Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CAVIUM, INC. | d211132dex991.htm |

| EX-10.1 - EX-10.1 - CAVIUM, INC. | d211132dex101.htm |

| EX-2.1 - EX-2.1 - CAVIUM, INC. | d211132dex21.htm |

| 8-K - 8-K - CAVIUM, INC. | d211132d8k.htm |

Cavium to acquire QLogic June 15, 2016 Cavium to acquire QLogic Soft colors Object titles 211, 213, 219 223, 235, 250 213, 231, 255 217, 219, 237 222, 245, 240 247, 241, 215 219, 244, 222 213, 215, 232 221, 222, 224 Exhibit 99.2

Certain statements made herein, including, for example, information regarding the proposed transaction between Cavium and QLogic, the expected timetable for completing the transaction, and the potential benefits of the transaction, are "forward-looking statements." These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, our actual results may differ materially from our expectations or projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings that could be instituted against QLogic or its directors or Cavium related to the merger agreement; the possibility that various conditions to the consummation of the Cavium exchange offer and merger may not be satisfied or waived, including the receipt of all regulatory clearances related to the merger; the failure of Cavium to obtain the necessary financing pursuant to the arrangements set forth in the debt commitment letter delivered pursuant to the merger agreement or otherwise; uncertainty as to how many shares of QLogic common stock will be tendered into the Cavium exchange offer; the risk that the Cavium exchange offer and merger will not close within the anticipated time periods; risks related to the ultimate outcome and results of integrating the operations of Cavium and QLogic, the ultimate outcome of Cavium's operating strategy applied to QLogic and the ultimate ability to realize synergies; the effects of the business combination on Cavium and QLogic, including the increased level of indebtedness resulting from the transaction, and the combined company's future financial condition, operating results, strategy and plans; risks that the proposed transaction disrupts current plans and operations, and potential difficulties in employee retention as a result of the merger; the risk of downturns in the semiconductor and networking industries; the effects of local and national economic, credit and capital market conditions on the economy in general; and other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in our other reports and other public filings with the U.S. Securities and Exchange Commission ("SEC"), including, but not limited to, those detailed in QLogic's Annual Report on Form 10-K for the year ended April 3, 2016, and Cavium's Annual Report on Form 10-K for the year ended December 31, 2015 and Cavium's most recent quarterly report filed with the SEC. The forward-looking statements contained herein are made only as of the date hereof, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Cautionary Note Concerning Forward-Looking Statements

This document relates to a pending business combination transaction between Cavium and QLogic. The exchange offer referenced in this document has not yet commenced. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Cavium will file a registration statement on Form S-4 related to the transaction with the SEC and may file amendments thereto. Cavium and a wholly-owned subsidiary of Cavium will file a tender offer statement on Schedule TO (including a prospectus/offer to exchange, a related letter of transmittal and other exchange offer documents) related to the transaction with the SEC and may file amendments thereto. QLogic will file a solicitation/recommendation statement on Schedule 14D-9 with the SEC and may file amendments thereto. QLogic and Cavium may also file other documents with the SEC regarding the transaction. This document is not a substitute for any registration statement, Schedule TO, Schedule 14D-9 or any other document which QLogic or Cavium may file with the SEC in connection with the transaction. Investors and security holders are urged to read the registration statement, the Schedule TO (including the prospectus/offer to exchange, related letter of transmittal and other exchange offer documents), the solicitation/recommendation statement on Schedule 14D-9 and the other relevant materials with respect to the transaction carefully and in their entirety when they become available before making any investment decision with respect to the transaction, because they will contain important information about the transaction. The prospectus/offer to exchange, the related letter of transmittal and certain other exchange offer documents, as well as the solicitation/recommendation statement, will be made available to all holders of QLogic’s stock at no expense to them. The exchange offer materials and the solicitation/recommendation statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies of the exchange offer materials and the solicitation/recommendation statement may be obtained for free by contacting Cavium’s Investor Relations department at (408) 943-7417 or at angel.atondo@cavium.com. Additional copies of the solicitation/recommendation statement may be obtained for free by contacting QLogic’s Investor Relations department at (949) 542-1330 or at doug.naylor@qlogic.com. In addition to the prospectus/offer to exchange, the related letter of transmittal and certain other exchange offer documents, as well as the solicitation/recommendation statement, Cavium and QLogic file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Cavium and QLogic at the SEC’s website at http://www.sec.gov. Additional Information and Where to Find It

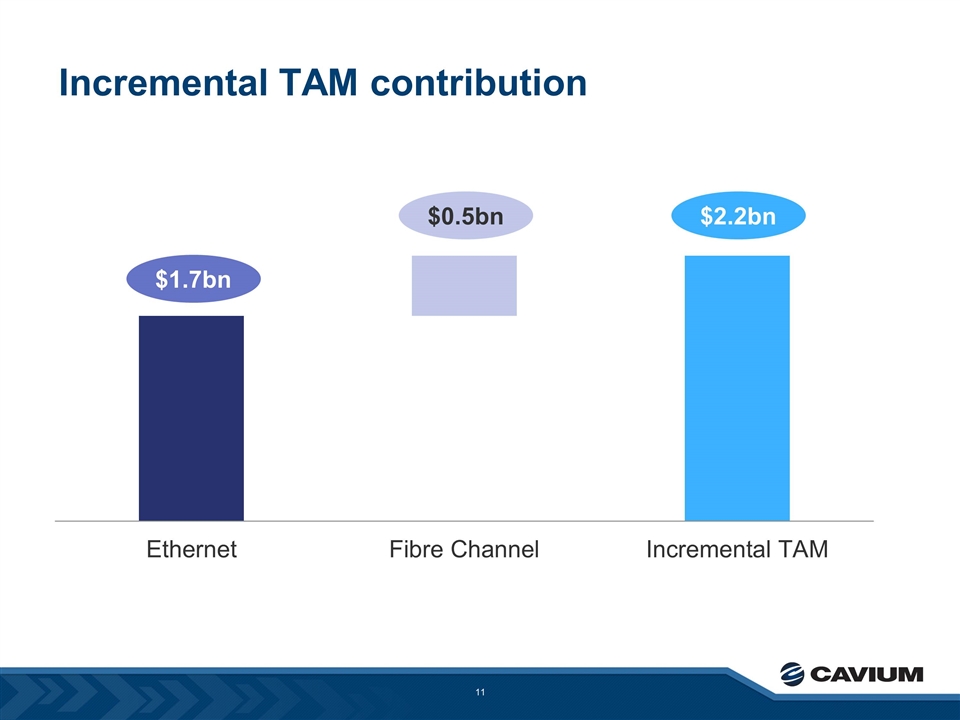

Strategic rationale Creates a leading, diversified pure-play infrastructure semiconductor company with significant growth at scale QLogic’s market-leading advanced connectivity and storage solutions expand Cavium’s footprint by adding an incremental $2+ billion TAM Manufacturing and sales synergies can drive revenue growth across combined customer base $45 million of identified annualized cost synergies $0.60 to $0.70 accretive to CY 2017 non-GAAP EPS 1 2 3 4 5

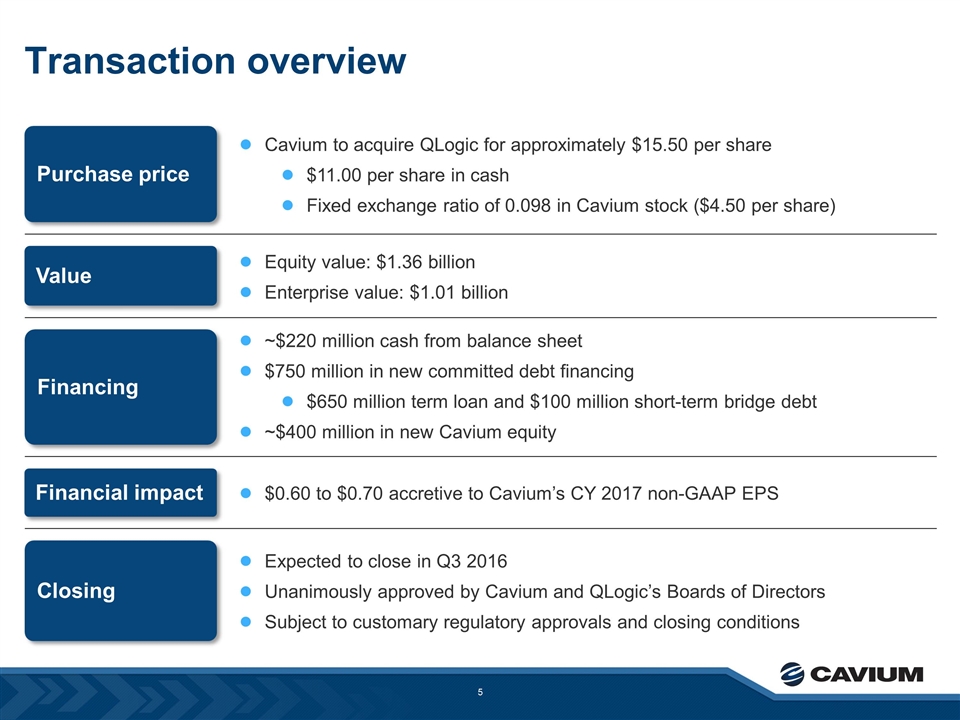

Cavium to acquire QLogic for approximately $15.50 per share $11.00 per share in cash Fixed exchange ratio of 0.098 in Cavium stock ($4.50 per share) Equity value: $1.36 billion Enterprise value: $1.01 billion ~$220 million cash from balance sheet $750 million in new committed debt financing $650 million term loan and $100 million short-term bridge debt ~$400 million in new Cavium equity $0.60 to $0.70 accretive to Cavium’s CY 2017 non-GAAP EPS Expected to close in Q3 2016 Unanimously approved by Cavium and QLogic’s Boards of Directors Subject to customary regulatory approvals and closing conditions Purchase price Value Financing Financial impact Closing Transaction overview

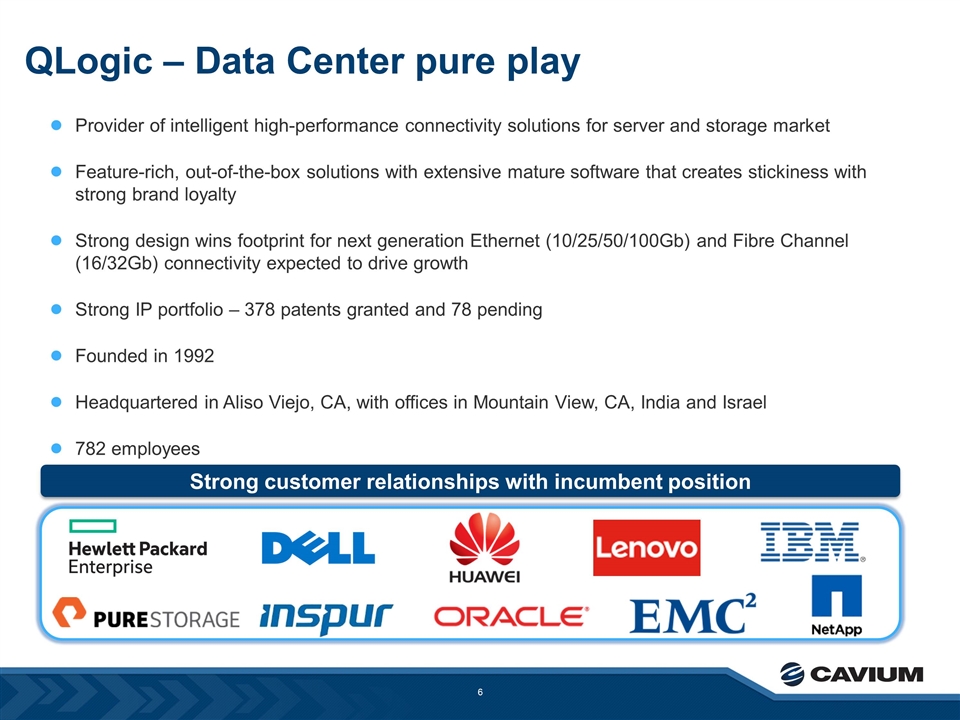

QLogic – Data Center pure play Provider of intelligent high-performance connectivity solutions for server and storage market Feature-rich, out-of-the-box solutions with extensive mature software that creates stickiness with strong brand loyalty Strong design wins footprint for next generation Ethernet (10/25/50/100Gb) and Fibre Channel (16/32Gb) connectivity expected to drive growth Strong IP portfolio – 378 patents granted and 78 pending Founded in 1992 Headquartered in Aliso Viejo, CA, with offices in Mountain View, CA, India and Israel 782 employees Great products, out of the box solutions, feature rich compatible software therefore strong brand and stickiness [Compatible with Linux, windows etc] Strong customer relationships with incumbent position

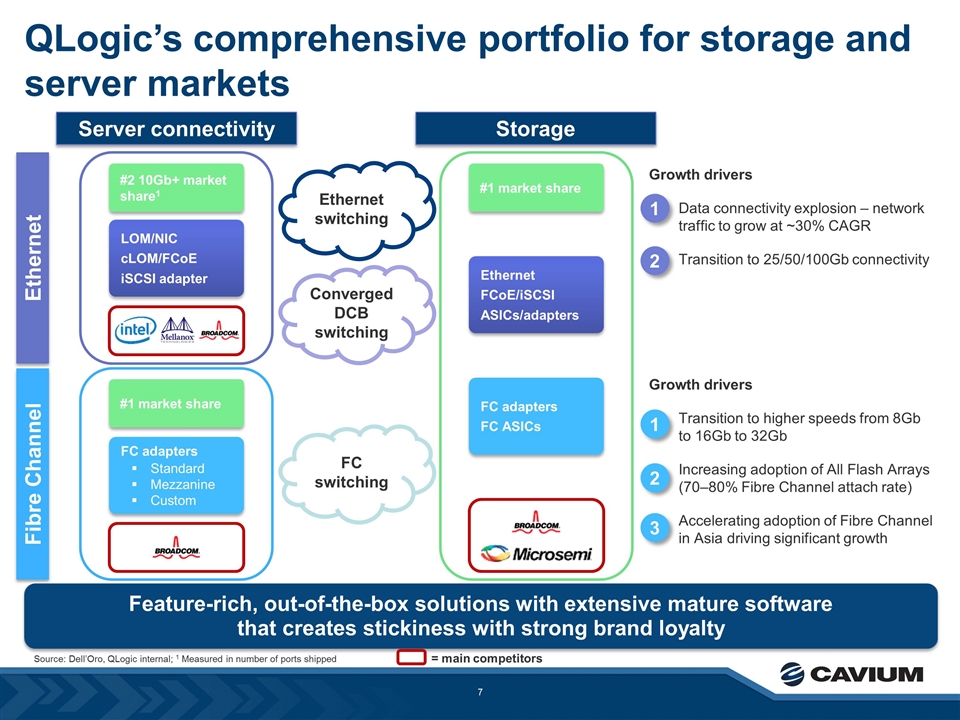

Source: Dell’Oro, QLogic internal; 1 Measured in number of ports shipped Transition from 10Gbs upwards Ethernet switching Converged DCB switching LOM/NIC cLOM/FCoE iSCSI adapter #2 10Gb+ market share1 Growth drivers Data connectivity explosion – network traffic to grow at ~30% CAGR Transition to 25/50/100Gb connectivity FC switching FC adapters Standard Mezzanine Custom #1 market share Ethernet FCoE/iSCSI ASICs/adapters #1 market share FC adapters FC ASICs Growth drivers Transition to higher speeds from 8Gb to 16Gb to 32Gb Increasing adoption of All Flash Arrays (70–80% Fibre Channel attach rate) Accelerating adoption of Fibre Channel in Asia driving significant growth Feature-rich, out-of-the-box solutions with extensive mature software that creates stickiness with strong brand loyalty = main competitors Ethernet Fibre Channel Server connectivity Storage QLogic’s comprehensive portfolio for storage and server markets 1 2 3 1 2 Feature rich out-of-the-box solutions with extensive mature software that creates stickiness with strong brand loyalty Feature rich out-of-the-box solutions with robust extensible software that creates stickiness and strong brand loyalty

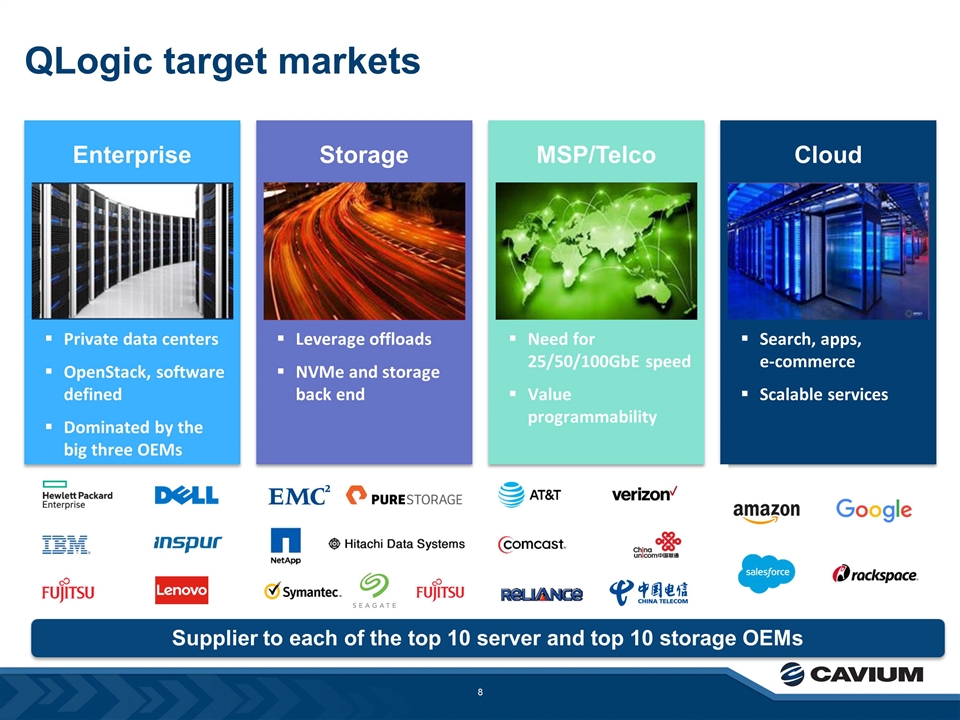

Cloud QLogic target markets Supplier to each of the top 10 server and top 10 storage OEMs Storage MSP/Telco Enterprise Private data centers OpenStack, software defined Dominated by the big three OEMs Leverage offloads NVMe and storage back end Need for 25/50/100GbE speed Value programmability Search, apps, e-commerce Scalable services

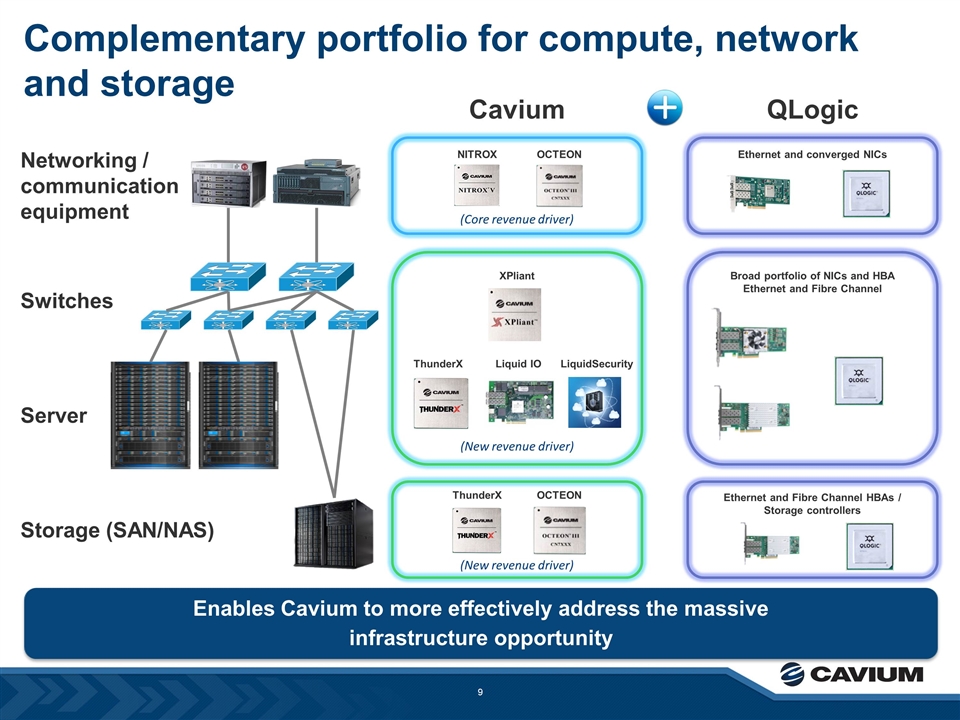

(Core revenue driver) Complementary portfolio for compute, network and storage Enables Cavium to more effectively address the massive infrastructure opportunity Networking / communication equipment Cavium QLogic Switches Storage (SAN/NAS) Server NITROX OCTEON (New revenue driver) XPliant Liquid IO (New revenue driver) ThunderX Broad portfolio of NICs and HBA Ethernet and Fibre Channel Ethernet and Fibre Channel HBAs / Storage controllers OCTEON Ethernet and converged NICs LiquidSecurity ThunderX

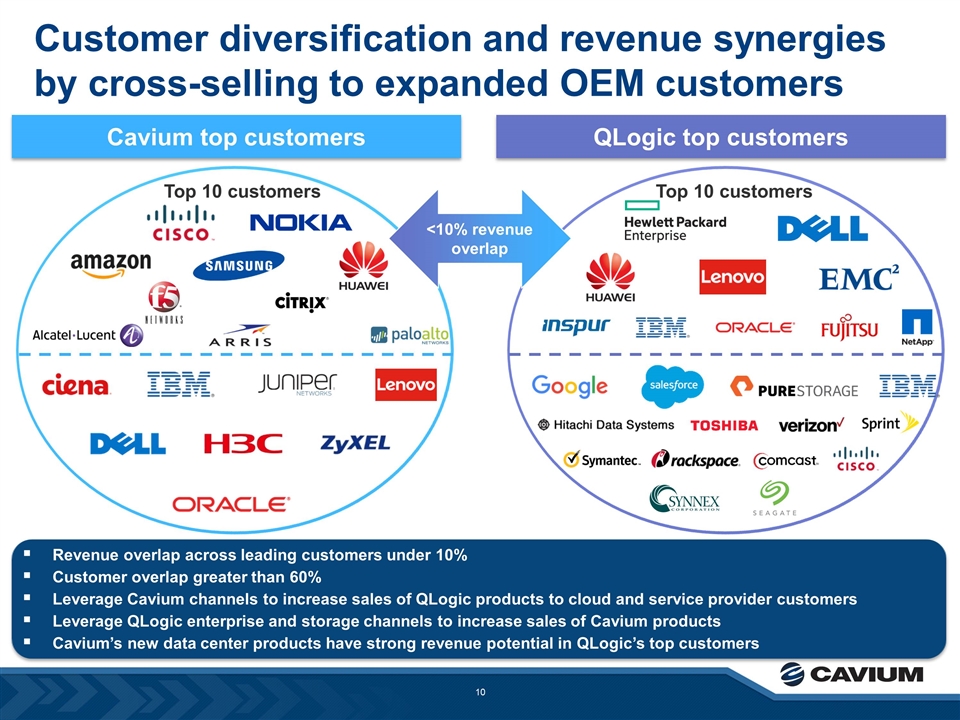

Customer diversification and revenue synergies by cross-selling to expanded OEM customers Revenue overlap across leading customers under 10% Customer overlap greater than 60% Leverage Cavium channels to increase sales of QLogic products to cloud and service provider customers Leverage QLogic enterprise and storage channels to increase sales of Cavium products Cavium’s new data center products have strong revenue potential in QLogic’s top customers Cavium top customers QLogic top customers Top 10 customers Top 10 customers <10% revenue overlap

$1.7bn $0.5bn $2.2bn Incremental TAM contribution

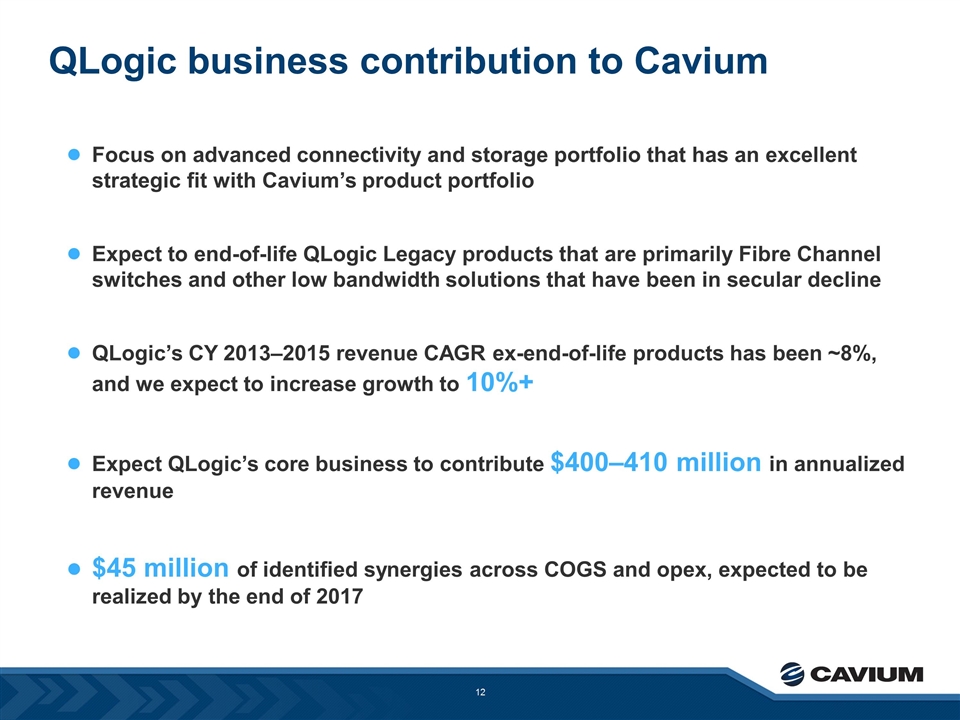

Focus on advanced connectivity and storage portfolio that has an excellent strategic fit with Cavium’s product portfolio Expect to end-of-life QLogic Legacy products that are primarily Fibre Channel switches and other low bandwidth solutions that have been in secular decline QLogic’s CY 2013–2015 revenue CAGR ex-end-of-life products has been ~8%, and we expect to increase growth to 10%+ Expect QLogic’s core business to contribute $400–410 million in annualized revenue $45 million of identified synergies across COGS and opex, expected to be realized by the end of 2017 QLogic business contribution to Cavium Focus on advanced connectivity portfolio that is core to Cavium Target to end of life by end of year their Legacy products (primarily Fiber Channel switch products and lower speed connectivity cards) Fiber Channel to be less than 25% of our combined business exiting CY 2017 Combined business to run at Cavium’s operating model exiting 2017 Expect QLogic’s core business to contribute $[410–420]mm annualized

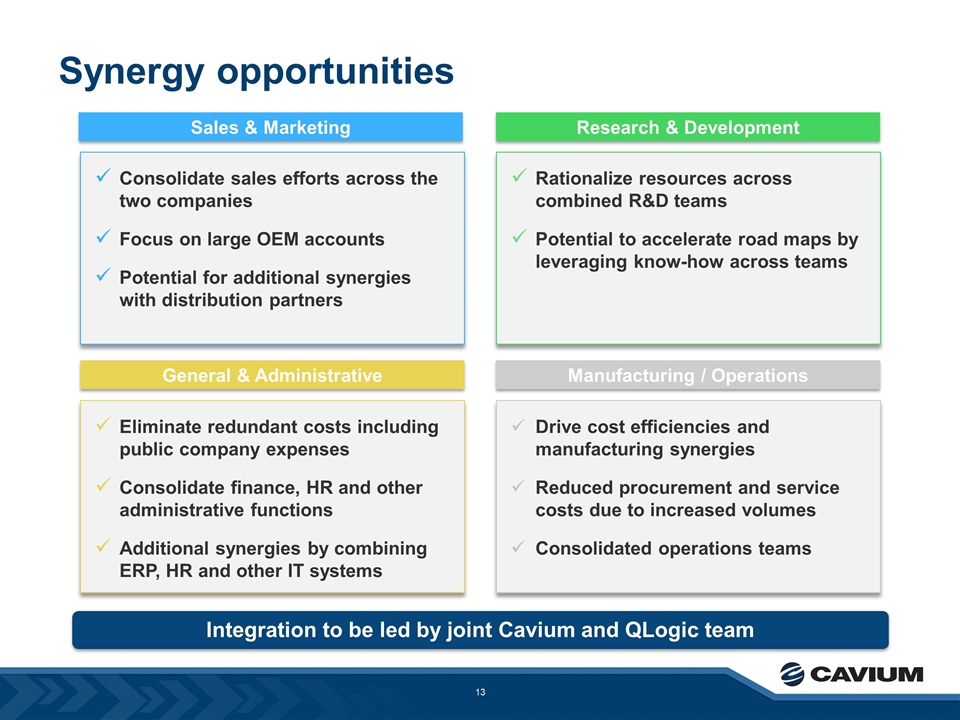

Synergy opportunities Consolidate sales efforts across the two companies Focus on large OEM accounts Potential for additional synergies with distribution partners Rationalize resources across combined R&D teams Potential to accelerate road maps by leveraging know-how across teams Eliminate redundant costs including public company expenses Consolidate finance, HR and other administrative functions Additional synergies by combining ERP, HR and other IT systems Drive cost efficiencies and manufacturing synergies Reduced procurement and service costs due to increased volumes Consolidated operations teams Sales & Marketing Research & Development General & Administrative Manufacturing / Operations Integration to be led by joint Cavium and QLogic team

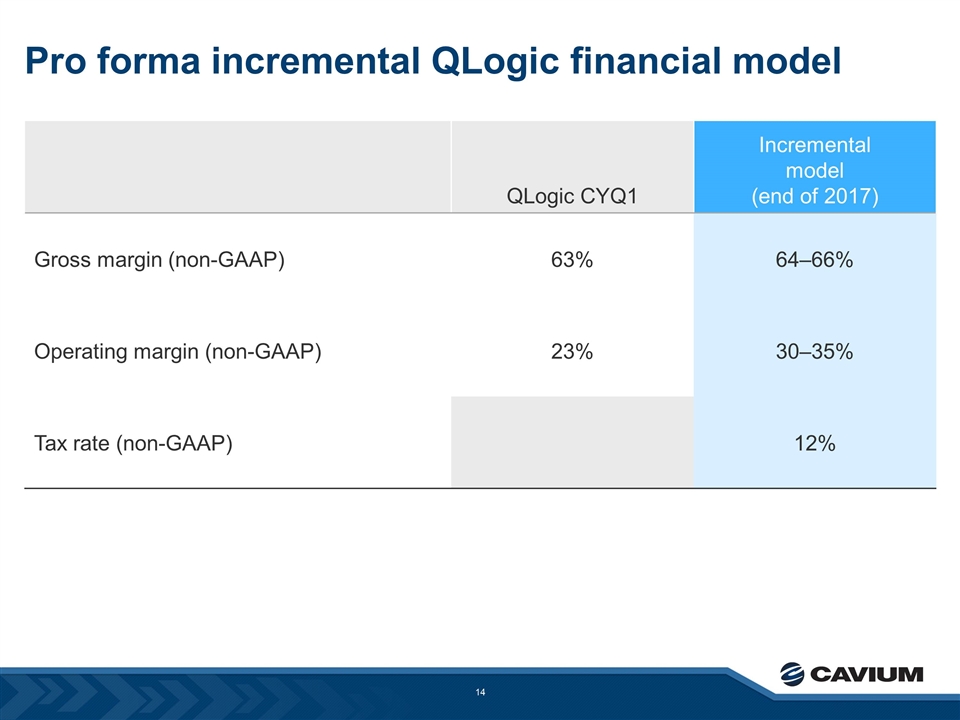

Pro forma incremental QLogic financial model QLogic CYQ1 Incremental model (end of 2017) Gross margin (non-GAAP) 63% 64–66% Operating margin (non-GAAP) 23% 30–35% Tax rate (non-GAAP) 12%

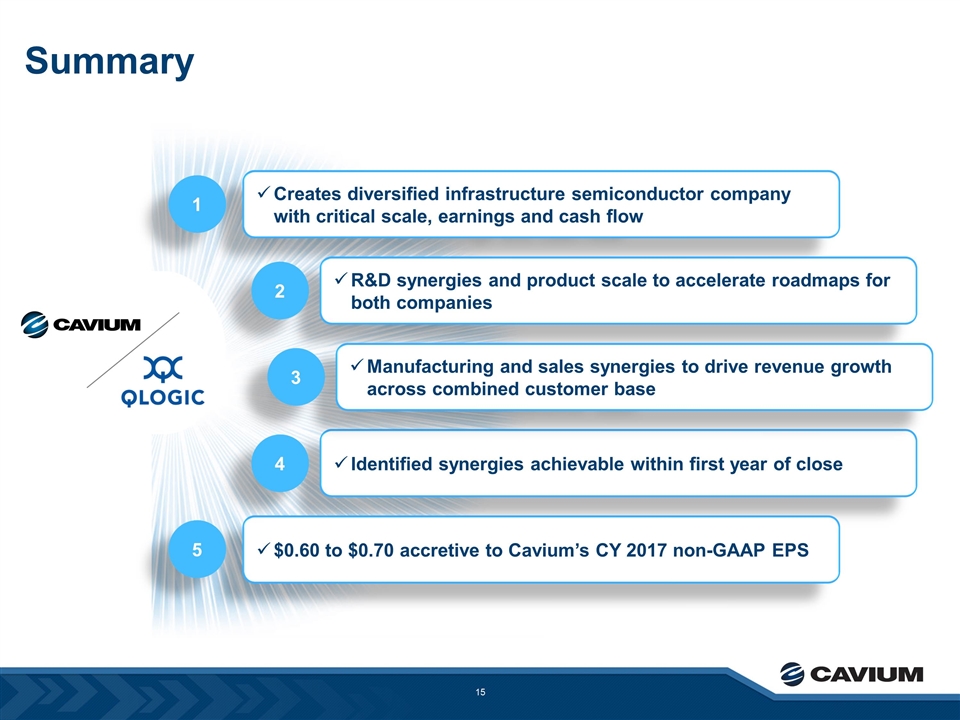

Summary Identified synergies achievable within first year of close $0.60 to $0.70 accretive to Cavium’s CY 2017 non-GAAP EPS Creates diversified infrastructure semiconductor company with critical scale, earnings and cash flow R&D synergies and product scale to accelerate roadmaps for both companies Manufacturing and sales synergies to drive revenue growth across combined customer base 1 2 4 5 3