc.

Investor Relations

Jean Fontana/Megan Crudele

203-682-8200

www.icrinc.com