Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Cuentas Inc. | f10q0316ex32ii_nextgroup.htm |

| EX-32.1 - CERTIFICATION - Cuentas Inc. | f10q0316ex32i_nextgroup.htm |

| EX-31.2 - CERTIFICATION - Cuentas Inc. | f10q0316ex31ii_nextgroup.htm |

| EX-31.1 - CERTIFICATION - Cuentas Inc. | f10q0316ex31i_nextgroup.htm |

UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUATERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE THREE MONTH PERIOD ENDED: MARCH 31, 2016

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 333-148987

NEXT GROUP HOLDINGS, INC

(Exact name of Registrant as specified in its charter)

| Florida | 20-3537265 | |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

1111 BRICKEL AVE, SUITE 2200, MIAMI, FL 33131

(Address of principal executive offices)

800-611-3622

(Registrant’s telephone number)

PLEASANT KIDS, INC

2600 WEST OLIVE AVENUE, 5F, BURBANK, CA 91505

(Former Name, Former Address and Former Fiscal Year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of May 2, 2016 the issuer had 225,160,716 shares of its common stock issued and outstanding.

Part I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

NEXT GROUP HOLDINGS, INC

(Unaudited)

Table of Contents

| Pages | ||

| Unaudited Consolidated Balance Sheets | 2 | |

| Unaudited Consolidated Statements of Operations | 3 | |

| Unaudited Consolidated Statements of Cash Flows | 4 | |

| Unaudited Statement of Stockholders’ Deficit | 5 | |

| Notes to Unaudited Consolidated Financial Statements | 6 - 18 |

| 1 |

NEXT GROUP HOLDINGS, INC

UNAUDITED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2016 | 2015 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 36,513 | $ | 18,047 | ||||

| Accounts receivable, net | 63,691 | 62,734 | ||||||

| Finance deposit | 25,000 | 25,000 | ||||||

| Loan receivable, related party | 60,000 | 60,000 | ||||||

| Loan receivable | 40,000 | 40,000 | ||||||

| Total Current Assets | 225,204 | 205,781 | ||||||

| Fixed Assets | ||||||||

| Property, plant and equipment, net of accumulated depreciation of $1,646 | 2,926 | - | ||||||

| Total Fixed Assets | 2,926 | - | ||||||

| Other Assets | ||||||||

| Due from Next Cala 360 – related party | 129,615 | 132,179 | ||||||

| License fee | 180,550 | 201,385 | ||||||

| Total Other Assets | 310,165 | 333,564 | ||||||

| Total Assets | $ | 538,295 | $ | 539,345 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Bank overdraft | $ | 1,996 | $ | - | ||||

| Accounts payable | 325,371 | 299,053 | ||||||

| Accrued expenses | 2,716 | - | ||||||

| Accrued interest | 23,934 | - | ||||||

| Accrued interest - related party | 351 | 349 | ||||||

| Accrued salary | 53,025 | - | ||||||

| Loan payable | 30,000 | 30,000 | ||||||

| Note payable, related party | 280,000 | 280,000 | ||||||

| Note payable, related party - Asiya Communication | 95,120 | 95,120 | ||||||

| Note payable, related party - Next Communication | 3,016,671 | 3,025,522 | ||||||

| Note payable - Pleasant Kids | - | 384,060 | ||||||

| Convertible notes payable, net of debt discounts of $310,807 and $0 | 650,193 | - | ||||||

| Derivative liability | 1,028,352 | - | ||||||

| Total Current Liabilities | 5,507,729 | 4,114,104 | ||||||

| Total Liabilities | 5,507,729 | 4,114,104 | ||||||

| Stockholders' Deficit | ||||||||

| Preferred stock, $0.001 par value, authorized 60,000,000 shares; Series A preferred stock; $0.001 par value, designated 50,000,000; 0 shares issued and outstanding as of March 31, 2016 and December 31,2015, respectively. | - | - | ||||||

| Series B preferred stock, $0.001 par value, designated 10,000,000; 10,000,000 issued and outstanding as of March 31, 2016 and December 31, 2015, respectively | 10,000 | 10,000 | ||||||

| Common stock, authorized 360,000,000 shares, $0.001 par value, 223,778,886 and 177,539,180 issued and outstanding as of March 31, 2016 and December 31, 2015, respectively | 223,779 | 177,539 | ||||||

| Additional paid in capital | (709,906 | ) | (23,868 | ) | ||||

| Subscription receivable | (10,000 | ) | (10,000 | ) | ||||

| Accumulated deficit | (4,465,358 | ) | (3,711,178 | ) | ||||

| Total Next Group Holdings, Inc. Deficit | (4,951,485 | ) | (3,557,507 | ) | ||||

| Non-controlling Interest in Subsidiaries | ||||||||

| Non-controlling interest - additional paid-in capital in consolidated subsidiaries | 38,570 | 38,570 | ||||||

| Non-controlling interest - accumulated deficit in consolidated subsidiaries | (56,519 | ) | (55,822 | ) | ||||

| Non-controlling interest in subsidiaries | (17,949 | ) | (17,252 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 538,295 | $ | 539,345 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements

| 2 |

NEXT GROUP HOLDINGS, INC

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months | ||||||||

| Ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| Revenues | $ | 82,303 | $ | 108,925 | ||||

| Revenues, related party | - | 44,121 | ||||||

| Cost of Revenues, related party | 107,161 | 11,262 | ||||||

| Gross Profit (Loss) | (24,858 | ) | 141,784 | |||||

| Operating Expenses: | ||||||||

| Consulting fees | 21,500 | - | ||||||

| Professional services | 216,576 | 7,270 | ||||||

| Officer compensation | 73,196 | 128,710 | ||||||

| General and administrative expense | 114,959 | 53,300 | ||||||

| Total Operating Expenses | 426,231 | 189,280 | ||||||

| Loss from operations | (451,089 | ) | (47,496 | ) | ||||

| Other Income (Expense): | ||||||||

| Other income | 2,879 | - | ||||||

| Interest expense | (276,900 | ) | - | |||||

| Penalties on convertible notes payable | (14,490 | ) | - | |||||

| Change in fair value of embedded derivative liability | (15,277 | ) | - | |||||

| Total other income (expenses) | (303,788 | ) | - | |||||

| Net loss before income taxes | (754,877 | ) | (47,496 | ) | ||||

| Income taxes | - | - | ||||||

| Net loss before non-controlling interest | (754,877 | ) | (47,496 | ) | ||||

| Net loss attributable to non-controlling interest | 697 | - | ||||||

| Net loss attributable to Next Group Holdings, Inc. | $ | (754,180 | ) | $ | (47,496 | ) | ||

| Loss per share; Basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average number of shares outstanding | 196,938,335 | 219,373,975 | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements

| 3 |

NEXT GROUP HOLDINGS, INC

STATEMENT OF STOCKHOLDERS' DEFICIT

March 31, 2016

| Total | Non-Controlling Interest | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Series A | Series B | Additional | Next Group | Additional | Non- | |||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Preferred Stock | Common Stock | Paid-in | Accumulated | Subscription | Holdings | Paid-in | Accumulated | Controlling | |||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Receivable | Deficit | Capital | Deficit | Interest | ||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2015 | - | $ | - | 10,000,000 | $ | 10,000 | 177,539,180 | $ | 177,539 | $ | (23,868 | ) | $ | (3,711,178 | ) | $ | (10,000 | ) | $ | (3,557,507 | ) | $ | 38,570 | $ | (55,822 | ) | $ | (17,252 | ) | |||||||||||||||||||||||

| Recapitalization | - | - | - | - | 44,784,795 | 44,785 | (1,077,401 | ) | - | - | (1,032,616 | ) | - | - | - | |||||||||||||||||||||||||||||||||||||

| Shares issued in exchange for loan pay | - | - | - | - | 450,000 | 450 | 12,810 | - | - | 13,260 | - | - | - | |||||||||||||||||||||||||||||||||||||||

| Stock issued for conversion of debt | - | - | - | - | 1,004,911 | 1,005 | 95,453 | - | - | 96,458 | - | - | - | |||||||||||||||||||||||||||||||||||||||

| Forgiveness of imputed interest on related party note payable | - | - | - | - | - | - | 60,168 | - | - | 60,168 | - | - | - | |||||||||||||||||||||||||||||||||||||||

| Derivative liability write off due to conversion of debt | - | - | - | - | - | - | 222,932 | - | - | 222,932 | - | - | - | |||||||||||||||||||||||||||||||||||||||

| Net loss for period ending March 31, 2016 | - | - | - | - | - | - | - | (754,180 | ) | - | (754,180 | ) | - | (697 | ) | (697 | ) | |||||||||||||||||||||||||||||||||||

| Balance March 31, 2016 | - | $ | - | 10,000,000 | $ | 10,000 | 223,778,886 | $ | 223,779 | $ | (709,906 | ) | $ | (4,465,358 | ) | $ | (10,000 | ) | $ | (4,951,485 | ) | $ | 38,570 | $ | (56,519 | ) | $ | (17,949 | ) | |||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements

| 4 |

NEXT GROUP HOLDINGS, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Three | For the Three | |||||||

| Months Ended | Months Ended | |||||||

| March 31, 2016 | March 31, 2015 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net Loss before non-controlling interest | $ | (754,877 | ) | $ | (47,496 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Imputed interest | 60,168 | - | ||||||

| Debt discount amortization | 157,059 | - | ||||||

| Depreciation expense | 216 | - | ||||||

| Debt issue costs expensed | 20,000 | - | ||||||

| Default penalties on convertible notes | 14,490 | - | ||||||

| Loss on derivative liability | 15,277 | - | ||||||

| Changes in Operating Assets and Liabilities: | ||||||||

| Accounts receivable | (957 | ) | (74,833 | ) | ||||

| Prepaid expenses | 20,835 | - | ||||||

| Accrued salary | 3,000 | - | ||||||

| Accrued interest | 26,166 | - | ||||||

| Accrued expense | 2,716 | - | ||||||

| Accounts payable | 66,068 | (7,904 | ) | |||||

| Net Cash Used by Operating Activities | (369,839 | ) | (130,233 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Notes receivable | - | (60,611 | ) | |||||

| Repayments of related party receivable | 2,564 | - | ||||||

| Net Cash Provided by Investing Activities | 2,564 | (60,611 | ) | |||||

| Cash Flows from Financing Activities: | ||||||||

| Bank overdraft | 908 | - | ||||||

| Proceeds from convertible notes | 392,500 | - | ||||||

| (Repayments of) proceeds from related party loans | (8,851 | ) | 220,899 | |||||

| Cash assumed through reverse recapitalization | 1,184 | - | ||||||

| Net Cash Provided by Financing Activities | 385,741 | 220,899 | ||||||

| Net Increase (Decrease) in Cash | 18,466 | 30,055 | ||||||

| Cash at Beginning of Period | 18,047 | 28,755 | ||||||

| Cash at End of Period | $ | 36,513 | $ | 58,810 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Supplemental disclosure of non-cash financing activities | ||||||||

| Common stock issued as loan repayment | $ | 13,260 | $ | - | ||||

| Common stock issued for conversion of note principal | $ | 86,940 | $ | - | ||||

| Common stock issued for conversion of accrued interest | $ | 9,518 | $ | - | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements

| 5 |

NEXT GROUP HOLDINGS, INC

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

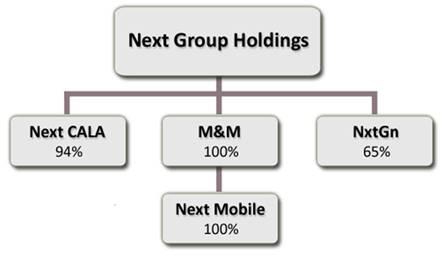

Next Group Holdings, Inc, (the Company) was incorporated under the laws of the State of Florida on September 21, 2005 to act as a holding company for its subsidiaries, both current and future. Its subsidiaries are Meimoun and Mammon, LLC (100% owned), Next Cala, Inc (94% owned). NxtGn, Inc. (65% owned) and Next Mobile 360, Inc. (100% owned).

Meimoun and Mammon, LLC (M&M) was formed under the laws of the State of Florida on May 21, 2001 as a real estate investment company. During the year ended December 31, 2010, M&M began winding down real estate operations and engaged in telecommunications services. M&M acquired telecom registrations, licenses and authorities to provide telecom services to the retail and wholesale markets including sales of prepaid long distance telecom services and Mobile Virtual Network Operator (MVNO) services. The services are sold under the brand name Next Mobile 360 and through the subsidiary of the same name.

Next Cala, Inc, (Cala) was formed under the laws of Florida on July 10, 2009 to the purpose of offering prepaid and reloadable debit cards to the retail market. Cala serves consumers in the underbanked and unbanked populations through Incomm, a leading provider of payment remittance services worldwide.

NxtGn, Inc. (NxtGn) was formed under the laws of Florida on August 24, 2011 to develop a unique High Definition telepresence product (AVYDA) which allows users to connect with celebrities, public figures, healthcare and education applications via a mobile phone, tablet or personal computer.

On December 31, 2015, NGH completed an Agreement and Plan of Merger (the “Merger Agreement”) with Pleasant Kids, Inc. (“Pleasant Kids”) and its wholly owned subsidiary, NGH Acquisition Corp. (“Acquisition Sub”), pursuant to which NGH merged with Acquisition Sub and Acquisition Sub was then merged into PLKD effective December 31, 2015. Under the terms of the Merger Agreement, the NGH shareholders received shares of PLKD common stock such that the NGH shareholders received approximately 80% of the total common shares and 100% of the preferred shares of PLKD issued and outstanding following the merger. Due to the nominal assets and limited operations of PLKD prior to the merger, the transaction was accorded reverse recapitalization accounting treatment under the provision of Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) 805 whereby NGH became the accounting acquirer (legal acquiree) and PLKD was treated as the accounting acquiree (legal acquirer). The historical financial records of the Company are those of the accounting acquirer (NGH) adjusted to reflect the legal capital of the accounting acquire (PLKD). As the transaction was treated as a recapitalization, no intangibles, including goodwill, were recognized. Concurrent with the effective date of the reverse recapitalization transaction, the Company adopted the fiscal year end of the accounting acquirer of December 31.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

The accompanying unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for reporting of interim financial information. Pursuant to such rules and regulations, certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted. Accordingly, these statements do not include all the disclosures normally required by accounting principles generally accepted in the United States for annual financial statements and should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this report. The accompanying consolidated condensed balance sheet as of December 31, 2015 has been derived from our unaudited financial statements. The condensed consolidated statements of operations and cash flows for the three months ended March 31, 2016 are not necessarily indicative of the results of operations or cash flows to be expected for any future period or for the year ending December 31, 2016.

The accompanying unaudited condensed consolidated financial statements have been prepared by management and in the opinion of management, the accompanying unaudited interim condensed consolidated financial statements contain all adjustments necessary to present fairly the financial position and results of operations as of the dates and for the periods presented.

Effective January 12, 2016, the Company changed its name from Pleasant Kids, Inc. (“PLKD”) to Next Group Holdings, Inc. (“NGH”).

| 6 |

Basis of Presentation

This summary of accounting policies for Next Group Holdings, Inc. is presented to assist in understanding the Company’s financial statements. The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America ("GAAP" accounting) and have been consistently applied in the preparation of the unaudited interim consolidated financial statements.

Use of Estimates

The preparation of unaudited interim consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements. Actual results could differ from those estimates. Estimates are used when accounting for allowances for bad debts, collectability of accounts receivable, and fair value calculations related to embedded derivative features of outstanding convertible notes payable.

Cash

For purposes of the statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents to the extent the funds are not being held for investment purposes. The Company held no cash equivalents as of March 31, 2016 or December 31, 2015.

Revenue recognition

The Company follows paragraph 605-10-S99 of the FASB Accounting Standards Codification for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

Property and equipment

Property and equipment are stated at cost less accumulated depreciation and amortization. The Company provides for depreciation and amortization using the straight-line method over the estimated useful lives of the related assets, which range from three to five years. Maintenance and repair costs are expensed as they are incurred while renewals and improvements which extend the useful life of an asset are capitalized. At the time of retirement or disposal of property and equipment, the cost and related accumulated depreciation and amortization are removed from the accounts and any resulting gain or loss is reflected in the results of operations.

Impairment of Long-Lived Assets

In accordance with ASC Topic 360, formerly SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, the Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of these assets may not be fully recoverable. The assessment of possible impairment is based on the Company’s ability to recover the carrying value of its asset based on estimates of its undiscounted future cash flows. If these estimated future cash flows are less than the carrying value of the asset, an impairment charge is recognized for the difference between the asset's estimated fair value and its carrying value. There was no impairment to its long-lived assets as of March 31, 2016 and December 31, 2015, respectively.

Non-Controlling Interest

The Company reports the non-controlling interest in its majority owned subsidiaries in the consolidated balance sheets within the stockholders’ deficit section, separately from the Company’s stockholders’ deficit. Non-controlling interest represents the non-controlling interest holders’ proportionate share of the equity of the Company’s majority-owned subsidiaries. Non-controlling interest is adjusted for the non-controlling interest holders’ proportionate share of the earnings or losses and other comprehensive income (loss) and the non-controlling interest continues to be attributed its share of losses even if that attribution results in a deficit non-controlling interest balance.

| 7 |

Derivative Financial Instruments

Fair value accounting requires bifurcation of embedded derivative instruments such as conversion features in convertible debt or equity instruments, and measurement of their fair value for accounting purposes. In assessing the convertible debt instruments, management determines if the convertible debt host instrument is conventional convertible debt and further if there is a beneficial conversion feature requiring measurement. If the instrument is not considered conventional convertible debt under ASC 470, the Company will continue its evaluation process of these instruments as derivative financial instruments under ASC 815.

Once determined, derivative liabilities are adjusted to reflect fair value at each reporting period end, with any increase or decrease in the fair value being recorded in results of operations as an adjustment to fair value of derivatives.

Fair Value of Financial Instruments

Fair value of certain of the Company’s financial instruments including cash, accounts receivable, account payable, accrued expenses, notes payables, and other accrued liabilities approximate cost because of their short maturities. The Company measures and reports fair value in accordance with ASC 820, “Fair Value Measurements and Disclosure” defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value investments.

Fair value, as defined in ASC 820, is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of an asset should reflect its highest and best use by market participants, principal (or most advantageous) markets, and an in-use or an in-exchange valuation premise. The fair value of a liability should reflect the risk of nonperformance, which includes, among other things, the Company’s credit risk.

Valuation techniques are generally classified into three categories: the market approach; the income approach; and the cost approach. The selection and application of one or more of the techniques may require significant judgment and are primarily dependent upon the characteristics of the asset or liability, and the quality and availability of inputs. Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. ASC 820 also provides fair value hierarchy for inputs and resulting measurement as follows:

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities; and

Level 3: Unobservable inputs for the asset or liability that are supported by little or no market activity, and that are significant to the fair values.

Fair value measurements are required to be disclosed by the Level within the fair value hierarchy in which the fair value measurements in their entirety fall. Fair value measurements using significant unobservable inputs (in Level 3 measurements) are subject to expanded disclosure requirements including a reconciliation of the beginning and ending balances, separately presenting changes during the period attributable to the following: (i) total gains or losses for the period (realized and unrealized), segregating those gains or losses included in earnings, and a description of where those gains or losses included in earning are reported in the statement of income.

The Company used Level 2 inputs for its valuation methodology for the conversion option liability in determining the fair value using the Black-Scholes option-pricing model with the following assumption inputs:

| March 31, 2016 | ||||

| Annual dividend yield | - | |||

| Expected life (years) | .05 - 1 | |||

| Risk-free interest rate | .59 | % | ||

| Expected volatility | 608.52 | % | ||

| Carrying Value | Fair Value Measurements at | |||||||||||||||

| As of | March 31, 2016 | |||||||||||||||

| March 31, | Using Fair Value Hierarchy | |||||||||||||||

| 2016 | Level 1 | Level 2 | Level 3 | |||||||||||||

| Liabilities | ||||||||||||||||

| Derivative liability | $ | 1,028,352 | $ | - | $ | - | $ | 1,028,352 | ||||||||

| Total | $ | 1,028,352 | $ | - | $ | - | $ | 1,028,352 | ||||||||

| 8 |

For the three months ending March 31, 2016 and 2015, the Company recognized a loss of $15,277 and $0 on the change in fair value of derivative liabilities. As at March 31, 2016 the Company did not identify any other assets or liabilities that are required to be presented on the balance sheet at fair value in accordance with ASC 825-10.

Income Taxes

Income taxes are accounted for under the assets and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. Use of net operating loss carry forwards for income tax purposes may be limited by Internal Revenue Code section 382 if a change of ownership occurs.

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company's net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company's net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity.

At March 31, 2016, the Company has nine outstanding convertible notes payable with conversion rights. The amount of outstanding principal on these convertible notes total $548,500 plus accrued interest of $18,955 for total convertible debts as of March 31, 2016 of $567,455 representing 5,158,106 new dilutive common shares if converted at the applicable rates. The effects of these notes have been excluded as the conversion would be anti-dilutive due to the net loss incurred in each period presented.

Dividends

The Company has not adopted any policy regarding payment of dividends. No dividends have been paid during any of the periods shown.

Advertising Costs

The Company's policy regarding advertising is to expense advertising when incurred.

Stock-Based Compensation

The Company accounts for equity instruments issued to parties other than employees for acquiring goods or services under guidance of subtopic 505-50 of the FASB Accounting Standards Codification (“Sub-topic 505-50”) and subtopic 718-20 for awards classified as equity to employees.

Related Parties

The registrant follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the Related parties include (a) affiliates of the registrant; (b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; (c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; (d) principal owners of the registrant; (e) management of the registrant; (f) other parties with which the registrant may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and (g) Other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

Accounts Receivable

Accounts receivable balances are established for amounts owed to the Company from its customers from the sales of services and products. The Company closely monitors the collectability of outstanding accounts receivable and provide an allowance for doubtful accounts based on estimated collections of outstanding amounts.

Loans Receivable

The Company carries loans receivable for unsecured amounts lent to unrelated and related parties. The balance due to the Company monitored for collectability. An allowance for uncollectible loans is established based on the estimated collectability of outstanding loans.

Subscription Receivable

During the year ended December 31, 2014, the Company accepted a $10,000 subscription receivable that remains outstanding as of March 31, 2016 and December 31, 2015. The subscription receivable is shown as a reduction to equity on the balance sheet pursuant to ASC 505.

| 9 |

The financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements. The disclosures shall include: (a) the nature of the relationship(s) involved; (b) description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; (c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and (d) amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Recently Issued Accounting Standards

In April 7, 2015 the FASB issued Accounting Standards Update “ASU” 2015-03 on “Interest — Imputation of Interest (Subtopic 835-30)” To simplify presentation of debt issuance costs, the amendments in this Update would require that debt issuance costs be presented in the balance sheet as a direct deduction from the carrying amount of debt liability, consistent with debt discounts or premiums. The recognition and measurement guidance for debt issuance costs would not be affected by the amendments in this Update. This ASU 2015-3 is effective for annual periods ending after December 15, 2015, and interim periods and annual periods thereafter. We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows or financial condition.

All other newly issued accounting pronouncements but not yet effective have been deemed either immaterial or not applicable.

NOTE 3 - GOING CONCERN

The Company's unaudited condensed interim financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The financial statements do not include any adjustment relating to recoverability and classification of recorded amounts of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company has a minimum cash balance available for payment of ongoing operating expense, has experienced losses from operations since inception, and it does not have a source of revenue sufficient to cover its operating costs. Its continued existence is dependent upon its ability to continue to execute its operating plan and to obtain additional debt or equity financing. There can be no assurance the necessary debt or equity financing will be available, or will be available on terms acceptable to the Company. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

NOTE 4 – LOANS RECEIVABLE

At the time of the merger discussed in Note 2, the Company had a loan that was made to an individual totaling $40,000 which was the balance on March 31, 2016 and on December 31, 2015, respectively. This loan was not memorialized in writing and accordingly, carries no terms as to repayment, interest or default.

As discussed in Note 7, during the year ended December 31, 2014, the Company made a series of loans to the sister of Mr. Arik Maimon, our Chief Executive Officer totaling $60,000. No repayments have been made leaving a total principal balance of $60,000 due at March 31, 2016 and December 31, 2015, respectively. These loans were not memorialized in writing and accordingly, carry no terms as to repayment, interest or default.

| 10 |

NOTE 5 – FIXED ASSETS

Property, plant and equipment consist of the following at March 31, 2016 and December 31, 2015:

| March 31, 2016 | December 31, 2015 | |||||||

| Office equipment | $ | 4,572 | $ | - | ||||

| Less: accumulated depreciation | (1,646 | ) | - | |||||

| Property and equipment, net | $ | 2,926 | $ | - | ||||

All of the equipment owned by the Company as of March 31, 2016 was acquired through the reverse recapitalization as discussed in Note 2. Depreciation expense for the three months ended March 31, 2016 and 2015 was $216 and $0, respectively.

NOTE 6 – CONVERTIBLE NOTES PAYABLE

The following is a summary of all of the convertible notes outstanding as of March 31, 2016:

| Issue Date | Due Date | Holder | Principal | Discount | Carrying Value | Accrued Interest | ||||||||||||||

| 8/12/2015 | 8/12/2016 | Noteholder 1 | $ | 82,500 | $ | (31,644 | ) | $ | 50,856 | $ | 4,068 | |||||||||

| 10/15/2015 | 10/15/2016 | Noteholder 1 | 82,500 | (45,205 | ) | 37,295 | 2,947 | |||||||||||||

| 11/25/2015 | 11/24/2016 | Noteholder 1 | 82,500 | (53,568 | ) | 28,932 | 2,296 | |||||||||||||

| 12/21/2015 | 12/21/2016 | Noteholder 1 | 27,000 | (19,677 | ) | 7,323 | 580 | |||||||||||||

| 1/15/2016 | 1/15/2017 | Noteholder 1 | 131,250 | - | 131,250 | 2,186 | ||||||||||||||

| 3/8/2016 | 3/8/2017 | Noteholder 1 | 50,000 | - | 50,000 | 241 | ||||||||||||||

| 7/27/2015 | 7/27/2016 | Noteholder 2 | 37,000 | (12,164 | ) | 24,836 | 1,987 | |||||||||||||

| 11/20/2015 | 11/20/2016 | Noteholder 2 | 37,000 | (23,619 | ) | 13,381 | 1,070 | |||||||||||||

| 11/9/2015 | 11/9/2016 | Noteholder 3 | 75,000 | (46,438 | ) | 28,562 | 2,285 | |||||||||||||

| 3/8/2016 | 3/8/2017 | Noteholder 3 | 50,000 | - | 50,000 | 241 | ||||||||||||||

| 1/19/2016 | 1/15/2017 | Noteholder 4 | 131,250 | - | 131,250 | 2,071 | ||||||||||||||

| 3/9/2016 | 3/8/2017 | Noteholder 4 | 50,000 | - | 50,000 | 241 | ||||||||||||||

| 11/9/2015 | 11/9/2016 | Noteholder 5 | 100,000 | (62,739 | ) | 37,261 | 2,981 | |||||||||||||

| 11/9/2015 | 11/9/2016 | Noteholder 6 | 25,000 | (15,753 | ) | 9,247 | 740 | |||||||||||||

| Totals | $ | 961,000 | $ | (310,807 | ) | $ | 650,193 | $ | 23,934 | |||||||||||

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on July 30, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $37,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The note contains a 5% OID such that the purchase price was $35,000. The Note, together with accrued interest at the annual rate of 8%, is due on July 30, 2016. The Note is convertible into the Company's common stock commencing at any time from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $37,000. The Company recorded $1,987 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on August 19, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $82,500 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The note contains a 7% OID such that the purchase price was $76,875. The Note, together with accrued interest at the annual rate of 8%, is due on August 19, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 55% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $82,500. The Company recorded $4,068 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on October 19, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $82,500 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on October 19, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $82,500. The Company recorded $2,947 of accrued interest pursuant to this convertible note.

| 11 |

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on November 13, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $75,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on November 13, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $75,000. The Company recorded $2,285 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on November 16, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $100,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on November 16, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $100,000. The Company recorded $2,981 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on November 17, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party, for the principal amount of $25,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on November 17, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $25,000. The Company recorded $740 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on November 20, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $37,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The note contains a 5% OID such that the purchase price was $35,000. The Note, together with accrued interest at the annual rate of 8%, is due on November 20, 2016. The Note is convertible into the Company's common stock commencing at any time from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $37,000. The Company recorded $1,070 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on November 25, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $82,500 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on November 25, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $82,500. The Company recorded $2,296 of accrued interest pursuant to this convertible note.

Through the reverse recapitalization as discussed in Note 2, the Company acquired a convertible note payable that was entered into by Pleasant Kids (PLKD) on December 24, 2015. PLKD sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $27,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on December 24, 2016. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $27,000. The Company recorded $580 of accrued interest pursuant to this convertible note.

| 12 |

On January 15, 2016, the Company sold and issued a Convertible Promissory Note to an unrelated party, for the principal amount of $131,250 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on January 15, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company analyzed the conversion feature of the agreement for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the embedded conversion features should be classified as a derivative because the exercise price of these convertible notes are subject to “reset” provisions in the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than conversion price of these notes. If these provisions are triggered, the conversion price of the note will be reduced. The Company has determined that the conversion feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with AC 815, the Company will bifurcate the conversion feature of the note and record a derivative liability upon the note qualifying for conversion rights. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $131,250. The Company recorded $2,186 of accrued interest pursuant to this convertible note.

On January 19, 2016, the Company sold and issued a Convertible Promissory Note to an unrelated party, for the principal amount of $131,250 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on January 19, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company analyzed the conversion feature of the agreement for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the embedded conversion features should be classified as a derivative because the exercise price of these convertible notes are subject to “reset” provisions in the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than conversion price of these notes. If these provisions are triggered, the conversion price of the note will be reduced. The Company has determined that the conversion feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with AC 815, the Company will bifurcate the conversion feature of the note and record a derivative liability upon the note qualifying for conversion rights. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $131,250. The Company recorded $2,071 of accrued interest pursuant to this convertible note.

On March 9, 2016, the Company sold and issued a Convertible Promissory Note to an unrelated party, for the principal amount of $50,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on March 9, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company analyzed the conversion feature of the agreement for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the embedded conversion features should be classified as a derivative because the exercise price of these convertible notes are subject to “reset” provisions in the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than conversion price of these notes. If these provisions are triggered, the conversion price of the note will be reduced. The Company has determined that the conversion feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with AC 815, the Company will bifurcate the conversion feature of the note and record a derivative liability upon the note qualifying for conversion rights. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $50,000. The Company recorded $241 of accrued interest pursuant to this convertible note.

On March 9, 2016, the Company sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $50,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on March 9, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company analyzed the conversion feature of the agreement for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the embedded conversion features should be classified as a derivative because the exercise price of these convertible notes are subject to “reset” provisions in the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than conversion price of these notes. If these provisions are triggered, the conversion price of the note will be reduced. The Company has determined that the conversion feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with AC 815, the Company will bifurcate the conversion feature of the note and record a derivative liability upon the note qualifying for conversion rights. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $50,000. The Company recorded $241 of accrued interest pursuant to this convertible note.

| 13 |

On March 9, 2016, the Company sold and issued a Convertible Promissory Note to an unrelated party for the principal amount of $50,000 pursuant to the terms of a Securities Purchase Agreement of even date therewith. The Note, together with accrued interest at the annual rate of 8%, is due on March 9, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company analyzed the conversion feature of the agreement for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the embedded conversion features should be classified as a derivative because the exercise price of these convertible notes are subject to “reset” provisions in the event the Company subsequently issues common stock, stock warrants, stock options or convertible debt with a stock price, exercise price or conversion price lower than conversion price of these notes. If these provisions are triggered, the conversion price of the note will be reduced. The Company has determined that the conversion feature is not considered to be solely indexed to the Company’s own stock and is therefore not afforded equity treatment. In accordance with AC 815, the Company will bifurcate the conversion feature of the note and record a derivative liability upon the note qualifying for conversion rights. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. As of March 31, 2016, the principal balance on the note is $50,000. The Company recorded $241 of accrued interest pursuant to this convertible note.

Accrued Interest

At March 31, 2016 and December 31, 2015, the Company has recorded accrued interest of $23,934 and $0 respectively pertaining to the outstanding convertible notes.

Derivative Liability

The embedded conversion features of the convertible notes payable discussed in Footnote 7 – Convertible Notes Payable contain variable conversion prices based on certain discounts from the Company’s common stock and create derivative instruments as such. Such embedded conversion features should be bifurcated and accounted for at fair value. At March 31, 2016 and December 31, 2015, the Company had $1,028,352 and $0 in derivative liability, respectively. In the three months ended March 31, 2016 and 2015, the Company recognized losses on changes in derivative liabilities of $15,277 and $0, respectively.

A summary of the changes in derivative liabilities balance as at March 31, 2016 is as follows:

| Fair Value of Embedded Derivative Liabilities: | ||||

| Balance as of December 31, 2015 | $ | - | ||

| Acquired in acquisition | 1,236,007 | |||

| Change in FMV | 15,277 | |||

| Change due to conversion | (222,932 | ) | ||

| Balance as of March 31, 2016 | $ | 1,028,352 | ||

We calculate the derivative liability using the Black Scholes Model which factors in the Company’s stock price volatility as well as the convertible terms applicable to the outstanding convertible notes. The following is the range of variables used in revaluing the derivative liabilities at March 31, 2016:

| March 31, 2016 | ||||

| Annual dividend yield | 0 | |||

| Expected life (years) of | 0.01 – .92 | |||

| Risk-free interest rate | .59 | |||

| Expected volatility | 608.52 | |||

NOTE 7 – RELATED PARTY TRANSACTIONS

The Company follows the provisions of ASC 850—Related Party Transactions & Disclosures relating to the identification of related parties and disclosure of related party transactions.

Our financial statements include disclosures of material related party transactions, other than expense allowances, and other similar items in the ordinary course of business. The disclosures include: (a) the nature of the relationship(s) involved; (b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; (c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and (d) amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

For the period ended March 31, 2016 and the year ended December 31, 2015, the Company has had extensive dealings with related parties including those in which our Chief Executive Officer holds a significant ownership interest as well as an executive position. Due to our operational losses, the Company has relied to a large extent on funding received from Next Communications, Inc., an organization in which our Chief Executive Officer and Chairman holds a controlling equity interest and holds an executive position.

| 14 |

With the exception of the Company’s purchase of a 9% interest in Next Cala, Inc. from a related party as described below, amounts scheduled below as “Due to related parties” and “Due from related parties” have not had their terms, including amounts, collection or repayment terms or similar provisions memorialized in formalized written agreements.

Related Party balances at March 31, 2016 and December 31, 2015 consisted of the following:

Loans receivable – related party

During the year ended December 31, 2014, the Company made a series of loans to the sister of Mr. Arik Maimon, our Chief Executive Officer totaling $60,000. No repayments have been made leaving a total principal balance of $60,000 due at March 31, 2016 and December 31, 2015, respectively. These loans were not memorialized in writing and accordingly, carry no terms as to repayment, interest or default.

Due from related parties

| March 31, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (a) Due from Next Cala 360, Inc. | 129,615 | 132,179 | ||||||

| Total Due from related parties | $ | 129,615 | $ | 132,179 | ||||

Due to related parties

| March 31, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (b) Due to Next Communications, Inc. | $ | 3,016,671 | $ | 3,025,522 | ||||

| (c) Due to Asiya Communications SAPI de C.V. | 95,120 | 95,120 | ||||||

| (d) Note payable -related party | 280,000 | 130,000 | ||||||

| Total Due from related parties | $ | 3,391,791 | $ | 3,250,642 | ||||

| (a) | Next Cala 360, is a Florida corporation established and managed by our Chief Executive Officer. | |

| (b) | Next Communication, Inc. is a corporation in which our Chief Executive Officer holds a controlling interest and serves as the Chief Executive Officer | |

| (c) | Asiya Communications SAPI de C.V.is a telecommunications company organized under the laws of Mexico, in which our Chief Executive Officer holds a substantial interest and is involved in active management. | |

| (d) | Amount due to Michael De Prado, President of the Company. Amounts due him include $130,000 related to the Company's purchase of his interest of Next Cala, Inc. and $150,000 related to his granting the Company voting control over his interest in Next Cala, Inc. |

During the three months ended March 31, 2016, the Company recorded interest expense of $60,168 using an interest rate equal to that on the outstanding convertible notes payable as discussed in Note 6 as imputed interest on the related party payable due to Next Communications. The interest was immediately forgiven by the related party and recorded to additional paid in capital.

Cost of Revenues (Related Party)

The Company purchases cellular minutes for wholesale distribution from Next Communication, Inc. Next Communications is a cellular company in which our Chief Executive Officer owns a 50% interest and serves as Chief Executive Officer. Purchases from Next Communications, Inc. represented 100% of the Company’s cost of revenues for the three months ended March 31, 2016 and 2015, respectively.

Revenues (Related Party)

During the three months ended March 31, 2015, the Company generated revenues from related parties totaling $44,121. Of this total, $41,688 was generated from Next Cala 360 and $2,433 was generated from a separate entity controlled by our CEO.

Compensation – Related Party

Mr. Arik S. Maimon is Chief Executive Officer and Chairman of the Company. From time to time, the Company compensates Mr. Maimon for his management services. These payments totaled $41,212 and $117,000 for the three months ended March 31, 2016 and March 31, 2015, respectively. Mr. Maimon does not have an employment or consulting agreement with the Company.

| 15 |

NOTE 8 – ACCRUED SALARY

The Company has a consulting agreement with Kenneth C. Wiedrich which requires monthly cash compensation of $3,000. During the year ended December 31, 2014, a former employee, Franjose Yglesias-Bertheau of Pleasant Kids (PLKD) filed lawsuit against PLKD claiming unpaid wages of $622,968 and was initially awarded that amount in a judgement. However, the judgement was later reversed and the Company does not expect to pay more than the accrued salary of $35,025 currently recorded.

As of March 31, 2016, accrued salaries total $53,025 as shown in the following table.

| March

31, 2016 | ||||

| Franjose Yglesias-Bertheau | $ | 35,025 | ||

| Kenneth Wiedrich | 18,000 | |||

| Total | $ | 53,025 | ||

NOTE 9 – STOCKHOLDERS’ EQUITY

Preferred Stock

At the time of incorporation, the Company was authorized to issue 60,000,000 shares of preferred stock with a par value of $0.001 of which 50,000,000 was designated Series A and 10,000,000 as Series B. With the completion of the recapitalization as discussed in Note 2, the outstanding Series A preferred shares were cancelled leaving a balance outstanding of Preferred Series A of 0.

The Company has 10,000,000 shares of Preferred Stock designated as Series B. The Series B Preferred Stock is not convertible into Common Stock at any time and is not entitled to dividends of any kind or liquidation, dissolution rights of any kind. The holders of Series B Preferred Stock shall be entitled to 1,000 votes for each share of Series B Stock that is held when voting together with holders of the Common Stock.

Common Stock

Effective November 20, 2015 the Company amended its Articles of Incorporation to decrease the common shares authorized from 9,500,000,000 to 360,000,000 with a par value off $0.001.

As discussed in Footnote 2 – Basis of Presentation the Company is accounting for the exchange as though it were a reverse recapitalization. Through the recapitalization, the Company assumed total net liabilities of $1,032,616.

During the three months ended March 31, 2016, the Company has issued shares of commons stock for the conversion of $72,450 of principal of convertible notes payable and $18,008 of accrued interest.

| Summary of common stock activity Since December 31, 2015: | Outstanding shares | |||

| December 31, 2015 – Balance | 177,539,180 | |||

| Jan 2016 - Recapitalization | 44,784,795 | |||

| January 2016 to March 2016 – shares issued for exchange of loan (a) | 450,000 | |||

| January 2016 to March 2016 – shares issued for conversion of convertible notes payable and accrued interest (b) | 1,004,911 | |||

| March 31, 2016 - Balance | 223,778,886 | |||

| (a) | Shares issued as repayment of outstanding loan principal of $13,260. The lender did not have conversion rights to convert the principal to common stock. However, the lender agreed to accept shares in lieu of cash repayment. |

| (b) | Shares issued in connection with outstanding convertible notes payable and convertible accrued interest on convertible notes payable in accordance with contractual terms of noteholders as discussed in Note 6. |

| 16 |

NOTE 10 – CUSTOMER CONCENTRATION

For the three months ended March 31, 2016, 92% of revenues were derived from four separate customers. For the three months ended March 31, 2015, 99% of revenues were derived from five customers, two of which are related parties representing 29% of the total revenues. The loss of any one of these customers would have a material adverse effect on the Company’s operations. The concentration of revenues during the three months ended March 31, 2016 and 2015 were:

| Three Months Ended March 31, | ||||||||||||||||

| 2016 | 2015 | |||||||||||||||

| Revenues | % of Total | Revenues | % of Total | |||||||||||||

| Customer 1 | $ | 8,499 | 10 | % | $ | - | 0 | % | ||||||||

| Customer 2 | 20,000 | 24 | % | - | 0 | % | ||||||||||

| Customer 3 | 12,301 | 15 | % | - | 0 | % | ||||||||||

| Customer 4 | 35,000 | 43 | % | - | 0 | % | ||||||||||

| Customer 5 | - | 0 | % | 30,584 | 20 | % | ||||||||||

| Customer 6 | - | 0 | % | 27,000 | 18 | % | ||||||||||

| Customer 7 | - | 0 | % | 50,000 | 33 | % | ||||||||||

| Customer 8, related party | - | 0 | % | 41,688 | 27 | % | ||||||||||

| Customer 9, related party | - | 0 | % | 2,433 | 1 | % | ||||||||||

| All Others | 6,503 | 8 | % | 1,341 | 1 | % | ||||||||||

| Total | $ | 82,303 | 100 | % | $ | 153,046 | 100 | % | ||||||||

NOTE 11 – COMMITMENTS AND CONTINGENCIES

The Company follows the guidance of ASC 450—Contingencies when accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

NOTE 12 – SUBSEQUENT EVENTS

Management has evaluated subsequent events pursuant to the requirements of ASC Topic 855 and has determined that other than listed below no material subsequent events exist through the date of this filing. All conversions of convertible notes to common stock were performed at the contractually obligated rates as set forth in each convertible note.

| 1. | On April 5, 2016, the Company issued 917,025 shares of common stock for the conversion of $82,500 of principal and $4,159 of interest on a convertible note dated 8/12/15 held by noteholder 1. The convertible note is a bifurcated derivative instrument and as such the conversion will also reduce the derivative liability by $132,859 and reduce the debt discount by $31,644 and also result in a loss from fair value change in derivative liability of $61,724 |

| 2. | On April 7, 2016, the Company issued 464,805 shares of common stock for the conversion of $37,000 of principal and $3,422 of interest on a convertible note dated 7/30/15 held by noteholder 2. The convertible note is a bifurcated derivative instrument and as such the conversion will also reduce the derivative liability by $56,951 and reduce the debt discount by $17,946 and also result in a loss from fair value change in derivative liability of $45,587. |

| 17 |

| 3. | On April 11, 2016, the Company issued a convertible debenture to an unrelated party in the amount of $82,500 of which the Company received $78,375 in cash after $4,125 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on April 11, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 4. | On April 11, 2016, the Company issued a convertible debenture to an unrelated party in the amount of $82,500 of which the Company received $78,375 in cash after $4,125 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on April 11, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 5. | On April 11, 2016, the Company issued a convertible debenture to an unrelated party in the amount of $82,500 of which the Company received $78,375 in cash after $4,125 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on April 11, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 6. | On May 16, 2016, the Company issued a convertible debenture to an unrelated party in the amount of $100,000 of which the Company received $95,000 in cash after $5,000 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on May 16, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 7. | On May 16, 2016, the Company issued a convertible debenture to an unrelated party in the amount of $100,000 of which the Company received $95,000 in cash after $5,000 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on May 16, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 8. | On May 16, 2016, the Company issued a convertible debenture to an unrelated aprty in the amount of $100,000 of which the Company received $95,000 in cash after $5,000 was deducted for legal fees. The Note, together with accrued interest at the annual rate of 8%, is due on May 16, 2017. The Note is convertible into the Company's common stock commencing 180 days from the date of issuance at a conversion price equal to 50% of the lowest closing bid price of the Company's common stock for the twenty prior trading days including the date of conversion. The Company has the right to prepay the Note at any time from the date of issuance until the note is paid in full at an amount equal to 150% of the then outstanding principal amount of the Note, including accrued and unpaid interest due on the prepayment date. |

| 18 |

ITEM 2. Management’s Discussion and Analysis and Results of Operations

The following discussion and analysis provides information which management of the Company believes to be relevant to an assessment and understanding of the Company’s results of operations and financial condition. This discussion should be read together with the Company’s financial statements and the notes to the financial statements, which are included in this report.

Forward-Looking Statements

This Report contains forward-looking statements that relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Report. Forward-looking statements are often identified by words like “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar words or expressions that, by their nature, refer to future events.