Attached files

| file | filename |

|---|---|

| 8-K - JULY 5TH 8K UPDATED RBL TERM SHEET BLOWOUT - Chaparral Energy, Inc. | cpr-8k_20160705.htm |

Updated term sheets June 21, 2016 STRICTLY PRIVATE AND CONFIDENTIAL Exhibit 99.1

This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan's policies on data privacy can be found at http://www.jpmorgan.com/pages/privacy. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. J.P. Morgan is the marketing name for the Corporate and Investment Banking activities of JPMorgan Chase Bank, N.A., JPMS (member, NYSE), J.P. Morgan PLC authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority and their investment banking affiliates. This presentation does not constitute a commitment by any J.P. Morgan entity to underwrite, subscribe for or place any securities or to extend or arrange credit or to provide any other services. This presentation is provided for information purposes only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. No assurance can be given that the transactions described herein could in fact be executed. Any transaction must comply with applicable regulatory and internal requirements and is subject to receipt of approvals. These materials may not be relied upon by you in evaluating the merits of participating in any of transactions described herein. You should consult your tax, legal and accounting or other advisors about the issues discussed herein and make an independent determination as to legal, tax and accounting implications of the transactions including the suitability of the transactions for your particular situation. In no event shall J.P. Morgan be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein. The Company acknowledges that J.P. Morgan may be providing debt financing, equity capital or other services (including financial advisory services) to other companies in respect of which the Company may have conflicting interests. The Company further acknowledges that J.P. Morgan is a full service securities firm and that J.P. Morgan may from time to time effect transactions for its own account or for the account of its customers and hold positions in loans, securities or options on loans or securities of the Company. J.P. Morgan or a company or person connected or associated with J.P. Morgan may be an underwriter or distributor of, or market maker or otherwise hold a long or short position as a principal in, a security or financial instrument (or in options, futures or other derivative instrument thereon) which has been discussed herein. Copyright 2014 JPMorgan Chase & Co. All rights reserved. Updated term sheets

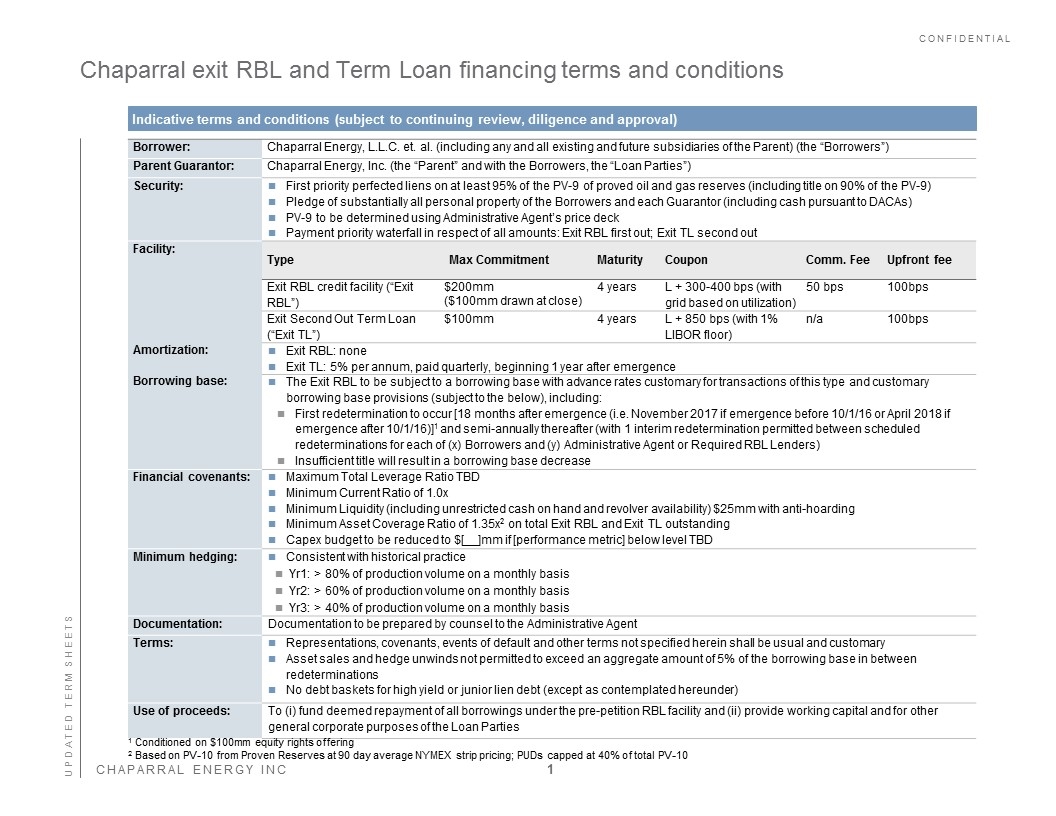

Indicative terms and conditions (subject to continuing review, diligence and approval) Borrower: Chaparral Energy, L.L.C. et. al. (including any and all existing and future subsidiaries of the Parent) (the “Borrowers”) Parent Guarantor: Chaparral Energy, Inc. (the “Parent” and with the Borrowers, the “Loan Parties”) Security: First priority perfected liens on at least 95% of the PV-9 of proved oil and gas reserves (including title on 90% of the PV-9) Pledge of substantially all personal property of the Borrowers and each Guarantor (including cash pursuant to DACAs) PV-9 to be determined using Administrative Agent’s price deck Payment priority waterfall in respect of all amounts: Exit RBL first out; Exit TL second out Facility: Type Max Commitment Maturity Coupon Comm. Fee Upfront fee Exit RBL credit facility (“Exit RBL”) $200mm ($100mm drawn at close) 4 years L + 300-400 bps (with grid based on utilization) 50 bps 100bps Exit Second Out Term Loan (“Exit TL”) $100mm 4 years L + 850 bps (with 1% LIBOR floor) n/a 100bps Amortization: Exit RBL: none Exit TL: 5% per annum, paid quarterly, beginning 1 year after emergence Borrowing base: The Exit RBL to be subject to a borrowing base with advance rates customary for transactions of this type and customary borrowing base provisions (subject to the below), including: First redetermination to occur [18 months after emergence (i.e. November 2017 if emergence before 10/1/16 or April 2018 if emergence after 10/1/16)]1 and semi-annually thereafter (with 1 interim redetermination permitted between scheduled redeterminations for each of (x) Borrowers and (y) Administrative Agent or Required RBL Lenders) Insufficient title will result in a borrowing base decrease Financial covenants: Maximum Total Leverage Ratio TBD Minimum Current Ratio of 1.0x Minimum Liquidity (including unrestricted cash on hand and revolver availability) $25mm with anti-hoarding Minimum Asset Coverage Ratio of 1.35x2 on total Exit RBL and Exit TL outstanding Capex budget to be reduced to $[__]mm if [performance metric] below level TBD Minimum hedging: Consistent with historical practice Yr1: > 80% of production volume on a monthly basis Yr2: > 60% of production volume on a monthly basis Yr3: > 40% of production volume on a monthly basis Documentation: Documentation to be prepared by counsel to the Administrative Agent Terms: Representations, covenants, events of default and other terms not specified herein shall be usual and customary Asset sales and hedge unwinds not permitted to exceed an aggregate amount of 5% of the borrowing base in between redeterminations No debt baskets for high yield or junior lien debt (except as contemplated hereunder) Use of proceeds: To (i) fund deemed repayment of all borrowings under the pre-petition RBL facility and (ii) provide working capital and for other general corporate purposes of the Loan Parties Updated term sheets 1 1 Conditioned on $100mm equity rights offering 2 Based on PV-10 from Proven Reserves at 90 day average NYMEX strip pricing; PUDs capped at 40% of total PV-10 Chaparral exit RBL and Term Loan financing terms and conditions

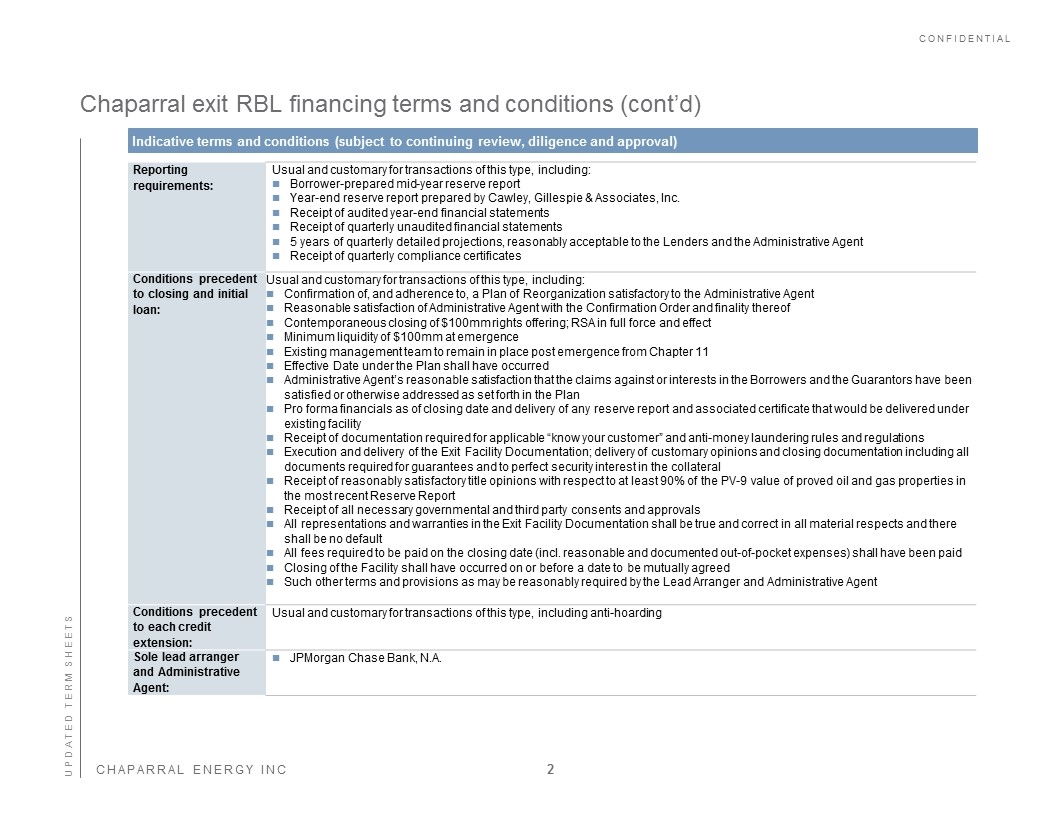

Indicative terms and conditions (subject to continuing review, diligence and approval) Reporting requirements: Usual and customary for transactions of this type, including: Borrower-prepared mid-year reserve report Year-end reserve report prepared by Cawley, Gillespie & Associates, Inc. Receipt of audited year-end financial statements Receipt of quarterly unaudited financial statements 5 years of quarterly detailed projections, reasonably acceptable to the Lenders and the Administrative Agent Receipt of quarterly compliance certificates Conditions precedent to closing and initial loan: Usual and customary for transactions of this type, including: Confirmation of, and adherence to, a Plan of Reorganization satisfactory to the Administrative Agent Reasonable satisfaction of Administrative Agent with the Confirmation Order and finality thereof Contemporaneous closing of $100mm rights offering; RSA in full force and effect Minimum liquidity of $100mm at emergence Existing management team to remain in place post emergence from Chapter 11 Effective Date under the Plan shall have occurred Administrative Agent’s reasonable satisfaction that the claims against or interests in the Borrowers and the Guarantors have been satisfied or otherwise addressed as set forth in the Plan Pro forma financials as of closing date and delivery of any reserve report and associated certificate that would be delivered under existing facility Receipt of documentation required for applicable “know your customer” and anti-money laundering rules and regulations Execution and delivery of the Exit Facility Documentation; delivery of customary opinions and closing documentation including all documents required for guarantees and to perfect security interest in the collateral Receipt of reasonably satisfactory title opinions with respect to at least 90% of the PV-9 value of proved oil and gas properties in the most recent Reserve Report Receipt of all necessary governmental and third party consents and approvals All representations and warranties in the Exit Facility Documentation shall be true and correct in all material respects and there shall be no default All fees required to be paid on the closing date (incl. reasonable and documented out-of-pocket expenses) shall have been paid Closing of the Facility shall have occurred on or before a date to be mutually agreed Such other terms and provisions as may be reasonably required by the Lead Arranger and Administrative Agent Conditions precedent to each credit extension: Usual and customary for transactions of this type, including anti-hoarding Sole lead arranger and Administrative Agent: JPMorgan Chase Bank, N.A. Updated term sheets 2 Chaparral exit RBL financing terms and conditions (cont’d)