Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Chaparral Energy, Inc. | cpr-8k_20160523.htm |

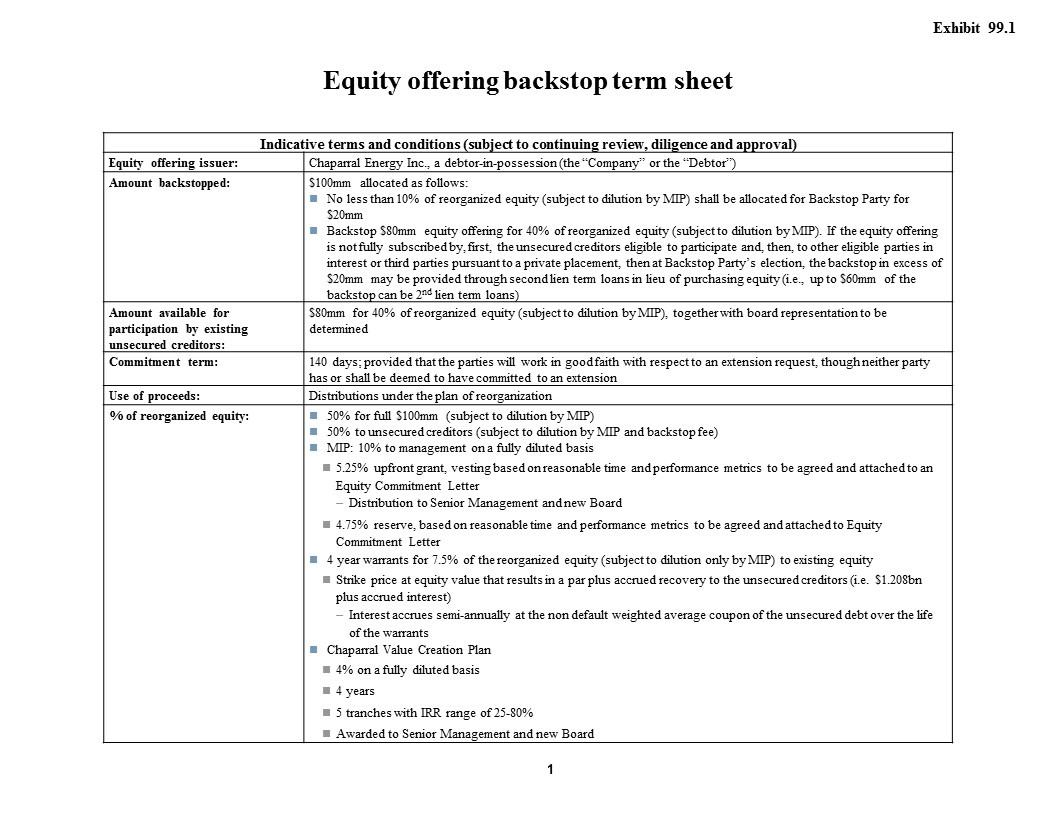

Indicative terms and conditions (subject to continuing review, diligence and approval) Equity offering issuer: Chaparral Energy Inc., a debtor-in-possession (the “Company” or the “Debtor”) Amount backstopped: $100mm allocated as follows: No less than 10% of reorganized equity (subject to dilution by MIP) shall be allocated for Backstop Party for $20mm Backstop $80mm equity offering for 40% of reorganized equity (subject to dilution by MIP). If the equity offering is not fully subscribed by, first, the unsecured creditors eligible to participate and, then, to other eligible parties in interest or third parties pursuant to a private placement, then at Backstop Party’s election, the backstop in excess of $20mm may be provided through second lien term loans in lieu of purchasing equity (i.e., up to $60mm of the backstop can be 2nd lien term loans) Amount available for participation by existing unsecured creditors: $80mm for 40% of reorganized equity (subject to dilution by MIP), together with board representation to be determined Commitment term: 140 days; provided that the parties will work in good faith with respect to an extension request, though neither party has or shall be deemed to have committed to an extension Use of proceeds: Distributions under the plan of reorganization % of reorganized equity: 50% for full $100mm (subject to dilution by MIP) 50% to unsecured creditors (subject to dilution by MIP and backstop fee) MIP: 10% to management on a fully diluted basis 5.25% upfront grant, vesting based on reasonable time and performance metrics to be agreed and attached to an Equity Commitment Letter Distribution to Senior Management and new Board 4.75% reserve, based on reasonable time and performance metrics to be agreed and attached to Equity Commitment Letter 4 year warrants for 7.5% of the reorganized equity (subject to dilution only by MIP) to existing equity Strike price at equity value that results in a par plus accrued recovery to the unsecured creditors (i.e. $1.208bn plus accrued interest) Interest accrues semi-annually at the non default weighted average coupon of the unsecured debt over the life of the warrants Chaparral Value Creation Plan 4% on a fully diluted basis 4 years 5 tranches with IRR range of 25-80% Awarded to Senior Management and new Board 1 Equity offering backstop term sheet Exhibit 99.1

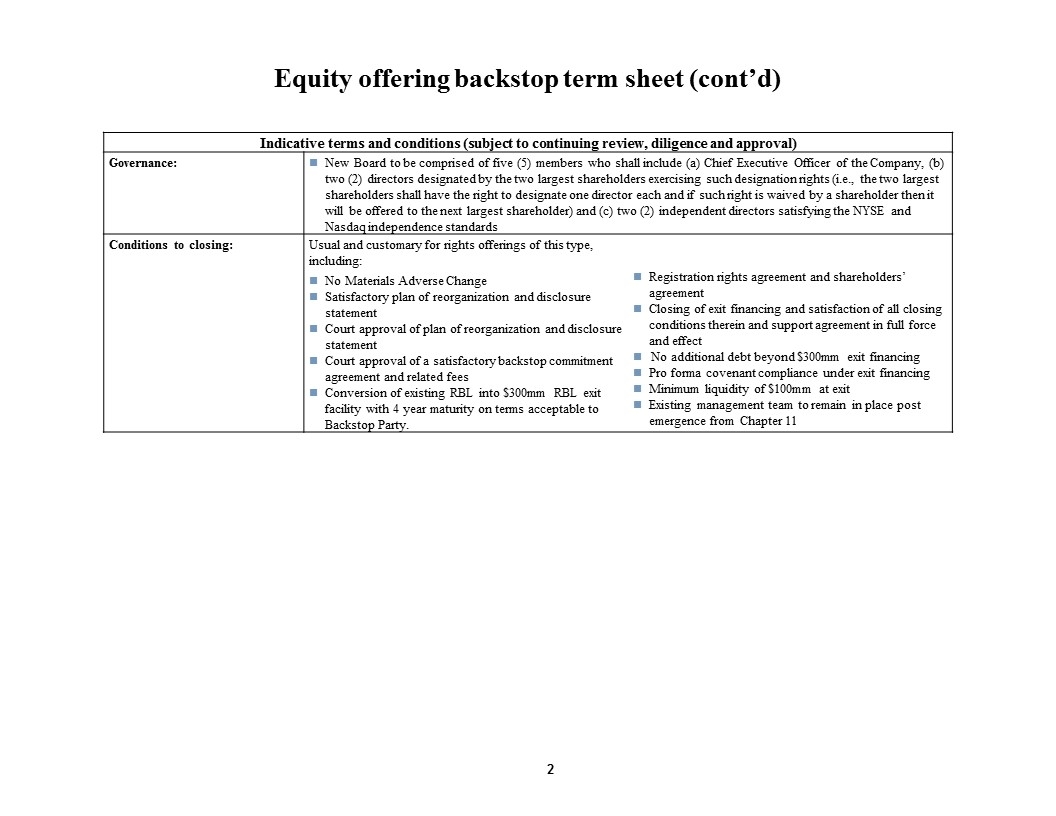

Indicative terms and conditions (subject to continuing review, diligence and approval) Governance: New Board to be comprised of five (5) members who shall include (a) Chief Executive Officer of the Company, (b) two (2) directors designated by the two largest shareholders exercising such designation rights (i.e., the two largest shareholders shall have the right to designate one director each and if such right is waived by a shareholder then it will be offered to the next largest shareholder) and (c) two (2) independent directors satisfying the NYSE and Nasdaq independence standards Conditions to closing: Usual and customary for rights offerings of this type, including: No Materials Adverse Change Satisfactory plan of reorganization and disclosure statement Court approval of plan of reorganization and disclosure statement Court approval of a satisfactory backstop commitment agreement and related fees Conversion of existing RBL into $300mm RBL exit facility with 4 year maturity on terms acceptable to Backstop Party. Registration rights agreement and shareholders’ agreement Closing of exit financing and satisfaction of all closing conditions therein and support agreement in full force and effect No additional debt beyond $300mm exit financing Pro forma covenant compliance under exit financing Minimum liquidity of $100mm at exit Existing management team to remain in place post emergence from Chapter 11 2 Equity offering backstop term sheet (cont’d)