Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PACIFIC MERCANTILE BANCORP | pmbcinvestorpresentationpr.htm |

| 8-K - 8-K - PACIFIC MERCANTILE BANCORP | pmbcinvestorpresentationau.htm |

INVESTOR PRESENTAT ION

A U G U S T 2 0 1 6

1

This presentation contains statements regarding our expectations, beliefs and views about our future financial performance and our business, trends

and expectations regarding the markets in which we operate, and our future plans. Those statements constitute “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, can be

identified by the fact that they do not relate strictly to historical or current facts. Often, they include words such as “believe,” “expect,” “anticipate,”

“intend,” “plan,” “estimate,” “project,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may”.

Forward-looking statements are based on current information available to us and our assumptions about future events over which we do not have

control. Moreover, our business and our markets are subject to a number of risks and uncertainties which could cause our actual financial

performance in the future, and the future performance of our markets (which can affect both our financial performance and the market prices of our

shares), to differ, possibly materially, from our expectations as set forth in the forward-looking statements contained in this presentation. In addition to

the risk of incurring loan losses, which is an inherent risk of the banking business, these risks and uncertainties include, but are not limited to, the

following: the risk that the economic recovery in the United States, which is still relatively fragile, will be adversely affected by domestic or international

economic conditions, which could cause us to incur additional loan losses and adversely affect our results of operations in the future; the risk that our

results of operations in the future will continue to be adversely affected by our exit from the wholesale residential mortgage lending business and the

risk that our commercial banking business will not generate the additional revenues needed to fully offset the decline in our mortgage banking

revenues within the next two to three years; the risk that our interest margins and, therefore, our net interest income will be adversely affected by

changes in prevailing interest rates; the risk that we will not succeed in further reducing our remaining nonperforming assets, in which event we would

face the prospect of further loan charge-offs and write-downs of other real estate owned and would continue to incur expenses associated with the

management and disposition of those assets; the risk that we will not be able to manage our interest rate risks effectively, in which event our operating

results could be harmed; the prospect that government regulation of banking and other financial services organizations will increase, causing our costs

of doing business to increase and restricting our ability to take advantage of business and growth opportunities. Additional information regarding these

and other risks and uncertainties to which our business is subject are contained in our Annual Report on Form 10-K for the year ended December 31,

2015 which is on file with the SEC as well as subsequent Quarterly Reports on Form 10-Q that we file with the SEC. Due to these and other risks and

uncertainties to which our business is subject, you are cautioned not to place undue reliance on the forward-looking statements contained in this news

release, which speak only as of its date, or to make predictions about our future financial performance based solely on our historical financial

performance. We disclaim any obligation to update or revise any of the forward-looking statements as a result of new information, future events or

otherwise, except as may be required by law.

FORWARD LOOKING STATEMENTS

2

CORPORATE OVERVIEW

_________________________________

PACIFIC MERCANTILE BANK IS A

COMMUNITY-BASED COMMERCIAL BANK

SERVING SOUTHERN CALIFORNIA

Bank founded in 1999

$1.1 billion in total assets

9 offices in Southern California

Focused on serving small- and

middle-market businesses

32% owned by Carpenter

Community BancFund

CORPORATE HEADQUARTERS

COSTA MESA, CALIFORNIA

3

OFFICE LOCATIONS

_________________________________

ONTARIO

BEVERLY HILLS

LA HABRA

COSTA MESA

IRVINE SPECTRUM

NEWPORT BEACH

LA JOLLA

4

INVESTOR HIGHLIGHTS

_________________________________

Opportunity to Capitalize on Turnaround Transitioning to Growth

Double-digit loan growth projected for 2016

18% DDA growth in 1H16

Discounted Valuation Trading at 1.2x TBV

Addressing Attractive Growth Markets

Comprehensive Client Engagement

Outstanding Growth Market of Southern California

Over 8,000 Potential Clients within Service Area

Improving Operational Leverage

High insider ownership (over 30%)

5

CORE MARKET OVERVIEW

_________________________________

Southern California

A LARGE ATTRACTIVE MARKET

* Source: National Venture Capital Association

** Source: California Employment Development Department

*** LA 5-County Area consists of Los Angeles, Orange, Riverside, San Bernardino and Ventura Counties

**** Source: Los Angeles County Economic Development Corporation

Large addressable market for small- and middle-market banking

97,000 businesses with fewer than 500 employees**

Strong growth in entrepreneurial businesses

5th largest market for VC investment in 2015 *

LA 5-County Area*** Expected to Add 158,000 Jobs in 2016 (2.1% employment growth)****

6

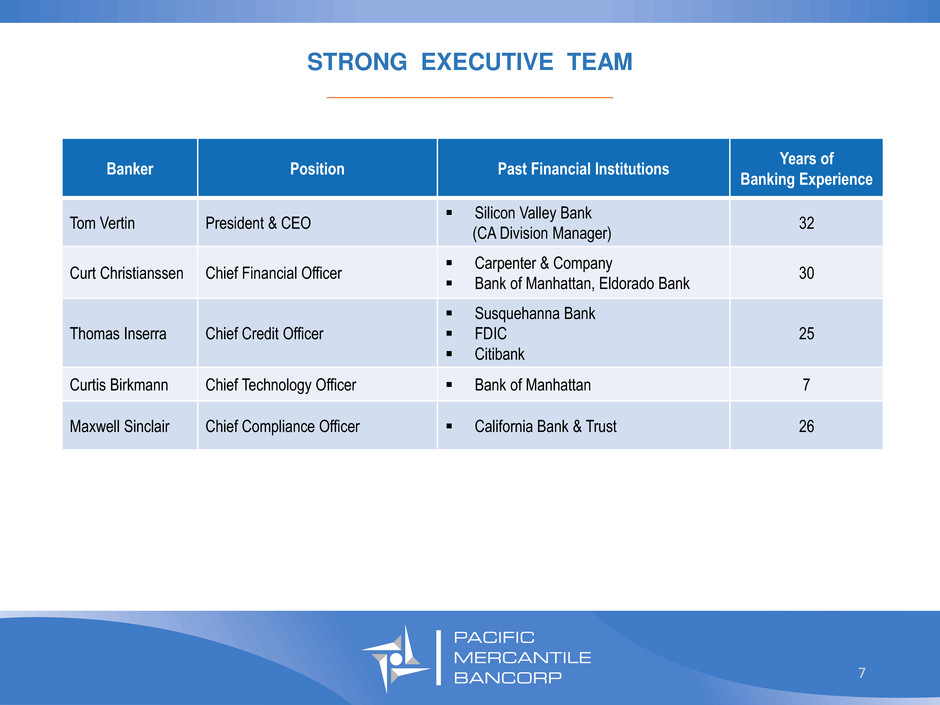

Banker Position Past Financial Institutions

Years of

Banking Experience

Tom Vertin President & CEO

Silicon Valley Bank

(CA Division Manager)

32

Curt Christianssen Chief Financial Officer

Carpenter & Company

Bank of Manhattan, Eldorado Bank

30

Thomas Inserra Chief Credit Officer

Susquehanna Bank

FDIC

Citibank

25

Curtis Birkmann Chief Technology Officer Bank of Manhattan 7

Maxwell Sinclair Chief Compliance Officer California Bank & Trust 26

STRONG EXECUTIVE TEAM

_________________________________

7

STRONG COMMERCIAL BANKING TEAM

_________________________________

Banker Position Past Financial Institutions

Years of

Banking

Experience

Kittridge Chamberlain Chief Banking Officer

Silicon Valley Bank

(Sr. Credit Officer, Western Div.)

30

Robert Anderson

Head of Product and Market

Development

Silicon Valley Bank

(Head of Orange County office)

20

Tom Wagner Chief Strategy Officer

Silicon Valley Bank

(Head of Corporate Finance)

30

Cindy Verity Head of Cash Management

Silicon Valley Bank

(Head of Treasury Management Sales)

30

Adrian Ward

Head of Entertainment Industries

Division

National Bank of California

(SVP, Entertainment)

23

8

MARKET POSITIONING

_________________________________

“Business Banking Beyond the Obvious”

Differentiating Strategy to Target Commercial Clients

9

Small- to Medium-

Sized Businesses

•Need for financial

guidance

• Limited internal

financial sophistication

• Limited outside

advisory support

Horizon Analytics

• Financial analysis

• Business planning

•Modeling and

forecasting

•Balance sheet

management

Service/Products

•Customized Commercial

Loans

•Asset Based Lending

•Owner Occupied RE

•Treasury Management

BALANCE SHEET OVERVIEW:

Loans, Deposits, Asset Quality, Capital

10

LOAN PORTFOLIO

FOCUS ON RELATIONSHIP LENDING

_________________________________

CRE: all other,

16.0%

CRE: owner-

occupied, 24.5%

Commercial,

38.7%

Multifamily,

[VALUE]

SFR,

[VALUE]

Other,

5.7%

$ 884 Million as of June 30, 2016

11

SIGNIFICANT SHIFT TO RELATIONSHIP LOANS

_________________________________

$158

$195 $191 $203 $217

$174

$156

$253

$323

$343

46.8%

48.2%

55.1%

63.2% 63.2%

45%

47%

49%

51%

53%

55%

57%

59%

61%

63%

65%

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

$600

2Q12 2Q13 2Q14 2Q15 2Q16

CRE OWNER-OCCUPIED C&I RELATIONSHIP LOANS AS A PERCENTAGE OF TOTAL LOANS

12

($

in

m

ill

io

n

s)

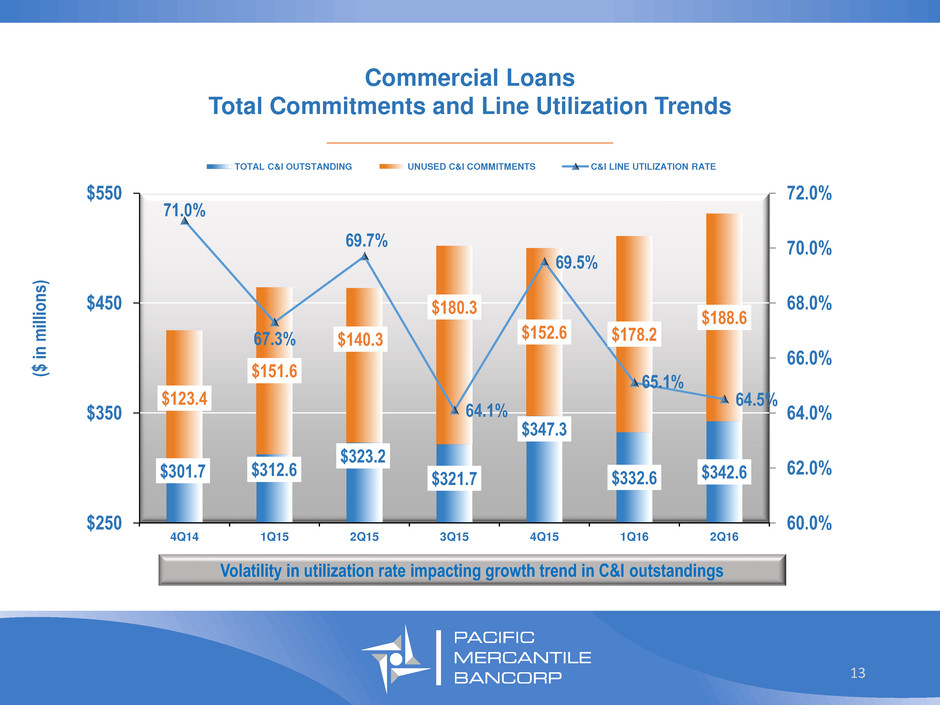

Commercial Loans

Total Commitments and Line Utilization Trends

_________________________________

$301.7 $312.6

$323.2

$321.7

$347.3

$332.6 $342.6

$123.4

$151.6

$140.3

$180.3

$152.6 $178.2

$188.6

71.0%

67.3%

69.7%

64.1%

69.5%

65.1%

64.5%

60.0%

62.0%

64.0%

66.0%

68.0%

70.0%

72.0%

$250

$350

$450

$550

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

TOTAL C&I OUTSTANDING UNUSED C&I COMMITMENTS C&I LINE UTILIZATION RATE

($

in

m

ill

io

n

s)

Volatility in utilization rate impacting growth trend in C&I outstandings

13

DEPOSIT COMPOSITION

FOCUSED ON CORE DEPOSITS

_________________________________

$937 Million as of June 30, 2016

Continuing to attract non-interest bearing deposits

Shifted balances out of CDs into savings and money market accounts

Savings and money market balances tend to be stickier and less price sensitive than CDs

Non-interest

bearing

31%

Interest

checking

6%

Savings/Money

Market

34%

Certificates of

Deposit

29%

Core Deposits as a Percentage of Total Deposits

14

61%

65%

64%

68%

69%

73%

71%

60%

62%

64%

66%

68%

70%

72%

74%

4Q15 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

ASSET QUALITY TRENDS

_________________________________

53% of NPAs Relate to Two Credits

0.52% 0.61%

1.15%

0.89% 0.81%

1.36% 1.17%

1.04%

2.10%

1.27%

0.38%

0.35%

0.23%

0.16%

0.32%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2Q15 3Q15 4Q15 1Q16 2Q16

NPAS/TOTAL ASSETS

Other Two Credits PMAR

0.04% 0.01% -0.05%

0.01%

0.09%

0.85%

-0.20%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

2Q15 3Q15 4Q15 1Q16 2Q16

NCOS/GROSS LOANS

Other NCOs One Credit

15

90% of 2Q16 NCOs Relate to

One Commercial Loan Participation

STRONG CAPITAL POSITION

_________________________________

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

TOTAL CAPITAL RATIO TIER 1 CAPITAL RATIO COMMON EQUITY TIER 1

CAPITAL RATIO

15.0%

13.8%

12.5%

10.0%

8.0%

6.5%

PMBC WELL-CAPITALIZED REQUIREMENT

16

As of June 30, 2016

OUTLOOK

17

DISRUPTION IN THE

CALIFORNIA LANDSCAPE

_________________________________

RBC acquisition of City National Bank

Western Alliance acquisition of Bridge Bank

PacWest Bancorp acquisition of Square 1 Bank

Key opportunities to add clients and banking teams

18

OUTLOOK

_________________________________

Double-digit loan growth in 2016 and beyond

Continued focus on growing commercial banking relationships

Expanded production staff will accelerate growth in core markets

Improving sales effectiveness and process throughput

Improving net interest margin

Loan-to-deposit ratio increasing

Diminishing impact of lost interest from non-accrual loans

Cost of funds declining

Higher non-interest income

New commercial clients using more treasury management products

Relatively stable expense levels

Continuing expense discipline

Increase in production staff cost offset by office transition

Steady increase in profitability

19

Strategic Change to More Effective Delivery Model

_________________________________

Transitioning from retail branches to smaller commercial banking offices

Cash management products used by commercial client base reduce need

for retail style branches

Cost savings from transition will be redeployed into more production staff

Planned addition of relationship managers during 2016

20

I n v e s t o r R e l a t i o n s :

C u r t C h r i s t i a n s s e n

( 7 1 4 ) 4 3 8 - 2 5 3 1

C u r t . c h r i s t i a n s s e n @ p m b a n k . c o m

21

APPENDIX

2Q16 Financial Statements

22

2Q16 Consolidated Statements of Income

(Dollars and numbers of shares in thousands, except per share data)

(Unaudited)

_______________________________

23

Three Months Ended

June 30, 2016

March 31,

2016 June 30, 2015

Jun '16 vs Mar

'16

% Change

Jun'16 vs Jun

'15

% Change

Total interest income $ 9,835 $ 9,954 $ 9,813 (1.2 )% 0.2 %

Total interest expense 1,355 1,251 1,324 8.3 % 2.3 %

Net interest income 8,480 8,703 8,489 (2.6 )% (0.1 )%

Provision for loan and lease losses 8,720 420 — 1,976.2 % 100.0 %

Net interest income (loss) after provision for loan and

lease losses (240 ) 8,283

8,489

(102.9 )% (102.8 )%

Non-interest income:

Service fees on deposits and other banking services 267 255 234 4.7 % 14.1 %

Net gain on sale of small business administration loans — 40 — (100.0 )% — %

Other non-interest income 597 459 382 30.1 % 56.3 %

Total non-interest income 864 754 616 14.6 % 40.3 %

Non-interest expense:

Salaries & employee benefits 5,506 5,687 5,423 (3.2 )% 1.5 %

Occupancy and equipment 1,243 1,168 1,182 6.4 % 5.2 %

Professional Fees 774 550 744 40.7 % 4.0 %

OREO expenses — (70 ) 59 (100.0 )% (100.0 )%

FDIC Expense 251 195 339 28.7 % (26.0 )%

Other non-interest expense 1,119 1,025 1,220 9.2 % (8.3 )%

Total non-interest expense 8,893 8,555 8,967 4.0 % (0.8 )%

(Loss) income before income taxes (8,269 ) 482 138 (1,815.6 )% (6,092.0 )%

Income tax (benefit) expense (3,559 ) 198 — (1,897.5 )% (100.0 )%

Net (loss) income (4,710 ) 284 138 (1,758.5 )% (3,513.0 )%

Accumulated undeclared dividends on preferred stock — — (309 ) — % (100.0 )%

Net (loss) income allocable to common shareholders $ (4,710 ) $ 284 $ (171 ) (1,758.5 )% 2,654.4 %

Basic (loss) income per common share:

Net (loss) income available to common shareholders $ (0.21 ) $ 0.01 $ (0.01 ) (2,200.0 )% 2,000.0 %

Diluted (loss) income per common share:

Net (loss) income available to common shareholders $ (0.21 ) $ 0.01 $ (0.01 ) (2,200.0 )% 2,000.0 %

Weighted average number of common shares outstanding:

Basic 22,962 22,873 19,774 0.4 % 16.1 %

Diluted 22,962 23,006 19,774 (0.2 )% 16.1 %

Ratios from continuing operations(1):

Return on average assets (1.71 )% 0.11 % 0.05 %

Return on average equity (13.96 )% 0.85 % 0.46 %

Efficiency ratio 95.17 % 90.46 % 98.48 %

2Q16 Consolidated Statements of Financial Condition

(Dollars in thousands, except share and book value data)

(Unaudited)

_______________________________

24

ASSETS June 30, 2016

December

31, 2015

Increase/

(Decrease)

Cash and due from banks $ 11,546 $ 10,645 8.5 %

Interest bearing deposits with financial institutions(1) 119,986 103,276 16.2 %

Interest bearing time deposits 3,917 4,665 (16.0 )%

Investment securities (including stock) 57,433 60,419 (4.9 )%

Loans (net of allowances of $13,429 and $12,716, respectively) 872,198 849,733 2.6 %

Other real estate owned — 650 (100.0 )%

Net deferred tax assets 20,507 17,576 16.7 %

Other assets 15,328 15,425 (0.6 )%

Total Assets $ 1,100,915 $ 1,062,389 3.6 %

LIABILITIES AND SHAREHOLDERS’ EQUITY

Non-interest bearing deposits $ 294,153 $ 249,676 17.8 %

Interest bearing deposits

Interest checking 59,720 51,210 16.6 %

Savings/money market 314,277 312,628 0.5 %

Certificates of deposit 268,519 280,326 (4.2 )%

Total interest bearing deposits 642,516 644,164 (0.3 )%

Total deposits 936,669 893,840 4.8 %

Other borrowings 10,000 10,000 — %

Other liabilities 5,697 7,106 (19.8 )%

Junior subordinated debentures 17,527 17,527 — %

Total liabilities 969,893 928,473 4.5 %

Shareholders’ equity 131,022 133,916 (2.2 )%

Total Liabilities and Shareholders’ Equity $ 1,100,915 $ 1,062,389 3.6 %

Tangible book value per share $ 5.70 $ 5.87 (2.9 )%

Tangible book value per share, as adjusted(2) $ 5.71 $ 5.90 (3.2 )%

Shares outstanding $ 22,984,453 $ 22,820,332 0.7 %