Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTAR ENERGY INC /KS | d182016d8k.htm |

| EX-99.2 - EX-99.2 - WESTAR ENERGY INC /KS | d182016dex992.htm |

Westar Energy Investor Update – May 31, 2016 Exhibit 99.1

May 31, 2016 Investor Update Forward-Looking Disclosure Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the transactions referred to in this material, Great Plains Energy Incorporated (“Great Plains”) expects to file a registration statement on Form S-4 with the Securities and Exchange Commission (“SEC”) containing a preliminary joint proxy statement of Great Plains and Westar Energy, Inc. (“Westar Energy”) that also constitutes a preliminary prospectus of Great Plains. After the registration statement is declared effective Great Plains and Westar Energy will mail a definitive proxy statement/prospectus to shareholders of Great Plains and shareholders of Westar Energy. This material is not a substitute for the joint proxy statement/prospectus or registration statement or for any other document that Great Plains or Westar Energy may file with the SEC and send to Great Plains’ and/or Westar Energy’s shareholders in connection with the proposed transactions. INVESTORS AND SECURITY HOLDERS OF GREAT PLAINS AND WESTAR ENERGY ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus (when available) and other documents filed with the SEC by Great Plains or Westar Energy through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Great Plains will be available free of charge on Great Plains’ website at www.greatplains.com, in the “Investor Relations” tab near the bottom of the page, or by contacting Great Plains’ Investor Relations Department at 1-800-245-5275. Copies of the documents filed with the SEC by Westar Energy will be available free of charge on Westar Energy’s website at www.westarenergy.com or by contacting Westar Energy’s Investor Relations Department at 785-575-8227. Great Plains and Westar Energy and their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies with respect to the proposed transactions under the rules of the SEC. Information about the directors and executive officers of Great Plains may be found in its 2015 Annual Report on Form 10-K filed with the SEC on February 24, 2016, and definitive proxy statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on March 24, 2016. Information about the directors and executive officers of Westar Energy may be found in its 2015 Annual Report on Form 10-K filed with the SEC on February 24, 2016, and definitive proxy statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on April 1, 2016. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC when they become available.

May 31, 2016 Investor Update Forward-Looking Disclosure Forward Looking Statements This communication contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 in connection with the proposed merger of Great Plains and Westar Energy. These statements include statements regarding describe nature of future statements, e.g. the anticipated closing date of the transaction or anticipated future results. Forward-looking statements may include words like “believe,” “anticipate,” “target,” “expect,” “pro forma,” “estimate,” “intend,” “guidance” or words of similar meaning. Forward-looking statements describe future plans, objectives, expectations or goals. Although Great Plains and Westar Energy believes that these statements are based on reasonable assumptions, all forward-looking statements involve risk and uncertainty. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as, without limitation, delays in completing the merger, including as a result of delays in obtaining regulatory approval or shareholder approval, changes in general economic conditions and regulatory and legislative changes that adversely affect the business in which Great Plains and Westar Energy are engaged. These forward looking statements speak only as of the date of this communication, and Great Plains and Westar Energy expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Great Plains’ or Westar Energy’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Great Plains and Westar Energy, including the most recent Forms 10-K and 10-Q, for additional information about Great Plains and Westar Energy and about the risks and uncertainties related to the business of each of Great Plains and Westar Energy which may affect the statements made in this communication.

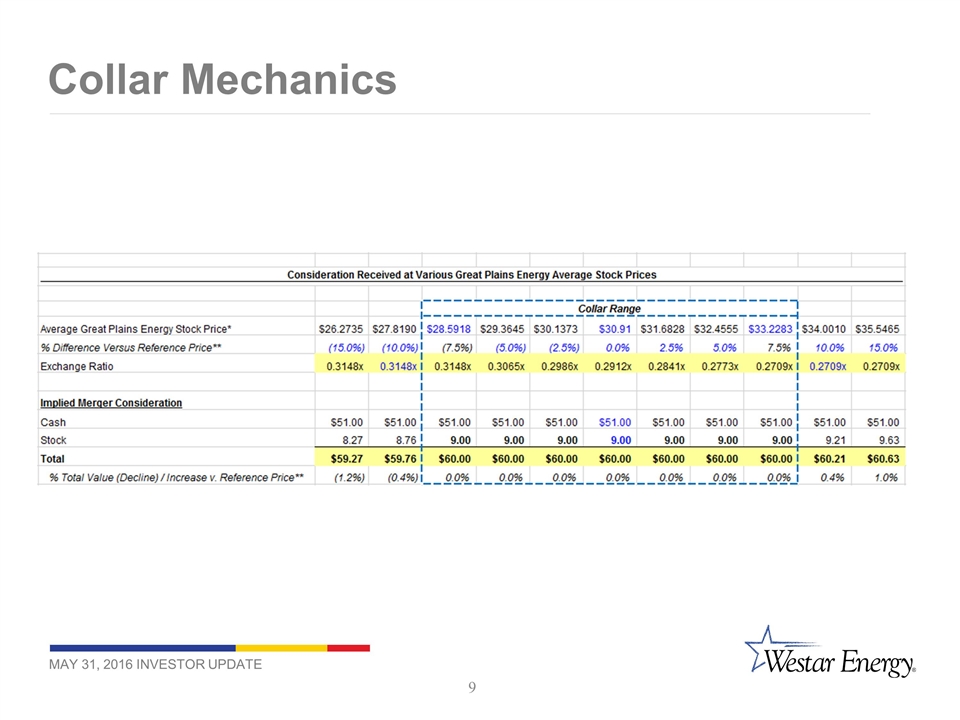

May 31, 2016 Investor Update Transaction Announcing definitive agreement for acquisition of Westar Energy by Great Plains Energy Value $60 per share Total enterprise value of $12.2 billion; total equity value of $8.6 billion Consideration 85% cash, representing fixed value of $51 per share 15% stock, representing exchange value of $9 per share Collar locks in value of share exchange portion within +/- 7.5% movement of Great Plains Energy stock price Meaningful continuing equity interest (~15%) in larger, strong, regional energy company

May 31, 2016 Investor Update Rationale Fulfills Westar’s position on M&A; consistent with earlier statements Expect industry consolidation to continue Eventually size matters Bigger companies better able to address industry change and manage costs for customers More likely to be seller than buyer Consider M&A opportunistically, rather than be forced Make decisions from position of strength Prefer certainty of value in terms of considerations

May 31, 2016 Investor Update Straight-Forward Path to Approval Both companies’ shareholders Kansas Corporation Commission 300 day statutory calendar Established criteria FERC NRC HSR waiting period

May 31, 2016 Investor Update Other Terms Reverse break-up fee $380 million in favor of Westar for failure to close Break-up fee for fiduciary out $180 million in favor of Westar, if Great Plains breaks $280 million in favor of Great Plains, if Westar breaks Westar protection against failed Great Plains shareholder vote $80 million in favor of Westar, if Great Plains shareholders don’t approve Social issues Westar to have one board seat Westar CEO to stay through closing Maintain Westar’s Topeka HQ Employee and community protections

May 31, 2016 Investor Update Collar Mechanics Consideration $51 per share in cash 85% cash limits exposure to Great Plains share price movement Great Plains stock valued at $9 if Great Plains share price as of closing is equal to or greater than $28.5918 and equal to or less than $33.283 Within +/- 7.5% movement in Great Plains share price, exchange ratio adjusts to fix share exchange value at $9 Outside +/-7.5% movement, exchange ratio is fixed, and exchange value adjusts 0.2709 Great Plains shares for each Westar share if Great Plains share price is above $33.283 as of closing 0.3148 Great Plains shares for each Westar share if Great Plains share price is below $28.5918 as of closing

May 31, 2016 Investor Update Collar Mechanics