Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - I-Minerals Inc | exhibit32-2.htm |

| EX-32.1 - CERTIFICATION - I-Minerals Inc | exhibit32-1.htm |

| EX-31.2 - CERTIFICATION - I-Minerals Inc | exhibit31-2.htm |

| EX-31.1 - CERTIFICATION - I-Minerals Inc | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 000-55321

I-MINERALS INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 20-4644299 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite 880, 580 Hornby Street, Vancouver, BC,

Canada V6C 3B6

(Address of principal executive offices)(Zip Code)

(877) 303-6573

Registrant’s telephone number, including area code

Not applicable

(Former name or former address if changed since last

report)

Securities registered under section 12(g) of the Exchange Act: Common shares with no par value.

Indicate

by check mark if the registrant is a well-known season issuer, as defined in

Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act.

Yes [ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate

by check mark whether the registrant is a shell company (as defined in rule

12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $11.5 million, based upon the closing sale price of the registrant’s common stock as reported by the TSX Venture Exchange on October 31, 2015 and converted to USD based on the Bank of Canada noon rate as of the same date.

As of July 27, 2016, the registrant had 87,308,952 outstanding shares of common stock.

I-Minerals Inc.

INDEX

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; changes in project parameters as plans continue to be refined; changes in labour costs or other costs of production; future mineral prices; equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavourable operating conditions and losses; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section titled "Risk Factors" in this Annual Report.

Forward looking statements are based on a number of material factors and assumptions, including the results of exploration and drilling activities, the availability and final receipt of required approvals, licenses and permits, that sufficient working capital is available to complete proposed exploration and drilling activities, that contracted parties provide goods and/or services on the agreed time frames, the equipment necessary for exploration is available as scheduled and does not incur unforeseen break downs, that no labour shortages or delays are incurred and that no unusual geological or technical problems occur. While we consider these assumptions may be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in the section titled “Risk Factors” in this Annual Report.

We intend to discuss in our Quarterly Reports and Annual Reports any events or circumstances that occurred during the period to which such documents relate that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this Annual Report. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on our business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forwarding looking statement.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” as used in this Annual Report are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of unit measures in a resource is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report and any documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

4

As used in this Annual Report, unless the context otherwise requires, “we,” “us,” “our,” the “Company” and “I-Minerals” refers to I-Minerals Inc. All dollar amounts in this registration statement are in U.S. dollars unless otherwise stated.

PART I

Item 1. Business.

General

We were incorporated under the laws of British Columbia, Canada in 1984. In 2004, we changed our corporate jurisdiction from a British Columbia company to a Canadian corporation. In December 2011, we amended our articles to change our name from “i-minerals inc.” to “I-Minerals Inc.”

The company engaged in the development of our Helmer-Bovill industrial minerals property (the “Helmer-Bovill Property”). The Helmer-Bovill Property, in which we hold a 100% interest, is comprised of 11 mineral leases totaling 5,140.64 acres located approximately 6 miles southwest of Bovill, Latah County, Idaho.

We acquired the Helmer-Bovill Property from Idaho Industrial Minerals (“IIM”) pursuant to an Assignment Agreement with Contingent Right of Reverter (the “IIM Agreement”) dated August 12, 2002, as amended August 10, 2005, August 10, 2008 and January 21, 2010, between I-Minerals USA (formerly Alchemy Kaolin Corporation), our wholly owned subsidiary, and IIM. Under the terms of the IIM Agreement, we issued a total of 1,800,000 common shares to IIM.

Our principal executive office is located at Suite 880, 580 Hornby Street, Vancouver, British Columbia, Canada and our telephone number is (877) 303-6573.

To date, we have not earned significant revenues from the operation of our mineral properties. Accordingly, we are dependent on debt and equity financing as its primary source of operating working capital. Our capital resources are largely determined by the strength of the junior resource markets and by the status of our projects in relation to these markets, and its ability to compete for investor support of its projects.

Our Principal Projects

Our activities at the Helmer-Bovill Property are focused on developing the Bovill Kaolin Project and the WBL Tailings Project.

The Bovill Kaolin Project

Our lead project, the Bovill Kaolin Project, is a strategically located long term resource of high purity quartz, potassium feldspar (“K-spar”), halloysite and kaolinite formed through weathering of a border phase of the Idaho Batholith causing all minerals to be contained within a fine white clay-sand mixture referred to as “primary clay.” The Bovill Kaolin Project is located within 3 miles of state highways with electricity and natural gas already at the property boundary.

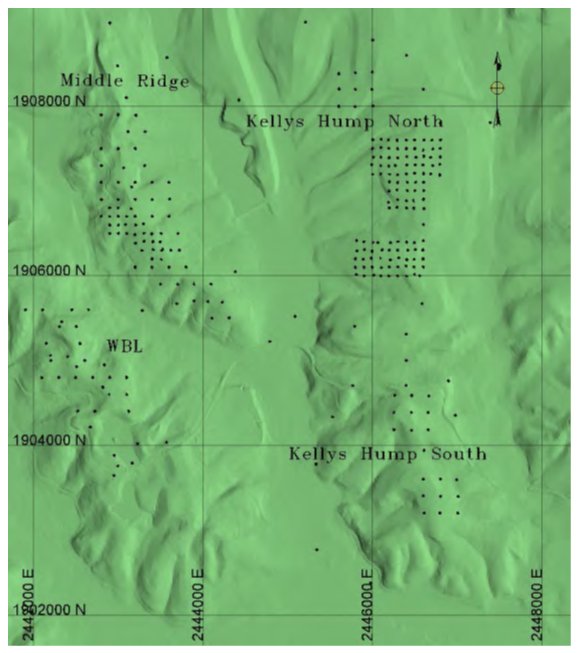

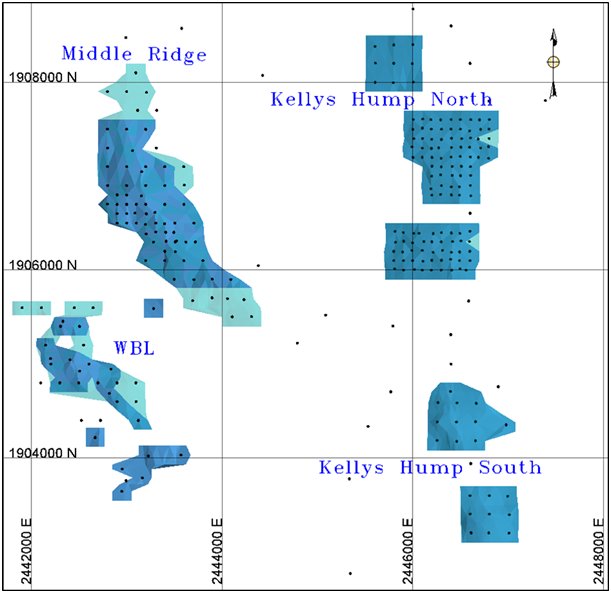

Since 2010, our exploration work has focused diamond drilling on the Bovill Kaolin Project. To date, a total of 258 diamond drill holes have been drilled totaling 28,251 feet. As a result of these drill campaigns, four deposits have been identified: Kelly’s Hump, Kelly’s Hump South, Middle Ridge and WBL.

In June 2014, we completed an updated pre-feasibility study on the Bovill Kaolin Project (the “2014 PFS”) and on March 8, 2016, we announced the economic results of our full feasibility study (the “2016 FS”), which included the following highlights:

-

Updated

Measured and Indicated Resource Estimate

- Measured Resources of 5.7 million tons containing 76.5% quartz/K-spar sand, 12.3% Kaolinite and 4.0% Halloysite.

- Indicated Resources of 15.5 million tons containing 57.0% quartz/K-spar sand, 15.5% Kaolinite and 2.8% Halloysite.

- 667,000 tons of contained halloysite, 3,119,000 tons of contained kaolinite and 13,235,000 tons of contained quartz/K-spar.

- Updated Mineral Reserves. All figures are in thousands of tons.

5

| Reserve | Proven | Probable | Total P&P |

| Tons (1000s) | 4,155 | 4,548 | 8,702 |

| Halloysite % | 4.8 | 4.0 | 4.4 |

| Halloysite Tons (1000s) | 200 | 182 | 382 |

| Kaolinite % | 11.1 | 12.5 | 11.8 |

| Kaolinite Tons (1000s) | 460 | 568 | 1,028 |

| Sand % | 77.8 | 76.8 | 77.3 |

| Sand Tons (1000s) | 3,234 | 3,491 | 6,725 |

Note that values

presented here have been rounded to reflect the level of accuracy.

Proven and Probable

Mineral Reserves are presented using a $57.00 NSR cutoff grade.

-

Economic

Analysis

- US$386 million Pre-Tax NPV; US$250 million After Tax NPV using a 6% discount rate.

- 31.6% Pre-Tax IRR; 25.8% After Tax IRR.

- Initial Capital Cost of $108.3 million and Total Life of Mine capital costs $120.0 million.

- Life of Mine in excess of 25 years with a stripping ratio of 0.54:1 (waste:ore).

- 3 year estimated after tax payback.

The full National Instrument (“NI”) 43-101 report was filed on www.sedar.com on April 20, 2016 and is available on the Company’s website. Going forward our focus is to complete the detailed engineering and commence efforts to raise the capital necessary to build the mine.

See “Properties – Helmer-Bovill Property – 2016 Feasibility Study”.

The WBL Tailings Project

We also plan to continue limited seasonal mining operations at the WBL Tailings Project. The WBL Tailings Project is feldspathic sands deposited as tailings from clay mining operations during the period from 1961 to 1974. In September 2012, we received approval of our Mine Plan of Operations (“MPO”) from the Idaho Department of Lands. The MPO allows us to mine up to 50,000 tons per annum of feldspathic sands from June to October for a period of 10 years. From 2013 through 2015 approximately 5,000 tons of tailings was extracted and sold to a local cement company and a local contractor.

Three Year History

During the last three fiscal years, our operations have focused on completing an extensive diamond drill program on the Bovill Kaolin Project, acquiring a 100% interest in the Helmer-Bovill Property, completion of the 2016 FS and initial submittal of the mine permit application to the State of Idaho.

Drill Programs at Bovill Kaolin Project

We have completed two extensive diamond drill programs on the Helmer-Bovill Property for the Bovill Kaolin Project totaling over 25,000 feet, most recently in 2013 where 167 diamond drill holes totaling 17,811 feet were completed at the Middle Ridge, Kelly Hump and Kelly South deposits. These programs allowed us to better define our four key deposits at the Bovill Kaolin Project and complete both our 2014 PFS and 2016 FS. See “Properties – Helmer-Bovill Property”.

WBL Tailings Project

In September 2012, we received approval of our MPO from the Idaho Department of Lands. The MPO allows us to mine up to 50,000 tons per annum from feldspathic sands from June to October for a period of 10 years. Shortly thereafter, we completed our first production and inaugural sales feldspathic sand from the WBL Tailings Project.

In November 2013, we entered into an agreement with Pre-Mix, Inc. of Pullman Washington (“Pre-Mix”) pursuant to which we sold 3,000 tons of sand tailings to Pre-Mix.

6

On April 28, 2014, we entered into a new contract with Pre-Mix for the sale of up to 30,000 tons per annum of screened K-spar / quartz sand. Under the terms of the contract, Pre-Mix is solely responsible for the operating costs to process and remove the K-spar / quartz sand. The term of the contract is until December 31, 2018 and may be extended for a further two years through the mutual consent of the parties.

During 2014 and 2015 approximately 5,000 tons of sand tailings from our WBL Tailings Project were sold generating limited revenues to date due to associated road improvement costs. It is important to note that the State of Idaho permits that allow us to produce the feldspathic sands from the WBL Tailings Project are essentially the same permits as we have applied for to bring the much larger Bovill Kaolin Deposit into production.

Acquisition of Helmer-Bovill Property

In January 2013, we acquired a 100% interest in our Helmer-Bovill Property. In order to acquire the Helmer-Bovill Property, we issued a total of 1,800,000 common shares, of which 1,300,000 common shares were issued as the final payment to IIM.

On December 2, 2015, we settled all lawsuits relating to the Helmer-Bovill Property pursuant to the terms of Global Settlement and Absolute Release Agreement (the “Settlement Agreement”) dated October 29, 2015 among us, Idaho Industrial Minerals, LLC (“IIM”), Hoodoo Resources, LLC (“Hoodoo”), the principal of Hoodoo, Robert Lemke (“Lemke”), Brent Thomson (“Thomson”), The Thomson Family Trust (the “Thomson Trust”) (IIM, Hoodoo, Lemke, Thomson and the Thomson Trust collectively referred to as the “Plaintiffs”), the Estate of Philip Nisbet (the “Nisbet Estate”), Allen Ball (“Ball”), the Allen Ball and Connie Ball Family Trust (the “Ball Trust”), Ball Ventures, LLC (“BV”) and BVNR Natural Resources LLC (“BVNR”) (Ball, the Ball Trust, BV and BVNR collectively referred to as the “Ball Entities”) and Northwest Kaolin, Inc. (“NWK”). Under the terms of the Settlement Agreement, we paid IIM the aggregate sum of $100,000 (the “I-Minerals Payment”) for the release of any and all claims made against us under the lawsuits by the Ball Entities and the Plaintiffs. In addition, IIM and NWK have expressly acknowledged and agreed that, upon receipt of the I-Minerals Payment, we have fulfilled all of our duties and obligations under the terms of the IIM Agreement relating to our Helmer-Bovill Property, and that any and all rights and claims of IIM and NWK to the mineral leases making up the Helmer-Bovill Property will be released and extinguished. See “Legal Proceedings” below.

Industrial Minerals

In carrying out our activities at the Bovill Kaolin Project, we are focused on the development and, based upon the positive results of the 2016 FS, raising sufficient capital to build the mine and commence the extraction of the industrial minerals set forth below.

Kaolin

Kaolin is a raw material used in the ceramic industry, especially in fine porcelains. Large quantities of kaolin are used in paper coating, filler, paint, plastics, fiberglass, catalysts, and other specialty applications. It is also used as a key ingredient in natural pesticides that are suitable for organic farming applications.

When kaolin is heated to about 850°, it is transformed into a dehydrated phase called "metakaolin." Metakaolin is considered a premium material as it adds strength and durability to cement based products. When metakaolin is added to cement-based mortars, it causes an aggressive reaction with calcium hydroxide (lime), turning the lime into a cementitious material yielding cement with enhanced performance characteristics including increased strength; reduced permeability; greater durability; effective control of efflorescence; and control of degradation caused by Alkali-Silica Reaction. A bridge deck in a northern climate where it is subject to the wear and tear associated with plowing and salting is a prime metakaolin application. We are continuing long term testing process of several metakaolin products produced from the Bovill Kaolin deposits and have received ASTM C-618 certification for two of our products indicating the Bovill Metakaolin is an accredited pozzolan that meets all strength and water consumption requirements. ASTM C-618 certification is a prerequisite for sales into the cement industry. Additional testing is focused on optimizing the fineness of the grind or particle size to create the metakaolin product that provides the greatest strength while meeting the water requirement criteria.

Our target market for metakaolin is the North American concrete and infrastructure industry. Premium white metakaolin is currently priced at $500 per ton in the Pacific Northwest due to the transportation costs to bring it from the southeastern USA. We are targeting applications where color is not as important and pricing used in the 2016 FS is $231 per ton. The 2016 FS forecasts average annual production of about 40,000 tons of Bovill Metakaolin and the Company has non-binding letters of interest from various cement and construction companies for tonnage well in excess of this amount.

7

Halloysite

We plan to sell Halloysite on a worldwide basis. Halloysite is chemically identical to kaolin. When water is added to the kaolin chemistry its plate like structure takes on a tubular shape, identified as halloysite. Much of the value of halloysite is generated by its tubular shape which can only be seen through very powerful microscopes and are commonly referred to as halloysite nanotubes and abbreviated as HNTs.

Historically, the primary use of halloysite has been in the manufacture of porcelain, bone china, and fine china where the combination of low iron and titanium content together with the hollow tubular shape of the mineral grains yields ceramic bodies with exceptional whiteness and translucency. However, the HNTs microscopic tubular shape is rapidly finding uses outside of the ceramics industry. Applications in commercial production would include use as a suspension agent in glaze preparations as well as in filters and inkjets, and as an ingredient in special paints applied to ships to prevent barnacles from growing on the ships’ hull. HNTs are also being increasingly used in plastic and polymer applications where the addition of HNTs increases strength while reducing the weight of these compounds. Perhaps the most exciting uses for HNTs are in life science applications where the inside of the hollow tube can be filled with active ingredients and as the clay tube erodes the active ingredients are released. Used in this manner the HNTs are a delivery vector made of natural materials.

The largest supplier of commercial halloysite product available at present is located in Maturi Bay, New Zealand. There is limited production in Poland, Turkey and China, and a development stage project in Utah with negligible commercial production. The largest halloysite supplier in the ceramics industry sells halloysite at a price from $135 to $3,000 per ton. The majority of imported halloysite in the United States for the ceramics industry is sold at a price of approximately $700 per ton.

Our halloysite is differentiated from those known halloysite deposits due to the high aspect ratio (the ratio of the length of the tube to the diameter of the tube) and by minimal levels of trace elements such as lead. We are not targeting ceramic applications with our halloysite and instead focusing on the life science and plastic and polymer applications. Third party research has indicated we have arguably the best halloysite for life science applications as the New Zealand deposit contains about 10% Cristobalite – a silica oxide that has been categorized as a carcinogen and the other deposits capable of meaningful commercial production have poorer aspect ratios and higher heavy metal / trace element content.

The Company is planning on producing two halloysite products. The first branded HalloPure will be about 70% halloysite and 30% kaolinite and will target the plastic and polymer and certain filtration applications. The second is branded ULTRA Hallopure and will be in excess of 90% halloysite and less than 10% kaolinite. Both are considered high value products. In the 2016 FS, halloysite production varied from about 10,000 tons to 15,000 tons per year, split equally between the two halloysite products. HalloPure was priced at about $700 per ton and ULTRA Hallopure at about $1,400 per ton.

To date we have received interest in our HNTs from a number of companies in a wide range of industries including: personal care products, nano-composites, fire retardants, biocides, plastic fillers, animal feed, paint, and ceramics. Most of these companies have received samples of our products produced at recent pilot plants with some companies receiving up to 50 kg for bench scale product testing. We have also provided samples free of charge to several universities to help with the development of other new HNT applications. Currently the Company has non-binding expressions of interest approximately equal to forecast production.

Quartz

Quartz (SiO2 or silicon dioxide) is crystalline silica, the second most common mineral in the crust of the earth. It is known for its hardness and is well known for its use in glass. However, different types of glass require different SiO2 purity levels with some types of glass requiring the SiO2 content in quartz to have purity levels in the 97-99% range to be suitable. Although silicon dioxide is abundant, not all deposits are chemically identical, with the SiO2 purity and the levels of various trace element impurities varying across different deposits. Contamination of quartz can be from mineral and fluid inclusions and non-silica elements entering atomic sites usually occupied by silicon and oxygen. Our quartz operations at the Bovill Kaolin Project will focus on two levels of purity in excess of 99.8% SiO2 and is prepared to introduce a third product as market conditions warrant.

The Company has branded the quartz products TrueQ. The least pure product is True Q1 where the “1” indicates the material has been processed once through flotation. The high purity product is True Q3 where the “3” indicates the material has been floated three times to remove the maximum amount of impurities possible. Bench scale production at the recent pilot plant indicates the True Q1 will grade 99.86% SiO2 or higher and the True Q3 99.97% SiO2 or higher. The True Q1 will be offered in three different grinds or particle size: 50 mesh, 200 mesh and 325 mesh. “Mesh” references the number of openings in a 1 inch by 1 inch screen. As additional work and expense is required to further grind the basic 50 mesh product into finer grained products (200 or 325 mesh products), the finer grind products sell at higher prices than the basic 50 mesh product.

8

The 2016 FS foresees total quartz production (True Q1 and True Q3) of approximately 108,000 tons per year. The higher value True Q3 markets will be harder to enter due to more stringent testing and competition. Accordingly, the 2016 FS does not foresee reaching full True Q3 production capacity until the third year of production with a significant discount offered to gain business in the first year. Pricing for the True Q1 ranges from $100 to $350 per ton depending on the fineness of grind (particle size) together with the customer’s volume and delivery method. Once markets for the True Q3 have been established (2 year delay) the 2016 FS contemplates a price of approximately $600 per ton. Currently the Company has non-binding expressions of interest equal to two or three times production capacity from producers of sodium silicate, paint, solar glass, optical glass, art glass, glass bulbs, and liquid crystal display (“LCD”) glass in North American and Asia.

Potassium-Feldspar (“K-spar”)

K-spar is primarily used in ceramic bodies and glazes. We have run several pilot plants to produce K-spar. Grades have varied between 12.2% K2O and 13.1% K2O with low iron and high alumina. A high quality K-spar product has high K2O, high alumina and low iron. Iron tends to cause a darkening of the glaze when the ceramics are heated to high temperatures in a kiln. The quality of the K-spar produced in the pilot plant exceeds virtually all other commercially available K-spar products. The North American market is currently in short supply and the sole producer is offering a product of 9.5% - 10.0% K2O and about twice the iron (Fe) content of our K-spar. The shortage is driven by the largest producer in the United States shut down production at its Georgia operations in December 2014 when it ran out of reserves after 57 years of production. This company is attempting to service the North American market with a more expensive European K-spar product. The ceramics industry has extensively tested our K-spar product and it has been favorably written up in trade publications. Interest in the K-spar product that will be marketed under the brand name Fortispar is very strong.

Similar to quartz, we will offer our Fortispar in three grinds or particle sizes; a basic 30 mesh product as well as 200 and 325 mesh fine grind products. Fortispar will be sold primarily into K-spar North American ceramics and glass industries. We also plan to focus on producers of high clarity glass, ceramics, sanitary ware, tableware, and paint. Industrial and marine paint manufacturers also use an ultra-fine grind variety of feldspar. Pricing of our Fortispar product in the 2016 FS ranged from $217 per ton for the basic 30 mesh product up to $400 per ton for small quantiles of the fine ground product. We currently have non-binding expressions of interest in our K-spar product in excess of our production capacity.

Competition

With the completion of the 2016 FS, upon receipt of our mine permit, we will be a development stage company. We compete with other mineral resource exploration and development companies for financing. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Government Regulations

Mining operations and exploration activities are subject to various national, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will obtain the licenses, permits or other authorizations currently required to conduct our exploration program. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Idaho and the United States.

In Idaho, our exploration activities are regulated by the Idaho Department of Lands (“IDL”) pursuant to the Idaho Rules Governing Exploration Surface Mining and Closure of Cyanidation Facilities pursuant to the Idaho Administrative Procedure Act. In order to carry out surface exploration and drilling activities, a company is required to file a Notification of Exploration with the IDL. In 2000, we filed our original Notification of Exploration with the IDL, which has been subsequently amended, for our surface exploration and drilling programs on the Helmer-Bovill Property.

9

In order to carry out mining activities, we are required to obtain a Mine Plan for Operations and Reclamation Plan (“MPO”). In 2012, we completed a MPO for the extraction of sand tailings on the WBL Tailings Project. The MPO permits us to mine the sand tailings between May to October for a period of 10 years (2012 – 2022). In May of 2016 we applied for an MPO for mining activities on the Bovill Kaolin Project. The IDL has responded to our initial submission and we are in the final stages of responding to the IDL inquiries. Management believes that receipt of the MPO in the third calendar quarter of 2016 is a reasonable expectation.

All leases are subject to rental fees of US$1.00 per acre each year and a production royalty of 5.0% based on gross proceeds. The production royalty is prepaid at a rate of US$500 per lease for the first five years and increases to US$1,000 per lease for the second five years of the lease.

Mining operations are also regulated by Mine and Safety Health Administration (“MSHA”). MSHA inspectors will periodically visit projects to monitor health and safety for the workers, and to inspect equipment and installations for code requirements. Although we are not engaged in mining operations, we require all of our workers to have completed safety training courses when working on our project.

Other regulatory requirements monitor the following:

| (a) | Explosives and explosives handling. |

| (b) | Use and occupancy of site structures associated with mining. |

| (c) | Hazardous materials and waste disposal. |

| (d) | State Historic site preservation. |

| (e) | Archaeological and paleontological finds associated with mining. |

We believe that we are in compliance with all laws and plans to continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect its business operations. There is however no assurance that any change in government regulation in the future will not adversely affect our business operations.

Environmental Liability

We will have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event that a potentially economic deposit is discovered.

In the application for the MPO, costs are estimated for reclamation after 12 months of work, which would include construction, and for reclamation of the entire project and the IDL must agree to those costs. Once the MPO is granted, I-Minerals must submit a surety or cash bond for the first 12 months to begin activities. After the first 12 months, the bond is increased to the full costs estimated to clean up the entire project.

Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| (i) | Water discharge will have to meet drinking water standards; |

| (ii) | Dust generation will have to be minimal or otherwise re-mediated; |

| (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| (v) | Ground water will have to be monitored for any potential contaminants; |

| (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

| (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

A reclamation bond of US$7,600 has been posted to cover the current plan of operations. The Storm Water Pollution Prevention Plan (SWPPP) has been publicly noted without objection as of November 16, 2012. The Company does not view the current environmental liability to be material as of April 30, 2016 as the amount is estimated to be below $5,000.

10

Employees

As of the date of this registration statement, we have five full time employees, four in Idaho plus our Chief Executive Officer in Utah.

Research and Development

We have not incurred any research and development expenditures since our inception.

Patents and Trademarks

As of February 23, 2016, The United States Patent and Trademark Office issued the company Certificates of Registration for the following marks: FortisparÒ (K feldspar), TrueQÒ (quartz), HalloPureÒ (standard halloysite), and ULTRA HalloPureÒ (high purity halloysite).

Item 1A. Risk Factors.

An investment in our common shares involves a high degree of risk. You should carefully consider the risks described below and the other information in this registration statement before investing in our common shares. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common shares could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Business

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activities and if we do not obtain sufficient financing, our business will fail.

To date, we have been involved primarily in the acquisition, exploration and development of our mineral properties. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon: (i) our ability to locate a profitable mineral property, and (ii) our ability to generate revenues.

For the next twelve months, management anticipates that the minimum cash requirements to fund our permitting activities, begin longer duration mine building activities and our general continued operations will be approximately $2,500,000. Accordingly, we do not have sufficient funds on hand to meet our planned expenditures over the next twelve months and will be required to raise additional financing.

Obtaining financing would be subject to a number of factors, including the market prices for industry minerals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Since our inception, we have relied on equity financings and loans to fund our operations. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation.

Because we are an exploration stage company, our business has a high risk of failure.

We are an exploration stage company that has incurred net losses since inception, we have not attained profitable operations and we are dependent upon obtaining adequate financing to complete our exploration activities. The success of our business operations will depend upon our ability to obtain further financing to complete our planned exploration program and to attain profitable operations. If we are not able to complete a successful exploration program and attain sustainable profitable operations, then our business will fail.

Our financial statements include disclosures expressing substantial doubt about our ability to continue as a going concern; as a result we could have difficulty finding additional financing.

Our financial statements have been prepared assuming that we will continue as a going concern. We have not generated significant revenues from our main operations since inception and have accumulated losses. As a result, our financial statements include disclosures expressing substantial doubt about our ability to continue as a going concern. Our ability to continue our operations depends on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that could result from the outcome of this uncertainty.

11

We do not have sufficient financial resources to operate for the next twelve months.

Our financial statements have been prepared assuming that we will continue as a going concern. We have not generated significant revenues from our main operations since inception and have accumulated losses. Our ability to continue our operations depends on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that could result from the outcome of this uncertainty.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

You should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Although we have known mineral reserves, there are uncertainties related to mineral reserve and mineralization estimates.

There are numerous uncertainties inherent in estimating proven and probable reserves and mineralization, including many factors beyond our control. The estimation of reserves and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may justify revision of such estimates. No assurances can be given that the volume and grade of reserves recovered and rates of production will not be less than anticipated. Assumptions about prices are subject to greater uncertainty and industrial mineral prices have fluctuated widely in the past. Declines in the market price of industrial minerals also may render reserves or mineralization containing relatively lower grades of ore uneconomic to exploit. Changes in operating and capital costs and other factors including, but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may materially and adversely affect reserves

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may result in our inability to complete our planned exploration program and/or obtain additional financing to fund our exploration program.

Because the prices of minerals fluctuate, if the price of minerals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those minerals and we will cease operations.

The profitability of mining operations is directly related to the market price of the industrial minerals being mined. The market price of industrial minerals may fluctuate widely and is affected by numerous factors beyond the control of any mining company. These factors include expectations with respect to the rate of inflation, the exchange rates of the dollar and other currencies, interest rates, global or regional political, economic or banking crises, and a number of other factors. If the market prices of the mineral commodities we plan to explore decline, this will have a negative effect on the availability of financing to us.

We may be required to defend title to the leases that comprise our Helmer-Bovill Property.

Title to mineral properties involves certain inherent risks due to the difficulties of determining the validity of certain claims, as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mineral properties. Although we have taken steps to verify title to mineral leases in which we have an interest, these procedures do not guarantee our title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

12

There are environmental risks associated with mineral exploration.

Environmental risks are inherent with mining operations. The legal framework governing this area is constantly developing, therefore we are unable to fully ascertain any future liability that may arise from the implementation of any new laws or regulations, although such laws and regulations are typically strict and may impose severe penalties (financial or otherwise). Our proposed activities of, as with any exploration, may have an environmental impact which may result in unbudgeted delays, damage, loss and other costs and obligations including, without limitation, rehabilitation and/or compensation. There is also a risk that our operations and financial position may be adversely affected by the actions of environmental groups or any other group or person opposed in general to our activities and, in particular, the proposed exploration and mining by us within the State of Idaho.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do. Due to our weaker competitive position, we may have greater difficulty in hiring and retaining qualified personnel to conduct our planned exploration and development activities, which could cause delays in our exploration programs.

There may be barriers in entering the market as we will be a new supplier of industrial mineral products.

We will be a new supplier of industrial mineral products. Accordingly, we will be competing with more established industrial mineral companies that currently supply the ceramics and glass industries with industry mineral products. Accordingly, the ceramics, glass and other industries may be reluctant to terminate existing supply relationships and retain our company as a supplier of industrial mineral products to them. In the event that we are unable to be retained by these industries, our operations may be negatively impacted.

Demand for our metakaolin products will be dependent on funding for infrastructure projects.

Metakaolin is significantly more expensive than other kaolin products, such as, fly ash. In the United States, the funding for infrastructure projects is low. As a result, fly ash is commonly used for infrastructure products due to its low cost. Accordingly, our future customers may be unable or unwilling to purchase our metakaolin products unless funding infrastructure projects is increased.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan and our business will fail

Our success will largely depend on our ability to hire highly qualified personnel with experience in geological exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Currently, we have not hired any key personnel. Our failure to hire key personnel when needed could have a significant negative effect on our business.

Risks Related To The Ownership of Our Shares

There has been a very limited public trading market for our securities in the United States, and the market for our securities in the United States may continue to be limited and be sporadic and highly volatile. Trading in our shares on the TSX Venture Exchange has sometimes been sporadic.

There is currently a limited public market for our common shares. Our common shares trade in Canada on the TSX Venture Exchange and over the counter in the United States on the OTCQX market place. We cannot assure you that an active market for our shares will be established or maintained in the future. The OTCQX is not a national securities exchange, and many companies have experienced limited liquidity when traded through this quotation system. Trading in our shares on the TSX Venture Exchange has sometimes been sporadic. Holders of our common shares may, therefore, have difficulty selling their shares, should they decide to do so. In addition, there can be no assurances that such markets will continue or that any shares, which may be purchased, may be sold without incurring a loss. The market price of our shares, from time to time, may not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value, and may not be indicative of the market price for the shares in the future.

In addition, the market price of our common stock may be volatile, which could cause the value of our common shares to decline. Securities markets experience significant price and volume fluctuations. This market volatility, as well as general economic conditions, could cause the market price of our common shares to fluctuate substantially. Many factors that are beyond our control may significantly affect the market price of our shares. These factors include:

13

| (a) | price and volume fluctuations in stock markets; |

| (b) | changes in our operating results; |

| (c) | any increase in losses from levels expected by securities analysts; |

| (d) | changes in regulatory policies or law; |

| (e) | operating performance of companies comparable to us; and |

| (f) | general economic trends and other external factors. |

Even if an active market for our common shares is established, stockholders may have to sell their shares at prices substantially lower than the price they paid for the shares or might otherwise receive than if an active public market existed.

We will likely conduct further offerings of our equity securities in the future, in which case your proportionate interest may become diluted.

Since our inception, we have relied on such sales of our common shares to fund our operations. We will likely be required to conduct additional equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common shares are issued in return for additional funds, the price per share could be lower than that paid by our current shareholders. We anticipate continuing to rely on equity sales of our common shares in order to fund our business operations. If we issue additional shares, your percentage interest in us could become diluted.

If we are, or were, a U.S. real property holding corporation, non-U.S. holders of our common stock or other security convertible into our common stock could be subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of such security.

If we are or ever have been a U.S. real property holding corporation (a “USRPHC”) under the Foreign Investment Real Property Tax Act of 1980, as amended (“FIRPTA”) and applicable United States Treasury regulations (collectively, the “FIRPTA Rules”), unless an exception applies, certain non-U.S. investors in our common stock (or options or warrants for our common stock) would be subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of shares of our common stock (or such options or warrants), and such non-U.S. investor would be required to file a United States federal income tax return. In addition, the purchaser of such common stock, option or warrant would be required to withhold from the purchase price an amount equal to 10% of the purchase price and remit such amount to the U.S. Internal Revenue Service.

We have not conducted a formal analysis of whether we are or have ever been a USRPHC. However, we believe that we may be a USRPHC. In general, under the FIRPTA Rules, a company is a USRPHC if its interests in U.S. real property comprise at least 50% of the fair market value of its assets. If we are or were a USRPHC, so long as our common stock is “regularly traded on an established securities market” (as defined under the FIRPTA Rules), a non-U.S. holder who, actually or constructively, holds or held no more than 5% of our common shares not subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of our common shares under FIRPTA. In addition, other interests in equity of a USRPHC may qualify for this exception if, on the date such interest was acquired, such interests had a fair market value no greater than the fair market value on that date of 5% of our common shares. Any of our common shares (or owners of options or warrants for our common shares) that are non-U.S. persons should consult their tax advisors to determine the consequences of investing in our common shares (or options or warrants).

The recently enacted JOBS Act will allow us to postpone the date by which we must comply with certain laws and regulations and to reduce the amount of information provided in reports filed with the SEC. We cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our common stock less attractive to investors.

We are and we will remain an "emerging growth company" until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of our initial public offering, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or (iv) the date on which we are deemed a "large accelerated filer" (with at least $700 million in public float) under the Exchange Act. For so long as we remain an "emerging growth company" as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" as described in further detail in the risk factors below. We cannot predict if investors will find our common stock less attractive because we will rely on some or all of these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. If we avail ourselves of certain exemptions from various reporting requirements, as is currently our plan, our reduced disclosure may make it more difficult for investors and securities analysts to evaluate us and may result in less investor confidence.

14

As an “emerging growth company” we are permitted to adopt accounting standards within the same timeframes as private companies. This may make it more difficult to compare our financial statements to the financial statements of other public companies.

Pursuant to the JOBS Act, as an “emerging growth company”, we are permitted to adopt new or revised accounting standards issued by the Public Company Accounting Oversight Board (PCAOB) on the same date as private companies rather than other public companies. The JOBS Act permits us to “opt out” of these extended transition periods, however we have not elected to opt out of these rules. This may make it more difficult to compare of our financial statements with other public companies that are not “emerging growth companies”.

The JOBS Act allows us to postpone the date by which we must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

We meet the definition of an “emerging growth company” and so long as we continue to qualify as an “emerging growth company,” we will, among other things:

- be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

- be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

- be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Exchange Act, as amended and instead provide a reduced level of disclosure concerning executive compensation; and

- be exempt from any rules that may be adopted by the PCAOB requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

We currently intend to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. We have elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that our independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as we qualify as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as we qualify as an “emerging growth company”, we may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate us. As a result, investor confidence in our company and the market price of our common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

15

Our securities are considered a penny stock.

Because our securities are considered a penny stock, shareholders will be more limited in their ability to sell their shares. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. Because our securities constitute “penny stocks” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the trading price of our common shares is less than $5.00 per share, the common shares will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| 2. | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| 3. | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| 4. | contains a toll-free telephone number for inquiries on disciplinary actions; |

| 5. | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| 6. | contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such shares; and (d) a monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our shares.

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties.

We currently do not own any real property. We currently sub lease on a month to month basis an office space located at Suite 880, 580 Hornby Street, Vancouver, BC Canada V6C 3B6, consisting of approximately 256 square feet at a cost of $1,500 per month.

HELMER-BOVILL PROPERTY

We own a 100% interest in our lead mineral project called the Helmer-Bovill Property. Our activities at the Helmer-Bovill Property are focused on developing the Bovill Kaolin Project and the WBL Tailings Project, which are located within the Helmer-Bovill Property.

16

We acquired the Helmer-Bovill Property from Idaho Industrial Minerals (“IIM”) pursuant to an Assignment Agreement with Contingent Right of Reverter dated August 12, 2002, as amended August 10, 2005, August 10, 2008 and January 21, 2010 (as amended, the “IIM Agreement”), between I-Minerals USA (formerly Alchemy Kaolin Corporation), our wholly owned subsidiary, and IIM. Under the terms of the IIM Agreement, IIM retained a contingent right of reverter with respect to the mineral lease applications (or the mineral leases acquired thereby) underlying the Helmer-Bovill Property if we failed meet our obligation to issue to IIM a total of 1,800,000 shares of our common stock, in tranches, based upon the completion of certain deliverables, and subject to such conditions as imposed by the TSX Venture Exchange. On January 22, 2013, we delivered the final tranche of the shares issuable to IIM. As such, we believe that the contingent right of reverter set out in the IIM Agreement has been extinguished, and that we have fulfilled all of our obligations under the IIM Agreement.

However, shortly after our delivery of the final tranche of shares to IIM, two minority members of IIM attempted to derivatively (and on behalf of IIM) reject our tender of shares. These minority members of IIM claimed that the deliverables were not completed and the right of reverter could be exercised. The majority member of IIM brought suit against the two minority members claiming that no such derivative right exists, that the minority members had no right or authority to reject the shares on behalf of IIM, and that we had fully complied with the terms of the IIM. We have since been brought into that lawsuit. Court-ordered mediation was held on May 28, 2015, in the lawsuit filed against the Company by Hoodoo Resources, LLC, and the Brent Thomson Family Trust (collectively, "the Plaintiffs"). The mediation sought to resolve the Plaintiffs’ claims against the Company, as well as the Company’s claims against the Plaintiffs.

Mediation was successful and the Plaintiffs and the Company entered into an agreement in principle to settle the parties’ claims against one another that was documented in a Binding Settlement Term Sheet. Thereafter, on December 2, 2015, we settled all lawsuits relating to the Helmer-Bovill Property pursuant to the terms of the Settlement Agreement. Under the terms of the Settlement Agreement, we paid IIM the aggregate sum of $100,000 (the “I-Minerals Payment”) for the release of any and all claims made against us under the lawsuits by the Ball Entities and the Plaintiffs. In addition, IIM and NWK have expressly acknowledged and agreed that, upon receipt of the I-Minerals Payment, we have fulfilled all of our duties and obligations under the terms of the IIM Agreement relating to our Helmer-Bovill Property, and that any and all rights and claims of IIM and NWK to the mineral leases making up the Helmer-Bovill Property will be released and extinguished. Refer to “Legal Proceedings” below for further information.

The technical information appearing below concerning the Helmer-Bovill Property is derived from the technical report titled Bovill Kaolin Project, Latah County, Idaho, USA, NI 43-101 Technical Report - Feasibility Study, Prepared For I-Minerals USA, Inc. with contributing consultants GBM Engineers LLC, Mine Development Associates. HDR Engineering Inc., SRK Consulting (U.S.), Inc., Tetra Tech, Compiled By GBM Project Number: 0530.

Description of Property

The Helmer-Bovill Property is a development stage open pit mining operation which will produce quartz sand, K- feldspar sand, kaolinite clay and halloysite clay. The area has been mined historically for similar products.

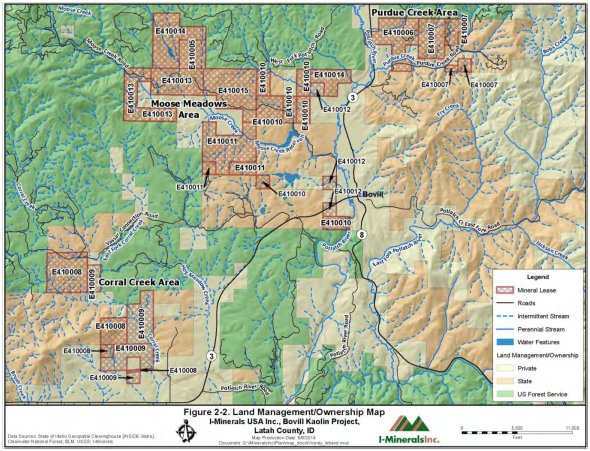

The Helmer-Bovill Property is located at geographical coordinates 46° 52' 43.5" N. latitude and 116° 25' 47.2" W longitude (State Plane, NAD 83, Zone 1103, Idaho West: 1 900 717 N, 2 454 671 E) in Latah County, Idaho, USA. The property currently totals 5,140.6 acres. The mineral leases are not adjoining, but are situated within three surveyed townships near the town of Bovill, Idaho.

17

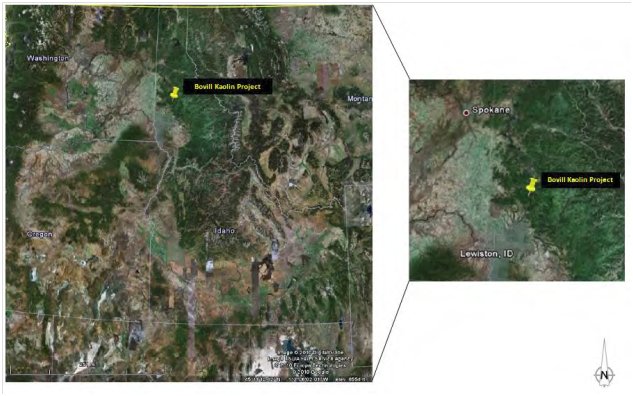

Figure 1. Location of the Helmer-Bovill Property

Figure 2. Location of Mineral Leases

18

Figure 3. Location of Deposits

The Helmer-Bovill Property area is located on endowment lands owned and administered by the IDL. These and other IDL holdings across the state of Idaho were granted to the state in 1890 by the federal government on the condition they produce maximum long-term financial returns for public schools and other beneficiaries. Therefore, IDL has a mandate for these lands to produce revenue to support the state’s public school system and other state institutions. To achieve this, IDL manages these properties primarily for profit through the production of timber, livestock grazing, and the extraction of mineable materials.

The State of Idaho endowments lands fall in two categories referred to as Fee Simple (FS) and Minerals Only (MO). The FS lands are where the State owns both mineral and surface rights. The MO lands are where the State owns mineral rights but someone else owns surface rights. The majority of the lands held by us are FS. All mineral resources and mineral reserves described in this report are located on FS lands. By way of our mineral leases, we have surface rights and legal access to the Helmer-Bovill Property provided it meets all permitting and bonding requirements administered by IDL. In the State of Idaho, mineral leases are not required to be physically located in the field. The mineral leases are currently described only on paper by the U.S. Public Land Survey Grid.

In 2002, we acquired from IIM, through our wholly owned subsidiary Alchemy Kaolin Corporation, 16 State of Idaho mineral lease applications in Latah County, Idaho, to cover deposits of feldspar, kaolin, and quartz located near Bovill, Idaho. In 2003, we converted these applications to ten mineral leases and subsequently obtained two more mineral leases. Renewal applications for all 12 leases were filed on April 27, 2012 with a US$3,000 application fee. As part of the renewal process, Idaho converted the 12 mineral leases into 10 revised mineral leases which were issued on February 28, 2013. Subsequently, during 2013 the State of Idaho granted one additional mineral lease to us. At this time, we hold 11 mineral leases totaling 5,140.64 acres. All current leases are valid until 2023. Due to recent changes in the law, we are exploring various options for renewal. All leases are subject to rental fees of US$1.00/acre/y and a production royalty of 5 percent of gross proceeds.

The production royalty is prepaid at a rate of US$500 per lease for the first five years, and increases to US$1,000 per lease for the second five years of the lease. The surface rights of the 11 mineral leases are owned by both the State of Idaho and some private landowners. However, the surface right of the mineral leases specific to the resource estimation contained in this report are all owned and administered by the State of Idaho. The U.S. Army Corps of Engineers (“USACE”) owns the surface rights of all waterways located within the mineral lease boundaries.

19

The details of the mineral leases that comprise the Helmer-Bovill Property are summarized below:

Table 4-1: Mineral Leases

|

Mineral Lease No. |

Township | Range | Section | Legal Description |

Endow- ment |

Status | Acres |

| E410005 | 41 North | 1 West | 16 | Govt Lots 1-2, N2SE | PS | FS | 172 |

| E410006 | 41 North | 1 East | 18 | Pt Gov Lot 2, NE, E2NW, W2SE, W2SESE | PS | FS | 377.75 |

| E410007 | 41 North | 1 East | 17 | W2NE, W2NENE, SESE | PS | FS | 140 |

| E410007 | 41 North | 1 East | NW, N2SW, S2SWSE | CI | FS | 260 | |

| E410008 | 40 North | 1 West | 6 | Govt Lots 9-11, SENW, E2SW, SWNE, W2SE | CI | FS | 370.8 |

| E410008 | 40 North | 1 West | 8 | SW | CI | FS | 160 |

| E410008 | 40 North | 1 West | 17 | NWNW and right of way in S2NE and N2SE | CI | FS | 53.17 |

| E410009 | 40 North | 1 West | 6 | E2SE | CI | MO | 80 |

| E410009 | 40 North | 1 West | 8 | S2NE, NENE, SE | CI | MO | 280 |

| E410009 | 40 North | 1 West | 17 | S2NW, NENW, N2NE, SENE, NWSE less right of way | CI | MO | 269.5 |

| E410010 | 41 North | 1 West | 23 | Govt Lots 5-8, E2SW | PS | FS | 242.44 |

| E410010 | 41 North | 1 West | 23 | Govt Lots 1-4, W2SE | NS | FS | 242.52 |

| E410010 | 41 North | 1 West | 35 | NWNW | PS | FS | 40 |

| E410010 | 41 North | 1 West | 36 | SESW, SWSE | PS | FS | 80 |

| E410011 | 41 North | 1 West | 27 | Govt Lots 1, 2, and 4 | PS | FS | 117.19 |

| E410011 | 41 North | 1 West | 27 | Gov Lot 3, W2NW, SENW, S2NE, N2S2, NENE | NS | FS | 438.73 |

| E410012 | 41 North | 1 West | 24 | Govt Lot 3 | PE | MO | 41.41 |

| E410012 | 41 North | 1 West | 36 | NENW, NESW | PS | MO | 80 |

| E410013 | 41 North | 1 West | 20 | W2NE, NENE, W2SE, SESE | NS | FS | 240 |

| E410013 | 41 North | 1 West | 21 | N2, S2SW | NS | FS | 400 |

| E410014 | 41 North | 1 West | 16 | Gov Lots 3 and 4, NW, N2SW, S2NE | PS | FS | 413.78 |

| E410014 | 41 North | 1 West | 24 | Gov Lot 2, E2NW, NWNE | PE | FS | 161.35 |

| E410015 | 41 North | 1 West | 22 | N2SE, SESE, N2, NESW | NS | FS | 480 |

| Total | 5140.64 | ||||||

The WBL Tailings Project is located on mineral lease E410013 and covers an area of approximately 650 feet wide by 900 feet long.

Location, Access and Infrastructure

The Helmer-Bovill Property is accessed by road from the town of Lewiston by following U.S Highway #12 to State Highway ID-3 N to Deary and then State Highway ID-8 E for 4 mi, then turning left on Moose Creek Road/National Forest Road 381 and following for 5.5 miles. ID-3 S/ID-8 W is an improved two lane road, while Moose Creek Road/National Forest Development Road 381 is a dirt/gravel road that provides access to State and Federal lands. In addition, access to specific areas to be mined will require either upgrades to former logging roads or construction of new access roads.

The nearest, large communities are Moscow, Idaho, which lies about 28 miles west-southwest of the Property, and Lewiston, Idaho, which lies about 33 miles to the southwest. Transport to the Helmer-Bovill Property would utilize standard over-highway vehicles.

Electric power would be provided by Avista Corp., but we would be required to construct approximately four miles of power lines.

Natural gas is available to the Helmer-Bovill Property from a natural gas pipeline that extends from Moscow to Bovill and is available to be utilized for this processing facility. Approximately two miles of pipeline would need to be constructed.

Water needed for processing would come from new wells located at the process site. Groundwater from drilled wells is typically used to serve domestic needs within the vicinity of the Property. Additional water is also available in a small reservoir north of the Helmer-Bovill Property. We intend to apply for water rights to this reservoir in the near future.

The region has a long history of clay production, forestry and farming. A labor force skilled in heavy equipment operation, trucking, and general labor exists within the surrounding communities and rural areas.

There are several suitable locations for potential tailings storage, mining waste disposal, and potential processing plants.

The WBL Tailings Project is mined using a loader and/or excavator or backhoe. If required, on-site power will be supplied by a diesel or gasoline power generator. Fuel supply will generally be provided by pickup truck fuel transfer tanks (typically 90 to 150 gallons). If fuel is temporarily stored on site, secondary containment will be used (either double-walled tanks or a secondary containment wall), and if fuel storage volume exceeds 1320 gallons, a Spill Prevention, Control Countermeasure plan will be developed in accordance with federal regulations. Water will be used only as dust control and will be taken from the WLB pits. Bottled water will be provided, as necessary for drinking water for employees and contractors.

20

Royalties, Agreements and Encumbrances