Attached files

| file | filename |

|---|---|

| XML - IDEA: XBRL DOCUMENT - Barnes & Noble Education, Inc. | R9999.htm |

| EX-32.2 - EXHIBIT 32.2 SECTION 906 CFO CERTIFICATION - Barnes & Noble Education, Inc. | bned-ex322_20160430xq416.htm |

| EX-32.1 - EXHIBIT 32.1 SECTION 906 CEO CERTIFICATION - Barnes & Noble Education, Inc. | bned-ex321_20160430xq416.htm |

| EX-31.2 - EXHIBIT 31.2 SECTION 302 CFO CERTIFICATION - Barnes & Noble Education, Inc. | bned-ex312_20160430xq416.htm |

| EX-31.1 - EXHIBIT 31.1 SECTION 302 CEO CERTIFICATION - Barnes & Noble Education, Inc. | bned-ex311_20160430xq416.htm |

| EX-23.1 - EXHIBIT 23.1 CONSENT - Barnes & Noble Education, Inc. | bned-ex231_20160430xq416.htm |

| EX-21.1 - EXHIBIT 21.1 LIST OF SUBSIDIARIES - Barnes & Noble Education, Inc. | bned-ex211_20160430xq416.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-37499

BARNES & NOBLE EDUCATION, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 46-0599018 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

120 Mountain View Blvd., Basking Ridge, NJ | 07920 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (908) 991-2665

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | Name of Exchange on which registered | |

Common Stock, $0.01 par value per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.(Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant was approximately $707 million based upon the closing market price of $14.75 per share of Common Stock on the New York Stock Exchange as of October 31, 2015. As of June 17, 2016, 46,308,085 shares of Common Stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2016 Annual Meeting of Shareholders are incorporated by reference into Part III.

1

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

INDEX TO FORM 10-K | ||

Page No. | ||

2

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and information relating to us and our business that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this communication, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “will,” “forecasts,” “projections,” and similar expressions, as they relate to us or our management, identify forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Such statements reflect our current views with respect to future events, the outcome of which is subject to certain risks, including, among others:

• | general competitive conditions, including actions our competitors may take to grow their businesses; |

• | a decline in college enrollment or decreased funding available for students; |

• | decisions by colleges and universities to outsource their bookstore operations or change the operation of their bookstores; |

• | the general economic environment and consumer spending patterns; |

• | decreased consumer demand for our products, low growth or declining sales; |

• | restructuring of our digital strategy may not result in the expected growth in our digital sales and/or profitability; |

• | risk that digital sales growth does not exceed the rate of investment spend; |

• | the performance of our online, digital and other initiatives, integration of and deployment of, additional products and services, and further enhancements to Yuzu® and any future higher education digital products, and the inability to achieve the expected cost savings; |

• | our ability to successfully implement our strategic initiatives including our ability to identify and execute upon additional acquisitions and strategic investments; |

• | technological changes; |

• | our international expansion could result in additional risks; |

• | our ability to attract and retain employees; |

• | challenges to running our company independently from Barnes & Noble, Inc. following the Spin-Off; |

• | the potential adverse impact on our business resulting from the Spin-Off; |

• | changes to payment terms, return policies, the discount or margin on products or other terms with our suppliers; |

• | risks associated with data privacy, information security and intellectual property; |

• | trends and challenges to our business and in the locations in which we have stores; |

• | non-renewal of contracts and higher-than-anticipated store closings; |

• | disruptions to our computer systems, data lines, telephone systems or supply chain, including the loss of suppliers; |

• | work stoppages or increases in labor costs; |

• | possible increases in shipping rates or interruptions in shipping service, effects of competition; |

• | obsolete or excessive inventory; |

• | product shortages; |

• | changes in law or regulation; |

• | the amount of our indebtedness and ability to comply with covenants applicable to any future debt financing; |

• | our ability to satisfy future capital and liquidity requirements; |

• | our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms; |

• | adverse results from litigation, governmental investigations or tax-related proceedings or audits; |

3

• | changes in accounting standards; and |

• | the other risks and uncertainties detailed in the section titled “Risk Factors” in Part I - Item 1A of this Form 10-K. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described as anticipated, believed, estimated, expected, intended or planned. Subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this Form 10-K.

AVAILABILITY OF INFORMATION

You may read and copy any materials Barnes & Noble Education, Inc. files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies of such materials also can be obtained free of charge at the SEC’s website, www.sec.gov, or by mail from the Public Reference Room of the SEC, at prescribed rates. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Barnes & Noble Education, Inc.’s SEC filings are also available to the public, free of charge, on its corporate website, www.bned.com, as soon as reasonably practicable after Barnes & Noble Education, Inc. electronically files such material with, or furnishes it to, the SEC. You may also request a copy of any of our filings with the SEC at no cost by writing us at Investor Relations, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, N.J. 07920. Barnes & Noble Education, Inc.’s common stock is traded on the New York Stock Exchange. Material filed by Barnes & Noble Education, Inc. can be inspected at the offices of the New York Stock Exchange at 20 Broad Street, New York, N.Y. 10005.

EXPLANATORY NOTE

On February 26, 2015, Barnes & Noble, Inc. (“Barnes & Noble”) announced plans for the complete legal and structural separation of Barnes & Noble Education, Inc. (the “Company”, "us", "we") from Barnes & Noble (the “Spin-Off”). Under the Separation and Distribution Agreement between Barnes & Noble and the Company (the “Separation and Distribution Agreement”), Barnes & Noble planned to distribute all of its equity interest in us, consisting of all of the outstanding shares of our Common Stock, to Barnes & Noble’s stockholders on a pro rata basis.

On July 14, 2015, Barnes & Noble approved the final distribution ratio and declared a pro rata dividend of the outstanding shares of our common stock, par value $0.01 per share (“Common Stock”), to Barnes & Noble’s existing stockholders. The pro rata dividend was made on August 2, 2015 to the Barnes & Noble stockholders of record (as of July 27, 2015). Each Barnes & Noble stockholder of record received a distribution of 0.632 shares of our Common Stock for each share of Barnes & Noble common stock held on the record date. Following the Spin-Off, Barnes & Noble does not own any equity interest in us.

On August 2, 2015, we completed the legal separation from Barnes & Noble, at which time we began to operate as an independent publicly-traded company. Our Common Stock began to trade on a “when-issued” basis on the New York Stock Exchange ("NYSE") under the symbol “BNED WI” beginning on July 23, 2015. On August 3, 2015, when-issued trading of our Common Stock ended, and our Common Stock began “regular-way” trading under the symbol “BNED.”

The results of operations for the 13 weeks ended August 1, 2015, Fiscal 2015, Fiscal 2014 (periods presented prior to the Spin-Off), reflected in our consolidated financial statements are presented on a stand-alone basis since we were still part of Barnes & Noble, Inc. until the consummation of the Spin-Off on August 2, 2015, and the results of operations for the 39 weeks ended April 30, 2016 reflected in our consolidated financial statements are presented on a consolidated basis as we became a separate consolidated entity.

4

PART I

Item 1. BUSINESS

Unless the context otherwise indicates, references in these Notes to the accompanying consolidated financial statements to “we,” “us,” “our” and “the Company” refer to Barnes & Noble Education, Inc., a Delaware corporation. References to “Barnes & Noble” refer to Barnes & Noble, Inc., a Delaware corporation, and its consolidated subsidiaries (other than Barnes & Noble Education, Inc. and its consolidated subsidiaries) unless the context otherwise requires. References to “Barnes & Noble College” refer to our college bookstore business operated through our subsidiary Barnes & Noble College Booksellers, LLC. .

Our fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of April. “Fiscal 2016” means the 52 weeks ended April 30, 2016, “Fiscal 2015” means the 52 weeks ended May 2, 2015, “Fiscal 2014” means the 53 weeks ended May 3, 2014, “Fiscal 2013” means the 52 weeks ended April 27, 2013, and “Fiscal 2012” means the 52 weeks ended April 28, 2012.

Unless otherwise indicated, market and industry information contained in this Form 10-K is based on information provided by the National Association of College Stores ("NACS") and management estimates of market shares.

OVERVIEW

Barnes & Noble Education, Inc., one of the largest contract operators of bookstores on college and university campuses across the United States and a leading provider of digital education services, enhances the academic and social purpose of educational institutions. As a strategic partner, we are committed to offering a complete support system and an unmatched retail and digital learning experience to foster student success in higher education. Through our wholly-owned subsidiary, Barnes & Noble College, we operate 751 campus bookstores and the school-branded e-commerce sites for each store, serving more than 5 million college students and their faculty nationwide. On August 2, 2015, we completed the legal separation from Barnes & Noble, Inc., at which time we began to operate as an independent publicly-traded company.

Overall educational spending in the United States continues to increase dramatically, and as tuition and other costs rise, colleges and universities face pressure to attract and retain students and provide them with innovative, affordable educational content and tools that support their educational development. While traditional print textbooks remain the first choice of students, demand for alternative forms of educational materials is growing.

We offer a comprehensive set of products and services to help students, faculty and administrators achieve their shared educational and social goals on college and university campuses across the United States. As one of the largest contract operators of bookstores and a provider of digital education services, we operate as a focal point for college life and learning, advancing the educational mission of our institution partners, enlivening campus culture and delivering an important revenue stream to our partner schools.

For over 5 million students and their faculty, our campus stores are a social and academic hub through which students can access affordable course materials and affinity products, including new and used print and digital textbooks, which are available for sale or rent; emblematic apparel and gifts; trade books (general reading); computer products; school and dorm supplies; café; convenience food and beverages; and graduation products. Through multi-year management service agreements with our schools, we typically have the sole right to operate the official school bookstore on college campuses. In turn, we pay the school a percentage of store sales and, in some cases, a minimum fixed guarantee. We create seamless retail experiences for our customers, both in our dynamic physical stores and on our official school-branded e-commerce sites for each school.

As of April 30, 2016, we operated 751 stores nationwide, which reached 26% of the total number of students enrolled at colleges and universities in the United States. Our stores are operated under 472 contracts, some of which cover multiple store locations, and 165 of our college and university affiliated bookstores are co-branded with the Barnes & Noble name.

Fiscal 2016 was an excellent year for new store signings, and we have a strong pipeline of new business opportunities. During the 2016 fiscal year, we opened 39 stores with estimated first year annual sales of $64 million. In addition, as of June 17, 2016, we have signed additional contracts for 32 new stores with estimated first year annual sales of $109 million. We expect these new stores to open during our fiscal year 2017.

We are well positioned to benefit from the continuing trend towards outsourcing across the campus bookstore market given our brand, reputation with institutions, students and faculty for service and our full suite of products and services including: bookstore management, textbook rental and digital delivery.

5

Strength of Our Business

We enhance the academic and social purpose of educational institutions by providing essential educational content and tools within a dynamic retail environment. Our products and services improve academic outcomes, provide support to students, and create loyalty and retention, while also supporting the financial goals of the colleges and universities we serve. We provide more than course materials and merchandise - we work as a true partner with colleges and universities, aligned with their missions and goals by acting as a valuable support system for students and faculty. We deliver an attractive retail and digital learning experience driven by innovation, advanced technologies and a deep understanding of the evolving needs and behaviors of our students, faculty and administrators. Our competitive strengths are:

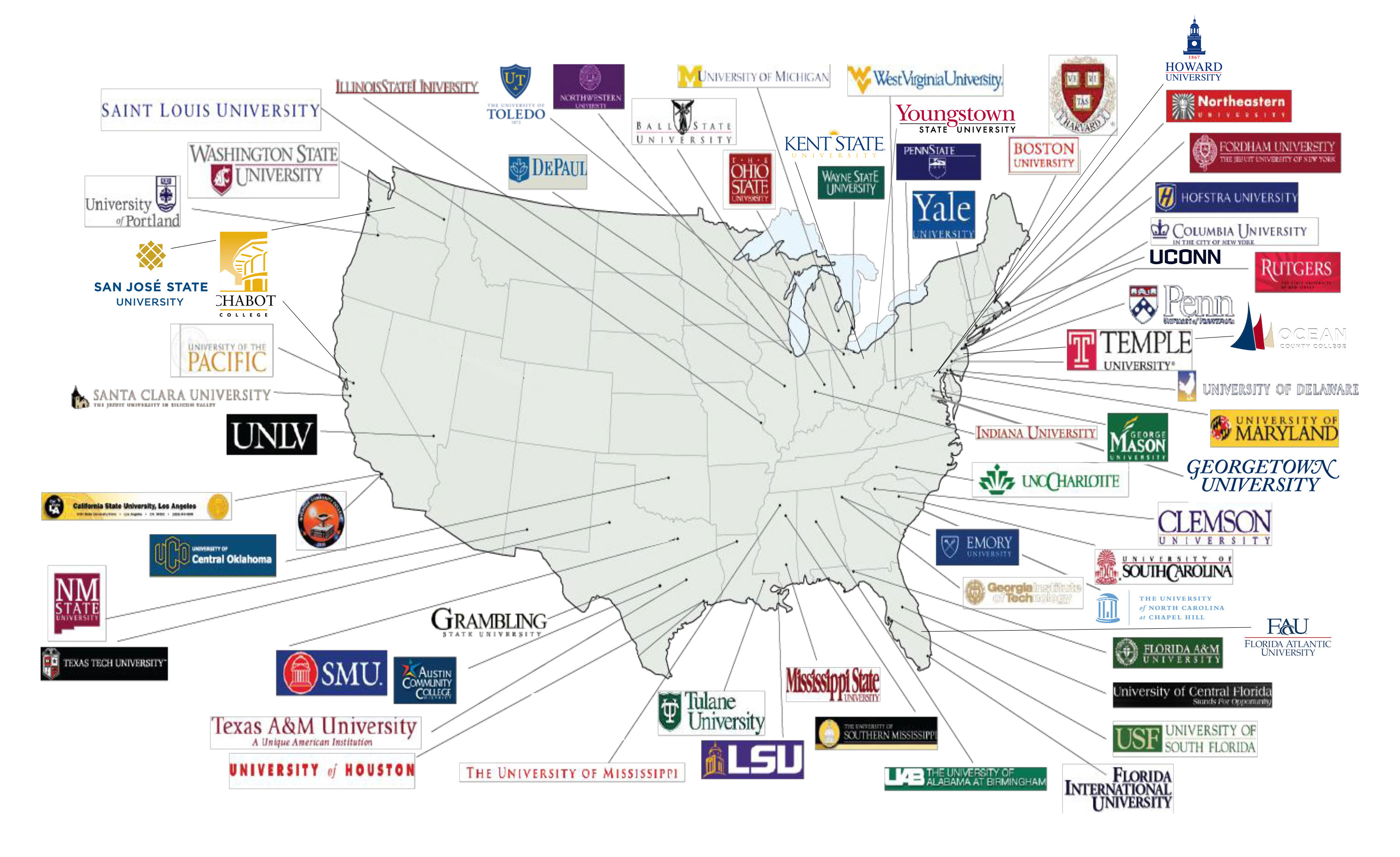

• | Large Footprint with Well-Recognized Brand: We are one of the largest operators of bookstores on college and university campuses in the United States, with 751 stores in 43 states and the District of Columbia as of April 30, 2016, which reached 26% of the total number of students enrolled at colleges and universities in the United States. The Barnes & Noble brand is virtually synonymous with bookselling, and we believe it is one of the most widely recognized and respected brands in the United States. Our large footprint and our reputation and credibility in the marketplace not only support our marketing efforts to universities, students and faculty, but are also important for leading publishers who rely on us as one of their primary distribution channels. |

• | Stable, Long-Term Contracts: We operate our stores under management contracts with colleges and universities that are typically for five year terms with renewal options, but can range from one to 15 years, and are typically cancelable by either party without penalty with 90 to 120 days' notice. From Fiscal 2013 through Fiscal 2016, 94% of these contracts were renewed or extended, often before their termination dates. In addition, these contracts are financially beneficial to us as we typically pay the college or university a percentage of our sales, including certain contracts with minimum guarantee payments. Therefore, the expense related to our college and university contracts is primarily a function of each stores' success. This arrangement is also beneficial to the colleges and universities, providing them with an incentive to encourage their students and faculty to shop at our affiliated stores. |

• | Well-Established Relationships: We have strong partnerships with college and university administrators, as well as with publishers, vendors and suppliers. |

◦ | With an average relationship tenure of 15 years, we generate value for our college and university partners, and our relationships are supported by innovative engagement programs and educational initiatives. Our decentralized management structure empowers local teams to make decisions based on the local campus needs and foster collaborative working relationships with our partners. |

◦ | We have long-term relationships with over 9,000 publishers, who can partner with us to access one of the largest distribution networks of college education materials in the United States. |

• | Direct Access to Students and Faculty: We have a flexible business model with excellent visibility into the needs of our customers, and the ability to achieve profitability typically within the first year of operation. Our stores serve as social hubs for over 5 million students and their faculty, allowing us to forge deep customer relationships and seamlessly integrate their systems with our technology. Our established position on campus as the official, contracted provider for bookstore services gives us direct access to students and faculty and translates into relatively modest customer acquisition costs and high customer conversion and retention rates. Our flexible research channels help us stay ahead of the rapidly changing needs and behaviors of our customers, and proactively respond with dynamic solutions. The ReFuel Agency College Explorer Study 2015 estimates $523 billion total annual spending for tuition, housing, etc. and $203 billion annual discretionary spending, such as for food, clothing, etc., for the college demographic. Brand partners looking to reach the college audience are also exploring how to leverage our unique position on campus to access the coveted demographic we serve. |

• | Highly Relevant Digital Products and Services: Our position as a strategic partner with our large footprint of existing and prospective colleges and universities allows us to use our suite of digital products and services to best serve their diverse needs and provides a broader scope of products and services beyond outsourcing of bookstore services. Digital products and services range from those related to providing accessible and affordable course materials solutions more directly related to our core business to analytic solutions designed to improve learning outcomes and retention rates. |

• | Seasoned Management Team: We have an experienced senior management team with a proven track record, and demonstrated expertise in college bookstore outsourcing and content distribution, marketing and retail operations, and in scaling digital educational products and services. |

6

Growth Drivers

The primary factors that we expect will enable us to grow our business are as follows:

• | Increasing Market Share with New Accounts: Historically, new store openings have been an important driver of growth. From Fiscal 2012 to end of Fiscal 2016, we increased the number of stores we serve from 636 to 751, or 18%. Currently, approximately 52% of college and university affiliated bookstores in the United States are operated by their respective institutions. As of the end of Fiscal 2016, we operated only 19% of all college and university affiliated bookstores in the United States. Based on the anticipated continuing trend towards outsourcing in the campus bookstore market, we intend to aggressively pursue these opportunities and bid on these contracts. We expect new store openings will be the most important driver of future growth in our business. |

• | Adapting our Merchandising Strategy and Product and Service Offerings: We create on campus and online retail destinations with services students want, and capture market share through new product offerings; enhanced marketing efforts using mobile, search and other technologies; increased local social and promotional offerings; and a broad category assortment of general merchandise, including school spirit apparel and gifts, school supplies, computer and technology products, dorm furnishings, graduation products, and café, convenience food and beverage offerings, marketed to our growing student and alumni base. We also are actively working with publishers by offering them access to FacultyEnlight®, our proprietary online platform, to expedite and better coordinate textbook adoption. |

• | Scalable and Advanced Digital Product and Solution Set: We leverage our digital technology platform to provide product and service offerings designed to address the most pressing issues in higher education, such as affordable and accessible course materials, retention solutions driven by our analytics platform, and products designed to drive and improve student outcomes. |

• | Expanding Strategic Opportunities through Acquisitions and Partnerships: We intend to pursue strategic relationships with companies that enhance our educational services or distribution platform, or create compelling content offerings. In Fiscal 2016, we acquired LoudCloud Systems, Inc., a sophisticated digital platform and analytics provider. We may also expand our current suite of digital content offerings and platform through acquisitions, internal or third-party software development and strategic partnerships. Expansion into new educational verticals and markets, such as K-12, vocational and international markets, will be opportunistically evaluated. |

Product and Service Offering

Our full suite of product offerings includes:

• | Textbook and Course Material Sales: Textbooks are a core product offering of our business. We work directly with faculty to ensure the correct textbooks are available in required formats before the start of classes. We provide students with affordable textbook solutions and educate them about each format through various means. During Fiscal 2016, we offered over 220,000 unique textbook titles for sale to support the course offerings on our campuses. |

• | Textbook and Course Material Rentals: Students are increasingly turning to renting as the most affordable way to obtain their textbooks, and we are an industry leader in textbook rentals. The majority of our robust title list is available for rent, including custom course packs and adaptive learning materials, along with traditional textbooks. We also offer a convenient buyout option to allow the customer to purchase the rented book at the end of the semester, thereby enhancing our revenue and improving our inventory management processes. |

• | General Merchandise: General merchandise sales are generated in-store, on campus at sporting and other events, as well as online through school-branded e-commerce sites. Our stores feature collegiate and athletic apparel relating to a school and/or its athletic programs and other custom-branded school spirit products, technology, supplies and convenience items. Other merchandise, such as laptops and other technology products, notebooks, backpacks, school and dormitory supplies and related items are also offered. In addition, as of April 30, 2016, we operated 80 customized cafés, featuring Starbucks Coffee®, and 18 stand-alone convenience stores, as well as diverse grab-and-go options including organic, vegan and gluten-free, and ethnic fare for students on the move. These offerings increase traffic and time spent in our stores. |

• | Trade: In our stores located on larger campuses, we carry an extensive selection of trade, academic and reference books, along with educational toys and games, and schedule store events, such as author signings, that extend beyond the academic community. The majority of our stores carry the most popular campus bestsellers, along with academically relevant titles. |

• | Digital Education: Using our LoudCloud platform (as described below), we offer a suite of digital content and learning materials to supplement our traditional products (textbooks and course materials) and help faculty provide a more robust educational experience for students. We enable educators to mix and author many forms of content, including eTextbooks and rich media, and provide them with adaptive analytics and assessment capabilities that, when combined, drive improved outcomes and better experiences for students. |

7

• | Brand Partnerships: United States college students spend billions on discretionary purchases each year in categories such as technology, clothing, entertainment, and food. As the official partner to the colleges and universities we serve, we are in a unique position to provide leading brands direct access to 5 million students who shop at our stores. We operate not just as a retailer, but as a media channel for these brands looking to target the college demographic. We are experts in creating strategic solutions and customer programs for brand partners, creating live touch points during the academic year through digital marketing, custom content, store brand building product sampling and live engagement at our locations in the center of campus life. We conduct business with a wide range of companies, including Adobe®, Verizon®, Nutella®, Visa Checkout®, West Elm® and Kind®. |

Platform Services

• | FacultyEnlight®: Our proprietary online platform enhances content search, discovery and adoption (i.e. textbook selection) by faculty on each campus. Thus far, approximately 245,000 faculty members use FacultyEnlight® to compare and contrast key decision-making factors, such as cost savings to students and format availability (including rental and digital options); read and write peer product reviews; and see what textbooks are being used by colleagues at other colleges and universities. This wealth of available information enables faculty to find and select the course materials that are both relevant to their subject matter and affordable to their students. FacultyEnlight® also provides us with a communication platform to connect with faculty directly, allowing us to better understand their needs, preferences and challenges when it comes to the textbook adoption process, and deliver our affordability message. |

• | Campus Connect Technologies™: We enhance the academic and social purpose of higher education institutions by integrating our technology and systems with the school’s technology and organizational infrastructure to forge a bond with the school with a particular emphasis on the needs of students and faculty. Our customizable technology delivers a seamless experience that enables faculty to research and select, and enables students to find and purchase, the most affordable course materials, maximizing savings and sales. Campus Connect Technologies™ platform includes: |

◦ | Simple Registration Integration: By linking the online course registration process to the bookstore’s e-commerce site, students can easily find their specific required course materials and purchase those materials immediately. They can view the list of necessary course materials and select their preferred format, delivery and payment method. |

◦ | Seamless LMS Integration: By tying directly into the school’s Learning Management System ("LMS"), faculty and students can easily purchase their course materials and leverage our single-sign on functionality - enabling a stronger connection between student, faculty and campus bookstore. |

◦ | Real-Time Financial Aid Platform: To help simplify financial aid transactions, we provide a sophisticated, real-time Student Financial Aid ("SFA") platform that is fully-integrated with any college or university’s financial aid systems and point-of-sale technology. This integration provides a direct and simple way for students to use their financial aid dollars in our stores and online, even before the start of classes. |

◦ | Dynamic Point of Sale ("POS") Platform: We build a secure, highly customized checkout experience for each campus, greatly expediting and simplifying a student’s shopping experience. Campus debit cards, financial aid and all major forms of tender are fully integrated, allowing students to check out from any register. |

◦ | Flexible Course Fee Solution: Through this model, all required course materials for a particular course or program are included in the cost of tuition. Students are guaranteed the course materials they need in the format they prefer. Course materials can be picked up at the campus store, shipped directly to the student or delivered digitally. |

• | LoudCloud Platform: Our LoudCloud platform is a sophisticated digital platform and analytics system that includes a competency based courseware platform, a learning analytics platform, an eReading product, and a learning management system. Its software captures and analyzes key behavioral and performance metrics from students, allowing educators to monitor and improve student success. The core framework, rooted in the student-centric design, simplifies course and content authoring using proprietary algorithms to inform and guide course progress. Our module-based architecture allows for customization and the ability to support different educational models, and support additional capabilities, including competency-based learning and courseware development. These tools enable teachers to provide, and students to experience, a more personalized learning experience and improve student success rates. Additionally, our LMS platform helps institutions handle all aspects of the learning process, including delivery and management of instructional content, learning goals, assessment, course administration and reporting. |

8

Customers and Distribution Network

We leverage our physical bookstores, e-commerce sites and digital platform to serve and interact with the key constituents in our business ecosystem and act as a key partner for students, universities and publishers.

We work with colleges and universities to transform the campus bookstore into a destination that enhances social and academic experiences. We offer students a customized retail experience, including what we believe to be the largest inventory of used and rental titles, as well as a number of other affordable textbook solutions, including digital textbooks and our Flexible Course Fee Solution. For the colleges and universities that we support, we provide a customized school official website for course materials and general merchandise, which includes emblematic apparel and gifts and school supplies. We provide faculty with valuable tools, resources and insights that allow them to gain a deeper understanding of student needs and higher education trends. We also offer approximately 5,000 publishers access to one of the largest distribution networks of college education materials in the United States.

As of April 30, 2016, we managed 751 bookstores nationwide across 43 states and the District of Columbia, serving over 5 million students and their faculty. During the period of Fiscal 2012 through Fiscal 2016, the number of stores we operated increased by 115, or approximately 18%, from 636 to 751, as a result of the increased demand for outsourcing in this market and the awarding of contracts for stores previously run by our competitors. In addition, as of June 17, 2016, we have signed additional contracts for 32 new stores, which we expect to open during our fiscal year 2017.

9

The number of Barnes & Noble College stores located in each state and the District of Columbia as of April 30, 2016, is listed below:

STATE | NUMBER OF STORES | STATE | NUMBER OF STORES | STATE | NUMBER OF STORES | |||||

Alabama | 18 | Kentucky | 32 | North Dakota | 1 | |||||

Arizona | 8 | Louisiana | 14 | Ohio | 41 | |||||

Arkansas | 7 | Maryland | 20 | Oklahoma | 5 | |||||

California | 44 | Massachusetts | 29 | Oregon | 5 | |||||

Colorado | 5 | Michigan | 36 | Pennsylvania | 63 | |||||

Connecticut | 5 | Minnesota | 7 | Rhode Island | 2 | |||||

Delaware | 2 | Mississippi | 9 | South Carolina | 19 | |||||

District of Columbia | 4 | Missouri | 8 | South Dakota | 2 | |||||

Florida | 46 | Nebraska | 1 | Tennessee | 12 | |||||

Georgia | 14 | Nevada | 2 | Texas | 67 | |||||

Hawaii | 3 | New Hampshire | 4 | Virginia | 20 | |||||

Illinois | 20 | New Jersey | 21 | Washington | 19 | |||||

Indiana | 14 | New Mexico | 6 | West Virginia | 11 | |||||

Iowa | 6 | New York | 66 | Wisconsin | 6 | |||||

Kansas | 2 | North Carolina | 25 | |||||||

Multichannel Retailer

As of April 30, 2016, we operated 751 bookstores in our dynamic, multichannel format on campuses of state universities, private universities and community colleges of various sizes. Our typical bookstore is located on campus in a location convenient to students and faculty. Of our 751 stores, 41 are academic superstores at select major campuses, including the Harvard Coop, University of Pennsylvania, Yale University, the College of William and Mary, Boston University, The Ohio State University, DePaul University, Vanderbilt University and Georgia Institute of Technology.

Our academic superstores include a café and carry a large selection of trade and reference books, as well as our campus bookstore offerings of course-required textbooks, supplies, emblematic clothing and gifts. Our academic superstores often act as an anchor to the local community; they are positioned in locations that attract customers from the neighborhood community, as well as students and faculty from the college or university. They are open extended hours and have ongoing events, such as author signings. These stores differ from our traditional-format stores because the majority has a customer base that includes the general public and sales which are less dependent on course-required materials.

e-Commerce Platform: With an active digital community of over 6.5 million customers, our official online bookstores for colleges or universities drove over $400 million of sales in Fiscal 2016, with transactions up over 8.5% over the prior fiscal year. Designed to appeal to students, parents and alumni, the school-branded sites offer simple and seamless textbook purchasing with free in-store pick up or shipping to any location, general merchandise promotions and collections that are customized to the individual user, as well as faculty course material adoption tools and customer service support. Our strategy has allowed us to connect and personalize our promotions directly to new students, parents and alumni, helping drive our online general merchandise sales. Additionally, our access to alumni through university alumni offices, including over 940,000 alumni with existing customer accounts, allow us to leverage digital marketing strategies on our dedicated fan and alumni e-commerce sites focused on athletic game day and other milestone events for further general merchandise sales growth in school-spirit apparel and related items.

Contracts

Our stores are typically operated under management agreements with the college or university to be the official university bookstore and the exclusive seller of course materials and supplies, including physical and digital products sold in-store, online or through learning management systems. Agreements are typically five years with renewal options, but can range from one to 15 years, and are typically cancelable by either party without penalty with 90 to120 days' notice. We pay the school a percentage of sales for the right to be the official college or university bookstore and the use of the premises; more than half of our agreements do not have any minimum guaranteed amount to be paid to our partners. In addition, we have the non-exclusive right to sell all items typically sold in a college bookstore both in-store and on the web. We also have the ability to integrate our systems with the university’s systems in order to accept student financial aid, university debit cards and other forms of payment. We are able to

10

obtain student and faculty email lists for direct communication which provide for seamless integration into the university community and potential co-branded marketing opportunities.

Over the past four years, we have renewed more than 94% of our agreements, with the majority of the agreements being renewed before their expiration dates and without going through a formal bid process.

Merchandising and Supply Chain Management

Our purchasing procedures vary by product type (i.e. textbooks, general merchandise or trade books). Purchases are made at the store level based on the relationships our managers have with the faculty, with strategic corporate oversight, while maintaining appropriate inventory levels. After titles are adopted for an upcoming term, we determine how much inventory we will need to purchase based on several factors, including student enrollment and the previous term’s textbook sales history. We first use our automated sourcing systems to determine if our stores have the necessary new or used books on hand and may transfer the inventory to the appropriate store. After internal sourcing, we purchase books from outside suppliers. As part of our contracts with institutions, we guarantee that we will order textbooks for all courses.

Our primary suppliers of new textbooks include Pearson Education, Cengage Learning, McGraw-Hill, MPS, MBS Textbook Exchange, Inc. (“MBS”), and John Wiley & Sons. Our primary suppliers of used textbooks are students, through returns of previously rented and purchased books, and MBS. The stores offer a "Cash for Books" program in which students can sell their books back to the store at the end of the semester, typically in December and May. Students typically receive 50% of the price they originally paid for the book if it has been adopted for a future class or the current wholesale price if it has not. Both unsold textbooks and trade books are generally returnable to publishers for full credit. For textbook sales and rentals, we utilize our sophisticated inventory management platforms to manage pricing and inventory across all our stores.

The larger stores feature an expanded selection of trade books and use the Barnes & Noble Book Master system, a proprietary merchandising system licensed from Barnes & Noble. Our home office merchants meet with publishers on a regular basis to identify new titles and trends to support this changing business. In the smaller stores, trade (general reading) book purchasing is controlled at the store level.

General merchandise vendors and products are initially selected by our home office merchants using the analytics and insights from our planning and allocation systems. This data is used to establish benchmarks across school type, region and the socio-economics of each of our partner institution’s student base to help local store management team forecast sales and trends. Recommended assortments are provided to the stores, and stores then make selections based on the perceived needs of each campus, reaching back out to the home office merchants with their recommendations on any additional campus specific needs.

Customer Marketing Strategies

Students, Parents, Alumni

Our expertise in student marketing is supported by our active digital community of over 6.5 million people, which includes engaged email subscribers and our continuous dialogue with customers on our school-customized social media channels, including Facebook, Instagram and Twitter, as well as our student blog, The College Juice. Our exclusive Student POV ("Point of View") online panel of over 8,000 students nationwide, as well as our Parent POV online panel of over 2,800 parents, helps us to better understand their attitudes, values and behaviors. Using a marketing automation platform, we segment students based on demographics and purchasing behavior to ensure our audience receives the most relevant messages and experience. Our dynamic email campaigns educate students on format and affordability options as well as ongoing promotions from game day to graduation. Through our search engine marketing strategies, we have been able to grow online textbook and apparel sales significantly.

One example of our commitment to turning our research insights into action is our Igniting the New Student Connection initiative. We connect with new students starting with their acceptance letters, allowing us to capture textbook sales from day one and building loyalty with new students and their parents, and this relationship continues over the lifecycle of their academic experience.

As rewarding and helpful as our connections are for new students, they also drive revenue. Nationwide, during the current fiscal year, we have built more than 440,000 connections with incoming students and their parents, resulting in increased revenues. These efforts have allowed us to recapture market share and cement the college bookstore as the student's first choice for everything they need for academic success. We also form the same personal connections with the alumni base, creating a customized loyalty program that builds and enhances relationships with them while driving revenue for the bookstore.

11

Business Conditions and Competition

The market for educational materials is undergoing unprecedented change. Overall spending on education, including tuition, continues to increase dramatically. As tuition and other costs rise, colleges and universities face increasing pressure to attract and retain students and provide them with innovative, affordable educational content and tools that support their educational development. While traditional print textbooks remain the first choice of students, demand for alternative forms of educational materials, including digital, media-rich content and study aids, is emerging. Current competitive dynamics in the market for distribution of course materials include:

• | A Majority of Traditional Campus Bookstores Have Yet to be Outsourced: Approximately 52% of college and university affiliated bookstores in the United States are operated by their respective institutions. As the delivery of educational materials continues to evolve, driven in large part by the growth of rentals and digital content, and the complexity of modern campus bookstore operations increases, institutions are increasingly outsourcing bookstore operations to third parties such as us, because we can offer a complete set of solutions to students and faculty. We believe that we will benefit from the continuing trend towards outsourcing across the campus bookstore market. |

• | Direct Relationship with a Coveted Demographic: Due to the disproportionate impact on trend-setting and early adoption, marketing to college students is important for many brands, as they seek more effective methods to engage with this audience. The importance of this demographic provides a significant opportunity to further monetize our direct relationship with more than 5 million students both during and beyond their college years. |

• | Increased Use of Online and Digital Platforms as Companions to Printed Course Materials: Students and faculty can now choose from a wider variety of educational content and tools than ever before, delivered across both traditional and digital platforms. Students and faculty are increasingly relying on online and digital platforms as a means to discover, consume and share educational content and access affordable non-traditional educational content, including online coursework and supplemental materials. Whereas some companies are creating digital delivery systems that would seek to make traditional textbooks obsolete, others are developing new technologies to complement traditional offerings. However, today, traditional print textbooks sold remain the first choice of students, according to the Student Monitor LLC, with 77% preferring a physical textbook (whether new, used, purchased or rented) over other options. In addition, printed course materials are the primary instructional resource for most courses and the highest revenue generator for most higher education publishers. |

• | Highly-Fragmented Educational Content Market Presents Opportunity for Consolidation: The evolving market for educational content is increasingly competitive, with a broad array of content providers, digital content delivery platforms, educational enterprise providers and campus store operators that compete to serve this approximately $13 billion market in educational books alone. As the market for educational content evolves, we believe there will be a significant opportunity to increase our market share. The traditional college bookstore market is very fragmented, with approximately 52% of college and university affiliated bookstores owned and operated by the college or university (institutional stores). The campus store continues to be the main source for books, course materials and general merchandise, such as school-branded apparel and gifts, computer products, school and dormitory supplies, café and convenience items. According to NACS, college and university store sales totaled approximately $10.3 billion during 2013. |

• | Distribution Network Evolving: The way course materials are distributed and consumed is changing significantly, a trend that is expected to continue. It is clear that significant change in the distribution of course materials is already underway as a result of start-ups promoting free online textbooks and generating revenue from related services, institutions licensing digital materials and providing them to students for a fee, or the surge of textbook rental programs in campus bookstores and online platforms. In addition to the campus bookstore, course materials are also sold through off-campus bookstores, e-commerce outlets, digital platform companies, publishers’ direct sales to institutions and students and student-to-student marketplaces. |

• | Expanding E-Commerce Business Focused on Athletics/Alumni: By rapidly scaling our dedicated alumni and fan e-commerce sites, we can leverage existing student and fan relationships, and exploit weak competition and grow market opportunities to drive increased sales of higher margin general merchandise product. |

The marketplace for course materials is highly competitive. The campus bookstore is no longer the sole provider of course materials. Students have many choices and options, including e-commerce outlets, digital platform companies, and publishers’ direct sales to students.

The following companies compete directly with us: Akademos, a virtual bookstore and marketplace for academic institutions; Amazon.com, an e-commerce operator and a provider of contract services to colleges and universities; BBA Solutions, a college textbook retailer; bn.com, the e-commerce platform of Barnes & Noble; Chegg.com, an online textbook rental company; CourseSmart, a digital course materials provider; eCampus, an online provider of course materials; Follett Corporation, a contract operator of campus bookstores; MBS Direct, an online bookstore provider; and Rafter, a course materials management solution for higher educational institutions.

12

Publishers are increasing efforts to sell directly to students, and technology companies, such as Apple, Google and Blackboard, are also increasing their digital offerings to students. In addition, student-to-student transactions are taking place on campuses and over the Internet.

Trends and Other Factors Affecting Our Business

Our business is dependent on the overall economic environment, college enrollment and consumer spending patterns. Our business is affected by funding levels at colleges and universities, by changes in enrollments at colleges and universities, and spending on textbooks and general merchandise. The growth of our business depends on our ability to attract new students and to increase the level of engagement by existing students.

Historically, increasing enrollment has been a significant driver of sales growth at campus bookstores, a trend that is expected to continue. According to the National Center for Education Statistics of the U.S. Department of Education ("NCES"), total enrollment in post-secondary degree-granting institutions is expected to increase 15.5%, from 20.6 million in 2012 to 23.8 million in 2023 driven by increased demand for educational services.

We expect awards of new accounts resulting in new store openings will continue to be an important driver of future growth in our business. We are awarded additional contracts for stores as colleges and universities decide to outsource their bookstore, and we also obtain new contracts for stores that were previously operated by competitors. Sales trends are primarily impacted by new store openings, increasing the students and faculty served, as well as changes in comparable store sales and store closings. We close stores at the end of their contract terms due to low profitability or because the new contract has been awarded to a competitor. Over the last four years, we have consistently opened new stores increasing our total number of stores open from 636 at the beginning of Fiscal 2012 to 751 at the end of Fiscal 2016.

We continue to see increasing trends towards outsourcing in the campus bookstore market, including virtual bookstores and online marketplace websites. We also continue to see a variety of business models being pursued for the provision of textbooks, course materials and general merchandise. In addition to the competition in the services we provide to our customers, our textbook business faces significant price competition. Many students purchase from multiple textbook providers, are highly price sensitive and can easily shift spending from one provider or format to another. Some of our competitors have adopted, and may continue to adopt, aggressive pricing policies and devote substantial resources to marketing, website and systems development.

As we expanded our textbook rental offerings, students have been shifting away from higher priced textbook purchases to lower priced rental options, which has resulted in lower textbook sales and increasing rental income. After several years of comparable store sales declines, primarily due to lower textbook unit volume, during the 52 weeks ended May 2, 2015, our comparable store sales trends improved for both textbooks and general merchandise. For the 52 weeks ended April 30, 2016, our comparable store sales declined primarily due to lower community college enrollment.

General merchandise sales have continued to increase as our product assortments continue to emphasize and reflect the changing consumer trends and we evolve our presentation concepts and merchandising of products in stores and online.

Contract costs, which are included in cost of sales, and primarily consist of the payments we make to the colleges and universities to operate their official bookstores (management service agreement costs), including rent expense, have generally increased as a percentage of sales as a result of increased competition for renewals and new store contracts.

Prior to the recent restructuring of our digital operation, selling and administrative expenses have generally increased primarily as a result of our investments in Yuzu®, our eTextbook platform. Additionally, selling and administrative expenses have increased due to infrastructure costs to support growth and costs associated with being an independent publicly-traded company. In an effort to reduce and manage digital expenditures, while at the same time maintaining high quality digital products, we restructured our digital operations in Fiscal 2016. We are closing our Yuzu® offices and eliminating staffing in California and Washington. The total cost of severance, retention, and other restructuring costs (i.e. facility exit costs) related to our Yuzu® operations will be approximately $11 million. We incurred approximately $8.8 million of restructuring costs in Fiscal 2016 and expect the restructuring to be completed in the first quarter of Fiscal 2017.

Additionally, we have effectively outsourced the Yuzu® eTexbook reading platform and have acquired LoudCloud Systems, Inc., a sophisticated digital platform and analytics provider. With the implementation of these initiatives, we expect to operate with a lower digital cost structure in fiscal 2017, as compared to our historical Yuzu® digital spend in previous years.

13

Seasonality

Our business is highly seasonal, with the major portion of sales and operating profit realized during the second and third fiscal quarters, when college students generally purchase and rent textbooks for the upcoming semesters. Revenue from the rental of physical textbooks is deferred and recognized over the rental period commencing at point of sale. Revenue from the rental of digital textbooks is recognized at time of sale. Our fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of April.

Segment

We have determined that we operate within a single reportable segment. We identified our single operating segment based on the way our business is managed (focusing on the financial information distributed) and the manner in which our chief operating decision maker allocates resources and assesses financial performance.

Corporate History

On September 30, 2009, Barnes & Noble acquired Barnes & Noble College Booksellers, LLC from Leonard and Louise Riggio. From that date until October 4, 2012, Barnes & Noble College Booksellers, LLC was wholly owned by Barnes & Noble Booksellers, Inc., a wholly owned subsidiary of Barnes & Noble. We were initially incorporated under the name NOOK Media Inc. in July 2012 to hold Barnes & Noble’s college and digital businesses. On October 4, 2012, Microsoft Corporation (“Microsoft”) acquired a 17.6% non-controlling preferred membership interest in our subsidiary NOOK Media LLC (“NOOK Media”), and through us, Barnes & Noble maintained an 82.4% controlling interest of the college and digital businesses.

On January 22, 2013, Pearson Education, Inc. (“Pearson”) acquired a 5% non-controlling preferred membership interest in NOOK Media, received warrants to purchase an additional preferred membership interest in NOOK Media and entered into a commercial agreement with NOOK Media relating to the college business.

On December 4, 2014, we re-acquired Microsoft’s interest in NOOK Media in exchange for cash and common stock of Barnes & Noble. On December 22, 2014, we also re-acquired Pearson’s interest in NOOK Media and related warrants previously issued to Pearson in exchange for cash and common stock of Barnes & Noble. As a result of these transactions, Barnes & Noble owned 100% of our Company prior to the Spin-Off.

In February 2015, we changed our name from NOOK Media Inc. to Barnes & Noble Education, Inc. and NOOK Media’s name to B&N Education, LLC.

On May 1, 2015, we distributed to Barnes & Noble all of the membership interests in NOOK Digital LLC (formerly known as barnesandnoble.com llc), which owns the NOOK digital business and which will continue to be owned by Barnes & Noble. At such time, we ceased to own any interest in the NOOK digital business.

On February 26, 2015, Barnes & Noble announced plans to Spin-Off its 100% equity interest in our Company. At the time of the Spin-Off on August 2, 2015, Barnes & Noble distributed all of its equity interest in us, consisting of all of the outstanding shares of our Common Stock, to Barnes & Noble’s stockholders on a pro rata basis (the “Distribution”). Following the Spin-Off, Barnes & Noble does not own any equity interest in us. On August 2, 2015, we completed the legal separation from Barnes & Noble, at which time we began to operate as an independent publicly-traded company. For details related to the Distribution of our Common Stock, see Item 8. Financial Statements and Supplementary Data - Note 6. Equity and Earnings Per Share.

In connection with the separation from Barnes & Noble, we entered into several agreements that govern the relationship between the parties after the separation and allocate between the parties various assets, liabilities, rights and obligations following the separation and also describe Barnes & Noble’s future commitments to provide us with certain transition services following the Spin-Off. For information on our on-going agreements with Barnes & Noble, Inc. see Item 8. Financial Statements and Supplementary Data - Note 10. Barnes & Noble, Inc. Transactions.

EMPLOYEES

As of April 30, 2016, we had approximately 5,500 full time and regularly scheduled part-time employees. In addition, we typically hire approximately 13,000 or more additional temporary employees during peak periods. Our employees are not represented by unions, with the exception of 28 employees. We believe that our relationship with our employees is good.

14

EXECUTIVE OFFICERS

The following sets forth information regarding our executive officers, including their positions (ages as of June 25, 2016):

Name | Age | Position | ||

Michael P. Huseby | 61 | Executive Chairman | ||

Max J. Roberts | 63 | Chief Executive Officer | ||

Patrick Maloney | 60 | Executive Vice President and Chief Operating Officer Executive Vice President and President, Barnes & Noble College | ||

William Maloney | 67 | Executive Vice President | ||

Barry Brover | 55 | Chief Financial Officer | ||

Kanuj Malhotra | 49 | Chief Strategy and Development Officer and Chief Operating Officer, Digital Education | ||

Suzanne E. Andrews | 56 | Vice President, General Counsel, and Corporate Secretary | ||

Jay Chakrapani | 45 | Vice President, Chief Digital Officer | ||

Stephen Culver | 51 | Vice President, Chief Information Officer | ||

Thomas D. Donohue | 46 | Vice President, Treasurer and Investor Relations | ||

Joel Friedman | 65 | Vice President, Chief Merchandising Officer | ||

JoAnn Magill | 62 | Vice President, Chief Human Resources Officer | ||

Lisa Malat | 56 | Vice President, Operations and Chief Marketing Officer | ||

Seema C. Paul | 52 | Vice President, Chief Accounting Officer | ||

Barnes & Noble Education, Inc. (the “Company”) became an independent publicly-traded company effective August 2, 2015 in connection with its spin-off from Barnes & Noble, Inc. Barnes & Noble College, is a subsidiary of the Company through which the college bookstore business is operated.

Michael P. Huseby, age 61, serves as our Executive Chairman, elected in August 2015, and a director, elected in July 2013. He has served as the Chief Executive Officer and a member of the board of directors of Barnes & Noble, Inc. from January 2014 until the Spin-Off. Previously, Mr. Huseby was appointed Chief Executive Officer of NOOK Media LLC and President of Barnes & Noble, Inc. in July 2013, and Chief Financial Officer of Barnes & Noble, Inc. in March 2012. From 2004 to 2011, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Cablevision Systems Corporation, a leading telecommunications and media company. He served on the Cablevision Systems Corporation Board in 2000 and 2001. Prior to joining Cablevision, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Charter Communications, Inc., then the fourth largest cable operator in the United States. Mr. Huseby served on the Board of Directors of Charter Communications from May 2013 to May 2016. From 1999 to 2002, Mr. Huseby served as Executive Vice President, Finance and Administration, of AT&T Broadband, a provider of cable television services. In addition, Mr. Huseby spent over 20 years at Arthur Andersen, LLP and Andersen Worldwide, S.C., where he held the position of Global Equity Partner.

Max J. Roberts, age 63, serves as our Chief Executive Officer. Mr. Roberts joined our company in 1996 as President, and has served as Chief Executive Officer, of Barnes & Noble College since August of 2013. Prior to joining Barnes & Noble College in 1996, Mr. Roberts held senior executive positions at Petrie Retail, R.H. Macy & Company and May Department Stores. Mr. Roberts started his professional career at the global public accounting firm of Touche Ross & Company (currently Deloitte).

Patrick Maloney, age 60, serves as our Executive Vice President and Chief Operating Officer. Mr. Maloney is also President of Barnes & Noble College. In this role, he oversees operations at all bookstores nationwide, including bookstore e-commerce, store design and construction, internal operations, learning and development, and book and general merchandising departments. Mr. Maloney began his career at Barnes & Noble in 1974 as a student and assistant manager at SUNY Stony Brook University.

William Maloney, age 67, serves as our Executive Vice President. Mr. Maloney has served as Executive Vice President of Barnes & Noble College since 2002. In this role, he oversees campus relations activities, builds partnerships and handles strategic planning and corporate marketing activities. Mr. Maloney began his career at Barnes & Noble in 1971 as a Regional Manager and Operations Director.

Barry Brover, age 55, serves as our Chief Financial Officer. In this role, he oversees all financial functions including treasury, investor relations, risk management, accounting, financial reporting, inventory control, accounts payable, internal audit, tax, financial planning and analysis. Mr. Brover has served as Chief Financial Officer of Barnes & Noble College since 2006. Mr. Brover joined Barnes & Noble College in 1986 and has held various executive positions with increasing responsibility. Prior to joining Barnes & Noble College, Mr. Brover started his career at KPMG where he earned his CPA.

15

Kanuj Malhotra, age 49, serves as our Chief Strategy and Development Officer and Chief Operating Officer, Digital Education. Mr. Malhotra was appointed Chief Financial Officer of NOOK Media LLC in July 2013. He joined Barnes & Noble as Vice President of Corporate Development in May 2012. Prior to joining the Company, Mr. Malhotra was Vice President and Finance Head for Kaplan Test Prep, a division of The Washington Post Company, from 2011 to 2012. At Kaplan, he led a business transformation from physical test centers to a digital online learning platform. From 2008 to 2010, Mr. Malhotra was Chief Financial Officer of Sloane Square Partners LLC. Between 2005 and 2007, he was the Chief Financial Officer for the International Division of the Cendant Marketing Group and Affinion International, which was divested by Cendant Corporation to Apollo Management. Mr. Malhotra began his career in Mergers and Acquisitions at Lehman Brothers.

Suzanne E. Andrews, age 56, joined the Company in September 2015 as Vice President, General Counsel, and Corporate Secretary. She is responsible for all legal matters for Barnes & Noble Education, and its subsidiaries, including management of outside counsel. She provides guidance to the Company and its Board of Directors on all corporate governance and Securities and Exchange Commission matters, including public disclosures, mergers and acquisitions, compliance, intellectual property, vendor management, e-commerce, litigation, and employment. Prior to joining Barnes & Noble Education, Ms. Andrews served as General Counsel to Investors Bank from 2013 to 2015, and General Counsel to Healthcare Finance Group from 2004 to 2013. Ms. Andrews has also held positions with several law firms in New York.

Jay Chakrapani, age 45, joined the Company in August 2015 as our Chief Digital Officer. In this role he leads the product planning and development for the digital business and is responsible for development of digital content offerings and operations. Prior to joining the Company, Mr. Chakrapani served as President of CK-12 Foundation, a digital learning company, from February 2013 to January 2015 and prior to that he was with McGraw-Hill Higher Education-Digital from 2007 to 2013.

Stephen Culver, age 51, serves as our Vice President, Chief Information Officer and is responsible for overseeing the Company’s Information Technology operations and strategic development. Prior to joining Barnes & Noble College in 2005, Mr. Culver held leadership positions in both the private and public sectors. He owned and presided over an Information Technology consulting company, which specialized in the retail and wholesale industries. As CIO of Giorgio Armani Corporation, he led the Information Technology operations during the development and expansion of their North American operations.

Thomas D. Donohue, age 46, serves as our Vice President, Investor Relations and Treasurer. Mr. Donohue served as Treasurer of Barnes & Noble, Inc. since June 2012. In that role, he was responsible for the leadership and direction of all treasury activities including corporate finance, capital structure, cash management, financial risk management, international finance, debt management and relationships with financial institutions. Prior to joining Barnes & Noble Inc., he worked at The Interpublic Group of Companies for 12 years, a global provider of advertising and marketing services, where he served as Vice President, Assistant Treasurer, International from May 2004 to May 2012.

Joel Friedman, age 65, serves as our Vice President, Chief Merchandising Officer. In his time at Barnes & Noble College, Mr. Friedman has managed the non-book sales, developed store concepts and directed the planning, design and interior build outs of the Company’s many store renovations and new store projects. He joined Barnes & Noble College in 1998 after a 20 year career in department store merchandising of menswear apparel in Boston with Federated based Filene’s and Jordan Marsh, a five year term in product development and sourcing of menswear and children’s apparel with Fredrick Atkins and a one year term with Capital Mercury, a wholesale importer, running their product development and design department.

JoAnn Magill, age 62, serves as our Vice President, Chief Human Resources Officer. In her time at Barnes & Noble College, Ms. Magill has been responsible for the development, implementation, and coordination of policies, practices and programs to include employee relations, recruitment, benefits, payroll and compensation for the bookstores and home office. She joined the company in 2003 after a five year career as the Vice President of Human Resources for the AT&T Broadband Media Services Team. Prior to that she had an extensive 25 year career with Pathmark Supermarkets, where she held a variety of field and corporate leadership roles.

Lisa Malat, age 56, serves as our Vice President, Operations and Chief Consumer Marketing Officer. Ms. Malat provides strategic direction and executive oversight to Barnes & Noble College’s campus stores in the areas of consumer and corporate marketing, learning and development and in-store and e-commerce strategy and operational efficiencies. Prior to joining Barnes & Noble College in 1996, Ms. Malat held several senior level management positions at Macy’s, including roles in store operations, process re-engineering, distribution, customer service, and learning and development.

Seema C. Paul, age 52, joined the Company in July 2015 as our Vice President, Chief Accounting Officer. In this role she manages the external reporting and technical accounting functions of the Company. Prior to joining the Company, Ms. Paul held positions of increasing responsibility at Covanta Holding Corporation, including Corporate Controller from July 2014 to July 2015, Senior Director-External Reporting & Technical Accounting from June 2013 to July 2014, Director-External Reporting from January 2011 to May 2013 and Manager-External Reporting from August 2005 to December 2010. Ms. Paul is a Certified Public Accountant and has held various senior financial roles with several large companies, including Net2Phone, Sybase, Inc. and Liberty Mutual Insurance Company.

16

Item 1A. RISK FACTORS

The risks and uncertainties described below are not the only ones faced by us. Additional risks and uncertainties not presently known or that are currently deemed immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows and the trading price of our Common Stock could be materially adversely affected.

Risks Relating to Our Business

We face significant competition in our business, and we expect such competition to increase.

The market for course materials, including textbooks and supplemental materials, is intensely competitive and subject to rapid change. We are experiencing growing competition from alternative media and alternative sources of textbooks and course-related materials, such as websites that sell textbooks, eTextbooks, digital content and other merchandise directly to students; online resources, including open educational resources; publishers bypassing the bookstore distribution channel by selling directly to students and educational institutions; print-on-demand textbooks; textbook rental companies; and student-to-student transactions over the Internet. We also have competition from other college bookstore operators and educational content providers, including Akademos, a virtual bookstore and marketplace for academic institutions; Amazon.com, an e-commerce operator and a provider of contract services to colleges and universities; BBA Solutions, a college textbook retailer; bn.com, the e-commerce platform of Barnes & Noble; Chegg.com, an online textbook rental company; CourseSmart, a digital course materials provider; eCampus, an online provider of course materials; Follett Corporation, a contract operator of campus bookstores; MBS Direct, an online bookstore provider; and Rafter, a course materials management solution for higher educational institutions. We also have competition from providers of eTextbooks, such as Apple iTunes, CourseSmart, Blackboard, Rafter and Google; and various private textbook rental websites. In addition, Amazon, Akademos and Rafter have recently begun to develop relationships with colleges and universities to provide online bookstore solutions. Many students purchase from multiple textbook providers, are highly price sensitive and can easily shift spending from one provider or format to another. As a consequence, in addition to being competitive in the services we provide to our customers, our textbook business faces significant price competition. Some of our competitors have adopted, and may continue to adopt, aggressive pricing policies and devote substantial resources to marketing, website and systems development. In addition, a variety of business models are being pursued for the provision of print textbooks, some of which may be more profitable or successful than our business model.

We may not be able to enter into new contracts and contracts for existing or additional college and university affiliated bookstores may not be profitable.

An important part of our business strategy is to expand sales for our college bookstore operations by being awarded additional contracts to manage bookstores for colleges and universities. Our ability to obtain those additional contracts is subject to a number of factors that we are not able to control. In addition, the anticipated strategic benefits of new and additional college and university bookstores may not be realized at all or may not be realized within the time frames contemplated by management. In particular, contracts for additional managed stores may involve a number of special risks, including adverse short-term effects on operating results, diversion of management’s attention and other resources, standardization of accounting systems, dependence on retaining, hiring and training key personnel, unanticipated problems or legal liabilities, and actions of our competitors and customers. Because certain terms of any contract are generally fixed for the initial term of the contract and involve judgments and estimates that may not be accurate, including for reasons outside of our control, we have contracts that are not profitable and may have such contracts in the future. Even if we have the right to terminate a contract, we may be reluctant to do so even when a contract is unprofitable due to, among other factors, the potential effect on our reputation.

We may not be able to successfully retain or renew our managed bookstore contracts on profitable terms.

We face significant competition in retaining existing store contracts and when renewing those contracts as they expire. Our contracts are typically for five years with renewal options, but can range from one to 15 years, and most contracts are cancelable by either party without penalty with 90 to 120 days' notice. We may not be successful in retaining our current contracts, renewing our current contracts or renewing our current contracts on terms that provide us the opportunity to improve or maintain the profitability of managing stores that are the subject matter of such contracts.

Our business is dependent on the overall economic environment, college enrollment and consumer spending patterns.

A deterioration of the current economic environment could have a material adverse effect on our financial condition and operating results, as well as our ability to fund our growth and strategic business initiatives. Our business is affected by funding levels at colleges and universities and by changes in enrollments at colleges and universities, changes in student enrollments and lower spending on textbooks and general merchandise. The growth of our business depends on our ability to attract new students and to increase the level of engagement by existing students. To the extent we are unable to attract new students or students spend less generally, our business could be adversely affected.

17

We face the risk of disruption of supplier relationships and/or supply chain and/or inventory surplus.