Exhibit 10.1

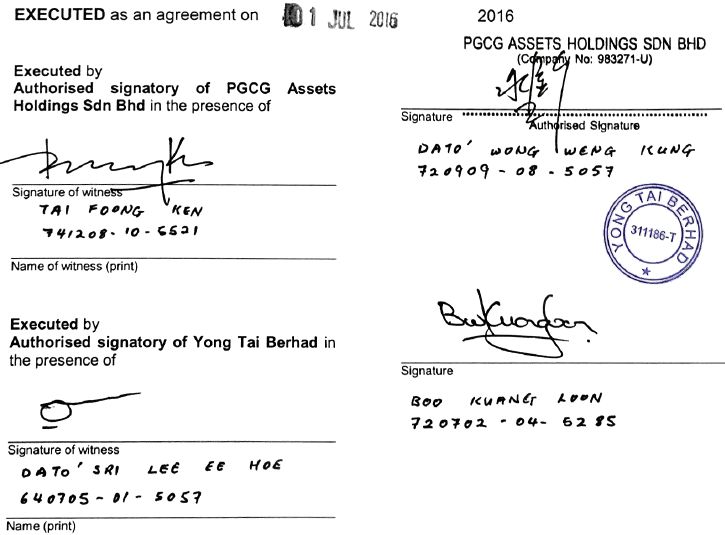

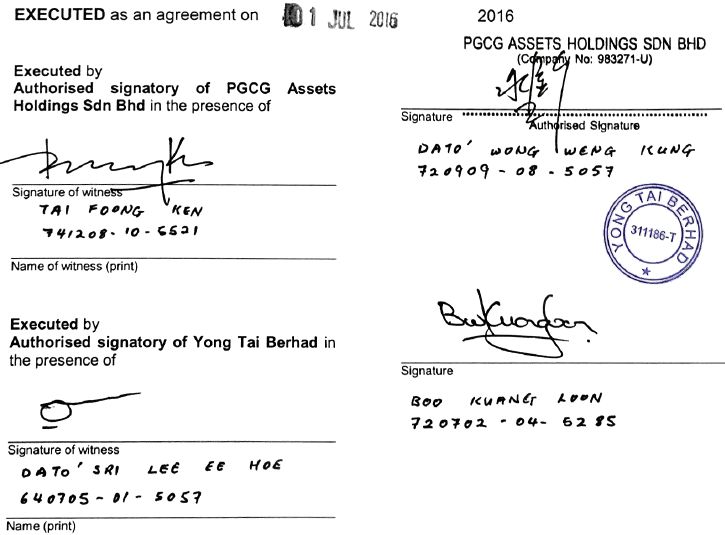

Date: July 1, 2016

Parties

| Name |

PGCG ASSETS HOLDINGS SDN BHD (PGCG) |

| Company Registration No |

983271-U |

| Address |

Registered Address : No.

37-2 (Room 1), Tingkat 2, Jalan Metro Perdana 7, Taman Usahawan Kepong, Kepong Utara, 52100 Wilayah Persekutuan Kuala Lumpur, Malaysia. |

| |

|

| Name |

Yong Tai Berhad (YTB) |

| Company Registration No |

311186-T |

| Address |

Registered Address : Ground

Floor, 8, Lorong Universiti B, Section 16, 46200 Petaling Jaya, Selangor Darul Ehsan, Malaysia. |

Background

| A | PGCG is a 90% indirectly owned subsidiary of Prime Global Capital Group Inc, a public listed company in the USA.

Prime Global Capital Group Inc is in the core business of plantation (namely palm oil, oilseed and durian plantation), assets holding

and development of commercial and residential real estate properties. |

| B | YTB is public listed company in the Main Market of Bursa Malaysia Berhad with its core business in property development, and

Impression Melaka as their flagship project. |

| C | PGCG is the registered owner of all that piece of leasehold land located at Puncak Alam held under H.S.(D) 5460,

PT No. 9135, Mukim Ijok, Daerah Kuala Selangor, Negeri Selangor measuring approximately 21.8921 hectors (Land)

which has obtained the approval from Majlis Daerah Kuala Selangor of a development order dated 24 February 2016 and 3 March 2016

to develop 1,039 units of mixed development properties comprising of 2-storey boulevard shop office, stratified affordable shops,

surau, community hall, 4 types of high rise apartment, 2 types of affordable apartments, 2 ½ storey superlink homes, 2 storey

link homes, 2 storey cluster semi-detached homes, cluster homes, 2 storey semi-detached homes, and 2 storey bungalow homes (Mixed

Development Properties). |

| D | PGCG

and YTB (collectively the Parties and each a Party) intend to jointly develop the land

and construct the Mixed Development Properties (Proposed JV). |

| E | This

memorandum of understanding (MOU) is to record the Parties’ intention to

negotiate and finalise the terms in respect of the Proposed JV. |

Principal

terms

| (a) | The purpose of this MOU is as an expression of the Parties sincere desire and intention to use

their best endeavours and efforts to negotiate exclusively with each other with the objective that mutual agreement is reached

as to the terms and conditions for the structure and implementation of the Proposed JV, and the major commercial terms set out

in clause 2 (Commercial Terms) and such other terms and conditions to be agreed between the parties and to enter into the

JV Agreement. |

| (a) | In executing this MOU, YTB has not independently verified the accuracy of the information previously

furnished by PGCG. This MOU is to be used as a basis for continued discussions only and the furtherance of the interest of the

Parties in the Proposed JV that shall be subject to the fulfilment of the conditions precedent below. |

The key commercial terms are:

| (a) | The Parties are considering entering into the Proposed JV. |

| (b) | PGCG will provide YTB with all such information and documents as may be reasonably required to

jointly develop the Land. |

| (c) | The indicative Gross Development Value for the Proposed JV is estimated to be Ringgit Malaysia

Five Hundred Ten Million only [RM510,000,000.00] (equivalent to approximately United States Dollars One Hundred Twenty Five Million

only [USD125,000,000.00]) based on the exchange rate of USD1 : RM4.08 as at 9.00am, 14.06.2016. This estimated Gross Development

Value is an estimate and may be revised accordingly during the negotiation of the terms for the JV Agreement. |

| (d) | PGCG and YTB shall be entitled to 20% and 80% respectively of the estimated Gross Development Value

for the Proposed JV of RM510,000,000.00 (approximately USD125,000,000.00) or at such percentage or estimated Gross Development

Value as may be mutually agreed upon at a later date between the Parties. |

| (e) | The participation of the Parties in the Proposed JV is conditional upon the following conditions

precedent being fulfilled on or before 5.00pm, Malaysian time on the expiry of 4 months from the date of this MOU with an automatic

extension of 2 months from the expiry therefrom or such later date as agreed between the Parties (Termination Date): |

| (i) | finalisation of the negotiations between the Parties and the terms and conditions and execution

and delivery of the JV Agreement, in the form and substance that is satisfactory to the Parties; |

| (ii) | completion of all viability studies, assessments and due diligences as required by YTB including

but not limited to financial, legal, tax, technical and business due diligences and due diligence on the Proposed JV, and the Parties

being satisfied with the results of such viability studies, assessments and due diligences; |

| (f) | The Parties shall use reasonable efforts to negotiate and enter into the JV Agreement which will

reflect the terms of this MOU and contain such other provisions as are usual and customary in transactions of this nature including

customary representations and warranties, customary conditions to closing, indemnifications and covenants and the Parties are satisfied

on the warranties as agreed between the parties. |

| 3. | Confidential information |

| 3.1 | Disclosure of information |

| (a) | Subject to clause 3.1(b), the parties must: |

| (i) | keep the Confidential Information confidential; |

| (ii) | not disclose the Confidential Information to any other party; |

| (iii) | keep confidential the fact that Confidential Information has been provided or is being reviewed; |

| (iv) | keep confidential any discussions in relation to the Proposed JV, including the fact that the parties

are discussing the Proposed JV; and |

| (b) | Clause 3.1(a) will not apply in the following circumstances: |

| (i) | any disclosures required by law, an order of a court, tribunal, governmental or regulatory body

of competent jurisdiction or the listing rules of any stock exchange and with the prior written consent of the other Parties; or |

| (ii) | any disclosures to the Parties' representatives who reasonably require access to the Confidential

Information in order that the Proposed JV may be achieved (Representatives). |

| (c) | The Parties must establish and maintain security measures to ensure that any Confidential Information

in its possession or under its control are secure at all times and will cooperate in the issuance of any press release, announcement

or communication to Representatives, employees, clients, the public or otherwise, concerning the Proposed JV. |

"Confidential Information"

means:

| (i) | all information and know-how (in whatever form) disclosed by or on behalf of a party to the other

party or any representative; and |

| (ii) | any copies of the Confidential Information, |

but does not include any information

which is in or in the future comes into:

| (ii) | the lawful possession of the parties or any of its Representatives, |

other than through a breach of

the terms of this MOU.

| 3.2 | Conditions of disclosure |

To the extent

that any information may contain any estimates or projections, YTB has made reasonable inquiry into the subject matter of such

estimates and projections.

If the JV Agreement concerning

the Proposed JV are not executed by 5.00pm, Malaysian time on the Termination Date (or such later date as agreed between the parties)

for whatever reason, then the Parties are released from all further obligations and liabilities under this MOU.

Each Party must do everything

necessary, or reasonably required, by the other party, to give effect to the intentions of the parties as expressed in this MOU.

Each of the Parties will bear

its own expenses in relation to this MOU and the transactions contemplated hereby.

| 5.3 | Governing Law and Jurisdiction |

This MOU is governed by the laws

of Malaysia and the parties submit to the non-exclusive jurisdiction of its courts.